Attached files

| file | filename |

|---|---|

| 8-K - AMERICAN CAMPUS COMMUNITIES, INC. 8-K - AMERICAN CAMPUS COMMUNITIES INC | a6749963.htm |

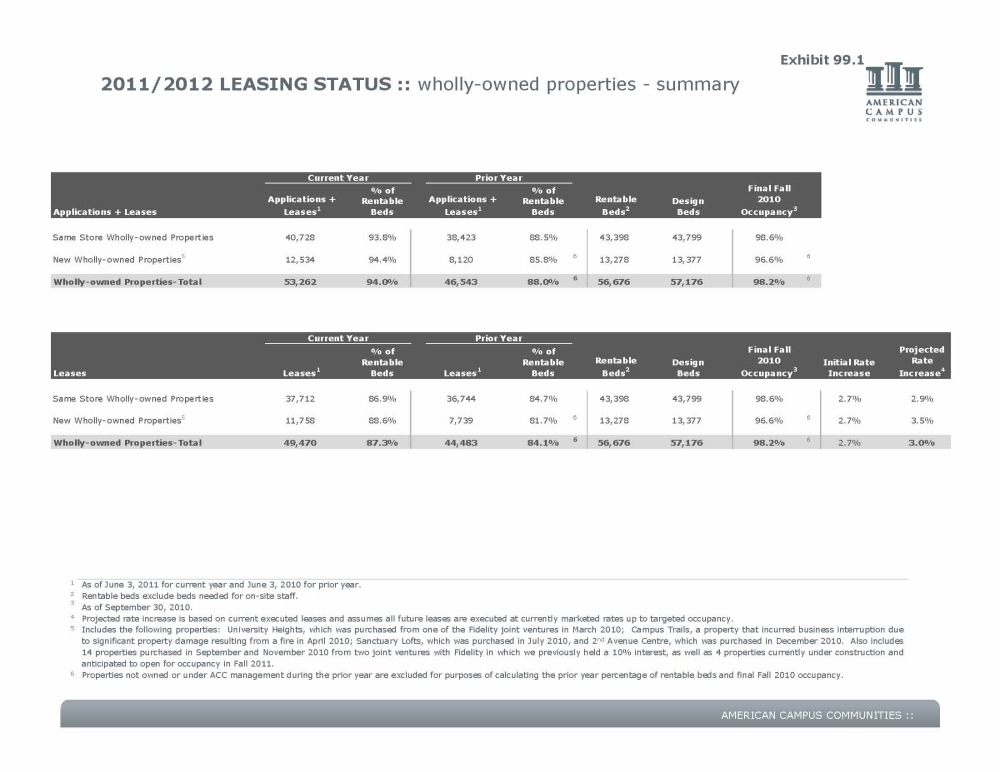

2011/2012 LEASING STATUS :: wholly-owned properties – summary Applications + Leases Applications + Leases 1% of Rentable Beds Applications + Leases1% of Rentable BedsRentableBeds2Design Beds Final Fall 2010 Occupancy 3 Same Store Wholly-owned Properties 40,728 93.8% 38,423 88.5% 43,398 43,799 98.6% New Wholly-owned Properties512,53494.4%8,12085.8%613,27813,37796.6%6Wholly-owned Properties-Total 53,262 94.0% 46,543 88.0% 656,676 57,176 98.2% 6 Leases Leases 1% of Rentable Beds Leases 1% of Rentable Beds Rentable Beds 2 Design Beds Final Fall 2010 Occupancy 3 Initial Increase Projected Store Wholly-owned Properties 37,712 86.9% 36,744 84.7% 43,398 43,799 98.6% New Wholly-owned Properties 511,758 88.6% 7,739 81.7% 613,278 13,377 96.6% 62.7%Wholly-owned Properties Total 49,470 87.3% 44,483 84.1% 656,676 57,176 98.2% 62.7% Current Year Prior Year 1 As of June3,2011 for current year and June 3,2010 for prior year. 2 Rentable beds exclude beds needed for on-site staff. 3 As of September 30,2010. 4 Projected rate increase is based on current executed leases and assumes all future leases are executed at currently marketed rates up to targeted occupancy. 5 Includes the following properties: University Heights, which was purchased from one of the Fidelity joint ventures in March2010; Campus Trails, a property that incurred business interruption due to significant property damage resulting from a fire in April 2010; Sanctuary Lofts, which was purchased in July2010,and 2nd Avenue Centre, which was purchased in December2010.Also includes 14 properties purchased in September and November 2010 from two joint ventures with Fidelity in which we previously held a 10% interest, a swell as 4 properties currently underconstruction and anticipated to open for occupancy in Fall 2011. 6 Properties not owned or under ACC management during the prior year are excluded for purposes of calculating the prior year percentage of rentable beds and final Fall 2010 occupancy. Exhibit 99.1