Attached files

| file | filename |

|---|---|

| EX-31.2 - INFRASTRUCTURE MATERIALS CORP. | v211004_ex31-2.htm |

| EX-32.1 - INFRASTRUCTURE MATERIALS CORP. | v211004_ex32-1.htm |

| EX-31.1 - INFRASTRUCTURE MATERIALS CORP. | v211004_ex31-1.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-Q

x

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the quarterly period ended December 31, 2010

¨ TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Commission

File Number: 000-52641

INFRASTRUCTURE MATERIALS CORP.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

98-0492752

|

|

|

(State

of incorporation)

|

(I.R.S.

Employer Identification No.)

|

1135

Terminal Way, Suite 207B

Reno,

NV 89502 USA

(Address

of Principal Executive Offices) (Zip Code)

775-322-4448

(Registrant’s

telephone number, including area code)

With a

copy to:

Jonathan

H. Gardner

Kavinoky

Cook LLP

726

Exchange St., Suite 800

Buffalo,

NY 14210

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

Registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days.

Yes þ No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes þ No o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer o

|

Accelerated

filer o

|

Non-accelerated

filer o

(Do

not check if a smaller reporting company)

|

Smaller

reporting company þ

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). Yes o No þ

The

number of shares of registrant’s common stock outstanding as of January 31,

2011 was 68,243,457.

INFRASTRUCTURE

MATERIALS CORP.

FORM

10-Q

FOR

THE QUARTERLY PERIOD ENDED DECEMBER 31, 2010

TABLE

OF CONTENTS

|

PAGE

|

|||

|

PART

1 – FINANCIAL INFORMATION

|

|||

|

Item

1.

|

Financial

Statements (Unaudited)

|

3

|

|

|

Item

2.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

24

|

|

|

Item

3.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

34

|

|

|

Item

4T.

|

Controls

and Procedures

|

35

|

|

|

PART

II – OTHER INFORMATION

|

|||

|

Item

1.

|

Legal

Proceedings

|

36

|

|

|

Item

1A.

|

Risk

Factors

|

36

|

|

|

Item

2.

|

Unregistered

Sale of Equity Securities and Use of Proceeds

|

39

|

|

|

Item

3.

|

Defaults

Upon Senior Securities

|

39

|

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

39

|

|

|

Item

5.

|

Other

Information

|

39

|

|

|

Item

6.

|

Exhibits

and Reports on Form 8-K

|

39

|

|

|

SIGNATURES

|

40

|

- 2

-

PART

1 – FINANCIAL INFORMATION

ITEM

1 Financial

Statements

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

CONTENTS

|

Interim

Consolidated Balance Sheets as of December 31, 2010 (unaudited) and June

30, 2010 (audited)

|

4

|

|

|

Interim

Consolidated Statements of Operations and Comprehensive Loss for the six

months

|

||

|

and

three months ended December 31, 2010 and December 31,

2009,

|

||

|

and

for the period from inception to December 31, 2010

|

5

|

|

|

Interim

Consolidated Statements of Changes in Stockholders' Equity for the six

months ended

|

||

|

December

31, 2010 and for the period from inception to December 31,

2010

|

6

|

|

|

Interim

Consolidated Statements of Cash Flows for the six months ended December

31, 2010

|

||

|

and

December 31, 2009, and for the period from inception to December 31,

2010

|

7

|

|

|

Condensed

Notes to Interim Consolidated Financial Statements

|

|

8 -

23

|

- 3

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Interim

Consolidated Balance Sheets as at

December

31, 2010 and June 30, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

December

31,

|

June

30,

|

|||||||

|

2010

|

2010

|

|||||||

|

$

|

$

|

|||||||

|

(unaudited)

|

(audited)

|

|||||||

|

ASSETS

|

||||||||

|

Current

|

||||||||

|

Cash

and cash equivalents

|

99,964 | 1,598,248 | ||||||

|

Short

term investments

|

388,092 | 586,745 | ||||||

|

Prepaid

expenses and other receivables

|

174,437 | 122,343 | ||||||

|

Total

Current Assets

|

662,493 | 2,307,336 | ||||||

|

Plant and Equipment, net

(Note 4)

|

897,706 | 971,280 | ||||||

|

Mineral Property Interests

(Note 5)

|

514,525 | 514,525 | ||||||

|

Total

Assets

|

2,074,724 | 3,793,141 | ||||||

|

LIABILITIES

|

||||||||

|

Current

|

||||||||

|

Accounts

payable

|

64,821 | 93,410 | ||||||

|

Accrued

liabilities

|

71,882 | 117,152 | ||||||

|

Total

Current Liabilities

|

136,703 | 210,562 | ||||||

|

Commitments and

Contingencies (Note 9)

|

||||||||

|

Related Party

Transactions (Note 10)

|

||||||||

|

Subsequent Events (Note

11)

|

||||||||

|

STOCKHOLDERS'

EQUITY

|

||||||||

|

Capital Stock (Note

6)

|

||||||||

|

Preferred

stock, $0.0001 par value, 50,000,000 shares authorized, none

issued

|

||||||||

|

and

outstanding

|

- | - | ||||||

|

Common

stock, $0.0001 par value, 100,000,000 shares authorized, 68,243,457

issued

|

||||||||

|

and

outstanding (June 30, 2010 – 68,193,457)

|

6,824 | 6,819 | ||||||

|

Additional

Paid-in Capital

|

20,579,879 | 20,511,458 | ||||||

|

Deficit

Accumulated During the Exploration Stage

|

(18,648,682 | ) | (16,935,698 | ) | ||||

|

Total

Stockholders' Equity

|

1,938,021 | 3,582,579 | ||||||

|

Total

Liabilities and Stockholders' Equity

|

2,074,724 | 3,793,141 | ||||||

See

Condensed Notes to the Interim Consolidated Financial

Statements

- 4

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Interim

Consolidated Statements of Operations and Comprehensive Loss

For the

six months and three months ended December 31, 2010 and December 31,

2009

and the

Period from Inception (June 3, 1999) to December 31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

For

the

|

For

the

|

For

the

|

For

the

|

|||||||||||||||||

|

six

months

|

six

months

|

three

months

|

three

months

|

|||||||||||||||||

|

Cumulative

|

ended

|

ended

|

ended

|

ended

|

||||||||||||||||

|

since

|

December

31,

|

December

31,

|

December

31,

|

December

31,

|

||||||||||||||||

|

inception

|

2010

|

2009

|

2010

|

2009

|

||||||||||||||||

|

$

|

$

|

$

|

$

|

$

|

||||||||||||||||

|

Operating

Expenses

|

||||||||||||||||||||

|

General

and administration

|

8,580,352 | 401,272 | 878,310 | 202,514 | 429,114 | |||||||||||||||

|

Project

expenses

|

9,640,002 | 1,239,746 | 1,346,853 | 146,355 | 561,082 | |||||||||||||||

|

Depreciation

|

962,288 | 73,574 | 90,368 | 36,787 | 45,113 | |||||||||||||||

|

Total

Operating Expenses

|

19,182,642 | 1,714,592 | 2,315,531 | 385,656 | 1,035,309 | |||||||||||||||

|

Loss

from Operations

|

(19,182,642 | ) | (1,714,592 | ) | (2,315,531 | ) | (385,656 | ) | (1,035,309 | ) | ||||||||||

|

Other

income-interest

|

385,768 | 1,608 | 25,651 | 594 | 11,298 | |||||||||||||||

|

Other

income-gain on bargain purchase (Note 5)

|

238,645 | - | - | - | - | |||||||||||||||

|

Interest Expense

|

(90,453 | ) | - | - | - | - | ||||||||||||||

|

Loss

and Comprehensive Loss

|

||||||||||||||||||||

|

before

Income Taxes

|

(18,648,682 | ) | (1,712,984 | ) | (2,289,880 | ) | (385,062 | ) | (1,024,011 | ) | ||||||||||

|

Provision

for income taxes

|

- | - | - | - | - | |||||||||||||||

|

Net

Loss and Comprehensive Loss

|

(18,648,682 | ) | (1,712,984 | ) | (2,289,880 | ) | (385,062 | ) | (1,024,011 | ) | ||||||||||

|

Loss

per Weighted Average Number

|

||||||||||||||||||||

|

of

Shares Outstanding

|

||||||||||||||||||||

|

-Basic

and Fully Diluted

|

(0.03 | ) | (0.04 | ) | (0.01 | ) | (0.02 | ) | ||||||||||||

|

Weighted

Average Number of

|

||||||||||||||||||||

|

Shares

Outstanding During the Periods

|

||||||||||||||||||||

|

-Basic

and Fully Diluted

|

68,218,729 | 60,198,500 | 68,243,457 | 60,198,500 | ||||||||||||||||

See

Condensed Notes to the Interim Consolidated Financial

Statements

- 5

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Interim

Consolidated Financial Statements of Changes in Stockholders’

Equity

From

Inception (June 3, 1999) to December 31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

Deficit

|

||||||||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||||||

|

Common

Stock

|

Additional

|

Deferred

|

during

the

|

Total

|

||||||||||||||||||||

|

Number

|

Paid-in

|

Stock

|

Exploration

|

Stockholders'

|

||||||||||||||||||||

|

of

Shares

|

Amount

|

Capital

|

Compensation

|

Stage

|

Equity

|

|||||||||||||||||||

|

$

|

$

|

$

|

$

|

$

|

||||||||||||||||||||

|

For

the period from inception (June 3, 1999) through July 1,

2004

|

1 | - | 5,895 | (5,895 | ) | - | ||||||||||||||||||

|

Net

(loss)

|

- | - | 910 | (910 | ) | - | ||||||||||||||||||

|

Balance,

June 30, 2005 (audited)

|

1 | - | 6,805 | - | (6,805 | ) | - | |||||||||||||||||

|

Contribution

to additional paid-in capital

|

- | - | 3,024 | 3,024 | ||||||||||||||||||||

|

Cancelled

shares

|

(1 | ) | - | (1 | ) | (1 | ) | |||||||||||||||||

|

Common

shares issued for nil consideration

|

14,360,000 | 1,436 | (1,436 | ) | - | - | ||||||||||||||||||

|

Common

shares issued for cash

|

2,050,000 | 205 | 414,795 | - | 415,000 | |||||||||||||||||||

|

Subscription

for stock

|

300,000 | - | 300,000 | |||||||||||||||||||||

|

Stock

issuance cost

|

- | - | (24,500 | ) | - | (24,500 | ) | |||||||||||||||||

|

Net

loss

|

- | - | - | (87,574 | ) | (87,574 | ) | |||||||||||||||||

|

Balance,

June 30, 2006 (audited)

|

16,410,000 | 1,641 | 698,687 | - | (94,379 | ) | 605,949 | |||||||||||||||||

|

Common

shares issued for cash

|

3,395,739 | 340 | 548,595 | - | 548,935 | |||||||||||||||||||

|

Common

shares issued to agents in lieu

|

||||||||||||||||||||||||

|

of

commission for placement of common

|

||||||||||||||||||||||||

|

shares

and convertible debentures

|

1,064,000 | 106 | 265,894 | - | 266,000 | |||||||||||||||||||

|

Common

shares issued for acquisition

|

||||||||||||||||||||||||

|

of

interests in mineral claims

|

3,540,600 | 354 | 884,796 | - | 885,150 | |||||||||||||||||||

|

Common

shares issued for acquisition

|

||||||||||||||||||||||||

|

of

interests in mineral claims

|

1,850,000 | 185 | 462,315 | - | 462,500 | |||||||||||||||||||

|

Common

shares issued for acquisition

|

||||||||||||||||||||||||

|

interests

in a refinery

|

88,500 | 9 | 22,116 | - | 22,125 | |||||||||||||||||||

|

Common

shares issued for purchase of

|

||||||||||||||||||||||||

|

a

mill with capital equipments

|

6,975,000 | 697 | 1,743,053 | - | 1,743,750 | |||||||||||||||||||

|

Stock

issuance cost

|

(59,426 | ) | (59,426 | ) | ||||||||||||||||||||

|

Stock

based compensation

|

30,026 | 30,026 | ||||||||||||||||||||||

|

Net

loss for the year ended June 30, 2007

|

- | - | - | (2,845,424 | ) | (2,845,424 | ) | |||||||||||||||||

|

Balance,

June 30, 2007 (audited)

|

33,323,839 | 3,332 | 4,596,056 | - | (2,939,803 | ) | 1,659,585 | |||||||||||||||||

|

Common

stock issued to consultants

|

3,000,000 | 300 | 2,249,700 | (1,875,000 | ) | - | 375,000 | |||||||||||||||||

|

Stock

based compensation

|

- | 139,272 | - | 139,272 | ||||||||||||||||||||

|

Warrant

modification expense

|

844,423 | 844,423 | ||||||||||||||||||||||

|

Conversion

of convertible debentures with

|

||||||||||||||||||||||||

|

accrued

interest

|

7,186,730 | 719 | 3,590,801 | - | - | 3,591,520 | ||||||||||||||||||

|

Common

shares issued for acquisition

|

||||||||||||||||||||||||

|

of

interests in mineral claims

|

175,000 | 18 | 104,982 | 105,000 | ||||||||||||||||||||

|

Common

stock issued to a consultant

|

100,000 | 10 | 57,990 | 58,000 | ||||||||||||||||||||

|

Amortization

of deferred stock

|

||||||||||||||||||||||||

|

compensation

|

562,500 | 562,500 | ||||||||||||||||||||||

|

Net

loss for the year

|

(4,635,465 | ) | (4,635,465 | ) | ||||||||||||||||||||

|

Balance

June 30, 2008 (audited)

|

43,785,569 | 4,379 | 11,583,224 | (1,312,500 | ) | (7,575,268 | ) | 2,699,835 | ||||||||||||||||

|

Common

shares issued for cash (net)

|

7,040,000 | 704 | 3,372,296 | - | - | 3,373,000 | ||||||||||||||||||

|

Common

stock issued to a consultant

|

75,000 | 7 | 43,493 | - | - | 43,500 | ||||||||||||||||||

|

Common

stock issued on acquisition of a

|

||||||||||||||||||||||||

|

subsidiary

|

397,024 | 40 | 31,722 | - | - | 31,762 | ||||||||||||||||||

|

Common

shares issued on warrant

|

||||||||||||||||||||||||

|

exercises

|

8,900,907 | 890 | 2,224,337 | - | - | 2,225,227 | ||||||||||||||||||

|

Stock

based compensation

|

814,050 | 814,050 | ||||||||||||||||||||||

|

Warrant

modification expense

|

346,673 | 346,673 | ||||||||||||||||||||||

|

Amortization

of deferred stock

|

||||||||||||||||||||||||

|

compensation

|

1,125,000 | 1,125,000 | ||||||||||||||||||||||

|

Net

loss for the year

|

(6,045,477 | ) | (6,045,477 | ) | ||||||||||||||||||||

|

Balance

June 30, 2009 (audited)

|

60,198,500 | 6,020 | 18,415,795 | (187,500 | ) | (13,620,745 | ) | 4,613,570 | ||||||||||||||||

|

Common

shares issued for cash

|

6,973,180 | 697 | 1,603,134 | 1,603,831 | ||||||||||||||||||||

|

Common

stock issued on acquisition of a

|

||||||||||||||||||||||||

|

subsidiary

|

1,021,777 | 102 | 275,778 | 275,880 | ||||||||||||||||||||

|

Stock

based compensation

|

216,751 | - | 216,751 | |||||||||||||||||||||

|

Amortization

of deferred stock

|

||||||||||||||||||||||||

|

compensation

|

187,500 | 187,500 | ||||||||||||||||||||||

|

Net

loss for the year

|

(3,314,953 | ) | (3,314,953 | ) | ||||||||||||||||||||

|

Balance

June 30, 2010 (audited)

|

68,193,457 | 6,819 | 20,511,458 | - | (16,935,698 | ) | 3,582,579 | |||||||||||||||||

|

Stock

based compensation

|

60,926 | - | 60,926 | |||||||||||||||||||||

|

Common

stock options exercised

|

50,000 | 5 | 7,495 | - | 7,500 | |||||||||||||||||||

|

Net

loss for the three month period

|

(1,712,984 | ) | (1,712,984 | ) | ||||||||||||||||||||

|

Balance

December 31, 2010 (unaudited)

|

68,243,457 | 6,824 | 20,579,879 | - | (18,648,682 | ) | 1,938,021 | |||||||||||||||||

See

Condensed Notes to the Interim Consolidated Financial

Statements

- 6

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Interim

Consolidated Statements of Cash Flows

For the

six months ended December 31, 2010 and December 31, 2009

and for

the period from Inception (June 3, 1999) to December 31, 2010.

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

Cumulative

|

For

the six

|

For

the six

|

||||||||||

|

Since

|

months

ended

|

months

ended

|

||||||||||

|

Inception

|

December

31, 2010

|

December

31, 2009

|

||||||||||

|

$

|

$

|

$

|

||||||||||

|

Cash

Flows from Operating Activities

|

||||||||||||

|

Net

loss

|

(18,648,682 | ) | (1,712,984 | ) | (2,289,880 | ) | ||||||

|

Adjustment

for:

|

||||||||||||

|

Depreciation

|

962,288 | 73,574 | 90,368 | |||||||||

|

Amortization

of debt issuance cost

|

247,490 | - | - | |||||||||

|

Loss

on disposal of plant and equipment

|

10,524 | - | ||||||||||

|

Gain

on Bargain Purchase (Note 5)

|

(238,645 | ) | - | - | ||||||||

|

Stock

based compensation

|

1,261,025 | 60,926 | 167,322 | |||||||||

|

Warrant

modification expense

|

1,191,096 | - | - | |||||||||

|

Shares

issued for mineral claims, as part of project expenses

|

1,452,650 | - | - | |||||||||

|

Shares

issued for consultant services expensed

|

2,351,500 | - | 187,500 | |||||||||

|

Shares

issued on acquisition of subsidiary

|

31,762 | - | - | |||||||||

|

Interest

on convertible debentures

|

90,453 | - | - | |||||||||

|

Changes

in non-cash working capital

|

||||||||||||

|

Prepaid

expenses and other receivables

|

(174,437 | ) | (52,094 | ) | 14,291 | |||||||

|

Accounts

payable

|

64,821 | (28,589 | ) | (56,503 | ) | |||||||

|

Accrued

liabilities

|

72,323 | (45,270 | ) | 72,805 | ||||||||

|

Net

cash used in operating activities

|

(11,325,832 | ) | (1,704,437 | ) | (1,814,097 | ) | ||||||

|

Cash

Flows from Investing Activities

|

||||||||||||

|

Decrease

(Increase) in Short-term investments

|

(388,092 | ) | 198,653 | 1,582,656 | ||||||||

|

Acquisition

of plant and equipment for cash

|

(106,977 | ) | - | (5,431 | ) | |||||||

|

Proceeds

from sale of plant and equipment

|

2,500 | - | - | |||||||||

|

Net

cash provided by (used in) investing activities

|

(492,569 | ) | 198,653 | 1,577,225 | ||||||||

|

Cash

Flows from Financing Activities

|

||||||||||||

|

Issuance

of common shares for cash

|

6,394,571 | - | - | |||||||||

|

Issuance

of common shares for warrant exercises

|

2,225,227 | - | - | |||||||||

|

Issuance

of common shares for option exercise

|

7,500 | 7,500 | ||||||||||

|

Issuance

of convertible debentures subsequently converted to cash

|

3,501,067 | - | - | |||||||||

|

Stock

and debenture placement commissions paid in cash

|

(210,000 | ) | - | - | ||||||||

|

Net

cash provided by financing activities

|

11,918,365 | 7,500 | - | |||||||||

|

Net

Change in Cash

|

99,964 | (1,498,284 | ) | (236,872 | ) | |||||||

|

Cash-

beginning of period

|

- | 1,598,248 | 420,266 | |||||||||

|

Cash

- end of period

|

99,964 | 99,964 | 183,394 | |||||||||

|

Supplemental

Cash Flow Information:

|

||||||||||||

|

Interest

Paid

|

- | - | - | |||||||||

|

Income

taxes paid

|

- | - | - | |||||||||

See

Condensed Notes to the Interim Consolidated Financial

Statements

- 7

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

1.

|

Basis

of Presentation

|

The

accompanying unaudited condensed consolidated financial statements of

Infrastructure Materials Corp. (the “Company”), have been prepared in accordance

with the instructions to Form 10-Q and therefore do not include all information

and footnotes necessary for a fair presentation of financial position, results

of operations and cash flows in conformity with U.S. generally accepted

accounting principles (GAAP); however, such information reflects all adjustments

that are, in the opinion of management, necessary for a fair statement of the

results for the interim periods. The condensed consolidated financial

statements should be read in conjunction with the consolidated financial

statements and Notes thereto together with management’s discussion and analysis

of financial condition and results of operations contained in the Company’s

annual report on Form 10-K for the year ended June 30, 2010. In the opinion of

management, the accompanying condensed consolidated financial statements reflect

all adjustments of a normal recurring nature considered necessary to fairly

state the financial position of the Company at December 31, 2010 and June

30, 2010, the results of its operations for the six-month periods ended

December 31, 2010 and December 31, 2009, and its cash flows for the six-month

periods ended December 31, 2010 and December 31, 2009. In addition, some of

the Company’s statements in this quarterly report on Form 10-Q may be considered

forward-looking and involve risks and uncertainties that could significantly

impact expected results. The results of operations for the six-month period

ended December 31, 2010 are not necessarily indicative of results to be expected

for the full year.

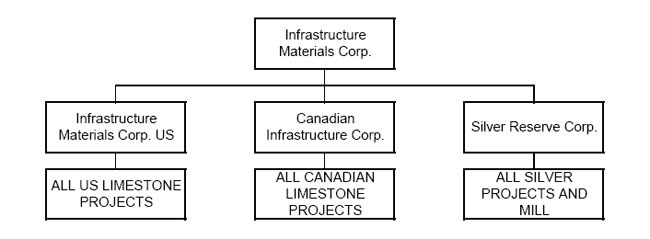

The

consolidated financial statements include the accounts of the Company and its

subsidiaries, Infrastructure Materials Corp US (“IMC US”), Silver Reserve Corp.

(“SRC” or “Silver Reserve”) and Canadian Infrastructure Corp. (“CIC”). All

material inter-company accounts and transactions have been

eliminated.

|

2.

|

Exploration

Stage Activities

|

The

Company's financial statements are presented on a going concern basis, which

contemplates the realization of assets and satisfaction of liabilities in the

normal course of business.

The

Company is in the exploration stage and has not yet realized revenues from its

planned operations. The Company has incurred a cumulative loss of

$18,648,682 from inception to December 31, 2010. The Company has

funded operations through the issuance of capital stock and convertible

debentures. In May and June of 2006, the Company closed a private

placement of its common stock for gross proceeds of $415,000. During the

year ended June 30, 2007 the Company raised $848,935 (including $300,000

received in the prior year as stock subscriptions) through private placement of

its common stock for cash. The Company also issued Convertible Debentures

in the amount of $1,020,862 during the year ended June 30, 2006 and issued

Convertible Debentures in the amount of $2,480,205 during the year ended June

30, 2007. During the three-month period ended September 30, 2008 the

Company completed private placements of common stock for proceeds of $3,373,000

net of cash expenses. During the three-month period ended March 31, 2009 as a

result of warrant exercises the Company issued common stock for proceeds of

$2,225,227. During the year ended June 30, 2009, the Company issued common stock

as a result of warrant exercises for proceeds of $2,225,227. In June 2010

the Company closed a private placement of its common stock for gross proceeds of

$1,603,831. Management's plan is to continue raising additional funds through

future equity or debt financing until it achieves profitable operations from

production of minerals or metals on its properties, if feasible. Also see

Note 11, Subsequent Events.

- 8

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

3.

|

Nature

of Operations

|

The

Company’s focus is on the exploration and development, if feasible, of

limestone, silver and other metals from its claims in the States of Nevada and

Arizona and the Canadian province of Manitoba.

The

Company is an exploration stage mining company and has not yet realized any

revenue from its operations. It is primarily engaged in the acquisition and

exploration of mineral properties. Mineral property acquisition costs are

initially capitalized in accordance with ASC 805-20-55-37, previously referenced

as the FASB Emerging Issues Task Force ("EITF") Issue 04-2. The Company

assesses the carrying costs for impairment under ASC 930 at each fiscal quarter

end. When it has been determined that a mineral property can be

economically developed as a result of establishing proven and probable reserves,

the costs incurred to develop such property will be capitalized. The

Company has determined that, except for the amount capitalized as Mineral

Property Interests for $514,525 (See Note 5, Mineral Property Interests), all

property payments are impaired and accordingly the Company has written off the

acquisition costs to project expenses. Once capitalized, such costs will

be amortized using the units-of-production method over the estimated life of the

probable reserve.

To date,

mineral property exploration costs have been expensed as incurred. To date

the Company has not established any proven or probable reserves on its mineral

properties.

The

Company’s limestone subsidiary, IMC US, controls 12 limestone Projects in

Nevada, made up of 782 mineral claims covering 16,156 acres. IMC US has acquired

100% of the Mineral Rights on an additional 1,120 acres, 50% of the Mineral

Rights on 7,400 acres, and 25% of the Mineral Rights on 160 acres. IMC US also

holds 20 mineral exploration permits covering 11,419 acres at two projects in

the state of Arizona. The Company has not yet determined that any of its claims

or mineral rights can be economically developed and has expensed related costs

to project expense. The Company’s assessment of the claims, exploration

permits and mineral rights may change after exploration of the

claims.

On

December 18, 2008, the Company incorporated a second wholly owned subsidiary in

the State of Delaware under its former name, “Silver Reserve Corp.” The

Company assigned all fourteen of its silver/base metal projects in Nevada to

this subsidiary. As of June 1, 2010, Silver Reserve Corp. terminated its

interests in one of the projects. The remaining thirteen claim groups

contain 347 claims covering 7,159 acres which include 10 patented claims and 2

leased patented claims.

On

October 14, 2010, SRC signed a letter of intent with International Millennium

Mining Corp. (“IMMC”) to sell an 85% interest in SRC’s NL Extension Projects

Claim Group (the “NL Project”). The NL Project consists of 18 mineral

claims located in Esmeralda County, Nevada. Pursuant to the letter of

intent, SRC will receive $350,000 and 1,925,000 shares of IMMC for the NL

Project. SRC will retain a 15% joint venture interest in the property as

well as a 2% net smelter royalty. The terms of the sale provide for the

above payments of cash and issuances of stock to SRC and to occur over a

five-year period. If the NL Project reaches feasibility based upon

criteria described in the letter of intent, SRC will be required to fund its

portion of the operating budget in order to retain its 15% joint venture

interest. The foregoing agreement is subject to SRC and IMMC entering into

definitive agreements and, in the case of IMMC, approval by the TSX-Venture

exchange of Canada.

- 9

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

3.

|

Nature

of Operations – Cont’d

|

SRC also

has a milling facility located in Mina, Nevada on six mill site claims covering

30 acres.

In

December 2009, the Company further expanded its limestone exploration activities

by acquiring limestone quarry leases located in Manitoba, Canada. The

Company acquired CIC, its wholly-owned Canadian subsidiary, pursuant to a Share

Exchange Agreement (the “CIC Agreement”) between the Company, CIC and Todd D.

Montgomery dated as of December 15, 2009. Mr. Montgomery was the sole

shareholder of CIC. Because Mr. Montgomery is also the Company’s Chief

Executive Officer and a member of its Board of Directors, the CIC Agreement was

approved by the disinterested members of the Company’s Board of Directors on

November 27, 2009, after obtaining an independent appraisal and market study for

the properties.

Under the

terms of the CIC Agreement, the Company acquired all of the issued and

outstanding stock of CIC in exchange for 1,021,777 shares of the Company.

The CIC Agreement closed on February 9, 2010. CIC controls 95 quarry

leases issued by the Province of Manitoba, Canada, covering 6,090 hectares

(15,049 acres). The Company accounted for the acquisition of CIC as a

business combination under the acquisition method as discussed in FASB ASC Topic

805.

ASC 805

requires acquisition-date fair value measurement of identifiable assets,

liabilities assumed and non-controlling interests in the acquiree. The

only assets acquired were CIC’S quarry leases having a fair value of $514,525

(CDN $550,000) that were recorded as an asset, “Mineral Property Interests,” on

the date of acquisition. The stock of the Company traded at $0.27 per

share on February 9, 2010, and the Company recorded a $275,880 increase in

shareholders’ equity reflecting the issuance of 1,021,777 common shares of the

Company in exchange for all issued and outstanding shares of CIC. There

were no liabilities assumed by the Company and no non-controlling interests in

CIC, resulting in a bargain purchase price of $238,645 that was recorded as

Other Income in the Company’s Consolidated Statements of Operations. Also

see Note 5, Mineral Property Interests.

- 10

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

4.

|

Plant

and Equipment, Net

|

Plant and

equipment are recorded at cost less accumulated depreciation. Depreciation

is provided commencing in the month following acquisition using the following

annual rate and method:

|

Computer

equipment

|

30 | % |

declining

balance method

|

|||

|

Office

furniture and fixtures

|

20 | % |

declining

balance method

|

|||

|

Plant

and Machinery

|

15 | % |

declining

balance method

|

|||

|

Tools

|

25 | % |

declining

balance method

|

|||

|

Vehicles

|

20 | % |

declining

balance method

|

|||

|

Consumables

|

50 | % |

declining

balance method

|

|||

|

Molds

|

30 | % |

declining

balance method

|

|||

|

Mobile

Equipment

|

20 | % |

declining

balance method

|

|||

|

Factory

Buildings

|

5 | % |

declining

balance

method

|

|

December 31, 2010

|

June 30, 2010

|

|||||||||||||||

|

Accumulated

|

Accumulated

|

|||||||||||||||

|

Cost

|

Depreciation

|

Cost

|

Depreciation

|

|||||||||||||

|

$

|

$

|

$

|

$

|

|||||||||||||

|

Computer

equipment

|

14,448 | 3,723 | 14,448 | 1,831 | ||||||||||||

|

Office,

furniture and fixtures

|

3,623 | 1,844 | 3,623 | 1,646 | ||||||||||||

|

Plant

and Machinery

|

1,514,511 | 761,550 | 1,514,511 | 700,499 | ||||||||||||

|

Tools

|

6,725 | 4,478 | 6,725 | 4,157 | ||||||||||||

|

Vehicles

|

76,928 | 39,176 | 76,928 | 34,981 | ||||||||||||

|

Consumables

|

64,197 | 60,686 | 64,197 | 59,516 | ||||||||||||

|

Molds

|

900 | 703 | 900 | 668 | ||||||||||||

|

Mobile

Equipment

|

73,927 | 45,355 | 73,927 | 42,181 | ||||||||||||

|

Factory

Buildings

|

74,849 | 14,887 | 74,849 | 13,349 | ||||||||||||

| 1,830,108 | 932,402 | 1,830,108 | 858,828 | |||||||||||||

|

Net

carrying amount

|

897,706 | 971,280 | ||||||||||||||

|

Depreciation

charges

|

73,574 | 177,321 | ||||||||||||||

- 11

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

5.

|

Mineral

Property Interests

|

The

Company entered into an agreement to acquire CIC as a wholly-owned subsidiary,

pursuant to a Share Exchange Agreement (the “CIC Agreement”) between the

Company, CIC and Todd D. Montgomery dated as of December 15, 2009. Under

the terms of the CIC Agreement, the Company acquired all of the issued and

outstanding stock of CIC in exchange for 1,021,777 shares of the Company.

The CIC Agreement closed on February 9, 2010. The Company accounted for

the acquisition of CIC as a business combination under the acquisition method as

discussed in FASB ASC Topic 805.

ASC 805

requires acquisition-date fair value measurement of identifiable assets,

liabilities assumed and non-controlling interests in the acquiree. There

were no liabilities recorded in the financial records of CIC as of February 9,

2010, the date of acquisition. Further, the Company acquired all the

issued and outstanding shares of CIC, resulting in the absence of

non-controlling interests in the acquiree.

|

Mineral

Property Interests, being quarry leases in the province of Manitoba,

Canada

|

||||

|

at

fair value (CDN $ 550,000), and amount recognized as

assets

|

||||

|

as

of the acquisition date

|

$ | 514,525 | ||

|

Fair

value, as of the acquisition date, of 1,021,777 common shares of the

Company

|

||||

|

issued

as consideration for all issued and outstanding shares of

CIC

|

$ | 275,880 | ||

|

Gain

on bargain purchase, being the excess of the fair value of net assets

acquired

|

||||

|

over

the purchase price, and recognized as Other Income

|

||||

|

in

the Statement of Operations

|

$ | 238,645 | ||

|

6.

|

Capital

stock and warrants

|

Six month period ended

December

31,

2010

On

September 30, 2010, the Company issued 50,000 shares of its common stock

pursuant to the exercise of options granted in accordance with its employee

stock option plan (the “2006 Stock Option Plan”). Also see Note 7, Stock

Based Compensation.

- 12

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

6.

|

Capital

stock and warrants – Cont’d

|

Year ended June 30,

2010

The

Company entered into an agreement to acquire CIC as a wholly-owned subsidiary,

pursuant to a Share Exchange Agreement (the “CIC Agreement”) between the

Company, CIC and Todd D. Montgomery dated as of December 15, 2009. Also see Note

3, Nature of Operations, and Note 5, Mineral Property Interests. Under the

terms of the CIC Agreement, the Company acquired all of the issued and

outstanding stock of CIC in exchange for 1,021,777 shares of the Company’s

common stock. The CIC Agreement closed on February 9, 2010.

On June

25, 2010, the Company completed a private placement of 6,973,180 shares of its

common stock at a price of $0.23 per share for total consideration of

$1,603,831. The private placement was exempt from registration under the

Securities Act of 1933, as amended (the “Securities Act”), pursuant to an

exemption afforded by Regulation S promulgated thereunder (“Regulation

S”). Each investor that participated in the private placement was a

non-“U.S. Person” as that term is defined under Regulation S.

Warrants

On August

22, 2008, the Company completed the private placements of 7,040,000 “Units” at

$0.50 per Unit. Each Unit consisted of one share of common stock and one

half-share purchase warrant (a “Warrant”). Each full Warrant entitled the

holder thereof to purchase one share of common stock at $0.75 on or before

September 1, 2010. In connection with the private placement, the Company

paid a commission of $147,000 and issued 294,000 “Broker Warrants,” also

expiring on September 1, 2010, to purchase Units at $0.50 per Unit. The

Units to be issued upon exercise of the broker warrants had the same terms as

those sold to investors.

On

December 11, 2008, the Board of Directors approved a one time offer to all

warrant holders to reduce the exercise price of all unexercised warrants from

$0.75 to $0.25 per share, if the warrants were exercised prior to February 28,

2009. Of the 3,520,000 Warrants issued on August 22, 2008, the Company

received elections to purchase 2,820,000 common shares under the exercise of

warrants at $0.25 per share.

The

700,000 unexercised Warrants issued on August 22, 2008 with an exercise price of

$0.75 per share, and the 294,000 Broker Warrants issued during the year ended

June 30, 2009 at an exercise price of $0.50 per Unit expired on September 1,

2010.

|

Number

of

|

||||||||||

|

Warrants

|

Exercise

|

|||||||||

|

Issued

|

Prices

|

Expiry Date

|

||||||||

|

$

|

||||||||||

|

Outstanding

at June 30, 2010 and average exercise price

|

994,000 | 0.66 |

September

1, 2010

|

|||||||

|

Issued

in six months ended December 31, 2010

|

- | - | ||||||||

|

Exercised

in six months ended December 31, 2010

|

- | - | ||||||||

|

Expired

in six months ended December 31, 2010 (issued in 2008)

|

(700,000 | ) | 0.75 | |||||||

|

Expired

in six months ended December 31, 2010 (issued in 2008)

|

(294,000 | ) | 0.50 | |||||||

|

Cancelled

in six months ended December 31, 2010

|

- | - | ||||||||

|

Outstanding

at December 31, 2010

|

- | |||||||||

- 13

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

7.

|

Stock

Based Compensation

|

In April

of 2006, the Board of Directors approved the Company’s 2006 Stock Option Plan,

the purpose of which is to enhance the Company's stockholder value and financial

performance by attracting, retaining and motivating the Company's officers,

directors, key employees, consultants and its affiliates and to encourage stock

ownership by such individuals by providing them with a means to acquire a

proprietary interest in the Company's success through stock

ownership.

Under the

2006 Stock Option Plan, officers, directors, employees and consultants who

provide services to the Company may be granted options to acquire shares of the

Company’s common stock at the fair market value of the stock on the date of

grant. Options may have a term of up to 10 years. The total number

of shares of common stock reserved for issuance under the 2006 Stock Option Plan

is 5,000,000.

Six month period ended December 31, 2010

On

September 30, 2010, 50,000 options issued in accordance with the Company’s 2006

Stock Option Plan were exercised and 200,000 options expired.

On

October 15, 2010, 300,000 options issued in accordance with the Company’s 2006

Stock Option Plan expired.

On

November 18, 2010, the Company granted options to a consultant to purchase up to

250,000 common shares at an exercise price of $0.16 per share. These

options were granted in accordance with the terms of the Company’s 2006 Stock

Option Plan and vest at a rate of 1/12 each month until fully vested. The

options granted have a term of 5 years.

On

November 24, 2010, the Company granted options to a consultant to purchase

up to 150,000 common shares at an exercise price of $0.16 per share. These

options were granted in accordance with the terms of the Company’s 2006 Stock

Option Plan and vest at a rate of 1/12 each month until fully vested. The

options granted have a term of 5 years.

For the

six month period ended December 31, 2010, the Company recognized in the

financial statements, stock-based compensation costs as reflected in the

following table. The fair value of each option used for the purpose of

estimating the stock compensation is based on the grant date using the

Black-Scholes option pricing model with the following weighted average

assumptions.

The

expected term calculation is based upon the term the option is expected to be

held, which is the full term of the option. The risk-free interest rate is

based upon the U.S. Treasury yield in effect at the time of grant for an

instrument with a maturity that is commensurate with the expected term of the

stock options. The dividend yield of zero is based on the fact that we

have never paid cash dividends on our common stock and we have no present

intention to pay cash dividends. The expected forfeiture rate of 0% is

based on the vesting of stock options in a short period of

time.

- 14

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

7.

|

Stock

Based Compensation – Cont’d

|

|

Date

of grant

|

Risk

free

rate

|

Volatility

factor

|

Expected

Dividends

|

Forfeiture

rate

|

Expected

life

|

Exercise

price

|

Total

number of

options

granted

|

Grant

date

fair

value

|

Stock-based

compensation

cost

expensed

during

the six

month

period

ended

December

31,

2010

|

Unexpended

Stock-based

compensation

cost

deferred

over

the vesting

period

|

||||||||||||||||||||||||||||

|

15-Jan-2010

|

2.61 | % | 137.23 | % | 0 | % | 0 | % |

5

years

|

$ | 0.25 | 250,000 | $ | 0.22 | $ | 27,808 | $ | 4,534 | ||||||||||||||||||||

|

17-Feb-2010

|

2.61 | % | 138.74 | % | 0 | % | 0 | % |

5

years

|

$ | 0.28 | 100,000 | $ | 0.25 | $ | 12,512 | $ | 3,196 | ||||||||||||||||||||

|

26-Apr-2010

|

2.61 | % | 145.58 | % | 0 | % | 0 | % |

5

years

|

$ | 0.23 | 50,000 | $ | 0.23 | $ | 5,714 | $ | 3,571 | ||||||||||||||||||||

|

1-Jun-2010

|

2.61 | % | 145.23 | % | 0 | % | 0 | % |

15

months

|

$ | 0.25 | 250,000 | $ | 0.07 | $ | 8,204 | $ | 6,732 | ||||||||||||||||||||

|

18-Nov-2010

|

3.00 | % | 150.47 | % | 0 | % | 0 | % |

5

years

|

$ | 0.16 | 250,000 | $ | 0.15 | $ | 4,407 | $ | 32,147 | ||||||||||||||||||||

|

24-Nov-2010

|

3.00 | % | 149.47 | % | 0 | % | 0 | % |

5

years

|

$ | 0.16 | 150,000 | $ | 0.15 | $ | 2,281 | $ | 19,627 | ||||||||||||||||||||

|

Total

|

1,050,000 | $ | 60,926 | $ | 69,807 | |||||||||||||||||||||||||||||||||

The

following table summarizes the options outstanding at December 31,

2010:

|

Outstanding,

beginning of year (audited)

|

4,850,000 | |||

|

Granted

|

400,000 | |||

|

Expired

|

(500,000 | ) | ||

|

Exercised

|

(50,000 | ) | ||

|

Forfeited

|

- | |||

|

Outstanding

at December 31, 2010

|

4,700,000 | |||

|

Exercisable

at December 31, 2010

|

4,174,999 |

As of

December 31, 2010, there was $69,807 of unrecognized expenses related to

non-vested stock-based compensation arrangements granted. The stock-based

compensation expense for the six-month period ended December 31, 2010 was

$60,926.

- 15

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

8.

|

Fair

Value of Financial Instruments

|

The fair

values of financial assets and financial liabilities measured in the balance

sheet as of December 31, 2010 are as follows:

|

Balance sheet

classification and nature

|

Carrying

Amount

$

|

Quoted prices

in active

markets for

identical assets

(Level 1)

$

|

Significant

observable

inputs

(Level 2)

$

|

Unobservable

inputs

(Level 3)

$

|

||||||||||||

|

Assets

|

||||||||||||||||

|

Cash

and cash equivalents

|

99,964 | 99,964 | ||||||||||||||

|

Short

Term Investments

|

388,092 | 388,092 | ||||||||||||||

|

Prepaid

expenses and other receivables

|

174,437 | 174,437 | ||||||||||||||

|

Liabilitites

|

||||||||||||||||

|

Accounts

Payable

|

64,821 | 64,821 | ||||||||||||||

|

Accrued

Liabilities

|

71,882 | 71,882 | ||||||||||||||

The fair

values of financial assets and financial liabilities measured in the balance

sheet as of June 30, 2010 are as follows:

|

Balance sheet

classification and nature

|

Carrying

Amount

$

|

Quoted prices

in actice

markets for

identical assets

(Level 1)

$

|

Significant

observable

inputs

(Level 2)

$

|

Unobservable

inputs

(Level 3)

$

|

||||||||||||

|

Assets

|

||||||||||||||||

|

Cash

and cash equivalents

|

1,598,248 | 1,598,248 | ||||||||||||||

|

Short

Term Investments

|

586,745 | 586,745 | ||||||||||||||

|

Prepaid

expenses and other receivables

|

122,343 | 122,343 | ||||||||||||||

|

Liabilitites

|

||||||||||||||||

|

Accounts

Payable

|

93,410 | 93,410 | ||||||||||||||

|

Accrued

Liabilities

|

117,152 | 117,152 | ||||||||||||||

Fair

value measurements of the Corporation’s cash and cash equivalents and short term

investments are classified as Level 1 because such measurements are determined

using quoted prices in active markets for identical assets. Fair value

measurements of prepaid expenses and other receivables, accounts payable and

accrued liabilities are classified as Level 3 because inputs are generally

unobservable and reflect management’s estimates of assumptions that market

participants would use in pricing the asset or liability.

- 16

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

9.

|

Commitments

and Contingencies

|

On August

1, 2006, the Company acquired the Pansy Lee Claims from Anglo Gold Mining Inc.

in exchange for 1,850,000 shares of the Company’s common stock pursuant to an

Asset Purchase Agreement dated August 1, 2006 (the “Pansy Lee Purchase

Agreement”). Pursuant to the Pansy Lee Purchase Agreement, in the event

that any one or more claims becomes a producing claim, our revenue is subject to

a 2% net smelter return royalty where net smelter returns are based upon gross

revenue. Gross revenue would be calculated after commercial production

commences and includes the aggregate of the following amounts: revenue received

by the Company from arm’s length purchasers of all mineral products produced

from the property, the fair market value of all products sold by the Company to

persons not dealing with the Company at arms length and the Company’s share of

the proceeds of insurance on products. From such revenue, the Company

would be permitted to deduct: sales charges levied by any sales agent

on the sale of products; transportation costs for products; all costs, expenses

and charges of any nature whatsoever which are either paid or incurred by the

Company in connection with the refinement and beneficiation of products after

leaving the property and all insurance costs and taxes. The 2% net smelter

royalty pertains to 8 of the 30 claims in this group.

On

September 14, 2007, the Company engaged Lumos & Associates, Inc. (“Lumos”)

to complete the regulatory permitting process for the Company’s Mill in Mina,

Nevada. The total consideration to be paid under the contract is

approximately $350,000. The permitting process is being carried out in

twelve stages. The completion date has not been determined. The Company is

required to authorize in writing each stage of the work before the work

proceeds. In December 2010 this contract was assigned by Lumos to Tetra Tech,

Inc. by mutual agreement of the Company, Lumos, and Tetra Tech, Inc. As

of December 31, 2010, the Company had recorded $323,924 for this contract

(June 30, 2010 - $318,832).

The

Company obtained 25 mineral claims (the “Option Claims”), located in Elko

County, Nevada pursuant to an option agreement (the “Option Agreement”) dated as

of May 1, 2008 (the “Date of Closing”) with Nevada Eagle Resources, LLC and

Steve Sutherland (together, the “Optionees”). The provisions of the Option

Agreement included, among others, payments of specified annual amounts ranging

from $10,000 to $80,000 by the Company to the Optionees over a period of ten

years. Effective June 1, 2010, the Company and the Optionees agreed to

terminate the Company’s interests in the Option Claims pursuant to

(1) payment by the Company of $8,750 to each of the Optionees, (2)

performance by the Company of such reclamation and remediation as required to

discharge the surface management bond posted by the Company pursuant to a Notice

of Intent filed with the BLM prior to undertaking exploration activity on the

Option Claims, and (3) conveyance by the Company to Nevada Eagle Resources, LLC

of the 124 mineral claims staked by the Company after the Date of Closing that

are within the Area of Interest described in the Option Agreement. As of

the date of this report, the undertakings described in (1) and (3) above have

been completed and (2) above is in progress. The 25 Option Claims together

with the 124 mineral claims staked by the Company have been referred to by the

Company as the “Medicine Claim Group.”

- 17

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

9.

|

Commitments

and Contingencies – Cont’d

|

Effective

as of June 23, 2008, the Company appointed Mason Douglas as the President of the

Company. Mr. Douglas is also a director of the Company. In connection with the

appointment, the Company entered into a consulting services agreement with a

corporation that is controlled by Mr. Douglas (the “Consulting Agreement”). The

Consulting Agreement has a term of one year and is then automatically renewable.

Either party may terminate the Consulting Agreement upon 90 days notice to the

other party. During the term of the Consulting Agreement the Company will pay a

fee of $8,500 per month and reimburse related business expenses. Mr. Douglas

does not receive a salary from the Company.

On

December 8, 2008 IMC US entered into a Mineral Rights Lease Agreement (the

“Edgar Lease Agreement”) with the Earl Edgar Mineral Trust (“Edgar”) to lease

certain mineral rights in Elko County, Nevada described below (the “Edgar

Property”). The term of the Edgar Lease Agreement is ten years and will

automatically renew on the same terms and conditions for additional ten-year

periods, provided IMC US is conducting exploration, development or mining either

on the surface or underground at the property. The rent is to be paid each

year on January 1st. $1.00 per net acre was paid upon execution of the

Edgar Lease Agreement. On January 1 of each year commencing in 2010 and

extending for so long as the Edgar Lease Agreement is in effect, IMC US is

obligated to make the following payments:

|

2010

|

$1.00

per net acre

|

|

|

2011

|

$2.00

per net acre

|

|

|

2012

|

$2.00

per net acre

|

|

|

2013

|

$3.00

per net acre

|

|

|

2014

|

$3.00

per net acre

|

|

|

2015

|

$4.00

per net acre

|

|

|

2016

|

$4.00

per net acre

|

|

|

2017

|

|

$5.00

per net acre in each year for the duration of the Edgar Lease

Agreement.

|

The Edgar

Lease Agreement covers 100% of the mineral rights on 1,120 acres of the Edgar

Property (“Property A”) and 50% of the mineral rights on 6,720 acres of the

Edgar Property (“Property B”). Edgar is entitled to receive a royalty of

$0.50 per ton for material mined and removed from Property A and $0.25 per ton

for material mined and removed from Property B during the term of the Edgar

Lease Agreement and any renewal thereof.

On April

9, 2009, the Company and Edgar entered into an Amendment to the Edgar Lease

Agreement (the “Amendment”), effective as of December 8, 2008. The

Amendment provides for Standard Steam LLC to carry out exploration for

geothermal energy sources on the Edgar Property after obtaining the written

consent of the Company. The Amendment also provides for other cooperation

with Standard Steam LLC regarding mineral rights on Property B of the Edgar

Property.

- 18

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

9.

|

Commitments

and Contingencies – Cont’d

|

On May

20, 2009, IMC US engaged Lumos to conduct base line studies for the Blue Nose

Project located in Lincoln County, Nevada with the intention of determining if a

suitable plant site can be located. The study includes analysis of rail

and road access and environmental considerations that could impede

development. The total consideration to be paid under the contract is

approximately $74,500. On September 28, 2009, the contract was amended to

add an environmental assessment and plan of operations for an additional amount

of approximately $62,000. The Company has to authorize each phase of the

work. In December 2010 this contract was assigned by Lumos to Tetra Tech,

Inc. by mutual agreement of the Company, Lumos, and Tetra Tech, Inc. As of

December 31, 2010, the Company had recorded total expenses of $130,101

pertaining to this contract with Lumos (June 30, 2010 -

$114,576).

By letter

dated November 27, 2009, the U.S. Attorney’s Office asked for contribution from

the Company for the cost of putting out a fire that occurred on May 8, 2008 on

approximately 451 acres of land owned by the BLM. The cost of putting out

the fire and rehabilitating the burned area was approximately $550,000.

The Company has denied any responsibility for the fire and has alerted its

liability insurance carrier. The Company has not accrued any costs for this

claim in its financial statements.

On

November 30, 2009, the Company entered into a consulting services agreement with

CLL Consulting, LLC (“CLL”) to provide for business and administrative services.

The Consulting Agreement has a term of one year and is automatically renewable

thereafter. Either party may terminate the Consulting Agreement upon 60 days

notice. During the term of the Consulting Agreement the Company will pay CLL a

fee of $6,083 per month and reimburse related business expenses.

On

November 30, 2009, IMC US entered into a Mineral Rights Agreement

with Perdriau Investment Corp. (“Perdriau”) to purchase 50% of the mineral

rights, including all easements, rights of way and appurtenant rights of any

type that run with the mineral rights in certain sections of Elko County, Nevada

(the “Perdriau Property”). The purchase price was $10 per net acre.

IMC US purchased 340 net acres for a total purchase price of $3,400. Perdriau

will be entitled to receive a royalty of $0.25 per ton for material mined and

removed from the Perdriau Property. Material mined and stored on the Perdriau

Property or adjacent property for reclamation purposes will not be subject to

any royalty. Material removed from the Perdriau Property for the purposes of

testing or bulk sampling, provided it does not exceed 50,000 tons, will also not

be subject to any royalty. The royalty will be calculated and paid within

45 days after the end of each calendar quarter.

On

January 15, 2010, the Company entered into an “Independent Contractor Agreement”

with Karl Frost. Mr. Frost was given the title of Chief Geologist of the Company

and will be responsible for the preparation and oversight of all geological

programs and activities. The Independent Contractor Agreement has a term of one

year and is automatically renewable thereafter. Either party may terminate the

agreement upon 60 days notice or in the case of breach or default with 5 days of

written notice. During the term of the agreement the Company will pay Mr. Frost

a fee of $12,500 per month and reimburse him for related business

expenses.

- 19

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

9.

|

Commitments

and Contingencies – Cont’d

|

As of

January 15, 2010, the Company entered into a Property Lease Agreement with

Eugene M. Hammond (the “Hammond Lease”) for surface rights on 80 acres in Elko

County, Nevada (the “Hammond Surface Rights”). The term of the Hammond

Lease is five years and the annual rent is $500. The Company is

responsible for the payment of all real estate taxes on the Hammond Surface

Rights. During the term of the Hammond Lease, the Company has the

exclusive right to conduct exploration and development work on the Hammond

Surface Rights. The results of all drilling and exploration are the

property of the Company. The Company is responsible for any environmental

damage caused by the Company and any reclamation costs required as a result of

drilling and testing. The Company has an option to purchase the property

covered by the Hammond Lease for $15,000, less the amount paid in rent during

the term of the Hammond Lease.

Also as

of January 15, 2010, IMC US entered into a Mineral Rights Agreement with Eugene

M. Hammond (the “Hammond Mineral Rights Agreement”) pursuant to which the

Company purchased a 25% interest in any and all minerals extracted from 160

acres (the “Hammond Mineral Rights Property”) covered by the Hammond Mineral

Rights Agreement. The purchase price was $400. In addition, the

seller is entitled to receive a royalty of $0.125 per ton on material mined and

removed from the Hammond Mineral Rights Property. The Hammond Mineral

Rights Agreement does not cover petroleum.

As of

February 1, 2010, the Company entered into a Consulting Services Agreement to

provide for receptionist and administrative services at its Reno, Nevada

corporate headquarters. Pursuant to this Agreement, the Company will pay

$51,000 per year for such services.

On March

25, 2010, IMC US engaged Lumos to conduct the second phase of base line studies

for the Blue Nose Project located in Lincoln County, Nevada with the intention

of determining if a suitable plant site can be located with emphasis on

transportation access and environmental considerations that could impede

development. The total consideration to be paid under the contract is

approximately $55,300. The Company is to authorize each phase of work before the

work proceeds. In December 2010 this contract was assigned by Lumos to Tetra

Tech, Inc. by mutual agreement of the Company, Lumos, and Tetra Tech, Inc.

As of December 31, 2010, the Company had recorded total expenses of $50,669

pertaining to this contract with Lumos (June 30, 2010 - $36,011).

On May

19, 2010, IMC US engaged Mine Development Associates, Inc. (“MDA”) to complete a

Resource Estimate, Pit Optimization and Canadian National Instrument 43-101

Report for the Blue Nose Project located in Lincoln County, Nevada. In its

proposal, MDA estimated the cost of these services to be $43,000 plus travel

expenses. The Company is to authorize each phase of work before the

work proceeds. As of December 31, 2010, the Company had recorded total expenses

of $23,619 pertaining to this engagement (June 30, 2010 - $0).

- 20

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

9.

|

Commitments

and Contingencies – Cont’d

|

As of

June 1, 2010, the Company entered into a Consulting Agreement with Teatyn

Enterprises Inc. (“Teatyn”) to provide business consulting and investor

relations consulting. Under the agreement, Teatyn will receive a

monthly fee of CDN $10,000, subject to monthly reductions of up to CDN $3,500 if

Teatyn enters into one or more agreements to provide similar services to other

companies of which the Company’s Chief Executive Officer is also a director or

officer. The agreement has an initial term of one year and can

be renewed on such terms as may be agreed upon between the

parties. The agreement may be terminated at any time by the Company

upon 30-days prior written notice or by Teatyn upon the occurrence of certain

events defined in the agreement. In addition the Company

granted Teatyn options to purchase up to 250,000 common shares at an exercise

price of $0.25 per share. These options vest at the rate of 20,833

options per month and expire on the date that is 90 days after the termination

of the Consulting Agreement. These options were not granted pursuant

to the Company’s 2006 Stock Option Plan. Upon exercise of the

options, Teatyn will receive restricted shares which cannot be re-sold unless

their re-sale is registered by the Company pursuant to the Securities Act or

there is an exemption for the re-sale of such shares such as the exemption

afforded by Rule 144 promulgated thereunder.

On

October 6, 2010, IMC US engaged Tetra Tech, Inc. to complete exploration

permitting activities for the Blye Canyon Project

located near Seligman, Arizona. The estimated total consideration to

be paid under the contract is $18,720. As of December 31, 2010, the Company had

not incurred any expenses pertaining to this contract.

The

Company has entered into operating leases for its office space and certain

office furniture and equipment. Rent payments associated with those leases for

the six month periods ended December 31, 2010, and December 31, 2009, were

$15,863 and $9,419, respectively. As of December 31, 2010, the

Company’s estimated future minimum cash payments under non-cancelable operating

leases for the years ending June 30, 2011, June 30, 2012, and June 30, 2013, are

$15,755, $16,572, and $338, respectively.

Maintaining Claims in Good

Standing

The

Company is required to pay to the BLM on or before September 1st of each

year, a fee in the amount of $140 per mineral claim held by the

Company. The total amount paid on August 31, 2010, was $159,740 for

1,141 claims held by the Company at that date.

Under

legislation enacted in Nevada in March 2010, claims owners are required to pay

the State of Nevada an annual fee based upon a tiered system that requires fees

ranging from $70 to $189 per claim, depending upon the total number of claims in

Nevada that an owner holds. The Company estimates, based upon the

1,123 claims held in Nevada as of December 31, 2010, that its annual fee will be

$85 per claim, for a total of $95,455, with the first such annual fee payable no

later than June 1, 2011.

The

Company is also required to pay annual fees to counties in which the claims are

held. In October 2010, the Company paid $12,188 to nine counties in

Nevada for annual claims-related fees.

The

Company also holds 9 patented claims and 2 leased patented claims in

Nevada. A patented claim is fee simple title to the

property. Patented claims are subject to taxes assessed by the local

community based on assessment rates set annually.

- 21

-

INFRASTRUCTURE

MATERIALS CORP.

(AN

EXPLORATION STAGE MINING COMPANY)

Condensed

Notes to Interim Consolidated Financial Statements

December

31, 2010

(Amounts

expressed in US Dollars)

(Unaudited-Prepared

by Management)

|

9.

|

Commitments

and Contingencies – Cont’d

|

The

Company holds 20 mineral exploration permits covering 20 sections or

portions of sections in the State of Arizona. Mineral exploration

permits have a duration of one year from the date of issuance. The

permits can be renewed for up to four additional one-year terms for a total of

five years and provide the holder of the permit with an exclusive right to

explore for minerals within the state land covered by the permit and to apply

for mineral leases to such land. The holder of a permit may remove

from the land only the amount of material required for sampling and testing and

is responsible for any damage or destruction caused by the holder’s exploration

activities. The holder of a permit is entitled to ingress and egress

to the covered site along routes approved by the Arizona State Land

Department. IMC US has posted a bond required by the State of

Arizona to back any reclamation required as a result of work