Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Tao Minerals Ltd. | exhibit32-1.htm |

| EX-31.1 - CERTIFICATION - Tao Minerals Ltd. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 31, 2011

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from [ ] to [ ]

Commission file number 000-52010

TAO MINERALS LTD.

(Exact

name of registrant as specified in its charter)

| Nevada | 20-1682702 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| Officina 301Edeficio El Crusero, Carrera 48, 12 Sur – 148 Medellin | |

| Colombia | N/A |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: 0115-314-2330

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange On Which Registered |

| N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of

class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes[ ] No[ x ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes[ ] No[ x ]

Indicate by check mark whether the registrant: (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports) and (2) has been subject to such

filing requirements for the last 90 days.

Yes[ ] No[ x ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-K (§229.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

Yes[ ] No[ ]

Indicate by check mark if disclosure of delinquent filers

pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant's

knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[

]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [ x ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes[ ] No[ x ]

The aggregate market value of Common Stock held by non-affiliates of the Registrant on July 31, 2010 was $75,786,702 based on a $0.255 average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

342,605,877 as of June 22, 2011

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

TABLE OF CONTENTS

3

PART I

| Item 1. | Business |

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this annual report, the terms we", "us", "our" and "our company" mean Tao Minerals Ltd. and our majority owned subsidiary, Minera Tao S.A., unless otherwise indicated.

Corporate Overview

The address of our principal executive office is Officina 301 Edeficio El Crusero, Carrera 48, 12 Sur – 148 Medellin Colombia. Our telephone numbers is 877-331-8777.

Corporate History

We were incorporated in the State of Nevada on September 23, 2004.

On July 16, 2008, through our majority owned subsidiary Minera Tao S.A., we entered into an amended option agreement with Agrominas De Colombia, LTDA to acquire 80% of a mining interest called El Comillo in Antioquia, Colombia. The agreement amended the terms of the original option agreement entered into by Minera Tao on October 2, 2007, and subsequently extended on April 18, 2008.

Under the terms of the amended option agreement, the purchase price of the option is $1.42 billion Colombian pesos or approximately US$825,000 dollars. We paid $80,000,000 pesos (approximately US$50,000) upon closing of the option agreement and are obligated to pay $40,000,000 pesos on the 15th of every month until $320,000,000 pesos has been paid. Thereafter 20% of production will be paid until $1.1 billion pesos have been received by Agrominas De Colombia. After the acquisition price is paid Agrominas De Colombia will continue to receive 20% of the mining production. Upon receipt of $1.42 billion pesos by Agrominas De Colombia the option will be exercised and 80% ownership in the property will be transferred to Minera Tao. To date, we have paid to Agrominas De Colombia $240,000,000 pesos (or US$150,000).

Effective September 21, 2009, we effected a 200 for 1 share consolidation of our authorized and issued and outstanding common stock. As a result, our authorized capital decreased from 552,000,000 shares of common stock with a par value of $0.001 to 2,760,000 shares of common stock with a par value of $0.001 and our issued and outstanding shares decreased from 547,370,946 shares of common stock to 2,736,854 shares of common stock.

4

The consolidation became effective with the Over-the-Counter Bulletin Board at the opening for trading on September 23, 2009 under the new stock symbol “TAON”. Our CUSIP number is 87600P303.

Effective July 1, 2010, we entered into a consulting services agreement with Kerry Associates, Inc., wherein Kerry Associates has the agreed to provide certain consulting services to our company for a period of 30 days. Under the terms of the agreement we paid Kerry Associates, Inc. $25,000 and issued to Kerry Associates, Inc. 2,000,000 restricted shares of our stock

We are a start-up, exploration stage company and have not yet generated or realized any revenues from our business operations. We must raise cash in order to implement our plan and stay in business.

We are in the mineral resource business. This business generally consists of three stages: exploration, development and production. Mineral resource companies that are in the exploration stage have not yet found mineral resources in commercially exploitable quantities, and are engaged in exploring land in an effort to discover them. Mineral resource companies that have located a mineral resource in commercially exploitable quantities and are preparing to extract that resource are in the development stage, while those engaged in the extraction of a known mineral resource are in the production stage. Our company is in the exploration stage.

The address of our principal executive office is Officina 301 Edeficio El Crusero, Carrera 48, 12 Sur – 148 Medellin Colombia. Our telephone numbers is 877-331-8777.

Our common stock is quoted on the OTC Bulletin Board under the symbol "TAON".

Mineral resource exploration can consist of several stages. The earliest stage usually consists of the identification of a potential prospect through either the discovery of a mineralized showing on that property or as the result of a property being in proximity to another property on which exploitable resources have been identified, whether or not they are or have in the past been extracted.

After the identification of a property as a potential prospect, the next stage would usually be the acquisition of a right to explore the area for mineral resources. This can consist of the outright acquisition of the land or the acquisition of specific, but limited, rights to the land (e.g., a license, lease or concession). After acquisition, exploration would probably begin with a surface examination by a prospector or professional geologist with the aim of identifying areas of potential mineralization, followed by detailed geological sampling and mapping of this showing with possible geophysical and geochemical grid surveys to establish whether a known trend of mineralization continues through un-exposed portions of the property (i.e., underground), possibly trenching in these covered areas to allow sampling of the underlying rock. Exploration also commonly includes systematic regularly spaced drilling in order to determine the extent and grade of the mineralized system at depth and over a given area, as well as gaining underground access by ramping or shafting in order to obtain bulk samples that would allow one to determine the ability to recover various commodities from the rock. Exploration might culminate in a feasibility study to ascertain if the mining of the minerals would be economic. A feasibility study is a study that reaches a conclusion with respect to the economics of bringing a mineral resource to the production stage.

Our mineral resource properties consist of exploration claims located in Columbia (Risaldo La Golondrina D14-082 mineral property located in Narino, Colombia) ( El Colmillo mineral property located in Antioquia, Colombia). There is no assurance that a commercially viable mineral deposit exists on any of our properties, and further exploration is required before we can evaluate whether any exist and, if so, whether it would be economically and legally feasible to develop or exploit those resources. Even if we complete our current exploration program and we are successful in identifying a mineral deposit, we would be required to spend substantial funds on further drilling and engineering studies before we could know whether that mineral deposit will constitute a reserve (a reserve is a commercially viable mineral deposit). Please refer to the section entitled ‘Risk Factors’, of this annual report on Form 10-K, for additional information about the risks of mineral exploration.

5

Our Current Business

We are an exploration stage company that has not yet generated or realized any revenues from our business operations. We have concentrated our recent exploration efforts on the La Golondrina Property in Columbia. In July, 2008 we acquired a mineral right in the El Colmillo property in Colombia. In October, 2009, our company decided to employ our efforts in exploration of the El Colmillo property for the next 12 months and will hold exploration of the Golondrina property until a determination of viability at El Colmillo can be determined. In December 2008, company personnel at the El Colmillo property were met by Colombian rebels who demanded a war tax to permit the development activities to continue. Our company immediately ceased any efforts at the mine and reported the situation to the Colombian government and to the issuer of the option. Our company invoked the force majeure section of the contract and we are waiting to see what developments will take place.

Research and Development

We do not currently have a formal research and development effort. We did not spend any funds on research and development during the last two fiscal years.

Purchase of Significant Equipment

We do not intend to purchase any significant equipment over the twelve months ending January 31, 2012.

Competition

We are a mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

Compliance with Government Regulation

We are committed to complying with and are, to our knowledge, in compliance with, all governmental and environmental regulations applicable to our company and our properties. Permits from a variety of regulatory authorities are required for many aspects of mine operation and reclamation. We cannot predict the extent to which these requirements will affect our company or our properties if we identify the existence of minerals in commercially exploitable quantities. In addition, future legislation and regulation could cause additional expense, capital expenditure, restrictions and delays in the exploration of our properties.

Subsidiaries

We have a majority owned subsidiary Minera Tao S.A.

Employees

As of June 22, 2010, we had no employees other than our directors and officers.

On September 1, 2008, we entered into an executive employment agreement with James Sikora, our president and chief executive officer. The agreement shall be for a period of thirty-six (36) months.

6

We also engage contractors from time to time to supply work on specific corporate business and exploration programs.

Consultants are retained on the basis of ability and experience. Except as set forth above, there is no preliminary agreement or understanding existing or under contemplation by us (or any person acting on our behalf) concerning any aspect of our operations pursuant to which any person would be hired, compensated or paid a finder’s fee.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark.

REPORTS TO SECURITY HOLDERS

We are required to file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission and our filings are available to the public over the internet at the Securities and Exchange Commission’s website at http://www.sec.gov. The public may read and copy any materials filed by us with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street N.E. Washington D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-732-0330. The SEC also maintains an Internet site that contains reports, proxy and formation statements, and other information regarding issuers that file electronically with the SEC, at http://www.sec.gov.

| Item 1A. | Risk Factors |

Risks Associated With Our Business

All of our properties are in the exploration stage. There is no assurance that we can establish the existence of any mineral resource on any of our properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from operations and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral resource in a commercially exploitable quantity, our business could fail.

Despite exploration work on our mineral properties, we have not established that any of them contain any mineral reserve, nor can there be any assurance that we will be able to do so. If we do not, our business could fail.

A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a "reserve" that meets the requirements of the Securities and Exchange Commission's Industry Guide 7 is extremely remote; in all probability our mineral resource property does not contain any 'reserve' and any funds that we spend on exploration will probably be lost.

Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that we will be able to develop our properties into producing mines and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

7

We have a limited operating history and as a result there is no assurance we can operate on a profitable basis.

We have a limited operating history and must be considered in the exploration stage. Our company's operations will be subject to all the risks inherent in the establishment of an exploration stage enterprise and the uncertainties arising from the absence of a significant operating history. Potential investors should be aware of the difficulties normally encountered by mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claims may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations of rock or land and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claims and acquire new claims for new exploration or cease operations. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations. No assurance can be given that we may be able to operate on a profitable basis.

If we do not obtain additional financing, our business will fail and our investors could lose their investment.

We had cash in the amount of $18,295 and a working capital deficit of $1,522,276 as at our year ended January 31, 2011. We currently do not generate revenues from our operations. Our business plan calls for substantial investment and cost in connection with the acquisition and exploration of our mineral properties currently under lease and option. Any direct acquisition of the claim under lease or option is subject to our ability to obtain the financing necessary for us to fund and carry out exploration programs on the properties. The requirements are substantial. We do not currently have any arrangements for additional financing and we can provide no assurance to investors that we will be able to find such financing if required. Obtaining additional financing would be subject to a number of factors, including market prices for minerals, investor acceptance of our properties, and investor sentiment. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. The most likely source of future funds presently available to us is through the sale of equity capital and loans. Any sale of share capital will result in dilution to existing shareholders.

Because there is no assurance that we will generate revenues, we face a high risk of business failure.

We have not earned any revenues as of the date of this annual report and have never been profitable. We do not have an interest in any revenue generating properties. We were incorporated in September 2004 and to date have been involved primarily in organizational activities and limited exploration activities. Prior to our being able to generate revenues, we will incur substantial operating and exploration expenditures without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We have limited operating history upon which an evaluation of our future success or failure can be made. Our net loss from inception to our year ended January 31, 2011 was $14,432,305. We have incurred losses for the year ended January 31, 2011 of $5,923,713. We recognize that if we are unable to generate significant revenues from our activities, we will not be able to earn profits or continue operations. Based upon current plans, we also expect to incur significant operating losses in the future. We cannot guarantee that we will be successful in raising capital to fund these operating losses or generate revenues in the future. We can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail and our investors could lose their investment.

Because of the speculative nature of the exploration of natural resource properties, there is substantial risk that this business will fail.

There is no assurance that any of the claims we explore or acquire will contain commercially exploitable reserves of minerals. Exploration for natural resources is a speculative venture involving substantial risk. Hazards such as unusual or unexpected geological formations and other conditions often result in unsuccessful exploration efforts.

8

We may also become subject to significant liability for pollution, cave-ins or hazards, which we cannot insure or which we may elect not to insure.

Our foremost project is located in Colombia where mineral exploration activities may be affected in varying degrees by political and government regulations which could have a negative impact on our ability to continue our operations.

Certain projects in which we have interests are located in Colombia. Mineral exploration activities in Colombia may be affected in varying degrees by political instabilities and government regulations relating to the mining industry. Any changes in regulations or shifts in political conditions are beyond our control and may adversely affect our business. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, income taxes, expropriations of property, environmental legislation and mine safety. The status of Colombia as a developing country may make it more difficult for us to obtain any required financing for our projects. The effect of all these factors cannot be accurately predicted. Notwithstanding the progress achieved in restructuring Colombia political institutions and revitalizing its economy, the present administration, or any successor government, may not be able to sustain the progress achieved. While the Colombian economy has experienced growth in recent years, such growth may not continue in the future at similar rates or at all. If the economy of Colombia fails to continue its growth or suffers a recession, we may not be able to continue our operations in that country. We do not carry political risk insurance.

If we cannot compete successfully for financing and for qualified managerial and technical employees, our exploration program may suffer.

Our competition in the mining industry includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration program may be slowed down or suspended.

If we are unable to hire and retain key personnel, we may not be able to implement our business plan.

Our success is also largely dependent on our ability to hire highly qualified personnel. This is particularly true in highly technical businesses such as mineral exploration. These individuals are in high demand and we may not be able to attract the personnel we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel, or may lose such employees after they are hired. Failure to hire key personnel when needed, or on acceptable terms, would have a significant negative effect on our business.

Inability of our officers and directors to devote sufficient time to the operation of the business may limit our company's success.

Presently some of our officers and directors allocate only a portion of their time to the operation of our business. If the business requires more time for operations than anticipated or the business develops faster than anticipated, the officers and directors may not be able to devote sufficient time to the operation of the business to ensure that it continues as a going concern. Even if this lack of sufficient time of our management is not fatal to our existence, it may result in limited growth and success of the business.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The exploration of valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

9

Our independent certified public accounting firm, in their Notes to the audited financial statements for the year ended January 31, 2011 states that there is a substantial doubt that we will be able to continue as a going concern.

Our independent certified public accounting firm state in their Notes to the audited financial statements for the year ended January 31, 2011, that we have experienced significant losses since inception. Failure to arrange adequate financing on acceptable terms and to achieve profitability would have an adverse effect on our financial position, results of operations, cash flows and prospects, there is a substantial doubt that we will be able to continue as a going concern.

We are subject to various government regulations and environmental concerns.

We are subject to various government and environmental regulations. Permits from a variety of regulatory authorities are required for many aspects of exploration, mining operations and reclamation. We cannot predict the extent to which future legislation and regulation could cause additional expense, capital expenditures, restrictions, and delays in the development of our U.S. or Colombian properties, including those with respect to unpatented mining claims.

Our activities are not only subject to extensive federal, state and local regulations controlling the exploration and mining of mineral properties, but also the possible effects of such activities upon the environment. Future legislation and regulations could cause additional expense, capital expenditures, restrictions and delays in the development of our properties, the extent of which cannot be predicted. Also, as discussed above, permits from a variety of regulatory authorities are required for many aspects of mine operation and reclamation. In the context of environmental permitting, including the approval of reclamation plans, we must comply with known standards, existing laws and regulations that may entail greater or lesser costs and delays, depending on the nature of the activity to be permitted and how stringently the regulations are implemented by the permitting authority. We are not presently aware of any specific material environmental constraint affecting our properties that would preclude the economic development or operation of any specific property.

If we become more active on our properties, it is reasonable to expect that compliance with environmental regulations will increase our costs. Such compliance may include feasibility studies on the surface impact of the our proposed operations; costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife, and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on any of our mineral properties.

Risks Associated with Our Common Stock

Trading on the OTC Bulletin Board may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the OTC Bulletin Board service of the Financial Industry Regulatory Authority. Trading in stock quoted on the OTC Bulletin Board is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTC Bulletin Board is not a stock exchange, and trading of securities on the OTC Bulletin Board is often more sporadic than the trading of securities listed on a quotation system like NASDAQ or a stock exchange like Amex. Accordingly, shareholders may have difficulty reselling any of their shares.

Our stock is a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations and FINRA’s sales practice requirements, which may limit a stockholder’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an

10

exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our common stock.

In addition to the “penny stock” rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the Financial Industry Regulatory Authority believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The Financial Industry Regulatory Authority ’ requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

Other Risks

Because some of our officers and directors are located in non-U.S. jurisdictions, you may have no effective recourse against the non U.S. officers and directors for misconduct and may not be able to enforce judgment and civil liabilities against our officers, directors, experts and agents.

Some of our directors and officers are nationals and/or residents of countries other than the United States, specifically Canada and Colombia, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

Trends, Risks and Uncertainties

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all of such risk factors before making an investment decision with respect to our common stock.

| Item 1B. | Unresolved Staff Comments |

As a “smaller reporting company”, we are not required to provide the information required by this Item.

11

| Item 2. | Properties |

Executive Offices

Our principal offices are located at Officina 301 Edeficio El Crusero, Carrera 48, 12 Sur – 148 Medellin Colombia. Our telephone number at our principal office is 011-574-311-0720. Our office is donated rent free by our President. We believe that our office space and facilities are sufficient to meet our present needs and do not anticipate any difficulty securing alternative or additional space, as needed, on terms acceptable to us.

Mineral Properties

There is no assurance that a commercially viable mineral deposit exists on any of our properties, including the La Golondrina or El Colmillo Property, or that we will be able to identify any mineral resource on any of these properties that can be developed profitably. Even if we do discover commercially exploitable levels of mineral resources on any of our properties there can be no assurance that we will be able to enter into commercial production of our mineral properties.

Golondria Gold-Silver Project

Acquisition, Location and Access

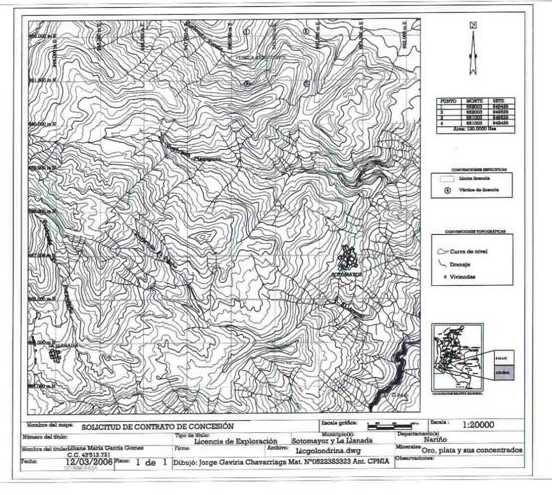

On February 1, 2006 we executed a letter agreement with Primecap Resources and Nueva California S.A., concerning the acquisition of an interest in the Risaraldo La Golondrina D14-082 property located in Narino, Colombia.

On March 5, 2006, we entered into an Assignment Agreement dated effective February 28, 2006 (the “Definitive Agreement”), with Primecap Resources Inc., of Las Vegas, Nevada, (Primecap), concerning the acquisition of Primecap’s option (the “Option”), to acquire a 100% interest in the Risaldo La Golondrina D14-082 mineral property located in Narino, Colombia (the “Property”). Primecap had been granted the Option by Nueva California S.A., of Medellin, Colombia, pursuant to the terms and conditions of a Heads of Agreement dated August 23, 2004 (the “HOA”).

The Definitive Agreement provides for the assignment of the Option for the following consideration:

| 1. |

Payment of US$150,000, payable on or before March 15, 2006 and upon execution of the Definitive Agreement; and | |

| 2. |

The issuance of 2,500,000 common shares in the capital stock of the company, subject to applicable trading restrictions, to Nueva California which will be issued either contemporaneous with the payment of US$150,000 or within 14 days of the execution of a Definitive Agreement, whichever is the earlier. | |

| 3. |

The issuance of 600,000 shares of common stock as follows: | |

|

300,000 as of August 23, 2006 and 300,000 shares as of August 23, 2007. |

In addition, we will assume Primecap’s financial obligations under the HOA.

On March 15, 2006, we entered into an amending agreement (the “Amending Agreement”) which agreement amended certain terms of the Definitive Agreement. The Amending Agreement provides for an extension to the payment terms such that the $150,000 payment time of March 15, 2006 was extended to April 15, 2006. The payment was made on April 10, 2006. On April 21, 2006 we issued 2,500,000 common shares to Nueva California SA pursuant to the terms of the Definitive Agreement.

12

On May 9, 2008 we entered into a second amending agreement which agreement amended certain terms of the Definitive Agreement. The second agreement modifies payments of $280,000 which would have to been made from August 23, 2005 through August 23, 2009 to two payments of $100,000 each on or before July 1, 2006 and on or before August 1, 2008. The first payment of $100,000 has been made. As of May 9, 2008 the company has not issued the 600,000 shares of common stock and has not received any notice of default from non issuance.

Items 1 through 6 of the HOA agreement are deleted. The total amounts payable to Primecap remains as amended in the first amendment. The second $100,000 payment is now due on or before August 1, 2008. As of January 31, 2009 the Company has not issued the 300,000 shares of common stock due August 23, 2006 and the 300,000 shares of common stock due August 23, 2007. The Company has accrued $51,000 as a liability for the issuance of 300,000 shares of common stock on August 23, 2006 at $.17 the closing price of the stock as of such date and $41,100 for the issuance liability of 300,000 shares of common stock at August 23, 2007 at $$.137 the closing price of the stock at such date. The Company has no further obligations under the HOA agreement other than those stated here.

The property is located within a mixture of small-scale mining and small-scale agricultural lands. Limited accommodations and supplies are available in Sotomayor, while Pasto acts as the main supply centre. The property is accessible from Sotomayor by a one-lane gravel road for the first four kilometres and then by a 1 kilometre ATV trail. Access to Sotomayor is from Pasto by a secondary gravel road, with travel time estimated to be 4 hrs. Transportation to Sotomayor is available in Pasto. The gravel roads are suitable for movement of heavy equipment.

ESTIMATED BUDGET, PHASE 1 PROGRAM

Chronological Schedule

| Weeks | |||||||||||

| Item | Labour | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 1 | Historical data | X | |||||||||

| 2 | Environmental Review | X | X | X | |||||||

| 3 | Regional Geological Mapping | X | |||||||||

| 4 | Stream Sediment Geochemistry | X | |||||||||

| 5 | Detailed Geological Mapping | X | X | X | |||||||

| 6 | Underground Sampling | X | X | ||||||||

| 7 | Soil Geochemistry | X | |||||||||

| 8 | Trench Sampling | X | |||||||||

| 9 | Rock Sampling (Prospecting) | X | |||||||||

| 10 | Sample Preparation/Analysis | X | X | X | X | ||||||

| 11 | Report | X | |||||||||

Expense Schedule

| ITEM |

# |

Cost/wk |

# Wks |

$US/day |

Total $US |

Comments | |

| 1 | Senior Geologist | 1 | $1400 | 6 | $200 | $8400 | |

| 2 | Junior Geologist | 2 | $875 | 6 | $125 | $10500 | |

| 3 | Labourers | 6 | $140 | 6 | $7 | $5040 | |

| 4 | Stream sample Analysis | 50 | $20/sample | $1000 | ICP+AuFA |

13

| 5 | Soil sample analysis | 50 | $20/sample | $1000 | ICP+AuFA | ||

| 6 | Underground sample analysis | 200 | $20/sample | $4000 | ICP+AuFA | ||

| 7 | Trenching/backhoe | 1 | $1500 | 1 | $45/hr | $1500 | RetroCAT100 |

| 8 | Food | 9 | $180 | 6 | $20 | $9720 | |

| 9 | Transportation | 1 | $400 | 6 | $2400 | Campero 4X4 | |

| 10 | Accommodation | 9 | $35 | 6 | $5 | $1890 | |

| 11 | Office Management-local | 1 | $1000 | 3 | $1000 | ||

| 12 | Administration-Medellin | 1 | $1000 | 12 | $4000/mo | $6000 | |

| TOTAL | $52,450 | ||||||

The proposed program is exploratory in nature as there are no proven reserves currently.

14

| POINT | NORTH | EAST |

| P.A. | 62.810 | 949.700 |

| 1 | 662.003 | 949.629.4 |

| 2 | 662.003 | 949.629.4 |

| 3 | 661.003 | 948.429.4 |

| 4 | 662.003 | 948.429.4 |

The above represents the longitude and latitude of the property representing 120 hectares. We have obtained a 30 year concession from under concession number 6927 from the department of Agrominas De Colombia LTDA. Our property is located in the municipality of Los Andes Sotomayor. We currently are in the process of exploration and do not have any production facilities.

History

Historically gold has been mined in the country since pre-Columbian times. Exploration of the Sierra Nevada de Santa Marta area, along the north coast of the country, was conducted by Alonso de Ojeda, one of the companions of Columbus. His work revealed the large amounts of precious metals held by the local Indians and led to the rapid Spanish colonization of the west coast and interior of South America. Much of Colombia was thus conquered and a number of towns established by 1539. Pasto was founded in 1537. From that time the population has spread out along the major river valleys, searching for land to cultivate and precious metals to mine, eventually reaching the valleys of tributaries of the Rio Pacual, where the town of Sotomayor was established. There are no government records of historical mining activity in the area of the Golondrina property

The Golondrina property was acquired by Colombian mining company Barro Blanco S.A Barro Blanco S.A. also acquired the Nueva Esparta property which lies approximately 4 kilometres to the east. Several other properties exist in the area of these two properties. Latingold optioned several properties from Barro Blanco S.A. and carried out exploration on those properties. This work included surface and underground mapping and sampling, as well as a Lithium-Bismuth surface geochemical survey. In 1998 Latingold abandoned its option.

Property Geology

The Golondrina Gold-Silver property is underlain by Dagua Group fine-grained layered quartzites (siliceous clastic sediments) of Cretaceous age. These contain minor basalt flows and diabase dikes of the same age. Intruded into these sediments is a small (2 km X 0.5 km) biotite-hornblende tonalite body of Tertiary age. It is associated with the larger Vergel STock, which is found 7 kilometers to the northwest. The intrusion has a 100 meter wide hornfelsed contact aureole against the sediments.

Mineralization on the Golondrina Project is confined to milky white quartz veins which contain disseminated sulphides. These sulphides include pyrite, chalcopyrite (copper) and galena (lead). Vein widths range between 5 and 50 centimeters.

We have not found any other mineral properties either for staking or purchasing but will seek other mineral properties during the next year so to diversify our holdings. Any staking and/or purchasing of mineral properties may involve the issuance of substantial blocks of our shares. We have no intentions of purchasing for cash or other considerations any mineral properties from our officers and/or directors.

15

El Colmillo Gold Project

Acquisition, Location and Access

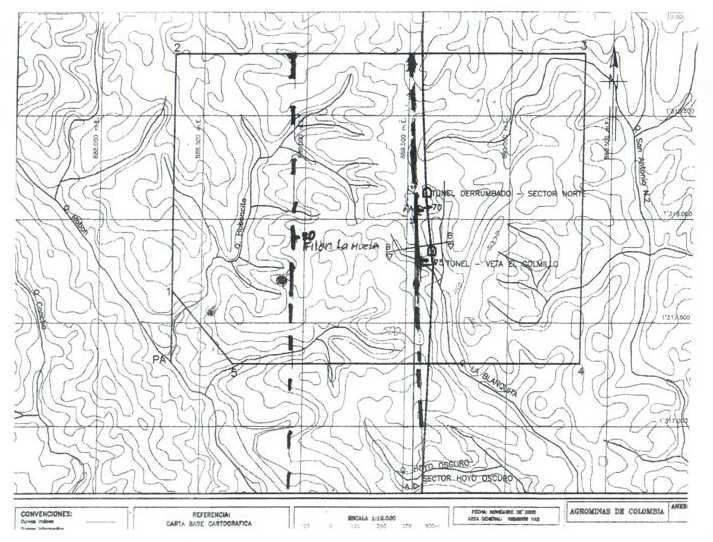

On July 16, 2008, through our majority owned subsidiary Minera Tao S.A. (“MT”), we entered into an amended option agreement with Agrominas De Colombia, LTDA (“AC”) to acquire 80% of a mining interest called El Comillo in Antioquia Colombia. The agreement amended the terms of the original option agreement entered into by MT on October 2, 2007, and subsequently extended on April 18, 2008.

Under the terms of the amended option agreement, the purchase price of the option is $1.42 billion Colombian pesos or approximately US$825,000 dollars at an exchange rate of $1,600 pesos for one dollar. We paid $80,000,000 pesos (approximately US$50,000) upon closing of the option agreement and are obligated to pay $40,000,000 pesos on the 15th of every month until $320,000,000 pesos has been paid. Thereafter 20% of production will be paid until $1.1 billion pesos have been received by AC. After the acquisition price is paid AC will continue to receive 20% of the mining production. Upon receipt of $1.42 billion pesos by AC the option will be exercised and 80% ownership in the property will be transferred to MT.

The El Colmillo vein-hosted gold deposit is located in a river basin which contains La Tinta Gorge, and more specifically in the sub river basin of the gorge La Blanquita, a tributary of the Nechí River.The concession covers an area of 296 hectares.

ESTIMATED BUDGET, PHASE 1 PROGRAM

In anticipation of our acquisition of our interest in the El Comillo mining property pursuant to our agreement with Agrominas De Colombia, LTDA, we are beginning the execution of our plan to upgrade the El Colmillo Gold Mine by implementing Phase I of the mine upgrade program.

Phase I of the program focuses on the existing mining works. The mine is currently idle and Phase I activities are designed to accomplish its reactivation to the extent of its existing full installed capacity. Actions to accomplish this will include developing the tunnels to increase the throughput volume of ore and, in concert with that, work to increase knowledge of the mine’s characterization in terms of its specific mineralogy to determine the best approach to the set-up of the upgraded gold recovery circuit.

Total monthly expenses for Phase I are estimated at $68,000 and will include, in addition to other unnamed items, specific expenditures for personnel, $16,000; fuel, $14,000; administration, $5,000; dynamite, $4,000 and an unspecified amount for repairs and adjustments to existing equipment. Capital costs to be incurred in Phase I are an estimated $12,000 for a jaw crusher and an estimated $14,000 for a 4 x 4 truck to transport fuel to the mine.

Finally, as part of the reactivation, Tao will be paying the annual tax for the exploration of the mine known as the “ cannon superficiario”.

The proposed program is exploratory in nature as there are no proven reserves currently.

In December 2008 Company personnel at the El Colmillo property were met by Colombian rebels who demanded a war tax to permit the development activities to continue. The Company immediately ceased any efforts at the mine and reported the situation to the Colombian government and to the issuer of the option. The Company invoked the force majoure section of the contract and is waiting to see what developments will take place.

16

| POINT | ||

| P.A. | 7 º35’00.59 | N |

| 2 | 7 º35’00.00 | N |

| 3 | 75 º20’00.00 | W |

| 4 | 75 º19’59.77 | W |

Property Geology

Bedrock consists of metamorphic rocks of sericite and graphitic aluminous schists. Alteration includes sericitization and chloritization, as well as silicification in the form of quartz. The dominant regional structures are the North Otú and North Bagre faults, with general directions N°1-14°W. Locally two faults which trend north-south and dip 60ºE have been observed. These two faults are concordant with the existing mineralization. It is suggest that they are part of the North Bagre fault system.

At least three veins are recognized in the El Colmillo mineralized zone. These include El Colmillo vein, La Muela vein and a third un-named subparallel vein. The first two show their moderate continuity by the presence of old

17

mine workings. Some of these are collapsed. In the un-named vein the continuity is recognized by old workings for about 5 m.

The vein El Colmillo has a strike direction that varies from N/75ºE to N30º-N40ºE with a thickness of between 0.20 m and 3.2 m. It is recognized along its course by small tunnels for a distance of about 300 m. Those faults associated with the mineralized veins are regional in extent, suggesting that there is a considerable potential for the mineralization to extend along those faults for an additional 1.2 km within the concession area and an additional 1 km outside of the concession.

The mineralization in El Colmillo is vein-hosted. The veins are composed of milky white quartz, with interleaves and interfingerings of schistose host rock. There are only minor amounts of sulfides in the examined levels. Galena is found locally.

| Item 3. | Legal Proceedings |

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

| Item 4. | [Removed and Reserved] |

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our Common stock is quoted on the OTC Bulletin Board under the Symbol "TAOL". We received approval on November 22, 2005 for trading under the symbol “TAOM”. On March 24, 2006 our symbol was changed to “TAOL” in connection with our forward stock split and on September 23, 2009 our symbol was changed to “TAON” in connection with a share consolidation.

The following table reflects the high and low bid information for our common stock obtained from Stockwatch and reflects inter-dealer prices, without retail mark-up, markdown or commission, and may not necessarily represent actual transactions.

The high and low bid prices of our common stock for the periods indicated below are as follows:

| OTC Bulletin Board | ||

| Quarter Ended | High | Low |

| January 31, 2011 | $0.035 | $0.0065 |

| October 31, 2010 | $0.049 | $0.0072 |

| July 31, 2010 | $0.72 | $0.022 |

| April 30, 2010 | $0.31 | $0.08 |

| January 31, 2010 | $0.12 | $0.06 |

| October 31, 2009 | $0.32 | $0.009 |

| July 31, 2009 | $0.0015 | $0.006 |

| April 30, 2009 | $0.0023 | $0.008 |

| January 31, 2009 | $0.0039 | $0.001 |

18

As of June 22, 2011, there were approximately 36 holders of record of our common stock. As of such date, 342,605,877 common shares were issued and outstanding.

Our common shares are issued in registered form. Transfer Online, Inc., 512 SE Salmon Street, Portland, OR, USA (Telephone: 503.227.2950) is the registrar and transfer agent for our common shares.

Dividend Policy

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our board of directors.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

Other than as disclosed below, we did not sell any equity securities which were not registered under the Securities Act during the year ended January 31, 2011 that were not otherwise disclosed on our quarterly reports on Form 10-Q or our current reports on Form 8-K filed during the year ended January 31, 2011.

Equity Compensation Plan Information

Except as disclosed below, we do not have a stock option plan in favor of any director, officer, consultant or employee of our company.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fourth quarter of our fiscal year ended January 31, 2011.

| Item 6. | Selected Financial Data |

As a “smaller reporting company”, we are not required to provide the information required by this Item.

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion should be read in conjunction with our audited financial statements and the related notes for the years ended January 31, 2011 and January 31, 2010 that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this annual report, particularly in the section entitled "Risk Factors" beginning on page 7 of this annual report.

Our audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Plan of Operations

Management plans to focus on Phase I of the mine upgrade program on the El Colmillo property until a determination of viability at El Colmillo can be determined. We intend to hold exploration of the Golondrina property until such time as the viability at El Colmillo can be determined.

Phase I of the program focuses on the existing mining works. The mine is currently idle and Phase I activities are designed to accomplish its reactivation to the extent of its existing full installed capacity. Actions to accomplish this

19

will include developing the tunnels to increase the throughput volume of ore and, in concert with that, work to increase knowledge of the mine’s characterization in terms of its specific mineralogy to determine the best approach to the set-up of the upgraded gold recovery circuit.

Total monthly expenses for Phase I are estimated at $68,000 and will include, in addition to other unnamed items, specific expenditures for personnel, $16,000; fuel, $14,000; administration, $5,000; dynamite, $4,000 and an unspecified amount for repairs and adjustments to existing equipment. Capital costs to be incurred in Phase I are an estimated $12,000 for a jaw crusher and an estimated $14,000 for a 4 x 4 truck to transport fuel to the mine.

Finally, as part of the reactivation, we will be paying the annual tax for the exploration of the mine known as the “cannon superficiario”.

In December 2008, company personnel at the El Colmillo property were met by Colombian rebels who demanded a war tax to permit the development activities to continue. Our company immediately ceased any efforts at the mine and reported the situation to the Colombian government and to the issuer of the option. Our company invoked the force majoure section of the contract and is waiting to see what developments will take place.

In May 2010, we retained the Colombian legal firm of Gutierrez Marquez Asesores S.A. to represent our company in all aspects of applicable Colombian law pertaining to our operations in Colombia.

Purchase of Significant Equipment

We do not intend to purchase any significant equipment over the next twelve months.

Personnel Plan

We do not expect any material changes in the number of employees over the next 12 month period (although we may enter into employment or consulting agreements with our officers or directors). We do and will continue to outsource contract employment as needed.

Off-Balance Sheet Arrangements

There are no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Our principal capital resources have been through the subscription and issuance of common stock, although we have also used stockholder loans and advances from related parties.

Results of Operations for the Years Ended January 31, 2011 and 2010

The following summary of our results of operations should be read in conjunction with our audited financial statements for the years ended January 31, 2011 and 2010.

Our operating results for the years ended January 31, 2011 and 2010 are summarized as follows:

| Year Ended | |||||||

| January 31 | |||||||

| 2011 | 2010 | ||||||

| Revenue | $ | Nil | $ | Nil | |||

| Total Operating Expenses | $ | 3,453,091 | $ | 405,212 | |||

| Other Income (Expenses) | $ | (2,470,622 | ) | $ | (210,910 | ) | |

20

| Year Ended | |||||||

| January 31 | |||||||

| 2011 | 2010 | ||||||

| Net Loss | $ | (5,923,713 | ) | $ | (616,040 | ) | |

Revenues

We have not earned any revenues since our inception and we do not anticipate earning revenues in the near future.

Operating Expenses

Our operating expenses for the year ended January 31, 2011 and January 31, 2010 are outlined in the table below:

| Year Ended | |||||||

| January 31 | |||||||

| 2011 | 2010 | ||||||

| Exploration expenses | $ | 25,524 | $ | Nil | |||

| Professional fees | $ | 51,450 | $ | 24,550 | |||

| Consulting fees | $ | 395,156 | $ | 269,500 | |||

| Legal fees | $ | 32,707 | $ | 12,548 | |||

| General and administrative | $ | 2,928,604 | $ | 98,614 | |||

| Impairment charge | $ | 19,650 | $ | Nil | |||

The increase in operating expenses for the year ended January 31, 2011, compared to the same period in fiscal 2010, was mainly due to an increase in stock based compensation.

Liquidity and Financial Condition

As of January 31, 2011, our total current assets were $26,990 and our total current liabilities were $1,579,266 and we had a working capital deficit of $1,552,276. Our financial statements report a net loss of $5,923,713 for the year ended January 31, 2011, and a net loss of $14,432,305 for the period from September 23, 2004 (date of inception) to January 31, 2011.

We have suffered recurring losses from operations. The continuation of our company is dependent upon our company attaining and maintaining profitable operations and raising additional capital as needed. In this regard we have raised additional capital through equity offerings and loan transactions.

| Cash Flows | As at | ||||||

| January 31, | |||||||

| 2011 | 2010 | ||||||

| Net Cash Used by Operating Activities | $ | (500,012 | ) | $ | (81,539 | ) | |

| Net Cash Used by Investing Activities | $ | Nil | $ | (19,051 | ) | ||

| Net Cash Provided by Financing Activities | $ | 520,300 | $ | 100,020 | |||

| Increase (Decrease) In Cash During The Period | $ | 10,430 | $ | (3 | ) | ||

We had cash in the amount of $18,295 as of January 31, 2011 as compared to $7,865 as of January 31, 2010. We had a working capital deficit of $1,552,276 as of January 31, 2011 compared to working capital deficit of $1,454,580 as of January 31, 2010.

21

Cash Requirements

We intend to conduct exploration activities on our properties during the next twelve months. We estimate our operating expenses and working capital requirements for the twelve month period to be as follows:

| Estimated Expenses For the Twelve Month Period ending January 31, 2012 | ||

| Operating Expenses | $ | 100,000 |

| Exploration | $ | 500,000 |

| Total | $ | 600,000 |

At present, our cash requirements for the next 12 months outweigh the funds available to maintain or develop our properties. Of the $600,000 that we require for the next 12 months, we had $18,295 in cash as of January 31, 2011, and a working capital deficit of $1,552,276. In order to improve our liquidity, we plan pursue additional equity financing from private investors or possibly a registered public offering. we do not currently have any definitive arrangements in place for the completion of any further private placement financings and there is no assurance that we will be successful in completing any further private placement financings. If we are unable to achieve the necessary additional financing, then we plan to reduce the amounts that we spend on our business activities and administrative expenses in order to be within the amount of capital resources that are available to us.

Research and Development

We do not intend to allocate any funds to research and development over the twelve months ending January 31, 2012.

Future Financings

We will require additional funds to implement our growth strategy in our new business. These funds may be raised through equity financing, debt financing, or other sources, which may result in further dilution in the equity ownership of our shares.

There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to obtain the additional financing on a timely basis should it be required, or generate significant material revenues from operations, we will not be able to meet our other obligations as they become due and we will be forced to scale down or perhaps even cease our operations.

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

Going Concern

We have suffered recurring losses from operations and are dependent on our ability to raise capital from stockholders or other sources to meet our obligations and repay our liabilities arising from normal business operations when they become due. In their report on our audited financial statements for the year ended January 31, 2011, our independent auditors included an explanatory paragraph regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosure describing the circumstances that lead to this disclosure by our independent auditors.

22

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with the accounting principles generally accepted in the United States of America. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management’s application of accounting policies. We believe that understanding the basis and nature of the estimates and assumptions involved with the following aspects of our financial statements is critical to an understanding of our financial statements.

Accounting Estimates

The preparation of financial statements in conformity with US generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Our company regularly evaluates estimates and assumptions related to valuation of long-lived assets, stock based compensation and deferred income tax asset valuation allowances. Our company bases our estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by our company may differ materially and adversely from our company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Cash Equivalents

For purposes of the statement of cash flows cash equivalents usually consist of highly liquid investments which are readily convertible into cash with maturity of three months or less when purchased.

Concentrations

Our company has no significant off-balance-sheet concentrations of credit risk such as foreign exchange contracts, options contracts or other foreign hedging arrangements. Our company maintains the majority of our cash balances with one financial institution, in the form of demand deposits. Our company’s assets and operations are concentrated in the country of Colombia, South America.

Mineral Interests

Mineral interests associated with other than owned properties are classified as tangible assets. The mineral rights will be amortized using the units-of-production method when production at each project commences.

Long-Lived Assets

In accordance with ASC 360, Property Plant and Equipment, our company tests long-lived assets or asset groups for recoverability when events or changes in circumstances indicate that their carrying amount may not be recoverable. Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end

23

of its estimated useful life. Recoverability is assessed based on the carrying amount of the asset and its fair value which is generally determined based on the sum of the undiscounted cash flows expected to result from the use and the eventual disposal of the asset, as well as specific appraisal in certain instances. An impairment loss is recognized when the carrying amount is not recoverable and exceeds fair value.

Foreign Currency Translation

Our company’s functional and reporting currency is the United States dollar. Management has adopted ASC 740 Foreign Currency Translation Matters. Monetary assets and liabilities denominated in foreign currencies are translated using the exchange rate prevailing at the balance sheet date. Non-monetary assets and liabilities denominated in foreign currencies are translated at rates of exchange in effect at the date of the transaction. Average monthly rates are used to translate revenues and expenses. Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are included in the determination of income. Our company has not, to the date of these financial statements, entered into derivative instruments to offset the impact of foreign currency fluctuations.

The financial statements of the subsidiary are translated to United States dollars in accordance with ASC 740 using period-end rates of exchange for assets and liabilities, and average rates of exchange for the year for revenues and expenses. Translation gains (losses) are recorded in accumulated other comprehensive income (loss) as a component of stockholders’ deficit. Foreign currency transaction gains and losses are included in current operations.

Environmental Costs

Environmental expenditures that relate to current operations are expensed or capitalized as appropriate. Expenditures that relate to an existing condition caused by past operations, and which do not contribute to current or future revenue generation, are expensed. Liabilities are recorded when environmental assessments and/or remedial efforts are probable, and the cost can be reasonably estimated. Generally, the timing of these accruals coincides with the earlier of completion of a feasibility study or our company’s commitments to plan of action based on the then known facts.

Loss per Share

Our company computes net earnings (loss) per share in accordance with ASC 260, Earnings Per Share, which requires presentation of both basic and diluted earnings per share (“EPS”) on the face of the income statement. Basic EPS is computed by dividing net earnings (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti-dilutive. Our company has $375,800 of convertible debentures which can be converted to common stock. These shares have not been included in any weighted average computations since the effect would be anti-dilutive.

Income Taxes

Our company accounts for income taxes under the ASC 740, Income Taxes. Under ASC 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under ASC 740, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

Fair Value of Financial Instruments

Our financial instruments consist principally of cash, accounts payable, derivative liabilities, amounts due to related parties, stock issuance liabilities and convertible notes. Pursuant to ASC 820, Fair Value Measurements and Disclosures, and ASC 825, Financial Instruments the fair value of our cash equivalents is determined based on

24

“Level 1” inputs, which consist of quoted prices in active markets for identical assets, the fair value of derivative liabilities, stock issuance liabilities and convertible notes are determined based on “Level 3” inputs, which consist of unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities. We believe that the recorded values of all of our other financial instruments approximate their current fair values because of their nature and respective relatively short maturity dates or durations.

Comprehensive Loss

ASC 220, Comprehensive Income establishes standards for the reporting and display of comprehensive loss and its components in the financial statements. At January 31, 2011 and 2010, our company’s only component of comprehensive loss was foreign currency translation adjustments. Accordingly, the balance of accumulated other comprehensive income was charged to operations.

Stock-Based Compensation

In accordance with ASC 718, Compensation – Stock Based Compensation, our company accounts for share-based payments using the fair value method. Common shares issued to third parties for non-cash consideration are valued based on the fair market value of the services provided or the fair market value of the common stock on the measurement date, whichever is more readily determinable.

Business Segments

Our company operates in one segment and therefore segment information is not presented.

Mining Properties and Exploration Costs

Exploration costs are charged to operations in the year in which they are incurred. Costs of acquiring mineral properties are capitalized until such time commencement of production commences or a determination that such property is not commercially viable.

Mining properties are, upon commencement of production, amortized over the estimated life of the ore body to which they relate or are written off if the property is abandoned or if there is considered to be a permanent impairment in value.

Investments in mining properties over which our company has significant influence but not joint control are accounted for using the equity method.

Site Restoration and Post Closure Costs

Expenditures related to ongoing environmental and reclamation activities are expensed, as incurred, unless previously accrued. Provisions for future site restoration and reclamation and other post closure costs in respect of operating facilities are charged to operations over the estimated life of the operating facility, commencing when a reasonably definitive estimate of the cost can be made

Accounting Changes and Error Corrections

Our company follows ASC 250, Accounting Changes and Error Corrections. Changes in accounting principle are reported through retrospective application of the new accounting principle to all prior periods. Errors in the financial statements of a prior period discovered subsequent to their issuance shall be reported as a prior-period adjustment by restating the prior period.

Recent Accounting Pronouncements

See Note 2 to our consolidated financial statements included in this report for discussion of recent accounting pronouncements.

25

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk |

As a “smaller reporting company”, we are not required to provide the information required by this Item.

| Item 8. | Financial Statements and Supplementary Data |

26

Report of Independent Registered Public Accounting Firm

Shareholders and Board of Directors

TAO MINERALS, LTD

Medellin, Columbia

I have audited the accompanying consolidated balance sheets of TAO MINERALS, LTD, and Subsidiary (an Exploration Stage Company) as of January 31, 2011 and 2010 and the related consolidated statements of operations, stockholders’ deficit, and cash flows for each of the years in the two-year period ended January 31, 2011. TAO MINERALS,LTD’S management is responsible for these financial statements. My responsibility is to express an opinion on these financial statements based on my audit.