UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

(Mark

One)

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For

fiscal year ended: December 31,

2009

|

OR

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For

the transition period from _______________ to

_______________

|

Commission

file number: 333-140148

|

|

Nevada

Gold Holdings, Inc.

|

|

|

(Exact

name of registrant as specified in its charter)

|

|

Nevada

|

20-3724068

|

|||

|

(State

or other jurisdiction of

incorporation

or organization)

|

(IRS

Employer Identification No.)

|

|

1640

Terrace Way

Walnut

Creek, California

|

94597

|

|||

|

(Address

of principal executive offices)

|

(Postal

Code)

|

Registrant’s

telephone number, including area code: (775) 835-6177

Securities

registered under Section 12(b) of the Act: None

Securities

registered under Section 12(g) of the Act: Common Stock, Par Value of $0.001 Per

Share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Exchange Act. Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months

(or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90

days. Yes x No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes o No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a smaller reporting company. See the

definitions of the “large accelerated filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

Large

Accelerated Filer o Accelerated

Filer o

Non-Accelerated

Filer o Smaller

reporting company x

(Do

not check if a smaller reporting company)

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).Yes o No x

On June

30, 2009, the last business day of the registrant’s most recently completed

second fiscal quarter, 48,121,946 shares of its Common Stock, $0.001 par value

per share (its only class of voting or non-voting common equity) were held by

non-affiliates of the registrant. The market value of those shares

was $10,586,828, based on the last sale price of $0.22 per share of the Common

Stock on that date. For this purpose, shares of Common Stock

beneficially owned by each executive officer and director of the registrant [and

each beneficial owner of 10% or more of the Common Stock outstanding] have been

excluded because such persons may be deemed to be affiliates. This determination

of affiliate status is not necessarily a conclusive determination for other

purposes.

As of

April 14, 2010, there were 76,430,476 shares of the registrant's common stock,

par value $0.001, issued and outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None

TABLE

OF CONTENTS

|

Item

|

Page

|

||

|

Available

Information

|

2

|

||

|

Forward-Looking

Statements

|

3

|

||

|

PART

I

|

4

|

||

|

1.

|

Business

|

4

|

|

|

1A.

|

Risk

Factors

|

12

|

|

|

2.

|

Properties

|

20

|

|

|

3.

|

Legal

Proceedings

|

27

|

|

|

4.

|

Submission

of Matters to a Vote of Security Holders

|

27

|

|

|

PART

II

|

28

|

||

|

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

28

|

|

|

6.

|

Selected

Financial Data

|

32

|

|

|

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

33

|

|

|

8.

|

Financial

Statements and Supplemental Data

|

35

|

|

|

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

35

|

|

|

9A.[T]

|

Controls

and Procedures

|

38

|

|

|

PART

III

|

39

|

||

|

10.

|

Directors,

Executive Officers, and Corporate Governance

|

39

|

|

|

11.

|

Executive

Compensation

|

41

|

|

|

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

44

|

|

|

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

45

|

|

|

14.

|

Principal

Accountant Fees and Services

|

46

|

|

|

PART

IV

|

47

|

||

|

|

|||

|

15.

|

Exhibits

and Financial Statement Schedules

|

47

|

|

AVAILABLE

INFORMATION

We file

annual, quarterly and current reports, proxy statements and other information

with the United States Securities and Exchange Commission (“SEC”). You may read

and copy any document we file with the SEC at the SEC’s Public Reference Room at

100 F Street, NE, Washington, DC 20549, U.S.A. You may obtain information on the

operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330 (or

1-202-551-8090). The SEC maintains an internet site that contains annual,

quarterly and current reports, proxy and information statements and other

information regarding issuers that file electronically with the SEC. Our

electronic SEC filings are available to the public at http://www.sec.gov.

Our

public internet site is http://www.nevadagoldholdings.com.

We make available free of charge through our internet site, via a

link to the SEC’s internet site at http://www.sec.gov,

our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports

on Form 8-K and amendments to those reports filed or furnished pursuant to

Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), as soon as reasonably practicable after we electronically files

such material with, or furnish it to, the SEC. We also make available through

our internet site, via a link to the SEC’s internet site, statements of

beneficial ownership of our equity securities filed by our directors, officers,

10% or greater shareholders and others under Section 16 of the Exchange

Act.

These

documents are also available in print without charge to any person who requests

them by writing or telephoning:

Nevada

Gold Holdings, Inc.

c/o

Gottbetter & Partners, LLP

488

Madison Avenue

New York,

New York 10022-5718

Telephone:

212-400-6900

Facsimile:

212-400-6901

2

FORWARD-LOOKING

STATEMENTS

This

Annual Report contains forward-looking statements, including, without

limitation, in the sections captioned “Description of Business,” “Risk Factors,”

and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations,” and elsewhere. Any and all statements contained in this Report that

are not statements of historical fact may be deemed forward-looking statements.

Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,”

“pro forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,”

“develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,”

and terms of similar import (including the negative of any of the foregoing) may

be intended to identify forward-looking statements. However, not all

forward-looking statements may contain one or more of these identifying terms.

Forward-looking statements in this Report may include, without limitation,

statements regarding (i) the plans and objectives of management for future

operations, including plans or objectives relating to exploration programs, (ii)

a projection of income (including income/loss), earnings (including

earnings/loss) per share, capital expenditures, dividends, capital structure or

other financial items, (iii) our future financial performance, including any

such statement contained in a discussion and analysis of financial condition by

management or in the results of operations included pursuant to the rules and

regulations of the SEC, and (iv) the assumptions underlying or relating to any

statement described in points (i), (ii) or (iii) above.

The

forward-looking statements are not meant to predict or guarantee actual results,

performance, events or circumstances and may not be realized because they are

based upon our current projections, plans, objectives, beliefs, expectations,

estimates and assumptions and are subject to a number of risks and uncertainties

and other influences, many of which we have no control over. Actual results and

the timing of certain events and circumstances may differ materially from those

described by the forward-looking statements as a result of these risks and

uncertainties. Factors that may influence or contribute to the inaccuracy of the

forward-looking statements or cause actual results to differ materially from

expected or desired results may include, without limitation, our inability to

obtain adequate financing, insufficient cash flows and resulting illiquidity,

our inability to expand our business, government regulations, lack of

diversification, volatility in the price of gold, increased competition, results

of arbitration and litigation, stock volatility and illiquidity, and our failure

to implement our business plans or strategies. A description of some of the

risks and uncertainties that could cause our actual results to differ materially

from those described by the forward-looking statements in this Report appears in

the section captioned “Risk Factors” and elsewhere in this Report.

Readers

are cautioned not to place undue reliance on forward-looking statements because

of the risks and uncertainties related to them and to the risk factors. We

disclaim any obligation to update the forward-looking statements contained in

this Report to reflect any new information or future events or circumstances or

otherwise.

Readers

should read this Report in conjunction with the discussion under the caption

“Risk Factors,” our financial statements and the related notes thereto in this

Report, and other documents which we may file from time to time with the

SEC.

3

PART I

|

ITEM

1.

|

BUSINESS

|

This

Report contains summaries of the material terms of various agreements executed

in connection with the transactions described herein. The summaries of these

agreements are subject to, and are qualified in their entirety by, reference to

these agreements, all of which are incorporated herein by

reference.

Historical

Development

We were

incorporated as Nano Holdings International, Inc., in Delaware on April 16,

2004. Prior to the Merger (as defined below), our business was to

sell party and drinking supplies, including gelatin shot mixes, shot glasses,

flavored sugar and salts, and various other drinking containers and

paraphernalia.

Name

Change and Capital Increase

On

November 3, 2008, we filed a Certificate of Amendment to our Certificate of

Incorporation with the Secretary of State of the State of Delaware, which (i)

changed our name from Nano Holdings International, Inc., to Nevada Gold

Holdings, Inc., and (ii) increased our authorized capital stock from 75,000,000

shares of common stock, par value $0.001, to 300,000,000 shares of common stock,

par value $0.001, and 10,000,000 shares of preferred stock, par value

$0.001.

As used

in this Report, unless otherwise stated or the context clearly indicates

otherwise, the term “Nano Holdings” refers to Nevada Gold Holdings, Inc., before

giving effect to the Merger (defined below), the term “NGE” refers to Nevada

Gold Enterprises, Inc., a Nevada corporation formed on October 7, 2008, before

giving effect to the Merger, the term “NGHI” refers to Nevada Gold Holdings,

Inc., after giving effect to the Merger, and the terms “Company,” “we,” “us,”

and “our” refer to Nevada Gold Holdings, Inc., and its wholly-owned subsidiary,

NGE, after giving effect to the Merger.

Stock

Splits

Our Board

of Directors authorized a 30.30303-for-1 forward split of our common stock, par

value $0.001 per share (“Common Stock”), in the form of a stock dividend (the

“2008 Stock Split”), which was paid on November 21, 2008, to Holders of record

on November 19, 2008. Our Board of Directors authorized a 2-for-1

forward split of our Common Stock, in the form of a stock dividend (the “2009

Stock Split”), which was paid on May 12, 2009, to Holders of record on May 8,

2009. All share and per share numbers in this Report relating to the Common

Stock have been adjusted to give effect to these stock splits, unless otherwise

stated.

Merger

On

December 31, 2008, pursuant to a Merger Agreement entered into on the same date,

Nevada Gold Acquisition Corp., a Nevada corporation formed on December 18, 2008,

and a wholly owned subsidiary of Nano Holdings (“Acquisition Sub”), merged with

and into NGE, with NGE being the surviving corporation (the “Merger”). As a

result of the Merger, NGE became a wholly-owned subsidiary of the

NGHI.

Pursuant

to the Merger, we ceased operating as a distributor of party and drinking

supplies and acquired the business of NGE to engage in the exploration and

eventual development of gold mines and have continued NGE’s existing business

operations as a publicly-traded company under the name Nevada Gold Holdings,

Inc. See “Split-Off Agreement” below.

At the

closing of the Merger, each of the 200 shares of NGE’s common stock issued and

outstanding immediately prior to the closing of the Merger was converted into

80,000 shares of our Common Stock. As a result, an aggregate of 16,000,000

shares of our Common Stock were issued to the holders of NGE’s common stock. NGE

did not have any stock options or warrants to purchase shares of its capital

stock outstanding at the time of the Merger.

4

The

Merger Agreement contains a post-closing adjustment to the number of shares of

Company Common Stock issued to the former NGE stockholders, in an amount up to

500,000 shares of Company Common Stock, to be issued to the former NGE

stockholders on a pro

rata basis for any breach of the Merger Agreement by Nevada Gold

Holdings, Inc., discovered during the two-year period following the Closing

Date. In order to secure the indemnification obligations of NGE under the Merger

Agreement, 5% of the shares of Company Common Stock to which the principal

former NGE stockholder (David Mathewson, who was also subsequent to the Merger

our sole director, Chief Executive Officer and President, and who is now still a

director of the Company) is entitled in exchange for his shares of NGE in

connection with the Merger will be held in escrow for a period of two years

pursuant to an escrow agreement.

The

Merger Agreement contained customary representations and warranties and pre- and

post-closing covenants of each party and customary closing conditions. Breaches

of the representations and warranties will be subject to customary

indemnification provisions.

The

Merger was treated as a recapitalization of the Company for financial accounting

purposes. NGE is considered the acquirer for accounting purposes, and the

historical financial statements of Nano Holdings before the Merger have been

replaced with the historical financial statements of NGE before the Merger in

all subsequent filings with the Securities and Exchange Commission (the

“SEC”).

The

parties have taken all actions necessary to ensure that the Merger is treated as

a tax-free exchange under Section 368(a) of the Internal Revenue Code of 1986,

as amended.

The

issuance of shares of Common Stock to holders of NGE’s capital stock in

connection with the Merger was not registered under the Securities Act, in

reliance upon the exemption from registration provided by Section 4(2) of the

Securities Act and Regulation D promulgated by the SEC under that section, which

exempt transactions by an issuer not involving any public offering. These

securities may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirement.

Split-Off

Agreement

Upon the

closing of the Merger, under the terms of a Split-Off Agreement, the Company

transferred all of its pre-Merger operating assets and liabilities to its

wholly-owned subsidiary, Sunshine Group, Inc., a Delaware

corporation (“Sunshine”) formed on December 18, 2008, including, without

limitation, the Company’s equity interests in Sunshine Group, LLC, a Florida

limited liability company (“Sunshine LLC”). Thereafter, pursuant to the

Split-Off Agreement, the Company transferred all of the outstanding shares of

capital stock of Sunshine to Marion R. “Butch” Barnes, William D. Blanchard and

Robert Barnes, pre-Merger stockholders of Nano Holdings (the “Split-Off”), in

consideration of and in exchange for (i) the surrender and cancellation of an

aggregate of 100,000,000 shares of the Company’s Common Stock held by those

stockholders and (ii) certain representations, covenants and

indemnities.

Private

Placements

On

December 31, 2008, NGHI closed a private placement (the “Bridge PPO”) of (a)

414,000 shares of Common Stock, at a purchase price of $0.25 per share, and (b)

$150,000 principal amount of its 10% Secured Convertible Promissory Note (the

“2008 Bridge Note”), at a purchase price of par, for aggregate gross proceeds of

$253,500, before deducting expenses related to the offerings. Upon

the closing of the Merger, the purchaser of the 2008 Bridge Note also received

150,000 shares of Common Stock under the terms of the 2008 Bridge

Note. (The 2008 Bridge Note has subsequently been repaid; see

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations – 2008 Bridge Note” for more information.)

5

On March

9, 2009, NGHI held a second closing of the Bridge PPO for 165,000 shares of

Common Stock, at a purchase price of $0.25 per share.

As an

inducement to certain investors to purchase Common Stock in the Bridge PPO, the

principal former NGE stockholder (David Mathewson, who was then our Chief

Executive Officer, President and sole director and is now our director) agreed

to transfer to those investors in private transactions an aggregate of 3,210,000

shares of the Company Common Stock that he received in the Merger.

On June

24, 2009, we closed a private placement (the “2009 PPO”) of 2,000,000 units of

our securities, at a purchase price of $0.25 per unit, each unit consisting of

one share of Common Stock and a warrant to purchase one share of Common Stock

for a period of five years, at an exercise price of $0.50 per share, for gross

proceeds of $500,000.

On

September 18, 2009, we held a second closing of the 2009 PPO for 1,000,000 of

the same units on the same terms, for gross proceeds of $250,000.

On

December 10, 2009, we borrowed $100,000 under a bridge loan note (the “2009

Bridge Note”) from a private institution. See “Management’s Discussion and

Analysis of Financial Condition and Results of Operations – 2009 Bridge Note”

for more information.

On

February 5, 2010, we entered into a financing arrangement with JMJ Financial

(the “Investor”), pursuant to which the Investor may lend us up to

$3,200,000. We issued convertible promissory notes to the Investor in

an aggregate principal amount of $3,200,000 (the “2010 Notes”). We

received $200,000 from the Investor on February 5, 2010. See

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations – 2010 Notes” for more information.

These

offerings and issuances were exempt from registration under the Securities Act

of 1933, as amended (the “Securities Act”). The Bridge PPO and the 2009 PPO were

exempt in reliance upon Regulation D and Regulation S promulgated by the SEC

under the Act and were sold only to “accredited investors,” as defined in

Regulation D and non-“U.S. persons” as defined in Regulation S. The

issuances of the 2008 Bridge Note, the 2009 Bridge Note and of the 2010 Notes

were exempt from registration under Section 4(2) of the Act as not involving any

public offering. These securities may not be offered or sold in the

United States absent registration or an applicable exemption from the

registration requirement. Additional information concerning the Bridge PPO, the

2008 Bridge Note, the 2009 PPO, the 2009 Bridge Note and the 2010 Notes is

presented below under “Management’s Discussion and Analysis of Financial

Condition and Results of Operations.”

Investor

Relations Agreement and Warrants

In the

Merger Agreement, we agreed to enter into an agreement with an investor

relations firm to be identified (the “IR Consultant”) to provide investor

relations services to the Company, pursuant to which we will agree to issue to

the IR Consultant warrants to purchase an aggregate of 1,000,000 shares of

Common Stock, exercisable for a period of five years, at an exercise price of

$1.00 per share.

2008

Equity Incentive Plan

Before

the Merger, Nano Holdings’ Board of Directors adopted, subject to

stockholder approval, the 2008 Equity Incentive Plan (the “2008 Plan”), which

provides for the issuance of up to 4,000,000 shares of Common Stock as incentive

awards granted to executive officers, key employees, consultants and

directors.

6

Lock-up

Agreements and Other Restrictions

In

connection with the Merger, David Mathewson, the then sole officer, director and

employee of the Company, and the two other former stockholders of NGE entered

into lock-up agreements, whereby they are restricted for a period of 24 months

(in the case of Mr. Mathewson) or 12 months (in the case of the other two

stockholders) from certain sales or dispositions of the Common Stock acquired by

them in the Merger. In addition, the Common Stock issued to the former NGE

stockholders in the Merger is not permitted to be included in a registration

statement for a period of 24 months after the closing. In addition, for a period

of 12 months after the closing, former NGE stockholders agreed to be subject to

restrictions on engaging in certain transactions, including effecting or

agreeing to effect short sales, whether or not against the box, establishing any

“put equivalent position” with respect to the Common Stock, borrowing or

pre-borrowing any shares of Common Stock, or granting other rights (including

put or call options) with respect to the Common Stock or with respect to any

security that includes, relates to or derives any significant part of its value

from the Common Stock, or otherwise seeks to hedge their position in the Common

Stock.

Directors

and Officers

Our Board

of Directors consists of three members. On the Closing Date of the Merger, David

Rector, the sole director of Nano Holdings before the Merger, resigned his

position as a director, and David Mathewson was appointed to fill the vacancy on

the Board of Directors. Also on the Closing Date, Mr. Rector, the President and

sole officer of Nano Holdings, resigned and Mr. Mathewson was appointed CEO,

President, Secretary and Treasurer by the Board. On November 5, 2009, Mr.

Mathewson resigned as CEO, President, Secretary and Treasurer (but remained on

the Board of Directors), and Mr. Rector was appointed a director and CEO,

President and Secretary. On November 13, 2009, John N. Braca was

appointed to the Board of Directors. See “Management – Directors and

Executive Officers.”

Accounting

Treatment; Change of Control

The

Merger was accounted for as a “reverse merger,” and NGE was deemed to be the

acquirer in the reverse merger. Consequently, the assets and liabilities and the

historical operations that will be reflected in the financial statements prior

to the Merger will be those of NGE and will be recorded at the historical cost

basis of NGE, and the consolidated financial statements after completion of the

Merger will include the assets and liabilities of NGE, historical operations of

NGE and operations of the Company and its subsidiary from the closing date of

the Merger. As a result of the issuance of the shares of Common Stock pursuant

to the Merger, a change in control of the Company occurred as of the date of

consummation of the Merger. Except as described in this Report, no arrangements

or understandings exist among present or former controlling stockholders with

respect to the election of members of our Board of Directors and, to our

knowledge, no other arrangements exist that might result in a change of control

of the Company.

We

continued to be a “smaller reporting company,” as defined under the Exchange

Act.

Overview

of Our Business

We are

engaged in the highly speculative business of exploring for gold. We currently

hold a lease on one property in northern Nevada, on which we have the right to

explore, and if warranted, mine for gold. Our current plan is to explore for

gold at our one property and to determine if it contains gold deposits which can

be mined at a profit. Our property is not known to contain gold which can be

mined at a profit. We have commenced initial exploration activities.

We also plan to acquire future exploration prospects, but have not identified

any specific future prospects at this time. Our exploration staff

consists solely of our Geological

Advisor, David Mathewson. We plan to engage independent engineers,

contractors and consultants on an as-needed basis. We cannot assure you that a

commercially exploitable gold deposit will be found on our

property.

7

In

Nevada, there are five property categories that can be available for exploration

and eventual development and mining: public lands, private fee lands, unpatented

mining claims, patented mining claims, and tribal lands. Our property consists

of unpatented mining claims on federal lands. The primary sources of land for

exploration and mining activities are land owned by the United States federal

government through the Bureau of Land Management and the United States Forest

Service, land owned by state governments, tribal governments and individuals, or

land obtained from entities which currently hold title to or lease government or

private lands.

We

currently have rights to explore for gold on one property, known as Tempo

Mineral Prospect, all of which we lease from Gold Standard Royalty

Corporation, a subsidiary of Golden Predator Mines Inc.,

which acquired its rights to this property from the Lyle F. Campbell

Trust of Reno, Nevada, which acquired its rights to this property from the

Federal Bureau of Land Management by staking. We acquired our interest in the

lease from KM Exploration, Ltd., a Nevada limited liability company in which our

director and Geological Advisor (and former CEO and President), David Mathewson,

had a 50% ownership interest prior to its dissolution. (See “Certain

Relationships and Related Transactions, and Director Independence”

below.) More details about our property may be found in the section

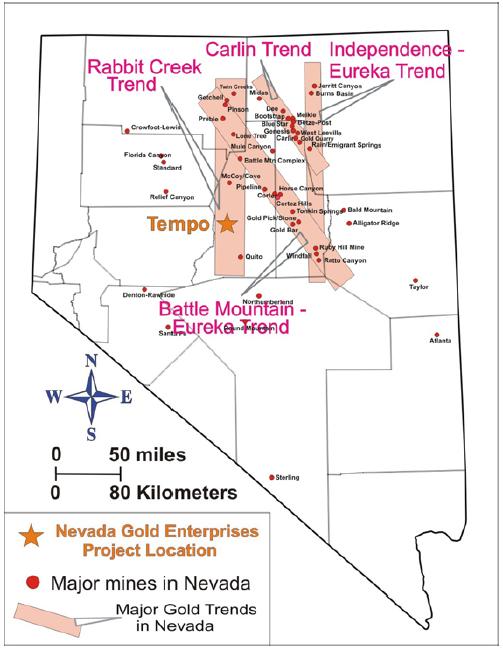

captioned “Properties.” Below is a map indicating the location of our property

in Nevada.

8

See Part

I, Item 2, “Properties,” below for more detailed information about the Tempo

Mineral Prospect and our exploration program.

Although

mineral exploration is a time consuming and expensive process with no assurance

of success, the process is straightforward. We first acquire the rights to

explore for gold. We then explore for gold by examining the soil, the rocks on

the surface, and by drilling into the ground to retrieve underground rock

samples, which can then be analyzed for their mineral content. This exploration

activity is undertaken in phases, with each successive phase built upon the

information previously gained in prior phases. If our exploration program

discovers what appears to be an area which may be able to be profitably mined

for gold, we will focus most of our activities on determining whether that is

feasible, including further delineation of the location, size and economic

feasibility of any such potential ore body.

In the

event that we discover gold deposits on our property which can be mined at a

profit, we will need to raise substantial additional financing in order for the

deposits to be developed. In such event, we may seek to enter into a

joint-venture agreement with another entity in order to mine our property or

enter into other arrangements. Any gold that is mined from our property will be

refined and eventually sold on the open market to dealers.

Competition

We

compete with other exploration companies, many of which possess greater

financial resources and technical abilities than we do. Our main areas of

competition are acquiring exploration rights and engaging qualified personnel.

The gold exploration industry is highly fragmented, and we are a very small

participant in this sector. Many of our competitors explore for a variety of

minerals and control many different properties around the world. Many of them

have been in business longer than we have and have probably established more

strategic partnerships and relationships and have greater financial

accessibility than we do.

There is

significant competition for properties suitable for gold exploration. As a

result, we may be unable to continue to acquire interests in attractive

properties on terms that we consider acceptable.

Market

for Gold

In the

event that gold is produced from our property, we believe that wholesale

purchasers for the gold would be readily available. Readily available wholesale

purchasers of gold and other precious metals exist in the United States and

throughout the world. Among the largest are Handy & Harman, Engelhard

Industries and Johnson Matthey, Ltd. Historically, these markets are liquid and

volatile. Wholesale purchase prices for precious metals can be affected by a

number of factors, all of which are beyond our control, including but not

limited to:

|

●

|

fluctuation

in the supply of, demand and market price for

gold;

|

|

●

|

mining

activities of our competitors;

|

|

●

|

sale

or purchase of gold by central banks and for investment purposes by

individuals and financial

institutions;

|

|

●

|

interest

rates;

|

|

●

|

currency

exchange rates;

|

|

●

|

inflation

or deflation;

|

|

●

|

fluctuation

in the value of the United States dollar and other currencies;

and

|

|

●

|

political

and economic conditions of major gold or other mineral-producing

countries.

|

9

10-Year

Gold Prices

If we

find gold that is deemed of economic grade and in sufficient quantities to

justify removal, we may seek additional capital through equity or debt financing

to build a mine and processing facility, or find some other entity to mine our

property on our behalf, or sell our rights to mine the gold. Upon mining, the

ore would be processed through a series of steps that produces a rough

concentrate. This rough concentrate is then sold to refiners and smelters for

the value of the minerals that it contains, less the cost of further

concentrating, refining and smelting. Refiners and smelters then sell the gold

on the open market through brokers who work for wholesalers including the major

wholesalers listed above. Based upon the current demand for gold, we believe

that we will not have any difficulty in selling any gold that we may recover.

However, we have not found any gold as of today, and there is no assurance that

we will find any gold in the future.

Hedging

Transactions

We do not

currently engage in hedging transactions and we have no hedged mineral

resources.

Compliance

with Government Regulation

Various

levels of governmental controls and regulations address, among other things, the

environmental impact of mineral exploration and mineral processing operations

and establish requirements for decommissioning of mineral exploration properties

after operations have ceased. With respect to the regulation of mineral

exploration and processing, legislation and regulations in various jurisdictions

establish performance standards, air and water quality emission standards and

other design or operational requirements for various aspects of the operations,

including health and safety standards. Legislation and regulations also

establish requirements for decommissioning, reclamation and rehabilitation of

mineral exploration properties following the cessation of operations and may

require that some former mineral properties be managed for long periods of time

after exploration activities have ceased.

Our

exploration activities are subject to various levels of federal and state laws

and regulations relating to protection of the environment, including

requirements for closure and reclamation of mineral exploration properties. Some

of the laws and regulations include the Clean Air Act, the Clean Water Act,

the Comprehensive Environmental Response, Compensation and Liability Act, the

Emergency Planning and Community Right-to-Know Act, the Endangered Species Act,

the Federal Land Policy and Management Act, the National Environmental Policy

Act, the Resource Conservation and Recovery Act, and all related state laws in

Nevada. Additionally, our property is subject to the federal General Mining Law

of 1872, which regulates how mineral claims on federal lands are

obtained.

10

In 1989,

the State of Nevada adopted the Mined Land Reclamation Act (the “Nevada MLR

Act”), which established design, operation, monitoring and closure requirements

for all mining operations in the state. The Nevada MLR Act has increased the

cost of designing, operating, monitoring and closing new mining facilities and

could affect the cost of operating, monitoring and closing existing mining

facilities. New facilities are also required to provide a reclamation plan and

financial assurance to ensure that the reclamation plan is implemented upon

completion of operations. The Nevada MLR Act also requires reclamation plans and

permits for exploration projects that will result in more than five acres of

surface disturbance.

We plan

to secure all necessary permits for our exploration activities and we will file

for the required permits to conduct our exploration programs as necessary. These

permits are usually obtained from either the Bureau of Land Management or the

United States Forest Service. Obtaining such permits usually requires the

posting of small bonds for subsequent remediation of trenching, drilling and

bulk-sampling. Delays in the granting of permits are not uncommon, and any

delays in the granting of permits may adversely affect our exploration

activities. Additionally, necessary permits may be denied, in which case we will

be unable to pursue our exploration activities. It may be possible to appeal any

denials of permits, but any such appeal will result in additional delays and

expense, which may cause you to lose all or part of your

investment.

We do not

anticipate discharging water into active streams, creeks, rivers, lakes or any

other bodies of water without an appropriate permit. We also do not anticipate

disturbing any endangered species or archaeological sites or causing damage to

our property. Re-contouring and re-vegetation of disturbed surface areas will be

completed pursuant to the applicable permits. The cost of remediation work

varies according to the degree of physical disturbance. It is difficult to

estimate the cost of compliance with environmental laws since the full nature

and extent of our proposed activities cannot be determined at this

time.

Employees

We

currently have one employee. In the future, if our activities grow, we may

hire personnel on an as-needed basis. For the foreseeable future, we plan to

engage freelance geologists, engineers and other consultants as

necessary.

Research

and Development Expenditures

We are

not currently conducting any research and development activities other than

those relating to the possible acquisition of new gold properties or projects.

As we proceed with our exploration programs we may need to engage additional

contractors and consider the possibility of adding permanent employees, as well

as the possible purchase or lease of equipment. Our planned exploration

activities are described in the section captioned “Management’s Discussion and

Analysis of Financial Condition and Results of Operations.”

Subsidiaries

Nevada

Gold Enterprises, Inc. (“NGE”) is our only subsidiary. The Company

owns 100% of the stock of NGE.

11

Patents/Trademarks/Licenses/Franchises/Concessions/Royalty

Agreements or Labor Contracts

We do not

own any patents or trademarks. Also, we are not a party to any license or

franchise agreements, concessions, or labor contracts. In the event that gold is

produced from our property, we will have to pay royalties as disclosed in the

section captioned “Properties.”

|

ITEM

1A.

|

RISK

FACTORS

|

THIS

ANNUAL REPORT ON FORM 10-K CONTAINS CERTAIN STATEMENTS RELATING TO FUTURE EVENTS

OR THE FUTURE FINANCIAL PERFORMANCE OF OUR COMPANY. YOU ARE CAUTIONED THAT SUCH

STATEMENTS ARE ONLY PREDICTIONS AND INVOLVE RISKS AND UNCERTAINTIES, AND THAT

ACTUAL EVENTS OR RESULTS MAY DIFFER MATERIALLY. IN EVALUATING SUCH STATEMENTS,

YOU SHOULD SPECIFICALLY CONSIDER THE VARIOUS FACTORS IDENTIFIED IN THIS ANNUAL

REPORT ON FORM 10-K, INCLUDING THE MATTERS SET FORTH BELOW, WHICH COULD CAUSE

ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE INDICATED BY SUCH FORWARD-LOOKING

STATEMENTS.

Risks

Related to the Business and Financial Condition

Our

business is exploring for gold, which is a highly speculative activity. An

investment in our securities involves a high degree of risk. You should not

invest in our securities if you cannot afford to lose your entire investment. In

deciding whether you should invest in our securities, you should carefully

consider the following information together with all of the other information

contained in this Current Report. Any of the following risk factors can cause

our business, prospects, financial condition or results of operations to suffer

and you to lose all or part of your investment.

[The loss of David Mathewson

would adversely affect our business because his expertise is indispensable; we

do not carry any key-man insurance. [Discuss

how to revise]

Our business depends upon the

continued active involvement of our Geological Advisor, David Mathewson. The

loss of Mr. Mathewson’s services would materially adversely affect our business

and prospects. We relied solely upon Mr.

Mathewson’s judgment and expertise in deciding to lease the Tempo property. We

did not independently visit, survey or examine the property before leasing it.

We are relying upon Mr. Mathewson’s familiarity with the property in

implementing our exploration program, which was designed by Mr. Mathewson. We

plan to rely upon Mr. Mathewson’s expertise in planning our future activities,

including the acquisition of exploration prospects. We do not believe that we

will be able to operate as planned in the event that Mr. Mathewson ceases to be

involved with us. You should carefully consider our reliance upon Mr.

Mathewson’s involvement and judgment before deciding whether to invest in our

securities.]

We plan

to engage independent engineers, contractors and consultants on an as-needed

basis.

Exploring

for gold is an inherently speculative business.

Exploring

for gold is a business that by its nature is very speculative. There is a strong

possibility that we will not discover any gold which can be mined at a profit.

Even if we do discover gold deposits, the deposit may not be of the quality or

size necessary for us to make a profit from actually mining it. Few properties

that are explored are ultimately developed into producing mines. Unusual or

unexpected geological formations, geological formation pressures, fires, power

outages, labor disruptions, flooding, explosions, cave-ins, landslides and the

inability to obtain suitable or adequate machinery, equipment or labor are just

some of the many risks involved in mineral exploration programs and the

subsequent development of gold deposits.

12

We

need to obtain additional financing to fund our exploration

program.

We do not

have sufficient capital to fund our exploration program as it is currently

planned or to fund the acquisition and exploration of new properties. We

estimate that we will need to raise approximately $750,000 to pay for our

exploration program through December 31, 2010, as it is currently planned and described in this

Report [where?],

and our estimated administrative expenses, lease payments and estimated claim

maintenance costs. We will likely require additional funding after

that date. We may be unable to secure additional financing on terms acceptable

to us, or at all, at times when we need such financing. Our inability to raise

additional funds on a timely basis could prevent us from achieving our business

objectives and could have a negative impact on our business, financial

condition, results of operations and the value of our securities. If

we raise additional funds by issuing additional equity or convertible debt

securities, the ownership percentages of existing stockholders will be reduced

and the securities that we may issue in the future may have rights, preferences

or privileges senior to those of the current holders of our Common Stock. Such

securities may also be issued at a discount to the market price of our Common

Stock, resulting in possible further dilution to the book value per share of

Common Stock. If we raise additional funds by issuing debt, we could be subject

to debt covenants that could place limitations on our operations and financial

flexibility.

The

global financial crisis may have an impact on our business and financial

condition in ways that we currently cannot predict.

The

continued credit crisis and related turmoil in the global financial system may

have an impact on our business and financial position. The recent high costs of

fuel and other consumables may negatively impact production costs at our

operations. In addition, the financial crisis may limit our ability to raise

capital through credit and equity markets. As discussed further below, the

prices of the metals that we may produce are affected by a number of factors,

and it is unknown how these factors will be impacted by a continuation of the

financial crisis.

Our

management has conflicts of interest.

One of

our directors David Mathewson, has private mining interests and also may serve

as a director of other gold exploration companies. Consequently, his personal

interests may come into conflict with our interests. Situations may arise where

Mr. Mathewson is presented with business opportunities which may be desirable

not only for us, but also to the other companies with which he is affiliated. In

addition to competition for suitable business opportunities, we also compete

with these other gold exploration companies for investment capital, technical

resources, key personnel and other things. You should carefully consider these

potential conflicts of interest before deciding whether to invest in our

securities.

Mr.

Mathewson previously held a 50% ownership interest in KM Exploration, Ltd., a

Nevada limited liability company, from which we acquired the lease for our Tempo

property. See “Certain Relationships and Related Transactions, and Director

Independence” below. The lease agreement relating to our property is described

in greater detail in the section captioned “Properties.”

We

do not know if our property contains any gold that can be mined at a

profit.

The

property on which we have the right to explore for gold is not known to have any

deposits of gold which can be mined at a profit. Whether a gold deposit can be

mined at a profit depends upon many factors. Some but not all of these factors

include: the particular attributes of the deposit, such as size, grade and

proximity to infrastructure; operating costs and capital expenditures required

to start mining a deposit; the availability and cost of financing; the price of

gold, which is highly volatile and cyclical; and government regulations,

including regulations relating to prices, taxes, royalties, land use, importing

and exporting of minerals and environmental protection.

13

We

are an exploration stage company with no mining operations and we may never have

any mining operations in the future.

Our

business is exploring for gold. In the unlikely event that we discover

commercially exploitable gold deposits, we will not be able to make any money

from them unless the gold is actually mined. We will need to either mine the

gold ourselves, find some other entity to mine our properties on our behalf, or

sell our rights to mine the gold. Mining operations in the United States are

subject to many different federal, state and local laws and regulations,

including stringent environmental, health and safety laws. If we assume any

operational responsibility for mining on our property, it is possible that we

will be unable to comply with current or future laws and regulations, which can

change at any time. It is possible that changes to these laws will be adverse to

any potential mining operations. Moreover, compliance with such laws may cause

substantial delays and require capital outlays in excess of those anticipated,

adversely affecting any potential mining operations. Our future mining

operations, if any, may also be subject to liability for pollution or other

environmental damage. It is possible that we will choose to not be insured

against this risk because of high insurance costs or other reasons.

We

are a new company with a short operating history and have only lost

money.

NGE, our

sole operating subsidiary, was formed on October 7, 2008. Our operating history

consists of starting our preliminary exploration activities. We have no

income-producing activities. We have already lost money because of the expenses

we have incurred in recruiting personnel, acquiring the rights to explore on our

property, and starting our preliminary exploration activities. Exploring for

gold is an inherently speculative activity. There is a strong possibility that

we will not find any commercially exploitable gold deposits on our property.

Because we are a gold exploration company, we may never achieve any meaningful

revenue.

We

may not be able to follow our internal procedures relating to the authorization

and reporting of our financial transactions, or such procedures may not function

as intended.

We are a

small company with limited resources. We have no full-time employees. This may

cause us not to comply with our internal procedures designed to assure that our

financial information is properly gathered and reported. In the event that we do

not follow these internal procedures, or if they do not function as intended, we

could publish materially incorrect financial statements. This could cause

investors to lose confidence in the accuracy of our reported financial

information, impair our ability to secure additional financing, and result in a

loss of your investment.

Our

business is subject to extensive environmental regulations which may make

exploring for or mining gold prohibitively expensive, and which may change at

any time.

All of

our operations are subject to extensive environmental regulations which can make

exploring for gold expensive or prohibit it altogether. We may be subject to

potential liabilities associated with the pollution of the environment and the

disposal of waste products that may occur as the result of our exploring for

gold on our properties. We may have to pay to remedy environmental pollution,

which may reduce the amount of money that we have available to use for exploring

for gold. This may adversely affect our financial position, which may cause you

to lose your investment. If we are unable to fully remedy an environmental

problem, we might be required to suspend operations or to enter into interim

compliance measures pending the completion of the required remedy. If a decision

is made to mine our Tempo property and we retain any operational responsibility

for doing so, our potential exposure for remediation may be significant, and

this may have a material adverse effect upon our business and financial

position. We have not purchased insurance for potential environmental risks

(including potential liability for pollution or other hazards associated with

the disposal of waste products from our exploration activities) because we

currently have no intention of mining our property. However, if we change our

business plan to include the mining of our property and assuming that we retain

operational responsibility for mining, then such insurance may not be available

to us on reasonable terms or at a reasonable price. All of our exploration and,

if warranted, development activities may be subject to regulation under one or

more local, state and federal environmental impact analyses and public review

processes. It is possible that future changes in applicable laws, regulations

and permits or changes in their enforcement or regulatory interpretation could

have significant impact on some portion of our business, which may require our

business to be economically re-evaluated from time to time. These risks include,

but are not limited to, the risk that regulatory authorities may increase

bonding requirements beyond our financial capability. Inasmuch as posting of

bonding in accordance with regulatory determinations is a condition to the right

to operate under all material operating permits, increases in bonding

requirements could prevent operations even if we are in full compliance with all

substantive environmental laws.

14

We

may be denied the government licenses and permits which we need to explore for

gold on our property. In the event that we discover commercially exploitable

gold deposits, we may be denied the additional government licenses and permits

which we will need to mine gold on our property.

Exploration

activities usually require the granting of permits from various governmental

agencies. For example, exploration drilling on unpatented mineral claims

requires a permit to be obtained from the United States Bureau of Land

Management, which may take several months or longer to grant the requested

permit. Depending on the size, location and scope of the exploration program,

additional permits may also be required before exploration activities can be

undertaken. Prehistoric or Indian grave yards, threatened or endangered species,

archeological sites or the possibility thereof, difficult access, excessive dust

and important nearby water resources may all result in the need for additional

permits before exploration activities can commence. As with all permitting

processes, there is the risk that unexpected delays and excessive costs may be

experienced in obtaining required permits. The needed permits may not be granted

at all. Delays in or our inability to obtain necessary permits will result in

unanticipated costs, which may result in serious adverse effects upon our

business.

The

value of our property is subject to volatility in the price of

gold.

Our

ability to obtain additional and continuing funding, and our profitability

should we ever commence mining operations, will be significantly affected by

changes in the market price of gold. Gold prices fluctuate widely and are

affected by numerous factors, all of which are beyond our control. Some of these

factors include the sale or purchase of gold by central banks and financial

institutions; interest rates; currency exchange rates; inflation or deflation;

fluctuation in the value of the United States dollar and other currencies;

speculation; global and regional supply and demand, including investment,

industrial and jewelry demand; and the political and economic conditions of

major gold or other mineral-producing countries throughout the world, such as

Russia and South Africa. The price of gold or other minerals have fluctuated

widely in recent years, and a decline in the price of gold could cause a

significant decrease in the value of our property, limit our ability to raise

money, and render continued exploration and development of our property

impracticable. If that happens, then we could lose our rights to our property

and be compelled to sell some or all of these rights. Additionally, the future

development of our mining property beyond the exploration stage is heavily

dependent upon the level of gold prices remaining sufficiently high to make the

development of our property economically viable. You may lose your investment if

the price of gold decreases. The greater the decrease in the price of gold, the

more likely it is that you will lose money.

Our

property title may be challenged. We are not insured against any challenges,

impairments or defects to our mineral claims or property title. We have not

verified title to our property.

Our

property is comprised of an unpatented lode claim created and maintained in

accordance with the federal General Mining Law of 1872. Unpatented lode claims

are unique U.S. property interests and are generally considered to be subject to

greater title risk than other real property interests because the validity of

unpatented lode claims is often uncertain. This uncertainty arises, in part, out

of the complex federal and state laws and regulations under the General Mining

Law. We have not conducted a title search on our Tempo Mineral Prospect

property. The uncertainty resulting from not having a title search on the

property leaves us exposed to potential title suits. Defending any challenges to

our property title will be costly, and may divert funds that could otherwise be

used for exploration activities and other purposes. In addition, unpatented lode

claims are always subject to possible challenges by third parties or contests by

the federal government, which, if successful, may prevent us from exploiting our

discovery of commercially extractable gold. Challenges to our title may increase

our costs of operation or limit our ability to explore on certain portions of

our property. We are not insured against challenges, impairments or defects to

our property title, nor do we intend to carry title insurance in the future.

Potential conflicts to our mineral claims are discussed in detail in the section

captioned “Properties.”

15

Possible

amendments to the General Mining Law could make it more difficult or impossible

for us to execute our business plan.

The U.S.

Congress has considered proposals to amend the General Mining Law of 1872 that

would have, among other things, permanently banned the sale of public land for

mining. The proposed amendment would have expanded the environmental regulations

to which we are subject and would have given Indian tribes the ability to hinder

or prohibit mining operations near tribal lands. The proposed amendment would

also have imposed a royalty of 4% of gross revenue on new mining operations

located on federal public land, which would have applied to all of our property.

The proposed amendment would have made it more expensive or perhaps too

expensive to recover any otherwise commercially exploitable gold deposits which

we may find on our property. While at this time the proposed amendment is no

longer pending, this or similar changes to the law in the future could have a

significant impact on our business model. Senator Harry Reid of Nevada, Senate

Majority Leader, has announced that because of other priorities, there will be

no consideration to deal with the General Mining Law of 1872 issue “this

year.”

Market

forces or unforeseen developments may prevent us from obtaining the supplies and

equipment necessary to explore for gold.

Gold

exploration is a very competitive business. Competitive demands for contractors

and unforeseen shortages of supplies and/or equipment could result in the

disruption of our planned exploration activities. Current demand for exploration

drilling services, equipment and supplies is robust and could result in suitable

equipment and skilled manpower being unavailable at scheduled times for our

exploration program. Fuel prices are extremely volatile as well. We will attempt

to locate suitable equipment, materials, manpower and fuel if sufficient funds

are available. If we cannot find the equipment and supplies needed for our

various exploration programs, we may have to suspend some or all of them until

equipment, supplies, funds and/or skilled manpower become available. Any such

disruption in our activities may adversely affect our exploration activities and

financial condition.

We

may not be able to maintain the infrastructure necessary to conduct exploration

activities.

Our

exploration activities depend upon adequate infrastructure. Reliable roads,

bridges, power sources and water supply are important factors which affect

capital and operating costs. Unusual or infrequent weather phenomena, sabotage,

government or other interference in the maintenance or provision of such

infrastructure could adversely affect our exploration activities and financial

condition.

Our

exploration activities may be adversely affected by the local climate, which

prevents us from exploring our property year-round.

The local

climate makes it impossible for us to conduct exploration activities on our

properties year-round. Because of their rural location and the lack of developed

infrastructure in the area, our properties are generally impassible during the

muddy season, which lasts roughly from December through May. During this time,

it may be difficult or impossible for us to access our property, make repairs,

or otherwise conduct exploration activities on them. Earthquakes, heavy rains,

snowstorms, and floods could result in serious damage to or the destruction of

facilities, equipment or means of access to our property, or may otherwise

prevent us from conducting exploration activities on our property.

16

We

do not carry any property or casualty insurance and do not intend to carry such

insurance in the future.

Our

business is subject to a number of risks and hazards generally, including but

not limited to adverse environmental conditions, industrial accidents, unusual

or unexpected geological conditions, ground or slope failures, cave-ins, changes

in the regulatory environment and natural phenomena such as inclement weather

conditions, floods and earthquakes. Such occurrences could result in damage to

our property, equipment, infrastructure, personal injury or death, environmental

damage, delays, monetary losses and possible legal liability. You could lose all

or part of your investment if any such catastrophic event occurs. We do not

carry any property or casualty insurance at this time, nor do we intend to carry

this type of insurance in the future (except that we will carry all insurance

that we are required to by law, such as motor vehicle insurance). Even if we do

obtain insurance, it may not cover all of the risks associated with our

operations. Insurance against risks such as environmental pollution or other

hazards as a result of exploration is generally not available to us or to other

companies in our business on acceptable terms. Should any events against which

we are not insured actually occur, we may become subject to substantial losses,

costs and liabilities which will adversely affect our financial

condition.

We

must make annual lease payments and claim maintenance payments or we will lose

our rights to our property.

We are

required under the terms of our property lease to make annual lease payments. We

are also required to make annual claim maintenance payments to Federal Bureau of

Land Management and to the county in which our property is located in order to

maintain our rights to explore and, if warranted, to develop our property. Our

annual claim maintenance payments currently total approximately $32,256. If we

fail to meet these obligations, we will lose the right to explore for gold on

our property. Our property lease is described in greater detail in the section

captioned “Properties.”

There

is a limited public market for our securities and they will not be listed on a

widely traded market in the foreseeable future.

There is

currently a limited public market for shares of our Common Stock and one may

never develop. Our Common Stock is quoted on the OTC Bulletin Board operated by

the National Association of Securities Dealers, Inc. The OTC Bulletin Board is a

thinly traded market and lacks the liquidity of certain other public markets

with which some investors may have more experience. We may not ever be able to

satisfy the listing requirements for our Common Stock to be listed on an

exchange or Nasdaq, which are often a more widely-traded and liquid market.

Some, but not all, of the factors which may delay or prevent the listing of our

Common Stock on a more widely-traded and liquid market include the following:

our stockholders’ equity may be insufficient; the market value of our

outstanding securities may be too low; our net income from operations may be too

low; our Common Stock may not be sufficiently widely held; we may not be able to

secure market makers for our Common Stock, and we may fail to meet the rules and

requirements mandated by the several exchanges and markets to have our Common

Stock listed.

We

cannot assure you that the Common Stock will become liquid or that it will be

listed on a securities exchange.

We expect

our Common Stock to remain eligible for quotation on the OTC Bulletin Board, or

on another over-the-counter quotation system. In those venues, however, an

investor may find it difficult to obtain accurate quotations as to the market

value of our Common Stock. In addition, if we fail to meet the criteria set

forth in SEC regulations, various requirements would be imposed by law on

broker-dealers who sell our securities to persons other than established

customers and accredited investors. Consequently, such regulations may deter

broker-dealers from recommending or selling our Common Stock, which may further

affect the liquidity of our Common Stock. This would also make it

more difficult for us to raise additional capital. While we intend eventually to

apply to list the Common Stock on the Nasdaq Stock Market, there can be no

assurance that such listing will be successful or that the Common Stock will

ever be listed on a national securities exchange.

17

“Penny

Stock” rules will initially make buying or selling our Common Stock difficult

because the broker-dealers selling our Common Stock will be subject to certain

limitations.

Trading

in our securities is subject to certain regulations adopted by the Securities

Exchange Commission, commonly known as the “penny stock” rules and which apply

to stocks selling below $5.00 per share. Our shares of Common Stock qualify as

“penny stocks” and are covered by Section 15(g) of the Exchange Act, which

imposes additional practice requirements on broker-dealers who sell shares of

such stocks in the market. “Penny stock” rules govern how broker-dealers can

deal with their clients and with “penny stocks.” For sales of our securities,

including the sale of any Common Stock by the selling shareholders, the

broker-dealer must make a special suitability determination and receive from you

a written agreement prior to making a sale of stock to you. The additional

burdens imposed upon broker-dealers by the “penny stock” rules may discourage

broker-dealers from effecting transactions in our securities, which could

severely affect their market price and liquidity. This could prevent you from

easily reselling your shares or warrants when they become freely tradable and

could cause the price of our securities to decline.

Compliance

with U.S. securities laws, including the Sarbanes-Oxley Act, will be costly and

time-consuming.

We are a

reporting company under U.S. securities laws, and we are obliged to comply with

the provisions of applicable U.S. laws and regulations, including the Securities

Act, the Exchange Act and the Sarbanes-Oxley Act of 2002 and the related rules

of the SEC, and the rules and regulations of the relevant U.S. market. Preparing

and filing annual and quarterly reports and other information with the SEC,

furnishing audited reports to stockholders and other compliance with these rules

and regulations will involve a material increase in regulatory, legal and

accounting expenses and the attention of management, and there can be no

assurance that we will be able to comply with the applicable regulations in a

timely manner, if at all.

We

do not plan to pay any dividends in the foreseeable future.

We have

never paid a dividend and we are unlikely to pay a dividend in the foreseeable

future, if ever. Whether any dividends are distributed in the future, as well as

the specific details of any such dividends, will be decided by our Board of

Directors based upon a number of factors, including but not limited to our

earnings, financial requirements and other conditions prevailing at the time. We

may never pay dividends. You should carefully consider this before deciding

whether to purchase our securities.

Securities

analysts may not initiate coverage or continue to cover our Common Stock, and

this may have a negative impact on its market price.

The

trading market for our Common Stock will depend, in part, on the research and

reports that securities analysts publish about our business. We do not have any

control over these analysts. There is no guarantee that securities analysts will

cover the Common Stock. If securities analysts do not cover the Common Stock,

the lack of research coverage may adversely affect its market price. If we are

covered by securities analysts, and our stock is the subject of an unfavorable

report, our stock price would likely decline. If one or more of these analysts

ceases to cover our Company or fails to publish regular reports on us, we could

lose visibility in the financial markets, which could cause our stock price or

trading volume to decline. In addition, because we became public through a

“reverse triangular merger,” we may have further difficulty attracting the

coverage of securities analysts.

18

You

may experience dilution of your ownership interests because of the future

issuance of additional shares of our Common Stock.

Any

future issuance of our equity or equity-backed securities may dilute

then-current stockholders’ ownership percentages and could also result in a

decrease in the fair market value of our equity securities, because our assets

would be owned by a larger pool of outstanding equity. As described above, we

may need to raise additional capital through public or private offerings of our

common or preferred stock or other securities that are convertible into or

exercisable for our common or preferred stock. We may also issue such securities

in connection with hiring or retaining employees and consultants (including

stock options issued under our equity incentive plans), as payment to providers

of goods and services, in connection with future acquisitions or for other

business purposes. Our Board of Directors may at any time authorize the issuance

of additional common or preferred stock without common stockholder approval,

subject only to the total number of authorized common and preferred shares set

forth in our articles of incorporation. The terms of equity securities issued by

us in future transactions may be more favorable to new investors, and may

include dividend and/or liquidation preferences, superior voting rights and the

issuance of warrants or other derivative securities, which may have a further

dilutive effect. Also, the future issuance of any such additional shares of

common or preferred stock or other securities may create downward pressure on

the trading price of the common stock. There can be no assurance that any such

future issuances will not be at a price (or exercise prices) below the price at

which shares of the common stock are then traded.

Any

failure to maintain effective internal control over our financial reporting

could materially adversely affect us.

Section

404 of the Sarbanes-Oxley Act of 2002 will require us to include in our annual

reports on Form 10-K, beginning with the Form 10-K for the fiscal year ending

December 31, 2010, an assessment by management of and an auditor attestation

report on the effectiveness of our internal control over financial reporting. In

addition, in future periods our independent auditors will be required to attest

to and report on management’s assessment of the effectiveness of such internal

control over financial reporting. While we intend to diligently and thoroughly

document, review, test and improve our internal control over financial reporting

in order to ensure compliance with Section 404, management may not be able to

conclude that our internal control over financial reporting is effective.

Furthermore, even if management were to reach such a conclusion, if our

independent auditors are not satisfied with the adequacy of our internal control

over financial reporting, or if the independent auditors interpret the

requirements, rules or regulations differently than we do, then they may decline

to attest to management’s assessment or may issue a report that is qualified.

Any of these events could result in a loss of investor confidence in the

reliability of our financial statements, which in turn could negatively impact

the price of our common stock.

In

particular, we must perform system and process evaluation and testing of our

internal control over financial reporting to allow management and our

independent registered public accounting firm to report on the effectiveness of

our internal control over financial reporting, as required by Section 404. Our

compliance with Section 404 will require that we incur substantial accounting

expense and expend significant management efforts. We currently do not have an

internal audit group, and we will need to retain the services of additional

accounting and financial staff or consultants with appropriate public company

experience and technical accounting knowledge to satisfy the ongoing

requirements of Section 404. We intend to review the effectiveness of our

internal controls and procedures and make any changes management determines

appropriate, including to achieve compliance with Section 404 by the date on

which we are required to so comply. However, any significant deficiencies in our