Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STERLING BANCORP | d8k.htm |

| EX-99.1 - PRESS RELEASE - STERLING BANCORP | dex991.htm |

Earnings Conference Call

Earnings Conference Call

July 26, 2011

July 26, 2011

(PBNY)

Exhibit 99.2 |

2

We make statements in this presentation, and we may from time to

time make other statements,

regarding our outlook or expectations for earnings, revenues, expenses and/or other

matters regarding or affecting us that are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act.

Forward-looking statements are typically identified by words such as

“believe”, “expect”, “anticipate", “intend", “outlook", “estimate", “forecast", “project”

and

other similar words and expressions.

These statements are based on the current beliefs and expectations of management.

Since these statements reflect the views of management concerning future

events, these statements involve risks, uncertainties, and

assumptions. These risks and uncertainties include among others:

changes in market interest rates and general and regional economic conditions;

changes in government regulations; changes in the value of goodwill and

intangible assets; changes in the quality or composition of the loan and

investment portfolios; potential breaches of information security,

competition from banks and non-banking companies; and other factors discussed in the

documents filed by us with the Securities and Exchange Commission from time to

time. These factors should be considered in evaluating the

forward-looking statements and undue reliance should not be placed on

such statements. Actual results or future events could differ, possibly

materially, from those that we anticipated in our forward-looking statements,

and future results could differ materially from our historical performance.

We undertake no obligation to update these forward-looking statements to

reflect events or circumstances that occur after the date on

which such statements were made.

Forward-looking

Forward-looking

Statements

Statements |

Provident Bank Investment Profile

Provident Bank Investment Profile

Attractive Regional Market

Low Cost, Longer Duration Funding Sources

Strong Capital and Liquidity

Credit Quality

Expandable Operating Platform

Positioning Relative to Competitors

3 |

Third

Quarter Result Summary Third Quarter Result Summary

Quarterly earnings of $1.9 MM vs. $4.8 MM last year and $3.6

MM last quarter

Diluted EPS of $0.05 per share

Net Interest Margin of 3.70% vs. 3.68% last quarter

Enhanced Commercial Loan Production

$125.5 MM in originations

Commercial pipeline at historical highs

Credit metrics

Substandard and special mention decline of $13.1 MM

NPL

increased

by

$10.9

MM

resulting

from

a

previously

classified

performing

TDR into non-accrual

4 |

5

Earning Assets and Loan Yields-

Earning Assets and Loan Yields-

Last Five Quarters

Last Five Quarters

6/30/10

9/30/10

12/31/10

3/31/11

6/30/11

YOY

6/10

6/11

Linked

Quarters

Earning

Asset Yield

4.87%

4.67%

4.54%

4.51%

4.50%

Down 37

Down 1

Loan Yields

5.68%

5.48%

5.47%

5.40%

5.41%

Down 27

Up 1

Investment

Yield and Other

Earning Assets

3.45%

3.16%

2.82%

2.91%

2.87%

Down 58

Down 4

Cost of Funds

1.00%

0.97%

0.93%

0.86%

0.83%

Down 17

Down 3

Total Deposits

0.37%

0.34%

0.32%

0.31%

0.29%

Down 8

Down 2

Borrowings

3.63%

3.53%

3.49%

3.58%

3.67%

Up 4

Up 9

NIM

3.91%

3.75%

3.66%

3.68%

3.70%

Down 21

Up 2 |

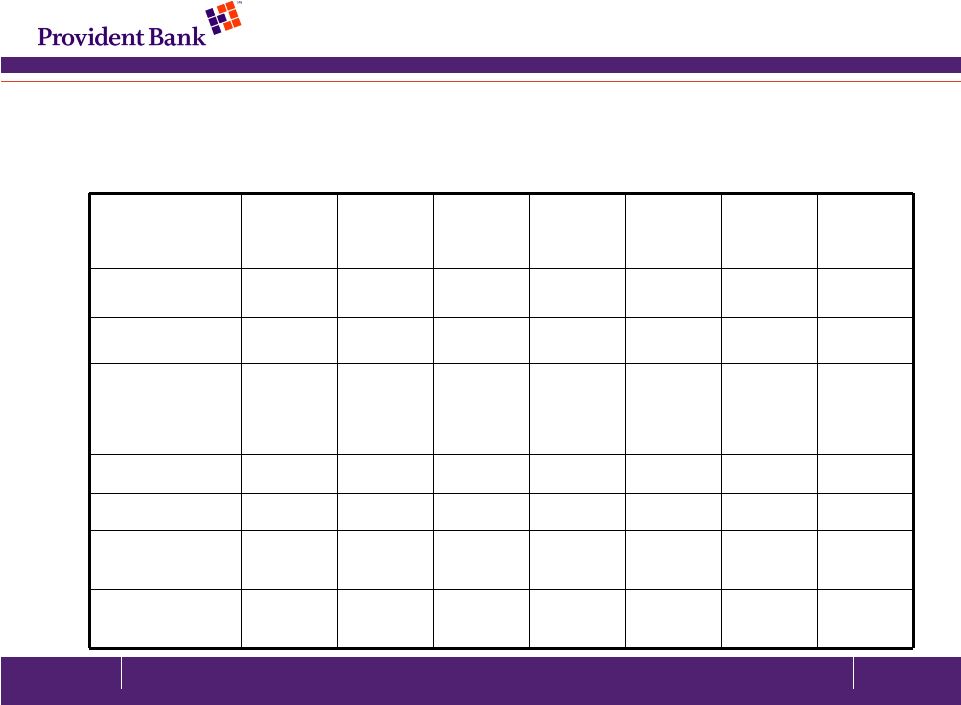

6

Loan Balance Sheet / Originations

Loan Balance Sheet / Originations

BALANCES

3Q10

2Q11

3Q11

% LINKED

YOY

C&I

129,314

122,769

124,345

1%

-4%

CRE

469,075

540,402

566,395

5%

21%

ADC

227,521

205,593

193,312

-6%

-15%

CBL

195,303

184,356

179,299

-3%

-8%

Total

Commercial

1,021,213

1,053,120

1,063,351

1%

4%

Consumer

240,364

227,391

226,518

-0.4%

-6%

Residential

444,160

401,309

395,403

-1%

-11%

Total

1,705,737

1,681,820

1,685,272

0.2%

-1%

ORIGINATIONS

3Q10

2Q11

3Q11

% LINKED

YOY

C&I

25,682

21,468

24,466

14%

-5%

CRE

54,538

42,029

63,140

50%

16%

ADC

32,196

10,558

25,012

137%

-22%

CBL

18,052

13,566

12,835

-5%

-29%

Total

Commercial

130,468

87,621

125,453

43%

-4%

Consumer

13,435

13,604

13,550

0%

1%

Residential

13,513

16,209

9,345

-42%

-31%

Total

157,416

117,434

148,348

26%

-6% |

7

Core Deposit Growth

Core Deposit Growth

3Q10

4Q10

1Q11

2Q11

3Q11

QTR

% Growth

YOY

% Growth

Retail Trans

307,673

279,283

318,514

327,674

329,793

0.65%

7.19%

Comm Trans

289,226

311,322

322,952

308,746

309,550

0.26%

7.03%

Muni Trans (1)

110,541

107,904

123,097

137,794

129,435

-6.07%

17.09%

Total Trans

707,440

698,509

764,563

774,214

768,778

-0.70%

8.67%

Savings

404,810

427,286

399,472

420,775

428,120

1.75%

5.76%

MMDA (2)

128,068

130,190

135,274

139,097

136,328

-1.99%

6.45%

Total

1,240,318

1,255,985

1,299,309

1,334,086

1,333,226

-0.06%

7.49%

% Core Deposits

65%

65%

65.60%

64.00%

63.55%

(1) Excludes municipal tax deposits

(2) Excluding Power and Premium MMDA and wholesale deposits, municipal

|

8

Strong Capital Position

Strong Capital Position

9/10

12/10

3/11

6/11

Tier 1 Leverage

8.43%

8.89%

9.1%

8.8%

Total RBC Ratio

13.3%

13.9%

13.9%

13.5%

Tangible

Capital/Tangible

Assets

9.33%

9.20%

9.31%

9.37%

Tangible Book

Value per Share

$6.96

$6.69

$6.74

$6.93 |

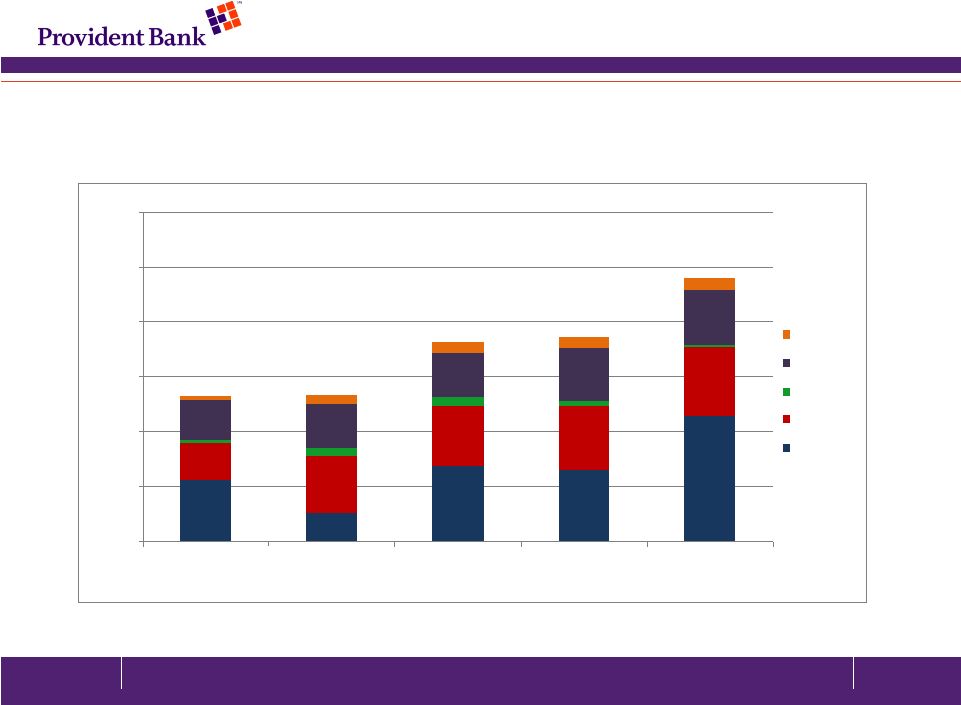

Non-Performing Loan Trend by Category

Non-Performing Loan Trend by Category

(Non-accrual and past due 90 days)

(Non-accrual and past due 90 days)

0

10000

20000

30000

40000

50000

60000

9/30/2009

9/30/2010

12/31/2010

3/31/2011

6/30/2011

Consumer

Residential

C&I

CRE

ADC

9 |

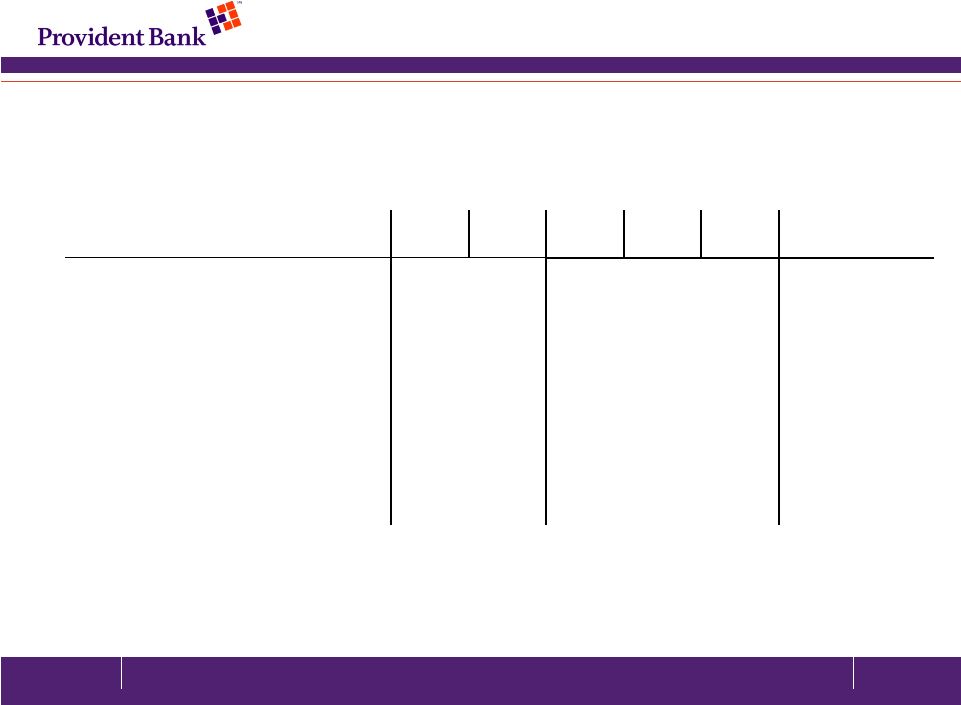

10

Credit Quality

Year Ended

9/30/09

Year Ended

9/30/10

1Q11

2Q11

3Q11

Thrift

Bank

Non-performing loans to

total loans

Net charge-offs to

average loans (1)

Loan loss reserve to total loans

1.76%

1.81%

1.83%

1.79%

1.74%

1.34%

1.53%

Non-performing assets & OREO

to total assets

Special Mention (MM)

$36.9

$37.9

$63.7

$27.1

$24.1

Substandard/Doubltful (MM)

$89.9

$130.7

$114.6

$113.9

$103.8

* Source: SNL

(1) Annualized

2.21%

0.71%

81%

1.46%

Peer As Of 3/31/11

1-5B MidAtlantic*

2.38%

2.85%

1.03%

61%

1.79%

1.55%

1.66%

1.48%

0.34%

0.37%

40%

71%

1.02%

1.35%

0.93%

Loan loss reserve to non-performing loans

0.62%

3.07%

1.58%

0.57%

115%

114%

2.13%

0.45%

86% |

Provident Bank Imperatives

Provident Bank Imperatives

Continue to improve credit metrics

Significantly improve efficiency levels

Grow revenue and earnings by expanding

client acquisitions

Overall Objective:

Become a Consistent Top Tier Performing Bank

11 |

Strategic Framework

Strategic Framework

Focus on high value client segments

Expand delivery channels and distribution to

increase client acquisitions

Execute effectively –

create a highly

productive performance culture

Proactively Manage Enterprise Risk

12 |

(PBNY) |