Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SENSUS USA INC | d8k.htm |

Business Overview

Sensus

January 2011

Exhibit 99.1 |

Safe

Harbor Statement 2

The statements made during this presentation, other than historical facts, are made

in reliance on the safe- harbor provisions of the Private Securities

Litigation Reform Act of 1995. These statements involve risks and

uncertainties and are subject to change at any time. These statements reflect the Company’s current

expectations regarding its financial position, revenues, cash flow and other

operating results, business strategy, financing plans, forecasted trends

related to the markets in which the Company operates, legal proceedings and

similar matters. We cannot assure you that the expectations expressed or implied in these

forward-looking statements will turn out to be accurate. Our actual results

could be materially different from our

operations

because

of

various

risks.

These

risks

include

any

future

restatements

of

our

consolidated

financial statements, our inability to maintain effective internal controls over

financial reporting, our susceptibility to macroeconomic downturns in the

United States and abroad, conditions in the residential, commercial and

industrial construction markets and in the automotive industry, our dependence on new

product development and intellectual property, and our dependence on independent

distributors and third- party contract manufacturers, automotive vehicle

production levels and schedules, our substantial financial leverage, debt

service and other cash requirements, liquidity constraints and risks related to future growth

and expansion. Other important risk factors that could cause actual events or

results to differ from those contained or implied in the forward-looking

statements include, without limitation, our ability to integrate acquired

companies, general economic and business conditions, competition, adverse changes in the

regulatory or legislative environment in which we operate, customer cancellations

and other factors beyond the Company’s control. We encourage you to

review our annual report on Form 10-K/A, which discusses in greater

detail our results of operations for the most recently completed fiscal year and consider the risks

that relate to any of our forward-looking statements.

|

Agenda

About Sensus

1

Dynamic Market Opportunities

2

Differentiated Technology Offerings

3

Current Market Leadership

4

Strong Financial Performance

5

3

Appendix

6 |

Sensus

Business Segments 4

1

* Revenue for Last Twelve Months Ended September 30, 2010 in millions

Reporting

Segment

Revenue*

Reach

Business Activity

Utility

Infrastructure

$743M

•

Global

•

Smart Grid communications networks including:

–

Smart metering, distribution automation, and

lighting control solutions and software

–

Demand response and Home Area Network

solutions and software

•

Water, gas and electric meters

All Other

$130M

•

USA

•

China

•

Pipe repair clamps & couplings

•

Aluminum die castings for automotive and other

applications |

Sweeping societal and industry changes

to conserve and efficiently use electricity

and water resources solidly position

Sensus

for strong profitable growth

Sensus

is Uniquely Positioned

5

1 |

1

About Sensus

•

$873 million of Net Sales at LTM Sept. 2010*

–

7% CAGR over 5 years

•

$107 million Adjusted EBITDA** at LTM Sept. 2010*

–

12% margin

•

Serves the global electric, water & gas markets with

–

Single, licensed communications network platform

•

Leader in the utility smart grid market

–

Over 8 million SmartPoint™

devices installed in full utility

deployments

•

More than a century of utility experience

–

Over 100 million meters installed worldwide

6

Headquarters

Raleigh, NC

* LTM Sept. represents the Last Twelve Months Ended September 30,

2010. ** See Appendix: Non-GAAP Measure. |

Presence on five

continents with nearly 4,000 people LTM Sep* $28

FY04 $12

LTM Sep* $177

FY04 $152

LTM Sep* $16

FY04 $7

LTM Sep* $606

FY04 $349

LTM Sep* $46

FY04 $9

Global Reach, Global Growth

7

Net

Sales

by

Geography

(US$

in

millions)

1

* “LTM Sep”

represents the Last Twelve Months Ended September 30, 2010. |

8

The global utility industry is

undergoing a dramatic

technology transformation

creating compelling

market

opportunities

2

Dynamic Market Opportunities |

Global

Market Drivers •

Increasing demand and conservation of energy

and water

•

Alternative/renewable energy and distributed

generation

•

Aging infrastructure and workforce

•

Real-time information requirements

•

Carbon emission and climate change initiatives

•

Active regulatory environments

9

2

Create tremendous opportunities for Sensus |

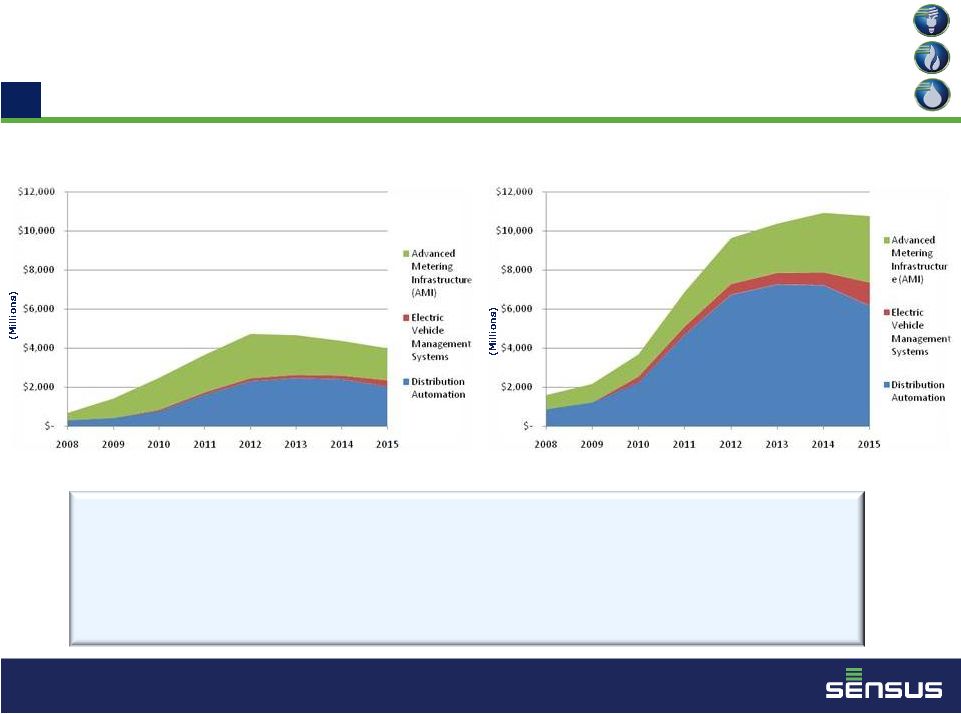

Electric Smart Grid

Market Projections

Smart Grid Revenue by Application, World Markets

(Excluding the United States): 2008-2015

Smart Grid Revenue by Application, United States: 2008-2015

10

•

The U.S. market is leading the global smart grid conversion

•

The U.S. smart grid market doubles over the next 5 years

•

Markets outside of U.S. are following the U.S. in smart grid conversion

and more than doubling over the next 5 years

•

Distribution Automation is accelerating

Source: Pike Research

Source: Pike Research

2 |

World

Water Availability is Declining 11

Source: Stockholm Environmental Institute

2

•

World population and demand for water are increasing

•

Conservation is becoming a global mandate

•

Accurate and timely monitoring and control of water usage is critical

•

Global water footprint positions Sensus

favorably for continued growth

•

The U.S. Environmental Protection Agency estimates $274 billion

will be

needed for U.S. water infrastructure over the next 20 years ($14

billion/year)

Water Availability:

Grey: No data

Dark Green: Very

high Light Orange: Low

Light Green:

High Dark Orange: Very Low

Yellow:

Average Red: Catastrophically low |

•

Technology transition to Smart

Meters is accelerating

•

Being led by the conversion of the

electric meter installed base

•

Water conversion is underway

•

Estimated that only 28 million of the

340 million meters have been

converted to date

•

2.7 billion global meter installed base

Sources: “The Scott AMR Report: AMR Deployments in North America, 2

Quarter 2010”; IMS Research; and Management estimates.

Global

Meter

Installed

Base

(units

in

millions)

1,277

976

442

2,695

Technology Transition Has Begun

North American Meter Installed Base

12

2

nd |

13

3

Differentiated Technology Offerings

Sensus, with its differentiated

offering and innovative

technology, is a well positioned

leader of the global utility

technology transformation |

14

•

Extensive portfolio of advanced metrology products for all utility types

–

iCON

®

-

advanced solid state electric meter

–

iPERL™

-

next generation water measurement technology

–

SONIX

®

-

ultrasonic gas meter

•

Advanced long-range, high-powered radio communications network

–

Protected, primary-use FCC licensed radio spectrum; Reliable for

utilities’ “mission critical”

applications

–

Avoids interference in the crowded public spectrum bands used by

mesh networks

–

Software defined radio enables over-the-air upgrades

•

Distribution Automation devices and software

–

Connects using integrated Sensus communications network

–

Interfaces with utility SCADA system

–

Integrated with all major Distribution Automation equipment manufacturers

•

Smart Grid Lighting

–

Induction lighting and long range radio supervisory control

•

Demand Response and Home Area Network solutions

–

Connect directly to the network or through electric meter via other

communications, e.g. Zigbee •

Fully integrated solution

–

Communications, software, metrology, distribution automation devices, demand

response and Home Area Network solutions

•

Flexible, scalable and adaptable software, network and data solutions delivery

–

Minimizes utility’s financial, operational and technological risk

–

Transforms data into information which can be used for decision support of mission

critical utility functions Sensus’

Differentiated Offering

3 |

Multiple Needs; One Network

15

3

Critical Infrastructure

Class Network:

•

Dedicated

•

Secure

•

Resilient

•

Universal |

16

Critical Infrastructure Class Network

Advantages

3

•

Advanced long-range, high-power radio communications technology

–

Deployed

using

a

star-based

“point-to-point”

structure;

not

a

mesh

system

–

Terrain Agnostic --

Cost efficiently covers both urban and rural environments

–

Global

Operability

--

One

technology

works

everywhere

in

the

world

•

Protected, primary-use FCC licensed radio spectrum

–

Eliminates interference inherent in crowded public spectrum bands

•

Software defined radio

–

Enables cost efficient and flexible over-the-air upgradability, unlike a chipset based

radio –

Helps

to

“Future-proof”

the

utility’s

investment

•

Fast, dedicated, application specific communications channels

–

Essential for “mission critical”

applications requiring low latency, e.g. distribution automation

•

Resilient, minimal infrastructure

–

Fully redundant end-to-end architecture. Robust infrastructure to withstand natural

disasters. –

Lowest initial installation and ongoing operating and maintenance costs

•

Advanced security

–

State-of-the-art key encryption at meter level; set at point of manufacture

•

FlexNet™

communications solution can cover all utility applications

–

Metering, distribution automation, demand response, Home Area Networks and emerging

technologies

–

2-way direct communications with battery powered water and gas meters

|

Global Reach, Global Technology

The Sensus

communications network deployed in North America has

now been successfully deployed around the globe

–

Multiple global engagements with utilities and partners

Technology addresses diverse customer needs

–

National scale deployments require a ubiquitous,

critical infrastructure-grade network

–

U.K. Nationwide Smart Metering Initiative -

with

ecosystem partners: Arqiva, BT and Detica

Multiple applications

–

Electric, water, gas and infrastructure control

3

17 |

18

Sensus is a market leader

building the Smart Grid for

energy and water…today

4

Current Market Leadership |

Sensus

Has Rapidly Emerged as a Leader

in N.A. Smart Grid Deployments

Source: The Scott Report: AMR Deployments in North America and Sensus

19

4

0

1

2

3

4

5

6

7

8

Cumulative

SmartPoints

Shipped

(Electric

+

Water

+

Gas)

•

Sensus’ Electric market

share increased from 3%

to 23% in two years

•

Dramatic growth in electric

Sensus SmartPoint™

deployments

•

Water market transitioning

from basic AMR to 2-way

smart metering

|

NA Smart Grid

Market

Source:

The Scott Report,

2 Quarter 2010

27 million devices

shipped to date

4

20

Source:

The Scott Report,

2 Quarter 2010

5 million meters

shipped annually

Residential and C&I

meters (1-way and 2-way)

NA Electric

Smart Meter/Endpoint Market

(in units)

NA Water

Smart Meter/Endpoint Market

(in units)

nd

nd |

Sensus

is Building the Smart Grid

for Water Today

•

Sensus

is enabling the Smart Grid for Water with innovative

technology

–

Sensus

communications network

–

iPERL™

water management device

–

Distribution Automation for water

–

Leak detection at end point and distribution network

•

Sensus

is building the Smart Grid for water

–

Over 1 million water SmartPoints™

installed over the past 6

quarters

–

Over 100 individual water utility Smart Grid projects completed or

in process

21

4

Critical

Infrastructure

Class Network

-

Dedicated -

Secure

-

Resilient

- Universal

iPERL

System

OMNI F2

Customer

Portal |

Water

Smart Grid Market •

Sensus

has a #2 market position in the World

Market Share for Advanced Metering

•

Global water market returning to historical

growth rates in excess of GDP

•

Conservation and efficiencies driving new

technology adoption

•

Broad integrated offering for the water smart

grid

–

Point-to-Point communications network

–

Innovative water management devices

–

Distribution automation / Leak detection

•

Extensive metrology offering for regions of the

world preparing for adoption of advanced

technology

•

Well positioned for growth with significant

global water market presence coupled with

advanced technology

North America Share for Water Residential and C&I

Advanced (1-way and 2-way) Meters (units)

Source:

The Scott Report,

2

Quarter 2010

5 million meters

shipped annually

World Residential Water Meter Market Share

-

Excluding China

(units)

Source:

IMS Research 2010

42 million meters

shipped annually

Others

86.5%

4

22

nd |

Gas

Smart Grid Drivers are Evolving …Sensus is Poised to Capitalize

•

Pipeline safety is a critical component of the Smart Grid for gas

–

Sensus technology enables utilities to respond to emergency

situations

•

System balancing and financial settlements are key functions

for gas utilities

–

Real-time access to SmartPoint™

data requires critical

infrastructure-class network

•

Sensus provides both the technology and communications that

create a Smart Grid for Gas

–

Sensus communications network

–

Sonix

®

ultrasonic gas meter

–

Sensus Remote Gas Shut-off device

–

Distribution Automation for gas

•

Sensus technology and market presence will lead the Smart

Grid for gas

–

Approximately 80 million gas meters installed in North America

and over 400 million worldwide

Remote

Shut-off

Device

Ultrasonic

Gas Meter

23

4

Customer

Portal

Critical Infrastructure

Class Network

-

Dedicated -

Secure

-

Resilient

- Universal |

Delivering market-leading

technology will continue to drive

increased profitability

24

5

Strong Financial Performance |

25

5

Evolution of Net Sales

Water Metering

40%

Gas Metering

8%

Precision

Die Casting

8%

Clamps &

Couplings

7%

Water Metering

60%

Gas Metering

12%

Precision

Die Casting

7%

Clamps &

Couplings

10%

Fiscal Year 2004 Net Sales

LTM September 2010 Net Sales

Conservation Solutions

11%

$59M

Conservation Solutions

37%

$324M, up 449%

Net Sales: $529M

Net Sales: $873M

(Fiscal year ended March 31)

Note: Conservation Solutions, Water Metering and Gas Metering make up the

“Utility Infrastructure and Related Communications Systems”

reporting segment. The “All Other”

reporting segment includes Precision Die Casting and Clamps & Couplings.

|

26

5

Financial Track Record

$97

$94

$91

$92

$105

$107

16%

15%

13%

12%

12%

12%

0%

5%

10%

15%

20%

25%

$0

$20

$40

$60

$80

$100

$120

FY

2006

FY

2007

FY

2008

FY

2009

FY

2010

LTM

Sept

$47

$29

$51

$61

$73

$53

$0

$10

$20

$30

$40

$50

$60

$70

$80

FY

2006

FY

2007

FY

2008

FY

2009

FY

2010

LTM

Sept

$614

$631

$722

$784

$844

$873

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

FY

2006

FY

2007

FY

2008

FY

2009

FY

2010

LTM

Sept

Net Sales

(1)

Net cash provided by operating activities as reported in the Company’s SEC filings.

Adjusted EBITDA* improves from 2008 due

to volume and operational leverage and

scale.

R&D investment rate in 2010 increased to

5.3% of net sales as technology is focused

across the Utility Infrastructure Systems

product portfolios.

2008

Sensus

launches

FlexNet™

systems

and enters AMI Electric markets.

2009 revenue traction attained as market

share expands rapidly to 23% with 8 million

SmartPoint™

devices shipped within 3 years.

Fiscal Year Ends March 31 LTM September

2010 (US$ in millions) Adjusted EBITDA *

Operating Cash Flow

(1)

Continued drive on balance sheet efficiency

through working capital initiatives. Days sales

cycle improved over 100% since 2008.

Maintained investments in infrastructure and

software to support market strategies and

commitments.

* See Appendix: Non-GAAP Measure

st |

Highlights

Leader in NA Electric Smart Grid

metering market

•Sensus

delivered 7 million to date

Leader in the rapidly evolving

Water Smart Grid market

•

Sensus

delivered 1 million to date

Leading market positions in mature

core water and gas metrology

Future revenue visibility

•

Only 27 million smart electric meters installed out

of 160 million North American installed base

•

Global potential to convert 1.3 billion meters

•

Only 1 million smart water meters installed out of

100 million North American installed base

•

Global potential to convert 1 billion meters

•

Established metrology business consistently

delivers Revenue, EBITDA and Cash Flow

•

Annual revenues > $400 million

•

Long-term electric smart grid contracts provide

visibility for future business and revenue

•

Include long-term contracts with the 3 largest North

American electric utilities (by market capitalization)

27

5 |

Thank You.

For more information visit us at

www.sensus.com |

29

Appendix

6 |

30

6

Appendix: Non-GAAP Measure

•

To enhance the comparability and usefulness of its financial

information, the Company provides Adjusted EBITDA to describe

more fully the results of its underlying business.

•

Adjusted

EBITDA

is

defined

as

consolidated

earnings

before

interest

expense, depreciation and amortization, and income taxes

plus (a) restructuring costs, (b) management fees and (c) acquisition-

related costs, and adjusted for other nonrecurring items.

•

Refer to the Company’s press release on Form 8-K filed December

20, 2010 for further discussion of non-GAAP measures.

|

31

6

Appendix: Non-GAAP Measure

A reconciliation of Adjusted EBITDA:

LTM

FY

FY

FY

FY

FY

Sept

Ended

Ended

Ended

Ended

Ended

(US$ in millions)

9/30/2010

3/31/2010

3/31/2009

3/31/2008

3/31/2007

3/31/2006

Consolidated net loss

$ (11.8)

$ (19.2)

$ (22.2)

$ (6.4)

$ (8.4)

$ (3.2)

Depreciation and amortization

47.1

45.5

46.6

47.7

48.1

42.4

Interest expense, net

45.3

43.6

39.9

41.8

42.4

39.3

Income tax provision (benefit)

3.4

(1.5)

(3.4)

(1.4)

0.5

8.2

Restructuring costs

19.0

25.9

9.9

7.0

8.5

7.2

Management fees

2.8

3.3

3.1

2.6

2.6

2.3

Acquisition-related costs

0.8

1.2

-

-

0.1

-

Loss on debt extinguishment

-

5.9

-

-

-

-

Other non-recurring items

-

-

3.3

-

-

1.1

Goodwill impairment

-

-

14.4

-

-

-

Gain from discontinued operations

-

-

-

-

(0.1)

-

Adjusted EBITDA (excluding discontinued operations)

$ 106.6

$ 104.7

$ 91.6

$ 91.3

$ 93.7

$ 97.3

|