Attached files

| file | filename |

|---|---|

| EX-32.2 - KINGOLD JEWELRY, INC. | v216529_ex32-2.htm |

| EX-31.2 - KINGOLD JEWELRY, INC. | v216529_ex31-2.htm |

| EX-32.1 - KINGOLD JEWELRY, INC. | v216529_ex32-1.htm |

| EX-31.1 - KINGOLD JEWELRY, INC. | v216529_ex31-1.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended: December 31, 2010

|

||

|

or

|

||

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from: _____________ to _____________

|

||

KINGOLD JEWELRY, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-15819

|

13-3883101

|

|

(State or Other Jurisdiction

|

(Commission

|

(I.R.S. Employer

|

|

of Incorporation or Organization)

|

File Number)

|

Identification No.)

|

15 Huangpu Science and Technology Park

Jiang’an District

Wuhan, Hubei Province, PRC 430023

(Address of Principal Executive Office) (Zip Code)

(011) 86 27 65694977

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

||

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, $0.001 par value

|

The NASDAQ Capital Market

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

||

|

Common Stock, $0.001 par value

|

||

| (Title of Class) | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

o Yes x No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

Large accelerated filer o

|

Accelerated filer x

|

|

|

|

|

|

|

Non-accelerated filer o

|

Smaller reporting company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes x No

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant was approximately $119,413,112 as of June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter.

The number of shares of the registrant’s Common Stock outstanding as of March 29, 2011 was 49,803,666.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from the Proxy Statement relating to the 2011 Annual Meeting of Stockholders.

2010 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

4

|

|

Item 1A.

|

Risk Factors

|

13

|

|

Item 1B.

|

Unresolved Staff Comments

|

27

|

|

Item 2.

|

Properties

|

27

|

|

Item 3.

|

Legal Proceedings

|

28

|

|

Item 4.

|

(Removed and Reserved)

|

28

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

29

|

|

Item 6.

|

Selected Financial Data

|

31

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

32

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

41

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

42

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosures

|

42

|

|

Item 9A.

|

Controls and Procedures

|

42

|

|

Item 9B

|

Other Information

|

43

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

44

|

|

Item 11.

|

Executive Compensation

|

44

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

45

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

45

|

|

Item 14.

|

Principal Accounting Fees and Services

|

45

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

46

|

|

SIGNATURES

|

50

|

|

2

CAUTIONARY STATEMENT FOR PURPOSES OF THE “SAFE HARBOR” STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Statements in this report that are not historical facts or information are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “project,” “forecast,” “plan,” “believe,” “may,” “expect,” “anticipate,” “intend,” “planned,” “potential,” “can,” “expectation” and similar expressions, or the negative of those expressions, may identify forward-looking statements. Such forward-looking statements are based on management’s reasonable current assumptions and expectations. Such forward-looking statements involve risks, uncertainties and other factors, which may cause our actual results, levels of activity, performance or achievement to be materially different from any future results expressed or implied by such forward-looking statements, and there can be no assurance that actual results will not differ materially from management’s expectations. Such factors include, among others, the following:

|

|

•

|

our ability to implement the key initiatives of, and realize the gross and operating margins and projected benefits (in the amounts and time schedules we expect) from, our business strategy;

|

|

|

•

|

non-performance of suppliers on their sale commitments and customers on their purchase commitments;

|

|

|

•

|

non-performance of third-party service providers;

|

|

|

•

|

adverse conditions in the industries in which our customers operate, including a general economic downturn , a recession globally, or sudden disruption in business conditions, and our ability to withstand an economic downturn, recession, cost inflation, competitive or other market pressures, or conditions;

|

|

|

•

|

the effect of political, economic, legal, tax and regulatory risks imposed on us, including foreign exchange or other restrictions, adoption, interpretation and enforcement of foreign laws including any changes thereto, as well as reviews and investigations by government regulators that have occurred or may occur from time to time, including, for example, local regulatory scrutiny in China;

|

|

|

•

|

our ability to manage growth;

|

|

|

•

|

our ability to successfully identify new business opportunities and identify and analyze acquisition candidates, secure financing on favorable terms and negotiate and consummate acquisitions as well as to successfully integrate or manage any acquired business;

|

|

|

•

|

our ability to integrate acquired businesses;

|

|

|

•

|

the effect of economic factors, including inflation and fluctuations in interest rates and currency exchange rates, foreign exchange restrictions and the potential effect of such factors on our business, results of operations and financial condition;

|

|

|

•

|

our ability to retain and attract senior management and other key employees;

|

|

|

•

|

any internal investigations and compliance reviews of Foreign Corrupt Practices Act and related U.S. and foreign law matters in China and additional countries, as well as any disruption or adverse consequences resulting from such investigations, reviews, related actions or litigation;

|

|

|

•

|

changes in PRC or U.S. tax laws;

|

|

|

•

|

increased levels of competition, and competitive uncertainties in our markets, including competition from companies in the gold jewelry industry in the PRC, some of which are larger than we are and have greater resources;

|

|

|

•

|

the impact of the seasonal nature of our business, adverse effect of rising energy, commodity and raw material prices, changes in market trends, purchasing habits of our consumers and changes in consumer preferences;

|

|

|

•

|

our ability to protect our intellectual property rights;

|

|

|

•

|

the risk of an adverse outcome in any material pending and future litigations;

|

|

|

•

|

our access to cash and financing and ability to secure financing at attractive rates;

|

|

|

•

|

the success of our research and development activities;

|

|

|

•

|

our ability to comply with environmental laws and regulations; and

|

|

|

•

|

other risks, including those described in the “Risk Factors” discussion of this annual report

|

We undertake no obligation to update any such forward looking statement, except as required by law.

3

PART I

ITEM 1. BUSINESS

Our Business

Through a variable interest entity relationship with Wuhan Kingold Jewelry Company Limited, we believe that we are one of the leading professional designers and manufacturers of high quality 24 Karat gold jewelry and Chinese ornaments developing, promoting, and selling a broad range of products to the rapidly expanding jewelry market across the Peoples Republic of China. According to accreditations provided by the China Gold Association, we ranked as one of the top three gold jewelry manufacturers in China in both 2008 and 2009. We offer a wide range of in-house designed products including but not limited to gold necklaces, rings, earrings, bracelets, and pendants. We launch as many as 900 new products each month, and approximately 10,000 every year.

We have historically sold our products directly to distributors, retailers and other wholesalers, who then sell our products to consumers through retail counters located in both department stores and other traditional stand-alone jewelry stores. We sell our products to our customers at a price that reflects the market price of the base material, plus a mark-up reflecting our design fees and processing fees. Typically this mark-up ranges from 4 – 6% of the price of the base material.

We aim to become an increasingly important participant in the PRC’s gold jewelry design and manufacturing sector. In addition to expanding our design and manufacturing capabilities, our goal is to provide a large variety of gold products in unique styles and superior quality under our brand, Kingold.

We are located in Wuhan which is one of the largest cities in China; we produced approximately 26 tons of 24K gold products, as compared to 15.3 tons of 24K gold products in 2009.

Industry and Market Overview

The Global Market

According to the World Gold Council, worldwide demand for gold, including gold products and gold purchased for investment, increased in 2010 to 3,812 metric tons from approximately 3,385 metric tons in 2009 and approximately 3,805 metric tons in 2008. Jewelry has historically taken the largest share of final demand for gold, accounting for around 57% of total demand (2007 – 2009 average), worth approximately $55 billion at the annual average gold price in 2009. Worldwide demand for gold jewelry in 2010 was approximately 2,060 metric tons, which increased from approximately 1,747 and 2,186 metric tons in 2009 and 2008, respectively.

The PRC Market

China’s market for jewelry and other luxury goods is expanding rapidly, in large part due to China’s rapid economic growth. According to the State Bureau of Statistics of China, China’s real gross domestic product, or GDP, grew by approximately 10.7%, 11.4%, 9%, 8.7% and 10.3% in 2006, 2007, 2008, 2009 and 2010, respectively. Economic growth in China has led to greater levels of personal disposable income and increased spending among China’s expanding consumer base. According to the Economist Intelligence Unit, or EIU, private consumption has grown at a 9% compound annual growth rate, or CAGR, over the last decade. According to the World Gold Council, Chinese gold demand has increased by 106% from 2002 to an estimated 443 metric tons in 2009, or an average of 8% per annum during the same period. According to Global Industry Analysts, Inc., or GIA, the total market size for precious jewelry will exceed $18.2 billion in 2010. China has historically been the second largest gold consumer following India. Gold consumption in China is largely driven by the demand for gold jewelry, which accounts for 92% of gold consumption.

We believe that China’s gold jewelry market will continue to grow as China’s economy continues to develop. Because gold has long been a symbol of wealth and prosperity in China, demand for gold jewelry, particularly 24 Karat gold jewelry, is firmly embedded in the country’s culture. Gold has long been viewed as both a secure and accessible savings vehicle, and as a symbol of wealth and prosperity in Chinese culture. In addition, gold jewelry plays an important role in marriage ceremonies, child births and other major life events in China. Gold ornaments, often in the shapes of dragons, horses and other cultural icons, have long been a customary gift for newly married-couples and newly-born children in China. As China’s population becomes more urban, more westernized and more affluent, gold, platinum and other precious metal jewelry are becoming increasingly popular and affordable fashion accessories. The gold jewelry market is currently benefiting from rising consumer spending and rapid urbanization of the Chinese population. We believe that jewelry companies like us, with a developed distribution network, attractive designs and reliable product quality, are well-positioned to build up our brands and capture an increasing share of China’s growing gold jewelry market.

4

Our Strengths

We believe the following strengths contribute to our competitive advantages and differentiate us from our competitors:

We have a proven manufacturing capability.

We have developed seven proprietary processes which we believe are well integrated and are crucial to gold jewelry manufacturing, namely the processes for 99.9% gold hardening, rubber mould opening efficiency, solder-less welding, pattern carving, chain weaving, dewaxing casting, and our coloring methods.

We have a proven design capability.

We have a large and experienced in-house design team with a track record of developing products that are fashionable and well received in the jewelry market. We launch as many as 900 new products each month and approximately 10,000 every year. We are committed to further strengthening our design team and continuing to improve the quality and novelty of our products so as to capture increased market share in the high-end gold jewelry market.

We believe that we have a superior brand awareness in China.

We have established the Kingold brand through our focused sales and marketing efforts, and we believe it is well known in China. We continue to devote significant effort towards brand development and marketing in an attempt to enhance the market recognition of our products, such as our M gold jewelry line of products. Our brand awareness was demonstrated in part by “Kingold” being named a “Famous Brand in Hubei Province,” “Famous Brand in China,” and “Famous Jewelry Brand” by the General Administration of Quality Supervision and China Top Brand Strategy Promotion Committee in 2007. We believe these awards have added credibility to and strengthened customers’ confidence in our products. We have also participated in various exhibitions and trade fairs to promote our products and brands.

We have a well established distribution network throughout China.

We have been actively operating in this industry for more than eight years since the gold jewelry industry became open to the private sector in 2002. In the jewelry industry, a well established and maintained distribution network is critical to success. We have established stable and mutually beneficial business relationships with many business partners, including large distributors, wholesalers and retailers. These relationships are essential to our company, and provide a key competitive advantage for us. We have distributors in most provinces, municipalities and autonomous regions in PRC.

We believe that we have significant advantages when compared to our competitors in the areas of capacity, technology and talent.

We have expanded our capacity significantly in recent years. In 2010, we produced 24K gold jewelry and Chinese ornaments with a total weight of approximately 26 tons, as opposed to approximately 15.3 tons, 14.3 tons and 11 tons, in 2009, 2008 and 2007, respectively. We attach great importance to the continuous improvement of our technology. Our gold processing systems dramatically reduce waste during the manufacturing process to approximately just one gram per kilogram of gold. We were certified as a “High-tech and Innovative Company” by Wuhan Science and Technology Bureau for the 2004 and 2006 biennial periods.

We have been awarded 23 patents granted by the State Intellectual Property Office of the PRC, and have filed applications for three patents which have been accepted and are under review by the State Intellectual Property Office of the PRC. We have made significant investment in training and retaining our own in-house design and manufacturing team. We have an exclusive agreement with the China University of Geosciences, School of Jewelry in Wuhan, which provides us with new, unique and innovative designs by students majoring in jewelry design and jewelry processing technology. These designs are proprietary to us, so our competitors do not have access to these designs. We also provide internships to talented students at the School of Jewelry which provides us with access to the designs that we believe are best suited for strong consumer sales.

We are a member of the Shanghai Gold Exchange which has very limited membership.

We have been a member of the Shanghai Gold Exchange since 2003. Although the Chinese government eliminated the absolute restriction on trading gold in general, the right to purchase gold directly from the Shanghai Gold Exchange is limited. The Shanghai Gold Exchange implements a membership system and only members can buy gold through its trading system. There were only 163 members of the Shanghai Gold Exchange throughout China in 2010. Non-members who want to purchase gold must deal with members at a higher purchase price compared to that for members.

5

We have an experienced management team in the Chinese gold industry.

We have a strong and stable management team with valuable experience in the PRC jewelry industry. Zhihong Jia, Wuhan Kingold’s major shareholder and founder, has been working in this industry for more than ten years. Bin Zhao, our general manager, has over 19 years of experience in jewelry businesses administration. Other members of our senior management team all have significant experience in key aspects of our operations, including product design, manufacturing, and sales and marketing.

Our Strategy

Our goal is to be the leading designer, manufacturer of 24 Karat gold jewelry products in China. We intend to achieve our goal by implementing the following strategies:

We intend to increase our capacity.

We intend to continue to expand the production capacity. We are in the process of hiring and training more than 100 new employees at our manufacturing facility in order to meet demand. We also intend to consider sub-contracting opportunities in order to further expand capacity. Given the fragmentation of the PRC gold jewelry and design industry, we believe there may be attractive consolidation opportunities which could allow us to further increase our market share.

We plan to continue to specialize in the manufacture of 24 Karat gold jewelry.

We intend to leverage our experience in jewelry design to introduce new fashionable products with strong market recognition, such as our Mgold jewelry line of products. By investing significantly in research and development, we plan to design new product lines of 24 Karat gold jewelry to meet specific needs of our target customers. By staying on top of market trends, expanding our design team and capabilities, we plan to continue to increase our revenues and market share.

We intent to further promote and improve the use of our brand recognition.

We intend to make significant efforts in growing our brand recognition of our Kingold brand and strengthening our market. As part of the initiative, we plan to launch an advertising campaign over Chinese television networks to promote our gold jewelry products as well as through popular magazines throughout China. Through marketing and promotion of our high end product lines, we believe the credentials and reputation of our brand will be further enhanced.

We will increase the automation in our production line.

Our production lines use modern technologies and production techniques that we strive to continuously improve. We plan to increase the level of automation in our production lines, which will lower our average costs and expand our production capacity.

We intend to enlarge our PRC customer base.

We intend to strive to expand our PRC customer base by strengthening current relationships with distributors, retailers and other wholesalers in our existing markets. We also plan to expand upon our customer base by developing new relationships with strategic distributors and retailers in markets we have not yet penetrated and adding customers in the PRC.

Products

We currently offer a wide range of 24 Karat gold products including 99.9% and 99% pure gold necklaces, rings, earrings, bracelets, pendants and gold bars. We launch as many as 900 new products each month and approximately 10,000 every year.

6

Design and Manufacturing

We have adopted a systematic approach that we believe is rigorous to product design and manufacturing. We employ a senior design team with members educated by top art schools or colleges in China including an exclusive agreement with the China University of Geosciences, School of Jewelry (Wuhan), with an average of three to five years of experience. Our design team develops and generates new ideas from a variety of sources, including direct customer feedback, trade shows, and industry conferences. We generally test the market potential and customer appeal of our new products and services through a wide out-reach program in specific regions prior to full commercial launch. We have a large-scale production base that includes a 74,933 square feet factory, a dedicated design, sales and marketing team, and more than 500 company-trained employees. Our production lines include automated jewelry processing equipment and procedures that we can rapidly modify to accommodate new designs and styles.

Supply of Raw Materials

We purchase gold, our major raw material, directly from the Shanghai Gold Exchange, of which we are a member. The membership grants us a privilege to the purchase of gold from the Shanghai Gold Exchange which non-members do not have.

Security Measures

We believe that we implement the best of breed security measures to protect our assets, including our 24 Karat gold, which we believe are well beyond those of our competitors. Our comprehensive security measures include a 24 hour onsite police station with direct deployment of officers and instant access to the Wuhan city police department, security guards at each point of entry and who roam our facilities, security cameras (with video surveillance by both random and fixed cameras), and alarm systems in our warehouse. Our gold is stored in a state of the art vault with encryption and authentication technology which requires several designated management employees to open the vault who all have different access codes only known to a limited number of officers. Therefore, no one individual can open our vault without the access codes of the others. In addition, every employee or visitor is required to pass through a security check (metal screen, etc.) when he or she enters and leaves the jewelry production area. We review our security measures on an annual basis and regularly look to upgrade our systems after such review.

Quality Control

We consider quality control an important factor for our business success. We have a strict quality control system which is implemented by a well-trained team to ensure effective quality control over every step of our business operation, from design and manufacturing to marketing and sales. We have received ISO 9001 accreditation from the International Organization for Standardization (“ISO”) attesting to our quality control systems. In 2004 we were named an “Honest and Trustworthy Enterprise” from Hubei Quality Supervising and Administration Bureau.

Sales and Marketing

Currently we have over 332 wholesale and retail customers covering 17 provinces in China. Except for our on-site exhibition store we currently do not carry out retail sales of jewelry products. We have very stable relationships with our major customers who have generally increased order volume year by year.

Major Customers

During the year ended December 31, 2010, approximately 29.59% of our net sales were generated from our five largest customers as compared to 31.49% for the year ended December 31, 2009. Our largest customer during the past two years, Shenzhen Yuehao Jewelry Co., Ltd accounted for 6.10% of our net sales for the year ended December 31, 2010 and 7.83% for the year ended December 31, 2009.

Research and Development

We have our own Research and Development, R&D, center made up of a design group and a technical development group. In 2010, we spent $90,000 on new product development (including sponsoring design interns and recruiting top designers and technicians) and $10,000 in technology improvement. In 2009, we spent $85,000 on new product development (including sponsoring design interns and recruiting top designers and technicians) and $10,000 in technology improvement. We believe that our company is among the few jewelry manufacturers in PRC that is equipped with modern facilities and technology. Through years of research, we have developed seven techniques which have been key drivers to our competitive strength and operating success. These techniques include 99.99% gold hardening, rubber mould opening efficiency, solder-less welding, pattern carving, chain weaving, dewaxing casting, and our coloring methods. Our track record of technical innovation has resulted in the development and acquisition of industry-leading equipment. This equipment ensures that we are able to produce special patterns and styles efficiently.

7

Competition

The jewelry industry in China is highly fragmented and very competitive. No single competitor has a significant percentage of the overall market. We believe that the market may become even more competitive as the industry grows and/or consolidates.

We produce high-quality jewelry for which the demand has grown year by year as income levels in China have risen and customers continue to appreciate the high quality of our products. We believe Kingold is well known as a nationwide famous trademark which has substantially differentiated us from most of our competitors.

We compete with local jewelry manufacturers and large foreign multinational companies that offer products similar to ours. Examples of our competition include, but are not limited to, Zhejiang Sun & Moon Jewelry Group Co., Ltd., Shenzhen Bo Fook Jewelry Co., Ltd., Shenzhen Ganlu Jewelry Co., Ltd., Magfrey Jewelry Co., Ltd., and Guangdong Chaohongji Co., Ltd.

Intellectual Property

We rely on a combination of patent, trademark and trade secret protection and other unpatented proprietary information to protect our intellectual property rights and to maintain and enhance our competitiveness in the jewelry industry.

We currently have 24 patents granted by the State Intellectual Property Office of the PRC, two of which expire in 2018, and twenty one in 2020 and have filed applications for three patents which have been accepted and are under review by the State Intellectual Property Office of the PRC.

We have ten registered trademarks in China, three of which expire in 2017, one in 2019, and six in 2020 and have filed applications for registration of five trademarks which have been accepted and are currently under review by the Trademark Office of the State Administration for Industry and Commerce of the PRC. In particular, “Kingold” has been named as a “Famous Brand in Hubei Province,” “Famous Brand in China,” and “Famous Jewelry Brand” by the General Administration of Quality Supervision and China Top Brand Strategy Promotion Committee.

We have implemented and enhanced intellectual property management procedures in an effort to protect our intellectual property rights. However, there can be no assurance that our intellectual property rights will not be challenged, invalidated, or circumvented, that others will not assert intellectual property rights to technologies that are relevant to us, or that our rights will give us a competitive advantage. In addition, the laws of China may not protect our proprietary rights to the same extent as the laws in other jurisdictions.

PRC Government Regulations

We are subject to various PRC laws and regulations which are relevant to our business. Our business license permits us to design, manufacture, sell and market jewelry products to department stores throughout China, and allows us to engage in the retail distribution of our products. Any further amendment to the scope of our business will require additional government approvals. We cannot assure you that we will be able to obtain the necessary government approval for any change or expansion of our business.

Under the applicable PRC laws, supplies of precious metals such as platinum, gold and silver are highly regulated by certain government agencies, such as the People’s Bank of China. The Shanghai Gold Exchange is the only PBOC authorized supplier of precious metal materials and is our primary source of supply for our raw materials, which substantially consist of precious metals. We are required to obtain and hold several membership and approval certificates from these government agencies in order to continue to conduct our business. We may be required to renew such memberships and to obtain approval certificates periodically. If we are unable to renew these periodic membership or approval certificates, it would materially affect our business operations. We are currently in good standing with these agencies.

We have also been granted independent import and export rights. These rights permit us to import and export jewelry in and out of China. With the relatively lower cost of production in China, we intend to expand into overseas markets after the launch of our China-based retail plan. We do not currently have plans to import jewelry into China.

Environment Protection

Our production facilities in Wuhan are subject to environmental regulation by both the central government of the PRC and by local government agencies. We have obtained all necessary operating permits as required from the Environmental Protection Bureau, and believe that we are in compliance with local regulations governing waste production and disposal, and that our production facilities have met the public safety requirements regarding refuse, emissions, lights, noise and radiation. Since our commencement of operations, we have not been cited for any environmental violations. Since our production process creates almost no waste water or pollution, our costs for environmental compliance have been minimal. During 2008, our costs for environmental compliance were approximately $43,000, primarily devoted to the purchase of a water filter tower and air purification tower. In 2009 and 2010, our costs for environmental compliance were less than $5,000 and $6,000, respectively.

8

Tax

Wuhan Kingold was incorporated in the PRC and is subject to PRC income tax which is computed according to the relevant laws and regulations in the PRC. The applicable income tax rate is 25%.

Pursuant to the Provisional Regulation of China on Value-Added Tax, or VAT, and its implementing rules, all entities and individuals that are engaged in the sale of goods, the provision of repairs and replacement services and the importation of goods in China are generally required to pay VAT at a rate of 17.0% of the gross sales proceeds received, less any deductible VAT already paid or borne by the taxpayer.

Foreign Currency Exchange

Under the PRC foreign currency exchange regulations applicable to us, the Renminbi is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of Renminbi for capital account items, such as direct investment, loan, security investment and repatriation of investment, however, is still subject to the approval of the PRC State Administration of Foreign Exchange, or SAFE. Foreign-invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from the SAFE. Capital investments by foreign-invested enterprises outside of China are also subject to limitations, which include approvals by the Ministry of Commerce, the SAFE and the State Reform and Development Commission.

Dividend Distributions

Under applicable PRC regulations, foreign-invested enterprises in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a foreign-invested enterprise in China is required to set aside at least 10.0% of their after-tax profits each year to its general reserves until the accumulative amount of such reserves has reached 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of a foreign-invested enterprise has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

Employees

As of December 31, 2010, we had approximately 507 full time employees all of which are located in PRC, except for our chief financial officer. There are no collective bargaining contracts covering any of our employees. We believe our relationship with our employees is satisfactory. Our full time employees are entitled to employee benefits including medical care, work related injury insurance, maternity insurance, unemployment insurance and pension benefits through a Chinese government mandated multi-employer defined contribution plan. We are required to accrue for those benefits based on certain percentages of the employees’ salaries and make contributions to the plans out of the amounts accrued for medical and pension benefits. The total provisions and contributions made for such employee benefits was $165,035, $146,520 and $124,911 for the years ended December 31, 2010, 2009 and 2008, respectively. The Chinese government is responsible for the medical benefits and the pension liability paid to these employees.

Effective from January 1, 2008, the PRC has introduced a new labor contract law that enhances rights for the nation’s workers, including open-ended work contracts and severance payment, such Law requires employers to enter into labor contracts with their workers in writing, restricts the use of temporary laborers and makes it harder to lay off employees. It also requires that employees with a fixed-term contract shall be entitled to an indefinite-term contract after the fixed-term contract has been renewed twice. Although the new labor contract law would increase our labor costs, we do not anticipate there will be any significantly effects on our overall profitability in the near future since such amount was historically not material to our operating cost. Management anticipates this may be a step toward improving candidate retention for skilled workers. None of our employees are covered by a collective bargaining agreement. We believe that we have a good relationship with our employees.

9

Company History

Since December 2009, we have been engaged in the design, manufacturing and sale of gold jewelry in the People’s Republic of China, or PRC, via a variable interest entity relationship with Wuhan Kingold Jewelry Company Limited, or Wuhan Kingold, a PRC company.

We were initially incorporated in 1995 in Delaware as Vanguard Enterprises, Inc. In 1999, we changed our corporate name to Activeworlds.com, Inc. (and subsequently to Activeworlds Corp.) and through a wholly-owned subsidiary we provided internet software products and services that enabled the delivery of three-dimensional content over the internet. We operated that business until September 11, 2002 when we sold that business to our former management and we became a shell company with no significant business operations. As a result of the consummation of a reverse acquisition transaction as described below, on December 23, 2009, we ceased to be a shell company and became an indirect holding company for Wuhan Vogue-Show Jewelry Co., Limited, or Vogue-Show, through Dragon Lead Group Limited, or Dragon Lead.

Acquisition of Kingold and Name Change

In December 2009, we acquired 100% of Dragon Lead from the shareholders of Dragon Lead in a share exchange transaction pursuant to which the shareholders of Dragon Lead exchanged 100% ownership in Dragon Lead, for 33,104,234 shares of our common stock. As a result, Dragon Lead became our wholly owned subsidiary. Dragon Lead owns 100% of Vogue-Show and Vogue-Show controls Wuhan Kingold through a series of variable interest entity agreements. We currently operate through Dragon Lead and Vogue-Show.

In February 2010, we changed our name to Kingold Jewelry, Inc. to better reflect our business.

Organizational History of Dragon Lead and its Subsidiaries

Dragon Lead Group Limited, or Dragon Lead, a British Virgin Islands (BVI) corporation was incorporated in the BVI on July 1, 2008 as an investment holding company. Dragon Lead owns 100% of the ownership interest in Vogue-Show.

Vogue-Show was incorporated in the PRC as a wholly foreign owned enterprise, or WFOE, on February 16, 2009. Wuhan Kingold was incorporated in the PRC as a limited liability company on August 2, 2002 by Zhihong Jia, as the major shareholder, and Xue Su Yue who sold her shares in Wuhan Kingold to Zhihong Jia and Chen Wei in 2003. On October 26, 2007, Wuhan Kingold was restructured as a joint stock company limited by shares. Its business activities are principally the design and manufacture of gold ornaments in the PRC. Wuhan Kingold’s business license will expire on March 4, 2021 and is renewable upon expiration. The registered and paid-in capital of Wuhan Kingold is RMB 120 million.

The Vogue-Show/Wuhan Kingold VIE Relationship

On June 30, 2009, Vogue-Show entered into a series of agreements with Wuhan Kingold and shareholders holding 95.83% of the outstanding equity of Wuhan Kingold under which Wuhan Kingold agreed to pay 95.83% of its after-tax profits to Vogue-Show and shareholders owning 95.83% of Wuhan Kingold’s shares have pledged their and delegated their voting power in Wuhan Kingold to Vogue-Show. Such share pledge is registered with the PRC Administration for Industry and Commerce.

The VIE agreements, which are described below, cover 95.83% of the equity interest in Wuhan Kingold covering 46 of Wuhan Kingold’s 47 shareholders and were created so that upon the closing of the reverse acquisition, as described below, we would be able to acquire control over Wuhan Kingold, as explained below. The balance of 4.17% of the equity interest in Wuhan Kingold is held by Beijing Shouchuang Investment Co. Ltd, a PRC State Owned Enterprise.

These contractual arrangements enable us to:

|

•

|

exercise effective control over our variable interest entity, Wuhan Kingold;

|

|

•

|

receive substantially all of the economic benefits from variable interest entity, Wuhan Kingold; and

|

|

•

|

have an exclusive option to purchase 95.83% of the equity interest in our variable interest entity, Wuhan Kingold, when and to the extent permitted by PRC law.

|

Through such arrangement, Wuhan Kingold has become Vogue-Show’s contractually controlled affiliate. In addition, Wuhan Kingold shareholders agreed to grant Vogue-Show a ten-year option to purchase a 95.83% equity interest in Wuhan Kingold at a price based on an appraisal provided by an asset evaluation institution which will be jointly appointed by Vogue-Show and the Wuhan Kingold shareholders. Concurrently, Wuhan Kingold agreed to grant Vogue-Show a ten-year option to purchase all of Wuhan Kingold’s assets at a price based on an appraisal provided by an asset evaluation institution which will be jointly appointed by Vogue-Show and Wuhan Kingold.

10

The VIE Agreements

Our relationship with Wuhan Kingold and its shareholders are governed by a series of contractual arrangements, which agreements provide as follows.

Exclusive Management Consulting and Technical Support Agreement. On June 30, 2009, Vogue-Show entered into an Exclusive Management Consulting and Technical Support Agreement with Wuhan Kingold, which agreement provides that Vogue-Show will be the exclusive provider of management consulting services to Wuhan Kingold, and obligated Vogue-Show to provide services to fully manage and control all internal operations of Wuhan Kingold, in exchange for receiving 95.83% of Wuhan Kingold’s profits. Payments will be made on a monthly basis. The term of this agreement will continue until it is either terminated by mutual agreement of the parties or until such time as Vogue-Show shall acquire 95.83% of the equity or assets of Wuhan Kingold.

Shareholders’ Voting Proxy Agreement. On June 30, 2009, shareholders holding 95.83% of the equity interest in Wuhan Kingold entered into a Shareholders’ Voting Proxy Agreement authorizing Vogue-Show to exercise any and all shareholder rights associated with their ownership in Wuhan Kingold, including the right to attend and vote their shares at shareholders’ meetings, the right to call shareholders’ meetings and the right to exercise all other shareholder voting rights as stipulated in the Articles of Association of Wuhan Kingold. The term of this agreement will continue until it is either terminated by mutual agreement of the parties or until such time as Vogue-Show shall acquire 95.83% of the equity or assets of Wuhan Kingold.

Purchase Option Agreement. On June 30, 2009, shareholders holding 95.83% of the equity interest in Wuhan Kingold entered into a Purchase Option Agreement with Vogue-Show, which provides that Vogue-Show will be entitled to acquire such Shareholders’ shares in Wuhan Kingold upon certain terms and conditions, if such a purchase is or becomes allowable under PRC laws and regulations. The Purchase Option Agreement also grants to Vogue-Show an option to purchase all of the assets of Wuhan Kingold. The exercise price for either the shares or the assets are to be as determined by a qualified third party appraiser. The term of this agreement is ten years from the date thereof.

Pledge of Equity Agreement On June 30, 2009, shareholders holding 95.83% of the equity interest in Wuhan Kingold entered in Pledge of Equity Agreement, pursuant to which each such shareholder pledges all of his shares of Wuhan Kingold to Vogue-Show, in order to guarantee performance under the Exclusive Management Consulting and Technical Support Agreement, Shareholders’ Voting Proxy Agreement and the Purchase Option Agreement. If Wuhan Kingold or any of its respective shareholders breaches its respective contractual obligations, Vogue-Show, as pledgee, will be entitled to certain rights, including the right to foreclose on the pledged equity interests.

Reverse Acquisition and Private Placement

On September 29, 2009, we entered into an Agreement and Plan of Reverse Acquisition with Vogue-Show, Dragon Lead, and the stockholders of Dragon Lead, or the Dragon Lead Stockholders. Pursuant to the acquisition agreement, we agreed to acquire 100% of the issued and outstanding capital stock of Dragon Lead in exchange for the issuance of 33,104,234 newly issued shares of our common stock. The acquisition agreement closed on or about December 23, 2009. Following the closing, Dragon Lead became our wholly-owned subsidiary.

The purpose of the reverse acquisition was to acquire control over Wuhan Kingold. We did not acquire Wuhan Kingold directly through the issuance of stock to Wuhan Kingold’s stockholders because under PRC law it is uncertain whether a share exchange would be legal. We instead chose to acquire control of Wuhan Kingold through the acquisition of Vogue Show and the VIE arrangements previously described in this annual report on Form 10-K. Certain rules and regulations in the PRC restrict the ability of non-PRC companies that are controlled by PRC residents to acquire PRC companies. There is significant uncertainty as to whether these rules and regulations require transactions of the type contemplated by our VIE arrangements, or of the type contemplated by the Call Option described below, to be approved by the PRC Ministry of Commerce, the China Securities and Regulatory Commission, or other agencies. For a discussion of the risks and uncertainties arising from these PRC rules and regulations, see “Risk Factors — Risks Related to Doing Business in the PRC — Recent PRC regulations relating to acquisitions of PRC companies by foreign entities may create regulatory uncertainties that could restrict or limit our ability to operate. Our failure to obtain the prior approval of the China Securities Regulatory Commission, or CSRC for the listing and trading of our common stock could have a material adverse effect on our business, operating results, reputation and trading price of our common stock,” beginning on page 21.

11

On December 23, 2009, immediately prior to the closing of the reverse acquisition, we completed a private placement with 14 investors. Pursuant to a securities purchase agreement entered into with the investors, we sold an aggregate of 5,120,483 newly issued shares of our common stock at $0.996 per share, for aggregate gross proceeds of approximately $5.1 million. The investors in the private placement also received five-year warrants to purchase up to 1,024,096 shares of common stock at the price of $0.996 per share. After commissions and expenses, we received net proceeds of approximately $4.55 million in the private placement. In addition, five-year warrants to purchase up to 1,536,145 shares of common stock at the price of $0.996 per share were issued to various consultants who assisted in the transaction.

All share and per share information for dates prior to August 10, 2010 concerning our common stock in the above discussion reflects a 1-for-2 reverse stock split.

As a result of the above transactions, we ceased being a “shell company” as defined in Rule 12b-2 under the Securities Act.

Also, on December 23, 2009, Fok Wing Lam Winnie (whose Mandarin name is Huo Yong Lin), the sole shareholder of Famous Grow and the majority shareholder of Dragon Lead prior to the closing of the reverse acquisition, entered into a call option agreement, as amended and restated, or call option, with Zhihong Jia and Bin Zhao to comply with PRC regulations that restrict PRC residents from owning offshore entities like us in direct exchange for their shares in the PRC operating company and as an inducement to encourage them to provide services to Wuhan Kingold and our company. The call option does not include a vesting schedule and continued employment is not a condition to the call option. Under the call option, as amended and restated, Fok Wing Lam Winnie granted to Zhihong Jia and Bin Zhao the right to acquire up to 100% of the shares of Famous Grow at an exercise price of $1.00, which is par value per share, or $0.001 per Famous Grow share, subject to any exercise notice at any time for a period of five years which was determined in an arm's length negotiation with the parties. While it is the case that our PRC counsel believes that this arrangement is lawful under PRC laws and regulations, there are, substantial uncertainties regarding the interpretation and application of current and future PRC laws and regulations, including regulations governing the validity and legality of such call options. Accordingly, we cannot assure you that PRC government authorities will not ultimately take a view contrary to the opinion of our PRC legal counsel. For a discussion of the risks and uncertainties arising from these PRC rules and regulations, see “Risk Factors — Risks Related to Doing Business in the PRC — Recent PRC regulations relating to acquisitions of PRC companies by foreign entities may create regulatory uncertainties that could restrict or limit our ability to operate. Our failure to obtain the prior approval of the China Securities Regulatory Commission, or CSRC for the listing and trading of our common stock could have a material adverse effect on our business, operating results, reputation and trading price of our common stock,” beginning on page 21.

Additionally, on December 23, 2009, immediately following the closing, Famous Grow Holdings Limited, a BVI limited liability company, or Famous Grow, Dragon Lead’s majority shareholder prior to the closing, together with Zhihong Jia, our chief executive officer and founder of Wuhan Kingold and Bin Zhao, our general manager, entered into a make good escrow agreement with the investors, pursuant to which, Famous Grow deposited a total of 1,895,609 of shares of common stock into an escrow account as “make good shares.” In the event that our after-PRC-tax net income for the years ended December 31, 2009, 2010 and 2011, is less than 70% of RMB 65.0 million, RMB 100.0 million and RMB 150.0 million, respectively, as set forth in the make good escrow agreement, part or all of the escrowed make good shares will be transferred to private placement investors on pro rata basis. Pursuant to the Make Good Escrow Agreement, 1,263,740 shares out of 1,895,609 shares (or 1/3 of the shares per year) are no longer subject to the escrow and none of such shares have been acquired from Famous Grow. Our after-PRC-tax net income for the year ended December 31, 2010 exceeded 70% of RMB 100.0 million and therefore, no “make good shares” were transferred as of December 31, 2010.

12

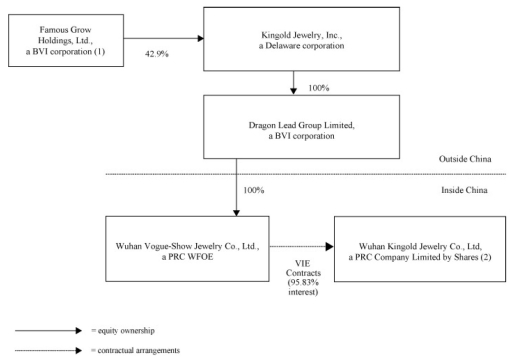

The following diagram illustrates our corporate structure as of the date of this annual report:

Notes:

|

|

(1)

|

Famous Grow is owned by Fok Wing Lam Winnie (whose Mandarin name is Huo Yong Lin). Pursuant to a Call Option Agreement, our founder, chairman and chief executive officer Zhihong Jia, and general manager and director, Bin Zhao, have a right to collectively acquire 100% of the ownership of Famous Grow.

|

|

|

(2)

|

Wuhan Kingold is 55.31% owned by Zhihong Jia, our founder, chairman and chief executive officer, 1.67% owned by Bin Zhao, our general manager and director, 4.17% owned by Beijing Shouchuang Investment Co. Ltd., a PRC state owned enterprise, with the balance of 38.85% owned by a total of 44 other shareholders, who are all PRC citizens. All of Wuhan Kingold’s shareholders, other than Beijing Shouchuang Investment Co. Ltd., have entered into the VIE agreements.

|

ITEM 1A. RISK FACTORS

You should carefully consider each of the following risks associated with an investment in our publicly traded securities and all of the other information in our 2010 Annual Report. Our business may also be adversely affected by risks and uncertainties not presently known to us or that we currently believe to be immaterial. If any of the events contemplated by the following discussion of risks should occur, our business, prospects, financial condition and results of operations may suffer.

Risks Related to our Business

Jewelry purchases are discretionary, may be particularly affected by adverse trends in the general economy, and an economic decline will make it more difficult to generate revenue.

The success of our operations depends, to a significant extent, upon a number of factors relating to discretionary consumer spending in China. These factors include economic conditions and perceptions of such conditions by consumers, employment rates, the level of consumers’ disposable income, business conditions, interest rates, consumer debt levels, availability of credit and levels of taxation in regional and local markets in China where we manufacture and sell our products. There can be no assurance that consumer spending on jewelry will not be adversely affected by changes in general economic conditions in China and globally.

13

While the Chinese economy has experienced rapid growth in recent years, such growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth can lead to growth in the money supply and rising inflation. During the past two decades, the rate of inflation in China has been as high as approximately 20%. If prices for our products rise at a rate that is insufficient to compensate for the rise in the costs of supplies such as raw materials, it may have an adverse effect on our profitability. During the recent global economic slowdown, the People’s Bank of China or PBOC set the interest rate at a rather low level and the central government implemented a several trillion of RMB stimulus plan which has brought increased liquidity into the market. However, if the global economy continues to recover it is very likely that PBOC will increase the interest rate. Significant increases in interest rates by the central bank could slow economic activity in China which may, in turn, materially increase our costs and reduce demand for our products.

Most of our sales are of products that include gold, precious metals and other commodities, and fluctuations in the availability and pricing of commodities would adversely impact our ability to obtain and make products at favorable prices.

The jewelry industry generally is affected by fluctuations in the price and supply of diamonds, gold, and, to a lesser extent, other precious and semi-precious metals and stones. In the past, we have not hedged our requirement for gold or other raw materials through the use of options, forward contracts or outright commodity purchasing. A significant increase in the price of gold could increase our production costs beyond the amount that we are able to pass on to our customers, which would adversely affect our sales and profitability. A significant disruption in our supply of gold, or other commodities could decrease our production and shipping levels, materially increase our operating costs and materially and adversely affect our profit margins. Shortages of gold, or other commodities, or interruptions in transportation systems, labor strikes, work stoppages, war, acts of terrorism, or other interruptions to or difficulties in the employment of labor or transportation in the markets in which we purchase our raw materials, may adversely affect our ability to maintain production of our products and sustain profitability. Although we generally attempt to pass increased commodity prices to our customers, there may be circumstances in which we are not able to do so. In addition, if we were to experience a significant or prolonged shortage of gold, we would be unable to meet our production schedules and to ship products to our customers in a timely manner, which would adversely affect our sales, margins and customer relations.

Furthermore, the value of our inventory may be affected by commodity prices. We record the value of our inventory using the weighted average method. As a result, decreases in the market value of precious metals such as gold would result in a lower stated value of our inventory, which may require us to take a charge for the decrease in the value of our inventory.

Competition in the jewelry industry could cause us to lose market share, thereby materially and adversely affecting our business, results of operations and financial condition.

The jewelry industry in China is highly fragmented and very competitive. We believe that the market may become even more competitive as the industry grows and/or consolidates. We compete with local jewelry manufacturers and large foreign multinational companies that offer products that are similar to ours. Some of these competitors have larger local or regional customer bases, more locations, more brand equity, and substantially greater financial, marketing and other resources than we have. As a result of this increasing competition, we could lose market share, thereby materially and adversely affecting our business, results of operations and financial condition.

We may need to raise additional funds in the future. These funds may not be available on acceptable terms or at all, and, without additional funds, we may not be able to maintain or expand our business.

Our operations require substantial funds to finance our operating expenses, to maintain and expand our manufacturing, marketing and sales capabilities and to cover public company costs. Without these funds, we may not be able to meet our goals.

We may seek additional funding through public or private financing or through collaborative arrangements with strategic partners. However, you should also be aware that in the future:

|

|

•

|

we cannot be certain that additional capital will be available on favorable terms, if at all;

|

|

|

•

|

any available additional financing may not be adequate to meet our goals; and

|

|

|

•

|

any equity financing would result in dilution to stockholders.

|

If we cannot raise additional funds when needed, or on acceptable terms, we may not be able to effectively execute our growth strategy (including entering the retail market), take advantage of future opportunities, or respond to competitive pressures or unanticipated requirements. In addition, we may be required to scale back or discontinue expansion plans, or obtain funds through strategic alliances that may require us to relinquish certain rights.

14

Our ability to maintain or increase our revenue could be harmed if we are unable to strengthen and maintain our brand image.

We believe that primary factors in facilitating customer buying decisions in China’s jewelry sector include price, confidence in the merchandise sold, and the level and quality of customer service. The ability to differentiate our products from competitors’ by our brand-based marketing strategies is a key factor in attracting consumers, and if our strategies and efforts to promote our brand, such as television and magazine advertising and beauty contest sponsorships fail to garner brand recognition, our ability to generate revenue may suffer. If we are unable to differentiate our products, our ability to sell our products wholesale and our planned sale of products retail will be adversely affected. If we fail to identify or react appropriately or timely to customer buying decisions, we could experience a reduction in consumer recognition of our products, a diminished brand image, higher markdowns, and costs to recast overstocked jewelry. These factors could result in lowering selling prices and sales volumes for our products, which could adversely affect our financial condition and results of operations

There is only one source in China for us to obtain the precious metals used in our jewelry products; accordingly, any interruptions of our arrangement with this source would disrupt our ability to fulfill customer orders and substantially affect our ability to continue our business operations.

Under the PRC law, supply of precious metals such as platinum, gold, and silver are highly regulated by PRC government agencies. The Shanghai Gold Exchange is the only supplier in China for gold used for our jewelry products. We are required to obtain and maintain several membership and approval certificates from government agencies in order to do business involving precious metals. The loss of our relationship or failure to renew our membership with the Shanghai Gold Exchange, or its inability to furnish precious metals to us as anticipated in terms of cost, quality, and timeliness, would adversely affect our ability to fulfill customer orders in accordance with our required delivery, quality, and performance requirements. If this situation were to occur, we would not have any alternative suppliers in China to obtain our raw materials from, which would result in a decline in revenue and revenue potential, and ultimately risk the overall continuation of our business operations.

If we are not able to adapt to changing jewelry trends in China, our inventory may be overstocked and we may be forced to reduce the price of our overstocked jewelry or incur the cost to recast it into new jewelry.

Our jewelry sales depend on consumer fashions, preferences for jewelry and the demand for particular products in China. Jewelry design trends in China can change rapidly. The ability to accurately predict future changes in taste, respond to changes in consumer preferences, carry the inventory demanded by customers, deliver the appropriate quality, price products correctly and implement effective purchasing procedures, all have an important influence on determining sales performance and maximizing gross margin. If we fail to anticipate, identify or react appropriately to changes in styles and trends, we could experience excess inventories, higher than normal markdowns or an inability to sell our products. If such a situation were to exist, we would need to incur additional costs to recast our products to fit the demand, and the labor and manufacturing costs previously invested in the recast products would be lost.

Our failure to manage growth effectively could have an adverse effect on our employee efficiency, product quality, working capital levels, and results of operations.

We intend to develop the retail distribution of our products, which we believe will result in rapid growth, but will also place significant demands on our managerial, operational and financial resources. Any significant growth in the market for our current wholesale business and our planned retail distribution would require us to expand our managerial, operational, financial, and other resources. During any period of growth, we may face problems related to our operational and financial systems and controls, including quality control and delivery and service capabilities. We also will need to continue to expand, train and manage our employee base. If we are unable to successfully build these skills and expand our number of skilled management and staff, we may be unsuccessful in achieving our intended level of growth.

Aside from increased difficulties in the management of human resources, we may also encounter working capital issues, as we will need increased liquidity to finance the purchases of raw materials and supplies, development of new products and the hiring of additional employees. Our failure to manage growth effectively may lead to operational and financial inefficiencies that will have a negative effect on our profitability. We cannot assure you that we will be able to timely and effectively meet that demand and maintain the quality standards required by our existing and potential customers.

We rely on our distribution network for virtually all of our revenues. Failure to maintain good distributor relations could materially disrupt our distribution business and harm our net sales.

Our business depends directly on the performance of our more than 200 distributors, which we also refer to as our customers. Our largest distributor accounted for approximately 6.10% and 7.83% of our gross revenues in 2010 and 2009, respectively. As we do not have long-term contracts with our distributors, it is critical that we maintain good relationships with them. However, maintaining good relationships with existing distributors and replacing any distributor is difficult and time consuming. Our failure to maintain good relationships with our distributors could materially disrupt our distribution business and harm our net sales.

15

Substantial defaults by our customers on accounts receivable could have a material adverse effect on our liquidity and results of operations.

As with most businesses in our industry, a substantial portion of our working capital consists of accounts receivable from customers. If customers responsible for a significant amount of accounts receivable were to become insolvent or otherwise unable to pay for our products, or to make payments in a timely manner, our liquidity and results of operations could be materially adversely affected. An economic or industry downturn could materially adversely affect the servicing of these accounts receivable, which could result in longer payment cycles, increased collections costs and defaults in excess of management’s expectations. In addition, as we increase our presence in the retail market, we expect the aging of our accounts receivable generated from sales through retail counters to increase as department stores typically defer payments to us of cash receipts collected by them on our behalf. A significant deterioration in our ability to collect on accounts receivable could affect our cash flow and working capital position and could also impact the cost or availability of financing available to us.

We must maintain a relatively large inventory of our raw materials and jewelry products to support customer delivery requirements, and if this inventory is lost due to theft, our results of operations would be negatively impacted.

We purchase large volumes of precious metals and store significant quantities of raw materials and jewelry products at our warehouse and show room in Wuhan, China. Although we have an inventory security system in place, we may be subject to future significant inventory losses due to third-party or employee theft from our warehouses or other forms of theft. The implementation of enhanced security measures beyond those that we already utilize, which include onsite police station with direct deployment of officers and instant access to Wuhan city police department, security cameras, and alarm systems in our warehouse, would increase our operating costs. Also, any such losses of inventory could exceed the limits of, or be subject to an exclusion from, coverage under our insurance policies. Claims filed by us under our insurance policies could lead to increases in the insurance premiums payable by us or the termination of coverage under the relevant policy.

Our business could be materially adversely affected if we cannot protect our intellectual property rights.

We have developed trademarks, patents, know-how, trade-names and other intellectual property rights that are of significant value to us. In particular, we have applied for patents on a limited number of designs of our jewelry products and trademarks as well. However, the legal regime governing intellectual property in the PRC is still evolving and the level of protection of intellectual property rights in the PRC may differ from those in other jurisdictions. Thus, it may be difficult to enforce our rights relating to these designs as well as our trademarks. Any unauthorized use of, or other infringement upon our designs or trademarks, could result in potential sales being diverted to such unauthorized sellers, and dilute the value of our brand.

We are dependent on certain key personnel, and the loss of these key personnel could have a material adverse effect on our business, financial conditions and results of operations.

Our success, to a great extent, has been attributable to the management, sales and marketing, and operational and technical expertise of certain key personnel. Moreover, our daily operation and performance rely heavily upon our senior management. There can be no assurance that we will be able to retain these officers or that such personnel may not receive and/or accept competing offers of employment. The loss of a significant number of these employees could have a material adverse effect upon our business, financial condition, and results of operations. We do not maintain key-man life insurance for any of our senior management.

We have short-term outstanding borrowings, and we may not be able to obtain extensions when they become mature.

Our notes payable to banks for short-term borrowings as of December 31, 2010 and 2009 were approximately $6.1 million and $8.8 million, respectively. These loans are either collateralized by our buildings, plant and machinery or guaranteed by a third party guarantor at the cost of certain guaranty fees. Interest expense paid for the years ended December 31, 2010, 2009 and 2008 were $479,133, $703,500 and $1,393,130, respectively, and fees paid to a third party guarantor for the years ended December 31, 2010, 2009 and 2008 were $67,719, $180,827 and $342,626, respectively. Our notes payable for short-term borrowing as of December 31, 2010 was approximately $6.1 million and bore an annual interest rate of 5.5755%. Generally, these short-term loans mature in one year or less and contain no renewal terms. However, in China, it is custom practice for banks and borrowers to negotiate roll-over or renewals of short-term borrowing on an on-going basis shortly before maturity.

16

Although we have renewed our borrowings in the past, we cannot assure you that we will be able to renew these loans in the future as they become mature. If we are unable to obtain renewals of these loans or sufficient alternative funding on reasonable terms from banks or other parties, we will have to repay these borrowings with the cash on our balance sheet or cash generated by our future operations, if any. We cannot assure you that our business will generate sufficient cash flow from operations to repay these borrowings.

Our quarterly results may fluctuate because of many factors and, as a result, investors should not rely on quarterly operating results as indicative of future results.

Fluctuations in operating results or the failure of operating results to meet the expectations of public market analysts and investors may negatively impact the value of our securities. Quarterly operating results may fluctuate in the future due to a variety of factors that could affect revenues or expenses in any particular quarter. Fluctuations in quarterly operating results could cause the value of our securities to decline. Investors should not rely on quarter-to-quarter comparisons of results of operations as an indication of future performance. As a result of the factors listed below, it is possible that in future periods the results of operations may be below the expectations of public market analysts and investors. This could cause the market price of our securities to decline. Factors that may affect our quarterly results include:

|

|

•

|

vulnerability of our business to a general economic downturn in China;

|

|

|

•

|

fluctuation and unpredictability of costs related to the gold, platinum and precious metals and other commodities used to manufacture our products;

|

|

|

•

|

seasonality of our business;

|

|

|

•

|

changes in the laws of the PRC that affect our operations;

|

|

|

•

|

competition from our competitors; and

|

|

|

•

|

our ability to obtain all necessary government certifications and/or licenses to conduct our business.

|

The loss or significant reduction in business of any of our key customers may affect our revenues and earnings.

We are dependent on a limited number of customers for a large portion of our business. During the year ended December 31, 2010, approximately 29.59% of our net sales were generated from our five largest customers as compared to 31.5% for the year ended December 31, 2009. Our largest customer accounted for approximately 6.10% and 7.8% of our net sales during the years ended December 31, 2010 and 2009, respectively. All purchases of our products by customers are made through purchase orders and we do not have long-term contracts with any of our customers. The loss of those customers, or any of our other customers to which we sell a significant amount of our products, or any significant portion of orders from those customers, or any material adverse change in the financial conditions of such customers could negatively affect our revenues and decrease our earnings, if we cannot find new customers in a timely manner.

We may not maintain sufficient insurance coverage for the risks associated with our business operations. As a result, we may incur uninsured losses.

Except for property, accident and automobile insurance, we do not have other insurance of such as business liability or disruption insurance coverage for our operations in the PRC. As a result, we may incur uninsured liabilities and losses as a result of the conduct of our business. There can be no guarantee that we will be able to obtain additional insurance coverage in the future, and even if we are able to obtain additional coverage, we may not carry sufficient insurance coverage to satisfy potential claims. Should uninsured losses occur, any purchasers of our common stock could lose their investment.

The current global financial crisis and economic downturn may have an adverse effect on our businesses, results of operation and financial condition.

The current global financial crisis and economic downturn have adversely affected economies and businesses around the world, including in China. Due to the global economical downturn, a decrease in consumer demand and a slowdown in domestic property investments, the economic situation in China has been challenging since the second half of 2008. This change in the macroeconomic conditions has had and may continue to have an adverse impact on our business and operations. If the current economic downturn continues, our business, results of operations and financial condition could be adversely affected.

17

Potential environmental liability could have a material adverse effect on our operations and financial condition.