Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WEST PHARMACEUTICAL SERVICES INC | a10-24156_18k.htm |

Exhibit 10.1

LEASE AGREEMENT

between

530 REGENCY DRIVE ASSOCIATES, L.P.,

a Pennsylvania limited partnership

as Landlord

and

WEST PHARMACEUTICAL SERVICES, INC.,

a Pennsylvania corporation

as Tenant

Dated as of

December 17, 2010

TABLE OF CONTENTS

|

|

|

Page |

|

|

|

|

|

1. |

Demise |

2 |

|

2. |

Project Conditions and Termination Rights |

2 |

|

3. |

Term |

4 |

|

4. |

Rent |

4 |

|

5. |

Improvements |

7 |

|

6. |

Use |

7 |

|

7. |

Operating Expenses and Taxes |

8 |

|

8. |

Compliance with Legal Requirements |

12 |

|

9. |

Right to Contest |

12 |

|

10. |

Liens |

13 |

|

11. |

Subordination |

13 |

|

12. |

Indemnification |

14 |

|

13. |

Environmental Matters |

15 |

|

14. |

Landlord’s Maintenance, Repairs and Services |

17 |

|

15. |

Tenant’s Maintenance and Repairs; No Waste |

21 |

|

16. |

Alterations |

21 |

|

17. |

Insurance; Waiver of Subrogation |

23 |

|

18. |

Destruction |

27 |

|

19. |

Landlord’s Financial Covenant |

31 |

|

20. |

Waiver of Liens |

31 |

|

21. |

Quiet Enjoyment |

31 |

|

22. |

Survival |

31 |

|

23. |

Subletting; Assignment |

31 |

|

24. |

Events of Default and Remedies |

32 |

|

25. |

Landlord Defaults |

38 |

|

26. |

Governmental Incentives |

40 |

|

27. |

Surrender; Holdover |

41 |

|

28. |

Notices |

41 |

|

29. |

Estoppel Certificates |

42 |

|

30. |

No Merger |

43 |

|

31. |

OFAC/Patriot Act |

43 |

|

32. |

Separability |

43 |

|

33. |

WAIVER OF TRIAL BY JURY |

43 |

|

34. |

Recording |

43 |

|

35. |

Landlord’s Right of Entry |

44 |

|

36. |

Right of First Offer on Space within Park |

44 |

|

37. |

Miscellaneous |

46 |

|

38. |

Representations |

47 |

|

39. |

Use of Roof |

49 |

|

40. |

Signs; Naming Rights, etc. |

50 |

|

41. |

Security Deposit |

51 |

|

42. |

Real Estate Brokers |

52 |

|

43. |

Option to Purchase |

52 |

|

44. |

Self-Help |

55 |

|

45. |

Declaration |

56 |

|

APPENDIX I |

Rules of Construction and Definitions |

|

SCHEDULE 1 |

Cash Requirements |

|

EXHIBIT A |

Description of Land |

|

EXHIBIT B |

Description of Existing Land |

|

EXHIBIT C |

Description of Additional Land |

|

EXHIBIT D |

Description of Park |

|

EXHIBIT E |

Permitted Encumbrances |

|

EXHIBIT F |

Work Letter |

|

EXHIBIT G |

Project Conditions and Milestones |

|

EXHIBIT H |

Basic Rent Calculation |

|

EXHIBIT I |

Fair Market Rental Value Determination |

|

EXHIBIT J |

Form of Subordination, Non-Disturbance and Attornment Agreement |

|

EXHIBIT K |

Environmental Reports |

|

EXHIBIT L |

Cleaning Specifications |

|

EXHIBIT M |

Form of Memorandum of Lease |

|

EXHIBIT N |

Intentionally Omitted |

|

EXHIBIT O |

Form of Landlord’s Waiver |

|

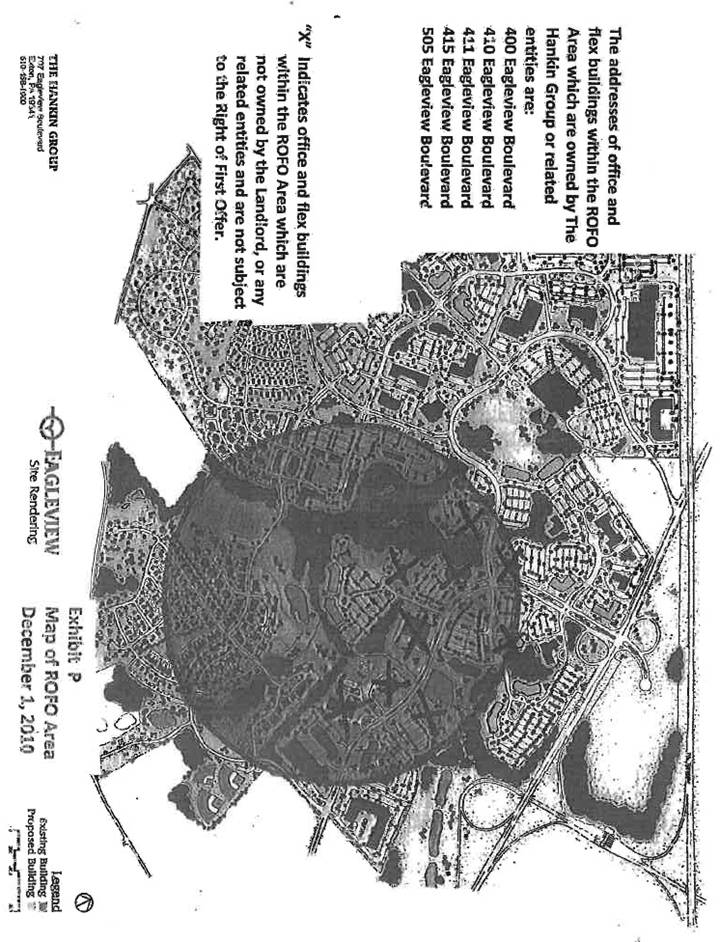

EXHIBIT P |

Map of ROFO Area |

|

EXHIBIT Q |

Industrial Waste Discharge Rider |

THIS LEASE AGREEMENT (as amended from time to time, this “Lease”) is dated as of December 17, 2010 between 530 REGENCY DRIVE ASSOCIATES, L.P., a Pennsylvania limited partnership (“Landlord”), having an office c/o The Hankin Group, 707 Eagleview Boulevard, Suite 400, P.O. Box 562 Exton, Pennsylvania 19341 and WEST PHARMACEUTICAL SERVICES, INC., a Pennsylvania corporation (herein, together with any Person succeeding thereto by consolidation, merger or acquisition of its assets substantially as an entirety, called “Tenant”), having an address at 101 Gordon Drive, Lionville, Pennsylvania, 19341.

BACKGROUND RECITALS

A. Capitalized terms not otherwise defined when they first appear are defined in Appendix I, and the rules of construction set forth in Appendix I apply thereto and hereto.

B. This Lease is made with reference to the following real and personal property (collectively, the “Leased Property”):

(1) All that certain real property located in Exton, Pennsylvania, as more particularly described in Exhibit A hereto, comprising approximately 21.098 acres, more or less, together with all Appurtenant Rights thereto (the “Land”). Approximately 14.674 acres of the Land, as more particularly described on Exhibit B hereto, is owned by Landlord (the “Existing Land”) and approximately 6.424 acres of the Land, as more particularly described on Exhibit C hereto, is owned by Marsh Creek Realty III Business Trust and will be purchased by Landlord as set forth in this Lease (the “Additional Land”);

(2) The Improvements to be constructed by Landlord on the Land and fixtures affixed thereto (including, without limitation, the Base Project Work and the Tenant Improvements) (collectively, together with any Alterations, additions or changes thereto, the “Building”), together with all parking facilities, driveways, walkways, signage, drainage facilities, landscaped areas, and other site improvements located on the Land (the Land, the Improvements and the fixtures being hereinafter collectively referred to as the “Real Property”);

(3) All fixtures, equipment, furniture, furnishings and appliances attached to or otherwise used in connection with, the Real Property to the extent being furnished and installed by Landlord pursuant to the Work Letter and this Lease (the “Personalty”); and

(4) The non-exclusive right and benefit to use the Common Facilities of the Park which inure to the benefit of the owners of Lots within the Park, established by that certain Amended and Restated Declaration of Easements and Protective Covenants and Restrictions for Eagleview Corporate Center dated as of July 12, 1990, last amended by Eighth Amendment dated November 13, 2006 (the “Declaration”).

C. The Real Property is located within the Park.

D. Landlord desires to acquire the Additional Land, construct the Improvements and lease the Real Property to Tenant and Tenant desires to Lease the Real Property from Landlord, subject to and upon the terms and conditions contained in this Lease.

TERMS AND CONDITIONS

In consideration of the mutual covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the parties hereto agree as follows:

1. Demise.

(a) Landlord leases to Tenant, and Tenant leases from Landlord, the Leased Property, subject to (i) the Permitted Encumbrances and (ii) the obligations of Landlord to complete the Base Project Work and the Tenant Improvements in accordance with this Lease, including without limitation, the requirements set forth in the Work Letter.

(b) At all times during the Term, Tenant shall have the exclusive right to use all of the parking spaces located on the Land, which shall not be less than 500, but in no event less than the number of parking spaces required by the approvals for the Project issued by applicable Governmental Authorities (the “Tenant Parking Facilities”). Such parking spaces shall be reserved for Tenant’s exclusive use and shall be installed by Landlord, along with signage, curbing and striping at Landlord’s sole cost and expense as part of the Base Project Work pursuant to the Work Letter.

(c) Landlord shall deliver the Leased Property to Tenant with the Base Project Work and Tenant Improvements “Substantially Complete” (as defined in Section 4(b) of the Work Letter).

(d) Within ninety (90) days after the Commencement Date, Architect shall measure the Building (using the BOMA/ANSI Z65.1-1996 Standard), which measurement shall be final and binding upon the Parties. Landlord and Tenant shall share equally in the fees of Architect in such measurement. Upon resolution of the measurement of the Building, all terms of this Lease dependent upon such measurement (e.g., the Improvement Allowance) shall be amended to reflect the actual measurement of the Building, retroactive to the Commencement Date, and any underpayment (or overpayment, as the case may be), if any, resulting from any term of this Lease subject to adjustment pursuant to this Section shall be paid by the Party owing the amount to the other Party within thirty (30) days thereafter.

(e) The background recitals set forth above are true and correct and are hereby incorporated into this Lease.

2. Project Conditions and Termination Rights.

(a) Landlord acknowledges that the construction, completion and delivery to Tenant of the Leased Property (including without limitation the Substantial Completion of all of the Base Project Work and TI Work, as those terms are defined in Section 2(a) and Section 3(c)(iii), respectively, in the Work Letter) within the time period provided in the Schedule (as defined in Section 1(b) of the Work Letter) is of the essence of this Lease, and is vital to Tenant’s willingness to enter into this Lease. In order to assure Tenant of Landlord’s diligence in prosecuting the actions necessary to achieve such timely construction, completion and delivery of the Leased Property, Landlord and Tenant have agreed to stipulate certain conditions

precedent to Tenant’s further obligations under this Lease, and to establish certain milestones to be satisfied by Landlord by certain dates, as set forth in this Section. Accordingly, as material inducement to Tenant to enter into this Lease, and in consideration of the covenants herein contained, Landlord and Tenant agree as follows that, notwithstanding anything to the contrary contained in this Lease or any of the Exhibits hereto and in addition to any other provisions of this Lease and any of the Exhibits hereto providing any rights (including without limitation any right of termination) concerning any other matters:

(i) Tenant shall have the option, in its sole discretion, to terminate this Lease by Notice to Landlord if (A) Landlord fails to satisfy the conditions set forth on Part A of Exhibit G attached hereto (“Preliminary Conditions”) on or before the date for the satisfaction thereof specified in Part A of Exhibit G, and (B) Tenant shall have given Landlord Notice of Landlord’s failure to satisfy such applicable Preliminary Condition and Landlord shall have failed to satisfy such applicable Preliminary Condition within thirty (30) days following Landlord’s receipt of such Notice.

(ii) Prior to Landlord completing the construction of the foundations for the Building as certified by the Architect, Tenant shall have the option, in its sole discretion, to terminate this Lease by Notice to Landlord if (A) Landlord fails to satisfy the milestones set forth on Part B of Exhibit G attached hereto (“Milestones” and each a “Milestone”) on or before the date for the satisfaction thereof specified in Part B of Exhibit G, as extended by reason of Unavoidable Delays as defined in, and in accordance with, the Work Letter, (B) Tenant, acting in good faith and reasonably, determines that the failure of such Milestone (alone or taken in consideration with other factors) is reasonably likely to result in a failure on the part of Landlord to achieve Substantial Completion of the Base Project Work and/or Substantial Completion of the Tenant Improvements on or before the applicable Outside Delivery Date (as defined in Section 4(e) of the Work Letter) therefor set forth in the Work Letter, and (C) in the good faith determination of Tenant, Landlord shall have failed, within thirty (30) days following Landlord’s receipt of such Notice, to have provided to Tenant adequate and reasonably substantiated assurances, that (1) Landlord will be able to satisfy the applicable Milestone within a reasonable and specific time, and (2) that the delay in satisfying the applicable Milestone will not, in fact, cause Landlord to fail to achieve Substantial Completion of the Base Project Work and/or Substantial Completion of the Tenant Improvements on or before the applicable Outside Delivery Date therefor set forth in the Work Letter.

(iii) After Landlord completes the construction of the foundations for the Building as certified by the Architect, Tenant shall have the option, in its sole discretion, to terminate this Lease as set forth in Section 4(f) of the Work Letter.

(b) If Tenant exercises any termination option provided to Tenant under this Section 2, this Lease shall terminate effective upon issuance of such Notice and thereupon this Lease shall be null and void, and neither party shall have any further liability or obligation to the other under or on account of this Lease excepting only any provisions hereof expressly surviving the termination of this Lease. None of the notice and cure periods applicable to a Landlord Default under Section 25(a) shall be applicable to any failure by Landlord under this Section 2. In addition, any such right of termination not exercised by Tenant by Notice issued to Landlord

within fifteen (15) days following the date established for a Milestone giving rise to such right of termination, shall be deemed waived by Tenant.

3. Term.

(a) Subject to the provisions of this Lease, Tenant shall have and hold the Leased Property for the Term unless sooner terminated or extended as hereinafter expressly provided in this Lease.

(b) If no Material Monetary Event of Default exists on the Basic Term Expiration Date or on the last day of the first Renewal Term, as applicable, and there has occurred: (1) no Event of Default as described in Section 24(a)(iii) and (iv) (relating to bankruptcy); and (2) no Event of Default on account of a breach by Tenant of its covenants in the Lease with respect to the prohibition of transfers without Landlord’s consent; then Tenant may renew the Term for two (2) additional terms having an aggregate term of not more than ten (10) years (each a “Renewal Term”, and collectively the “Renewal Terms”). The first Renewal Term shall have a term of not less than three (3) years or more than seven (7) years as elected by Tenant in its sole discretion, and the second Renewal Term shall have a term equal to ten (10) years less the number of years of the first Renewal Term. A Renewal Term shall commence the day after the Basic Term Expiration Date (or the expiration date of the then expiring Renewal Term, as applicable). Each renewal option, if exercised by Tenant, shall be exercised by Tenant only for the entire Leased Property and upon Notice to Landlord sent not less than one (1) year before the date on which the then current Basic Term or Renewal Term is to end. Such Notice for each Renewal Term shall contain Tenant’s election regarding the number of years of such Renewal Term. Either Party, upon request of the other, will execute, acknowledge and deliver to the other Party by no later than ten (10) Business Days prior to commencement of the applicable Renewal Term, in form suitable for recording, an instrument confirming that (i) such option has been effectively exercised, (ii) the extended expiration date of the Term, and (iii) the remaining years, if any, available pursuant to options to renew granted under this Section.

(c) Though this Lease is effective from the Effective Date, no Rent will be payable, no occupancy shall be presumed and the Term shall not begin until the later to occur of (i) January 16, 2013, and (ii) thirty (30) days after Substantial Completion of the Project under the terms of the Work Letter (the “Commencement Date”). At the request of Landlord or Tenant (collectively, the “Parties”, and each a “Party”), the Parties agree to execute and acknowledge a recordable document confirming the Commencement Date and Expiration Date. If prior to the Commencement Date following Substantial Completion of the Tenant Improvements by Landlord, Tenant uses the Leased Property for installation of cabling, furnishings and the like, Tenant will be responsible for Operating Expenses and utilities during such preliminary period.

4. Rent.

(a) (i) Tenant shall pay the Basic Rent on a monthly basis in advance to Landlord (or to Lender, if Tenant receives Notice to do so from either Landlord or Lender) commencing on the Commencement Date and on each subsequent Basic Rent Payment Date during the Term in lawful money of the United States of America in immediately available federal funds before

11:00 A.M., New York time, to such account in such bank as Landlord (or Lender, if Tenant receives a Notice to pay Basic Rent directly to Lender) may from time to time designate to Tenant in writing. Basic Rent shall be determined in accordance with the provisions set forth on Exhibit H. If the Commencement Date falls on a day other than the first day of a calendar month, the Basic Rent shall be due and payable for such month, apportioned on a per diem basis for the period between the Commencement Date and the first day of the next first full calendar month in the Term and such apportioned sum shall be paid within five (5) Business Days following the Commencement Date.

(ii) The parties acknowledge that since the Basic Rent is based on actual costs incurred to complete the Project, the actual Basic Rent may not be known until after Substantial Completion of the Project. Accordingly, the parties agree that if the Basic Rent is not determined before the Commencement Date, then Tenant shall pay an estimated Basic Rent based on an estimated Basic Rent as determined in accordance with the procedures set forth in this Section 4(a)(ii) (the “Estimated Basic Rent”). Subject to reconciliation as set forth in Section 4(a)(iii) below, no later than sixty (60) days before the Commencement Date, Landlord shall send Tenant Notice of Landlord’s reasonable estimate of the Basic Rent showing in detail, with supporting documentation, Landlord’s reasonable determination of the components of the Basic Rent, which Notice shall contain a statement in bold type and capital letters stating “FAILURE TO RESPOND TO THIS NOTICE WITHIN FIFTEEN (15) DAYS SHALL BE A DEEMED APPROVAL BY TENANT” as a condition to the effectiveness of such Notice. Tenant shall have fifteen (15) days after receipt of Landlord’s estimate to accept or reject Landlord’s estimate of the Basic Rent. If Tenant fails to send Notice to Landlord of its rejection, Tenant shall be deemed to have accepted Landlord’s estimate. If Tenant rejects Landlord’s estimate, it must send Notice to Landlord setting forth the reasons for such rejection or requesting such additional information that Tenant may need to better analyze Landlord’s estimate. For the fifteen (15) day period after Landlord receives Tenant’s rejection Notice, the parties shall meet and negotiate in good faith to agree on the Estimated Basic Rent. If no agreement is reached after such period, then Tenant shall pay to Landlord the amount of Estimated Basic Rent which is not in dispute, and within ten (10) days of the dispute being resolved, Tenant shall pay any additional Estimated Basic Rent to Landlord.

(iii) If the actual Basic Rent is not known and agreed to prior to the Commencement Date, then, subject to Section 4(a)(ii) above, in the event of a dispute, Tenant shall pay the Estimated Basic Rent until the actual Basic Rent is determined. During a period of not more than sixty (60) days after the Substantial Completion of the Project, the parties agree to cooperate with one another and to meet and negotiate in good faith to agree on the Estimated Basic Rent based on the final and actual components of Basic Rent (as set forth on Exhibit H). Once the final Basic Rent is determined, if such actual Basic Rent is higher than the Estimated Basic Rent, Tenant will pay to Landlord within ten (10) days of such determination, the difference between the Estimated Basic Rent and the actual Basic Rent; and if such actual Basic Rent is lower than the Estimated Basic Rent, Landlord shall refund to Tenant within ten (10) days of such determination, the difference between the actual Basic Rent and the Estimated Basic Rent. Once the final Basic Rent is determined, the parties shall enter into a Rent Determination Certificate that will set forth the agreed to Basic Rent.

(iv) On the first (1st) day of the second Lease Year of the Term, and on the same day of each subsequent Lease Year, the Basic Rent for the Leased Property shall increase by fifty cents ($0.50) per RSF above the Basic Rent payable in the immediately preceding Lease Year.

(b) (i) Basic Rent for each Renewal Term shall be an amount equal to ninety-five percent (95%) of the annual Fair Market Rental Value for the Leased Property.

(ii) Basic Rent that accrues and for which Tenant becomes liable for any partial calendar month at the beginning of a Renewal Term shall be payable in advance on the first Basic Rent Payment Date of such Renewal Term. Thereafter, during any Renewal Term, Tenant shall be liable for, and shall pay, the Basic Rent on each Basic Rent Payment Date (or, if earlier on the date such Renewal Term or the Lease expires or is terminated) during such Renewal Term.

(c) In addition, Tenant shall pay Operating Expenses and Taxes in accordance with Section 7, and utilities for the Leased Property and all other Additional Rent directly to the Person entitled to payment thereof within the time periods set forth herein, and if no such period is established, then within thirty (30) days of receipt of a reasonably detailed statement as to the amount and nature of such Additional Rent. If Tenant fails to pay or discharge any Additional Rent in accordance with the terms of this Lease, Landlord may exercise all rights and remedies provided for herein or by law or otherwise in the case of nonpayment of Basic Rent.

(d) Tenant shall also pay to Landlord on demand, as Additional Rent, interest at the Overdue Rate on all overdue installments of Basic Rent and Additional Rent from the expiration of any applicable grace or cure periods, until paid in full.

(e) To defray Landlord’s expense in handling and processing a delinquent payment of Basic Rent or Additional Rent and to compensate Landlord for its loss of the use of such delinquent payment of Basic Rent or Additional Rent, Tenant shall pay to Landlord on demand, as Additional Rent, a late payment fee on any amount not paid when due equal to the greater of (i) two percent (2%) of any overdue amount and (ii) five thousand dollars ($5,000); provided however, that with respect to any installment of Basic Rent or Additional Rent which is not paid when due, Landlord shall not impose a late payment fee unless Tenant fails to make such payment within ten (10) days after Landlord’s issuance of Notice of non-payment, subject however, to the limitation that after Landlord has issued two (2) Notices of non-payment of either Basic Rent, Additional Rent or both within a twelve (12) month period, Tenant shall not be entitled to Notice prior to the assessment of the late payment fee for any delinquent payment during such twelve (12) month period.

(f) Should the Term commence at any time other than the first day or terminate on other than the last day of a calendar month or calendar year the amount of Basic Rent and Additional Rent due from Tenant shall be proportionately adjusted based on that portion of the month or year that this Lease was in effect.

5. Improvements.

(a) Base Project Work. The Base Project Work shall be performed and completed by Landlord, at Landlord’s sole expense, in accordance with the provisions of the Work Letter.

(b) Tenant Improvements.

(i) The Tenant Improvements will be constructed by Landlord for Tenant’s use and the costs of performing such work shall be apportioned between Landlord and Tenant as set forth in the Work Letter. The Work Letter also sets forth the obligations and responsibilities of Tenant and Landlord for the design and construction of the Tenant Improvements.

(ii) In no event shall Tenant be obligated to accept delivery of the Leased Property or portions thereof prior to Substantial Completion of the Project (as defined in Section 4(b) of the Work Letter) and in no event shall Tenant be obligated to pay Rent before January 16, 2013.

(c) Reference is made to the Work Letter for provisions concerning the obligations of Landlord for certain work and improvements for Tenant’s benefit, including without limitation certain outside date or dates for Landlord’s completion of such work and improvements, and the liabilities and obligations of Landlord in the event of Landlord’s failure to achieve completion of such work, and Tenant’s obligations concerning such work, all of which are incorporated herein as though fully set forth herein.

(d) Landlord agrees to provide Tenant with an allowance up to the sum of Forty-Five Dollars ($45.00) per RSF of the Building (the “Improvement Allowance”), all or a part of which Tenant has the option to use or not use pursuant to Section 3(g)(ii) of the Work Letter, to provide funding for the Tenant Improvements and to reimburse Tenant for certain other costs and expenses incurred or to be incurred by Tenant with respect to this Lease and the design, construction and occupancy of the Leased Property, as more particularly set forth in the Work Letter. The Improvement Allowance, or so much thereof as shall be drawn by Tenant, shall be included in the Project Cost in determining the Basic Rent hereunder.

(e) The Tenant Improvements (excluding any Tenant’s Property pertaining to Tenant’s business operations, and any signs and other items containing Tenant’s tradenames or other proprietary marks or names) shall at all times be the property of Landlord automatically and without requiring further action by Landlord or Tenant.

6. Use. Tenant may use the Leased Property for general office use, laboratory and research use, prototype manufacturing and all uses incidental and ancillary to such use, and for any other lawful use (the “Permitted Use”). Notwithstanding anything to the contrary provided in this Section 6, Tenant shall not (a) use or occupy the Leased Property, or (b) knowingly permit the use or occupancy of the Leased Property, in a way that would:

(i) violate any applicable certificate of occupancy for the Leased Property or other Legal Requirement applicable to the Leased Property;

(ii) make void or voidable any Policy of insurance then in force with respect to the Leased Property, or render it impossible to obtain Casualty or other insurance thereon

required to be furnished by Tenant under this Lease; provided, however, Landlord acknowledges and agrees that use of the Leased Property for the Permitted Use will not violate this covenant.

(iii) cause structural or other damage to the Leased Property, or constitute a private or public nuisance or waste;

(iv) violate the provisions of Section 13 hereof;

(v) violate any of the use restrictions contained in the Declaration;

(vi) violate the provisions of the Industrial Waste Discharge Rider attached to this Lease; or

(vii) discharge wastewater of a volume in excess of 5,600 gallons per day.

7. Operating Expenses and Taxes.

(a) Operating Expenses.

(i) Commencing on or prior to the date that is ninety (90) days before the Commencement Date, and then at least ninety (90) days prior to each subsequent calendar year during the Term, a proposed Operating Budget (the “Operating Budget”) shall be prepared by Landlord (reasonably based on the actual Operating Expenses for the preceding calendar year (except for the first Operating Budget) and Landlord’s reasonable projections of any anticipated increases or decreases thereof) and submitted in draft form (with reasonable detail sufficient to inform Tenant of the nature and amount of proposed expenditures) to Tenant for review. All Operating Expenses shall be determined in accordance with GAAP. Accompanying such proposed Operating Budget, Landlord shall submit to Tenant a calculation showing Tenant’s monthly Operating Expense payment on the basis of such proposed Operating Budget, which payment shall equal one twelfth (1/12th) of the annual Operating Budget (the “Monthly Operating Expense Estimate”). Tenant shall provide to Landlord any questions, comments or proposed revisions to such proposed Operating Budget within twenty (20) days after receipt thereof, and Landlord and Tenant shall cooperate in good faith to address any questions, comments or proposed revisions presented by Tenant. The final Operating Budget shall be the Operating Budget submitted by Landlord to Tenant which accompanies Landlord’s response to Tenant’s questions, comments or proposed revisions to the proposed Operating Budget and shall be subject to adjustment as set forth in Sections 7(a)(iii) and 7(a)(iv). Landlord shall submit to Tenant a calculation showing Tenant’s Monthly Operating Expense Estimate on the basis of such final Operating Budget.

(ii) Beginning on the Commencement Date and on the first (1st) day of the first full month after the Commencement Date and continuing thereafter during the Term on the first day of each month, Tenant will pay Landlord, as Additional Rent, the Monthly Operating Expense Estimate. The Monthly Operating Expense Estimate for a period less than a full calendar month shall be duly prorated. Notwithstanding the foregoing, on the date of execution of this Lease, Tenant shall pay to Landlord on account of Operating Expenses for the first month of the Term, Landlord’s good faith estimate of one twelfth of the expected annual Operating

Expenses. Such payment shall be credited against the actual monthly installment for the first full month of the Term when the Monthly Operating Expense Estimate is established.

(iii) Within ninety (90) days after the close of each calendar year, Landlord shall deliver to Tenant an itemized statement prepared by Landlord’s property management company or chief operating officer, or by a certified public accountant (“Landlord’s Statement”) showing in reasonable detail the (A) actual Operating Expenses for the previous calendar year broken down by component expenses; (B) the amount paid by Tenant during the calendar year towards Operating Expenses; and (C) the amount Tenant owes to Landlord, or the amount of the refund Landlord owes to Tenant on account of any underpayment or overpayment by Tenant. Any such amount due from Tenant to Landlord shall be paid within thirty (30) days after receipt of the most recent Landlord’s Statement. Any such refund due from Landlord to Tenant shall be credited against the next due payment of Operating Expenses or, if at the end of the Term, refunded to Tenant.

(iv) Any Landlord’s Statement or other Notice from Landlord pursuant to this Section 7 shall be deemed approved by Tenant as correct unless Tenant shall notify Landlord in writing within two (2) years following receipt that it disputes the correctness of the Landlord’s Statement or other Notice, specifying in reasonable detail the basis for such assertion. Within such two (2) year period (or within ninety (90) days after Tenant sends such Notice of dispute to Landlord, whichever is longer), Tenant and its authorized representatives shall have the right, at its sole cost and expense, to inspect and/or audit Landlord’s books and records at Landlord’s place of business or such other place Landlord regularly maintains such books and records (in either case in the Philadelphia metropolitan area) with respect to the items of Operating Expenses, the calculation of Operating Expenses, and Tenant’s Monthly Operating Expense Estimate set forth on a Landlord’s Statement. Landlord shall maintain reasonable books and records with respect to the Operating Expenses. If Tenant’s audit reveals recurring or systemic errors or overcharges that relate to periods earlier than two (2) years before Tenant’s receipt of Landlord’s Statement, then Tenant shall be permitted to dispute and audit such charges occurring earlier than such two (2) year period. If, as a result of an inspection of Landlord’s books and records or an audit, it is determined that Landlord has overcharged Tenant, Landlord shall provide Tenant with a credit against Tenant’s next payment(s) of Basic Rent (or, if the Term of the Lease has ended, pay Tenant directly) the amount of such overcharge plus any taxes thereon not otherwise recovered by Tenant at the Overdue Rate from the date such overcharge and taxes, if applicable, were paid by Tenant. Notwithstanding the performance of any dispute or audit, Tenant shall continue to make payments in accordance with the last Operating Budget pending the results of such audit. If the results of any audit reveal that Landlord overstated Operating Expenses by more than four percent (4.0%), then Landlord shall pay the reasonable cost of such audit; provided, however, if the compensation for the auditor who performed such audit was based on a percentage of savings or commission basis, then Landlord shall not be obligated to pay such cost.

(v) Landlord’s failure to submit a bill (whether actual or estimated) for Operating Expenses to Tenant within one hundred eighty (180) days after the expiration of the calendar year in which such Operating Expenses were incurred, shall relieve Tenant of its obligation to pay such Operating Expenses, except that the foregoing shall not apply to a good faith, erroneous omission from a Landlord’s Statement of particular items which should have

been included in Operating Expenses, which are brought to Tenant’s attention as part of a subsequent Landlord’s Statement.

(vi) Notwithstanding any provision to the contrary in this Lease, Tenant may, from time-to-time during the Term and following not less than six (6) months prior notice to Landlord, elect to assume responsibility (and either perform such services itself or contract with a third party provider) for all property management maintenance and repair obligations otherwise the responsibility of Landlord hereunder and otherwise payable by Tenant as Operating Expenses if Tenant, in its reasonable discretion, determines that Landlord (or Landlord’s property manager) has persistently and repeatedly failed to maintain the Leased Property in a manner consistent with a Class “A” office/laboratory building in the Philadelphia metropolitan area or that the costs charged for such services exceed then-market costs for such services. If Tenant desires to make such election due solely to Tenant’s dissatisfaction with the standard of service provided by Landlord, prior to making such election, Tenant shall provide Landlord with Notice of the specific incidents by which Landlord has failed to provide service appropriate for a Class A office/laboratory building, and Landlord shall provide Tenant with Notice of Landlord’s proposed response to remedy such failures, and Landlord shall have a period of sixty (60) days to implement such responses. If despite such remedial efforts, Landlord continues to fail to meet the standard of service appropriate for a Class A office/laboratory building, then Tenant shall have the right to assume responsibility for management of the Building, or hire a reputable property management firm with experience in managing Class A office and laboratory buildings to do so. If Tenant makes such election due solely to Tenant’s dissatisfaction with the costs of Landlord’s services, then if Tenant has obtained an offer from a third-party property manager with the required qualifications described above to deliver such services to Tenant which Tenant is willing to accept (a “New Offer”) before Tenant accepts such New Offer, it shall send a Notice to Landlord of such New Offer and Landlord shall have ten (10) days from its receipt of such New Offer to match the New Offer. If Landlord matches the New Offer, then Tenant shall rescind its election and Landlord shall continue to manage the Leased Property on the terms of the New Offer. If Landlord refuses to match or fails to accept the New Offer by Notice to Tenant within such ten (10) day period, Landlord shall be deemed to have rejected the New Offer and Tenant shall be free to accept such New Offer. If Tenant makes an election to assume responsibility for property management, maintenance and repair obligations, or hires a third party provider to do so, Tenant agrees to indemnify, defend and hold each Landlord Indemnified Party harmless from any loss, costs and damages (including reasonable attorney’s fees and costs) suffered by Landlord or any Landlord Indemnified Party arising from any negligent act or omission of Tenant or such third party provider in connection with the performance of such property management, maintenance and repair obligations, and to provide Landlord with evidence of insurance which is generally provided by property management companies for the benefit of owners of commercial office and laboratory buildings, which insurance shall name Landlord, and any Lender, as additional insureds, and which insurance shall not be subject to cancellation or modification without thirty (30) days’ prior Notice to Landlord and Lender. Any property management agreement between Tenant and such third party provider shall be fully subordinated to the Mortgage on terms reasonably acceptable to Lender, Tenant and such third party provider, and terminable without penalty at the election of Lender.

(b) Taxes.

(i) No later than thirty (30) days after its receipt, Landlord shall deliver to Tenant copies of all Tax bills, invoices and notices regarding the Leased Property. In addition, Landlord shall promptly deliver to Tenant following receipt true and complete copies of all notices received by Landlord concerning any actual or proposed changes in the assessment of the Leased Property, or any portion thereof.

(ii) Landlord covenants to pay all Taxes before such Taxes are due and in all events by the date required for Landlord to receive the maximum discount available by the relevant Governmental Authority. Tenant shall not be obligated to pay, and Landlord shall pay, any and all penalties, late fees or other charges assessed on account of any Taxes not being paid in accordance with the preceding sentence. Subject to Tenant’s rights to contest in accordance with Section 9, Tenant shall reimburse Landlord for any Taxes levied or assessed against the Leased Property applicable to the Term within sixty (60) days after Tenant’s receipt of an invoice from Landlord seeking reimbursement, together with a copy of the paid bill for such Taxes issued by the applicable Governmental Authority. Tenant shall not be obligated for any Taxes applicable to time periods before or after the Term and any Taxes reimbursed by Tenant which are applicable to time periods before or after the Term shall be refunded to Tenant by Landlord within thirty (30) days of the end of the Term.

(iii) Nothing in this Lease shall require Tenant to pay any franchise, excise, estate, inheritance, succession, transfer (other than as set forth above), net income or profits taxes of Landlord, any taxes imposed by any Governmental Authority on, or measured by, the net income of Landlord, unless any such tax is in lieu of or a substitute for any other tax or assessment upon or with respect to the Leased Property, or in lieu of any increase in any such tax or assessment upon or with respect to the Leased Property, in which case, to the extent it is a substitute for another tax or assessment upon or with respect to the Leased Property, or in lieu of any increase in any such tax or assessment upon or with respect to the Leased Property, such tax would be payable by Tenant hereunder.

(iv) Except for Taxes Tenant pays in installments, Landlord and Tenant shall prorate on a day-for-day basis Taxes paid by Tenant as of the Commencement Date and as of the date on which this Lease terminates.

(v) Tenant shall also pay before any penalties or fines are assessed to the appropriate Governmental Authority any use and occupancy tax in connection with Tenant’s use of the Leased Property. In the event Landlord is required by law to collect such tax, Tenant shall pay such use and occupancy tax to Landlord or its designee as Additional Rent within thirty (30) days of demand. With respect to any Taxes which Landlord requires that Tenant pay to Landlord or which are by virtue of Legal Requirements required to be paid to Landlord, Landlord shall remit any amounts so paid to Landlord to the appropriate Governmental Authority and return a receipt for or other evidence of such payment to Tenant no later than the day prior to the delinquency date therefor. Any payments received by Landlord from a Governmental Authority representing a refund or return of an overpayment of Taxes paid by Tenant, shall be promptly remitted by Landlord to Tenant.

8. Compliance with Legal Requirements.

(a) Tenant shall, at its sole cost and expense, promptly comply with all Legal Requirements affecting the Leased Property, insofar as any thereof relate to or affect Tenant’s specific use or occupancy of the Leased Property (other than general office use and uses ancillary thereto) or relate to any of Tenant’s Alterations.

(b) If, from and after the Commencement Date, any change in Legal Requirements require any alteration, renovation, improvement or replacement of all or any part of the Leased Property (each a “Code Modification”), Landlord shall make such Code Modification at Landlord’s cost and expense, and Tenant shall pay for such costs as provided in Section 7(a) above to the extent that such costs are considered Operating Expenses under this Lease.

(c) Notwithstanding any language to the contrary in this Section 8, in no event shall Tenant be required to make any structural changes to the Leased Property, and if any are required as part of a Code Modification or a change in Legal Requirements after the Commencement Date, for any reason, such work shall be performed by Landlord, and Tenant shall only pay for such costs as provided in Section 7(a) above to the extent that such costs are considered Operating Expenses under this Lease. To the extent that such costs are incurred due to a required Code Modification resulting from Tenant’s laboratory use or other specialty use other than general office use or uses ancillary thereto, such costs shall be reimbursed as part of Operating Expenses at the time incurred.

(d) Landlord shall, at its sole cost and expense, deliver the Leased Property in compliance with all Legal Requirements, including the Americans with Disabilities Act (“ADA”).

9. Right to Contest.

After prior Notice to Landlord, Tenant may contest (including through abatement proceedings), at its sole expense, by appropriate legal proceedings, promptly initiated and conducted in good faith and with due diligence to a final settlement or conclusion, the amount or validity or application of any Taxes, Liens, and/or any Legal Requirement affecting the Leased Property, and postpone payment of or compliance with the same during the pendency of such contest if (a) the commencement and continuation of such proceedings shall suspend the collection thereof from, and suspend the enforcement thereof against Landlord and the Leased Property, (b) no part or interest of the Leased Property, nor any Basic Rent or Additional Rent or this Lease shall be interfered with or shall be in danger of being sold, forfeited, attached, terminated, cancelled or lost, (c) at no time during the permitted contest shall there be a risk of the imposition of civil or criminal liability or penalty on Landlord for failure to comply therewith, and (d) Tenant shall satisfy any Legal Requirements incident to such contest, including, if required, that the Taxes be paid in full or a Lien be bonded with the applicable court before being contested. Tenant shall promptly pay any judgments or decrees entered against Tenant or the Leased Property, and all fees or expenses incurred by Tenant in connection with such contest. Promptly after the final determination of such contest, Tenant shall fully pay and discharge any amounts which shall be levied, assessed, charged or imposed or be determined to be payable therein or in connection therewith, whether technically assessed against Tenant or

Landlord, together with any penalties, costs, fines, interest, fees and expenses thereof or in connection therewith, and Tenant shall perform all acts the performance of which shall be ordered or decreed because of the final determination of such contest, which obligations shall survive the end of the Term.

10. Liens. Subject to Tenant’s rights to contest in accordance with Section 9, during the Term, Tenant will, at its sole expense, promptly remove and discharge of record, by bond or otherwise, any Liens in or upon the Leased Property relating to contractual obligations of Tenant or other acts or omissions of Tenant, its agents and contractors, and their subcontractors, sub-subcontractors and any other person who, under applicable law, has standing to file a mechanic’s lien no later than thirty (30) days after Tenant receives Notice of the filing of any such Lien. If Tenant fails to discharge any such Lien as required by the prior sentence, then Landlord may discharge such Lien by payment or bond or both, and Tenant will repay to Landlord, upon demand, all amounts incurred by Landlord therefor, and also any fees and expenses incurred by Landlord in connection therewith, together with interest on all such amounts calculated at the Overdue Rate from the date such are incurred by Landlord until such are paid by Tenant. Tenant’s obligations in this Section 10 shall survive the end of the Term.

11. Subordination.

(a) This Lease and Tenant’s interest and rights hereunder are and shall be subject and subordinate at all times to the lien of any first Mortgage, hereafter created on or against the Leased Property, and all amendments, restatements, renewals, modifications, consolidations, refinancing, assignments and extensions thereof, provided that the Lender has executed, acknowledged and delivered to Tenant a commercially reasonable Subordination, Attornment and Non-Disturbance Agreement (“SNDA”), substantially in the form of that attached as Exhibit J to this Lease, or as otherwise acceptable to Lender and Tenant, which provides that: (i) Tenant’s possession of the Leased Property and other rights hereunder shall not be disturbed in any proceeding to foreclose the mortgage or in any other action instituted in connection with such mortgage, (ii) Tenant shall not be named as a defendant in any foreclosure action or proceeding which may be instituted by the holder of such mortgage, and (iii) if the Lender or any other person acquires title to the Leased Property through foreclosure or otherwise, this Lease shall continue in full force and effect as a direct lease between Tenant and the new owner, and the new owner shall assume and perform all of the terms, covenants and conditions of this Lease. Tenant agrees upon demand to execute, acknowledge and deliver any such SNDA, provided that no such instrument shall alter Tenant’s rights and obligations under this Lease. Notwithstanding the foregoing, any such Lender may at any time subordinate its Mortgage to this Lease, without Tenant’s consent, by Notice in writing to Tenant, and thereupon this Lease shall be deemed prior to such Mortgage without regard to their respective dates of execution, delivery or recording and in that event such holder shall have the same rights with respect to this Lease as though this Lease had been executed prior to the execution, delivery and recording of such Mortgage and had been assigned to such Lender.

(b) Notwithstanding the foregoing, if any Lender requires this Lease to be subordinate to its Mortgage and, at such time, Substantial Completion of the Base Project Work and the Tenant Improvements (with any punchlist fully performed) has not occurred and the Improvement Allowance has not been fully funded by Landlord or any other funding or payment

obligations of Landlord under this Lease have not been fully performed (each of the foregoing an “Unperformed Landlord Obligation”), then Landlord shall obtain an SNDA that satisfies Tenant’s SNDA Requirements. If such Lender requires an SNDA that does not satisfy Tenant’s SNDA Requirements, Tenant may refuse to enter into such SNDA and in such event this Lease shall not be subordinate to such Lender’s Mortgage.

(c) Tenant shall attorn, from time to time, to the Lender under each Mortgage and/or the Lender of such subsequent Mortgage, or any purchaser or transferee of the Leased Property (including, a transferee in foreclosure or pursuant to a deed in lieu of foreclosure), or any Person that succeeds to all or any part of Landlord’s interest in the Leased Property, for the remainder of the Term, if such holder or such purchaser or transferee, shall then be entitled to possession of the Leased Property subject to compliance with the provisions of this Lease and the applicable SNDA. The provisions of this Subsection shall inure to the benefit of such Lender or such purchaser or transferee, shall apply notwithstanding that, as a matter of law, this Lease may terminate upon the foreclosure of the Mortgage (in which event the parties shall execute a new lease for the remainder of the Term on the same terms set forth herein), shall be self-operative upon any such demand, and no further instrument shall be required to give effect to said provisions. Each such party, however, upon demand of the other, shall execute, from time to time, instruments to confirm the foregoing provisions hereof, reasonably satisfactory to the requesting party, to acknowledge the subordination, non-disturbance and attornment as are provided herein and to set forth the terms and conditions of its tenancy.

12. Indemnification.

(a) Except to the extent that such loss, costs or damages were caused by negligence or willful misconduct of Landlord, its employees, agents or contractors, Tenant hereby agrees to indemnify, defend and hold each Landlord Indemnified Party harmless from any loss, costs and damages (including reasonable attorney’s fees and costs) suffered by Landlord or any Landlord Indemnified Party, if, and then only to the extent same is the result of (i) any claim by a third party, its agents, employees or contractors arising from Tenant’s use or occupancy of the Leased Property; (ii) an Event of Default by Tenant under this Lease or any failure by Tenant to perform any of the terms or conditions of this Lease to be performed by it; (iii) any material breach of any representations and warranties made by Tenant hereunder; or (iv) any losses caused by the negligence or willful misconduct of Tenant or any of Tenant’s employees, agents or contractors. Tenant shall have the right to designate counsel acceptable to Landlord, such approval not to be unreasonably withheld, conditioned or delayed, to assume the defense of any such third party claim on behalf of itself and Landlord. Landlord shall not have the right to settle any claim without the consent of Tenant, which consent shall not be unreasonably withheld, conditioned or delayed. This indemnity shall survive the expiration of the Term or earlier termination of this Lease.

(b) Except to the extent that such loss, costs or damages were caused by negligence or willful misconduct of Tenant, its employees, agents or contractors, Landlord hereby agrees to indemnify, defend and hold Tenant and each Tenant Indemnified Party harmless from any loss, costs and damages (including reasonable attorney’s fees and costs) suffered by Tenant or any Tenant Indemnified party, if, and then only to the extent same is the result of (i) any claim by a third party, its agents, employees or contractors arising from the Common Facilities (excluding

the Leased Property); (ii) an Event of Default by Landlord under this Lease or any failure by Landlord to perform any of the terms or conditions of this Lease to be performed by it; (iii) any material breach of any representations and warranties made by Landlord hereunder; (iv) any repair, maintenance or replacement of or to the Leased Property performed by or at the direction of Landlord for which Landlord assumes responsibility by the terms of this Lease; or (v) any losses caused by the negligence or willful misconduct of Landlord or any of Landlord’s employees, agents or contractors. Landlord shall have the right to designate counsel acceptable to Tenant, such approval not to be unreasonably withheld, conditioned or delayed, to assume the defense of any such third party claim on behalf of itself and Landlord. Tenant shall not have the right to settle any claim without the consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed. This indemnity shall survive the expiration of the Term or earlier termination of this Lease.

(c) Any amounts payable to an Indemnified Party because of the application of this Section 12 shall be payable on demand and shall bear interest at the Overdue Rate from ten (10) days following the date such Indemnified Party demands payment until paid in full; provided, however, if it is finally judicially determined that the Indemnified Liabilities resulted from the gross negligence or willful misconduct of any Indemnified Party, any amounts already paid pursuant to this Section 12 to that class of Indemnified Parties shall be refunded to the Party that made such payment(s). Each of Landlord’s and Tenant’s representations, warranties and agreements, and the rights and remedies of each Indemnified Party under this Section 12, are in addition to and not in limitation of any other representations, warranties, agreements, rights and remedies provided in this Lease or otherwise at law or in equity, and shall survive the end of the Term.

(d) Notwithstanding any provision in this Lease to the contrary, each party waives against the other any right to recover consequential damages and punitive damages.

13. Environmental Matters.

(a) Tenant (i) will not conduct any activity on the Leased Property that will use or produce any Hazardous Substances, except for such activities that are both (A) part of the ordinary course of Tenant’s business activities and (B) conducted in accordance with all Environmental Laws; and (ii) will not use the Leased Property in any manner for the storage of any Hazardous Substances except for storage of such materials that are both (A) used in the ordinary course of Tenant’s business and (B) properly stored in a manner and location satisfying all Environmental Laws. If any Hazardous Substances are introduced on the Leased Property in violation of the above provisions of this Section, the same shall be immediately removed by Tenant, with proper disposal, and all required cleanup procedures shall be diligently undertaken pursuant to all Environmental Laws. If at any time during or after the Term the Leased Property is found to be so contaminated or subject to such conditions as a result of Tenant’s failure to comply with the foregoing provisions, then, to such extent, Tenant shall indemnify, hold harmless and defend Landlord and the Landlord Indemnified Parties from all claims, demands, actions, liabilities, costs, expenses, damages and obligations of any nature as a result thereof. Except for Hazardous Substances that were released, existed in, on or near the Leased Property as of the Commencement Date, or that were introduced or released at, on or near the Leased Property by Landlord or Landlord’s agents, employees or contractors, Tenant shall remove all

Hazardous Substances from the Leased Property that are required to be removed under applicable Environmental Laws in accordance with such laws. Not more than once during any twelve (12) month period (unless Landlord has reasonable cause to do so more frequently), Landlord may, upon reasonable advance Notice to Tenant, enter the Leased Property and conduct environmental inspections and tests therein as it may require from time to time, provided that Landlord shall use reasonable due diligence to minimize the interference with Tenant’s business. Such inspections and tests shall be conducted at Landlord’s expense, unless they reveal that Tenant has not complied with the requirements of this Section, in which case Tenant shall reimburse Landlord for the reasonable cost thereof within thirty (30) days after Landlord’s request therefor together with reasonable and customary back-up documentation.

(b) Tenant agrees to notify Landlord promptly upon Tenant’s Actual Knowledge thereof of any disposal of Hazardous Substances at the Leased Property, of any discovery of Hazardous Substances at the Leased Property, or of any notice by a governmental authority or private party alleging or suggesting that a disposal of Hazardous Substances by Tenant, its employees, agents or contractors on or near the Leased Property may have occurred. Furthermore, Tenant shall provide Landlord with full and complete access to any documents or information in its possession or control relevant to the question of the generation, treatment, storage, or disposal of Hazardous Substances by Tenant, its employees, agents or contractors on or near the Leased Property.

(c) Prior to the execution of this Lease, Landlord has furnished to Tenant copies of the environmental assessment reports and related documents identified as Exhibit K. Landlord represents and warrants to Tenant that, except as may be disclosed in the environmental assessment reports and related documents identified in Exhibit K, Landlord has not received any Notice, demand, claim, citation, complaint, request for information or similar communication with respect to, and does not otherwise have Actual Knowledge of, the existence of Hazardous Substances at the Leased Property or elsewhere in the Park in violation of Environmental Laws. Notwithstanding anything to the contrary in this Lease, Tenant shall not be responsible, and Landlord hereby indemnifies, holds harmless and agrees to defend Tenant and the Tenant Indemnified Parties from and against any and all liabilities, claims, costs and expenses, including reasonable attorneys’ fees, arising from any release or threat of release or the presence or existence of Hazardous Substances at the Leased Property if caused by Landlord or persons acting under Landlord, if existing elsewhere in the Park, or if existing at the Leased Property or elsewhere in the Park on or prior to the Commencement Date. Without limiting the foregoing, in the event any Hazardous Substances are discovered at the Leased Property during the excavation or construction process, Landlord shall, at Landlord’s sole cost and expense, promptly take all such necessary action to ensure that the Leased Property complies with all applicable Environmental Laws. Notwithstanding anything to the contrary in this Lease, Landlord shall not place an activity or use limitation on the Leased Property or any part thereof that would impair, other than in a de minimus manner, Tenant’s right to use the Leased Property for the Permitted Use.

(d) Should any release of any Hazardous Substances occur at the Leased Property or elsewhere in the Park which is not the responsibility of Tenant as set forth herein, upon receipt of Actual Knowledge thereof Landlord shall promptly contain such release, and if required by Environmental Laws, regulations and ordinances, remove and dispose of, off the Leased

Property or the Park, or otherwise remediate (in accordance with Environmental Laws), such Hazardous Substances and any material that was contaminated by the release, and remedy and mitigate threats to human health or the environment relating to such release in compliance with all applicable Environmental Laws and remediate all other conditions of the Leased Property and the Park that have resulted therefrom and that interfere, other than in a de minimus manner, with Tenant’s ability to use and occupy the Leased Property for the conduct of Tenant’s business operations in the usual course, or that would under applicable Legal Requirements, preclude or materially impede Tenant’s right to use and occupy the Leased Property. If a third party is responsible to Landlord for any remediation, damage or claims for which Landlord is responsible hereunder, Landlord may cause such party to perform Landlord’s obligations hereunder in accordance with the foregoing provisions.

14. Landlord’s Maintenance, Repairs and Services.

(a) Maintenance and Repair.

(i) Landlord (A) shall replace, as necessary, at its sole cost and expense (and without inclusion in Operating Expenses; provided, however, costs for replacements of parts of structural elements may be included in Operating Expenses if such cost is properly treated as an expense under GAAP), the structure of the Building, the structural elements of the roof, the roof membrane, floor slabs, footings and foundations, exterior curtain and structural walls, and supporting systems, and the Building Systems, but only to the extent same are included in the Base Project Work or are installed, modified or supplemented by Landlord (including, without limitation, the Building chiller equipment), (B) shall (and without inclusion in Operating Expenses, except to the extent that the cost thereof is properly treated as an expense in accordance with GAAP), maintain and/or repair, as necessary, the structure of the Building, the structural elements of the roof, the roof membrane, floor slabs, footings and foundations, exterior curtain and structural walls, and supporting systems, and the Building Systems, but only to the extent same are included in the Base Project Work or are installed, modified or supplemented by Landlord (including, without limitation, the Building chiller equipment), and (C) shall make all other Capital Repairs, which Capital Repairs shall be at Landlord’s sole cost and expense. In addition, as part of the Operating Expenses (but only to the extent permitted under Section 7 above and not excluded from the definition of Operating Expenses contained in Appendix 1) and to the extent not included in clauses (A), (B) or (C) above, Landlord shall maintain, repair and/or replace, as necessary, all of the non-structural elements of the Leased Property (including the windows, glass or plate glass, and doors), the Building Systems that were included in the TI Work and all other components of the Leased Property in a condition consistent with the standards of maintenance and operation found in other Class “A” office/laboratory buildings located in the Philadelphia metropolitan area, reasonable wear and tear and non-casualty damages caused by Tenant, its agents and contractors excluded. With respect to any repair, replacement and maintenance work performed by Landlord as provided in this Section, Landlord shall use commercially reasonable efforts not to interfere, other than in a de minimus manner, with Tenant’s use of the Leased Property. In addition to the above obligations, Landlord shall be responsible, at its sole expense (and not included in Operating Expenses), (x) for performing all work required under Landlord’s warranty of the Base Project Work and Tenant Improvements as set forth in the Work Letter, if and to the extent work required under Landlord’s warranty is discovered and brought to Landlord’s attention within the longer period of: (1) one (1) year

following the Commencement Date, or (2) such longer warranty period that may be available for any such Work or for any equipment incorporated into the Base Project Work and Tenant Improvements pursuant to the specifications for the same, and (y) for correcting latent defects in the Base Project Work and the TI Work throughout the Lease Term, which defects in such work (A) were not built in substantial conformity with the relevant approved plans and specifications for such work, (B) were not built in accordance with Legal Requirements, or (C) were not built in a good and workmanlike manner in accordance with the standards set forth in the Work Letter.

(ii) If Landlord desires to do any work (for preventive maintenance or repairs or otherwise) that would require an interruption of power or any other utility to the Leased Property or any interference, other than in a de minimus manner, with Tenant’s operations or access to the Leased Property, the following requirements shall apply: (A) Landlord shall give Tenant not less than ten (10) days advance Notice of such planned work (except in the event of an emergency in which case Landlord shall give such Notice as is practicable under the circumstances), (B) such work may only occur during times reasonably approved by Tenant (and the Parties agree it shall be reasonable for Tenant to require that such work occur outside of normal business hours), and (C) in the case of a power interruption, if requested by Tenant (to the extent Tenant cannot supply its own back-up power) Landlord shall exercise its best efforts in good faith to provide a source of back-up power for the Leased Property to allow Tenant to continue its normal business operations during such interruption. Landlord acknowledges that Tenant performs ongoing testing, experiments and research at the Leased Property which may be jeopardized by any power interruption. As a result, no interruptions within the reasonable control of Landlord shall be permitted unless Landlord provides Tenant assurances that such interruptions will not impact Tenant’s ongoing testing, experiments and research. The cost of supplying such back-up power shall be included in Operating Expenses if and to the extent that the work necessitating the use of such back-up power is being done by Landlord as part of the performance of its repair and maintenance obligations under this Lease, but such cost shall not exceed the utility cost that Tenant would otherwise have paid had such interruption not occurred.

(b) Property Management. Subject to Tenant’s right to assume management of the Leased Property pursuant to Section 7(a)(vi) above, Landlord shall manage or shall hire a third-party property management company reasonably acceptable to Tenant (the “Property Manager”), to manage the Leased Property consistent with the standards of maintenance and operation found in other Class “A” office/laboratory buildings located in the Philadelphia metropolitan area for an annual property management fee of not more than four percent (4%) of the sum of Basic Rent, plus those Operating Expenses managed by Landlord or the Property Manager and not including Taxes, electricity, natural gas, water, sewer and other utilities consumed by Tenant at the Leased Property, and any other costs paid directly by Tenant) which fee shall be added to and be paid as part of Operating Expenses. The cost of building management personnel at or below the level of property manager who are reasonably necessary for the management, operation and maintenance of the Leased Property as agreed to by Tenant, will be charged to Tenant in addition to this fee (such additional personnel costs are to be included with the other Operating Expenses based on the amount of time such personnel devote to the Leased Property as opposed to the time devoted to other properties managed by the Property Manager). Notwithstanding any language to the contrary in this Lease, during the Term Tenant shall have the right to (a) review Property Manager’s annual budget for Operating Expenses, (b) approve Property Manager’s selection of the management and building

engineering personnel with responsibility for the Leased Property, which approval shall not be unreasonably withheld, conditioned, or delayed, and (c) replace the Property Manager in accordance with Section 7(a)(vi) above. Such budget shall be a good faith projection only, and shall not constitute a guarantee or cap applicable to actual Operating Expenses.

(c) Utilities. Landlord shall furnish the Leased Property with electricity, natural gas, ventilation, heating and air conditioning, sewer (subject to limitations on discharge as provided in the Industrial Waste Discharge Rider attached to and made part of this Lease as Exhibit Q) and hot and cold potable water in accordance with the Base Project Specifications for the normal use and occupancy of the Leased Property for the Permitted Use (including Tenant’s Laboratory Space (as defined in Section 3(c)(v) of the Work Letter)) twenty-four (24) hours per day, seven (7) days a week. Landlord shall furnish the Leased Property with electricity in accordance with the approved Base Project Construction Documents (as defined in Section 2(a) of the Work Letter) and TI Work Plans (as defined in Section 3(c)(i) of the Work Letter). Tenant shall identify and Landlord shall approve during the design process outlined in the Work Letter any additional or upgraded service Tenant may require for Tenant’s communications and networking systems, specialized equipment, Laboratory Space and other needs of Tenant. Tenant agrees to pay monthly (or at such other billing period required by the applicable utility provider) directly to the utility provider all charges for heat and air conditioning and electricity, natural gas, sewer, water and other utilities used by Tenant at the Leased Property. Bills for water and sewer service shall either be issued directly to Tenant for payment, in which event Tenant shall forward a copy of each bill to Landlord promptly following receipt, or to Landlord, in which event Landlord shall promptly forward each bill to Tenant following receipt for payment by Tenant. A separate meter shall be installed with respect to the Leased Property (and the heating and air-conditioning equipment servicing the Leased Property shall be attached to such meter) as part of the Base Project Specifications and Tenant shall pay for the consumption of such electricity and natural gas based upon its metered usage. In addition, Tenant shall pay all utility charges billed to Landlord and allocated to the Land and/or Building under the Declaration at Landlord’s actual cost, subject to all applicable discounts, and with no service fee, markup or other sum payable to Landlord on account of such charges in excess of the amounts billed to Landlord by the applicable utility provider or ECCA, plus amounts properly charged by ECCA as part of its management fee pursuant to the terms of the Declaration. Landlord shall use commercially reasonable efforts to have ECCA select utility providers providing services at competitive market rates. Tenant shall pay all bills for utility usage within thirty (30) days after receipt thereof. Notwithstanding the foregoing, Landlord shall have the right to retain any savings actually realized from any solar electric or other alternative energy system serving the Leased Property installed solely at Landlord’s cost (and without reimbursement from or cost to Tenant) for electricity generated by such system; provided that the electric charges to Tenant for its electricity at the Leased Property do not exceed what the utility company would otherwise have charged Tenant directly for such electricity.

(d) HVAC Standards. Upon commissioning of the Building’s HVAC system, Landlord shall certify that the Building’s HVAC systems will perform in accordance with the approved Base Project Construction Documents and the approved TI Work Plans and at the ASHRAE 189.1 standards for “green” commercial buildings, and allow Tenant’s technical services team and consultants to evaluate and confirm the same. The Building’s HVAC system shall be designed, constructed and commissioned in accordance with the approved Base Project

Construction Documents and the approved TI Work Plans and in a manner consistent with best industry practices to optimize energy efficiency and meet the reliability and redundancy requirements of Tenant. The Building’s HVAC system shall be designed to include consideration of special metering and other installed systems to meet current requirements for certification under existing LEED standards for Operations and Maintenance. All enhanced commissioning reports are to be reviewed and approved by Tenant.

(e) Cleaning Specifications. Landlord shall clean the Leased Property five (5) days per week pursuant to the Cleaning Specifications set forth in the attached Exhibit F. Landlord shall cause all such cleaning personnel (and others engaged by Landlord or the Property Manager to perform Landlord’s duties with regard to the operation, maintenance and repair of the Leased Property) to adhere to Tenant’s corporate security and insurance requirements, as promulgated from time-to-time. Tenant reserves the right to approve Landlord’s selection of the cleaning personnel and the cost of such janitorial services. The cost of these janitorial services shall be included in the Operating Expenses. If at any time Tenant alleges in a Notice to Landlord (a “Janitorial Deficiency Notice”) that the janitorial services to the Leased Property have persistently failed to conform to the requirements of Exhibit F hereto in a manner consistent with a Class “A” office building in the Philadelphia metropolitan area, Landlord and Tenant shall cause their executive representatives to meet promptly to identify the alleged deficiencies, and to establish and implement actions and procedures to redress those deficiencies in a manner reasonably acceptable to Tenant. If Landlord and Tenant are unable to agree, within fifteen (15) days following receipt by Landlord of the Janitorial Deficiency Notice, upon actions and procedures to redress the alleged deficiencies to the reasonable satisfaction of Tenant, Tenant may engage directly a replacement janitorial service contractor for the performance of janitorial services to the Leased Property and the Operating Expenses shall be equitably reduced and adjusted to take this into account. If Tenant takes such action, before hiring any such replacement janitorial service, tenant shall give Landlord the right to match the level of service and pricing of such replacement janitorial service.

(f) Interruption of Services. In the event that any utilities serving the Leased Property, sewer, road infrastructure, or other third party service necessary to operate Tenant’s Business at the Leased Property is interrupted, which interruption is due to the negligent or willful acts or omissions of Landlord, Property Manager or any of their respective agents, contractors, or employees, and Landlord fails to restore any such utility, sewer, road infrastructure or other third party service and such failure continues for more than two (2) days after Landlord’s receipt of oral or Notice from Tenant, then (i) Rent shall abate under this Lease until such service interruption is fully restored, and (ii) Tenant shall be entitled to perform the work itself and submit an invoice to Landlord for the actual cost of the necessary work performed and Landlord shall pay Tenant for such services within thirty (30) days following receipt of Tenant’s invoice, together with interest at the Overdue Rate from the date such costs were incurred by Tenant.

(g) Access. Tenant shall have access to the Building and the Leased Property, and Landlord shall provide utilities and services to the Leased Property as set forth in the Lease, on a twenty-four (24) hours per day, seven (7) days per week basis, as Tenant may request.

(h) Common Facilities. Landlord shall maintain and repair, or cause ECCA to maintain and repair, the Common Facilities in a manner consistent with first class business parks located in the Philadelphia metropolitan area. Tenant shall pay its pro rata share (which shall be determined in accordance with the Declaration) of the electricity and other utility charges and other assessments allocated to the Building and Land and properly charged to Landlord pursuant to the Declaration (“Common Area Charges”). All such prorated Common Area Charges assessed by the ECCA shall be included in Operating Expenses; provided, however, that all such charges shall be subject to the exclusions to Operating Expenses as set forth in the definition of Operating Expenses set forth in Appendix I. Landlord represents and warrants that ECCA assesses a management fee of four percent (4%) of all Common Area Charges for the Park to all tenants and owners in the Park, and based on such representation, Tenant agrees that it shall pay its pro rata share of such management fee as part of Operating Expenses, subject to the limitations set forth above. All charges for common electric and utility services assessed by Landlord or ECCA for the Common Facilities shall be charged at Landlord’s or ECCA’s actual cost, with all applicable discounts applied, with no mark-up billing fee, service fee or other amounts as provided herein.

15. Tenant’s Maintenance and Repairs; No Waste.

(a) Tenant will, at its sole cost, at all times maintain in good condition and repair any specialized equipment installed by Tenant at the Leased Property and any special equipment used by Tenant in the Laboratory Space. In addition, Tenant shall keep the Leased Property orderly and free of rubbish, and shall not commit any waste of the Leased Property, or remove, demolish or alter the Improvements, except for Alterations performed in accordance with Section 16 below.

16. Alterations.