Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AgFeed Industries, Inc. | v228787_8k.htm |

Exhibit 99.1

AgFeed Industries, Inc.

Presentation

to

The GHS Conference 2011

NASDAQ: FEED

NYSE Alternext: ALHOG

San Francisco, CA

18 July 2011

Safe Harbor Statement

This presentation contains “forward -looking statements ” within the meaning of the “safe-harbor” provisions of the Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including changes from anticipated levels of sales, future national or regional economic and competitive conditions, changes in relationships with customers, access to capital, difficulties in developing and marketing new products, marketing existing products, customer acceptance of existing and new products, and other factors. Accordingly, although the Company believes that the expectations reflected in such forward -looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. The Company has no obligation to update the forward -looking information contained in this presentation .

Vision

Aligning global production resources to provide a reliable supply of safe pork and pork products

Mission

Establish AgFeed as a leader in supplying an expanding base of global customers with the highest quality pork while demonstrating leadership in food safety, production efficiency, sustainability and environmental stewardship

AgFeed: An Overview

An international agribusiness aligning global production resources .

Animal Nutrition

Hog Production

AgFeed Industries, Inc.

An International Agribusiness

Harvest

AgFeed: Transformation

AgFeed Industries, Inc. is a NASDAQ listed international agribusiness operating in the United States & China; ticker symbol FEED. It is also listed in Europe on the NYSE Alternext: ALHOG

During the winter and spring of 2010, the Board embarked on a series of initiatives to fully transform the Company . The strategy was to capture the additional revenue and profit associated with the full supply/value chain available to a vertically integrated market participant

These initiatives were signaled by AgFeed ’s announcement that it would be entering the harvest/processing segment of the pork business and dramatically demonstrated by the acquisition of M2P2 - a leading U.S. hog production company in September 2010

One year after embarking on this strategic plan, we have transformed; our Board of Directors, Executive Management, base of operations & revenue, upgraded our information systems and audit team are now poised for the next steps in the ongoing transformation of the Company

Last week, we announced the next significant step in this process: the agreement to acquire operating businesses in the United States to anchor our harvest and processing operations . These are the necessary precursor to executing our Global Markets initiative, and the final step in the integrated strategy devised in early 2010.

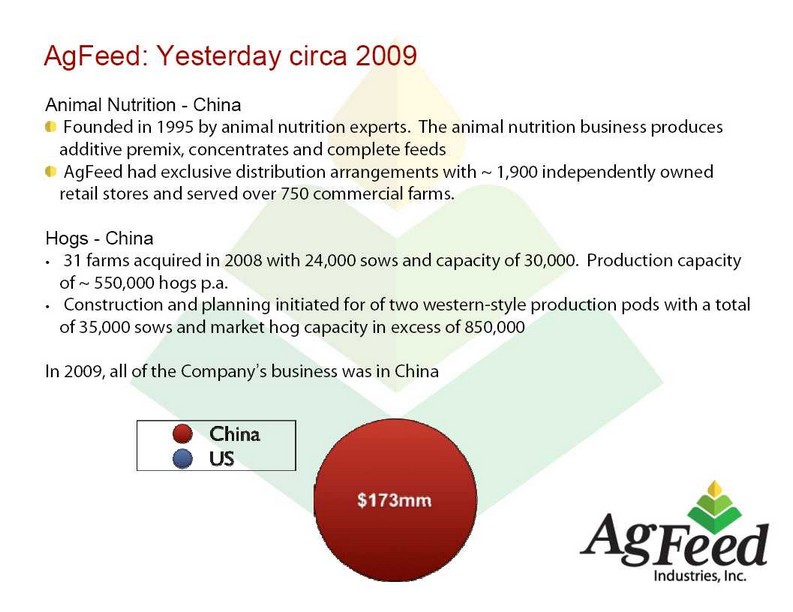

AgFeed: Yesterday circa 2009

Animal Nutrition - China

Founded in 1995 by animal nutrition experts . The animal nutrition business produces additive premix, concentrates and complete feeds AgFeed had exclusive distribution arrangements with ~ 1,900 independently owned retail stores and served over 750 commercial farms.

Hogs - China

|

•

|

31 farms acquired in 2008 with 24,000 sows and capacity of 30,000. Production capacity of ~ 550,000 hogs p.a.

|

|

•

|

Construction and planning initiated for of two western-style production pods with a total of 35,000 sows and market hog capacity in excess of 850,000

|

In 2009, all of the Company ’s business was in China

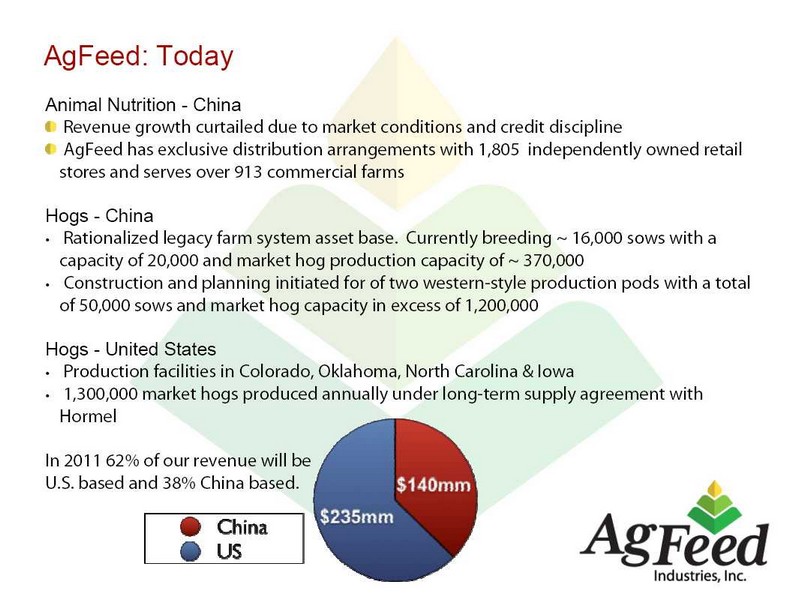

AgFeed: Today

Animal Nutrition - China

Revenue growth curtailed due to market conditions and credit discipline

AgFeed has exclusive distribution arrangements with 1,805 independently owned retail stores and serves over 913 commercial farms

Hogs - China

|

•

|

Rationalized legacy farm system asset base. Currently breeding ~ 16,000 sows with a capacity of 20,000 and market hog production capacity of ~ 370,000

|

|

•

|

Construction and planning initiated for of two western-style production pods with a total of 50,000 sows and market hog capacity in excess of 1,200,000

|

Hogs - United States

|

•

|

Production facilities in Colorado, Oklahoma, North Carolina & Iowa

|

|

•

|

1,300,000 market hogs produced annually under long-term supply agreement with Hormel

|

In 2011 62% of our revenue will be

U.S. based and 38% China based.

AgFeed: Tomorrow

Hogs - United States

Existing production facilities in Colorado, Oklahoma, North Carolina & Iowa. Expect 1,300,000 market hogs produced annually under long-term supply agreement with Hormel

Hogs - China

|

•

|

Legacy farm system anticipates breeding approximately 20,000 sows and annual market hog output approaching 400,000.

|

|

•

|

Ongoing construction of of two western-style production pods with a currently planned total of 50,000 sows and market hog capacity in excess of 1,200,000.

|

Harvest & Processing - United States

|

•

|

Recently announced potential acquisitions represent entry to this segement and platform for expansion in the U.S. & China.

|

Animal Nutrition - China

|

•

|

Continued market presence with a dwindling proportion of sales devoted to our own hog production systems

|

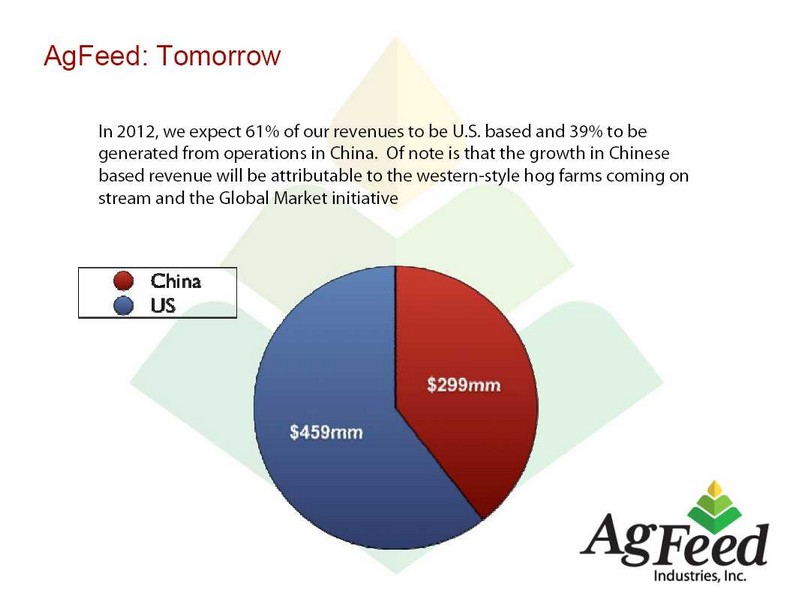

AgFeed: Tomorrow

In 2012, we expect 61% of our revenues to be U.S. based and 39% to be generated from operations in China. Of note is that the growth in Chinese based revenue will be attributable to the western -style hog farms coming on stream and the Global Market initiative

Global Pork Market: Macro Factors

Pork is a staple of human consumption . Globally pork is consumed in significantly greater volume than any other meat

In 2010, approximately 1.2 billion hogs were slaughtered globally yielding close to 110,00,000 metric tons of pork

One half of global hog production is in China. Second largest producer is the U.S. with 10% of global production

Global demand is expected to increase by approximately 23% by 2020, over half of which will be driven by China

Meat demand and production strains continue to increase as China’s 250 million middle class grows in addition to rapid urbanization

Sources include: USDA, Rabobank, China Research and Intelligence, Access Asia Limited, Institute for Rural America & eFeedlink .com

Global Pork Market: Macro Factors

•Pork exporters are lead by the United States, EU, Canada & Brazil with the U.S., Brazil and Canada being the low cost producers

•20% of U.S. hog production is dedicated to export providing an export market share of 38%

•Management expects domestic Chinese demand to grow by 7% - 8% p.a., thereby rapidly exceeding domestic production capacity and leading to growing export opportunities

Sources include: USDA, Rabobank, China Research and Intelligence, Access Asia Limited, Institute for Rural America & eFeedlink .com

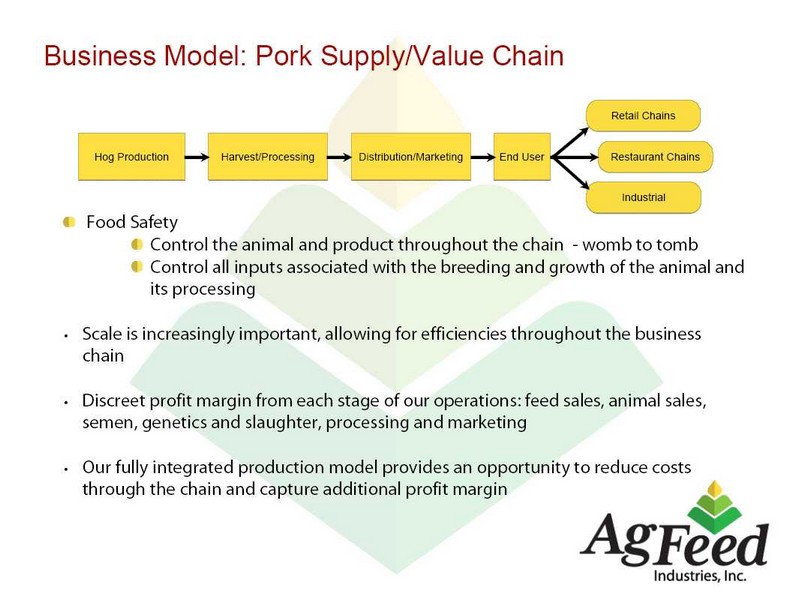

Business Model: Pork Supply/Value Chain

Food Safety

Control the animal and product throughout the chain - womb to tomb Control all inputs associated with the breeding and growth of the animal and its processing

|

•

|

Scale is increasingly important, allowing for efficiencies throughout the business chain

|

|

•

|

Discreet profit margin from each stage of our operations: feed sales, animal sales, semen, genetics and slaughter, processing and marketing

|

|

•

|

Our fully integrated production model provides an opportunity to reduce costs through the chain and capture additional profit margin

|

Hog Production: U.S. & China

Our U. S. production system, M2P2, is an industry leader in terms of all productivity and efficiency metrics and will produce over 1,300,000

M2P2 provides a base of expertise, technology and human capital which can be leveraged over a broader U.S production base and exported to our Chinese production system

Legacy hog production system in China, under M2P2 management, is showing greater operating discipline and efficiency

Flagship western -style farm in China was populated in Q1 2011 and will deliver hogs to market in Q1 2012

20,000 sows are expected to be producing within our western -style production system by 2013

Harvest & Processing: Pending Acquisitions

Harvest and Processing acquisitions announced last week represent AgFeed ’s next step in deploying a fully integrated hog production system

These acquisitions will add over $180 million in U.S. based revenue and over $13 million of EBITDA to our results annually

The acquisition of talented management teams will be instrumental to the development of Harvest facilities tied to our western -style farms in China

We anticipate building harvest facilities that will be located and scaled to serve the production output of our western -style farms in Dahua and Xinyu

We expect the fully integrated production model assuring verifiably safe pork and standard processing will be attractive to major international distributors and processors targeting the Chinese and south Asian markets

Global Markets:

Marketing & Distribution

AgFeed ’s Global Market initiative represents the final step in our strategic actions to develop the company into an integrated market participant

Align our global production resources to become a leading supplier to global customers

Demand pull strategy for institutional, food service and high end retail markets

Institutional requirements for quantity, quality and safety throughout the supply chain

Protection of “brand equity” vital to our customers

Leverage our Chinese “domestic ” footprint to capitalize on the significant growth available through exports to China

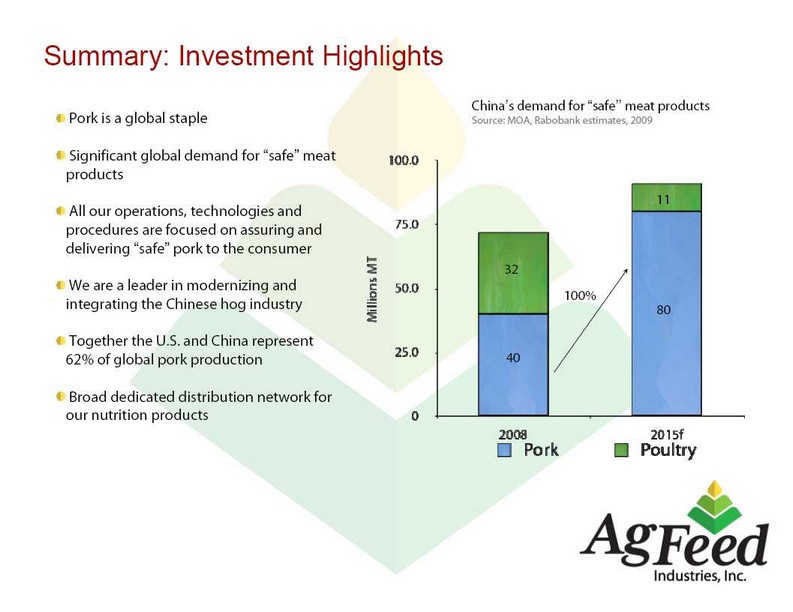

Summary: Investment Highlights

Pork is a global staple

Significant global demand for “safe” meat products

All our operations, technologies and procedures are focused on assuring and delivering “safe” pork to the consumer

We are a leader in modernizing and integrating the Chinese hog industry

Together the U.S. and China represent 62% of global pork production

Broad dedicated distribution network for our nutrition products

China’s demand for “safe’’ meat products

Source: MOA, Rabobank estimates, 2009

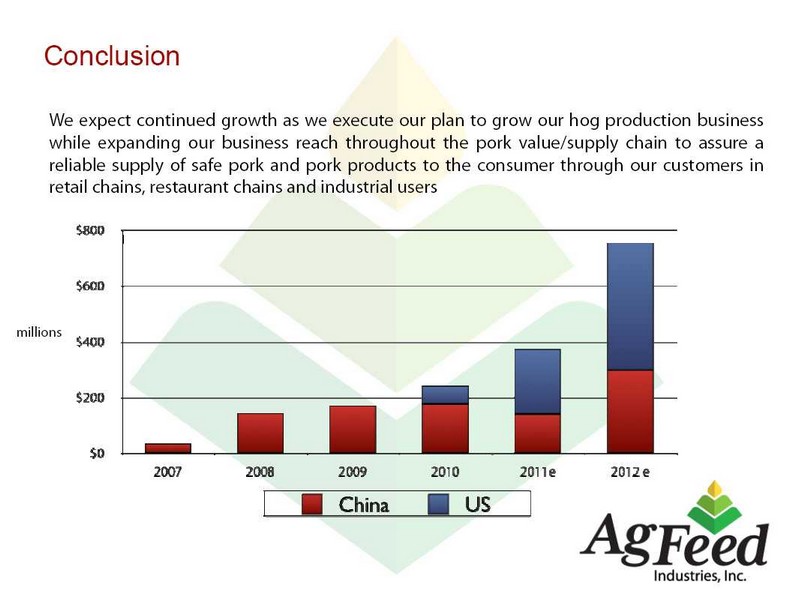

Conclusion

We expect continued growth as we execute our plan to grow our hog production business while expanding our business reach throughout the pork value/supply chain to assure a reliable supply of safe pork and pork products to the consumer through our customers in retail chains, restaurant chains and industrial users