Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - HOT TOPIC INC /CA/ | a6673438ex31_2.htm |

| EX-32.1 - EXHIBIT 32.1 - HOT TOPIC INC /CA/ | a6673438ex32_1.htm |

| EX-23.1 - EXHIBIT 23.1 - HOT TOPIC INC /CA/ | a6673438ex23_1.htm |

| EX-31.1 - EXHIBIT 31.1 - HOT TOPIC INC /CA/ | a6673438ex31_1.htm |

| EX-10.9A - EXHIBIT 10.9A - HOT TOPIC INC /CA/ | a6673438ex10_9a.htm |

| EX-10.22A - EXHIBIT 10.22A - HOT TOPIC INC /CA/ | a6673438ex10_22a.htm |

| EX-10.16A - EXHIBIT 10.16A - HOT TOPIC INC /CA/ | a6673438ex10_16a.htm |

| EX-10.21A - EXHIBIT 10.21A - HOT TOPIC INC /CA/ | a6673438ex10_21a.htm |

| EX-10.14A - EXHIBIT 10.14A - HOT TOPIC INC /CA/ | a6673438ex10_14a.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended January 29, 2011

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission File 0-28784

_______________

HOT TOPIC, INC.

(Exact name of Registrant as specified in its charter)

_______________

|

California

|

77-0198182

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

18305 E. San Jose Ave.

City of Industry, California

|

91748

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (626) 839-4681

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Exchange on Which Registered

|

|

Common Stock, no par value

|

Nasdaq Stock Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer x |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ¨ No x

The aggregate market value of Common Stock held by non-affiliates of the Registrant as of July 31, 2010, the last business day of the Registrant’s most recently completed second fiscal quarter, was approximately $235,825,169 based on the closing price on that date of the Registrant’s Common Stock on the Nasdaq Stock Market. All outstanding shares of voting stock, except for shares held by executive officers and members of the Board of Directors and their affiliates are deemed to be held by non-affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the Registrant’s Common Stock was 44,648,406 as of April 4, 2011.

Documents Incorporated By Reference

Certain portions of the Registrant’s Definitive Proxy Statement for the Annual Meeting of Shareholders to be held on June 8, 2011 to be filed with the Securities and Exchange Commission (the “SEC”) no later than 120 days after January 29, 2011, are incorporated by reference into Part III of this Form 10-K (Items 10 through 14).

HOT TOPIC, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE

FISCAL YEAR ENDED JANUARY 29, 2011

TABLE OF CONTENTS

|

Page

|

||

|

1

|

||

|

12

|

||

|

22

|

||

|

22

|

||

|

22

|

||

|

22

|

||

|

23

|

||

|

25

|

||

|

25

|

||

|

36

|

||

|

37

|

||

|

37

|

||

|

37

|

||

|

39

|

||

|

41

|

||

|

41

|

||

|

41

|

||

|

41

|

||

|

41

|

||

|

42

|

Cautionary Statement Regarding Forward-Looking Statements From time to time, in both written reports (such as this report) and oral statements, we make “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We intend that such forward-looking statements be subject to the “safe harbors” created by these sections. Generally, the words “believes,” “anticipates,” “expects,” “continue,” “intends,” “will,” “may,” “plans” and similar expressions identify such forward-looking statements, although not all forward-looking statements contain these identifying words. These statements include, for example, statements regarding our expectations, beliefs, intentions or strategies regarding the future, such as the extent and timing of future revenues and expenses, economic conditions affecting consumer demand, ability to realize anticipated benefits of cost reduction plans and business changes, ability to grow or maintain comparable store sales, response to new concepts and other expected financial results and information. All forward-looking statements included in this report are based on information available to us as of the date of this report and we assume no obligation to update or revise any forward-looking statements to reflect events or circumstances that occur after such statements are made. Readers are cautioned not to place undue reliance on these forward-looking statements as they involve risks and uncertainties which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements. These risks, as well as other risks and uncertainties, are located in the company’s reports on Forms 10-K, 10-Q and 8-K filed with or furnished to the Securities and Exchange Commission, or SEC, including in Part I, Item 1A under the caption “Risk Factors” and in Part II, Item 7 under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this report.

Available Information Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed with or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act, are available free of charge on our investor relations website, investorrelations.hottopic.com, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. We also make available our Standards of Business Ethics at that website.

Fiscal Year Our fiscal year ends on the Saturday nearest to January 31. References to fiscal 2011, 2010, 2009, 2008 and 2007 refer to the 52-week periods ending January 28, 2012, January 29, 2011, January 30, 2010, January 31, 2009 and February 2, 2008. Fiscal 2006 refers to the 53-week period ended February 3, 2007.

References to Hot Topic, Inc. Throughout this report, the terms “we,” “us,” “our,” “company” and similar references refer to Hot Topic, Inc. and its wholly-owned subsidiaries.

|

BUSINESS

|

General We are a mall and web-based specialty retailer of apparel, accessories, music and gift items for young men and women whose lifestyles reflect a passion for music, fashion and pop culture. We operate under two primary concepts: Hot Topic and Torrid. Music and pop culture are the overriding inspirations at Hot Topic and Torrid is focused on providing the best in fashion to young plus-size women. We generate revenues primarily through our retail stores in the United States of America, Puerto Rico and Canada, and online through our websites. We were incorporated in California in 1988.

Concepts

Hot Topic At our Hot Topic stores and on our website hottopic.com, we sell a selection of licensed and non-licensed apparel, accessories and gift items that are influenced by popular music artists and pop culture trends. We also sell a limited assortment of music CDs and DVDs. Our merchandise is designed to appeal to young men and women primarily between the ages of 12 and 22 who are passionate about and have diverse tastes in music and pop culture.

1

We strive to consistently be the first to expose our customers to new music, pop culture and fashion trends. We believe our ability to quickly identify, source, and oftentimes negotiate exclusivity for, unique and diverse merchandise centered around music and pop culture is one of our competitive strengths. We also believe that our deep-rooted knowledge of music and pop culture, distinctive store design and rich music experiences that we offer (in-store, in-mall and at other venues), are competitive strengths. We opened our first Hot Topic store in California in fiscal 1989 and have since gained a national presence in the Unites States. We also operate in Canada and Puerto Rico.

Torrid At our Torrid stores and on our website torrid.com, we sell fashion forward apparel, lingerie, shoes and accessories for plus-size young women primarily between the ages of 15 and 29. It is designed to appeal to women sized 12 to 26 who are young at heart and in attitude and who want their clothes to be an extension of their lifestyles. We believe that our ability to provide our plus-size customers with easy access to the latest and best in fashion without sacrificing fit or style is a core competitive strength of Torrid. We opened our first Torrid store in fiscal 2001.

ShockHound At shockhound.com, we sell MP3s encompassing multiple music genres as well as a selection of apparel, accessories and gift items that are influenced by multi-genre music artists. Customers also have access to exclusive editorial and video content and a social networking community. Our customers may make MP3 and merchandise purchases in a single transaction. During the first quarter of fiscal 2011, we announced that ShockHound’s operations will be discontinued. Refer to “NOTE 15 – Subsequent Events” contained in the consolidated financial statements and Notes included elsewhere in this annual report on Form 10-K for more information concerning the discontinuation of ShockHound.

Merchandising

Hot Topic Merchandise Hot Topic’s music/pop culture-licensed merchandise includes tee shirts, hats, posters, stickers, patches, books, novelty accessories, CDs and DVDs and the music/pop culture-influenced merchandise includes women’s and men’s apparel and accessories, such as woven and knit tops, skirts, pants, shorts, jackets, shoes, costume jewelry, body jewelry, intimate apparel, sunglasses, cosmetics, leather accessories and gift items. Hot Topic’s diverse and extensive selection of merchandise is regularly tested to stay current with customer demand and new product trends. We have several lines of private label merchandise to complement and supplement our current product offerings.

The following table shows, for the periods indicated, Hot Topic’s major merchandise categories expressed as a percentage of net sales:

|

Fiscal Year

|

||||||||

|

2010

|

2009

|

|||||||

|

Fashion accessories

|

33 | % | 31 | % | ||||

|

Fashion apparel

|

12 | 14 | ||||||

|

License

|

27 | 30 | ||||||

|

Music

|

26 | 23 | ||||||

|

Other

|

2 | 2 | ||||||

| 100 | % | 100 | % | |||||

Torrid Merchandise Torrid sells both branded and private label merchandise that includes casual and dressy jeans and pants, fashion and novelty tops, sweaters, skirts, jackets, dresses, hosiery, shoes, intimate apparel and fashion accessories.

2

The following table shows, for the periods indicated, Torrid’s major merchandise categories expressed as a percentage of net sales:

|

Fiscal Year

|

||||||||

|

2010

|

2009

|

|||||||

|

Apparel

|

75 | % | 76 | % | ||||

|

Accessories

|

25 | 24 | ||||||

| 100 | % | 100 | % | |||||

Merchandising Staff Hot Topic’s team consists of a Chief Music Officer, Divisional Merchandise Managers, a staff of buyers and assistant buyers who manage the various product categories, a Trend Director and an Internet team. Torrid’s team consists of a Chief Merchandising Officer, a buying team, a product development team, a sourcing team, a fit and quality assurance team as well as an Internet team. In determining which Hot Topic merchandise to buy, the merchants spend considerable time viewing music videos, reviewing industry music sales, viewing movie releases that appeal to our teen customers, monitoring music radio station air play, viewing YouTube videos, consulting with sales associates, reviewing customer requests, attending trade shows, nightclubs and concerts, reading music and fashion industry periodicals and monitoring music, pop culture and social media websites. Their goal is not only to identify emerging trends early, but to quickly move on from them before the popularity of the trends wane. At Torrid, in order to remain in tune with reigning trends and preferences, the merchandising team conducts fashion research from a variety of sources within and outside the United States. Such sources include fashion hot spots, customer and store associate feedback, entertainment and pop culture venues and trade shows.

Purchasing Our goal is to provide exclusive, diverse, trend-setting merchandise to our customers early and at the right price. We purchase merchandise from a broad base of domestic and international vendors and only commit to a majority of the merchandise in as little as two weeks and as much as three months in advance of delivery, depending on the category, in order to respond quickly to emerging trends. We regularly monitor sales to determine desirable product types and quantities, emerging or declining trends and the spending patterns of our customers. We solicit input from our vendors and maintain productive relationships with them to support our effort to deliver quality, fashionable merchandise that is reflective of new and emerging trends. No vendor individually accounted for more than 10% of our merchandise purchases during fiscal 2010.

Planning and Allocation Planning and allocation of our inventory is done by merchandise classification and Stock Keeping Unit, or SKU, using integrated third-party software. Most merchandise is ordered in bulk and then allocated to each store based on sales performance and inventory levels. Our buyers, merchandise planners and allocation analysts consider current inventory levels, sales history, projected sales, planned inventories, store demographics, geographic preferences, store openings and planned markdown dates to determine SKU reorder quantities.

Distribution and Fulfillment To facilitate timely and efficient merchandise distribution to our stores and internet customers, we have distribution centers located in California and Tennessee, both of which are sufficient to meet our anticipated needs over the next several years. Substantially all merchandise is delivered to our distribution centers and within one to two business days of receipt, it is inspected, allocated, picked, prepared and boxed for shipment to our stores and internet customers. Merchandise is shipped from the distribution centers daily and minimal back stock is maintained.

3

Location and Site Selection As of the end of fiscal 2010, we operated 657 and 153 primarily mall-based Hot Topic and Torrid stores, respectively, in the United States, Puerto Rico and Canada. Refer to “Item 2 – Properties” for a geographical breakdown of stores by state and country. In selecting a site for a new store, we target high-traffic shopping areas with favorable lease terms and suitable demographics of likely customers.

Design and Environment The look and feel of our Hot Topic and Torrid stores continue to evolve. Our newer Hot Topic stores are designed to have an open, transparent look with all-glass store fronts and smaller, mobile floor fixtures that we believe highlight the merchandise and encourage easy navigation and discovery throughout the store. Our Torrid stores present a youthful atmosphere designed to create a comfortable and fun environment for our customers.

Sales During fiscal 2010, average sales per Hot Topic store was $0.8 million and average sales per square foot of store space was $426. Average sales per Torrid store in fiscal 2010 was $0.8 million and average sales per square foot of store space was $326.

Expansion We have significantly slowed our new store growth and aggressively pursue renegotiating or extending existing leases with more favorable terms. We continue to close stores that do not meet our expectations of profitability and remodel or relocate stores where there is a reasonable expectation of satisfactory sales results after the remodel or relocation.

In fiscal 2010, our capital investment to open a typical new or remodeled Hot Topic store in the United States, including leasehold improvements and furniture and fixtures, was approximately $188,000, while our capital investment to open a new Hot Topic store in Canada was approximately $367,000. These stores have square footage similar to current averages of 1,762 square feet. The average initial gross inventory for a new Hot Topic store opened in fiscal 2010 was approximately $102,000 and the average pre-opening costs for a new Hot Topic store in the United States and Canada were approximately $18,000 and $59,000, respectively. Initial inventory requirements vary at new stores depending on the season and current merchandise trends.

In fiscal 2010, our capital investment to open a new Torrid store, including leasehold improvements and furniture and fixtures, was approximately $264,000. The average initial gross inventory for a new Torrid store opened in fiscal 2010 was approximately $89,000. Initial inventory requirements vary at new stores depending on the season and current merchandise trends. The average pre-opening costs in fiscal 2010 for a new Torrid store were approximately $26,000. The new Torrid stores have square footage similar to current averages of 2,496 square feet.

4

The following table shows our historical store expansion and closure activity for the periods indicated and our planned activity in fiscal 2011. All store expansion and closure activity is evaluated by our real estate committee.

|

Number of Stores

|

||||||||||||||||||||||||

|

Estimate

|

Actual

|

|||||||||||||||||||||||

|

Fiscal Year

|

||||||||||||||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||||||

|

Hot Topic

|

||||||||||||||||||||||||

|

Beginning of Period

|

657 | 680 | 681 | 690 | 694 | 663 | ||||||||||||||||||

|

Open *

|

3 | 6 | 2 | 4 | 9 | 34 | ||||||||||||||||||

|

Close **

|

(25 | ) | (29 | ) | (3 | ) | (13 | ) | (13 | ) | (3 | ) | ||||||||||||

|

End of Period

|

635 | 657 | 680 | 681 | 690 | 694 | ||||||||||||||||||

|

Remodeled/relocated

|

30 | 24 | 16 | 14 | 70 | 22 | ||||||||||||||||||

|

Torrid

|

||||||||||||||||||||||||

|

Beginning of Period

|

153 | 156 | 159 | 151 | 131 | 120 | ||||||||||||||||||

|

Open

|

5 | 3 | 1 | 11 | 23 | 12 | ||||||||||||||||||

|

Close **

|

(5 | ) | (6 | ) | (4 | ) | (3 | ) | (3 | ) | (1 | ) | ||||||||||||

|

End of Period

|

153 | 153 | 156 | 159 | 151 | 131 | ||||||||||||||||||

|

Remodeled/relocated

|

5 | - | - | - | 1 | - | ||||||||||||||||||

|

* Includes three new stores opened in Canada during the third quarter of fiscal 2010.

|

||||||||||||||||||||||||

|

** Includes stores impacted by our cost reduction plan.

|

||||||||||||||||||||||||

Operation Teams Hot Topic and Torrid each have a Vice President of Store Operations who leads a divisional operations team. Supporting the Vice President of Store Operations for each division are regional directors who oversee multiple district managers, and district managers who typically oversee approximately ten stores. A typical store has a store manager, two assistant managers, and five to eight part-time sales associates, depending on the season. We believe our distinct culture attracts Hot Topic sales associates that are passionate about music and pop culture and Torrid sales associates that are passionate about fashion for the plus-size customer. Each member of our store operation teams receive comprehensive training that is customized to fit their roles and responsibilities. In addition to base pay and the opportunity to participate in our Employee Stock Purchase Plan and the Hot Topic 401(k) Plan if eligible, we offer incentive programs to some members of our store operations teams based on achieving certain sales levels.

eCommerce Operations

Websites Our hottopic.com and torrid.com websites provide convenient access to a broad selection of merchandise for sale, including some Internet exclusive items, information on upcoming events, promotions, store locations, job postings and community features. Customers may also access our hottopic.com website through touchscreen kiosk terminals located within each Hot Topic store. These kiosks allow customers to access, purchase and ship merchandise from hottopic.com to the store or their homes.

5

The following table shows, for the periods indicated, Internet sales for Hot Topic and Torrid (in thousands, except percent amounts):

|

Fiscal Year

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

Hot Topic Internet Sales

|

$ | 40,100 | $ | 35,800 | $ | 30,100 | ||||||

|

Hot Topic Internet Sales as a Percentage of Total Hot Topic Sales

|

7.4 | % | 6.3 | % | 5.0 | % | ||||||

|

Torrid Internet Sales

|

$ | 33,695 | $ | 29,500 | $ | 23,700 | ||||||

|

Torrid Internet Sales as a Percentage of Total Torrid Sales

|

21.6 | % | 19.2 | % | 15.7 | % | ||||||

Marketing

Hot Topic We strive to increase sales and our brand recognition, enhance the customer shopping experience and reach out to new customers using a unique combination of tools including: promotional signage in stores and on our website; viral online marketing; branded gift cards; through our loyalty program; social media; reliance on our customers and associates; compelling store designs; and experiential events. During the fourth quarter of 2009, we launched our loyalty program, HT+1. HT+1 is free to join and is designed to build customer loyalty and encourage repeat sales by allowing members an opportunity to earn points in a variety of ways, including store visits, store purchase and online purchases. In addition, HT+1 allows us to communicate to members about products and events that are relevant to them as well as giving members access to exclusive events that are not available to other customers. Touchscreen kiosk terminals located within each Hot Topic store offer another way that members may access their HT+1 loyalty accounts. Since the launch, over six million people have become HT+1 members.

Torrid We seek to build the Torrid brand with many of the same tools used by Hot Topic, as well as with print media, direct mail, special television promotional segments and national “model search” contests. Our Torrid loyalty program, divastyle®, gives us the chance to regularly communicate with our most loyal Torrid customers. They are rewarded throughout the year with special offers, promotions, information and updates on new products and current trends available at Torrid. Customers may also participate in our private label Torrid credit card program, divastatusSM.

Information Technology Our information systems provide for the integration of store, internet, merchandising, distribution, financial and human resources records and data. Many of these information systems have been customized in varying degrees to fit our business needs and we license a full range of software from different vendors. We regularly upgrade existing systems or replace all or part of an existing system with one that we believe is better suited to our business. In addition, we occasionally implement new technology to support our business.

Trademarks Our trademarks, which constitute our primary intellectual property, have been registered or are the subject of pending applications in the United States Patent and Trademark Office and with the registries of many foreign countries. In addition, we have common law rights to certain trademarks, service marks and trade names used in our business from time to time. We are unaware of the use of any of our marks raising any claims of infringement or other challenges to our right to use our marks in the United States.

Seasonality Our business, particularly at Hot Topic, is subject to seasonal influences, with heavier concentrations of sales during the back-to-school, Halloween and holiday (defined as the week of Thanksgiving through the first few days of January) seasons and other periods when schools are not in session. The holiday season has historically been our single most important selling season. We believe that the importance of the summer vacation and back-to-school seasons (which affect operating results in the second and third quarters, respectively) and to a lesser extent, the spring break season (which affects operating results in the first quarter), as well as Halloween (which affects operating results in the third quarter), all reduce our dependence on the holiday selling season, but this may not always be the case or always affect the company to the same degree. As is the case with many retailers of apparel, accessories and related merchandise, we typically experience lower net sales in the first and second fiscal quarters relative to other quarters.

\

6

Competition The apparel, music and accessory categories within the retail industry in which we operate are highly competitive and are subject to rapidly changing consumer demands and preferences. We compete with numerous retailers for vendors, teenage and young adult customers, suitable store locations and qualified associates and management personnel. We currently compete with street alternative stores located primarily in metropolitan areas; shopping mall-based teenage-focused retailers; big-box discount stores; music stores; mail order catalogs and websites; and with numerous potential competitors who may begin or increase efforts to market and sell products competitive with Hot Topic and Torrid products. Torrid has additional competitors who operate plus-size departments in department stores and discount stores. Increased competition could have a material adverse effect on our business, results of operations and financial condition.

Employees As of the end of fiscal 2010, we employed approximately 2,400 full-time and 6,500 part-time associates. Of our 8,900 associates, approximately 800 were headquarters and distribution center personnel and the remainder were field management and store associates. The number of part-time associates changes based upon seasonal needs. None of our associates are covered by collective bargaining agreements.

Executive Officers Our executive officers and their ages are as follows:

|

Name

|

Age

|

Position

|

|

Lisa Harper

|

51

|

Chief Executive Officer and Director

|

|

Gerald Cook

|

58

|

Chief Operating Officer

|

|

Chris Daniel

|

53

|

President, Torrid

|

|

James McGinty

|

48

|

Chief Financial Officer

|

|

John Kirkpatrick

|

42

|

Senior Vice President, Chief Music Officer, Hot Topic

|

|

George Wehlitz, Jr.

|

50

|

Vice President, Finance

|

Lisa Harper has served as Chief Executive Officer since March 2011, and served on our Board of Directors since June 2008. Prior to joining us, she served as Chairman of the Board of Directors of the Gymboree Corporation, a publicly-traded corporation operating a chain of specialty retail stores for children and women, from June 2002 until her retirement in July 2006. From January 2006 through July 2006, Ms. Harper served as Chief Creative Officer of the Gymboree Corporation. From February 2001 through January 2006, Ms. Harper served as Chief Executive Officer of the Gymboree Corporation and from February 2001 through June 2002, she was Vice Chairman of the Gymboree Corporation’s Board of Directors. From 1995 through 2001, Ms. Harper held various merchandising and design positions at the Gymboree Corporation and before that, held similar positions with several other clothing retailers, including Limited Too, Esprit de Corp., GapKids, Mervyn’s, and Levi Strauss. Ms. Harper also served as a director of Longs Drug Stores Corporation from February 2006 to May 2008. Since 2008, Ms. Harper has developed and operated a hotel in Mexico. Ms. Harper holds a degree from the University of North Carolina at Chapel Hill.

Gerald Cook has served as Chief Operating Officer since June 2008. From November 2005 through June 2008, he served as President, Hot Topic Inc. From September 2003 to October 2005, he was President of the Hot Topic division. From February 2001 to September 2003, he was Chief Operating Officer. From February 1999 until joining us, he was the President and Chief Operating Officer of Travel 2000, Inc. From 1995 to 1998, Mr. Cook was Senior Vice President, Operations for The Bombay Company, Inc. and from 1989 to 1995, Mr. Cook was the Vice President, Stores and the Vice President, General Merchandising Manager of Woman’s World Stores. Prior to 1989, he held management positions with Barnes & Noble/B Dalton, The Gap Stores and the Limited, Inc. Mr. Cook holds a B.S. degree in Business Administration from the University of Minnesota.

7

Chris Daniel has served as President of our Torrid division since November 2006. From September 2006 to November 2006, he was Senior Vice President, Chief Merchandising Officer for Torrid and from October 2004 to August 2006, he was Vice President, General Merchandise Manager for Torrid. Prior to joining Torrid, Mr. Daniel held various design and merchandising positions with national department and specialty retailers. Mr. Daniel holds a B.A. degree in English Literature from the University of Richmond in Richmond, Virginia. Mr. Daniel has tendered his resignation as President of our Torrid division, effective as of April, 29, 2011, but prior to that time he continues to serve as President of our Torrid division and assist in transition matters.

James McGinty has served as Chief Financial Officer since February 2001. Mr. McGinty joined us in August 2000 as Vice President, Finance and was promoted to Chief Financial Officer in February 2001. From July 1996 to July 2000, Mr. McGinty was Vice President-Controller at Victoria’s Secret Stores, the leading brand and largest specialty retailer division of the Limited, Inc. From 1984 to 1996, he held various financial and accounting positions within the Structure and Express divisions of The Limited, Inc. Mr. McGinty holds a B.S. degree in Accounting from Miami University in Oxford, Ohio.

John Kirkpatrick joined us in April 2007 as Senior Vice President, Chief Music Officer of our Hot Topic division. From 2004 to 2007, Mr. Kirkpatrick served as Senior Vice President, Music and Creative Affairs at Paramount Pictures. Prior to that, Mr. Kirkpatrick served as Senior Vice President, A&R / Soundtracks at Elektra Records from 1996 to 2004. From 1990 to 1996, he held various management positions at Laffitte Entertainment Division. Mr. Kirkpatrick attended the University of South Florida.

George Wehlitz Jr. joined us in April 2008 as Vice President, Finance. From November 2005 to January 2008, Mr. Wehlitz was Chief Financial Officer at Cycle Gear, Inc., a specialty retailer of motorcycle apparel and accessories. Mr. Wehlitz previously served Hot Topic, Inc. as Vice President, Controller in February 2002, and then served as Vice President, Finance from August 2003 to November 2005. From August 2000 to February 2002, Mr. Wehlitz was Chief Financial Officer at The Popcorn Factory, a catalog company for gourmet popcorn gifts. From 1987 to 2000, Mr. Wehlitz held various financial-related positions, at the divisional and corporate level, for The Bombay Company, Inc. Mr. Wehlitz holds a B.A. degree in Accounting from Texas Christian University and is a Certified Public Accountant.

|

RISK FACTORS

|

CERTAIN RISKS TO OUR BUSINESS

The statements in this section describe the major risks to our business and should be considered carefully, in connection with all of the other information set forth in this annual report on Form 10-K and our quarterly reports on Form 10-Q and current reports on Form 8-K. The risks described below are not the only risks we face. Additional risks that are not presently known to us or that we currently deem to be immaterial may also affect our business. If any of the events, conditions, occurrences or circumstances identified as a risk, or an additional risk, actually occurs, our business, financial condition, results of operations, stock price, reputation and ability to achieve anticipated results could be affected.

Our success relies on popularity of music, pop culture and fashion trends, and our ability to react to them

Our financial performance is largely dependent upon the continued popularity of apparel, accessories and other merchandise inspired by music, film, television, pop culture, and fashion trends, particularly among teenagers and college-age adults. The popularity of such products is influenced by the Internet; music videos and music television networks; the emergence of new artists; the success of music releases, movies and television shows; and music/pop culture-related products. The popularity of particular types of music, movies, television shows, artists, actors, styles, trends and brands is constantly changing. Our failure to anticipate, identify and react appropriately to changing trends and preferences of our customers could lead to, among other things, excess inventories and higher markdowns. There can be no assurance that the products we sell will be accepted by our customers.

8

We depend on a small number of key licensed products for a portion of our earnings and lower than expected sales of those products or the inability to obtain new licensed products could adversely affect our revenues

We license from others the rights to produce and/or sell certain products that contain a third party’s trademarks, designs and other intellectual property. If the popularity of those licensed products diminishes or if we are unable to obtain new licensed products with comparable consumer demand, our sales could decline. Furthermore, we may not be able to prevent a licensor from choosing not to renew a license with us and/or from licensing a product to one of our competitors.

Our recently announced cost reduction and operational initiatives may not achieve their anticipated benefits and could adversely affect our operations and revenues and our ability to respond to future growth opportunities

We are currently implementing a plan to reduce company overhead and close underperforming stores. In addition, we recently announced certain business changes that involve discontinuing our ShockHound operations, writing down unproductive inventory and writing down fixed assets that are no longer critical to the strategic direction of the company. The estimated costs and charges associated with these initiatives may vary materially based upon a variety of factors, including the timing of the execution of the initiatives, the outcome of negotiations with landlords and other third parties and unexpected costs. Any such factor could result in our not realizing the anticipated benefits from the initiatives. Even if we are successful in implementing these initiatives, the loss of personnel and reduction in the number of stores we operate, among other things, may result in decreased operational efficiencies, unanticipated operational challenges and decreased revenues, or leave us unprepared to take advantage of growth opportunities in the future.

Our access to merchandise could be hurt by changes in vendors’ business condition

Our financial performance depends on our ability to obtain our merchandise in sufficient quantities at competitive prices. We depend on independent contractors and vendors to manufacture our merchandise. Substantially all of our music/pop culture-licensed products are available from vendors that have exclusive license rights. In addition, we rely on small, specialized vendors, some of which create unique products primarily for us who generally have limited resources, production capacities and operating histories. Lack of access to capital, as a result of the current economic conditions or otherwise and changes in vendors’ compliance and certification procedures may cause our vendors to delay, reduce or eliminate shipment of products we otherwise would sell in our stores. We generally do not have long-term purchase contracts or other contractual assurances of continued supply, pricing or access to new products. There can be no assurance that we will be able to acquire desired merchandise in sufficient quantities on acceptable terms in the future.

Remodeling, relocating, closing and opening stores may not achieve the anticipated benefits and could create challenges we may not be able to adequately meet

We depend on our ability to manage our existing store base, ensure that the performance of our remodeled and relocated stores is at acceptable levels, open new stores, and close underperforming stores. In order to open, remodel and relocate stores, among other things, we need to locate suitable store sites, negotiate acceptable lease terms, obtain or maintain adequate capital resources on acceptable terms, source sufficient levels of inventory, hire and train store managers and sales associates, integrate new or relocated stores into our existing operations and maintain adequate distribution center space and information technology systems. Moving or expanding store locations and operating stores in new markets, especially markets outside the continental United States, may present competitive, merchandising and regulatory challenges we do not have experience in or know how to face. There can be no assurance that moving or expanding store locations and operating stores in new markets will not adversely affect the individual financial performance of our existing stores or our overall results of operations. In the event that the number of our stores increases, we may face risks associated with market saturation of our products and concepts. Similarly, there can be no assurance that remodeling or relocating existing stores will not adversely affect either the individual financial performance of the store prior to the change, or our overall results of operations. Furthermore, there can be no assurance that we will successfully achieve our remodel or expansion targets or, if achieved, that planned remodel or expansion will result in profitable operations.

9

Our business strategy requires innovating and improving our operations, and we may not be able to do this sufficiently to effectively prevent a negative impact on our business and financial results

To be successful we must innovate our products, our stores, and the shopping experience for our customers. We recently began offering a print-on-demand product which allows us to print designs on tees and hoodies. Such innovation involves risks, including that we will not properly anticipate the need for or rate of change, that we are not able to successfully bring about such change, that we will not be able to produce anticipated results, and that our customers will not be receptive to the change. Such innovation also involves significant capital expenditures and other costs that we may not be able to recover if the innovation is not favorably received by our customers.

Failure of our vendors to use acceptable ethical business practices could negatively impact our business

We expect our vendors to operate in compliance with applicable laws, rules and regulations regarding working conditions, employment practices, environmental compliance and with intellectual property laws. However, we do not control their labor and other business practices. Further, we do not inspect our manufacturers’ operations and would not be immediately aware of any noncompliance by our vendors with applicable domestic or international laws and standards, including our internal standards. If one of our vendors violates labor or other laws or implements labor or other business practices that are regarded as unethical, the shipment of merchandise to us could be interrupted, orders could be canceled, relationships could be terminated and our reputation could be damaged.

Technology and other risks associated with our Internet sales could hinder our overall financial performance

We sell merchandise over the Internet through websites we control and affiliated websites controlled by others. Our Internet sales encompass a significant portion of our total sales and are dependent on our ability to drive Internet traffic to our websites. Our Internet operations are subject to numerous risks and pose risks to our overall business, including, among other things, the inability to successfully establish partnerships that are instrumental in driving traffic to our websites, diversion of sales from our stores; liability for online content; computer privacy concerns; rapid technological changes and the need to invest in additional computer hardware and software to support sales; hiring, retention and training of personnel to conduct the Internet operations; failure of computer hardware and software, including computer viruses, telecommunication failures, online security breaches and similar disruptions; governmental regulations; and credit card fraud. There can be no assurance that our Internet operations will achieve sales and profitability levels that justify our investment in them.

System security risk issues and system failures could disrupt our internal operations or information technology services provided to customers

Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate our confidential information or that of third parties, create system disruptions or cause shutdowns. As a result, we could incur significant expenses addressing problems created by security breaches of our network. Moreover, we could incur significant expenses in connection with system failures. In addition, hardware and operating system software and applications that we procure from third parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the system. The costs to us to eliminate or alleviate security problems, viruses and bugs could be significant, and the efforts to address these problems could result in interruptions, delays or cessation of service that may impede our sales, distribution or other critical functions. In addition, our systems are not fully redundant and could be subject to failure. Our disaster recovery planning may not be sufficient, and we may not have adequate insurance coverage to compensate us for any significant casualty loss.

10

Loss of key people or an inability to hire necessary and significant personnel could hurt our business

Our ability to achieve and maintain operating efficiency and to anticipate and effectively respond to changing trends and consumer preferences depends in part on our ability to retain and attract senior management and other key personnel in our operations, merchandising, music and other departments. Competition for these personnel is intense, and we cannot be sure that we will be able to retain or attract qualified personnel as needed. The sudden loss of the services of key people could have a material adverse effect on our business, results of operations and financial condition.

Our supply chain has risks and uncertainties that could affect our sales and business

The merchandise we sell is obtained from vendors and manufacturers in the United States and outside of the country. Generally, this product is shipped to our distribution centers in California and Tennessee, and from our distribution centers to our stores or directly to our customers using Federal Express and the United States Postal Service. Certain products we sell are imported and subject to delivery delays based on availability and port capacity. Our reliance on Federal Express and the United States Postal Service for shipments is subject to risks associated with their ability to provide delivery services that meet our shipping needs and our ability to obtain such services at an affordable cost. We are also dependent upon the ability to hire temporary associates to adequately staff our distribution centers, particularly during busy periods such as the holiday season. We may not be able to achieve or maintain operating efficiencies using two distribution centers that are located approximately 2,000 miles apart.

Risks associated with contracting directly with manufacturers for merchandise could hinder our financial performance

Over time, we expect to source an increasingly greater percentage of our merchandise directly from manufacturers. We have limited experience in sourcing and importing merchandise directly from manufacturers. We may encounter administrative challenges and operational difficulties with the manufacturers from which we may source our merchandise. Operational difficulties could include reductions in the availability of production capacity, errors in complying with merchandise specifications, insufficient quality control and failures to meet production deadlines. A manufacturer’s failure to ship merchandise to us on a timely basis or to meet the required quality standards could cause supply shortages that could result in lost sales.

We could acquire merchandise without full rights to sell it, which could inhibit sales and lead to disputes or litigation

We purchase licensed merchandise from vendors who represent that they hold manufacturing and distribution rights to such merchandise. We also contract directly with licensors to obtain the manufacturing and distribution rights. We do not independently verify whether these vendors legally hold adequate rights to the licensed properties they are manufacturing, distributing or licensing. If we license merchandise that we have not legally obtained the rights to sell, we could be obligated to remove such merchandise from our stores, incur costs associated with destruction of merchandise and be subject to liability under various civil and criminal causes of action, including actions to recover unpaid royalties and other damages. As we expand our efforts to contract directly with manufacturers and licensors for licensed merchandise, we may incur difficulties securing the necessary manufacturing and distribution rights. Even when we have secured the rights needed to sell such products in the United States, we may not be able to secure the rights to sell the products outside of the United States.

11

There are litigation and other claims against us from time to time, which could distract management from our business activities and could lead to adverse consequences to our business and financial condition

We are involved from time to time with litigation and other claims against us. Often these cases can raise complex factual and legal issues, which are subject to risks and uncertainties and which could require significant management time. Although we do not currently believe that the outcome of any current litigation and claims against us will have a material adverse effect on our overall financial condition, we have, in the past, incurred unexpected expense in connection with litigation matters. In the future, adverse settlements or resolutions may negatively impact earnings or injunctions against us could have an adverse effect on our business by requiring us to do or prohibiting us from doing certain things. We may in the future be the target of material litigation, including class-action and securities litigation, which could result in substantial costs and divert our management’s attention and resources.

We materially rely on ecommerce, information and other technology systems, including such technology provided by third parties

We believe our dependence on ecommerce, information and other technology systems, including technology provided by third parties will increase in the future, and it is possible we may not be able to obtain, maintain or use such systems as quickly or as effectively as needed. Implementing new systems, modifying existing systems, and restoring such systems and technology following a shut-down could present technological and operational challenges which we are unprepared for. We continue to evaluate the adequacy of the ecommerce, information and other technology systems we use to operate our business. Our failure to adapt to changing technological needs could have a material adverse effect on our results of operations and financial condition. We have agreements with third-party providers to maintain our ecommerce and information technology systems, including content. We would be negatively impacted if such third parties fail to provide such services, including by way of the malfunction of third-party sites, hardware, software and other equipment; service outages of third-party sites; third-party claims of data privacy, security breaches and intellectual property infringement; and poor integration of our technology into their software and services.

Uncertainty in the global capital and credit markets may materially impair the liquidity of a portion of our cash and investment portfolio

We hold cash, cash equivalents and short- and long-term investments, including auction rate securities (discussed in more detail in “NOTE 1 – Organization and Summary of Significant Accounting Policies” contained in the financial statements and Notes included elsewhere in this annual report on Form 10-K). Auctions representing the auction rate securities we hold have continued to fail and will limit our ability to liquidate these investments for some period of time. Although the money market funds and municipal bonds we hold are highly rated and are comprised of high-quality, liquid instruments, if the financial markets trading the underlying assets experience a disruption, we may need to temporarily rely on other forms of liquidity. In addition, a risk exists that our cash and investments may not always be optimally managed and this may affect our profitability and results of operations.

Limitations on the number of shares available for grant could adversely affect our ability to attract and retain employees

We have historically used stock options as a component of our total employee compensation program in order to align employees’ interests with the interests of our shareholders, encourage employee retention and provide competitive compensation and benefit packages. In recent years, we have experienced limitations on the number of shares available for grant under our equity compensation plans. Difficulties relating to obtaining shareholder approval of an increase in the shares available for grant under our equity compensation plans could make it more challenging or impossible for us to grant stock-based payments to employees in the future.

Our charter documents and other circumstances could prevent a takeover or cause dilution of our existing shareholders, which could be detrimental to existing shareholders

Our Articles of Incorporation and Bylaws contain provisions that may have the effect of delaying, deterring or preventing a takeover of Hot Topic, Inc. For instance, our Articles of Incorporation include certain “fair price provisions” generally prohibiting business combinations with controlling or significant shareholders unless certain minimum price or procedural requirements are satisfied, and our Bylaws prohibit shareholder action by written consent. Additionally, our Board of Directors, or Board, has the authority to issue, without shareholder approval, up to 10,000,000 shares of “blank check” preferred stock having such rights, preferences and privileges as designated by the Board. The issuance of these shares could have a dilutive effect on shareholders and potentially prohibit a takeover of Hot Topic, Inc. by requiring the preferred shareholders to approve such a transaction. We also have a significant number of authorized and unissued shares of our common stock available under our Articles of Incorporation. These shares provide us with the flexibility to issue our common stock for future business and financial purposes including stock splits, raising capital and providing equity incentives to employees, officers and directors. The issuance of these shares could result in dilution to our shareholders.

12

We are dependent upon malls remaining popular as shopping destinations, the ability of shopping mall anchor tenants and other attractions to generate customer traffic and maintaining good relationships with shopping mall operators

The global economic downturn and other factors have diminished the ability of shopping mall operators to operate profitably and, in some cases, forced them to declare bankruptcy or cease operations entirely. The ongoing slowdown in the United States economy, uncertain economic outlook, and other factors could continue to curtail shopping mall development, decrease shopping mall traffic, reduce the number of hours shopping mall operators keep their shopping malls open, cause shopping mall operators to lower their operational standards and negatively impact our lease contracts. Consolidation of ownership of shopping malls may give landlords more leverage in negotiations and adversely affect our ability to negotiate favorable lease terms. Such consolidation may result in increased lease related costs to the company. We believe we have generally favorable relationships with shopping mall operators and developers, however if this changed it could inhibit our ability to negotiate with them and may make it more difficult for us to manage our leases, including for us to expand, remodel or relocate to certain sites. If our relations with shopping mall operators or developers become strained, or we otherwise encounter difficulties in leasing store sites, we may not be able to open stores in malls we would otherwise be interested in maintaining stores; we may not be able to negotiate lease terms favorable to the company; and we may be inhibited in our ability to close underperforming stores.

We face intense competition

The apparel, music and accessory categories within the retail industry in which we operate are highly competitive. Increased competition could have a material adverse effect on our business, results of operations and financial condition. Our competitors, particularly big-box retailers, may have the ability to sell merchandise at substantially lower prices than we are able to sell such merchandise. This may cause us to incur greater than anticipated price reductions and unanticipated increases in our inventories for such products. It may also cause us to elect not to sell such products, despite the fact the products would otherwise attract customers and sell well in our stores.

We are responsible for maintaining the privacy of personally identifiable information of our customers

We are highly dependent on the use of credit cards to complete sale transactions in our stores and through our websites. If we fail to comply with Payment Card Industry (PCI) Data Security Standards, we may become subject to fines or limitations on our ability to accept credit cards. Through our sale transactions, loyalty programs and other methods, we obtain information about our customers which is subject to federal and state privacy laws. These laws are constantly changing. If we fail to comply with these laws, we may be subject to fines or penalties.

Timing, seasonal issues and other fluctuations outside of our control could negatively impact our financial performance for given periods

Our business, particularly our Hot Topic division, is subject to seasonal influences that affect our comparable store sales. There are heavier concentrations of sales during the back-to-school, Halloween and holiday (defined as the week of Thanksgiving through the first few days of January) seasons and other periods when schools are not in session. Our results of operations may fluctuate materially depending on, among other things, the timing of store openings and related pre-opening and other startup expenses; net sales contributed by new stores; increases or decreases in comparable store sales; timing, popularity and our ability to obtain, certain pop culture-related licenses, including on an exclusive basis; releases of new music, film and television; releases of new music/pop culture-related products; our ability to efficiently source and distribute products; changes in our merchandise mix and the challenges involved in getting the right mix into stores at the right time; shifts in timing of certain holidays; changes in our merchandise mix; weather conditions; and overall economic conditions.

13

Our profitability could be adversely affected by volatile commodity prices, including petroleum and cotton

The profitability of our business depends to a certain degree upon the price of certain commodities, including petroleum and cotton products. We are affected by changes in such prices to the extent that such commodities are part of the costs of delivery of merchandise to our stores and to the extent that the commodities are used in the production of our merchandise.

Significant fluctuation in the value of the U.S. dollar or foreign exchange rates may affect our profitability

Substantially all of our foreign purchases of merchandise have been negotiated and paid for in U.S. dollars. As a result, our sourcing operations may be adversely affected by significant fluctuation in the value of the U.S. dollar against foreign currencies, restrictions on the transfer of funds and other trade disruptions. A portion of our revenues come from foreign markets. Changes in foreign exchange rates applicable to these markets may adversely affect our revenues, even if the volume of sales remains the same. We may not be able to repatriate revenues earned in foreign markets.

Recording impairment charges for certain underperforming stores may negatively impact our future financial condition or results of operations, and closing stores might not have a positive impact on our operating results

We are required to assess, and where appropriate, record a charge for, the impairment of underperforming assets. This may negatively impact our reported and future financial condition and results of operations. In addition, we continue to close stores that do not meet our expectations of profitability which may cause us to impair or accelerate the depreciation of certain store assets and incur additional amounts for lease termination, severance and other closing costs. There can be no assurance that we will not incur future impairment charges and store closure expenses for underperforming assets or that store closures will have a significant positive impact on our operating results.

Changes in laws, including employment laws and laws related to our merchandise, could make conducting our business more expensive or change the way we do business

Changes in laws and any future changes could make our operations more expensive or require us to change the way we do business. Changes in federal and state minimum wage laws could require us to change our entire wage structure for stores. Other laws related to treatment of employees, including laws related to employee benefits and privacy, could also negatively impact us, such as by increasing medical insurance costs and related expenses. Changes in product safety or other consumer protection laws could lead to increased costs to us for certain merchandise, additional labor costs associated with readying merchandise for sale or serve as the basis for litigation.

A disruption of imports may increase our costs and reduce our supply of merchandise

We receive apparel and other merchandise from foreign sources, both purchased directly in foreign markets and indirectly through domestic vendors with foreign sources. As a result of our reliance on international vendors and manufacturers, we are subject to the risks generally associated with global trade and doing business abroad, which include foreign laws and regulations, political unrest, disruptions or delays in cross-border shipments and changes in economic conditions in countries in which our merchandise is manufactured. In addition, disease outbreaks, terrorist acts and military conflict could increase the risks of doing business with suppliers who rely on foreign markets. Trade restrictions in the form of tariffs or quotas, or both, that are applicable to the merchandise we sell also could affect the importation of the merchandise and increase the cost and reduce the supply of products available to us. Further, changes in tariffs or quotas for merchandise imported from individual foreign countries could lead us to shift our sources of supply among various countries. Any shift we might undertake in the future could result in a disruption of our sources of supply and lead to a reduction in our revenues and earnings. Supply chain security initiatives undertaken by the United States or foreign governments that impede the normal flow of product could also negatively impact our business.

14

We incur costs associated with regulatory compliance, and this cost could be significant

There are numerous regulatory requirements for public companies that we comply with or may be required to comply with in the future associated with our business operations and compliance with these rules could result in the diversion of management’s time and attention, which could be disruptive to normal business operations. These regulations may include more stringent accounting standards, taxation requirements (including changes in applicable income tax rate, new tax laws and revised tax law interpretations), trade restrictions, regulations regarding financial matters, privacy and data security, environmental regulations, advertising, safety and product liability. We may in the future be required to adopt International Financial Reporting Standards, and doing so could be time-consuming and cause us to incur significant expense. If we do not satisfactorily or timely comply with these requirements, possible consequences could include sanction or investigation by regulatory authorities such as the SEC or the Nasdaq Stock Market; fines and penalties; incomplete or late filing of our periodic reports, including our annual report on Form 10-K or quarterly reports on Form 10-Q or civil or criminal liability.

Government or consumer concerns about product safety could result in regulatory actions, recalls or changes to laws, which could harm our reputation, increase costs or reduce sales

We are subject to regulation by the Consumer Product Safety Commission and similar state and international regulatory authorities, and our products could be subject to involuntary recalls and other actions by these authorities. We purchase merchandise from suppliers domestically as well as outside the United States. One or more of our suppliers might not adhere to product safety requirements or our quality control standards, and we might not identify the deficiency before such merchandise is received by our customers. Issues of product safety could result in a recall of products we sell. Additionally, regulatory authorities, including the Consumer Product Safety Commission, have undertaken reviews of product safety and are in the process of enacting or are considering various proposals for more stringent laws and regulations. In particular, the U.S. Congress has enacted the Consumer Product Safety Improvement Act of 2008, which imposes significant new requirements on the sale of consumer products and enhanced penalties for noncompliance. Such regulations contain provisions which have uncertain applicability to products we sell, and such lack of certainty may inhibit our willingness carry products or cause us to carry product we otherwise would not. These regulations could result in delays in getting products to our stores, lost sales, the rejection of our products by consumers, damage to our reputation or material increases in our costs, and may have a material adverse effect on our business. Moreover, individuals and organizations may assert legal claims for our non-compliance with consumer product rules and regulations, and we may be subject to lawsuits relating to these claims. There is a risk that these claims or liabilities may exceed or fall outside of the scope of indemnities provided by third parties or outside the coverages of our insurance policies.

Economic conditions could decrease consumer spending and reduce our sales

Certain economic conditions could affect the level of consumer spending on merchandise we offer, including, among others, employment levels; salary and wage levels, particularly of teens and college-age adults; interest rates; availability of consumer credit; taxation; and consumer confidence in future economic conditions. For example, the global economic downturn has significantly reduced consumer spending levels and mall customer traffic in general. The ongoing slowdown in the United States economy and uncertain economic outlook could continue to cause lower consumer spending levels and mall customer traffic which could adversely affect our sales results and financial performance. In addition, we are highly dependent on a significant level of teenage and college-age spending on music/pop culture-licensed and music/pop culture-influenced products, and we likely would be adversely affected if economic conditions limited such spending.

15

War, terrorism and other catastrophes could negatively impact our customers, places where we do business and our expenses

The continued threat of terrorism, heightened security and military action in response to this threat, any future acts of terrorism, and significant natural disasters or other catastrophic events may cause disruption and create uncertainties that affect our business. To the extent that such disruptions or uncertainties negatively impact shopping patterns and/or shopping mall traffic, or adversely affect consumer confidence or the economy in general, our business, operating results and financial condition could be materially and adversely affected. A significant natural disaster or other catastrophic event affecting our facilities could materially affect our supply chain, our information systems and other aspects of our operations.

Our stock price could fluctuate substantially for reasons outside of our control

Our common stock is quoted on the Nasdaq Stock Market, which has experienced, and is likely to experience in the future, significant price and volume fluctuations, which could adversely affect our stock price without regard to our financial performance. In addition, we believe that factors such as quarterly fluctuations in our financial results and comparable store sales; announcements by other apparel, accessory, music and gift item retailers; the trading volume of our stock; changes in estimates of our performance by securities analysts; litigation; overall economic and political conditions, including the global economic downturn; the condition of the financial markets, including the credit crisis; and other events or factors outside of our control could cause our stock price to fluctuate substantially.

Environmental risks associated with the retail industry may result in significant costs and decreased sales

We are exposed to risks arising out of environmental matters and existing and potential laws relating to the protection of the environment. Adverse and unexpected weather conditions, including such conditions caused by the global climate change phenomena, could affect our supply chain, mall traffic and customer interest in our products. We receive apparel and other merchandise from foreign sources, both purchased directly in foreign markets and indirectly through domestic vendors with foreign sources. Stricter global and domestic greenhouse gas emission requirements may cause our vendors to incur higher costs, including increased transportation costs. There is a risk that we may occupy retail space that may require remediation to comply with environmental laws. In addition to potential liability for remediation costs, the cleanup process may cause our stores to be closed for an extended period of time, resulting in loss of sales.

|

UNRESOLVED STAFF COMMENTS

|

None.

|

PROPERTIES

|

We lease all of our existing store locations, with lease terms expiring between 2011 and 2021. As of the end of fiscal 2010, we had a total of approximately 1,160,000 leased store square feet for Hot Topic and approximately 382,000 leased store square feet for Torrid. The leases for most of the existing stores are for approximately ten-year terms and provide for minimum rent payments as well as contingent rent based upon a percent of sales in excess of the specified minimums.

We lease our headquarters and distribution center facility, located in City of Industry, California, which is approximately 250,000 square feet. Our lease expires in April 2014, with an option to renew for two more five-year terms, and the annual base rent is approximately $1.1 million. We own our distribution center in LaVergne, Tennessee, which is approximately 300,000 square feet.

16

The following chart shows, as of the end of fiscal 2010, the number of Hot Topic and Torrid stores operated within each state in the United States, Puerto Rico and Canada, as well as the aggregate number of Hot Topic and Torrid stores we operated as of the end of fiscal 2009:

|

Hot Topic, Inc. Stores

|

||||||||||||

|

Hot Topic Stores

|

Torrid Stores

|

Total Company

|

||||||||||

|

Alabama

|

7 | - | 7 | |||||||||

|

Alaska

|

3 | 2 | 5 | |||||||||

|

Arizona

|

17 | 7 | 24 | |||||||||

|

Arkansas

|

6 | - | 6 | |||||||||

|

California

|

79 | 48 | 127 | |||||||||

|

Colorado

|

13 | 2 | 15 | |||||||||

|

Connecticut

|

9 | 3 | 12 | |||||||||

|

Delaware

|

2 | - | 2 | |||||||||

|

Florida

|

40 | 5 | 45 | |||||||||

|

Georgia

|

13 | 3 | 16 | |||||||||

|

Hawaii

|

5 | - | 5 | |||||||||

|

Idaho

|

4 | 1 | 5 | |||||||||

|

Illinois

|

20 | 9 | 29 | |||||||||

|

Indiana

|

15 | 1 | 16 | |||||||||

|

Iowa

|

8 | 1 | 9 | |||||||||

|

Kansas

|

6 | - | 6 | |||||||||

|

Kentucky

|

9 | 1 | 10 | |||||||||

|

Louisiana

|

8 | 2 | 10 | |||||||||

|

Maine

|

2 | - | 2 | |||||||||

|

Maryland

|

14 | 4 | 18 | |||||||||

|

Massachusetts

|

18 | 2 | 20 | |||||||||

|

Michigan

|

20 | 2 | 22 | |||||||||

|

Minnesota

|

10 | 1 | 11 | |||||||||

|

Mississippi

|

4 | - | 4 | |||||||||

|

Missouri

|

13 | 3 | 16 | |||||||||

|

Montana

|

4 | - | 4 | |||||||||

|

Nebraska

|

4 | 1 | 5 | |||||||||

|

Nevada

|

7 | 2 | 9 | |||||||||

|

New Hampshire

|

5 | 1 | 6 | |||||||||

|

New Jersey

|

17 | 4 | 21 | |||||||||

|

New Mexico

|

7 | 1 | 8 | |||||||||

|

New York

|

27 | 5 | 32 | |||||||||

|

North Carolina

|

15 | 2 | 17 | |||||||||

|

North Dakota

|

4 | - | 4 | |||||||||

|

Ohio

|

27 | 5 | 32 | |||||||||

|

Oklahoma

|

8 | - | 8 | |||||||||

|

Oregon

|

7 | 3 | 10 | |||||||||

|

Pennsylvania

|

33 | 1 | 34 | |||||||||

|

Rhode Island

|

1 | - | 1 | |||||||||

|

South Carolina

|

7 | - | 7 | |||||||||

|

South Dakota

|

2 | 1 | 3 | |||||||||

|

Tennessee

|

11 | 1 | 12 | |||||||||

|

Texas

|

56 | 14 | 70 | |||||||||

|

Utah

|

7 | 2 | 9 | |||||||||

|

Vermont

|

1 | - | 1 | |||||||||

|

Virginia

|

19 | 3 | 22 | |||||||||

|

Washington

|

18 | 7 | 25 | |||||||||

|

West Virginia

|

5 | - | 5 | |||||||||

|

Wisconsin

|

11 | 2 | 13 | |||||||||

|

Wyoming

|

1 | - | 1 | |||||||||

|

Canada

|

3 | - | 3 | |||||||||

|

Puerto Rico

|

5 | 1 | 6 | |||||||||

|

FY 2010 Total

|

657 | 153 | 810 | |||||||||

|

FY 2009 Total

|

680 | 156 | 836 | |||||||||

17

|

LEGAL PROCEEDINGS

|

Our legal proceedings are discussed in more detail in “NOTE 9 – Commitments and Contingencies” contained in the consolidated financial statements and Notes included elsewhere in this annual report on Form 10-K.

ITEM 4. RESERVED

18

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

Our common stock is traded on the Nasdaq Stock Market under the symbol “HOTT.” The following table shows, for the periods indicated, the high and low sales prices of our shares of common stock, as reported on the Nasdaq Stock Market. Such quotations represent inter-dealer prices without retail markup, markdown or commission and may not necessarily represent actual transactions.

|

2010 Fiscal Year Quarters

|

High

|

Low

|

||||||

|

First Quarter

|

$ | 9.96 | $ | 5.26 | ||||

|

Second Quarter

|

$ | 7.99 | $ | 4.67 | ||||

|

Third Quarter

|

$ | 6.26 | $ | 4.58 | ||||

|

Fourth Quarter

|

$ | 6.75 | $ | 5.31 | ||||

|

2009 Fiscal Year Quarters

|

High

|

Low

|

||||||

|

First Quarter

|

$ | 13.87 | $ | 8.13 | ||||

|

Second Quarter

|

$ | 12.50 | $ | 6.66 | ||||

|

Third Quarter

|

$ | 8.95 | $ | 6.53 | ||||

|

Fourth Quarter

|

$ | 7.80 | $ | 5.25 | ||||

On April 4, 2011, the last sales price of our common stock as reported on the Nasdaq Stock Market was $5.52 per share. As of April 4, 2011, there were approximately 179 holders of record of our common stock. This number does not reflect the actual number of beneficial holders of our common stock, which we believe is significantly higher.

We began to pay cash dividends during the first quarter of fiscal 2010. Cash dividends are discussed in more detail in “NOTE 4 – Cash Dividends” contained in the consolidated financial statements and Notes included elsewhere in this annual report on Form 10-K.

Please see “Item 12 – Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters” included elsewhere in this annual report on Form 10-K for information about our equity compensation plans.

19

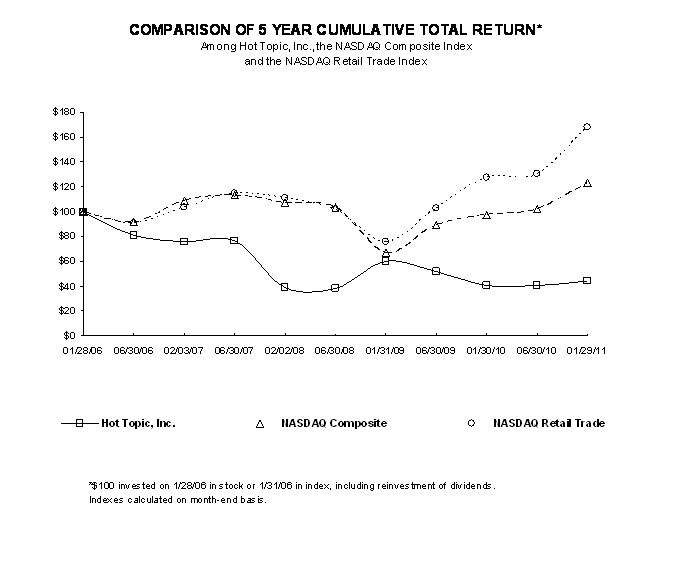

PERFORMANCE MEASUREMENT COMPARISON