Attached files

| file | filename |

|---|---|

| EX-32.1 - HK BATTERY TECHNOLOGY INC | v218780_32-1.htm |

| EX-21.1 - HK BATTERY TECHNOLOGY INC | v218780_21-1.htm |

| EX-31.1 - HK BATTERY TECHNOLOGY INC | v218780_31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For fiscal year ended: December 31, 2010

OR

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _______________ to _______________

Commission file number: 333-140148

|

Nevada Gold Holdings, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

20-3724068

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

|

800 E. Colorado Blvd., Suite 888 Pasadena, California

|

91101

|

|

|

(Address of principal executive offices)

|

(Postal Code)

|

Registrant’s telephone number, including area code: 626-683-7330

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: Common Stock, Par Value of $0.001 Per Share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a smaller reporting company. See the definitions of the “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer o

|

Accelerated Filer o

|

|

Non-Accelerated Filer

|

Smaller reporting company x

|

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes o No x

On June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, approximately 3,477,000 shares of its Common Stock, $0.001 par value per share (its only class of voting or non-voting common equity) were held by non-affiliates of the registrant. The market value of those shares was approximately $1,043,100, based on the last sale price of $0.30 per share of the Common Stock on that date. For this purpose, shares of Common Stock beneficially owned by each executive officer and director of the registrant and each beneficial owner of 10% or more of the Common Stock outstanding have been excluded because such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of April 14, 2011, there were 43,844,054 shares of the registrant’s common stock, par value $0.001, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

|

Item

|

|

Page

|

|

Available Information

|

|

1

|

|

|

|

|

|

Forward-Looking Statements

|

|

2

|

|

PART I

|

|

3 |

|

|

|

|

|

1. Business

|

|

3 |

|

1A. Risk Factors

|

|

11 |

|

2. Properties

|

|

19 |

|

3. Legal Proceedings

|

|

25 |

|

4. (Removed and Reserved)

|

|

26 |

|

PART II

|

|

26 |

|

|

||

|

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

26 |

|

6. Selected Financial Data

|

|

29 |

|

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

29 |

|

8. Financial Statements and Supplemental Data

|

|

32 |

|

9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

32 |

|

9A. Controls and Procedures

|

|

33 |

|

PART III

|

|

34 |

|

|

||

|

10. Directors, Executive Officers, and Corporate Governance

|

|

34 |

|

11. Executive Compensation

|

|

37 |

|

12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

41 |

|

13. Certain Relationships and Related Transactions, and Director Independence

|

|

42 |

|

14. Principal Accountant Fees and Services

|

|

43 |

|

PART IV

|

|

44 |

|

|

||

|

15. Exhibits and Financial Statement Schedules

|

|

44 |

i

AVAILABLE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the United States Securities and Exchange Commission (“SEC”). You may read and copy any document we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549, U.S.A. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330 (or 1-202-551-8090). The SEC maintains an internet site that contains annual, quarterly and current reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Our electronic SEC filings are available to the public at http://www.sec.gov.

Our public internet site is http://www.nevadagoldholdings.com. We make available free of charge through our internet site, via a link to the SEC’s internet site at http://www.sec.gov, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after we electronically files such material with, or furnish it to, the SEC. We also make available through our internet site, via a link to the SEC’s internet site, statements of beneficial ownership of our equity securities filed by our directors, officers, 10% or greater shareholders and others under Section 16 of the Exchange Act.

These documents are also available in print without charge to any person who requests them by writing or telephoning:

Nevada Gold Holdings, Inc.

c/o Gottbetter & Partners, LLP

488 Madison Avenue

New York, New York 10022-5718

Telephone: 212-400-6900

Facsimile: 212-400-6901

1

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements, including, without limitation, in the sections captioned “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to exploration programs, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the SEC, and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, insufficient cash flows and resulting illiquidity, our inability to expand our business, government regulations, lack of diversification, volatility in the price of gold, increased competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Report appears in the section captioned “Risk Factors” and elsewhere in this Report.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise.

Readers should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and other documents which we may file from time to time with the SEC.

2

PART I

ITEM 1. BUSINESS

This Report contains summaries of the material terms of various agreements executed in connection with the transactions described herein. The summaries of these agreements are subject to, and are qualified in their entirety by reference to, these agreements, all of which are incorporated herein by reference.

Historical Development

We were incorporated as Nano Holdings International, Inc., in Delaware on April 16, 2004. Prior to the Merger (as defined below), our business was to sell party and drinking supplies, including gelatin shot mixes, shot glasses, flavored sugar and salts, and various other drinking containers and paraphernalia.

Name Change and Capital Increase

On November 3, 2008, we filed a Certificate of Amendment to our Certificate of Incorporation with the Secretary of State of the State of Delaware, which (i) changed our name from Nano Holdings International, Inc., to Nevada Gold Holdings, Inc., and (ii) increased our authorized capital stock from 75,000,000 shares of common stock, par value $0.001, to 300,000,000 shares of common stock, par value $0.001, and 10,000,000 shares of preferred stock, par value $0.001.

As used in this Report, unless otherwise stated or the context clearly indicates otherwise, the term “Nano Holdings” refers to us before giving effect to the Merger (defined below), the term “NGE” refers to Nevada Gold Enterprises, Inc., a Nevada corporation formed on October 7, 2008, before giving effect to the Merger, the term “NGHI” refers to Nevada Gold Holdings, Inc., after giving effect to the Merger, and the terms “Company,” “we,” “us,” and “our” refer to Nevada Gold Holdings, Inc., and its wholly owned subsidiary, NGE, after giving effect to the Merger.

Stock Splits

Our Board of Directors authorized a 30.30303-for-1 forward split of our common stock, par value $0.001 per share (“Common Stock”), in the form of a stock dividend, which was paid on November 21, 2008, to holders of record on November 19, 2008. Our Board of Directors authorized a 2-for-1 forward split of our Common Stock, in the form of a stock dividend, which was paid on May 12, 2009, to holders of record on May 8, 2009. Our Board of Directors and our stockholders authorized a one-for-fifteen reverse split of our Common Stock, which was effected on September 15, 2010. All share and per share numbers in this Report relating to the Common Stock have been adjusted to give effect to these stock splits, unless otherwise stated.

Merger

On December 31, 2008, pursuant to a Merger Agreement entered into on the same date, Nevada Gold Acquisition Corp., a Nevada corporation formed on December 18, 2008, and a wholly owned subsidiary of Nano Holdings (“Acquisition Sub”), merged with and into NGE, with NGE being the surviving corporation (the “Merger”). As a result of the Merger, NGE became a wholly owned subsidiary of NGHI.

Pursuant to the Merger, we ceased operating as a distributor of party and drinking supplies and acquired the business of NGE to engage in the exploration and eventual development of gold mines, and we have continued NGE’s existing business operations as a publicly traded company under the name Nevada Gold Holdings, Inc. See “Split-Off Agreement” below.

At the closing of the Merger, each of the 200 shares of NGE’s common stock issued and outstanding immediately prior to the closing of the Merger was converted into 4,658,263 shares of our Common Stock. As a result, an aggregate of 2,626,263 shares of our Common Stock were issued to the holders of NGE’s common stock. NGE did not have any stock options or warrants to purchase shares of its capital stock outstanding at the time of the Merger.

3

The Merger Agreement contained a post-closing adjustment to the number of shares of Common Stock issued to the former NGE stockholders, in an amount up to 33,333 shares of Company Common Stock, to be issued to the former NGE stockholders on a pro rata basis for any breach of the Merger Agreement by Nevada Gold Holdings, Inc., discovered during the two-year period following the Closing Date. In order to secure the indemnification obligations of NGE under the Merger Agreement, 5% of the shares of Common Stock to which the principal former NGE stockholder (David Mathewson, who was also subsequent to the Merger our sole director, Chief Executive Officer and President, and who is now still a director of the Company) was entitled in exchange for his shares of NGE in connection with the Merger were held in escrow for a period of two years pursuant to an escrow agreement. These shares have been released from the escrow in full.

The Merger Agreement contained customary representations and warranties and pre- and post-closing covenants of each party and customary closing conditions. Breaches of the representations and warranties were subject to customary indemnification provisions.

The Merger was treated as a recapitalization of the Company for financial accounting purposes. NGE is considered the acquirer for accounting purposes, and the historical financial statements of Nano Holdings before the Merger were replaced with the historical financial statements of NGE before the Merger in all subsequent filings with the Securities and Exchange Commission (the “SEC”).

The parties took all actions necessary to ensure that the Merger was treated as a tax-free exchange under Section 368(a) of the Internal Revenue Code of 1986, as amended.

The issuance of shares of Common Stock to holders of NGE’s capital stock in connection with the Merger was not registered under the Securities Act, in reliance upon the exemption from registration provided by Section 4(2) of the Securities Act and Regulation D promulgated by the SEC under that section, which exempt transactions by an issuer not involving any public offering. These securities may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirement.

Split-Off Agreement

Upon the closing of the Merger, under the terms of a Split-Off Agreement, the Company transferred all of its pre-Merger operating assets and liabilities to its wholly owned subsidiary, Sunshine Group, Inc., a Delaware corporation (“Sunshine”) formed on December 18, 2008, including, without limitation, the Company’s equity interests in Sunshine Group, LLC, a Florida limited liability company (“Sunshine LLC”). Thereafter, pursuant to the Split-Off Agreement, we transferred all of the outstanding shares of capital stock of Sunshine to Marion R. “Butch” Barnes, William D. Blanchard and Robert Barnes, pre-Merger stockholders of Nano Holdings (the “Split-Off”), in consideration of and in exchange for (i) the surrender and cancellation of an aggregate of 6,666,667 shares of our Common Stock held by those stockholders and (ii) certain representations, covenants and indemnities.

Accounting Treatment; Change of Control

The Merger was accounted for as a “reverse merger,” and NGE was deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that are reflected in our financial statements prior to the Merger are those of NGE and have been recorded at the historical cost basis of NGE, and our consolidated financial statements after completion of the Merger include the assets and liabilities of NGE, historical operations of NGE and operations of NGHI and its subsidiary from the closing date of the Merger. As a result of the issuance of the shares of Common Stock pursuant to the Merger, a change in control of the Company occurred as of the date of consummation of the Merger. Except as described in this Report, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of members of our Board of Directors and, to our knowledge, no other arrangements exist that might result in a change of control of the Company.

4

Private Placements

On December 31, 2008, NGHI closed a private placement (the “Bridge PPO”) of (a) 55,200 shares of Common Stock, at a purchase price of $1.30 per share, and (b) $150,000 principal amount of its 10% Secured Convertible Promissory Note (the “2008 Bridge Note”), at a purchase price of par, for aggregate gross proceeds of $253,500, before deducting expenses related to the offerings. Upon the closing of the Merger, the purchaser of the 2008 Bridge Note also received 20,000 shares of Common Stock under the terms of the 2008 Bridge Note. (The 2008 Bridge Note has subsequently been repaid.)

On March 9, 2009, NGHI held a second closing of the Bridge PPO for 20,000 shares of Common Stock, at a purchase price of $2.06 per share.

As an inducement to certain investors to purchase Common Stock in the Bridge PPO, the principal former NGE stockholder (David Mathewson, who was then our Chief Executive Officer, President and sole director and is now our director) agreed to transfer to those investors in private transactions an aggregate of 214,000 shares of the Company Common Stock that he received in the Merger.

On June 24, 2009, we closed a private placement (the “2009 PPO”) of 133,333 units of our securities, at a purchase price of $3.75 per unit, each unit consisting of one share of Common Stock and a warrant to purchase one share of Common Stock for a period of five years, at an exercise price of $7.50 per share, for gross proceeds of $500,000.

On September 18, 2009, we held a second closing of the 2009 PPO for 68,667 of the same units on the same terms, for gross proceeds of $250,000.

On December 10, 2009, we borrowed $100,000 under a bridge loan note (the “2009 Bridge Note”) from a private institution. This note was converted into Common Stock on October 29, 2010. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – 2009 Bridge Note” for more information.

On February 5, 2010, we entered into a financing arrangement with JMJ Financial (the “Investor”), pursuant to which the Investor would lend us up to $3,200,000. We issued convertible promissory notes to the Investor in an aggregate principal amount of $3,200,000 (the “2010 JMJ Notes”). We received $200,000 from the Investor on February 5, 2010. On May 6, 2010, we repaid $200,000 from existing cash resources to the Investor as payment in full and complete satisfaction all of the Company’s obligations pursuant to the financing agreement, and the financing arrangement was cancelled. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – 2010 JMJ Notes” for more information.

On May 24, 2010, we borrowed $50,000 under a convertible bridge loan note from a private institution; in August 2010, we entered into three additional convertible bridge loan notes with an aggregate principal amount of $125,000 with three private investors; and on October 1, 2010, we entered into an additional convertible bridge loan note with a principal balance of $25,000 with a private investor (the “2010 Bridge Notes”). See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – 2010 Bridge Notes” for more information.

On October 29, 2010, November 16, 2010, and November 19, 2010 we held closings of a private placement offering (the “2010 PPO”) for a total of 38,833,356 units of our securities, at an offering price of $0.10 per unit, each unit consisting of one share of Common Stock and a warrant to purchase one share of Common Stock for a period of five years, at an exercise price of $0.10 per share. Of the $3,883,337 gross proceeds, $3,450,000 consisted of cash consideration, $313,337 came from the automatic conversion of principal and interest on all the convertible notes, and $120,000 represented the discharge of certain accounts payable. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – 2010 PPO” for more information.

5

Far East Golden Resources Investment Limited, a Hong Kong limited liability company (“Far East Golden Resources”), and a wholly owned subsidiary of Hybrid Kinetic Group Limited, an exempt company incorporated in Bermuda with limited liability, purchased 30,000,000 of the units in the 2010 PPO. We agreed with Far East Golden Resources to increase the size of our Board of Directors to seven members, and Far East Golden Resources is entitled to nominate four candidates to the Board. Immediately following the initial closing of the 2010 PPO, Far East Golden Resources beneficially owned 86.1% of the Company’s outstanding Common Stock (calculated as set forth in Rule 13d-3 under the Securities Exchange Act of 1934, as amended), based on its holding 30,000,000 shares of Common Stock and warrants (that are currently exercisable) to purchase 30,000,000 shares of Common Stock, and based on 37,851,862 shares of Common Stock then outstanding. By the conclusion of the 2010 PPO, additional shares of Common Stock were outstanding, and Far East Golden Resources’ beneficial ownership had declined to approximately 82.3%.

Investor Relations Agreement and Warrants

In the Merger Agreement, we agreed to enter into an agreement with an investor relations firm to be identified (the “IR Consultant”) to provide investor relations services to the Company, pursuant to which we will agree to issue to the IR Consultant warrants to purchase an aggregate of 66,667 shares of Common Stock, exercisable for a period of five years, at an exercise price of $15.00 per share.

2008 Equity Incentive Plan

Our 2008 Equity Incentive Plan (as amended, the “2008 Plan”), provides for the issuance of up to 4,507,371 shares of Common Stock (subject to automatic annual increases based on increases in our capitalization) as incentive awards granted to executive officers, key employees, consultants and directors. See “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities – Securities Authorized for Issuance under Equity Compensation Plans” for more information.

Overview of Our Business

We are engaged in the highly speculative business of exploring for gold. We currently hold a lease on one property in northern Nevada, on which we have the right to explore, and if warranted, mine for gold. Our current plan is to explore for gold at our one property and to determine if it contains gold deposits which can be mined at a profit. Our property is not known to contain gold which can be mined at a profit. We have commenced initial exploration activities. We also plan to acquire future exploration prospects, but have not identified any specific future prospects at this time. Our exploration staff consists solely of our Geological Advisor, David Mathewson. We plan to engage independent engineers, contractors and consultants on an as-needed basis. We cannot assure you that a commercially exploitable gold deposit will be found on our property.

In Nevada, there are five property categories that can be available for exploration and eventual development and mining: public lands, private fee lands, unpatented mining claims, patented mining claims, and tribal lands. Our property consists of unpatented mining claims on federal lands. The primary sources of land for exploration and mining activities are land owned by the United States federal government through the Bureau of Land Management and the United States Forest Service, land owned by state governments, tribal governments and individuals, or land obtained from entities which currently hold title to or lease government or private lands.

6

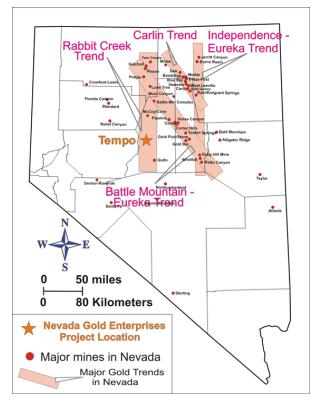

We currently have rights to explore for gold on one property, known as Tempo Mineral Prospect, which was acquired prior to Merger, all of which we lease from Gold Standard Royalty Corporation, a subsidiary of Golden Predator Mines Inc., which acquired its rights to this property from the Lyle F. Campbell Trust of Reno, Nevada, which acquired its rights to this property from the Federal Bureau of Land Management by staking. We acquired our interest in the lease from KM Exploration, Ltd., a Nevada limited liability company in which our director and Geological Advisor (and former CEO and President), David Mathewson, had a 50% ownership interest prior to its dissolution. (See “Certain Relationships and Related Transactions, and Director Independence” below.) More details about our property may be found in the section captioned “Properties.” Below is a map indicating the location of our property in Nevada.

See Part I, Item 2, “Properties,” below for more detailed information about the Tempo Mineral Prospect and our exploration program.

Although mineral exploration is a time consuming and expensive process with no assurance of success, the process is straightforward. We first acquire the rights to explore for gold. We then explore for gold by examining the soil, the rocks on the surface, and by drilling into the ground to retrieve underground rock samples, which can then be analyzed for their mineral content. This exploration activity is undertaken in phases, with each successive phase built upon the information previously gained in prior phases. If our exploration program discovers what appears to be an area which may be able to be profitably mined for gold, we will focus most of our activities on determining whether that is feasible, including further delineation of the location, size and economic feasibility of any such potential ore body.

7

In the event that we discover gold deposits on our property which can be mined at a profit, we will need to raise substantial additional financing in order for the deposits to be developed. In such event, we may seek to enter into a joint-venture agreement with another entity in order to mine our property or enter into other arrangements. Any gold that is mined from our property will be refined and eventually sold on the open market to dealers.

Competition

We compete with other exploration companies, many of which possess greater financial resources and technical abilities than we do. Our main areas of competition are acquiring exploration rights and engaging qualified personnel. The gold exploration industry is highly fragmented, and we are a very small participant in this sector. Many of our competitors explore for a variety of minerals and control many different properties around the world. Many of them have been in business longer than we have and have probably established more strategic partnerships and relationships and have greater financial accessibility than we do.

There is significant competition for properties suitable for gold exploration. As a result, we may be unable to continue to acquire interests in attractive properties on terms that we consider acceptable.

Market for Gold

In the event that gold is produced from our property, we believe that wholesale purchasers for the gold would be readily available. Readily available wholesale purchasers of gold and other precious metals exist in the United States and throughout the world. Among the largest are Handy & Harman, Engelhard Industries and Johnson Matthey, Ltd. Historically, these markets are liquid and volatile. Wholesale purchase prices for precious metals can be affected by a number of factors, all of which are beyond our control, including but not limited to:

|

●

|

fluctuation in the supply of, demand and market price for gold;

|

|

●

|

mining activities of our competitors;

|

|

●

|

sale or purchase of gold by central banks and for investment purposes by individuals and financial institutions;

|

|

●

|

interest rates;

|

|

●

|

currency exchange rates;

|

|

●

|

inflation or deflation;

|

|

●

|

fluctuation in the value of the United States dollar and other currencies; and

|

|

●

|

political and economic conditions of major gold or other mineral-producing countries.

|

8

10-Year Gold Prices

If we find gold that is deemed of economic grade and in sufficient quantities to justify removal, we may seek additional capital through equity or debt financing to build a mine and processing facility, or find some other entity to mine our property on our behalf, or sell our rights to mine the gold. Upon mining, the ore would be processed through a series of steps that produces a rough concentrate. This rough concentrate is then sold to refiners and smelters for the value of the minerals that it contains, less the cost of further concentrating, refining and smelting. Refiners and smelters then sell the gold on the open market through brokers who work for wholesalers including the major wholesalers listed above. Based upon the current demand for gold, we believe that we will not have any difficulty in selling any gold that we may recover. However, we have not found any gold as of today, and there is no assurance that we will find any gold in the future.

Hedging Transactions

We do not currently engage in hedging transactions and we have no hedged mineral resources.

Compliance with Government Regulation

Various levels of governmental controls and regulations address, among other things, the environmental impact of mineral exploration and mineral processing operations and establish requirements for decommissioning of mineral exploration properties after operations have ceased. With respect to the regulation of mineral exploration and processing, legislation and regulations in various jurisdictions establish performance standards, air and water quality emission standards and other design or operational requirements for various aspects of the operations, including health and safety standards. Legislation and regulations also establish requirements for decommissioning, reclamation and rehabilitation of mineral exploration properties following the cessation of operations and may require that some former mineral properties be managed for long periods of time after exploration activities have ceased.

Our exploration activities are subject to various levels of federal and state laws and regulations relating to protection of the environment, including requirements for closure and reclamation of mineral exploration properties. Some of the laws and regulations include the Clean Air Act, the Clean Water Act, the Comprehensive Environmental Response, Compensation and Liability Act, the Emergency Planning and Community Right-to-Know Act, the Endangered Species Act, the Federal Land Policy and Management Act, the National Environmental Policy Act, the Resource Conservation and Recovery Act, and all related state laws in Nevada. Additionally, our property is subject to the federal General Mining Law of 1872, which regulates how mineral claims on federal lands are obtained.

9

In 1989, the State of Nevada adopted the Mined Land Reclamation Act (the “Nevada MLR Act”), which established design, operation, monitoring and closure requirements for all mining operations in the state. The Nevada MLR Act has increased the cost of designing, operating, monitoring and closing new mining facilities and could affect the cost of operating, monitoring and closing existing mining facilities. New facilities are also required to provide a reclamation plan and financial assurance to ensure that the reclamation plan is implemented upon completion of operations. The Nevada MLR Act also requires reclamation plans and permits for exploration projects that will result in more than five acres of surface disturbance.

We have secured all necessary permits for our exploration activities planned in 2011 and we will file for additional required permits to conduct our exploration programs as necessary. These permits are usually obtained from either the Bureau of Land Management or the United States Forest Service. Obtaining such permits usually requires the posting of small bonds for subsequent remediation of trenching, drilling and bulk-sampling. Delays in the granting of permits are not uncommon, and any delays in the granting of permits may adversely affect our exploration activities. Additionally, necessary permits may be denied, in which case we will be unable to pursue our exploration activities. It may be possible to appeal any denials of permits, but any such appeal will result in additional delays and expense, which may cause you to lose all or part of your investment.

We do not anticipate discharging water into active streams, creeks, rivers, lakes or any other bodies of water without an appropriate permit. We also do not anticipate disturbing any endangered species or archaeological sites or causing damage to our property. Re-contouring and re-vegetation of disturbed surface areas will be completed pursuant to the applicable permits. The cost of remediation work varies according to the degree of physical disturbance. It is difficult to estimate the cost of compliance with environmental laws since the full nature and extent of our proposed activities cannot be determined at this time.

Employees

We currently have two full-time employees and one part-time employee. In the future, if our activities grow, we may hire personnel on an as-needed basis. For the foreseeable future, we plan to engage freelance geologists, engineers and other consultants as necessary.

Research and Development Expenditures

We are not currently conducting any research and development activities other than those relating to the possible acquisition of new gold properties or projects. As we proceed with our exploration programs we may need to engage additional contractors and consider the possibility of adding permanent employees, as well as the possible purchase or lease of equipment. Our planned exploration activities are described in the section captioned “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Subsidiaries

Nevada Gold Enterprises, Inc. (“NGE”) is our only subsidiary. The Company owns 100% of the stock of NGE.

10

Patents/Trademarks/Licenses/Franchises/Concessions/Royalty Agreements or Labor Contracts

We do not own any patents or trademarks. Also, we are not a party to any license or franchise agreements, concessions, or labor contracts. In the event that gold is produced from our property, we will have to pay royalties as disclosed in the section captioned “Properties.”

ITEM 1A. RISK FACTORS

THIS ANNUAL REPORT ON FORM 10-K CONTAINS CERTAIN STATEMENTS RELATING TO FUTURE EVENTS OR THE FUTURE FINANCIAL PERFORMANCE OF OUR COMPANY. YOU ARE CAUTIONED THAT SUCH STATEMENTS ARE ONLY PREDICTIONS AND INVOLVE RISKS AND UNCERTAINTIES, AND THAT ACTUAL EVENTS OR RESULTS MAY DIFFER MATERIALLY. IN EVALUATING SUCH STATEMENTS, YOU SHOULD SPECIFICALLY CONSIDER THE VARIOUS FACTORS IDENTIFIED IN THIS ANNUAL REPORT ON FORM 10-K, INCLUDING THE MATTERS SET FORTH BELOW, WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE INDICATED BY SUCH FORWARD-LOOKING STATEMENTS.

Risks Related to the Business and Financial Condition

Our business is exploring for gold, which is a highly speculative activity. An investment in our securities involves a high degree of risk. You should not invest in our securities if you cannot afford to lose your entire investment. In deciding whether you should invest in our securities, you should carefully consider the following information together with all of the other information contained in this Current Report. Any of the following risk factors can cause our business, prospects, financial condition or results of operations to suffer and you to lose all or part of your investment.

Exploring for gold is an inherently speculative business.

Exploring for gold is a business that by its nature is very speculative. There is a strong possibility that we will not discover any gold which can be mined at a profit. Even if we do discover gold deposits, the deposit may not be of the quality or size necessary for us to make a profit from actually mining it. Few properties that are explored are ultimately developed into producing mines. Unusual or unexpected geological formations, geological formation pressures, fires, power outages, labor disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labor are just some of the many risks involved in mineral exploration programs and the subsequent development of gold deposits.

We will need to obtain additional financing to fund our exploration program.

Although we have sufficient capital to fund our exploration program as it is currently planned through the end of 2011, we do not have sufficient capital to fund our exploration program as it is currently planned thereafter or to fund the acquisition and exploration of new properties. We estimate that we will need to raise approximately $1.5 million to pay for our exploration program through December 31, 2012, as it is currently planned and described in this Report, and our estimated administrative expenses, lease payments and estimated claim maintenance costs. We will likely require additional funding after that date. We may be unable to secure additional financing on terms acceptable to us, or at all, at times when we need such financing. Our inability to raise additional funds on a timely basis could prevent us from achieving our business objectives and could have a negative impact on our business, financial condition, results of operations and the value of our securities. If we raise additional funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders will be reduced and the securities that we may issue in the future may have rights, preferences or privileges senior to those of the current holders of our Common Stock. Such securities may also be issued at a discount to the market price of our Common Stock, resulting in possible further dilution to the book value per share of Common Stock. If we raise additional funds by issuing debt, we could be subject to debt covenants that could place limitations on our operations and financial flexibility.

11

The global financial crisis may have an impact on our business and financial condition in ways that we currently cannot predict.

The continued credit crisis and related turmoil in the global financial system may have an impact on our business and financial position. The recent high costs of fuel and other consumables may negatively impact production costs at our operations. In addition, the financial crisis may limit our ability to raise capital through credit and equity markets. As discussed further below, the prices of the metals that we may produce are affected by a number of factors, and it is unknown how these factors will be impacted by a continuation of the financial crisis.

Our management has conflicts of interest.

One of our directors, David Mathewson, has private mining interests and also may serve as a director of other gold exploration companies. Consequently, his personal interests may come into conflict with our interests. Situations may arise where Mr. Mathewson is presented with business opportunities which may be desirable not only for us, but also to the other companies with which he is affiliated. In addition to competition for suitable business opportunities, we also compete with these other gold exploration companies for investment capital, technical resources, key personnel and other things. You should carefully consider these potential conflicts of interest before deciding whether to invest in our securities.

Mr. Mathewson previously held a 50% ownership interest in KM Exploration, Ltd., a Nevada limited liability company, from which we acquired the lease for our Tempo property. See “Certain Relationships and Related Transactions, and Director Independence” below. The lease agreement relating to our property is described in greater detail in the section captioned “Properties.”

We do not know if our property contains any gold that can be mined at a profit.

The property on which we have the right to explore for gold is not known to have any deposits of gold which can be mined at a profit. Whether a gold deposit can be mined at a profit depends upon many factors. Some but not all of these factors include: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; operating costs and capital expenditures required to start mining a deposit; the availability and cost of financing; the price of gold, which is highly volatile and cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of minerals and environmental protection.

We are an exploration stage company with no mining operations and we may never have any mining operations in the future.

Our business is exploring for gold. In the unlikely event that we discover commercially exploitable gold deposits, we will not be able to make any money from them unless the gold is actually mined. We will need to either mine the gold ourselves, find some other entity to mine our properties on our behalf, or sell our rights to mine the gold. Mining operations in the United States are subject to many different federal, state and local laws and regulations, including stringent environmental, health and safety laws. If we assume any operational responsibility for mining on our property, it is possible that we will be unable to comply with current or future laws and regulations, which can change at any time. It is possible that changes to these laws will be adverse to any potential mining operations. Moreover, compliance with such laws may cause substantial delays and require capital outlays in excess of those anticipated, adversely affecting any potential mining operations. Our future mining operations, if any, may also be subject to liability for pollution or other environmental damage. It is possible that we will choose to not be insured against this risk because of high insurance costs or other reasons.

12

We are a new company with a short operating history and have only lost money.

NGE, our sole operating subsidiary, was formed on October 7, 2008. Our operating history consists of starting our preliminary exploration activities. We have no income-producing activities. We have already lost money because of the expenses we have incurred in acquiring the rights to explore on our property, and starting our preliminary exploration activities. Exploring for gold is an inherently speculative activity. There is a strong possibility that we will not find any commercially exploitable gold deposits on our property. Because we are a gold exploration company, we may never achieve any meaningful revenue.

We may not be able to follow our internal procedures relating to the authorization and reporting of our financial transactions, or such procedures may not function as intended.

We are a small company with limited resources. We have two full-time employees and one part-time employee. This may cause us not to comply with our internal procedures designed to assure that our financial information is properly gathered and reported. In the event that we do not follow these internal procedures, or if they do not function as intended, we could publish materially incorrect financial statements. This could cause investors to lose confidence in the accuracy of our reported financial information, impair our ability to secure additional financing, and result in a loss of your investment.

Our business is subject to extensive environmental regulations which may make exploring for or mining gold prohibitively expensive, and which may change at any time.

All of our operations are subject to extensive environmental regulations which can make exploring for gold expensive or prohibit it altogether. We may be subject to potential liabilities associated with the pollution of the environment and the disposal of waste products that may occur as the result of our exploring for gold on our properties. We may have to pay to remedy environmental pollution, which may reduce the amount of money that we have available to use for exploring for gold. This may adversely affect our financial position, which may cause you to lose your investment. If we are unable to fully remedy an environmental problem, we might be required to suspend operations or to enter into interim compliance measures pending the completion of the required remedy. If a decision is made to mine our Tempo property and we retain any operational responsibility for doing so, our potential exposure for remediation may be significant, and this may have a material adverse effect upon our business and financial position. We have not purchased insurance for potential environmental risks (including potential liability for pollution or other hazards associated with the disposal of waste products from our exploration activities) because we currently have no intention of mining our property. However, if we change our business plan to include the mining of our property and assuming that we retain operational responsibility for mining, then such insurance may not be available to us on reasonable terms or at a reasonable price. All of our exploration and, if warranted, development activities may be subject to regulation under one or more local, state and federal environmental impact analyses and public review processes. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have significant impact on some portion of our business, which may require our business to be economically re-evaluated from time to time. These risks include, but are not limited to, the risk that regulatory authorities may increase bonding requirements beyond our financial capability. Inasmuch as posting of bonding in accordance with regulatory determinations is a condition to the right to operate under all material operating permits, increases in bonding requirements could prevent operations even if we are in full compliance with all substantive environmental laws.

13

We may be denied the government licenses and permits which we need to explore for gold on our property. In the event that we discover commercially exploitable gold deposits, we may be denied the additional government licenses and permits which we will need to mine gold on our property.

Exploration activities usually require the granting of permits from various governmental agencies. For example, exploration drilling on unpatented mineral claims requires a permit to be obtained from the United States Bureau of Land Management, which may take several months or longer to grant the requested permit. Depending on the size, location and scope of the exploration program, additional permits may also be required before exploration activities can be undertaken. Prehistoric or Indian grave yards, threatened or endangered species, archeological sites or the possibility thereof, difficult access, excessive dust and important nearby water resources may all result in the need for additional permits before exploration activities can commence. As with all permitting processes, there is the risk that unexpected delays and excessive costs may be experienced in obtaining required permits. The needed permits may not be granted at all. Delays in or our inability to obtain necessary permits will result in unanticipated costs, which may result in serious adverse effects upon our business.

The value of our property is subject to volatility in the price of gold.

Our ability to obtain additional and continuing funding, and our profitability should we ever commence mining operations, will be significantly affected by changes in the market price of gold. Gold prices fluctuate widely and are affected by numerous factors, all of which are beyond our control. Some of these factors include the sale or purchase of gold by central banks and financial institutions; interest rates; currency exchange rates; inflation or deflation; fluctuation in the value of the United States dollar and other currencies; speculation; global and regional supply and demand, including investment, industrial and jewelry demand; and the political and economic conditions of major gold or other mineral-producing countries throughout the world, such as Russia and South Africa. The price of gold or other minerals have fluctuated widely in recent years, and a decline in the price of gold could cause a significant decrease in the value of our property, limit our ability to raise money, and render continued exploration and development of our property impracticable. If that happens, then we could lose our rights to our property and be compelled to sell some or all of these rights. Additionally, the future development of our mining property beyond the exploration stage is heavily dependent upon the level of gold prices remaining sufficiently high to make the development of our property economically viable. You may lose your investment if the price of gold decreases. The greater the decrease in the price of gold, the more likely it is that you will lose money.

Our property title may be challenged. We are not insured against any challenges, impairments or defects to our mineral claims or property title. We have not verified title to our property.

Our property is comprised of an unpatented lode claim created and maintained in accordance with the federal General Mining Law of 1872. Unpatented lode claims are unique U.S. property interests and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented lode claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations under the General Mining Law. We have not conducted a title search on our Tempo Mineral Prospect property. The uncertainty resulting from not having a title search on the property leaves us exposed to potential title suits. Defending any challenges to our property title will be costly, and may divert funds that could otherwise be used for exploration activities and other purposes. In addition, unpatented lode claims are always subject to possible challenges by third parties or contests by the federal government, which, if successful, may prevent us from exploiting our discovery of commercially extractable gold. Challenges to our title may increase our costs of operation or limit our ability to explore on certain portions of our property. We are not insured against challenges, impairments or defects to our property title, nor do we intend to carry title insurance in the future. Potential conflicts to our mineral claims are discussed in detail in the section captioned “Properties.”

14

Possible amendments to the General Mining Law could make it more difficult or impossible for us to execute our business plan.

The U.S. Congress has considered proposals to amend the General Mining Law of 1872 that would have, among other things, permanently banned the sale of public land for mining. The proposed amendment would have expanded the environmental regulations to which we are subject and would have given Indian tribes the ability to hinder or prohibit mining operations near tribal lands. The proposed amendment would also have imposed a royalty of 4% of gross revenue on new mining operations located on federal public land, which would have applied to all of our property. The proposed amendment would have made it more expensive or perhaps too expensive to recover any otherwise commercially exploitable gold deposits which we may find on our property. While at this time the proposed amendment is no longer pending, this or similar changes to the law in the future could have a significant impact on our business model.

Market forces or unforeseen developments may prevent us from obtaining the supplies and equipment necessary to explore for gold.

Gold exploration is a very competitive business. Competitive demands for contractors and unforeseen shortages of supplies and/or equipment could result in the disruption of our planned exploration activities. Current demand for exploration drilling services, equipment and supplies is robust and could result in suitable equipment and skilled manpower being unavailable at scheduled times for our exploration program. Fuel prices are extremely volatile as well. We will attempt to locate suitable equipment, materials, manpower and fuel if sufficient funds are available. If we cannot find the equipment and supplies needed for our various exploration programs, we may have to suspend some or all of them until equipment, supplies, funds and/or skilled manpower become available. Any such disruption in our activities may adversely affect our exploration activities and financial condition.

We may not be able to maintain the infrastructure necessary to conduct exploration activities.

Our exploration activities depend upon adequate infrastructure. Reliable roads, bridges, power sources and water supply are important factors which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect our exploration activities and financial condition.

Our exploration activities may be adversely affected by the local climate, which prevents us from exploring our property year-round.

The local climate makes it impossible for us to conduct exploration activities on our properties year-round. Because of their rural location and the lack of developed infrastructure in the area, our properties are generally impassible during the muddy season, which lasts roughly from December through May. During this time, it may be difficult or impossible for us to access our property, make repairs, or otherwise conduct exploration activities on them. Earthquakes, heavy rains, snowstorms, and floods could result in serious damage to or the destruction of facilities, equipment or means of access to our property, or may otherwise prevent us from conducting exploration activities on our property.

We do not carry any property or casualty insurance and do not intend to carry such insurance in the future.

Our business is subject to a number of risks and hazards generally, including but not limited to adverse environmental conditions, industrial accidents, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to our property, equipment, infrastructure, personal injury or death, environmental damage, delays, monetary losses and possible legal liability. You could lose all or part of your investment if any such catastrophic event occurs. We do not carry any property or casualty insurance at this time, nor do we intend to carry this type of insurance in the future (except that we will carry all insurance that we are required to by law, such as motor vehicle insurance). Even if we do obtain insurance, it may not cover all of the risks associated with our operations. Insurance against risks such as environmental pollution or other hazards as a result of exploration is generally not available to us or to other companies in our business on acceptable terms. Should any events against which we are not insured actually occur, we may become subject to substantial losses, costs and liabilities which will adversely affect our financial condition.

15

We must make annual lease payments and claim maintenance payments or we will lose our rights to our property.

We are required under the terms of our property lease to make annual lease payments. We are also required to make annual claim maintenance payments to Federal Bureau of Land Management and to the county in which our property is located in order to maintain our rights to explore and, if warranted, to develop our property. Our annual claim maintenance payments currently total approximately $32,000. If we fail to meet these obligations, we will lose the right to explore for gold on our property. Our property lease is described in greater detail in the section captioned “Properties.”

There is a limited public market for our securities and they will not be listed on a widely traded market in the foreseeable future.

There is currently a limited public market for shares of our Common Stock and one may never develop. Our Common Stock is quoted on the OTC Bulletin Board operated by FINRA. The OTC Bulletin Board is a thinly traded market and lacks the liquidity of certain other public markets with which some investors may have more experience. We may not ever be able to satisfy the listing requirements for our Common Stock to be listed on an exchange or Nasdaq, which are often more widely-traded and liquid markets. Some, but not all, of the factors which may delay or prevent the listing of our Common Stock on a more widely-traded and liquid market include the following: our stockholders’ equity may be insufficient; the market value of our outstanding securities may be too low; our net income from operations may be too low; our Common Stock may not be sufficiently widely held; we may not be able to secure market makers for our Common Stock, and we may fail to meet the rules and requirements mandated by the several exchanges and markets to have our Common Stock listed.

We cannot assure you that the Common Stock will become liquid or that it will be listed on a securities exchange.

We expect our Common Stock to remain eligible for quotation on the OTC Bulletin Board, or on another over-the-counter quotation system. In those venues, however, an investor may find it difficult to obtain accurate quotations as to the market value of our Common Stock. In addition, if we fail to meet the criteria set forth in SEC regulations, various requirements would be imposed by law on broker-dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling our Common Stock, which may further affect the liquidity of our Common Stock. This would also make it more difficult for us to raise additional capital. While we intend eventually to apply to list the Common Stock on the Nasdaq Stock Market, there can be no assurance that such listing will be successful or that the Common Stock will ever be listed on a national securities exchange.

“Penny Stock” rules will initially make buying or selling our Common Stock difficult because the broker-dealers selling our Common Stock will be subject to certain limitations.

Trading in our securities is subject to certain regulations adopted by the Securities Exchange Commission, commonly known as the “penny stock” rules and which generally apply to stocks selling below $5.00 per share. Our shares of Common Stock qualify as “penny stocks” and are covered by Section 15(g) of the Exchange Act, which imposes additional practice requirements on broker-dealers who sell shares of such stocks in the market. “Penny stock” rules govern how broker-dealers can deal with their clients and with “penny stocks.” For sales of our securities, including the sale of any Common Stock by the selling shareholders, the broker-dealer must make a special suitability determination and receive from you a written agreement prior to making a sale of stock to you. The additional burdens imposed upon broker-dealers by the “penny stock” rules may discourage broker-dealers from effecting transactions in our securities, which could severely affect their market price and liquidity. This could prevent you from easily reselling your shares or warrants when they become freely tradable and could cause the price of our securities to decline.

16

Compliance with U.S. securities laws, including the Sarbanes-Oxley Act, will be costly and time-consuming.

We are a reporting company under U.S. securities laws, and we are obliged to comply with the provisions of applicable U.S. laws and regulations, including the Securities Act, the Exchange Act and the Sarbanes-Oxley Act of 2002 and the related rules of the SEC, and the rules and regulations of the relevant U.S. market. Preparing and filing annual and quarterly reports and other information with the SEC, furnishing audited reports to stockholders and other compliance with these rules and regulations involves continual and significant regulatory, legal and accounting expenses. There can be no assurance that we will continue to be able to comply with the applicable regulations in a timely manner, if at all.

We do not plan to pay any dividends in the foreseeable future.

We have never paid a dividend and we are unlikely to pay a dividend in the foreseeable future, if ever. Whether any dividends are distributed in the future, as well as the specific details of any such dividends, will be decided by our Board of Directors based upon a number of factors, including but not limited to our earnings, financial requirements and other conditions prevailing at the time. We may never pay dividends. You should carefully consider this before deciding whether to purchase our securities.

Securities analysts may not initiate coverage or continue to cover our Common Stock, and this may have a negative impact on its market price.

The trading market for our Common Stock will depend, in part, on the research and reports that securities analysts publish about our business. We do not have any control over these analysts. There is no guarantee that securities analysts will cover the Common Stock. If securities analysts do not cover the Common Stock, the lack of research coverage may adversely affect its market price. If we are covered by securities analysts, and our stock is the subject of an unfavorable report, our stock price would likely decline. If one or more of these analysts ceases to cover our Company or fails to publish regular reports on us, we could lose visibility in the financial markets, which could cause our stock price or trading volume to decline. In addition, because we became public through a “reverse triangular merger,” we may have further difficulty attracting the coverage of securities analysts.

You may experience dilution of your ownership interests because of the future issuance of additional shares of our Common Stock.

Any future issuance of our equity or equity-backed securities may dilute then-current stockholders’ ownership percentages and could also result in a decrease in the fair market value of our equity securities, because our assets would be owned by a larger pool of outstanding equity. As described above, we may need to raise additional capital through public or private offerings of our common or preferred stock or other securities that are convertible into or exercisable for our common or preferred stock. We may also issue such securities in connection with hiring or retaining employees and consultants (including stock options issued under our equity incentive plans), as payment to providers of goods and services, in connection with future acquisitions or for other business purposes. Our Board of Directors may at any time authorize the issuance of additional common or preferred stock without common stockholder approval, subject only to the total number of authorized common and preferred shares set forth in our articles of incorporation. The terms of equity securities issued by us in future transactions may be more favorable to new investors, and may include dividend and/or liquidation preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect. Also, the future issuance of any such additional shares of common or preferred stock or other securities may create downward pressure on the trading price of the common stock. There can be no assurance that any such future issuances will not be at a price (or exercise prices) below the price at which shares of the common stock are then traded.

17

Any failure to maintain effective internal control over our financial reporting could materially adversely affect us.

Section 404 of the Sarbanes-Oxley Act of 2002 will require us to include in our annual reports on Form 10-K, beginning with the Form 10-K for the fiscal year ending December 31, 2010, an assessment by management of the effectiveness of our internal control over financial reporting. While we intend to diligently and thoroughly document, review, test and improve our internal control over financial reporting in order to ensure compliance with Section 404, management may not be able to conclude that our internal control over financial reporting is effective. This could result in a loss of investor confidence in the reliability of our financial statements, which in turn could negatively impact the price of our common stock.

In particular, we must perform system and process evaluation and testing of our internal control over financial reporting to allow management to report on the effectiveness of our internal control over financial reporting, as required by Section 404. Our compliance with Section 404 will require that we incur substantial expense and expend significant management efforts. We currently do not have an internal audit group, and we will need to retain the services of additional accounting and financial staff or consultants with appropriate public company experience and technical accounting knowledge to satisfy the ongoing requirements of Section 404. We intend to review the effectiveness of our internal controls and procedures and make any changes management determines appropriate, including to achieve compliance with Section 404. However, any significant deficiencies in our control systems may affect our ability to comply with SEC reporting requirements and any applicable listing standards or cause our financial statements to contain material misstatements, which could negatively affect the market price and trading liquidity of our common stock and cause investors to lose confidence in our reported financial information, as well as subject us to civil or criminal investigations and penalties.

Our principal stockholders have the power to control the Company because they hold a majority of our outstanding shares of Common Stock.

As of April 14, 2011, our directors, executive officers and principal stockholder beneficially owned approximately 86% of our outstanding Common Stock. As of that date, Far East Golden Resources beneficially owned 82.3% of our outstanding Common Stock, our director David C. Mathewson beneficially owned 3.5% of our outstanding Common Stock and our directors and executive officers as a group beneficially owned 3.7% of our outstanding Common Stock. (See Item 12, “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters,” for more information.) Far East Golden Resources has the power to elect all of our directors, to control our business and affairs and to control the vote on substantially all other corporate matters without the approval of other stockholders. Furthermore, such concentration of voting power would enable those stockholders to delay, deferr or prevent a change in control of the company, impede a merger, consolidation, takeover or other business combination involving the Company, or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of the Company. This may adversely affect the value of your investment, and you should carefully consider this concentration of ownership before deciding whether to invest in our Company. Each stockholder who beneficially owns more than 5% of our outstanding shares of Common Stock is identified in “Security Ownership of Certain Beneficial Owners and Management.”

18

We are a holding company that depends on cash flow from our subsidiary to meet our obligations and pay dividends.

We are a holding company with no material assets other than cash and the stock of our wholly owned subsidiary, NGE. Accordingly, we anticipate that all of our operations will be conducted by NGE (and any additional subsidiaries we may form or acquire). We currently expect that the earnings and cash flow of our subsidiary will primarily be retained and used by it in its operations, including servicing any debt obligations it may have now or in the future. Therefore, our subsidiary may not be able to generate sufficient cash flow to distribute funds to us in order to allow us to pay our obligations as they become due or, although we do not anticipate paying any dividends in the foreseeable future, pay future dividends on, or make any distributions with respect to, our common or other stock. Additionally, our ability to participate as an equity holder in any distribution of assets of any subsidiary upon liquidation is generally subordinate to the claims of creditors of such subsidiary.

ITEM 2. PROPERTIES

Executive Offices

Our business office is located at 800 E. Colorado Blvd., Suite 888, Pasadena, California 91101, in the offices of Far East Golden Resources. It contains office furniture and equipment sufficient to administer our current business. Office services and office space are provided without charge by the primary shareholder of the Company. Such costs are immaterial to the consolidated financial statements and accordingly, have not been reflected therein.

Tempo Mineral Prospect (“Tempo”)

We have the right to explore for gold on a property located in Austin, Nevada, known as Tempo Mineral Prospect. We acquired our original exploration rights to the Tempo Mineral Prospect pursuant to a lease with Gold Standard Royalty Corporation, a subsidiary of Golden Predator Mines Inc. (the “Lessor”), which acquired its rights to this property from the Lyle F. Campbell Trust of Reno, Nevada, an entity with which we are not affiliated and which acquired its rights to Tempo Mineral Prospect from the Federal Bureau of Land Management by staking. The lease covers 206 contiguous unpatented lode claims, totaling 2,920 acres. We may terminate our lease of the Tempo Mineral Prospect at any time. Our property is not known to contain gold that can be mined at a profit, although the area in which our property is located has a history of mining activity by others. Our current property was selected by our director and Geological Advisor, and former CEO and President, David Mathewson.

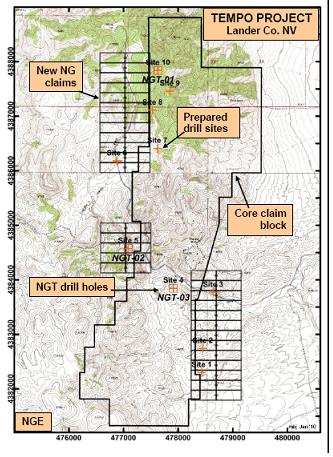

In October 2009, we located an additional 60 unpatented mining claims, in three groups, as shown on the map below. These claims are contiguous with and lie within the area of interest (AOI) of the Tempo lease.

Property Description, Location and Access

Tempo is located in the southern Ravenswood Mountains 14 miles northwest of Austin, Nevada, within the north-south trending Rabbit Creek Gold Trend. Tempo is a Carlin-style sediment-hosted gold exploration target. The property consists of 206 unpatented mining claims totaling approximately 4,000 acres, in a contiguous block approximately 6.5 miles north to south and up to 1.8 miles east to west, covering approximately 6.5 square miles.

Tempo is accessible through good roads as well as cross-country. Access is generally available from May through December. Between December and May is the muddy season, during which wet weather and poor road conditions will generally prevent us from accessing the property. We know of no environmental or archeological issues related to this property.

19

Map of Tempo Mineral Prospect

20

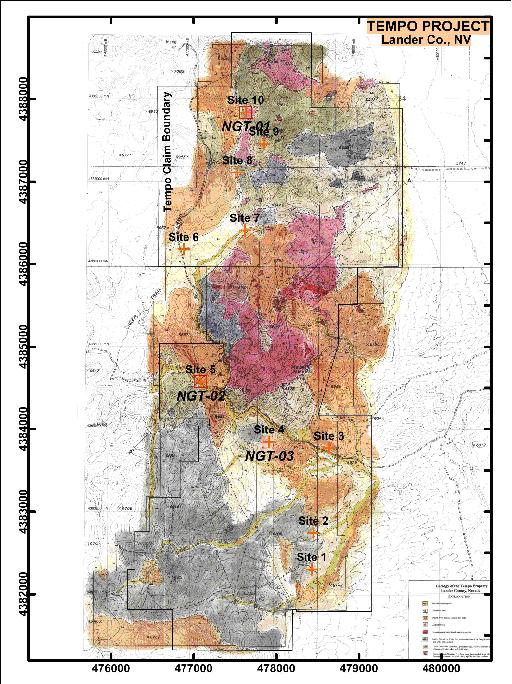

Tempo Geology

21

Title Report

We have not conducted a title survey on Tempo, and have no immediate plans to do so in the future.

Geology and History

We believe that Tempo’s geology, geochemistry and alteration are typical of those in the Rabbit Creek gold trend. The central target is defined by a gold and arsenic soil anomaly approximately 5,000 feet in strike length. Both upper-plate and permissive lower-plate rocks are present. Rock samples indicate a high of 20 gm/t for gold and 300 gm/t for silver. The central portion of the property covers approximately one square mile of lower plate carbonate rock intruded by Laramide diorites with associated gold-bearing skarn. The northern third of the property includes numerous exposures of lower-plate carbonate rocks within a large expanse of non-permissive upper-plate rocks. Jasperoids are common and contain anomalous to very anomalous gold and arsenic values.

Previous work at Tempo by numerous companies includes geologic mapping; extensive rock chip and soil sampling; IP, resistivity, air and ground magnetic, and gravity geophysical surveys; and close and wide spaced reverse circulation drilling. Results of much of this work are in a digital archive that constitutes an important database for continued evaluation of the property.

Synthesis of mapped faults and structures interpreted from gravity, magnetic, and resistivity geophysical surveys defines four regions of relatively complex structural intersections. These areas are candidates for enhanced flow of potential ore-forming hydrothermal fluids.

Compilation of archive rock chip and soil geochemical data defines seven areas 1,500 to 6,000 feet long of robust, combined anomalous gold, arsenic, antimony, mercury and silver in both rocks and soils. These anomalies coincide with or are adjacent to regions of complex structural intersections and deserve adequate drill tests through the Roberts Mountains Formation.

Based on review of historical drill information, we believe that the targeted Roberts Mountains Formation is poorly tested by past drilling. Of the approximately 123 holes (with known collar coordinates) previously drilled by others in and adjacent to the Tempo claim block, 64 bottom in Tertiary volcanic units or in the upper plate of the Roberts Mountains Thrust and do not reach the potential host rocks. Of the 58 holes that do intersect the Roberts Mountains Formation, only 13 are deeper than 600 feet, and only five, including NGT-01 and NGT-02 drilled by us, test the bottom contact of the Roberts Mountains Formation, an important ore horizon at the Jerritt Canyon mine in the Independence Range, Elko Co., Nevada.

With respect to drill tests of the seven areas of robust geochemical anomalies, only two contain drill holes that intersect the Roberts Mountains Formation, three contain holes that do not reach the target unit, and two have not been drill tested.