Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - China Biologic Products Holdings, Inc. | exhibit21.htm |

| EX-32.2 - EXHIBIT 32.2 - China Biologic Products Holdings, Inc. | exhibit32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - China Biologic Products Holdings, Inc. | exhibit32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - China Biologic Products Holdings, Inc. | exhibit31-1.htm |

| EX-23.2 - EXHIBIT 23.2 - China Biologic Products Holdings, Inc. | exhibit23-2.htm |

| EX-31.2 - EXHIBIT 31.2 - China Biologic Products Holdings, Inc. | exhibit31-2.htm |

| EX-23.1 - EXHIBIT 23.1 - China Biologic Products Holdings, Inc. | exhibit23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

(Mark One)

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2010

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________to _____________

Commission File No. 001-34566

CHINA BIOLOGIC PRODUCTS,

INC.

(Exact name of registrant as specified in its

charter)

| Delaware | 75-2308816 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) |

No. 14 East Hushan Road

Tai’an City, Shandong 271000

People’s Republic of China

(Address of principal executive offices)

(+86) 538-620-2306

(Registrant’s telephone

number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [x]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [x]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [x] |

| Non-Accelerated Filer [ ] | Smaller reporting company [x] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [x]

As of June 30, 2010 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the shares of the registrant’s common stock held by non-affiliates (based upon the closing sale price of such shares as reported on the NASDAQ Global Select Market) was approximately $96.3 million. Shares of the registrant’s common stock held by each executive officer and director and each by each person who owns 10% or more of the outstanding common stock have been excluded from the calculation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There were a total of 24,351,125 shares of the registrant’s common stock outstanding as of March 25, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

None.

| Annual Report on Form 10-K |

| For the Fiscal Year Ended December 31, 2010 |

TABLE OF CONTENTS

| Item 1. | Business. | 1 |

| Item 1A. | Risk Factors | 16 |

| Item 1B. | Unresolved Staff Comments. | 29 |

| Item 2. | Properties. | 29 |

| Item 3. | Legal Proceedings. | 29 |

| Item 4. | (Removed and Reserved). | 33 |

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 33 |

| Item 6. | Selected Financial Data | 34 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 34 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 42 |

| Item 8. | Financial Statements and Supplementary Data. | 43 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 43 |

| Item 9A. | Controls and Procedures | 44 |

| Item 9B. | Other Information | 45 |

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance. | 45 |

| Item 11. | Executive Compensation | 52 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 56 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 56 |

| Item 14. | Principal Accounting Fees and Services. | 60 |

PART IV

| Item 15. | Exhibits, Financial Statement Schedules | 61 |

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements. Risks and uncertainties that could cause actual results to differ materially from those anticipated include risks related to, among others: our ability to overcome competition from local and overseas pharmaceutical enterprises; decrease in the availability, or increase in the cost, of plasma; failure to obtain PRC governmental approval to increase retail prices of certain of our biopharmaceutical products; difficulty in servicing our debt; loss of key members of our senior management; and unexpected changes in the PRC government’s regulation of the biopharmaceutical industry in China, or changes in China’s economic situation and legal environment. Additional disclosures regarding factors that could cause our results and performance to differ from results or performance anticipated by this report are discussed in Item 1A. “Risk Factors.”

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation, except as required by law, to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

- “China Biologic,” the “Company,” “we,” “us,” or “our,” are to the combined business of China Biologic Products, Inc., a Delaware corporation, and its direct and indirect subsidiaries;

- “Logic Express” are to our wholly owned subsidiary Logic Express Limited, a BVI company;

- “Logic Holdings” are to our wholly-owned subsidiary Logic Holdings (Hong Kong) Limited, a Hong Kong company;

- “Logic China” are to our wholly owned subsidiary Logic Management and Consulting (China) Co., Ltd., a PRC company;

- “Logic Beijing” are to our wholly owned subsidiary Logic Taibang Bio-Tech Institute (Beijing), a PRC company;

- “Dalin” are to our majority owned subsidiary Guiyang Dalin Biologic Technologies Co., Ltd., a PRC limited company;

- “Shandong Taibang” are to our majority owned subsidiary Shandong Taibang Biological Products Co. Ltd., a sino-foreign joint venture incorporated in China;

- “Taibang Medical” are to our wholly owned subsidiary Shandong Taibang Medical Company, a PRC company;

- “Guizhou Taibang” are to our majority owned subsidiary Guizhou Taibang Biological Products Co., Ltd., a PRC company, formerly, Guiyang Qianfeng Biological Products Co., Ltd.;

- “Huitian” are to our minority owned subsidiary Xi'an Huitian Blood Products Co., Ltd., a PRC company;

- “BVI” are to the British Virgin Islands;

- “Hong Kong” are to the Hong Kong Special Administrative Region of the People’s Republic of China;

- “PRC” and “China” are to the People’s Republic of China;

- “SEC” are to the Securities and Exchange Commission;

- “Securities Act” are to the Securities Act of 1933, as amended;

- “Exchange Act” are to the Securities Exchange Act of 1934, as amended;

- “Renminbi” and “RMB” are to the legal currency of China; and

- “U.S. dollars,” “dollars” and “$” are to the legal currency of the United States.

1

PART I

ITEM 1. BUSINESS.

Overview of Our Business

We are a biopharmaceutical company and through our indirect PRC subsidiaries, Shandong Taibang and Guizhou Taibang, and our minority-owned PRC investee, Huitian, we are principally engaged in the research, development, manufacturing and sales of plasma-based pharmaceutical products in China. Shandong Taibang operates from our manufacturing facility located in Tai’an, Shandong Province, and Guizhou Taibang operates from our manufacturing facility located in Guiyang City, Guizhou Province. Our minority owned investee, Huitian, operates from its facility in Shaanxi Province. The plasma-based biopharmaceutical manufacturing industry in China is highly regulated by both the provincial and central governments. Accordingly, the manufacturing process of our products is strictly monitored from the initial collection of plasma from human donors to finished products. Our principal products include our approved human albumin and immunoglobulin products.

We are approved to sell human albumin 20%/10ml, 20%/25ml and 20%/50ml, 10%/10ml, 10%/25ml, 10%/50ml and 25%/50ml. Human albumin is our top-selling product. Sales of these human albumin products represented approximately 48.0%, 49.7% and 57.8% of our total revenues, respectively, for the each of the years ended December 31, 2010, 2009 and 2008. Human albumin is principally used to increase blood volume while immunoglobulin, one of our other major products, is used for certain disease preventions and cures. The Company’s approved human albumin and immunoglobulin products use human plasma as raw material. Albumin has been used for almost 50 years to treat critically ill patients by replacing lost fluid and maintaining adequate blood volume and pressure. All of our products are prescription medicines administered in the form of injections.

We sell our products to customers in the PRC, mainly hospitals and inoculation centers. Our sales have historically been made on the basis of short-term arrangements and our largest customers have changed over the years. For the years ended December 31, 2010, 2009 and 2008, our top 5 customers accounted for approximately 12.3%, 10.7% and 16.2%, respectively, of our total revenue. For the years ended December 31, 2010, 2009 and 2008, our largest customer accounted for approximately 2.8%, 4.0% and 6.4%, of our revenue, respectively. As we continue to diversify our geographic presence, customer base and product mix, we expect that our largest customers will continue to change from year to year. We have product liability insurance covering all of our products. However, since our establishment in 2002, there has not been any product liability claims nor has any legal action been filed against the Company brought by patients related to the use of our products.

Our principal executive offices are located at No. 14 East Hushan Road, Tai’an City, Shandong, the People’s Republic of China 271000. Our corporate telephone number is (86) 538-620-2306 and our fax number is (86)538-620-3895. We maintain a website at http://www.chinabiologic.com that contains information about our operating company, but that information is not part of this report.

Our History and Background

China Biologic Products, Inc. was originally incorporated on December 20, 1989 under the laws of the State of Texas, as Shepherd Food Equipment, Inc. On November 20, 2000, Shepherd Food Equipment, Inc. changed its corporate name to Shepherd Food Equipment, Inc. Acquisition Corp., which is the survivor of a May 28, 2003 merger with GRC Holdings, Inc. or GRC. In the merger, the Company adopted the Articles of Incorporation and By-Laws of GRC and changed its corporate name to GRC Holdings, Inc. On January 10, 2007, a Plan of Conversion became effective pursuant to which GRC was converted into a Delaware corporation and changed its name to China Biologic Products, Inc.

Acquisition of Logic Express

On July 19, 2006, we completed a reverse acquisition with Logic Express, whereby we issued to the shareholders of Logic Express 18,484,715 shares of our common stock in exchange for 100% of the issued and outstanding shares of capital stock of Logic Express and its majority-owned Chinese operating subsidiary, Shandong Taibang. As a result of the reverse acquisition, Logic Express became our 100% owned subsidiary, the former shareholders of Logic Express became our controlling stockholders with 96.1% of our common stock, and Shandong Taibang became our 82.76% majority-owned indirect subsidiary. Shandong Taibang is a sino-foreign joint venture company established on October 23, 2002 with a registered capital of RMB 80 million (then approximately $10.3 million).

Acquisition of Plasma Stations

In December 2006, our subsidiary, Shandong Taibang, acquired all the assets of five plasma stations in Shandong Province. We obtained the permit to operate the stations in January 2007. In April 2007, Shandong Taibang acquired certain assets of two plasma stations in Guangxi Province. The two plasma stations obtained their operating permits in February and April 2007, respectively.

2

We acquired the assets of these plasma stations through separate Shandong Taibang subsidiaries, specially formed for this purpose. The subsidiaries holding six of our new plasma stations are the Xia Jin Plasma Company, the Qi He Plasma Company, the He Ze Plasma Company, the Huan Jiang Plasma Company, the Liao Cheng Plasma Company, and the Zhang Qiu Plasma Company. The seventh plasma station is held by the Fang Cheng Plasma Company, which at the time was 80% owned by Shandong Taibang and 20% owned by Feng Lin, an unrelated third party. On January 13, 2010, Shandong Taibang acquired the 20% non-controlling interest in the Fang Cheng Plasma Company, and it is now wholly-owned by Shandong Taibang. In January 2007, Shandong Taibang also signed a letter of intent to acquire certain assets of a plasma station in Guangxi Province, however, we have not consummated this acquisition as the permit for this station is in dispute, as described in Item 3, “Legal Proceedings.”

In June 2008, we received approval from the Guangxi Province Bureau of Health to set up a new plasma collection station in Pu Bei County, Guangxi Province. The new plasma collection station will be located in the Centralized Industry Zone of Pu Bei County and when it becomes operational, it will replace our existing Fang Cheng Plasma Collection Station. We decided to relocate the Fang Cheng Plasma Collection Station to a more strategic location, also in Guangxi, to increase collection volumes.

On January 22, 2010, Shandong Taibang entered into an equity transfer agreement with Yuncheng Ziguang Biotechnology Co., Ltd. (“Yuncheng Ziguang”), located in Yuncheng, Shandong Province. Under the terms of the equity transfer agreement, Shandong Taibang agreed to purchase 100% of Yuncheng Ziguang’s equity interest at a purchase price of RMB 10,066,672 (approximately $1,476,781), which was paid on February 24, 2010. The purpose of this acquisition is for relocation of Shandong Taibang’s He Ze Plasma Company into the nearby Yuncheng Ziguang facility. In February 2011, the He Ze Plasma Company moved into the Yuncheng Ziguang facility and began collecting plasma. Currently Yuncheng Ziguang has no other operations.

On July 7, 2010, Shandong Taibang invested RMB 6,000,000 (approximately $910,200) to establish a wholly-owned subsidiary, Ning Yang Plasma Company, in Shandong Province. The Ning Yang Plasma Company was still under construction as of December 31, 2010.

On July 20, 2010, Shandong Taibang invested another RMB 6,000,000 (approximately $910,200) to establish a wholly-owned subsidiary, Yishui Plasma Company, in Shandong Province. The Yi Shui Plasma Company obtained its operating permits from relevant PRC authorities on December 6, 2010, and had commenced operation as of December 31, 2010.

Establishment of Taibang Medical

In September 2006, Shandong Taibang established a wholly owned subsidiary, Taibang Medical (known then as Shandong Missile Medical Co., Ltd.), with registered capital of $384,600, fully paid on March 1, 2007. On February 7, 2007, Taibang Medical obtained a distribution license for biological products, except for vaccine, from the Shandong Food and Drug Administration, for a license period of five years from the date of obtaining the license. The registration of Taibang Medical was ultimately approved by Shandong Provincial Department of Foreign Trade and Economic Cooperation on July 4, 2007 and Taibang Medical was registered on July 19, 2007. The scope of business is wholesale of biological products, except vaccines, with a license period of 25 years from the date of registration.

On August 14, 2009, we changed Taibang Medical’s name from Shandong Missile Medical Co., Ltd. to Shandong Taibang Medical Company. In addition, the registered capital of Taibang Medical was increased by RMB 2,000,000 (approximately $293,400) to $733,500.

On July 8, 2010, Logic China, our PRC operating subsidiary, entered into an equity transfer agreement to purchase 100% of the equity interest in Taibang Medical from Shandong Taibang with a cash purchase price of RMB 6,440,000 (approximately $947,327). The equity transfer was registered with the local Administration for Industry and Commerce, or the AIC, on September 10, 2010 and the purchase price was fully paid on September 23, 2010. With this equity transfer, Taibang Medical is now the Company’s indirect wholly-owned subsidiary and the Company will be able to consolidate its resources in the sale and marketing of Shandong Taibang and Guizhou Taibang’s products.

Formation of Hong Kong Subsidiary

On December 12, 2008, we established Logic Holdings, our wholly-owned Hong Kong subsidiary, for the purpose of being a holding company for our majority equity interest in Dalin.

Dalin Acquisition and Entrustment Agreement

We completed the acquisition of 90% interest in Dalin in April 2009 upon payment of 90% of the purchase price. We substantially paid the remaining 10% of the purchase price, RMB 19,440,000 (approximately $2,844,350), on April 9, 2010, the one-year anniversary of the approval of the equity transfer by the local Administration for Industry and Commerce, or AIC.

3

On January 4, 2011, we entered into an equity transfer agreement with Shaowen Fan to acquire the remaining 10% minority interest in Dalin for a purchase price of RMB 50,000,000 (approximately $7,585,000). The equity transfer was registered with the local AIC on January 26, 2011 and the purchase price was fully paid as of February 22, 2011 in accordance with the equity transfer agreement. With this equity transfer, Guiyang Dalin is now the Company’s indirect wholly-owned subsidiary.

On April 6, 2009, Logic Express entered into an agreement with Shandong Institute, the noncontrolling interest holders in Shandong Taibang, pursuant to which, Shandong Institute would provide an advance to assist Logic Express’s purchase of 90% Dalin's equity interests. Under the terms of the agreement, Shandong Institute agreed to provide advance of $3,792,500 (RMB25,000,000), representing 12.86% of the Company’s purchase consideration in Dalin to the Company for one year, bearing interest equal to the higher of a proportionate share of the net income of Dalin during the year ended December 31, 2009 or 6% per annum. On April 12, 2010, the Company fully paid the advance from Shandong Institute and the interest of approximately $1.3 million, which was less than the Company’s previous estimate by approximately $0.9 million. The Company recorded the difference between the previous estimate and actual payment in other income of the consolidated statement of income for the year ended December 31, 2010.

As part of our due diligence investigation into Dalin and Guizhou Taibang, we discovered that our indirect interest in Guizhou Taibang acquired under the equity transfer agreement may be diluted to as low as 41.3%. The local AIC records show Dalin as a 54% shareholder of Guizhou Taibang; however, the AIC records do not reflect a potential issuance of Guizhou Taibang’s equity interests to certain investors in May 2007, pursuant to a capital increase agreement. Guizhou Taibang has received the consideration for the potential issuance of equity interests, but the increase in registered capital and the related issuance of the equity interest has not yet been registered with the local AIC, pending the outcome of a minority shareholder suit against Guizhou Taibang and its then shareholders, alleging violation of the shareholder’s right of first refusal in connection with the May 2007 equity issuance. For details regarding the Guizhou Taibang shareholder suit and our position with respect to the May 2007 equity issuance of Guizhou Taibang’s equity interests, see our disclosure under Item 3, “Legal Proceedings” herein.

Guizhou Taibang is one of the largest plasma-based biopharmaceutical companies in China and is the only manufacturer currently operating in Guizhou Province. With a population of 39 million, Guizhou Province has historically produced the highest volumes of plasma collection in China, because a higher proportion of its population has been willing to engage in the collection process. Guizhou Province has a total of 19 plasma collection stations in operation, collecting approximately 1,200 tons of plasma supply every year. Guizhou Taibang owns seven of these plasma collection stations, of which five are currently in operation and collecting approximately 300 tons of plasma supply per year, with an annual capacity of 400 tons. We intend to employ more advanced collection techniques at these stations to improve yields and generate additional plasma supply. Guizhou Taibang is in compliance with Good Manufacturing Practices, or GMP, standards, and has been approved by the PRC’s State Food and Drug Administration, or SFDA, to produce six types of plasma-based products including Human Albumin, Human Immunoglobulin, Human Intravenous Immunoglobulin, Human Hepatitis B Immunoglobulin, Human Tetanus Immunoglobulin and Human Rabies Immune Globulin.

On December 30, 2010, the Guiyang AIC approved Guizhou Taibang’s application to change its name to Guizhou Taibang Biological Products Co., Ltd. We expect that the name change will facilitate the Company’s promotion of the “Taibang” brand name and further the Company’s integration of its marketing efforts.

On November 11, 2010, the Company established Guiyang Qianfeng Biological Technology Co., Ltd., a wholly-owned subsidiary of Guizhou Taibang, in Guiyang, Guizhou, for the purpose of research and development of placenta based products.

Huitian Acquisition

We purchased a 35% equity interest in Huitian at a purchase price of RMB 44,000,000 (approximately $6,454,800) in October 2008. Huitian is a manufacturer of plasma-based biopharmaceutical products in Shaanxi Province and is one of only 32 such manufacturers in China which are government approved. Shaanxi Province, which has a population of 37 million, has had a historically high collection volume with approximately ten plasma collection stations in operation, collecting approximately 300 tons of plasma supply each year. Only four of the collection stations in Shaanxi Province are government approved and three of these are owned by Huitian. Huitian produces about 80 tons of plasma-based products per year and has 200 tons of annual production capacity. We believe Huitian provides a strong long-term growth potential. Huitian is in compliance with GMP standards and it is also approved by the SFDA for the production of Human Albumin, Human Immunoglobulin, Human Immunoglobulin for Intravenous Injection, and Human Hepatitis B Immunoglobulin products.

4

Formation of PRC Subsidiaries

On December 21, 2009, our Hong Kong subsidiary, Logic Holdings, established Logic China for the purpose of holding our majority equity interest in Dalin and to facilitate our Chinese operations at the holding company level. On December 28, 2009, the Company transferred its 90% equity interest in Dalin from Logic Holdings to Logic China to complete this process.

On August 5, 2010, Logic China formed a wholly-owned subsidiary, Logic Taibang Bio-Tech Institute (Beijing) (“Logic Beijing”), with a registered capital of RMB 1 million (approximately, $149,700). Logic Beijing was established to operate all research and development activities of the Company and its subsidiaries.

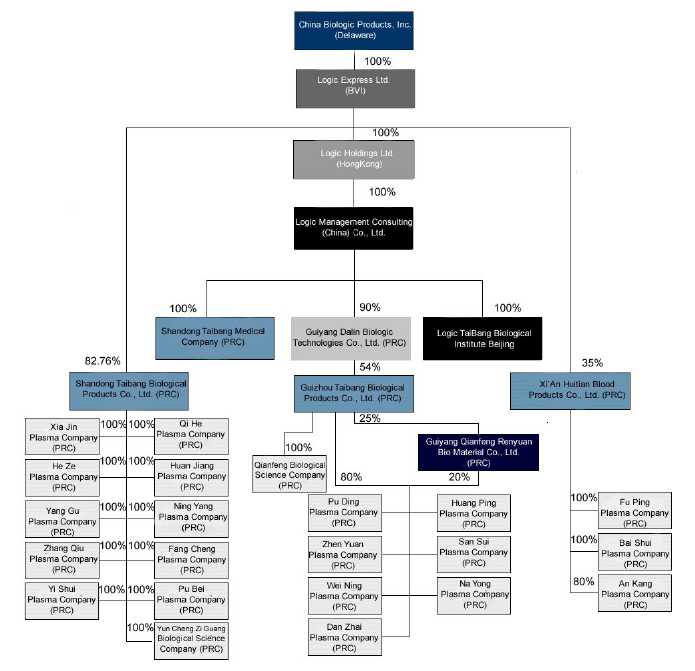

Corporate Structure

The following chart reflects our current corporate organizational structure:

5

Our Industry

Plasma Collection in China

The collection of human plasma in China is generally influenced by a number of factors such as government regulations, geographical locations of collection stations, sanitary conditions of collection stations, living standards of the donors, and cultural and religious beliefs. Until 2006, only licensed Plasmapheresis stations owned and operated by the government could collect human plasma. Furthermore, each collection station was only allowed to supply plasma to the one manufacturer that had signed the “Quality Responsibility” statement with them. However, in March 2006, the Ministry of Health promulgated certain “Measures on Reforming Plasma Collection Stations,” or the Blood Collection Measures, whereby the ownership and management of PRC plasma stations are required to be transferred to plasma-based biopharmaceutical companies and the local government is charged with regulatory supervision and administrative control in accordance with the policies of the central government. Plasma stations that did not complete their reform by December 31, 2006 risked revocation of their license to collect plasma.

The supply of plasma for plasma-based products in the PRC has been on the decline since 2003 from the historical high of annual supply of approximately 7,000 tons to approximately 4,000 tons. We believe that this decline is a direct result of the government’s industry reforms of the country’s collection practices which led to the closure of many stations that did not meet the new industry standards. Based on reports promulgated by the PRC Ministry of Health, we estimate that the current annual supply of plasma in China amounts to approximately 4,000 tons, as compared to 30,000 tons in the global market, with the six largest manufacturers of plasma products accounting for approximately 50% of the annual plasma collection. In spite of the shortage of plasma supply, revenues from the sale of plasma products in China amounted to approximately $1.1 billion in 2009 per management’s estimate, and revenues from the sale of human albumin products accounted for about 70%. We expect that the plasma derivatives market to grow at a 15% rate per year through 2011.

We believe that these regulatory changes, including measures which limit illegal selling of blood, have improved the quality of blood and plasma by increasing cleanliness standards at blood collection stations. As the operation of the plasma stations become more regulated and the donor population expands, we believe that the overall quality of raw materials, such as human albumin will continue to improve, leading to a safer, more reliable finished product.

Plasma-Based Products Industry in China

We produce approved human albumin and immunoglobulin products, with human plasma as the main ingredient. In addition to the low usage ratio of such products in China as compared to other more developed countries, there is a significant difference in the make up and range of the plasma-based pharmaceutical products. Based on our analysis, in most developed countries like the United States, clotting factor products accounts for the majority of the plasma-based biopharmaceutical products, while in China, human albumin products accounts for the vast majority of such products. Specifically, total clotting factor products and human albumin products, account for approximately 40% and 25%, respectively, of United States’ total annual plasma-derived products, and account for approximately 3% and 59%, respectively, of China’s.

Our Growth Strategy

Our mission is to become a first-class biopharmaceutical enterprise in China. To achieve this objective, we have implemented the following strategies:

- Securing the supply of plasma. Due to the shortage of plasma and the reform of the ownership of plasma stations, our immediate strategy is to negotiate and acquire plasma stations in order to secure our plasma supply. In December 2006, we acquired five of the plasma stations in Shandong Province. Furthermore, in January 2007, we acquired two additional plasma stations in Guangxi Province. In June 2008, we received approval from the Guangxi Province Bureau of Health to set up a new plasma collection station in Pu Bei County, Guangxi Province, which, when operational, will replace our existing Fang Cheng Plasma Collection Station. We decided to relocate the Fang Cheng Plasma Collection Station to a more strategic location to increase collection volumes. During the construction period, the station will still continue with its normal operations. With the approval of the Centralized Industry Zone of Pu Bei County, once the Fang Cheng Plasma Collection Station becomes operational, we hope to expand its coverage area to secure higher collection volumes in the future. In January, 2010, Shandong Taibang purchased 100% of Yuncheng Ziguang Biotechnology Co., Ltd., or Yuncheng Ziguang, located in Yuncheng, Shandong Province, for the purpose of relocation of Shandong Taibang’s He Ze Plasma Company, or He Ze, into the nearby Yuncheng Ziguang facility. In February 2011, the He Ze Plasma Company moved into Yuncheng Ziguang and began collecting plasma. We hope to expand He Ze to secure higher collection volumes in the future. In 2010, we additionally established two new plasma companies in Shandong Province, one of which began operation in December 2010 and the other of which is still under construction. We also expect that our acquisition of Dalin and its PRC operating subsidiary, Guizhou Taibang, and our acquisition of a minority equity interest in Huitian, will help secure our plasma supply as well as expand production capacity and market coverage.

6

-

Acquisition of competitors and/or other biologic related companies. In addition to organic growth, acquisition is an important part of our expansion strategy. Although there are about 32 approved plasma-based biopharmaceutical manufacturers in the market, we believe that there are only 26 manufacturers in operation, only about half of whom will be competitive. The top six manufacturers in China account for more than 50% market share. Furthermore, we believe that the regulatory authorities are considering further reforming the industry and those smaller, less competitive manufacturers will face the possibility of having their manufacturing permits revoked by the regulators, making them potential targets for acquisition. Also, if we are presented with appropriate opportunities, we may acquire additional companies, products or technologies in the biologic related sectors (including but not limited to medical, pharmaceutical and biopharmaceutical).

-

Further strengthening of research and development capability. We believe that, unlike other more developed countries such as the U.S., China’s plasma-based biopharmaceutical products are at the initial stage of development. There are many other plasma-based products that are being used in the U.S. which are not currently being manufactured in China. We intend to strengthen our research and development capability so as to expand our product line to include higher-margin, technologically more advanced plasma-based biopharmaceutical products. We believe that our increased focus on research and development will give us a competitive advantage over our competitors.

-

Market development and network expansion. Leveraging on the high quality and excellent safety record of our products, we intend to (i) enhance our product penetration with our existing customers by introducing new products and (ii) extend the reach of our products from our current market to include other provinces where we envision significant market potential.

Our Products

Our principal products are our approved human albumin and immunoglobulin products. We are currently approved to produce 21 biopharmaceutical products in eight major categories as follows:

| Approved Products (1)(2) | Cure/Use |

| Human Albumin: - 20%/10ml, 20%/25ml, 20%/50ml, 10%/10ml, 10%/25ml, 10%/50ml and 25%/50ml | Shock caused by blood loss trauma or burn; raised intracranial pressure caused by hydrocephalus or trauma; Oedema or ascites caused by hepatocirrhosis and nephropathy; prevention and cure of low-density- lipoproteinemia; and Neonatal hyperbilirubinemia. |

| Human Hepatitis B Immunoglobulin – 100 International Units, or IU, 200IU, 400IU | Prevention of measles and contagious hepatitis. When applied together with antibiotics, its curative effect on certain severe bacteria or virus infection may be improved. |

| Human Immunoglobulin – 10%/3ml and 10%/1.5ml | Original immunoglobulin deficiency, such as X chain low immunoglobulin, familiar variable immune deficiency, immunoglobulin G secondary deficiency; Secondary immunoglobulin deficiency: such as severe infection, newborn sepsis; and Auto-immune deficiency diseases, such as original thrombocytopenia purpura or kawasaki disease. |

| Human Immunoglobulin for Intravenous Injection – 5%/25ml and 5%/50ml | Same as above |

| Human Immunoglobulin-5g/vial | Same as above |

| Thymopolypeptides Injection – 20mg/2ml,5mg/2ml | Cure for various original and secondary T-cell deficiency syndromes, some auto-immune deficiency diseases and various cell immunity deficiency diseases, and assists in the treatment for tumors. |

| Human Rabies Immunoglobulin – 100IU, 200IU and 500IU | Mainly for passive immunity from bites or claws by rabies or other infected animals. All patients suspected of being exposed to rabies will be treated with a combined dose of rabies vaccine and human rabies immunoglobulin. |

| Human Tetanus Immunoglobulin – 250IU | Mainly used for the prevention and therapy of tetanus. Particularly applied to patients who have allergic reactions to Tetanus Antitoxin. (3) |

| (1) |

“%” represents the degree of dosage concentration for the product and each product has its own dosage requirement. For example, Human Albumin 20%/10ml means 2g of Human Albumin is contained in each 10ml packaging and Human Immunoglobulin 10%/3ml means 300mg of Human Immunoglobulin is contained in each 3ml packaging. Under PRC law, each variation in the packaging, dosage and concentration of medical products requires registration and approval by the SFDA. During this process the altered product is not commercially available for sale. For example, among our Human Albumin products only Human Albumin 20%/10ml, 20%/25ml, 20%/50ml, 10%/10ml, 10%/25ml, 10%/50ml, and 25%/50ml products are currently approved and are commercially available. |

7

| (2) | “IU” means International Units, or IU. IU is a unit used to measure the activity of many vitamins, hormones, enzymes, and drugs. An IU is the amount of a substance that has a certain biological effect. For each substance there is an international agreement on the biological effect that is expected for 1 IU. In the case of Immunoglobulin, it means the number of effective units of antibodies in each package. When exposed to an antigen, the body views it as foreign material, and takes steps to neutralize the antigen. Typically, the body accomplishes this by making antibodies, which are intended to defend the body from invasion by potentially dangerous substances. These antibodies can be beneficial, as is the case when the body learns to fight a virus, or they can be harmful, in the instance of allergies. In a situation when the body cannot effectively react with these antigens, injection of our product will provide sufficient antibodies to neutralize the antigens. |

| (3) | “Tetanus Antitoxin” is a cheaper injection treatment for tetanus. However it is not widely used because most people are allergic to it. |

______________

Human albumin is principally used to increase blood volume while immunoglobulin is used for certain disease preventions and cures. Albumin is also used to treat critically ill patients by replacing lost fluid and maintaining adequate blood volume and pressure. Our approved human albumin and immunoglobulin products use human plasma as the basic raw material. All of our approved products are prescription medicines administered in the form of injections.

Under PRC law, each variation in the packaging, dosage and concentration of medical products requires registration and approval by the SFDA. During this process the altered product is not commercially available for sale. For example, among our human albumin products only Human Albumin 20%/10ml, 20%/25ml, 20%/50ml, 10%/10ml, 10%/25ml, 10%/50ml, and 25%/50ml products are currently approved and are commercially available. Accordingly, all references, in this report, to our manufacture and sale of human albumin relate to our approved human albumin products.

We have two product liability insurances covering Shandong Taibang and Guizhou Taibang’s products in the amount of approximately $3,034,000 (RMB 20,000,000) each. Since our establishment in 2002, there has not been any product liability claims nor has any legal action been filed against us by patients related to the use of our products.

Raw Materials

Plasma

Plasma is the principal raw material for our biopharmaceutical products. Until 2006, all plasma collection stations were owned by the PRC government. Following the mandated privatization of plasma stations resulted from the Ministry of Health’s Blood Collection Measures, we acquired our stable of plasma collection stations. We believe that the acquisitions of plasma stations will give us a controlled source of plasma and better control over the quality and quantity produced. We will also be able to have increased control over the cost of plasma. Finally, we believe that we will enjoy benefits of economies of scale with respect to the administration and management expenses of our several plasma stations.

We spent $51.0 million, $35.6 million and $14.0 million on the collection of plasma in 2010, 2009 and 2008, respectively. Currently, we own six operating plasma collection stations in Shandong province, two in Guangxi province and five in Guizhou province, and two under construction in each of Shandong and Guangxi provinces. We currently maintain sufficient plasma supply for approximately 6 months of production. In March 2007, the SFDA implemented new measures on biopharmaceutical industry effective as of July 1, 2008, requiring plasma raw material to be kept for at least 90 days before being put into production. In view of the new measures, in due course we will extend our plasma supply for approximately four months. We have not experienced any interruptions to our production due to shortage of plasma.

Other Raw Materials and Packaging Materials

Other raw materials used in the production of our biopharmaceutical products include: reagents, consumables and packaging materials. The principal packaging materials we use include glass bottles for our injection products, external packaging and printed instructions for our biopharmaceutical products. We acquire our raw materials and packaging materials from our approved suppliers in China and overseas. We select our suppliers based on quality, consistency, price and delivery of the raw materials which they supply.

We have not experienced any shortage of supply on these raw materials and packaging materials and there has not been any significant problem with the quality of materials supplied by these suppliers.

Our Major Suppliers

The table below lists our major suppliers as of December 31, 2010, showing the cumulative dollar amount of raw materials and supplies purchased from them during the fiscal year ended December 31, 2010, and the percentage of purchases from each supplier as compared to procurement of all raw materials.

8

Rank |

Supplier's Name |

Cumulative Amount Purchased During Fiscal Year 2010 (US$) |

Percentage of Total Purchases During Fiscal Year 2010 |

| 1 | Sansui Plasma Station | 3,086,695 | 20.6% |

| 2 | Chongqing Sanda Weiye Pharmaceutical Products Company | 1,575,679 | 10.5% |

| 3 | Sichuan Nangeer Biological Medical Company | 940,706 | 6.3% |

| 4 | Chengdu Yingde Industrial Equipment Installation Company | 888,406 | 5.9% |

| 5 | Tai'an City Ruifeng Company | 603,326 | 4.0% |

| 6 | Guizhou Nengji Industrial Company | 483,010 | 3.2% |

| 7 | Beijing Wantai Biological Pharmacy Enterprise | 397,938 | 2.7% |

| 8 | Shijiangzhuang Dongsai Trading Company | 389,230 | 2.6% |

| 9 | Beijing Zhongtianbaiyi Technology Development Company | 360,451 | 2.4% |

| 10 | Guangzhou Maige Biologic Technology Company | 249,934 | 1.7% |

| TOTAL | 8,975,375 | 60.0% |

Except for the Sansui Plasma Station, none of the above suppliers are plasma suppliers. The majority of our plasma were collected through our majority-owned plasma stations. These stations purchase, collect, examine and deepfreeze plasma on behalf of Shandong Taibang and Guizhou Taibang, subject to rules and specifications that meet the Provincial SFDA’s requirements for quality, packaging and storage. The stations must only collect plasma from healthy donors within their respective districts and in accordance with a time table set by Shandong Taibang or Guizhou Taibang. The plasma must: be negative HbsAg, anti-HCV, anti-HIV and reaction of serum to RPR; contain an ALT ≤25 units (ALT), plasma protein ≥55g/l; contain no virus pollution or visible erythrolysis, lipemia, macroscopic red blood cell or any other irregular finding. In addition, the plasma must be packaged in 25 separate 600g bags, boxed with a packing list and labeled to be consistent with computer records and must be stored at -20°C within limited time after collection to ensure that it will congeal within 6 hours. Shandong Taibang and Guizhou Taibang are fully responsible for the overall technical guidance and quality supervision.

Our Major Customers

Due to the nature of our products and the current regulations, all of our customers are located in China. We have established relationships with most of our key customers since our establishment in 2002. For the fiscal year ended December 31, 2010, our top five customers, based on sales revenue and the percentage of their contribution to our revenues, were as follows:

Rank |

Customer’s Name |

Revenues During Fiscal Year 2010 (US$) |

Percentage of Total Sales

During Fiscal Year 2010 |

| 1 | Yunnan JianRong Biologic Product Company | 3,895,986 | 2.8% |

| 2 | Handan Zhiying Medical Company | 3,675,226 | 2.6% |

| 3 | Guangdong Meheco Medicine Company | 3,278,723 | 2.3% |

| 4 | Guangdong Minshengtang Medicine Company | 3,272,824 | 2.3% |

| 5 | Shanghai Pharmaceutical Co., Ltd. | 3,170,650 | 2.3% |

| TOTAL | 17,293,409 | 12.3% |

Sales, Marketing and Distribution

Because all of our products are prescription drugs, we can only sell to hospitals and inoculation centers directly or through approved distributors. For the years ended December 31, 2010, 2009 and 2008, direct sales to distributors represented approximately 48.9%, 67.3% and 65.6%, respectively, of our revenues. Our five largest customers in the aggregate accounted for approximately 12.3%, 10.7% and 16.2% of our total revenues for the years ended December 31, 2010, 2009 and 2008, respectively. Our largest customer accounted for approximately 2.8%, 4.0% and 6.2% of our total revenues for the years ended December 31, 2010, 2009 and 2008, respectively.

As part of our effort to ensure the quality of our distributors, we conduct due diligence to verify whether potential distributors have obtained necessary permits and licenses and facilities (such as cold storage) for the distribution of our biopharmaceutical products. We also assess the distributors’ financial condition before appointing them as distributors. Certain of our regional distributors are appointed on an exclusive basis within a specified area. The supply contracts normally set out the quantity and price of products. For distributors, they also contain guidelines for the sale and distribution of our products, including restrictions on the geographical area to which the products could be sold. We provide our distributors with training in relation to our products and on sales techniques. We have implemented a coding system for our products for easy tracking. Depending on the relationship and the creditability of the distributors, we generally grant a credit period of no longer than 30 days to distributors with some exceptions. For hospitals and clinics, we generally grant a credit period of no longer than 90 days. We had a bad debt credit of $0.1 million for 2010, a bad debt expense of $0.3 million for 2009 and a bad debt credit of $0.1 million for 2008 related to the sales of our products. The $0.1 million bad debt credit for both 2010 and 2008 is due to recovery of bad debt previously reserved.

9

Our current key market is in Shandong province, representing approximately 22.0%, 25.5% and 48.1% of our total revenues for the years ended December 31, 2010, 2009 and 2008, respectively. Prior to the acquisition of Dalin and Huitian, our strategy has been to focus our marketing efforts in Jiangsu, Zhejiang, Henan and the northeastern part of China. With the advantage of the scale of economy, the Company has been expanding its sales efforts into 30 provinces and municipal cities, especially those provinces that were untapped by Shandong Taibang previously, with Shandong and Guangdong provinces accounting for more than 30.8% of the total sales during 2010.

Our marketing and after-sales services department currently employs approximately 93 employees.

We believe that due to the unique nature of our products, the key emphasis on our marketing efforts centers on product safety, brand recognition, timely availability and pricing. As all of our products are prescription medicines, we are not allowed to advertise our products in the mass media. For the years ended December 31, 2010, 2009 and 2008, total sales and marketing expenses amounted to approximately $7.4 million, $3.5 million and $2.2 million, respectively, representing approximately 3.0%, 4.4% and 4.7%, respectively, of our revenues.

Our Research and Development Efforts

The Shandong Institute was established in 1971. The Shandong Institute is the research arm established by and directly administrated by the Shandong Provincial health department. It was the only entity approved for the research, development and production of biological and plasma-based biopharmaceutical products in Shandong Province, the second largest province in China. Since 1998, it promoted GMP management in the production process of blood products and became one of the first blood products manufacturing enterprises to obtain GMP Certification in China. In 2002, the Shandong Institute transferred all of its business and the licenses necessary to carry on its business and seconded certain of its employees to our subsidiary, Shandong Taibang. We were awarded the advanced high-tech enterprise certification by the Department of Science and Technology of Shandong Province in 2005 and 2008 and by the Ministry of Science and Technology of China in 2006. In 2007, we were admitted as a member of the Shandong Institute of Medicine and awarded the “Advanced Enterprise” accolade by the Shandong Blood Center. We were also awarded the “Advanced Technology Certification for Foreign Funded Enterprises” by the Department of Foreign Trade and Economic Cooperation of Shandong Province in 2008.

We employ a market driven approach to initiate research and development projects including both product and production technique development. We believe that the key to the industry revolves around (i) safety of products and (ii) maximizing the yield per unit volume of plasma. Our research and development efforts are focused around the following areas:

- broaden the breadth and depth of our portfolio of plasma-based biopharmaceutical products;

- enhance the yield per unit volume of plasma through new collection techniques;

- maximize manufacturing efficiency and safety;

- promote product safety through implementation of new technologies; and

- refine production technology for existing products.

Our research center is located on the same premises as the factory, which is located in Tai’an City, Shandong Province. The research center is equipped with specialized equipment including advanced testing and analytical equipment, such as atomic absorptimeter, fully automated blood coagulation analyzer, high performance liquid chromatograph, gas chromatograph, radioimmunoassay analyzer, ultraviolet-visible spectrophotometer, and protein chromatograph, most of which have been imported from the US, Japan, Italy, Germany and Australia. Our research and development department is comprised of about 30 researchers. All of them hold degrees in areas such as medicine, pharmacy, biology, and biochemistry. Our research center carries out development and registration of our products.

All the products we currently manufacture have been developed in-house. The following table outlines our research and development work in progress:

| Products Currently in Development |

Cure/Use |

Status of Product Development |

Stage* |

| Human Prothrombin Complex Concentrate | Used for the prophylaxis and treatment of bleeding in patients with single or multiple congenital deficiencies of factor II or X and in patients with single or multiple acquired prothrombin complex factor deficiency requiring partial or complete reversal. | Application made to the SFDA for official production permit and product certification. Commercial production expected in second half of 2011. | 9 |

| Human Coagulation Factor VIII | Use for coagulopathie such as Hemophilia A and increase concentration of coagulation factor VIII. | Application made to the SFDA for official production permit and product certification Commercial production expected in first half of 2011. | 9 |

10

| Human Hepatitis B Immunoglobulin (PH4) for Intravenous Injection | Prevention of measles and contagious hepatitis. When applied together with antibiotics, its curative effect on certain severe bacteria or virus infection may be improved. | Clinical trial just commenced Commercial production expected in 2014. | 8 |

| Human Fibrinogen | Cure for lack of fibrinogen and increase human fibrinogen concentration. | Clinical trial program under SFDA review. Commercial production in 2014. | 7 |

| Varicella Hyperimmune Globulins | Used for treatment of eczema vaccinatum, vaccinia necrosum, and ocular vaccinia | Develop scope and technique for testing the new medicine. | 3 |

| Human Immunoglobulin for Intravenous Injection – 10% | Cure for original immunoglobulin deficiency; secondary immunoglobulin deficiency and Auto-immune deficiency diseases | Develop laboratory-scale manufacturing process. | 3 |

* These stages refer to the stages in the regulatory approval process for our products disclosed under the heading “Regulation” in this report.

For the fiscal years ended December 31, 2001, 2009 and 2008, total research and development expenses amounted to approximately $2.3 million, $1.7 million and $1.2 million, respectively, representing approximately 1.7%, 1.4% and 2.5%, respectively, of our revenues.

Our Competition

We are subject to intense competition. There are both local and overseas pharmaceutical enterprises that are engaged in the manufacture and sale of potential substitute or similar biopharmaceutical products as our products in the PRC. These competitors may have more capital, better research and development resources, manufacturing and marketing capability and experience than we do. In our industry, we compete based upon product quality, product cost, ability to produce a diverse range of products and logistical capabilities.

We believe that we have strengthened our position in the marketplace with our acquisition of Dalin and its 54% majority-owned operating subsidiary, Guizhou Taibang and a 35% equity interest in Huitian, Xi’an-based biopharmaceutical company.

Our profitability may be adversely affected if (i) competition intensifies; (ii) competitors drastically reduce prices; (iii) PRC government’s interference on prices; or (iv) competitors develop new products or product substitutes having comparable medicinal applications or therapeutic effects which are more effective and /or less costly than those produced by us.

Other approved biopharmaceutical manufacturers in the PRC are entitled to produce many of the products produced by us. There are currently about 32 approved manufacturers of plasma-based pharmaceutical products in China. Many of these manufacturers are essentially producing the same type of products that we produce: human albumin and various types of immunoglobulin. However, due to recent Ministry of Health regulations, we believe that it is difficult for new manufacturers to enter into the industry. We believe that our major competitors in the albumin and immunoglobulin market in China are Hua Lan Biological Engineering, Shanghai Institute of Biological Products, Shanghai RAAS Blood Products Co. Ltd., Beijing Tiantan Biological Products, and Sichuan Yuanda Shuyang Pharmaceutical Co.

In addition, competition from imported products and China’s admission as a member of the WTO creates increased competition. The PRC became a member of the WTO in December 2001. Competition in the biopharmaceutical industry in the PRC will intensify generally in two respects. With lower import tariffs, we anticipate that imported biopharmaceutical products manufactured overseas may become increasingly competitive with domestically produced products in terms of pricing. We also believe that well-established foreign biopharmaceutical manufacturers may set up production facilities in the PRC and compete with domestic manufacturers directly. With the expected increased supply of competitively priced biopharmaceutical products in the PRC, we may face with increased competition from foreign biopharmaceutical products, including the types of products manufactured by US manufacturers and other manufacturers. In 2009 and 2010, we have seen a substantial increase in the volume of imported human albumin in China. If the trend of importation of human albumin continues, we may face more fierce competition in domestic human albumin market.

We believe that we have secured better ranking in 2010 based on our analysis of data regarding the approval for sales of plasma-derived products published by China National Institute for the Control of Pharmaceutical and Biological Products throughout of the year. Our past financial performance is attributable to our market position in the industry. Furthermore, while each of the plasma products related companies have their own product composition which include 3 main categories namely human albumin, human immunoglobulin and lyophilized human factor, we are currently developing lyophilized human factor products which we expect to launch in 2011. We will continue to meet challenges and secure our market position by enhancing our existing products, introducing new products to meet customer demand, delivering quality products to our customers in a timely manner and maintaining our established industry reputation.

11

Our Intellectual Property

Pursuant to a Trademark License Agreement with the Shandong Institute, we hold the exclusive license to a Trademark Registration Certificate (No.3375484) issued by the PRC Industry and Commerce Administration Trademark Bureau. The class of goods on which the trademark has been approved to use include: drug for human beings, serum, microorganism products for medicine and veterinary medicine, plasma, medical blood, and medical biological product. The registration will expire in June 2014. The Shandong Institute has allowed us to use the trademark for free until May 2011. We expect to develop and register our own trademark before the termination of this license.

In addition, we have registered the following domain names: www.chinabiologic.com and www.ctbb.com.cn.

Regulation

This section summarizes the major PRC regulations relating to our business.

Due to the nature of our products, we are supervised by various levels of the PRC Ministry of Health and/or SFDA. Such supervision includes the safety standards regulating our source supplies (mainly plasma), our manufacturing process through the issuance of our GMP Certification and the inspection of our finished products.

We are also subject other PRC regulations, including those relating to taxation, foreign currency exchange and dividend distributions.

Plasma Collection

Substantially all plasma donations for commercialized plasma-based biopharmaceutical products are done through plasmapheresis donation stations. Plasmapheresis donation means donors give only selected blood components — platelets, plasma, red cells, infection-fighting white cells called granulocytes, or a combination of these, depending on donors blood type and the needs of the community. Plasmapheresis stations in China are commonly used to collect plasma. In China, current regulations only allow an individual donor to donate blood in 14-day intervals, with a maximum quantity of 580ml (or about 600 gram) per donation.

The following are the regulatory requirements to establish a plasmapheresis station in China:

- meet the overall plan in terms of the total number, distribution, and operational scale of plasmapheresis stations;

- have the required professional health care technicians to operate a station;

- have the facility and a hygienic environment to operate a station;

- have an identification system to identify donors;

- have the equipment to operate a station; and

- have the equipment and quality control technicians to ensure the quality of the plasma collected.

As a result of the overhaul by the four ministries of the State Council in May 2004, we estimate that the number of collection stations (including plasma stations) that meet the standards imposed by the PRC has been reduced from approximately 156 to approximately 120. Plasma stations were customarily owned and managed by the PRC health authorities. In March 2006, the Ministry of Health promulgated the Blood Collection Measures whereby the ownership and management of the plasma stations must be transferred to plasma-based biopharmaceutical companies while the regulatory supervision and administrative control remain with the government. For those plasma stations which did not complete their reform by December 31, 2006, their license to collect plasma will be revoked. As a result, all plasma stations are now having direct supply relationship with their parent fractionation facilities.

Set out below are some of the safety features at China’s collection stations:

-

Collection stations can only source plasma from donors within the assigned district approved by the provincial health authorities.

-

Collection stations must perform a health check on the donor. Once the donor passes the health check, a “donor permit” is issued to the donor. The standards of the health check are established by the health authorities at the State Council level.

-

The design and printing of the “donor permit” is administrated by the provincial health authorities, autonomous region or municipality government, as the case maybe. The “donor permit” cannot be altered, copied or assigned.

-

Before donors can donate plasma, the station must verify their identities and the validity of their “donor permits.” The donors must pass the verification procedures before they are given a health check and blood test. For those donors who have passed the verification, health check and blood test and whose plasma were donated according to prescribed procedures, the station will setup a record.

12

- All collection stations are subject to the regulations on transmittable diseases prevention. They must strictly adhere to the sanitary requirements and reporting procedures in the event of an epidemic situation.

The operation of plasma collection stations is strictly regulated by the PRC government. With the restarts of previous stations and newly built stations, the Company estimated that there are approximately 140 plasma stations in operation in China.

Importation of Blood Products

According to current Chinese regulations, the following blood products are banned from importation to China:

-

Plasma – frozen, liquid and freeze-dried Human Plasma;

-

Immunoglobulin – Human Normal Immunoglobulin, Specific Immunoglobulin, Human Anti-Tetanus Immunoglobulin, Human Anti-hemophilia Globulin, Human Anti-HBs Immunoglobulin, Human Anti- D(Rho) Immunoglobulin and Immunoglobulin For Intravenous Administration;

-

Factor VIII – Cryoprecipitated Factor VIII and Factor VIII Concentrate (only Bayer is allowed, under a special arrangement with PRC government, to import this product into PRC, commencing November 2007);

-

Factor IX Concentrate;

-

Human Fibrinogen;

-

Platelet Concentrate;

-

Human Prothrombin Complex;

-

Whole blood or blood components.

Production of Plasma-based Products

The manufacture and sale of plasma-based biopharmaceutical products is strictly regulated by the PRC government. For example, under PRC law, each variation in the packaging, dosage and concentration of medical products requires registration and approval by the SFDA. During this process the altered product is not commercially available for sale. For example, among our human albumin products only Human Albumin 20%/10ml, 20%/25ml, 20%/50ml, 10%/10ml, 10%/25ml, 10%/50ml, and 25%/50ml products are currently approved and are commercially available. Accordingly, all references, in this report, to our manufacture and sale of human albumin relate to our approved human albumin products.

The table below shows the PRC approval process for the manufacture and sale of new medicines:

| Stage (Estimated Time Period) | Activities | |

| 1 | Planning Stage (1 month) | Prior to the development of potential new products, our Research & Development department will engage in a comprehensive review of existing medical literature, patent status and market information, including expected product demand and other competition, in order to determine the feasibility of development and production of a new product offering. Although this typically takes about 1 month to complete, this stage precedes development efforts for a new product, which could take several months or even years to complete. For products with lengthy development periods, we may be required to periodically revisit this stage to confirm the feasibility of continued development efforts. |

| 2 | Feasibility study and assumption clarification (2 months) | If we determine that development, ownership and marketing of a potential new product is possible and potentially advantageous, we proceed with development efforts. However, potential new products are typically developed in a laboratory or small batch setting, and in order to obtain approval for potential new products and to market new products, we must develop a plan for testing and producing the new product. The first step in developing such plan is a feasibility study and assumption clarification. This study is conducted following or during development of a new product, and involves a review and study of the feasibility of our technical, production and financial capabilities, production conditions and financial forecasts. We also review the feasibility of preparing and conducting a clinical study, or a Clinical Trial program, during this stage. |

| 3 | Develop scope and technique for testing the new medicine (6 months) | If following completion of a Stage 2 study we make a determination that producing and testing a potential new product is feasible and potentially advantageous, we will develop the scope and techniques for testing the potential new product. This involves confirming the sourcing of materials needed for production and marketing of the potential new product and development of the method of production, dosage design and prescription selections. During this stage, we will also develop a clinical research sample. |

13

| 4 | Preparation of a virus inactivation report and submission to the National Institute for the Control of Pharmaceutical and Biological Products, or NICPBP, for preliminary review (4-6 months) | If following development of testing methods for the potential new product we determine that testing can be successfully completed, we will prepare and finalize the virus inactivation method for the potential new product. We are then required to prepare a report with details on the production method and procedures and basis of quality evaluation for preliminary review by the NICPBP. NICPBP staff usually makes an onsite visit during this stage to supervise testing and re-testing of the virus inactivation process. Tested samples will be sent back to the NICPBP central office in Beijing for evaluation. |

| 5 | R&D test product information submitted to the SFDA for preliminary assessment (4-6 months) | Before the NICPBP can determine that our clinical research sampling and virus inactivation method and procedures are successful, we are required to submit our clinical research sampling and virus inactivation method and procedures to the SFDA via the provincial FDA for preliminary assessment. We also develop the parameters for a Clinical Trial program at this stage. Our program usually requires the establishment of a committee comprised of our Research and Development staff whose responsibility is to communicate with the hospitals and doctors who are invited to participate in the trial. After our submission of information to the SFDA we will become subject to random onsite sampling by the SFDA as they review our reports and procedures regarding testing of the potential product. The SFDA will usually inform us of the exact sampling date and SFDA staff will randomly select certain samples during their visit for additional testing. The SFDA will then provide us with their preliminary assessment of our new product and our related procedures. Depending on the results of its preliminary assessment the SFDA may recommend that we alter certain aspects of our reports and proposed Clinical Trial programs, or even repeat our Stage 3 and Stage 4 trials and resubmit related reports. The SFDA review process typically takes 4-6 months, but this process could take longer if we are required to amend or repeat our trials or if we amend our reports in order to obtain more a favorable preliminary assessment. |

| 6 | Formal application to the NICPBP for test of virus inactivation and for CDE certification of Clinical Trial (6-7 months) | Once we receive a favorable or satisfactory preliminary assessment from the SFDA, the NICPBP will continue the process begun at Stage 4. The NICPBP will conduct tests of virus inactivation based on defined medical literature and on our prescribed procedures and method of production. If the tests are successful, the NICPBP will transfer the application to the CDE for review of our prescribed procedures and method of production and the CDE may request additional information before making a determination. If the CDE is satisfied with our procedures and method of production it will certify the new product for production for Clinical Trial. |

| 7 | SFDA review of Clinical Trial program for approval (1 month) | Following provision of the CDE product certification, we must submit our Clinical Trial program (developed at Stage 5 and 6) to the SFDA for formal approval. The SFDA may request additional information regarding our proposed Clinical Trial program. If the SFDA rejects our Clinical Trial program or requires changes to any of our procedures and methods, we may be required to amend our Clinical Trial program, which may require repeating several of the processes previously conducted. The criteria for SFDA approval for Clinical Trial programs are based on Good Clinical Practice which is publicly available in the PRC. |

| 8 |

Clinical Trial: Phases 1 to 4 (3 years for a

new drug and 2 years for a generic drug) |

Following approval of our Clinical Trial

program by the SFDA, we will begin Clinical Trials of the potential new

product. There are four phases to the clinical trial process and any

failure of the potential new product at any of the Clinical Trial phases,

could cause a significant delay in approval of the new product, or

termination of the new product launch: Phase 1: Basic clinical pharmacology and human safety evaluation studies are conducted by the Company. Prior to determining the effectiveness of our potential new product, we must determine that certain pharmacological and safety standards are met by our potential new product. These standards are set in stage 4 or according to medical literature. If the clinical trial indicates that such standards are met, we then move on to Phase 2 of the trials. If the Phase 1 standards are not met, we may be required to conduct further R&D on the potential new product, alter the new product formulation and amend the Clinical Trial program, which could require that we repeat several of the stages referenced above. Phase 2: A preliminary exploration of the product's therapeutic efficacy is conducted by the Company. If we determine at this stage that the potential new product is not effective, we may conduct further R&D on the potential new product, alter the new product formulation and amend the Clinical Trial program, which would require that we repeat several of the stages referenced above. Phase 3: If we determine that the potential new product meets the required standards of Phases 1 and 2 above, we must then submit a report of the Clinical Trial results to the SFDA together with an application for trial production of the product. If the SFDA rejects application for trial production or otherwise requires a repeat of our Clinical Trials, we may be required to repeat all or a portion of our Clinical Trial program, which may require repeating several of the processes previously conducted. Phase 4: If we receive SFDA approval to conduct a trial production of the new product, we will then conduct a larger test of approximately 2,000 samples. We will conduct this test while also conducting a new drug post- marketing study. |

14

| 9 | Application to the SFDA for official production permit and product certification (8- 9 months) | The trial production of the potential new product will be monitored by an SFDA inspector who will also make onsite visits and assess the results of the trial production. We will also be required to prepare and submit to the SFDA a report of the trial production results by gathering statistical information obtained during the trial period. The CDE will also conduct a final review of the trial production for the potential new product. Upon satisfactory completion of the trial production, the CDE will inform the SFDA. The SFDA will then issue a permit to us for official production, the issuance of which is announced on the SFDA's website, and copied to the NICPBP and the provincial FDA. The SFDA will also issue the new product a Good Manufacturing Practice, or GMP, certification. The provincial FDA will follow with the issuance of a provincial production permit for the new product. Although the SFDA's criteria for final approval of new products are not publicly available in the PRC, if a manufacturer makes the adjustments to its methods and procedures recommended by the SFDA earlier on in the product approval process, it is likely that the SFDA will approve the new product for production. |

| 10 | Commercial Production | Following issuance of state and provincial production permits and certifications, we may begin production of the new product. |

Pricing

In addition, there are regulations regarding the retail price, rather than regulations of wholesale prices, of our products. According to the “Regulations on controlling blood products” promulgated by the State Council in 1996, the price (retail) setting standard and regulatory functions reside with regional offices of the Pricing Bureau and the Ministry of Health. Presently, there are retail pricing guidelines for hospitals which sell our human albumin and immunoglobulin products to patients as prescribed by the relevant regulators in each region. The retail pricing guidelines are established based on, amongst other things, the regional living standards and the cost of production of the manufacturers. The hospitals cannot sell the products to patients at prices exceeding the highest retail price prescribed by the relevant regulators. There is no pricing guideline on the ex-factory price to the hospital and the distributors. The highest retail price guideline is revised occasionally.

Taxation

On March 16, 2007, the National People's Congress of China passed a new Enterprise Income Tax Law, or EIT Law, and on November 28, 2007, the State Council of China passed its implementing rules, which took effect on January 1, 2008. Before the implementation of the EIT Law, foreign invested enterprises, or FIEs, established in the PRC, unless granted preferential tax treatments by the PRC government, were generally subject to an earned income tax, or EIT, rate of 33.0%, which included a 30.0% state income tax and a 3.0% local income tax. The EIT Law and its implementing rules impose a unified EIT of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions. However, the EIT Law gives FIEs established before March 16, 2007, or Old FIEs, a five-year grandfather period during which they can continue to enjoy their existing preferential tax treatments. During this five-year grandfather period, Old FIEs that enjoyed tax rates lower than 25% under the original EIT Law can gradually increase their EIT rate by 2% per year until their tax rate reaches 25%. In addition, the Old FIEs that are eligible for the “two-year exemption and three-year half reduction” or “five-year exemption and five-year half-reduction” under the original EIT law, are allowed to continue enjoying their preference until these holidays expire.