Attached files

Exhibit 10.1

Legacy Baytech Park

Lease Agreement

Basic Lease Information

| Lease Date: | May 24, 2006 | |||

| Landlord: | LEGACY PARTNERS I SAN JOSE, LLC, | |||

| a Delaware limited liability company | ||||

| Landlord’s Address: | c/o Legacy Partners Commercial, Inc. | |||

| 4000 East Third Avenue, Suite 600 | ||||

| Foster City, California 94404-4805 | ||||

| Tenant: | Endwave Corporation, a Delaware corporation | |||

| Tenant’s Address: | 776 Palomar Avenue | |||

| Sunnyvale, California 94085 | ||||

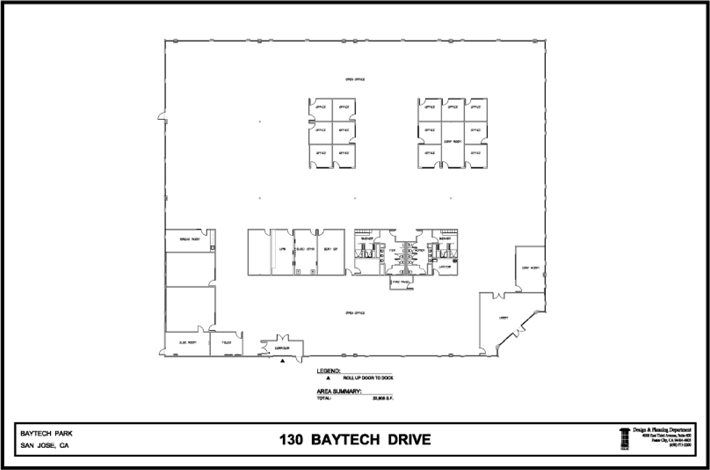

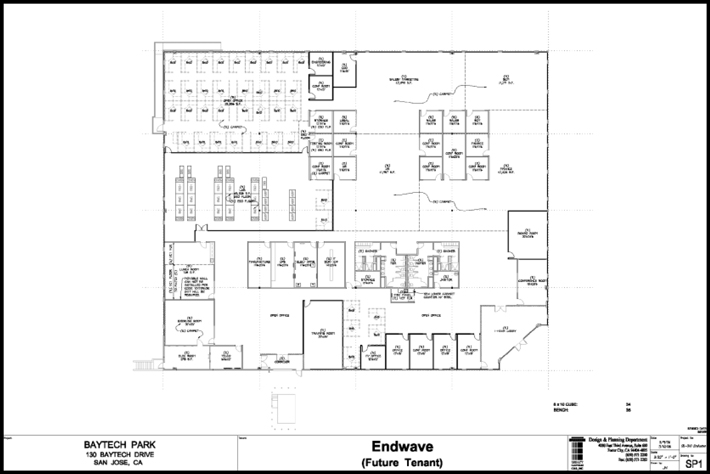

| Premises: | Approximately 32,805 rentable square feet as shown on Exhibit A | |||

| Premises Address: | 130 Baytech Drive | |||

| San Jose, California 95134-2302 | ||||

| Building : | Approximately 32,805 rentable square feet | |||

| Lot: | APN 015-030-93 | |||

| Legacy Baytech Park (“Park”): | Approximately 187,742 rentable square feet | |||

i.

| Term: | The commencement date of the Lease (“Commencement Date”) shall occur on August 15, 2006 unless the Tenant Improvements are not Substantially Complete (as each term is defined in Exhibit B) on or before such date, in which case, the Commencement Date shall be the date the Tenant Improvements are Substantially Complete; provided, however, if Tenant occupies the Premises prior to Substantial Completion of the Tenant Improvements for the purpose of doing business, then the Commencement Date shall be the date Tenant occupies the Premises. The expiration date of the Lease (“Expiration Date”) shall occur on that date which is sixty (60) months following the Commencement Date. |

Base Rent (¶3):

| Months of Term |

Base Rent Per Month | |||

| 01 – 12 |

$ | 21,323.25 | ||

| 13 – 24 |

$ | 30,508.65 | ||

| 25 – 26 |

$ | 31,164.75 | ||

| 37 – 48 |

$ | 31,820.85 | ||

| 49 – 60 |

$ | 32,476.95 | ||

| Advance Rent (¶3): | Thirty Thousand Forty-Nine and 38/100 Dollars ($30,049.38) | |

| Security Deposit (¶4): | Forty Thousand Three Hundred Fifty and 00/100 ($40,350.00) | |

| Tenant’s Share of Operating Expenses (¶6.1): | 17.47% of the Park | |

| Tenant’s Share of Tax Expenses (¶6.2): | 17.47% of the Park | |

| Tenant’s Share of Common Area Utility Costs (¶7.2): | 17.47% of the Park | |

| Tenant’s Share of Utility Expenses (¶7.1): | 17.47% of the Park | |

ii.

| Permitted Uses (¶9): | The Premises shall be used solely for office, research and development, software, storage, light assembly, marketing and for no other purpose without Landlord’s prior written consent, but only to the extent permitted by the City of San Jose, California, and all agencies and governmental authorities having jurisdiction thereof. | |||

| Parking Spaces: | One Hundred Twenty-Three (123) non-exclusive and non-designated spaces in the Park | |||

| Broker (¶33): | Marty Morici, Colliers International for Tenant | |||

| Commercial Property Services (CPS) for Landlord | ||||

| Exhibits: | Exhibit A - | Premises, Building, Lot and/or Park | ||

| Exhibit B - | Tenant Improvements | |||

| Exhibit C - | Rules and Regulations | |||

| Exhibit D - | Intentionally omitted | |||

| Exhibit E - | Tenant’s Initial Hazardous Materials Disclosure Certificate | |||

| Exhibit F - | Change of Commencement Date — Example | |||

| Exhibit G - | Sign Criteria | |||

| Addenda: | Addendum 1 - | Option to Extend the Lease Term | ||

| Addendum 2 - | Letter of Credit | |||

iii.

TABLE OF CONTENTS

| PAGE | ||||||

| 1. |

Premises | 1 | ||||

| 2. |

Occupancy; Adjustment of Commencement Date | 1 | ||||

| 3. |

Rent | 2 | ||||

| 4. |

Security Deposit | 3 | ||||

| 5. |

Condition of Premises; Tenant Improvements | 3 | ||||

| 6. |

Additional Rent | 4 | ||||

| 7. |

Utilities and Services | 7 | ||||

| 8. |

Late Charges | 7 | ||||

| 9. |

Use of Premises | 8 | ||||

| 10. |

Alterations; and Surrender of Premises | 9 | ||||

| 11. |

Repairs and Maintenance | 12 | ||||

| 12. |

Insurance | 13 | ||||

| 13. |

Limitation of Liability and Indemnity | 15 | ||||

| 14. |

Assignment and Subleasing | 15 | ||||

| 15. |

Subordination | 18 | ||||

| 16. |

Right of Entry | 19 | ||||

| 17. |

Estoppel Certificate | 19 | ||||

| 18. |

Tenant’s Default | 20 | ||||

| 19. |

Remedies for Tenant’s Default | 21 | ||||

| 20. |

Holding Over | 22 | ||||

| 21. |

Landlord’s Default | 23 | ||||

| 22. |

Parking | 23 | ||||

iv.

| 23. |

Transfer of Landlord’s Interest | 23 | ||||

| 24. |

Waiver | 23 | ||||

| 25. |

Casualty Damage | 24 | ||||

| 26. |

Condemnation | 25 | ||||

| 27. |

Environmental Matters/Hazardous Materials | 26 | ||||

| 28. |

Financial Statements | 28 | ||||

| 29. |

General Provisions | 28 | ||||

| 30. |

Signs | 30 | ||||

| 31. |

Mortgagee Protection | 31 | ||||

| 32. |

Warranties of Tenant | 31 | ||||

| 33. |

Brokerage Commission | 31 | ||||

| 34. |

Quiet Enjoyment | 32 | ||||

| 35. |

Cubicles | 32 | ||||

v.

Lease Agreement

The Basic Lease Information and this Lease are, and shall be construed as, a single instrument.

1. Premises

Landlord leases the Premises to Tenant upon the terms and conditions contained herein. Tenant shall have the right to use, on a non-exclusive basis, parking areas and ancillary facilities located within the Common Areas of the Park, subject to the terms of this Lease. For purposes of this Lease, (i) as of the Lease Date, the rentable square footage area of each of the Premises, the Building and the Park shall be deemed to be the number of rentable square feet as set forth in the Basic Lease Information, (ii) the rentable square footage of the Premises may include a proportionate share of certain areas used in common by all occupants of the Building and/or the Park (for example corridors, common rest-rooms, an electrical room or telephone room) and (iii) the number of rentable square feet of any of the Building and the Park may subsequently change after the Lease Date commensurate with any physical modifications to any of the foregoing by Landlord (but not as a result of calculation using another standard of measurement), and Tenant’s Share shall accordingly change. The term “Project” means and collectively refers to the Building, Common Areas, Lot and Park.

2. Occupancy; Adjustment of Commencement Date

2.1 If Landlord, for any reason whatsoever, cannot deliver possession of the Premises to Tenant on the Commencement Date in the condition specified in Section 5 and Exhibit B hereof, Landlord shall neither be subject to any liability nor shall the validity of this Lease be affected; provided, the Term and the obligation to pay Rent shall commence on the date the Premises are in the condition required by Section 5 and Exhibit B and possession is actually tendered to Tenant and the Expiration Date shall be extended commensurately. If the commencement date and/or the expiration date of this Lease is other than the Commencement Date and Expiration Date specified in the Basic Lease Information, the parties shall execute a written amendment to this Lease, substantially in the form of Exhibit F hereto specifying the actual commencement date, expiration date and the date on which Tenant is to commence paying Rent. Tenant shall execute and return such amendment to Landlord within fifteen (15) days after Tenant’s receipt thereof. The word “Term” means the initial term of this Lease and any valid extension(s) thereof.

2.2 If Landlord permits Tenant to occupy the Premises prior to the actual Commencement Date, such occupancy shall be at Tenant’s sole risk and subject to all the provisions of this Lease (including Tenant’s obligation to pay Rent). Additionally, Landlord shall have the right to impose additional reasonable conditions on Tenant’s early occupancy. As set forth in Section 13 of Exhibit B hereto, Tenant may access the Premises prior to the Completion Date (as defined in Exhibit B) to perform Tenant’s Pre-Occupancy Work (as defined in Exhibit B).

2.3 Tenant shall have a one-time option (the “Termination Option”) to terminate this Lease, effective as of the last day of the forty-second (42nd) full calendar month of the Lease Term (“Effective Date”). In the event this Lease is not terminated effective as of the Effective Date, this Lease shall continue in full force and effect. The Termination Option is granted subject to the following terms and conditions:

2.3.1 Tenant delivers to Landlord a written notice of Tenant’s election to exercise the Termination Option (“Termination Notice”), which notice is given not less than three hundred sixty five (365) days prior to the Effective Date (the “Termination Date”);

2.3.2 Tenant shall not have been in default of its obligations under this Lease beyond any applicable cure periods at any time during the Lease Term; and

1

2.3.3 Tenant pays to Landlord, concurrently with Tenant’s exercise of the Termination Option and delivery to Landlord of the Termination Notice as required above, a cash lease termination fee (collectively, the “Fee”) in the aggregate amount of (a) a sum equal to the unamortized portion of the costs of the improvements and alterations made by Landlord to the Premises; (b) a sum equal to the unamortized portion of the brokerage commissions paid by Landlord in connection with this Lease and (c) an additional fee in the amount of Sixty Thousand Dollars ($60,000). If the Termination Notice is not given as and when required by the provisions of this Section 2.2 set forth above and the sums required by the provisions of this Section 2.2 set forth above are not paid concurrently with Tenant’s delivery to Landlord of the Termination Notice, then Tenant’s Termination Option as provided for herein shall forever terminate and be of no further force or effect. At all times during the period from the date the Termination Notice is given through the Termination Date Tenant shall be fully obligated to perform all obligations required to be performed by it under the Lease as and when required by this Lease, including, without limitation, the payment of Base Rent and Tenant’s Share of Direct Expenses.

2.3.4 If Tenant timely and properly exercises the Termination Option, (i) all Rent payable under this Lease shall be paid through and apportioned as of the Termination Date (in addition to payment by Tenant of the Fee); (ii) neither party shall have any rights, estates, liabilities, or obligations under this Lease for the period accruing after the Termination Date, except those which, by the provisions of this Lease, expressly survive the expiration or termination of the Lease; (iii) Tenant shall surrender and vacate the Premises and deliver possession thereof to Landlord on or before the Termination Date in the condition required under this Lease for surrender of the Premises; and (iv) Landlord and Tenant shall enter into a written agreement reflecting the termination of this Lease upon the terms provided for herein, which agreement shall be executed within thirty (30) days after Tenant exercises the Termination Option and delivers to Landlord the Termination Notice and Fee required above. It is the parties’ intention that nothing contained herein shall impair, diminish or otherwise prevent Landlord from recovering from Tenant such additional sums as may be necessary for payment of Tenant’s Share of Operating Expenses, Tax Expenses, Common Area Utility Costs, and Utility Expenses and any other sums due and payable under this Lease (provided such sums relate to items accrued prior to the expiration or earlier termination of the Lease), including without limitation, any sums required to repair any damage to the Premises and/or restore the Premises to the condition required under the provisions of this Lease.

2.3.5 The Termination Option shall automatically terminate and become null and void upon the earlier to occur of (i) the default by Tenant beyond any applicable cure periods of its obligations under this Lease at any time during the Lease Term; (ii) the termination of Tenant’s right to possession of the Premises; or (iii) the failure of Tenant to timely or properly exercise the Termination Option as contemplated herein. This Termination Option is personal to Tenant, and any Affiliate (as defined in Section 14.8 below) and may not be assigned, voluntarily or involuntarily, to any party or entity, separate from or as part of the Lease.

3. Rent

On the date that Tenant executes this Lease, Tenant shall deliver to Landlord the original executed Lease, the Advance Rent (which shall be applied against Rent payable for the first month(s) Tenant is required to pay Rent), the Security Deposit, and all insurance certificates required to be delivered under Section 12 and Exhibit B of this Lease. Tenant agrees to pay Landlord without prior notice or demand, abatement, offset, deduction or claim, in advance at Landlord’s Address, on the Commencement Date and thereafter on the

2

first (1st) day of each month throughout the Term (i) Base Rent and (ii) as Additional Rent, Tenant’s Share of Operating Expenses, Tax Expenses, Common Area Utility Costs, and Utility Expenses. The term “Rent” means the aggregate of all these amounts. If Landlord permits Tenant to occupy the Premises without requiring Tenant to pay rental payments for a period of time, the waiver of the requirement to pay rental payments shall only apply to the waiver of Base Rent. If any rental payment date (including the Commencement Date) falls on a day of the month other than the first day of such month or if any rental payment is for a period which is shorter than one (1) month, then the rental for any such fractional month shall be a proportionate amount of a full calendar month’s rental based on the proportion that the number of days in such fractional month bears to the number of days in the calendar month during which the fractional month occurs. All other payments or adjustments required to be made under the terms of this Lease that require proration on a time basis shall be prorated in the same manner. To the extent not already paid as part of the Advance Rent any prorated Rent shall be paid on the Commencement Date, and any prorated Rent for the final calendar month shall be paid on the first day of the calendar month in which the date of expiration or termination occurs.

4. Security Deposit

Simultaneously with Tenant’s execution and delivery of this Lease, Tenant shall deliver to Landlord, as a Security Deposit for the faithful performance by Tenant of its obligations under this Lease, the amount specified in the Basic Lease Information. If Tenant is in default hereunder, Landlord may, but without obligation to do so, use all or any portion of the Security Deposit to cure the default or to compensate Landlord for all damages sustained by Landlord in connection therewith. Tenant shall, immediately on demand, pay to Landlord a sum equal to the portion of the Security Deposit so applied or used to replenish the amount of the Security Deposit held to increase such deposit to the amount initially deposited with Landlord. At the expiration or earlier termination of this Lease, within the time period(s) prescribed by California Civil Code Section 1950.7 (or any successor law), Landlord shall return the Security Deposit to Tenant, less such amounts as are reasonably necessary, as determined by Landlord, to remedy Tenant’s default(s) hereunder or to otherwise restore the Premises to a clean and safe condition, reasonable wear and tear excepted. If the cost to restore the Premises exceeds the amount of the Security Deposit, Tenant shall promptly deliver to Landlord any and all of such excess sums. Landlord shall not be required to segregate the Security Deposit from other funds, and, unless required by law, interest shall not be paid on the Security Deposit. Tenant shall not have any use of, or right of offset against, the Security Deposit.

5. Condition of Premises; Tenant Improvements

Tenant agrees (i) to accept the Premises on the Commencement Date (and by taking possession of the Premises Tenant shall be deemed to have accepted the Premises) as then being suitable for Tenant’s intended use and in good operating order, condition and repair in its then existing “AS IS” condition, except as otherwise set forth in Exhibit B hereto and (ii) that except as expressly set forth in this Lease, neither Landlord nor any of Landlord’s agents, representatives or employees has made any representations as to the suitability, fitness or condition of the Premises for the conduct of Tenant’s business or for any other purpose, including without limitation, any storage incidental thereto. The Tenant Improvements (defined in Exhibit B) shall be installed in accordance with the terms and provisions of Exhibit B. Notwithstanding the foregoing, within five (5) business days after the Substantial Completion (as such term is defined in Exhibit B hereto) of the Tenant Improvements representatives of Landlord and Tenant shall make a joint inspection of the Tenant Improvements and the results of such inspection shall be set forth in a written list specifying the incomplete items as well as those items for which corrections need to be made (the “Punchlist Items”). Landlord and Tenant shall promptly (by no later than three (3) business days thereafter) and in good faith approve the written list of Punchlist Items. Landlord, at its sole cost and expense, shall use commercially reasonable efforts to cause the Punchlist Items to be completed and/or corrected, as applicable, within thirty (30) days following the approval by Landlord and Tenant of the written list of Punchlist Items. Upon completion of the Punchlist Items to Tenant’s reasonable satisfaction Tenant shall promptly notify Landlord in writing that such items have been completed to Tenant’s reasonable satisfaction.

3

6. Additional Rent

Landlord and Tenant intend that this Lease be a “triple net lease.” The costs and expenses described in this Section 6 and all other sums, charges, costs and expenses specified in this Lease other than Base Rent are to be paid by Tenant to Landlord as additional rent (collectively, “Additional Rent”).

6.1 Operating Expenses:

6.1.1 Definition of Operating Expenses: Tenant shall pay to Landlord Tenant’s Share of all Operating Expenses as Additional Rent. The term “Operating Expenses” means the total amounts paid or payable by Landlord in connection with the ownership, management, maintenance, repair and operation of the Premises and Project, except as expressly excluded from the definition of Operating Expenses. The term “Common Areas” means (a) all areas and facilities within the Park exclusive of the Premises and other portions of the Park leasable exclusively to other tenants and (b) the areas within the Building which are not leased exclusively to any tenant in the Building. The Common Areas include, but are not limited to, interior lobbies, main electric room, telecommunications closets, mezzanines, parking areas, access and perimeter roads, sidewalks, and landscaped areas (and Tenant acknowledges and agrees that the size and shape of the Common Areas may be altered in the event the parcel or subdivision map referenced below in this Section 6.1.1 is recorded). Operating Expenses may include, but are not limited to, Landlord’s cost of: (i) repairs to, and maintenance of, the roof membrane, the non-structural portions of the roof and the non-structural elements of the perimeter exterior walls of the Building; (ii) maintaining the Common Areas of the Building and Park; (iii) annual insurance premium(s) for any and all insurance Landlord elects to obtain, including without limitation, “all risk” or “special purpose” coverage, earthquake and flood for the Project, rental value insurance, and subject to Section 25 below, any deductible; (iv) (a) modifications and/or new improvements to any portion of the Project occasioned by any rules, laws or regulations effective subsequent to the Lease Date; (b) reasonably necessary replacement improvements to any portion of the Project after the Commencement Date amortized as set forth below; and (c) new improvements to the Project that are intended to reduce operating costs or improve life/safety conditions; provided, if such costs are of a capital nature, then such costs or allocable portions thereof shall be amortized on a straight-line basis over the estimated useful life of the capital item in accordance with real estate industry standards, as reasonably determined by Landlord (but in no event less than ten (10) years), together with reasonable interest on the unamortized balance; (v) the management and administration of the Project, including, without limitation, a property management fee, accounting, auditing, billing, postage, salaries and benefits for employees, whether located on the Project or off-site, payroll taxes and legal and accounting costs and all fees, licenses and permits related to the ownership, operation and management of the Project; (vi) preventative maintenance and repair contracts including, but not limited to, contracts for elevator systems (if any), heating, ventilation and air conditioning systems and lifts for disabled persons; (vii) security and fire protection services for any portion of the Project, if and to the extent, in Landlord’s sole discretion, such services are provided; (viii) the creation and modification of any licenses, easements or other similar undertakings with respect to the Project, including, without limitation, the cost of the creation, management and operation of an owner’s association to manage and operate the Park at any time and from time to time (the “Association”); (ix) supplies, materials, equipment, rental equipment and other similar items used in the operation and/or maintenance of the Project and any reasonable reserves established for replacement or repair of any Common Area improvements or equipment; (x) any and all levies, charges, fees and/or assessments payable to the Association or any other applicable owner’s association or similar body; (xi) any barrier removal work or other required improvements, alterations or work to any portion of the Project generally required under the ADA (defined below) (the “ADA Work”); provided, if such ADA Work is required under the ADA due to Tenant’s use of the Premises or any Alteration (defined below) (other

4

than the initial Tenant Improvements) made to the Premises by or on behalf of Tenant, then the cost of such ADA Work shall be borne solely by Tenant and shall not be included as part of the Operating Expenses; and (xii) the repairs and maintenance items set forth in Section 11.2 below. Landlord shall have the right, from time to time, to equitably allocate and prorate some or all of the Operating Expenses among different tenants and/or different buildings of the Project and/or on a building by building basis and Tenant acknowledges and agrees that Landlord shall have the right, in its sole and absolute discretion, to record a parcel or subdivision map with respect to the Park or a portion of the Park, the recordation of which may have the effect of increasing or decreasing Tenant’s Share of Operating Expenses. In either of such events, Tenant’s Share of Operating Expenses shall be commensurately revised to reflect any such increases or decreases that may result therefrom.

6.1.2 Operating Expense Exclusions: The term “Operating Expenses” shall not include: (i) costs (including permit, license, and inspection fees) incurred in renovating, improving or decorating vacant space or space for other tenants within the Project; (ii) costs incurred because Landlord or another tenant actually violated the terms and conditions of any lease within the Project; (iii) legal and auditing fees (other than those fees reasonably incurred in connection with the maintenance and operation of any portion the Project), leasing commissions, advertising expenses, and other costs incurred in connection with the original leasing of the Project or future re-leasing of any portion of the Project; (iv) depreciation of the Building or any other improvements situated within the Project; (v) any items for which Landlord is actually reimbursed; (vi) costs of repairs or other work necessitated by casualty (excluding any deductibles) and/or costs of repair or other work necessitated by the exercise of the right of eminent domain to the extent insurance proceeds or a condemnation award, as applicable, is actually received by Landlord for such purposes; provided, such costs of repairs or other work shall be paid by the parties in accordance with the provisions of Sections 25 and 26, below; (vii) other than any interest charges for capital improvements referred to in Section 6.1.1(iv) hereinabove, any interest or payments on any financing for the Building or the Park, interest and penalties incurred as a result of Landlord’s late payment of any invoice (provided that Tenant pays Tenant’s Share of Operating Expenses and Tax Expenses to Landlord when due as set forth herein), and any bad debt loss, rent loss or reserves for same; (viii) costs associated with the investigation and/or remediation of Hazardous Materials (hereafter defined) present in, on or about any portion of the Project, unless such costs and expenses are the responsibility of Tenant as provided in Section 27 hereof, in which event such costs and expenses shall be paid solely by Tenant in accordance with Section 27 hereof; (ix) Landlord’s cost for the repairs and maintenance items set forth in Section 11.3; (x) overhead and profit increment paid to Landlord or to subsidiaries or affiliates of Landlord for goods and/or services in the Project to the extent the same exceeds the costs of such by unaffiliated third parties on a competitive basis; or any costs included in Operating Expenses representing an amount paid to any entity related to Landlord which is in excess of the amount which would have been paid in the absence of such relationship; (xi) any payments under a ground lease or master lease; (xii) any costs, fines, or penalties incurred due to violations by Landlord of any governmental rule or authority, this Lease or any other lease in the Project, or due to Landlord’s gross negligence or willful misconduct; (xiii) the cost of correcting any building code or other violations, which written violations were actually known to Landlord prior to the Commencement Date of this Lease; (xiv) the cost of containing, removing, or otherwise remediating any contamination of the Project (including the underlying land and ground water) by any Hazardous Materials (including, without limitation, asbestos and “PCB’s”) in the event such contamination is not the responsibility or liability of Tenant under Section 27 of this Lease; (xv) management costs to the extent they exceed commercially reasonable management fees at comparable properties or business parks; (xvi) costs for sculpture, paintings, or other objects of art (and insurance thereon or extraordinary security in connection therewith); and (xvii) any costs which may be incurred by Landlord to bring the Project into compliance with the ADA in effect prior to the Commencement Date, except to the extent such non-compliance results from Tenant’s particular use of the Premises.

6.2 Tax Expenses: Tenant shall pay to Landlord Tenant’s Share of all Tax Expenses applicable to the Project. Prior to delinquency, Tenant shall pay any and all taxes and assessments levied upon Tenant’s Property (defined below in Section 10) located or installed in or about the Premises by, or on behalf of Tenant. To the extent any such taxes or

5

assessments are not separately assessed or billed to Tenant, then Tenant shall pay the amount thereof as invoiced by Landlord. Tenant shall also reimburse and pay Landlord, as Additional Rent, within ten (10) days after demand therefor, one hundred percent (100%) of (i) any increase in real property taxes attributable to any and all Alterations (defined below in Section 10), Tenant Improvements, fixtures, equipment or other improvements of any kind whatsoever placed in, on or about the Premises for the benefit of, at the request of, or by Tenant, and (ii) taxes and assessments levied or assessed upon or with respect to the possession, operation, use or occupancy by Tenant of the Premises or any other portion of the Project. “Tax Expenses” means, without limitation, any form of tax and assessment (general, special, supplemental, ordinary or extraordinary), commercial rental tax, payments under any improvement bond or bonds, license fees, license tax, business license fee, rental tax, transaction tax or levy imposed by any authority having the direct or indirect power of tax (including any governmental, school, agricultural, lighting or other improvement district) as against any legal or equitable interest of Landlord in the Premises, Project or Park or any other tax, fee, or excise, however described, including, but not limited to, any tax resulting from the recordation of any parcel or subdivision map with respect to the Park and/or any tax imposed in substitution (partially or totally) of any tax previously included within the definition of Tax Expenses. “Tax Expenses” shall not include (a) any franchise, estate, inheritance, net income, or excess profits tax imposed upon Landlord, (b) any penalty or fee imposed solely as a result of Landlord’s failure to pay Tax Expenses when due, and (c) any items included as Operating Expenses. In the event that a parcel or subdivision map with respect to the Park or a portion of the Park is recorded by Landlord, Tenant’s Share of Tax Expenses shall be commensurately revised to reflect any increases or decreases that may result from the impact of such parcel or subdivision map.

6.3 Payment of Expenses: Landlord shall estimate Tenant’s Share of the Operating Expenses and Tax Expenses for the calendar year in which the Lease commences. Commencing on the Commencement Date, one-twelfth (1/12th) of this estimated amount shall be paid by Tenant to Landlord, as Additional Rent, and thereafter on the first (1st) day of each month throughout the remaining months of such calendar year. Thereafter, Landlord may estimate such expenses for each calendar year during the Term of this Lease and Tenant shall pay one-twelfth (1/12th) of such estimated amount as Additional Rent on the first (1st) day of each month throughout the Term. Tenant’s obligation to pay Tenant’s Share of Operating Expenses and Tax Expenses shall survive the expiration or earlier termination of this Lease.

6.4 Annual Reconciliation: By June 30th of each calendar year, Landlord shall furnish Tenant with an accounting of actual and accrued Operating Expenses and Tax Expenses; provided, failure by Landlord to give such accounting by such date shall not constitute a waiver by Landlord of its right to collect any underpayment by Tenant at any time. Within thirty (30) days of Landlord’s delivery of such accounting, Tenant shall pay to Landlord the amount of any underpayment. Landlord shall credit the amount of any overpayment by Tenant toward the next estimated monthly installment(s) falling due, or if the Term of the Lease has expired, refund the amount of overpayment to Tenant as soon as possible thereafter, and no later than thirty (30) days following the finalization of such accounting. If the Term of the Lease expires prior to the annual reconciliation of expenses Landlord shall have the right to reasonably estimate Tenant’s Share of such expenses, and deduct any underpayment from Tenant’s Security Deposit. Failure by Landlord to accurately estimate Tenant’s Share of such expenses or to otherwise perform such reconciliation shall not constitute a waiver of Landlord’s right to collect any underpayment at any time during the Term or after the expiration or earlier termination of this Lease.

6.5 Audit: After delivery to Landlord of at least thirty (30) days prior written notice, Tenant, at its sole cost and expense through any accountant designated by it, shall have the right to examine and/or audit the books and records evidencing such expenses for the previous one (1) calendar year, during Landlord’s reasonable business hours but not more frequently than once during any calendar year. Tenant may not compensate any such accountant on a contingency fee basis. The results of any such audit (and

6

any negotiations between the parties related thereto) shall be maintained strictly confidential by Tenant and its accounting firm and shall not be disclosed, published or otherwise disseminated to any other party other than to Landlord and its authorized agents, unless required by applicable law. Landlord and Tenant each shall use its commercially reasonable efforts to cooperate in such negotiations and to promptly resolve any discrepancies between Landlord and Tenant in the accounting of such expenses. If through such audit it is determined that there is a discrepancy of more than five percent (5%), then Landlord shall reimburse Tenant for the reasonable accounting costs and expenses incurred by Tenant in performing such audit, including Tenant’s in-house or outside auditors or accountants.

7. Utilities and Services

Tenant shall pay the cost of all (i) water, sewer use, sewer discharge fees and sewer connection fees, gas, electricity, telephone, telecommunications, cabling and other utilities billed or metered separately to the Premises and (ii) refuse pickup and janitorial service to the Premises.

7.1 Utility Expenses: Tenant shall pay to Landlord Tenant’s Share of any utility fees, use charges, or similar services that are not billed or metered separately to Tenant (collectively, “Utility Expenses”). If Landlord reasonably determines that Tenant’s Share of Utility Expenses is not commensurate with Tenant’s use of such services, Tenant shall pay to Landlord the amount which is attributable to Tenant’s use of the utilities or similar services, as reasonably estimated and determined by Landlord, based upon factors such as size of the Premises and intensity of use of such utilities by Tenant such that Tenant shall pay the portion of such charges reasonably consistent with Tenant’s use of such utilities and similar services. Tenant shall also pay Tenant’s Share of any assessments, charges and fees included within any tax bill for the Lot on which the Premises are situated, including without limitation, entitlement fees, allocation unit fees and sewer use fees. Notwithstanding anything to the contrary in this Section 7, if Tenant disputes Landlord’s determination of Tenant’s Share of Utility Expenses, Landlord shall, at Tenant’s sole cost and expense, have the right, in its sole and absolute discretion, to perform all work necessary to separately meter (with PG&E meters if such utility is gas or electric) the utility usage of the Premises.

7.2 Common Area Utility Costs: Tenant shall pay to Landlord Tenant’s Share of any Common Area utility fees, charges and expenses (collectively, “Common Area Utility Costs”). Tenant shall pay to Landlord one-twelfth (1/12th) of the estimated amount of Tenant’s Share of the Common Area Utility Costs on the Commencement Date and thereafter on the first (1st) day of each month throughout the Term. Any reconciliation thereof shall be substantially in the same manner as set forth in Section 6.4 above. Tenant acknowledges and agrees that Tenant’s Share of Common Area Utility Costs may increase or decrease in the event of the recordation of a parcel or subdivision map with respect to the Park or a portion of the Park.

7.3 Miscellaneous: Tenant acknowledges that the Premises may become subject to the rationing of utility services or restrictions on utility use as required by a public utility company, governmental agency or other similar entity having jurisdiction thereof. Tenant agrees that its tenancy and occupancy hereunder shall be subject to such rationing restrictions as may be imposed upon Landlord, Tenant, the Premises, or other portions of the Project, and Tenant shall in no event be excused or relieved from any covenant or obligation to be kept or performed by Tenant by reason of any such rationing or restrictions.

8. Late Charges

The sums and charges set forth in this Section 8 shall be “Additional Rent”. Tenant acknowledges that late payment (the second (2nd) day of each month or any time thereafter) of Rent and all other sums due hereunder, will cause Landlord to incur costs not contemplated by this Lease. Such costs may include, without limitation, processing and accounting charges, and late charges that may be imposed on Landlord by the terms of any note secured by any encumbrance

7

against the Premises, and late charges and penalties due to the late payment of real property taxes on the Premises. Therefore, if any installment of Rent or any other sum payable by Tenant is not received by Landlord when due, Tenant shall promptly pay to Landlord a late charge, as liquidated damages, in an amount equal to ten percent (10%) of such delinquent amount plus interest thereon at ten percent (10%) per annum for every month or portion thereof that such sums remain unpaid. Notwithstanding the foregoing, Landlord waives the late charge for the first (1st) instance during the Term in which Tenant fails to timely pay Rent, and interest shall not commence to accrue until the third (3rd) day following Landlord’s giving to Tenant its notice of default. If Tenant delivers to Landlord two (2) checks for which there are not sufficient funds, Landlord may require Tenant to replace such check with a cashier’s check for the amount of such check and all other charges payable hereunder. The parties agree that this late charge and the other charges referenced above represent a fair and reasonable estimate of the costs that Landlord will incur by reason of such late payment by Tenant, excluding attorneys’ fees and costs. Acceptance of any late charge or other charges shall not constitute a waiver by Landlord of Tenant’s default with respect to the delinquent amount, nor prevent Landlord from exercising any of the other rights and remedies available to Landlord for any other default of Tenant under this Lease.

9. Use of Premises

9.1 Compliance with Laws, Recorded Matters, and Rules and Regulations: The Premises shall be used solely for the permitted uses specified in the Basic Lease Information and for no other uses without Landlord’s prior written consent. Landlord’s consent shall not be unreasonably conditioned, withheld or delayed so long as the proposed change in use (i) does not involve the use of Hazardous Materials other than as expressly permitted under the provisions of Section 27 below, (ii) does not require any additional parking spaces, and (iii) is compatible and consistent with the other uses then being made in the Project, as reasonably determined by Landlord. The use of the Premises by Tenant and its employees, representatives, agents, invitees, licensees, subtenants, customers or contractors (collectively, “Tenant’s Representatives”) shall be subject to, and at all times in compliance with, (a) any and all applicable laws, rules, codes, ordinances, statutes, orders and regulations as same exist from time to time throughout the Term (collectively, the “Laws”), including without limitation, the requirements of the Americans with Disabilities Act, a federal law codified at 42 U.S.C. 12101 et seq., including, but not limited to Title III thereof, all regulations and guidelines related thereto and all requirements of Title 24 of the State of California (collectively, the “ADA”), (b) any and all instruments, licenses, restrictions, easements or similar instruments, conveyances or encumbrances which are at any time required to be made by or given by Landlord relating to the initial development of the Project and/or the construction, from time to time, of any additional improvements in the Project, including without limitation, any Tenant Improvements (collectively, “Development Documents”), (c) any and all documents, easements, covenants, conditions and restrictions, and similar instruments, together with any and all amendments and supplements thereto made, from time to time, each of which has been or hereafter is recorded in any official or public records with respect to the Premises or any other portion of the Project (collectively, “Recorded Matters”), and (d) any and all by laws, rules and regulations set forth in Exhibit C hereto, any other reasonable rules and regulations now or hereafter promulgated by Landlord, and any rules, restrictions and/or regulations imposed by the Association or any other applicable owners association or similar entity (collectively, “Rules and Regulations”). Landlord reserves to itself the right, from time to time, (1) to grant, without the consent of Tenant, such easements, rights and dedications that Landlord deems reasonably necessary, whether in connection with the recordation of a parcel or subdivision map or otherwise; (2) to cause the recordation of parcel or subdivision maps and/or restrictions, so long as such easements, rights, dedications, maps and restrictions, as applicable, do not materially and adversely interfere with Tenant’s operations in the Premises; and (3) to create the Association. Tenant agrees to sign promptly any documents reasonably requested by Landlord to effectuate any such easements, rights, dedications, maps or restrictions, to acknowledge creation of the Association or as otherwise

8

reasonably requested by Landlord. Tenant agrees to, and does hereby, assume full and complete responsibility (x) to ensure that the Premises, including without limitation, the Tenant Improvements, are in compliance with all applicable Laws throughout the Term and (y) for the payment of all costs, fees and expenses associated with any modifications, improvements or other Alterations to the Premises and/or any other portion of the Project occasioned by the enactment of, or changes to, any Laws arising from Tenant’s particular use of the Premises or Alterations or other improvements made to the Premises regardless of when such Laws became effective. Tenant shall have no right to initiate, submit an application for, or otherwise request, any land use approvals or entitlements with respect to the Premises or any other portion of the Project. Tenant shall not be responsible for any violation or non-compliance of Laws with regard to the Premises to the extent such violation or non-compliance of Laws exists prior to the Commencement Date; provided, however, from and after the Commencement Date, Tenant shall be solely responsible for (y) the payment of all costs, fees and expenses associated with any modifications, improvements or other Alterations to the Premises and/or any other portion of the Project occasioned by the enactment of, or changes to, any Laws arising from Tenant’s particular use of the Premises or Alterations made to the Premises regardless of when such Laws became effective and (z) the payment of capital expenditures as part of Operating Expenses to the extent set forth in Section 6.1.1 above.

9.2 Prohibition on Use: Tenant shall not use the Premises or permit anything to be done in or about the Premises nor keep or bring anything therein which will increase the existing rate of or affect any policy of insurance upon the Building or any of its contents, or cause a cancellation of any insurance policy. No auctions may be conducted in, on or about any portion of the Premises or the Project without Landlord’s prior written consent thereto. Tenant shall not do or permit anything to be done in or about the Premises which will obstruct or interfere with the rights of Landlord or other tenants or occupants of any portion of the Project. The Premises shall not be used for any unlawful purpose. Tenant shall not cause, maintain or permit any private or public nuisance in, on or about any portion of the Premises or the Project, including, but not limited to, any offensive odors, noises, fumes or vibrations. Tenant shall not damage or deface or otherwise commit or suffer to be committed any waste in, upon or about the Premises or any other portion of the Project. Tenant shall not place or store, nor permit any other person or entity to place or store, any property, equipment, materials, supplies or personal property outside of the Premises. Tenant shall not permit any animals, including, but not limited to, any household pets, to be brought or kept in or about the Premises. Tenant shall neither install any radio or television antenna, satellite dish, microwave or other device on the roof or exterior walls of the Building or any other portion of the Project nor make any penetrations of or to the roof of the Building. Tenant shall not interfere with radio, telecommunication, or television broadcasting or reception from or in the Building or elsewhere. Tenant shall place no loads upon the floors, walls, or ceilings in excess of the maximum designed load permitted by the applicable Uniform Building Code or which may damage the Building or outside areas within the Project.

10. Alterations; and Surrender of Premises

10.1 Alterations: Tenant shall be permitted to make, at its sole cost and expense, non-structural alterations and additions to the interior of the Premises without obtaining Landlord’s prior written consent, provided said alterations are not part of Tenant’s Wi-Fi Network (defined hereinbelow), do not affect the Building systems and the cost of such alterations does not exceed Fifty Thousand Dollars ($50,000) each job and One Hundred Thousand Dollars ($100,000) cumulatively each calendar year (the “Permitted Improvements”). Tenant, however, shall first notify Landlord of such Permitted Improvements so that Landlord may post a Notice of Non-Responsibility on the Premises. Except for the Permitted Improvements, Tenant shall neither install any signs, fixtures, or improvements, nor make or permit any other alterations or additions (individually, an “Alteration”, and collectively, “Alterations”) to the Premises without the prior written consent of Landlord, which consent shall not be unreasonably withheld so long as any such Alteration does not affect the Building systems, structural integrity or structural components of the Premises or Building. If any such Alteration is expressly permitted by Landlord, Tenant shall deliver at least ten (10) days prior written notice to Landlord, from the date Tenant commences construction, sufficient to enable Landlord to post and record a Notice of Non-Responsibility. Tenant

9

shall obtain all permits or other governmental approvals prior to commencing any work and deliver a copy of same to Landlord. All Alterations shall be (i) at Tenant’s sole cost and expense in accordance with plans and specifications which have been previously submitted to and approved in writing by Landlord, and shall be installed by a licensed, insured (and bonded, at Landlord’s option) contractor (reasonably approved by Landlord) in compliance with all applicable Laws, Development Documents, Recorded Matters, and Rules and Regulations and (ii) performed in a good and workmanlike manner and so as not to obstruct access to any portion of the Project or any business of Landlord or any other tenant. Landlord’s approval of any plans, specifications or working drawings for Tenant’s Alterations shall neither create nor impose any responsibility or liability on the part of Landlord for their completeness, design sufficiency, or compliance with any Laws. As Additional Rent, Tenant shall reimburse Landlord, within ten (10) days after demand, for actual and reasonable legal, engineering, architectural, planning and other expenses incurred by Landlord in connection with Tenant’s Alterations, plus Tenant shall pay to Landlord a fee equal to five percent (5%) of the total cost of the Alterations. If Tenant makes any Alterations, Tenant shall carry “Builder’s All Risk” insurance, in an amount approved by Landlord and such other insurance as Landlord may require. All such Alterations shall be insured by Tenant in accordance with Section 12 of this Lease immediately upon completion. Tenant shall keep the Premises and the Lot on which the Premises are situated free from any liens arising out of any work performed, materials furnished or obligations incurred by or on behalf of Tenant. Tenant shall, prior to commencing any Alterations, (a) cause its contractor(s) and/or major subcontractor(s) to provide insurance as reasonably required by Landlord, and (b) provide such assurances to Landlord, including without limitation, waivers of lien, surety company performance bonds (for projects estimated to cost in excess of $150,000) as Landlord shall require to assure payment of the costs thereof to protect Landlord and the Project from and against any mechanic’s, materialmen’s or other liens.

10.1.1 Wi-Fi Network: Without limiting the generality of the foregoing, in the event Tenant desires to install wireless intranet, Internet and communications network (“Wi-Fi Network”) in the Premises for the use by Tenant and its employees, then the same shall be subject to the provisions of this Section 10.1.1 (in addition to the other provisions of this Section 10). In the event Landlord consents to Tenant’s installation of such Wi-Fi Network, Tenant shall, in accordance with Section 10.2 below, remove the Wi-Fi Network from the Premises prior to the termination of the Lease. Tenant shall use the Wi-Fi Network so as not to cause any interference to other tenants in the Building or to other tenants at the Park or with any other tenant’s communication equipment, and not to damage the Building or Park or interfere with the normal operation of the Building or Park and Tenant hereby agrees to indemnify, defend and hold Landlord harmless from and against any and all claims, costs, damages, expenses and liabilities (including attorneys’ fees) arising out of Tenant’s failure to comply with the provisions of this Section 10.1.1, except to the extent same is caused by the gross negligence or willful misconduct of Landlord and which is not covered by the insurance carried by Tenant under this Lease (or which would not be covered by the insurance required to be carried by Tenant under this Lease). Should any interference occur, Tenant shall take all necessary steps as soon as reasonably possible and no later than three (3) calendar days following such occurrence to correct such interference. If such interference continues after such three (3) day period, Tenant shall immediately cease operating such Wi-Fi Network until such interference is corrected or remedied to Landlord’s reasonable satisfaction. Tenant acknowledges that Landlord has granted and/or may grant telecommunication rights to other tenants and occupants of the Building and to telecommunication service providers and in no event shall Landlord be liable to Tenant for any interference of the same with such Wi-Fi Network. Landlord makes no representation that the Wi-Fi Network will be able to receive or transmit communication signals without interference or disturbance. Tenant shall (i) be solely responsible for any damage caused as a result of the Wi-Fi Network, (ii) promptly pay any tax, license or permit fees charged pursuant to any laws or regulations in connection with the installation, maintenance or use of the Wi-Fi Network and comply with all precautions and safeguards recommended by all governmental authorities, and (iii) pay for all necessary repairs, replacements to or maintenance of the Wi-Fi Network. Should Landlord be required to retain professionals to research any interference issues that may arise and to confirm Tenant’s compliance with the terms of this Section 10.11, Landlord shall retain such professionals at commercially reasonable rates, and Tenant shall reimburse

10

Landlord within thirty (30) days following submission to Tenant of an invoice from Landlord, which costs shall not exceed $1,000 per year (except in the event of a default by Tenant hereunder). This reimbursement obligation is independent of any rights or remedies Landlord may have in the event of a breach of default by Tenant under this Lease.

10.2 Surrender of Premises: At the expiration of the Term or earlier termination of this Lease, except as provided below in Section 10.2.1, Tenant shall surrender the Premises to Landlord (a) in good condition and repair (damage by acts of God, casualty, and normal wear and tear excepted), but with all interior walls cleaned, any carpets cleaned, all floors cleaned and waxed, all non-working light bulbs and ballasts replaced and all roll-up doors and plumbing fixtures in good condition and working order, and (b) in accordance with Section 27 hereof. Normal wear and tear shall not include any damage or deterioration that would have been prevented by proper maintenance by Tenant, or Tenant otherwise performing all of its obligations under this Lease, or any damage or deterioration due to or associated with prolonged hours, non-office use, unusually heavy people loads (defined as more than one person per two hundred (200) rentable square feet), unusually heavy utility use, unusually heavy floor loads, or other unusual occupancy factors. Except as set forth below in Section 10.2.1, on or before the expiration or earlier termination of this Lease, Tenant shall remove (i) all of Tenant’s Property (defined below) and Tenant’s signage from the Premises and other portions of the Project, (ii) any Alterations Landlord may require Tenant, by notice to Tenant given at or about the time of Landlord’s granting of consent to their installation, to remove, and Tenant shall repair any damage caused by all of such removal activities, at Tenant’s sole expense. “Tenant’s Property” means all equipment, trade fixtures, furnishings, all telephone, data, and other cabling and wiring (including any cabling and wiring associated with the Wi-Fi Network, if any) installed or caused to be installed by Tenant (including any cabling and wiring, installed above the ceiling of the Premises or below the floor of the Premises), inventories, goods and personal property of Tenant. Any of Tenant’s Property not so removed by Tenant as required herein shall be deemed abandoned and may be stored, removed, and disposed of by Landlord at Tenant’s expense, and Tenant waives all claims against Landlord for any damages resulting from Landlord’s retention and disposition of such property; provided, however, Tenant shall remain liable to Landlord for all costs incurred in storing and disposing of such abandoned property of Tenant. Landlord may elect to take responsibility to remove any such wiring or cabling installed above the ceiling or beneath the floors of the Premises, in which case Tenant shall pay Landlord for the actual cost incurred by Landlord therefor, (together with a five percent (5%) supervision/administration fee) within thirty (30) days after being billed for the same. All Alterations except those which Landlord requires Tenant to remove, shall remain in the Premises as the property of Landlord. Tenant shall indemnify, defend and hold the Indemnitees (hereafter defined) harmless from and against any and all Claims (defined below) (x) arising from any delay by Tenant in so surrendering the Premises including, without limitation, any Claims made against Landlord by any succeeding tenant or prospective tenant founded on or resulting from such delay and (y) suffered by Landlord due to lost opportunities to lease any portion of the Premises to any such succeeding tenant or prospective tenant.

10.2.1 Restoration Obligation. Notwithstanding anything to the contrary in this Section 10, prior to Tenant’s surrender of the Premises, Tenant shall have the obligation to restore the area of the Premises in which Tenant’s lab shall be located to its original condition at the time of Lease execution, including, but not limited to, restoring smooth surface ceiling tiles and ESD flooring to Building Standard finishes, removal of lab equipment electrical stubbed to the distribution panel, and demolition of lab partitions; provided, however, Tenant shall not be required to remove any dedicated heating, ventilating and air conditioning (“HVAC”) unit(s) serving the lab; rather, Tenant shall have the right to leave the HVAC unit on the roof but shall remove all electrical components related to the HVAC, ductwork, diffusers and any other components related to the HVAC and make any necessary repairs to the Premises, to the reasonable satisfaction of Landlord. Such work shall be at Tenant’s sole cost and expense and shall be performed prior to the expiration or earlier termination of the Term of the Lease.

11

11. Repairs and Maintenance

11.1 Tenant’s Repairs and Maintenance Obligations: Except for those portions of the Building to be maintained by Landlord, as provided in Sections 11.2 and 11.3 below, Tenant shall, at its sole cost and expense, keep and maintain all parts of the Premises and such portions of the Building as are within the exclusive control of Tenant in good, clean and safe condition and repair, promptly making all necessary repairs and replacements, whether ordinary or extraordinary, with materials and workmanship of the same character, kind and quality as the original thereof, all of the foregoing in accordance with the applicable provisions of Section 10 hereof, and to the reasonable satisfaction of Landlord including, but not limited to, repairing any damage (and replacing any property so damaged) caused by Tenant or any of Tenant’s Representatives, or due to or associated with prolonged hours, non-office use, unusually heavy people loads (defined as more than one person per two hundred (200) rentable square feet), unusually heavy utility use, unusually heavy floor loads, or other unusual occupancy factors, and restoring the Premises and other portions of the Project to the condition existing prior to the occurrence of such damage. Without limiting any of the foregoing, Tenant shall be solely responsible for promptly maintaining, repairing and replacing (a) all mechanical systems, heating, ventilation and air conditioning (“HVAC”) systems serving the Premises, (b) all plumbing work and fixtures, (c) electrical wiring systems, fixtures and equipment exclusively serving the Premises, (d) all interior lighting (including, without limitation, light bulbs and/or ballasts) and exterior lighting exclusively serving the Premises or adjacent to the Premises, (e) all glass, windows, window frames, window casements, skylights, interior and exterior doors, door frames and door closers, (f) all roll-up doors, ramps and dock equipment, including without limitation, dock bumpers, dock plates, dock seals, dock levelers and dock lights, (g) all tenant signage, (h) lifts for disabled persons serving the Premises, (i) sprinkler systems, fire protection systems and security systems, except to the extent maintained by Landlord, and (j) all partitions, fixtures, equipment, interior painting, interior walls and floors, and floor coverings of the Premises and every part thereof (including, without limitation, any demising walls contiguous to any portion of the Premises). Tenant shall maintain throughout the Term a current contract with a vendor qualified to repair and maintain the HVAC systems serving the Premises, which vendor shall be reasonably approved by Landlord. Additionally, Tenant shall be solely responsible for the performance of the regular removal of trash and debris. Notwithstanding the foregoing, Landlord shall have the right, but not the obligation, exercisable at any time, to directly contract with an HVAC vendor to perform the preventive maintenance on the mechanical and/or HVAC equipment, including, without limitation, the right to obtain a semi-annual HVAC condition report, in which event the costs and expenses associated with such services and/or report shall be part of the definition of Operating Expenses herein. Should Landlord elect to directly contract for such HVAC condition report, then Tenant, upon receipt of such report, shall promptly make all repairs and/or replacements indicated on such report. So long as Tenant does not utilize the generator currently located at the Building or request its use, Tenant shall have no responsibility for any repairs or maintenance of such generator at the Building.

11.2 Maintenance by Landlord: Subject to Tenant’s obligation under Section 6 to reimburse Landlord, in the form of Additional Rent, for Tenant’s Share of the cost and expense of the following described items, Landlord shall repair and maintain the following items: fire protection services; the roof and roof coverings (provided that Tenant installs no additional air conditioning or other equipment on the roof that damages the roof coverings, in which event Tenant shall pay all costs relating to the presence of such additional equipment); any elevator that serves the Premises; the plumbing and mechanical systems serving the Building, including the boiler for the Building but excluding the plumbing, mechanical and electrical systems exclusively serving the Premises; any rail spur and rail crossing; exterior painting of the Building; and the parking areas, pavement, landscaping, sprinkler systems, sidewalks, driveways, curbs, and lighting systems in the Common Areas. If Landlord elects to perform any repair or restoration work required to be performed by Tenant, Tenant shall reimburse Landlord upon demand for all costs and expenses incurred by Landlord in connection therewith. Tenant shall promptly report, in writing, to Landlord any defective condition known to it which Landlord is required to repair.

11.3 Landlord’s Repairs and Maintenance Obligations: Subject to the provisions of Sections 25 and 26, and except for repairs rendered necessary by the intentional or negligent acts or omissions of Tenant or any of Tenant’s Representatives or

12

Tenant’s failure to perform its obligations under Section 11.1 above, Landlord shall, at Landlord’s sole cost and expense, keep in good repair the structural portions of the floors, foundations and exterior perimeter walls of the Building (exclusive of glass and exterior doors), and the structural portions of the roof of the Building (excluding the roof membrane).

11.4 Tenant’s Failure to Perform Repairs and Maintenance Obligations: If Tenant refuses or neglects to repair and maintain the Premises and the other areas properly as required herein and to the reasonable satisfaction of Landlord, (i) Landlord may, but without obligation to do so, at any time make such repairs or maintenance without Landlord having any liability to Tenant for any loss or damage that may accrue to Tenant’s Property or to Tenant’s business by reason thereof, except to the extent any damage is caused by the willful misconduct or gross negligence of Landlord or its authorized agents and representatives and (ii) Tenant shall pay to Landlord, as Additional Rent, Landlord’s costs and expenses incurred therefor. Tenant’s obligations under this Section 11 shall survive the expiration of the Term or earlier termination thereof. Tenant hereby waives any right to repair at the expense of Landlord under any applicable Laws now or hereafter in effect.

12. Insurance

12.1 Types of Insurance: Tenant shall maintain in full force and effect at all times during the Term, at Tenant’s sole cost and expense, for the protection of Tenant and Landlord, as their interests may appear, policies of insurance issued by carriers reasonably acceptable to Landlord and its lender which afford the following coverages: (i) worker’s compensation and employer’s liability, as required by law; (ii) commercial general liability insurance (occurrence form) providing coverage against any and all claims for bodily injury and property damage occurring in, on or about the Premises arising out of Tenant’s and Tenant’s Representatives’ use or occupancy of the Premises and such insurance shall (a) include coverage for blanket contractual liability, fire damage, premises, personal injury, completed operations and products liability, and (b) have a combined single limit of not less than Two Million Dollars ($2,000,000) per occurrence with a Three Million Dollar ($3,000,000) aggregate limit and excess/umbrella insurance in the amount of Three Million Dollars ($3,000,000) (if Tenant has other locations which it owns or leases, the policy shall include an aggregate limit per location endorsement); (iii) comprehensive automobile liability insurance with a combined single limit of at least $1,000,000 per occurrence for claims arising out of any company owned automobiles; (iv) “all risk” or “special purpose” property insurance, including without limitation, sprinkler leakage, covering damage to or loss of any of Tenant’s Property and the Tenant Improvements (including the Cubicles and Equipment (as defined in Section 35)) located in, on or about the Premises, and in addition, coverage for flood and business interruption of Tenant, together with, if the property of any of Tenant’s invitees, vendors or customers is to be kept in the Premises, warehouser’s legal liability or bailee customers insurance for the full replacement cost of the property belonging to such parties and located in the Premises. Such insurance shall be written on a replacement cost basis (without deduction for depreciation) in an amount equal to one hundred percent (100%) of the full replacement value of the aggregate of the items referred to in this clause (iv); and (v) such other insurance or higher limits of liability as is then customarily required for similar types of buildings within the general vicinity of the Project or as may be reasonably required by any of Landlord’s lenders.

12.2 Insurance Policies: Insurance required to be maintained by Tenant shall be written by companies (i) licensed to do business in the State of California, (ii) domiciled in the United States of America, and (iii) having a “General Policyholders Rating” of at least A:X (or such higher rating as may be required by a lender having a lien on the Premises) as set forth in the most current issue of “A.M. Best’s Rating Guides.” Any deductible amounts under any of the insurance policies required hereunder shall not exceed Five Thousand Dollars ($5,000). Tenant shall deliver to Landlord certificates of insurance and true and complete copies of any and all endorsements required herein for all insurance required to be maintained by Tenant hereunder at the time of execution of this Lease by Tenant. Tenant shall, at least fifteen (15) days prior to expiration of each policy, furnish Landlord with certificates of renewal or “binders” thereof. Each certificate shall expressly provide that such policies shall not be cancelable or otherwise subject to material modification except after thirty

13

(30) days prior written notice to the parties named as additional insureds as required in this Lease (except for cancellation for nonpayment of premium, in which event cancellation shall not take effect until at least ten (10) days’ notice has been given to Landlord). Tenant shall have the right to provide insurance coverage which it is obligated to carry pursuant to the terms of this Lease under a blanket insurance policy, provided such blanket policy expressly affords coverage for the Premises and Landlord as required by this Lease.

12.3 Additional Insureds and Coverage: Each of Landlord, Landlord’s property management company or agent, and Landlord’s lender(s) having a lien against the Premises or any other portion of the Project shall be named as additional insureds or loss payees (as applicable) under all of the policies required in Section 12.1(ii) and, with respect to the Tenant Improvements, in Section 12.1(iv) hereof. All such policies shall provide for severability of interest. All insurance to be maintained by Tenant shall, except for workers’ compensation and employer’s liability insurance, be primary, without right of contribution from insurance maintained by Landlord. Any umbrella/excess liability policy (which shall be in “following form”) shall provide that if the underlying aggregate is exhausted, the excess coverage will drop down as primary insurance. The limits of insurance maintained by Tenant shall not limit Tenant’s liability under this Lease. It is the parties’ intention that the insurance to be procured and maintained by Tenant as required herein shall provide coverage for any and all damage or injury arising from or related to Tenant’s operations of its business and/or Tenant’s or Tenant’s Representatives’ use of the Premises and any of the areas within the Project. Notwithstanding anything to the contrary contained herein, to the extent Landlord’s cost of maintaining insurance with respect to the Building and/or any other buildings within the Project is increased as a result of Tenant’s acts, omissions, Alterations, improvements, use or occupancy of the Premises, Tenant shall pay one hundred percent (100%) of, and for, each such increase as Additional Rent.

12.4 Failure of Tenant to Purchase and Maintain Insurance: If Tenant fails to obtain and maintain the insurance required herein throughout the Term, Landlord may, but without obligation to do so, purchase the necessary insurance and pay the premiums therefor. If Landlord so elects to purchase such insurance, Tenant shall promptly pay to Landlord as Additional Rent, the amount so paid by Landlord, upon Landlord’s demand therefor. In addition, Landlord may recover from Tenant and Tenant agrees to pay, as Additional Rent, any and all Claims which Landlord may incur due to Tenant’s failure to obtain and maintain such insurance.

12.5 Waiver of Subrogation: Landlord and Tenant mutually waive their respective rights of recovery against each other for any loss of, or damage to, either party’s property to the extent that such loss or damage is insured by an insurance policy required to be in effect at the time of such loss or damage. Each party shall obtain any special endorsements, if required by its insurer, whereby the insurer waives its rights of subrogation against the other party. This provision is intended to waive fully, and for the benefit of the parties hereto, any rights and/or claims which might give rise to a right of subrogation in favor of any insurance carrier.

12.6 Landlord’s Insurance: Landlord shall maintain in full force and effect during the Term of this Lease, subject to reimbursement as provided in Section 6, policies of insurance which afford such coverages as are commercially reasonable and as is consistent with other properties in Landlord’s or Landlord’s affiliates’ portfolio. Notwithstanding the foregoing, Landlord shall obtain and keep in force during the Term of this Lease, as an item of Operating Expenses, a policy or policies in the name of Landlord, with loss payable to Landlord and to the holders of any mortgages, deeds of trust or ground leases on the Premises (“Lender(s)”), (i) on an “all risk” or “special form” basis, insuring loss or damage to the Building, including all improvements, fixtures (other than trade fixtures) and permanent additions (ii) insuring loss or damage to the Tenant Improvements (but not any of Tenant’s Personal Property (as defined in Exhibit B) or the Nitrogen Tank) caused by earthquake. Except as set forth above with respect to earthquake coverage for the Tenant Improvements, all alterations, additions and improvements made to the Premises by Tenant (including the Tenant Improvements and the Nitrogen Tank) shall be insured by Tenant rather than by Landlord. Subject to the foregoing, the amount of the “all risk” or “special

14

form” insurance procured by Landlord shall be equal to at least ninety percent (90%) of the full replacement cost of the Building (excluding the cost of excavation and installation of footings), including all improvements and permanent additions as the same shall exist from time to time, or the amount required by Lenders. At Landlord’s option, Landlord shall insure against all risks of direct physical loss or damage to the Building (including, without limitation, the perils of flood and earthquake), including coverage for any additional costs resulting from debris removal and reasonable amounts of coverage for the enforcement of any ordinance or law regulating the reconstruction or replacement of any undamaged sections of the Building required to be demolished or removed by reason of the enforcement of any building, zoning, safety or land use laws as the result of a covered cause of loss. If any such insurance coverage procured by Landlord has a deductible clause, the deductible shall not exceed reasonable amounts and as is then consistent with Landlord’s or its affiliates’ portfolio, and in the event of any casualty, the amount of such deductible shall be an item of Operating Expenses as so limited. Notwithstanding anything to the contrary contained herein, to the extent the cost of maintaining insurance with respect to the Building is increased as a result of Tenant’s acts, omissions, alterations, improvements (including, without limitation, the Tenant Improvements), use or occupancy of the Premises, Tenant shall pay one hundred percent (100%) of, and for, such increase(s) as Additional Rent.

13. Limitation of Liability and Indemnity

Except to the extent of Claims (defined below) resulting from the gross negligence or willful misconduct of Landlord or its authorized representatives, Tenant agrees to protect, defend (with counsel reasonably acceptable to Landlord) and hold Landlord and Landlord’s lenders, partners, members, property management company (if other than Landlord), agents, directors, officers, employees, representatives, contractors, successors and assigns and each of their respective partners, members, directors, officers, employees, representatives, agents, contractors, heirs, successors and assigns (collectively, the “Indemnitees”) harmless and indemnify the Indemnitees from and against all liabilities, damages, demands, penalties, costs, claims, losses, judgments, charges and expenses (including reasonable attorneys’ fees, costs of court and expenses necessary in the prosecution or defense of any litigation including the enforcement of this provision) (collectively, “Claims”) arising from or in any way related to, directly or indirectly, (i) Tenant’s or Tenant’s Representatives’ use of the Premises and other portions of the Project, (ii) the conduct of Tenant’s business, (iii) from any activity, work or thing done, permitted or suffered by Tenant in or about the Premises, and/or (iv) Tenant’s failure to perform any covenant or obligation of Tenant under this Lease. Tenant agrees that the obligations of Tenant herein shall survive the expiration or earlier termination of this Lease.

Except to the extent of Claims resulting from the gross negligence or willful misconduct of Landlord or its authorized representatives, to the fullest extent permitted by law, Tenant agrees that neither Landlord nor any of the Indemnitees shall at any time or to any extent whatsoever be liable, responsible or in any way accountable for any loss, liability, injury, death or damage to persons or property which at any time may be suffered or sustained by Tenant or by any person(s) whomsoever who may at any time be using, occupying or visiting the Premises or any other portion of the Project, including, but not limited to, any acts, errors or omissions of any other tenants or occupants of the Project. Tenant shall not, in any event or circumstance, be permitted to offset or otherwise credit against any payments of Rent required herein for matters for which Landlord may be liable hereunder.

14. Assignment and Subleasing

14.1 Prohibition: Except in connection with a Transfer (defined below) to an Affiliate, Tenant shall not, without the prior written consent of Landlord, assign, mortgage, hypothecate, encumber, grant any license or concession, pledge or otherwise transfer this Lease or any interest herein, permit any assignment or other transfer of this Lease by operation of law, sublet the Premises or any part thereof, or permit the use of the Premises by any persons other than Tenant and Tenant’s Representatives (collectively, “Transfers” and any entity to whom any Transfer is made or sought to be made is

15

sometimes referred to as a “Transferee”). No consent to any Transfer shall constitute a waiver of the provisions of this Section 14, and all subsequent Transfers may be made only with the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed, but which consent shall be subject to the provisions of this Section 14.

14.2 Request for Consent: If Tenant seeks to make a Transfer, Tenant shall notify Landlord, in writing (“Tenant’s Notice”), and deliver to Landlord at least thirty (30) days prior to the proposed commencement date of the Transfer (“Proposed Effective Date”) the following: (i) a description of the portion of the Premises to be transferred (the “Subject Space”); (ii) all of the terms of the proposed Transfer, including without limitation, the Proposed Effective Date, the name and address of the proposed Transferee, and a copy of the existing or proposed assignment, sublease or other agreement governing the proposed Transfer; (iii) current financial statements of the proposed Transferee certified by an officer, member, partner or owner thereof, and audited financial statements for the previous three (3) most recent consecutive fiscal years if available; and (iv) such other information as Landlord may then reasonably require. Within twenty (20) days after Landlord’s receipt of the Tenant’s Notice (the “Landlord Response Period”) Landlord shall notify Tenant, in writing, of its determination with respect to such requested proposed Transfer and Landlord’s election as set forth in Section 14.5. If Landlord does not elect to recapture pursuant to Section 14.5 and Landlord does consent to the requested proposed Transfer, Tenant may thereafter assign its interests in and to this Lease or sublease all or a portion of the Premises to the same party and on the same terms as set forth in the Tenant’s Notice.