Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K - WEST PHARMACEUTICAL SERVICES INC | form8k.htm |

WEST PHARMACEUTICAL SERVICES UPDATE

Solutions for Injectable Drug Delivery NYSE:WST www.westpharma.com

CJS Securities’

11th Annual “New Ideas for the New Year”

Investor Conference

New York, NY January 12, 2011

This presentation contains “forward-looking statements”, as that term is defined in the Private

Securities Litigation Reform Act of 1995, that are based on management’s beliefs and

assumptions, current expectations, estimates and forecasts. Statements that are not

historical facts, including statements that are preceded by, followed by, or that include, words

such as “estimate,” “expect,” “intend,” “believe,” “plan,” “anticipate” and other words and terms

of similar meaning are forward-looking statements. West’s estimated or anticipated future

results, product performance or other non-historical facts are forward-looking and reflect our

current perspective on existing trends and information.

Securities Litigation Reform Act of 1995, that are based on management’s beliefs and

assumptions, current expectations, estimates and forecasts. Statements that are not

historical facts, including statements that are preceded by, followed by, or that include, words

such as “estimate,” “expect,” “intend,” “believe,” “plan,” “anticipate” and other words and terms

of similar meaning are forward-looking statements. West’s estimated or anticipated future

results, product performance or other non-historical facts are forward-looking and reflect our

current perspective on existing trends and information.

Many of the factors that will determine the Company’s future results are beyond the ability of

the Company to control or predict. These statements are subject to known or unknown risks

or uncertainties, and therefore, actual results could differ materially from past results and

those expressed or implied in any forward-looking statement. You should bear this in mind as

you consider forward-looking statements. A non-exclusive list of important factors that may

affect future results may be found in West’s filings with the Securities and Exchange

Commission, including our annual report on Form 10-K and our periodic reports on Form 10-

Q and Form 8-K. You should evaluate any statement in light of these important factors.

the Company to control or predict. These statements are subject to known or unknown risks

or uncertainties, and therefore, actual results could differ materially from past results and

those expressed or implied in any forward-looking statement. You should bear this in mind as

you consider forward-looking statements. A non-exclusive list of important factors that may

affect future results may be found in West’s filings with the Securities and Exchange

Commission, including our annual report on Form 10-K and our periodic reports on Form 10-

Q and Form 8-K. You should evaluate any statement in light of these important factors.

Safe Harbor Statement

2

West is a globally diversified manufacturer of products consumed in the healthcare and

consumer markets.

consumer markets.

Every day over 80 million West and Daikyo products are used to enhance the quality of

healthcare worldwide.

healthcare worldwide.

3

A Diverse, Stable Customer Base

Pharmaceutical/Biotech

Generic

Medical Device

4

West’s Structure

Packaging Systems

• 9-month 2010 sales: $591 MM

• Established leadership

• High market share

• Stable growth rate

Delivery Systems

• 9-month 2010 sales: $240 MM

• Proprietary devices

• Contract manufacturing

• High projected growth rate

Development

Primary Package

Administration

5

2010 Retrospective

• Operating Challenges:

– Currency volatility

– Increased R&D spending on new product programs

– Manufacturing footprint: Phased reductions of operations at St. Austell,

UK and Montgomery, PA plants announced in Q4

UK and Montgomery, PA plants announced in Q4

• Nine-Months ended September 30, 2010

– Sales up 8.6% (9.4% excluding currency effects)

– Operating Profit up 11.9%

– Earnings per Diluted Share $1.70 vs $1.53

– Capex $49.8 million

• Q4, Full-year 2010 results to be announced February 17, 2011

• Second-half 2009 results yield difficult 2010 comparisons:

– $22 million of 2009 H1N1 Sales, of which $12 million were in Q4 ‘09

– Average $/Euro exchange of $1.45 in second half 2009, $1.48 in Q4 ’09

6

2011 Outlook

• Asymmetrical global economic recovery

– Europe, US, Japan remain sluggish

– China, India, Brazil stronger

– Continuing currencies, commodity price volatility

• New product approvals delayed

– Bydureon

– Benlysta

– Expansion of indications for approved drugs difficult (Avastin)

• Broader trends in Pharma/Device markets continue:

– Generic shift to India

– Pharma M&A - shift to large molecules

– Rising competitive and pricing pressures

• More demanding regulatory environment

• Anticipate revenue growth of 3-5%, excluding currency effects.

7

• Packaging Systems Segment

– Demographics and increasing prevalence of chronic disease

– Biologics

– Growth in Emerging Markets

– Increased access to Healthcare

– Escalating quality expectations: “Zero Defects”

• Delivery Systems Segment

– Glass compatibility/breakage issues

– Demand for combination products that promote safety, dosing accuracy,

ease of use, and deliver cost savings

ease of use, and deliver cost savings

Growth Drivers

8

• Packaging Systems (Pharm Systems) Segment

– The Global Quality Initiative

• Grow incremental value per unit - e.g WESTAR RU Launch

– Geographic expansion - capacity investments in Asia

– Improved operating efficiency: lean operations

– Strategic acquisitions and partnerships

• Delivery Systems (Tech Group) Segment

– Expand proprietary offerings

– Capitalize on emerging CZ opportunities

– Develop new platform opportunities - combination products

Growth Strategy

9

|

Category

|

Key Customers

|

Projected

Growth |

|

Diabetes

|

|

> 10 %

|

|

Oncology

|

|

> 10 %

|

|

Vaccines

|

|

> 10 %

|

|

Autoimmune

|

|

> 8%

|

IMS April 2010 Report; Business Insights 2009; GBI Research 2009

10

Therapeutic Category Growth Drivers

Traditional Pharmaceutical Delivery

West MixJect®

and Vial2Bag®

and Vial2Bag®

Prefilled Glass

Cartridge and

Pen

Cartridge and

Pen

Glass

Vials

and

Syringes

Vials

and

Syringes

11

High-Value Products Drive Growth

Westar® RS

State of the art

ready-to-sterilize

elastomer closures

Westar® RU

Sterile ready-to-

use syringe

plungers and

closures

use syringe

plungers and

closures

Envision™

Technically advanced,

automated vision

inspection system

NovaPure™

Unrivaled

Quality…by

design

12

Value Proposition

Proprietary

Products

Products

Revenue and

Margin

Opportunity

Margin

Opportunity

Disposable Device

Components

Components

Westar® RS

Mix2Vial®

NovaGuard™

éris™

Westar® RU

Standard

Components

Components

Consumer

Products

Products

Packaging

Delivery

13

Faster Growth of High-Value Products

Pharmaceutical Packaging Systems

Pharmaceutical Packaging Systems

14

Future Pharmaceutical Delivery

West

ConfiDose®

Auto-injector

System

ConfiDose®

Auto-injector

System

West

Electronic

Patch-injector

Electronic

Patch-injector

15

Integrated Solutions for Container, Administration

and Injection Systems

and Injection Systems

Daikyo Crystal Zenith®

Bulk Drug

Containers

Vials &

Plastic Caps

Plastic Caps

Insert Needle

& Luer Lock

Syringes

& Luer Lock

Syringes

Cartridges

Novel Devices

Administration Systems

Reconstitution

& Transfer

Systems

& Transfer

Systems

ConfiDose® and Eris™ are registered trademarks and trademarks of West Pharmaceutical Services, Inc. in the United States and other jurisdictions.

Daikyo Crystal Zenith® is a registered trademark of Daikyo Seiko, Ltd.

16

Electronic

Patch Injector

Patch Injector

Injection Systems

NovaGuard™

Needle Safety

Needle Safety

ConfiDose®

Auto-Injector

System

Auto-Injector

System

Eris™

Needle Safety

Needle Safety

Prototype

Intradermal

Adapter

Intradermal

Adapter

Concerns With Glass Syringes

• Interaction with sensitive biologics

• Protein aggregation (silicone oil)

• Residual chemicals (tungsten, glue)

• Glass flakes

• Breakage

• In process

• Within auto-injector systems

• Recent FDA recalls

• Dimensional variation

• Breakage in auto-injector systems

• Designed for manual injection

• Variable silicone distribution

• Amount of silicone coverage

• Age of barrel

• Inconsistent break force and

sustaining-force

sustaining-force

• Quality

• Cosmetic defects

• High levels of inspection necessary

• High “cost of quality”

Siliconized Glass Syringe

Crystal Zenith Syringe

17

2010 Glass-related Recalls

18

Electronic Patch Injector System

• Controlled, subcutaneous, micro-

infusion delivery of high volumes

and high viscosity drugs

infusion delivery of high volumes

and high viscosity drugs

• Prefilled cartridge, no need for

user filling

user filling

• Based on Daikyo CZ cartridge

• Compact

• Hidden needle for safety

• Single push-button operation

• Fully programmable

19

Prototype Electronic Patch Injector Operation

Programmed by PDA or PC

Dose may be customized

Attached and activated by patient

20

Our Long-Term Focus

• Pharmaceutical Packaging Systems

– Organic growth (on average) of 3-5% per year

– Margin expansion through improved operating efficiency, product mix

– Capital investments targeted at enhanced quality and value

• Pharmaceutical Delivery Systems

– Deliver the potential of Daikyo CZ products

– Increase healthcare-consumable contract manufacturing revenue

– Grow proprietary safety and delivery system businesses

• Financial discipline

– Operating cash flow: Discretionary SG&A, R&D and capital spending that

are supported by revenue growth.

are supported by revenue growth.

– Deliver returns on invested capital (“ROIC”) that regularly exceed weighted

average cost of capital (“WACC”).

average cost of capital (“WACC”).

– Align incentives with financial performance and value creation

21

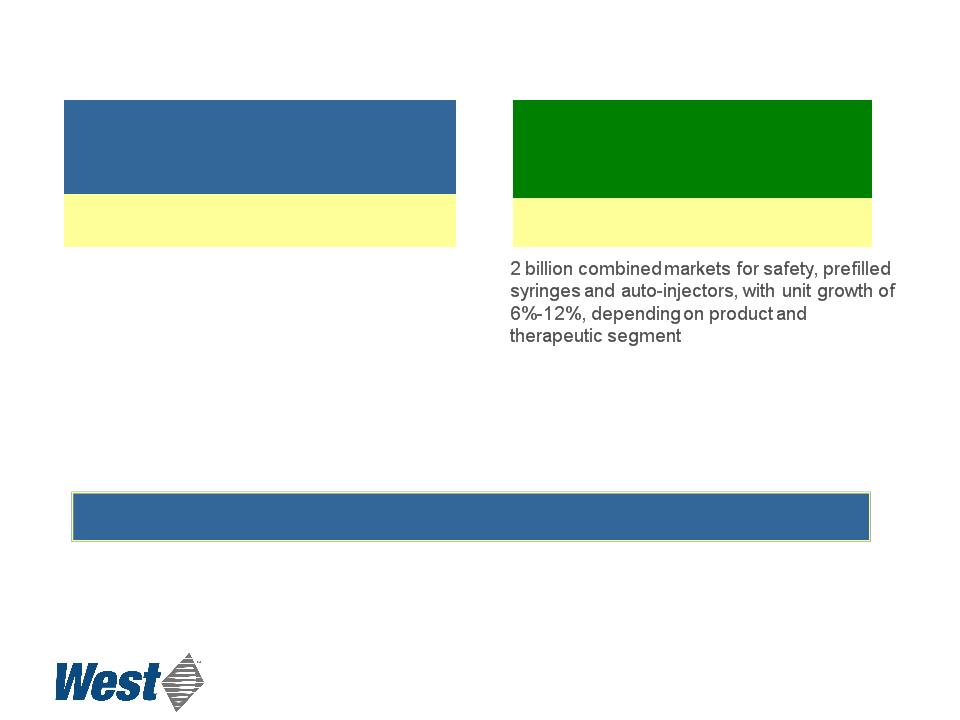

Long-Term Growth Opportunity

Strategic Planning Goals:

• Projected 2014 sales of $0.6 billion

• Projected 2014 Operating margin: > 20%

$1.5 billion market for components with unit

growth 0% to 8% per year, depending on

product and therapeutic segment

growth 0% to 8% per year, depending on

product and therapeutic segment

Strategic Planning Goals:

• Projected 2014 sales of $1.0 billion

• Projected 2014 Operating margin: > 20%

|

Pharmaceutical

Packaging Systems

|

|

Primary Container Solutions

|

|

Pharmaceutical Delivery

Systems |

|

Administration Systems

|

Consolidated 2014 Planning Objectives

• 2014 Sales: $1.6 billion

• 2014 Operating Margin: 19%

• 2014 Consolidated ROIC: 17%

22

Summary

• Well positioned

– Substantial market share

– Proprietary technology

– Diversified customer base

– Global footprint

• Significant growth potential

– Strength in new product pipeline

– Preferred products for biologics

• The financial strength to invest

– Reliable operating cash flow

– Balance sheet strength

• 2010 Year-end call

– February 17, 2011 - 9:00AM

Injectable Container Solutions

Advanced

Injection

Systems

Injection

Systems

Prefillable Syringe Systems

Safety and Administration

Systems

Systems

23

WEST PHARMACEUTICAL SERVICES UPDATE

Solutions for Injectable Drug Delivery NYSE:WST www.westpharma.com

24