Attached files

Exhibit 99.3

February 10, 2011

2010 Full-Year and Fourth-Quarter

Results

1 |

2

Introduction

Unless otherwise stated, we will be talking about results for the full-year or

fourth-quarter 2010 and comparing them with the same period in 2009

References to PMI volumes refer to PMI shipment data, unless otherwise

stated

Industry volume and market shares are the latest data available from a

number of internal and external sources

Acquisitions, for the purposes of this presentation, also include our business

combination with Fortune Tobacco Corporation in the Philippines

Organic volume refers to volume excluding acquisitions

Net revenues exclude excise taxes

OCI stands for Operating Companies Income, which is defined as operating

income before general corporate expenses and the amortization of

intangibles. OCI growth rates are on an adjusted basis which excludes asset

impairment, exit and other costs

Data tables showing adjustments to net revenues and Operating Companies

Income, or “OCI”, for currency, acquisitions, asset impairment, exit and

other costs, free cash flow calculations, adjustments to EPS, and

reconciliations to U.S. GAAP measures are at the end of today’s web

cast slides and are posted on our web site |

3

Forward-Looking and Cautionary Statements

This presentation and related discussion contain statements that, to the

extent they do not relate strictly to historical or current facts, constitute

“forward-looking statements”

within the meaning of the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements are

based on current plans, estimates and expectations, and are not

guarantees of future performance. They are based on management’s

expectations that involve a number of business risks and uncertainties,

any of which could cause actual results to differ materially from those

expressed in or implied by the forward-looking statements. PMI

undertakes no obligation to publicly update or revise any forward-looking

statements, except in the normal course of its public disclosure

obligations. The risks and uncertainties relating to the forward-looking

statements in this presentation include those described under Item 1A.

“Risk Factors”

in PMI’s Form 10-Q for the quarter ended September 30,

2010, filed with the Securities and Exchange Commission.

|

4

2010 PMI Highlights

Solid financial performance, given:

Unprecedented excise tax increases in six markets

Continued economic uncertainty and high unemployment

Consumer downtrading in some markets

More pronounced patterns of heightened price competition

Surge in illicit trade in markets where disruptive tax increases

were implemented

Robust increases in EPS and cash flow

Outperformed our international competitors in terms of

organic volume and market share growth

Source: PMI Financials and PMI estimates

•

•

•

–

–

–

–

– |

5

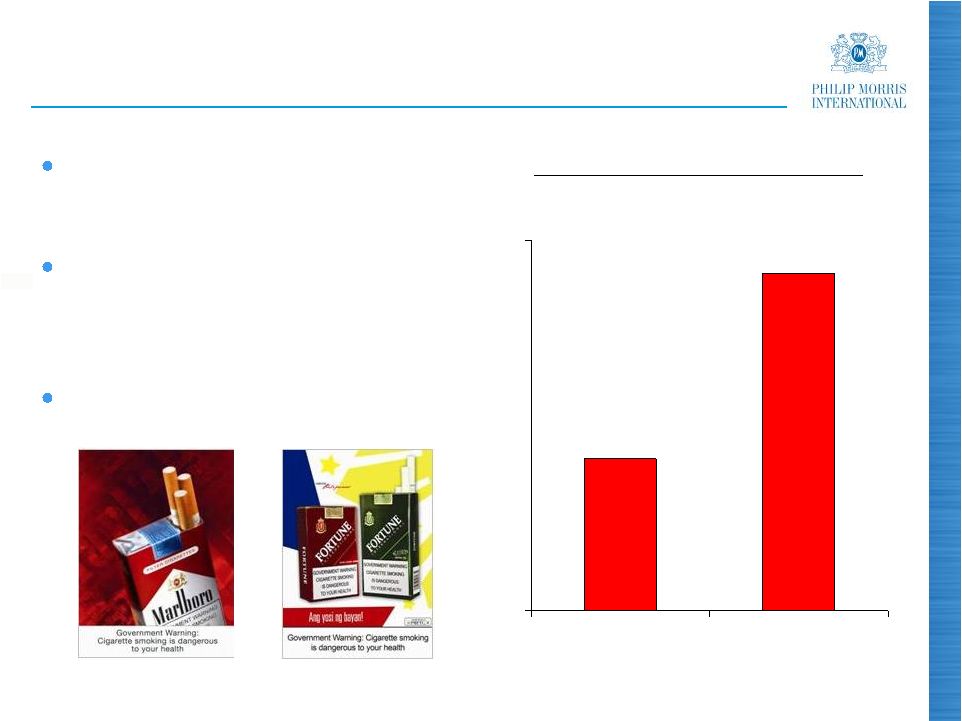

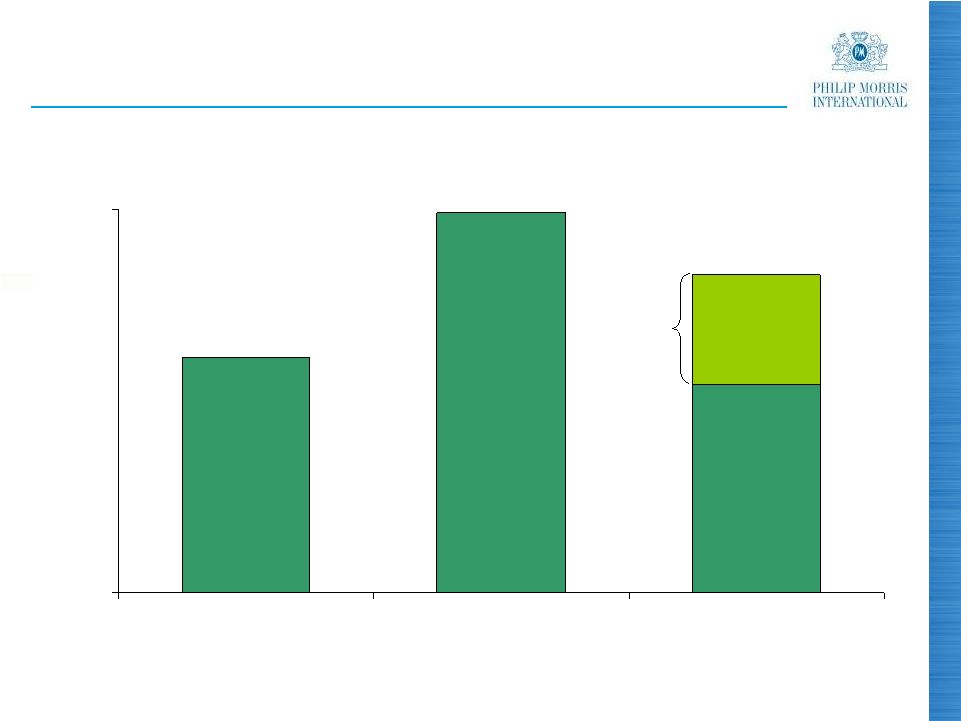

2010 Strategic Highlight -

Philippines

Business combination with

Fortune Tobacco in February

2010

101 billion unit market,

characterized by favorable

demographics and increasing

purchasing power

Strong potential for solid income

growth

(a) Excluding China

Source: PMI estimates

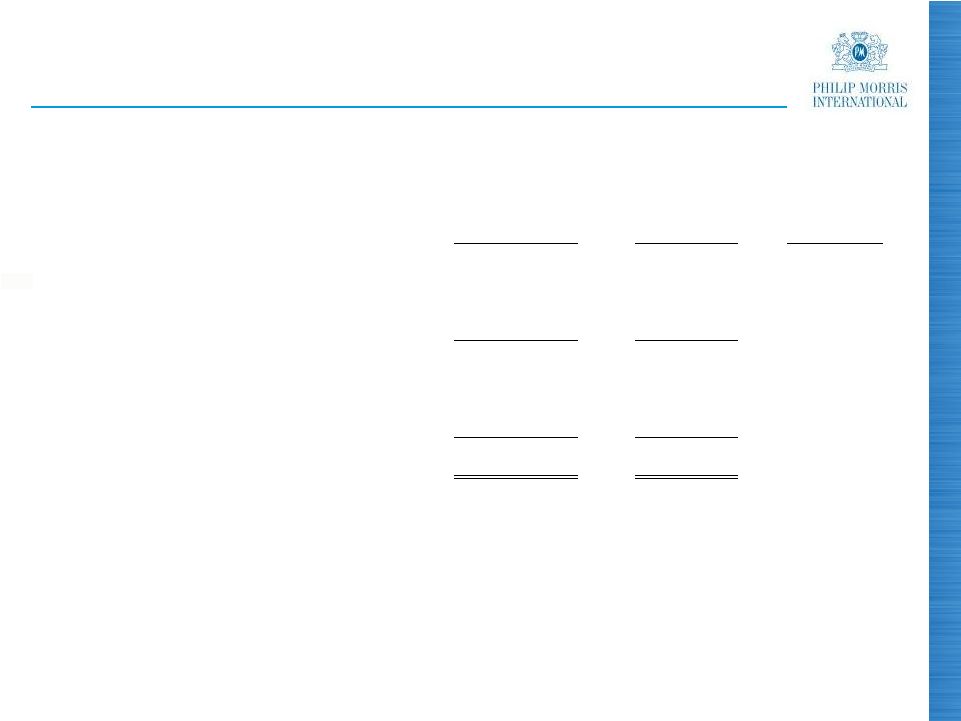

19.1

24.1

15

25

2009

2010

(%)

PMI Asia Region Market Share

(a) |

6

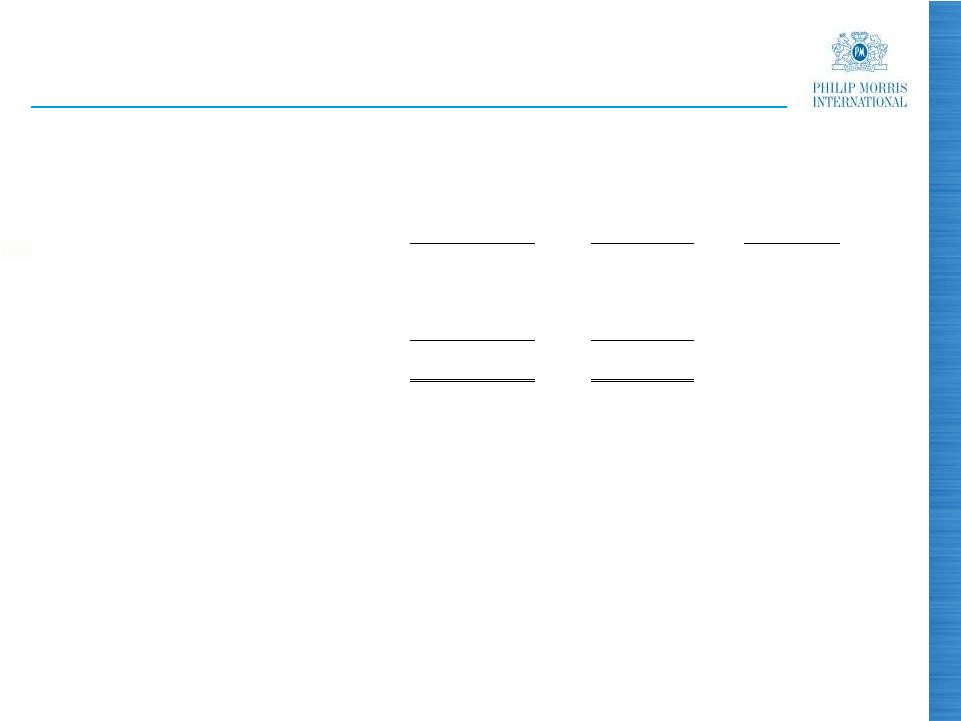

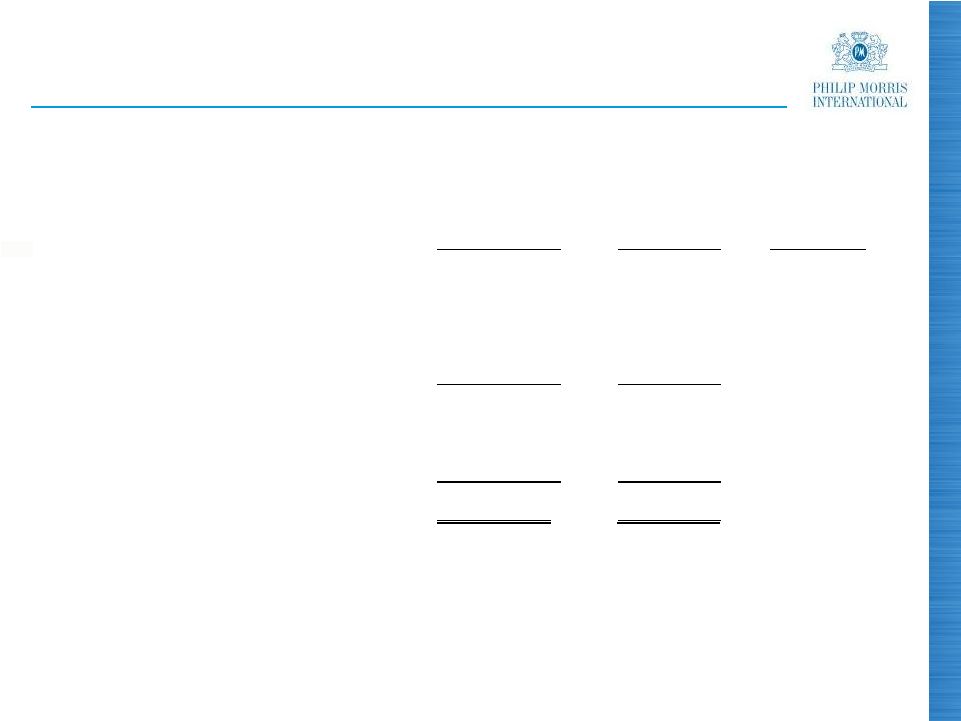

PMI Results

Source: PMI Financials

-

5.1%

+ 3.1%

-

2.5%

+ 4.1%

Cigarette Volume

Excl.

Acquisitions

Actual

Excl.

Acquisitions

Actual

Fourth-Quarter 2010

Full-Year 2010

(% Growth vs. same

period in 2009) |

7

34.6

35.0

36.2

32

37

2009

2010

Q4

34.9

35.5

36.1

32

37

2009

2010

Q4

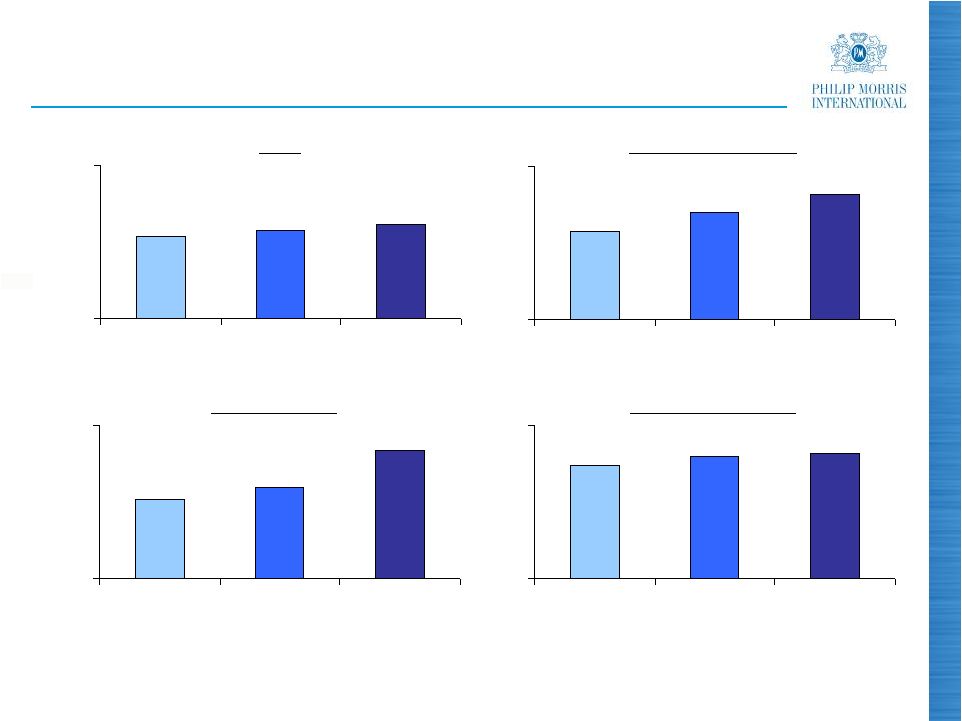

PMI Market Share Developments

(a)

(a)

Excluding USA and China. Historical data adjusted for pro-forma inclusion of

business combination with FTC in the Philippines (b)

Also excluding duty-free

(c)

List of Organisation for Economic Co-operation and Development (OECD) member

countries are listed on their website (www.oecd.org) Source: PMI

estimates (%)

23.7

24.0

24.1

20

25

2009

2010

Q4

Non-OECD

Markets

(b)

(%)

2010

2010

27.7

27.9

28.1

25

30

2009

2010

Q4

Total

(%)

Top

30

OCI

Markets

(%)

2010

2010

OECD Markets

(b)(c) |

8

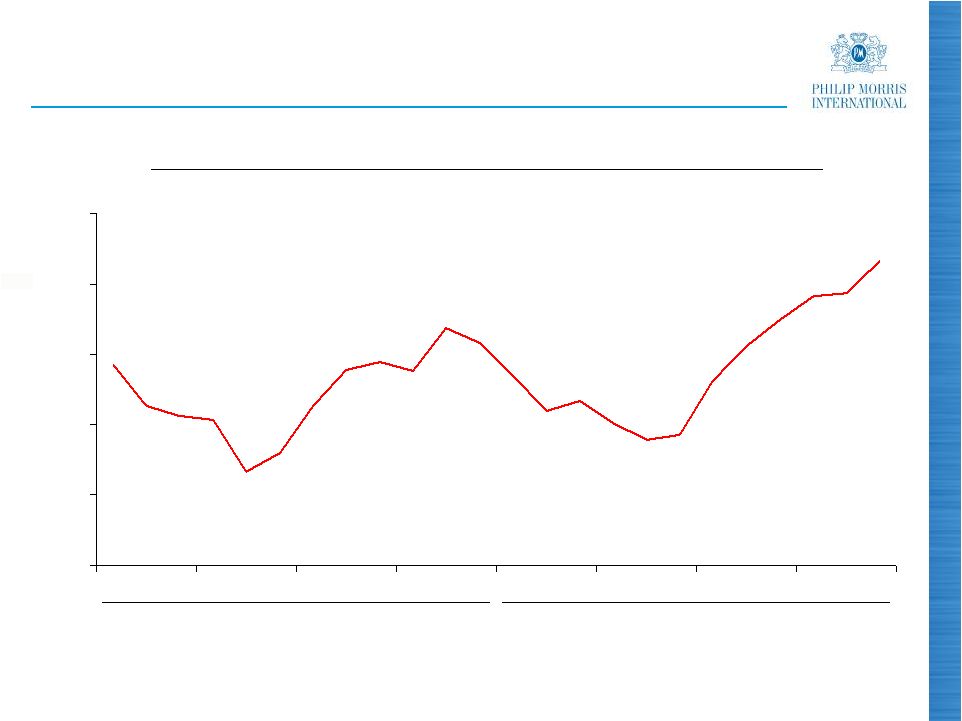

Marlboro

–

Market Share

8.8

8.9

9.0

9.1

9.2

9.3

2009

2010

Marlboro

Global

Share

of

Market

(a)

–

6

Months

Moving

Average

(%)

(a)

Excluding China and USA

Source: PMI estimates

Q4

Q3

Q2

Q1

Q4

Q3

Q2

Q1 |

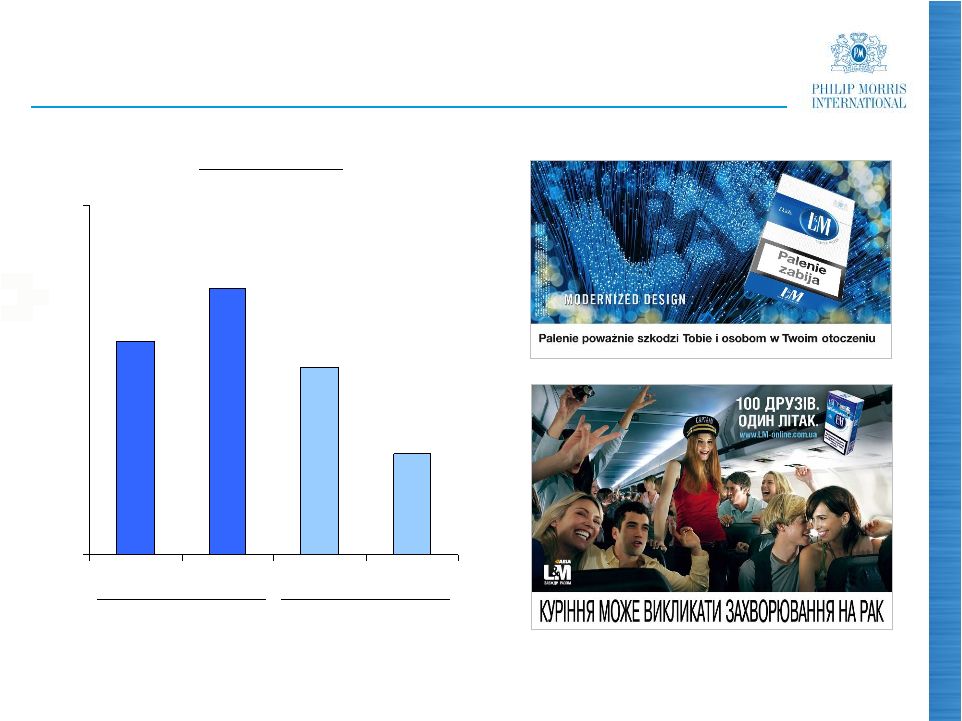

9

4.9

6.1

4.3

2.3

0

8

2007

2010

2007

2010

L&M

Market Share

(%)

(a)

Eastern Europe markets are: Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan,

Kyrgyzstan, Moldova, Mongolia, Russia, Tadjikistan, Turkmenistan, Ukraine

and Uzbekistan Source: PMI estimates

EU Region

Eastern Europe

(a) |

10

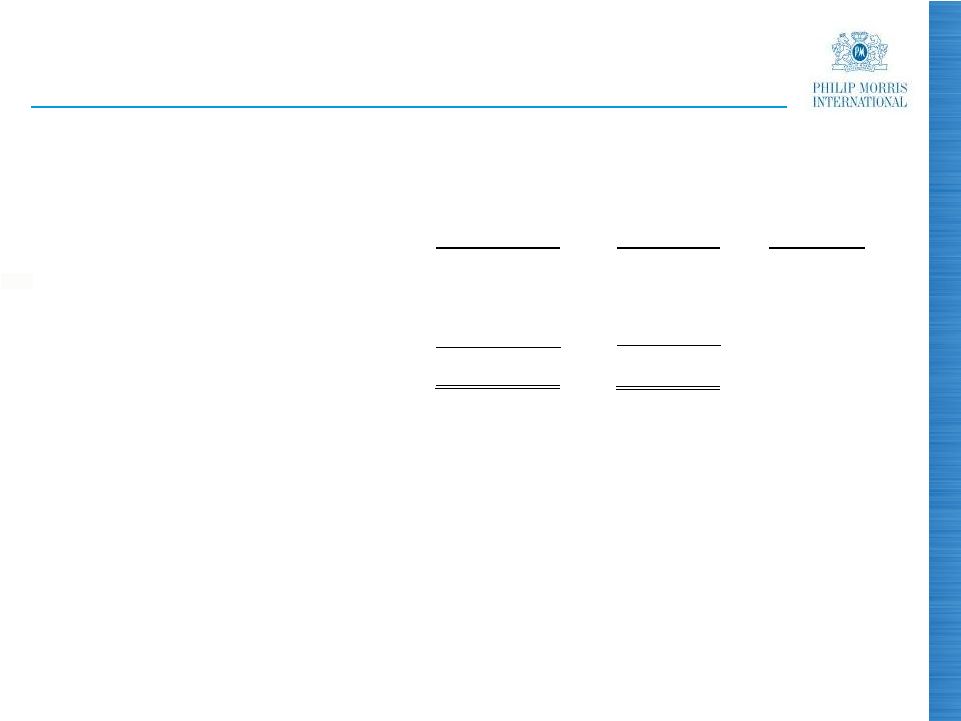

PMI Results

Source: PMI Financials

+ 2.8%

+ 4.8%

+ 3.4%

+ 8.7%

Net Revenues

Excl. Curr. &

Acquisitions

Actual

Excl. Curr. &

Acquisitions

Actual

Fourth-Quarter 2010

Full-Year 2010

(% Growth vs. same

period in 2009) |

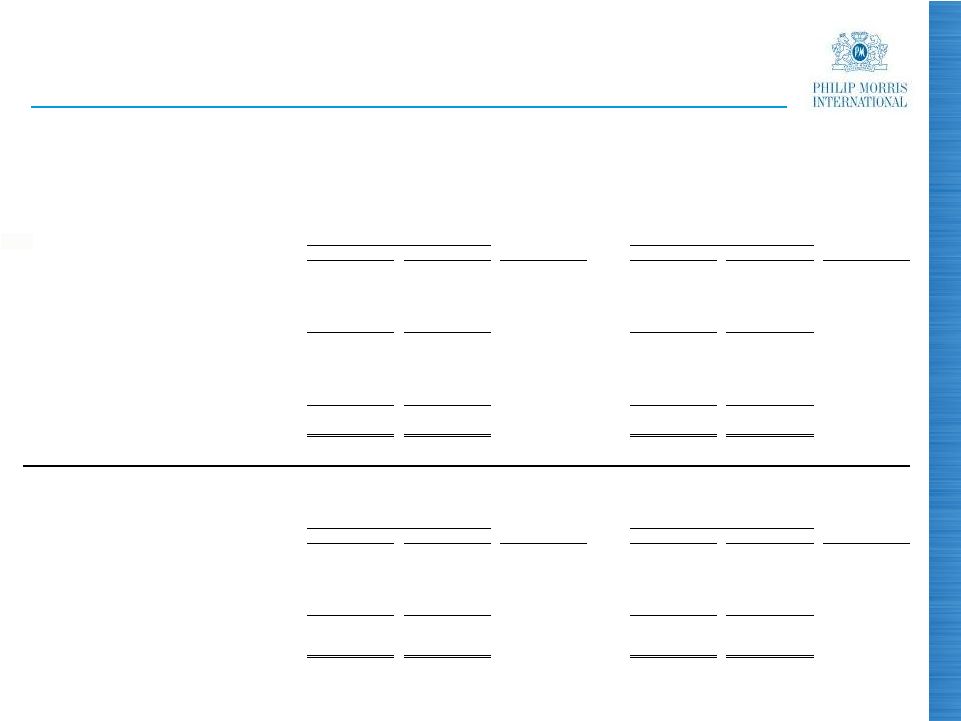

11

PMI Results

Source: PMI Financials

+ 9.9%

+ 12.2%

+ 5.8%

+ 10.3%

Adjusted OCI

+ 2.8%

+ 4.8%

+ 3.4%

+ 8.7%

Net Revenues

Excl. Curr. &

Acquisitions

Actual

Excl. Curr. &

Acquisitions

Actual

Fourth-Quarter 2010

Full-Year 2010

(% Growth vs. same

period in 2009) |

12

Pricing Variance

1,082

580

1,223

1,984

1,662

0

2,000

2008

2009

2010

($ million)

Q4

YTD

Sep

35%

Source: PMI Financials |

13

Operating Margins

Adjusted OCI Margins

2.6

37.7

40.3

0.9

41.7

42.6

Total

0.7

28.0

28.7

0.3

30.0

30.3

LA&C

8.9

29.3

38.2

1.4

37.3

38.7

Asia

0.7

36.4

37.1

2.4

39.2

41.6

EEMA

0.7 pp

48.0 %

48.7 %

0.2 pp

50.2 %

50.4 %

EU

Variance

2009

2010

(a)

Variance

2009

2010

(a)

Fourth-Quarter

Full-Year

(a)

Excluding currency and acquisitions

Source: PMI Financials |

14

PMI Results

+ 18.5%

(a)

+ 19.8%

+ 14.0%

(a)

+ 17.6%

Adjusted diluted EPS

+ 9.9%

+ 12.2%

+ 5.8%

+ 10.3%

Adjusted OCI

+ 2.8%

+ 4.8%

+ 3.4%

+ 8.7%

Net Revenues

Excl. Curr. &

Acquisitions

Actual

Excl. Curr. &

Acquisitions

Actual

Fourth-Quarter 2010

Full-Year 2010

(% Growth vs. same

period in 2009)

(a)

Only excludes currency

Source: PMI Financials |

15

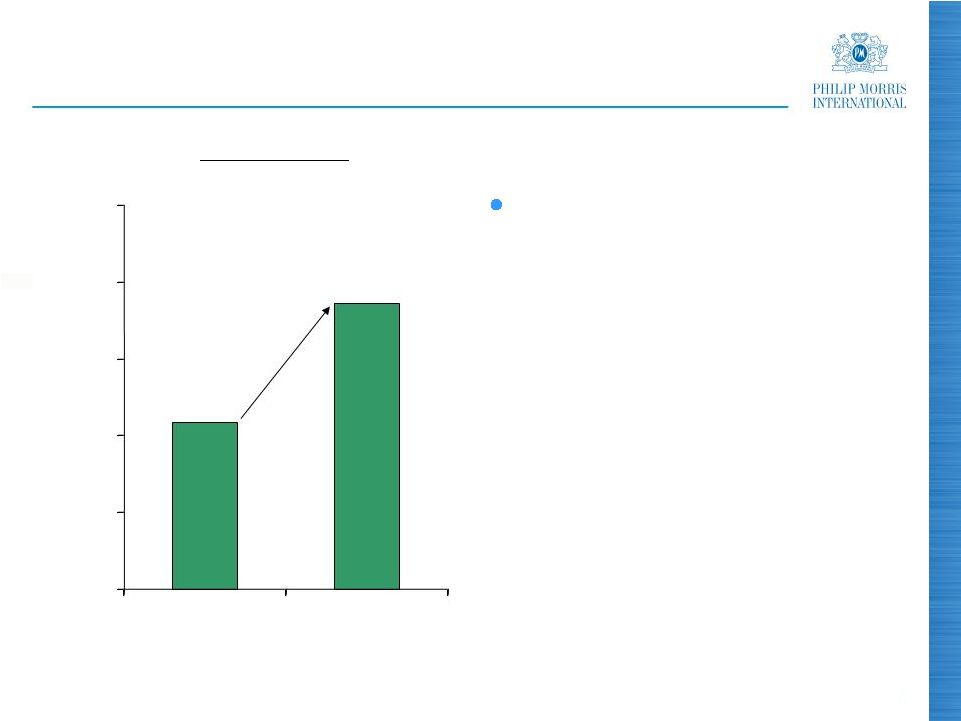

Cash Flow

(a)

Free cash flow equals net cash provided by operating activities less capital

expenditures Source: PMI Financials

Free Cash Flow

(a)

($ million)

+21.7%

Improvement driven in

large part by the strict

management of our

working capital, and in

particular a reduction in

our receivables and in

inventories

7,169

8,724

5,000

6,000

7,000

8,000

9,000

10,000

2009

2010 |

16

Cumulative Operating Cash Flow (2008-2010)

6.6

7.9

7.3

7.9

7.8

9.4

21.7

25.2

March 2008

Actual

2008

2009

2010

($ billion)

Source: PMI Financials

Forecast

Results |

17

Shareholder Returns

Cumulative increase in dividend of 39.1% since March

2008 spin-off

By the end of December 2010, total of 334 million shares

had been repurchased, representing 15.8% of shares

outstanding at that time, at an average price of $47.83

•

• |

18

2011 EPS Guidance

At prevailing exchange rates, reported diluted EPS

guidance for 2011 is $4.35 to $4.45, versus $3.92 in 2010

On an adjusted basis, compared to $3.87 in 2010, this

corresponds to a growth rate of approximately 12.5% to

15% at prevailing exchange rates, or approximately 10%

to 12.5% on a currency neutral basis

2011 guidance assumes an effective underlying tax rate

that is expected to be some 70 basis points higher than

that incurred in 2010

Source: PMI Forecasts

•

•

• |

19

Excise Taxation

Disruptive excise tax increases remain the key risk to our

business

Outlook is for reasonable increases in 2011 other than in

Mexico

•

• |

20

Excise Taxation

Disruptive excise tax increases remain the key risk to our

business

Outlook is for reasonable increases in 2011 other than in

Mexico

New EU excise tax directive since January 2011

Important structural improvements in excise tax systems

in France, Greece, the Netherlands and Sweden

Visibility in Germany for five-year period |

21

2011 Business Outlook

Reasonable excise tax increases, except Mexico

High unemployment continuing to impact industry volumes

and mix

Recent

events

in

North

Africa

likely

to

impact

our

performance

there, but hope this will be a temporary phenomenon |

22

2011 Business Outlook

Reasonable excise tax increases, except Mexico

High unemployment continuing to impact industry volumes

and mix

Recent

events

in

North

Africa

likely

to

impact

our

performance

there, but hope this will be a temporary phenomenon

Organic

volume

performance

expected

to

be

in

line

with

2010 |

23

2011 Business Outlook

Reasonable excise tax increases, except Mexico

High unemployment continuing to impact industry volumes

and mix

Recent

events

in

North

Africa

likely

to

impact

our

performance

there, but hope this will be a temporary phenomenon

Organic

volume

performance

expected

to

be

in

line

with

2010

Anticipate a solid market share performance |

24

2011 Business Outlook

Reasonable excise tax increases, except Mexico

High unemployment continuing to impact industry volumes

and mix

Recent

events

in

North

Africa

likely

to

impact

our

performance

there, but hope this will be a temporary phenomenon

Organic

volume

performance

expected

to

be

in

line

with

2010

Anticipate a solid market share performance

Pricing

will

continue

to

be

the

key

driver

of

profitability

growth |

25

2011 Business Outlook

Reasonable excise tax increases, except Mexico

High unemployment continuing to impact industry volumes

and mix

Recent

events

in

North

Africa

likely

to

impact

our

performance

there, but hope this will be a temporary phenomenon

Organic

volume

performance

expected

to

be

in

line

with

2010

Anticipate a solid market share performance

Pricing

will

continue

to

be

the

key

driver

of

profitability

growth

Some continued pressure on costs |

26

2011 Business Outlook

Reasonable excise tax increases, except Mexico

High unemployment continuing to impact industry volumes

and mix

Recent

events

in

North

Africa

likely

to

impact

our

performance

there, but hope this will be a temporary phenomenon

Organic

volume

performance

expected

to

be

in

line

with

2010

Anticipate a solid market share performance

Pricing

will

continue

to

be

the

key

driver

of

profitability

growth

Some continued pressure on costs

$250 million pretax target for cost savings in 2011 |

27

2011 Business Outlook

Reasonable excise tax increases, except Mexico

High unemployment continuing to impact industry volumes

and mix

Recent events in North Africa likely to impact our performance

there, but hope this will be a temporary phenomenon

Organic volume performance expected to be in line with 2010

Anticipate a solid market share performance

Pricing will continue to be the key driver of profitability growth

Some continued pressure on costs

$250 million pretax target for cost savings in 2011

Forecast strong cash flow performance

$5 billion in share repurchases anticipated in 2011

•

•

•

•

•

•

•

•

•

• |

28

2011 Business Outlook

Reasonable excise tax increases, except Mexico

High unemployment continuing to impact industry volumes

and mix

Recent events in North Africa likely to impact our performance

there, but hope this will be a temporary phenomenon

Organic volume performance expected to be in line with 2010

Anticipate a solid market share performance

Pricing will continue to be the key driver of profitability growth

Some continued pressure on costs

$250 million pretax target for cost savings in 2011

Forecast strong cash flow performance

$5 billion in share repurchases anticipated in 2011

2011: another solid year of growth expected for PMI |

29

Questions & Answers

2010 Full-Year and Fourth-Quarter

Results |

30

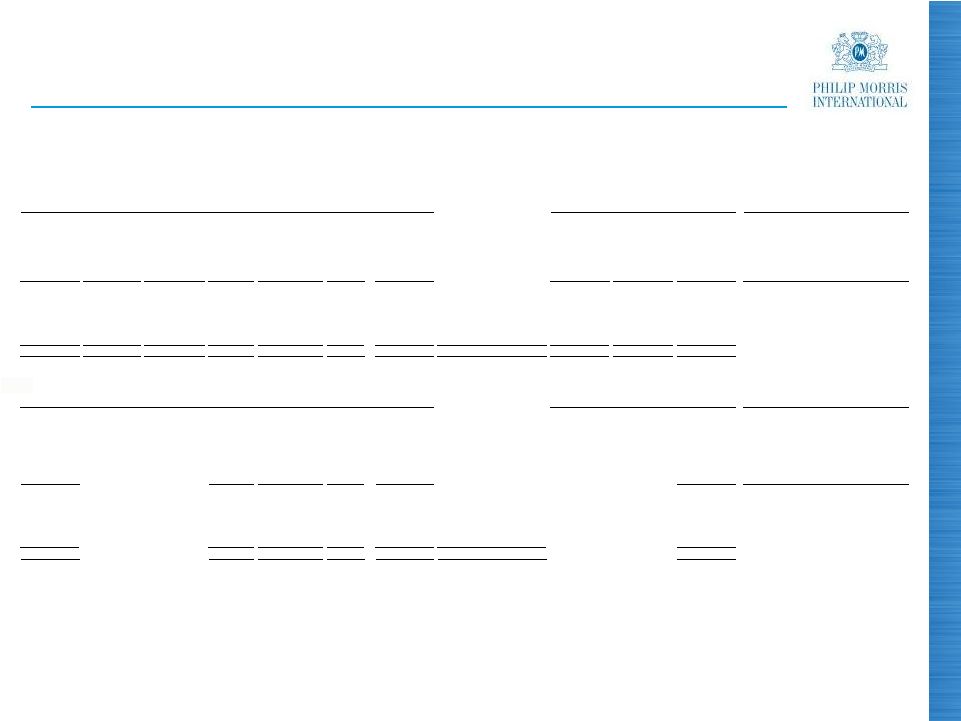

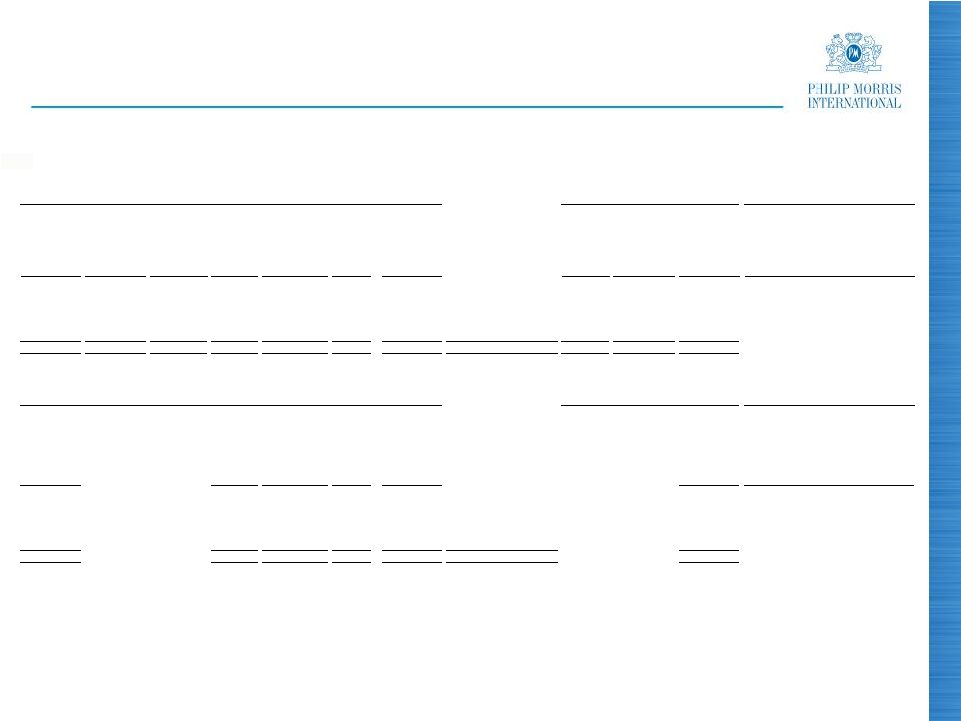

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Adjustments for the Impact of Currency and Acquisitions

For the Quarters Ended December 31,

($ in millions)

(Unaudited)

(1)

Represents the business combination in the Philippines

(2)

Represents the business combination in the Philippines, including $20 million of

asset impairment and exit costs due to a contract termination Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Less

Currency

Reported Net

Revenues

excluding

Excise Taxes &

Currency

Less

Acquisi-

tions

Reported Net

Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

6,997

$

4,804

$

2,193

$

(166)

$

2,359

$

-

$

2,359

$

European Union

7,562

$

5,196

$

2,366

$

(7.3)%

(0.3)%

(0.3)%

4,263

2,385

1,878

(29)

1,907

-

1,907

EEMA

3,912

2,039

1,873

0.3%

1.8%

1.8%

4,141

2,035

2,106

127

1,979

171

(1)

1,808

Asia

3,439

1,725

1,714

22.9%

15.5%

5.5%

2,406

1,546

860

28

832

-

832

Latin America & Canada

2,095

1,331

764

12.6%

8.9%

8.9%

17,807

$

10,770

$

7,037

$

(40)

$

7,077

$

171

$

6,906

$

PMI Total

17,008

$

10,291

$

6,717

$

4.8%

5.4%

2.8%

Reported

Operating

Companies

Income

Less

Currency

Reported

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Reported

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

1,031

$

(110)

$

1,141

$

-

$

1,141

$

European Union

1,109

$

(7.0)%

2.9%

2.9%

740

33

707

-

707

EEMA

681

8.7%

3.8%

3.8%

790

79

711

21

(2)

690

Asia

503

57.1%

41.4%

37.2%

254

16

238

(1)

239

Latin America & Canada

214

18.7%

11.2%

11.7%

2,815

$

18

$

2,797

$

20

$

2,777

$

PMI Total

2,507

$

12.3%

11.6%

10.8%

2010

2009

% Change in Reported Operating

Companies Income

2010

2009

% Change in Reported Net Revenues

excluding Excise Taxes |

31

Reported

Operating

Companies

Income

Less

Asset

Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Less

Currency

Adjusted

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Less

Asset

Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Adjusted

Adjusted

excluding

Currency

Adjusted

excluding

Currency &

Acquisitions

1,031

$

(7)

$

1,038

$

(110)

$

1,148

$

-

$

1,148

$

European Union

1,109

$

(26)

$

1,135

$

(8.5)%

1.1%

1.1%

740

-

740

33

707

-

707

EEMA

681

-

681

8.7%

3.8%

3.8%

790

(20)

810

79

731

41

(1)

690

Asia

503

-

503

61.0%

45.3%

37.2%

254

-

254

16

238

(1)

239

Latin America & Canada

214

-

214

18.7%

11.2%

11.7%

2,815

$

(27)

$

2,842

$

18

$

2,824

$

40

$

2,784

$

PMI Total

2,507

$

(26)

$

2,533

$

12.2%

11.5%

9.9%

% Points Change

Adjusted

Operating

Companies

Income

excluding

Currency

Net Revenues

excluding

Excise Taxes &

Currency

(2)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Net Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

(2)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency &

Acquisitions

Adjusted

Operating

Companies

Income

Net Revenue

excluding

Excise

Taxes

(2)

Adjusted

Operating

Companies

Income

Margin

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income

Margin

excluding

Currency &

Acquisitions

1,148

$

2,359

$

48.7%

1,148

$

2,359

$

48.7%

European Union

1,135

$

2,366

$

48.0%

0.7

0.7

707

1,907

37.1%

707

1,907

37.1%

EEMA

681

1,873

36.4%

0.7

0.7

731

1,979

36.9%

690

1,808

38.2%

Asia

503

1,714

29.3%

7.6

8.9

238

832

28.6%

239

832

28.7%

Latin America & Canada

214

764

28.0%

0.6

0.7

2,824

$

7,077

$

39.9%

2,784

$

6,906

$

40.3%

PMI Total

2,533

$

6,717

$

37.7%

2.2

2.6

% Change in Adjusted Operating

Companies Income

2009

2010

2009

2010

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Operating Companies Income to Adjusted Operating

Companies Income & Reconciliation of Adjusted Operating Companies Income

Margin, excluding Currency and Acquisitions For the Quarters Ended December

31, ($ in millions)

(Unaudited)

(1)

Represents the business combination in the Philippines

(2)

For the calculation of net revenues excluding excise taxes, currency and

acquisitions refer to previous slide |

32

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted

Diluted EPS, excluding Currency For the Quarters Ended December 31,

(Unaudited)

2010

2009

% Change

Reported Diluted EPS

0.96

$

0.80

$

20.0%

Adjustments:

Asset impairment and exit costs

0.01

0.01

Adjusted Diluted EPS

0.97

$

0.81

$

19.8%

Less:

Currency Impact

0.01

Adjusted Diluted EPS, excluding Currency

0.96

$

0.81

$

18.5% |

33

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Reported Diluted EPS, excluding

Currency For the Quarters Ended December 31,

(Unaudited)

2010

2009

% Change

Reported Diluted EPS

0.96

$

0.80

$

20.0%

Less:

Currency Impact

0.01

Reported Diluted EPS, excluding Currency

0.95

$

0.80

$

18.8% |

34

Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Less

Currency

Reported Net

Revenues

excluding

Excise Taxes &

Currency

Less

Acquisi-

tions

Reported Net

Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

Reported

Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

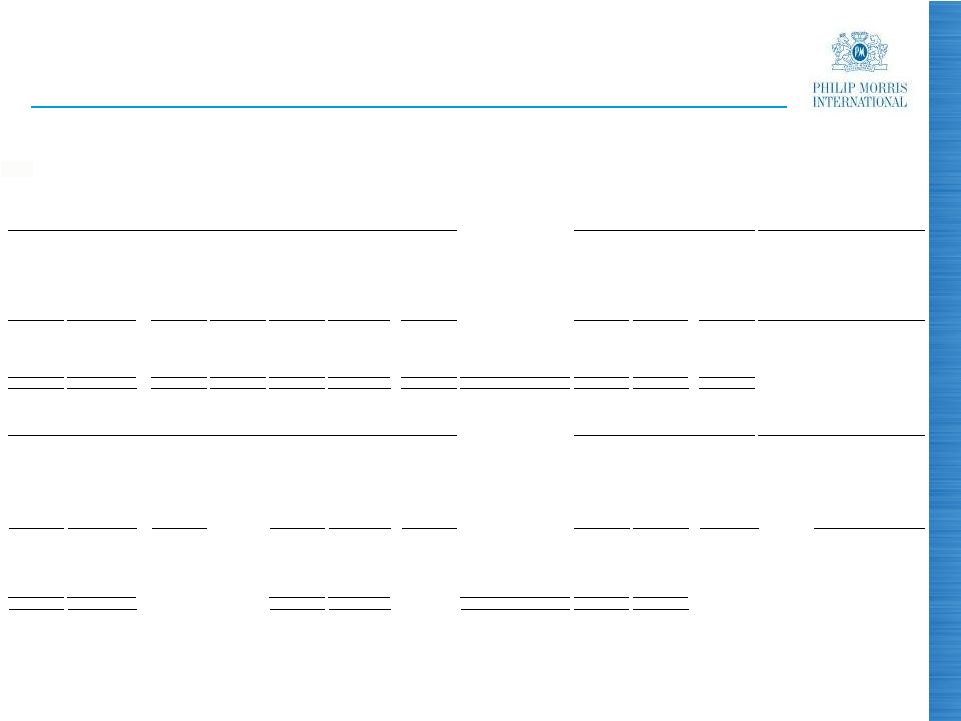

28,050

$

19,239

$

8,811

$

(172)

$

8,983

$

3

$

8,980

$

European Union

28,550

$

19,509

$

9,041

$

(2.5)%

(0.6)%

(0.7)%

15,928

8,519

7,409

76

7,333

80

7,253

EEMA

13,865

7,070

6,795

9.0%

7.9%

6.7%

15,235

7,300

7,935

611

7,324

548

(1)

6,776

Asia

12,413

5,885

6,528

21.6%

12.2%

3.8%

8,500

5,447

3,053

179

2,874

-

2,874

Latin America & Canada

7,252

4,581

2,671

14.3%

7.6%

7.6%

67,713

$

40,505

$

27,208

$

694

$

26,514

$

631

$

25,883

$

PMI Total

62,080

$

37,045

$

25,035

$

8.7%

5.9%

3.4%

Reported

Operating

Companies

Income

Less

Currency

Reported

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Reported

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

4,311

$

(191)

$

4,502

$

2

$

4,500

$

European Union

4,506

$

(4.3)%

(0.1)%

(0.1)%

3,152

107

3,045

28

3,017

EEMA

2,663

18.4%

14.3%

13.3%

3,049

342

2,707

84

(2)

2,623

Asia

2,436

25.2%

11.1%

7.7%

953

85

868

(3)

871

Latin America & Canada

666

43.1%

30.3%

30.8%

11,465

$

343

$

11,122

$

111

$

11,011

$

PMI Total

10,271

$

11.6%

8.3%

7.2%

% Change in Reported Net Revenues

excluding Excise Taxes

2010

2009

% Change in Reported Operating

Companies Income

2010

2009

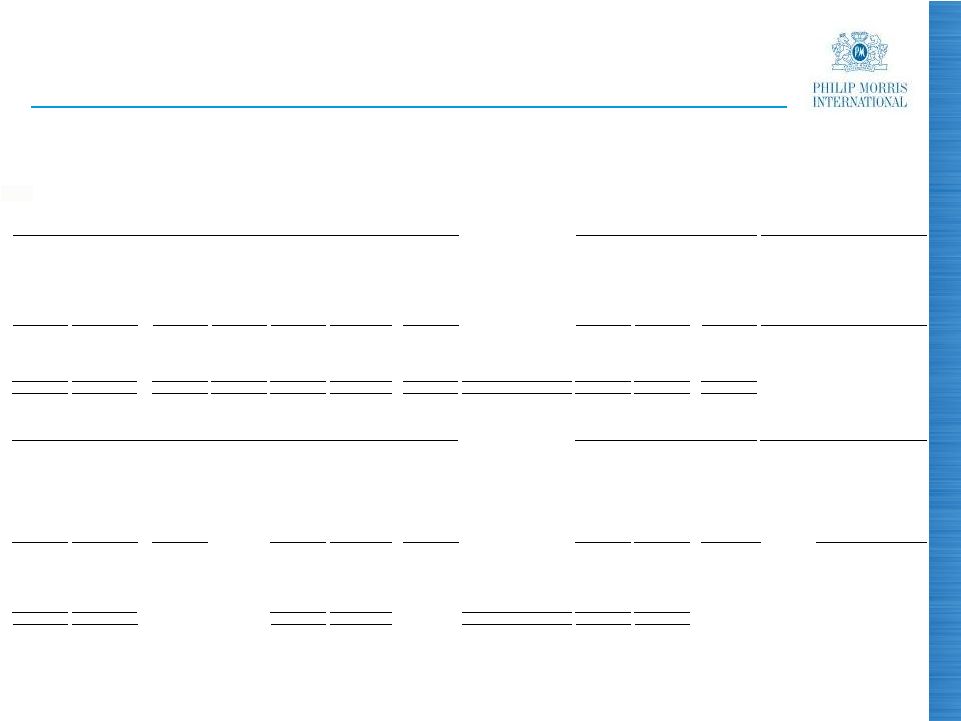

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Adjustments for the Impact of Currency and Acquisitions

For the Years Ended December 31,

($ in millions)

(Unaudited)

(1)

Represents the business combination in the Philippines

(2)

Represents the business combination in the Philippines, including $20 million of

asset impairment and exit costs due to a contract termination |

35

Reported

Operating

Companies

Income

Less

Asset

Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Less

Currency

Adjusted

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Less

Asset

Impairment /

Exit Costs &

Other

Adjusted

Operating

Companies

Income

Adjusted

Adjusted

excluding

Currency

Adjusted

excluding

Currency &

Acquisitions

4,311

$

(27)

$

4,338

$

(191)

$

4,529

$

2

$

4,527

$

European Union

4,506

$

(29)

$

4,535

$

(4.3)%

(0.1)%

(0.2)%

3,152

-

3,152

107

3,045

28

3,017

EEMA

2,663

-

2,663

18.4%

14.3%

13.3%

3,049

(20)

3,069

342

2,727

104

(1)

2,623

Asia

2,436

-

2,436

26.0%

11.9%

7.7%

953

-

953

85

868

(3)

871

Latin America & Canada

666

(135)

(2)

801

19.0%

8.4%

8.7%

11,465

$

(47)

$

11,512

$

343

$

11,169

$

131

$

11,038

$

PMI Total

10,271

$

(164)

$

10,435

$

10.3%

7.0%

5.8%

% Points Change

Adjusted

Operating

Companies

Income

excluding

Currency

Net Revenues

excluding Excise

Taxes &

Currency

(3)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Net Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

(3)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency &

Acquisitions

Adjusted

Operating

Companies

Income

Net Revenues

excluding

Excise

Taxes

(3)

Adjusted

Operating

Companies

Income

Margin

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income

Margin

excluding

Currency &

Acquisitions

4,529

$

8,983

$

50.4%

4,527

$

8,980

$

50.4%

European Union

4,535

$

9,041

$

50.2%

0.2

0.2

3,045

7,333

41.5%

3,017

7,253

41.6%

EEMA

2,663

6,795

39.2%

2.3

2.4

2,727

7,324

37.2%

2,623

6,776

38.7%

Asia

2,436

6,528

37.3%

(0.1)

1.4

868

2,874

30.2%

871

2,874

30.3%

Latin America & Canada

801

2,671

30.0%

0.2

0.3

11,169

$

26,514

$

42.1%

11,038

$

25,883

$

42.6%

PMI Total

10,435

$

25,035

$

41.7%

0.4

0.9

2009

2010

2009

2010

% Change in Adjusted Operating

Companies Income

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Operating Companies Income to Adjusted Operating

Companies Income & Reconciliation of Adjusted Operating Companies Income

Margin, excluding Currency and Acquisitions For the Years Ended December

31, ($ in millions)

(Unaudited)

(1)

Represents the business combination in the Philippines

(2)

Represents the 2009 Colombian investment and cooperation agreement charge

(3)

For the calculation of net revenues excluding excise taxes, currency and

acquisitions refer to previous slide |

36

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted

Diluted EPS, excluding Currency For the Years Ended December 31,

(Unaudited)

2010

2009

% Change

Reported Diluted EPS

3.92

$

3.24

$

21.0%

Adjustments:

Colombian investment and cooperation agreement charge

-

0.04

Tax items

(0.07)

-

Asset impairment and exit costs

0.02

0.01

Adjusted Diluted EPS

3.87

$

3.29

$

17.6%

Less:

Currency Impact

0.12

Adjusted Diluted EPS, excluding Currency

3.75

$

3.29

$

14.0% |

37

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Reported Diluted EPS, excluding

Currency For the Years Ended December 31,

(Unaudited)

2010

2009

% Change

Reported Diluted EPS

3.92

$

3.24

$

21.0%

Less:

Currency Impact

0.12

Reported Diluted EPS, excluding Currency

3.80

$

3.24

$

17.3% |

38

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation

of

Operating

Cash

Flow

to

Free

Cash

Flow

and

Free

Cash

Flow,

excluding

Currency

Reconciliation of Operating Cash Flow to Operating Cash Flow, excluding

Currency For the Quarters and Years Ended December 31,

($ in millions)

(Unaudited)

(a) Operating Cash Flow

For the Quarters Ended

For the Years Ended

December 31,

December 31,

2010

2009

% Change

2010

2009

% Change

Net

cash

provided

by

operating

activities

(a)

1,581

$

1,465

$

7.9%

9,437

$

7,884

$

19.7%

Less:

Capital expenditures

230

232

713

715

Free cash flow

1,351

$

1,233

$

9.6%

8,724

$

7,169

$

21.7%

Less:

Currency impact

6

(2)

Free cash flow, excluding Currency

1,345

$

1,233

$

9.1%

8,726

$

7,169

$

21.7%

For the Quarters Ended

For the Years Ended

December 31,

December 31,

2010

2009

% Change

2010

2009

% Change

Net

cash

provided

by

operating

activities

(a)

1,581

$

1,465

$

7.9%

9,437

$

7,884

$

19.7%

Less:

Currency impact

5

23

Net cash provided by operating activities,

excluding Currency

1,576

$

1,465

$

7.6%

9,414

$

7,884

$

19.4% |

2010

Full-Year and Fourth-Quarter Results

February 10, 2011

39 |