Attached files

| file | filename |

|---|---|

| EX-3.(I)1 - EX-3.(I)1 - AgFeed Industries, Inc. | v214718_ex3-1.htm |

| EX-32.1 - EX-32.1 - AgFeed Industries, Inc. | v214718_ex32-1.htm |

| EX-21.1 - EX-21.1 - AgFeed Industries, Inc. | v214718_ex21-1.htm |

| EX-31.2 - EX-31.2 - AgFeed Industries, Inc. | v214718_ex31-2.htm |

| EX-32.2 - EX-32.2 - AgFeed Industries, Inc. | v214718_ex32-2.htm |

| EX-23.1 - EX-23.1 - AgFeed Industries, Inc. | v214718_ex23-1.htm |

| EX-31.1 - EX-31.1 - AgFeed Industries, Inc. | v214718_ex31-1.htm |

| EX-23.2 - AgFeed Industries, Inc. | v214718_ex23-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to _____________

Commission File No. 001-33674

AGFEED INDUSTRIES, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

|

20-2597168

|

|

(State or Other Jurisdiction

of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

Rm. A1001-1002, Tower 16

Hengmao Int’l Center, 333 S. Guangchang Rd.

Nanchang, Jiangxi Province, China 330003

(Address of Principal Executive Offices, including zip code)

011-86-0791-6669093

(Registrant’s Telephone Number, Including Area Code)

Securities registered under Section 12(b) of the Exchange Act:

|

Common Stock, $0.001 par value

|

|

The Nasdaq Stock Market LLC

|

|

(Title of each class)

|

|

(Name of each exchange on which registered)

|

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405) during the preceding 12 months (or for such period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

|

Large accelerated filer ¨

|

Accelerated filer x

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company ¨

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

The aggregate market value of the voting stock and non-voting common equity held by non-affiliates of the registrant, computed by reference to the price at which the common stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter, is $114,161,575.

The number of shares of Common Stock outstanding as of March 15, 2011 was 55,777,843.

Documents Incorporated by Reference: Portions of the registrant’s proxy statement for its 2011 annual meeting of shareholders, which the registrant expects to file with the Securities and Exchange Commission (“SEC”) within 120 days after December 31, 2010 are incorporated by reference into Part III of this annual report.

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

1

|

|

|

Item 1.

|

Business.

|

1

|

|

Item 1A.

|

Risk Factors

|

17

|

|

Item 1B.

|

Unresolved Staff Comments.

|

31

|

|

Item 2.

|

Properties.

|

31

|

|

Item 3.

|

Legal Proceedings.

|

31

|

|

Item 4.

|

(Removed and Reserved).

|

31

|

|

PART II

|

32

|

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities.

|

32

|

|

Item 6.

|

Selected Financial Data.

|

33

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

34

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

46

|

|

Item 8.

|

Financial Statements and Supplementary Data.

|

47

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

|

47

|

|

Item 9A.

|

Controls and Procedures

|

47

|

|

Item 9B.

|

Other Information.

|

49

|

|

PART III

|

50

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

50

|

|

Item 11.

|

Executive Compensation.

|

50

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters.

|

50

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

50

|

|

Item 14.

|

Principal Accounting Fees and Services.

|

50

|

|

PART IV

|

50

|

|

|

Item 15.

|

Exhibit, Financial Statement Schedules.

|

50

|

|

SIGNATURES

|

||

|

EXHIBITS

|

||

The statements contained in this annual report that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to our financial condition, results of operations and business, which can be identified by the use of forward-looking terminology, such as “estimates,” “projects,” “plans,” “believes,” “expects,” “anticipates,” “intends,” or the negative thereof or other variations thereon, or by discussions of strategy that involve risks and uncertainties. Management wishes to caution the reader of the forward-looking statements that such statements, which are contained in this annual report, reflect our current beliefs

with respect to future events and involve known and unknown risks, uncertainties and other factors, including, but not limited to, economic, competitive, regulatory, technological, key employee, and general business factors affecting our operations, markets, growth, services, products, licenses and other factors discussed in our other filings with the Securities and Exchange Commission (“SEC”), and that these statements are only estimates or predictions. No assurances can be given regarding the achievement of future results, as actual results may differ materially as a result of risks facing us, and actual events may differ from the assumptions underlying the statements that have been made regarding anticipated events.

These forward-looking statements are subject to numerous assumptions, risks and uncertainties that may cause our actual results to be materially different from any future results expressed or implied by us in those statements. Some of these risks are described in Item 1A. “Risk Factors” and Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this annual report.

These risk factors should be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. All written and oral forward-looking statements made in connection with this annual report that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Given these uncertainties, we caution investors not to unduly rely on our forward-looking statements, each of which speaks only as of the date made, even if subsequently made available on our website or otherwise. We do not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward- looking statements

to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events. Further, the information about our intentions contained in this document is a statement of our intention as of the date of this document and is based upon, among other things, the existing regulatory environment, industry conditions, market conditions and prices, the economy in general and our assumptions as of such date. We may change our intentions, at any time and without notice, based upon any changes in such factors, in our assumptions or otherwise.

PART I

In this Annual Report on Form 10-K, we will refer to AgFeed Industries, Inc., a Nevada corporation, as “AgFeed,” “our company,” “we,” “us,” and “our.”

Item 1. Business.

OVERVIEW

We are a Nevada corporation engaged in the animal nutrition and commercial hog producing businesses in the People’s Republic of China (“China”) through our indirect operating subsidiaries. We were incorporated on March 30, 2005 in Nevada. Since October 31, 2006, our principal place of business has been based in China. As a result of a merger into a wholly-owned subsidiary, we changed our name to AgFeed Industries, Inc. on November 17, 2006. Our principal executive offices are located at Rm. A1001-1002, Tower 16, Hengmao Int’l Center, 333 S. Guangchang Rd., Nanchang, Jiangxi Province, China 330003. Our telephone number is +86-0791-6669093. Our website is http://www.agfeedinc.com.

Our animal nutrition business consists of the research and development, manufacture, marketing and sale of additive premix (“premix”), concentrates and complete feed for use in the domestic animal husbandry markets, primarily for hog production in China. We have been in the premix feed business since 1995 and now operate five premix feed manufacturing facilities located in the provinces of Jiangxi, Guangxi, Shandong and Hainan and the municipality of Shanghai.

We entered the hog breeding and production business in November 2007. In this business, we mainly produce hogs for slaughter and sell breeding stock. From November 2007 through late 2008 we acquired one breeder farm and 29 meat hog producing farms in the Jiangxi, Shanghai, Hainan, Guangxi and Fujian provinces. In November 2009, we opened our first farm based on Western hog production technology in the city of Da Hua, Guangxi Province. In December 2009, we began stocking a second breeder farm in the city of Gangda, Guangxi Province. We also completed the construction of a nucleus farm in the city of Wuning, Jiangxi Province in November 2009. This farm will be developed and operated by Hypor AgFeed Breeding Company Inc., a joint venture with Hypor, B.V., a Hendrix Genetics Company, entered into in December 2009. We

own two breeder farms and 29 meat hog producing farms in the Jiangxi, Shanghai, Hainan, Guangxi and Fujian provinces.

1

On April 2009, we formed a strategic alliance with Hypor. The alliance has four phases: (1) upgrading the genetic base of our existing herds; (2) creating a sow farrow-to-finish nucleus facility to supply superior breeding stock to be utilized in our production systems and for sale to outside commercial hog farms; (3) establishing high health, top quality genetics to the farms being developed by AgFeed International Protein; and (4) developing gene transfer centers to maximize the use of the top performing boars in China across our production system. On December 17, 2009, we formed Hypor AgFeed Breeding Company with Hypor to develop, operate and market a genetic nucleus farm in Wuning, China. Hypor AgFeed Breeding is owned 85% indirectly by us and 15% by Hypor.

On July 2009, we formed a joint venture, AgFeed International Protein Technology Corp., which focuses on enhancing hog production systems for Chinese and other Pan Asian clients based on modern western standards to increase productivity and ensure the highest bio-security health standards in the Pan Asian hog industry. The joint venture was formed to take advantage of the commercialization and consolidation of the hog industry being fostered by the Chinese central and local governments. We are the joint venture’s first client. AgFeed International Protein is owned 84.9% indirectly by us and 15.1% by certain other individuals, including some of our affiliates.

We entered the hog breeding and production business in the United States in September 2010 with the acquisition of M2 P2, LLC (“M2P2”). The purchase of M2P2 allowed the Company to establish hog farm operations in the United States and obtain a breadth and depth of human resources that it expects to be instrumental in the development of the Company’s western-style hog farms in China. M2P2 operates hog farms and facilities in Colorado, Oklahoma, North Carolina and Iowa.

Market Dynamics

We expect that both of our Chinese businesses, animal nutrition and hog production, will witness significant consolidation going forward due to the convergence of government policies and natural market forces, with food safety driving this change. Investment opportunities will expand as the mode of operation in both animal husbandry and animal feed production evolve from traditional modes to modern, industrial scale and highly professional enterprises. This will lead to a much smaller number of larger integrated market participants. Scale will become increasingly important in both the hog and feed businesses.

The dual imperatives of government regulation to assure food safety and the security of the food chain together with heightened consumer demand for high quality and reliably safe food will act to drive consolidation and market growth for those producers that are positioned to comply with the evolving regulatory and consumer market. The growing urbanization of China will further consolidate markets and will require industrial scale market participants in order to efficiently and effectively serve a much more concentrated distribution system of supermarkets.

Falling provincial barriers and value added tax reforms will aid the consolidation within our industry. Pork remains not only a staple of the Chinese diet but also the primary source of protein. We have strategically positioned our business units both operationally and financially to take advantage of these market dynamics and to assure the quality and safety of the pork supplied to the Chinese consumer.

ANIMAL NUTRITION BUSINESS

We manufacture, distribute, market and sell three main product lines - premix, concentrates and complete feed for use in all stages of a pig’s life. We conduct these operations through our subsidiaries, Shandong AgFeed Agribusiness Co., Ltd. (“Shandong Feed”), Hainan HopeJia Feed Co., Ltd. (“HopeJia”), Nanchang AgFeed Animal Feed Co., Ltd. (“Nanchang Feed”), Shanghai AgFeed Animal Feed Co., Ltd. (“Shanghai Feed”), and Nanning AgFeed Animal Feed Co., Ltd. (“Nanning Feed”) (collectively, our feed operating companies). We also provide educational, technical and veterinary support to our customers and distributor base.

Our feed operating companies operate manufacturing facilities in the provinces of Jiangxi, Guangxi, Shandong and Hainan and the municipality of Shanghai, primarily serving the hog industry. Each feed operating company independently conducts local marketing and sales efforts while our operation in Jiangxi province is primarily responsible for our ongoing research and development efforts.

2

Livestock producers may directly buy animal feed in finished form, referred to as “complete” feed, which contains a concentrate of additive premix and the foundational grains in one complete package, or, they may choose to buy the premix and then combine it with protein, corn, hay, wheat and other elements readily available in the market to make their own complete feed. Premix provides the essential amino acids and binder necessary for proper absorption of protein by pigs. Feeding pigs a balanced diet is an essential part of the pork profit equation, and the quality of feed and nutrition has a measurable effect on profits. Feed represents a significant portion of hog production expenses, generally in the range of 65% to 75% of total costs.

Our total feed output in 2010 was approximately 177,000 metric tons (117,000 metric tons in 2009), consisting of 34,000 metric tons of premix, 36,000 metric tons of concentrates and 107,000 metric tons of complete feed. Our 2010 output represents a 51% increase over our 2009 feed output. Our 2010 revenues grew to $120 million from $78 million in 2009, with revenues from our affiliated hog farms accounting for $14 million and $14 million, respectively.

It is typical for a feed company to pass on ingredient price increases or decreases to the customer that materially influence revenues and cost of goods sold without materially impacting the net gross margin of the business.

Additive Premix

According to the different growth stages of a pig, different additives are necessary to accelerate the growth of the animal and provide safe products for consumption. Premix is composed mainly of vitamins, trace minerals, medicaments and feed supplements. We market 30 different brands of premix that are priced from standard to premium to satisfy wide-ranging customer demand. Within each brand there are 8 different mixes that correspond to the different stages of a pig’s life cycle: newborn to 15 kg, 15-30 kg, 30-60 kg, market ready, over 60 kg boar, replacement gilt, mating/pregnant, and lactating. Additionally, we add value to our products by customizing the premix to specific customer needs. Large-scale pig farms are typically the biggest consumers of our premix. Our veterinarians work with these large pig

farms to determine the optimal formulation of feed.

Premix sales represent approximately 19% of our annual feed revenues, including sales to hog farms owned, operated or controlled by our affiliates, and carry a gross profit margin of approximately 27%. Our ability to formulate customized premix fodder to meet customer specifications enables us to charge a premium for our products. We achieved an average price of $679/metric ton for our premix during the twelve months ended December 31, 2010. We are also able to justify premium pricing due to the strong brand names we have established in our markets through our hands-on after market support and the market-recognized superiority of our products’ effectiveness, resulting from our research and development program. Large-scale commercial hog farms (producing 10,000 market hogs or more per year) are willing to pay

a premium for more effective products to produce healthy piglets, control disease and market profitable pork products.

Concentrate Feed

Concentrates, mainly composed of high protein, vitamins, amino acids, minerals and antibiotics, are designed to supply nutrition necessary for pigs, including piglets weaned to 15 kg and lactating pigs. We produce different brands of concentrates with different formulations catering to different customer needs and climate.

Concentrates include premix and the protein for all phases of a pig’s life cycle. The farmer adds the carbohydrate (typically corn) to make a complete ration. This allows farmers the ability to use their own grown corn or other carbohydrate source.

Sales of concentrates represent approximately 33% of our annual feed revenues, including sales to hog farms owned, operated or controlled by our affiliates, and carry a gross profit margin of approximately 16%. We have the ability to formulate concentrates to meet various nutrient specifications. The average price of our concentrates during the twelve months ended December 31, 2010 was $1,081/metric ton.

Complete Feed

Complete feed consists of premix, protein and carbohydrates, providing a total feed ration for the animal. Commercial farmers favor the utilization of complete feeds in order to better provide the nutrient needs for the various stages of the life cycle of the pig. Complete feeds offer consistent particle size, guarantee proper mixing distribution of ingredients and eliminate the need for commercial farmers to maintain inventories of corn and soybean meal.

3

We produce piglet complete feed designed to both nourish and protect newborns. This product is composed primarily of proteins, such as fishmeal and soybean (30%), and raw material grains, such as corn and chaff (roughly 65%). Local climate and environment also influence the formulation of the piglet blend. We intend to expand our product offerings to meet the growing demand for complete feed for all stages of a pig’s life cycle as more and more small farms and mid-size farms are moving to purchase complete feed.

Complete feed sales represent approximately 48% of our annual feed revenues, including sales to our hog farms, and carry a gross profit margin of approximately 12%. We have the ability to formulate complete feeds to meet various nutrient specifications, including piglet feeds. The average price of our complete feed during the nine twelve months ended December 31, 2010 was $544/metric ton.

Market Information

In its Research Report on Chinese Feed Industry, 2009-2010, China Research and Intelligence reported that China’s feed manufacturing industry is the world’s second largest feed producer and is becoming an important industry in China. It is predicted that Chinese total feed production will surpass that of the United States to rank first globally within five years. Further, the report states the feed industry grew from 96 million metric tons in 2004 to 140 million metric tons in 2009 or from RMB 243 billion ($36.3 billion) in 2004 to RMB 401 billion ($59.9 billion) in 2009. Specific to the hog feed component, the report indicated that pig feed grew from 33.5% of all feed in China in 2008 to 35.8% of all feed in China in 2009, an increase of 6.7%. The report predicts that the entire feed market will grow

from RMB 420 billion ($62.8 billion) in 2010 to RMB 580 billion ($86.7 billion) in 2014, an increase of 38%. Based upon the continuing decline in demand for meat and egg poultry feed, the report further predicts that pig feed demand is expected to continue to experience stable growth.

The feed industry in China, initially developed during the 1980s, was transformed by the adoption of feed and feed additives regulations in the early 1990s. These regulations emphasized labeling standards for the different grades of product. These standards assisted in regulating the feed industry’s expansion through eliminating substandard products and fraudulent labeling. In 2009, the new food safety law strengthened the government’s supervisory powers, unified food safety standards, changed the licensing system, and increased liabilities for non-compliance.

Management views the feed industry as an important component of the adjustment of China’s agricultural and rural economic structure. A feed industry that is highly efficient and produces safe, high quality product is the foundation for the sustainable development of an animal husbandry industry capable of safely feeding China’s growing urban population.

Chinese consumers consume pork as their primary source of meat and therefore consume more pork each year than the rest of the world combined. The pork consumed represents 62% of all meat consumed in China.

The major hog production areas in China are:

|

Percentage of

Total Hog

Production

in China

|

||||

|

|

|

|

|

|

|

North China (Hebei, Shangdong, Henan, Jiangsu):

|

|

|

29.4

|

%

|

|

Yangtze Delta (Hubei, Hunan, Jiangxi):

|

|

|

21.6

|

%

|

|

Sichuan Basin:

|

|

|

13.1

|

%

|

|

Guangdong and Guangxi provinces:

|

|

|

8.8

|

%

|

|

Northeast China:

|

|

|

8.0

|

%

|

Our feed operating companies primarily serve customers in the Yangtze Delta and Guangdong and Guangxi provinces where over 30% of China’s hog production is based.

4

According to the Research Report on Chinese Feed Industry, 2009-2010, China Research and Intelligence states that the animal feed industry in China is highly fragmented with over 10,000 producers, most with an annual production of less than 10,000 tons. Consolidation is a central theme in the government’s efforts to restructure the industry and promote industrial modernization. We expect that this consolidation of the feed industry will reduce the number of producers to less than 1,000 large-scale feed enterprises by 2015.

Sales and Marketing

Nanchang Feed markets its products under the following brands: “Advantage,” “Best,” “Best Growth,” “Best King,” “Best Silver,” “Block,” “BML,” “Classic,” “JWT,” and “Nanny.” Shanghai Feed markets its products under the following brands: “Baby Joy,” “Best,” “Little Horse,” “Sow Care,” and “Strong.” Nanning Feed markets its products under the following brands: “Huijie” and “Lucky Bull.” HopeJia Hainan markets its products under the brand name “HeJie,” and Shandong Feed markets its products under the “AgFeed” brand name. Our

sales force and technicians call directly on the pig farms to introduce new product developments and improvements to existing products to existing and potential clients. We also conduct educational seminars in pig farming regions to explain the benefits of a balanced, nutritious diet for pigs in producing a healthy herd and to educate farmers to properly prepare and mix feed components. While these services are not unique among premix manufacturers, we believe our services in this area are superior to our competitors as we have a highly responsive, professional and experienced technical services team and a sales team, most of whom received college or post-graduate degrees in veterinary science, animal science or animal nutrition, and are able to provide general technical services as needed. As we market and sell directly to pig farmers, we are able to collect and analyze data, which assists in the preparation and design of new products. We attend agricultural conventions that take

place in the market areas where we conduct business as well as in provinces that we expect to enter. We also place advertisements and promotional pieces in agricultural trade journals.

We sell our products directly to 838 large commercial hog farms. On average, each large commercial farm purchases approximately three metric tons of premix, two metric tons of concentrates and one metric ton of complete feed per month.

Additionally, we work with independently owned and operated feed distribution chain stores that exclusively distribute our premix feed products throughout China. This program allows us to cost-effectively sell our products to the individual “mom and pop” farmer that may raise only a few hogs per year for personal consumption or for sale in the marketplace as an additional source of income. These distribution stores generally sell approximately two metric tons of premix, one metric ton of concentrates and one metric ton of complete feed per month. As of December 31, 2010, we had a distributor base of 1,909, comprised of 1,280 exclusive feed distribution chain stores and 629 non-exclusive distributors. The sales data of distributors indicates that smaller farms tend to be more sensitive to price increases

than the large-scale hog farms, which place more emphasis on customer service and other ancillary services we provide.

Our exclusive distributor program allows distributors to forgo an initiation fee and still receive marketing and technical training from our staff. Each distributor signs an exclusivity agreement with us, agreeing not to sell any other brand of pig feed products and to decorate its store with approved marketing materials and signage. Additionally, these distributors are encouraged to buy animal health care products, such as quality vaccines and veterinary drugs that we sell as agent, which encourages a diversified product structure for the distributor while further strengthening our relationship. We work closely with each exclusive distributor to coordinate promotional activities and provide ongoing support by our sales force, including three to four training sessions annually. While we provide training, sales

support and promotional activities to our non-exclusive distributors, such activities are on a much more limited basis.

In addition, each distributor must: (i) during a three month probationary period pass a screening process based on performance benchmarks, (ii) abide by our rules and receive ongoing training from our sales and technical staff, (iii) support the sales of our new products when launched in the distributor’s territory, and (vi) remain within our guidelines for payment of products purchased from us. Our exclusive distributors receive priority in purchasing new products when they are launched.

Suppliers

Normally, purchases of raw materials are made on an “as needed” basis each month. Both our warehouse managers and purchasing department coordinate orders to optimize on-site inventory levels and take advantage of favorable market prices. We sign long-term contracts with leading soybean meal suppliers when our purchasing specialists deem it appropriate. We have also established long-term relationships with “accredited key suppliers” by setting up five supply bases in China’s largest corn production areas, which centralizes our purchasing and logistics resources, and reduces or eliminates agent commissions.

5

We have implemented a “supplier accreditation system.” Regularly, suppliers of raw materials are jointly selected and rated by our purchasing center and technical center according to the quality of their supplies, price and credit record. Generally, all of our purchases are made from qualified suppliers. Raw materials are generally purchased by our purchasing center to take advantage of the economies of scale associated with our size.

Research and Development

We engage in continuous research and development to maintain a competitive advantage in the marketplace and keep pace with current developments. We also sponsor research alliances with Jiangxi Agricultural University, South China Agricultural University, Nanjing Agricultural University and Zhejiang Agricultural University. As a result of our research and development, we were among the first in China to test an antibiotics-free production technology and apply a low-protein diet formulation, which may prove to be effective and could reduce the cost of hog production.

For example, in July 2009, we launched a joint research program with Jiangxi Agricultural University to study animal nutrition and genetics. Under the program, we make available labs and equipment while the Jiangxi provincial government and Jiangxi Agricultural University have collectively committed up to approximately $100,000 over three years to reimburse us for such lab equipment and to pay post-graduate students to work on these projects.

Intellectual Property

We have been granted the right to use trademarks to the following trade names for use on our products: “AgFeed,” “Best,” “Huijie,” “HeJie,” “Block,” “JWT,” “Lucky Bull,” “Advantage,” “BML,” “Nanny,” “Classic,” “Little Horse,” “Strong,” Baby Joy,” “Best Silver,” and “Best King.” These names are known in the provinces in which we conduct business. We do not hold any patents or intend to apply for patents on proprietary technology or formulas relating to our feed products. The formulas for our feed products are considered trade secrets and are protected as such.

Government and Environmental Regulation

Our feed products and services are subject to substantial regulation by governmental agencies responsible for the agricultural and commerce industries. We are required to obtain business and company registrations and production licenses under the laws and regulations of China, the provincial governments of Jiangxi, Hainan, Shandong, and Guangxi and the municipal government of Shanghai. All of our feed products are certified on a regular basis and must be in compliance with the laws and regulations of provincial and other local governments and industry agencies.

Prior to engaging in any production or marketing of feed products, all products must receive a formal production license pursuant to the National Code of Feed and Feed Additives, promulgated by the National State Council of China, and qualified products reports from the Technology and Supervision Bureau. All of our feed products have earned these formal approvals, which are valid for five years from the date of issuance.

The central government, through the Ministry of Agriculture, issues production licenses. The Ministry of Agriculture dispatches officials at the local level to review staff qualifications, production facilities, quality control, and management departments for competency. These licenses are valid for five years from the date of issuance and are renewable at the end of such period. Provincial production permits are also required for all entities involved in the manufacture of animal feed and feed components. Provincial permits are issued for all products manufactured at each facility. Each facility as currently operated has the necessary permits for all products produced at each such operating facilities. These permits are valid for five years from the date of issuance and are renewable at the end of such period. Our

feed operating entities currently have the approvals necessary to operate our animal nutrition business in the same provinces and regions as before the reorganization.

There is no material cost in obtaining and maintaining these licenses and permits, but it is illegal to do business without them. If any production license or product permit were lost, production would need to cease until a new license or permit was obtained, which would likely take a minimum of 30 to 45 days to receive, and the loss of which could result in the imposition of regulatory fines.

We are also subject to China’s National Environmental Protection Law as well as a number of other national and local laws and regulations involving pollutant discharge and air, water and noise pollution.

6

Competition

There is a broad market for animal feed and a corresponding diversity when evaluating the overall quality and market focus of animal feed enterprises. We face competition on a local and regional level. Many of our local competitors operate on a small scale have comparatively limited resources to devote to science, research, development and training. Due to the highly fragmented nature of the industry, we experience varying degrees and types of competition from region to region. Our local competitors include Da Bei Nong in Jiangxi province, Fuj Minke Biology Company in Fujian province, Zheng Da in various provinces, Xinnong located in the Shanghai area and Provimi in Guangxi. Regional competitors include Sichuan New Hope Agribusiness, Tongwei Company Limited, Ning Bo Tech Bank Company Limited and Zhengbang

Group.

Management believes feed manufacturers have to depend on scale to generate returns. Product homogenization forces feed companies to compete based on price and brand recognition. The breadth of distribution channels is a key competitive factor.

Employees

As of December 31, 2010, our feed operating companies had a total of 532 employees. We believe the relationship with our employees is good.

Facilities

Our operation in Jiangxi province is located in Chang Bei District Industrial Park, in Nanchang, Jiangxi Province. We have been granted the land use rights to three buildings consisting of an office building, a factory and a dormitory the Municipal Administration of State-Owned Land. Currently, an additional warehouse is under construction at this location. Our right to use the land runs through December 2049.

Our operation in the municipality of Shanghai is located at No. 4188 Taiqing Road, Fengxian District, Shanghai. We lease from a third party two industrial units and office space through 2017.

Our operation in Guangxi province is located in Coastal Industrial Park, Liangqin District, Nanning City, Guangxi Province. We have been granted the land use rights to three buildings consisting of an office building, a production plant and a worker dormitory from the Housing Bureau and Land Administrative Bureau of Langqin District, Nanning City. Our right to use the land runs through October 2056.

Our operation in Shandong province is located at No. 4 Chuangye Street, East New Area, in the city of Taian, Shandong Province. This facility, which we lease from a third party, consists of four buildings, one for manufacturing, one for offices, one for a warehouse and one for dormitory facilities. The master lease for this facility runs through 2018.

Our operation in Hainan is located on South Wuting Road, Laocheng Development Zone, Chengmai County, Hainan Province. We operate three buildings consisting of an office building, production plant and a worker dormitory. We have been granted the right to use the land was granted by Housing Bureau and Land Administration Bureau of Hainan Province through January 2056.

We believe our existing facilities are adequate for our current requirements. As our workforce expands, however, we may need additional space, which we believe can be leased or constructed on commercially reasonable terms.

COMMERCIAL HOG PRODUCTION BUSINESS

At December 31, 2010, we owned two breeder hog farms and 29 meat producing hog farms located in Jiangxi, Shanghai, Hainan, Guangxi, and Fujian provinces, which are strategically located in or near the largest pork consumption areas in China. In the United States we own 10 sow farms in Colorado, Oklahoma and North Carolina. We also operate a contract finishing system in Iowa of over 200 farms.

We entered the hog farming business on November 9, 2007. Our meat hog producing farms generate revenue primarily from the sale of meat hogs to processors. In China, our meat hogs are sold primarily in Jiangxi, Shanghai, Hainan, Guangxi, Fujian, Guangdong and other neighboring provinces. In the United States almost all of our hogs are sold under contract to a major U.S. packer. In November 2009, we broke ground on our first "Western-model" farm in the city of Da Hua, Guangxi Province. We also completed the construction of a nucleus farm in the city of Wuning, Jiangxi Province in November 2009. This farm will be operated by Hypor AgFeed Breeding Company.

7

In February 2010, we entered into negotiations to participate in a hog production project in conjunction with Xinyu City in Jiangxi Province. The proposed project is a plan to build 5 western model hog farms with the initial phase of the project to encompass an investment of $18 million for the construction of two 5,000 head sow farms, one 200 head boar stud farm and one 2,600 head multiplier facility. Upon completion the initial phase, the project is expected to have an annual production capacity of 230,000 hogs. In April of 2010 these negotiations were successfully completed and construction began in May 2010. The local government has commenced construction of the infrastructure necessary to support this project, including roads, power and, most critically, water.

Our breeder farms generate revenue primarily from the sale of breeder hogs to commercial hog farms and, to a lesser extent, the sale of meat hogs to hog slaughterhouses. Our customers include large-scale hog farms, mid-scale hog farms and small-scale farms. Our breeder hogs are sold throughout China, primarily in southeastern China. In the United States, our breeder hogs are used exclusively for our own production system.

Our strategic alliance with Hypor, announced in April of 2009, has four phases: (1) upgrading the genetic base of our existing herds; (2) creating a sow farrow-to-finish nucleus facility (Wuning Farms) to supply superior breeding stock to be utilized in our production systems and for sale to outside commercial hog farms; (3) establishing high health, top quality genetics to the farms being developed by AgFeed International Protein; and (4) developing gene transfer centers to maximize the use of the top performing boars in China across AgFeed's production system. On December 17, 2009, we formed Hypor AgFeed Breeding Company with Hypor to develop, and operate a genetic nucleus farm in Wuning, China. This farm commenced operations during the fourth quarter of 2010. Hypor AgFeed Breeding Company is owned 85% by us and

15% by Hypor.

On September 13, 2010, pursuant to a Membership Purchase Agreement (the “Purchase Agreement”), the Company acquired all of the outstanding equity interests of M2P2 from AF Sellco, LLC. In connection with closing following the post-closing adjustment, the Company delivered to AF Sellco, LLC (i) an amount in cash equal to approximately $12.2 million, (ii) 1,286,588 shares of common stock, and (iii) a promissory note in the amount of approximately $9.6 million. The shares of common stock issued pursuant to the Purchase Agreement are subject to a lock-up period ending on the 18-month anniversary of the closing of the transaction. However, during this lock-up period, one-third of the common stock shall be released from the lock-up restriction on each 6-month anniversary of the closing of the transaction. We

also granted AF Sellco, LLC a perfected first-priority lien on, and security interest in, all of the outstanding equity interests of M2P2 as collateral security for the Company’s obligations on the promissory notes.

Through its 10 sow farms and its contract finishing system, M2P2 marketed approximately 1.3 million hogs in 2010.

Our current strategic plan for our Chinese operations calls for us to develop, during 2009-2012, a production platform capable of producing 2 million hogs per year by 2015. The key element to this future growth is modern hog production technologies and science based genetics, which is underscored by our joint ventures with Hypor and our acquisition of M2P2. Our Lushan and Gangda Breeding Farm are now fully stocked with the Hypor Large White Pureline Sows, the Hypor Landrace Pureline Boars and the Duroc Terminal Sire.

The demand for safe food is the key driver in our strategy “AgFeed, Government and Farmer”. The local governments have partnered with AgFeed in the cities of Dahua and Xinyu to build agricultural industrial parks that will produce top health and safe pork meat for the Chinese consumer.

Chinese Vice Premier Li Keqiang said, "Food is essential, and safety should be a top priority. Food safety is closely related to people's lives and health and economic development and social harmony," at a State Council meeting in Beijing. In June 2009, food safety laws were passed in China and passed down to the local governments for implementation.

According to the China Feed Industry Association, China has the world's largest market for hog production, which processed 625 million hogs in 2009, compared to approximately 100 million in the U.S. More than 1.2 billion Chinese consume pork as their primary source of meat. 62% of all meat consumed in China is pork. Chinese consumers consume more pork each year than the rest of the world combined. China’s pork consumption is forecast to increase to 47.0 million metric tons in 2010 up from 44.9 million metric tons in 2008, or about 5%. Projected pork demand by 2015 is estimated to approach 68.0 million metric tons, an increase of 51% from 2008.

8

The Chinese government supports smaller hog producers with subsidies, insurance, vaccines, caps on feed costs and land use grants. Hog production is exempt from all income taxes, and sow owners receive government grants and subsidies.

Hog Production – China

The 29 meat hog producing farms we owned at December 31, 2010 generated revenue primarily from the sale of meat hogs to processing plants. Our meat hogs are sold primarily in Jiangxi, Shanghai, Hainan, Guangxi, Fujian, Guangdong and other neighboring provinces. Our breeder farms generate revenue primarily from the sale of breeder hogs to commercial hog farms and, to a lesser extent, the sale of meat hogs to processing plants. Customers of Lushan and Gangda include large-scale hog farms, mid-scale hog farms and small-scale farms. Our breeder hogs are sold throughout China, primarily in southeastern China.

Breeder hogs are either purebred hogs or crossbred hogs that have the genetic trait for mating. We use hogs that contain this trait for breeding and also sell them to commercial meat hog farms throughout China so that the commercial farms may use the hogs in their own reproduction programs. Commercial sows (parent stock) are used for gestating and producing piglets.

Among the purebred hogs, our primary varieties are the Yorkshire, the Landrace and the Duroc. The Yorkshire, which originated in England, is known for its rapid growth, high rate of lean meat and its reproductive capacity. The Landrace, originated in Denmark, is also known for its rapid growth and its high rate of lean meat. The Duroc, which originated in the United States, is considered a highly-successful male parent in crossbreeding.

Market Description

General

After 30 years of development, China’s hog industry is rapidly maturing. At this stage disease control, price risk management and meticulous management are the foundation of competiveness. The ideal development is to form a fully integrated chain with feed, cultivation, breeding, processing and sale. In the next ten years the hog industry is expected to develop into a stage of industrial scale and branding.

China is the world’s biggest hog producer and pork consumer; the global pig meat market is dominated by China. According to statistics from the US Department of Agriculture, China produces 50% of all the pig meat production in the world. For 2009, China is expected to produce close to 47.0 million metric tons of an estimated world production of approximately 95.0 million metric tons.

According to the China Feed Industry Association, China has the world’s largest and most profitable market for hog production, which process over 600 million hogs annually, compared to approximately 100 million in the US. More than 1.2 billion Chinese consume pork as their primary source of meat. 62% of all protein consumed in China is pork. Chinese consumers consume more pork each year than the rest of the world combined. China’s pork consumption is forecast to increase to 47.0 million metric tons in 2010 up from 44.9 million metric tons in 2008, an increase of about 5%. Projected pork demand by 2015 is estimated to approach 68.0 million metric tons, an increase of 51%.

Urbanization and the growth of the middle class (250 million people in 2008) along with China’s policies protecting the swine industry reflect the importance of hog production as a social, economic and security issue for the consumer market in China. Since the early 1990’s per capita pork consumption in China has increased from 10kg/year to 40kg/year. Demand for freshly slaughtered pork remains high in most Chinese market segments. Urbanization also gives rise to supermarket chains that contribute to the shaping of consumer demand for food safety and the evolution of the pork supply value chain.

China instituted a number of laws to induce swine production. On January 1, 2008, the State Council announced a new regulation exempting companies involved in hog rearing from corporate income tax. Additionally, the Food Safety Law, which became effective on June 1, 2009, allows the government to take affirmative action that will strengthen food safety control “from the production line to the dining table”. The Chinese Government created a hog futures exchange to permit hedging of contracts that became operational in 2009. Further, the Chinese Government has developed a “Strategic Meat Reserve” that is stocked predominantly with pork reserves and a live herd of 500,000 pigs. These policies and programs stress the value the central Chinese Government places on hog production.

9

Meat Hogs

According to the Foreign Agricultural Services, China is the world’s largest producer of pork and pork is the most widely- consumed meat in China. The Foreign Agricultural Services determined that pork accounted for 65% of the total meat production in China in 2008. A 2008 Agricultural Report published by Purdue University forecasts that China’s pork imports in 2009 may increase by nine percent to 555,000 million metric tons slightly up from 505,000 million metric tons in 2008. Strong demand and short supply are forecast to drive imports, although it appears the recent downturn in the global economic picture will curtail the Chinese import of both frozen and live swine. There are over 160 local pig breeds in China. Chinese farms are looking to import foreign breeds that may improve the genetic profile

of China’s hog population, with the result being healthier animals and lower production costs.

Meat hog production in China is dominated by backyard farms (those that sell 5-10 hogs annually) and small farms (those that sell less than 100 hogs annually). These farms accounted for an estimated 70% of all China hog production during 2010. These farms sell their products to local rural markets. The remaining 25% of China’s hog production comes from larger farms - those that sell between 100 and 500 head a year account for 2 1 % of the production, those that sell between 500 and 10,000 head account for an additional 3% and those that sell between 10,000 and 50,000 hogs account for the remaining 2% of the annual production.

Suppliers

Feed is the most significant cost of operating a hog farm. Historically, our hog farms purchased feed products and raw materials such as corn and soybeans from several feed suppliers under short-term contracts. Under our ownership, the hog farms primarily use our premix as the base of their feed supply and enter into long-term contracts with the suppliers of feed additives in order to meet their feed requirements. The use of our premix laid the groundwork for our hog farms to produce hogs that are accredited as “green” pork.

Research and Development

We are participants in two ongoing research programs. We have been selected into the National Hog Production System, where individuals from China’s top 52 hog farms share their expertise and research and development results. We are also a member of the National Pig Genetics Association which focuses on the selection of high-lean meat breeder hogs and the other program focuses on improving the reproductive traits of breeder hogs.

Intellectual Property

Lushan has developed advanced mating technologies that are designed for foreign and domestic breeder hogs. It employs proprietary techniques to manage mating patterns. We do not hold any patents covering these technologies and have no present intention to apply for patents on them.

Government Regulation

Hog breeding is subject to substantial licensing requirements and regulation. In order to sell breeder hogs in China a breeder hog farm must be awarded a breeder’s license by the local government authorities. Only those breeder hog farms that have qualified staff, specialized equipment and are in segregated locations to avoid the spread of disease are eligible for licensing. Meat hog farms do not require a license. The Agricultural Departments of Jiangxi and Guangxi Provinces issued Breeder Hog Farm Licenses to Lushan and Gangda.

Competition

The hog production business in China is highly segmented. As we discussed above, about 70% of the hogs produced in the country are produced by smaller farms, who sell their inventory to rural markets. The remaining 30% of hog producers are spread throughout the entirety of China and the market for their inventory tends to be within their geographic territory. We primarily market our products within Jiangxi, Shanghai, Hainan, Guangxi and Fujian provinces and the territory of the surrounding provinces that is close in proximity to our hog farms. As a result, we compete broadly with the producers in these geographic regions. Our hog production business occupies the whole of southeastern China, including the metropolitan areas of Shanghai and Hong Kong.

10

Employees

As of December 31, 2010, our Chinese hog farms had a total of 1,024 employees, as compared to 1,290 employees at December 31, 2009. We believe the relationship with our employees is good.

Facilities

Breeder Farms

Lushan’s primary facility is a breeder hog farm located in the town of Hualin, Jiangxi Province. The facility, which is situated on 258,000 square meters of developed land, is leased from the Chinese government for a period of 29 years and is scheduled to expire on April 13, 2034. Lushan’s breeder hog farm contains two separated areas, one for sows and the other for boars and gilts, with a total of 15,800 square meters of buildings. Lushan pays a nominal annual rent under the terms of the lease.

Gangda, a wholly owned subsidiary of Guangxi Huijie, is a breeder farm located in Guigang, Guangxi Province. Guangxi Huijie acquired all of the rights to the land, pig houses, office buildings, heating system, power and water supply system in our acquisition of Gangda. Gangda contains two separated areas, one for sows and one for boars and gilts, with a total of 34,000 square meters of buildings. The right to use the land was granted by Housing Bureau and Land Administration Bureau of Guangxi Province through March 31, 2025.

Meat Hog Producing Farms

Wannian Xiandai Animal Husbandry Limited Liability Co. (“Wannian”), a wholly owned subsidiary of Nanchang Best Animal Husbandry Co., Ltd. (“Nanchang Best”), is located in Jiangxi Province. Wannian subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 10 years from January 3, 2008.

Jiangxi Huyun Livestock Co., Ltd. (“Huyun”), a majority owned subsidiary of Nanchang Best, is located in Jiangxi Province. Huyun subleases the property from the other shareholders of Huyun and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 10 years from January 3, 2008.

Ganzhou Green Animal Husbandry Develop Co., Ltd. (“Ganzhou”), a majority owned subsidiary of Nanchang Best, is located in Jiangxi Province. Ganzhou subleases the property from the other shareholders of Ganzhou and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 10 years from January 4, 2008.

Gang Feng Animal Husbandry Co., Ltd. (“Gang Feng”), a wholly owned subsidiary of Nanchang Best, is located in the town of Jiangxi Province. Gang Feng subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 6 and 1/2 years from January 7, 2008.

Yichun Tianpeng Domestic Livestock Farm, Ltd. (“Yichun”), a majority owned subsidiary of Nanchang Best, is located in Jiangxi Province. Yichun subleases the property from the other shareholders of Yichun and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 10 years from January 9, 2008.

Zhejiang Pinghu Yongxin Hog Farm (“Zhejiang Yongxin”), a wholly owned subsidiary of Nanchang Best, is located in Zhejiang Province. Zhejiang Yongxin subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 12 years from April 18, 2008.

Shanghai Fengxian Hog Farm (“Shanghai Fengxian”), a wholly owned subsidiary of Nanchang Best, is located in Shanghai. Shanghai Fengxian subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 14 years from May 1, 2008.

11

Shanghai Tuanxi Hog Farm (“Shanghai Tuanxi”), a wholly owned subsidiary of Nanchang Best, is located in Shanghai. Shanghai Tuanxi subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 10 years from May 1, 2008.

Shanghai Senrong Hog Farm (“Shanghai Senrong”), a wholly owned subsidiary of Nanchang Best, is located in Shanghai. Shanghai Senrong subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 15 years from May 1, 2008.

Fujian Xiamen Muxin Hog Farm (“Fujian Muxin”), a wholly owned subsidiary of Nanchang Best, is located in Fujian Province. Fujian Muxin subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 10 years from April 30, 2008.

Xiamen Yuanshengtai Food Co., Ltd. (“Fujian Yuanshengtai”), a wholly owned subsidiary of Nanchang Best, is located in Fujian Province. Fujian Yuanshengtai subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 10 years from April 30, 2008.

Jiangxi Zhiliang Hog Farm (Jiangxi Zhiliang”), a wholly owned subsidiary of Nanchang Best, is located in Jiangxi Province. Jiangxi Zhiliang subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 22 years from April 30, 2008.

Shanghai WeiSheng Hog Raising Co., Ltd.(“Shanghai Weisheng”), a wholly owned subsidiary of Nanchang Best, is located in Shanghai. Shanghai Weisheng subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 30 years from June 1, 2008.

Nanping Minkang Hog Farm (“Nanping Minkang”), a wholly owned subsidiary of Shanghai Best Animal Husbandry Co., Ltd. (“Shanghai Best”), is located in Fujian Province. Nanping Minkang subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 15 years from September 17, 2008.

Guangdong Lianjiang Xinfa Hog Farm (“Guangdong Xinfa”), a majority owned subsidiary of Guangxi Huijie, is located in Guangdong Province. Guangdong Xinfa subleases the property from the other shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 12 years from May 30, 2008.

Guangxi Nanning Wanghua Hog Farm (“Guangxi Wanghua”), a wholly owned subsidiary of Guangxi Huijie Sci & Tech Feed Co., Ltd. (“Guangxi Huijie”), is located in Guangxi Province. Guangxi Wanghua subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 10 years from May 30, 2008.

Guangxi Linxing Hog Farm (“Guangxi Linxing”), a wholly owned subsidiary of Guangxi Wanghua, is located in Guangxi Province. Guangxi Linxing subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 10 years from September 20, 2008.

Nanning Shunhua Hog Farm Co., Ltd. (“Nanning Shunhua”), a wholly owned subsidiary of Guangxi Wanghua, is located in Guangxi Province. Nanning Shunhua subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 10 years from October 28, 2008.

Nanning Shunan Hog Farm Co., Ltd.(“Nanning Shunan”), a wholly owned subsidiary of Guangxi Wanghua, is located in Guangxi Province. Nanning Shunan subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 10 years from October 29, 2008.

Guangxi Gangxuan Hog Farm Co., Ltd. (“Guangxi Gangxuan”), a wholly owned subsidiary of Gangda, is located in Guangxi Province. Guangxi Gangxuan subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 11 years from September 20, 2008.

12

Guangxi Xingye Guihong Hog Farm (“Guangxi Guihong”), a wholly owned subsidiary of Guangxi Huijie, is located in Guangxi Province. Guangxi Huijie acquired all of the rights to the land, pig houses, office buildings, heating system, power and water supply system in our acquisition of Guangxi Guihong. The right to use the land was granted by Housing Bureau and Land Administration Bureau of Guangxi Province through May 30,2025.

Hainan Haikou Meilan Hog Farm (“Hainan Meilan”), a wholly owned subsidiary of Guangxi Huijie, is located in Hainan Province. Guangxi Huijie acquired all of the rights to the land, pig houses, office buildings, heating system, power and water supply system in our acquisition of Hainan Meilan. The right to use the land was granted by Housing Bureau and Land Administration Bureau of Guangxi Province through April 12, 2033.

Hainan Haikou Wohao Hog Farm (“Hainan Wohao”), a wholly owned subsidiary of Guangxi Huijie, is located in Hainan Province. Guangxi Huijie acquired all of the rights to the land, pig houses, office buildings, heating system, power and water supply system in our acquisition of Hainan Wohao. The right to use the land was granted by Housing Bureau and Land Administration Bureau of Guangxi Province through April 18, 2038.

Guangxi Guilin Fuzhi Hog Farm (“Guangxi Fuzhi”), a majority owned subsidiary of Guangxi Huijie, is located in Guangxi Province. Guangxi Fuzhi subleases the property from the other shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 20 years from May 30, 2008.

Fujian Jianhua Hog Farm (“Fujian Jianhua”), a wholly owned subsidiary of Best Swine, is located in Fujian Province. Fujian Jianhua subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 15 years from April 22, 2008.

Fujian Fengxiang Agribusiness Co., Ltd. (“Fujian Fengxiang”), a wholly owned subsidiary of Best Swine, is located in Fujian Province. Fujian Fengxiang subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 15 years from April 30, 2008.

Nanping Kangda Animal Husbandry Co., Ltd. (“Nanping Kangda”), a wholly owned subsidiary of Best Swine, is located in Fujian Province. Nanping Kangda subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 15 years from May 27, 2008.

Fujian Jianxi Breeder Hog Farm Co., Ltd. (“Fujian Jianxi”), a wholly owned subsidiary of Best Swine, is located in Fujian Province. Fujian Jianxi subleases the property from the former shareholders and includes the land, pig houses, office buildings, heating system, power and water supply system. The lease runs for 15 years from May 25, 2008.

Da Hua AgFeed Animal Husbandry Co., Ltd. (“Da Hua”) is located in Guangxi Province. Da Hua leases the property from local farmers. The property contains 387,000 square meters of land. The lease runs for 30 years from October 2009.

Wuning Farm is located on land situated in Wuning County, Jiangxi Province. Wuning Farm leases land from local village committee. The lease runs for 30 years expiring in April 2038. Wuning Farm contains two separated areas, one for sows and the other for boars and gilts, with a total of 23,675 square meters of buildings. This farm is not yet stocked with livestock.

Hog Production – United States – M2P2

On September 13, 2010, the Company acquired all of the outstanding equity interests of M2P2 from AF Sellco, LLC. Through its 10 sow farms and its contract finishing system, M2P2 marketed approximately 1,300,000 in 2010. M2P2’s sow farms are located in Colorado, Oklahoma and North Carolina. At these locations sows are bred and piglets are weaned. The contract finishing system of over 220 farms is concentrated in Iowa. M2P2 contracts with local farmers and other landowners to raise piglets to market weights under the direction and supervision of M2P2.

M2P2 was the 23rd largest hog producer in the United States as of December 31, 2010.

The key to our success in the United States is the business relationship that we maintain with independent farmers. We have business relationships with private landowners and independent farmers in our contract finishing system where hogs born in our facilities are grown to market weights. Substantially all of our production is sold under long-term industry standard contracts to one of the United States’ leading processors, Hormel Foods Corporation. The initial term of these contracts expire on defined dates ranging to 2012 and 2018, and are automatically extended unless either party provides the required notice of nonrenewal. Neither party has provided notice of nonrenewal. These contracts provide for formula based pricing.

13

Market Description

General

The U.S. hog industry produces approximately 110,000,000 hogs annually in a highly efficient and consolidating industry. In its initial period of consolidation during the 1990’s contract production grew to dominate the hog industry. Contract production refers to agreements under which a grower commits its production to a specific buyer under a long-term agreement. According to industry sources approximately 80% of U.S. hog production is committed under long-term production contracts.

Suppliers

Feed is the most significant cost of operating a hog farm. Through relationships with toll mills, M2P2 procures finished feed for the growing of wean-to-finish animals in our finishing system throughout Iowa. Through two company owned feed mills, M2P2 produces its own finished feed products for use in its farrowing production units. All feed and raw material components of our feed, corn, soybean meal and other commodity items are purchased under short-term arrangements.

Research & Development

As part of our dedication to achieving continuous improvement in our operations we maintain a program of scientifically and statistically testing our processes and procedures in order to identify incremental production efficiencies.

Intellectual Property

We do not own or license any material intellectual property rights in connection with our U.S. hog production business.

Government Regulations

In the United States, our facilities for hog production and housing live swine are subject to a variety of federal, state and local environmental laws and regulations, which include provisions relating to the discharge of materials into the environment and generally provide for protection of the environment. We believe we are in substantial compliance with such applicable laws and regulations and are not aware of any violations of such laws and regulations likely to result in material penalties or material increases in compliance costs. The cost of compliance with such laws and regulations has not had a material adverse effect on our capital expenditures, earnings or competitive position and is not anticipated to have a material adverse effect in the future.

Competition

Other hog producers include; Smithfield Foods, Triumph Foods, Seaboard Foods, Iowa Select Farms, the Pipestone System, the Maschhoffs, Prestige Farms, Cargill, the Carthage System and AVM Management Services. These producers are either captive to its parent food processing company or grow hogs under contract for specific buyers as such the domestic hog production industry is not characterized by a classic day-to-day competitive dynamic, but rather a longer-term competitive dynamic whereby long-term efficiency, stability and productivity plays a vital role in winning long-term relationships.

Employees

As of December 31, 2010, M2P2 had 200 employees. We believe the relationship with our employees is good.

Facilities

We have production and operations in Colorado, Iowa, North Carolina and Oklahoma. The table below identifies our material facilities, all of which are owned:

14

|

Location

|

Function

|

Sow

Capacity

(in heads)

|

||||

|

Kiowa County, Colorado

|

Nucleus Farm

|

2,000 | ||||

|

Kiowa County, Colorado

|

Multipliers Farm

|

7,600 | ||||

|

Beaver County, Oklahoma

|

Sow Farm

|

1,600 | ||||

|

Beaver County, Oklahoma

|

Sow Farm

|

1,500 | ||||

|

Beaver County, Oklahoma

|

Sow Farm

|

1,300 | ||||

|

Beaver County, Oklahoma

|

Sow Farm

|

1,500 | ||||

|

Beaver County, Oklahoma

|

Sow Farm

|

1,500 | ||||

|

Beaver County, Oklahoma

|

Sow Farm

|

2,300 | ||||

|

Tryell County, North Carolina

|

Sow Farm

|

10,000 | ||||

The table below identifies the facilities which we own:

|

Function

|

Number

|

Sow

Capacity

(in heads)

|

Location

|

||||||

|

Nucleus Farms

|

1 | 2,000 |

Colorado

|

||||||

|

Multipliers Farms

|

2 | 9,600 |

Colorado

|

||||||

|

Sow Farms

|

7 | 19,700 |

North Carolina and Oklahoma

|

||||||

|

Nursery Farms

|

3 |

Colorado

|

|||||||

|

Finishing Farms

|

4 |

Colorado

|

|||||||

|

Supporting Offices/Warehouses

|

3 | ||||||||

|

Truck Wash

|

2 |

North Carolina and Colorado

|

|||||||

|

Pig Staging Site

|

1 |

North Carolina and Colorado

|

|||||||

|

Rendering Terminal

|

1 |

Colorado

|

|||||||

|

Employee Dwellings

|

5 | ||||||||

|

Isolation Facility

|

1 |

North Carolina

|

|||||||

HISTORY

We are a Nevada corporation incorporated on March 30, 2005. Since October 31, 2006, we have been engaged in the animal nutrition and commercial hog production business in China. Following our acquisition of M2P2 on September 13, 2010, we commenced hog operation in the United States.

On June 24, 2008, we completed the acquisition of premix feed company HopeJia for a negotiated purchase price of RMB28,600,000 (approximately US$4.2 million).

On November 9, 2007, we acquired 90% of the issued and outstanding capital stock of Lushan, a hog breeding operation. The aggregate purchase price was RMB20,112,020, equivalent to approximately US$2.7 million on the date of the transaction. In connection with this transaction, we also assumed and satisfied at closing RMB4,919,980 (approximately US$660,400) of indebtedness owed by Lushan. The acquisition of Lushan marked our entrance into the hog production business. Since November 2007, we have acquired 30 operating meat hog producing farms.

In January 2008, we acquired at least a majority interest in five additional hog farms. Specifically:

|

|

·

|

we acquired 70% of the issued and outstanding capital stock of Wannian on January 3rd for RMB 12,250,000 (approximately US$1.7 million); we acquired the remaining 30% equity interest in Wannian on September 8th for RMB6,012,500 (approximately US$0.9 million);

|

|

|

·

|

we acquired 70% of the issued and outstanding capital stock of Huyun on January 3rd for RMB6,482,000 (approximately US$0.9 million);

|

|

|

·

|

we acquired 60% of the issued and outstanding capital stock of Ganzhou on January 4th for RMB6,480,000 (approximately US$0.9 million);

|

15

|

|

·

|

we acquired all of the hogs and stock of Gang Feng on January 7th for RMB4,820,000 (approximately US$0.7 million); and

|

|

|

·

|

we acquired 55% of the issued and outstanding capital stock of Yichun on January 9th for RMB8,855,000 (approximately US$1.2 million).

|

On March 19, 2008, Best Swine was formed as a wholly-owned subsidiary of AgFeed. Best Swine was incorporated under the laws of China on March 19, 2008 and is situated in Futian Township, Wuning County, Jiangxi Province, China and is in the business of raising, breeding and selling hogs for use in China’s pork production and hog breeding markets.

On April 30, 2008, we acquired all of the equity interest in an additional 16 hog farms. Specifically, we acquired:

|

Name of Hog Farm

|

Purchase Price in RMB

|

Purchase Price in US$ (

|

|||

|

Guangxi Wanghua

|

26,030,000

|

$

|

3.7 million

|

||

|

Gangda

|

14,520,000

|

$

|

2.1 million

|

||

|

Guangxi Guihong

|

42,500,000

|

$

|

6.1 million

|

||

|

Hainan Meilan

|

14,700,000

|

$

|

2.1 million

|

||

|

Hainan Wohao

|

15,200,000

|

$

|

2.2 million

|

||

|

Guangxi Fuzhi

|

12,000,000

|

$

|

1.7 million

|

||

|

Guangdong Xinfa

|

11,000,000

|

$

|

1.6 million

|

||

|

Zhejiang Yongxin

|

10,480,000

|

$

|

1.5 million

|

||

|

Shanghai Fengxian

|

35,000,000

|

$

|

5.0 million

|

||

|

Shanghai Tuanxi

|

7,000,000

|

$

|

1.0 million

|

||

|

Shanghai Senrong

|

30,000,000

|

$

|

4.3 million

|

||

|

Fujian Muxin

|

29,320,000

|

$

|

4.2 million

|

||

|

Fujian Yuanshengtai

|

26,200,000

|

$

|

3.7 million

|

||

|

Fujian Jianhua

|

32,000,000

|

$

|

4.6 million

|

||

|

Fujian Fengxiang

|

8,100,000

|

$

|

1.2 million

|

||

|

Jiangxi Zhiliang

|

8,000,000

|

$

|

1.1 million

|

||

(1) based on then-current conversion rate

On May 28, 2008, we acquired all of the equity interest in Nanping Kangda for RMB5,821,000 (approximately US$0.9 million) and all of the equity interest in Fujian Jianxi for RMB16,338,166 (approximately US$2.4 million).

On June 25, 2008, we acquired all of the equity interest in Shanghai Weisheng for RMB12,820,000 (approximately US$1.9 million).

In September 2008, we acquired all of the equity interest in three additional hog farms. Specifically:

|

|

·

|

we purchased Nanping Minkang for RMB9,865,000 (approximately US$1.4 million) on September 8th; and

|

|

|

·

|

we purchased Nanning Shunan for RMB9,256,000 (approximately US$1.4 million) and Guangxi Gangxuan for RMB8,569,000 (approximately US$1.3 million) on September 10th.

|

In October 2008, we acquired all of the equity interest in two more hog farms. Specifically:

|

|

·

|

on October 28, 2008, we purchased Guangxi Linxing for RMB7,850,000 (approximately US$1.2 million); and

|

|

|

·

|

on October 29, 2008, we purchased Nanning Shunhua for RMB8,260,000 (approximately US$1.2 million).

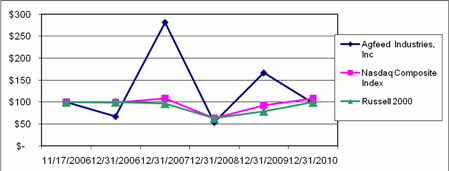

|