Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OM GROUP INC | d8k.htm |

| EX-2.1 - EX-2.1 - OM GROUP INC | dex21.htm |

| EX-99.1 - EX-99.1 - OM GROUP INC | dex991.htm |

| EX-10.1 - EX 10.1 - OM GROUP INC | dex101.htm |

Vacuumschmelze (VAC)

Acquisition

July 5, 2011

Exhibit 99.2 |

Forward-Looking Statements

This presentation may include forward-looking statements for purposes of the

safe harbor provisions of the Private Securities Litigation Reform Act of

1995. Such forward-looking statements are based upon specific

assumptions and are subject to uncertainties and factors relating to the

company's operations and business environment, all of which are difficult to

predict and many of which are beyond the control of the company.

These uncertainties and

factors could cause actual results of the company to differ materially from those

expressed or implied in the forward-looking statements contained in the

foregoing discussion. A more complete disclosure about forward-looking

statements can be found in our most recent annual report on Form 10-K.

The company undertakes no obligation to update any forward-looking

statements as a result of future developments or new information. 2

|

Agenda

Transaction Overview

VAC -

Company Overview

Transaction Rationale

Financial Summary

3 |

Transaction Overview |

OM

Group acquisition of VAC creates meaningful expansion into adjacent and high

growth markets Agrees to acquire VAC Holding GmbH from One Equity

Partners Leading producer of advanced materials and integrated magnetic

solutions Market leader in solar inverter technology and positioned to grow

with wind energy output

Supplier of technically differentiated products to automotive, electrical

distribution and retail sectors

Contributes complementary value-added specialty products with strong recurring

cash flows and an attractive growth profile

Purchase price of €700mm to be funded through equity, available cash and

new credit facilities

Maintain financial strength and flexibility

Expected closing in 3Q 2011 subject to customary regulatory approvals

5 |

…

and delivers on our strategic objectives to transform

through diversification

VAC participates in attractive market sectors

Above GDP underlying organic growth potential

High margin potential through product differentiation

Enhances position and expertise in innovative technologies serving

diverse range of end markets

Maintains global exposure while fortifying presence in key regions

Moves us closer to the end user

Customer partnership in new product development

Enables OMG to enhance value-add proposition

6 |

VAC

– Company Overview |

A

global business with diverse and attractive end markets Founded in 1923

Headquarters: Hanau, Germany

Employees: 4,500 worldwide

160 R&D scientists and engineers

Manufacturing facilities: 7

Three divisions:

Materials & Parts (MP) -

#1 market position globally

Cores & Components (CC) -

#1 market position globally

Permanent Magnets (PM) -

#1 market position in Europe; #5 market position

globally

Customer base of over 1,600 with no one customer accounting for

more than 9% of sales

End markets: Aerospace, Automation & Drives, Automotive,

Electronic Article Surveillance, Energy Conversion & Distribution,

Electrical Installation Technology & Industrial Technology

Strong senior management with 27 years’

industry experience

Company Description

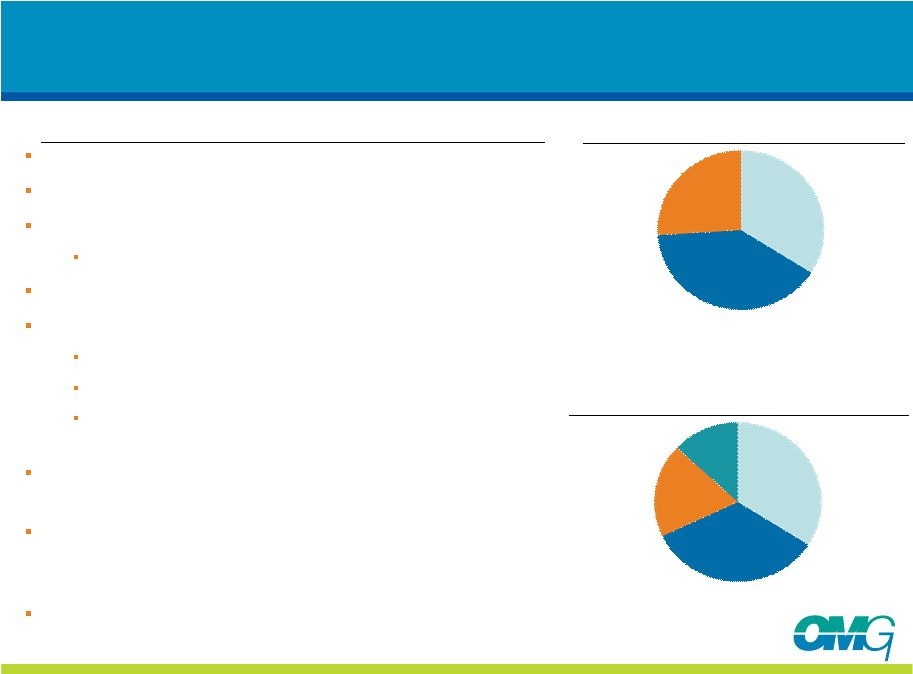

Q1 2011 LTM Sales by Segment

Q1 2011 LTM Sales by Geography

MP

34%

PM

27%

CC

39%

Total Net Sales (unaudited): €389m

(1)

Germany

34%

Europe

(ex-Germany)

34%

Asia

19%

Americas

13%

Total Net Sales (unaudited): €389m

(1)

8

(1) VAC financial results presented on IFRS basis |

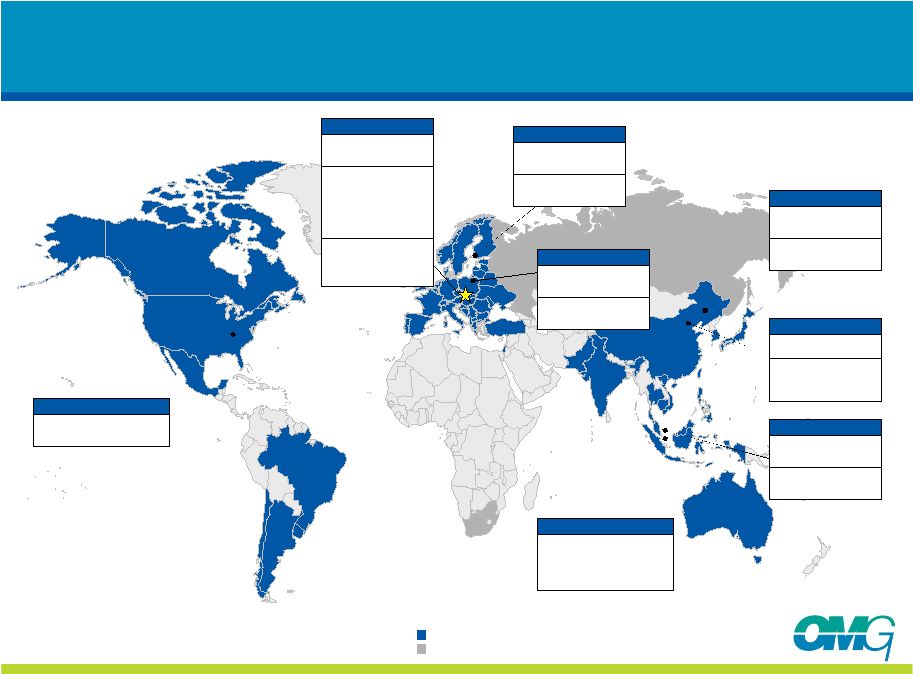

Global footprint supports strong regional demand and furthers

portfolio diversification

9

Hanau, Germany

Employees:

1,350

Global Headquarters

R&D Center

Manufacturing

Technology Base

BUs: MP, PM, CC

Ulvila, Finland

Employees:

70

Neorem (since 2007)

BUs: PM

Shenyang, China

Employees:

1,100

Established in 2001

BUs: CC

Beijing, China

Employees:

430

SANVAC Joint Venture

(since 2005)

BUs: PM

Horna Stred, Slovakia

Employees:

1,100

NAFTA Sales Headquarters

Employee: 21

Elizabethtown, KY

Asia/ Pacific Region Sales

Headquarters

Employees: 17

Singapore

Sales offices with direct representatives

Source: Company information

Pekan, Malaysia

Employees:

780

Established in 1996

BUs: CC

Sales partners/cooperations

Established in 1997

BUs: CC, MP, PM

European Sales

Headquarters

Employees: 34 |

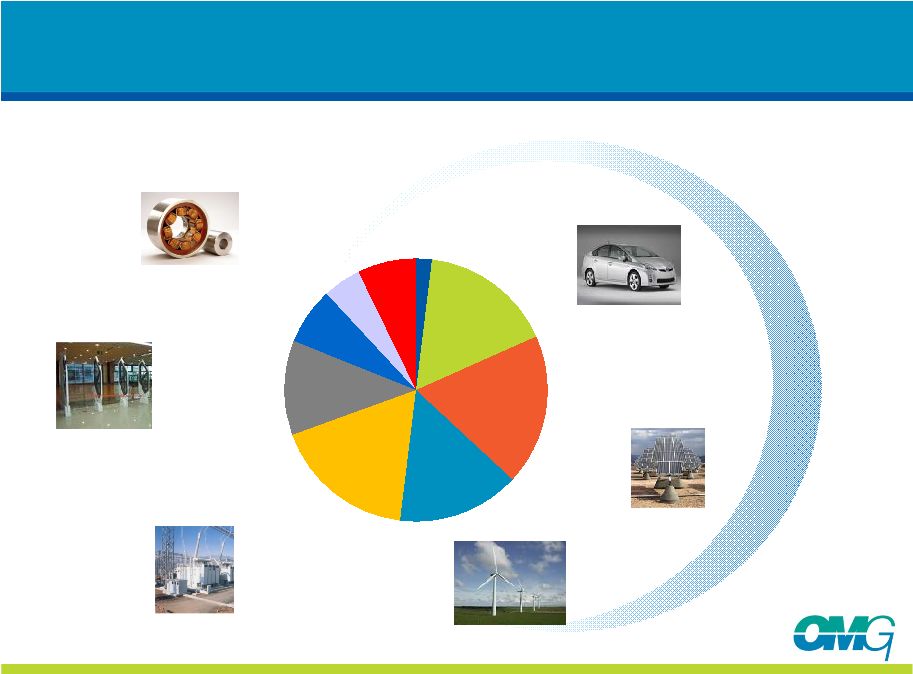

VAC

serves a diversified and fast-growing set of end market segments

Aerospace &

Transportation

Automation & Drives

Automotive

Electronic Article

Surveillance &

Communication

Energy Conversion &

Distribution

Electrical

Installation

Technology

Industrial

Technology

Distributors

Other

2%

15%

16%

12%

19%

17%

7%

5%

7%

10

Source: VAC Management. |

Transaction Rationale |

VAC’s strategic fit with OMG

Established company driven by technological innovation

Recognized leader in the high-growth end markets it serves

Proven business model which yields attractive, sustainable margins

Product offerings move OMG closer to customer

Highly specialized products with high barriers to entry

Organic and strategic growth opportunities

Favorable positioning in China and other emerging economies

Meets financial criteria

12 |

VAC

aligns with OMG’s strategic objectives Leverage Existing

Competencies

Process & product know-how in inorganic

materials

Converting key raw materials to technically-

differentiated products and components

Collaboration with customers to add market value

Broaden into

Adjacent Markets

Extends geographic reach in Europe and Asia

Expands position in solar energy

Create New

Growth Platforms

Strong position in wind energy

Creates position in automation, automotive,

energy conversion & distribution, and electrical

installation

13 |

Financial Summary |

VAC

meets or exceeds financial acquisition criteria Creates corporate scale with

approximately: $1.9B in net sales

$200M in operating profit

Accretive to earnings

Provides sustainable earnings linked to product innovation

Expands margins

Strong cash flow from operations

Financial synergies

Utilizes European cash balance

Preserves balance sheet strength and flexibility at low leverage

15 |

Acquisition financing

Purchase price of €700 million (approximately $1 billion)

Implies 8.6x

(1)

EBITDA transaction multiple on 2011E basis

New $900mm credit facilities (USD / €), including new $200mm revolving

credit facility

$50mm of OMG common equity

Remaining closing amounts to come from available cash

New revolver to remain undrawn at closing

Financing commitments to support transaction

BofA Merrill Lynch, PNC and BNP Paribas

Expected Net Debt / EBITDA ratio below 2.0x

16

(1) Multiple based upon EBITDA according to IFRS accounting principles

|

Continued diversification of OMG’s technology platforms

(1) Unaudited; assumes USD/EUR= 1.45; VAC results presented on IFRS basis

Q1 2011 LTM Sales ($m)

Advanced

Materials

52%

Battery

Technologies

10%

Specialty

Chemicals

39%

Advanced

Materials

35%

Battery

Technologies

7%

Specialty

Chemicals

26%

VAC

32%

OMG Stand-Alone

Pro Forma

(1)

Total Sales: $1.2B

Total Sales: $1.9B

17 |

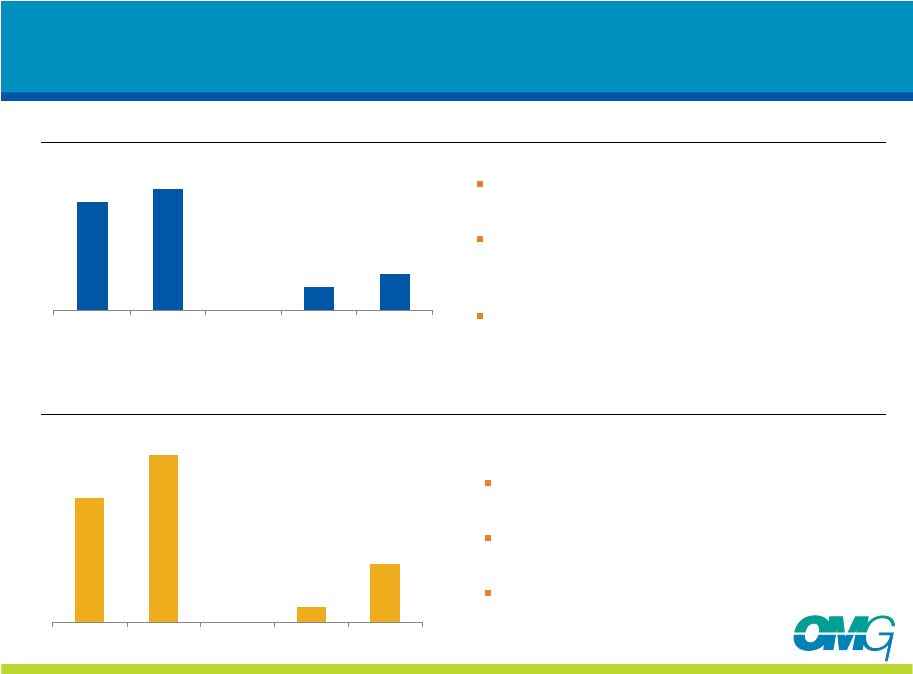

€

346

€

389

€

74

€

117

2010

Q1 '11 LTM

Q1 '10

Q1 '11

€

40

€

54

€

5

€

19

2010

Q1 '11 LTM

Q1 '10

Q1 '11

VAC is a profitable, growth company

Sales rebounded from 2009 downturn;

exceeded pre-crisis levels in 2010

Growth from continuous product innovation

and a focused market approach with an

emphasis on fast-growing niches

High single-digit growth expectations

Total Net Sales (€m)

(1)

Operating Profit (€m)

(1)

Attractive Operating Profit margins

exceeding pre-crisis levels

Continuing product mix shift to higher value-

added products

Margin improvement expected in 2011 and

beyond

18

(1) VAC financial results presented on IFRS basis |

VAC

enhances long-term outlook and earnings growth Favorable long-term

growth characteristics of end markets Healthy organic growth engine driven by

innovative technology Technically differentiated products customers use to

meet exacting performance requirements

Proven capability to successfully integrate acquisitions

Financial discipline and flexibility to enhance shareholder value

19 |

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |