Attached files

| file | filename |

|---|---|

| EX-10.12 - EXHIBIT 10.12 FORM OF WARRANT - GROW CAPITAL, INC. | ex1012.htm |

| EX-31.2 - EXHIBIT 31.2 - GROW CAPITAL, INC. | calibrusexh31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - GROW CAPITAL, INC. | calibrusexh31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - GROW CAPITAL, INC. | calibrusexh32-1.htm |

| EX-10.11 - EXHIBIT 10.11 FORM OF CONVERTIBLE DEBENTURE - GROW CAPITAL, INC. | ex1011.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

oTRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to __________

Commission File Number: 000-53408

Calibrus, Inc.

(Exact name of registrant as specified in charter)

| Nevada | 86-0970023 |

| State or other jurisdiction of | (I.R.S. Employer I.D. No.) |

| incorporation or organization | |

| 1225 West Washington Street, Suite 213, Tempe, AZ | 85281 |

| (Address of principal executive offices) | (Zip Code) |

| Issuer's telephone number, including area code: (602) 778-7500 | |

| Securities registered pursuant to section 12(b) of the Act: | |

| Title of each class | Name of each exchange on which registered |

| None | N/A |

| Securities registered pursuant to section 12(g) of the Act: | |

| Common Stock, $0.001 par value | |

| (Title of class) | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

1

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked prices of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: Currently, the average of the bid and ask price is $.30 per share giving the shares held by non-affiliates a value of $1,052,380. Since the Registrant does not have an active trading market this numbers may not be reliable indication of the share price.

As of March 21, 2010, the Registrant had 6,794,600 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the part of the Form 10-K (e.g., part I, part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or other information statement; and (3) Any prospectus filed pursuant to rule 424(b) or (c) under the Securities Act of 1933: NONE

2

PART I

ITEM 1. BUSINESS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This periodic report contains certain forward-looking statements with respect to the financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive positions, growth opportunities for existing products, plans and objectives of management. Statements in this periodic report that are not historical facts are hereby identified as “forward-looking statements.”

Overview

Calibrus, Inc. is a technology based company established in 1999. We have two business units that leverage our technology capabilities. We have provided Hosted Business Solutions for ten years and now plan to expand our offerings to offer a social networking site called JabberMonkey (Jabbermonkey.com) and development of a location based social networking application for smart phones called Fanatic Fans.

Through our Hosted Business Solutions, we provide Third Party Verification (TPV) Services, Hosted Call Recording Services and Interactive Voice Response/Voice Recognition Unit (IVR/VRU) Services to some telecom, cable and insurance companies. We estimate that we have processed over 50 million live agent calls/recordings and 5 million IVR calls/recordings to date serving these companies. With over 70 employees, the latest equipment and in-house designed software and solutions, we are the hosted solution company that companies can trust with their data.

Our technology provides us with the ability to provide fully-integrated live voice, data, and automated services and combinations of services out of a unified platform. Our system’s processes and functionality allow our IT staff to easily design and build systems that satisfy clients’ process requirements. Using our technology has allowed us to develop and build customized web-based solutions incorporating call recording, “click to call” and voice message broadcast functionality.

Calibrus has leveraged our technology capabilities to expand into the growing market of social expression websites. Leveraging the software development experience we have obtained over the last 10 years, we created the site JabberMonkey.com which just completed the beta phase of development. JabberMonkey is a site where users can have an interactive experience of asking questions of other members, post comments and have ongoing interactive video and text chats.

Calibrus Products and Services - Calibrus Hosted Third Party Verification (TPV) Services

Calibrus' Third Party Verification service is easy to use and offers both Live Operator and IVR/VRU Third Party Verification services. Calibrus’ Live Operators process thousands of TPV calls daily. To date, Live Operator TPV has been the solution of choice for several of our largest customers. Live operators offer the best customer experience and typically higher success rates over IVR/VRU solutions. Our Automated IVR (Interactive Voice Response)/ VRU (Voice Recognition Unit) solution offers a low-cost alternative to a live voice agent while ensuring compliance with both FCC and State PUC (Public Utility Commission) Third Party Verification requirements. Our IVR systems feature intuitive scripting to automatically ensure the correct questions are asked. Our custom IVR solutions enable client’s customers to easily opt-out to a live agent at any time if they require personal attention.

What is Third Party Verification?

Third Party Verification is the confirmation of a customer’s order by an independent third party. This process protects both the customer and the company selling services from fraud and slamming/cramming of products onto their lines. Once the sale has been made, the customer is transferred to an independent Third Party, such as Calibrus, that will read a pre-determined script to which the customer will answer yes or no.

In 1996, the Federal Communications Commission, FCC, enacted the Telecommunications Act which forced the Regional Bell Operating Companies to open their lines to competition. Accordingly, telecom companies were required to allow competitors to lease their lines and provide service to customers at a rate set by each individual State’s Utility Commission. This was to promote competition and help new competitors compete with the larger telecom companies on a level playing field. Unfortunately, this led to another phenomena called slamming, customers being switched from one company to another without their approval, and sometimes without any knowledge whatsoever until they received their bill.

3

In response to slamming, legislation was enacted that required companies that were changing a customer’s dial tone or long distance to their services would have to first obtain the customer’s approval in one of three ways:

|

·

|

A written and signed Letter of Authorization indicating that customer agrees to the change.

|

|

·

|

An automated or live agent independent third party that the customer is transferred to for the verification.

|

|

·

|

An electronic Signature on an electronic Letter of Authorization, usually done on websites.

|

Calibrus fulfills the second requirement, providing both automated IVR/VRU and Live Agent Third party Verification Services for our clients.

Automated IVR/VRU Service Highlights

|

·

|

Dual Channel Recording to Eliminate the Loss of Interactions/Customer Statements

|

|

·

|

Very Low Implementation and Ongoing Cost

|

|

·

|

Simple to Set Up, Implement and Launch

|

|

·

|

Close to Real-Time Call Record and File Retrieval and Posting

|

|

·

|

Dedicated Management and IT Resources, 24/7 Availability

|

|

·

|

Superior Value and Cost Competitive IVR Services

|

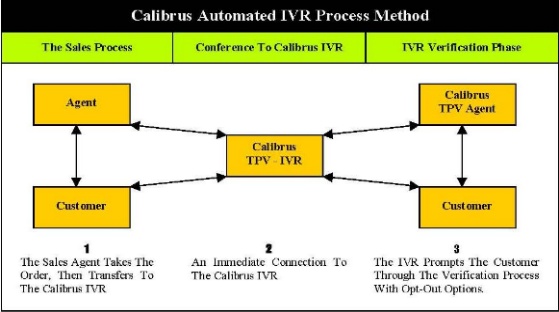

Our automated IVR verification method provides customers with a pre-determined script to comply with each client’s unique verification requirements. The following diagram demonstrates our basic Automated IVR Process Method:

4

Our Automated IVR/VRU TPV services are priced on per transaction or per minute usage.

Live Operator TPV

In addition to our automated TPV services, we also offer Live Operator TPV Service. When customers want to provide live interactions with ultimate flexibility, our Live Operator Services can be used in conjunction with our automated TPV services or as a stand alone service. Customers that select our Live Operator service offering will see several benefits, such as:

| · | Better Customer Experience | |

| · | Superior Universal Language Coverage (i.e. Spanish, Chinese, Japanese, Korean, etc.) | |

| · | Documented Higher Success Rates (success rates average over 96%) | |

| · | Higher Success Rates Mean: | |

| ° | Less Back Room Clean-up Expense | |

| ° | Fewer Lost Sales due to Non-Verified TPV’s | |

| · | Close to Real-Time Call Record and File Retrieval and Posting | |

| · | Cost Competitive Live Operator Answering Service | |

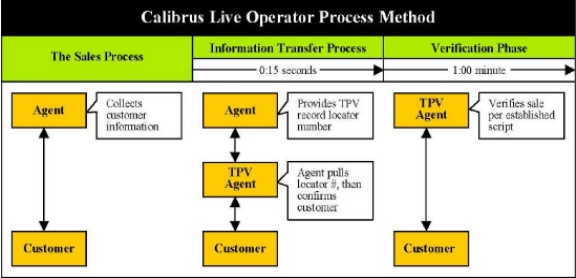

Calibrus has developed a TPV process that allows for a very efficient transfer of data from a sales agent to a Calibrus Live Operator. This process reduces call lengths, agent errors, and TPV costs. The following is a diagram of our Live Operator TPV Process Method.

Our Live Operator Third Party Verification solution helps our customers meet compliance requirements and improve their overall business processes. TPV revenue accounted for approximately 98.8% of the Company’s total revenue. For 2010, 89% of our TPV revenue was derived from Live Operator services and 11% was derived IVR/VRU services. Our TPV services are priced on per transaction or per minute usage.

VOIP Verifications

Calibrus Live Agent VOIP Verifications provide a solution for customers that want to provide live interactions with the ultimate flexibility. Automated IVR Verifications is a low-cost alternative to a live voice agent that still complies with both FCC and State PUC Third Party Verification requirements. Intuitive scripting ensures the correct questions are automatically asked. Customers can easily opt-out to a live agent at any time if they require personal attention.

Hosted Call Recording

Calibrus’ Call Recording service is easy to use and cost-effective and offers a number of features necessary for a superior call recording solution. Calibrus’ Hosted Call Recording solutions are an alternative for companies that do not wish to invest in expensive hardware, maintenance and support of a state-of-the-art call recording system.

5

Our Hosted Call Recording Features include:

|

·

|

All Inclusive Pay-As-You-Go Pricing Model by the Minute or by the Transaction/Call

|

|

·

|

No Maintenance, Upgrade, Programming, Site/Seat Licensing or Change Fees

|

|

·

|

Call Record & File Access 24/7 Via a Secured Website for Easy Retrieval

|

|

·

|

Customized Reporting Options

|

|

·

|

High Quality Recording with Redundant Systems and Disaster Recovery

|

|

·

|

Compatible and Flexible Process can be used with Virtually Any System

|

|

·

|

Optional Quality Control Monitoring and Evaluation Services

|

Hosted Call Recording for the Insurance Industry

Our call recording solution assists insurance companies to record and retain valuable, mission critical conversations that occur during claim statements and interviews, while, we believe, improving efficiencies and reducing costs in the claims process.

Calibrus’ recording process is easy to use, secure and completely customizable. Insurance adjusters can set up a call and start recording quickly without expensive equipment. The Calibrus system ties important information for the claim, claim number, interviewee name, and other information to the file so customers can sort it later. The adjustor dials into Calibrus and records the conversation with the claimant and simply hangs up when finished. The recording will be processed and available within minutes after the call is finished and accessible via the reporting website. If necessary, Calibrus can send a confirmation email to the adjuster that includes a hyperlink to the recording for easy retrieval.

Once the recording has ended a secure password protected web-based reporting website allows claims managers, compliance officers and executives to access the recordings of the claim statements and interviews in seconds. Indexing of the data such as claim number, insured name, interviewee name, and adjuster ID allows authorized individuals the ability to search on things such as claim number and find all associated recordings for that claim. The reporting website serves as a quality assurance and management tool as well, providing the ability to pull up all recordings for an adjuster ID, and listen to every call that a particular adjuster did that day.

For independent/contracted adjusters out in the field, Calibrus has developed an upload tool to provide insurance companies with the ability to combine all of their digital claims recordings, whether done internally or externally by contracted companies, into one database. The Calibrus upload capability allows external adjustors/interviewers to record interviews “on the street” and then upload them to the Calibrus database using a secure web portal. Independent adjusters can use any handheld recorder that can download a recording into a .wav file format onto their computers.

The upload process is very simple to use: Access the secure web portal, enter in the information into the portal to be tied to the recording, mark the “Upload” existing file checkbox, identify the file and hit submit. The file is then uploaded into the Claims Recording Database and is then available to pull in the reporting website. Calibrus offers insurance companies the ability to switch to a hosted solution without having to invest heavily into an internal recording solution. By using our hosted solution, customers forgo having to invest in hardware, software, site licenses, continuous upgrades, storage facilities and dedicated IT support. We handle all of that for our customers, and get a recording solution in place within weeks. Other benefits of using our solution are immediate access for playback of the recorded statement, back up

redundancy of the digital .wav file for security purposes, enhanced call tracking and data analysis, ability by managers to quickly review calls and provide coaching easily, and customizable report capabilities. For 2010, 1.2% of our total revenue was derived from Call Recording services.

6

Voice Message Broadcasting (VMB)

Our web-based voice message broadcasting solution has the ability to contact hundreds to thousands of people in seconds. We can create dialing parameters based upon dialing lists, the message to be sent and the times to call out on, which can be adjusted to fit time zones across the nation. Customers can broadcast caller id and change and record their message in a matter of minutes.

Our voice message broadcasting programs can assist in:

|

·

|

Retail Sales Alerts

|

|

·

|

Thank You Messages

|

|

·

|

Direct Customers to your Website

|

|

·

|

Relationship calls – Happy Birthday, Anniversary, etc.

|

|

·

|

Political Campaigns – Get out to Vote

|

|

·

|

Customer Loyalty Campaigns to Repeat Customers

|

|

·

|

Meeting/Conference Notifications

|

|

·

|

Fundraising

|

|

·

|

Sports Team Advertising

|

|

·

|

School and Emergency Notifications

|

Calibrus Click-To-Call Services “ClickTalk”

Calibrus “ClickTalk” service allows customers to put a button or icon on a website or web-listing that will allow customers to contact others by telephone automatically and anonymously. The “ClickTalk” functionality has a variety of uses:

|

·

|

Call Tracking

|

|

·

|

Lead Generation

|

|

·

|

Save Sales on Cancellations

|

|

·

|

Online Phone Surveys

|

|

·

|

Real Estate Listings

|

When someone presses the Calibrus “ClickTalk” button a pop up appears so that they can enter their phone number. Once a phone number is entered and they hit the submit button, the Calibrus system places an outbound call to them and once they have answered our system places a second call to a pre-programmed number and connects you with the customer.

Call Center Services

Calibrus, Inc. has been delivering call center services since 1999 to large and small businesses. Calibrus live operator agents can provide call center services to customers who want to grow their business or handle temporary, seasonal or overflow volume.

Several call center services Calibrus can provide are:

| Outbound | Inbound |

| Cold Calls | Customer Support/Help Desk |

| Outbound Telemarketing | Order Taking/Fulfillment |

| Phone Surveys | Answering Service |

| Lead Qualifying | Sales Verifications |

| Direct Mail Follow up | Seminar Sign-up |

| Fundraising | |

| Political Campaigns | |

| Internet Sales Verifications | |

| Collections |

7

SpeechTrack.com

Calibrus has developed a hosted call recording utility that anyone can use from any phone. Through the SpeechTrack.com website anyone can record a phone conversation whether they are at work, home or on a cell phone. SpeechTrack enables phone conversations to be recorded easily, and securely, at a low per minute cost. SpeechTrack is an ideal solution for any individual, independent professional or small business owner. SpeechTrack is a hosted solution that requires no hardware or software to be purchased. SpeechTrack can also be used for dictation purposes. Customers can access their recordings online on SpeechTrack’s secure website. Customers can add notes to the recording file to keep track of their calls and they can also download the recordings to their computer. Our plan is to market SpeechTrack.com to small to midsize businesses and individual professionals through several different marketing channels, including internet advertising, radio ads, forums, blogs and traditional print media.

Businesses and individuals use SpeechTrack for:

Staffing and Training

Protection/Disputes/Resolution – Prove “who said what” in a dispute

Confirmation of Agreements or Document Replacement

Compliance

Best Practice/Advice or Instructions

SpeechTrack users use our service for a myriad of purposes. Below is a partial list of just some of the types of independent professionals/small business owners that may utilize Speechtrack.

Attorneys

Accountants

Contractors/Vendors

Doctors

Executive Coaching

Service Providers

Sales Professionals

Private Investigators

Project Manager/Coordinators

Insurance Agents

Mortgage/Financial Brokers

Conference Calls

Market Researchers

Technology

Using software based PBX (public exchange system – best known as a telephone switch), ACD (automated call distribution), network equipment, data storage arrays, and servers; we have developed object oriented software application building blocks and relational databases. Because we record every verification conversation digitally, our system allows clients to be actively involved in monitoring and managing our services through secure Internet sites, VPN (virtual private networks), and dedicated point-to-point connectivity. By allowing near real time review of data and verification conversations, this infrastructure allows our clients to actively participate in the management of their programs. We virtually eliminate data errors because the majority of the data is transferred electronically.

8

Redundancy and Safeguards

Calibrus has worked diligently to provide the necessary redundancy and disaster recovery requirements to our clients. We offer a number of safeguards for our clients including separate power generation units in the event of a failure by the utility; we have UPS’s (uninterrupted power supply) for all network and telecom equipment; we have a UPS on every agent station and our system up-time was over 99.9% for the last two years. For telecom access Calibrus utilizes two separate long distance providers that both have multiple access points into the Phoenix Metro area. One telecom company provides the primary number while the second provides the back-up number to prevent any downtime that could arise in a particular company’s network.

Calibrus’ facilities, equipment and technology are structured to ensure uptime and eliminate the worry of fiber cuts which could disrupt our business. Since Calibrus is connected to the telecom’s network, we are able to install additional T1’s or PTP (point-to-point) data circuits on a significantly reduced timeframe. It is common to have new circuits delivered and functioning within 10 business days, much quicker than the 30-45 business days most companies will receive. Calibrus uses multiple telephone switches, firewalls, routers and networks; and have automated tape back-up guards against data loss, corruption and down time.

The Company’s technology is capable of receiving and interpreting automatic number identification information. Calibrus can then use this information in conjunction with our computer telephone integration functionalities for reporting and indexing functionality.

Security

Calibrus understands the need to protect data belonging to our customers. With that understanding, we have developed strict guidelines to protect customer information. Controlled access to data centers, physical security measures, and strong passwords on all network equipment ensures that only authorized personnel can gain entrance to sensitive areas and protects Calibrus’ internal vulnerabilities. Firewalls, Access Control Lists and VPNs ensure that data is safe from external vulnerabilities.

We do offer several levels of securing access to our client’s data, as it can vary from client to client. With the web based utility that some clients utilize we offer password protection and unique individual logins that can be completely

controlled and maintained by the client by a custom interface, which can also be password protected, if necessary. Some of our clients find that task to be burdensome due to their number of agents and managers. For those specific clients, if they are coming through a proxy, we can limit access to the websites, both agent entry and to trusted internet protocol. This would limit the access to only those that are coming through the company’s client side channel to the Calibrus website.

Reporting

Calibrus custom builds all reports to suit our client’s needs because we have found that the information that each customer requires may be different from the information required by another customer. All telephone switches are centralized in our server databases and therefore, we can easily relate customer data with call data. As a result, we can custom build reports to the specifications of our clients and provide the data in any format to the client: Excel, fixed length and comma delimited, and deliver it in multiple ways, such as through a website, Web Service, e-mail, connect direct or FTP (file transfer protocol). We build all return files to client specifications and can deliver them at the times the client requests.

9

Regulations

Third Party Verification is mandated by both the FCC and State PUC agencies. Third Party Verification is the confirmation of a customer’s order by an independent third party. This process protects both the customer and the company selling from fraud and slamming/cramming of products onto their lines. Once the sale has been made the customer is transferred to an independent Third Party that will read a pre-determined script to which the customer will answer yes or no.

In 1996, the Federal Communications Commission, FCC, enacted the Telecommunications Act which forced the Regional Bell Operating Companies to open their lines to competition. Accordingly, they were required to allow competitors to lease their lines and provide service to customers at a rate set by each individual State’s Utility Commission. This was to promote competition and help new competitors compete with the large corporations on a level playing field.

This led to another phenomena called slamming, customers being switched from one company to another without their approval, and sometimes without any knowledge whatsoever until they received their bill.

In response to this, legislation was enacted that required companies that were changing a customer’s Dial Tone or Long Distance to their services would have to first obtain the customer’s approval in one of three ways.

|

·

|

A written and signed Letter of Authorization indicating that customer agrees to the change.

|

|

·

|

An automated or live agent independent third party that the customer is transferred to for the verification.

|

|

·

|

An electronic Signature on an electronic Letter of Authorization, usually done on websites.

|

Calibrus fulfills the second requirement, providing both automated IVR, and Live Agent Third Party Verifications Services for our clients. Third Party Verification though intended to be a protection for the customer, is also a protection for the company initiating the switch as well. The necessity for TPV prevents companies from switching customers without their approval, and it also prevents a customer, or another company, from alleging that the company switched a customer without their approval. The protection that TPV provides for the company is critical as the fines levied by the FCC and the State PUCs can run in the millions of dollars and also include the loss of the ability to sell telecommunications products in a specific area.

Even though Calibrus acts as a Third Party Verification provider, Calibrus is not directly subject to any regulations. The service or process that we provide for our clients does have several defined rules and regulations that must be followed. For example, scripts that are implemented and used in both our Live Operator and IVR/VRU TPV services must be read verbatim to the customer. There are certain pre-defined questions that must be asked to the customer and certain types of information must be gathered from the customer in order for the TPV to be verified. The FCC and each State PUC has varying requirements in regards to the information that must be communicated to the customer and the information that must be captured. In addition, there are record keeping requirements for both data and voice for each Third Party Verification transaction. Whether the TPV is conducted by a Live Operator or IVR/VRU TPV there must be a voice recording of the customer responding to the script and the data that was captured during the transaction must also be recorded. The voice recordings and associated data must be archived and made available for up to thirty six (36) months.

10

Competitors

Calibrus faces numerous competitors both within and outside the United States. Many of Calibrus’ competitors are much larger and better financed. The only barrier to entry in Calibrus markets is sufficient start up capital to buy initial equipment and such costs are not substantial. With the low barriers to entry, Calibrus faces competition from a large number of competitors with similar capabilities. Most call centers, both inside and outside the United States, either have similar technology or could develop similar technology. We initially were able to stay ahead of competitors by having a low cost business model but many competitors have reduced their costs to be similar to our costs. As such, the competition for customers has become more competitive.

Some of Calibrus’ competitors include VoiceLog, now owned and operated by BSG Group, 3PV and Data Exchange. Although these are some of the larger competitors there are a substantial number of competitors of similar size to Calibrus that we compete against. Calibrus competes with these competitors for business by offering superior quality of service that is reliable and low cost in the market. Even with quality of services that we believe we offer, competition in our industry generally comes down to pricing. As such, there is constant pressure on margins and the need to keep costs low to be able to effectively compete in our industry.

Concentration of Customers

As the number of telecommunications companies has decreased, we have seen a concentration of revenues coming from two primary customers. In 2007 AT&T Communications and Cox Communications exceeded approximately eighty percent of our revenues for the first time. Currently nearly eighty percent of our revenues are still derived from these two customers. For the years ended December 31, 2010 and 2009, AT&T Communications accounted for 68% and 55% and Cox Communications 17% and 25%, respectively, of our revenues. This revenue is derived from our TPV business. If we were to lose one of these customers before our other business lines start generating more revenue, it could have a detrimental effect on our ability to stay in business. We are actively moving away from the TPV business being our primary operations and are hopeful that we will be able to reduce our reliance on these two customers. We made the decision to diversify our product offerings based on our belief that consolidation in the telecommunications industry has reduced the number of telephone customers changing carriers. As such, the need for third party verification has decreased. We believe there will continue to be customers changing phone carriers but as the number decreases the revenue we receive from our third party verification business continues to decline. We believe it is prudent to seek other sources of revenue.

Our contract with AT&T expired on December 31, 2009. We signed two short-term contract extensions with modified pricing through March 2010. On April 8, 2010 the Company signed a new contract with AT&T. The contract sets forth our pricing terms and provides the conditions on which we are to provide service to AT&T including that our services are deemed performed when provided. The Company also signed a contract extension with Qwest Communications during the year ended December 31, 2010 with new pricing terms. For the year ended December 31, 2009 the Company signed a new contract with Cox Communications to provide TPV services via IVR with a Live Opt-Out option with new pricing terms.

New Calibrus Products and Services - JabberMonkey.com and Fanatic Fans

Fanatic Fans

In the second half of 2010 we commenced development of a location based social networking application for smart phones called Fanatic Fans.

Fanatic Fans aim is to inform fans about upcoming live events in the Sports and Music industries by giving users the ability to interact with live events, share their experiences, and earn rewards for attending live events. Users will be able to browse a calendar of upcoming events which can be segmented by region and artist. From here users can get detailed information on the event and discuss the event with other fans. While at an event users will be able to share their experiences with social networks Facebook and Twitter, and communicate with other people at the event. Users will be able to unlock virtual awards and earn virtual points in recognition of attending events. Within their profile users can browse and view the items they have unlocked and receive news on their favorite artists. Finally Users can redeem their virtual points for food/drinks, apparel and event tickets in the application award section.

11

Fanatic Fans will reward fans for their support of their favorite sports team, music artist or band. National and local businesses will be able to market to fans that attend the events by listing promotions (goods and services) on our application. Businesses will list their promotions (i.e. After the Diamondbacks Game Come to Hanney’s Restaurant and Receive One Free Beer or 50% Off any Appetizer! Redeem for 50 Points) and users can view and redeem these promotions and offers that are specific to their interests. Fanatic Fans will also hold contests and provide recognition to the most Fanatic Fans.

Functionality

When a user is at an event the app will automatically determine the event their attending using the phones GPS. The user will be able to view information on the show including a list of the artists performing at the show. There will also be a string of comments from other users allowing fans to interact with one another while at the show. From here the user will be prompted to check in, while checking in they will be prompted to leave a comment and post their comment to Twitter and Facebook. By checking in the user will unlock a virtual award which can also be published to Facebook and Twitter. Users will also earn virtual currency by checking into a location. After checking in the user will return to the comments page where they can continue to read and add comments about the show.

When a user is not at a show they can use Fanatic Fans to locate upcoming shows. They can browse a calendar of all upcoming shows and sort by location and artists that they follow. Users can then get information on the show including; time, location, and performing artists. Users can also view tips created by other members and add tips of their own. Finally users can confirm that they are going to attend an event and tell their friends by publishing to Facebook and Twitter.

Fanatic will feature a profile page which will allow users to view their past activity within the app and receive news updates on their favorite artists. They can view all the awards that they have unlocked, and all the shows that they have attended. They can also receive the latest news posts of some of their favorite music artist. Finally, users can adjust their personal settings from their profile including which artists they wish to follow, their home town, and their Facebook and twitter account information.

Basic Functionality (at launch of Fanatic Fans)

Check into an Event

Get information on the event

Communicate with other fans at the event using a messaging board

Post messages to Facebook and Twitter

Unlock Virtual awards

Earn virtual points and badges

Look up upcoming events in your area, and entire tour schedules of your artists

View all your awards and your rank among other users

Redeem your currency for goods

Vendor/Business can list promotions for users to redeem Fanatic Fan virtual points.

Buy Tickets to live events through a third party

Competition

Fanatic Fans will be entering into one of the fastest growing segments of location based social networking and as such will face intense competition from applications such as Foursquare and Gowalla. Competitors in this space are very well financed and have the advantage of having already captured consumers that may be unwilling to switch to a new application. At this time, we have no intellectual property protection and are only now preparing preliminary patent and trademark filings. It is still unknown if any of our filings will lead to actually receiving provisional patents or final patents or trademarks.

Marketing

Our initial marketing will be aimed at attracting consumers through the respective application stores such as The AppStore on Itunes, attendance at live events and links to the application download from participating vendors. However, to attract these users we first must establish JabberMonkey as a unique interactive experience that differs from the other social networking sites.

Revenue Model

Our initial revenue model will be based on advertising. As such, we do not anticipate any revenue for some time. To be able to sell advertisements we will need to have a certain level of users which we think will take most of 2011 to achieve. If we are not able to attract sufficient users, we will not be able to engage in any advertisement.

12

The Company also intends on generating revenue from monthly fees for businesses listing promotions inside of the application.

Technology

The Fanatic Fans application can be used by Apple and Android Smart Phones. The application will utilize GPS functionality built into smart phones along with existing data and Wi-Fi capabilities.

Development

The Company is currently developing the application and intends to submit the application for approval with Apple in the second quarter of 2011.

JabberMonkey.com

JabberMonkey is a social expression site that features questions on issues and topics that are current and relevant to its members. JabberMonkey questions will be on pertinent issues that in many instances will evoke an emotional response from its members. Many of the questions on JabberMonkey will provide the individuals voting with a voice to cause an action or affect a result.

There are many emotional issues or events that occur around the world that JabberMonkey will post questions about allowing JabberMonkey members to express themselves, participate and cause an action or outcome. One could imagine what some of these might be:

· A famous rock band might participate with JabberMonkey and allow JabberMonkey members to vote on the songs and the order the songs would be played at their next concert.

· A business wants to get individuals to provide feedback and name their next product. JabberMonkey members can vote, provide feedback about the product and name the new product.

13

· A famous sports athlete through a video blog asks the question “if I win the US Open Golf Tournament what charity should I donate $250,000 of the $1,000,000 prize money?” Which charity has the most votes, wins and that is who will get the money.

a) American Red Cross

b) PETA

c) The Make a Wish Foundation

d) Boys and Girls Club of America

e) Breast Cancer Research Foundation

JabberMonkey members will vote and provide their comments on an issue and then see instant feedback on how others are feeling about a topic or issue and view comments made by others. JabberMonkey members will be able to express themselves by answering questions, posting there own questions, text blogging, video blogging, participating in forums, creating profiles, posting videos, photos, audio files, and rate other JabberMonkey members questions and content.

JabberMonkey members will also be able to meet new people and make new friends. When answering a question or participating in a group, members will be able to meet people with similar interests, they will then be able to become friends on JabberMonkey. They can then communicate via messaging, chat, and video voice calling as well as sharing photos, videos and other electronic media.

JabberMonkey questions will range across all categories of life, and run the gamut from serious to silly. The categories and sub-categories will allow for targeted feedback.

Categories could range from Entertainment to Music and Business, etc. Each category will also contain subcategories to encompass a wide range of topics and interests.

In addition to being able to conduct polls and questions, JabberMonkey offers a unique user experience by being able to offer interactive communication and high definition video. While most social networking sites offer only a static page for the user, JabberMonkey offers video communications between multiple users at once, the ability to quickly load video, and the ability to set up groups or companies into secure sites. JabberMonkey also takes advantage of other companies’ storage by allowing links to other web sites such as YouTube or Google.

Calibrus’ focus has been to develop and distinguish JabberMonkey from the other social networking sites, which are very static and rely only on instant messaging and fixed web pages. Calibrus has focused on designing a site that is easy to use and is video intensive with user friendly software for video attachment and conferencing.

JabberMonkey completed its alpha testing and moved into beta testing in December 2009. The Beta testing ran through the end of November 2010 and the first official non-beta version of the website was released in December 2010. We do not have the capital required to commence our marketing plan related to the website and thus do not anticipate any revenue from JabberMonkey until late in 2011, if we obtain sufficient capital.

Competition

JabberMonkey will be entering into one of the fastest growing segments of the internet and as such will face intense competition from sites such as MySpace and Facebook. Although Calibrus believes the JabberMonkey site offers new features, it is likely the other sites will soon be able to offer similar features. Competitors in this space are very well financed and have the advantage of having already captured consumers that may be unwilling to switch to a new site. At this time, we have no intellectual property protection and are only now preparing preliminary patent and trademark filings. It is still unknown if any of our filings will lead to actually receiving provisional patents or final patents or trademarks. Although we believe our site offers unique features, we cannot say if other companies are developing similar features to their social networking sites. Additionally, many of the features of our site could be developed by other sites with variations that could possibly get around any intellectual property protections we are able to obtain.

14

The competition we face will make it difficult to attract customers from established sites such as Facebook and MySpace given their financial capabilities. Additionally, we believe we have only a small window to establish our site as being unique before the other social networking sites are able to come up with similar offerings. If we are unsuccessful in the short term in establishing a unique site that draws consumers, it will be difficult to compete against the other sites that we assume are working on similar interactive features. Additionally, some of these sites are backed by the largest players in the industry such as Google which can provide financial support far beyond anything we can raise at this time or in the perceived future.

Marketing

Our initial marketing will be aimed at attracting consumers from focusing on affinity sites and limited advertising on college and sports talk shows. We believe initial consumers can be attracted through links on web pages at Facebook, MySpace and Twitter. However, to attract these users we first must establish JabberMonkey as a unique interactive experience that differs from the other social networking sites.

This initial marketing efforts will be directed at targeted groups and communities which would see the advantage of being able to communicate on their topic areas and have on-line conversations. Such groups would be gamers, sports enthusiast, school communities, clubs and political or civic organizations. To this end, we are reviewing the cost to advertise on radio particularly sports radio and on certain online sites. As our capital for marketing is very limited, we may have to focus initially on one advertising market or focus on a slow growth and word of mouth communications depending on the final development cost of the JabberMonkey site and how much capital we were able to raise.

Revenue Model

Our initial revenue model will be based on advertising. As such, we do not anticipate any revenue for some time. To be able to sell advertisements on our site, we will need to have a certain level of users which we think will take most of 2011 to achieve. If we are not able to attract sufficient users, we will not be able to engage in any advertisement.

Once the site is up and running, we will also look at data mining as another source of revenue. With our existing product line, we have gained some limited experience in data mining and believe it offers another revenue source to be able to obtain information from consumers using the JabberMonkey site and sell such information to companies that would be able to use the information in their advertising or other business needs. This would not be an initial source of revenue as we will have to have sufficient users to make data mining effective and it will have to be developed with a view to not drive away potential users.

We also are analyzing charging consumers for certain features of our site but at this time, we believe it is more important to drive consumers to our site and will make everything available for free and focus on advertising revenues. Once we obtain a certain level of users, we may start offering more products that we believe we can charge for such as storage or secure web pages for communications. At this time, we do not know when we would be able to start charging for such product offerings, if ever.

Development

The Company closed the alpha testing phase of development during December, 2009. The site reached the beta testing phase in the first part of December, 2009 and ran through November 2010. The first non-beta version of the website went into operation in December 2010. To date the Company has not begun to aggressively market the website due to a lack of sufficient capital.

During our alpha development we essentially started limited testing on the software and functionality developed to run the JabberMonkey site. At this phase of development we had limited number of individuals, primarily our employees, testing the site and giving feedback as to its functionality. We also revised the software and tried to work out any issues found in the initial development. The beta stage of testing and development commenced in December 2009 and ran through November 2010. During the beta phase of development we expanded the number of users and continued testing and enhancements to the functionality of the website.

15

Even after completing the beta phase, we could still have software and hardware development problems once the full launch of the site is made and additional users are added. We cannot say how our software and hardware will function under the strain of a large number of users.

Intellectual Property

In addition to our own development team, we have contracted with Meomyo Development out of India to assist in the development of our JabberMonkey website. Meomyo has expertise in the development of websites and interactive solutions for websites which our internal developers did not currently possess. Meomyo’s contract gives the work product and intellectual property rights to Calibrus. However, even with the rights provided to Calibrus, we cannot prevent them from taking their knowledge gained by working on the JabberMonkey site and applying it to other web developments. The contract does attempt to limit the ability of Meomyo to provide services to competitors of Calibrus but given the geographical difficulty of policing an India company with offices in Dubai, it may not be possible to stop Meomyo from providing services.

We will be dependent in many ways, on our ability to launch our site and attract consumers before our competitors can develop features which would be a direct competitor to the features in our site. At this time, our ability to be able to attract consumers is unknown as we have only just completed the beta phase of development and released the website for general use and are not certain of the acceptance of our web site and interactive features.

Patents, Trademarks, Licenses, Franchises, Concessions, Royalty Agreements or Labor Contracts, including Duration

We protect some of our technology as trade secrets and, where appropriate, we use trademarks or register trademarks in connection with products and our core name. We currently have two patent applications on file with the US Patent and Trademark Office related to our JabberMonkey social expression website. We have two trademarks covering our name “Calibrus” and “JabberMonkey”.

Research and Development Costs During the Last Two Fiscal Years

For the years ended December 31, 2010 and 2009 the Company incurred Research and Development Costs of $232,327 and $545,485, respectively. Research and Development expense related to the continued development of the Company’s JabberMonkey website and its additional project Fanatic Fans. We expect as we expand into new markets we will continue to incur additional research and development costs.

ITEM 1A. RISK FACTORS

Calibrus’ operations are subject to a number of risks including:

Management focus will be on development of JabberMonkey and Fanatic Fans, both of which are new businesses and we do not know if consumers will like the sites or that we will be able to monetize the sites to produce revenues.

Management made the determination in late 2008 that its existing business model was going to face continued revenue reduction due to the consolidation in the telecommunication industry. As such, management set out to develop alternative business operations that utilized the core expertise of Calibrus employees and technology. The result of this development was Fanatic Fans, a location based social networking application for smart phones, and JabberMonkey, a social networking site that features interactive communications among its participants as opposed to the more traditional static pages found on most social networking sites. As Fanatic Fans and JabberMonkey will increasingly be the focus of the business going forward, we will face competition from well established and funded companies. Additionally, as a new business there is no guarantee our Fanatic Fans and JabberMonkey offerings will be successful in attracting users. These factors create substantial risk for investors and the strong likelihood that any investment could result in the loss of an investor’s entire investment.

16

Both Fanatic Fans and JabberMonkey, will be entering a very crowded social networking marketplace where existing competitors have years of experience, are well financed and have the name recognition to draw consumers none of which we possess.

Management has determined that the future direction of Calibrus will focus on its Fanatic Fans and JabberMonkey offerings. This puts Calibrus’ business focus in a very competitive field dominated by several very large and well financed companies such as Facebook, MySpace and Twitter and a number of mobile social networking applications for smart phones, such as Fouresquare and Gowalla. These companies have established an online presence and community that have become destinations in themselves and it will be difficult to make inroads into this space. Calibrus will be dependent on a new twist to entry into this space but in the end, all social networking sites have similar features and it is likely that if any part of the Calibrus offering becomes compelling, the competitors will adjust their offerings to be directly competitive with Calibrus. This creates substantial uncertainty on Calibrus’ ability to survive in this space or to be able to attract enough users to be able to monetize its site to produce revenues.

The revenue models for Fanatic Fans and JabberMonkey require we first obtain a sufficient number of users before we can sell advertisements or generate other revenue and it will take time to generate such users and to then monetize the site.

Fanatic Fans and JabberMonkey will be dependent on selling advertisements and finding other ways to monetize our users by selling add on services. For a social networking site or application to be able to sell advertisements, they first must attract a sufficient number of users to gain the interest of advertisers in buying ads on the sites. It will take time and money to bring users to our site and application and there is no assurance any users will come. These time frames along with the general state of development create additional uncertainty as to the potential success of Calibrus. The site and application may not even work as we plan and even if they do there can be no assurance any users will come, that advertisers will want to advertise or that Calibrus can monetize them. Additionally, it will be costly to continue development and launch the site and application.

We have only just completed the Beta Phase of development of JabberMonkey and have not commenced the beta phase of Fanatic Fans and do not know if the they will work at full functionality or be a site consumers will want to use.

Calibrus has completed the beta phase of development for JabbeMonkey which was an initial deployment of the software and site and limited testing by a small group of users. Beta phase has not yet been reached on Fanatic Fans. At this time, we cannot say with certainty if either will work on a larger scale or that unknown problems will not arise. There is no assurance we could raise additional capital to launch and market the offerings or if we could raise additional capital at what cost. Additional capital would most likely result in substantial dilution to current stockholders. Accordingly, stockholders of Calibrus will be backing an unproven product which may not function as described and could result in Calibrus having financial difficulties in the future.

We currently do not have any patents associated with our Fanatic Fans or JabberMonkey site and if we are not able to develop intellectual property protection around the offerings, we may not be able to prevent competitors from recreating our product offering.

We have filed for a trademark on our JabberMonkey name and received approval during the year ended December 31, 2010. We filed for a trademark for Fanatic Fans in July 2010. We do not have any intellectual property protection on the features and software behind Fanatic Fans or JabberMonkey. We have filed two patent applications with the US Patent and Trademark Office on various features of our JabberMonkey site. However, we do not know at this time if such applications will result in patents being issued. Even if we receive patent applications, there is no guarantee that one of our competitors will not be able to find a variation on our services that are not patent protected and be able to directly compete with our take on the social networking experience.

Calibrus’ projections do not show revenue from Fanatic Fans or JabberMonkey for some time and it will be dependent on additional capital to fund operations and continued development until such revenue can be generated.

17

Since a certain level of consumers must become users of Fanatic Fans and JabberMonkey before they can be monetized to produce revenue, management is of the belief that it will have to raise substantial more capital to reach profitability. We just finished the beta phase of development of JabberMonkey in November 2010 and have not commenced a beta phase for Fantic Fans. With a lack of capital to execute on the marketing plan of the website it is unknown when and if the website will be able to attract the required number of users to successfully monetize the website. It is likely stockholders will suffer further dilution as we raise additional capital and if management cannot raise additional capital stockholders would likely lose most of their investment. There is no guarantee that we could raise such future capital.

Our existing management team has no experience in operating a social networking site or any other web based business.

Our current management does not have any experience in operating a social networking site and has never operated a web based business. Our software developers experience has been in developing tools for businesses and focusing on call center software. We will be expanding on our internal capabilities and be dependent on outside software engineers to drive our development. If our management is not able to execute on our business plan, it is likely stockholders would lose their entire investment.

Our existing business has seen decreasing revenues and we do not have the funds to repay our convertible debentures outstanding.

We have issued $1,085,000 principal amount of convertible subordinated debentures as of March 23, 2011. Our current revenue stream from TPV is decreasing and although management has worked to reduce expenses, we are losing money and anticipate we will continue to lose money for the foreseeable future. As such, we do not have the funds to repay the outstanding debentures and are dependent on additional capital coming in to repay the debentures. We cannot project when the new product offerings will be successful and if we are unable to return to profitability, we may not be able to repay the Debenture. Additionally, it would be difficult to convince new investors to contribute money that was going to be used to repay existing debts.

We currently have losses from operations and will need additional capital to execute our business plan.

We had losses from operations with a loss from operations of $27,426 and a net loss of $128,263 for the year ended December 31, 2010, and we have had to rely on existing capital to cover the losses. For the year ended December 31, 2010, our current assets have been reduced to $400,642. As consolidation has come over the telecommunications business, our TPV business has been reduced. We have been leveraging our technology capabilities to expand into new areas but it will take some time for the new areas to replace the loss in business from our TPV operations. If we are not able to generate sufficient revenues, we will be forced to seek additional capital to fund potential shortfalls. There can be no assurance that we will be able to raise additional capital or that we will be able to raise capital on terms that are favorable to Calibrus and current stockholders.

If we are not able to stop our losses or expand into new areas, we may be forced to terminate operations.

With revenues from our main business, TPV, being reduced as a result of consolidation in the telecommunications’ industry, we have had to look to expand into new areas. Our TPV revenue has seen year over year declines from a high of approximately $11,300,000 in 2003 to revenues of approximately $3,745,000 in 2010. There was a reduction of approximately $500,000 from TPV revenues in 2009 to 2010. If our expansion efforts with JabberMonkey or Fanatic Fans do not prove successful, our ability to stay in operation is questionable. We have already reduced our expenses related to TPV to be able to make a profit at anticipated revenue levels. Even with the reduced expenses, we still operate at a net loss. Our future success will depend, to a great extent, on the success of JabberMonkey or Fanatic Fans. Since we have not entered the full operational phase of JabberMonkey or Fanatic Fans, prospective investors will not be able to rely on an operating history when evaluating our potential. If our expansion efforts do not prove successful, it is likely we would only be able to operate the TPV business at a small operating profit. Certainly not at a sufficient amount to repay our existing debt obligations.

18

With our expansion into new business areas, our ability to raise additional capital may be key to our success and without additional capital, we may not be able to stay in business.

We have been losing money and need to expand into new business areas as our TPV business, which has been our primary operations, has declining revenue and only small operating profits. Even if we leverage our current technology and infrastructure, without additional capital it will be difficult for us to enter into new business markets. With the current credit crisis in the United States, it may be difficult to raise capital and we do not think traditional forms of financing, such as bank loans, will be available for us. Given the current economic times, we would anticipate it being difficult to raise any capital and believe the terms we could obtain may not be very favorable, possibly resulting in substantial dilution to current shareholders. There can be no assurance that we will be able to raise the required capital.

Our inability to adequately retain or protect our employees, customer relationships and proprietary technology could harm our ability to compete.

Our future success and ability to compete depends in part upon our employees and their customer relationships, as well as our proprietary technology. Despite our efforts, we may not prevent third parties from soliciting our employees or customers or infringing upon or misappropriating our intellectual property. Our employees, customer relationships and intellectual property may not provide us with a competitive advantage adequate to prevent the competitors from entering the markets for our products and services. Additionally, our competitors, which are larger and better financed, could independently develop non-infringing technologies that are competitive with, and equivalent or superior to our technology.

We face numerous competitors and as a result, we may not get the business we seek.

We have many competitors with comparable technology and capabilities that compete for the same group of customers. Our competitors are competent and experienced and are continuously working to take projects away from us. Many of our competitors have greater financial, technical, marketing and other resources than we do. Our ability to compete effectively may be adversely affected by the ability of these competitors to devote greater resources to the sale and marketing of their products and services.

We currently depend upon a single customer segment, the telecommunication market, for the majority of revenues and a decrease in its demand for our services or pricing modifications in this segment would have a material adverse effect on our business, operations, and financial condition.

Currently, a substantial part of our revenue sources come from our TPV business related to telecommunications. As the telecommunication business has consolidated, we have already seen a reduction in revenue. If this market segment continues to consolidate, we could see a further reduction in the TPV revenue from telecommunications. Although we have moved to expand our product offerings, it will take time for our new offerings to gain acceptance in the marketplace and there can be no assurances that the new product offerings will prove successful. Accordingly, it is possible, we could see further reduction in business and increased losses if the TPV business is reduced further.

Almost 85% of our revenues are derived from two customers and the loss of either customer would have a material adverse effect on our business, operations and financial condition.

Currently, almost 85% of our revenues are derived from AT&T Communications and Cox Communications. For the year ended December 31, 2010 AT&T Communications accounted for 68% of our revenue and Cox Communications accounted for 17% of our revenues. AT&T Communications accounted for 55% of our revenue in 2009 and Cox Communications accounted for 25% of our revenues in 2009. It is unlikely we could replace either client in the short term and may not have the resources to survive long enough to add additional product offerings without the ongoing revenue from these customers.

19

We may not be able to adapt quickly enough to changing customer requirements and industry standards.

We are in an industry dependent on technology and the ability to adapt this technology to changing market needs. We may not be able to adapt quickly enough to changing customer requirements and preferences and industry standards. Competitors are continually introducing new products and services with new technologies. These changes and the emergence of new industry standards and practices could render our existing products obsolete and will require us to spend funds on research and development to stay competitive.

Efforts to expand will place a significant strain on our management, operational, financial and other resources.

We plan to expand our operations by introducing JabberMonkey and Fanatic Fans and aggressively marketing them, which will place a significant strain on our management, operations, technical performance and financial resources. There can be no assurance that we will be able to manage expansion effectively. Our current and planned personnel, systems, procedures, and controls may not be adequate to support and effectively manage our future operations, especially as we employ personnel in multiple geographic locations. We may not be able to hire, train, retain, motivate, and manage required personnel, which may limit our growth. If any of this were to occur, it could damage our reputation, limit our growth, negatively affect our operating results and harm our business.

We have limited funds upon which to rely for adjusting to business variations and for growing new business.

We have been experiencing losses, with a net loss of $128,263 and $408,842 for the years ended December 31, 2010 and 2009, respectively. These losses are the result of consolidation in the telecommunication business and our continuing research and development expenses related to new business lines. We are actively diversifying our product offerings to adjust to changes in our customers and the telecommunications’ industry. We had negative working capital of $1,692,763 at December 31, 2010. Given our limited working capital, if we were to lose existing customers, it could further hurt our ability to continue in business. It is likely we will have to seek additional capital in the future as we seek to expand our product offerings. There can be no assurance we will be able to raise additional capital and even if we are successful in raising additional capital, that we will be able to raise capital on reasonable terms. If we do raise capital, our existing shareholders will incur substantial and immediate dilution.

We may issue more stock without shareholder input or consent which could dilute the book value for stockholders.

The board of directors has authority, without action by or vote of the shareholders, to issue all or part of the authorized but unissued shares. In addition, the board of directors has authority, without action by or vote of the shareholders, to fix and determine the rights, preferences, and privileges of the preferred stock, which may be given voting rights superior to that of the common stock. Any issuance of additional shares of common stock or preferred stock will dilute the ownership percentage of shareholders and may further dilute the book value of Calibrus’ shares. It is likely we will seek additional capital in the future to fund operations. Any future capital will most likely reduce current investors’ percentage of ownership.

Your ability to sell shares may be limited if the price of our stock is below $5.00 per share because of special sales practice requirements applicable to "designated securities" or "penny stock."

If the bid price for our common stock is below $5.00 per share, our common stock would be subject to special sales practice requirements applicable to “designated securities” on “penny stocks” which is stock that trades below $5.00 per share and whose underlying companies do not meet certain minimum asset requirements. No assurance can be given that the bid price for our common stock will be above $5.00 per share. If such $5.00 minimum bid price is not maintained and another exemption is not available, our common stock would be subject to additional sales practice requirements imposed on broker-dealers who sell the common stock to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse). For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser's written agreement to the transaction prior to the sale. These limitations make it difficult for broker dealers to sell penny stocks and most will not recommend a penny stock or sell a penny stock except to long term customers who are accredited investors. Because of these limitations many brokers do not follow penny stocks or recommend them to clients. Consequently, the penny stock rules may affect the ability of broker-dealers to sell our common stock and also may affect the ability of persons acquiring our common stock to resell such securities in any trading market that may develop. If brokers do not recommend Calibrus to their clients, it may be difficult to establish a market for the securities or to develop a wide spread shareholder base. Therefore, an investor trying to resell our shares may have difficulty because there may be little demand for our shares and even small share sales may result in a reduction in our share price.

20

Current management and our founders own over fifty percent of our outstanding shares and will control Calibrus leaving other shareholders of Calibrus dependent on management’s ability and making it difficult to change management or our direction if an investor should become dissatisfied with management or our business model.

Calibrus management and founders currently own 50.74% of our issued and outstanding shares of common stock. As a result, management will most likely be in a position to elect at least a majority of the Board of Directors, to dissolve, merge or sell the assets, and to direct our business affairs without shareholder input or consent. As such, outside shareholders will not have the ability to change management or the direction of the Company and will be subject to the judgment and decisions of current management for the foreseeable future.

Management is reviewing the recently enacted legislation related to healthcare and its impact on Company results.

Calibrus management is currently reviewing the recently enacted healthcare package and its effect on future financial results of the Company. At this time it has not been determined whether this will have a material effect on financial results. It is possible it may have a material effect on financial results.

Employees

As of March 31, 2011, we had 50 full-time employees and 22 part-time employees.

Offices

Our offices are located at 1225 West Washington Street, Tempe, Arizona 85281 where we lease approximately 7,767 square feet. Our lease runs through October 31, 2015 at a lease rate of approximately $19 per square foot, including common area charges, for an annual lease amount of $138,500, or $11,538 per month. Management believes our current lease will serve current and future expansion plans through its term.

21

ITEM 2. PROPERTIES

Our offices are located at 1225 West Washington, Tempe, Arizona 85281 where we lease approximately 7,767 square feet. Our lease runs through October 31, 2015, at a lease rate of approximately $19 per square foot, including common area charges, for an annual lease amount of $138,500 or $11,538 per month. Management believes our current lease will serve current and future expansion plans through the term of our lease.

ITEM 3. LEGAL PROCEEDINGS

On September 13, 2010, a former employee filed a lawsuit in the Superior Court of the State of Arizona, in and for the County of Maricopa (Case No. CV2010-027027) against the Company. The complaint was hand-written and does not itemize the specific legal claims, b ut could include (1) discrimination (no statute identified), (2) failure to pay minimum wage or overtime (no statute identified), (3) retaliation, (4) assault, and (5) intentional infliction of emotional distress. The court entered a scheduling order on March 15, 2011, setting a discovery schedule. The Company intends to vigourously defend this matter. The suit is currently in the discovery phase and as such, the likelihood of any outcome is indeterminable. As such, the accompanying financial statements have not been adjusted to reflect any possible outcome.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITIES HOLDERS

None.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Calibrus’ common stock is quoted on OTC Bulletin Board, under the symbol “CALB.” Our common stock is traded on the OTCBB but has had limited trading activity. Our stock was included in the OTC Bulletin Board in December 2009, but was not eligible for trading until February 2010. The first trades in the Company’s common stock did not occur until April 2010.

| Quarter Ended | High Bid | Low Bid |

| December 2009 | * | * |

| March 31, 2010 | * | * |

| June 30, 2010 | $1.01 | $0.45 |

| September 30, 2010 | $0.75 | $0.51 |

| December 31, 2010 | $0.54 | $0.30 |

(*) The Company’s stock did not commence trading until April 2010. As such, no historical data is available for the Company’s common stock prior to that date.

22

At March 23, 2011, the bid and asked price for the Company's Common Stock was $0.28 and $0.38. All prices listed herein reflect inter-dealer prices, without retail mark-up, mark-down or commissions and may not represent actual transactions with retail customers. Since its inception, Calibrus has not paid any dividends on shares of common stock, and Calibrus does not anticipate that it will pay dividends in the foreseeable future. At December 31, 2010, we had approximately 120 shareholders of record. As of December 31, 2010, Calibrus had 6,794,600 shares of our common stock issued and outstanding. At March 31, 2011, Calibrus had 6,794,600 shares of its common stock issued and outstanding.

Possible Sale of Common Stock Pursuant to Rule 144

Calibrus has previously issued shares of common stock that constitute restricted securities as that term is defined in Rule 144 adopted under the Securities Act. Subject to certain restrictions, such securities may generally be sold in limited amounts under Rule 144. Except for 500 shares of Calibrus’ common stock issued in 2006, all of Calibrus issued 6,794,600 shares have been outstanding for several years with the majority of the shares issued in 1999 and 2000. Accordingly, all of the shares of common stock outstanding would meet the time test of Rule 144 and potentially be available for resale. With the number of shares potentially becoming available for resale, there could be a depressive effect on any market that may develop for Calibrus’ common stock.

Reports to Shareholders

This report will be available over the internet at the Securities and Exchange Commission web site www.sec.gov.

Recent Sales of Unregistered Securities

We issued options to our executive officers and directors during the year ended December 31, 2010. Options issued were only to executive officers and directors and, accordingly, we believe all issuances are exempt from the registration provisions of the Securities Act of 1933. We issued a total of 1,494,167 options in 2010. No shares of our common stock were issued in 2010 and 2009.