Attached files

| file | filename |

|---|---|

| 8-K - 8-K_12/07/2010 - NORTHWESTERN CORP | ek_120710.htm |

December 9, 2010

Omni Berkshire Place

New York

2011 Analyst Day

2

forward-looking statement…

During the course of this presentation, there will be forward-looking

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.”

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.”

The information in this presentation is based upon our current

expectations as of the date hereof unless otherwise noted. Our actual

future business and financial performance may differ materially and

adversely from our expectations expressed in any forward-looking

statements. We undertake no obligation to revise or publicly update

our forward-looking statements or this presentation for any reason.

Although our expectations and beliefs are based on reasonable

assumptions, actual results may differ materially. The factors that may

affect our results are listed in certain of our press releases and

disclosed in the Company’s public filings with the SEC.

expectations as of the date hereof unless otherwise noted. Our actual

future business and financial performance may differ materially and

adversely from our expectations expressed in any forward-looking

statements. We undertake no obligation to revise or publicly update

our forward-looking statements or this presentation for any reason.

Although our expectations and beliefs are based on reasonable

assumptions, actual results may differ materially. The factors that may

affect our results are listed in certain of our press releases and

disclosed in the Company’s public filings with the SEC.

3

who we are…

Above data as of 9/30/10

(1) Book capitalization calculated as total debt, excluding capital leases, plus shareholders’ equity.

¾ 661,000 customers

» 399,000 electric

» 262,000 natural gas

¾ Approximately 123,000 square

miles of service territory in

Montana, South Dakota, and Nebraska

miles of service territory in

Montana, South Dakota, and Nebraska

» 32,000 miles of electric T&D lines

» 8,400 miles of natural gas T&D pipelines

» 18 Bcf natural gas storage

» 8 Bcf natural gas proven reserves

¾ Total generation (mostly base load coal)

» MT - 222 MW - regulated

» SD - 312 MW - regulated

¾ Total Assets: $2,899 MM

¾ Total Capitalization: $1,834 MM(1)

¾ Total Employees: 1,354

Located in states with relatively stable economies with

opportunity for system investment and grid expansion .

opportunity for system investment and grid expansion .

4

NorthWestern’s attributes…

¾ Solid operations

» Cost competitive

» Above-average reliability

» Award-winning customer service

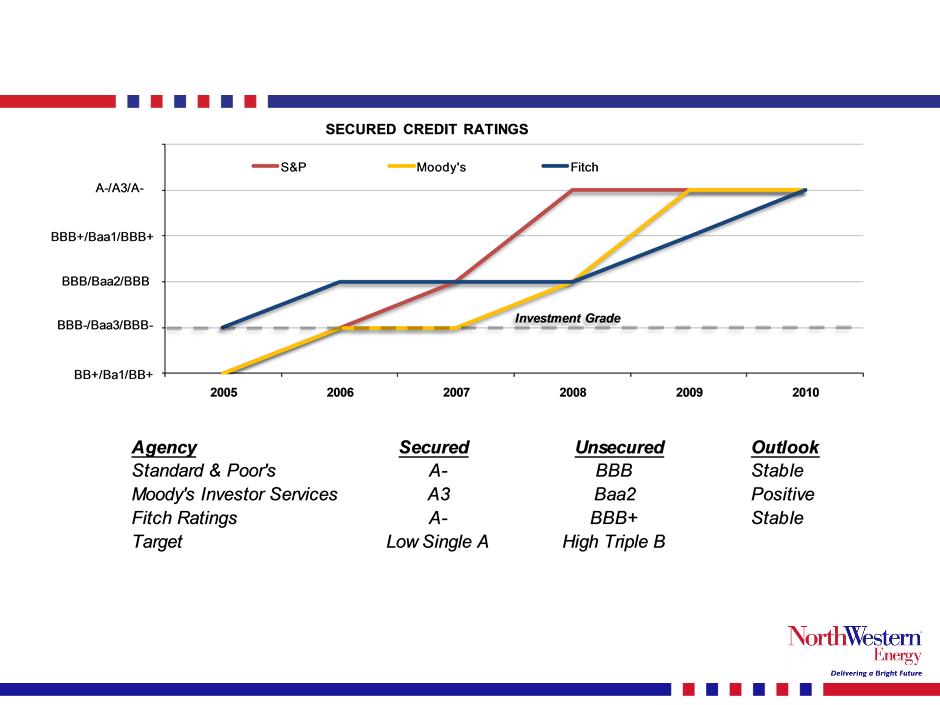

¾ Low single A secured credit ratings with a strong balance sheet and liquidity

» April 15, 2010 Fitch upgraded secured and unsecured ratings to A- and BBB+ respectively

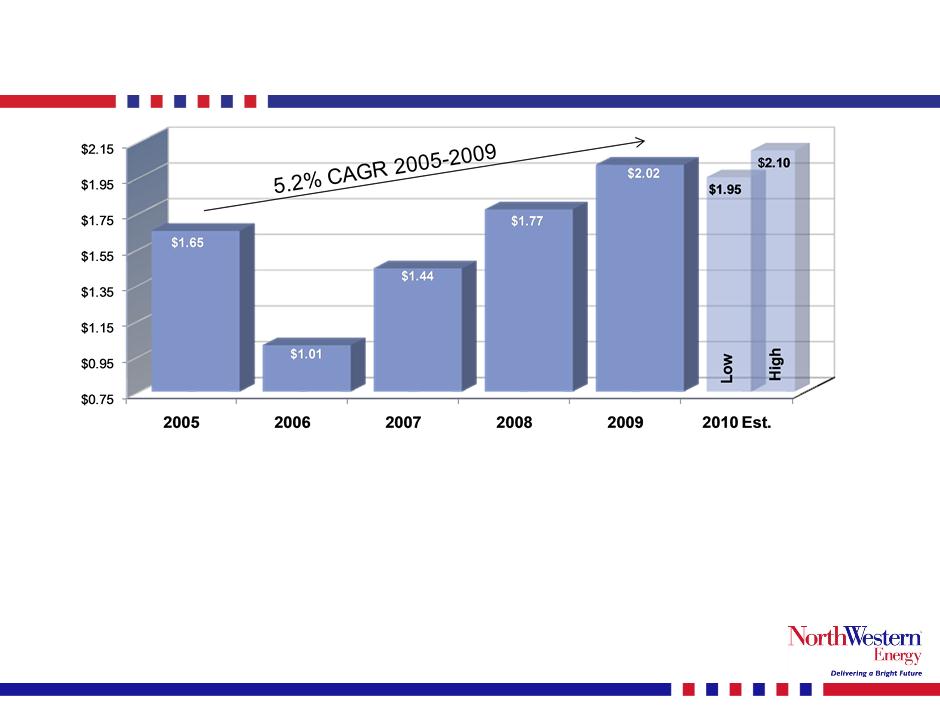

¾ Positive earnings and ROE trend

» Delivery services rate cases for Montana electric and natural gas

» Mill Creek Generation Station anticipated into rates early 2011

¾ Strong cash flows

» NOLs and repair tax deduction provide an effective tax shield until likely 2014

» 94% pension funded status at end of 2009

¾ Competitive total shareholder return and dividend that has increased every year

since 2005

since 2005

» Added to S&P 600 SmallCap Index on April 9, 2010

¾ Constructive regulatory environment

¾ Forbes.com listed as one of “100 Most Trustworthy Companies”

¾ Realistic investment opportunities

Brian Bird

Chief Financial Officer

strong credit ratings…

6

A security rating is not a recommendation to buy, sell or hold securities. Such rating may be subject to revision or

withdrawal at any time by the credit rating agency and each rating should be evaluated independently of any other rating.

withdrawal at any time by the credit rating agency and each rating should be evaluated independently of any other rating.

7

strong balance sheet and liquidity…

¾ Total liquidity approximately $145 million

¾ Total Debt / Total capitalization of 55.8%(1)

¾ In past two years refinanced nearly all outstanding debt

» In May 2010 we refinanced existing $225 million, 5.875% Senior Secured Notes

due 2014 with 5.01% First Mortgage Bonds due 2025.

due 2014 with 5.01% First Mortgage Bonds due 2025.

» Reduced long term debt cost from 6.8% to 5.6%

¾ Nearly all long-term debt matures after 2015

» Increased average debt maturity from 8.8yrs to 11.5yrs

(1) Total capitalization as of 9/30/10

(2) Excludes outstanding 9/30/10 Revolver balance of $109 million maturing in 2012.

8

strong cash flows…

Earnings trend and NOLs provide strong cash flows to

fund future investment.

fund future investment.

solid pension funding position…

9

Data source: SNL Financial

As a result of the significant contribution of $93 million to our pension

plan and solid market returns in 2009, we are better positioned than

our peers at December 31, 2009

plan and solid market returns in 2009, we are better positioned than

our peers at December 31, 2009

10

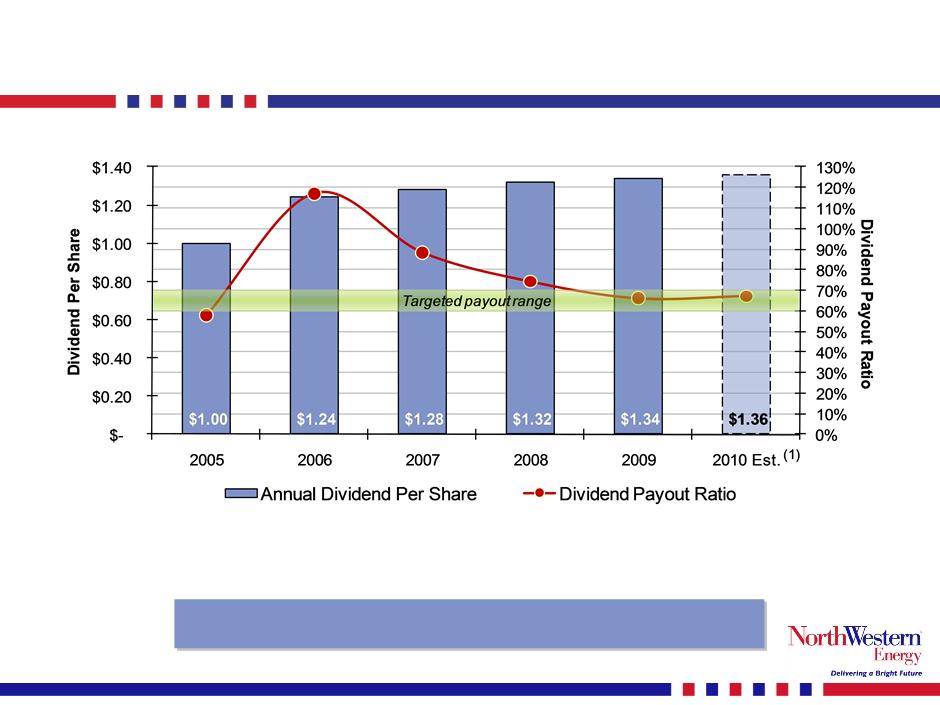

and sustainable dividend…

Goal for dividend payout ratio of 60% - 70%.

Current dividend yield about 5% with year-over-year dividend growth.

Current dividend yield about 5% with year-over-year dividend growth.

(1) 2010 estimated payout range assumes midpoint of $1.95 - $2.10 guidance range

11

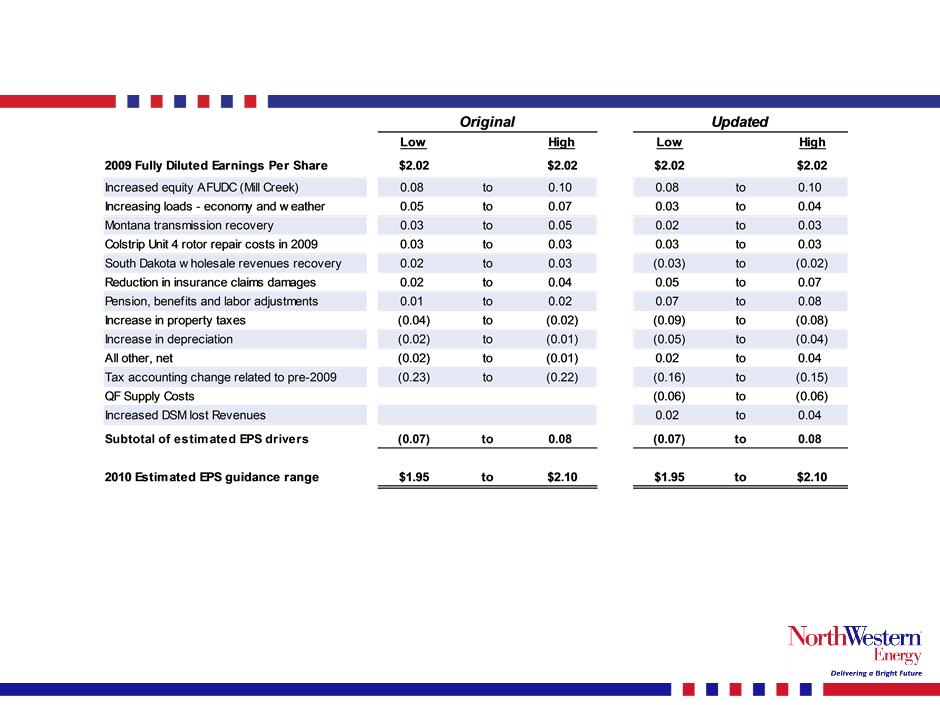

reaffirming 2010 EPS guidance…

¾ The major assumptions include, but are not limited to, the following

expectations:

expectations:

» Excludes approximately $.06/share for the 2010 estimated effect of the Montana rate increase proposed by

the Stipulation, which is pending approval by the MPSC;

the Stipulation, which is pending approval by the MPSC;

» The release of the second quarter 2010 valuation allowance of approximately $.06/share against certain

state NOL carryforwards is excluded from the earnings outlook;

state NOL carryforwards is excluded from the earnings outlook;

» The tax benefit associated with the IRS approval of a tax accounting method to deduct repairs is included

in the earnings outlook;

in the earnings outlook;

» Fully diluted average shares outstanding of 36.5 million; and

» Normal weather in the Company’s electric and natural gas service territories for the remainder of 2010.

2009 to 2010 earnings bridge…

12

The major assumptions include, but are not limited to, the following expectations:

» Excludes approximately $.06/share for the 2010 estimated effect of the Montana rate increase proposed by the Stipulation, which is pending

approval by the MPSC;

approval by the MPSC;

» The release of the second quarter 2010 valuation allowance of approximately $.06/share against certain state NOL carryforwards is excluded

from the earnings outlook;

from the earnings outlook;

» The tax benefit associated with the IRS approval of a tax accounting method to deduct repairs is included in the earnings outlook;

» Fully diluted average shares outstanding of 36.5 million; and

» Normal weather in the Company’s electric and natural gas service territories for the remainder of 2010.

13

near-term potential earnings drivers…

¾ 2011 expectations/assumptions:

» Mill Creek in rate base in 2011 adding about $.20/share

♦ $7.5 million incremental post-tax contribution compared to 2010

♦ MCGS rates pick up full interest costs & equity return in 2011

» Full year effect of Montana rate adjustment adds roughly $.05/share

♦ Preliminary MPSC decision agreeing to $6.7 million stipulation settlement

♦ Preliminary MPSC decision on ‘decoupling’ decreases the settlement by $1.3 million

♦ Recorded about $3 million in rate increase in 2010

» Increase in gross margin over 2010 of $.20/share to $.30/share:

♦ Expiration of CU4 legacy contract adding approximately $.10/share

● Expense obligation reduction of $3.8 million, after tax

♦ Improvement in volumes over 2010 of $.10/share to $.20/share

● Montana retail volumes increase from mild 2010 weather

● Montana wholesale transmission volume increases

● Montana gas volumes due to mild 2010 winter weather

» Offset by increases in expenses over 2010 of $.25/share to $.35/share

♦ Labor, Maintenance, Property taxes, and Depreciation

¾ 2012 expectations:

» Full year effect of South Dakota and Nebraska natural gas rate cases

» AFUDC on Montana wind projects

» If Battle Creek in rate base, pursuing additional natural gas reserves

Bob Rowe

President and CEO

15

constructive regulatory environment…

¾ Montana

» Rate case

♦ MPSC reached a decision on the rate case at a recent work session; decision and

approval is subject to MPSC issuance of a final order

approval is subject to MPSC issuance of a final order

● MPSC approved the Stipulated settlement with Consumer Counsel for a $6.7 million

rate increase

rate increase

● MPSC also approved allocated cost of service and rate design and inverted block

rates

rates

● Decoupling addressed with the following adjustments:

► Electric rate base only

► 10.0% ROE

► Weather adjusted (weather risk is on the Company)

► Potential impact to Company is $1.3 million in revenues annually

► Company will evaluate decoupling options after the order is released on decoupling

● Order expected in December 2010

» Mill Creek Generation Station filed

♦ Interim rates approved by the MPSC and will be in effect January 1, 2011

♦ Prudency case to be filed Q1 2011

» MPSC election results

♦ Two new commissioners beginning Jan 1, 2011

♦ Current Chairman will leave office Dec 31, 2010

16

regulatory environment con’t…

¾ South Dakota

» Expect to file natural gas rate cases during 2011 pending 2010 results

» Expect to file on environmental rider on the Neal plant for emissions compliance

» Election results

♦ Current Chairman Dusty Johnson re-elected but appointed by new Governor to be Chief

of Staff

of Staff

♦ Outgoing South Dakota Secretary of State, Chris Nelson, has been appointed PUC

commissioner by the Governor beginning January 1, 2011

commissioner by the Governor beginning January 1, 2011

¾ Nebraska

» Expect to file natural gas rate cases during 2011 pending 2010 results

¾ FERC

» Encouraged Company to develop MSTI on a cost of service basis by requesting

appropriate tariff waivers for existing OATT

appropriate tariff waivers for existing OATT

» Approved 230kV Renewable Collector Open Season

» Docket filed for Mill Creek on April 10, 2010 to establish rates as of January 1, 2011

♦ October 15, 2010, Order issued authorizing us to put our filed tariffs in place January 1,

2011, subject to refund, and set the case for hearing.

2011, subject to refund, and set the case for hearing.

17

regulatory milestones in 2011…

|

Montana

|

|

|

Distribution Infrastructure

|

|

|

¾Accounting Order (in 2010)

¾Make filing

|

Q4

Q2

|

|

Prudency Review for Mill Creek

|

|

|

PInterim filing (in 2010)

|

Q4

|

|

¾Prudency filing

|

Q1

|

|

¾FERC filing

|

Q2

|

|

Approval for Montana Wind Projects

|

|

|

¾Pre - approval filing

|

Q2

|

|

|

|

|

Natural Gas - Rate base Battle Creek

|

|

|

¾Rate base filing

|

Q2

|

|

|

|

|

South Dakota

|

|

|

Natural Gas Rate Case

|

|

|

¾File rate case pending 2010 results

|

Q2

|

|

Environmental riders for Big Stone &

Neal |

|

|

¾Environmental rider filing on Neal

|

Q2

|

|

|

|

|

Nebraska

|

|

|

Natural Gas Rate Case

|

|

|

¾File rate case pending 2010 results

|

Q2

|

|

|

|

|

|

|

|

|

|

longer term investment opportunities…

¾ Distribution system enhancements

» Incremental rate based investment to enhance reliability and

capacity, improve rural service, and prepare the system for

potential smart grid applications

capacity, improve rural service, and prepare the system for

potential smart grid applications

¾ Energy supply

» Big Stone and Neal plants’ pollution control equipment

» Natural gas reserves

» South Dakota peaking generation

» Wind projects and other renewable projects

¾ Transmission projects

» Network upgrades

» Colstrip 500 kV upgrade

» 230 kV Renewable Collector System

» Mountain States Transmission Intertie (MSTI)

» South Dakota transmission opportunities

18

Curt Pohl

Vice President - Retail Operations

20

distribution infrastructure project …

¾ Project Scope:

» Electric $222M CAPEX $55M O&M

» Gas $50M CAPEX $16M O&M

¾ Project Goals:

» Electric System

♦ Arrest or reverse the trend in aging infrastructure

proactive vs. reactive…

(what is the least cost replacement rate?)

(what is the least cost replacement rate?)

21

22

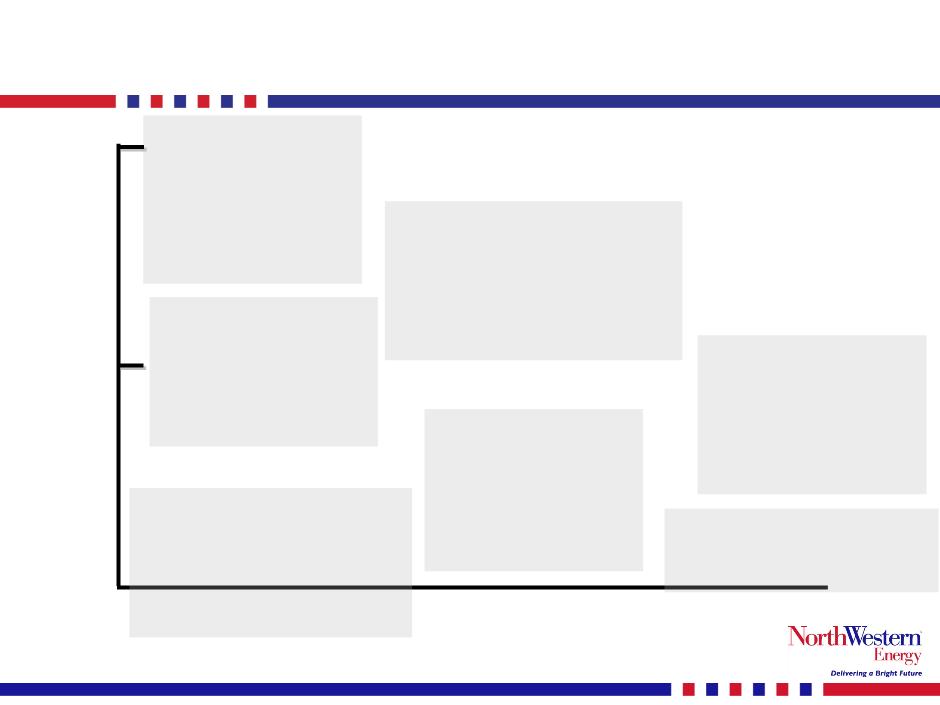

electric plan components…

Poles

Accelerated inspection

and replacement

and replacement

5 Year cycle

$90M Capex $8M O&M

5 year

costs

(millions)

costs

(millions)

50

100

U/G Cable

Accelerated

replacement (10 years)

replacement (10 years)

Collect data

$46M Capex $3 O&M

Tree Trimming

Accelerated trimming

(5 years)

(5 years)

Cut beetle kill trees

$24M O&M

Substations &

Automation

Automation

Accelerated inspection and

replace

replace

Install communications

$57M Capex $5M O&M

Capacity Margins

Maintain current

Improve transfer

capabilities

capabilities

$21M Capex

Rural Reliability

Eliminate all 4Q circuits

$8M Capex $8M O&M

Overhead Equip.

Accelerated inspection and

replacement (3 years)

replacement (3 years)

Collect data

$7M O&M

TOTAL est. = $222M Capex & $55M O&M

23

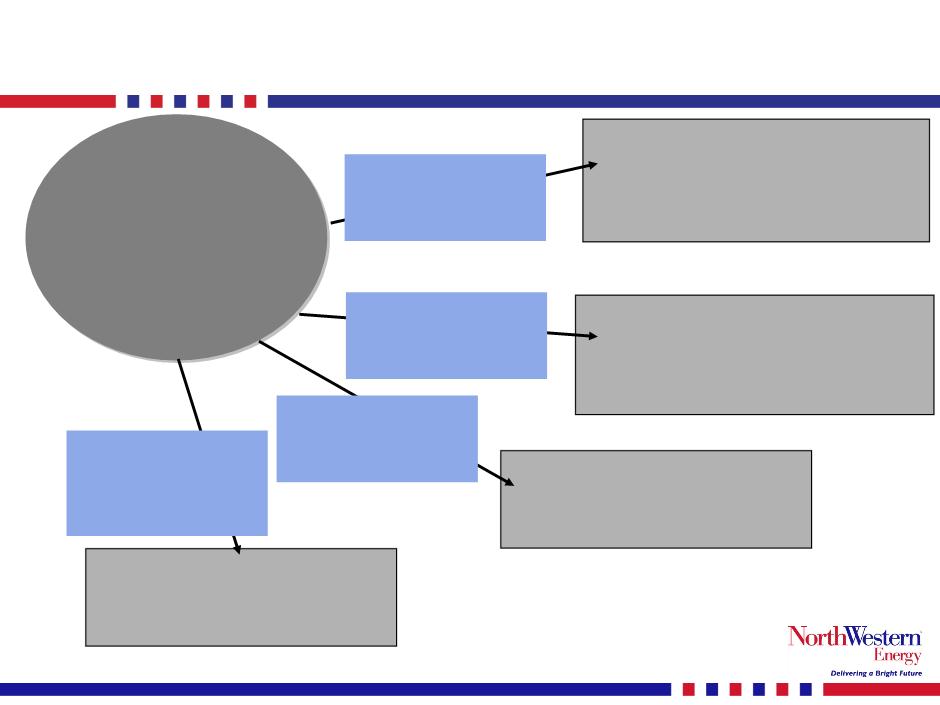

gas plan components…

NWE’s Gas

Distribution

Infrastructure

Plan

Distribution

Infrastructure

Plan

Mitigation of Safety Threats

5 Projects

$45M Capex $1.5M O&M

Evaluation and ranking of components

for leak potential

for leak potential

Damage Prevention

$7.6M O&M

Tactics to minimize third party damage

leading to excavation-related leaks

leading to excavation-related leaks

DIMP-guided threat

analysis of system

components

analysis of system

components

(5 projects)

Operational and

administrative initiatives

to reduce third party

leaks

administrative initiatives

to reduce third party

leaks

Data Acquisition

$0.4 CAPEX $2M O&M

The foundation of the process

Operational Review

$5M Capex $5M O&M

Appropriate actions to improve

operations

operations

Long-term data needs to

facilitate DIMP

implementation

facilitate DIMP

implementation

System operational

improvement initiatives

(e.g., zone valves now

under study)

improvement initiatives

(e.g., zone valves now

under study)

TOTAL est. = $50M Capex & $16M O&M

Dave Gates

Vice President - Wholesale Operations

25

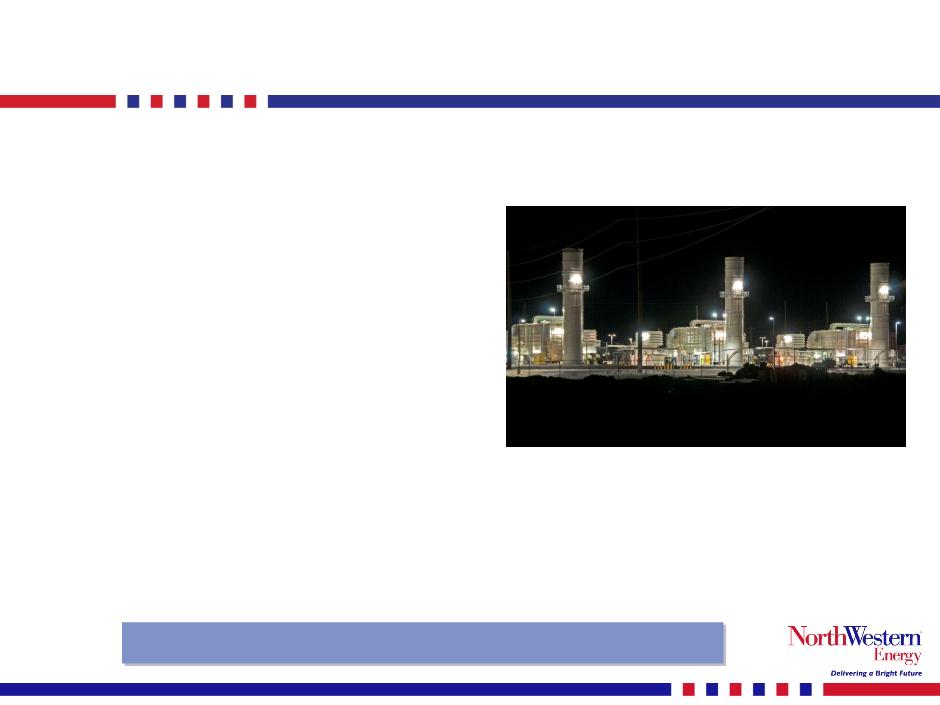

generation growth highlights…

Mill Creek Generating Unit

in Montana

in Montana

¾ What:

120-150 MW plant near Anaconda,

MT

MT

» Built for regulation services to

balance supply and load for NWE’s

Balancing Area

balance supply and load for NWE’s

Balancing Area

» Rate based cost of service

investment

investment

» Final costs right at $200 million

¾ Why:

Existing services became more

expensive and scarce and

existing contract for services

expiring on January 1, 2011

expensive and scarce and

existing contract for services

expiring on January 1, 2011

In service date for Mill Creek Generation Station = Jan 1, 2011

26

Mill Creek project milestones…

2010 and Prior

Mill Creek

ü Pre-approved for public interest by the MPSC

2009

2009

ü Begin construction 2009

ü Construction completed 2010

ü Plant ‘test fired’ 2010

ü Interim rates approved 2010

(both at FERC and MT PSC)

2011

Mill Creek

¾ Final Prudency filed with MPSC Q1

¾ FERC rate settlement Q2

¾ Expected decision on prudency from MPSC Q3

27

generation growth highlights…

Renewable Generation in

Montana

Montana

¾ What:

25-50 MW’s of Wind Generation

» Could be PPA or rate based asset

» Estimated construction cost

between $40 - $100 million

between $40 - $100 million

¾ Why:

Needed to meet the Montana RPS

standard of 10% by 2012 and 15%

by 2015.

standard of 10% by 2012 and 15%

by 2015.

Needs to be added to meet Montana RPS

28

generation investments…

Peaking Plant in South

Dakota

Dakota

¾ What:

60 MW peaking plant near Aberdeen, SD

» Current contract expires December

2012

2012

» Rate based cost of service investment

» Estimated to cost around $60 million

¾ Why:

» Existing regional services are

becoming scarce

becoming scarce

» Current capacity market conditions

make it prudent to recheck

assumptions and alternatives to

confirm timing

make it prudent to recheck

assumptions and alternatives to

confirm timing

In service date for SD Peaker 2013-2015

29

pollution control investments…

Pollution Control -

Big Stone Plant (SD)

¾ What:

Emissions reduction to Big Stone

454 MW plant located in NE SD

454 MW plant located in NE SD

» Compliance with Clean Air

Visibility Rule

Visibility Rule

» Estimated to cost between $130 -

$150 million for our portion (23.4%)

$150 million for our portion (23.4%)

» Emissions tracker mechanism

exists with SDPUC

exists with SDPUC

¾ Why:

EPA requires reduction of SO2,

NOx, Hg, etc, etc.

NOx, Hg, etc, etc.

Required to occur by 2016

30

pollution control investments…

Pollution Control -

Neal Plant (SD)

¾ What:

Scrubber installation to 655 MW

Neal plant located in NW Iowa

Neal plant located in NW Iowa

» Compliance with Clean Air

Visibility Rule

Visibility Rule

» Estimated to cost between $15 -

$25 million for our portion (8.7%)

$25 million for our portion (8.7%)

» Emissions tracker mechanism

exists with SDPUC

exists with SDPUC

¾ Why:

EPA requires reduction of SO2,

NOx, Hg, etc, etc.

NOx, Hg, etc, etc.

Expected by 2014

31

natural gas supply…

Battle Creek acquisition

¾ Purchase of proven natural gas

reserves located proximate to our MT

system

reserves located proximate to our MT

system

» ½ bcf annual production (8.7 bcf

total)

total)

» Represents 2.4% of MT retail

usage

usage

» Interim rates collected through

monthly tracker, including return

on investment, beginning 11-1-10

monthly tracker, including return

on investment, beginning 11-1-10

» Initial Purchase price of $11.4 M

» Acquired an additional $1 million

ownership interest in field on

December 3, 2010

ownership interest in field on

December 3, 2010

¾ Why:

Provide stable long term pricing to rate

payors while earning a modest return

payors while earning a modest return

Closed on acquisition in September and December 2010

wind - a new cash crop?…

32

33

our proposed transmission projects…

34

extended open seasons…

¾ MSTI siting delays:

» Draft EIS delayed by Jefferson County, MT litigation against MDEQ

¾ General economic conditions:

» Slow down in economy making developers cautious on LT

commitments

commitments

» Low natural gas prices making renewables less cost effective

¾ Market confusion:

» Confusion in California market making it difficult to understand

probability

probability

¾ Potential Federal Legislation:

» Federal policy needs clarity around renewables to advance wind

generation

generation

Expected to remain open until the end of 2011

35

Electric Transmission America study

…

…

Headed by AEP & MidAmerican Energy

1. Phase 2 of study just

released

released

2. Summarizes two

overlay paths to

consider

overlay paths to

consider

3. Transmission

supporting integration

of about 55 GW of

wind generation

supporting integration

of about 55 GW of

wind generation

4. Estimated overlay cost

range between $20 -

$25 Billion

range between $20 -

$25 Billion

5. South Dakota would

have over 4,000 MW

wind generation

deployed in 2029

have over 4,000 MW

wind generation

deployed in 2029

36

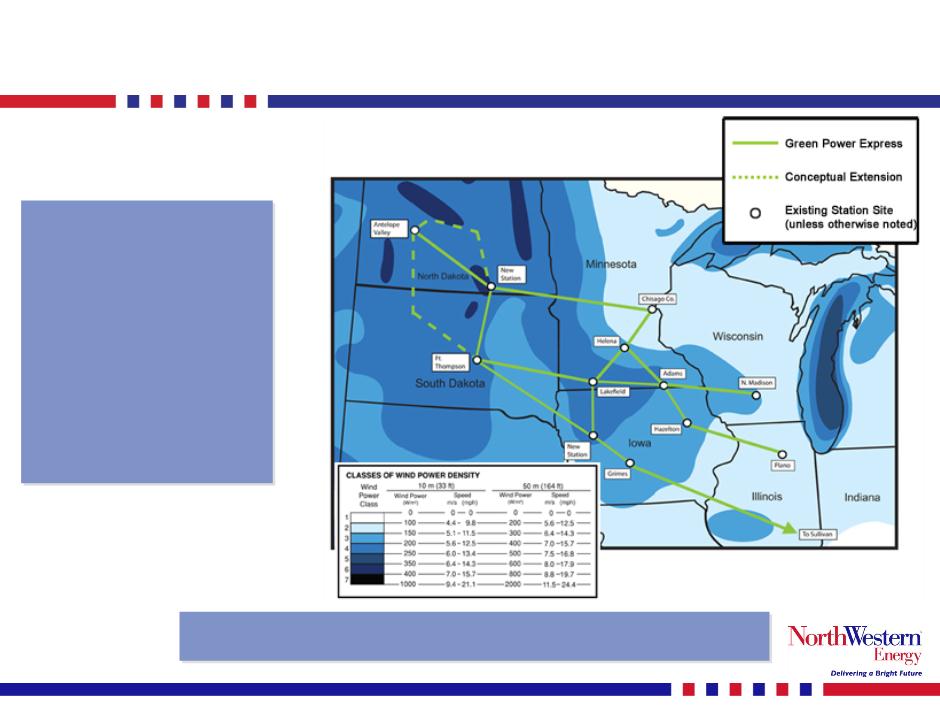

Green Power Express …

Headed by ITC Holdings

1. Transfer capacity of 10

-12 GW of power

supporting up to 22

GW of new wind

generation

-12 GW of power

supporting up to 22

GW of new wind

generation

2. Crosses 7 states,

numerous utility areas

and two RTO’s

numerous utility areas

and two RTO’s

3. Estimated cost of

project $10 - $12 Billion

project $10 - $12 Billion

4. Investment in SD

would be significant

would be significant

37

potential project summary…

Opportunity to increase and diversify earnings as compared with

our existing $1.8 billion rate base (including Mill Creek).

our existing $1.8 billion rate base (including Mill Creek).

in summary…

¾ Solid operations

¾ Low single A secured credit ratings with a strong

balance sheet and liquidity

balance sheet and liquidity

¾ Positive earnings and ROE trend

¾ Strong cash flows

¾ Competitive total shareholder return and dividend

that has increased every year since 2005

that has increased every year since 2005

¾ Constructive regulatory environment

¾ Forbes.com “100 Most Trustworthy Companies”

¾ Realistic investment opportunities

38