Attached files

| file | filename |

|---|---|

| 8-K - PDL BIOPHARMA 8-K 5-24-2011 - PDL BIOPHARMA, INC. | form8k.htm |

| EX-99.2 - EXHIBIT 99.2 - PDL BIOPHARMA, INC. | ex99_2.htm |

Exhibit 99.1

1

Non-Deal Roadshow

May 24-25, 2011

Forward Looking Statements

This presentation contains forward-looking statements, including PDL’s expectations with respect to its future royalty

revenues, expenses, net income, and cash provided by operating activities.

revenues, expenses, net income, and cash provided by operating activities.

Each of these forward-looking statements involves risks and uncertainties. Actual results may differ materially from those,

express or implied, in these forward-looking statements. Factors that may cause differences between current expectations

and actual results include, but are not limited to, the following:

express or implied, in these forward-looking statements. Factors that may cause differences between current expectations

and actual results include, but are not limited to, the following:

▪The expected rate of growth in royalty-bearing product sales by PDL’s existing licensees;

•The relative mix of royalty-bearing Genentech products manufactured and sold outside the U.S. versus manufactured or

sold in the U.S.;

sold in the U.S.;

•The ability of PDL’s licensees to receive regulatory approvals to market and launch new royalty-bearing products and

whether such products, if launched, will be commercially successful;

whether such products, if launched, will be commercially successful;

•Changes in any of the other assumptions on which PDL’s projected royalty revenues are based;

•Changes in foreign currency rates;

•Positive or negative results in PDL’s attempt to acquire royalty-related assets;

•The outcome of pending litigation or disputes, including PDL’s current dispute with Genentech related to ex-U.S. sales of

Genentech licensed products; and

Genentech licensed products; and

•The failure of licensees to comply with existing license agreements, including any failure to pay royalties due.

Other factors that may cause PDL’s actual results to differ materially from those expressed or implied in the forward-

looking statements in this presentation are discussed in PDL’s filings with the SEC, including the "Risk Factors" sections of

its annual and quarterly reports filed with the SEC. Copies of PDL’s filings with the SEC may be obtained at the "Investors"

section of PDL’s website at www.pdl.com. PDL expressly disclaims any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements contained herein to reflect any change in PDL’s expectations with

regard thereto or any change in events, conditions or circumstances on which any such statements are based for any

reason, except as required by law, even as new information becomes available or other events occur in the future. All

forward-looking statements in this presentation are qualified in their entirety by this cautionary statement.

looking statements in this presentation are discussed in PDL’s filings with the SEC, including the "Risk Factors" sections of

its annual and quarterly reports filed with the SEC. Copies of PDL’s filings with the SEC may be obtained at the "Investors"

section of PDL’s website at www.pdl.com. PDL expressly disclaims any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements contained herein to reflect any change in PDL’s expectations with

regard thereto or any change in events, conditions or circumstances on which any such statements are based for any

reason, except as required by law, even as new information becomes available or other events occur in the future. All

forward-looking statements in this presentation are qualified in their entirety by this cautionary statement.

2

|

Company:

|

PDL BioPharma, Inc.

|

|

Ticker:

|

PDLI (NASDAQ)

|

|

Location:

|

Incline Village, Nevada

|

|

Employees:

|

Less than 10

|

|

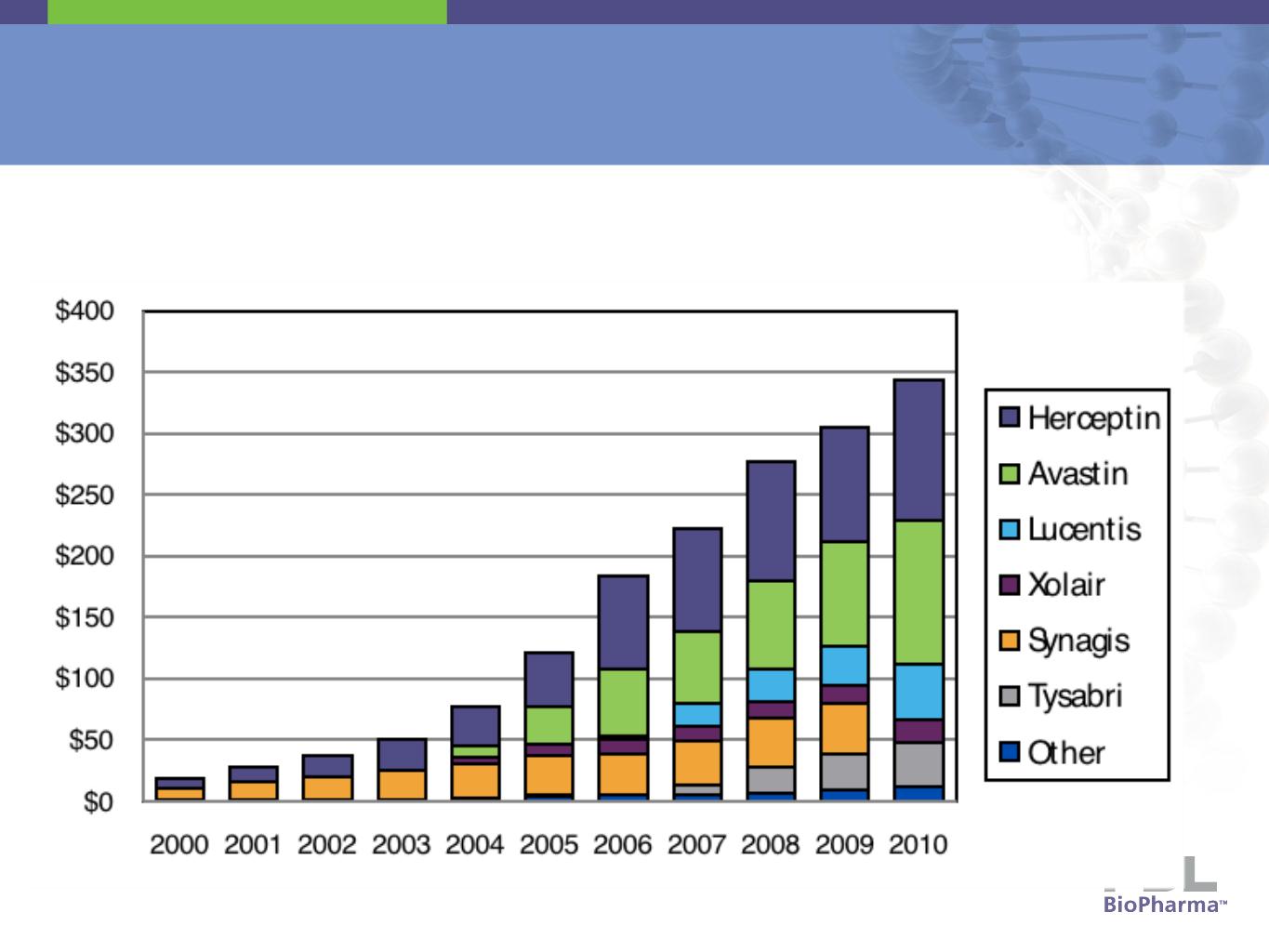

2010 Revenues:

|

$345 million

|

|

2011- Q1 Revenue:

|

$83 million

|

|

2011 Regular Dividends:

|

$0.15 /share paid on March 15, June 15,

September 15 & December 15 |

|

Q1-2011 Cash Position1:

|

$193 million

|

|

Shares O/S2:

|

~ 140 million

|

|

Average Daily Volume:

|

~ 3 million shares

|

Key Information

3

1. As of March 31, 2011; 2. Not fully diluted

Overview of PDL BioPharma

4

Company Overview

•PDL pioneered the humanization of monoclonal antibodies

which enabled the discovery of a new generation of targeted

treatments for cancer and immunologic diseases

which enabled the discovery of a new generation of targeted

treatments for cancer and immunologic diseases

•PDL’s primary assets are its antibody humanization patents

and royalty assets which consist of its Queen et al. patents

and license agreements

and royalty assets which consist of its Queen et al. patents

and license agreements

•Licensees consist of large biotechnology and pharmaceutical

companies including Roche/Genentech/ Novartis,

Elan/BiogenIdec, Pfizer/Wyeth/J&J and Chugai

companies including Roche/Genentech/ Novartis,

Elan/BiogenIdec, Pfizer/Wyeth/J&J and Chugai

5

Antibody Humanization Technology

• Antibodies are naturally produced by humans to fight

foreign substances, such as bacteria and viruses

foreign substances, such as bacteria and viruses

• In the 1980’s, scientists began creating antibodies in

non-human immune systems, such as those of mice,

that could target specific sites on cells to fight various

human diseases

non-human immune systems, such as those of mice,

that could target specific sites on cells to fight various

human diseases

• However, mouse derived antibodies are recognized by

the human body as foreign substances and may be

rejected by the human immune system

the human body as foreign substances and may be

rejected by the human immune system

6

• PDL’s technology allows for the “humanization” of mouse derived antibodies by moving the

important binding regions from the mouse antibody onto a human framework

important binding regions from the mouse antibody onto a human framework

• PDL’s humanization technology is important because the humanized antibodies retain the binding

and activity levels from the original mouse antibody

and activity levels from the original mouse antibody

• PDL’s technology has been incorporated into antibodies to treat cancer, eye diseases, arthritis,

multiple sclerosis and other health conditions with aggregate annual sales of over $17 billion

multiple sclerosis and other health conditions with aggregate annual sales of over $17 billion

Mission Statement

• Queen et al. Patents

▪ Manage patent portfolio

▪ Manage license agreements

• Purchase new royalty generating assets

▪ Assets that improve shareholder return

▪ Commercial stage assets

▪ Prefer biologics with strong patent protection

• Optimize return for shareholders

7

Corporate Governance

Management

• John McLaughlin

President & CEO

President & CEO

• Christine Larson

VP & CFO

VP & CFO

• Christopher Stone

VP, General Counsel &

Secretary

VP, General Counsel &

Secretary

• Caroline Krumel

VP of Finance

VP of Finance

• Danny Hart

Associate General Counsel

Associate General Counsel

Board of Directors

• Fred Frank

Lead Director

Lead Director

• Jody Lindell

• John McLaughlin

• Paul Sandman

• Harold Selick

8

Licensed Products and Royalty Revenue

9

Licensed Products and Royalty Revenue

10

1. As reported to PDL by its licensee 2. As reported by Roche; assume 1.155 CHF/USD

How Long will PDL Receive Royalties from

Queen et al. Patents?

Queen et al. Patents?

• PDL’s revenues consist of royalties generated on sales of licensed products

▪Sold before the expiration of the Queen et al. patents in mid-2013 through end of 2014

or

▪Made prior to the expiration of the Queen et al. patents and sold anytime thereafter

11

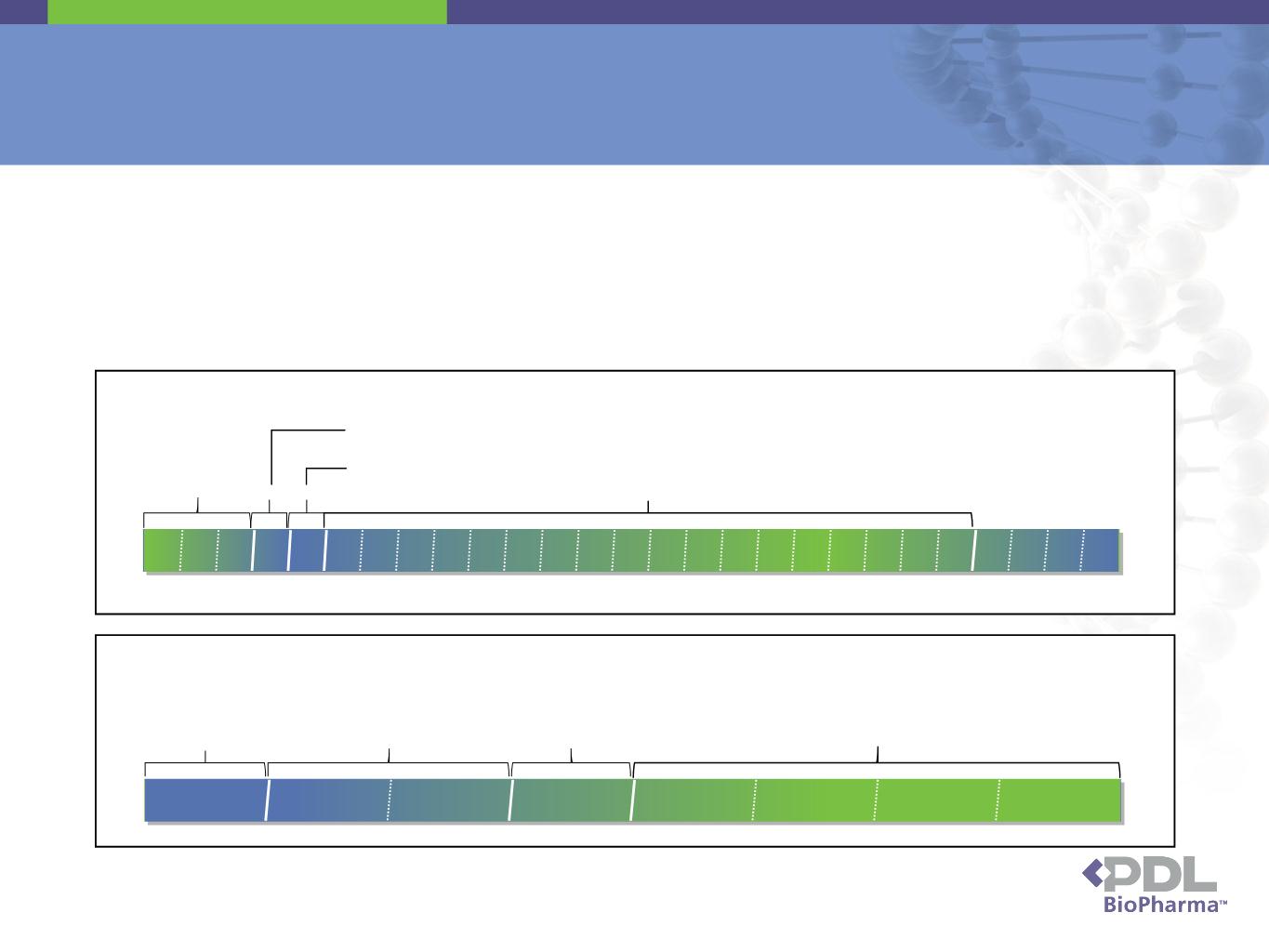

Example of Antibody Formulation, Fill and Finish Schedule

½ month

1 month

½ month

2-3 months

Thaw, Formulation &

Vial Filling

Vial Filling

Quality

Release

Release

Packaging

& Quality

& Quality

Inventory

Example of Antibody Bulk Manufacturing Schedule

Cell

Culture

Quality Release

Testing

Testing

Bulk Frozen Storage

1 mo

3 mos

5 mos

10 mos

15 mos

20 mos

27 mos

3 mos

2-18 months

1mo

1mo

Purification to Concentrated Bulk/Frozen

|

Genentech Product Made or Sold in U.S.

|

|

|

Net Sales up to $1.5 Billion

|

3.0%

|

|

Net Sales Between $1.5 Billion and $2.5 Billion

|

2.5%

|

|

Net Sales Between $2.5 Billion and $4.0 Billion

|

2.0%

|

|

Net Sales Over $4.0 Billion

|

1.0%

|

|

Genentech Product Made and Sold Ex-U.S.

|

|

|

All Sales

|

3.0%

|

Queen et al Patents - Royalty Rates

12

• Tysabri and Actemra

• Flat, low single-digit royalty

• Genentech Products (Avastin, Herceptin, Lucentis1 and Xolair)

• Tiered royalties on product made or sold in US

• Flat, 3% royalty on product made and sold outside US

• Blended global royalty rate on Genentech Products in 2010 was 1.9%

• Blended royalty rate on Genentech Products in 2010 made or sold in US was 1.5%

1. As part of a settlement with Novartis, which commercializes Lucentis outside US, PDL agreed to pay to Novartis certain amounts

based on net sales of Lucentis made by Novartis during calendar year 2011 and beyond. The amounts to be paid are less than we

receive in royalties on such sales and we do not currently expect such amount to materially impact our total annual revenues.

based on net sales of Lucentis made by Novartis during calendar year 2011 and beyond. The amounts to be paid are less than we

receive in royalties on such sales and we do not currently expect such amount to materially impact our total annual revenues.

Shift of Manufacturing Sites = Higher Royalties

• Roche is moving some manufacturing ex-US which may result in higher royalties to PDL

due to the flat 3% royalty for Genentech Products made and sold ex-US

due to the flat 3% royalty for Genentech Products made and sold ex-US

▪ Current production at Penzburg (Herceptin) and Basel (Avastin) plants

▪ Two new plants in Singapore (CHO = antibody and e. coli = antibody fragment)

- E. coli (Lucentis) and CHO (Avastin) plants are approved for commercial supply to the US

- E. coli and CHO plants are expected to be approved for commercial supply to the EU in 2011

- Currently, all Lucentis is made in the US

13

Percent of Total Worldwide Sales1

1. As reported to PDL by its licensee

Royalty Revenue & Licensed Products

14

Royalties by Product

($ in millions)

Royalty Products - Approved

15

Royalty Products - Avastin

16

|

Licensee

|

Product

|

Status

|

Indications

|

|

Roche (Genentech)

|

Avastin

|

Approved

sBLA

Phase 3

|

Colorectal Cancer

NSCLC

Metastatic Renal Cell

Glioblastoma

Metastatic Breast HER2- 1st Line

Metastatic Breast HER2- 2nd Line

Ovarian Cancer

Gastric

|

|

|

|||

|

|

|||

|

|

|||

|

Elan

|

|||

•On December 16, 2010, FDA notified Roche/Genentech of its intention to withdraw Avastin’s

approval as first line treatment for HER2- breast cancer in combination with paclitaxel.

approval as first line treatment for HER2- breast cancer in combination with paclitaxel.

•In response to request from Genentech, FDA scheduled a hearing on June 28-29, 2011 to

allow Genentech to present why Avastin should remain FDA-approved for HER2- breast cancer.

allow Genentech to present why Avastin should remain FDA-approved for HER2- breast cancer.

•On December 16, 2010, EMEA narrowed, but did not withdraw Avastin’s approval for first line

treatment of HER2- breast cancer in combination with paclitaxel.

treatment of HER2- breast cancer in combination with paclitaxel.

•Roche lowered its estimate of peak annual sales from of Avastin from CHF8 - CHF9 billion to

CHF7 billion.

CHF7 billion.

•On April 15, 2011, Roche announced that CHMP issued a positive opinion for the use of

Avastin in combination with Xeloda for 1st-line HER 2- breast cancer.

Avastin in combination with Xeloda for 1st-line HER 2- breast cancer.

•Based on our internal model, we project Avastin for treatment of metastatic HER2- breast

cancer represents slightly more than 2% of total PDL royalty revenue.

cancer represents slightly more than 2% of total PDL royalty revenue.

Royalty Products - Avastin

17

|

Licensee

|

Product

|

Status

|

Indications

|

|

Roche (Genentech)

|

Avastin

|

Approved

sBLA

Phase 3

|

Colorectal Cancer

NSCLC

Metastatic Renal Cell

Glioblastoma

Metastatic Breast HER2- 1st Line

Metastatic Breast HER2- 2nd Line

Ovarian Cancer

Gastric

|

|

|

|||

|

|

|||

|

|

|||

|

Elan

|

|||

•On February 7, 2011, Genentech reported that Phase 3 trial in women with previously treated

(recurrent), platinum-sensitive ovarian cancer showed an improvement in progression free

survival in those patients treated with Avastin in combination with chemotherapy (carboplatin

and gemcitabine) followed by continued use of Avastin alone compared to those treated with

chemotherapy alone.

(recurrent), platinum-sensitive ovarian cancer showed an improvement in progression free

survival in those patients treated with Avastin in combination with chemotherapy (carboplatin

and gemcitabine) followed by continued use of Avastin alone compared to those treated with

chemotherapy alone.

•Two previous Phase 3 studies in women with newly diagnosed ovarian cancer demonstrated

that front-line Avastin in combination with standard chemotherapy (carboplatin and paclitaxel),

followed by the continued use of Avastin alone, significantly increased progression free survival

compared to treatment with chemotherapy alone.

that front-line Avastin in combination with standard chemotherapy (carboplatin and paclitaxel),

followed by the continued use of Avastin alone, significantly increased progression free survival

compared to treatment with chemotherapy alone.

•Roche has submitted an application for approval for first line treatment in EU and expects a

decision later in 2011.

decision later in 2011.

•Genentech expects to file an application for approval in US in 2011.

18

|

Phase 2 ISP

|

Retinopathy of Prematurity

|

||

|

|

Herceptin

|

Approved

|

Breast HER2+ Cancer

HER2+ Stomach and Gastro-Esophageal cancers

|

|

|

Lucentis

|

Approved

Approved

Phase 3

|

AMD

RVO

DME

|

|

|

Xolair

|

Approved

sBLA

|

Moderate-Severe Asthma

Pediatric Asthma

|

|

Elan

|

Tysabri

|

Approved

|

Multiple Sclerosis

|

|

Roche (Chugai)

|

Actemra

|

Approved

|

Rheumatoid Arthritis

|

•On February 16, Research to Prevent Blindness Foundation and the U.S. National Eye Institute

announced results from a trial showing that just 4% of the infants who developed retinopathy of

prematurity and were treated with Avastin suffered a recurrence of the disease compared to

22% of those babies with the disease who received laser treatment.

announced results from a trial showing that just 4% of the infants who developed retinopathy of

prematurity and were treated with Avastin suffered a recurrence of the disease compared to

22% of those babies with the disease who received laser treatment.

•Retinopathy of prematurity is a disease that harms the retina and is the most common cause of

blindness in infants.

blindness in infants.

•Because the trial was not sponsored by Genentech/Roche, it is not clear whether they will seek

approval for this indication.

approval for this indication.

•The publication of this data in the February 17 issue of the New England Journal of Medicine

should result in significant off-label use in this disease.

should result in significant off-label use in this disease.

Royalty Products - Lucentis

|

|

|||

|

|

Lucentis

|

Approved

Approved

Phase 3 (US)

|

AMD

RVO

DME

|

|

|

Xolair

|

Approved

sBLA

|

Moderate-Severe Asthma

Pediatric Asthma

|

|

Elan

|

Tysabri

|

Approved

|

Multiple Sclerosis

|

|

Roche (Chugai)

|

Actemra

|

Approved

|

Rheumatoid Arthritis

|

•On January 7, Novartis announced that Lucentis has been approved in the EU for the treatment

of visual impairment due to diabetic macular edema (DME).

of visual impairment due to diabetic macular edema (DME).

•DME is a leading cause of blindness in the working-age population in most developed

countries.

countries.

•On February 11, 2011, Genentech announced that one of two Phase 3 studies evaluating in

patients with DME showed that a significantly higher percentage of patients receiving monthly

dosing of Lucentis achieved an improvement in vision of at least 15 letters on the eye chart at

24 months compared to those in a control group, who received a placebo injection.

patients with DME showed that a significantly higher percentage of patients receiving monthly

dosing of Lucentis achieved an improvement in vision of at least 15 letters on the eye chart at

24 months compared to those in a control group, who received a placebo injection.

19

|

|

|||

|

|

Lucentis

|

Approved

Approved

Phase 3

|

AMD

RVO

DME

|

|

|

Xolair

|

Approved

sBLA

|

Moderate-Severe Asthma

Pediatric Asthma

|

|

Elan

|

Tysabri

|

Approved

|

Multiple Sclerosis

|

|

Roche (Chugai)

|

Actemra

|

Approved

|

Rheumatoid Arthritis

|

•On November 22, 2010, Regeneron and its partner, Bayer, reported top line data from two

Phase 3 trials investigating its VEGF Trap in age-related macular degeneration (AMD) patients

which suggest that it may be injected into the eye every other month with safety and efficacy

comparable to that of monthly dosing of Lucentis.

Phase 3 trials investigating its VEGF Trap in age-related macular degeneration (AMD) patients

which suggest that it may be injected into the eye every other month with safety and efficacy

comparable to that of monthly dosing of Lucentis.

•On December 20, 2010, Regeneron has also reported positive Phase 3 data in the treatment of

retinal vein occlusion (RVO) for which Lucentis is approved.

retinal vein occlusion (RVO) for which Lucentis is approved.

•Unlike the AMD trial, monthly administration was used in the RVO trial, which does not

afford a dosing advantage with respect to Lucentis.

afford a dosing advantage with respect to Lucentis.

•On February 22, 2011, Regeneron and its partner, Bayer, filed an application for approval of its

VEGF Trap for treatment of AMD with a PDUFA date of August 20, 2011 based on priority

review.

VEGF Trap for treatment of AMD with a PDUFA date of August 20, 2011 based on priority

review.

•Regeneron filed suit in February 2011 seeking a summary judgment that it does not infringe

Genentech’s patents.

Genentech’s patents.

•Genentech filed a countersuit in April 2011 asserting that Regeneron is willfully infringing

Genentech’s patents, seeking treble damages and asking for injunctive relief.

Genentech’s patents, seeking treble damages and asking for injunctive relief.

20

Royalty Products - Lucentis

|

Licensee

|

Product

|

Status

|

Indications

|

|

|

HER2+ Stomach and Gastro-Esophageal cancers

|

||

|

|

Lucentis

|

Approved

Approved

Phase 3

|

AMD

RVO

DME

|

|

|

Xolair

|

Approved

sBLA

|

Moderate-Severe Asthma

Pediatric Asthma

|

|

Elan

|

Tysabri

|

Approved

|

Multiple Sclerosis

|

|

Roche (Chugai)

|

Actemra

|

Approved

|

Rheumatoid Arthritis

|

•On April 4, 2011, Genentech and Johns Hopkins University reported results of a review of files

of 77,886 patients with AMD who received either Avastin off-label or Lucentis.

of 77,886 patients with AMD who received either Avastin off-label or Lucentis.

•Patients receiving Avastin off-label had an 11% increased risk of overall mortality, 57%

increased risk of hemorrhagic cerebrovascular accident, 80% more likely to have ocular

inflammation and 11% more likely to have cataract surgery following treatment than Lucentis

treated patients.

increased risk of hemorrhagic cerebrovascular accident, 80% more likely to have ocular

inflammation and 11% more likely to have cataract surgery following treatment than Lucentis

treated patients.

•Authors of the study note that it is limited due to incomplete information on confounding factors

such as smoking, lipid and blood pressure levels, etc.

such as smoking, lipid and blood pressure levels, etc.

21

Royalty Products - Lucentis

|

|

|||

|

|

Lucentis

|

Approved

Approved

Phase 3

|

AMD

RVO

DME

|

|

|

Xolair

|

Approved

sBLA

|

Moderate-Severe Asthma

Pediatric Asthma

|

|

Elan

|

Tysabri

|

Approved

|

Multiple Sclerosis

|

|

Roche (Chugai)

|

Actemra

|

Approved

|

Rheumatoid Arthritis

|

•On April 28, 2011, New England Journal of Medicine reported the results from the NEI’s CATT

study comparing Lucentis and Avastin on fixed and variable schedules in the treatment of AMD.

study comparing Lucentis and Avastin on fixed and variable schedules in the treatment of AMD.

•Efficacy results from the first year of the two year study showed that, with respect to the primary

endpoint of mean change in visual acuity (number of lines of letters on an eye chart) at 12

months, less expensive Avastin was not inferior to Lucentis.

endpoint of mean change in visual acuity (number of lines of letters on an eye chart) at 12

months, less expensive Avastin was not inferior to Lucentis.

•It is estimated that off label use of Avastin in the U.S. was 60% prior to the results of the

CATT trial.

CATT trial.

•At 12 months, serious adverse events (primarily hospitalizations) occurred at a 24 percent rate

for patients receiving Avastin and a 19 percent rate for patients receiving Lucentis. However,

preliminary 24 month safety data showed no difference between Lucentis and Avastin treated

patients in terms of death, stroke and all arteriothrombotic events.

for patients receiving Avastin and a 19 percent rate for patients receiving Lucentis. However,

preliminary 24 month safety data showed no difference between Lucentis and Avastin treated

patients in terms of death, stroke and all arteriothrombotic events.

22

Royalty Products - Tysabri

23

|

Licensee

|

Product

|

Status

|

Indications

|

|

|

|||

|

|

|||

|

|

Xolair

|

Approved

sBLA

|

Moderate-Severe Asthma

Pediatric Asthma

|

|

Elan

|

Tysabri

|

Approved

|

Multiple Sclerosis

|

|

Roche (Chugai)

|

Actemra

|

Approved

|

Rheumatoid Arthritis

|

•Biogen Idec and Elan made regulatory filings with FDA and EMA to update the label of Tysabri

to reflect that anti-JC virus antibody status could be used to stratify the risk of progressive

multifocal leukoencephalopathy (PML).

to reflect that anti-JC virus antibody status could be used to stratify the risk of progressive

multifocal leukoencephalopathy (PML).

•On April 18, 2011, CHMP recommended inclusion of JC virus (JCV) status as a risk factor

the product label for Tysabri in the EU.

the product label for Tysabri in the EU.

•The CHMP also recommended a five-year renewal of the Tysabri’s Marketing Authorization

in the EU.

in the EU.

•On April 22, 2011, FDA disclosed the estimated risk of PML infection in Tysabri treated patients

is 0.3 per 1,000 patients during the first two years of treatment, 1.5 per 1,000 patients during

months 25 to 36, and 0.9 per 1,000 after three years. Limited data is available beyond four

years.

is 0.3 per 1,000 patients during the first two years of treatment, 1.5 per 1,000 patients during

months 25 to 36, and 0.9 per 1,000 after three years. Limited data is available beyond four

years.

|

Licensee

|

Product

|

Status

|

Indications

|

|

Roche (Genentech)

|

Avastin

|

Approved

|

Colorectal Cancer

NSCLC

|

|

|

|||

|

|

Phase 3

|

DME

|

|

|

|

Xolair

|

Approved

sBLA

|

Moderate-Severe Asthma

Pediatric Asthma

|

|

Elan

|

Tysabri

|

Approved

|

Multiple Sclerosis

|

|

Roche (Chugai)

|

Actemra

|

Approved

|

Rheumatoid Arthritis

|

Royalty Products - Actemra

24

•On January 5, 2011, Roche announced that FDA expanded the Actemra label to include

inhibition and slowing of structural joint damage, improvement of physical function, and

achievement of major clinical response in adult patients with moderately to severely active

rheumatoid arthritis.

inhibition and slowing of structural joint damage, improvement of physical function, and

achievement of major clinical response in adult patients with moderately to severely active

rheumatoid arthritis.

•On April 18, 2011, FDA approved Actemra to treat patients age 2 and older with active

systemic juvenile idiopathic arthritis (SJIA).

systemic juvenile idiopathic arthritis (SJIA).

•It is the first and only approved treatment for SJIA, a rare and severe form of arthritis

affecting children.

affecting children.

Potential Royalty Products

- Development Stage

- Development Stage

25

|

Licensee

|

Product

|

Status

|

Indications

|

|

Roche (Genentech)

|

T-DM1

|

Phase 2 & 3

|

Breast HER2+ Cancer

|

|

|

Ocrelizumab

|

Phase 2b

|

Relapsing Remitting Multiple Sclerosis

|

|

|

Pertuzumab

|

Phase 3

|

Metastatic HER2+ Breast Cancer

|

|

Roche

|

Afutuzumab

|

Phase 3

|

Chronic Lymphocytic Leukemia

|

|

Elan/J&J/Pfizer

|

Bapineuzumab

|

Phase 3

|

Alzheimer’s Disease

|

|

Lilly

|

|||

|

Eisai

|

Potential Royalty Products - T-DM1

•On October 13, 2010, Roche/Genentech announced preliminary, six month results from a

Phase 3 trial in second line HER2+ breast cancer patients which showed that 48% of women

treated with T-DM1 had their tumors shrink compared with 41% of those taking the combination

of Herceptin and Taxotere.

Phase 3 trial in second line HER2+ breast cancer patients which showed that 48% of women

treated with T-DM1 had their tumors shrink compared with 41% of those taking the combination

of Herceptin and Taxotere.

•Among the women taking the standard therapy, 75% had side effects of grade 3 or higher

on a 5-point scale, compared with 37% of those getting T-DM1.

on a 5-point scale, compared with 37% of those getting T-DM1.

Potential Royalty Products - Pertuzumab

|

Licensee

|

Product

|

Status

|

Indications

|

|

Roche (Genentech)

|

T-DM1

|

Phase 2 & 3

|

Breast HER2+ Cancer

|

|

|

Ocrelizumab

|

Phase 2b

|

Relapsing Remitting Multiple Sclerosis

|

|

|

Pertuzumab

|

Phase 3

|

Metastatic HER2+ Breast Cancer

|

|

Roche

|

Afutuzumab

|

Phase 3

|

Chronic Lymphocytic Leukemia

|

|

Elan/J&J/Pfizer

|

Bapineuzumab

|

Phase 3

|

Alzheimer’s Disease

|

|

Lilly

|

Solanezumab

|

Phase 3

|

Alzheimer’s Disease

|

•On December 10, 2010, Roche/Genentech reported the results from a Phase 2 trial

investigating the neoadjuvant (prior to surgery) use of pertuzumab and Herceptin plus

chemotherapy for the treatment of early-stage, HER2+ breast cancer.

investigating the neoadjuvant (prior to surgery) use of pertuzumab and Herceptin plus

chemotherapy for the treatment of early-stage, HER2+ breast cancer.

•Treatment significantly improved the rate of complete tumor disappearance in the breast by

more than half compared to Herceptin plus docetaxel, p=0.014.

more than half compared to Herceptin plus docetaxel, p=0.014.

•Roche expects a global regulatory filing of pertuzumab at the end of 2011.

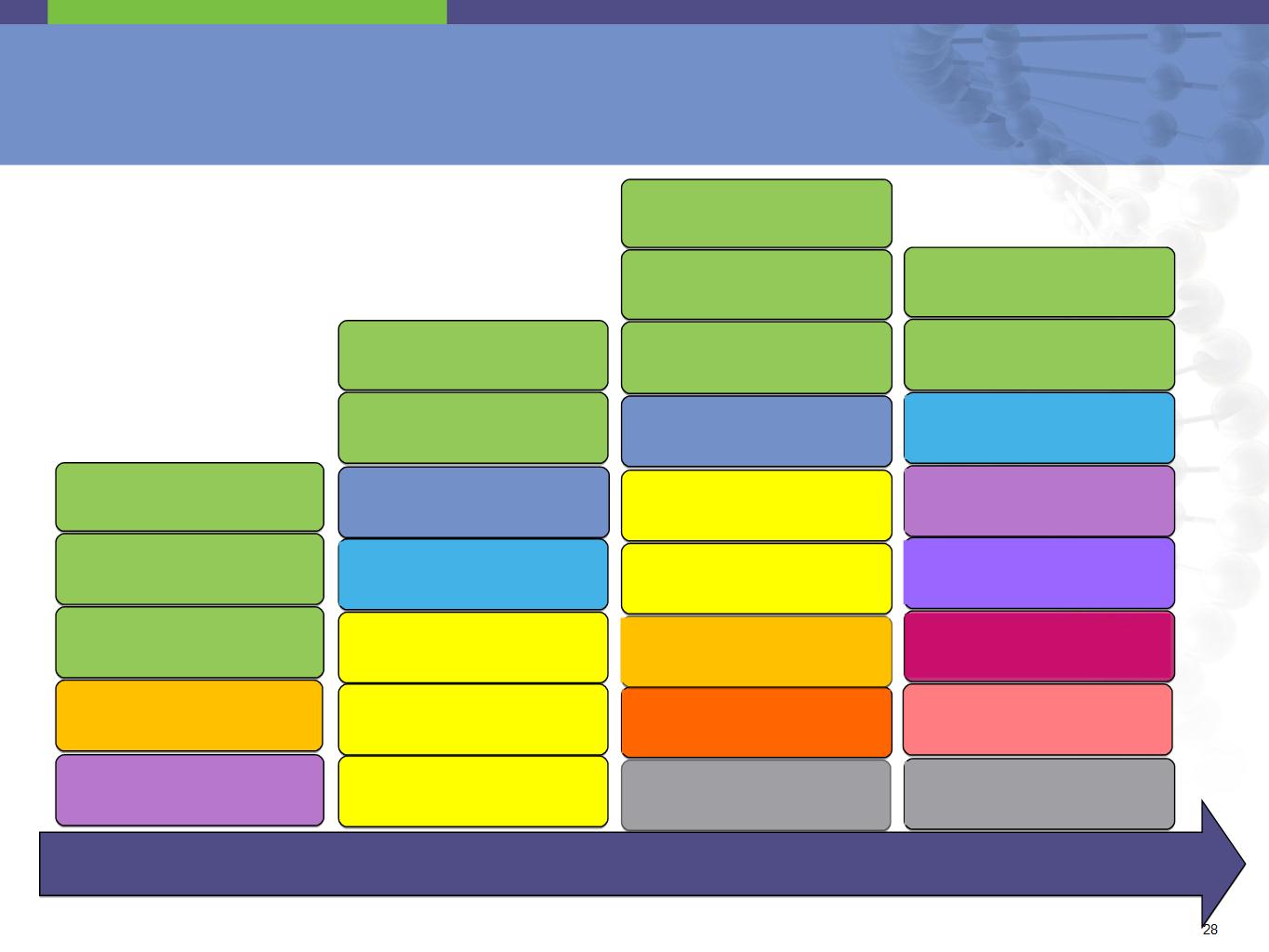

Genentech / Roche - Product Pipeline

2011

2012

2013

Post 2013

Avastin

Ovarian Cancer 1st Line US

Lucentis

Diabetic Macular Edema (US)

Pertuzumab1

mBC HER2+ 1st Line

Avastin + Herceptin

mBC HER+ 2nd Line

Avastin

Relapsed Ovarian Cancer

T-DM1

HER 2+ Advanced mBC

Actemra

RA DMARD H2H (EU)

Actemra

Ankylosing Spondylitis

Herceptin

Subcutaneous Formulation

Avastin & Herceptin

HER2+ mBC 1st Line

Avastin

mCRC TML

Actemra

SC Formulation (EU)

Afutuzumab (GA101)

Chronic Lymphocytic Leukemia

Actemra

Early Rheumatoid Arthritis

Avastin

BC Adjuvant HER2+

Avastin

BC Adj Triple Negative

Herceptin

BC HER 2+ Adj 2 Year

Xolair

Chronic Idiopathic Urticaria

Avastin

Glioblastoma 1st Line

Actemra

SC Formulation (US)

Lucentis

AMD High Dose (US)

Avastin

HER 2- BC adj

Avastin

NSCLC adj

Afutuzumab (GA101)

Non-Hodgkin’s Lymphoma

T-DM1

HER 2+ mBC 1st Line

Pertuzumab1

HER 2+ EBC

Ocrelizumab1

PPMS & RRMS

Lebrikizumab1

Asthma

Rontalizumab1

Systemic Lupus Erythematosus

1. Not a licensed product; source Roche investor update, April 14, 2011

US & EU Filings Calendar

Financial Update

29

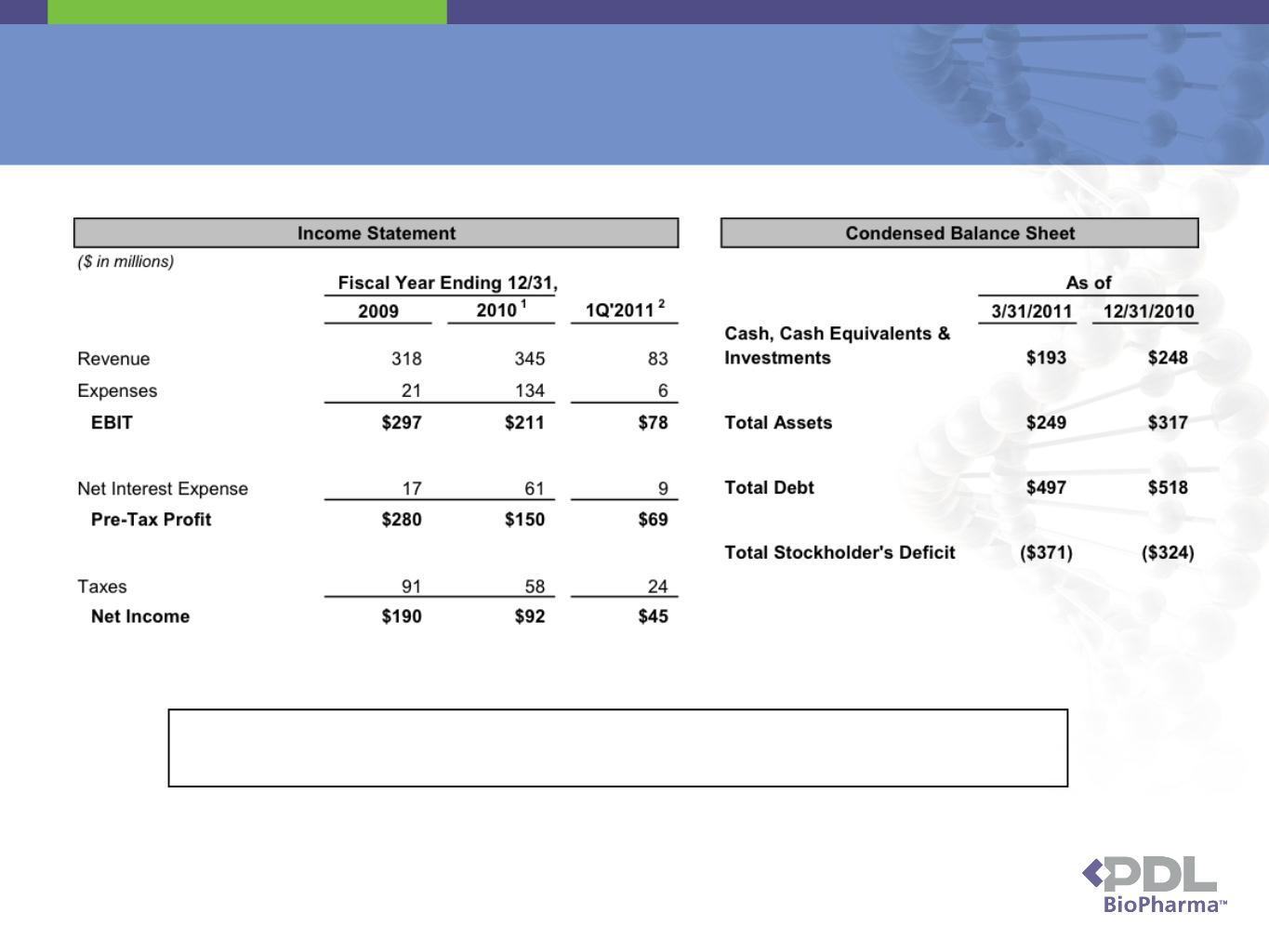

Financial Overview

30

1.Includes $92.5 million one time legal settlement to MedImmune. Net interest expense includes

$17.6 million loss on convertible note retirement.

$17.6 million loss on convertible note retirement.

2.Includes $10.0 million one time legal settlement from UCB.

New 2015 Convertible Notes

• Terms

▪ $135 million convertible, non-callable senior notes due May 2015

- Bankers exercised option to purchase an additional ~$20 million increasing total to ~$155

million

million

▪ Coupon rate is 3.75%

▪ Conversion price is $7.92/share

▪ Bond hedge effectively increases conversion price to $9.31½ /share

• Timing

▪ Transaction was priced on May 10th and closed on May 16th

• Use of Proceeds

▪ Redeem PDL’s convertible notes due in February 2012 with a current

principal balance of $133 million

principal balance of $133 million

▪ Pay cost of convertible note hedge transactions

▪ General corporate purposes

31

$497 Million Debt

• $250 million 2.00% convertible senior notes due February 2012; current principal

balance of $133 million

balance of $133 million

▪Conversion rate is 144.474 shares / $1,000 face amount ($6.92/share)

▪Issued a notice of redemption for cash on May 23 effective as of June 30 for all outstanding Notes at

redemption price of 100.29% (approximately $1,010.3444 per $1,000 principal amount of Notes)

redemption price of 100.29% (approximately $1,010.3444 per $1,000 principal amount of Notes)

▪Using cash from new 2015 Notes

• $180 million 2.875% convertible senior notes due February 2015 placed November 1,

2010

2010

▪Conversion rate is 144.474 shares / $1,000 face amount ($6.92/share)

• $300 million 10.25% secured non-recourse notes; current principal balance of $184

million

million

▪Distributed $200 million of proceeds as special dividend of $1.67/share in December 2009

▪Approximately 40% of Genentech royalties dedicated to quarterly principal and interest payments; principal

repayment fluctuates in relation to royalties received

repayment fluctuates in relation to royalties received

▪Anticipated final maturity is September 2012; legal maturity is March 2015

▪After final maturity, securitized Genentech royalties will be retained by PDL

• In order to pay a dividend, PDL must first satisfy a net assets test at the time of dividend

declaration by Board of Directors

declaration by Board of Directors

32

Legal Matters

33

Recent Resolution of Legal Disputes

• PDL has resolved all challenges to the Queen et al. Patents in the

U.S. Patent and Trademark Office (USPTO) and the European Patent

Office (EPO) as well as its dispute with MedImmune

U.S. Patent and Trademark Office (USPTO) and the European Patent

Office (EPO) as well as its dispute with MedImmune

▪ UCB Pharma

- PDL received $10 million from UCB and PDL agreed not to sue UCB for any royalties related

to Cimzia

to Cimzia

- UCB terminated patent interference proceedings before the USPTO and withdrew its

opposition appeal in the EPO

opposition appeal in the EPO

▪ MedImmune

- PDL paid MedImmune $65 million on February 15, 2011 and will pay them an additional $27.5

million by February 2012

million by February 2012

- MedImmune ceased support of any party in the EPO opposition appeal

▪ Novartis

- PDL dismissed its claims against Novartis in its Nevada lawsuit

- Novartis withdrew its opposition appeal to PDL’s European patent in EPO

- PDL will pay Novartis an amount based on Novartis’ net ex-U.S. sales of Lucentis during

calendar year 2011 and beyond

calendar year 2011 and beyond

▪ BioTransplant

- PDL acquired BioTransplant, a bankrupt company and instructed BioTransplant to withdraw

its opposition appeal in the EPO

its opposition appeal in the EPO

34

Pending Dispute with Genentech and Roche

• In August 2010, Genentech sent a fax on behalf of Roche and Novartis

asserting its products do not infringe PDL’s supplementary protection

certificates (SPCs)

asserting its products do not infringe PDL’s supplementary protection

certificates (SPCs)

▪ Products include Avastin, Herceptin, Lucentis and Xolair

▪ SPCs are extensions of patent term in Europe that are issued on a country-by-country and

product-by-product basis

product-by-product basis

• PDL Response

▪ Genentech’s assertions are without merit

▪ PDL disagrees with Genentech’s assertions of non-infringement

▪ Genentech had waived its rights to challenge our patents, including SPCs in its 2003

Settlement Agreement with PDL

Settlement Agreement with PDL

• 2003 Settlement Agreement

▪ Resolved intellectual property disputes between the two companies at that time

▪ Limits Genentech’s ability to challenge infringement of PDL’s patent rights, including SPCs,

and waives Genentech’s right to challenge or assist other in challenging the validity of our

patent rights

and waives Genentech’s right to challenge or assist other in challenging the validity of our

patent rights

35

Nevada Lawsuit Against Genentech/Roche

•PDL filed a lawsuit against Genentech and Roche in Nevada

state court

state court

▪ Lawsuit states that fax constitutes a breach of 2003 Settlement Agreement

because Genentech assisted Roche in challenging PDL’s patents and SPCs

because Genentech assisted Roche in challenging PDL’s patents and SPCs

▪ Complaint seeks compensatory damages, including liquidated damages and

other monetary remedies set forth in the 2003 Settlement Agreement, punitive

damages and attorney’s fees

other monetary remedies set forth in the 2003 Settlement Agreement, punitive

damages and attorney’s fees

•In November 2010, Genentech and Roche filed two motions to

dismiss

dismiss

▪ They contend that 2003 Settlement Agreement applies only to PDL’s U.S.

patent rights

patent rights

▪ They asserted that the Nevada court lacks personal jurisdiction over Roche

▪ On April 21, 2011, Nevada court heard arguments on two Genentech and

Roche motions

Roche motions

▪ If case proceeds, trial is not yet scheduled and not expected until 2012

36

Optimizing Stockholder Return

37

Business Strategy

• Purchase new royalty assets and

ladder like a bond portfolio

ladder like a bond portfolio

▪ Continue to reinvest in new royalty assets

and pay dividends

and pay dividends

▪ Debt repaid by end of 2015

▪ Company continues as long as it can

generate satisfactory return

generate satisfactory return

• If unable to acquire royalty assets on

attractive terms, build cash reserves to

attractive terms, build cash reserves to

▪ Repay debt

▪ Use all excess cash to pay dividends to

enhance shareholder return

enhance shareholder return

▪ Wind-up company in 2016 timeframe

38

• Queen et al. patents expire end of 2014; we

anticipate royalties will likely continue to ~

2016

anticipate royalties will likely continue to ~

2016

• There are two possible pathways forward

for PDL

for PDL

Optimizing Stockholder Return

• Continuously evaluating

alternatives

alternatives

▪ Dividends

▪ Capital restructure

▪ Share repurchase

▪ Company sale

▪ Purchase of commercial stage, royalty

generating assets

generating assets

39

Investment Highlights

• Strong historic revenue growth from approved products

• Potential for additional indications from existing

products, new product approvals and purchase of new

royalty assets

products, new product approvals and purchase of new

royalty assets

• Potential to grow and diversify revenues with the

addition of new royalty assets

addition of new royalty assets

• Significantly reduced expenses with no R&D burn

• Liquidity - volume averages 3 million shares/day

• Return to stockholders

▪ In 2011, $0.60/share to be paid in quarterly regular dividends of

$0.15/share in March 15, June 15, September 15 and December

15

$0.15/share in March 15, June 15, September 15 and December

15

40

Appendix

41

Avastin

• Licensor

▪Genentech (US) and Roche (ex-US)

• Mechanism

▪As a tumor grows, it exceeds the ability of the local blood supply

to nourish it

to nourish it

▪Tumor causes up regulation of vascular endothelial growth factor

(VEGF) stimulating angiogenesis or the growth of leaky blood

vessels to nourish the tumor

(VEGF) stimulating angiogenesis or the growth of leaky blood

vessels to nourish the tumor

▪Avastin targets and inhibits VEGF reduction in blood vessels

“starving” the tumor

“starving” the tumor

• Approvals

▪Metastatic colorectal cancer, advanced non-small cell lung

cancer, renal cancer, metastatic HER2- breast cancer and

glioblastoma

cancer, renal cancer, metastatic HER2- breast cancer and

glioblastoma

• Sales

▪2010 worldwide net sales of $6.4 billion1

- US is reviewing approval for metastatic HER2- breast cancer and EU has

narrowed this label, resulting in drop in sales for this indication

narrowed this label, resulting in drop in sales for this indication

42

Treatment with Avastin

reduces vascularization

or blood supply of tumor

reduces vascularization

or blood supply of tumor

1. As reported to PDL by its licensee

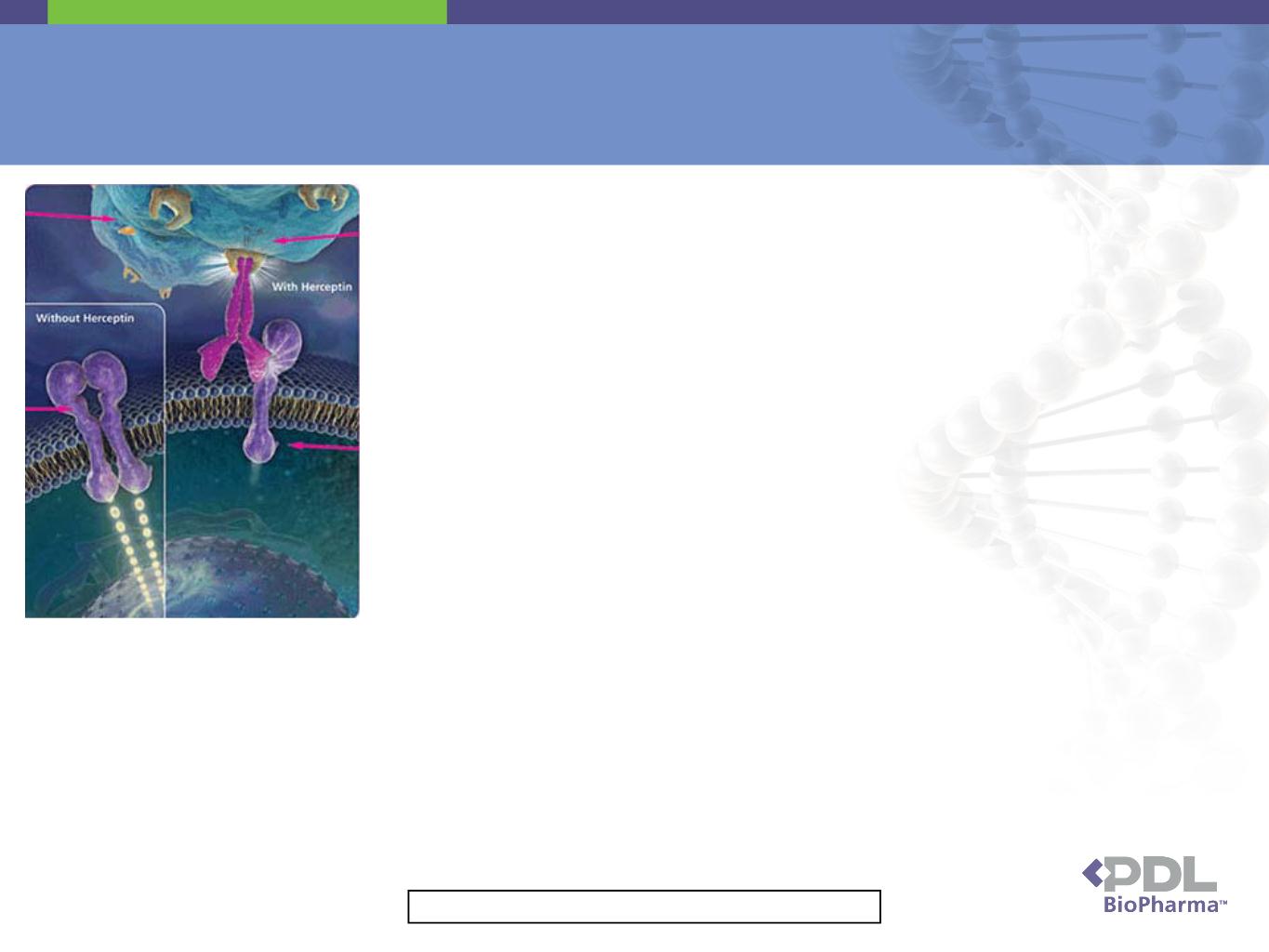

Herceptin

• Licensor

▪ Genentech (US) and Roche (ex-US)

• Mechanism

▪ Some breast cancer cells make too many (over-express)

copies of a particular gene known as HER2 that causes

rapid growth of the breast cancer cell

copies of a particular gene known as HER2 that causes

rapid growth of the breast cancer cell

▪ Herceptin works by attaching itself to the HER2 receptors

on the surface of breast cancer cells, blocking them from

receiving growth signals and slowing or stopping the

growth of the breast cancer cell

on the surface of breast cancer cells, blocking them from

receiving growth signals and slowing or stopping the

growth of the breast cancer cell

▪ Herceptin also fights breast cancer by alerting the immune

system to destroy cancer cells onto which it is attached

system to destroy cancer cells onto which it is attached

• Approvals

▪ Metastatic HER2+ breast cancer, metastatic HER2+

stomach cancer

stomach cancer

• Sales

▪ 2010 worldwide net sales of $5.4 billion1

43

Without Herceptin treatment,

cell surface receptors signal

into the HER2+ breast cancer

cell to proliferate

cell surface receptors signal

into the HER2+ breast cancer

cell to proliferate

Herceptin binds to cell surface

receptors inhibiting intracellular

signals thus preventing cancer

cell proliferation and signaling

the immune system to “kill” the

cancer cell

receptors inhibiting intracellular

signals thus preventing cancer

cell proliferation and signaling

the immune system to “kill” the

cancer cell

1. As reported to PDL by its licensee

Lucentis

44

• Licensor

▪ Genentech (US) and Novartis (ex-US)

• Mechanism

▪ A form of VEGF known as VEGF-A causes the

formation of leaky blood vessels result in the

swelling in the macula and vision loss

formation of leaky blood vessels result in the

swelling in the macula and vision loss

▪ Lucentis binds to and inhibits VEGF-A before it can

cause the formation of the leaky blood vessels

preserving and sometimes improving vision

cause the formation of the leaky blood vessels

preserving and sometimes improving vision

• Approvals

▪ Wet age-related macular degeneration (AMD),

macular edema or swelling following retinal vein

occlusion, diabetic macular edema

macular edema or swelling following retinal vein

occlusion, diabetic macular edema

• Sales

▪ 2010 worldwide net sales of $3.0 billion1

- Recent NIH study comparing safety and effectiveness of

Lucentis finds less expensive Avastin equally efficacious -

will adversely affect future Lucentis sales for AMD

Lucentis finds less expensive Avastin equally efficacious -

will adversely affect future Lucentis sales for AMD

- It’s estimated that in the U.S. 60% of AMD patients are

already treated with off-label Avastin

already treated with off-label Avastin

Cross

section of

normal

macula at

back of eye

section of

normal

macula at

back of eye

Cross

section of

macula with

AMD causing

loss of vision

section of

macula with

AMD causing

loss of vision

Amsler Grid as

seen through

normal eyes

seen through

normal eyes

Amsler Grid as

seen through

eyes with AMD

seen through

eyes with AMD

1. As reported to PDL by its licensee

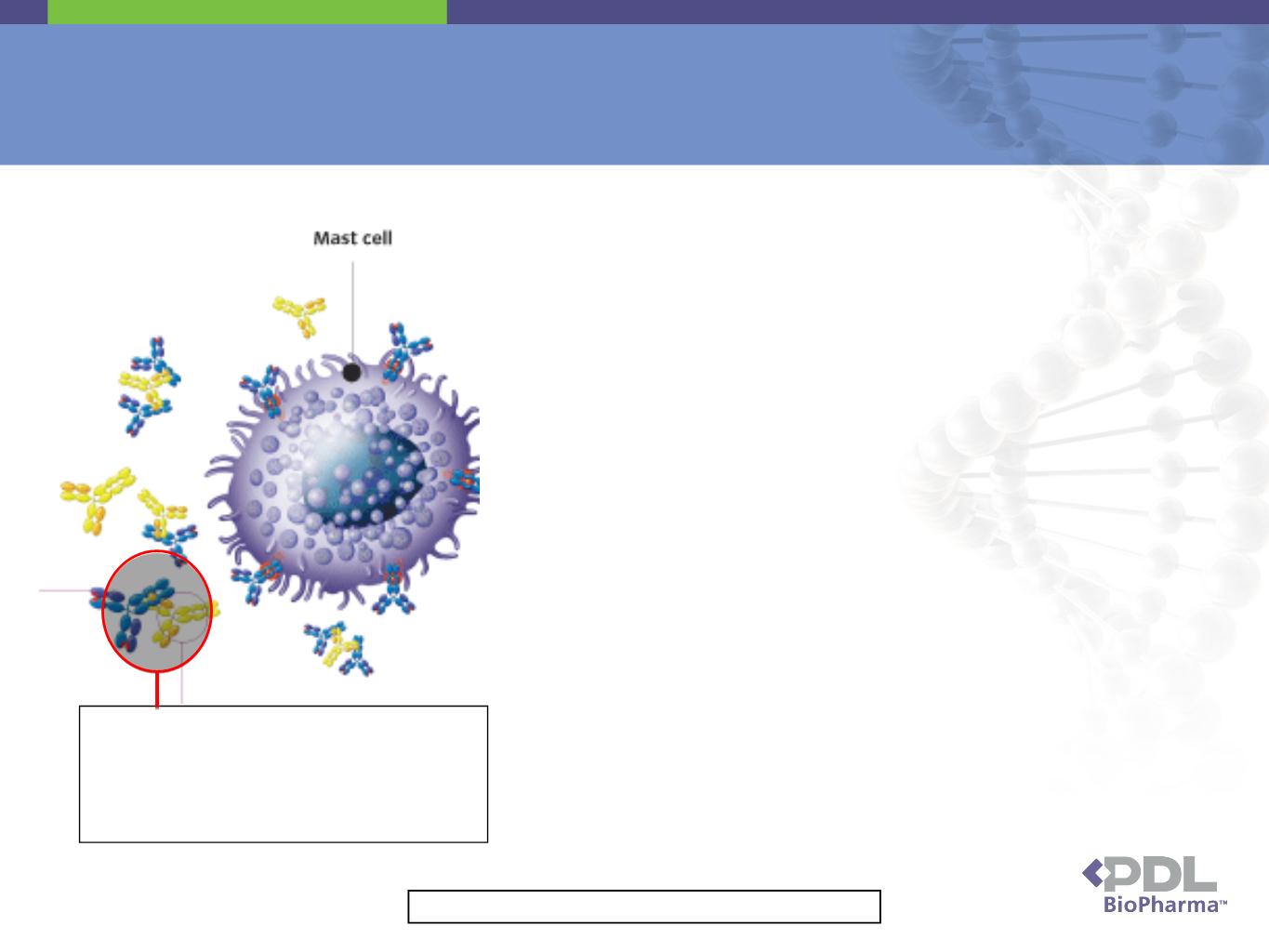

Xolair

45

• Licensor

▪ Genentech (US) and Novartis (ex-US)

• Mechanism

▪ IgE plays a role in allergic disease by

causing the release of inflammatory

mediators from mast cells that result in

sneezing, wheezing and asthma

causing the release of inflammatory

mediators from mast cells that result in

sneezing, wheezing and asthma

▪ Xolair binds to and neutralizes circulating

IgE by preventing IgE from binding to its

mast-cell receptor

IgE by preventing IgE from binding to its

mast-cell receptor

• Approvals

▪ Moderate-to-severe persistent asthma

• Sales

▪ 2010 worldwide net sales of $1.0 billion1

Xolair antibody (yellow) binds to IgE

(blue) preventing IgE from binding to

mast cell. Otherwise, IgE binding to

mast cell would result in wheezing,

sneezing and asthma.

(blue) preventing IgE from binding to

mast cell. Otherwise, IgE binding to

mast cell would result in wheezing,

sneezing and asthma.

1. As reported to PDL by its licensee

Tysabri

46

In MS, the body’s

autoimmune system is

inappropriately activated,

resulting in it attacking the

body. Here, defense cells,

known as T cells, are

activated.

autoimmune system is

inappropriately activated,

resulting in it attacking the

body. Here, defense cells,

known as T cells, are

activated.

Activated T cells are able

to cross the blood brain

barrier affording them

access to nerve cells.

to cross the blood brain

barrier affording them

access to nerve cells.

Activated T cells attack,

and recruit other defense

cells known as

macrophages, to attack

and consume the myelin

sheath or insulation

surrounding nerve fibers.

The resulting holes in the

myelin slow the

transmission of impulses

along the nerve and cause

the symptoms of MS.

and recruit other defense

cells known as

macrophages, to attack

and consume the myelin

sheath or insulation

surrounding nerve fibers.

The resulting holes in the

myelin slow the

transmission of impulses

along the nerve and cause

the symptoms of MS.

1. As reported to PDL by its licensee

Actemra

47

• Licensor

▪ Roche and Chugai

• Mechanism

▪ Rheumatoid arthritis (RA) is an autoimmune disease in

which the body's immune system attacks itself

which the body's immune system attacks itself

▪ One of the defense mechanisms inappropriately activated

in RA is IL-6, which can result in destruction of the cartilage

between joints causing the symptoms of RA

in RA is IL-6, which can result in destruction of the cartilage

between joints causing the symptoms of RA

▪ Actemra binds to and neutralizes IL-6 preventing it from

destroying cartilage thereby blocking one of the causes of

RA

destroying cartilage thereby blocking one of the causes of

RA

• Approvals

▪ Treatment of signs and symptoms in moderate-to-severe

adult RA patients, slowing of structural damage to joints

caused by RA and preservation physical function of joints

afflicted by RA

adult RA patients, slowing of structural damage to joints

caused by RA and preservation physical function of joints

afflicted by RA

• Sales

▪ 2010 worldwide net sales of $459 million1

It is the degradation and

eventual destruction of this

cartilage that causes the

symptoms of RA.

eventual destruction of this

cartilage that causes the

symptoms of RA.

1. As reported by Roche; assume 1.155 CHF/USD