Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEW JERSEY RESOURCES CORP | d8k.htm |

Exhibit 4.1

EXECUTION COPY

New Jersey Resources Corporation

$75,000,000

Shelf Note Purchase Agreement

Dated as of June 30, 2011

TABLE OF CONTENTS

| Page | ||||||

| SECTION 1. AUTHORIZATION OF NOTES | 1 | |||||

| Section 1.1. |

Authorization of Notes | 1 | ||||

| SECTION 2. SALE AND PURCHASE OF NOTES; GUARANTY | 2 | |||||

| Section 2.1. |

Sale and Purchase of Notes | 2 | ||||

| Section 2.2. |

Guaranty Agreement | 6 | ||||

| SECTION 3. [INTENTIONALLY OMITTED] | 7 | |||||

| SECTION 4. CONDITIONS TO CLOSING | 7 | |||||

| Section 4.1 |

Notes | 7 | ||||

| Section 4.2. |

Representations and Warranties | 7 | ||||

| Section 4.3. |

Performance; No Default | 7 | ||||

| Section 4.4. |

Compliance Certificates | 7 | ||||

| Section 4.5. |

Guaranty Agreement | 8 | ||||

| Section 4.6. |

Opinions of Counsel | 8 | ||||

| Section 4.7. |

Purchase Permitted by Applicable Law, Etc. | 8 | ||||

| Section 4.9. |

Payment of Special Counsel Fees | 9 | ||||

| Section 4.10. |

Private Placement Number | 9 | ||||

| Section 4.11. |

Changes in Corporate Structure | 9 | ||||

| Section 4.12. |

Proceedings and Documents | 9 | ||||

| SECTION 5. REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 9 | |||||

| Section 5.1. |

Organization; Power and Authority | 9 | ||||

| Section 5.2. |

Authorization, Etc. | 9 | ||||

| Section 5.3. |

Disclosure | 10 | ||||

| Section 5.4. |

Organization and Ownership of Shares of Subsidiaries | 10 | ||||

| Section 5.5. |

Financial Statements | 11 | ||||

| Section 5.6. |

Compliance with Laws, Other Instruments, Etc. | 12 | ||||

| Section 5.7. |

Governmental Authorizations, Etc. | 12 | ||||

| Section 5.8. |

Litigation; Observance of Statutes and Orders | 12 | ||||

| Section 5.9. |

Taxes | 13 | ||||

| Section 5.10. |

Title to Property; Leases | 13 | ||||

| Section 5.11. |

Licenses, Permits, Etc. | 13 | ||||

| Section 5.12. |

Compliance with ERISA | 13 | ||||

| Section 5.13. |

Private Offering by the Company | 14 | ||||

| Section 5.14. |

Use of Proceeds; Margin Regulations | 15 | ||||

| Section 5.15. |

Existing Debt | 15 | ||||

| Section 5.16. |

Foreign Assets Control Regulations, Etc. | 15 | ||||

| Section 5.17. |

Status under Certain Statutes | 16 | ||||

| Section 5.18. |

Environmental Matters | 16 | ||||

-i-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| Section 5.19. |

Notes Rank Pari Passu | 17 | ||||

| SECTION 6. REPRESENTATIONS OF THE PURCHASERS | 17 | |||||

| Section 6.1. |

Purchase for Investment | 17 | ||||

| Section 6.2. |

Source of Funds | 17 | ||||

| SECTION 7. INFORMATION AS TO COMPANY | 19 | |||||

| Section 7.1. |

Financial and Business Information | 19 | ||||

| Section 7.2. |

Officer’s Certificate | 22 | ||||

| Section 7.3. |

Inspection | 22 | ||||

| SECTION 8. PREPAYMENT OF THE NOTES | 23 | |||||

| Section 8.1. |

Required Prepayments | 23 | ||||

| Section 8.2. |

Optional Prepayments with Make-Whole Amount | 23 | ||||

| Section 8.3. |

Allocation of Partial Prepayments | 23 | ||||

| Section 8.4. |

Maturity; Surrender, Etc. | 24 | ||||

| Section 8.5. |

Purchase of Notes | 24 | ||||

| Section 8.7. |

Make-Whole Amount for Notes | 24 | ||||

| SECTION 9. AFFIRMATIVE COVENANTS | 26 | |||||

| Section 9.1. |

Compliance with Law | 26 | ||||

| Section 9.2. |

Insurance | 26 | ||||

| Section 9.3. |

Maintenance of Properties | 26 | ||||

| Section 9.4. |

Payment of Taxes and Claims | 27 | ||||

| Section 9.5. |

Corporate Existence, Etc. | 27 | ||||

| Section 9.6. |

Ownership of Subsidiaries | 27 | ||||

| Section 9.7. |

Guaranty Agreement | 27 | ||||

| Section 9.8. |

New Jersey Natural Gas Regulated Nature | 29 | ||||

| Section 9.9. |

Notes to Rank Pari Passu | 29 | ||||

| Section 9.10 |

Most Favored Lender Status | 29 | ||||

| SECTION 10. NEGATIVE COVENANTS | 30 | |||||

| Section 10.1. |

Leverage Ratio | 30 | ||||

| Section 10.2. |

Limitation on Priority Debt | 30 | ||||

| Section 10.3. |

Liens | 30 | ||||

| Section 10.4. |

Restricted Payments | 33 | ||||

| Section 10.5. |

Restrictions on Dividends of Subsidiaries, Etc. | 33 | ||||

| Section 10.6. |

Sale of Assets, Etc. | 33 | ||||

| Section 10.7. |

Merger, Consolidation, Etc. | 34 | ||||

-ii-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| Section 10.8. |

Disposal of Ownership of a Restricted Subsidiary | 35 | ||||

| Section 10.9. |

Limitations on Subsidiaries, Partnerships and Joint Ventures | 35 | ||||

| Section 10.10. |

Limitation on Certain Leases | 35 | ||||

| Section 10.11. |

Nature of Business | 36 | ||||

| Section 10.12. |

Transactions with Affiliates | 36 | ||||

| Section 10.13. |

Designation of Restricted and Unrestricted Subsidiaries | 36 | ||||

| Section 10.14. |

Terrorism Sanctions Regulations | 37 | ||||

| SECTION 11. EVENTS OF DEFAULT | 37 | |||||

| SECTION 12. REMEDIES ON DEFAULT, ETC. | 40 | |||||

| Section 12.1. |

Acceleration | 40 | ||||

| Section 12.2. |

Other Remedies | 40 | ||||

| Section 12.3. |

Rescission | 40 | ||||

| Section 12.4. |

No Waivers or Election of Remedies, Expenses, Etc. | 41 | ||||

| SECTION 13. REGISTRATION; EXCHANGE; SUBSTITUTION OF NOTES | 41 | |||||

| Section 13.1. |

Registration of Notes | 41 | ||||

| Section 13.2. |

Transfer and Exchange of Notes | 41 | ||||

| Section 13.3. |

Replacement of Notes | 42 | ||||

| SECTION 14. PAYMENTS ON NOTES | 42 | |||||

| Section 14.1. |

Place of Payment | 42 | ||||

| Section 14.2. |

Home Office Payment | 42 | ||||

| SECTION 15. EXPENSES, ETC. | 43 | |||||

| Section 15.1. |

Transaction Expenses | 43 | ||||

| Section 15.2. |

Survival | 43 | ||||

| SECTION 16. SURVIVAL OF REPRESENTATIONS AND WARRANTIES; ENTIRE AGREEMENT | 43 | |||||

| SECTION 17. AMENDMENT AND WAIVER | 44 | |||||

| Section 17.1. |

Requirements | 44 | ||||

| Section 17.2. |

Solicitation of Holders of Notes | 44 | ||||

| Section 17.3. |

Binding Effect, Etc. | 45 | ||||

| Section 17.4. |

Notes Held by Company, Etc. | 45 | ||||

| SECTION 18. NOTICES | 45 | |||||

-iii-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| SECTION 19. REPRODUCTION OF DOCUMENTS | 46 | |||||

| SECTION 20. CONFIDENTIAL INFORMATION | 46 | |||||

| SECTION 21. SUBSTITUTION OF PURCHASER | 47 | |||||

| SECTION 22. MISCELLANEOUS | 48 | |||||

| Section 22.1. |

Successors and Assigns | 48 | ||||

| Section 22.2. |

Submission to Jurisdiction; Waiver of Jury Trial | 48 | ||||

| Section 22.3. |

Payments Due on Non-Business Days | 48 | ||||

| Section 22.4. |

Accounting Terms | 49 | ||||

| Section 22.5. |

Severability | 49 | ||||

| Section 22.6. |

Construction | 49 | ||||

| Section 22.7. |

Counterparts | 49 | ||||

| Section 22.8. |

Governing Law | 49 | ||||

-iv-

Attachments to Note Purchase Agreement:

| Schedule A | — | Information Relating to Prudential Investment Management, Inc. | ||

| Information Schedule | ||||

| Schedule B | — | Defined Terms | ||

| Schedule 5.3 | — | Disclosure Materials | ||

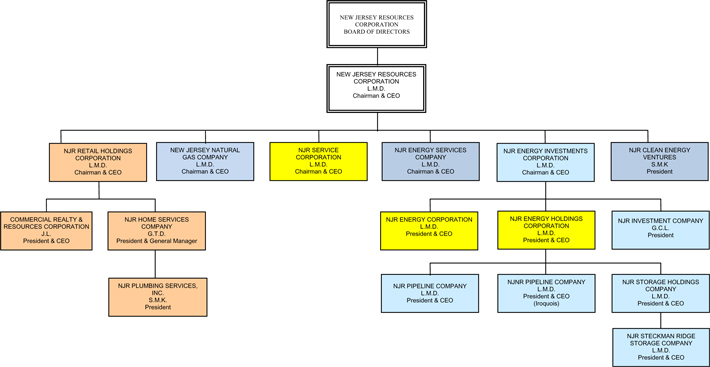

| Schedule 5.4 | — | Subsidiaries of the Company and Ownership of Subsidiary Stock | ||

| Schedule 5.8 | — | Certain Litigation | ||

| Schedule 5.11 | — | Patents, Etc. | ||

| Schedule 5.15 | — | Existing Debt | ||

| Exhibit 1 | — | Form of Note | ||

| Exhibit 2.1(d) | — | Form of Request for Purchase | ||

| Exhibit 2.1(f) | — | Form of Confirmation of Acceptance | ||

| Exhibit 2.2 | — | Form of Subsidiary Guaranty Agreement | ||

| Exhibit 4.6(a) | — | Form of Opinion of Special Counsel for the Company and the Guarantors | ||

| Exhibit 4.6(b) | — | Form of Opinion of Special Counsel for the Purchasers | ||

-v-

New Jersey Resources Corporation

1415 Wyckoff Road

Wall, New Jersey 07719

Dated as of June 30, 2011

Prudential Investment Management, Inc. (“Prudential”)

Each other Prudential Affiliate (as hereinafter

defined) which becomes bound by certain

provisions of this Agreement as hereinafter

provided

c/o Prudential Capital Group

2200 Ross Avenue, Suite 4200E

Dallas, Texas 75201

Ladies and Gentlemen:

New Jersey Resources Corporation, a New Jersey corporation (the “Company”), agrees with you and with any Purchasers (as hereinafter defined) as follows:

SECTION 1. AUTHORIZATION OF NOTES.

Section 1.1. Authorization of Notes. The Company may authorize the issue and sale from time to time on or before June 30, 2014, in one or more Series (as hereinafter defined), of up to $75,000,000 aggregate principal amount of its senior promissory notes (the “Notes,” such term to include any such notes issued in substitution therefor pursuant to Section 13), to be dated the date of issue thereof, to mature, in the case of each Note so issued, no more than 20 years after the date of original issuance thereof, to have an average life, in the case of each Note so issued, of no more than 20 years after the date of original issuance thereof, to bear interest on the unpaid balance thereof from the date thereof at the rate per annum, and to have such other particular terms, as shall be set forth, in the case of each Note so issued, in the Confirmation of Acceptance with respect to such Note delivered pursuant to Section 2.1(f). The Notes of any Series shall be substantially in the form set out in Exhibit 1, with such changes therefrom, if any, as may be approved by the Purchasers of the Notes of such Series and the Company. Certain capitalized terms used in this Agreement are defined in Schedule B; references to a “Schedule” or an “Exhibit” are, unless otherwise specified, to a Schedule or an Exhibit attached to this Agreement. Notes which have (i) the same final maturity, (ii) the same principal prepayment dates, (iii) the same principal prepayment amounts (as a percentage of the original principal amount of each Note), (iv) the same interest rate, (v) the same interest payment periods and (vi) the same date of issuance (which, in the case of a Note issued in exchange for another Note, shall be deemed for these purposes the date on which such Note’s ultimate predecessor Note was issued), are herein called a “Series” of Notes.

SECTION 2. SALE AND PURCHASE OF NOTES; GUARANTY.

Section 2.1. Sale and Purchase of Notes.

Section 2.1(a). Facility. Prudential is willing to consider, in its sole discretion and within limits which may be authorized for purchase by Prudential Affiliates from time to time, the purchase of Notes pursuant to this Agreement. The willingness of Prudential to consider such purchase of Notes is herein called the “Facility”. At any time, the aggregate principal amount of Notes stated in Section 1.1, minus the aggregate principal amount of Notes purchased and sold pursuant to this Agreement prior to such time, minus the aggregate principal amount of Accepted Notes (as hereinafter defined) which have not yet been purchased and sold hereunder prior to such time, is herein called the “Available Facility Amount” at such time. NOTWITHSTANDING THE WILLINGNESS OF PRUDENTIAL TO CONSIDER THE POSSIBLE PURCHASES OF NOTES BY PRUDENTIAL OR PRUDENTIAL AFFILIATES, THIS AGREEMENT IS ENTERED INTO ON THE EXPRESS UNDERSTANDING THAT (A) NEITHER PRUDENTIAL NOR ANY PRUDENTIAL AFFILIATE SHALL BE OBLIGATED TO MAKE OR ACCEPT OFFERS TO PURCHASE NOTES, OR TO QUOTE RATES, SPREADS OR OTHER TERMS WITH RESPECT TO SPECIFIC PURCHASES OF NOTES, AND THIS AGREEMENT SHALL IN NO WAY BE CONSTRUED AS A COMMITMENT BY PRUDENTIAL OR ANY PRUDENTIAL AFFILIATE, AND (B) NONE OF THE COMPANY NOR ANY OF ITS AFFILIATES SHALL BE OBLIGATED TO OFFER TO SELL OR (EXCEPT PURSUANT TO AN ACCEPTANCE AS PROVIDED IN SECTION 2.1(f)) SELL NOTES OR TO MAKE ANY REQUESTS FOR PURCHASE, AND THIS AGREEMENT SHALL IN NO WAY BE CONSTRUED AS A COMMITMENT BY THE COMPANY OR ANY OF ITS AFFILIATES TO DO SO.

Section 2.1(b). Issuance Period. Notes may be issued and sold pursuant to this Agreement until the earlier of (i) the third anniversary of the date of this Agreement (or if the date of such anniversary is not a Business Day, the Business Day next preceding such anniversary), (ii) the 30th day after Prudential shall have given to the Company, or the Company shall have given to Prudential, a written notice stating that it elects to terminate the issuance and sale of Notes pursuant to this Agreement (or if such 30th day is not a Business Day, the Business Day next preceding such 30th day), (iii) the last Closing Day after which there is no Available Facility Amount, (iv) the termination of the Facility under Section 12.1 of this Agreement, and (v) the acceleration of any Note under Section 12.1 of this Agreement. The period during which Notes may be issued and sold pursuant to this Agreement is herein called the “Issuance Period”.

Section 2.1(c). Periodic Spread Information. Provided no Default or Event of Default exists, not later than 9:30 A.M. (New York City local time) on a Business Day during the Issuance Period if there is an Available Facility Amount on such Business Day, the Company may request by telecopier or telephone, and Prudential will, to the extent reasonably practicable, provide to the Company on such Business Day (or, if such request is received after 9:30 A.M. (New York City local time) on such Business Day, on the following Business Day), information (by telecopier or telephone) with respect to various spreads at which Prudential or Prudential Affiliates might be interested in purchasing Notes of different average lives; provided, however, that the Company may not make such requests more frequently than once in every five Business

- 2 -

Days or such other period as shall be mutually agreed to by the Company and Prudential. At the time of making any such request the Company will also notify Prudential of any changes to any representations or warranties or updated Schedules then known by the Company to be included in any Request for Purchase (provided that no failure by the Company to comply with this sentence shall be the basis for any Default or Event of Default hereunder). The amount and content of information so provided shall be in the sole discretion of Prudential but it is the intent of Prudential to provide information which will be of use to the Company in determining whether to initiate procedures for use of the Facility. Information so provided shall not constitute an offer to purchase Notes, and neither Prudential nor any Prudential Affiliate shall be obligated to purchase Notes at the spreads specified. Information so provided shall be representative of potential interest only for the period commencing on the day such information is provided and ending on the earlier of the fifth Business Day after such day and the first day after such day on which further spread information is provided. Prudential may suspend or terminate providing information pursuant to this Section 2.1(c) for any reason, including its determination that the credit quality of the Company has declined since the date of this Agreement.

Section 2.1(d). Request for Purchase. The Company may from time to time during the Issuance Period make requests for purchases of Notes (each such request being herein called a “Request for Purchase”). Each Request for Purchase shall be made to Prudential by facsimile transmission or overnight delivery service, and shall (i) specify the aggregate principal amount of Notes covered thereby, which shall not be less than $5,000,000 and not be greater than the Available Facility Amount at the time such Request for Purchase is made, (ii) specify the principal amounts, final maturities (which shall be no more than 20 years from the date of issuance), average life (which shall be no more than 20 years from the date of issuance), principal prepayment dates (if any) and amounts and interest payment periods (quarterly or semi-annually in arrears) of the Notes covered thereby, (iii) specify the use of proceeds of such Notes, (iv) specify the proposed day for the closing of the purchase and sale of such Notes, which shall be a Business Day during the Issuance Period not less than 10 days and not more than 25 days after the making of such Request for Purchase, (v) specify the number of the account and the name and address of the depository institution to which the purchase prices of such Notes are to be transferred on the Closing Day for such purchase and sale, (vi) certify that the representations and warranties contained in Section 5, as updated by any updates thereto set forth in such Request for Purchase, are true on and as of the date of such Request for Purchase and that there exists on the date of such Request for Purchase no Event of Default or Default, and (vii) be substantially in the form of Exhibit 2.1(d) attached hereto. Each Request for Purchase shall be in writing and shall be deemed made when received by Prudential.

Section 2.1(e). Rate Quotes. Not later than five Business Days after the Company shall have given Prudential a Request for Purchase pursuant to Section 2.1(d), Prudential may, but shall be under no obligation to, provide to the Company by telephone or facsimile transmission, in each case between 9:30 A.M. and 1:30 P.M. New York City local time (or such later time as Prudential may elect) interest rate quotes for the several principal amounts, maturities, principal prepayment schedules and interest payment periods of Notes specified in such Request for Purchase. Each quote shall represent the interest rate per annum payable on the outstanding principal balance of such Notes at which a Prudential Affiliate or Affiliates would be willing to purchase such Notes at 100% of the principal amount thereof.

- 3 -

Section 2.1(f). Acceptance. Within the Acceptance Window with respect to any interest rate quotes provided pursuant to Section 2.1(e), the Company may, subject to Section 2.1(g), elect to accept such interest rate quotes as to not less than $5,000,000 aggregate principal amount of the Notes specified in the related Request for Purchase. Such election shall be made by an Authorized Officer of the Company notifying Prudential by telephone or facsimile transmission within the Acceptance Window that the Company elects to accept such interest rate quotes, specifying the Notes (each such Note being herein called an “Accepted Note”) as to which such acceptance (herein called an “Acceptance”) relates. The day the Company notifies Prudential of an Acceptance with respect to any Accepted Notes is herein called the “Acceptance Day” for such Accepted Notes. Any interest rate quotes as to which Prudential does not receive an Acceptance within the Acceptance Window shall expire, and no purchase or sale of Notes hereunder shall be made based on such expired interest rate quotes. Subject to Section 2.1(g) and the other terms and conditions hereof, the Company agrees to sell to a Prudential Affiliate or Affiliates, and Prudential agrees to cause the purchase by a Prudential Affiliate or Affiliates of, the Accepted Notes at 100% of the principal amount of such Notes. As soon as practicable following the Acceptance Day, the Company and each Prudential Affiliate which is to purchase any such Accepted Notes will execute a confirmation of such Acceptance substantially in the form of Exhibit 2.1(f) attached hereto (herein called a “Confirmation of Acceptance”). Notwithstanding the Acceptance of any interest rate quote, if the related Request for Purchase contains any updates to the representations or warranties contained in Section 5 hereof or any updated Schedules to this Agreement, then Prudential or any Prudential Affiliate may, in its sole discretion, but no later than 5:00 PM New York City time on the third Business Day after Prudential received the related Request for Purchase in writing containing any updates to the representations or warranties contained in Section 5 hereof or any updated Schedules to this Agreement, decline to execute a Confirmation of Acceptance with respect to the Accepted Notes relating to such Acceptance and there shall be no agreement of purchase and sale with respect to such Accepted Note. Prudential agrees to notify the Company of any such declination by Prudential or any Prudential Affiliate with respect to any Accepted Notes and no Cancellation Fee or Delayed Delivery Fee shall be due from the Company with respect to such Accepted Notes. If the Company should fail to execute and return to Prudential within three Business Days following the Company’s receipt thereof a Confirmation of Acceptance with respect to any Accepted Notes, Prudential or any Prudential Affiliate may at its election at any time prior to Prudential’s receipt thereof cancel the closing with respect to such Accepted Notes by so notifying the Company in writing.

Section 2.1(g). Market Disruption. Notwithstanding the provisions of Section 2.1(f), if Prudential shall have provided interest rate quotes pursuant to Section 2.1(e) and thereafter prior to the time an Acceptance with respect to such quotes shall have been notified to Prudential in accordance with Section 2.1(f) the domestic market for U.S. Treasury securities, derivatives or other financial instruments shall have closed or there shall have occurred a general suspension, material limitation, or significant disruption of trading in securities generally on the New York Stock Exchange or in the domestic market for U.S. Treasury securities, derivatives or other financial instruments, then such interest rate quotes shall expire, and no purchase or sale of Notes hereunder shall be made based on such expired interest rate quotes. If the Company thereafter notifies Prudential of the Acceptance of any such interest rate quotes, such Acceptance shall be ineffective for all purposes of this Agreement, and Prudential shall promptly notify the Company that the provisions of this Section 2.1(g) are applicable with respect to such Acceptance.

- 4 -

Section 2.1(h). Facility Closings. Not later than 11:30 A.M. (New York City local time) on the Closing Day for any Accepted Notes, the Company will deliver to each Purchaser listed in the Confirmation of Acceptance relating thereto at the offices of Schiff Hardin LLP, Suite 6600, 233 South Wacker Drive, Chicago, Illinois 60606, Attention: Mark C. Zaander, or at such other place as Prudential may have directed, the Accepted Notes to be purchased by such Purchaser in the form of one or more Notes in authorized denominations as such Purchaser may request for each Series of Accepted Notes to be purchased on the Closing Day, dated the Closing Day and registered in such Purchaser’s name (or in the name of its nominee), against payment of the purchase price thereof by transfer of immediately available funds for credit to the Company’s account specified in the Request for Purchase of such Notes. If the Company fails to tender to any Purchaser the Accepted Notes to be purchased by such Purchaser on the scheduled Closing Day for such Accepted Notes as provided above in this Section 2.1(h), or any of the conditions specified in Section 4 shall not have been fulfilled by the time required on such scheduled Closing Day, the Company shall, prior to 1:00 P.M., New York City local time, on such scheduled Closing Day notify Prudential (which notification shall be deemed received by each Purchaser) in writing whether (i) such closing is to be rescheduled (such rescheduled date to be a Business Day during the Issuance Period not less than one Business Day and not more than 10 Business Days after such scheduled Closing Day (the “Rescheduled Closing Day”)) and certify to Prudential (which certification shall be for the benefit of each Purchaser) that the Company reasonably believes that it will be able to comply with the conditions set forth in Section 4 on such Rescheduled Closing Day and that the Company will pay the Delayed Delivery Fee in accordance with Section 2.1(i)(i) or (ii) such closing is to be canceled. In the event that the Company shall fail to give such notice referred to in the preceding sentence, Prudential (on behalf of each Purchaser) may at its election, at any time after 1:00 P.M., New York City local time, on such scheduled Closing Day, notify the Company in writing that such closing is to be canceled. Notwithstanding anything to the contrary appearing in this Agreement, the Company may not elect to reschedule a closing with respect to any given Accepted Notes on more than one occasion, unless Prudential shall have otherwise consented in writing.

- 5 -

Section 2.1(i). Fees.

Section 2.1(i)(i). Delayed Delivery Fee. If the closing of the purchase and sale of any Accepted Note is delayed for any reason beyond the original Closing Day for such Accepted Note (other than solely as a result of the failure of the Purchaser thereof to tender the purchase price of such Accepted Note on such original Closing Day when all conditions precedent to such Purchaser’s obligation to purchase and pay for such Accepted Note in Section 4 hereof have been satisfied on such original Closing Day), the Company will pay to the Purchaser which shall have agreed to purchase such Accepted Note (a) on the Cancellation Date or actual closing date of such purchase and sale and (b) if earlier, the next Business Day following 90 days after the Acceptance Day for such Accepted Note and on each Business Day following 90 days after the prior payment hereunder, a fee (herein called the “Delayed Delivery Fee”) calculated as follows:

(BEY – MMY) X DTS/360 X PA

where “BEY” means Bond Equivalent Yield, i.e., the bond equivalent yield per annum of such Accepted Note; “MMY” means Money Market Yield, i.e., the yield per annum on a commercial paper investment of the highest quality selected by Prudential in good faith and having a maturity date or dates the same as, or closest to, the Rescheduled Closing Day or Rescheduled Closing Days for such Accepted Note (a new alternative investment being selected by Prudential each time such closing is delayed); “DTS” means Days to Settlement, i.e., the number of actual days elapsed from and including the original Closing Day for such Accepted Note (in the case of the first such payment with respect to such Accepted Note) or from and including the date of the next preceding payment (in the case of any subsequent Delayed Delivery Fee payment with respect to such Accepted Note) to but excluding the date of such payment; and “PA” means Principal Amount, i.e., the principal amount of the Accepted Note for which such calculation is being made. In no case shall the Delayed Delivery Fee be less than zero. Nothing contained herein shall obligate any Purchaser to purchase any Accepted Note on any day other than the Closing Day for such Accepted Note, as the same may be rescheduled from time to time in compliance with Section 2.1(h).

Section 2.1(i)(ii). Cancellation Fee. If the Company at any time notifies Prudential in writing that the Company is canceling the closing of the purchase and sale of any Accepted Note, or if Prudential notifies the Company in writing under the circumstances set forth in the last sentence of Section 2.1(f) or the penultimate sentence of Section 2.1(h) that the closing of the purchase and sale of such Accepted Note is to be canceled, or if the closing of the purchase and sale of such Accepted Note is not consummated on or prior to the last day of the Issuance Period (the date of any such notification or the last day of the Issuance Period, as the case may be, being herein called the “Cancellation Date”), the Company will pay to the Purchaser which shall have agreed to purchase such Accepted Note on the Cancellation Date in immediately available funds an amount (the “Cancellation Fee”) calculated as follows:

PI X PA

where “PI” means Price Increase, i.e., the quotient (expressed in decimals) obtained by dividing (a) the excess of the ask price (as determined by Prudential in good faith) of the Hedge Treasury Note(s) on the Cancellation Date over the bid price (as determined by Prudential in good faith) of the Hedge Treasury Notes(s) on the Acceptance Day for such Accepted Note by (b) such bid price; and “PA” has the meaning ascribed to it in Section 2.1(i)(i). The foregoing bid and ask prices shall be as reported by TradeWeb LLC (or, if such data for any reason ceases to be available through TradeWeb LLC, any publicly available source of similar market data). Each price shall be based on a U.S. Treasury security having a par value of $100.00 and shall be rounded to the second decimal place. In no case shall the Cancellation Fee be less than zero.

Section 2.2. Guaranty Agreement. The obligations of the Company hereunder and under the Notes are absolutely, unconditionally and irrevocably guaranteed by each Restricted Subsidiary existing on the date of this Agreement and each other Subsidiary from time to time required to guaranty the Notes pursuant to Section 9.7 (each a “Guarantor” and, collectively, the “Guarantors”), pursuant to that certain Subsidiary Guaranty Agreement dated as of the date hereof (as the same may be amended, supplemented, restated or otherwise modified from time to time, the “Guaranty Agreement”) substantially in the form of Exhibit 2.2.

- 6 -

SECTION 3. [INTENTIONALLY OMITTED].

SECTION 4. CONDITIONS TO CLOSING.

Each Purchaser’s obligation to purchase and pay for the Notes of any Series to be sold to such Purchaser on any Closing Day is subject to the fulfillment to such Purchaser’s satisfaction, prior to or on the Closing Day for such Series of Notes, of the following conditions:

Section 4.1 Notes. Each Purchaser of the Notes of such Series shall have received the Note(s) to be purchased by such Purchaser on such Closing Day substantially in the form of Exhibit 1 duly executed and delivered by the Company.

Section 4.2. Representations and Warranties. (a) The representations and warranties of the Company in this Agreement shall be correct when made on and as of such Closing Day, except (a) for such representations and warranties as of a specified date (which representations and warranties shall be correct as of such specified date) and (b) as otherwise noted in the applicable Request for Purchase for such Series of Notes.

(b) The representations and warranties of each Guarantor in the Guaranty Agreement shall be correct when made on and as of such Closing Day, except (a) for such representations and warranties as of a specified date (which representations and warranties shall be correct as of such specified date) and (b) as otherwise noted in the applicable Request for Purchase for such Series of Notes.

Section 4.3. Performance; No Default. The Company and each Guarantor shall have performed and complied with all agreements and conditions contained in this Agreement or in the Guaranty Agreement, as applicable, required to be performed or complied with by it prior to or on such Closing Day, and after giving effect to the issue and sale of the Notes of such Series (and the application of the proceeds thereof as contemplated by the Request for Purchase relating thereto), no Default or Event of Default shall have occurred and be continuing.

Section 4.4. Compliance Certificates.

(a) Officer’s Certificate. (1) The Company shall have delivered to such Purchaser an Officer’s Certificate, dated such Closing Day, certifying that the conditions specified in Sections 4.2, 4.3 and 4.11 have been fulfilled.

(2) Each Guarantor shall have delivered to such Purchaser an Officer’s Certificate, dated such Closing Day, certifying that the conditions specified in Section 4.2(b) and 4.3 have been fulfilled.

(3) A duly authorized Senior Financial Officer shall execute and deliver to each such Purchaser and each holder of Notes an Officer’s Certificate dated the date of issue of such Series of Notes stating that such officer has reviewed the provisions of this Agreement and setting forth the information and computations (in sufficient detail) required to establish whether after giving effect to the issuance of such Notes and after giving effect to the application of the proceeds thereof, the Company is in compliance with the requirements of Section 10.1 on such date.

- 7 -

(b) Secretary’s Certificate. (1) The Company shall have delivered to such Purchaser a certificate of its Secretary, dated such Closing Day, certifying as to the resolutions attached thereto and other corporate proceedings relating to the authorization, execution and delivery of the Notes of such Series and this Agreement.

(2) Each Guarantor shall have delivered to such Purchaser a certificate of its Secretary, dated such Closing Day, certifying as to the resolutions attached thereto and other corporate or similar proceedings relating to the authorization, execution and delivery of the Guaranty Agreement.

Section 4.5. Guaranty Agreement. The Guaranty Agreement shall have been duly authorized, executed and delivered by each Guarantor and shall be in full force and effect and such Purchaser shall have received a duly executed copy thereof. Each Guarantor shall have executed and delivered such documents and agreements as any Purchaser of such Series of Notes or other holder of Notes may reasonably require to confirm that the Guaranty Agreement guarantees the obligations of the Company under the Notes of such Series and under each other Series of Notes outstanding.

Section 4.6. Opinions of Counsel. Such Purchaser shall have received opinions in form and substance satisfactory to such Purchaser, dated such Closing Day (a) from Richard Reich, Esq., Assistant General Counsel of NJR Service Corporation, and of Troutman Sanders LLP, in each case special counsel for the Company and the Guarantors, covering the matters set forth in Exhibit 4.6(a) and covering such other matters incident to the transactions contemplated hereby as such Purchaser or special counsel to the Purchasers may reasonably request (and the Company hereby instructs its counsel to deliver such opinion to such Purchaser) and (b) from Schiff Hardin LLP, special counsel to the Purchasers of the Notes of such Series, or such other special counsel as such Purchasers shall have designated, in connection with such transactions, substantially in the form set forth in Exhibit 4.6(b) and covering such other matters incident to such transactions as such Purchaser may reasonably request.

Section 4.7. Purchase Permitted by Applicable Law, Etc. On such Closing Day, such Purchaser’s purchase of Notes of such Series shall (a) be permitted by the laws and regulations of each jurisdiction to which such Purchaser is subject, without recourse to provisions (such as Section 1405(a)(8) of the New York Insurance Law) permitting limited investments by insurance companies without restriction as to the character of the particular investment, (b) not violate any applicable law or regulation (including, without limitation, Regulation T, U or X of the Board of Governors of the Federal Reserve System) and (c) not subject such Purchaser to any tax, penalty or liability under or pursuant to any applicable law or regulation which was not in effect on the date of this Agreement. If requested by any Purchaser, such Purchaser shall have received an Officer’s Certificate certifying as to such matters of fact as such Purchaser may reasonably specify to enable it to determine whether such purchase is so permitted.

- 8 -

Section 4.8. Payment of Fees. The Company shall have paid to such Purchaser in immediately available funds any fees due it pursuant to or in connection with this Agreement, including any Delayed Delivery Fee due pursuant to Section 2.1(i)(i).

Section 4.9. Payment of Special Counsel Fees. Without limiting the provisions of Section 15.1, the Company shall have paid on or before such Closing Day the reasonable fees, charges and disbursements of special counsel to the Purchasers referred to in Section 4.6(b) to the extent reflected in a statement of such counsel rendered to the Company at least one Business Day prior to such Closing Day.

Section 4.10. Private Placement Number. A Private Placement Number issued by Standard & Poor’s CUSIP Service Bureau (in cooperation with the Securities Valuation Office of the National Association of Insurance Commissioners) shall have been obtained for the Notes of such Series.

Section 4.11. Changes in Corporate Structure. Except as disclosed in writing to Prudential prior to the delivery of the Request for Purchase relating to such Series of Notes, the Company shall not have changed its jurisdiction of incorporation or been a party to any merger or consolidation and shall not have succeeded to all or any substantial part of the liabilities of any other entity, at any time following the date of the most recent financial statements referred to in Section 5.5.

Section 4.12. Proceedings and Documents. All corporate and other proceedings in connection with the transactions contemplated by this Agreement and all documents and instruments incident to such transactions shall be satisfactory to such Purchaser and special counsel to the Purchasers, and such Purchaser and special counsel to the Purchasers shall have received all such counterpart originals or certified or other copies of such documents as such Purchaser or special counsel to the Purchasers may reasonably request.

SECTION 5. REPRESENTATIONS AND WARRANTIES OF THE COMPANY.

The Company represents and warrants to each Purchaser that:

Section 5.1. Organization; Power and Authority. The Company is a corporation duly organized, validly existing and in good standing under the laws of its jurisdiction of incorporation, and is duly qualified as a foreign corporation and is in good standing in each jurisdiction in which such qualification is required by law, other than those jurisdictions as to which the failure to be so qualified or in good standing would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. The Company has the corporate power and authority to own or lease the properties it purports to own or lease, to transact the business it transacts and proposes to transact, to execute and deliver this Agreement and the Notes and to perform the provisions hereof and thereof.

Section 5.2. Authorization, Etc. (a) This Agreement and the Notes have been duly authorized by all necessary corporate action on the part of the Company, and this Agreement constitutes, and upon execution and delivery thereof each Note will constitute, a legal, valid and binding obligation of the Company enforceable against the Company in accordance with its terms, except as such enforceability may be limited by (1) applicable bankruptcy, insolvency,

- 9 -

reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and (2) general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law).

(b) The Guaranty Agreement has been duly authorized by all necessary corporate or other action on the part of each Guarantor, and the Guaranty Agreement constitutes a legal, valid and binding obligation of each Guarantor enforceable against each Guarantor in accordance with its terms, except as such enforceability may be limited by (1) applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and (2) general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law).

Section 5.3. Disclosure. As of any date upon which this representation is being made, except as disclosed in Schedule 5.3, this Agreement, the documents, certificates or other writings identified in Schedule 5.3, the financial statements referred to in Section 5.5 or in the other documents, certificates and statements furnished to Prudential by or on behalf of the Company prior to the date hereof (in the case of the making of this representation at the time of the execution of this Agreement) or with the Request for Purchase with respect to a Series of Notes (in the case of the making of this representation with respect to the issuance of such Series of Notes) (collectively, the “Disclosure Documents”), taken as a whole, when read in conjunction with the information with respect to the Company and its Subsidiaries that may be available on the website of the Securities and Exchange Commission (presently www.sec.gov), do not contain any untrue statement of a material fact or omit to state any material fact necessary to make the statements therein not misleading in light of the circumstances under which they were made. As of any date upon which this representation is being made, except as disclosed in the Disclosure Documents, since the end of the most recent fiscal year for which such audited financial statements had been furnished to Prudential at the time of the execution of this Agreement by Prudential (in the case of the making of this representation at the time of the execution of this Agreement) or since the end of the most recent fiscal year for which audited financial statements described in clause (i) of Section 5.5 had been provided to Prudential prior to the time Prudential was provided with the Request for Purchase with respect to a Series of Notes (in the case of the making of this representation at the time of the issuance of such Series of Notes), there has been no change in the financial condition, operations, business or properties of the Company, any of its Restricted Subsidiaries or New Jersey Natural Gas except changes that, individually or in the aggregate, would not reasonably be expected to have a Material Adverse Effect.

Section 5.4. Organization and Ownership of Shares of Subsidiaries. (a) Schedule 5.4 (as such Schedule is attached hereto, in the case of the making of this representation at the time of the execution of this Agreement, or as such Schedule was delivered to Prudential with the Request for Purchase with respect to a Series of Notes, in the case of the making of this representation with respect to the issuance of such Series of Notes) is (except as noted therein) a complete and correct list of the Company’s Subsidiaries as of the date this representation is being made, showing, as to each Subsidiary, the correct name thereof, the jurisdiction of its organization, the percentage of shares of each class of its capital stock or similar equity interests outstanding owned by the Company and each other Subsidiary and whether or not such Subsidiary is a Restricted Subsidiary, an Inactive Subsidiary and/or a Regulated Entity.

- 10 -

(b) As of the date this representation is being made, all of the outstanding shares of capital stock or similar equity interests of each Restricted Subsidiary and New Jersey Natural Gas shown in Schedule 5.4 (as such Schedule is attached hereto, in the case of the making of this representation at the time of the execution of this Agreement, or as such Schedule was delivered to Prudential with the Request for Purchase with respect to a Series of Notes, in the case of the making of this representation with respect to the issuance of such Series of Notes) as being owned by the Company and its Subsidiaries have been validly issued, are fully paid and nonassessable and are owned by the Company or another Subsidiary free and clear of any Lien (except as otherwise disclosed in Schedule 5.4 (as such Schedule is attached hereto, in the case of the making of this representation at the time of the execution of this Agreement, or as such Schedule was delivered to Prudential with the Request for Purchase with respect to a Series of Notes, in the case of the making of this representation with respect to the issuance of such Series of Notes)).

(c) Each Restricted Subsidiary identified in Schedule 5.4 (as such Schedule is attached hereto, in the case of the making of this representation at the time of the execution of this Agreement, or as such Schedule was delivered to Prudential with the Request for Purchase with respect to a Series of Notes, in the case of the making of this representation with respect to the issuance of such Series of Notes) and New Jersey Natural Gas is, on the date this representation is being made, a corporation or other legal entity duly organized, validly existing and in good standing under the laws of its jurisdiction of organization, and is duly qualified as a foreign corporation or other legal entity and is in good standing in each jurisdiction in which such qualification is required by law, other than those jurisdictions as to which the failure to be so qualified or in good standing would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. Each such Restricted Subsidiary and New Jersey Natural Gas has, on the date hereof, the corporate or other power and authority to own or lease the properties it purports to own or lease, to transact the business it transacts and proposes to transact and, in the case of each Restricted Subsidiary that is a Guarantor, to execute and deliver the Guaranty Agreement and to perform the provisions thereof.

Section 5.5. Financial Statements. The Company has delivered to Prudential (which may have been delivered by Electronic Delivery) the following financial statements: (i) a consolidated balance sheet of the Company and its Subsidiaries and a balance sheet of New Jersey Natural Gas Company as at September 30 in each of the three fiscal years of the Company and New Jersey Natural Gas Company most recently completed prior to the date as of which this representation is made or repeated (other than fiscal years completed within 100 days prior to such date for which audited financial statements have not been released) and consolidated statements of income and cash flows and a consolidated statement of shareholders’ equity of the Company and its Subsidiaries and of New Jersey Natural Gas Company for each such year, all reported on by Deloitte & Touche LLP (or such other nationally recognized accounting firm as may be reasonably acceptable to such Prudential) and (ii) consolidated balance sheet of the Company and its Subsidiaries and a balance sheet of New Jersey Natural Gas Company as at the end of the quarterly period (if any) most recently completed prior to such date and after the end of such fiscal year (other than quarterly periods completed within 55 days prior to such date for which financial statements have not been released) and the comparable quarterly period in the preceding fiscal year and consolidated statements of income and cash flows and a consolidated statement of shareholders’ equity for the Company and its Subsidiaries and New Jersey Natural

- 11 -

Gas Company periods from the beginning of the fiscal years in which such quarterly periods are included to the end of such quarterly periods, prepared by the Company or New Jersey Natural Gas Company, as the case may be. All of said financial statements (including in each case the related schedules and notes) fairly present in all material respects the consolidated financial position of the Company and its Subsidiaries as of the respective dates specified in such Schedule and the consolidated results of their operations and cash flows for the respective periods so specified and have been prepared in accordance with GAAP consistently applied throughout the periods involved except as set forth in the notes thereto (subject, in the case of any interim financial statements, to normal year-end adjustments) The Company and its Subsidiaries did not have, on the date of such financial statements, any Material liabilities that are not disclosed on such financial statements or otherwise disclosed in the Disclosure Documents.

Section 5.6. Compliance with Laws, Other Instruments, Etc. The execution, delivery and performance by the Company of this Agreement and the Notes and the execution and delivery by each Guarantor of the Guaranty Agreement will not (a) contravene, result in any breach of, or constitute a default under, or result in the creation of any Lien in respect of any property of the Company, any Restricted Subsidiary or New Jersey Natural Gas under, any indenture, mortgage, deed of trust, loan, purchase or credit agreement, lease, corporate charter or by-laws, or any other Material agreement or instrument to which the Company, any Restricted Subsidiary or New Jersey Natural Gas is bound or by which the Company, any Restricted Subsidiary or New Jersey Natural Gas or any of their respective properties may be bound or affected, (b) conflict with or result in a breach of any of the terms, conditions or provisions of any order, judgment, decree or ruling of any court, arbitrator or Governmental Authority applicable to the Company, any Restricted Subsidiary or New Jersey Natural Gas or (c) violate any provision of any statute or other rule or regulation of any Governmental Authority applicable to the Company, any Restricted Subsidiary or New Jersey Natural Gas.

Section 5.7. Governmental Authorizations, Etc. No consent, approval or authorization of, or registration, filing or declaration with, any Governmental Authority is required to be done or made, as the case may be, by the Company or any Guarantor in connection with the execution, delivery or performance by (a) the Company of this Agreement or the Notes or (b) any Guarantor of the Guaranty Agreement, in each case, other than such consents, approvals, authorizations, registrations, filings or declarations that have been obtained or made prior to the applicable Closing Day.

Section 5.8. Litigation; Observance of Statutes and Orders. (a) Except as disclosed in Schedule 5.8 (as such Schedule is attached hereto, in the case of the making of this representation at the time of the execution of this Agreement, or as such Schedule was delivered to Prudential with the Request for Purchase with respect to a Series of Notes, in the case of the making of this representation with respect to the issuance of such Series of Notes), as of the date this representation is being made there are no actions, suits or proceedings pending or, to the knowledge of the Company, threatened against or affecting the Company, any Restricted Subsidiary or New Jersey Natural Gas or any property of the Company, any Restricted Subsidiary or New Jersey Natural Gas in any court or before any arbitrator of any kind or before or by any Governmental Authority that, individually or in the aggregate, would reasonably be expected to have a Material Adverse Effect.

- 12 -

(b) None of the Company, any Restricted Subsidiary or New Jersey Natural Gas is in default under any order, judgment, decree or ruling of any court, arbitrator or Governmental Authority or is in violation of any applicable law, ordinance, rule or regulation (including, without limitation, ERISA (with respect to any Plan), Environmental Laws or the USA Patriot Act) of any Governmental Authority, which default or violation, individually or in the aggregate, would reasonably be expected to have a Material Adverse Effect.

Section 5.9. Taxes. The Company and its Subsidiaries have filed all income tax returns that are required to have been filed in any jurisdiction, and have paid all taxes shown to be due and payable on such returns and all other taxes and assessments payable by them, to the extent such taxes and assessments have become due and payable and before they have become delinquent, except for any taxes and assessments (a) the amount of which is not, individually or in the aggregate, Material or (b) the amount, applicability or validity of which is currently being contested in good faith by appropriate proceedings and with respect to which the Company or a Subsidiary, as the case may be, has established adequate reserves in accordance with GAAP. The charges, accruals and reserves on the books of the Company and its Subsidiaries in respect of Federal, state or other taxes for all fiscal periods are adequate. The Federal income tax liabilities of the Company and its Subsidiaries have been determined by the Internal Revenue Service and paid for all fiscal years up to and including the fiscal year ended September 30, 2006.

Section 5.10. Title to Property; Leases. The Company, its Restricted Subsidiaries and New Jersey Natural Gas have good and sufficient title related to the ownership of their respective Material properties, including all such Material properties reflected in the most recent audited balance sheet referred to in Section 5.5 or purported to have been acquired by the Company, any Restricted Subsidiary or New Jersey Natural Gas after said date (except as sold or otherwise disposed of in the ordinary course of business or otherwise to the extent not prohibited hereunder), in each case free and clear of Liens prohibited by this Agreement, except for those defects in title that, individually or in the aggregate, would not have a Material Adverse Effect. All Material leases are valid and subsisting and are in full force and effect in all material respects.

Section 5.11. Licenses, Permits, Etc. Except as disclosed in Schedule 5.11 (as such Schedule is attached hereto, in the case of the making of this representation at the time of the execution of this Agreement, or as such Schedule was delivered to Prudential with the Request for Purchase with respect to a Series of Notes, in the case of the making of this representation with respect to the issuance of such Series of Notes), the Company, its Restricted Subsidiaries and New Jersey Natural Gas own or possess all licenses, permits, franchises, authorizations, patents, copyrights, proprietary software, service marks, trademarks, trade names and domain names or rights thereto, that are Material, without known conflict with the rights of others, except for those conflicts that, individually or in the aggregate, would not have a Material Adverse Effect.

Section 5.12. Compliance with ERISA. (a) The Company and each ERISA Affiliate have operated and administered each Plan in compliance with all applicable laws except for such instances of noncompliance as have not resulted in and would not reasonably be expected to result in a Material Adverse Effect. Neither the Company nor any ERISA Affiliate has incurred

- 13 -

any liability pursuant to Title I or IV of ERISA or the penalty or excise tax provisions of the Code relating to employee benefit plans (as defined in Section 3 of ERISA) with respect to any Plan, other than for claims for benefits and funding obligations in the ordinary course, and no event, transaction or condition has occurred or exists with respect to any Plan that would reasonably be expected to result in the incurrence of any such liability under Title I or IV of ERISA or the penalty or excise tax provisions of the Code by the Company or any ERISA Affiliate, or in the imposition of any Lien under Section 430 of the Code or Section 4068 of ERISA on any of the rights, properties or assets of the Company or any ERISA Affiliate, other than any such liabilities or Liens as would not, individually or in the aggregate, be reasonably expected to result in a Material Adverse Effect.

(b) The present value of the aggregate benefit liabilities under each of the Plans which are subject to Title IV of ERISA (other than Multiemployer Plans), determined as of the end of such Plan’s most recently ended plan year on the basis of the actuarial assumptions specified for funding purposes in such Plan’s most recent actuarial valuation report, did not exceed the aggregate current value of the assets of such Plans allocable to such benefit liabilities by more than $25,000,000. The term “benefit liabilities” has the meaning specified in Section 4001 of ERISA and the terms “current value” and “present value” have the meanings specified in Section 3 of ERISA.

(c) The Company and its ERISA Affiliates have not incurred withdrawal liabilities under Section 4201 or 4204 of ERISA (and are not subject to contingent withdrawal liabilities under Section 4204) in respect of Multiemployer Plans that, individually or in the aggregate, are reasonably expected to result in a Material Adverse Effect.

(d) The accumulated post-retirement benefit obligation (determined as of the last day of the Company’s most recently ended fiscal year in accordance with Financial Accounting Standards Board Statement No. 106, without regard to liabilities attributable to continuation coverage mandated by Section 4980B of the Code) of the Company, its Restricted Subsidiaries and New Jersey Natural Gas is not reasonably expected to result in a Material Adverse Effect.

(e) The execution and delivery of this Agreement and the issuance and sale of the Notes hereunder will not involve any transaction that is subject to the prohibitions of Section 406(a)(1)(A)-(D) of ERISA or in connection with which a tax could be imposed pursuant to Section 4975(c)(1)(A)-(D) of the Code. The representation by the Company in the first sentence of this Section 5.12(e) with respect to each Purchaser is made in reliance upon and subject to the accuracy of such Purchaser’s representation in Section 6.2 as to the sources of the funds used to pay the purchase price of the Notes to be purchased by such Purchaser.

Section 5.13. Private Offering by the Company. Neither the Company nor anyone authorized to act on its behalf has offered the Notes or the Guaranty Agreement or any similar securities for sale to, or solicited any offer to buy any of the same from, or otherwise approached or negotiated in respect thereof with, any Person other than the Purchasers and other Institutional Investors of the type described in clause (c) of the definition thereof, each of which has been offered the Notes and the Guaranty Agreement at a private sale for investment. Neither the Company nor anyone authorized to act on its behalf has taken, or will take, any action that would subject the issuance or sale of the Notes or the execution and performance of the Guaranty Agreement to the registration requirements of Section 5 of the Securities Act.

- 14 -

Section 5.14. Use of Proceeds; Margin Regulations. The Company will apply the proceeds of the sale of the Notes of any Series as set forth in Request for Purchase for the Notes of such Series. No part of the proceeds from the sale of the Notes hereunder will be used, directly or indirectly, for the purpose of buying or carrying any margin stock within the meaning of Regulation U of the Board of Governors of the Federal Reserve System (12 CFR 221), or for the purpose of buying or carrying or trading in any securities under such circumstances as to involve the Company in a violation of Regulation X of said Board (12 CFR 224) or to involve any broker or dealer in a violation of Regulation T of said Board (12 CFR 220). Margin stock does not constitute more than 25% of the value of the consolidated assets of the Company and its Subsidiaries and the Company does not have any present intention that margin stock will constitute more than 25% of the value of such assets. As used in this Section, the terms “margin stock” and “purpose of buying or carrying” shall have the meanings assigned to them in said Regulation U. None of the proceeds of the sale of any Notes will be used to finance a Hostile Tender Offer.

Section 5.15. Existing Debt. (a) Schedule 5.15 sets forth a complete and correct list of all outstanding Debt of the Company, its Restricted Subsidiaries and New Jersey Natural Gas as of March 31, 2011, and between such date to the date of this Agreement, except as described therein, there has been no Material change in the amounts, interest rates, sinking funds, installment payments or maturities of the Debt of the Company, its Restricted Subsidiaries or New Jersey Natural Gas. None of the Company, any Restricted Subsidiary or New Jersey Natural Gas is in default in the payment of any principal or interest on any Debt of the Company, such Restricted Subsidiary or New Jersey Natural Gas and no event or condition exists with respect to any Debt of the Company, any Restricted Subsidiary or New Jersey Natural Gas the outstanding principal amount of which exceeds $5,000,000 that would permit (or that with notice or the lapse of time, or both, would permit) one or more Persons to cause such Debt to become due and payable before its stated maturity or before its regularly scheduled dates of payment.

(b) Neither the Company nor any Subsidiary is a party to, or otherwise subject to any provision contained in, any instrument evidencing Debt of the Company or such Subsidiary, any agreement relating thereto or any other agreement (including, but not limited to, its charter or other organizational document) which limits the amount of, or otherwise imposes restrictions on the incurring of, Debt of the Company or any Guarantor, except as specifically indicated in Schedule 5.15 (as such Schedule is attached hereto, in the case of the making of this representation at the time of the execution of this Agreement, or as such Schedule was delivered to Prudential with the Request for Purchase with respect to a Series of Notes, in the case of the making of this representation with respect to the issuance of such Series of Notes).

Section 5.16. Foreign Assets Control Regulations, Etc. (a) Neither the sale of the Notes by the Company hereunder nor its use of the proceeds thereof will violate the Anti-Terrorism Order, the USA Patriot Act, the Trading with the Enemy Act, as amended, or any of the foreign assets control regulations of the United States Treasury Department (31 CFR, Subtitle B, Chapter V, as amended) or any enabling legislation or executive order relating thereto.

- 15 -

(b) Neither the Company nor any Subsidiary (1) is a Person described or designated in the Specially Designated Nationals and Blocked Persons List of the Office of Foreign Assets Control or in Section 1 of the Anti-Terrorism Order or (2) engages in any dealings or transactions with any such Person. The Company and its Subsidiaries are in compliance, in all material respects, with the USA Patriot Act.

(c) No part of the proceeds from the sale of the Notes hereunder will be used, directly or indirectly, for any payments to any governmental official or employee, political party, official of a political party, candidate for political office, or anyone else acting in an official capacity, in order to obtain, retain or direct business or obtain any improper advantage, in violation of the United States Foreign Corrupt Practices Act of 1977, as amended, assuming in all cases that such Act applies to the Company.

Section 5.17. Status under Certain Statutes. Neither the Company nor any Subsidiary is an “investment company” registered or required to be registered under the Investment Company Act of 1940 or an “affiliated person” of an “investment company” or an “affiliated person” of such “affiliated person” or under the “control” of an “investment company” as such terms are defined in the Investment Company Act of 1940, as amended, and shall not become such an “investment company” or such an “affiliated person” or under such “control.” Neither the Company nor any Subsidiary is a “holding company” or a “subsidiary company” of a “holding company,” or an “affiliate” of a “holding company” or of a “subsidiary company” of a “holding company” within the meaning of the Public Utility Holding Company Act of 2005, as amended. Based upon the immediately preceding sentence, neither the Company nor the issue and sale of the Notes is subject to regulation under the Public Utility Holding Company Act of 2005, as amended. Neither the Company nor any Subsidiary is subject to the ICC Termination Act of 1995, as amended, or the Federal Power Act, as amended. Neither the Company nor any Subsidiary (other than New Jersey Natural Gas) is subject to any Federal or state statute or regulation limiting its ability to incur Debt.

Section 5.18. Environmental Matters. None of the Company, any Restricted Subsidiary or New Jersey Natural Gas has actual knowledge of any claim or has received any written notice of any claim, and no proceeding has been instituted raising any claim against the Company, any of its Restricted Subsidiaries or New Jersey Natural Gas or any of their respective real properties now or formerly owned, leased or operated by any of them or other assets, alleging any damage to the environment or violation of any Environmental Laws, except, in each case, such as would not reasonably be expected to result in a Material Adverse Effect. Except as otherwise disclosed to the Purchasers in writing:

(a) none of the Company, any Restricted Subsidiary or New Jersey Natural Gas has actual knowledge of any facts which would give rise to any claim, public or private, of violation of Environmental Laws or damage to the environment emanating from, occurring on or in any way related to real properties now or formerly owned, leased or operated by any of them or to other assets or their use, except, in each case, such as would not reasonably be expected to result in a Material Adverse Effect;

(b) none of the Company, any of its Restricted Subsidiaries or New Jersey Natural Gas has stored any Hazardous Materials on real properties now or formerly

- 16 -

owned, leased or operated by any of them or has disposed of any Hazardous Materials in a manner contrary to any Environmental Laws in each case in any manner that would reasonably be expected to result in a Material Adverse Effect; and

(c) all buildings on all real properties now owned or operated by the Company, any of its Restricted Subsidiaries or New Jersey Natural Gas are in compliance with applicable Environmental Laws, except where failure to comply would not reasonably be expected to result in a Material Adverse Effect.

Section 5.19. Notes Rank Pari Passu. The obligations of the Company under this Agreement and the Notes rank at least pari passu in right of payment with all other unsecured Senior Debt (actual or contingent) of the Company, including, without limitation, all unsecured Senior Debt of the Company described in Schedule 5.15 (as such Schedule is attached hereto, in the case of the making of this representation at the time of the execution of this Agreement, or as such Schedule was delivered to Prudential with the Request for Purchase with respect to a Series of Notes, in the case of the making of this representation with respect to the issuance of such Series of Notes).

SECTION 6. REPRESENTATIONS OF THE PURCHASERS.

Section 6.1. Purchase for Investment. Each Purchaser of the Notes of any Series severally represents that it is purchasing the Notes of such Series for its own account or for one or more separate accounts maintained by such Purchaser or for the account of one or more pension or trust funds and not with a view to the distribution thereof, provided that the disposition of such Purchaser’s or such pension or trust fund’s property shall at all times be within such Purchaser’s or such pension or trust fund’s control. Each Purchaser represents that it is an “accredited investor,” as defined in Rule 501(a)(1), (2), (3) or (7) of Regulation D under the Securities Act. Each Purchaser understands that the Notes have not been registered under the Securities Act and may be resold only if registered pursuant to the provisions of the Securities Act or if an exemption from registration is available, except under circumstances where neither such registration nor such an exemption is required by law, and that the Company is not required to register the Notes. Each Purchaser also represents that the Company has made available to it, a reasonable time prior to the consummation of the transactions contemplated hereby, the opportunity to ask questions and receive answers concerning the terms and conditions of the offering of the Notes that it is purchasing or shall purchase and to obtain any additional information which the Company possesses or could acquire without unreasonable effort or expense.

Section 6.2. Source of Funds. Each Purchaser severally represents that at least one of the following statements is an accurate representation as to each source of funds (a “Source”) to be used by such Purchaser to pay the purchase price of the Notes of any Series to be purchased by such Purchaser hereunder:

(a) the Source is an “insurance company general account” (as the term is defined in the United States Department of Labor’s Prohibited Transaction Exemption (“PTE”) 95-60) in respect of which the reserves and liabilities (as defined by the annual statement for life insurance companies approved by the National Association of

- 17 -

Insurance Commissioners (the “NAIC Annual Statement”)) for the general account contract(s) held by or on behalf of any employee benefit plan together with the amount of the reserves and liabilities for the general account contract(s) held by or on behalf of any other employee benefit plans maintained by the same employer (or affiliate thereof as defined in PTE 95-60) or by the same employee organization in the general account do not exceed 10% of the total reserves and liabilities of the general account (exclusive of separate account liabilities) plus surplus as set forth in the NAIC Annual Statement filed with such Purchaser’s state of domicile; or

(b) the Source is a separate account that is maintained solely in connection with such Purchaser’s fixed contractual obligations under which the amounts payable, or credited, to any employee benefit plan (or its related trust) that has any interest in such separate account (or to any participant or beneficiary of such plan (including any annuitant)) are not affected in any manner by the investment performance of the separate account; or

(c) the Source is either (1) an insurance company pooled separate account, within the meaning of PTE 90-1 or (2) a bank collective investment fund, within the meaning of the PTE 91-38 and, except as disclosed by such Purchaser to the Company in writing pursuant to this clause (c), no employee benefit plan or group of plans maintained by the same employer or employee organization beneficially owns more than 10% of all assets allocated to such pooled separate account or collective investment fund; or

(d) the Source constitutes assets of an “investment fund” (within the meaning of Part V of PTE 84-14 (the “QPAM Exemption”)) managed by a “qualified professional asset manager” or “QPAM” (within the meaning of Part V of the QPAM Exemption), no employee benefit plan’s assets that are included in such investment fund, when combined with the assets of all other employee benefit plans established or maintained by the same employer or by an affiliate (within the meaning of Section V(c)(1) of the QPAM Exemption) of such employer or by the same employee organization and managed by such QPAM, exceed 20% of the total client assets managed by such QPAM, the conditions of Part I(c) and (g) of the QPAM Exemption are satisfied, neither the QPAM nor a Person controlling or controlled by the QPAM (applying the definition of “control” in Section V(e) of the QPAM Exemption) owns a 5% or more interest in the Company and (1) the identity of such QPAM and (2) the names of all employee benefit plans whose assets are included in such investment fund have been disclosed to the Company in writing pursuant to this clause (d); or

(e) the Source constitutes assets of a “plan(s)” (within the meaning of Section IV of PTE 96-23 (the “INHAM Exemption”)) managed by an “in-house asset manager” or “INHAM” (within the meaning of Part IV of the INHAM Exemption), the conditions of Part I(a), (g) and (h) of the INHAM Exemption are satisfied, neither the INHAM nor a Person controlling or controlled by the INHAM (applying the definition of “control” in Section IV(d) of the INHAM Exemption) owns a 5% or more interest in the Company and (1) the identity of such INHAM and (2) the name(s) of the employee benefit plan(s) whose assets constitute the Source have been disclosed to the Company in writing pursuant to this clause (e); or

- 18 -

(f) the Source is a governmental plan; or

(g) the Source is one or more employee benefit plans, or a separate account or trust fund comprised of one or more employee benefit plans, each of which has been identified to the Company in writing pursuant to this clause (g); or

(h) the Source does not include assets of (i) any employee benefit plan, other than a plan exempt from the coverage of ERISA, or (ii) any “plan” as defined in Section 4975(e)(1) of the Code.

As used in this Section 6.2, the terms “employee benefit plan,” “governmental plan,” and “separate account” shall have the respective meanings assigned to such terms in Section 3 of ERISA.

SECTION 7. INFORMATION AS TO COMPANY.

Section 7.1. Financial and Business Information. The Company shall deliver to Prudential and to each holder of Notes that is an Institutional Investor:

(a) Quarterly Statements — within 55 days after the end of each quarterly fiscal period in each fiscal year of the Company (other than the last quarterly fiscal period of each such fiscal year), duplicate copies of:

(1) a consolidated and consolidating balance sheet of the Company and its Subsidiaries and New Jersey Natural Gas and its Subsidiaries as at the end of such quarter, and

(2) consolidated and consolidating statements of income, changes in shareholders’ equity and cash flows of the Company and its Subsidiaries and New Jersey Natural Gas and its Subsidiaries for such quarter and (in the case of the second and third quarters) for the portion of the fiscal year ending with such quarter,

setting forth in each case in comparative form the figures for the corresponding periods in the previous fiscal year, all in reasonable detail, prepared in accordance with GAAP applicable to quarterly financial statements generally, and certified by a Senior Financial Officer as fairly presenting, in all material respects, the financial position of the companies being reported on and their results of operations and cash flows, subject to changes resulting from normal year-end adjustments, provided that delivery within the time period specified above of copies of the Company’s Quarterly Report on Form 10-Q prepared in compliance with the requirements therefor and filed with the Securities and Exchange Commission shall be deemed to satisfy the requirements of this Section 7.1(a), and provided, further, that the Company shall be deemed to have made such delivery of such Form 10-Q if it shall have timely made such Form 10-Q available on “EDGAR” and on its home page on the worldwide web (at the date of this Agreement located at: http//www.njresources.com) and shall have given Prudential and such holder prompt notice of such availability on EDGAR and on its home page in connection with each delivery (such availability and notice thereof being referred to as “Electronic Delivery”);

- 19 -

(b) Annual Statements — within 100 days after the end of each fiscal year of the Company, duplicate copies of:

(1) a consolidated and consolidating balance sheet of the Company and its Subsidiaries and New Jersey Natural Gas and its Subsidiaries as at the end of such year, and

(2) consolidated and consolidating statements of income, changes in shareholders’ equity and cash flows of the Company and its Subsidiaries and New Jersey Natural Gas and its Subsidiaries, for such year,

setting forth in each case in comparative form the figures for the previous fiscal year, all in reasonable detail, prepared in accordance with GAAP, with such consolidated financial statements accompanied by an opinion thereon of independent certified public accountants of recognized national standing, which opinion shall state that such financial statements present fairly, in all material respects, the financial position of the companies being reported upon and their results of operations and cash flows and have been prepared in conformity with GAAP, and that the examination of such accountants in connection with such financial statements has been made in accordance with generally accepted auditing standards, and that such audit provides a reasonable basis for such opinion in the circumstances, provided that the delivery within the time period specified above of the Company’s Annual Report on Form 10-K for such fiscal year (together with the Company’s annual report to shareholders, if any, prepared pursuant to Rule 14a-3 under the Exchange Act) prepared in accordance with the requirements therefor and filed with the Securities and Exchange Commission shall be deemed to satisfy the requirements of this Section 7.1(b), and provided, further, that the Company shall be deemed to have made such delivery of such Form 10-K if it shall have timely made Electronic Delivery thereof;