Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT_99-1 - CEO REMARKS - JOHN W. SOMERHALDER II - SOUTHERN Co GAS | exhibit_99-1.htm |

| EX-99.2 - EXHIBIT_99-2 - SOUTHSTAR - MICHAEL A. BRASWELL - SOUTHERN Co GAS | exhibit_99-2.htm |

| EX-99.4 - EXHIBIT_99-4 - GAAP RECONCILIATIONS - SOUTHERN Co GAS | exhibit_99-4.htm |

| 8-K - FORM 8-K - SOUTHERN Co GAS | form8_k.htm |

Pivotal

Dana Grams - President, Pivotal Energy Development

Pivotal Energy Overview

• Customers include utilities, gas marketers and E&P companies

• Favorable storage locations with significant pipeline interconnectivity

• Current operating facilities:

o Jefferson Island Storage & Hub

(JISH) near Henry Hub in South

Louisiana

(JISH) near Henry Hub in South

Louisiana

o Golden Triangle Storage (GTS) in

East Texas

East Texas

o Pivotal Propane of Virginia (PPOV)

• Option to develop:

o Triple Diamond Storage (TDS)

Golden Triangle

Storage

Storage

Jefferson Island

Storage & Hub

Storage & Hub

Pivotal

Propane of

Virginia

Propane of

Virginia

Triple Diamond

Storage

Storage

Pivotal is focused on high deliverability salt dome storage and related business

development opportunities.

development opportunities.

2010 Accomplishments

• Jefferson Island Storage & Hub

o Settled lawsuit over mineral rights

o Re-filed permit application for expansion

o Completed mechanical integrity tests

o Initiated limited trading activity

• Golden Triangle Storage

o Stopped leaching Cavern 1 at 6 Bcf in

June 2010

June 2010

o Interim commercial service September

2010

2010

o Completed dewatering December 2010

o Started leaching Cavern 2

GTS Cavern 1 - Three

Dimensional Sonar Picture

Dimensional Sonar Picture

1,250 Ft

Empire State

Building

Building

Jefferson Island Storage & Hub

JISH Facility

• Purchased by AGL in 2004 for $90 MM

• Two current caverns with combined 7 Bcf

working gas capacity in operation since 1995

working gas capacity in operation since 1995

• Significantly upgraded the facility’s

compression, header and meter capacities

compression, header and meter capacities

• 15 miles dual 16” header with 9 interconnects

• Injection / Withdrawal - 360 / 720 Mdth

• Contract Status:

o 82% contracted for 2011; weighted average

term of 2.2 years

term of 2.2 years

o Optimizing remaining capacity in 2011

JISH Expansion

• Filed key applications for Department of

Natural Resources (DNR) permit and Corps of

Engineers permit

Natural Resources (DNR) permit and Corps of

Engineers permit

• Process slowed due to gulf spill and

subsequent drain on resources of Louisiana

regulators

subsequent drain on resources of Louisiana

regulators

• Project will commence based on commercial

conditions and will consist of:

conditions and will consist of:

o Completing the raw water and disposal well

facilities

facilities

o Solution mining Caverns 3 & 4, adding 12

Bcf of working gas capacity

Bcf of working gas capacity

Delcambre

Erath

Jefferson Island

Storage and Hub

Storage and Hub

Columbia Gulf Transmission

Gulf South Pipeline

Natural Gas Pipeline Co. of America

Sabine Pipeline

Sea Robin Pipeline

Tennessee Gas Pipeline

Texas Gas Transmission

”

2

-

16

”

Pipelines

-

5.2 miles

Cavern #1

Cavern #2

4-12” Pipelines - 0.8 miles

Trunkline

Gas Pipeline

Columbia Gulf Transmission

Gulf South Pipeline

Natural Gas Pipeline Co. of America

Sabine Pipeline

Sea Robin Pipeline

Tennessee Gas Pipeline

Texas Gas Transmission

Crosstex LIG

9.4 miles

2

-

16

”

Pipelines

-

5.2 miles

Lake Peigneur

Jefferson Island Station

Facilities

Facilities

Cavern #1

Cavern #2

Trunkline

2-16” Pipelines -

Golden Triangle Storage

GTS Facility

• FERC permitted December 2007

• Commenced construction May 2008

• Cavern 1 in-service with 6 Bcf working gas capacity

• Cavern 2 expected to be 7.2 Bcf by 12/31/2011

• Commercial service of Cavern 2 can begin 2Q12

• 9 miles of dual 24” pipeline with 6 interconnects

• Injection / Withdrawal - 300 / 600 Mdth

Contract Status

• 2 Bcf firm capacity contracted for 5yr

term

term

• Optimizing and marketing remaining

capacity for 2011

capacity for 2011

Capital Expenditures

• Total project cost ~ $325 MM

• Remaining capex of $41 MM (as of

1/1/2011) to complete, which is largely

pad gas for Cavern 2

1/1/2011) to complete, which is largely

pad gas for Cavern 2

Texas

Eastern

Eastern

Houston

Pipeline

Pipeline

Florida Gas

Transmission

Transmission

Kinder

Morgan

TX

Morgan

TX

Centana

Golden

Pass

Pipeline

Pass

Pipeline

Golden Triangle

Storage and Hub

Storage and Hub

Golden Triangle

Pipeline Header

Pipeline Header

2-24”

1-24”

2-24”

Orange

County

County

Neches

River

River

Beaumont

Cavern #1

Cavern #2

Market Fundamentals

• Storage fundamentals are cyclical

o Natural gas market is growing

o Significant barriers now exist to develop new storage

• Uncertainty favors natural gas

o Commodity price of natural gas remains low relative to oil

o Inflation

o Declining deliverability of shale wells increases need for storage alternatives

o Initial production from new basins showing promise

o Renewable energy sources are growing, but economics often require subsidies

o Carbon / greenhouse gas legislation signifies shift away from coal and oil

• Maintaining long-term view

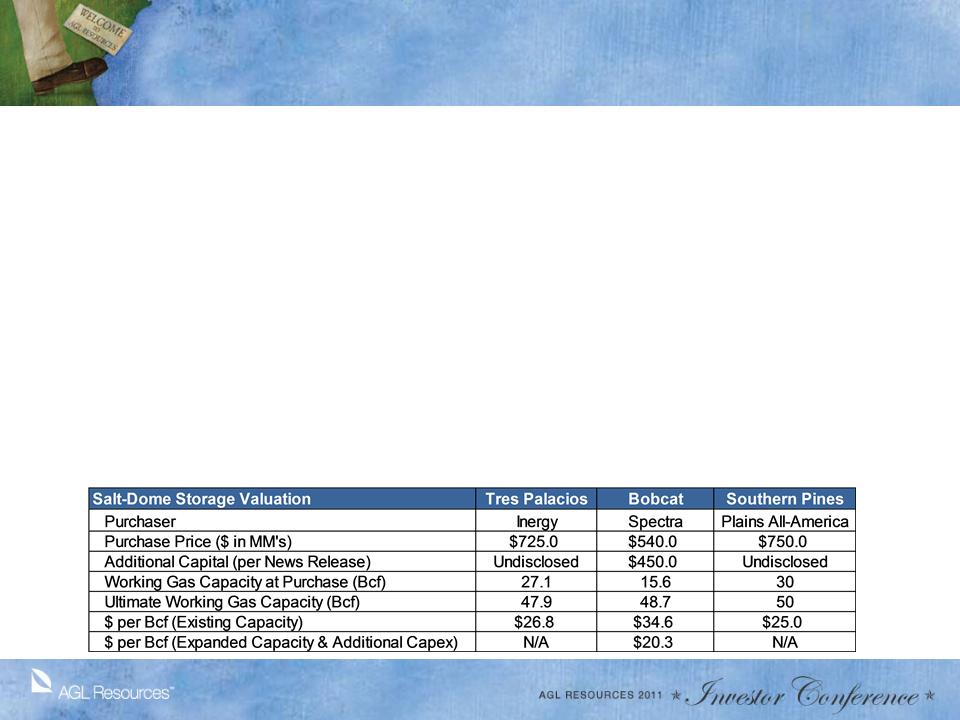

• Salt-dome storage valuations remain high

Key Storage Rate Drivers

NYMEX Monthly Volatility 1990-2011

April - 2011

Overall Supply / Demand

April - 2011

Source: BENTEK

Sources: Wood Mackenzie, EIA, FERC, Pivotal

201 Bcf

Storage Additions Lag Behind Use

On average, from 1995-2010 growth in storage capacity has lagged behind

the estimated growth in maximum stored capacity by over 35 Bcf/year.

the estimated growth in maximum stored capacity by over 35 Bcf/year.

2011 Priorities and Objectives

• 2011 Priorities

o Jefferson Island Storage & Hub

– Continue permitting process for Caverns 3 & 4 (expected early 2012)

– Enhance commercial and marketing efforts

o Golden Triangle Storage

– Contract remaining 4 Bcf at Cavern 1

– Successfully leach Cavern 2 to ~7.2 Bcf working gas capacity

– Obtain FERC certificate for Caverns 3 & 4

• Pivotal long-term business strategy

o Permitting measured expansions

o Increased optionality

o Long-term portfolio value

• Pivotal advantages

o Well capitalized

o Good locations with low cost expansion opportunities

o Strong customer focus

o Experienced management team / sustainable organization

Cautionary Statements and Supplemental Information

Forward-Looking Statements

Certain expectations and projections regarding our future performance referenced in this presentation, in other reports or statements we file with the SEC or otherwise release to the public, and on our

website, are forward-looking statements. Senior officers and other employees may also make verbal statements to analysts, investors, regulators, the media and others that are forward-looking.

Forward-looking statements involve matters that are not historical facts, such as statements regarding our future operations, prospects, strategies, financial condition, economic performance (including

growth and earnings), industry conditions and demand for our products and services. Because these statements involve anticipated events or conditions, forward-looking statements often include

words such as "anticipate," "assume," "believe," "can," "could," "estimate," "expect," "forecast," "future," "goal," "indicate," "intend," "may," "outlook," "plan," "potential," "predict," "project," "seek,"

"should," "target," "would," or similar expressions. Forward-looking statements contained in this presentation include, without limitation, statements regarding future earnings per share, dividend growth

and EBIT contribution, our priorities for 2011 and the proposed merger with Nicor Inc. Our expectations are not guarantees and are based on currently available competitive, financial and economic

data along with our operating plans. While we believe our expectations are reasonable in view of the currently available information, our expectations are subject to future events, risks and

uncertainties, and there are several factors - many beyond our control - that could cause results to differ significantly from our expectations.

website, are forward-looking statements. Senior officers and other employees may also make verbal statements to analysts, investors, regulators, the media and others that are forward-looking.

Forward-looking statements involve matters that are not historical facts, such as statements regarding our future operations, prospects, strategies, financial condition, economic performance (including

growth and earnings), industry conditions and demand for our products and services. Because these statements involve anticipated events or conditions, forward-looking statements often include

words such as "anticipate," "assume," "believe," "can," "could," "estimate," "expect," "forecast," "future," "goal," "indicate," "intend," "may," "outlook," "plan," "potential," "predict," "project," "seek,"

"should," "target," "would," or similar expressions. Forward-looking statements contained in this presentation include, without limitation, statements regarding future earnings per share, dividend growth

and EBIT contribution, our priorities for 2011 and the proposed merger with Nicor Inc. Our expectations are not guarantees and are based on currently available competitive, financial and economic

data along with our operating plans. While we believe our expectations are reasonable in view of the currently available information, our expectations are subject to future events, risks and

uncertainties, and there are several factors - many beyond our control - that could cause results to differ significantly from our expectations.

Such events, risks and uncertainties include, but are not limited to, changes in price, supply and demand for natural gas and related products; the impact of changes in state and federal legislation and

regulation including changes related to climate change; actions taken by government agencies on rates and other matters; concentration of credit risk; utility and energy industry consolidation; the

impact on cost and timeliness of construction projects by government and other approvals, development project delays, adequacy of supply of diversified vendors, unexpected change in project costs,

including the cost of funds to finance these projects; the impact of acquisitions and divestitures; direct or indirect effects on our business, financial condition or liquidity resulting from a change in our

credit ratings or the credit ratings of our counterparties or competitors; interest rate fluctuations; financial market conditions, including recent disruptions in the capital markets and lending environment

and the current economic downturn; general economic conditions; uncertainties about environmental issues and the related impact of such issues; the impact of changes in weather, including climate

change, on the temperature-sensitive portions of our business; the impact of natural disasters such as hurricanes on the supply and price of natural gas; acts of war or terrorism; and other factors

which are provided in detail in our filings with the Securities and Exchange Commission. Forward-looking statements are only as of the date they are made, and we do not undertake to update these

statements to reflect subsequent changes.

regulation including changes related to climate change; actions taken by government agencies on rates and other matters; concentration of credit risk; utility and energy industry consolidation; the

impact on cost and timeliness of construction projects by government and other approvals, development project delays, adequacy of supply of diversified vendors, unexpected change in project costs,

including the cost of funds to finance these projects; the impact of acquisitions and divestitures; direct or indirect effects on our business, financial condition or liquidity resulting from a change in our

credit ratings or the credit ratings of our counterparties or competitors; interest rate fluctuations; financial market conditions, including recent disruptions in the capital markets and lending environment

and the current economic downturn; general economic conditions; uncertainties about environmental issues and the related impact of such issues; the impact of changes in weather, including climate

change, on the temperature-sensitive portions of our business; the impact of natural disasters such as hurricanes on the supply and price of natural gas; acts of war or terrorism; and other factors

which are provided in detail in our filings with the Securities and Exchange Commission. Forward-looking statements are only as of the date they are made, and we do not undertake to update these

statements to reflect subsequent changes.

Supplemental Information

Company management evaluates segment financial performance based on earnings before interest and taxes (EBIT), which includes the effects of corporate expense allocations and on operating

margin. EBIT is a non-GAAP (accounting principles generally accepted in the United States of America) financial measure that includes operating income, other income and expenses. Items that are

not included in EBIT are financing costs, including debt and interest expense and income taxes. The company evaluates each of these items on a consolidated level and believes EBIT is a useful

measurement of our performance because it provides information that can be used to evaluate the effectiveness of our businesses from an operational perspective, exclusive of the costs to finance

those activities and exclusive of income taxes, neither of which is directly relevant to the efficiency of those operations. Operating margin is a non-GAAP measure calculated as operating revenues

minus cost of gas, excluding operation and maintenance expense, depreciation and amortization, and taxes other than income taxes. These items are included in the company's calculation of

operating income. The company believes operating margin is a better indicator than operating revenues of the contribution resulting from customer growth, since cost of gas is generally passed

directly through to customers. In addition, in this presentation, the company has presented its earnings per share excluding expenses incurred with respect to the proposed Nicor merger. As the

company does not routinely engage in transactions of the magnitude of the proposed Nicor merger, and consequently does not regularly incur transaction related expenses with correlative size, the

company believes presenting EPS excluding Nicor merger expenses provides investors with an additional measure of the company’s core operating performance. EBIT, operating margin and EPS

excluding merger expenses should not be considered as alternatives to, or more meaningful indicators of, the company's operating performance than operating income, net income attributable to AGL

Resources Inc. or EPS as determined in accordance with GAAP. In addition, the company's EBIT, operating margin and non-GAAP EPS may not be comparable to similarly titled measures of another

company. We also present certain non-GAAP financial measures excluding the effects of our proposed merger with Nicor. Because we complete material mergers and acquisitions only occasionally,

we believe excluding these effects from certain measures is useful because they allow investors to more easily evaluate and compare the performance of the Company's core businesses from period

to period. Reconciliations of non-GAAP financial measures referenced in this presentation are available on the company’s Web site at www.aglresources.com

margin. EBIT is a non-GAAP (accounting principles generally accepted in the United States of America) financial measure that includes operating income, other income and expenses. Items that are

not included in EBIT are financing costs, including debt and interest expense and income taxes. The company evaluates each of these items on a consolidated level and believes EBIT is a useful

measurement of our performance because it provides information that can be used to evaluate the effectiveness of our businesses from an operational perspective, exclusive of the costs to finance

those activities and exclusive of income taxes, neither of which is directly relevant to the efficiency of those operations. Operating margin is a non-GAAP measure calculated as operating revenues

minus cost of gas, excluding operation and maintenance expense, depreciation and amortization, and taxes other than income taxes. These items are included in the company's calculation of

operating income. The company believes operating margin is a better indicator than operating revenues of the contribution resulting from customer growth, since cost of gas is generally passed

directly through to customers. In addition, in this presentation, the company has presented its earnings per share excluding expenses incurred with respect to the proposed Nicor merger. As the

company does not routinely engage in transactions of the magnitude of the proposed Nicor merger, and consequently does not regularly incur transaction related expenses with correlative size, the

company believes presenting EPS excluding Nicor merger expenses provides investors with an additional measure of the company’s core operating performance. EBIT, operating margin and EPS

excluding merger expenses should not be considered as alternatives to, or more meaningful indicators of, the company's operating performance than operating income, net income attributable to AGL

Resources Inc. or EPS as determined in accordance with GAAP. In addition, the company's EBIT, operating margin and non-GAAP EPS may not be comparable to similarly titled measures of another

company. We also present certain non-GAAP financial measures excluding the effects of our proposed merger with Nicor. Because we complete material mergers and acquisitions only occasionally,

we believe excluding these effects from certain measures is useful because they allow investors to more easily evaluate and compare the performance of the Company's core businesses from period

to period. Reconciliations of non-GAAP financial measures referenced in this presentation are available on the company’s Web site at www.aglresources.com

10