Attached files

2011

Second-Quarter Earnings Results

July 21, 2011

Exhibit 99.3 |

2

Introduction

Unless otherwise stated, we will be talking about results for the

second-quarter 2011 and comparing them with the same period in

2010

References to PMI volumes refer to PMI shipment data, unless

otherwise stated

Industry volume and market shares are the latest data available from

a number of internal and external sources

Organic volume refers to volume excluding acquisitions

Net revenues exclude excise taxes

OCI stands for Operating Companies Income, which is defined as

operating income before general corporate expenses and the

amortization of intangibles. OCI growth rates are on an adjusted

basis, which excludes asset impairment, exit and other costs

Data tables showing adjustments to net revenues and OCI for

currency, acquisitions, asset impairment, exit and other costs, free

cash flow calculations, adjustments to EPS, and reconciliations to

U.S. GAAP measures are at the end of today’s web cast slides and

are posted on our web site |

3

Forward-Looking and Cautionary Statements

This presentation and related discussion contain statements that, to

the extent they do not relate strictly to historical or current facts,

constitute “forward-looking statements”

within the meaning of the

Private Securities Litigation Reform Act of 1995. Such forward-looking

statements are based on current plans, estimates and expectations,

and are not guarantees of future performance. They are based on

management’s expectations that involve a number of business risks

and uncertainties, any of which could cause actual results to differ

materially from those expressed in or implied by the forward-looking

statements. PMI undertakes no obligation to publicly update or revise

any forward-looking statements, except in the normal course of its

public disclosure obligations. The risks and uncertainties relating to

the forward-looking statements in this presentation include those

described

under

Item

1A.

“Risk

Factors”

in

PMI’s

Form

10-Q

for

the

quarter ended March 31, 2011, filed with the Securities and Exchange

Commission |

4

Second-Quarter 2011 Results

Very strong financial performance:

Key drivers:

Excellent results in the Asia Region, led by Indonesia, Japan,

Korea and the Philippines

Higher prices in a wide range of markets

Q2,

2011

Results

(a)

Organic Cigarette Volume

+0.1%

Net

Revenues

+10.1%

Adjusted OCI

+16.5%

Adjusted Diluted EPS

+21.0%

(a)

All financial growth rates exclude currency. Net revenues and OCI growth rates also exclude

acquisitions Source: PMI Financials |

5

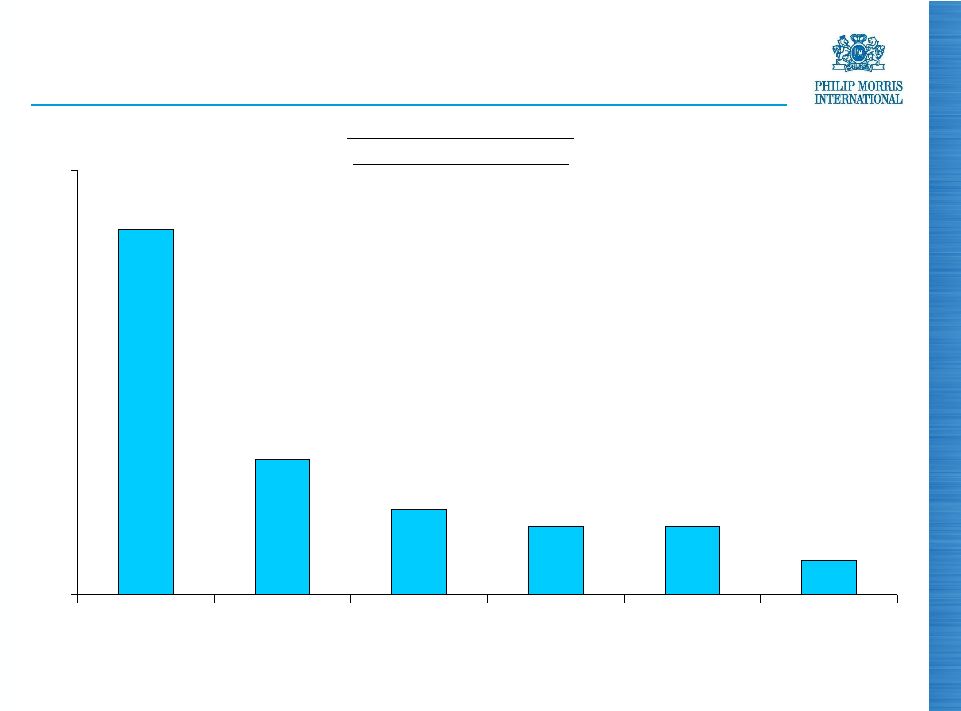

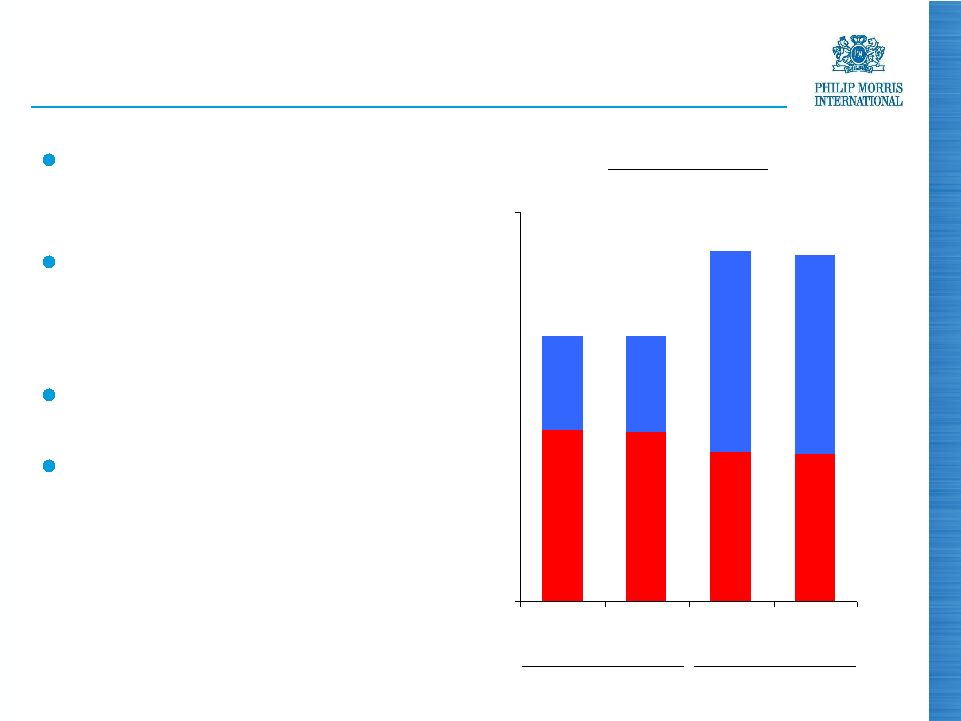

Pricing Variance

Pricing remains the key

driver of our increased

profitability

During the last three

months, PMI implemented

or announced price

increases in numerous

markets

Pricing situation in Spain

improved in July

Source: PMI Financials

($ mio)

790

1,070

Q2

Q1

449

453

341

617

0

600

1,200

2010

2011 |

6

PMI Market Share Developments

(%)

Top 30 PMI OCI Markets

Source: PMI Financials and estimates

36.2

38.5

30

35

40

Q2, 2010

Q2, 2011 |

7

Marlboro

Market Share Developments

Market Shares

Q2, 2010

Q2, 2011

Variance

EU

18.1 %

18.1 %

-

pp

EEMA

6.3

6.9

0.6

Asia

(a)

6.0

6.7

0.7

LA&C

13.6

13.7

0.1

Total

(a)(b)

8.9

9.3

0.4

(a)

Excluding PRC

(b)

Also excluding the USA

Source: PMI estimates |

8

L&M

Market Share Developments

Market Share Increases

Q2, 2011 vs. Q2, 2010

(pp)

Turkey

(a)

Netherlands

Germany

Poland

Slovakia

Egypt

4.3

1.6

0.8

1.0

0.8

0.4

(a)

QTD May

Source: A.C. Nielsen and PMI estimates

0

5 |

9

2011 EPS Guidance

Reported diluted EPS guidance for 2011 is being raised

by a further 15 cents to $4.70 to $4.80

Ten cents of the increase are attributable to

improvements in the business, largely Japan

Five cents relate to a more favorable currency outlook at

prevailing exchange rates

Compared to our adjusted diluted EPS of $3.87 in 2010,

this corresponds to a growth rate of approximately 21.5 to

24% at prevailing exchange rates, and approximately

15% to 17.5% excluding currency

Source: PMI forecasts |

10

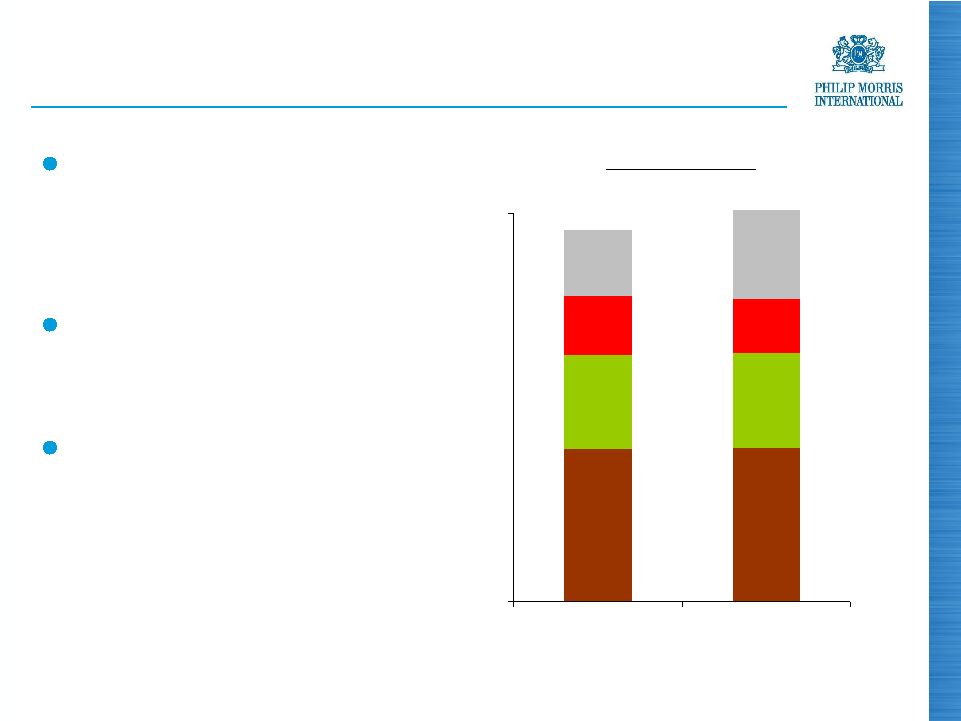

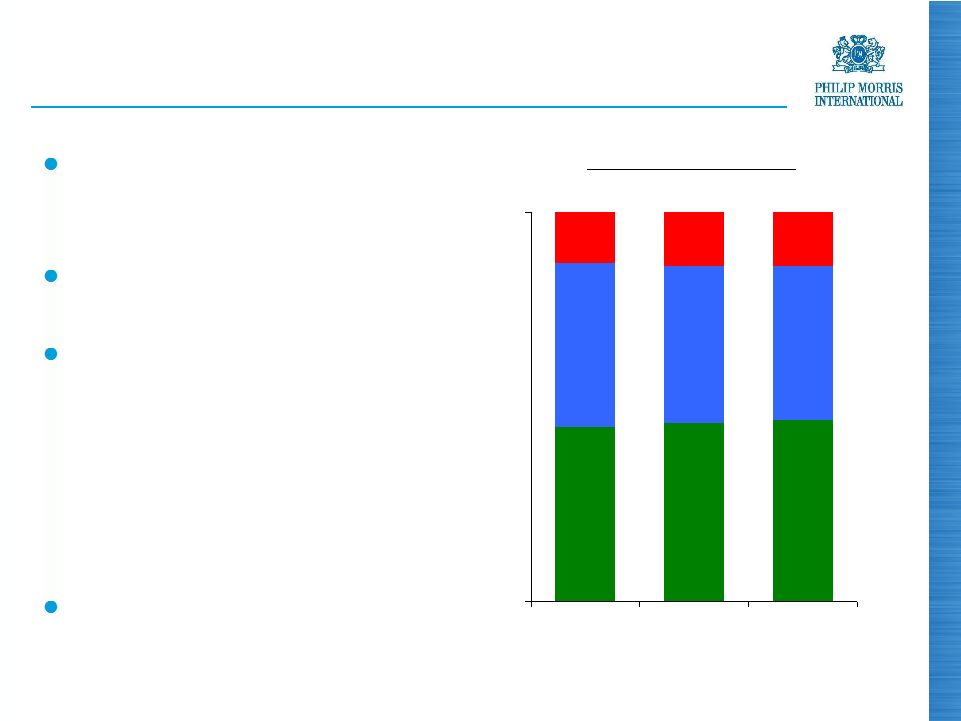

PMI Results by Region

Asia

(a)

Eastern Europe, Middle East & Africa Region

Source: PMI Financials

H1, 2011 Net Revenues:

$15.1 billion

H1, 2011 Adjusted OCI:

$6.9 billion

EEMA

(a)

EU

Latin America

& Canada

Latin America

& Canada

Asia

EU

EEMA

(a)

24%

35%

30%

11%

23%

36%

33%

8% |

11

Japan

Source: PMI Financials and Tobacco Institute of Japan

Total PMI

PMI shipments to Japan

reached 19.5 billion units

in Q2, 2011, up 1.9 billion,

or 11.0%

Second half impact subject

to complex interaction of

multiple factors

New base for industry

volume and PMI share will

not be clear until Q4, 2011,

at the earliest

Other

Lark

Marlboro

24.3

42.0

2010

2011

(%)

PMI Market Share

10.8

16.4

6.7

14.4

11.2

6.8

0

50

Q2

Q2 |

12

Indonesia

Strong economy and

relatively soft Q2, 2010,

drove industry volume up

13.9% in Q2, 2011

PMI volume up 20.7% to

22.6 billion units in the

same period

Strong profitability growth

in Asia’s second largest

market after China

Source: PMI estimates and PMI Financials

2010

2011

Other

Marlboro

Dji Sam Soe

Sampoerna A

28.6

30.2

(%)

PMI Market Share

Total PMI

11.7

11.8

7.3

7.3

4.2

4.5

0

30

Q2

Q2 |

13

Korea

Strong volume and share

growth momentum

continued, driven by

Marlboro

and

Parliament

Innovative Marlboro

menthol line extensions

contributed 1.0 share

points in Q2, 2011

PMI seeking to secure

excise tax reform

Source: PMI Financials and Hankook Research

(%)

2010

2011

Other

Parliament

Marlboro

16.6

19.9

Total PMI

PMI Market Share

6.8

8.6

5.5

6.7

0

20

Q2

Q2 |

14

EEMA Region

PMI’s organic volume declined by 3.4% due primarily to

Ukraine

Full-year Regional volume expected to be stable

Net revenues and adjusted OCI, excluding currency and

acquisitions, were up 3.6% and 4.8%, respectively in Q2

Profitability improvement driven by:

Increased volumes in Turkey and North Africa, and

Higher prices across the Region, most notably in Russia,

partly offset by

Lower volumes in Eastern Europe, and

Increased investments in business building initiatives in Russia

Source: PMI Financials |

15

Russia

Investments to support strong

performance of Parliament,

Chesterfield

and Bond Street,

and address Marlboro

issues

Market share down 0.1pp QTD

May, 2011, to 25.4%

PMI price increase announced

earlier this month

Limited consumer uptrading and

expected overall market decline

of 2-3% this year, in line with

2010

Russian Government has

approved new road map for

excise taxes

Source: A.C. Nielsen, PMI estimates and Russian Ministry of Finance |

16

Ukraine

Estimated industry volume

decline of 15% distorted by

trade loading in Q2, 2010

Total market expected to

stabilize during second half

PMI share down 3.5pp to

32.1% in the second quarter,

due to under-representation in

super-low segment. Issue

being addressed through

more attractive pricing of

Bond Street

Market

shares

of

Parliament

and

Marlboro

are

growing

Source: PMI estimates and A.C. Nielsen

(%)

2010

2011

Industry Price Segments

Premium

Mid/Low

2010

Super-

Low

44.9

45.7

46.5

42.1

40.5

39.5

13.8

14.0

13.0

0

100

H1

H2

H1 |

17

Turkey

Total market has stabilized

PMI volume up 12.1% in Q2,

2011

PMI reached a market share

of 44.6% in QTD May, 2011,

up 3.8pp

PMI share improvement in

all three price segments, led

by Parliament, Muratti

and

L&M

(%)

2010

2011

Total

PMI

Premium

Mid

Low

40.8

44.6

PMI Market Share

(a)

QTD May

Source: PMI estimates, PMI Financials and A.C. Nielsen

(a)

19.0

21.4

5.8

6.2

17.0

16.0

0

45

Q2

Q3

Q4

Q1

Q2 |

18

EU Region

Despite the issues that continued to impact Spain and to

a lesser extent Greece, the results in the second quarter

were more positive:

-

Industry volume declined by a modest 1.7%

-

PMI volume was 3.1% lower due to Greece, Poland and Spain

-

further 0.3pp to 6.6%

-

Net revenues and adjusted OCI were up 0.7% and 2.3%,

respectively, excluding currency and acquisitions

Source: PMI estimates and PMI Financials

Marlboro’s Regional

share

was

stable

at

18.1%

and

L&M

grew

a |

19

Cigarettes

Fine cut

Germany

Total industry volumes of

cigarettes and fine cut have

increased this year

PMI cigarette and fine cut

market shares are growing

Very strong performance of

L&M

Unit margin-enhancing price

increases implemented

Continued growth of “maxi”

pack segment

(a) Big packs (22-25 cigs) and Maxi packs (26+ cigs)

Source: PMI estimates

(%)

2011

2010

PMI Market Share

2011

(%)

Big and Maxi Packs

(a)

SoM

Maxi

Big

35.6

35.9

14.4

14.8

2009

2010

36.4

40.5

40.2

5.2

7.1

10.0

0

50

FY

FY

H1

0

40

H1

H1 |

20

Spain

Source: PMI estimates

(%)

2010

2011

PMI Market Share

High unemployment

Cigarette industry contracting at

double-digit rate and consumer

downtrading

Price competition exacerbated in

May/June this year

Recent developments indicate the

situation has improved

BUT

31.2

31.3

31.0

30.4

32.6

31.6

25

35

Q1

Q2

Q3

Q4

Q1

Q2 |

21

France and Italy

Industry cigarette volume up

1.8% in France and stable in

Italy during Q2, 2011

Following entry of Marlboro,

PMI became market leader in

fine cut in France in Q2 with a

share of 25.0%, up 5.6pp

High single digit profitability

increases in both markets

PMI has announced a price

increase of €0.10/pack in Italy

Source: PMI estimates

Other

Marlboro

40.8

40.9

(%)

54.1

53.4

2010

2011

2010

2011

France

France

Italy

PMI Market Shares

Total

PMI

26.3

26.0

23.0

22.7

14.5

14.9

31.1

30.7

0

60

Q2

Q2

Q2

Q2 |

22

Greece

Government has increased

Minimum Excise Tax from

75% to 100% of excise tax on

“WAP”

(Weighted Average

Price)

Tax pass-on at bottom of the

market (€2.40/20) is almost

€0.50/20

PMI has announced price

increase on L&M

25s from

€3.20 to €3.70 per pack

Price gap reduction should

help spur Marlboro

share

recovery

Source: Greek Ministry of Finance and PMI estimates

2010

2011

Marlboro

Market Share

(%)

19.7

19.4

18.7

20.0

19.3

21.7

15

25

Q1

Q2

Q3

Q4

Q1

Q2 |

23

Latin America & Canada Region

Regional volume down

4.8%, driven by impact of

tax-driven price increases

in Mexico and timing of

shipments in Brazil

Strong Marlboro

performance

Regional net revenues

grew by 5.8% and

adjusted OCI was up

8.8%, both excluding

currency and acquisitions

Source: PMI Financials and PMI estimates

(%)

2010

2011

Mexico

Marlboro

Market Share

Argentina

Marlboro

Market Share

(%)

2010

2011

48.2

52.0

45

50

55

Q2

Q2

23.4

24.0

20

25

Q2

Q2 |

24

Australia -

Plain Packaging

Australian Government appears intent on mandating the

implementation of plain packaging

Plain packaging will result in the illegal confiscation of our

very valuable trademarks and branded assets

PMI has served notice of its intention to file an arbitration

claim for compensation under the Hong Kong –

Australia

Bilateral Investment Treaty |

25

Adjusted OCI Margins

Second-Quarter

2011

(a)

2010

Variance

(a)

EU

48.9 %

48.1 %

0.8 pp

EEMA

42.1

41.6

0.5

Asia

46.2

39.8

6.4

LA&C

32.5

31.6

0.9

Total

44.6

42.1

2.5

(a)

Excluding currency and acquisitions

Source: PMI Financials |

26

Free Cash

Flow

(a)

Free cash flow equals net cash provided by operating activities less capital expenditures

Source: PMI Financials

Free Cash Flow

(a)

($ million)

+19.4%

Quarterly increase of $402

million, or 12.2%,

excluding currency

Driven mainly by our

excellent business results

For the first half, free cash

flow is up more than $1

billion to nearly $6.2 billion

Currency

3,296

3,934

236

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Q2, 2010

Q2, 2011 |

27

Share Repurchases

During the second quarter, PMI spent $1.5 billion to

purchase a further 22.7 million shares at an average price

of $68.32 per share

Since the March 2008 spin, 17.9% of shares outstanding

at that time have been repurchased

Source: PMI Financials |

28

Summary

Very strong second-quarter results

Adjusted diluted EPS growth of 21.0%, excluding

currency

Outlook is promising, with strong market share and

business momentum

Pricing remains the key driver of profitability, with Spain a

special case

Very limited input cost pressures and we expect to

exceed our $250 million annual productivity target

2011 reported diluted EPS guidance raised by another 15

cents to a range of $4.70-$4.80

We continue to use our growing cash flow to generously

reward our shareholders

Source: PMI Financials |

Questions & Answers

2011 Second-Quarter Results |

30

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Adjustments for the Impact of Currency and Acquisitions

For the Quarters Ended June 30,

($ in millions)

(Unaudited)

Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Less

Currency

Reported Net

Revenues

excluding

Excise Taxes &

Currency

Less

Acquisi-

tions

Reported Net

Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

Reported

Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

8,080

$

5,583

$

2,497

$

187

$

2,310

$

-

$

2,310

$

European Union

7,260

$

4,965

$

2,295

$

8.8%

0.7%

0.7%

4,603

2,591

2,012

55

1,957

-

1,957

EEMA

4,125

2,236

1,889

6.5%

3.6%

3.6%

5,146

2,210

2,936

222

2,714

3

2,711

Asia

3,903

1,780

2,123

38.3%

27.8%

27.7%

2,405

1,577

828

30

798

-

798

Latin America & Canada

2,095

1,341

754

9.8%

5.8%

5.8%

20,234

$

11,961

$

8,273

$

494

$

7,779

$

3

$

7,776

$

PMI Total

17,383

$

10,322

$

7,061

$

17.2%

10.2%

10.1%

Reported

Operating

Companies

Income

Less

Currency

Reported

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Reported

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

1,280

$

152

$

1,128

$

(1)

$

1,129

$

European Union

1,105

$

15.8%

2.1%

2.2%

835

11

824

-

824

EEMA

786

6.2%

4.8%

4.8%

1,398

145

1,253

1

1,252

Asia

845

65.4%

48.3%

48.2%

268

9

259

-

259

Latin America & Canada

238

12.6%

8.8%

8.8%

3,781

$

317

$

3,464

$

-

$

3,464

$

PMI Total

2,974

$

27.1%

16.5%

16.5%

2011

2010

% Change in Reported Operating

Companies Income

2011

2010

% Change in Reported Net Revenues

excluding Excise Taxes |

31

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Operating Companies Income to Adjusted Operating

Companies Income & Reconciliation of Adjusted Operating Companies Income

Margin, excluding Currency and Acquisitions For the Quarters Ended June

30, ($ in millions)

(Unaudited)

(a) For the calculation of net revenues excluding excise taxes, currency and

acquisitions, refer to previous slide Reported

Operating

Companies

Income

Less

Asset

Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Less

Currency

Adjusted

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Less

Asset Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Adjusted

Adjusted

excluding

Currency

Adjusted

excluding

Currency &

Acquisitions

1,280

$

(1)

$

1,281

$

152

$

1,129

$

(1)

$

1,130

$

European Union

1,105

$

-

$

1,105

$

15.9%

2.2%

2.3%

835

-

835

11

824

-

824

EEMA

786

-

786

6.2%

4.8%

4.8%

1,398

-

1,398

145

1,253

1

1,252

Asia

845

-

845

65.4%

48.3%

48.2%

268

-

268

9

259

-

259

Latin America & Canada

238

-

238

12.6%

8.8%

8.8%

3,781

$

(1)

$

3,782

$

317

$

3,465

$

-

$

3,465

$

PMI Total

2,974

$

-

$

2,974

$

27.2%

16.5%

16.5%

% Points Change

Adjusted

Operating

Companies

Income

excluding

Currency

Net Revenues

excluding

Excise Taxes &

Currency

(a)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Net Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

(a)

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

Adjusted

Operating

Companies

Income

Net Revenues

excluding Excise

Taxes

(a)

Adjusted

Operating

Companies

Income

Margin

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

1,129

$

2,310

$

48.9%

1,130

$

2,310

$

48.9%

European Union

1,105

$

2,295

$

48.1%

0.8

0.8

824

1,957

42.1%

824

1,957

42.1%

EEMA

786

1,889

41.6%

0.5

0.5

1,253

2,714

46.2%

1,252

2,711

46.2%

Asia

845

2,123

39.8%

6.4

6.4

259

798

32.5%

259

798

32.5%

Latin America & Canada

238

754

31.6%

0.9

0.9

3,465

$

7,779

$

44.5%

3,465

$

7,776

$

44.6%

PMI Total

2,974

$

7,061

$

42.1%

2.4

2.5

% Change in Adjusted Operating

Companies Income

2010

2011

2010

2011 |

32

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted

Diluted EPS, excluding Currency For the Quarters Ended June 30,

(Unaudited)

2011

2010

% Change

Reported Diluted EPS

1.35

$

1.07

$

26.2%

Adjustments:

Asset impairment and exit costs

-

-

Tax items

(0.01)

(0.07)

Adjusted Diluted EPS

1.34

$

1.00

$

34.0%

Less:

Currency impact

0.13

Adjusted Diluted EPS, excluding Currency

1.21

$

1.00

$

21.0% |

For

the Quarters Ended For the Six Months Ended

June 30,

June 30,

2011

2010

% Change

2011

2010

% Change

Net

cash

provided

by

operating

activities

(a)

4,120

$

3,465

$

18.9%

6,515

$

5,439

$

19.8%

Less:

Capital expenditures

186

169

345

319

Free cash flow

3,934

$

3,296

$

19.4%

6,170

$

5,120

$

20.5%

Less:

Currency impact

236

264

Free cash flow, excluding currency

3,698

$

3,296

$

12.2%

5,906

$

5,120

$

15.4%

33

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation

of

Operating

Cash

Flow

to

Free

Cash

Flow

and

Free

Cash

Flow,

excluding

Currency

For the Quarters and Six Months Ended June 30,

($ in millions)

(Unaudited)

(a) Operating Cash Flow |

34

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Adjustments for the Impact of Currency and Acquisitions

For the Six Months Ended June 30,

($ in millions)

(Unaudited)

(a) Includes the business combination in the Philippines ($105)

(b) Includes the business combination in the Philippines ($23)

Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Less

Currency

Reported Net

Revenues

excluding

Excise Taxes &

Currency

Less

Acquisi-

tions

Reported Net

Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

Reported

Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

14,495

$

9,997

$

4,498

$

81

$

4,417

$

-

$

4,417

$

European Union

14,008

$

9,529

$

4,479

$

0.4%

(1.4)%

(1.4)%

8,274

4,575

3,699

26

3,673

-

3,673

EEMA

7,481

3,846

3,635

1.8%

1.0%

1.0%

9,434

4,175

5,259

350

4,909

108

(a)

4,801

Asia

7,465

3,469

3,996

31.6%

22.8%

20.1%

4,561

2,953

1,608

54

1,554

-

1,554

Latin America & Canada

4,016

2,569

1,447

11.1%

7.4%

7.4%

36,764

$

21,700

$

15,064

$

511

$

14,553

$

108

$

14,445

$

PMI Total

32,970

$

19,413

$

13,557

$

11.1%

7.3%

6.6%

Reported

Operating

Companies

Income

Less

Currency

Reported

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Reported

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

2,286

$

131

$

2,155

$

(1)

$

2,156

$

European Union

2,167

$

5.5%

(0.6)%

(0.5)%

1,557

(1)

1,558

-

1,558

EEMA

1,556

0.1%

0.1%

0.1%

2,491

247

2,244

24

(b)

2,220

Asia

1,569

58.8%

43.0%

41.5%

519

10

509

-

509

Latin America & Canada

455

14.1%

11.9%

11.9%

6,853

$

387

$

6,466

$

23

$

6,443

$

PMI Total

5,747

$

19.2%

12.5%

12.1%

% Change in Reported Net Revenues

excluding Excise Taxes

2011

2010

% Change in Reported Operating

Companies Income

2011

2010 |

35

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Operating Companies Income to Adjusted Operating

Companies Income & Reconciliation of Adjusted Operating Companies Income

Margin, excluding Currency and Acquisitions For the Six Months Ended June

30, ($ in millions)

(Unaudited)

(a) Includes the business combination in the Philippines ($23)

(b) For the calculation of net revenues excluding excise taxes, currency and

acquisitions, refer to previous slide Reported

Operating

Companies

Income

Less

Asset

Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Less

Currency

Adjusted

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Less

Asset Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Adjusted

Adjusted

excluding

Currency

Adjusted

excluding

Currency &

Acquisitions

2,286

$

(12)

$

2,298

$

131

$

2,167

$

(1)

$

2,168

$

European Union

2,167

$

-

$

2,167

$

6.0%

-

%

-

%

1,557

(2)

1,559

(1)

1,560

-

1,560

EEMA

1,556

-

1,556

0.2%

0.3%

0.3%

2,491

(2)

2,493

247

2,246

24

(a)

2,222

Asia

1,569

-

1,569

58.9%

43.1%

41.6%

519

(1)

520

10

510

-

510

Latin America & Canada

455

-

455

14.3%

12.1%

12.1%

6,853

$

(17)

$

6,870

$

387

$

6,483

$

23

$

6,460

$

PMI Total

5,747

$

-

$

5,747

$

19.5%

12.8%

12.4%

% Points Change

Adjusted

Operating

Companies

Income

excluding

Currency

Net Revenues

excluding

Excise Taxes &

Currency

(b)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Net Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

(b)

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

Adjusted

Operating

Companies

Income

Net Revenues

excluding Excise

Taxes

(b)

Adjusted

Operating

Companies

Income

Margin

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

2,167

$

4,417

$

49.1%

2,168

$

4,417

$

49.1%

European Union

2,167

$

4,479

$

48.4%

0.7

0.7

1,560

3,673

42.5%

1,560

3,673

42.5%

EEMA

1,556

3,635

42.8%

(0.3)

(0.3)

2,246

4,909

45.8%

2,222

4,801

46.3%

Asia

1,569

3,996

39.3%

6.5

7.0

510

1,554

32.8%

510

1,554

32.8%

Latin America & Canada

455

1,447

31.4%

1.4

1.4

6,483

$

14,553

$

44.5%

6,460

$

14,445

$

44.7%

PMI Total

5,747

$

13,557

$

42.4%

2.1

2.3

2010

2011

2010

2011

% Change in Adjusted Operating

Companies Income |

36

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS

For the Year Ended December 31,

(Unaudited)

2010

Reported Diluted EPS

3.92

$

Adjustments:

Tax items

(0.07)

Asset impairment and exit costs

0.02

Adjusted Diluted EPS

3.87

$

|

2011

Second-Quarter Results July 21, 2011 |