Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K BARCLAYS CONFERENCE - WEST PHARMACEUTICAL SERVICES INC | form8k.htm |

WEST PHARMACEUTICAL SERVICES OVERVIEW

Solutions for Injectable Drug Delivery NYSE:WST www.westpharma.com

Barclays Capital

2011 Global Healthcare Conference

Miami, FL March 16, 2011

Safe Harbor Statement

2

Cautionary Statement Under the Private Securities Litigation Reform Act of 1995

This presentation and any accompanying management commentary contain “forward-looking statements” as

that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, but are

not limited to statements about expected financial results for 2011 and future years.

that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, but are

not limited to statements about expected financial results for 2011 and future years.

Each of these estimates is based on preliminary information, and actual results could differ from these

preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in our

press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual Report

on Form 10-K as filed with the Securities and Exchange Commission and as revised or supplemented by our

quarterly reports on Form 10-Q, could cause our actual results to differ materially from those estimated or

predicted in the forward-looking statements. You should evaluate any statement in light of these important

factors. Except as required by law or regulation, we undertake no obligation to publicly update any forward-

looking statements, whether as a result of new information, future events, or otherwise.

preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in our

press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual Report

on Form 10-K as filed with the Securities and Exchange Commission and as revised or supplemented by our

quarterly reports on Form 10-Q, could cause our actual results to differ materially from those estimated or

predicted in the forward-looking statements. You should evaluate any statement in light of these important

factors. Except as required by law or regulation, we undertake no obligation to publicly update any forward-

looking statements, whether as a result of new information, future events, or otherwise.

Non-GAAP Financial Measures

Certain financial measures included in these presentation materials, and which may be referred to in

management’s discussion of the Company’s results and outlook, are Non-GAAP (Generally Accepted

Accounting Principles) financial measures. Please refer to the “Non-GAAP Financial Measures” and “Notes

to Non-GAAP Financial Measures” at the end of these materials for more information. Non-GAAP financial

measures should not be considered in isolation or as an alternative to such measures determined in

accordance with GAAP.

management’s discussion of the Company’s results and outlook, are Non-GAAP (Generally Accepted

Accounting Principles) financial measures. Please refer to the “Non-GAAP Financial Measures” and “Notes

to Non-GAAP Financial Measures” at the end of these materials for more information. Non-GAAP financial

measures should not be considered in isolation or as an alternative to such measures determined in

accordance with GAAP.

West is a globally diversified manufacturer of products consumed in the healthcare and

consumer markets.

consumer markets.

Every day over 80 million components manufactured by West, and our partner Daikyo, are

used to enhance the quality of healthcare worldwide.

used to enhance the quality of healthcare worldwide.

3

A Diverse, Stable Customer Base

Pharmaceutical/Biotech

Generic

Medical Device

4

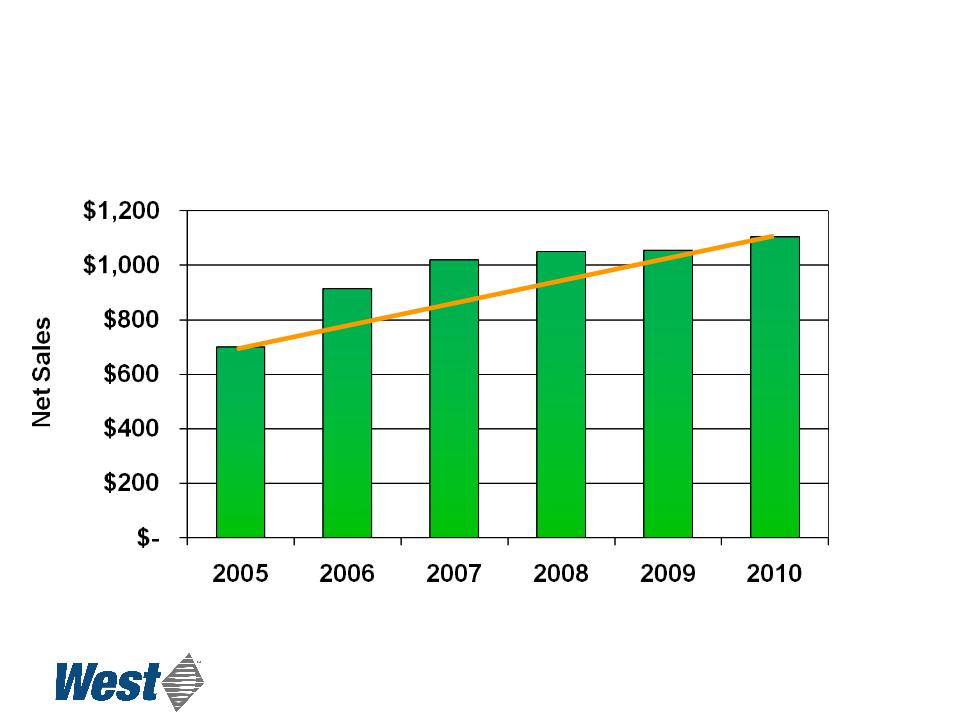

Sales

($ in millions)

($ in millions)

5

Compound annual growth rate: 8.9%

Summary 2010 Results

6

|

|

Three Months

Ended December 31

|

Year

Ended

December 31

|

||

|

2010

|

2009

|

2010

|

2009

|

|

|

|

|

|

|

|

|

Net Sales

|

$ 276.8

|

$ 293.4

|

$ 1,104.7

|

$ 1,055.7

|

|

Gross Profit

|

78.0

|

83.9

|

318.1

|

303.6

|

|

Reported Operating Profit

|

5.9

|

21.7

|

90.7

|

97.5

|

|

Adjusted Operating Profit (1)

|

20.6

|

32.0

|

104.8

|

105.0

|

|

Reported Diluted EPS

|

$ 0.18

|

$ 0.59

|

$ 1.89

|

$ 2.12

|

|

Adjusted Diluted EPS(1)

|

$ 0.42

|

$ 0.67

|

$ 2.10

|

$ 2.11

|

(1) See “Non-GAAP Financial Measures” and “Notes to Non-GAAP Financial Measures” (Slides 33 - 36)

2010 vs. 2009

Adjusted Diluted EPS

Adjusted Diluted EPS

7

|

2009 Adjusted Diluted EPS(1)

|

$ 2.11

|

|

|

|

|

Foreign Exchange

|

(0.17)

|

|

|

|

|

Lost H1N1 Sales

|

(0.16)

|

|

|

|

|

R&D

|

(0.09)

|

|

|

|

|

Other Operations

|

0.45

|

|

|

|

|

All Other

|

(0.04)

|

|

|

|

|

2010 Adjusted Diluted EPS(1)

|

$ 2.10

|

(1) See “Non-GAAP Financial Measures” and “Notes to Non-GAAP Financial Measures” (Slides 33 - 36)

Market Issues

• Asymmetric global economic recovery

– Europe, US, Japan remain sluggish

– China, India, Brazil stronger

– Continuing Fx, commodity price volatility

• More demanding regulatory environment

• Broader trends in Pharma/Device markets continue:

– Unknown impact of healthcare legislation

– Thin near term pipelines

– Pharma M&A - shift to large molecules

– Increased manufacturing outsourcing (India generic growth)

8

• Pharmaceutical Packaging Segment

– Demographics and increasing prevalence of chronic disease

– Biologics

– Growth in Emerging Markets

– Increased access to Healthcare

– Escalating quality expectations: “Zero Defects”

• Delivery Systems Segment

– Demand for combination products that promote safety, dosing accuracy,

ease of use, and deliver cost savings

ease of use, and deliver cost savings

– Drug product life cycle management

– Glass compatibility/breakage issues

What will Drive Future Growth?

9

|

Category

|

Key Customers

|

Projected

Growth |

|

Diabetes

|

|

> 10 %

|

|

Oncology

|

|

> 10 %

|

|

Vaccines

|

|

> 10 %

|

|

Autoimmune

|

|

> 8%

|

IMS April 2010 Report; Business Insights 2009; GBI Research 2009

10

Therapeutic Category Growth Drivers

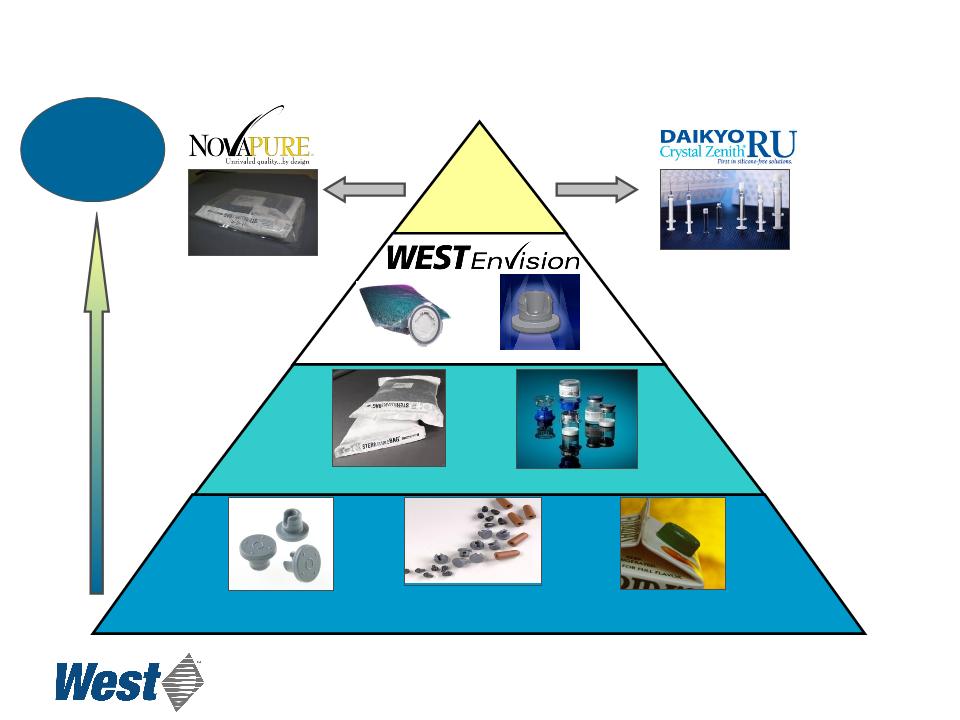

2010 Segment Reorganization

Packaging Systems

• Established leadership

• High market share

• Stable growth rate

Delivery Systems

• Proprietary devices

• Contract manufacturing

• High projected growth rate

Development

Primary Package

Administration

11

$785M

$324M

Pharmaceutical Packaging Systems

Packaging Components for Small Volume Parenterals

Packaging Components for Small Volume Parenterals

Plungers, Tip-caps, Needle

shields for Glass Syringes

shields for Glass Syringes

Plungers, lined-seals

for Glass Cartridges for

Pens

for Glass Cartridges for

Pens

Closures for

Glass Vials

Glass Vials

12

• Packaging Systems Segment

– Grow incremental value per unit

– Geographic expansion - capacity investments in Asia

– Improved operating efficiency: lean operations

– Strategic acquisitions and partnerships

Growth Strategy

13

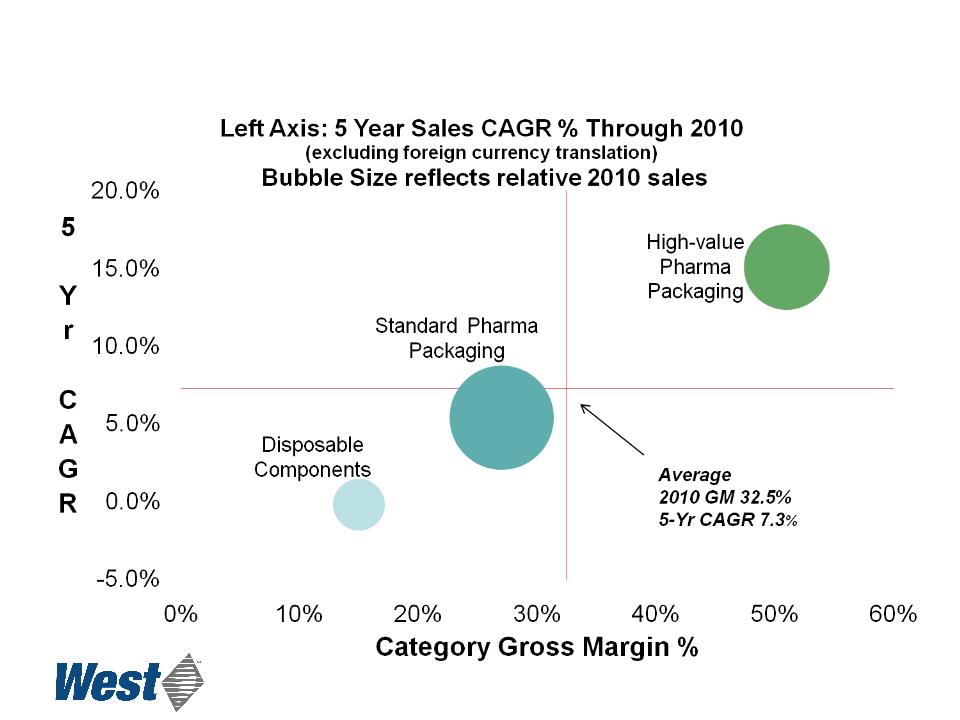

Faster Growth of High-Value Products

Pharmaceutical Packaging Systems

Pharmaceutical Packaging Systems

14

Value Proposition

Proprietary

Products

Products

Revenue and

Margin

Opportunity

Margin

Opportunity

Disposable Device

Components

Components

Westar® RS

Mix2Vial®

Westar® RU

Standard

Components

Components

Consumer

Products

Products

Packaging

Delivery

15

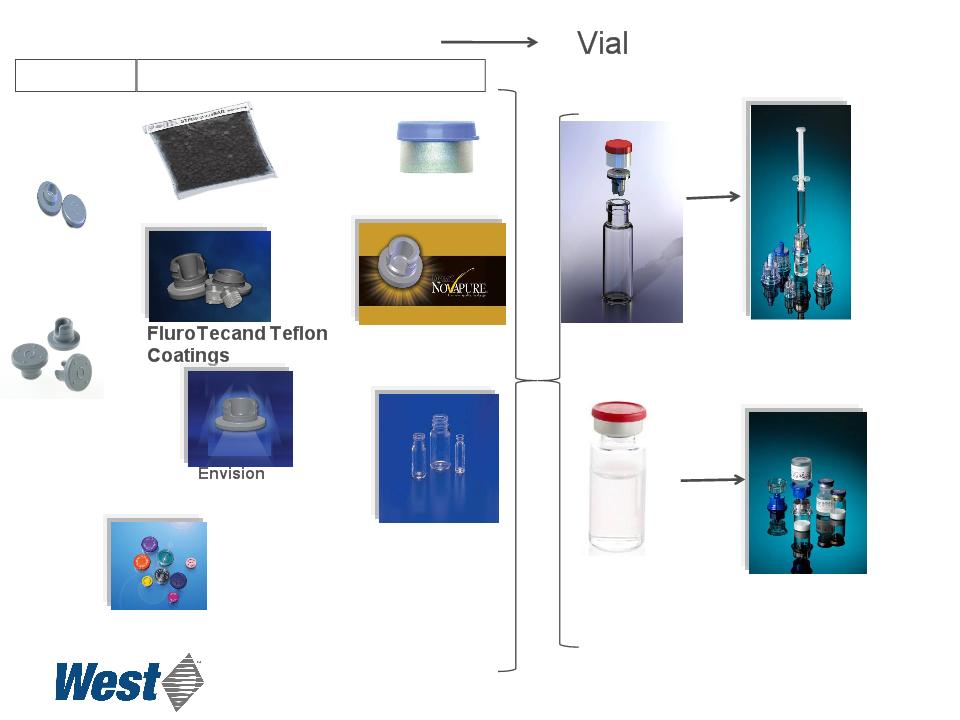

Ready Pack™ System

(Kitted RU Vials, stoppers & seals)

Utilizes West’s proprietary FluroTec®

technology

FluroTec® technology is licensed from Daikyo Seiko, Ltd.

16

CZ® Vials

Daikyo Resin CZ®

Utilizes Daikyo Crystal Zenith®

proprietary technology

proprietary technology

lyophilized vial

Mix2Vial®

Utilizes

Medimop’s

proprietary

technologies

Medimop’s

proprietary

technologies

serum vial

RU Seals

NovaPure™

Utilizes West’s

proprietary

proprietary

FluroTec®

technology

technology

Vial Adapters

Utilizes Medimop’s

proprietary

technologies

proprietary

technologies

Formats

West Products for Drug Vials

West Reconstitution &

Fluid Transfer

Products

Products

Standard

Value - added features & processing

Spectra Seals

WestarRS®

Technically advanced,

automated vision

inspection system

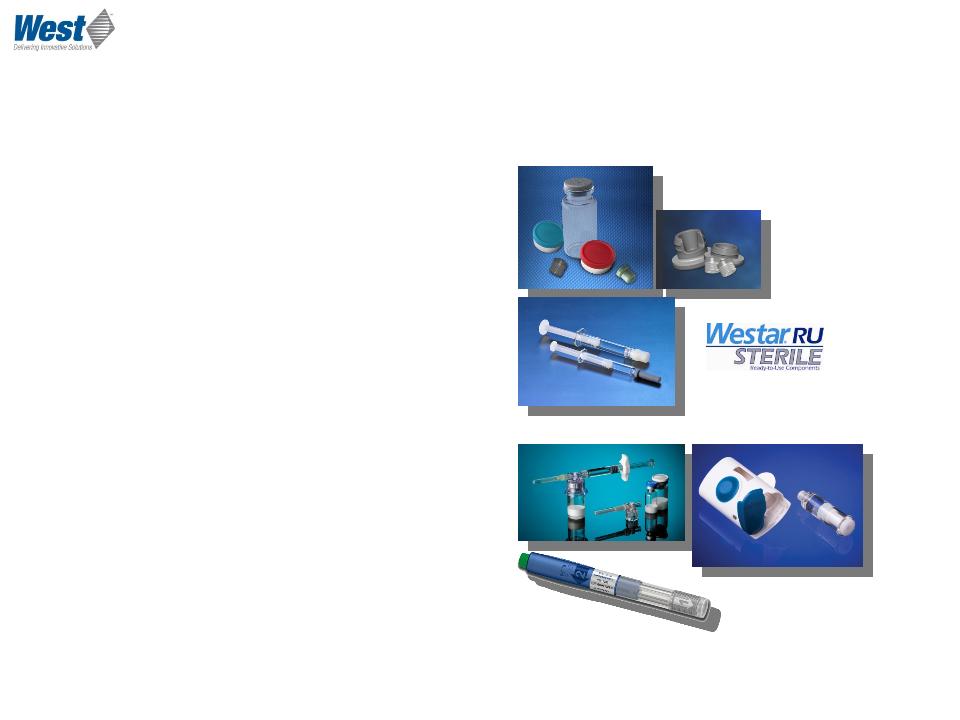

Delivery Systems

West ConfiDose®

Auto-injector System

Auto-injector System

Daikyo Crystal Zenith®

Life-cycle Containment Solutions

Life-cycle Containment Solutions

West Electronic

Patch-injector

Patch-injector

17

Daikyo Crystal Zenith® is a registered trademark of Daikyo, Seiko, Ltd.

West MixJect® and

Vial2Bag®

Vial2Bag®

Proprietary Components, Devices and Systems

• Delivery Systems Segment

– Leverage life cycle management opportunities

– Realize commercial potential of CZ

– Develop new platform opportunities - combination products

– Custom solution provider

Growth Strategy

18

Drivers for Pharma Industry Life Cycle

Management

Management

• To maximize the value of the drug development program

– Extend the value of the molecule as an asset

• Delivery systems as drug formulation life cycle management

– Generate more revenue per dose

• To expand or retain market share in a competitive

environment

environment

– Reduce preparation and administration time

– Improve patient compliance

– Ease of use for self administration

– Accurate delivery of dosage

19

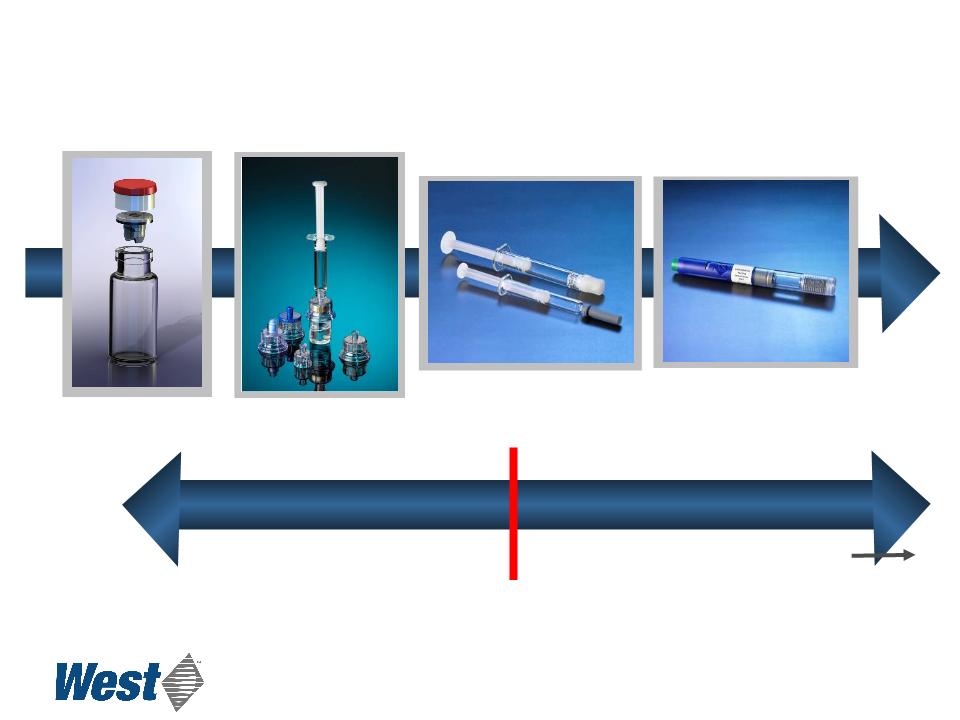

Pharma Industry Drug Life Cycle Management

Phase I

Phase II

Phase III

Post-Market Life Cycle Management

8 - 10 years

2 - 3 years

2 - 3 years

Regulatory

Approval

Discovery

20

FluroTec® technology is licensed from Daikyo Seiko, Ltd.

21

NovaPure™

Utilizes West’s

proprietary

proprietary

Pre-fillable

Formats

(shown in CZ®)

West Products for Pre-fillable Formats

Standard

Value - added features & processing

WestarRS®

Plungers

Tip Caps

Needle

Shields

Shields

Cartridge

Plungers

Plungers

Cartridge

seals

seals

PFS Plungers

Utilizes West’s

proprietary

proprietary

FluroTec®

technology

technology

RU CZ® Insert Needle

Syringe

Syringe

Westar® RU

Plungers in Port

Bag

Plungers in Port

Bag

Utilizes West’s

proprietary FluroTec®

technology

proprietary FluroTec®

technology

CZ® Luer-

lock syringe

lock syringe

NovaGuard™

Passive Safety

Needle

Passive Safety

Needle

ConfiDose™ Auto

Injector

Injector

West’proprietary

technology

technology

Electronic

Patch

Injector

Patch

Injector

West proprietary

technology

technology

Westar® RU

State of the art ready-to-

use syringe plungers

use syringe plungers

CZ® Cartidges

Concerns With Glass Syringes

• Interaction with sensitive biologics

• Protein aggregation (silicone oil)

• Residual chemicals (tungsten, glue)

• Glass flakes

• Breakage

• In process

• Within auto-injector systems

• Recent FDA recalls

• Dimensional variation

• Breakage in auto-injector systems

• Designed for manual injection

• Variable silicone distribution

• Amount of silicone coverage

• Age of barrel

• Inconsistent break force and

sustaining-force

sustaining-force

• Quality

• Cosmetic defects

• High levels of inspection necessary

• High “cost of quality”

Siliconized Glass Syringe

Crystal Zenith Syringe

22

2010 Glass-related Recalls

23

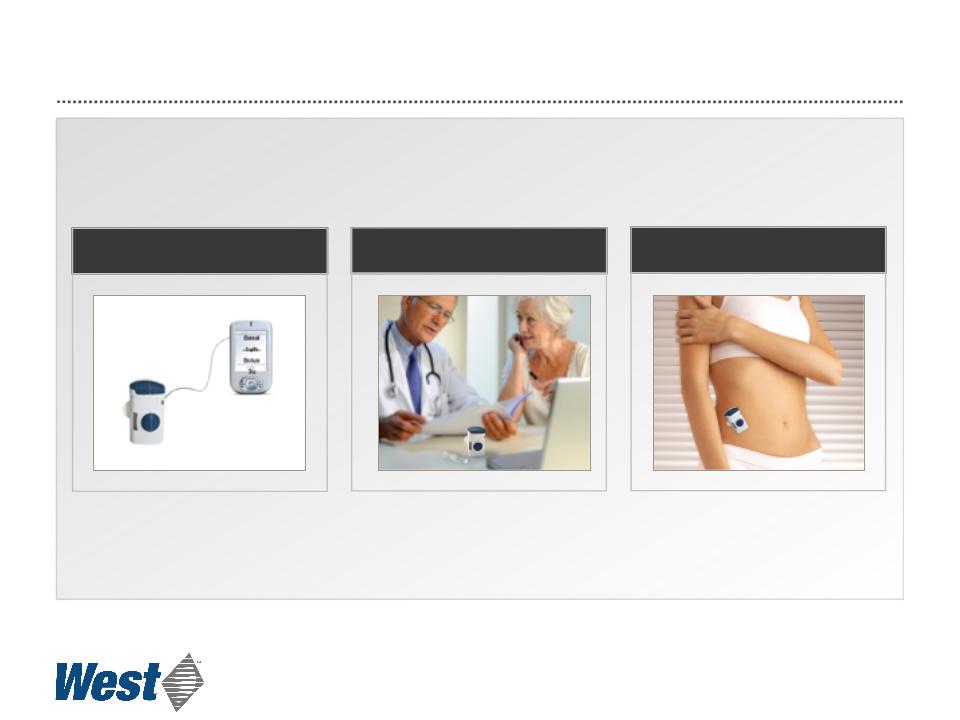

Electronic Patch Injector System

• Controlled, subcutaneous, micro-

infusion delivery of high volumes

and high viscosity drugs

infusion delivery of high volumes

and high viscosity drugs

• Prefilled cartridge, no need for

user filling

user filling

• Based on Daikyo CZ cartridge

• Compact

• Hidden needle for safety

• Single push-button operation

• Fully programmable

24

Prototype Electronic Patch Injector Operation

Programmed by PDA or PC

Dose may be customized

Attached and activated by patient

25

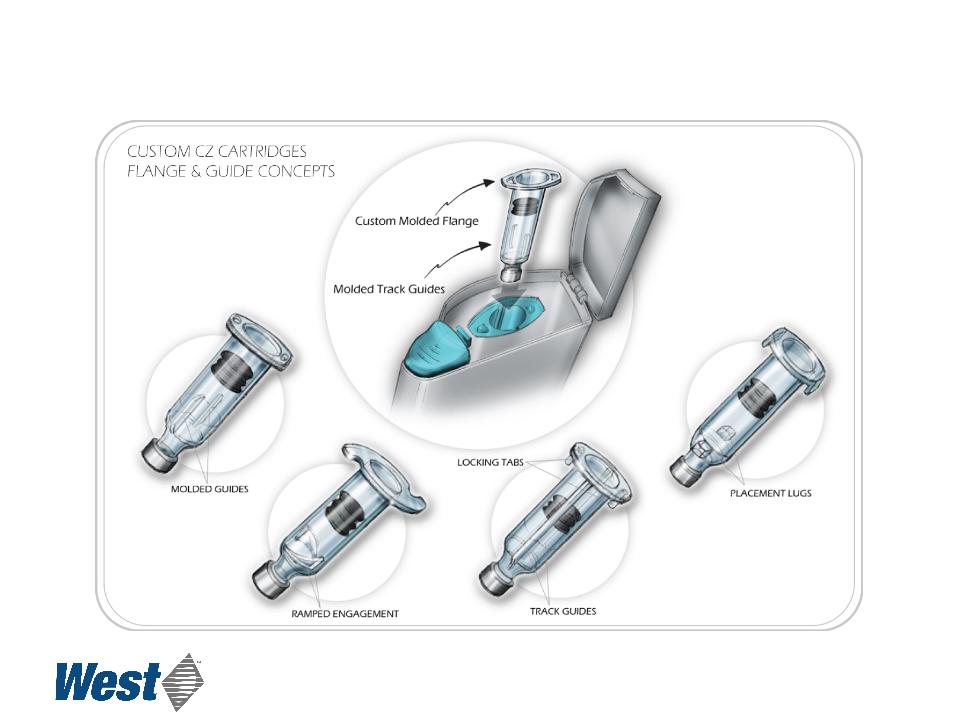

Custom Delivery Device Utilizing Daikyo CZ® Resin

Utilizes Daikyo’s proprietary Crystal Zenith technology

Daikyo Crystal Zenith® is a registered trademark of Daikyo, Seiko, Ltd.

26

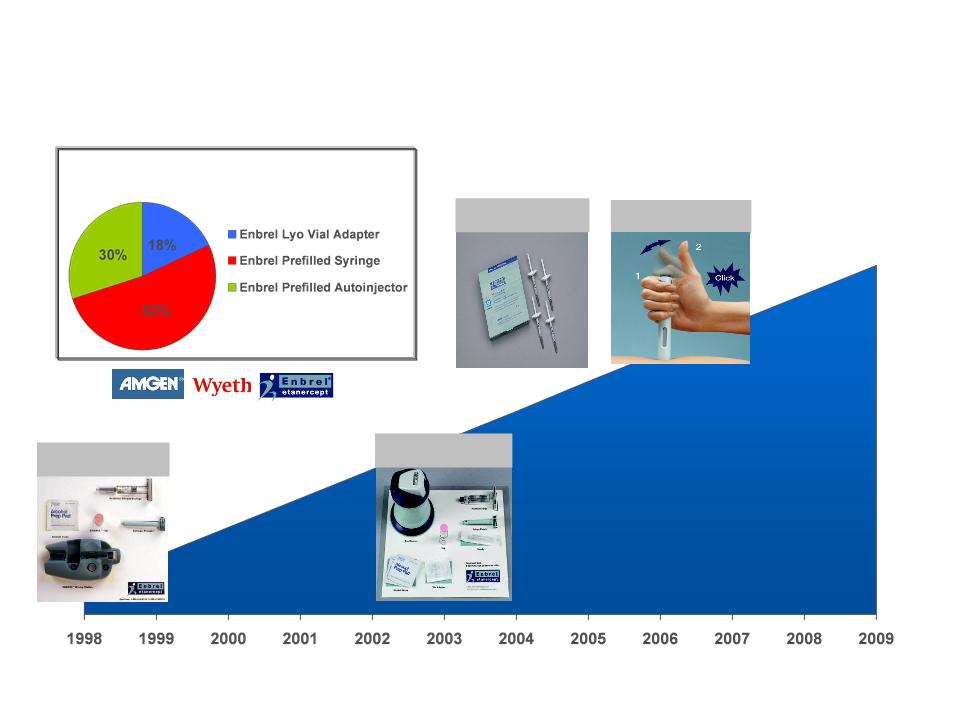

West’s Strategy Drives Revenue

Growth in Excess of Unit Growth

Growth in Excess of Unit Growth

Lyo Mixing Station

Launched 1998

Lyo Vial Adapter

Launched in 2003

Prefilled Syringe

Launched in 2004

General trend for level of device

features and functionality

US Sales by Device for 2007*

(One year after Autoinjector launch)

* Data source IMS Health

Taken from presentation at Management Forum Annual Conference in London (March 22 & 23, 2010), Don Rogers, Genentech

Prefilled Auto Injector

Launched in 2006

27

Our Long-Term Focus

• Pharmaceutical Packaging Systems

– Organic growth (on average) of 3-5% per year

– Margin expansion through operating efficiency, product mix

– Capital investments targeted at enhanced quality and value

• Pharmaceutical Delivery Systems

– Deliver the potential of Daikyo CZ products

– Increase healthcare-consumable contract manufacturing revenue

– Grow proprietary safety and delivery system businesses

• Financial discipline

– Operating cash flow: Discretionary SG&A, R&D and capital spending that

are supported by revenue growth

are supported by revenue growth

– Deliver returns on invested capital (“ROIC”) that regularly exceed weighted

average cost of capital (“WACC”)

average cost of capital (“WACC”)

– Align incentives with financial performance and value creation

28

Long-Term Growth Opportunity

Strategic Planning Goals:

• Projected 2014 sales of $0.6 billion

• Projected 2014 Operating margin: > 20%

$1.5 billion market for components with unit

growth 0% to 8% per year, depending on

product and therapeutic segment

growth 0% to 8% per year, depending on

product and therapeutic segment

Strategic Planning Goals:

• Projected 2014 sales of $1.0 billion

• Projected 2014 Operating margin: > 20%

|

Pharmaceutical

Packaging Systems

|

|

Primary Container Solutions

|

|

Pharmaceutical Delivery

Systems |

|

Administration Systems

|

Consolidated 2014 Planning Objectives

• 2014 Sales: $1.6 billion

• 2014 Operating Margin: 19%

29

|

|

|

Raw Material Cost

|

|

Factor

Pricing (modestly higher)

Unit Volume (slow growth)

Mix (continuing shift)

cost increases)

Raw material cost

Labor (~ inflation)

|

||

|

Comprise approximately 1/3rd of COGS

Materials include: Synthetic elastomer and

polymer and film (petroleum based), aluminum, natural rubber 2011 plans based on expected 5% increases

vs. YTD actual material price increases that have been notably higher (oil, natural rubber, aluminum ingot). Mitigation:

• Cost:

Ø Contractual terms for purchases delay pass

-through of oil surcharges Ø Hedging program

• Revenue:

ØContracted sales price escalators

ØMaterial surcharges on other sales

|

||

|

|

30

2011 Full-year Financial Guidance

|

($ millions, except EPS)

|

2011 Revenue(1)

|

Gross Profit %(1)

|

|

Pharmaceutical Packaging

Systems Segment |

$ 810 - $ 830

|

33.4%

|

|

|

|

|

|

Pharmaceutical Delivery

Systems Segment |

$325 - $340

|

20.5%

|

|

|

|

|

|

Consolidated

|

$1,140 - $1,170

|

29.7%

|

|

|

2011 Adjusted Diluted EPS(1)(2)

|

|

|

|

$2.25 - $2.45

|

|

(1) Guidance includes various currency exchange rate assumptions, most significantly the Euro at $1.35 for 2011. Actual

results will vary as a result of variability of exchange rates.

results will vary as a result of variability of exchange rates.

(2) See “Cautionary Statement” (Slide 2), and “Non-GAAP Financial Measures” and “Notes to Non-GAAP Financial Measures”

(Slides 33-36).

(Slides 33-36).

31

32

Pharmaceutical Packaging Systems

Pharmaceutical Delivery Systems

• Well positioned

– Substantial market share

– Proprietary technology

– Diversified customer base

– Global footprint

• Stability with growth potential

– Strength in new product pipeline

– Preferred products for biologics

• The financial strength to invest

– Reliable operating cash flow

– Balance sheet strength

Summary

33

Non-GAAP Financial Measures(1)

Three Months Ended December 31, 2010 and 2009

Three Months Ended December 31, 2010 and 2009

(in millions, except per share data)

|

|

As Reported

December 31,

2010

|

Restructuring

and related charges |

Discrete

tax items |

Non-GAAP(1)

December 31,

2010

|

|

Operating profit

|

$5.9

|

$14.7

|

$-

|

$20.6

|

|

Interest expense, net

|

4.4

|

-

|

-

|

4.4

|

|

Income before income taxes

|

1.5

|

14.7

|

-

|

16.2

|

|

Income tax expense (benefit)

|

(3.6)

|

5.3

|

1.1

|

2.8

|

|

Equity in net income of affiliated companies

|

0.8

|

-

|

-

|

0.8

|

|

Net income

|

$5.9

|

$9.4

|

($1.1)

|

$14.2

|

|

|

|

|

|

|

|

Net income per diluted share

|

$0.18

|

$0.27

|

($0.03)

|

$0.42

|

|

|

As Reported

December 31,

2009

|

Restructuring

and other |

Brazil tax

amnesty |

Discrete tax

items |

Non-GAAP(1)

December 31,

2009

|

|

Operating profit

|

$21.7

|

$8.4

|

$1.9

|

$-

|

$32.0

|

|

Interest expense, net

|

3.9

|

-

|

-

|

-

|

3.9

|

|

Income before income taxes

|

17.8

|

8.4

|

1.9

|

-

|

28.1

|

|

Income tax expense (benefit)

|

(1.1)

|

2.8

|

0.6

|

4.0

|

6.3

|

|

Equity in net income of affiliated companies

|

1.4

|

-

|

-

|

-

|

1.4

|

|

Net income

|

$20.3

|

$5.6

|

$1.3

|

($4.0)

|

$23.2

|

|

|

|

|

|

|

|

|

Net income per diluted share

|

$0.59

|

$0.16

|

$0.03

|

($0.11)

|

$0.67

|

(1) See “Notes to Non-GAAP Financial Measures”(Slides 35 - 36), “Cautionary Statement” (Slide 2)

|

|

As Reported

December 31,

2010

|

Restructuring

and related charges |

Acquisition-

related contingencies |

Discrete

tax items |

Non-GAAP

December 31,

2010

|

|

Operating profit

|

$90.7

|

$15.9

|

($1.8)

|

$-

|

$104.8

|

|

Interest expense, net

|

16.2

|

-

|

-

|

-

|

16.2

|

|

Income before income taxes

|

74.5

|

15.9

|

(1.8)

|

-

|

88.6

|

|

Income tax expense

|

13.6

|

5.7

|

(0.2)

|

1.1

|

20.2

|

|

Equity in net income of affiliated

companies |

4.4

|

-

|

-

|

-

|

4.4

|

|

Net income

|

$65.3

|

$10.2

|

($1.6)

|

($1.1)

|

$72.8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per diluted share

|

$1.89

|

$0.28

|

($0.04)

|

($0.03)

|

$2.10

|

34

|

|

As Reported

December 31,

2009

|

Restructuring

and other |

Brazil tax

amnesty |

Discrete tax

items |

Non-GAAP

December 31,

2009

|

|

Operating profit

|

$97.5

|

$9.5

|

($2.0)

|

$-

|

$105.0

|

|

Interest expense, net

|

14.4

|

-

|

-

|

-

|

14.4

|

|

Income before income taxes

|

83.1

|

9.5

|

(2.0)

|

-

|

90.6

|

|

Income tax expense

|

13.5

|

3.2

|

(1.6)

|

6.1

|

21.2

|

|

Equity in net income of affiliated companies

|

3.0

|

-

|

-

|

-

|

3.0

|

|

Net income

|

$72.6

|

$6.3

|

($0.4)

|

($6.1)

|

$72.4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per diluted share

|

$2.12

|

$0.17

|

($0.01)

|

($0.17)

|

$2.11

|

Non-GAAP Financial Measures(1)

Year Ended December 31, 2010 and 2009

Year Ended December 31, 2010 and 2009

(1) See “Notes to Non-GAAP Financial Measures”(Slides 35 - 36), “Cautionary Statement” (Slide 2)

(in millions, except per share data)

NOTES TO NON-GAAP FINANCIAL MEASURES

For additional details, please see today’s press release and Safe Harbor Statement.

For additional details, please see today’s press release and Safe Harbor Statement.

These slides use non-GAAP financial measures. West believes that these non-GAAP measures of financial results provide useful

information to management and investors regarding certain business trends relating to West’s financial condition, results of operations and

the Company’s overall performance. Our executive management team uses adjusted operating profit and adjusted diluted EPS to evaluate

the performance of the Company in terms of profitability and to compare operating results to prior periods. Adjusted operating profit is also

used to evaluate changes in the operating results of each segment and to allocate resources to our segments. The Company believes that

the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and

trends in comparing its financial measures with other companies.

information to management and investors regarding certain business trends relating to West’s financial condition, results of operations and

the Company’s overall performance. Our executive management team uses adjusted operating profit and adjusted diluted EPS to evaluate

the performance of the Company in terms of profitability and to compare operating results to prior periods. Adjusted operating profit is also

used to evaluate changes in the operating results of each segment and to allocate resources to our segments. The Company believes that

the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and

trends in comparing its financial measures with other companies.

Our executive management does not consider such non-GAAP measures in isolation or as an alternative to such measures determined in

accordance with GAAP. The principal limitation of such non-GAAP financial measures is that they exclude significant expenses and income

that are required by GAAP to be recorded. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by

management about which items are excluded from the non-GAAP financial measures. In order to compensate for these limitations, our

executive management presents its non-GAAP financial measures in connection with its GAAP results. We urge investors and potential

investors to review the reconciliation of our non-GAAP financial measures to the comparable GAAP financial measures, and not rely on any

single financial measure to evaluate the Company’s business.

accordance with GAAP. The principal limitation of such non-GAAP financial measures is that they exclude significant expenses and income

that are required by GAAP to be recorded. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by

management about which items are excluded from the non-GAAP financial measures. In order to compensate for these limitations, our

executive management presents its non-GAAP financial measures in connection with its GAAP results. We urge investors and potential

investors to review the reconciliation of our non-GAAP financial measures to the comparable GAAP financial measures, and not rely on any

single financial measure to evaluate the Company’s business.

In calculating adjusted operating profit and adjusted diluted EPS, we exclude the impact of items that are not considered representative of

ongoing operations. Such items include restructuring and related costs, certain asset impairments, other specifically identified gains or

losses, and discrete income tax items. A reconciliation of these adjusted non-GAAP measures to the comparable GAAP financial measures

is included below.

ongoing operations. Such items include restructuring and related costs, certain asset impairments, other specifically identified gains or

losses, and discrete income tax items. A reconciliation of these adjusted non-GAAP measures to the comparable GAAP financial measures

is included below.

The following is a description of the items excluded from adjusted operating profit and adjusted diluted EPS:

•Restructuring and related charges: During the three and twelve months ended December 31, 2010, we incurred restructuring,

impairment and related charges of $14.7 million and $15.9 million, respectively. The majority of these costs related to the restructuring plan

announced in December of 2010.

impairment and related charges of $14.7 million and $15.9 million, respectively. The majority of these costs related to the restructuring plan

announced in December of 2010.

• During the three and twelve months ended December 31, 2009, we recognized restructuring and other charges of $8.4 million and $9.5

million, respectively. The majority of these charges related to a restructuring program launched in the fourth quarter of 2009 to exit certain

specialized laboratory service offerings and consolidate contract-manufacturing operations. The 2009 restructuring program was completed

during the fourth quarter of 2010.

million, respectively. The majority of these charges related to a restructuring program launched in the fourth quarter of 2009 to exit certain

specialized laboratory service offerings and consolidate contract-manufacturing operations. The 2009 restructuring program was completed

during the fourth quarter of 2010.

(continued on following slide)

35

NOTES TO NON-GAAP FINANCIAL MEASURES

For additional details, please see today’s press release and Safe Harbor Statement.

For additional details, please see today’s press release and Safe Harbor Statement.

Reconciliation of 2011 Adjusted Guidance to 2011 Reported Guidance:

(1) Guidance includes various currency exchange rate assumptions, most significantly the Euro at $1.35 for

2011. Actual results will vary as a result of variability of exchange rates.

2011. Actual results will vary as a result of variability of exchange rates.

|

|

Full Year 2011 Guidance (1)

|

|

|

Diluted Earnings Per Share

|

|

Adjusted guidance

|

$2.25 to $2.45

|

|

Restructuring, net of tax

|

(0.05) - (0.06)

|

|

Reported guidance

|

$2.19 to $2.40

|

(continued from prior slide)

• Acquisition-related contingencies: During the third quarter of 2010, we reduced our liability for contingent consideration

associated with our 2009 Eris™ acquisition by $1.8 million to reflect our revised assessment of fair value, as affected by a

reduction in the probability of attaining certain milestones over the next four years.

associated with our 2009 Eris™ acquisition by $1.8 million to reflect our revised assessment of fair value, as affected by a

reduction in the probability of attaining certain milestones over the next four years.

• Brazil Tax Amnesty: During September 2009, we enrolled in a tax amnesty program in Brazil which entitled us to a reduction in

certain tax-related penalties, interest and other costs in exchange for our irrevocable declaration of all specified tax obligations.

The fourth quarter 2009 pre-tax charge of $1.9 million was the result of an adjustment to the original amnesty benefit to reflect the

impact of a newly-issued ordinance. The full-year impact was a pre-tax gain of $2.0 million, or $0.4 million after tax.

certain tax-related penalties, interest and other costs in exchange for our irrevocable declaration of all specified tax obligations.

The fourth quarter 2009 pre-tax charge of $1.9 million was the result of an adjustment to the original amnesty benefit to reflect the

impact of a newly-issued ordinance. The full-year impact was a pre-tax gain of $2.0 million, or $0.4 million after tax.

• Discrete tax items: During the fourth quarter of 2010, we recognized $1.1 million in net discrete tax benefits, the majority of

which resulted from the expiration of open tax audit periods in various tax jurisdictions. During the three and twelve months ended

December 31, 2009, we recognized discrete tax benefits of $4.0 million and $6.1 million, respectively. During 2009, we recognized

tax credits of $2.4 million resulting from the identification of additional qualified R&D activities related to prior years, and other tax

provision benefits of $0.9 million primarily from the reversal of valuation allowances on prior-year tax losses carried forward. We

also recognized a $2.8 million net tax provision benefit, principally resulting from the completion of a tax audit and the expiration of

open tax periods in various tax jurisdictions.

which resulted from the expiration of open tax audit periods in various tax jurisdictions. During the three and twelve months ended

December 31, 2009, we recognized discrete tax benefits of $4.0 million and $6.1 million, respectively. During 2009, we recognized

tax credits of $2.4 million resulting from the identification of additional qualified R&D activities related to prior years, and other tax

provision benefits of $0.9 million primarily from the reversal of valuation allowances on prior-year tax losses carried forward. We

also recognized a $2.8 million net tax provision benefit, principally resulting from the completion of a tax audit and the expiration of

open tax periods in various tax jurisdictions.

36

WEST PHARMACEUTICAL SERVICES OVERVIEW

Solutions for Injectable Drug Delivery NYSE:WST www.westpharma.com

Barclays Capital

2011 Global Healthcare Conference

Miami, FL March 16, 2011