Attached files

| file | filename |

|---|---|

| EX-21 - China Premium Lifestyle Enterprise, Inc. | v216638_ex21.htm |

| EX-32.2 - China Premium Lifestyle Enterprise, Inc. | v216638_ex32-2.htm |

| EX-31.1 - China Premium Lifestyle Enterprise, Inc. | v216638_ex31-1.htm |

| EX-32.1 - China Premium Lifestyle Enterprise, Inc. | v216638_ex32-1.htm |

| EX-23.1 - China Premium Lifestyle Enterprise, Inc. | v216638_ex23-1.htm |

| EX-31.2 - China Premium Lifestyle Enterprise, Inc. | v216638_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from __________________ to _____________________

Commission File No. 333-120807

CHINA PREMIUM LIFESTYLE ENTERPRISE, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

11-3718650

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

|

|

28/F, King Palace Plaza,

No. 52A Sha Tsui Road,

Tsuen Wan, N.T. Hong Kong

|

||

|

(Address of principal executive offices)

|

||

|

(852) 2954-2469

|

||

|

(Registrant's telephone number, including area code)

|

||

|

Securities registered pursuant to Section 12(b) of the Act:

|

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

None

|

None

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act (Check One):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the registrant's common stock held by non-affiliates of the registrant as of June 30, 2010, the last day of registrant’s most recently completed second fiscal quarter, was $554,295 (based on the closing sales price of the registrant's common stock on that date). Shares of the registrant's common stock held by each officer and director and each person who owns more than 5% or more of the outstanding common stock of the registrant have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 29, 2011, 24,534,492 shares of the registrant’s common stock were issued and outstanding.

CHINA PREMIUM LIFESTYLE ENTERPRISE, INC.

TABLE OF CONTENTS

TO ANNUAL REPORT ON FORM 10-K

|

Page

|

|||

|

Part I

|

|||

|

Item 1

|

Description of Business

|

1

|

|

|

Item 1A

|

Risk Factors

|

11

|

|

|

Item 1B

|

Unresolved Staff Comments

|

25

|

|

|

Item 2

|

Properties

|

25

|

|

|

Item 3

|

Legal Proceedings

|

25

|

|

|

Item 4

|

Submission of Matters to a Vote of Security Holders

|

26

|

|

|

Part II

|

|||

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

27

|

|

|

Item 6

|

Selected Financial Data

|

28

|

|

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

28

|

|

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk

|

41

|

|

|

Item 8

|

Financial Statements and Supplementary Data

|

42

|

|

|

Item 9

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

43

|

|

|

Item 9A

|

Controls and Procedures

|

43

|

|

|

Item 9B

|

Other Information

|

44

|

|

|

Part III

|

|||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

45

|

|

|

Item 11

|

Executive Compensation

|

47

|

|

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

51

|

|

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

53

|

|

|

Item 14

|

Principal Accountant Fees and Services

|

55

|

|

|

Part IV

|

|||

|

Item 15

|

Exhibits and Financial Statement Schedules

|

56

|

|

|

Signatures

|

61

|

A-1

CAUTION REGARDING FORWARD-LOOKING INFORMATION

All statements contained in this Annual Report on Form 10-K for China Premium Lifestyle Enterprise, Inc., other than statements of historical facts, that address future activities, events or developments are forward-looking statements, including, but not limited to, statements containing the words or phrases “would be, “will allow,” “intends to,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “believe,” “plan,” “intend,” “estimate” and words of similar import. These statements are based on certain assumptions and analyses made by us in light of our experience and our assessment of historical trends, current conditions and expected future developments as well as other factors we believe are appropriate under the circumstances. However, whether actual results will conform to the expectations and predictions of management is subject to a number of risks and uncertainties that may cause actual results to differ materially. These risks and uncertainties include: (a) general economic conditions in the Hong Kong Special Administrative Region (“Hong Kong”), the Macau Special Administrative Region (“Macau”) and the People’s Republic of China (“Mainland China”); (b) regulatory factors in Hong Kong, Macau and Mainland China that may lead to additional costs or otherwise negatively affect our business; (c) whether we are able to manage our planned growth efficiently, including whether our management will be able to: (i) identify, hire, train, retain, motivate and manage required personnel or (ii) successfully manage and exploit existing and potential market opportunities; (d) whether we are able to generate sufficient revenues or obtain financing to sustain and grow our operations; (e) our exposure to foreign currency fluctuations; (f) whether we are able to successfully fulfill our primary cash requirements which are explained below under “ Financial Condition, Liquidity and Capital Resources”; (g) whether worldwide economic conditions will negatively affect the automobile retail industry in Hong Kong, Macau and Mainland China, and (h) other factors or conditions described in Item 1A – Risk Factors in Part 1 of this Annual Report on Form 10-K. Statements made herein are as of the date of the filing of this Form 10-K with the Securities and Exchange Commission and should not be relied upon as of any subsequent date. Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim any obligation, to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

You should carefully review the risk factors described in this report and other documents we will file from time to time with the Securities and Exchange Commission, including our Quarterly Reports on Form 10-Q to be filed by us in our 2011 fiscal year, which runs from January 1, 2011 to December 31, 2011.

As used in this Form 10-K, unless the context requires otherwise, “we”, “us”, “OTCBB: CPLY” or the “Company” means China Premium Lifestyle Enterprise, Inc. and its subsidiaries, taken together as a whole.

A-2

ITEM 1. DESCRIPTION OF BUSINESS

COMPANY OVERVIEW AND HISTORY

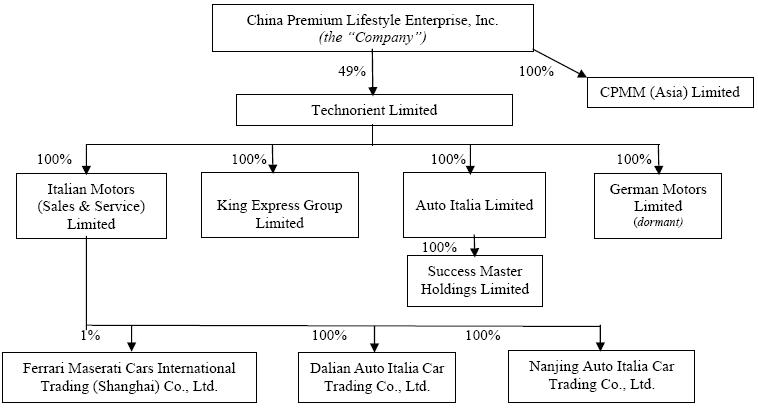

China Premium Lifestyle Enterprise, Inc. is in the business of the importation, distribution and sales of premium brand luxury products in Hong Kong, Macau, and Mainland China, (which for the purposes of this report excludes Hong Kong, Macau and Taiwan). Currently, the Company’s main business is its 49% ownership interest in Technorient Limited, a Hong Kong corporation (“Technorient”). The business of Technorient and its subsidiaries consists mainly of the importation, sales and after-sales service of Italian “Ferrari” and “Maserati” branded cars and spare parts in Hong Kong, Macau and Mainland China. In 2008, through its wholly-owned subsidiary, CPMM (Asia) Limited (f/k/a Leader Mount Limited), a Hong Kong corporation (“CPMM Asia”), the Company began importing, distributing and selling premium brand apparel in Hong Kong, Macau, Mainland China and Taiwan.

The Company was originally formed in the State of Nevada on April 19, 2004 under its predecessor name, Xact Aid, Inc. (“Xact Aid”). On April 30, 2004, the Company issued 1,000 shares of its common stock (representing all of its issued and outstanding shares) to Addison-Davis Diagnostics, Inc. (f/k/a QT5, Inc.), a Delaware corporation (“Addison-Davis”), in consideration of Addison-Davis advancing start-up and operating capital.

On November 15, 2004, the Company acquired a line of first aid products for minor injuries from Addison-Davis in accordance with an Agreement of Sale and Transfer of Assets entered into between the Company and Addison-Davis.

On December 22, 2005 the Company acquired 100% of the issued and outstanding shares of Brooke Carlyle Life Sciences, Inc., a Nevada corporation (“Brooke Carlyle”), a development stage company with a business plan to develop an online internet portal containing information on sexually transmitted diseases, which was intended to generate revenue from advertising from pharmaceutical companies.

In early 2006, the Company’s management team determined that it was no longer in the best interests of the Company and its stockholders to continue pursuing sales and marketing efforts for the line of first aid products acquired from Addison-Davis. In an effort to bring revenues and profitable operations to the Company, management sought to effect a transaction that would attract a viable business operation and enable the Company to liquidate its liabilities.

On May 4, 2006, the Company entered into a Stock Purchase Agreement with Nexgen Biogroup, Inc. (“Nexgen”), pursuant to which the Company sold the shares of Brooke Carlyle, which at that time represented all or substantially all of the assets of the Company (including the Xact Aid business assets), for $1,000 cash, representing a consideration of $0.001 per share.

On September 5, 2006, the Company acquired 49% of Technorient through a share exchange (the “Exchange”), with the result that the shareholders of Technorient became the beneficial owners of approximately 49% of the Company’s stock. In connection with the Exchange, 3,000,000 shares of common stock owned by Federico G. Cabo, one of our former directors, and 6,000,000 shares of common stock owned by Fred De Luca, then our secretary and a director, were cancelled. The terms of the Exchange were determined through arms-length negotiations between the Company and Technorient. The Exchange was completed pursuant to a Share Exchange Agreement, which was later reformed pursuant to the Reformation Agreement dated May 5, 2009, as reported by the Company in a Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on May 11, 2009.

1

The Exchange resulted in a change of control whereby the Company issued: (i) an aggregate of 89,689,881 common shares in exchange for 49% of the issued and outstanding shares of Technorient, and (ii) an aggregate of 21,629,337 shares of common stock in connection with certain debt conversions. The 89,689,881 shares were issued in two tranches pursuant to the terms and conditions of the Share Exchange Agreement and the Reformation Agreement: (i) 72,000,000 shares were issued at closing of the Exchange on September 5, 2006; and (ii) an additional 3,537,977 shares were issued on December 7, 2007 upon the effectiveness of and giving effect to the Company’s one-for-five reverse stock split (which shares would have been equal to 17,689,881 shares on a pre-reverse split basis). As a result of the Exchange, the Company became a 49% shareholder of Technorient on a fully-diluted basis. Additionally, as a condition to the closing of the Exchange, the Company sold the capital stock of Brooke Carlyle to Nexgen (which, prior to the Exchange, constituted all of the Company’s assets), for $1,000 cash.

After the closing of the Exchange, the Company’s main business became its 49% ownership interest in Technorient.

On December 27, 2006, the Company effected a change of the Company’s name from “Xact Aid, Inc.” to “China Premium Lifestyle Enterprise, Inc.” The Company name change and a new trading symbol (OTCBB: CPMM) became effective on the OTC Bulletin Board on December 28, 2006.

In March 2007, the Company entered into an agreement with Falber Confezioni, S.R.L. (“Falber”) to become the sole importer and distributor of John Richmond, Richmond X and Richmond Denim clothing for men and women in Hong Kong, Macau, Taiwan and in Mainland China commencing in the Spring/Summer season of 2008 and ending in the Fall/Winter season of 2012.

On April 3, 2007, the Company established CPMM Asia as a wholly owned subsidiary. CPMM Asia is principally engaged in the distribution of luxury brand apparel. The sale and distribution of premium brand apparel was wound down in 2009 due to lack of sales, which was primarily attributable to the downturn in the global economy and the tightening of consumer spending in Mainland China.

TECHNORIENT OVERVIEW

Ownership

In 1993, Corich Enterprises, Inc., a British Virgin Islands corporation (“Corich”), acquired 37.7% of the then issued share capital of Technorient. Herbert Adamczyk, our Chief Operating Officer and a Director, held approximately 28.2% of the then issued and outstanding capital shares of Technorient. Between 1995 and early 2006, Corich increased its interest in Technorient to approximately 90% through a series of transactions, while Mr. Adamczyk decreased his interest to approximately 10%. Upon completion of the Exchange on September 5, 2006, Corich and the Company held approximately 51% and 49% of Technorient, respectively.

History and Development

Technorient’s tradition of excellence with luxury sports automobiles extends back to the founding of German Motors Limited (“German Motors”) by Mr. Adamczyk in 1974 as a service center for high performance sports cars, including Ferrari. After some years of development, and largely as a result of its record in high quality service and support for the auto racing industry in both Hong Kong and Macau, German Motors became the exclusive dealer for Ferrari in Hong Kong and Macau in 1983. Technorient was formed in 1983, and in 1985 became the holding company for Auto Italia Limited (“Auto Italia”), German Motors, Italian Motors (Sales & Service) (“Italian Motors”), Italian Motors (Sales & Service) Limited (“IML”) and King Express Group Limited (“King Express”) (Auto Italia, German Motors, Italian Motors, IML and King Express are collectively referred to herein as the “Technorient Group”).

2

Auto Italia was established in Hong Kong on September 25, 1984 to trade cars and related accessories and provide car repair services. It was the exclusive importer and distributor for Lancia and subsequently Fiat automobiles in Hong Kong and Macau until the early 1990s when Lancia discontinued its right hand drive model range. Auto Italia withdrew from its Fiat distributorship at the same time due to the unsuitability of the vehicles for the Hong Kong market. Subsequent to the cessation of its Lancia and Fiat distributorships, Auto Italia, a Maserati dealer since 1994, was awarded exclusive dealership rights for Maserati automobiles in Hong Kong and in Macau in 1996.

In 1992, IML was appointed as sole Ferrari importer and distributor for Hong Kong and Macau, and later (1994 – 2004) was also exclusive importer for Mainland China. In 2003, IML transferred its entire car trading business to Auto Italia, which in turn set up a new subdivision, Italian Motors, to continue the business. In 2008, IML formed a wholly owned subsidiary named Nanjing Auto Italia Car Trading Co., Ltd. in Mainland China to engage in the distribution of Ferrari and Maserati cars in Nanjing.

IML is a 1% equity holder in Ferrari Maserati Cars International Trading (Shanghai) Co. Ltd., an equity joint venture company created in 2004 with Ferrari S.p.A. and the Beijing-based Poly Investment Group to handle sales, marketing and distribution of Maserati and Ferrari automobiles in Mainland China. We refer to Ferrari Maserati Cars International Trading (Shanghai) Co. Ltd. as the “Shanghai JV”. The Shanghai JV is currently building a network of dealerships for Ferrari and Maserati in Mainland China.

Auto Italia and Italian Motors operate from eight locations in Hong Kong, Macau and Mainland China, incorporating sales, spare parts, service and body and paint shop facilities for Ferrari and Maserati.

Management believes that the Technorient Group’s customer base of high net worth individuals in Hong Kong and Mainland China is well-established. Through its sales performance and reputation for first class facilities and customer service, the Technorient Group enjoys an excellent relationship with senior management of both Ferrari S.p.A. and Maserati S.p.A.

Management of Technorient views the rapid development of the consumer market in Mainland China, particularly the market for luxury products, as an opportunity to leverage the Company’s existing high net worth customer base and reputation to develop a platform for distribution of a wide range of luxury items, including additional high end (performance) autos, luxury yachts and other premium lifestyle items. Despite a somewhat gloomy world economy, a 2009 report issued by McKinsey & Company forecast that spending on luxury goods in greater Mainland China would grow by 18% annually to about $27bn by 2015, while other analysts have predicted annual growth as high as 25%.

In keeping with management’s business development plans, King Express was appointed in 2007 by AgustaWestland as its exclusive distributor for the complete fleet of AgustaWestland commercial helicopters in Hong Kong and Macau and as non-exclusive distributor for the highly strategic Pearl River Delta region of Southern Mainland China. The AgustaWestland helicopters business is still in its preparatory stage.

3

Ferrari/Maserati Mainland China

The Technorient Group sold the first Ferrari in Mainland China in 1993. By 2005, over 100 units were sold, reflecting the emergence of Mainland China as one of Ferrari’s key growth markets, alongside Latin America and Russia. In accordance with its worldwide policy of owning the primary importer in a major export market, Ferrari S.p.A. approached Technorient management in 2002 to request guidance on how to best establish its own importing operations in Mainland China. Technorient introduced Ferrari S.p.A. to Poly Group, a powerful industrial entity, after having established that a joint venture with a well-connected local business entity would be the most appropriate structure.

As a result, on August 27, 2004, Technorient, Ferrari S.p.A. and Poly Technologies, Inc. formed the Shanghai JV, an equity Sino-foreign joint venture in Mainland China, to engage in the import, distribution and sale, through a local network of car dealers, of Ferrari and Maserati cars, spare parts and ancillary products. Ownership of the Shanghai JV at inception was Ferrari S.p.A. 40%, Technorient Group (through IML) 30% and Poly Group 30%, with Dr. Richard Man Fai Lee, our Chairman, Chief Executive Officer and President, and also the Chairman of Technorient, appointed as Chairman and authorized representative of the Shanghai JV.

Upon formation, the Shanghai JV acquired from IML at cost all of the dealer network and importer operations established by IML, including residual cars allocated for Mainland China.

Because the structure of the Shanghai JV precludes its shareholders from direct ownership of licensed dealers in Mainland China and in view of Technorient’s strategy to develop a luxury brand platform amongst its high net worth clients, Technorient’s management subsequently approached Ferrari S.p.A. to dispose of IML’s interest in the Shanghai JV so that Technorient could acquire an independent dealer network in Mainland China and, among other things, maintain its direct customer relationships. As part of this arrangement, Technorient applies for dealer licenses in key markets in Mainland China such as Dalian and Nanjing (already awarded) and may, in conjunction with Ferrari, continue to build its dealer network to capitalize on its client base in Mainland China and pursue its luxury brand platform.

Accordingly, IML entered into an agreement with the Shanghai JV parties to dispose of 29% of its equity interest in the Shanghai JV in July 2006. The disposal was completed in December 2007 and after the disposal, IML continued to hold a 1% equity interest in the Shanghai JV. Beginning in 2006, the Technorient Group was able to act as an authorized dealer of Ferrari and Maserati cars in certain cities in Mainland China that were allocated in cooperation with the Shanghai JV. In January 2006, IML formed Dalian Auto Italia in Mainland China to sell Ferrari and Maserati cars in Dalian, China. At formation, IML owned 95% of the equity interest in Dalian Auto Italia, and on August 3, 2007, IML acquired the remaining 5% of equity interest in Dalian Auto Italia.

On August 7, 2008, IML formed a wholly owned subsidiary named Nanjing Auto Italia Car Trading Co., Ltd. in Mainland China to engage in the distribution of Ferrari and Maserati cars in Nanjing.

Operations

As the primary importer and distributor for Ferrari/Maserati brands for Hong Kong, Macau and Mainland China (until 2004), Technorient was responsible for introducing and developing a viable market for high performance luxury motor cars in those territories. After formation of the Shanghai JV in 2004, Technorient retained and continues its role as exclusive importer and dealer for both Ferrari and Maserati brands in Hong Kong and Macau, each of which is a significant market in its own right, while developing an independent dealership network in Mainland China in close cooperation with the Shanghai JV.

4

A key aspect of any Ferrari importer worldwide is the strength of the relationship with Ferrari S.p.A. management in Maranello, Italy. With its internationally recognized logo and current worldwide production of only 6,600 units, the Ferrari brand connotes an image of performance and exclusivity unique in the auto world. Management of Ferrari S.p.A. understands the importance of importer performance in maintaining this image and accordingly requires the highest level of commitment from their importers.

Importership agreements are renewed annually and vehicle allocations are made largely through negotiation and are based on past sales levels. Allocations largely determine waiting lists for certain models, which in developed markets such as the United States and Europe, can stretch out to 3 years. While there is no obligation on our part to purchase any specific year’s allocation, a key to success as a Ferrari importer is the ability to increase allocations regularly. Technorient’s management has historically enjoyed a unique ability to achieve this, through the strength of their 20-year relationship with Ferrari and proven success in building important markets for Ferrari and Maserati in Hong Kong and Mainland China. As a result, waiting lists for new cars in Mainland China are relatively short, an important advantage in newly developing markets where patience levels amongst the newly wealthy for their high end purchases are relatively low.

Market Analysis

Hong Kong and Macau

After several years of steady growth, the market in Hong Kong and Macau for super luxury performance vehicles was severely impacted by the public health crisis precipitated by severe acute respiratory syndrome, or SARS, and the resulting economic downturn in 2003 which, together with the imposition of a poorly conceived luxury tax (now reduced and restructured) reduced Ferrari sales to a fraction of the prior period. Between 2004 and the first half of 2008, Hong Kong and Macau experienced an economic boom, built largely on the robust performance of the Chinese economy, particularly on the consumption side. During the last half of 2008, Hong Kong and Macau began to feel the effects of the worldwide economic slowdown.

The difficult commercial environment of 2009 has given way to a vastly improved business environment in our markets. The Company has reason to be cautiously optimistic regarding prospects for increased sales of vehicles, both new and used. Official data released by the Hong Kong Government’s Census and Statistics Department indicates that Hong Kong’s economy recorded a seventh straight quarter of expansion in the fourth quarter of 2010, with gross domestic product growing at 6.8% year-on-year.

Sales for Ferrari and Maserati stabilized at around 140 units in 2005 with annual growth in the region of 15% reaching close to 290 units in 2010. Our orders for new Ferrari and Maserati automobiles increased significantly in 2010. Given the relatively small but extremely wealthy customer base for the Group’s products in Hong Kong and Macau, management believes that sales will remain steady, despite the currently experienced slowdown, while the proportion of sales in Mainland China is expected to continue to increase.

Mainland China

The consumer market in Mainland China has emerged as an engine of economic growth during the past years. In 2005, Mainland China overtook Japan as the second largest car market in the world after the United States, with 5.9 million vehicles sold in 2005. In 2009, Mainland China overtook United States as the largest car market in the world, with 13.6 million vehicles sold. Although inflationary pressures are predicted to increase in Mainland China in the coming year, the economy is nevertheless expected to remain strong in 2011 having grown by approximately 10% year-on-year in 2010. Mainland China’s consumers continue to exhibit increasing interest and ability to purchase luxury goods. Despite a somewhat gloomy world economy, a recent report issued by McKinsey & Company forecast that spending on luxury goods in greater China would grow by 18% annually to about $27bn by 2015, while other analysts have predicted annual growth as high as 25%.

5

Business Strategy

Technorient’s main strategy of building a luxury brand platform in Mainland China is centered around the continued development of an independent dealer network for the key brands of Ferrari and Maserati. This network, like the dealerships in Dalian and Nanjing, will be developed, in cooperation with Ferrari S.p.A. and Maserati S.p.A., both through new operations and acquisitions of existing dealerships in key industrial regions with a high concentration of wealthy individuals who form an important part of Technorient’s customer base.

As the business of Technorient develops, it is management’s intention that additional key brands, consistent with the platform and character of the business, will be acquired from Technorient’s parent company Wo Kee Hong (Holdings) Limited or from third parties. An example is the acquisition of the distributorship rights in Hong Kong and Macau for AgustaWestland helicopters.

PRINCIPAL PRODUCTS OR SERVICES AND THEIR MARKETS

Currently, Technorient imports, distributes, and provides after-sale service for Italian “Ferrari” and “Maserati” branded cars in Hong Kong, Macau and parts of Mainland China.

The following table reflects our percentage of total revenues of Technorient by business segment for our last three fiscal years:

|

Percentage of Total Revenues of Technorient as of

|

||||||||||||

|

Business Segment

|

December 31,

2010

|

December 31,

2009

|

December 31,

2008

|

|||||||||

|

New and used vehicles

|

93 | % | 93 | % | 94 | % | ||||||

|

Parts and services

|

7 | % | 7 | % | 6 | % | ||||||

Further information regarding our business segments is provided in Note 18 of our consolidated financial statements included in this Annual Report on Form 10-K.

OUR AUTOMOBILE DEALERSHIPS

Importership/Dealership Agreements

Each of our importers operates under separate agreements with the manufacturers of each brand of vehicle. These agreements contain provisions and standards governing almost every aspect of the business, including ownership, management, personnel, training, maintenance of minimum working capital and in some cases net worth, maintenance of minimum lines of credit, advertising and marketing, facilities, signs, products and services, acquisitions of other dealerships (including restrictions on how many dealerships can be acquired or operated in any given market), maintenance of minimum amounts of insurance, achievement of minimum customer service standards and monthly financial reporting. Typically, the importer’s principal and/or the owner of the dealership may not be changed without the manufacturer’s consent.

6

In exchange for complying with these provisions and standards, we are currently granted the exclusive right to sell Ferrari and Maserati automobiles and related parts and services in Hong Kong and Macau, and we have also been granted the exclusive right to sell Ferrari and Maserati automobiles and related parts and services at our Dalian and Nanjing dealerships in Mainland China. The agreements also typically grant the exclusive license to use each manufacturer’s trademarks, service marks and designs in connection with our sales and service of its brands in our designated territories at our dealerships. Some of our franchise agreements are renewed annually. The agreements also permit the manufacturer to terminate or not renew the agreement for a variety of causes, including failure to adequately operate the dealership, insolvency or bankruptcy, impairment of the dealer’s reputation or financial standing, changes in the dealership’s management, owners or location without consent, failure to maintain adequate working capital, changes in the dealership’s financial or other condition, failure to submit required information to the manufacturer on a timely basis, failure to obtain and maintain any permit or license necessary to operate the dealership, and material breaches of other provisions of the agreement.

Store Operations

With the appointment of the Nanjing dealership in the Yangtze River Delta Economic Zone in 2008, Technorient now has eight authorized showrooms and after-sales parts and service facilities throughout Hong Kong, Macau, and Mainland China.

|

Location

|

Store

|

Franchises

|

Year Opened/Acquired

|

|||

|

Hong Kong

|

Tai Kok Tsui

|

Ferrari & Maserati

|

1990

|

|||

|

Hong Kong

|

Causeway Bay

|

Ferrari

|

1998

|

|||

|

Hong Kong

|

Ap Lei Chau

|

Ferrari & Maserati

|

2005

|

|||

|

Hong Kong

|

Wanchai

|

Maserati

|

2005

|

|||

|

Mainland China

|

Dalian

|

Ferrari & Maserati

|

2006

|

|||

|

Mainland China

|

Dalian

|

Ferrari & Maserati

|

2008

|

|||

|

Mainland China

|

Nanjing

|

Ferrari & Maserati

|

2008

|

|||

|

Hong Kong

|

Shatin

|

Ferrari & Maserati

|

2009

|

After-sale Service and Parts

Technorient’s automotive service and parts operations are an integral part of establishing customer loyalty and contribute significantly to our overall revenue and profits. Technorient’s service philosophy has always been based around a racing team type support structure, with 24 hour service, spare parts and consultation. This approach, developed from the auto racing background of Technorient’s key principals, has proven to be very successful in building long-term relationships with wealthy clients.

We provide parts and service primarily for the vehicle brands sold by our stores, but we also service other vehicles. In 2010, our service, body and parts operations generated approximately $11.5 million in revenues, or 7.2% of total revenues of Technorient. We set prices to reflect the varying difficulty of the types of repair and the cost and availability of parts. Revenues from the service and parts departments are particularly important during economic downturns as owners tend to repair their existing used vehicles rather than buy new vehicles during such periods. This helps to counter the effects of a drop in new vehicle sales that may occur in a slow economic environment. Technorient’s focus on service advisor training, as well as a number of pricing and cost saving initiatives across the entire service and parts business lines, have led to improvements in same-store service and parts sales in 2010 compared to 2009, as well as improvements in gross profit margins achieved. Further, our focus on satisfying the client in both the sales and after-sales areas has led to consistently high levels of recommendation and endorsement, and additional and repeat business, all of which has benefited Technorient for over thirty years.

7

SUPPLIERS

Our major suppliers are as follows:

|

ITEM

|

|

SOURCE AND LOCATION

|

|

Ferrari automobiles and automobile parts

|

Ferrari S.p.A., Maranello, Italy

|

|

|

Maserati automobiles and automobile parts

|

Maserati S.p.A., Modena, Italy

|

|

|

AgustaWestland helicopters (1)

|

Agusta S.p.A., Italy

|

|

(1)

|

We anticipate that delivery of AgustaWestland helicopters will begin during 2012.

|

SEASONAL VARIATIONS

Our business is modestly seasonal overall. Our operations generally experience higher volumes of vehicle sales in the fourth fiscal quarter of each year due in part to manufacturers’ production and delivery patterns.

ADVERTISING

Technorient’s commitment to maintaining the highest levels of service facilities and after sales service is supplemented by an active promotional program complemented by media events and classic/performance car rallies.

We conduct extensive product promotional advertising in several venues:

· Local television exposure;

· City promotional materials;

· Local print media; and

· On-site point-of-purchase.

We also maintain a web site (www.chinapremiumlifestyle.com) that generates leads and provides information for our customers. We use the Internet site as a marketing tool to familiarize customers with us, our stores and the products we sell, rather than to complete purchases. Although many customers use the Internet to research information about new vehicles, nearly all ultimately visit a store to complete the sale and take delivery of the vehicle.

BACKLOG ORDERS

The limited supply of cars by Ferrari and Maserati factories is a worldwide phenomenon due to the limited production capacity. We have many customers who have paid a deposit and are prepared to wait for years for new cars. As a result, we have backlog orders. Our backlog orders with our manufacturers as of December 31, 2010 were approximately $178.8 million compared to approximately $221.5 million at December 31, 2009.

MANAGEMENT INFORMATION SYSTEMS

We consolidate financial, accounting and other relevant data received from our operations in Hong Kong, Macau and Mainland China through a private communication system.

8

COMPETITION

In new and used vehicle sales, our operations compete primarily with other franchised dealerships of luxury vehicles in our markets. We rely on advertising and merchandising, sales expertise, service reputation, strong brand names and location of our operations to sell new vehicles. See “Risk Factors — OTHER BUSINESS OPERATING RISKS — Substantial competition in automobile sales may adversely affect our profitability due to our need to lower prices to sustain sales and profitability.”

We compete with other automobile dealers and franchised and independent service centers for non-warranty repair and routine maintenance business. We believe that the principal competitive factors in parts and service sales are the use of factory-approved replacement parts, factory-trained technicians, price, the familiarity with a manufacturer’s brands and models, and the quality of customer service.

We compete with other business entities for dealership rights in different areas of Mainland China. Some of our competitors may have greater financial resources and competition may increase the cost of acquiring such dealership rights.

ENVIRONMENTAL MATTERS

Technorient is subject to environmental laws and regulations in Hong Kong, Macau and Mainland China, including those governing discharges into the air and water, the installation, maintenance, operation and removal of aboveground and underground storage tanks, the use, handling, storage and disposal of hazardous substances and other materials and the investigation and remediation of contamination. As with automotive dealerships generally, and service, parts and body shop operations in particular, this business involves the generation, use, handling and contracting for recycling or disposal of hazardous or toxic substances or wastes, including environmentally sensitive materials such as motor oil, waste motor oil and filters, transmission fluid, antifreeze, refrigerant, waste paint and lacquer thinner, batteries, solvents, lubricants, degreasing agents, gasoline and diesel fuels. Similar to many of our competitors, Technorient has incurred and will continue to incur, capital and operating expenditures and other costs in complying with such laws and regulations. Various health and safety standards also apply to our operations.

We believe that Technorient does not have any material environmental liabilities and that compliance with environmental laws and regulations will not, individually or in the aggregate, have a material adverse effect on our results of operations, financial condition or cash flows. However, environmental laws and regulations are complex and subject to change. In addition, in connection with the opening of any new dealerships, it is possible that we will assume or become subject to new or unforeseen environmental costs or liabilities, some of which may be material. Compliance with current, amended, new or more stringent laws or regulations, stricter interpretations of existing laws or the future discovery of environmental conditions could require additional expenditures, and such expenditures could be material.

REGULATION

Our automobile business is subject to regulation, supervision and licensing under Hong Kong, Macau, and Chinese laws, ordinances and regulations. A number of regulations affect our business of marketing, selling, and servicing automobiles. Under the laws of the jurisdictions in which we currently operate or into which we may expand, we typically must obtain a license in order to establish, operate or relocate a dealership or operate an automotive repair service, including dealer, sales and/or automotive repair business licenses issued by relevant authorities. These laws also regulate our conduct of business, including our advertising, operating, employment and sales practices. Other laws and regulations include franchise laws and regulations, laws and regulations applicable to motor vehicle dealers, as well as wage-hour, anti-discrimination and other employment practices laws. We actively make efforts to assure compliance with these regulations.

9

EMPLOYEES

As of December 31, 2010, we employed approximately 214 full time employees. We believe we have good relationships with our employees. We are not party or subject to any collective bargaining agreements.

REPORTS TO SECURITY HOLDERS

We are subject to the informational requirements of Section 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, we file annual, quarterly and other reports and information with the SEC. You may read and copy these reports and other information we file at the SEC’s public reference room at 100 F Street, NE., Washington, D.C. 20549 on official business days from 10:00 am until 3:00 pm. You may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. Our filings are also available to the public from commercial document retrieval services and the Internet worldwide website maintained by the Securities and Exchange Commission at www.sec.gov. You may also request copies of our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act free of charge as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC by requesting copies of such reports in writing. Such written requests should be directed to our corporate secretary and sent to our executive offices at the address set forth below.

Our principle executive office is located at 28/F, King Palace Plaza, No. 52A Sha Tsui Road, Tsuen Wan, N.T. Hong Kong. Our website is http://www.chinapremiumlifestyle.com, our phone number is (+852) 2954-2469 and our email address is: ir@chinapremiumlifestyle.com.

10

ITEM 1A. RISK FACTORS

The following information describes certain significant risks and uncertainties inherent in our business. Some of these risks are described below and you should take these risks into account in evaluating us or any investment decision involving us. This section does not describe all risks applicable to us, our industry or our business, and it is intended only as a summary of certain material factors. You should carefully consider such risks and uncertainties, together with the other information contained herein and in the documents incorporated herein by reference. If any of the following risks and uncertainties, or if any other disclosed risks and uncertainties, actually occurs, our business, financial condition or operating results could be harmed substantially.

RISKS RELATED TO OUR BUSINESS

The global credit and banking crisis may negatively affect our business, results of operations, and financial condition.

The global financial crisis that began in 2007 and the subsequent economic recession and instability in the global financial system has had, and may continue to have, an impact on our business and our financial condition. If conditions in the financial markets do not improve, our ability to access the capital markets may be restricted at a time when we would like, or need, to access such markets, which could have an impact on our flexibility to react to changing economic and business conditions. The credit crisis could have an impact on any potential lenders or on our customers, causing them to fail to meet their obligations to us.

Our business could be impacted by these events and may be further impacted by: the insolvency of key channel partners impairing our distribution channels; counterparty failures negatively impacting our treasury functions, including timely access to our cash reserves; and increased expense or inability to obtain short-term financing if banks providing our line of credit are unable to lend us money when it is needed for our operations.

Our business and the automotive retail industry in general are susceptible to adverse economic conditions, including changes in consumer confidence and changes in fuel prices and credit availability, which could have a material adverse effect on our business, revenues and profitability.

We believe the automotive retail industry is influenced by general economic conditions and particularly by consumer confidence, the level of personal discretionary spending, interest rates, fuel prices, unemployment rates and credit availability. Historically, unit sales of motor vehicles, particularly new and used vehicles, have been cyclical, fluctuating with general economic cycles. During economic downturns, retail new vehicle sales typically experience periods of decline characterized by oversupply and weak demand. Although incentive programs initiated by manufacturers may abate these historical trends, the automotive retail industry may experience sustained periods of decline in vehicle sales in the future. Any decline or change of this type could have a material adverse effect on our business, revenues, cash flows and profitability.

In addition, local economic, competitive and other conditions affect the performance of our operations. Our revenues, cash flows and profitability depend substantially on general economic conditions and spending habits in Hong Kong, Macau and in those regions of Mainland China where Technorient maintains its operations.

11

Unrest and civil disturbances, particularly in oil-producing regions, may affect fuel prices, credit availability and consumer confidence in general, which could have a material adverse effect on our business, revenues and profitability.

Our vehicles are luxury items. In times of political unrest or instability, consumers may choose to defer planned purchases of luxury items.

The recent unrest in the Middle East has triggered rising crude oil prices as well as rising prices for the fuel powering our vehicles. Persistent unrest in oil-producing regions may cause fuel prices to rise further, which in turn may affect consumer preferences in connection with the purchase of our vehicles. Consumers may be less likely to purchase more expensive vehicles, such as luxury automobiles and more likely to purchase smaller, less expensive vehicles, or fuel-efficient, hybrid or electric vehicles. Further increases in fuel prices could have a material adverse effect on our business, revenues, cash flows and profitability.

RISKS RELATED TO AUTOMOTIVE MANUFACTURERS

If we fail to obtain a desirable mix of popular new vehicles from manufacturers our profitability will be negatively affected.

We depend on the manufacturers to provide us with a desirable mix of new vehicles. The most popular vehicles usually produce the highest profit margins and are frequently difficult to obtain from the manufacturers. If Technorient cannot obtain sufficient quantities of the most popular models, our profitability may be adversely affected. Sales of less desirable models may reduce our profit margins. Some principals generally allocate their vehicles amongst their importers/distributors based on their sales history. If our operations experience prolonged sales slumps, our allocation of popular vehicles may be reduced and new vehicle sales and profits may decline. Similarly, the delivery of vehicles, particularly newer, more popular vehicles, from manufacturers at a time later than scheduled could lead to reduced sales during those periods.

Adverse conditions affecting one or more automotive manufacturers may negatively impact our revenues and profitability.

Our success depends on the overall success of the line of vehicles that each of our operations sells. As a result, our success depends to a great extent on the automotive manufacturers’ financial condition, marketing, vehicle design, production and distribution capabilities and their reputations, management and labor relations. In 2010, sales of new Ferrari and Maserati vehicles accounted for 53% and 24%, respectively, of Technorient’s total revenues. A significant decline in the sale of new vehicles produced by these manufacturers, or the loss or deterioration of our relationships with one or more of these manufacturers, could have a material adverse effect on our results of operations, financial condition or cash flows. Events such as labor strikes that may adversely affect a manufacturer may also materially adversely affect us. In particular, labor strikes at a manufacturer or supplier that continue for a substantial period of time could have a material adverse effect on our business. Similarly, the delivery of vehicles from manufacturers at a time later than scheduled, which may occur particularly during periods of new product introductions, has led, and could in the future lead, to reduced sales during those periods. In addition, any event that causes adverse publicity involving one or more automotive manufacturers or their vehicles may have a material adverse effect on our results of operations, financial condition or cash flows.

12

If we fail to obtain renewals of one or more of our franchise agreements on favorable terms or substantial franchises are terminated, our operations may be significantly impaired.

Each of our businesses operates under a franchise agreement. Without a franchise agreement, we cannot obtain new vehicles from the manufacturer. As a result, we are significantly dependent on our relationships with these manufacturers, which exercise a great degree of influence over our operations through the franchise agreements. Each of our franchise agreements may be terminated or not renewed by the manufacturer for a variety of reasons, including any unapproved changes of ownership or management and other material breaches of the franchise agreements. We cannot guarantee all of our franchise agreements will be renewed or that the terms of the renewals will be as favorable to us as our current agreements. In addition, actions taken by manufacturers to exploit their bargaining position in negotiating the terms of renewals of franchise agreements or otherwise could also have a material adverse effect on our revenues and profitability.

Our results of operations may be materially and adversely affected to the extent that Technorient’s franchise rights become compromised or our operations restricted due to the terms of our franchise agreements or if we lose substantial franchises.

Technorient’s franchise agreements with Ferrari and Maserati do not give us the exclusive right to sell their products within Mainland China. As a result, the Shanghai JV may appoint additional dealers in neighboring cities that may indirectly compete against us. The appointment of new dealerships near our existing dealership could materially adversely affect our operations and reduce the profitability of our existing dealership.

Our success depends upon the continued viability and overall success of a limited number of manufacturers.

The following table sets forth the percentage of our new vehicle retail unit sales attributable to the manufacturers we represented during 2010 that accounted for 100% of our new vehicle retail unit sales:

|

Manufacturer

|

Percentage of New Vehicle Retail

Units Sold during the Twelve Months Ended

December 31, 2010

|

|

|

Ferrari

|

53%

|

|

|

Maserati

|

47%

|

Ferrari and Maserati vehicles represented 100% of our total new vehicle retail units sold in 2010. We are subject to a concentration of risk in the event of financial distress, including potential bankruptcy, of these vehicle manufacturers.

In the event of a bankruptcy by a vehicle manufacturer, among other things: (1) the manufacturer could attempt to terminate all or certain of our franchises, and we may not receive adequate compensation for them, (2) we may not be able to collect some or all of our significant receivables that are due from such manufacturer and we may be subject to preference claims relating to payments made by such manufacturer prior to bankruptcy, (3) such manufacturer may be unable to maintain an adequate, or any, supply of vehicles, and (4) consumer demand for such manufacturer’s products could be materially adversely affected.

Vehicle manufacturers may be adversely impacted by economic downturns or recessions, significant declines in the sales of their new vehicles, increases in interest rates, declines in their credit ratings, labor strikes or similar disruptions (including within their major suppliers), supply shortages or rising raw material costs, rising employee benefit costs, adverse publicity that may reduce consumer demand for their products (including due to bankruptcy), product defects, vehicle recall campaigns, litigation, poor product mix or unappealing vehicle design, or other adverse events. These and other risks could materially adversely affect any manufacturer and impact its ability to profitably design, market, produce or distribute new vehicles, which in turn could materially adversely affect our business, results of operations, financial condition, stockholders’ equity, cash flows and prospects.

13

Automotive manufacturers exercise significant control over our operations and we depend on them in order to operate our business.

Manufacturers exercise a great degree of control over our operations. For example, manufacturers can require us to meet specified standards of appearance, require us to meet specified financial criteria such as maintenance of minimum net working capital and, in some cases, minimum net worth, impose minimum customer service and satisfaction standards, set standards regarding the maintenance of inventories of vehicles and parts and govern the extent to which our businesses can utilize the manufacturers’ names and trademarks. In many cases the manufacturer must consent to the replacement of the principal.

If manufacturers discontinue sales incentives, warranties and other promotional programs, our results of operations may be materially adversely affected.

We depend on our manufacturers for sales incentives, warranties and other programs that are intended to promote dealership sales or support dealership profitability. Manufacturers historically have made many changes to their incentive programs during each year. Some of the key incentive programs include:

|

|

·

|

incentives on new vehicles; and

|

|

|

·

|

warranties on new and used vehicles.

|

A discontinuation or change in our manufacturers’ incentive programs could adversely affect our business.

Our manufacturers generally require that our premises meet defined image and facility standards and may direct us to implement costly capital improvements as a condition for renewing certain franchise agreements. All of these requirements could impose significant capital expenditures on us in the future.

Pursuant to our franchise agreements, our operations are required to maintain a certain minimum working capital, as determined by the manufacturers. This requirement could force us to utilize available capital to maintain manufacturer-required working capital levels thereby limiting our ability to apply profits generated from one subsidiary for use in other subsidiaries or, in some cases, at the parent company. These factors, either alone or in combination, could cause us to divert our financial resources to capital projects from uses that management believes may be of higher long-term value to us.

RISKS RELATED TO OUR ACQUISITION STRATEGY

Growth in our revenues and earnings will be impacted by our ability to acquire and successfully integrate and operate more dealerships in Mainland China.

Growth in our revenues and earnings depends substantially on our ability to acquire and successfully integrate and operate more dealerships in Mainland China. We cannot provide assurances that we will be able to identify and acquire or establish dealerships in the future. In addition, we cannot provide assurances that any acquisition will be successful or on terms and conditions consistent with past acquisitions. Restrictions by our manufacturers may directly or indirectly limit our ability to acquire additional dealerships. In addition, increased competition for acquisitions may develop, which could result in fewer acquisition opportunities available to us and/or higher acquisition prices. Some of our competitors may have greater financial resources than us.

14

We require additional capital in order to acquire or open additional dealerships. In the past, we have financed these acquisitions with a combination of cash flow from operations and proceeds from borrowings under our credit facilities.

We currently intend to finance future acquisitions or open new dealerships by using cash and issuing shares of our common stock as partial consideration for acquired dealerships. The use of common stock as consideration for acquisitions will depend on three factors: (1) the market value of our common stock at the time of the acquisition, (2) the willingness of potential acquisition candidates to accept common stock as part of the consideration for the sale of their businesses, and (3) our determination of what is in our best interests. If potential acquisition candidates are unwilling to accept our common stock, we will rely solely on available cash or proceeds from debt or equity financings, which could adversely affect our acquisition program. Accordingly, our ability to make acquisitions could be adversely affected if the price of our common stock is depressed.

Managing and integrating additional dealerships into our existing mix of dealerships may result in substantial costs, diversion of our management’s attention, delays, or other operational or financial problems.

Acquisitions involve a number of special risks, including:

· incurring significantly higher capital expenditures and operating expenses;

· failing to integrate the operations and personnel of the new or acquired dealerships;

· entering new markets with which we are not familiar;

· incurring undiscovered liabilities at new or acquired dealerships;

· disrupting our ongoing business;

· failing to obtain or retain key personnel at new or acquired dealerships;

· impairing relationships with employees, manufacturers and customers; and

· incorrectly valuing acquired entities,

some or all of which could have a material adverse effect on our business, financial condition, cash flows and results of operations. Although we conduct what we believe to be a prudent level of investigation regarding the operating condition of the businesses we purchase in light of the circumstances of each transaction, an unavoidable level of risk remains regarding the actual operating condition of these businesses.

Acquiring legal entities, as opposed to only dealership assets, may subject us to unforeseen liabilities that we are unable to detect prior to completing the acquisition or liabilities that turn out to be greater than those we had expected. These liabilities may include liabilities of the prior owner or operator that arise from environmental laws for which we, as a successor owner, may be responsible. Until we actually assume operating control of such business assets, we may not be able to ascertain the actual value of the acquired entity.

15

If we lose key personnel or are unable to attract additional qualified personnel, our business could be adversely affected because we rely on the industry knowledge and relationships of our key personnel.

We believe our success depends to a significant extent upon the efforts and abilities of our executive officers, senior management and key employees. Additionally, our business is dependent upon our ability to continue to attract and retain qualified personnel, including the management of acquired dealerships. The market for qualified employees in the industry and in the regions in which we operate, particularly for general managers and sales and service personnel, is highly competitive and may subject us to increased labor costs during periods of low unemployment.

The unexpected or unanticipated loss of the services of one or more members of our senior management team could have a material adverse effect on us and materially impair the efficiency and productivity of our operations. We do not have key man insurance for any of our executive officers or key personnel. In addition, the loss of any of our key employees or the failure to attract qualified managers could have a material adverse effect on our business and may materially impact the ability of our dealerships to conduct their operations.

OTHER BUSINESS OPERATING RISKS

Changes in interest rates could adversely impact our profitability.

Some of our borrowings under various credit facilities bear variable interest rates. Therefore, our interest expense will rise with increases in interest rates. Rising interest rates may also have the effect of depressing demand in the interest rate sensitive aspects of our business, particularly new and used vehicle sales, because some of our customers finance their vehicle purchases. As a result, rising interest rates may have the effect of simultaneously increasing our costs and reducing our revenues.

Our insurance does not fully cover all of our operational risks, and changes in the cost of insurance or the availability of insurance could materially increase our insurance costs or result in a decrease in our insurance coverage.

The operation of automobile dealerships is subject to compliance with a wide range of laws and regulations and is subject to a broad variety of risks. While we have some insurance coverage including material property damage and public liability insurance, we are self-insured for a portion of our potential liabilities. In certain instances, our insurance may not fully cover an insured loss depending on the magnitude and nature of the claim. Additionally, changes in the cost of insurance or the availability of insurance in the future could substantially increase our costs to maintain our current level of coverage or could cause us to reduce our insurance coverage and increase the portion of our risks that we self-insure.

We are subject to a number of risks associated with importing vehicles.

Our business involves the sale of new and used vehicles, vehicle parts or vehicles composed of parts that are manufactured outside Mainland China, Hong Kong and Macau. As a result, our operations are subject to customary risks associated with imported merchandise, including fluctuations in the value of currencies, import duties, exchange controls, differing tax structures, trade restrictions, transportation costs, work stoppages and general political and economic conditions in foreign countries.

The countries from which our products are imported may, from time to time, impose new quotas, duties, tariffs or other restrictions, or adjust presently prevailing quotas, duties or tariffs on imported merchandise. Any of those impositions or adjustments could affect our operations and our ability to purchase imported vehicles and parts at reasonable prices, which could have an adverse effect on our business.

16

The seasonality of the automobile retail business magnifies the importance of our fourth quarter results.

The automobile industry experiences seasonal variations in revenues. In Hong Kong, a higher amount of vehicle sales generally occurs in the fourth fiscal quarter of each year due in part to manufacturers’ production and delivery patterns, and the introduction of new vehicle models. Therefore, if conditions surface in the fourth quarter that depress or affect automotive sales, such as major geopolitical events, high fuel costs, depressed economic conditions or similar adverse conditions, our revenues for the year may be disproportionately adversely affected.

Substantial competition in automotive sales and services may adversely affect our profitability due to our need to lower prices to sustain sales and profitability.

The automotive retail industry is highly competitive. Depending on the geographic market, we compete with:

|

·

|

franchised automotive dealerships in our markets that sell similar makes of new and used vehicles that we offer, occasionally at lower prices than we do;

|

|

·

|

other national or regional affiliated groups of franchised dealerships;

|

|

·

|

private market buyers and sellers of used vehicles; and

|

|

·

|

independent service and repair shops.

|

As we seek to acquire or establish dealerships in new markets, we may face significant competition as we strive to gain market share. Some of our competitors may have greater financial, marketing and personnel resources and lower overhead and sales costs than we have. We typically rely on advertising, merchandising, sales expertise, service reputation and dealership location in order to sell new vehicles. Although our franchise agreements with Ferrari and Maserati grant us the exclusive right to sell their products within certain geographic areas, our revenues and profitability may be materially and adversely affected if competing dealerships expand their market share or are awarded additional franchises by manufacturers that supply our dealerships.

In addition to competition for vehicle sales, our dealerships compete with independent garages for non-warranty repair and routine maintenance business. Our dealerships compete with other automotive dealers, service stores and auto parts retailers in their parts operations. We believe that the principal competitive factors in service and parts sales are the quality of customer service, the use of factory-approved replacement parts, familiarity with a manufacturer’s brands and models, convenience, the competence of technicians, location, and price.

We are currently involved in legal proceedings. Although the Company’s demurrer challenging all claims against it was sustained and the court entered a judgment of dismissal dismissing the Company from the proceedings, the plaintiff may appeal the judgment or take other steps to pursue the claims asserted against the Company.

As discussed in greater detail in Part I, Item 3, Legal Proceedings, of this Report, we were made aware on or about December 1, 2009 that the Company was named as a co-defendant in a state court action, Addison-Davis Diagnostics, Inc. v. Edward W. Withrow, III, et al., California Superior Court, Ventura County, Case No. 56-2009-00361702-CU-FR-VTA. The plaintiff named the Company as a co-defendant in seven of the thirteen causes of action in the plaintiff’s second amended complaint, including claims for fraud, negligent misrepresentation, conversion (two claims), constructive trust, unjust enrichment and an accounting. The Company filed a demurrer challenging all claims asserted against it. Pursuant to an order dated February 7, 2011, the court sustained the Company’s demurrer to the plaintiff’s second amended complaint on all counts, without leave to amend. A judgment of dismissal was entered by the court on March 9, 2011. On March 10, 2011, a notice of entry of judgment was served on all parties to the action and the plaintiff has 60 days from such date to file a notice of appeal with the court. The Company continues to deny any alleged wrongdoing in connection with the claims asserted in the action and intends to vigorously defend those claims, including any appeal by the plaintiff of the court’s final judgment in the action or any other steps taken by the plaintiff to pursue the claims asserted against the Company in the action. At this time, we are unable to evaluate the likelihood of an outcome, favorable or unfavorable, with respect to any appeal or other steps taken by the plaintiff with respect to its claims or to estimate the amount or range of a possible loss. However, an adverse result in the action could have a material adverse effect on our operations.

17

Due to the nature of the automotive retailing business, we may be involved in legal proceedings or suffer losses that could have a material adverse effect on our business.

We will continue to be involved in legal proceedings in the ordinary course of business. A significant judgment against us, the loss of a significant license or permit, or the imposition of a significant fine could have a material adverse effect on our business, financial condition and future prospects. In addition, it is possible that we could suffer losses at individual dealerships due to fraud or theft.

We are subject to substantial regulation which may adversely affect our profitability and significantly increase our costs in the future.

A number of laws and regulations affect our business, including laws and regulations relating to business corporations generally and the environment. Any failure to comply with these laws and regulations may result in the assessment of administrative, civil, or criminal penalties, the imposition of remedial obligations or the issuance of injunctions limiting or prohibiting our operations. We must obtain various licenses in order to operate our businesses, including dealer, sales, finance and insurance-related licenses issued by authorities. These laws also regulate our conduct of business, including our advertising, operating, financing, employment and sales practices.

We are subject to a wide range of environmental laws and regulations, including those governing discharges into the air and water, the operation and removal of underground and aboveground storage tanks, the use, handling, storage and disposal of hazardous substances and other materials, and the investigation and remediation of contamination. As with automotive dealerships generally, and service, parts and body shop operations in particular, our business involves the use, storage, handling and contracting for recycling or disposal of hazardous materials or wastes and other environmentally sensitive materials. Operations involving the management of hazardous and non-hazardous materials are subject to Chinese, Hong Kong and Macau environmental regulations and statutes. Similar to many of our competitors, we have incurred and will continue to incur, capital and operating expenditures and other costs in complying with such environmental laws and regulations.

Further, environmental laws and regulations are complex and subject to change. The environmental regulatory structure is not well-developed in our markets and we may be exposed to sudden and drastic changes in this area which could require material expenditures by the Company. In addition, in connection with any acquisitions or openings of new dealerships, it is possible that we will assume or become subject to new or unforeseen environmental costs or liabilities, some of which may be material. In connection with our dispositions, or prior dispositions made by companies we acquire, we may retain exposure for environmental costs and liabilities, some of which may be material. We may be required to make material additional expenditures to comply with existing or future laws or regulations, or as a result of the future discovery of environmental conditions.

18

Our indebtedness and lease obligations could materially adversely affect our financial health, limit our ability to finance future acquisitions and capital expenditures, and prevent us from fulfilling our financial obligations.

Our indebtedness and lease obligations could have important consequences to you, including the following:

|

|

·

|

our ability to obtain additional financing for acquisitions, capital expenditures, working capital or general corporate purposes may be impaired in the future;

|

|

|

·

|

a portion of our current cash flow from operations must be dedicated to the payment of principal on our indebtedness, thereby reducing the funds available to us for our operations and other purposes;

|

|

|

·

|

some of our borrowings are and will continue to be at variable rates of interest, which exposes us to the risk of increasing interest rates; and

|

|

|

·

|

we may be substantially more leveraged than some of our competitors, which may place us at a relative competitive disadvantage and make us more vulnerable to changing market conditions and regulations.

|

Adverse conditions affecting the manufacturers may negatively impact our profitability.

The success of each of our businesses depends to a great extent on vehicle manufacturers’:

· financial condition;

· marketing efforts;

· vehicle design;

· production capabilities;

· reputation;

· management; and

· labor relations.

Adverse conditions affecting these and other important aspects of manufacturers’ operations and public relations may adversely affect our ability to market their automobiles to the public and, as a result, significantly and adversely affect our profitability.

19

Fluctuation in the value of Renminbi, the Macau Pataca and Hong Kong Dollar relative to other currencies may have a material adverse effect on our business and/or an investment in our shares.

The value of RMB, Hong Kong Dollar and the Macau Pataca against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions. Since 1994, the conversion of Renminbi (“RMB”) into foreign currencies, including Hong Kong and U.S. dollars, has been based on rates set by the People’s Bank of China, or PBOC, which are set daily based on the previous day’s Chinese interbank foreign exchange market rate and current exchange rates on the world financial markets. Since 1994, the official exchange rate for the conversion of RMB to U.S. dollars has generally been stable. On July 21, 2005, however, PBOC announced a reform of its exchange rate system. Under the reform, Renminbi is no longer effectively linked to the U.S. dollar but instead is allowed to trade in a tight 0.3% band against a basket of foreign currencies. If the RMB were to increase in value against the U.S. dollar, for example, mainland Chinese consumers would experience a reduction in the relative prices of goods and services, which may translate into a positive increase in sales. On the other hand, a decrease in the value of the RMB against the U.S. dollar would have the opposite effect and may adversely affect our results of operations. Any significant revaluation of RMB may materially and adversely affect our cash flows, revenues, earnings and financial position, and the value of, and any dividends payments. For example, an appreciation of RMB against the U.S. dollar or Hong Kong dollars would make any new RMB-denominated investments or expenditures more costly to us, to the extent that we need to convert U.S. dollars or Hong Kong dollars into RMB for such purposes. In addition, a strengthening of the U.S. dollar against the Hong Kong Dollar or the Macau Pataca, if it occurred, would adversely affect the value of your investment.

Our Business is Primarily Reliant on the Business of Technorient.

Our primary business is our 49% ownership interest in Technorient. As a result, our financial results are substantially dependent on the operational and financial results of Technorient. In the event that sales trends or economic conditions for Technorient decline, our financial results may be materially adversely affected.

RISKS RELATED TO DOING BUSINESS IN MAINLAND CHINA

Although only a small proportion of our business is currently conducted in Mainland China, it is our intention to expand our business portfolio in Mainland China in the future, in which case, the following risk factors should be addressed: