Attached files

| file | filename |

|---|---|

| EX-31.1 - ONE Holdings, Corp. | csev_ex311.htm |

| EX-32.1 - ONE Holdings, Corp. | csev_ex321.htm |

| EX-31.2 - ONE Holdings, Corp. | csev_ex312.htm |

| EX-32.2 - ONE Holdings, Corp. | csev_ex322.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

Commission file number 333-136643

|

ONE BIO, CORP.

|

||

|

(Exact Name of Registrant as Specified In Its Charter)

|

||

|

Florida

|

59-3656663

|

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

| 19950 West Country Club Drive, Suite 100, Aventura, Florida | 33180 | |

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

(305)3288662

|

||

|

(Registrant's Telephone Number, Including Area Code)

|

20900 NE 30th Avenue Suite 842 Aventura Florida 33180

Former Name and Address

Securities registered under Section 12(b) of the Act: NONE

Securities registered pursuant to Section 12(g) of the Act: NONE

(Title of Class)

_____________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d0 of the act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in rule 12-b-2 of the Exchange Act. (Check One):

| Large Accelerated Filer | o | Accelerated Filer | o | Non-accelerated Filer | o | Smaller Reporting Company | þ |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes o No þ

The aggregate market value of the registrants voting and non-voting common equity held by non-affiliates as of December 31, 2010, was approximately $12,602,431.

The number of shares of common stock outstanding as of March 15, 2011 was 6,725,862.

TABLE OF CONTENTS

| PART I | |||||

| Item 1. | Description of Business | 2 | |||

| Item 1A | Risk Factors | 22 | |||

| Item 1B | Unresolved Staff Comments | 44 | |||

| Item 2. | Description of Property | 44 | |||

| Item 3. | Legal Proceedings | 46 | |||

| Item 4. | [Reserved] | 46 | |||

| PART II | |||||

| Item 5. | Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 47 | |||

| Item 6. | Selected Financial Data | 47 | |||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results | 48 | |||

| Item 8. | Financial Statements | 57 | |||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 57 | |||

| Item 9A. | Controls and Procedures | 57 | |||

| PART III | |||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 58 | |||

| Item 11. | Executive Compensation | 62 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 62 | |||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 63 | |||

| Item 14 | Principal Accountant Fees and Services | 64 | |||

| Item 15. | Exhibits and Financial Statement Schedules | 65 | |||

| SIGNATURES | 67 | ||||

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. These statements involve risks and uncertainties, including, among other things, statements regarding our business strategy, future revenues and anticipated costs and expenses. Such forward-looking statements include, among others, those statements including the words “expects,” “anticipates,” “intends,” “believes,” “may,” “will,” “should,” “could,” “plans,” “estimates,” and similar language or negative of such terms. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this report. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we do not know whether we can achieve positive future results, levels of activity, performance, or goals. Actual events or results may differ materially. We undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances taking place after the date of this document.

1

PART I

|

ITEM 1.

|

DESCRIPTION OF BUSINESS

|

1.1 Business

ONE Bio, Corp. (the “Company” and/or "ONE" and/or “Registrant”) (www.onehcorp.com) headquartered in Aventura, FL, is an award winning, innovative company utilizing green process manufacturing to produce raw chemicals and herbal extracts, natural supplements and organic products. ONE is focused on the Asia Pacific region and the United States of America. Key products include widely recognized Solanesol, Ganoderma Tea, CoQ10, Resveratrol, 5-HTP, organic fertilizers, and organic bamboo health food and beverages. ONE's growth plan targets an aggressive organic growth strategy supported by strategic acquisition. We are committed to becoming a leader in agritech utilizing green processes, combining our experience in producing our chemical and herbal extract products, natural supplements and organic products with seasoned North American managerial expertise. Our key market is Asia-Pacific which currently generates approximately 79% of our revenue followed by North and South America that generates 21% of our revenue. (Unless otherwise specified all dollar amounts in this prospectus are in U.S. dollars.) We are headquartered in Aventura, Florida; however, our primary contractually controlled operating enterprises, Sanming Huajian Bio-Engineering Co., Ltd. (“Sanming”) and Jianou Lujian Foodstuff Co., are based in Sanming City and Jianou City, respectively, in the Fujian province of the People’s Republic of China (“PRC”).

1.2 Our History

The Company was incorporated under the laws of the State of Florida on June 30, 2000 under the name of Contracted Services, Inc.

On January 8, 2010, the Company entered into a Securities Purchase and Registration Rights Agreement with certain institutional and accredited investors pursuant to which the investors purchased $3,000,000 in aggregate principal amount of our 8% Convertible Promissory Notes. The Convertible Notes are due on October 11, 2010, and are convertible at the elections of the Investors into shares of our Common Stock at an initial Conversion Price equal to the lesser of (a) $6.077 per share, or (b) 65% of the price per share offered by the Company in any publicly offered Common Stock or other equity-linked financing by the Company that is closed within nine months of the Initial Closing (each, a “New Financing”). Pursuant to the SPA, we also issued to the Investors five (5) year warrants (“Warrants”) to purchase an aggregate of 49,366 shares of our Common Stock at an initial exercise equal to the lesser of (a) $6.077 per share, or (b) 65% of the price per share offered by us in any New Financing. Effective June 30, 2010, the Company modified the terms of its existing bridge loan agreement which was entered into on February 11, 2010. The modifications include the cancellation of both the conversion feature embedded in the note and the detachable warrant, along with a two month extension of the note’s maturity date to December 10, 2010, with an option to further extend the notes maturity to January 10, 2011 (the “Amended Maturity Date”). On December 20, 2010, ONE entered into a loan extension agreement with an effective date of December 10, 2010, with UTA Capital and other investors (the “Investors”) to extend and modify the securities purchase agreement to January 31, 2011. In exchange for the Investors’ agreement to extend the maturity date, the Company agreed to issue to the Investors on January 1, 2011 warrants that shall be immediately exercisable for a period of five (5) years which shall entitle the purchasers to purchase up to an aggregate of 60,000 shares of common stock at an initial exercise price of $3.75 per share. Effective January 31, 2011, the Company entered into a Third Loan Extension Agreement with the Investors to extend the securities purchase agreement to April 1, 2011 with options for further extensions to May, 1, 2011 and June 1, 2011. In exchange for the Investors agreement to extend the maturity dates, we agreed to pay an extension fee of $29,000 and to issue to the Investors five (5) year second extension warrants to purchase 90,000 shares of Common stock at $3.00 per share. If the loan is extended to May 1, the Company agrees to pay a fee of $72,500 and to issue to the Investors 58,000 shares of Common stock for no additional consideration and to cause one or more of our principal shareholders to deposit 300,000 shares of our Common Stock as additional pledged stock under the stockholder pledge and security agreement. The Investors also agreed to convert $150,000 in principal amount of the amended notes into shares of Common stock under the terms of the Third Loan Agreement.

2

In January 2010, the Company issued 10,000 shares of Series A Preferred Stock to the Chairman and the CEO in the amount of 3,733 and 6,267 respectively. This action, approved by the Board, was in consideration and recognition of the agreement by the executives to pledge 6 million shares of common stock in satisfaction of the share pledge condition of the Bridge Loan Financing Agreement. Holders of the Series A Preferred Stock shall be entitled to cast two thousand (2,000) votes for each share held of the Series A Preferred Stock on all matters presented to the shareholders of the Company for a shareholder vote which shall vote along with holders of the Company’s Common Stock on such matters.

On April 14, 2010, the Company entered into a Share Purchase Agreement (the “Selling Shareholder SPA”), with Min Zhao (our director and president of our CHE business unit), (the “Selling Shareholder”), pursuant to which, among other things we acquired from the Selling Shareholder 1,632,150 shares of common stock of Green Planet owned by the Selling Shareholder in consideration for 260,000 shares (adjusted for the 1 for 5 stock splits of August 2010) of our restricted common stock. The number of shares of our common stock issuable to the Selling Shareholder is subject to adjustment as set forth in the Selling Shareholder SPA. As part of this transaction, the Selling Shareholder agreed to a lock-up and leak-out period as further defined in this agreement. At the same time, we received from a certain Green Planet shareholder 1,216,184 shares of common stock of Green Planet. As a consequence of these transactions, we now own 92.5% of the outstanding common stock of Green Planet.

Also on April 14, 2010, the Company entered into an agreement with Green Planet pursuant to which, among other things,

|

(i)

|

that certain Amended and Restated Green Planet Preferred Stock Purchase Agreement made effective as of June 17, 2009, between us and Green Planet (“Amended and Restated GP Preferred Stock Agreement”) was cancelled,

|

|

(ii)

|

we returned to Green Planet the 5,101shares of Green Planet preferred stock that were issued to us pursuant to the Amended and Restated GP Preferred Stock Agreement, and

|

|

(iii)

|

Green Planet returned to us the 200,962 shares (adjusted for the 1 for 5 stock splits of November 2009 and August 2010) of our common stock that we issued to Green Planet pursuant to the Amended and Restated GP Preferred Stock Agreement.

|

Additionally, on April 14, 2010, Green Planet granted to ONE an option to acquire 100% of the stock of Elevated Throne Overseas Ltd. (“Elevated Throne”), Green Planet’s 100% owned BVI subsidiary. In the event we exercise this option, the closing of the transaction will be subject to the approval of Green Planet’s stockholders. As consideration for our exercise of this option, we will be required to

|

(i)

|

convert the $1,700,000 loan we made to Elevated Throne on or about January 19, 2010, into an equity investment in Elevated Throne,

|

|

(ii)

|

convert the $300,000 loan we made to Green Planet on or about September 1, 2009, into a $300,000 equity investment in Elevated Throne,

|

|

(iii)

|

cancel that certain Convertible Note Purchase Agreement between us and Green Planet dated on or about September 1, 2009, and

|

|

(iv)

|

cancel that certain 10% Convertible Bridge Loan Note Due September 1, 2010, in the principal amount of $300,000 from Green Planet to us.

|

On September 14, 2010 FINRA advised the Company that they would process the Company’s 1 for 5 reverse stock split previously disclosed in the Company’s July 27, 2010, Definitive Information Statement on Schedule 14 (c), relating to an amendment to the Company’s Articles of Incorporation to: (i) reduce the number of authorized shares of common stock from 150,000,000 shares to 30,000,000 shares: and (ii) effecting a 1 for 5 reverse split of the Company’s common stock.

3

Subsequent to the filing and effectiveness of above referenced amendment to the Company’s Articles of Incorporation, the Company then filed on August 30, 2010 another amendment to its Articles of Incorporation also previously disclosed in the Company’s July 27, 2010, Definitive Information Statement on Schedule 14 (c) pursuant to which the number of authorized shares of common stock was increased from 30,000,000 shares to 100,000,000.

On December 20, 2010, we delivered written notice to Green Planet Bioengineering, Co., Ltd. (“Green Planet”) that we elected to exercise the option we were granted pursuant to that certain Option Agreement dated April 14, 2010 (the “Option Agreement”), to acquire 100% of the stock of Elevated Throne Overseas Ltd. (“Elevated Throne”), Green Planet’s 100% owned BVI subsidiary and in consideration therefore we agreed to (i) convert the $1,700,000 loan we made to Elevated Throne on or about January 19, 2010, into an equity investment in Elevated Throne, (ii) convert the $300,000 loan we made to Green Planet on or about September 1, 2009, into a $300,000 equity investment in Elevated Throne, (iii) cancel that certain Convertible Note Purchase Agreement between us and Green Planet dated on or about September 1, 2009, and (iv) cancel that certain 10% Convertible Bridge Loan Note Due September 1, 2010, in the principal amount of $300,000 from us to Green Planet, (collectively referred to as the “Transaction”).

On December 20, 2010, we, as the owner of 92.5% of the outstanding common stock of Green Planet by Majority Shareholder Written Consent in Lieu of a Special Meeting of Stockholders approved, authorized, and ratified the Transaction contemplated by the Option Agreement and the exercise by us of the Option as described above retroactive as of April 14, 2010.

On June 4, 2009, Abacus Global Investments, Corp. (“Abacus”) entered into a material definitive agreement pursuant to which Abacus acquired eighteen million seven hundred fifty thousand (18,750,000) shares of the Contracted Services, Inc.’s common stock representing 92.25% of the Company’s issued and outstanding stock. The transaction closed on June 9, 2009. Following the transaction, Abacus Global Investments, Corp. controlled 92.25% of the Registrant’s outstanding capital stock. Additionally, effective June 9, 2009, Marius Silvasan was appointed as a director and as the interim President of the Company.

On June 9, 2009, the Company filed an amendment to its Articles of Incorporation pursuant to which the Company’s name was changed to ONE HOLDINGS, CORP. (“ONE”). The Company also changed its registered address on the same day.

Upon Abacus’ acquisition of majority control of the Company and following the name change to ONE, Abacus changed the Company’s business focus to its current strategy.

On July 22, 2009, the Company acquired from certain shareholders (“GP Shareholders”) of Green Planet Bioengineering Co., Ltd., a Delaware corporation (“Green Planet”) 80% of the issued and outstanding shares of common stock of Green Planet. The Company also acquired 5,101 shares of Green Planet preferred stock which preferred stock provides the Company the right to vote 1,000 votes on all matters submitted to a vote of the shareholders of Green Planet and is convertible into 1,000 shares of Green Planet common stock. The Company acquired the Green Planet preferred stock in consideration for the issuance by the Company to Green Planet of 200,962 shares (adjusted for the 1 for 5 stock splits of November 2009 and August 2010) of the Company’s common stock. As part of this Green Planet transaction, Green Planet and the GP Shareholders deposited into an Escrow thirty-five percent (35%) of the Company’s shares issued to Green Planet and the GP Shareholders and in the event Green Planet’s EBITDA for fiscal year 2009 is less than GP’s EBITDA for fiscal 2008, the number of shares of Registrant’s stock issued to Green Planet and the GP Shareholders shall be proportionately reduced as provided for in the Green Planet Preferred Stock Purchase Agreement (the “Preferred Stock Purchase Agreements”) and the Stock Purchase Agreement (“GP SPA”) with the GP Shareholders. Green Planet and the GP Shareholders are also subject to a lockup and leak out period and has one piggy-back registration right as further defined in the Green Planet Preferred Stock Purchase Agreement and GP SPA. As a result of the Green Planet transactions, the Company has become the majority shareholder of Green Planet and based upon the number of shares outstanding and assuming conversion or the Green Planet preferred stock into common stock, the Company would own approximately 83% of Green Planet’s shares. Green Planet owns 100% of Fujian Green Planet Bioengineering Co., Ltd., (“Fujian Green Planet”), a WFOE, that through a series of contractual arrangements has effective control of the business and operations of and has an irrevocable option to purchase the equity and/or assets of Sanming (a PRC company), a green process manufacturer of high quality health supplements. Consequently, the Company effectively controls the business and operations of Green Planet, Fujian Green Planet (a GP WFOE) and Sanming.

4

On September 3, 2009, ONE acquired from the shareholders of Trade Finance Solutions ("collectively referred to as "TFS Shareholders") 3,990 shares representing 99.75% of the Shareholders' common shares owned in Trade Finance Solutions Inc. ("TFS"). For the TFS shares, each TFS Shareholder is to receive shares of the Registrant's common stock and cash payments as per the Share Purchase Agreement with the TFS Shareholders (“TFS SPA”). The cash component of the purchase price will be calculated on an earn-out basis based on TFS' monthly EBIT (earnings before interest and taxes) beginning with the measuring period as defined in the TFS SPA not to exceed the purchase price of $6,000,000. In addition to the cash portion of the purchase price, the TFS Shareholders shall receive 1 share of ONE common stock (adjusted for forward or reverse splits following the closing) for every $5.00 in EBIT achieved during the measuring period ("TFS Stock Compensation") subject to a maximum TFS Stock Compensation of 1.2 million shares of Registrant's common stock. The TFS Shareholders are subject to a lockup and leak out period as further defined in the TFS SPA. Upon the purchase of the TFS Common Shares from the TFS Shareholders, Registrant has become the majority shareholder of TFS. TFS was acquired to support Registrant’s international expansion by handling the logistics, fulfillment and financing for the group’s sales outside PRC. TFS provides balance sheet financing solutions and mitigates the group’s international credit exposure by insuring all international receivables through A-rated third party insurance providers. The TFS acquisition is strategic to the Company beyond the direct and immediate financial contribution TFS will bring to sales and net income because it will provide the Company the ability to use TFS as an internal financing arm ready, able and dedicated to fund and facilitate the growth of the Company’s core agritech business.

On September 27, 2009, the Company acquired through a variety of transactions, 83% control of Jianou Lujian Foodstuff Co., Ltd. (“JLF”), a company based in PRC. The Registrant executed and consummated a Share Exchange Agreement (the “Supreme Agreement”) by and among: (i) the Company’s 100% owned subsidiary United Green Technology Inc., a Nevada corporation, (“UGTI”), (ii) Supreme Discovery Group Limited, a British Virgin Islands Company (“Supreme”), and (iii) the stockholders who owned 100% of Supreme’s common stock (the “Supreme Shareholders”). Supreme is the parent company of Fujian United Bamboo Technology Company Ltd., a wholly foreign-owned enterprise (“JLF WFOE”) organized under the laws of the PRC. The stockholders of Supreme are Tang Jinrong, Li Lifang and Tang Shuiyou, who are also the owners of JLF. JLF WFOE through a series of contractual arrangements has effective control of the business and operations of and has an irrevocable option to purchase the equity and/or assets of JLF. Consequently, the Company effectively controls the business and operations of Supreme, JLF WFOE and JLF.

Pursuant to the Supreme Agreement, at the closing, the Supreme Shareholders sold, transferred and assigned 100% of the outstanding common stock of Supreme to the Company’s wholly-owned subsidiary UGTI in exchange for (i) cash, (ii) shares of the Company’s common stock, and (iii) 20% of the issued and outstanding shares of common stock of UGTI. The Company thereby acquired through UGTI ownership of all of the outstanding stock of Supreme which owns 100% ownership of JLF WFOE. As part of this transaction the Supreme Shareholders deposited into an Escrow thirty-five percent (35%) of the Company’s shares of common stock issued to them and in the event UGTI’s EBITDA for fiscal year 2010 is less than UGTI’s EBITDA for fiscal 2009, the number of shares of the Company’s stock issued to Supreme Shareholders shall be proportionately reduced as provided for in the Supreme Agreement. Supreme Shareholders are also subject to a lockup and leak out period and have one piggy-back registration right as further defined in the Agreement. JLF is an award winning green-technology agritech company that specializes in the production of organic products and fertilizers based on bamboo. JLF holds bamboo land contracts in Fujian Province, one of PRC’s largest bamboo growing areas. JLF is the third largest bamboo producer in PRC and is the first bamboo company in PRC to gain food safety certification from China (HACCP), Japan (JAS) and Europe (ESFA). JLF was also the first company in PRC to formulate a “zero-to-zero” process starting from cultivation to distribution including the development of organic fertilizers from bamboo skins to eliminate waste.

Effective October 26, 2009, the Company amended its Articles of Incorporation to: (i) authorize a class of preferred stock consisting of 10,000,000 shares, $0.001 par value per share; (ii) designating 10,000 shares of the preferred stock as Series A Preferred Stock; (iii) reducing the number of authorized shares of common stock from 750,000,000 shares to 150,000,000 shares and changing the par value to $0.001 per share; (iv) changing the name of the Registrant to ONE Bio, Corp.; and (v) effecting a five (5) for one (1) reverse split of the Registrant’s Common Stock.

On November 3, 2009, the Company and UGTI cancelled and replaced the UGTI Preferred Stock Purchase Agreement and entered into a Share Purchase Agreement (the “UGTI Share Purchase Agreement”). Pursuant to the UGTI Share Purchase Agreement, we agreed to purchase from UGTI, and UGTI agreed to sell to us 10,000 shares of UGTI Common Stock in consideration for a cash payment of $1,200,000 in which $180,000 was paid in May 2010 and $1,020,000 originally due in November 2010, but deferred until 2011 per Bridge Loan Agreement.. As a result of the foregoing UGTI transactions, the Company is now 98% shareholder of UGTI.

On November 11, 2009, the Company filed an application to list its common stock on the NASDAQ Capital Market. The Company believes it currently fulfills or will shortly meet all applicable NASDAQ Capital Market listing requirements. The Company's listing application is subject to review and approval by NASDAQ's Listing Qualifications Department for compliance with all NASDAQ Capital Market standards.

5

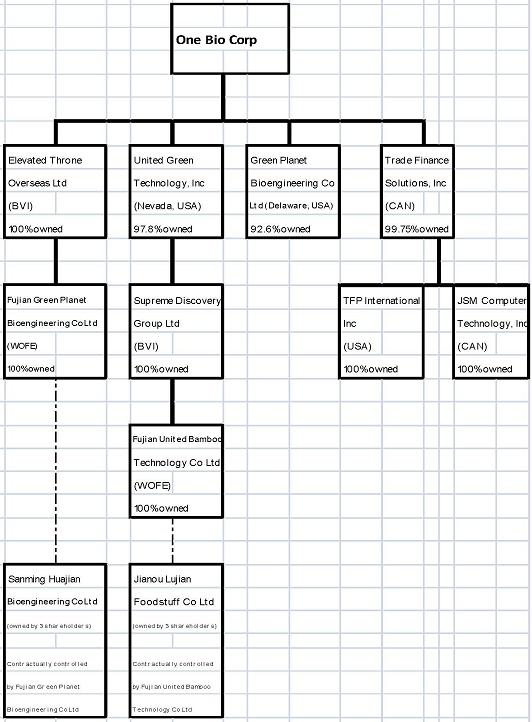

1.2.1 Corporate Structure

The Corporate Structure of ONE consists of the companies under various business units which can be summarized as follows:

6

1.3 Business Overview

ONE Bio, Corp. headquartered in Aventura, FL, is an award winning, innovative agritech company that utilizes green process manufacturing to produce raw chemicals and herbal extracts, natural supplements and organic products. ONE is focused on the Asia-Pacific region and the United States of America. Key products include widely recognized Solanesol, Ganoderma Tea, CoQ10, Resveratrol and 5-HTP, organic fertilizers, and organic bamboo health food and beverages. ONE's growth plan targets an aggressive organic growth strategy supported by strategic acquisition. We are committed to becoming a leader in agritech utilizing green processes, combining our experience in producing our award winning chemical and herbal extract products with proven North American managerial expertise.

We are headquartered in Aventura, FL, USA; however, our primary operating enterprises, Sanming and JLF are based in Sanming City and Jianou City, respectively, in the Fujian province of PRC. Our key market is Asia-Pacific which currently generates approximately 79% of our revenue followed by North and South America that generates 21% of our revenue.

1.3.1 Operational Summary

Our operations are divided into two principal complementary business units that focus on producing chemical and herbal extracts (our “CHE” business unit) and organic products (our “OP” business unit) utilizing green processes. We also have an internal financing business unit that was acquired to support our international expansion by handling the logistics, fulfillment and financing for the group’s sales outside PRC. TFS provides balance sheet financing solutions and mitigates the group’s international credit exposure by insuring all international receivables through A-rated third party insurance providers.

In order to harvest the benefits of integrating growing and profitable Chinese operating enterprises with the management and financial techniques available to North American enterprises, we adhere to a “Yin-Yang” management strategy based on the Chinese Philosophy of “Correlative Thinking”. The core components of this approach are: constructing a strong, balanced team; addressing the needs of investors; and realizing the importance of diversity.

In practical terms, our strategy is to combine the manufacturing expertise and work ethic of the Eastern world with the investment experience and management skills of seasoned North American companies. Our team in PRC works together with our North American management to grow our core business, and provide transparency with an emphasis on risk management and internal controls.

1.3.1 (a) Elevated Throne and our Chemical and Herbal Extract (“CHE”) operating division

Our CHE business unit operates under the umbrella of our subsidiary Elevated Throne which contractually controls and operates Sanming. Sanming is the principle operating enterprise of this business unit and is located in and organized under the laws of the PRC.

Sanming is a research and development company with a focus on improving human health through the development, manufacture and commercialization of bio-ecological products and over-the-counter products utilizing extractions from tobacco leaves. Sanming's position in the agritech industry comes from its research and development which utilizes patented methods to create downstream products ranging from plant indigenous medicine and pharmaceutical intermediates to eco-friendly products. Since 2007, Sanming has developed a variety of natural organic products using tobacco leaves.

Our CHE unit produces chemical and herbal extracts for use in a wide range of health and wellness products. Utilizing green technology and proprietary processes, this unit extracts health supplements, fertilizers, and pesticides from waste tobacco. Our chemical extraction processes from tobacco leaves and delivers high purity Solanesol (98%) which can be further extracted into Coenzyme Q10 also known as CoQ10. The discarded tobacco leaves are further extracted to produce organic fertilizers both powdered and particulate and thereby substantially eliminates waste in the process. Our CHE unit also extracts from a variety of plants Resveratrol, Sarcandra and 5-HTP, which are key components in many consumer health and wellness products. Additionally, the Company has introduced its first over the counter (“OTC”) product a Ganoderma Tea extract which has been favorably received in the PRC market.

7

We distribute our CHE products through established independent third party distributors who enter into renewable one year distribution agreements with us. Our distributors are focused on the bio-health industry and raw chemical intermediates industry. This permits use to more accurately forecast sales and required production. In addition, feedback from our distributors provides us with good visibility on changes in consumer demand. In addition, we have established distribution channels, such as universities and hospital research centers, through referrals obtained from the support of local government in some provinces.

Our CHE business unit is a research & development company with a focus on improving human health through the development, manufacture and commercialization of bio-ecological products and over-the-counter products utilizing the extractions of tobacco leaves and a variety of other plant materials.

This business unit produces chemical and herbal extracts for use in a wide range of health and wellness products, including:

|

|

●

|

Chemical Extracts

|

|

|

°

|

Solanesol which is extracted from discarded tobacco leaves is the mother chemical intermediate for many high-value bio-chemicals such as Coenzyme Q10 and vitamin-K analogues.

|

|

|

°

|

Coenzyme Q10 (which is a derivative from Solanesol) is a non-specific immune intensifier, which takes part in cell metabolism and respiration.

|

|

|

●

|

Herbal Extracts

|

|

|

°

|

Resveratrol is an active component and a powerful antioxidant extracted from Huzhang (Polygonum cuspidatum).

|

|

|

°

|

5-HTP (5-Hydroxytryptophan) which is extracted from Griffonia seed has been studied and clinically shown to be of benefit in the treatment of primary fibromyalgia, insomnia, depression, and weight control.1

|

|

|

°

|

Ganoderma Tea which is extracted from Rechee Mushrooms and has a long tradition in PRC to promote health and wellness.

|

|

|

°

|

Powdered & Particulate Fertilizers are extracted from discarded tobacco leaves.

|

While various research studies have shown beneficial effects on humans from the consumption of these chemical and herbal extracts, to date we know of no government body like the U.S. Food and Drug Administration or China’s State Food and Drug Administration that has approved these supplements for the treatment of any disease.

The vertically integrated process of the CHE business unit can be summarized as follows:

Access to Raw Materials

- more than 4,000 leased acres of land for herb cultivation in Sanming province

- contractual relationships to purchase discarded tobacco leaves

8

Extraction Process / Value Creation

- green technology and proprietary processes utilized in the extraction processes

- cost-effective process and access to raw materials contribute to gross margins in excess of 50%

Products

- chemical and herbal extracts that are sold as ingredients for medical, health and wellness products

- over-the-counter health and natural supplements

- organic fertilizers

_______________

1 -Birdsall, Timothy C. “5-Hydroxytryptophan: A Clinically-Effective Serotonin Precursor”, Alternative Medicine Review, Vol. 3, Number 4, 1998, p.271.

1.3.1 (b) UGTI and our Organic Products (“OP”) operating division

Our OP business unit operates under the umbrella of our subsidiary United Green Technology Inc. (“UGTI”) which contractually controls and operates Jianou Lujian Foodstuff Co. (“JLF”). JLF is the principle operating enterprise of this business unit and is located in and organized under the laws of the PRC.

JLF is an award-winning green-technology enterprise that specializes in the production of organic products and fertilizers based on bamboo. JLF was also one of the first companies in PRC to formulate a "zero-to-zero" process starting from cultivation to distribution, and taking it further by developing organic fertilizers from bamboo skins and thereby substantially eliminates waste in the process. JLF concentrates on processing bamboo shoots and bamboos which it sells domestically in PRC and exports to other countries. JLF is the third largest bamboo producer in PRC and is the first bamboo company in PRC to gain food safety certification from PRC (HACCP), Japan (JAS) and Europe (ESFA).

Our OP unit manufactures a variety of consumer and commercial-use health and energy drinks, organic food products and fertilizers primarily based on bamboo. Organic food products based on bamboo are low in saturated fat, cholesterol and sodium yet high in dietary fiber, vitamin C, potassium, zinc, and numerous other nutrients, making bamboo shoots popular for weight loss and maintaining a healthy lifestyle. Also, the Moso bamboo leaf extract, which contains soluble and insoluble fiber and antioxidants, is used to make a caffeine-free energy drink or is infused into white rice creating green bamboo rice with health benefits. Our OP unit also uses bamboo skins to produce organic fertilizers, thereby substantially eliminating waste in the process.

Presently, JLF operates production lines to produce both 18L boiled bamboo shoot cans and boiled vegetable cans. This includes the production of 50 kinds of products, such as 18L boiled bamboo shoot cans, boiled bamboo shoot cans with vacuum packing, boiled mixed vegetables, boiled seasoned vegetables and Kamameshi (a Japanese rice dish), with a quality rating that meets national and international standards. The boiled bamboo shoots and mixed vegetables account for the majority of the products sold with approximately 83% of all products sold domestically and approximately 17% exported to other countries such as Japan, Southeast Asia, Europe and North America.

We distribute our OP products directly to large supermarket chains (such as Kobe Bussan in Japan), hotels, hospitals and restaurants. We also distribute our products through a network of independent third party distributors who enter into renewable one year distribution agreements with us.

9

Our OP business unit focuses on improving human health through the development, manufacture and commercialization of a variety of consumer and commercial use organic health and energy drinks, organic food products, organic agricultural products and fertilizers based on bamboo, including:

|

|

●

|

Vacuum packed for freshness:

|

|

|

o

|

Fresh Moso Bamboo shoots

|

|

|

o

|

Seasoned organic bamboo shoots

|

|

|

o

|

Seasoned organic vegetables

|

|

|

o

|

Seasoned organic vegetables with bamboo shoots

|

|

|

●

|

Convenient supermarket packages: cooked

|

|

|

o

|

Seasoned bamboo shoots

|

|

|

o

|

Seasoned vegetables

|

|

|

o

|

Seasoned vegetable and rice packages

|

|

|

●

|

Canned industrial use or commercial use (i.e. for hotels, restaurants):

|

|

|

o

|

Water bamboo shoots

|

|

|

o

|

Water chestnuts

|

|

|

o

|

Water baby corn

|

|

|

o

|

Water mixed vegetables

|

|

|

o

|

Organic fruits

|

|

|

●

|

Extracts: used for organic energy beverages

|

|

|

o

|

Bamboo extracts

|

|

|

●

|

Fertilizers:

|

|

|

o

|

Organic fertilizers using bamboo skin

|

10

The vertically integrated process of the CHE business unit can be summarized as follows:

Access to Raw Materials

- more than 17,000 leased acres of certified Moso bamboo and vegetable land growing water chestnuts, baby corn and others in Fujian province,

- Fujian province is one of the largest bamboo lands in the PRC.

Manufacturing Process / Value Creation

- “zero-to-zero” process from bamboo cultivation to the manufacturing of end products and production of organic fertilizers from waste,

- virtually everything grown is used, reducing the need for fertilizers and cutting energy consumption and costs.

Products

- health and energy drinks and organic food products, including private label products for Kobe Bussan Supermarkets in Japan,

- organic drinks,

- fresh vegetables,

- organic fertilizers

1.3.1 (c) TFS and our financing unit

Our internal financing business unit operates under the umbrella of our 99.75% owned subsidiary Trade Finance Solutions (“TFS”), an Ontario, Canada, company. TFS was established in 2006 to provide creative financing solutions, including purchase order financing, fulfillment services and factoring or invoice discounting for credit worthy customers of eligible goods and services. TFS has a branch office in Miami, Florida. TFS has 2 wholly owned subsidiaries, TFP International Inc., a Florida corporation, which operates the Miami office, and JSM Computer Technology, Inc, an Ontario, Canada, company. The remaining 0.25% of TFS is owned by an individual, who is not an affiliate of ONE Bio.

TFS was acquired to support our international expansion by handling the logistics, fulfillment and financing for the group’s sales outside PRC. TFS provides balance sheet financing solutions and mitigates the group’s international credit exposure by insuring all international receivables through A-rated third party insurance providers. TFS conducts a thorough review and due diligence examination of potential borrowers and the respective borrower’s customers before the particular transaction is approved. An analysis of each individual transaction also takes place through TFS’ credit approval process, in order to ensure that all parties in the transaction receive value, and that TFS will be re-paid according to the terms agreed to in the particular transaction. Security for the financing includes a first lien position on the receivables and assets of the client (UCC, PPSA), personal guaranty and credit insurance. In addition, 100% of TFS’ financing transactions are credit insured with large, multi-national insurance companies. In a typical financing transaction, a letter of credit will be utilized to provide all parties with the protections on agreed to delivery, quality and timelines. TFS’ clients are primarily small and medium size businesses registered and/or located in the United States and Canada, which export their products internationally. Through TFS we also offer purchase order financing to third-party clients that purchase products from our CHE business unit and our OP business unit to assist in the collection process, and expedite cash flow and debt repayment.

Our internal financing business unit offers factoring or invoice discounting financing, where TFS, as factor, purchases the client’s credit insured receivables (i.e., invoices) for products or services satisfactorily rendered to creditworthy customers. By selling receivables to TFS, the client can generate cash almost immediately, instead of waiting the usual 30, 60, 90 days. TFS will verify, insure and control the transaction with the ultimate payer. TFS also offers purchase order financing (or “PO Funding”) which is a mechanism put in place to provide a short-term finance option to clients who have pre-sold finished goods and a requirement to pre-pay suppliers. All these PO Funding transactions are on a “per project” basis. Typically the client has a purchase order from a credit insured customer but does not have the cash resources to pay their supplier upfront. TFS typically requires that the client must have “pre-sold” the goods with strong profit margins. TFS utilizes letters of credit to purchase the goods from the supplier and protect all parties. Once the goods are accepted by the end customer, TFS then factors the invoice and pays off the purchase order facility; and fulfillment services, most of which are provided through TFP and which involves the goods being acquired by TFP on terms negotiated with both supplier and end-client. Here TFP has established credit insurance and marine cargo insurance policies. The customer provides the purchase order and sales contract to TFP, which completes the transaction and disburses the proceeds.

11

Historically TFS has funded its financing transactions through the sale of debentures to institutional investors and high net worth investors, often on an individual transaction basis. The debentures pay quarterly interest to the investors solely from the interest and fees generated from the financing business unit’s activities. The debenture is secured by the assets of TFS with no recourse to other assets or business units of ONE Bio. Through ONE Bio, TFS has greater access to capital to finance its business and through its association with our other business units, access to new international markets.

1.4 Sales and Marketing

The Company’s marketing and sales strategy is characterized by:

|

|

|

|

|

|

|

●

|

High Growth, agri-tech business units that utilize green technology and proprietary processes to grow both organic food products and plants that through the use of proprietary processes, produce chemical and herbal extracts for use in a wide range of health and wellness products;

|

|||

|

|

|

|||

|

|

●

|

Proprietary processes and access to raw materials to generate desirable high gross margins;

|

||

|

|

|

|||

|

●

|

Continuously developing organic products and health products to expand its product offering including items with retail potential which will add demand for existing products;

|

|||

|

|

||||

|

|

●

|

Markets its products throughout PRC, Japan, Europe and the United States;

|

||

|

|

|

|||

|

|

●

|

Direct sales model supported with over 35 sales associates who work with our established direct channel and distribution organizations;

|

||

|

|

●

|

Establish referral programs with major universities where distributors look for new products and technologies;

|

||

|

|

●

|

Multi-channel approach to reach potential distributors and customers (including major retailers such as but not limited to mass merchandisers, large retailers, major hotel chains, hospitals and senior homes);

|

||

|

|

●

|

Use the following channels for visibility with potential distributors:

|

||

|

|

|

|

||

|

|

|

●

|

Web advertising

|

|

|

|

|

|

|

|

|

|

|

|

–

|

Internal web optimization

|

|

|

|

|

|

|

|

|

|

|

–

|

Search engine optimization

|

|

|

|

|

|

|

|

|

|

|

–

|

Sponsored links

|

|

|

|

|

|

|

|

|

●

|

Trade shows

|

||

|

|

|

|

|

|

|

|

|

●

|

Exhibitions

|

|

|

|

|

|

|

|

|

|

|

●

|

Conferences

|

|

|

|

||||

|

|

●

|

Use contacts within local provincial governments to refer us to established distributors.

|

||

12

As for the retail over-the-counter products such as the company’s organic Ganoderma Tea, we run aggressive advertising and marketing campaigns such as:

|

●

|

TV advertising campaign (including static advertisements and interviews)

|

|

|

●

|

Local and national newspapers

|

|

|

●

|

Radio advertising campaign (including static advertisements and interviews)

|

|

|

●

|

Web advertising campaign

|

1.5 Market Analysis

1.5.1 Focus on Asia-Pacific Region

“Asia remains firmly in the lead of the global economic recovery and strong growth in the region is set to continue”, the International Monetary Fund (IMF) said in its latest Regional Economic Outlook for Asia and the Pacific which was released in Jakarta, Indonesia. The expansion in Asia exceeded expectations in the first half of the year, the IMF said, prompting the Fund to revise up its 2010 growth forecast for the region to 8 percent, nearly 1 percentage point higher than its April forecast. Economies across the region are expanding strongly. PRC and India are leading the way with projected 2010 growth rates of 10.5 percent and 9.7 percent, respectively, while Indonesia is expected to grow by 6 percent. In Japan, growth is expected to moderate to a more sustainable pace of 6.8 percent. This continued strength in PRC is evidenced by, among other things, significant growth in retail sales as well as urban fixed-asset investment. Despite the global economic downturn, PRC’s economic growth continues to outpace the rest of the world.

Our product lines and strategic focus are designed to capitalize on this growth. At the same time, many small businesses in Asia-Pacific continue to be undervalued, providing significant opportunities for us to accretively acquire companies that complement our business strategy. Smaller and mid-size Asian companies, partially due to numerous listing requirements in Asia, recognize the value of combining with us and as such, these target companies can be acquired at more reasonable prices. On the cost side, traditionally lower labor costs in the Asia-Pacific Region contribute to higher profit margins, while still maintaining very high product quality standards.

1.5.2 PRC’s Expanding Organic Products Industry

The global organic food market has developed rapidly during the past six years, according to the Gain Report dated October 26, 2010, with organic food and beverage sales reaching $7.2 billion in 2008, an increase of more than 140 percent from the former $3 billion record in 2003. PRC’s participation is on the rise. Some analysts expect domestic sales of organic products in PRC to be as high as $3.6 to $8.7 billion by 2015. PRC’s organic food market is still in the early stages of development but profit margins potentially can be high and market prospects are arguably large.

With the rapid development of living standards in PRC and the Asia-Pacific Region in recent years, organic agriculture and the market for organic foods in PRC and the Asia-Pacific Region are developing at a rate of 30% per annum. In 2005, PRC introduced the China National Organic Product Standard and The Rule on Implementation of Organic Products Certification which covers production certification and imports of organic food products. By the end of 2007, PRC became the second largest area of certified organic cultivation land (4.10 million hectares), producing about 30 categories and more than 500 species of organic products. Due to the advantages of abundant resources, market demand, government support and promotion of health benefits, we believe that PRC's organic food industry will continue to experience strong growth in the future.

13

1.6 Complimentary Strategies

We have assembled a combination of complementary strengths that we believe will enable us to successfully implement our organic growth strategies to capitalize on the large and growing markets for our agritech and organic products, and accretive acquisitions.

|

·

|

Rapid and Sustainable Growth Strategy

|

We believe that our growth strategy allows us to focus our resources to capitalize on opportunities. By first focusing on accretive and synergistic acquisitions, we believe that we will accelerate our expansion beyond what would be achieved through a pure organic growth strategy. Once substantial mass is achieved, we then intend to integrate the acquisitions to improve profitability, achieve production and technology synergies, capitalize on efficiencies of scale and expand our product portfolio, distribution channels and customer base. We believe that this strategy will increase our product diversification, reduce our business risks and increase our accretive opportunities.

|

·

|

Established Platform for Organic Growth

|

We are a vertically integrated company with our own agricultural lands, research and development, proprietary manufacturing processes and distribution channels. Our operating companies are profitable and have established branded products and experienced management teams. We believe that these capabilities position us for organic growth in our product offerings and will serve as a template for successfully integrating additional acquisitions.

|

·

|

Research and Development Team with Ability to Identify Commercially Viable Products

|

Led by our Chief scientist, Dr. Jian Ming Chan, we have assembled what we believe to be a skilled and experienced research and development team that includes engineers, chemists, doctorates and adjunct professors. In addition to possessing a multi-discipline background, our research and development team has affiliations with several prominent research universities in PRC, including the Fudan University. Our team has leveraged these relationships and their own skills to produce, among other things, our proprietary extraction process, which affords us a production cost advantage, and our “zero-to-zero” green production process, which is favored by government authorities. An essential component of our growth strategy is to expand our product offerings through both acquisition and organic growth. We look to our research and development team to continue to provide the new products and innovative production techniques that will fuel our continued organic growth and provide us with a competitive advantage.

|

·

|

Experienced Managers with the Ability to Identify and Integrate Acquisitions

|

We have assembled a team with significant successful mergers and acquisition experience. Our CEO, Marius Silvasan, is a senior executive with over 17 years of experience in business development, M&A, marketing, sales, finance and distribution. Our Chairman, Michael Weingarten, is a seasoned executive and entrepreneur with over 30 years of experience in distribution, manufacturing and managing companies from early stage of development to multimillion dollar corporations worldwide. Mr. Weingarten also has extensive experience in mergers and acquisitions, having participated in over 40 such transactions throughout his career. We believe that that our North American management team positions us properly to participate in the consolidation of our industries.

14

|

·

|

Seasoned Managers with the Ability to Create and Sustain Operating Success

|

Our PRC operations team is led by Min Zhao and Jin Rong Tang, seasoned and highly-qualified managers with extensive industry-specific sales, marketing and production experience. Mr. Zhao has over 20 years of business experience at a number of successful companies where he served in senior positions ranging from general manager to chairman. Mr. Tang was selected as one of the Top Ten Most Outstanding Young Entrepreneurs in 2009 and serves as the Executive Vice President of Fujian Bamboo Association as well as the President of Nanping Association of Young Entrepreneurs. Under their direction, our operating business units have achieved and sustained profitability. We believe that these individuals and their respective teams are well-positioned to execute our growth plans.

|

·

|

Create Win-Win Relationships for Participants

|

We believe that our strategy provides us with an excellent opportunity to participate in the growth of PRC and the entire Asia-Pacific Region. To our acquisition targets, we believe that we offer owners of smaller private companies the opportunity to diversify their investment by being part of a larger multi-faceted public company and at the same time provide access to capital that would not be available to them otherwise. To the Chinese government, we offer a “zero-to-zero” green process, which minimizes waste. To our customers, we offer safe, high-quality, organic products. To our research partners, we offer practical implementation of innovative technology, and to our suppliers, we offer a stable well-managed growth partner.

1.7 Challenges to our Growth

While we believe we will be able to capitalize on our strengths, we are mindful of the significant challenges we face in implementing our growth plan, including:

● Potential Changes in Government Regulation

● Increasing Capital Requirements

● Market Development

● Changes in the Economic Environment

● Changes in Currency Exchange Rates

We believe that our strategy provides us with an excellent opportunity to participate in the growth of PRC and the entire Asia-Pacific region. To our acquisition targets, we believe that we offer owners of smaller private companies the opportunity to diversify their investment by being part of a larger multi-faceted public company and at the same time provide access to capital that would not be available to them otherwise. To the Chinese government, we offer green production processes which reduce waste. To our customers, we offer safe, high-quality, organic products. To our research partners, we offer practical implementation of innovative technology, and to our suppliers, we offer a stable well-managed growth partner.

1.7.1 CHE Organic Growth Strategy

Our CHE business unit’s principal revenue-producing activity involves the extraction of chemical and herbal extracts, including Solanesol, from discarded tobacco leaves and a variety of plants and materials. Our CHE business unit has the contractual relationships necessary to receive tobacco leaves from tobacco companies on an ongoing basis. This business unit also has established relationships to negotiate additional tobacco leaf contracts necessary to support the organic growth rate of our CHE business unit.

15

Our CHE business unit has a patented cost-effective process that extracts Solanesol from discarded tobacco leaves and the resulting residue is further processed to produce organic fertilizer. Because we are able to extract two products from our extraction process, we believe we are able to generate higher margins than we would if we used a traditional single product fermentation extraction process. Additionally, we can further process the Solanesol to produce Coenzyme Q10 (“CoQ10”). Our CHE business unit has the expertise, ability and market demand to expand its manufacturing capacity and to vertically integrate the chemical extract subsidiary. Hence, we intend to invest in increasing our manufacturing capacity to a level adequate to support the CHE business unit’s planned organic growth. As part of our vertical growth strategy, we have added our first over the counter product Ganoderma Tea, which has contributed to our increase in revenue during the fiscal year.

We intend to expand our CHE distribution sales channels horizontally to include other Asia-Pacific countries, Europe and the United States of America. Our entry into these markets will follow the launch of our finished or “end user” over-the-counter products and the establishment of distribution relationships.

1.7.2 OP Organic Growth Strategy

Our OP business unit’s principal revenue-producing activity involves the production of organic food products primarily from bamboo. This business unit continues to lease access to land for its bamboo cultivation as part of its vertical integration and organic growth strategy. We intend to continue to grow our capacity to cultivate bamboo and organic products. During the fiscal year, we have developed our own products for distribution rather than distribute raw materials through the distribution channel which resulted in a significant increase in our revenues.

Our management has also identified several key strategic areas as targeted opportunities for horizontal expansion both in PRC and abroad. This business unit already distributes its products in Japan and PRC. We intend to increase the distribution of our OP products in those markets and to expand into other Asia-Pacific countries, Europe and the United States of America, once we have identified and established distribution relationships in those markets. In conjunction with the expanded sales and distribution initiative, our OP business unit is also in frequent contact and discussions with both the local and federal PRC government to obtain additional land lease rights for rich bamboo. Our OP business unit has been successful in procuring these rights and expects this to continue, resulting in increased production capacity and allowing for expansion of the product lines.

Recruitment and qualification of distributors within the targeted regions has been implemented and the process is ongoing. Distributors catering to organic food retailers and health stores are our primary targets. The existing distribution in each region is assessed and our OP business unit makes the decision to either engage distributors or to sign direct distribution agreements with the retailers to reach its target market. We believe that mix of both strategies can be implemented within a targeted region.

1.7.3 Accretive Growth Strategy

We have a focused growth strategy through acquisition for the next twenty-four to thirty-six months. We believe that we are in a good position to complete one or more strategic acquisitions during said period of time. Furthermore, we believe this strategy will allow us to grow at an accelerated, controlled, and accretive pace. From time to time we are engaged in preliminary discussions with potential acquisition candidates that would be a fit based upon our business model. We are currently engaged in preliminary discussions with a few potential acquisition candidates that we believe fit our business model. It is possible that those preliminary discussions could culminate in one or more strategic acquisitions. However, no assurances can be given that we will pursue or that that we will be able to close any acquisition within our desired time frame. Following our initial twenty-four to thirty-six months growth strategy focused on strategic acquisitions we intend to put a greater focus on organic growth, consolidation and integration of redundant labor, plant and equipment.

16

We believe that there are compelling opportunities to acquire target companies in the region at attractive multiples. The acquisition targets we seek are profitable and well-run companies whose potential is constrained due to lack of access to capital from financial markets. We provide that access along with the added benefit of our management expertise and strategic direction. We intend to achieve scale by acquiring companies or assets that have one or more of the following characteristics:

● An established customer base

● Existing plant and equipment

● Excess production capacity

● Attractive and complementary product portfolio

● Vertical or horizontal integration synergy

● Innovative patents and/or technology

● Processes or products with scalability

● Established complementary distribution channels

We also believe that management expertise is an essential ingredient to achieving scale, both organically and by acquisition. To execute this strategy, we have brought together both the financial and transactional expertise to identify and acquire accretive and synergistic targets and the operational expertise to effectively integrate operations and profitably expand business or product lines. We believe our management and operations teams combine the operational expertise and work ethics of the Asia-Pacific region with the managerial, financial, and transactional skills of North America. Our CHE and OP business units will principally execute and manage our organic growth strategies.

1.8 Manufacturing and distribution of our products in PRC and other countries

Our CHE and OP business units produce different products. Our CHE business unit produces raw materials such as intermediate chemicals and herbal extracts that are primarily focused on the nutraceutical, health supplement and vitamins market segments (see “Chemical and Herbal Extracts” herein for a list of our CHE products). Our OP business unit produces primarily organic food products (see “Organic Products” herein for a list of our OP products). Our CHE and OP business units also produce fertilizers.

We currently distribute our products in PRC and export and distribute our products to Japan and other Asia-Pacific countries. We intend to establish distribution relationships in order to expand our distribution into other Asia-Pacific countries, the U.S and Europe. The manufacture, exportation and distribution of our products in PRC, and Japan and other Asia-Pacific countries are not subject to any health or governmental standards or regulations. However, the exportation of our products will be subject to U.S. standards and regulations once we expand to the U.S. In anticipation of expanding to the U.S., we have registered our facilities with the U.S. FDA. In order to facilitate food, pharmaceutical and product safety, many countries have embraced various manufacturing and quality control standards. Generally compliance with these standards is voluntary and failure to satisfy these standards does not necessarily disqualify manufacturers from exporting their products to a particular country. However, compliance with FDA regulations is required in order to export and distribute products to the U.S. The principal voluntary standards for our current and intended regions of distribution are: current Good Manufacturing Practices (“cGMP”); HACCP (Hazard Analysis Critical Control Points); and JAS (Japanese Agricultural Standard). Under these standards, the burden is on the manufacturer to establish safety and efficacy. Generally these standards focus on how products are produced, maintained and held, the facility where the products are produced, and the documentation that is to be maintained by the producer to demonstrate the producer’s compliance with these standards, and the labeling of the products. The respective governing bodies generally do not certify the producer’s compliance with the applicable standards. If a consumer files a complaint regarding a producer’s product and the product is found to cause a health hazard, the producer’s facilities will generally be inspected by the applicable governing body and if such inspection reveals that the producer’s processes, documentation or products do not meet the applicable standards, the export of the products to the applicable country may be blocked until the producer can demonstrate that the problem has been rectified. Certain of the governing bodies (such as the FDA) may require a recall of the adulterated product. Producers often obtain a certification from an independent certification company (such as Underwriters’ Laboratories) regarding the producer’s satisfaction of the generally accepted standards of the particular country; but such independent certification is voluntary and is not binding on the applicable governing body. However, unlike many of the other governing bodies, JAS issues certifications covering food labeling and products that have been reviewed and inspected by JAS regarding compliance with JAS Standards.

17

The following is a description of the above mentioned standards. All of the following standards, except FDA registration, are voluntary and undertaken by us to enhance the quality and marketability of our products and our failure to satisfy these standards will not preclude us from distributing and/or exporting our products a particular country or region.

|

|

●

|

cGMP (current Good Manufacturing Practices): cGMP are the current accepted standards of design, operation, practice, and sanitization for facilities that manufacture, package or hold foods and dietary supplements. Compliance with the cGMP standards, requires an inspection of the facilities to determine whether these standards are satisfied.

|

|

|

●

|

HACCP (Hazard Analysis Critical Control Points): HACCP is a system used to manage food safety through the analysis and control of biological, chemical, and physical hazards from raw material production, procurement and handling, to manufacturing, distribution and consumption of the finished product. We believe our CHE and OP facilities utilize HACCP in order to reduce the risk of hazards getting into our products. We believe our OP facility complies with HACCP standards and we have obtained an independent certification in PRC from China Quality Certification Center, an independent certification company. Our CHE business unit facilities have not been certified, and no certification is required.

|

|

|

●

|

FDA Registration: In contemplation and preparation for exporting our products for distribution in the United States, we have registered our CHE and OP facilities with the FDA pursuant to the Public Health Security and Bioterrorism Preparedness and Response Act of 2002. This Act allows the FDA and other authorities to determine the source and cause of any deliberate or accidental contamination of food. For this, the FDA uses information provided by registered food facilities prior to entry into the U.S. of food and beverages for human and animal consumption. Pursuant to this Act, the owner, the operator or agent in charge of a domestic or foreign food facility must register that facility with the FDA and provide necessary information as requested in order to import the food into the U.S. Foreign facilities are required to report emergency contact information. Except for specific exemptions, the registration requirements apply to all facilities that manufacture, process, pack, transport, distribute, receive, or hold food regulated by the FDA, including animal feed, dietary supplements, infant formula, beverages (including alcoholic beverages) and food additives. Failure of a domestic or foreign facility to register, update required elements, or cancel its registration in accordance with this Act is prohibited under the Federal Food, Drug, and Cosmetic Act and a facility that fails to register with the FDA may have its goods seized by the U.S. Customs and Border Protection agency and/or fined. Prior notice of imported foods must be provided to the FDA within prescribed time periods. The notice must include a description of the article, the manufacturer and shipper, the grower (if known), the country of origin, the country from which the article is shipped, and the anticipated port of entry. After such notice has been submitted, the FDA will provide a prior notice confirmation number that the information has been successfully received by the FDA. Once the FDA issues the confirmation number, the FDA reviews the information submitted and determines whether the cargo must be examined. If the review concludes that no further action is necessary, a customs entry may be processed for that importation. If the review concludes that further action is necessary, the importation of the food may be detained at the port of entry or prevented until any problems or errors are corrected.

|

|

|

●

|

JAS (Japanese Agricultural Standard): The JAS standards apply to organic plants, organic processed foods of plant origin, organic livestock products, organic processed foods of animal origin and organic feeds. These standards set forth requirements that producers of these products must comply with, if they wish to label their products “Organic”. Our OP facilities comply with the JAS standards. In addition, our JAS facilities have been certified by a registered certifying body. The JAS certification allows us to attach the organic JAS logo to products produced or manufactured in our OP facilities to indicate that they comply with relevant organic JAS standards. The fact that we maintain one or more JAS Certifications is not a guarantee that each and every OP product we produce will always be entitled to claim organic status. By submitting to these standards, we are able to put the JAS labels on our OP division products, which we believe enhances the marketability of these products. If we were to lose one or both of our JAS Certifications, we would still be able to distribute our products in Japan; however, we would not be permitted to affix the JAS labels to our products until we demonstrate that we are JAS compliant. The JAS standards are voluntary, but necessary, in order to distribute our products with the JAS labels.

|

The fact that we comply with a particular standard, system or regulations (i.e., cGMP, HACCP, FDA, JAS) is not a guarantee that each and every product we produce will be absolutely safe for consumption. Many factors can conspire to cause products such as the ones we manufacture and distribute to be adulterated or impure. If a product we produce is discovered to be adulterated, causes illness or injury, or fails to meet standards for purity or identity, such a problem can lead to interruptions of production, product recalls and claims against us. The applicable regulatory agencies, including the FDA and PRC’s State Food and Drug Administration (“SFDA”) may conduct on-sight inspections of our facilities. If we fail an inspection, the regulatory agency may order us to close one or more facilities. Furthermore, our products may be inspected during the import process into one of our targeted countries, and failure to pass inspection would result in our products being refused entry by that country.

18

We believe we are eligible to distribute in PRC all of our products produced at our facilities. Based on our JAS certification, we believe we are eligible to export and distribute in Japan all of our OP products with JAS Organic labels certified by JAS. Based upon the registration of our CHE and OP facilities with the U.S. FDA, we believe we are eligible to export and distribute all of the products to the U.S.

The following table sets forth the standards/ rules applicable to our CHE and OP business units in the indicated countries:

|

Country

|

Standards applicable to CHE

products in the country/region

|

Standards applicable to OP

products in the country/region

|

||||

|

Japan

|

No compliance required to distribute in Japan and JAS Certification not applicable

|

Voluntary JAS certification necessary for Organic labeling, but not necessary for importation and distribution (certification obtained)

|

||||

|

United States

|

U.S. FDA – facility registration is required

(facilities have been registered)

|

U.S. FDA – facility registration is required

(facilities have been registered)

|

||||

|

China

|

No compliance required

|

No compliance required (Voluntary HACCP compliance has been instituted and independent non-binding certification has been obtained)

|

In the past, we have focused our sales and distribution efforts to PRC and Japan and with only limited distribution of only certain of our OP products and no distribution of our CHE products in Europe. We intend to establish distribution relationships in other Asia-Pacific countries, Europe and the U.S. so that we can expand distribution of our products to these markets. The foregoing notwithstanding, we may from time to time, on a case by case basis, distribute our products in Europe.

1.9 Intellectual Property

Patents approved and issued by the PRC is as follows:

| Patent Name |

Certificate No

|

Date | Expiry | Designer | Owner | |||||

| Synchronization high efficiency process of Solanesol and Nicotine Sulphate |

200610069846.6

|

2006.8.10 | 2026.8.10 |

Zhao Min, ChenYanmei, Liu Caiqing

|

Sanming Huajian Bio- engineering Co Ltd

|

19

The following table is a list of our Patents applications pending approval by the PRC:

|

Patent Name

|

Application No.

|

Date

|

Expiry

|

Designer

|

Owner

|

|||||

|

A Method of Eliminating Plum Bum Products with basic liquid of zymogene mung bean

|

200710009735.0

|

2007.11.1

|

20 years after the application

|

Lin Xuanxian, Chen Jianmin, Chen Yanmei

|

Sanming Huajian Bioengineering Co., Ltd. & Lin Xuan Xian

|

|||||

|

Purified craftsmanship of coenzyme Q10

|

200810072112.2

|

2008.11.13

|

20 years after the application

|

Chen Yanmei, Zhao Min

|

Sanming Huajian Bioengineering Co., Ltd.

|

|||||

|

New craftsmanship of extracting high content resveratrol from polygonum cuspidatum

|

200910306409.5

|

2009.8.31

|

20 years after the application

|

Zhao Min, Chen Yanmei, Yu Feng

|

Sanming Huajian Bioengineering Co., Ltd.

|

|||||

|

Craftsmanship of extracting high content 5-HTP from griffonia seeds

|

200910306408.0

|

2009.8.31

|

20 years after the application

|

Zhao Min, Yu Feng, Chen Yanmei

|

Sanming Huajian Bioengineering Co., Ltd.

|

|||||

|

Craftsmanship and application of extracting isofraxidin and flavonoid from sarcandra glabra at the same time

|

200910307418.6

|

2009.9.22

|

20 years after the application

|

Zhao Min, Yu Feng, Chen Yanmei

|

Sanming Huajian Bioengineering Co., Ltd.

|

|||||

|

One effective method for extracting tanshinone IIA and salvianolic acid B from salvia miltiorrhiza at the same time

|

201010227720.3

|

2010.7.15

|

20 years after the application

|

Zhao Min, Yu Feng, Chen Yanmei

|

Sanming Huajian Bioengineering Co., Ltd.

|

|||||

|

The producing method for a weight-losing milk tea

|

201010227720.3

|

2010.7.15

|

20 years after the application

|

Zhao Min, Yu Feng, Chen Yanmei

|

Green Planet Bioengineering Co., Ltd.

|

|||||

|

A cultivating method of interplanting stevia among tobaccos

|

201010233987.3

|

2010.7.22

|

20 years after the application

|

Zhao Min, Yu Feng, Chen Yanmei

|

Sanming Huajian Bioengineering Co., Ltd.

|

Note- The patent of “Solanesol-clean extraction method” is exclusively owned by Fudan University. However, we have obtained the right to use this technology patent.

Since August 11, 2006, we have been designing the “synchronization and high efficiency process of Solanesol and Nicotine Sulphate” and applied for the patent ownership and have used it in the production process.

20

1.10 Trademarks

The following table is a list of our current trademarks approved and issued by the PRC:

|

Trademark

|

Certificate No.

|

Date

|

Expiry