Attached files

| file | filename |

|---|---|

| 8-K - PPBI 8K 2011 INVESTOR PRESENTATION - PACIFIC PREMIER BANCORP INC | ppbi_8k-2011junepres.htm |

www.ppbi.com

Investor Presentation

Investor Presentation

First Quarter 2011

First Quarter 2011

Steven R. Gardner

Steven R. Gardner

President & CEO

President & CEO

1

www.ppbi.com

This presentation contains forward-looking statements regarding events or future financial performance

of the Company, including statements with respect to our objectives and strategies, and the results of

our operations and our business. These statements are based on management's current expectations and

beliefs concerning future developments and their potential effects on the Company. There can be no

assurance that future developments affecting the Company will be the same as those anticipated by

management. Actual results may differ from those projected in the forward-looking statements. We

caution readers of this presentation not to place undue reliance on these forward-looking statements as

a number of risks could cause future results to differ materially from these statements. These risks

include, but are not limited to, the following: changes in the performance of the financial markets;

changes in the demand for and market acceptance of the Company's products and services; changes in

general economic conditions including interest rates, presence of competitors with greater financial

resources, and the impact of competitive projects and pricing; the effect of the Company's policies; the

continued availability of adequate funding sources; and various legal, regulatory and litigation risks; as

well as those additional risks identified in risks factors discussed in the reports filed by the Company

with the SEC, which are available on its website at www.sec.gov. The Company does not undertake

any obligation to update any forward-looking statements for any reason, even if new information

becomes available or other events occur in the future.

of the Company, including statements with respect to our objectives and strategies, and the results of

our operations and our business. These statements are based on management's current expectations and

beliefs concerning future developments and their potential effects on the Company. There can be no

assurance that future developments affecting the Company will be the same as those anticipated by

management. Actual results may differ from those projected in the forward-looking statements. We

caution readers of this presentation not to place undue reliance on these forward-looking statements as

a number of risks could cause future results to differ materially from these statements. These risks

include, but are not limited to, the following: changes in the performance of the financial markets;

changes in the demand for and market acceptance of the Company's products and services; changes in

general economic conditions including interest rates, presence of competitors with greater financial

resources, and the impact of competitive projects and pricing; the effect of the Company's policies; the

continued availability of adequate funding sources; and various legal, regulatory and litigation risks; as

well as those additional risks identified in risks factors discussed in the reports filed by the Company

with the SEC, which are available on its website at www.sec.gov. The Company does not undertake

any obligation to update any forward-looking statements for any reason, even if new information

becomes available or other events occur in the future.

2

www.ppbi.com

• In 1983, Pacific Premier Bank (the

“Bank”) was founded and later expanded

into subprime lending

“Bank”) was founded and later expanded

into subprime lending

• By 1999, growing losses prompted the

Bank to refocus its strategy

Bank to refocus its strategy

• In 2000, the current management team

took over and developed a three phase

strategic plan to transform the Bank from

a nationwide subprime lender into a

traditional Community Bank

took over and developed a three phase

strategic plan to transform the Bank from

a nationwide subprime lender into a

traditional Community Bank

Phase 1 - Recapitalize Pacific Premier

• Issued $12 million note and warrants

• Lowered the risk profile of the Bank

Phase 2 - Return to Profitability

• Grew the balance sheet

• Raised $27 million via secondary offering

Phase 3 - Commercial Bank Model

• Diversify loan and deposit portfolios

• Raised $15 million Offensive Capital

• Q1 2011 closed on FDIC acquisition of

Canyon National Bank

Canyon National Bank

3

www.ppbi.com

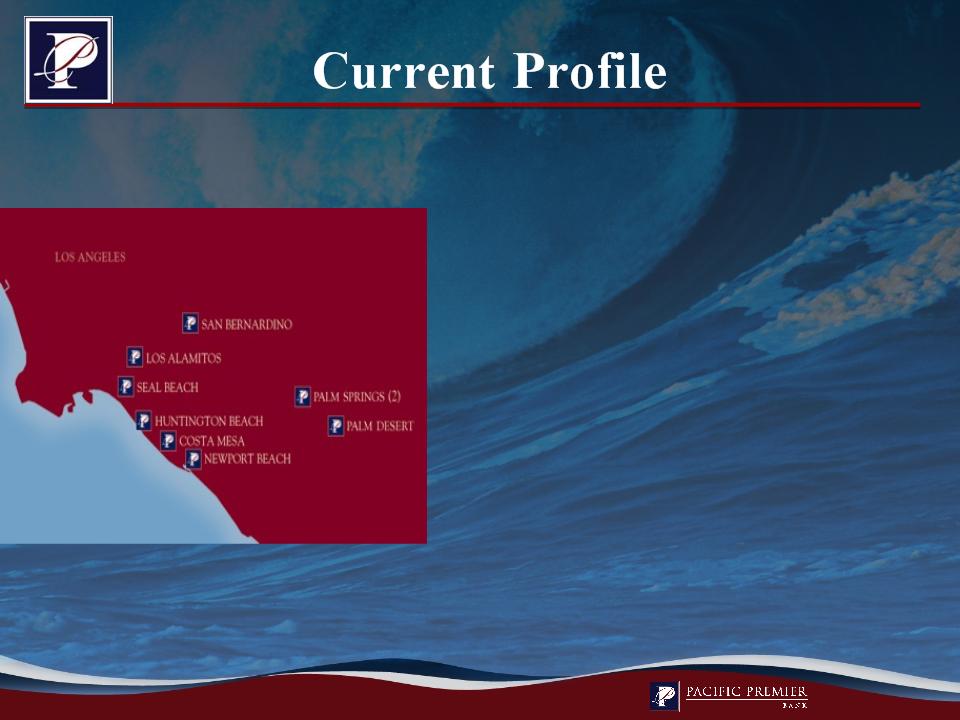

|

Headquarters:

|

Costa Mesa, CA

|

|

Business Focus:

|

Small and middle market

businesses |

|

Total Assets:

|

$956.5 million

|

|

Branches:

|

9 locations

|

|

TCE:

|

8.11%

|

|

FD book value:

|

$ 7.64

|

|

ROAA:

|

2.16%

|

|

ROAE :

|

23.25%

|

At March 31, 2011

4

www.ppbi.com

Strong Management Team

|

Name

|

Position

|

Age

|

Experience

|

|

Steve Gardner

|

President & CEO

|

50

|

27

|

|

Kent Smith

|

EVP & Chief Financial Officer

|

49

|

25

|

|

Eddie Wilcox

|

EVP & Chief Banking Officer

|

44

|

22

|

|

Mike Karr

|

EVP & Chief Credit Officer

|

42

|

21

|

|

Steve Arnold

|

SVP & General Counsel

|

41

|

19

|

|

Tom Rice

|

SVP & Chief Information Officer

|

39

|

18

|

5

www.ppbi.com

|

|

(dollars in thousands, except per share data)

|

||||

|

Balance Sheets

|

QTD

3/31/11

|

QTD

12/31/10

|

QTD

9/30/10

|

QTD

6/30/10

|

QTD

3/31/10

|

|

Total assets

|

$ 956,482

|

$ 826,816

|

$ 821,320

|

$ 797,242

|

$ 767,644

|

|

Net loans

|

691,074

|

555,538

|

543,284

|

543,023

|

537,882

|

|

Total deposits

|

832,786

|

659,240

|

656,791

|

632,043

|

612,901

|

|

Total borrowings

|

38,810

|

78,810

|

76,810

|

76,810

|

76,810

|

|

|

|||||

|

Statements of Operations

|

|

|

|

|

|

|

Net interest income

|

$ 9,102

|

$ 7,533

|

$ 7,402

|

$ 6,842

|

$ 6,660

|

|

Provision for loan losses

|

106

|

0

|

397

|

639

|

1,056

|

|

Noninterest income

|

5,239

|

14

|

674

|

(1,038)

|

(726)

|

|

Noninterest expense

|

6,359

|

5,009

|

4,809

|

4,808

|

4,322

|

|

Net income

|

4,772

|

1,600

|

1,845

|

337

|

456

|

|

|

|

|

|

|

|

|

Bank Capital Ratios

|

|

|

|

|

|

|

Tier 1 leverage

|

9.09

|

10.29

|

10.15

|

10.30

|

10.01

|

|

Tier 1 risk based

|

10.29

|

14.03

|

14.01

|

13.88

|

13.96

|

|

Total risk based

|

11.40

|

15.28

|

15.26

|

15.13

|

15.21

|

6

www.ppbi.com

7

www.ppbi.com

• Expansion opportunities - FDIC and traditional M&A

• Relationship banking - small/middle market businesses

• Proactive credit management

• Potential to grow fee income/consumer products

Develop the Bank into one of Southern California’s

top performing commercial banks

top performing commercial banks

8

www.ppbi.com

Texas ratio defined as NPAs + 90 days PD / tangible common equity plus

loan loss reserves; Circle radius represents 100 miles

loan loss reserves; Circle radius represents 100 miles

SoCal Stressed Institutions

|

Possible failures as of March 31, 2011 within

100 miles of Costa Mesa, California

|

||

|

|

Texas Ratio

|

# of Institutions

|

|

Near term

|

100% +

|

10

|

|

Longer term

|

50% to 100%

|

31

|

Possible near and longer term failures

Texas Ratio > 100%

Texas Ratio b/t 50-100%

Source: SNL Financial

9

www.ppbi.com

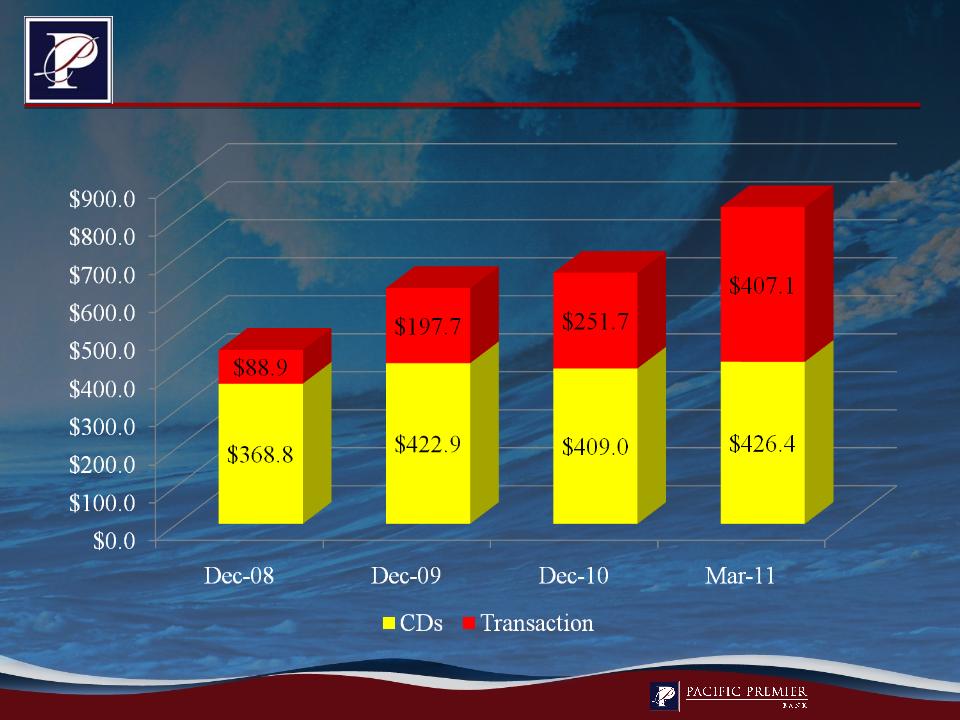

Strong Core Deposit Growth

1.07%

1.40%

1.78%

Cost - 3.28%

10

www.ppbi.com

0.39%

0.72%

0.93%

Cost - 1.18%

11

www.ppbi.com

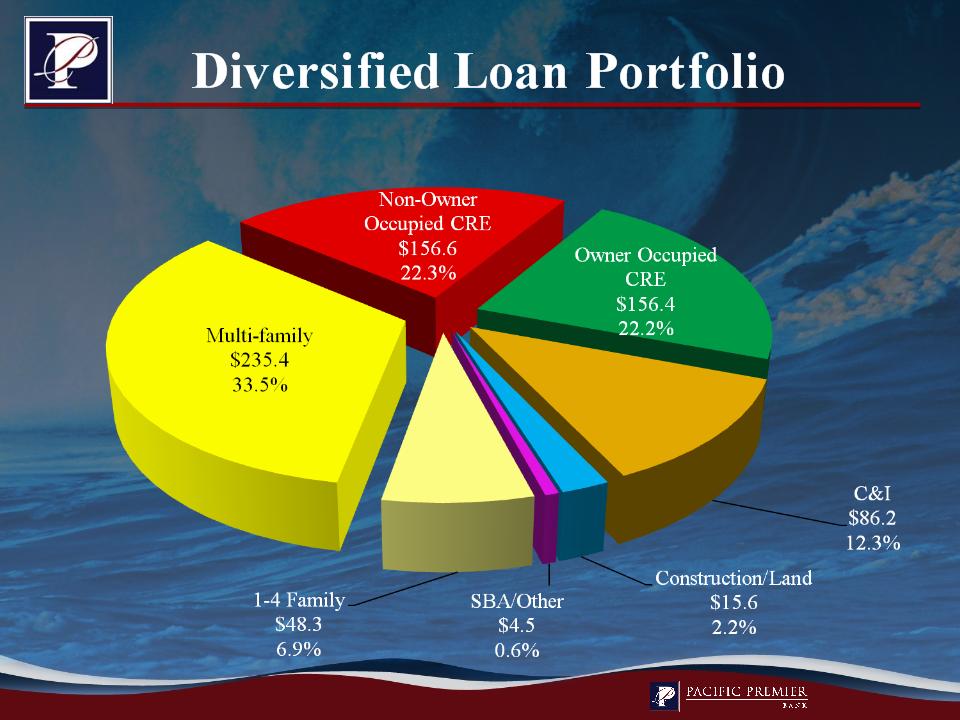

At March 31, 2011

(in millions)

12

www.ppbi.com

• Overall Underwriting Philosophy:

• Global cash flow focused

• Loans:

• Business - owner occupied CRE and C&I

• Investor owned CRE approach

• No CRE TDR, no covenant lite, no high risk lending

• Personal guarantees, cross collateral and cross guarantees

• Proactive Portfolio Management

13

www.ppbi.com

At March 31, 2011

(in millions)

14

www.ppbi.com

|

|

Average

Loan Size

|

Average

Rate |

Seasoning

(months) |

LTV

|

DCR

|

|

Real estate loans:

|

|

|

|

|

|

|

Multi-family

|

$ 1,002,000

|

6.17%

|

54

|

70%

|

1.20

|

|

Non O/O CRE

|

$ 998,000

|

6.73%

|

51

|

61%

|

1.33

|

|

Res. 1-4 1st

|

$ 178,000

|

5.45%

|

42

|

68%

|

----

|

|

Business loans:

|

|

|

|

|

|

|

O/O CRE

|

$ 631,000

|

6.52%

|

64

|

53%

|

----

|

|

C & I

|

$ 237,000

|

6.40%

|

37

|

----

|

----

|

|

SBA

|

$ 113,000

|

5.82%

|

29

|

----

|

----

|

At March 31, 2011

15

www.ppbi.com

|

|

3/31/11

|

12/31/10

|

12/31/09

|

12/31/08

|

|

Balance

|

$235.4

|

$243.6

|

$278.7

|

$287.6

|

|

Avg. balance

|

$1.002

|

$1.041

|

$1.053

|

$1.053

|

|

Rate

|

6.17%

|

6.21%

|

6.20%

|

6.30%

|

|

LTV

|

70%

|

69%

|

67%

|

65%

|

|

DCR

|

1.20

|

1.20

|

1.20

|

1.47

|

(dollars in millions)

16

www.ppbi.com

Non-owner occupied CRE

|

|

3/31/11

|

12/31/10

|

12/31/09

|

12/31/08

|

|

Balance

|

$156.6

|

$130.5

|

$149.6

|

$163.4

|

|

Avg. balance

|

$.998

|

$1.165

|

$1.216

|

$1.202

|

|

Rate

|

6.73%

|

6.66%

|

6.85%

|

7.04%

|

|

LTV

|

61%

|

59%

|

59%

|

57%

|

|

DCR

|

1.33

|

1.30

|

1.42

|

1.54

|

(dollars in millions)

17

www.ppbi.com

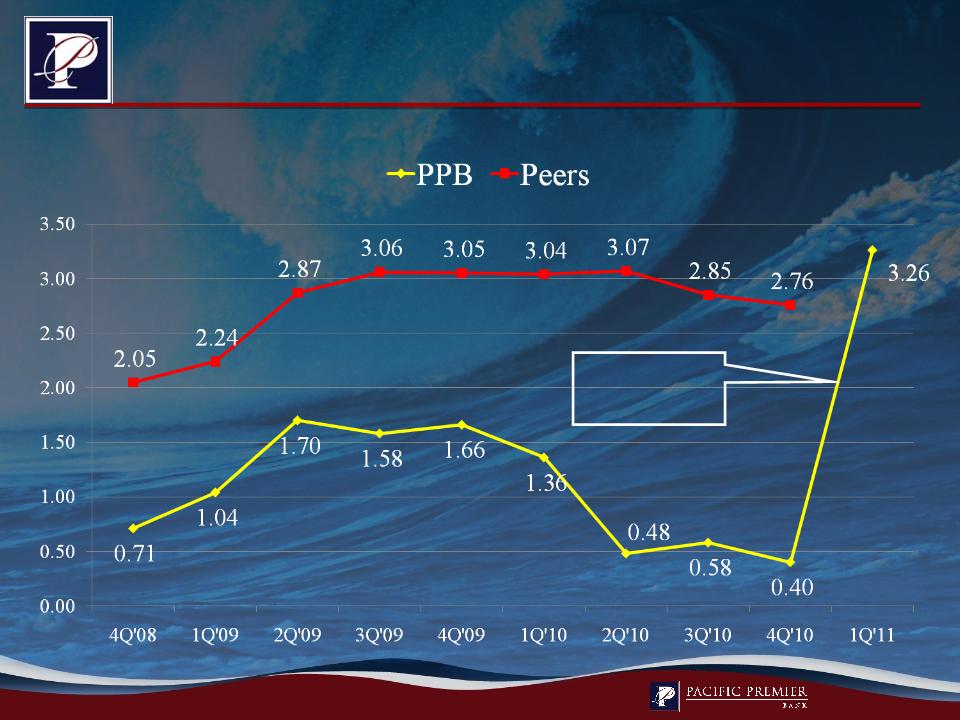

Strong Loan Performance

Delinquency to Total Loans

California peer group consists of all insured California institutions in the FFIEC database

CNB Acquisition

2/11/11

18

www.ppbi.com

Proactive Asset Management

California peer group consists of all insured California institutions in the FFIEC database

Nonperforming Assets to Total Assets

CNB Acquisition

2/11/11

19

www.ppbi.com

• Bank gaining market share from competitors

• So. CA still one of the best banking markets

• Target rich environment for acquisitions

• Proven management team and track record

20

www.ppbi.com

Questions?

Questions?

21