Attached files

| file | filename |

|---|---|

| EX-31.2 - INFRASTRUCTURE MATERIALS CORP. | v198853_ex31-2.htm |

| EX-32.1 - INFRASTRUCTURE MATERIALS CORP. | v198853_ex32-1.htm |

| EX-31.1 - INFRASTRUCTURE MATERIALS CORP. | v198853_ex31-1.htm |

| EX-23.1 - INFRASTRUCTURE MATERIALS CORP. | v198853_ex23-1.htm |

| EX-21.1 - INFRASTRUCTURE MATERIALS CORP. | v198853_ex21-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

|

(Mark

one)

|

|

|

x

|

Annual

report under Section 13 or 15(d) of the Securities Exchange Act of

1934

|

|

For

the Fiscal Year June 30, 2010, or

|

|

|

¨

|

Transition

report pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

|

000-52641

Commission

File Number

INFRASTRUCTURE

MATERIALS CORP.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

98-0492752

|

|

|

(State

or other jurisdiction of incorporation or

organization)

|

(I.R.S.

Employer Identification Number)

|

1135

Terminal Way, Suite 207B

Reno,

NV 89502 USA

(Address

of Principal Executive Offices) (Zip Code)

775-322-4448

(Registrant’s

telephone number, including area code)

With a

copy to:

Jonathan

H. Gardner

Kavinoky

Cook LLP

726

Exchange St., Suite 800

Buffalo,

NY 14210

Securities

registered under Section 12(b) of the Exchange Act: None

Securities

registered under Section 12(g) of the Exchange Act:

Common Stock, par value

$0.0001 per share

Indicate by check mark if the

registrant is a well-known seasoned issuer as defined by Rule 405 of the

Securities Act Yes ¨

Nox

Indicate by check mark if the

registrant is not required to file reports pursuant to Rule 13 or Section 15(d)

of the Act Yes ¨

No x

Indicate by check mark whether

the issuer (1) has filed all reports required to be filed by Section 13 or 15(d)

of the Exchange Act during the past 12 months (or for such shorter period that

the registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes x

No ¨

Indicate by check mark whether

the registrant has submitted electronically and posted on its corporate web

site, if any, every Interactive Data File required to be submitted and posted

pursuant Rule 405 of Regulation S-T (s 220.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required

to submit and post such files. Yes ¨

No ¨

Check if disclosure of

delinquent filers in response to Item 405 of Regulation S-K is not contained in

this form, and no disclosure will be contained, to the best of registrant's

knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K.

¨

Indicate by check mark whether

the registrant is a large accelerated filer, a non-accelerated filer or a

smaller reporter.

|

Large

accelerated filer ¨

|

Accelerated

filer

¨

|

|

Non-accelerated

filer ¨

|

Smaller

reporting company x

|

Indicate

by check mark whether registrant is a shell company (as defined in Rule 12b-2 of

the Exchange Act). ¨ Yes

x

No

The

issuer had no revenue during the year ended June 30, 2010.

The

aggregate market value of the Common Stock held by non-affiliates of the issuer,

as of June 30, 2010 was approximately $8,673,151 based upon a share valuation of

$0.21 per share. This share valuation is based upon the closing price of the

Company’s shares as of June 30, 2010. For purposes of this disclosure, shares of

Common Stock held by persons who the issuer believes beneficially own more than

5% of the outstanding shares of Common Stock and shares held by officers and

directors of the issuer have been excluded because such persons may be deemed to

be affiliates of the issuer.

As of

June 30, 2010, 68,193,457 shares of the issuer’s Common Stock were outstanding.

No other classes of stock have been issued by the issuer.

Transitional

Small Business Disclosure Yes o No x

TABLE

OF CONTENTS

|

Page

|

||

|

Part

I

|

||

|

Item

1.

|

Description

of Business and Risk Factors

|

3

|

|

Item

1A.

|

Risk

Factors

|

4

|

|

Item

2.

|

Properties

|

7

|

|

Item

3.

|

Legal

Proceedings

|

32

|

|

Item

4.

|

Removed

and Reserved

|

32

|

|

Part

II

|

||

|

Item

5.

|

Market

For Common Equity, Related Stockholder Matters and Small Business Issuer

Purchase of Equity Securities

|

33

|

|

Item

6.

|

Selected

Financial Data

|

36

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

37

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

47

|

|

Item

8.

|

Financial

Statements and Supplementary Data

|

47

|

|

Item

9.

|

Change

in and Disagreements With Accountants on Accounting and Financial

Disclosure

|

47

|

|

Item

9A.

|

Controls

and Procedures

|

47

|

|

Item

9A(T)

|

Controls

and Procedures

|

47

|

|

Item

9B.

|

Other

Information

|

49

|

|

Part

III

|

||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

50

|

|

Item

11.

|

Executive

Compensation

|

54

|

|

|

||

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

57

|

|

Item

13.

|

Certain

Relationships and Related Transactions

|

59

|

|

Item

14.

|

Principal

Accountant Fees and Services

|

60

|

|

PART

IV

|

||

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

60

|

2

PART

I

This

Annual Report on Form 10-K contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, which

include, without limitation, statements about our explorations, development,

efforts to raise capital, expected financial performance and other aspects of

our business identified in this Annual Report, as well as other reports that we

file from time to time with the Securities and Exchange Commission. Any

statements about our business, financial results, financial condition and

operations contained in this Annual Report that are not statements of historical

fact may be deemed to be forward-looking statements. Without limiting the

foregoing, the words “believes,” “anticipates,” “expects,” “intends,”

“projects,” or similar expressions are intended to identify forward-looking

statements. Our actual results could differ materially from those

expressed or implied by these forward-looking statements as a result of various

factors, including the risk factors described in the section entitled, RISK

FACTORS and elsewhere in this report. We undertake no obligation to update

publicly any forward-looking statements for any reason, except as required by

law, even as new information becomes available or other events occur in the

future.

Item

1. Description of Business.

Our name

is Infrastructure

Materials Corp. and we sometimes refer to ourselves in this report as

“Infrastructure Materials” or “Infrastructure”, the “Company” or as “we,” “our,”

or “us.” We are engaged in the exploration and development of cement grade

limestone properties located in the states of Nevada, Idaho and Arizona and the

Canadian Province of Manitoba. As of the date of this report, we hold 1,941

claims on land owned or controlled by the United States Department of Interior

Bureau of Land Management (“BLM”). The Company also holds mineral rights or

surface rights for 4,940 net acres and 12 patent claims. Our claims cover 25

projects in Nevada and one project in Idaho. We have several exploration permits

in effect with the State of Arizona covering two additional projects located

near the municipalities of Benson and Seligman, Arizona. We also own a milling

facility located on six BLM mill site claims in Nevada. The Company also holds

95 quarry leases in south-central Manitoba, Canada. Our efforts going forward

through our current fiscal year ending June 30, 2011, will be concentrated on

development of our Blue Nose Project located in Lincoln County, Nevada and

further exploration for other limestone deposits in strategic locations that can

serve areas with a shortage of cement production.

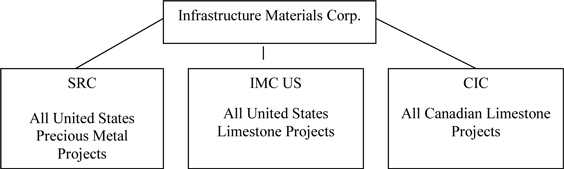

Infrastructure

has three wholly-owned subsidiaries. They are (a) Infrastructure Materials Corp

US, a Nevada corporation (“IMC US”) that holds title to our limestone related

claims and leases in the United States, (b) Silver Reserve Corp., a Delaware

corporation (“Silver Reserve” or “SRC”) that holds title to our precious metal

claims and leases, and (c) Canadian Infrastructure Corp, an Ontario, Canada

corporation (“CIC”). As of November, 2008, the Company re-focused its attention

and resources on the acquisition and exploration of limestone mineral claims.

Prior to that date, the Company was principally focused on the precious metal

properties now held by Silver Reserve. As of the period covered by this report,

the Company’s principal focus is on the limestone properties held by IMC US and

CIC. The following diagram illustrates our corporate structure.

3

Our head

office is at 1135 Terminal Way, Suite 207B, Reno, Nevada 89502 and our

administration office is also at this address. Our telephone number is

775-322-4448.

Item

1A. Risk Factors

The

following are certain risk factors that could affect our business, financial

condition, operating results and cash flows. These risk factors should be

considered in connection with evaluating the forward-looking statements because

they could cause actual results to differ materially from those expressed in any

forward-looking statement. The risk factors highlighted below are not the only

ones we face. If any of these events actually occur, our business, financial

condition, operating results or cash flows could be negatively

affected.

|

1.

|

THE

COMPANY HAS NO SOURCE OF OPERATING REVENUE AND EXPECTS TO INCUR

SIGNIFICANT EXPENSES BEFORE ESTABLISHING AN OPERATING COMPANY, IF IT IS

ABLE TO ESTABLISH AN OPERATING COMPANY AT

ALL.

|

Currently,

the Company has no source of revenue, limited working capital and no commitments

to obtain additional financing. The Company will require additional working

capital to carry out its exploration programs. The Company has no operating

history upon which an evaluation of its future success or failure can be made.

The ability to achieve and maintain profitability and positive cash flow is

dependent upon:

|

|

-

|

further

exploration of our properties and the results of that

exploration.

|

|

|

-

|

raising

the capital necessary to conduct this exploration and preserve the

Company’s Properties.

|

|

|

-

|

raising

capital to develop our properties, establish a mining operation, and

operate this mine in a profitable manner if any of these activities are

warranted by the results of our exploration programs and a feasibility

study.

|

Because

the Company has no operating revenue, it expects to incur operating losses in

future periods as it continues to spend funds to explore its properties. Failure

to raise the necessary capital to continue exploration could cause the Company

to go out of business.

|

2.

|

WE

WILL NEED TO RAISE ADDITIONAL FINANCING TO COMPLETE FURTHER

EXPLORATION

|

We will

require significant additional financing in order to continue our exploration

activities and our assessment of the commercial viability of our properties.

There can be no assurance that we will be successful in our efforts to raise

these require funds, or on terms satisfactory to us. The continued exploration

of current and future mineral properties and the development of our business will depend upon our

ability to establish the commercial viability of our properties and to

ultimately develop cash flow from operations and reach profitable operations. We

currently are in an exploration stage and we have no revenue from operations and

we are experiencing significant cash outflow from operating activities. If we

are unable to obtain additional financing, we will not be able to continue our

exploration activities and our assessment of the commercial viability of our

precious metal and mineral properties.

4

|

3.

|

WE

HAVE NO RESERVES AND WE MAY FIND THAT OUR PROPERTIES ARE NOT COMMERCIALLY

VIABLE

|

Our

properties do not contain reserves in accordance with the definitions adopted by

the Securities and Exchange Commission, and there is no assurance that any

exploration programs that we undertake will establish reserves. All of our

mineral properties are in the exploration stage as opposed to the development

stage and have no known body of economic mineralization. The known

mineralization at these projects has not yet been determined, and may never be

determined to be economic. We plan to conduct further exploration activities on

our properties, which future exploration may include the completion of

feasibility studies necessary to evaluate whether a

commercial mineable mineral exists on any of our properties. There is a

substantial risk that these exploration activities will not result in

discoveries of commercially recoverable quantities of minerals. Any

determination that our properties contain commercially recoverable quantities of

minerals may not be reached until such time that final comprehensive feasibility

studies have been concluded that establish that a potential mine is likely to be

economic. There is a substantial risk that any preliminary or final feasibility

studies carried out by us will not result in a positive determination that our

mineral properties can be commercially developed.

|

4.

|

WE

HAVE A HISTORY OF OPERATING LOSSES AND THERE CAN BE NO ASSURANCES WE WILL

BE PROFITABLE IN THE FUTURE.

|

We have a

history of operating losses, expect to continue to incur losses, and may never

be profitable. Further, we have been dependent on sales of our equity securities

and debt financing to meet our cash requirements. . We have incurred losses

totalling $16,935,698 from inception to June 30, 2010, and incurred losses of

$3,314,953 during the fiscal year ended June 30, 2010. Further, we do not expect

positive cash flow from operations in the near term. There is no assurance that

actual cash requirements will not exceed our estimates. In particular,

additional capital may be required in the event that: (i) the costs to acquire

additional mineral exploration claims are more than we currently anticipate; or

(ii) exploration and or future potential mining costs for additional claims

increase beyond our expectations.

|

5.

|

THE

RISKS ASSOCIATED WITH EXPLORATION COULD CAUSE PERSONAL INJURY OR DEATH,

ENVIRONMENTAL DAMAGE AND POSSIBLE LEGAL

LIABILITY.

|

We are

not currently engaged in mining operations because we are in the exploration

phase. However, our exploration operations could expose the Company to liability

for personal injury or death, property damage or environmental damage. We do not

presently carry property and liability insurance. Cost effective insurance

contains exclusions and limitations on coverage and may be unavailable in some

circumstances.

|

6.

|

BECAUSE

OF THE UNIQUE DIFFICULTIES AND UNCERTAINTIES INHERENT IN MINERAL

EXPLORATION VENTURES AND CURRENT DETERIORATION IN EQUITY MARKETS, WE FACE

A HIGH RISK OF BUSINESS FAILURE.

|

Investors

should be aware of the difficulties normally encountered by new mineral

exploration companies and the high rate of failure of such enterprises. Our

prospects are further complicated by a pronounced deterioration in equity markets

and constriction in equity capital available to finance and maintain our

exploration activities. Our likelihood of success must be considered in light of

the problems, expenses, difficulties, complications and delays encountered in

connection with the exploration of the mineral properties that we plan to

undertake and the difficult economy and market volatility that we are

experiencing. Moreover, most exploration projects do not result in the discovery

of commercial mineable deposits.

5

|

7.

|

OUR

BUSINESS IS AFFECTED

BY CHANGES IN COMMODITY PRICES.

|

Our

ability to raise capital and explore our properties and the future profitability

of those operations is directly related to the market price of certain minerals

such as silver and limestone as well as the price and availability of cement.

The Company is negatively affected by the current decline in commodity

prices

|

8.

|

THE

COMPANY COULD ENCOUNTER REGULATORY AND PERMITTING

DELAYS.

|

The

Company could face delays in obtaining permits to operate on the property

covered by the claims. Such delays could jeopardize financing, if any is

available, which could result in having to delay or abandon work on some or all

of the properties.

|

9.

|

THERE

ARE PENNY STOCK SECURITIES LAW CONSIDERATIONS THAT COULD LIMIT YOUR

ABILITY TO SELL YOUR SHARES.

|

Our

common stock is considered a "penny stock" and the sale of our stock by you will

be subject to the "penny stock rules" of the Securities and Exchange Commission.

The penny stock rules require broker-dealers to take steps before making any

penny stock trades in customer accounts. As a result, the market for our shares

could be illiquid and there could be delays in the trading of our stock which

would negatively affect your ability to sell your shares and could negatively

affect the trading price of your shares.

|

10.

|

CURRENT

LEVELS OF MARKET VOLATILITY COULD HAVE ADVERSE

IMPACTS

|

The

capital and credit markets have been experiencing volatility and disruption. If

the current levels of market disruption and volatility continue or worsen, there

can be no assurance that the Company will not experience adverse effects, which

may be material. These effects may include, but are not limited to, difficulties

in raising additional capital or debt and a smaller pool of investors and

funding sources. There is thus no assurance the Company will have access to the

equity capital markets to obtain financing when necessary or

desirable.

|

11.

|

WE

DO NOT INTEND TO PAY DIVIDENDS IN THE FORESEEABLE

FUTURE.

|

We have

never declared or paid a dividend on our common stock. We intend to retain

earnings, if any, for use in the operation and expansion of our business and,

therefore, do not anticipate paying any dividends in the foreseeable

future.

6

Item

2 Properties

Description

of Property held by IMC US, a wholly-owned subsidiary of Infrastructure

Materials Corp.

The

following claim groups and leased mineral rights are described below: The Morgan

Hill Claim Group, the Rock Hill Claim Group, the Buffalo Mountain Claim Group,

the MM Claim Group, the Royale Claim Group, the Blue Nose Claim Group, the Wood

Hills Claim Group, the Pequop Claim Group, the Burnt Springs Claim Group, the

Jumbled Mountain Claim Group, the Lime Mountain Claim Group, the Ragged Top

Claim Group, the Blye Canyon Project, the Tres Alamos Project and the Aspen

Claim Group.

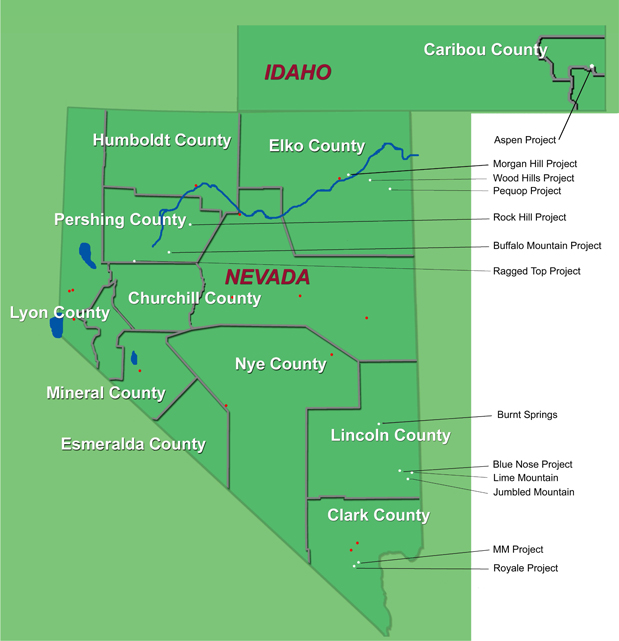

Nevada

and Idaho Property Location and Description

The

following is a map highlighting the counties in the States of Nevada and Idaho

where the properties held by IMC US are located.

7

The

Morgan Hill Claim Group (other than the leased properties identified below), the

Rock Hill Claim Group, the Aspen Claim Group and the Buffalo Mountain Claim

Group were acquired as of November 7, 2008 when the Company purchased its now

wholly–owned subsidiary, IMC US.

Morgan

Hill Claim Group

The

Morgan Hill Claim Group consists of 208 unpatented, lode mineral claims located

in Elko County, Nevada, approximately 20 miles west of the town of Wells,

Nevada. The claims are situated about five miles north of Interstate 80 and the

Union-Pacific rail line. The property is accessed via the I80 River Ranch Exit.

The Morgan Hill claims cover approximately 4,297 acres of land managed by the

BLM. The Morgan Hill claims cover a northeast trending package of sediments

which include a block of favorable massive limestone that has a 2.5 mile strike

length. This limestone exceeds 250 feet in thickness. The claim area contains

very significant amounts of fine grained limestone within the Devonian Devil’s

Gate and Nevada Formations. The unit thickness appears to range up to 500 feet

and has varying amounts of interbedded magnesium oxide. There is adjacent

sandstone for a silica supply required for cement. Morgan Hill has topography

conducive to open pit mining. Preliminary tonnage estimates are positive with

little to no initial strip ratio. Area topography allows access to drill areas

with a track mounted drill rig. The property lies within 5 miles of the

railhead. It is believed to be situated to competitively reach markets in Salt

Lake City, Reno, Southern Idaho and Northern California. We have completed a

24-hole drill program on the project identifying three separate cement grade

limestone zones of indeterminate thickness. Further drilling will be required to

verify the thickness and continuity of the cement and high grade

zones.

The 208

Morgan Hill lode mining claims are identified by number as Nevada Mining Claims

(“NMC”) in the BLM records as follows:

NMC

989047 through 989130,

NMC

997410 through 997438, and

NMC

1006464 through 1006558.

Subsequent

to the period covered by this report, the Company elected to abandon 78 of the

208 claims.

IMC US is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to the Morgan Hill claims. IMC

US will remain as the record holder of the claims as long as it continues to

make all payments required by law to maintain the claims. Currently, a claim

holder is required to pay an annual fee to the BLM of $140 per claim on or

before September 1 of each year. Under legislation enacted in Nevada in March of

2010, claims owners are required to pay the State of Nevada an annual fee based

upon a tiered system that requires fees ranging from $70 to $189 per claim,

depending upon the total number of claims in Nevada that an owner holds. The

Company estimates, based upon its anticipated total number of claims to be held

in Nevada as of the next calculation date, that its annual fee will be $85 per

claim with the first such annual fee payable no later than June 1, 2011. In

addition, a claim holder is required to pay annual County filing fees in most

counties within Nevada and Idaho.

Included

in the Morgan Hill Claim Group are three groups of mineral rights known as: (a)

the Perdriau Mineral Rights, (b) the Hammond Mineral and Surface Rights and (c)

the Earl Edgar Mineral Trust Mineral Rights.

8

The

Perdriau Mineral Rights

On

November 30, 2009 IMC US entered into a Mineral Rights Agreement with Perdriau

Investment Corp. (“Perdriau”) to purchase 50% of the mineral rights, including

all easements, rights of way and appurtenant rights of any type that run with

the mineral rights located in the section of Elko County, Nevada identified

below (the “Perdriau Property”). The purchase price was $10 per net acre. IMC US

purchased 340 net acres for a total purchase price of $3,400. Perdriau will be

entitled to receive a royalty of $0.25 per ton for material mined and removed

from the Perdriau Property. Material mined and stored on the Perdriau Property

or adjacent property for reclamation purposes will not be subject to any

royalty. Material removed from the Perdriau Property for the purposes of testing

or bulk sampling, provided it does not exceed 50,000 tons, will also not be

subject to any royalty. The royalty will be calculated and paid within 45 days

after the end of each calendar quarter.

The

following description of the Perdriau Property is based upon reference points

used in the Public Land Survey System (the “PLSS”) that is maintained by the

BLM. The Perdriau Property is located on The National Map at T37N, R58E Elko

County, Nevada in the following sections:

|

Section

9

|

SW

¼

|

80

acres

|

||

|

Section

15

|

W1/2

W1/2

|

80

acres

|

||

|

Section

19

|

SE

¼

|

80

acres

|

||

|

Section

21

|

N1/2

NE1/4

|

20

acres

|

||

|

Section

21

|

SW

¼

|

80

acres

|

||

|

Total

Net acres

|

|

340

acres

|

||

Hammond

Surface Rights Lease and Mineral Rights Agreement

As of

January 15, 2010, the Company entered into a Property Lease Agreement with

Eugene M. Hammond (the “Hammond Lease”) for surface rights on 80 acres in Elko

County, Nevada described below (the “Hammond Surface Rights”). The term of the

Hammond Lease is five years and the annual rent is $500. The lessee is

responsible for the payment of all real estate taxes on the Hammond Surface

Rights. During the term of the Hammond Lease, the lessee has the exclusive right

to conduct exploration and development work on the Hammond Surface Rights. The

results of all drilling and exploration are of the property of the lessee. The

lessee is responsible for any environmental damage caused by the lessee and any

reclamation costs required as a result of drilling and testing. The lessee has

an option to purchase the property covered by the Hammond Lease for $15,000,

less the amount paid in rent during the term of the Hammond Lease. The Hammond

Surface Rights are located at the following PLSS coordinates: T37N, R58E,

Section 17, S ½ SE ¼, Elko County, Nevada.

Also as

of January 15, 2010, IMC US entered into a Mineral Rights Agreement with Eugene

M. Hammond (the “Hammond Mineral Rights Agreement”) pursuant to which the

Company purchased a 25% interest in any and all minerals extracted from the 160

acres covered by the Hammond Mineral Rights Agreement, as described below (the

“Hammond Mineral Rights Property”). The purchase price was $400. In addition,

the seller is entitled to receive a royalty of $0.125 per ton on material mined

and removed from the Hammond Mineral Rights Property. The Hammond Mineral Rights

Agreement does not cover petroleum. The Hammond Mineral Rights Property is

located at the following PLSS coordinates: T37N, R58E, Section 17, SE ¼, Elko

County, Nevada.

Earl

Edgar Mineral Trust Mineral Rights

On

December 8, 2008 IMC US entered into a Mineral Rights Lease Agreement (the

“Edgar Lease Agreement”) with the Earl Edgar Mineral Trust (the “Edgar”) to

lease certain mineral rights in Elko County, Nevada described below (the “Edgar

Property”). The term of the Edgar Lease Agreement is ten years and will

automatically renew on the same terms and conditions for additional ten-year

periods, provided the lessee is conducting exploration, development or mining

either on the surface or underground at the property. The rent is to be paid

each year on January 1st. $1.00 per net acre was paid upon execution of the

Edgar Lease Agreement. On January 1 of each year commencing in 2010 and

extending for so long as the Edgar Lease Agreement is in effect, the lessee is

obligated to make the following payments:

9

|

2010

|

$1.00

per net acre

|

|

|

2011

|

$2.00

per net acre

|

|

|

2012

|

$2.00

per net acre

|

|

|

2013

|

$3.00

per net acre

|

|

|

2014

|

$3.00

per net acre

|

|

|

2015

|

$4.00

per net acre

|

|

|

2016

|

$4.00

per net acre

|

|

|

2017

|

$5.00

per net acre in each year for the duration of the Edgar Lease

Agreement.

|

The Edgar

Lease Agreement covers 100% of the mineral rights on 1,120 acres of the Edgar

Property (“Property A”) and 50% of the mineral rights on 6,720 acres of the

Edgar Property (“Property B”). Edgar is entitled to receive a royalty of $0.50

per ton for material mined and removed from Property A and $0.25 per ton for

material mined and removed from Property B during the term of the Edgar Lease

Agreement and any renewal thereof.

On April

9, 2009 the Company and Edgar entered into an Amendment to the Edgar Lease

Agreement (the “Amendment”), effective as of December 8, 2008. The Amendment

provides for Standard Steam LLC to carry out exploration for geothermal energy

sources on the Edgar Property after obtaining the written consent of the

Company. The Amendment also provides for other cooperation with Standard Steam

LLC regarding mineral rights on Property B of the Edgar Property.

Property

A of the Edgar Property is located at the following PLSS coordinates: T37N, R58E

Elko County, NV in the following sections:

|

Section

3

|

W

¼

|

320

acres

|

||

|

Section

9

|

SE

¼

|

160

acres

|

||

|

Section

15

|

E ½

W ½

|

160

acres

|

||

|

Section

21

|

NW

¼

|

|||

|

S ½

NE ¼

|

240

acres

|

|||

|

Section

23

|

S ½

NW ¼

|

|||

|

SW

¼

|

240

acres

|

|||

|

Total

Net acres

|

1120

acres

|

Property

B of the Edgar Property is located at the following PLSS coordinates in Elko

County, NV in the following townships, ranges and sections:

|

T37N,

R58E

|

||||

|

Section

3

|

E

½

|

320

acres

|

||

|

Section

9

|

SW

¼

|

160

acres

|

||

|

Section

15

|

W ½

W ½

|

|||

|

E

½

|

480

acres

|

|||

|

Section

17

|

all

|

640

acres

|

||

|

Section

19

|

SE

¼

|

160

acres

|

||

|

Section

21

|

S

½

|

|||

|

N ½

NE ¼

|

400

acres

|

|||

|

Section

23

|

N ½

NW ¼

|

|||

|

E

½

|

400

acres

|

|||

|

Section

27

|

All

|

640

acres

|

||

|

Section

29

|

All

|

640

acres

|

||

|

Section

31

|

All

|

640

acres

|

||

|

Section

33

|

All

|

640

acres

|

10

|

Section

35

|

All

|

640

acres

|

||

|

T

36 N, R 58 E

|

||||

|

Section

1

|

N

½

|

640

acres

|

||

|

T

37 N, R 59 E

|

||||

|

Section

31

|

All

|

640

acres

|

||

|

Total

Net Acres

|

3360

acres

|

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Rock

Hill Claim Group

The Rock

Hill Claim Group consists of 12 unpatented, lode mineral claims located in

Pershing County, Nevada, approximately 12 miles southeast of Mill City, Nevada.

Access is along unpaved roads about 25 miles southwest of Winnemucca, Nevada.

The Rock Hill claims cover approximately 248 acres. The property geology

indicates two basic units most likely in the rocks of the Natchez Pass

Formation. Each of the two limestone units is up to 300-400 feet thick with

siltstone/sandstone interbeds of variable thickness. The property is

approximately 12-14 miles from the current railhead in the Dunn Glenn area. Due

to the topography, access to this project would be difficult.

The 12

Rock Hill lode mining claims are identified by Nevada Mining Claim number in the

BLM records as follows:

NMC

1003539 through 1003545, and

NMC

1003575 through 1003579

IMC US is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to the above claims. IMC US will

remain as the record holder of the claims as long as it continues to make all

payments required by law to maintain the claims. These payments include an

annual fee of $140 per claim to the BLM and an annual fee estimated to be $85

per claim to the State of Nevada payable no later than June 1, 2011. In

addition, a claim holder is required to pay annual County filing fees in most

counties within Nevada and Idaho.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Aspen

Claim Group

The Aspen

Claim Group consists of 63 unpatented, lode mineral claims located in Caribou

and Bear Lake Counties in Aspen, Idaho, north of Montpelier and east of Soda

Springs. The claim group covers approximately 1,302 acres. The Aspen claims are

accessible from the southeast corner of Idaho. These lands are managed by the

U.S. Forest Service. The dominant rock type at Aspen is the Aspen Range

Formation and the Birdseye limestone member which is approximately 400 feet

thick. Adjacent sandstones of the Wells Formation provide a ready supply of

silica for cement. Geochemical results of samples taken from the property

indicate cement grade limestone ranging between 94% and 95%+ calcium carbonate

with minimal magnesium.

11

The 63

Aspen lode mining claims are identified in the BLM records by Idaho Mining Claim

numbers: IMC196421 through 196438, 196448 through 196456, 196466 through196474

and 196493 through 196419.

Subsequent

to the period covered by this report, the Company elected to abandon all 63

claims in this claim group.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Buffalo

Mountain Claim Group

The

Buffalo Mountain Claim Group consists of 9 unpatented, lode mineral claims

located in Pershing County, Nevada, approximately 20 miles northeast of the town

of Lovelock, Nevada. The Buffalo Mountain claims cover approximately 186 acres.

Access is along unpaved roads after leaving the interstate 4 miles north of

Lovelock. The geology indicates limestone within the Natchez Pass Formation. Due

to the topography, access to this area would be difficult.

The 9

Buffalo Mountain lode mining claims are identified in the BLM records by Nevada

Mining Claim numbers NMC 1003510 through 1003518.

IMC US is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to the above claims. IMC US will

remain as the record holder of the claims as long as it continues to make all

payments required by law to maintain the claims. These payments include an

annual fee of $140 per claim to the BLM and an annual fee estimated to be $85

per claim to the State of Nevada payable no later than June 1, 2011. In

addition, a claim holder is required to pay annual County filing fees in most

counties within Nevada and Idaho.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

MM

Claim Group

The MM

Claim Group consists of 68 unpatented, lode mineral claims located in Clark

County, Nevada, approximately 10 miles south of Las Vegas, Nevada. The claim

group covers approximately 1,405 acres. This claim group was acquired as a

result of IMC US locating and staking the claims. Work has been conducted to

define the potential of the claim group. Samples have been taken with 10%

running an acceptable cement grade which may define a specific rock unit.

Surface mapping is completed and on file. Access is by paved and unpaved roads

south from Las Vegas.

The 68 MM

lode mining claims are identified in the BLM records by Nevada Mining Claim

numbers: NMC 1002566, 1002567, 1002575, 1002576, 1002584, 1002585 and 1002593

through 1002654.

Subsequent

to the period covered by this report, the Company elected to abandon 15 of the

68 claims.

IMC US is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to the above claims. IMC US will

remain as the record holder of the claims as long as it continues to make all

payments required by law to maintain the claims. These payments include an

annual fee of $140 per claim to the BLM and an annual fee estimated to be $85

per claim to the State of Nevada payable no later than June 1, 2011. In

addition, a claim holder is required to pay annual County filing fees in most

counties within Nevada and Idaho.

12

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Royale

Claim Group

The

Royale Claim Group consists of 21 unpatented, lode mineral claims located in

Clark County, Nevada, approximately 15 miles south of Las Vegas, Nevada. The

claim group covers approximately 434 acres. This claim group was acquired as a

result of IMC US locating and staking the claims. Reconnaissance exploration

indicates good quality carbonates on the surface by visual inspection of hand

samples and geochemistry. Large areas on this group are accessible by track

mounted drilling equipment. Mapping and sampling is completed and on file.

Access is by a paved road located 18 miles south from Las Vegas and by an

unpaved road located 6 miles to the northwest.

The 21

Royale lode mining claims are identified in the BLM records by Nevada Mining

Claim numbers: NMC 1002680, 1002681, 1002689, 1002690, 1003242 through 1003245,

1003322, 1003323, 1003330 through 1003335, 10033344 and 1003357 through

1003360.

Subsequent

to the period covered by this report, the Company elected to abandon 17 of the

21 claims.

IMC US is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to the above claims. IMC US will

remain as the record holder of the claims as long as it continues to make all

payments required by law to maintain the claims. These payments include an

annual fee of $140 per claim to the BLM and an annual fee estimated to be $85

per claim to the State of Nevada payable no later than June 1, 2011. In

addition, a claim holder is required to pay annual County filing fees in most

counties within Nevada and Idaho.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Blue

Nose Claim Group

The Blue

Nose Claim Group consists of 301 unpatented, lode mineral claims located in

Lincoln County, Nevada, west of Tule Desert, along the south edge of the Clover

Mountains. The claim group covers approximately 6,219 acres. This claim group

was acquired as a result of IMC US locating and staking the claims. The property

was surface mapped in November of 2008 to define favorable rock horizons.

Results from this sampling indicate 60% of samples are of cement grade material.

The Claim group is 8 miles east of the Union Pacific rail line in the Meadow

Valley Wash. Access is via the graded Carp and Bunker Peak roads. Our Phase 1

drilling consisted of 10 holes. Eight of the 10 holes

drilled in the first phase of drilling encountered cement grade limestone assay

between 88% and 100% calcium carbonate with holes 8 and 10 failing to intercept

any significant cement grade thicknesses or values within 300 feet of the

surface due to their position being higher in the rock section. Based upon an

analysis of the first phase of drilling it appears that the limestone beds are

dipping to the west. Strip ratios in the area of the drill holes are

considered acceptable. Areas

of elevated

magnesium were encountered but do not appear to affect the overall value of the

cement grade zone. Subsequent

to the period covered by this report, the Company completed a drilling program

consisting of 28 holes for a total of 17,000 feet. Earlier drilling phases

included an additional 13,000 feet. Drilling has offered a better understanding

of the two units of limestone that make up the Monte Cristo Formation on the

Blue Nose Property. Drilling indicates a 100-150 foot thick upper

limestone unit with a moderate amount of silica needed for cement, and a lower

high grade white limestone formation that is 400-450 feet thick. As

expected, the bottom of the Monte Cristo Formation represents a thick dolomite

bed.

The

initial assay results from the first two holes received (BNR-42 and BNR-44) of

the Plan of Operations Drill Program are encouraging for limestone suited for

cement production. Below is a brief summary of the grades of calcium carbonate

(%) over depth in holes BNR-42 and BNR-44:

|

·

|

BNR-42: 0’-145’

– 100%; 150’-195’ – 97.95%; 295’-315’ – 86.23%; 330’-340’ – 91.44%;

375’-380’ – 96.55%

|

|

·

|

BNR-44:

10’-25’ – 88.19%; 30’-70’ – 95.15%; 75’-170’ – 89.56%; 175’-185’ – 90.35%;

220’-225’ – 88.91%; 225’-260’ – 98.99%; 265’-290’ – 89.21%; 295’-305’ –

89.95%; 310’-335’ – 100%

|

Once the

remaining assay results are received from the laboratory, the Company will

proceed with building the cross sections and assay files for potential resource

calculations that will be conducted by an independent

consultant. Currently, the drill holes are being surveyed to

accurately locate the drill collars.

The 301

Blue Nose lode mining claims are identified in the BLM records by Nevada Mining

Claim numbers: NMC 1002031 through 1002327 and 1014085 through

1014088.

13

Subsequent

to the period covered by this Report, the Company elected to abandon 46 of the

301 claims.

IMC US is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to the above claims. IMC US will

remain as the record holder of the claims as long as it continues to make all

payments required by law to maintain the claims. These payments include an

annual fee of $140 per claim to the BLM and an annual fee estimated to be $85

per claim to the State of Nevada payable no later than June 1, 2011. In

addition, a claim holder is required to pay annual County filing fees in most

counties within Nevada and Idaho.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Wood

Hills Claim Group

The Wood

Hills Claim Group consists of 129 unpatented lode mineral claims located in

Eastern Elko County, Nevada near Wells, Nevada. This claim group was acquired as

a result of IMC US locating and staking the claims. The claims are about 5 miles

southeast of the town. The claim group covers approximately 2665 acres. Access

is along unpaved roads to the project. Rail lines and Interstate Highway 80 run

through Wells. Limestone beds of the Devils Gate Formation and the Ely Formation

are exposed in gently dipping beds near the top and the southern extent of the

Wood Hills claims. Over 50 surface samples have been taken that show good cement

grade limestone.

The 129

Wood Hills lode mining claims are identified in the BLM records by Nevada Mining

Claim numbers: NMC 1020023 through 1020151.

Subsequent

to the period covered by this report, the Company elected to abandon 53 of the

129 claims.

IMC US is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to the above claims. IMC US will

remain as the record holder of the claims as long as it continues to make all

payments required by law to maintain the claims. These payments include an

annual fee of $140 per claim to the BLM and an annual fee estimated to be $85

per claim to the State of Nevada payable no later than June 1, 2011. In

addition, a claim holder is required to pay annual County filing fees in most

counties within Nevada and Idaho.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Pequop

Claim Group

The

Pequop Claim Group consists of 71 unpatented, lode mineral claims. This claim

group was acquired as a result IMC US locating and staking the claims. The

Pequop claims are located approximately 35 miles southeast of Wells, Nevada in

Elko County. They are reached by traveling south on Highway 93 about 12 miles

and then 20 miles to the east and south along a gravel road to the central

portion of the Pequop Range. The claim group covers approximately 1467 acres.

Railroad tracks are within a half mile of the southern portion of the claims.

East dipping and northeast striking beds of the Ely Formation are exposed here.

They stretch for over 2 miles to the north from the railroad tunnel in the

Southern Pequops. A number of the samples show good cement grade limestone with

some chert (fine grained silica rich sediments) beds and silicic limestone beds.

These silicic rocks could be used for a silica source in a limestone operation

to make cement.

The 71

Pequop lode mining claims are identified in the BLM records by Nevada Mining

Claim numbers: NMC 1020152 through 1020222.

14

Subsequent

to the period covered by this report, the Company elected to abandon 36 of the

71 claims.

IMC US is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to the above claims. IMC US will

remain as the record holder of the claims as long as it continues to make all

payments required by law to maintain the claims. These payments include an

annual fee of $140 per claim to the BLM and an annual fee estimated to be $85

per claim to the State of Nevada payable no later than June 1, 2011. In

addition, a claim holder is required to pay annual County filing fees in most

counties within Nevada and Idaho.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Ragged

Top Claim Group

The

Ragged Top Claim Group consists of 76 unpatented, lode mineral claims located in

both Pershing and Churchill Counties. This claim group was acquired as a result

IMC US locating and staking the claims. The claim group covers approximately

1570 acres and is located 23 miles southwest of Lovelock, Nevada and 8 miles

northwest of Interstate Highway 80, along an unpaved road from the Union Pacific

Rail corridor. Access is via the unpaved road. These claims cover 14 exposures

of limestone seen in the gently rolling hillsides. The claims have been mapped

and a number of surface samples have been taken.

The 76

Ragged Top lode mining claims are identified in the BLM records by Nevada Mining

Claim numbers: NMC 1014006 through 1014029, 1014031 through 1014037, 1014040

through 1014049 and 1014050 through 1014084.

Subsequent

to the date of this report, the Company elected to abandon 31 of the 76

claims.

IMC US is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to the above claims. IMC US will

remain as the record holder of the claims as long as it continues to make all

payments required by law to maintain the claims. These payments include an

annual fee of $140 per claim to the BLM and an annual fee estimated to be $85

per claim to the State of Nevada payable no later than June 1, 2011. In

addition, a claim holder is required to pay annual County filing fees in most

counties within Nevada and Idaho.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Lime

Mountain Claim Group

The Lime

Mountain Claim Group consists of 139 unpatented, lode mineral claims located in

eastern Lincoln County, Nevada, about 35 miles southeast of Caliente, Nevada and

about 90 miles northeast of Las Vegas, Nevada. This claim group was acquired as

a result IMC US locating and staking the claims. Access is south from Caliente

along state highway 317 to Elgin and then another 15 miles south on the dirt

road to Lyman Crossing where the road goes east for 15 miles to Lime Mountain.

The claim group covers approximately 2872 acres. A railroad line runs

north-south along Meadow Valley Wash through Lyman Crossing and Elgin. The

limestone crops out in a north-south line that is 2 miles long and is

approximately 1 mile wide. The project has been mapped and over 40 surface

samples have been taken. Many of the samples show cement grade

limestone.

The 139

Lime Mountain lode mining claims are identified in the BLM records by Nevada

Mining Claim numbers: NMC 1014089 through 1014226, and 1014469.

15

Subsequent

to the period covered by this report, the Company elected to abandon 70 of the

139 claims.

IMC US is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to the above claims. IMC US will

remain as the record holder of the claims as long as it continues to make all

payments required by law to maintain the claims. These payments include an

annual fee of $140 per claim to the BLM and an annual fee estimated to be $85

per claim to the State of Nevada payable no later than June 1, 2011. In

addition, a claim holder is required to pay annual County filing fees in most

counties within Nevada and Idaho.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Jumbled

Mountain Claim Group

The

Jumbled Mountain Claim Group consists of 242 unpatented, lode mineral claims

that are located in eastern Lincoln County, Nevada, about 90 miles northeast of

Las Vegas, Nevada. This claim group was acquired as a result IMC US locating and

staking the claims. Access is from Mesquite, Nevada along 20 miles of highway

and 35 miles of unpaved roads. The claims are located over three isolated

outcroppings of limestone covering approximately 5000 acres. These areas have

been mapped and sampled. There have been 283 surface rock chip samples

taken.

The 242

Jumbled Mountain lode mining claims are identified in the BLM records by Nevada

Mining Claim numbers: NMC 1014227 through 1014282, and 1014283 through

1014468.

Subsequent

to the period covered by this report, the Company elected to abandon 155 of the

242 claims.

IMC US is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to the above claims. IMC US will

remain as the record holder of the claims as long as it continues to make all

payments required by law to maintain the claims. These payments include an

annual fee of $140 per claim to the BLM and an annual fee estimated to be $85

per claim to the State of Nevada payable no later than June 1, 2011. In

addition, a claim holder is required to pay annual County filing fees in most

counties within Nevada and Idaho.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Burnt

Springs Claim Group

The Burnt

Springs Claim Group consists of 50 unpatented, lode mineral claims located in

the Burnt Springs Range 6 to 10 miles west and northwest of the Union Pacific

railway at Caliente, Nevada. This claim group was acquired as a result IMC US

locating and staking the claims. Access is along a paved highway for 7 miles

then 6 miles over unpaved roads. The claims are in three separate blocks in the

central part of Lincoln County, Nevada and cover approximately 1054 acres. The

Burnt Springs claims are located on thick bedded limestone sequences of the

lower Highland Peak Formation which are thinly covered by other rocks. A total

of 76 rock chips samples have been taken from the Highland Peak Formation in the

area of the claims.

The 50

Burnt Springs lode mining claims are identified in the BLM records by Nevada

Mining Claim numbers: NMC 1017566 through 1017586, and 1017588 through

1017616.

16

Subsequent

to the period covered by this report, the Company elected to abandon 25 of the

50 claims.

IMC US is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to the above claims. IMC US will

remain as the record holder of the claims as long as it continues to make all

payments required by law to maintain the claims. These payments include an

annual fee of $140 per claim to the BLM and an annual fee estimated to be $85

per claim to the State of Nevada payable no later than June 1, 2011. In

addition, a claim holder is required to pay annual County filing fees in most

counties within Nevada and Idaho.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

17

Arizona

Property Location and Description

The

following is a map highlighting the counties in the State of Arizona and the

areas where IMC US holds mineral exploration permits.

The

interests of IMC US in Arizona consist of mineral exploration permits that have

a duration of one year from the date of issuance. The permits can be renewed for

up to four additional one-year terms for a total of five years and provide the

holder of the permit with an exclusive right to explore for minerals within the

state land covered by the permit and to apply for mineral leases to such land.

The holder of a permit may remove from the land only the amount of material

required for sampling and testing and is responsible for any damage or

destruction caused by the holder’s exploration activities. The holder of a

permit is entitled to ingress and egress to the covered site along routes

approved by the Arizona State Land Department. IMC US has posted a bond required

by the State of Arizona to back any reclamation required as a result of work

performed. The permit is renewable if the holder has expended not less than

$10.00 per acre during each of the first two year-long periods and $20.00 per

acre during each of the next three year-long periods. The permit fee is $2.00

per acre for the first two years and $1.00 per acre per year for the following

three years. Upon termination of a mineral exploration permit, the State of

Arizona is entitled to information collected by the permit holder. In the event

that a permit holder discovers a valuable mineral deposit, the permit holder may

apply to the Arizona State Land Department for a mineral lease having a term of

20 years and renewable for an additional 20 years. A permit holder shall be the

preferred recipient of the mineral lease, provided that all applicable

requirements are met. A mineral lease entitles the lessee to develop and

establish a mine on the leased premises, provided that a mine plan and all

necessary approvals are obtained.

18

Blye

Canyon Project

The Blye

Canyon Project consists of four State of Arizona mineral exploration permits

numbered 08-114298 through 08-114301.

The Blye

Canyon Project area is about 23 miles west of Seligman in northwest Arizona.

Access is west from Seligman, 25 miles on Highway 66 and then south of Highway

66 about 8 miles on unpaved roads to the border of Yavapai and Mohave Counties.

IMC US holds mineral exploration permits issued by the State of Arizona on 3.5

sections of land totaling 2,227 acres. The basal unit in the rocks in this area

is a 300 feet-thick high magnesium carbonate sediment with minor chert (high

silica sediment) and limestone beds. Overlying this is a clean gray white

limestone that may be 100 to 150 feet thick. The gently north to northeast

dipping rocks have little relief in the low rolling hills. The project area has

been mapped and over a hundred samples have been taken. Many cement grade values

were found in the samples.

Subsequent

to the period covered by this report, the Company received from the State of

Arizona approval of mineral exploration permits for two additional sections

covering 1,280 acres.

THERE ARE

NO KNOWN “RESERVES” IN THIS LEASE GROUP. OUR OPERATIONS WITH RESPECT TO THIS

LEASED GROUP ARE ENTIRELY EXPLORATORY.

Tres

Alamos Project

The Tres

Alamos Project consists of 14 State of Arizona mineral exploration permits

numbered 08-114302 through 08-114304 and 08-114314 through

08-114324.

The Tres

Alamos Project is located 65 miles east of Tucson and 18 miles northeast of

Benson, Arizona. Access is along paved and unpaved roads north and east of

Benson. IMC US has leased 14 sections of State of Arizona land in the Little

Dragoon Mountains and the area just north of them in Cochise County. These

permits cover about 7911 acres. Railroad lines are approximately 12 miles to the

southeast of the project area. Tres Alamos Wash and the Palomas Ridge to the

north are the areas with limestone outcrops. The limestone beds have a moderate

east dip and northwest strike in the area of Palomas Ridge. The exposures of the

limestone sediments stretch over 8000 feet in the NW-SE direction on Palomas

Ridge and for about 2000 feet in the SW-NE direction. In Tres Alamos Wash, the

beds dip to the southeast and strike generally northeast. Over 300 surface rock

chip samples have been taken and indicate good cement grade limestone. The area

has been mapped by a consulting geologist.

19

Description

of Property held by Canadian Infrastructure Corp.(“CIC”), a wholly-owned

subsidiary of Infrastructure Materials Corp.

Property

Location and Description

In

December of 2009, the Company expanded its area of exploration to include areas

with a potential for cement stone located in south-central Manitoba, Canada. The

Company acquired Canadian Infrastructure

Corp.(“CIC”),

as a wholly-owned subsidiary pursuant to a Share Exchange Agreement (the

“Agreement”) between the Company, CIC and Todd D. Montgomery dated as of

December 15, 2009. See Item 7, Management’s Discussion and Analysis of

Financial Condition and Results of Operations and Item 13, Certain Relationships

and Related Transactions, and Director Independence herein. CIC holds 95 quarry

leases granted by the Province of Manitoba on three properties known as the

Dauphin property, the Winnipegosis property and the Spence property. These

leases cover 6,090 hectares or 15,049 acres. Exploration had been done on all

three properties in the past.

The

following is a map highlighting the properties held by CIC in Manitoba,

Canada.

SMD

Mining Ltd., which merged with Eldorado Mining to become Cameco, carried out

drilling and sampling on the Dauphin property in 1988 – 89. In 1991, Cameco

carried out compilation geology, sampling and drilling on the Winnipegosis

property. In 1992 Continental Lime Ltd. carried out outcrop sampling and

drilling on the Spence property. The Dauphin property covers an area of high

calcium shale known as the White Speckled Shale unit of Cretaceous age. This

unit is from 2 to 8 meters in thickness. The Winnipegosis and Spence properties

cover an area of high calcium limestone, part of the Dawson Bay Formation of

Devonian age. CIC drilled the Dauphin property in 2009. The drilling was done to

verify the original Cameco drilling and also to extend the

zone.

20

Dauphin

Group - The Dauphin Property, the Winnipegosis Property and the Spence

Property

The

Dauphin Property consists of 35 quarry mineral leases. The 35 quarry mineral

leases are identified by Quarry Lease number in the Manitoba Innovation, Energy

and Mines, Mines Branch records as follows: QL-1958 through 1981 and 2055

through 2065.

The

Winnipegosis Property consists of 25 quarry mineral leases identified by Quarry

Lease number in the Manitoba Innovation, Energy and Mines, Mines Branch records

as follows: QL-1983 through 2004 and 2050 through 2052.

The

Spence Property consists of 35 quarry mineral leases identified by Quarry Lease

number in the Manitoba Innovation, Energy and Mines, Mines Branch records as

follows: QL-2005 through 2011, 2013, 2015 through 2033, 2037, and 2039 through

2045.

CIC is

the registered lessee of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to these claims. CIC will remain

as the record holder of the claims as long as it continues to make all payments

required by law to maintain the claims. Currently, a claim holder is required to

pay annual rent of CDN$24 per hectare of fraction thereof per

lease.

THERE ARE

NO KNOWN “RESERVES” IN THIS LEASED GROUP. OUR OPERATIONS WITH RESPECT TO THIS

LEASED GROUP ARE ENTIRELY EXPLORATORY.

21

Description

of Property held by Silver Reserve Corp. (“SRC”), a wholly-owned subsidiary of

Infrastructure Materials Corp.

Property

Location and Description

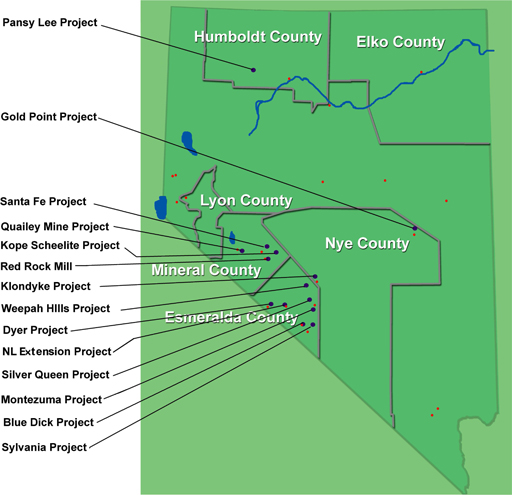

The

following is a map highlighting the counties in the State of Nevada where the

properties held by SRC are located.

The

following claim groups are described below: Klondyke Claim Group, Dyer Claim

Group, Montezuma Claim Group, Nivloc Claim Group (now identified as NL Extension

Projects Claim Group), Sylvania Claim Group, Santa Fe Claim Group, Silver Queen

Claim Group, Blue Dick Claim Group, Weepah Hills Claim Group, Kope Scheelite

Group, Quailey Patented Claims and Quailey Unpatented Claims, Pansy Lee Claim

Group, Gold Point Claim Group and Red Rock Mill. These claims were originally

acquired by the Company and assigned to SRC.

Mohave

Property Purchase Agreement

On August

1, 2006, the Company entered into a property purchase agreement (the “Mojave

Property Purchase Agreement”) with the Mojave Silver Company, Inc. (the “Mojave

Silver Property”) to acquire a 100% interest in claims located in Esmeralda

County and Mineral County, Nevada (as further described below) and known as the

Klondyke Claim Group, Dyer Claim Group, Montezuma Claim Group, Nivloc Claim

Group (now identified as NL Extension Projects Claim Group), Sylvania Claim

Group, Santa Fe Claim Group, Silver Queen Claim Group, Blue Dick Claim Group,

Weepah Hills Claim Groups, Kope Scheelite Group, Quailey Patented Claims and

Quailey Unpatented Claims (collectively the “Mojave Claims”). The Mojave Claims

were conveyed in

exchange for 3,540,600 shares of the Company’s common stock, then valued at

$885,150. All of the Mojave Claims were subsequently assigned to our

wholly-owned subsidiary, SRC.

22

Silver

Queen Claim Group

The

Silver Queen Claim Group consists of 147 unpatented, lode mineral claims located

in Esmeralda County, Nevada, approximately nine miles west of Silver Peak,

Nevada on Highway 47. The claim area covers approximately 3,037 acres. The

property is accessed by dirt roadways.

The

claims are located in the Red Mountain District. The Silver Queen Claim Group

covers a northwest trending group of silver deposits that include the Silver

Queen and Mohawk mines. In 1920 a producing mine was constructed and production

continued through the late 1950's at the Mohawk location.

In June

2008 four drill holes were completed to depths of 400 to 500 feet vertically in

the Silver Queen area on surface anomalies noted during grid sampling. In July

2008 five holes were drilled to intercept unmined mineralized zones noted by a

previous operator within the Mohawk workings.

SRC is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to these claims. SRC will remain

as the record holder of the claims as long as it continues to make all payments

required by law to maintain the claims. These payments include an annual fee of

$140 per claim to the BLM and an annual fee estimated to be $85 per claim to the

State of Nevada payable no later than June 1, 2011. In addition, a claim holder

is required to pay annual County filing fees in most counties within Nevada and

Idaho.

The 147

Silver Queen lode mining claims are identified in the BLM records by Nevada

Mining Claim numbers: NMC 969847 through 969850, 870453 through 870535, 966963

through 967017, 986543, 969852 through 969853, 737071 and 737072.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

NL Extension Projects Claim

Group

The NL

Extension Projects Claim Group consists of 18 unpatented, lode mineral claims

located in Esmeralda County, Nevada, approximately 6.5 miles southwest of Silver

Peak, Nevada on Highway 47. The claim group covers approximately 372 acres. In

previous reports filed by the Company, this claim group was sometimes referred

to as the “Nivloc Claim Group.”

The NL

Extension Projects Claims are located approximately 6.5 miles southwest of

Silver Peak, Nevada and are accessible along a dirt road 7 miles west of Silver

Peak. Elevations on the property range from 5900 feet to 6400 feet. The NL

Extension Projects Claims lie on the eastern flank of Red Mountain and, with the

Sixteen-to-One and Mohawk deposits, form a mineralized zone which trends

northwesterly. The veins trend northeasterly across the zone. The Nivloc Mine

operated from 1937 to 1943. The Nivloc Mine is adjacent but not within the claim

group held by the Company. The Nivloc mine encountered non-mineralized

carbonates at around 900 feet and we assume that the reserves here are

exhausted.

A 5-hole

exploratory reverse circulation drill program was completed by SRC in January

2008. Hole NL5 intersected 30 feet with an average grade of 2.5 ounce silver and

0.033 ounce gold per ton. The hole also intersected a second 15-foot zone with

five feet grading 21 ounces silver and an average grade of 8.5 ounce silver per

ton but no gold. These intersections appear to be extension of the Nivloc veins

2800 feet east of the old mine workings. Hole NL3 also appeared to intercept the

vein but was abandoned due to up-hole collapse. Two additional core holes were

drilled to target the veins intersection in NL5 from different angles to verify

if the original intercepts went through the vein.

23

SRC is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to these claims. SRC will remain

as the record holder of the claims as long as it continues to make all payments

required by law to maintain the claims. These payments include an annual fee of

$140 per claim to the BLM and an annual fee estimated to be $85 per claim to the

State of Nevada payable no later than June 1, 2011. In addition, a claim holder

is required to pay annual County filing fees in most counties within Nevada and

Idaho.

The 18 NL

Extension lode mining claims are identified in the BLM records by Nevada Mining

Claim numbers: NMC 867511 through 867525 and 964719 through 964721.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS

CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Klondyke

Claim Group

The

Klondyke Claim Group consists of 104 unpatented, lode mineral claims located in

Esmeralda County, Nevada. The Klondyke Claim Group is accessible by road from

Tonopah, Nevada. The property lies at elevations ranging from 5,400 feet to

5,908 feet. The claim group covers approximately 2,149 acres and is accessed by

Nevada Route 93 and dirt road access. Fifty-six claims were acquired pursuant to

the Mojave Purchase Agreement. SRC staked an additional forty-eight

claims.

The

Klondyke district, which was discovered in 1899, lies about 10 miles south of

Tonopah, Nevada. Most of the deposits occur in veins within limestone carrying

both silver and gold. The claim area hosts numerous prospects and mine shafts.

The property geology was mapped at a scale of 1:12000 in 2007 and 5 separate

sample grids were laid out and sampled to cover what appeared to be anomalous

zones outlined during the mapping program.

Mapping

and grid sampling to date indicate strong NE/SW bearing anomalous zones to the

south of the old mine working where the structure runs NW/SE. Surface sampling

in this zone carried grades as high as 42.3 oz silver and 0.1 oz gold per

ton.

Grid

sampling has identified a large gold-only anomalous zone in the southern portion

of the property. A trenching program is recommended to expand this

anomaly.

SRC is

the registered holder of this claim group. There are no underlying agreements or

royalty interests of third parties that pertain to these claims. SRC will remain

as the record holder of the claims as long as it continues to make all payments

required by law to maintain the claims. These payments include an annual fee of

$140 per claim to the BLM and an annual fee estimated to be $85 per claim to the

State of Nevada payable no later than June 1, 2011. In addition, a claim holder

is required to pay annual County filing fees in most counties within Nevada and

Idaho.

The 104

Klondyke lode mining claims are identified in the BLM records by Nevada Mining

Claim numbers: NMC 867448 through 867503, 936129 through 936136, 964630 through

964635, 964637 through 964656, 964662 through 964667, 944675, 964682, 964689,

and 964696 through 964700.

Subsequent

to the period covered by this report, the Company elected to abandon 56 of the

104 claims.

24

In

addition, we lease two patented claims from Ovidia Harting (“Harting”) pursuant

to a Lease Agreement dated May 30, 2008. The Lease Agreement has a

renewable term of 10 years and permits SRC to explore the area covered by the

patented claims. The Lease Agreement provides for annual payments of

$1,000 per claim to Harting. The Lease Agreement also provides that

we pay the real estate taxes imposed by Esmeralda County. These two

patented claims are subject to a 3% net smelter return royalty to be calculated

and paid to Harting within 45 days after the end of each calendar

quarter. These claims are known as the President and Annex claims,

survey No. 4141 in Section 30T IN, R43E of Esmeralda County. The

Company may terminate this Lease Agreement at any time by giving 60 days notice

in writing to Harting.

THERE ARE

NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT

TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Dyer

Claim Group

The Dyer