Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - China Biologic Products Holdings, Inc. | exhibit21.htm |

| EX-32.1 - EXHIBIT 32.1 - China Biologic Products Holdings, Inc. | exhibit32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - China Biologic Products Holdings, Inc. | exhibit32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - China Biologic Products Holdings, Inc. | exhibit31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - China Biologic Products Holdings, Inc. | exhibit31-2.htm |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q /A

(Amendment No. 1)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: June 30, 2010

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________to _____________

Commission File Number: 001-34566

CHINA BIOLOGIC PRODUCTS, INC.

(Name of Small Business Issuer in Its Charter)

| DELAWARE | 75-2308816 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) |

No. 14 East Hushan Road,

Taian City, Shandong

People’s Republic of China 271000

(Address of principal

executive offices)

(+86) 538-620-2306

(Registrant’s telephone number,

including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The number of shares outstanding of each of the issuer’s classes of common equity, as of August 9, 2010 is as follows:

| Class of Securities | Shares Outstanding |

| Common Stock, $0.0001 par value | 23,513,533 |

EXPLANATORY NOTE

China Biologic Products, Inc. (the "Company") is filing this Amendment No. 1 to its Quarterly Report on Form 10-Q (the "Amendment") to restate its consolidated financial statements for the three months and six months ended June 30, 2010, previously filed with the Securities and Exchange Commission on August 13, 2010 (the "the Original Filing"). This Amendment is being filed to amend the recognition of fair value of the callable feature for the warrants issued in 2006 and recognition of deferred tax liabilities in connection with business combination of Guiyang Dalin Biologic Technologies Co., Ltd. (“Dalin”).

Recognition of fair value of the callable feature for the warrants issued in 2006

In 2006, the Company issued 1,070,000 warrants (the “2006 Warrants”) to certain accredited investors. According to the terms of the 2006 Warrants, the Company may, in its sole discretion, elect to require the 2006 Warrants holders to exercise up to all of the unexercised portion of the 2006 Warrants (“Callable Feature”). The Company inadvertently omitted the fair value of the Callable Features embedded in the 2006 Warrants when reclassifying the fair value of 2006 Warrants from equity to derivative liabilities as of January 1, 2009 in adopting EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) Is Indexed to an Entity's Own Stock” (FASB ASC 815-40-15-5) (“EITF 07-05”). As a result, the retained earnings and additional paid-in capital should have been increased by $535,615 and $138,160, respectively, and the derivative liabilities should have been decreased by $673,775 as of January 1, 2009. The retained earnings and additional paid-in capital should have been increased by $1,246,476 and decreased by $1,246,476, respectively, as of June 30, 2010.

Recognition of deferred tax liabilities in connection with the business combination of Dalin

In connection with the business combination of Dalin in 2009, the Company misinterpreted US GAAP regarding the accounting for the business combination. As a result, the Company did not recognize deferred tax liabilities for differences between the assigned values and the tax bases of the intangible assets and certain property, plant and equipment acquired in the business combination as in accordance with ASC Topic 740, Income Taxes. As of January 1, 2009, deferred tax liabilities of $4,749,099 should have been recognized with a corresponding increase in goodwill of $4,749,099. During the six months ended June 30, 2010, the Company also should have recorded deferred tax benefit representing the tax effect of the amortization of intangible assets and the depreciation of property, plant and equipment for the six months ended June 30, 2010. As a result, the goodwill, deferred tax liabilities, retained earnings, accumulated other comprehensive income and noncontrolling interest should have been increased by $4,794,669, $4,041,837, $348,616, $1,577 and $402,639, respectively, as of June 30, 2010. The net income, net income attributable to noncontrolling interest and other comprehensive income of the Company should have been increased by $124,986, $66,847 and $3,040, respectively, for three months ended June 30, 2010 and $249,905, $133,657 and $3,083, respectively, for six months ended June 30, 2010.

For the purposes of the Amendment, and in accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended, each item of the Original Filing that was affected by the restatement has been amended and restated in its entirety. Unless otherwise indicated, this report speaks only as of the date that the Original Filing was filed. No attempt has been made in this Amendment to update other disclosures presented in the Original Filing. This Amendment does not reflect events occurring after the filing of the Original Filing or modify or update those disclosures, including the exhibits to the Original Filing affected by subsequent events, except that this Amendment includes as exhibits 31.1, 31.2, 32.1 and 32.2 new certifications by the Company’s Chief Executive Officer and Chief Financial Officer as required by Rule 12b-15.

| TABLE OF CONTENTS | ||

| PART I | FINANCIAL INFORMATION | |

| ITEM 1. | FINANCIAL STATEMENTS. | 2 |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. | 45 |

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 56 |

| ITEM 4 | CONTROLS AND PROCEDURES. | 57 |

| . | ||

| PART II | OTHER INFORMATION | |

| ITEM 1. | LEGAL PROCEEDINGS. | 57 |

| ITEM 1A. | RISK FACTORS. | 60 |

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS. | 60 |

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES. | 60 |

| ITEM 4. | (REMOVED AND RESERVED). | 60 |

| ITEM 5. | OTHER INFORMATION. | 60 |

| ITEM 6. | EXHIBITS. | 60 |

PART I

FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

CHINA BIOLOGIC PRODUCTS, INC.

INDEX TO

CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED

JUNE 30, 2010 AND 2009

| Contents | Page(s) |

| Consolidated Balance Sheets as of June 30, 2010 (unaudited) and December 31, 2009 | 3 |

| Consolidated Statements of Income and Other Comprehensive Income for the three and six months ended June 30, 2010 and 2009 (unaudited) | 4 |

| Consolidated Statements of Changes in Equity (unaudited) | 5 |

| Consolidated Statements of Cash Flows for the six months ended June 30, 2010 and 2009 (unaudited) | 6 |

| Notes to the Consolidated Financial Statements (unaudited) | 7 |

CHINA BIOLOGIC PRODUCTS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

AS OF JUNE 30, 2010 and DECEMBER

31, 2009

| ASSETS | ||||||

| June 30, | December 31, | |||||

| 2010 | 2009 | |||||

| (Unaudited) | ||||||

| ( As Restated – Note 2) | ||||||

|

|

||||||

|

CURRENT ASSETS: |

||||||

|

Cash and cash equivalents |

$ | 56,263,131 | $ | 53,843,951 | ||

|

Accounts receivable, net of allowance for doubtful accounts of $1,253,975 and $1,254,955 as of June 30,2010 and December 31, 2009, respectively |

5,658,429 | 1,767,076 | ||||

|

Accounts receivable - related party |

229,817 | 222,617 | ||||

|

Other receivables |

2,291,010 | 2,186,441 | ||||

|

Inventories, net of allowance for obsolete of $742,269 and $519,333 as of June 30, 2010 and December 31, 2009, respectively |

41,434,786 | 35,132,724 | ||||

|

Prepayments and deferred expense |

1,848,327 | 1,299,125 | ||||

|

Deferred tax assets |

1,119,908 | 1,053,771 | ||||

|

Total current assets |

108,845,408 | 95,505,705 | ||||

|

|

||||||

|

PLANT AND EQUIPMENT, net |

35,598,253 | 28,873,413 | ||||

|

|

||||||

|

OTHER ASSETS: |

||||||

|

Investment in unconsolidated affiliate |

7,001,553 | 6,627,355 | ||||

|

Prepayments - non-current |

2,637,092 | 3,223,960 | ||||

|

Intangible assets, net |

19,988,081 | 21,180,322 | ||||

|

Goodwill |

17,220,258 | 17,200,728 | ||||

|

Total other assets |

46,846,984 | 48,232,365 | ||||

|

|

||||||

|

Total assets |

$ | 191,290,645 | $ | 172,611,483 | ||

|

|

||||||

|

LIABILITIES AND EQUITY |

||||||

|

|

||||||

|

CURRENT LIABILITIES: |

||||||

|

Accounts payable |

$ | 3,268,413 | $ | 3,701,843 | ||

|

Notes payable |

- | 48,598 | ||||

|

Short term loans - bank |

5,965,650 | 4,474,350 | ||||

|

Short term loans - holder of noncontrolling interest |

- | 3,652,500 | ||||

|

Other payables and accrued liabilities |

20,592,061 | 19,246,814 | ||||

|

Other payable - related parties |

3,100,153 | 3,087,527 | ||||

|

Accrued interest - holder of noncontrolling interest |

- | 2,068,526 | ||||

|

Customer deposits |

4,051,003 | 3,868,577 | ||||

|

Taxes payable |

7,509,571 | 8,774,079 | ||||

|

Investment payable |

78,800 | 2,195,365 | ||||

|

Current maturities of notes payable, net of discount of $7,112,409 as of June 30, 2010 |

387,591 | - | ||||

|

Total current liabilities |

44,953,242 | 51,118,179 | ||||

|

|

||||||

|

OTHER LIABILITIES: |

||||||

|

Other payable - land use right |

324,265 | 323,687 | ||||

|

Derivative liability - conversion option |

13,522,842 | 19,960,145 | ||||

|

Fair value of derivative instruments |

8,658,837 | 12,701,262 | ||||

|

Deferred tax liabilities |

4,041,837 | 4,275,295 | ||||

|

Notes payable, net of discount of $8,464,380 as of December 31, 2009 |

- | 89,760 | ||||

|

Total other liabilities |

26,547,781 | 37,350,149 | ||||

|

|

||||||

|

Total liabilities |

71,501,023 | 88,468,328 | ||||

|

|

||||||

|

COMMITMENTS AND CONTINGENCIES |

||||||

|

|

||||||

|

EQUITY: |

||||||

|

Common stock,

$0.0001 par value, 100,000,000 shares authorized, |

2,351 | 2,305 | ||||

|

Additional paid-in-capital |

26,824,278 | 21,270,601 | ||||

|

Statutory reserves |

23,233,527 | 17,414,769 | ||||

|

Retained earnings |

24,562,122 | 6,781,449 | ||||

|

Accumulated other comprehensive income |

4,522,321 | 4,227,537 | ||||

|

Total shareholders' equity |

79,144,599 | 49,696,661 | ||||

|

|

||||||

|

NONCONTROLLING INTEREST |

40,645,023 | 34,446,494 | ||||

|

|

||||||

|

Total equity |

119,789,622 | 84,143,155 | ||||

|

|

||||||

|

Total liabilities and equity |

$ | 191,290,645 | $ | 172,611,483 | ||

The accompanying notes are an integral part of these consolidated statements.

-3-

CHINA BIOLOGIC PRODUCTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND OTHER COMPREHENSIVE INCOME

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2010 AND 2009

(Unaudited)

| Three months ended | Six months ended | |||||||||||

| June 30, | June 30, | |||||||||||

| 2010 | 2009 | 2010 | 2009 | |||||||||

| (As Restated – Note 2) | (As Restated – Note 2) | |||||||||||

|

REVENUES: |

||||||||||||

|

Revenues |

$ | 40,580,807 | $ | 33,030,868 | $ | 67,442,329 | $ | 53,936,737 | ||||

|

Revenues - related party |

327,509 | 150,677 | 564,540 | 393,406 | ||||||||

|

Total revenues |

40,908,316 | 33,181,545 | 68,006,869 | 54,330,143 | ||||||||

|

|

||||||||||||

|

COST OF REVENUES: |

||||||||||||

|

Cost of revenues |

9,058,906 | 9,161,765 | 15,857,760 | 15,376,695 | ||||||||

|

|

||||||||||||

|

GROSS PROFIT |

31,849,410 | 24,019,780 | 52,149,109 | 38,953,448 | ||||||||

|

|

||||||||||||

|

OPERATING EXPENSES: |

||||||||||||

|

Selling expenses |

1,856,881 | 1,114,614 | 2,799,789 | 1,694,110 | ||||||||

|

General and administrative expenses |

5,905,950 | 6,004,802 | 10,868,202 | 9,827,709 | ||||||||

|

Research and development expenses |

1,317,483 | 367,856 | 2,486,138 | 835,583 | ||||||||

|

Total operating expenses |

9,080,314 | 7,487,272 | 16,154,129 | 12,357,402 | ||||||||

|

|

||||||||||||

|

INCOME FROM OPERATIONS |

22,769,096 | 16,532,508 | 35,994,980 | 26,596,046 | ||||||||

|

|

||||||||||||

|

OTHER (INCOME) EXPENSE : |

||||||||||||

|

Equity in loss (income) of unconsolidated affiliate |

(157,114 | ) | 90,390 | (345,655 | ) | 50,143 | ||||||

|

Change in fair value of derivative liabilities |

(2,270,829 | ) | 432,889 | (6,104,406 | ) | 842,181 | ||||||

|

Interest expense, net |

439,005 | 883,914 | 620,058 | 1,254,767 | ||||||||

|

Other income - related party |

(449 | ) | - | (914,738 | ) | - | ||||||

|

Other expense, net |

102,914 | (16,005 | ) | 197,234 | 35,310 | |||||||

|

Total other (income) expense, net |

(1,886,473 | ) | 1,391,188 | (6,547,507 | ) | 2,182,401 | ||||||

|

|

||||||||||||

|

INCOME BEFORE PROVISION FOR INCOME TAXES AND NONCONTROLLING INTEREST |

24,655,569 | 15,141,320 | 42,542,487 | 24,413,645 | ||||||||

|

|

||||||||||||

|

PROVISION FOR INCOME TAXES |

4,961,895 | 2,857,199 | 8,033,042 | 4,762,594 | ||||||||

|

|

||||||||||||

|

NET INCOME |

19,693,674 | 12,284,121 | 34,509,445 | 19,651,051 | ||||||||

|

|

||||||||||||

|

Less: Net income attributable to noncontrolling interest |

6,757,992 | 4,401,127 | 10,910,014 | 7,459,261 | ||||||||

|

|

||||||||||||

|

NET INCOME ATTRIBUTABLE TO CONTROLLING INTEREST |

12,935,682 | 7,882,994 | 23,599,431 | 12,191,790 | ||||||||

|

|

||||||||||||

|

OTHER COMPREHENSIVE INCOME: |

||||||||||||

|

Foreign currency translation adjustments |

275,440 | (1,301 | ) | 294,784 | 17,332 | |||||||

|

Comprehensive (income) loss attributable to noncontrolling interest |

164,372 | (33,422 | ) | 140,417 | 393,876 | |||||||

|

COMPREHENSIVE INCOME |

$ | 13,375,494 | $ | 7,848,271 | $ | 24,034,632 | $ | 12,602,998 | ||||

|

|

||||||||||||

|

BASIC EARNINGS PER SHARE: |

||||||||||||

|

Weighted average number of shares |

23,511,435 | 21,442,909 | 23,449,508 | 21,438,948 | ||||||||

|

Earnings per share |

$ | 0.55 | $ | 0.37 | $ | 1.01 | $ | 0.57 | ||||

|

|

||||||||||||

|

DILUTED EARNINGS PER SHARE: |

||||||||||||

|

Weighted average number of shares |

26,599,255 | 21,442,909 | 26,541,685 | 21,438,948 | ||||||||

|

Earnings per share |

$ | 0.41 | $ | 0.37 | $ | 0.68 | $ | 0.57 | ||||

The accompanying notes are an integral part of these consolidated statements.

-4-

CHINA BIOLOGIC PRODUCTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

| Accumulated | ||||||||||||||||||||||||

| Common stock | Additional | Retained earnings | other | |||||||||||||||||||||

| Paid-in | Statutory | comprehensive | Noncontrolling | |||||||||||||||||||||

| Shares | Par value | capital | reserves | Unrestricted | income (loss) | interest | Totals | |||||||||||||||||

|

BALANCE, December 31, 2008 |

21,434,942 | $ | 2,143 | $ | 10,700,032 | $ | 6,989,801 | $ | 15,392,253 | $ | 4,159,298 | $ | 4,805,381 | $ | 42,048,908 | |||||||||

|

|

||||||||||||||||||||||||

|

Cumulative effect of reclassification of warrants |

(600,289 | ) | (393,962 | ) | (994,251 | ) | ||||||||||||||||||

|

Stock based compensation |

54,967 | 54,967 | ||||||||||||||||||||||

|

Issuance of common stock upon exercise of warrants |

40,000 | 4 | 211,297 | 211,301 | ||||||||||||||||||||

|

Net income |

12,191,790 | 7,459,261 | 19,651,051 | |||||||||||||||||||||

|

Dividend declared to noncontrolling interest |

(4,633,987 | ) | (4,633,987 | ) | ||||||||||||||||||||

|

Noncontrolling interest acquired from acquisition |

21,525,059 | 21,525,059 | ||||||||||||||||||||||

|

Adjustment to statutory reserve |

4,748,201 | (4,748,201 | ) | - | ||||||||||||||||||||

|

Foreign currency translation adjustments |

17,332 | 393,876 | 411,208 | |||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

BALANCE, June 30, 2009 (unaudited) |

21,474,942 | $ | 2,147 | $ | 10,366,007 | $ | 11,738,002 | $ | 22,441,880 | $ | 4,176,630 | $ | 29,549,590 | $ | 78,274,256 | |||||||||

|

|

||||||||||||||||||||||||

|

Stock based compensation |

7,314 | 7,314 | ||||||||||||||||||||||

|

Issuance of common stock upon exercise of warrants |

1,244,000 | 124 | 8,359,984 | 8,360,108 | ||||||||||||||||||||

|

Issuance of common stock upon conversion of convertible notes |

250,000 | 25 | 2,187,305 | 2,187,330 | ||||||||||||||||||||

|

Stock option exercised |

87,500 | 9 | 349,991 | 350,000 | ||||||||||||||||||||

|

Net income |

(9,983,664 | ) | 9,156,397 | (827,267 | ) | |||||||||||||||||||

|

Dividend declared to noncontrolling interest |

(4,321,405 | ) | (4,321,405 | ) | ||||||||||||||||||||

|

Adjustment to statutory reserve |

5,676,767 | (5,676,767 | ) | - | ||||||||||||||||||||

|

Foreign currency translation adjustments |

50,907 | 61,912 | 112,819 | |||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

BALANCE, December 31, 2009 |

23,056,442 | $ | 2,305 | $ | 21,270,601 | $ | 17,414,769 | $ | 6,781,449 | $ | 4,227,537 | $ | 34,446,494 | $ | 84,143,155 | |||||||||

|

|

||||||||||||||||||||||||

|

Stock based compensation |

617,841 | 617,841 | ||||||||||||||||||||||

|

Issuance of common stock upon exercise of warrants |

180,826 | 18 | 2,436,907 | 2,436,925 | ||||||||||||||||||||

|

Issuance of common stock upon conversion of convertible notes |

263,535 | 27 | 2,498,930 | 2,498,957 | ||||||||||||||||||||

|

Stock option exercised |

12,730 | 1 | (1 | ) | - | |||||||||||||||||||

|

Net income, as restated (Note 2) |

23,599,431 | 10,910,014 | 34,509,445 | |||||||||||||||||||||

|

Dividend declared to noncontrolling interest |

(4,864,572 | ) | (4,864,572 | ) | ||||||||||||||||||||

|

Adjustment to statutory reserve |

5,818,758 | (5,818,758 | ) | - | ||||||||||||||||||||

|

Noncontrolling interest transfer per equity transferred in Fangcheng |

12,670 | 12,670 | ||||||||||||||||||||||

|

Foreign currency translation adjustments, as restated (Note 2) |

294,784 | 140,417 | 435,201 | |||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

BALANCE, June 30, 2010 (unaudited), as restated (Note 2) |

23,513,533 | $ | 2,351 | $ | 26,824,278 | $ | 23,233,527 | $ | 24,562,122 | $ | 4,522,321 | $ | 40,645,023 | $ | 119,789,622 | |||||||||

The accompanying notes are an integral part of these consolidated statements.

-5-

CHINA BIOLOGIC PRODUCTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS

ENDED JUNE 30, 2010 AND 2009

(Unaudited)

| 2010 | 2009 | |||||

| (As Restated – Note 2) | ||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

||||||

|

Net income attributable to controlling interest |

$ | 23,599,431 | $ | 12,191,790 | ||

|

Net income attributable to noncontrolling interest |

10,910,014 | 7,459,261 | ||||

|

Consolidated net income |

34,509,445 | 19,651,051 | ||||

|

Adjustments to reconcile net income to cash provided by operating activities: |

||||||

|

Depreciation |

1,670,321 | 1,589,625 | ||||

|

Amortization |

1,740,659 | 1,704,248 | ||||

|

(Gain) Loss on disposal of equipment |

3,020 | (506 | ) | |||

|

Recovery of bad debt previously reserved |

(8,973 | ) | (22,311 | ) | ||

|

Allowance for bad debt - other receivables and prepayment |

432,895 | 406,736 | ||||

|

Allowance for obsolete inventories |

219,897 | - | ||||

|

Deferred tax benefit, net |

(311,476 | ) | (249,701 | ) | ||

|

Stock based compensation |

617,841 | 54,967 | ||||

|

Change in fair value of derivative liabilities |

(6,104,406 | ) | 842,181 | |||

|

Amortization of deferred note issuance cost |

171,667 | 25,323 | ||||

|

Amortization of discount on convertible notes |

312,259 | 20,356 | ||||

|

Equity in (income) loss of unconsolidated affiliate |

(345,655 | ) | 50,143 | |||

|

Change in operating assets and liabilities: |

||||||

|

Accounts receivable |

(3,861,953 | ) | (676,036 | ) | ||

|

Accounts receivable - related party |

(6,264 | ) | (375,810 | ) | ||

|

Other receivables |

(95,231 | ) | (23,082 | ) | ||

|

Inventories |

(6,351,255 | ) | (4,130,960 | ) | ||

|

Prepayments and deferred expenses |

(849,198 | ) | (750,937 | ) | ||

|

Accounts payable |

(446,713 | ) | (50,767 | ) | ||

|

Other payables and accrued liabilities |

1,252,134 | 4,594,379 | ||||

|

Accrued interest - holder of noncontrolling interest |

(2,068,526 | ) | 911,084 | |||

|

Customer deposits |

169,398 | 4,251,476 | ||||

|

Taxes payable |

(1,294,805 | ) | 608,063 | |||

|

Net cash provided by operating activities |

19,355,081 | 28,429,522 | ||||

|

|

||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

||||||

|

Cash acquired through acquisition |

- | 11,943,673 | ||||

|

Payments made for acquisition |

(4,022,288 | ) | (10,373,854 | ) | ||

|

Purchase of plant and equipment |

(6,154,212 | ) | (1,865,746 | ) | ||

|

Additions to intangible assets |

(87,769 | ) | (1,014,766 | ) | ||

|

Advances on non-current assets |

(471,667 | ) | (590,428 | ) | ||

|

Net cash used in investing activities |

(10,735,936 | ) | (1,901,121 | ) | ||

|

|

||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

||||||

|

Proceeds from warrants conversion |

689,160 | 113,700 | ||||

|

Proceeds from issuance of convertible notes |

- | 8,971,337 | ||||

|

Repayments of former shareholders loan in acquiring company |

- | (2,652,737 | ) | |||

|

Proceeds from short term loans - bank |

5,867,600 | 13,513,754 | ||||

|

Payments on short term loans - bank |

(4,400,700 | ) | - | |||

|

Payments on long term loan - bank |

- | (5,862,800 | ) | |||

|

Repayments of non-controlling shareholder loan |

(3,652,500 | ) | - | |||

|

Payments on notes payables |

(48,595 | ) | - | |||

|

Distribution paid to noncontrolling interest shareholders |

(4,864,240 | ) | - | |||

|

Net cash (used in) provided by financing activities |

(6,409,275 | ) | 14,083,254 | |||

|

|

||||||

|

EFFECTS OF EXCHANGE RATE CHANGE IN CASH |

209,310 | 52,750 | ||||

|

|

||||||

|

INCREASE IN CASH |

2,419,180 | 40,664,405 | ||||

|

|

||||||

|

CASH and CASH EQUIVALENTS, beginning of periods |

53,843,951 | 8,814,616 | ||||

|

|

||||||

|

CASH and CASH EQUIVALENTS, end of periods |

$ | 56,263,131 | $ | 49,479,021 | ||

|

|

||||||

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION |

||||||

|

Income taxes paid |

$ | 9,500,399 | $ | 4,351,056 | ||

|

Interest paid |

$ | 161,684 | $ | 715,158 | ||

|

Non-cash investing and financing activities: |

||||||

|

Reclassification of derivative liability to equity related to conversion of convertible notes |

$ | 2,498,957 | $ | - | ||

|

Reclassification of derivative liability to equity related to exercise of warrants |

$ | 1,747,765 | $ | 97,601 | ||

|

Distribution paid in exchange of holder of noncontrolling interest loan |

$ | - | $ | 3,736,773 | ||

|

Distribution paid by offsetting accounts receivable - related party |

$ | - | $ | 3,720,649 | ||

|

Net assets addition with unpaid commitment |

$ | - | $ | 2,849,321 | ||

|

Intangible assets acquired with prepayments made in prior periods |

$ | 440,070 | $ | - | ||

|

Plant and equipment acquired with prepayments made in prior periods |

$ | 629,166 | $ | 14,290,227 |

The accompanying notes are an integral part of these consolidated statements.

-6-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2010

(Unaudited)

Note 1 – Organization background and principal activities

Principal Activities and Reorganization

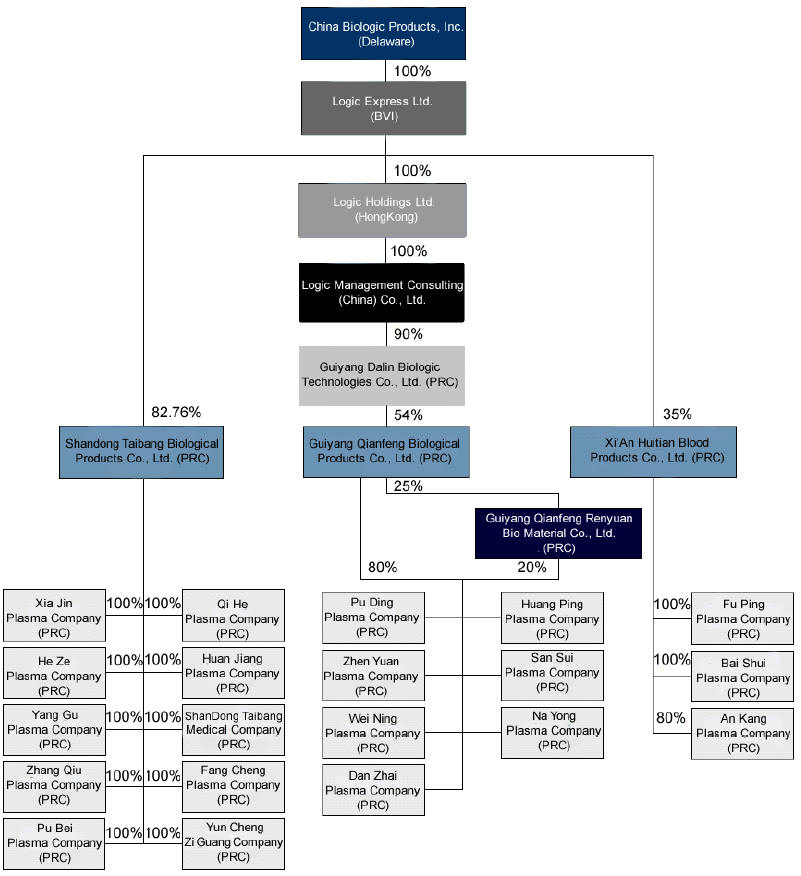

China Biologic Products, Inc. (the “Company” or “CBP”) was originally incorporated in 1992 under the laws of the state of Texas. After it completed the acquisition with Logic Express Limited, it converted to a Delaware corporation. The Company through its direct and indirect subsidiaries is principally engaged in the research, development, commercialization, manufacture and sale of human blood products to customers in the People’s Republic of China (the “PRC”) and to some extent in India.

Current Development

Dalin Acquisition and Entrustment Agreement

Logic Express Ltd. (“Logic Express”), CBP’s wholly owned subsidiary, through Logic Holdings(Hong Kong) Ltd. (“Logic Holdings”) completed the acquisition of 90% interest in Guiyang Dalin Biologic Technologies Co. Ltd. (“Dalin”), previously known as Chongqing Dalin Biologic Technologies Co. Ltd., in April 2009 upon payment of 90% of the total purchase price of approximately RMB 194,400,000 ($28,479,600). The Company is obligated to pay the remaining 10% of the purchase price, RMB 19,440,000 (approximately $2,847,960), on or before April 9, 2010, the one-year anniversary of the local Administration for Industry and Commerce’s approval of the equity transfer. On April 9, 2010, the Company paid the final 10% of the total purchase price according to the equity transfer agreement.

In accordance with the terms of the equity transfer agreement, Logic Holdings effectively became a 90% shareholder in Dalin, including the right to receive its pro rata share of the profits on January 1, 2009.

On April 6, 2009, Logic Express entered into an equity transfer and entrustment agreement, or Entrustment Agreement, among Logic Express, Shandong Taibang Biological Products Co. Ltd (“Shandong Taibang”), and the Shandong Institute of Biological Products (“the Shandong Institute”), the holder of the minority interests in Shandong Taibang, pursuant to which, Logic Express agreed to permit Shandong Taibang and the Shandong Institute to participate in the indirect purchase of Qianfeng’s equity interests. Under the terms of the Entrustment Agreement, Shandong Taibang agreed to contribute 18% or RMB 35,000,000 (approximately $5,116,184) of the Dalin purchase price and the Shandong Institute agreed to contribute 12.86% or RMB 25,000,000 (approximately $3,654,917) of the Dalin purchase price. Logic Express is obligated to repay to Shandong Taibang and the Shandong Institute their respective investment amounts on or before April 6th, 2010, along with their pro rata share, based on their percentage of the Dalin purchase price contributed, of any distribution on the indirect equity investment in Qianfeng payable to Logic Express during 2009. On April 12, 2010, the Company fully paid Shandong Institute and Shandong Taibang on the respective investment amounts, as well as the interest, according to the Entrustment Agreement, as described in more detail in Note 3 below.

Formation of PRC Subsidiary

On December 21, 2009, the Company established Logic Management and Consulting (China) Co., Ltd. (“Logic China”), wholly-owned by the Hong Kong subsidiary, for the purpose of being a holding company for the majority interest in Dalin and to facilitate our Chinese operation at the holding company level. On December 28, 2009, the Company transferred the 90% equity interest in Guiyang Dalin from Logic Holding to Logic China to better situate the Company in PRC operations.

Acquisition of 20% of equity interest in Fangcheng Plasma Co.

On January 13, 2010, the 20% title of Fangcheng Plasma Company was transferred from former non-controlling interest to Taibang, who is now the 100% owner of Fangcheng Plasma Company.

Acquisition of Ziguang Bio-Technology Co.

On January 22, 2010, Shandong Taibang entered into an Equity Transfer Agreement with Yuncheng Ziguang Biotechnology Co., Ltd. which is located in Yuncheng, Shandong Province. Under the terms of the Equity Transfer Agreement, Shandong Taibang agreed to purchase 100% of Yuncheng Ziguang’s equity interest at a purchase price of RMB 10,066,672 (approximately $1,476,781), which was paid on February 24, 2010. The purpose of this acquisition is for relocation of Shandong Taibang’s Yang Gu Plasma Company into the facility of Yuncheng Ziguang. Currently, Yuncheng Ziguang has no operation and is under the construction for such purpose.

-7-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2010

(Unaudited)

Note 2–Restatement of June 30, 2010 consolidated financial statements

This financial statements contain restatements related to the recognition of fair value of the callable feature for the warrants issued in 2006 and recognition of deferred tax liabilities in connection with business combination of Dalin for the three months and six months ended and as of June 30, 2010.

Recognition of fair value of the callable feature for the warrants issued in 2006

In 2006, the Company issued 1,070,000 warrants (the “2006 Warrants”) to certain accredited investors. According to the terms of the 2006 Warrants, the Company may, in its sole discretion, elect to require the 2006 Warrants holders to exercise up to all of the unexercised portion of the 2006 Warrants (“Callable Feature”). The Company inadvertently omitted the fair value of the Callable Features embedded in the 2006 Warrants when reclassifying the fair value of 2006 Warrants from equity to derivative liabilities as of January 1, 2009 in adopting EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) Is Indexed to an Entity's Own Stock” (FASB ASC 815-40-15-5) (“EITF 07-05”). As a result, the retained earnings and additional paid-in capital should have been increased by $535,615 and $138,160, respectively, and the derivative liabilities should have been decreased by $673,775 as of January 1, 2009. The retained earnings and additional paid-in capital should have been increased by $1,246,476 and decreased by $1,246,476, respectively, as of June 30, 2010.

Recognition of deferred tax liabilities in connection with the business combination of Dalin

In connection with the business combination of Dalin in 2009 (see Note 1), the Company misinterpreted US GAAP regarding the accounting for business combination. As a result, the Company did not recognize deferred tax liabilities for differences between the assigned values and the tax bases of the intangible assets and certain property, plant and equipment acquired in the business combination as in accordance with ASC Topic 740, Income Taxes. As of January 1, 2009, deferred tax liabilities of $4,749,099 should have been recognized with a corresponding increase in goodwill of $4,749,099. During the six months ended June 30, 2010, the Company also should have recorded deferred tax benefit representing the tax effect of the amortization of intangible assets and the depreciation of property, plant and equipment for the six months ended June 30, 2010. As a result, the goodwill, deferred tax liabilities, retained earnings, accumulated other comprehensive income and noncontrolling interest should have been increased by $4,794,669, $4,041,837, $348,616, $1,577 and $402,639, respectively, as of June 30, 2010. The net income, net income attributable to noncontrolling interest and other comprehensive income of the Company should have been increased by $124,986, $66,847 and $3,040, respectively, for three months ended June 30, 2010 and $249,905, $133,657 and $3,083, respectively, for six months ended June 30, 2010.

The impact of these restatements on the June 30, 2010 financial statements is reflected in the following tables:

|

|

As Previously | |||||||||||||||||

|

Balance Sheet Amounts |

Reported | Restatement | As Restated | |||||||||||||||

|

Goodwill |

$ | 12,425,589 | $ | 4,794,669 | $ | 17,220,258 | ||||||||||||

|

Total assets |

186,495,976 | 4,794,669 | 191,290,645 | |||||||||||||||

|

Deferred tax liabilities (note 14) |

- | 4,041,837 | 4,041,837 | |||||||||||||||

|

Total liabilities |

67,459,186 | 4,041,837 | 71,501,023 | |||||||||||||||

|

Additional paid-in-capital |

28,070,754 | (1,246,476 | ) | 26,824,278 | ||||||||||||||

|

Retained earnings |

22,967,030 | 1,595,092 | 24,562,122 | |||||||||||||||

|

Accumulated other comprehensive income |

4,520,744 | 1,577 | 4,522,321 | |||||||||||||||

|

Noncontrolling interest (note 21) |

40,242,384 | 402,639 | 40,645,023 | |||||||||||||||

|

Total stockholders' equity |

119,036,790 | 752,832 | 119,789,622 |

|

|

For the three months ended June 30, 2010 | For the six months ended June 30, 2010 | ||||||||||||||||

|

Statement of Operations and Other Comprehensive |

As Previously | As Previously | ||||||||||||||||

|

Income Amounts |

Reported | Restatement | As Restated | Reported | Restatement | As Restated | ||||||||||||

|

Provision for income taxes (note 14) |

$ | 5,086,881 | $ | (124,986 | ) | $ | 4,961,895 | $ | 8,282,947 | $ | (249,905 | ) | $ | 8,033,042 | ||||

|

Net income |

19,568,688 | 124,986 | 19,693,674 | 34,259,540 | 249,905 | 34,509,445 | ||||||||||||

|

Net income attributable to noncontrolling interest (note 21) |

6,691,145 | 66,847 | 6,757,992 | 10,776,357 | 133,657 | 10,910,014 | ||||||||||||

|

Other comprehensive income |

436,772 | 3,040 | 439,812 | 432,118 | 3,083 | 435,201 | ||||||||||||

|

Foreign currency translation adjustments |

274,049 | 1,391 | 275,440 | 293,350 | 1,434 | 294,784 | ||||||||||||

|

Other comprehensive income attributable to noncontrolling interest |

162,723 | 1,649 | 164,372 | 138,768 | 1,649 | 140,417 | ||||||||||||

|

Comprehensive income attributed to controlling interest |

13,151,592 | 59,530 | 13,211,122 | 23,776,533 | 117,682 | 23,894,215 | ||||||||||||

|

Basic earnings per share (note 13) |

$ | 0.55 | $ | - | $ | 0.55 | $ | 1.00 | $ | 0.01 | $ | 1.01 | ||||||

|

Diluted earnings per share (note 13) |

$ | 0.49 | $ | (0.08 | ) | $ | 0.41 | $ | 0.90 | $ | (0.22 | ) | $ | 0.68 | ||||

|

|

||||||||||||||||||

|

|

As Previously | |||||||||||||||||

|

Statement of Cash Flow |

Reported | Restatement | As Restated | |||||||||||||||

|

Net income |

$ | 34,259,540 | $ | 249,905 | $ | 34,509,445 | ||||||||||||

|

Deferred tax benefit, net |

(61,571 | ) | (249,905 | ) | (311,476 | ) | ||||||||||||

Note 3 – Summary of significant accounting policies

Basis of Presentation

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America. The Company’s functional currency is the Chinese Renminbi (“RMB”); however, the Company’s reporting currency is the United States Dollar (“USD”); therefore, the accompanying consolidated financial statements have been translated and presented in USD. All material inter-company transactions and balances have been eliminated in the consolidation.

While management has included all normal recurring adjustments considered necessary to give a fair presentation of the operating results for the periods presented, interim results are not necessarily indicative of results for a full year. The information included in this Form 10-Q should be read in conjunction with information included in the 2009 annual report filed on Form 10-K.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. For example, management estimates the fair value of stock based compensation, potential losses on outstanding receivables and slow-moving inventories, impairment loss of long-lived assets, allocation of plasma production cost, as well as bonus accruals for year end management bonus. Management believes that the estimates utilized in preparing its financial statements are reasonable and prudent. Actual results could differ from these estimates.

-8-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2010

(Unaudited)

Foreign Currency Translation

The reporting currency of the Company is the US dollar. The Company’s functional currency is the Chinese Renminbi (“RMB”), also the local currency of the Company’s principal operating subsidiaries. Results of operations and cash flows are translated at average exchange rates during the period. Assets and liabilities are translated at the unified exchange rate as quoted by the People’s Bank of China at the end of the period. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the consolidated statements of changes in equity. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

In accordance with Financial Accounting Standards Board’s (FASB) accounting standard, cash flows from the Company's operations is calculated based upon the local currencies. As a result, amounts related to assets and liabilities reported on the consolidated statement of cash flows will not necessarily agree with changes in the corresponding balances on the consolidated balance sheet.

The consolidated balance sheet amounts, with the exception of equity, at June 30, 2010 and December 31, 2009 were translated at RMB 6.79 to $1.00 and RMB 6.82 to $1.00, respectively. The equity accounts were stated at their historical rate. The average translation rates applied to consolidated statements of income for the three months ended June 30, 2010 and 2009 were RMB 6.82 and RMB 6.82 to $1.00, respectively. The average translation rates applied to consolidated statements of income and cash flow for the six months ended June 30, 2010 and 2009 were RMB 6.82 and RMB 6.82 to $1.00, respectively.

Revenue Recognition

The Company recognizes revenue when products are delivered and the customer takes ownership and assumes risk of loss, collection of the relevant receivable is probable, persuasive evidence of an arrangement exists and the sales price is fixed or determinable, which are generally considered to be met upon delivery and acceptance of products at the customer site. Sales are presented net of any discounts given to customers. As a policy, the Company does not accept any product returns and based on the Company’s records, product returns, if any, are immaterial. Sales revenue represents the invoiced value of goods, net of a value-added tax (“VAT”).

The Company’s revenues are primarily derived from the manufacture and sale of human blood products. The Company’s revenues by significant types of product for the three and six months ended June 30, 2010 and 2009 are as follows:

-9-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2010

(Unaudited)

| Three months ended June 30, | Six months ended June 30, | |||||||||||

| (Unaudited) |

(Unaudited) |

|||||||||||

| 2010 | 2009 | 2010 | 2009 | |||||||||

| Human Albumin – 20%/10% in 10ml, 25ml and 50ml | $ | 18,989,767 | $ | 15,741,932 | $ | 31,689,174 | $ | 28,093,631 | ||||

| Human Hepatitis B Immunoglobulin | 2,839,125 | 1,234,060 | 6,171,432 | 1,294,159 | ||||||||

| Human Immunoglobulin for Intravenous Injection | 16,095,707 | 14,163,778 | 21,491,172 | 19,536,280 | ||||||||

| Human Rabies Immunoglobulin | 1,326,275 | 926,240 | 5,104,397 | 2,555,251 | ||||||||

| Human Tetanus Immunoglobulin | 1,168,355 | 342,924 | 1,855,670 | 1,372,610 | ||||||||

| Human Immunoglobulin | 200,531 | 322,063 | 850,504 | 535,940 | ||||||||

| Others | 288,556 | 450,548 |

844,520

|

942,272

|

||||||||

| Totals | $ |

40,908,316

|

$ |

33,181,545

|

$ |

68,006,869

|

$ |

54,330,143

|

||||

The Company is engaged in sale of human blood products to customers in China and India. The amount sold in India was less than 10% of total sales for the three and six months ended June 30, 2010 and June 30, 2009, respectively.

Shipping and Handling

Shipping and handling costs related to costs of goods sold are included in selling expenses and totaled $90,388 and $79,611 for the three months ended June 30, 2010 and 2009, respectively. For the six months ended June 30, 2010 and 2009, costs totaled $158,823 and $123,791, respectively.

Financial Instruments

On January 1, 2008, the Company adopted FASB’s accounting standard related to fair value measurements and began recording financial assets and liabilities subject to recurring fair value measurement at the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. These fair value principles prioritize valuation inputs across three broad levels. Receivables, payables, short and long term loans, and derivative liabilities qualify as financial instruments. Management concluded the carrying values of the receivables, payables and short term loans approximate their fair values because of the short period of time between the origination of such instruments and their expected realization, and if applicable, their stated rates of interest are equivalent to interest rates currently available. The fair values of the long term debt and derivative liabilities are measured pursuant to the three levels defined by the FASB’s accounting standard as follow:

-

Level 1: inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

-

Level 2: inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments.

-

Level 3: inputs to the valuation methodology are unobservable and significant to the fair value.

-10-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30,

2010

(Unaudited)

As required by FASB’s accounting standard, financial assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. Depending on the product and the terms of the transaction, the fair value of the derivative liabilities were modeled using a series of techniques, including closed-form analytic formula, such as the Black-Scholes Option Pricing Model, which does not entail material subjectivity because the methodology employed does not necessitate significant judgment, and the pricing inputs are observed from actively quoted markets. Derivative liabilities related to warrants issued by the Company and the liability related to derivative instruments (including the conversion option) embedded in the Company’s Senior Secured Convertible Notes are carried at fair value, with changes in the fair value charged or credited to income. The fair values are determined using the Black-Scholes Model or a binomial model, defined in FASB’s accounting standard related to fair value measurements as level 2 inputs.

| Carrying Value as of June 30, 2010 |

Fair Value Measurements at June 30,

2010 using Fair Value Hierarchy (Unaudited) |

|||||||||||

| (Unaudited) | Level 1 | Level 2 | Level 3 | |||||||||

| Derivative liabilities-Conversion option | $ | 13,522,842 | $ | - | $ | 13,522,842 | $ | - | ||||

| Warrants liabilities | $ | 8,658,837 | $ | - | $ | 8,658,837 | $ | - | ||||

The assumptions used in calculating the fair value of the derivative liabilities as of June 30, 2010 using the Black-Scholes option pricing model are as follows:

| Conversion Options | Warrants | |||||

| Expected dividend yield | 0% | 0% | ||||

| Risk-free interest rate | 0.32% | 0.60% | ||||

| Expected life (in years) | 0.93 | 1.95 | ||||

| Weighted average expected volatility | 80% | 120% |

The Company did not identify any other assets or liabilities that are required to be presented on the balance sheet at fair value in accordance with FASB’s accounting standard.

Concentration Risks

The Company's operations are carried out in the PRC and are subject to specific considerations and significant risks not typically associated with companies in North America and Western Europe. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC, and by the general state of the PRC economy. The Company's results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

The Company maintains balances at financial institutions which, from time to time, may exceed Federal Deposit Insurance Corporation insured limits for the banks located in the United States or may exceed Hong Kong Deposit Protection Board insured limits for the banks located in Hong Kong. Balances at financial institutions or state-owned banks within the PRC are not covered by insurance. Total cash in banks as of June 30, 2010 and December 31, 2009 amounted to $56,118,364 and $53,576,495, respectively, $570,424 and $1,009,053 of which are covered by insurance, respectively. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts.

-11-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2010

(Unaudited)

The Company’s major product, human albumin: 20%/10ml, 20%/25ml, 20%/50ml, 10%/10ml, 10%/25ml and 10%/50ml, accounted for 46.4% and 47.4% of the total revenues for the three months ended June 30, 2010 and 2009, respectively, and 46.6% and 51.7% of total revenues for the six months ended June 30, 2010 and 2009, respectively. If the market demands for human albumin cannot be sustained in the future or if the price of human albumin decreases, it would adversely affect the Company’s operating results.

All of the Company’s customers are located in the PRC and India. As of June 30, 2010 and 2009, the Company had no significant concentration of credit risk. There were no customers that individually comprised 10% or more of the revenue during the three and six months ended June 30, 2010 and 2009. Only one customer represented more than 10% of trade receivables at June 30, 2010 and no individual customer represented more than 10% of trade receivables at December 31, 2009. The Company performs ongoing credit evaluations of its customers’ financial condition and, generally, requires no collateral from its customers.

There were one and two vendors that individually comprised 10% or more of the purchase during the three and six months ended June 30, 2010 and no vendor that individually comprised 10% or more of the purchase during the same period in 2009. There were one individual vendors represented more than 10% of accounts payables at June 30, 2010 and none individual vendors represented more than 10% of accounts payables at December 31, 2009.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand and demand deposits in accounts maintained with state-owned banks within the PRC, Hong Kong and the United States. The Company considers all highly liquid investments with original maturities of three months or less at the time of purchase to be cash equivalents.

Accounts Receivable

During the normal course of business, the Company extends unsecured credit to its customers. Management reviews its accounts receivable on a regular basis to determine if the allowance for doubtful accounts is adequate. An estimate for doubtful accounts is made when collection of the full amount is no longer probable. Account balances are written-off after management has exhausted all efforts of collection.

Inventories

Inventories are stated at the lower of cost or market using the weighted average method. The cost of major raw materials (plasma) used in the production are being allocated based on the management’s estimation of historical yields and market value from the annual production for each different products. The cost of finished goods included direct costs of raw materials as well as direct labor used in production. Indirect production costs such as utilities and indirect labor related to production such as assembling, shipping and handling for raw material costs are also included in the cost of inventories.

-12-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2010

(Unaudited)

The Company reviews its inventory periodically for possible obsolete goods and cost in excess of net realizable value to determine if any reserves are necessary. As of June 30, 2010 and December 31, 2009, the Company reserved $742,269 and $519,333, respectively, as allowance for obsolete inventory for raw material plasma that may not qualify for production due to the 90-day quarantine period rules implemented by State Food and Drug Administration ("SFDA") on July 1, 2008.

Plant and Equipment

Plant and equipment are stated at cost less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated useful lives of the assets with 5% residual value.

Estimated useful lives of the assets are as follows:

| Estimated Useful Life | |||

| Buildings and improvement | 30 years | ||

| Machinery and equipment | 10 years | ||

| Furniture, fixtures ,office equipment and vehicle | 5-10 years |

Construction in progress represents the costs incurred in connection with the construction of buildings, new additions, and capitalized interest incurred in connection with the Company’s plant facilities. In accordance with the provisions of FASB’s accounting standard related to capitalization of interest, interest incurred on borrowings is capitalized to the extent that borrowings do not exceed construction in progress. The credit is a reduction of interest expense. No depreciation is provided for construction in progress until such time as the assets are completed and placed into service. Maintenance, repairs and minor renewals are charged directly to expenses as incurred. Major additions and betterment to property and equipment are capitalized.

The Company periodically evaluates the carrying value of long-lived assets in accordance with FASB’s accounting standard related to accounting for impairment and disposal of long-lived assets. When estimated cash flows generated by those assets are less than the carrying amounts of the asset, the Company recognizes an impairment loss. Based on its review, the Company believes that, as of June 30, 2010 and December 31, 2009, there were no impairments of its long-lived assets.

Investment in Unconsolidated Affiliate

Equity method investments are recorded at original cost and adjusted to recognize the Company’s proportionate share of the investee’s net income or losses and additional contributions made and distributions received. The Company recognizes a loss if it is determined that other than temporary decline in the value of the investment exists. Subsidiary in which the Company has the ability to exercise significant influence, but does not have a controlling interest is accounted for using the equity method. Significant influence is generally considered to exist when the Company has an ownership interest in the voting stock between 20% and 50%, and other factors, such as representation on the Board of Directors, voting rights and the impact of commercial arrangements, are considered in determining whether the equity method of accounting is appropriate. The Company accounts for investments with ownership less than 20% using cost method.

-13-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30,

2010

(Unaudited)

Intangible Assets

Intangible assets are stated at cost (estimated fair value upon contribution or acquisition), less accumulated amortization. Amortization expense is recognized on the straight-line basis over the estimated useful lives of the assets as follows:

| Intangible assets |

Estimated useful lives |

||

| Land use rights | 39-50 years | ||

| Permits and licenses | 5-10 years | ||

| Blood donor network | 10 years | ||

| Software | 3.8 years | ||

| Good Manufacturing Practice certificate | 5-10 years | ||

| Long-term customer-relationship intangible assets | 4 years |

All land in the PRC is owned by the government; however, the government grants “land use rights.” The Company has obtained rights to use most parcels of land for 50 years, and several parcels of land in entity Qianfeng for 39 years. The Company amortizes the cost of the land use rights over their useful life using the straight-line method.

Other intangible assets represent permits, licenses, blood donor network, software, Good Manufacturing Practice (“GMP”) certificate and long-term customer-relationship intangible assets. The Company amortized the cost of these intangible assets over their useful life using the straight-line method.

Intangible assets of the Company are reviewed at least annually or more often if circumstances dictate, to determine whether their carrying value has become impaired. The Company considers assets to be impaired if the carrying value exceeds the future projected cash flows from related operations. The Company also re-evaluates the years of amortization to determine whether subsequent events and circumstances warrant revised estimates of useful lives. As of June 30, 2010, the Company expects these assets to be fully recoverable.

Goodwill

Goodwill represents the excess of the cost of an acquisition over the fair value of the Company’s share of the net identifiable assets of the acquired subsidiary at the date of acquisition. Goodwill is tested annually for impairment and carried at cost less accumulated impairment losses. Impairment losses on goodwill are not reversed. Gains and losses on the disposal of an entity include the carrying amount of goodwill relating to the entity sold.

-14-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2010

(Unaudited)

Customer Deposits

Payments received before all of the relevant criteria for revenue recognition are recorded as customer deposits.

Research and Development Costs

Research and development costs composed of salary, material used and other expense as incurred.

Material used for the production of our new products that are pending for the approval from SFDA to validate for production are recorded in research and development expenses.

Retirement and Other Post Retirement Benefits

Contributions to retirement schemes (which are defined contribution plans) are charged to the statement of operations as and when the related employee service is provided.

Product Liability

The Company’s products are covered by two product liability insurance of approximately $2,934,000 (RMB 20,000,000) each for Shandong Taibang and Qianfeng. As of June 30, 2010 and December 31, 2009, no claim on the insurance policy was filed. However, there is one pre-existing potential claim against Qianfeng’s products outstanding, which are still pending and the Company believes to be immaterial to the consolidated financial statements for the period ended June 30, 2010.

Income Taxes

The Company reports income taxes pursuant to FASB’s accounting standard for income taxes. Under the asset and liability method of accounting for income taxes as required by this accounting standard, deferred income tax liabilities and assets are determined based on the temporary differences between the financial statement and tax basis of assets and liabilities using tax rates expected to be in effect during the years in which the basis differences reverse. A valuation allowance is recorded when it is more likely than not that some of the deferred tax assets will not be realized. FASB’s accounting standard for accounting for uncertainty in income taxes requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Income tax positions must meet a more-likely-than-not recognition threshold to be recognized. A tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded.

-15-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2010

(Unaudited)

Deferred tax is accounted for using the balance sheet liability method in respect of temporary differences arising from differences between the carrying amount of assets and liabilities in the financial statements and the corresponding tax basis used in the computation of assessable tax profit. In principle, deferred tax liabilities are recognized for all taxable temporary differences, and deferred tax assets are recognized to the extent that it is probable that taxable profit will be available against which deductible temporary differences can be utilized.

Deferred tax is calculated using tax rates that are expected to apply to the period when the asset is realized or the liability is settled. Deferred tax is charged or credited in the income statement, except when it is related to items credited or charged directly to equity, in which case the deferred tax is also dealt with in equity.

Deferred tax assets and liabilities are offset when they related to income taxes levied by the same taxation authority and the Company intends to settle its current tax assets and liabilities on a net basis.

Provision for income taxes consist of taxes currently due plus deferred taxes. Penalties and interest incurred related to underpayment of income tax are classified as income tax expense in the year incurred. No significant penalties or interest relating to income taxes have been incurred during the three and six months ended June 30, 2010 and 2009. GAAP also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosures and transition.

Value Added Tax

Enterprises or individuals, who sell products, engage in repair and maintenance or import and export goods in the PRC are subject to a VAT in accordance with Chinese laws. The VAT rate applicable to the Company is 6% of the gross sales price. Products distributed by Shandong Medical are subjected to a 17% VAT. No credit is available for VAT paid on purchases of raw material, and immaterial Credit is applied for VAT paid on supplies purchase.

Stock-based Compensation

The Company accounts and reports stock-based compensation pursuant to FASB’s accounting standard related to accounting for stock-based compensation which defines a fair-value-based method of accounting for stock based employee compensation and transactions in which an entity issues its equity instruments to acquire goods and services from non-employees. Stock compensation for stock granted to non-employees has been determined in accordance with this standard as the fair value of the consideration received or the fair value of equity instruments issued, whichever is more reliably measured.

-16-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2010

(Unaudited)

Noncontrolling Interest

Effective January 1, 2009, the Company adopted FASB’s accounting standard regarding non-controlling interest in consolidated financial statements. Certain provisions of this statement are required to be adopted retrospectively for all periods presented. Such provisions include a requirement that the carrying value of noncontrolling interests (previously referred to as minority interests) be removed from the mezzanine section of the balance sheet and reclassified as equity.

Further, as a result of adoption this accounting standard, net income attributable to noncontrolling interests is now excluded from the determination of consolidated net income.

-17-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2010

(Unaudited)

Recently Issued Accounting Pronouncements

In January 2010, FASB issued ASU No. 2010-01- Accounting for Distributions to Shareholders with Components of Stock and Cash. The amendments in this Update clarify that the stock portion of a distribution to shareholders that allows them to elect to receive cash or stock with a potential limitation on the total amount of cash that all shareholders can elect to receive in the aggregate is considered a share issuance that is reflected in EPS prospectively and is not a stock dividend for purposes of applying Topics 505 and 260 (Equity and Earnings Per Share). The amendments in this update are effective for interim and annual periods ending on or after December 15, 2009, and should be applied on a retrospective basis. The Company adopted this standard and the adoption of this standard did not have a material effect on the Company’s consolidated financial statements.

In January 2010, FASB issued ASU No. 2010-02 – Accounting and Reporting for Decreases in Ownership of a Subsidiary – a Scope Clarification. The amendments in this Update affect accounting and reporting by an entity that experiences a decrease in ownership in a subsidiary that is a business or nonprofit activity. The amendments also affect accounting and reporting by an entity that exchanges a group of assets that constitutes a business or nonprofit activity for an equity interest in another entity. The amendments in this update are effective beginning in the period that an entity adopts SFAS No. 160, “Non-controlling Interests in Consolidated Financial Statements – An Amendment of ARB No. 51.” If an entity has previously adopted SFAS No. 160 as of the date the amendments in this update are included in the Accounting Standards Codification, the amendments in this update are effective beginning in the first interim or annual reporting period ending on or after December 15, 2009. The amendments in this update should be applied retrospectively to the first period that an entity adopted SFAS No. 160. The Company adopted this standard and the adoption of this standard did not have material effect on the Company’s consolidated financial statements.

In January 2010, FASB issued ASU No. 2010-06 – Improving Disclosures about Fair Value Measurements. This update provides amendments to Subtopic 820-10 that requires new disclosure as follows: 1) Transfers in and out of Levels 1 and 2. A reporting entity should disclose separately the amounts of significant transfers in and out of Level 1 and Level 2 fair value measurements and describe the reasons for the transfers. 2) Activity in Level 3 fair value measurements. In the reconciliation for fair value measurements using significant unobservable inputs (Level 3), a reporting entity should present separately information about purchases, sales, issuances, and settlements (that is, on a gross basis rather than as one net number).This update provides amendments to Subtopic 820-10 that clarify existing disclosures as follows: 1) Level of disaggregation. A reporting entity should provide fair value measurement disclosures for each class of assets and liabilities. A class is often a subset of assets or liabilities within a line item in the statement of financial position. A reporting entity needs to use judgment in determining the appropriate classes of assets and liabilities. 2) Disclosures about inputs and valuation techniques. A reporting entity should provide disclosures about the valuation techniques and inputs used to measure fair value for both recurring and nonrecurring fair value measurements. Those disclosures are required for fair value measurements that fall in either Level 2 or Level 3.The new disclosures and clarifications of existing disclosures are effective for interim and annual reporting periods beginning after December 15, 2009, except for the disclosures about purchases, sales, issuances, and settlements in the roll forward of activity in Level 3 fair value measurements. Those disclosures are effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. The Company is currently evaluating the impact of this ASU, however, the Company does not expect the adoption of this ASU to have a material impact on its consolidated financial statements.

-18-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2010

(Unaudited)

In February 2010, the FASB issued Accounting Standards Update 2010-09, “Subsequent Events (Topic 855): Amendments to Certain Recognition and Disclosure Requirements,” or ASU 2010-09. ASU 2010-09 primarily rescinds the requirement that, for listed companies, financial statements clearly disclose the date through which subsequent events have been evaluated. Subsequent events must still be evaluated through the date of financial statement issuance; however, the disclosure requirement has been removed to avoid conflicts with other SEC guidelines. ASU 2010-09 was effective immediately upon issuance and was adopted in February 2010.

In April 2010, the FASB issued Accounting Standards Update 2010-13, “Compensation—Stock Compensation (Topic 718): Effect of Denominating the Exercise Price of a Share-Based Payment Award in the Currency of the Market in Which the Underlying Equity Security Trades,” or ASU 2010-13. This Update provides amendments to Topic 718 to clarify that an employee share-based payment award with an exercise price denominated in currency of a market in which a substantial porting of the entity’s equity securities trades should not be considered to contain a condition that is not a market, performance, or service condition. Therefore, an entity would not classify such an award as a liability if it otherwise qualifies as equity. The amendments in this Update are effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2010. The Company does not expect the adoption of ASU 2010-17 to have a significant impact on its consolidated financial statements.

In April 2010, the FASB issued Accounting Standard Update 20-10-17, “Revenue Recognition—Milestone Method (Topic 605): Milestone Method of Revenue Recognition” or ASU 2010-17. This Update provides guidance on the recognition of revenue under the milestone method, which allows a vendor to adopt an accounting policy to recognize all of the arrangement consideration that is contingent on the achievement of a substantive milestone (milestone consideration) in the period the milestone is achieved. The pronouncement is effective on a prospective basis for milestones achieved in fiscal years and interim periods within those years, beginning on or after June 15, 2010. Adoption of ASU 2010-17 does not have any significant impacts on its consolidated financial statements.

Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation. These reclassifications have no effect on net income or cash flows.

Note 4 – Related party transactions

The material related party transactions undertaken by the Company with related parties as of June 30, 2010 and December 31, 2009 are presented as follows:

-19-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30,

2010

(Unaudited)

| June 30, 2010 | December 31, | ||||||||

| Assets | Purpose | (unaudited) | 2009 | ||||||

| Accounts receivable – related party(1) | Processing fees | $ | 229,817 | $ | 222,617 | ||||

| June 30, 2010 | December 31, | ||||||||

| Liabilities |

Purpose |

(unaudited) | 2009 | ||||||

| Short term loans – holder of noncontrolling interest(2) | Loan | $ | - | $ | 3,652,500 | ||||

| Accrued interest – holder of noncontrolling interest(2) | Interest payable | $ | - | $ | 2,068,526 | ||||

| Other payable – related parties(3) | Loan | $ | 2,131,455 | $ | 2,122,772 | ||||

| Other payable – related parties(4) | Contribution | 968,109 | 964,168 | ||||||

| Distribution payable to noncontrolling interest | Distribution | 589 | 587 | ||||||

| Total other payable – related parties | $ | 3,100,153 | $ | 3,087,527 |

(1) Qianfeng provides processing services for Guizhou Eakan, one of the Qianfeng’s non-controlling shareholders. The Company’s total processing services income amounted to $125,628 and $150,677 for the three months period ended June 30, 2010 and 2009, respectively. The Company’s total processing services income amounted to $362,659 and $393,406 for the six months period ended June 30, 2010 and 2009, respectively. Starting from second quarter of 2010, Qianfeng changed the business model from processing service to full manufacturing, which includes raw material procurement, and selling of finished goods to Guizhou Eakan, The Company’s sales income amounted to $201,881 for the three and six-month period ended June 30, 2010. As of June 30, 2010 and December 31, 2009, accounts receivable due from Guizhou Eakan amounted to $229,817 and $222,617, respectively. The outstanding balance as of June 30, 2010 has been paid in cash in July 2010.

(2) On April 6, 2009, Logic Express entered into an equity transfer and entrustment agreement, or Entrustment Agreement, among Logic Express, Shandong Taibang, and the Shandong Institute of Biological Products, or the Shandong Institute, the holder of the noncontrolling interests in Shandong Taibang, pursuant to which, Logic Express agreed to permit Shandong Taibang and the Shandong Institute to participate in the indirect purchase of Qianfeng's equity interests. Under the terms of the Entrustment Agreement, Shandong Institute agreed to contribute 12.86% or $3,652,500 (RMB 25,000,000) of the Dalin purchase price. Logic express is obligated to repay to the Shandong Institute their investment amount on or before April 6th, 2010, along with their pro rata share, based on their percentage of the Dalin purchase price contributed, of any distribution on the indirect equity investment in Qianfeng payable to Logic Express during 2009. As of June 30, 2010, the Company was able to settle the interest liability with Shandong Institute for $913,839 less than the Company’s previous’ estimation and resulted in an other non-operating income of $913,839. On April 12, 2010, the Company fully paid the Shandong Institute and Shandong Taibang on the respective investment amounts, as well as the interest, according the Entrustment Agreement. The interest paid to the Shandong Institute is approximately $1,154,687 final interest settlement plus additional interest of $135,541 for the six days from April 6, 2010 to April 12, 2010.

(3) Qianfeng has payables to Guizhou Eakan Investing Corp. in the amount of approximately $2,131,455 (RMB14,470,160). Guizhou Eakan Investing Corp. is one of the shareholders of Guizhou Eakan, one of the Qianfeng’s minority shareholders. The Company borrowed this non-interest bearing amount for working capital purposes. The balance is due on demand in the form of cash.

-20-

CHINA BIOLOGIC PRODUCTS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2010

(Unaudited)

(4) Qianfeng has payables to Guizhou Jie’an, a holder of noncontrolling interest, in amount of approximately $968,109 (RMB 6,569,840). In 2007, Qianfeng received additional contributions from Guizhou Jie’an in the amount of $962,853 to maintain Jie’an ownership interest in the Company at 9%. However, due to legal dispute among Shareholders over Raising Additional Capital as stated in the legal proceeding section, commitment and contingent liabilities, the money may be returned to Jie’an. During the second quarter of 2010, Jie’an requested Qianfeng to register its 1.8 million shares of additional capital infusion as per Equity Purchase Agreement and was approved by the majority shareholders of Qianfeng in a shareholders meeting held in the second quarter of 2010. However, the request is still waiting for the Company’s Board to ratify the validity and the completion of the registration with PRC’s local AIC. If such request is granted, Dalin’s ownership in Qianfeng will be diluted from 54% to 52.54%.

Note 5 – Accounts receivable

| Trade accounts receivable consist of the following: | ||||||

| June 30, 2010 | December 31, 2009 | |||||

| (unaudited) | ||||||

| Trade accounts receivable | $ | 6,912,404 | $ | 3,022,031 | ||

| Less: Allowance for doubtful accounts | (1,253,975 | ) | (1,254,955 | ) | ||

| Total | $ | 5,658,429 | $ | 1,767,076 |