Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SOUTHERN Co GAS | form8_k.htm |

| EX-99.1 - JOINT PRESS RELEASE OF AGL RESOURCES INC. AND NICOR INC. - SOUTHERN Co GAS | exhibit99_1.htm |

December 2010

2

Safe Harbor Pages

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Forward Looking Statements

To the extent any statements made in this presentation contain information that is not historical, these statements are forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (collectively, “forward-

looking statements”).

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (collectively, “forward-

looking statements”).

These forward-looking statements relate to, among other things, the expected benefits of the proposed merger such as efficiencies, cost savings, tax benefits,

enhanced revenues and cash flow, growth potential, market profile and financial strength; the competitive ability and position of the combined company; and the

expected timing of the completion of the transaction. Forward-looking statements can generally be identified by the use of words such as “believe”, “anticipate”,

“expect”, “estimate”, “intend”, “continue”, “plan”, “project”, “will”, “may”, “should”, “could”, “would”, “target”, “potential” and other similar expressions. In addition, any

statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. Although certain of

these statements set out herein are indicated above, all of the statements in this presentation that contain forward-looking statements are qualified by these

cautionary statements. Although AGL Resources and Nicor believe that the expectations reflected in such forward-looking statements are reasonable, such

statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in

making forward-looking statements, including, but not limited to, factors and assumptions regarding the items outlined above. Actual results may differ materially

from those expressed or implied in such statements. Important factors that could cause actual results to differ materially from these expectations include, among

other things, the following: the failure to receive, on a timely basis or otherwise, the required approvals by AGL Resources and Nicor stockholders and

government or regulatory agencies (including the terms of such approvals); the risk that a condition to closing of the merger may not be satisfied; the possibility

that the anticipated benefits and synergies from the proposed merger cannot be fully realized or may take longer to realize than expected; the possibility that costs

or difficulties related to the integration of AGL Resources and Nicor operations will be greater than expected; the ability of the combined company to retain and

hire key personnel and maintain relationships with customers, suppliers or other business partners; the impact of legislative, regulatory, competitive and

technological changes; the risk that the credit ratings of the combined company may be different from what the companies expect; and other risk factors relating to

the energy industry, as detailed from time to time in each of AGL Resources’ and Nicor’s reports filed with the Securities and Exchange Commission (“SEC”).

There can be no assurance that the proposed merger will in fact be consummated.

enhanced revenues and cash flow, growth potential, market profile and financial strength; the competitive ability and position of the combined company; and the

expected timing of the completion of the transaction. Forward-looking statements can generally be identified by the use of words such as “believe”, “anticipate”,

“expect”, “estimate”, “intend”, “continue”, “plan”, “project”, “will”, “may”, “should”, “could”, “would”, “target”, “potential” and other similar expressions. In addition, any

statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. Although certain of

these statements set out herein are indicated above, all of the statements in this presentation that contain forward-looking statements are qualified by these

cautionary statements. Although AGL Resources and Nicor believe that the expectations reflected in such forward-looking statements are reasonable, such

statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in

making forward-looking statements, including, but not limited to, factors and assumptions regarding the items outlined above. Actual results may differ materially

from those expressed or implied in such statements. Important factors that could cause actual results to differ materially from these expectations include, among

other things, the following: the failure to receive, on a timely basis or otherwise, the required approvals by AGL Resources and Nicor stockholders and

government or regulatory agencies (including the terms of such approvals); the risk that a condition to closing of the merger may not be satisfied; the possibility

that the anticipated benefits and synergies from the proposed merger cannot be fully realized or may take longer to realize than expected; the possibility that costs

or difficulties related to the integration of AGL Resources and Nicor operations will be greater than expected; the ability of the combined company to retain and

hire key personnel and maintain relationships with customers, suppliers or other business partners; the impact of legislative, regulatory, competitive and

technological changes; the risk that the credit ratings of the combined company may be different from what the companies expect; and other risk factors relating to

the energy industry, as detailed from time to time in each of AGL Resources’ and Nicor’s reports filed with the Securities and Exchange Commission (“SEC”).

There can be no assurance that the proposed merger will in fact be consummated.

Additional information about these factors and about the material factors or assumptions underlying such forward-looking statements may be found in AGL

Resources’ and Nicor’s release regarding the merger, as well as under Item 1.A. in each of AGL Resources’ and Nicor’s Annual Report on Form 10-K for the fiscal

year ended 2009, and Item 1.A in each of AGL Resources’ and Nicor’s most recent Quarterly Report on Form 10-Q for the quarterly period ended September 30,

2010. AGL Resources and Nicor caution that the foregoing list of important factors that may affect future results is not exhaustive. When relying on forward-

looking statements to make decisions with respect to AGL Resources and Nicor, investors and others should carefully consider the foregoing factors and other

uncertainties and potential events. All subsequent written and oral forward looking statements concerning the proposed merger or other matters attributable to

AGL Resources or Nicor or persons acting on their behalf are expressly qualified by the cautionary statements referenced above. The forward-looking statements

contained herein speak only as of the date of this presentation. Neither AGL Resources nor Nicor undertakes any obligation to update or revise any forward-

looking statement, except as may be required by law.

Resources’ and Nicor’s release regarding the merger, as well as under Item 1.A. in each of AGL Resources’ and Nicor’s Annual Report on Form 10-K for the fiscal

year ended 2009, and Item 1.A in each of AGL Resources’ and Nicor’s most recent Quarterly Report on Form 10-Q for the quarterly period ended September 30,

2010. AGL Resources and Nicor caution that the foregoing list of important factors that may affect future results is not exhaustive. When relying on forward-

looking statements to make decisions with respect to AGL Resources and Nicor, investors and others should carefully consider the foregoing factors and other

uncertainties and potential events. All subsequent written and oral forward looking statements concerning the proposed merger or other matters attributable to

AGL Resources or Nicor or persons acting on their behalf are expressly qualified by the cautionary statements referenced above. The forward-looking statements

contained herein speak only as of the date of this presentation. Neither AGL Resources nor Nicor undertakes any obligation to update or revise any forward-

looking statement, except as may be required by law.

3

Additional Information About the Merger

and Where to Find It

and Where to Find It

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

In connection with the proposed merger, AGL Resources plans to file with the SEC a Registration Statement on Form S-4 that will include a joint proxy statement

of AGL Resources and Nicor that also constitutes a prospectus of AGL Resources. AGL Resources and Nicor will mail the joint proxy statement/prospectus to

their respective stockholders. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE

BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. You will be able to obtain the joint proxy statement/prospectus, as well as other filings containing

information about AGL Resources and Nicor, free of charge, at the website maintained by the SEC at www.sec.gov. You may also obtain these documents, free

of charge, from AGL Resources’ website (www.aglresources.com) under the tab Investor Relations/SEC Filings or by directing a request to AGL Resources, P.O.

Box 4569, Atlanta, GA, 30302-4569. You may also obtain these documents, free of charge, from Nicor’s website (www.nicor.com) under the tab Investor

Information/SEC Filings or by directing a request to Nicor, P.O. Box 3014, Naperville, IL 60566-7014.

of AGL Resources and Nicor that also constitutes a prospectus of AGL Resources. AGL Resources and Nicor will mail the joint proxy statement/prospectus to

their respective stockholders. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE

BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. You will be able to obtain the joint proxy statement/prospectus, as well as other filings containing

information about AGL Resources and Nicor, free of charge, at the website maintained by the SEC at www.sec.gov. You may also obtain these documents, free

of charge, from AGL Resources’ website (www.aglresources.com) under the tab Investor Relations/SEC Filings or by directing a request to AGL Resources, P.O.

Box 4569, Atlanta, GA, 30302-4569. You may also obtain these documents, free of charge, from Nicor’s website (www.nicor.com) under the tab Investor

Information/SEC Filings or by directing a request to Nicor, P.O. Box 3014, Naperville, IL 60566-7014.

The respective directors and executive officers of AGL Resources and Nicor, and other persons, may be deemed to be participants in the solicitation of proxies in

respect of the proposed transaction. Information regarding AGL Resources’ directors and executive officers is available in its definitive proxy statement filed with

the SEC by AGL Resources on March 15, 2010, and information regarding Nicor directors and executive officers is available in its definitive proxy statement filed

with the SEC by Nicor on March 10, 2010. These documents can be obtained free of charge from the sources indicated above. Other information regarding the

interests of the participants in the proxy solicitation will be included in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC

when they become available. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any

securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

respect of the proposed transaction. Information regarding AGL Resources’ directors and executive officers is available in its definitive proxy statement filed with

the SEC by AGL Resources on March 15, 2010, and information regarding Nicor directors and executive officers is available in its definitive proxy statement filed

with the SEC by Nicor on March 10, 2010. These documents can be obtained free of charge from the sources indicated above. Other information regarding the

interests of the participants in the proxy solicitation will be included in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC

when they become available. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any

securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Transaction Overview

Key Terms

• AGL Resources to acquire Nicor Inc. for $3.1 billion based on $53.00 per Nicor share

Ø 40% cash, funded by long-term bonds prior to closing

Ø 60% stock

• Implied transaction premium of ~22% to unaffected closing price on December 1, 2010

• Implied transaction premium of ~17% based on the average volume-weighted Nicor closing

price over the last 20 trading days ending December 1, 2010

price over the last 20 trading days ending December 1, 2010

• Pro forma ownership: 67% AGL Resources / 33% Nicor

Dividend

Profile

Profile

Management &

Governance

Governance

• John Somerhalder to serve as Chairman, President and CEO of combined company

• Four Nicor board members to join AGL Resources board of directors

• Corporate headquarters in Atlanta, GA

• Distribution headquarters in Naperville, IL (Chicago suburb)

Approvals and

Timing

Timing

• Nicor and AGL Resources shareholder votes

• Primary required regulatory approvals

Ø Illinois Commerce Commission

Ø Hart-Scott-Rodino

Ø Federal Communications Commission

• Closing expected in the second half of 2011

4

• Dividend maintained for AGL Resources shareholders

• Implied 32% increase for stock portion of Nicor merger consideration

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

5

• Visible and achievable financial and operational benefits driven by

increased scale and scope

increased scale and scope

• Creates one of the lowest cost, most diversified natural gas utilities

• Combination of complementary unregulated businesses enhances

platform for growth

platform for growth

• Leverages AGL Resources’ transaction integration expertise

• Enhances earnings profile through expected EPS accretion and

increased growth rate

increased growth rate

• Combined company expected to maintain solid investment-grade

credit ratings

credit ratings

AGL Resources Combination Rationale

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

6

6

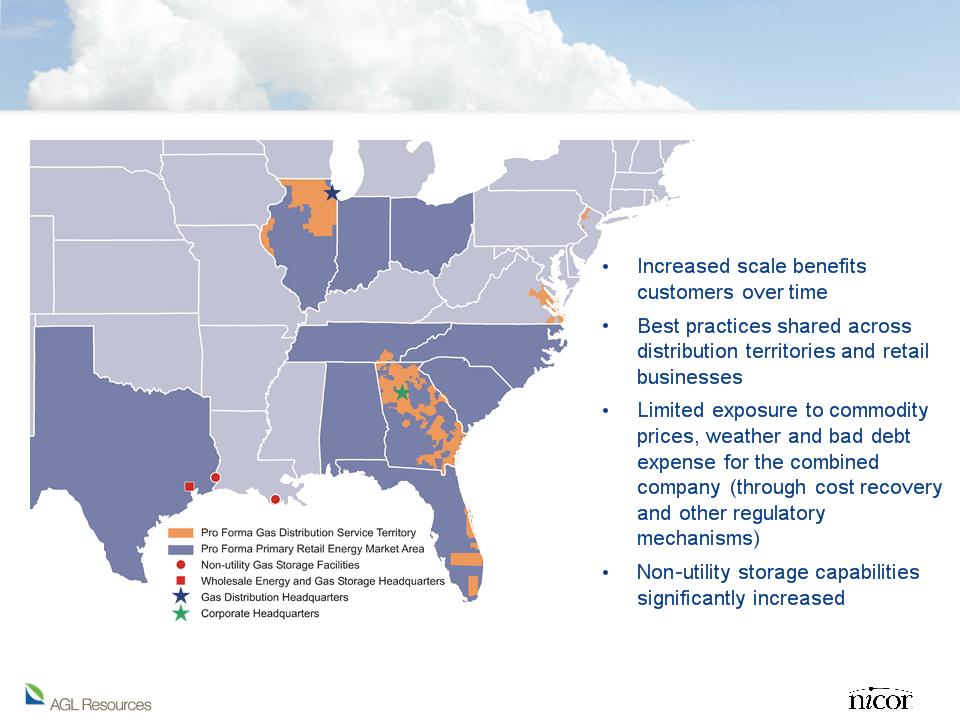

Combination Creates a Leading Gas

Distribution Business

Note: Map excludes Nicor Tropical Shipping business and Central Valley natural gas storage facility under construction in California.

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

7

Scale Enhancing Transaction

Market Capitalization ($bn)

Last Reported FY Distribution Customers (mm)

|

Market Cap ($bn)1

|

$4.4

|

|

LTM Revenue ($bn)

|

$5.1

|

|

LTM EBITDA ($bn)

|

$1.1

|

|

Utility Customers (mm)

|

4.5

|

|

2009 Rate Base ($bn)

|

$3.8

|

|

Regulated States

|

7

|

|

Total Employees

|

6,400

|

|

Retail Customers (mm)

|

1.1

|

|

Wholesale Gas Delivery

(Bcf/d) |

4.7

|

|

2012E Non Utility Storage

(Bcf) |

31

|

Combined Pro Forma Statistics

Source: SEC filings and Bloomberg as of 01-Dec-2010

1 Illustrative AGL Resources pro forma market capitalization based on AGL Resources share price as of 01-Dec-2010 and pro forma share count of 116.9 AGL Resources shares.

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

8

• Creates incremental revenue opportunities

• Integration of non-utility businesses enhances leadership position

across natural gas value chain

across natural gas value chain

– Leverages retail experience of both companies, including unique

Nicor service offerings

Nicor service offerings

– Combined company will have experience with salt dome, reservoir,

aquifer and market area LNG storage

aquifer and market area LNG storage

– Synergies expected from expanded geographic scope for Sequent

and consolidation of middle and back-office functions

and consolidation of middle and back-office functions

• Both companies have effectively run asset optimization

businesses

businesses

• Additional cost and revenue opportunities expected as we grow the

business

business

Complementary Unregulated Businesses

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Unregulated Asset Overview

Retail

Wholesale

Storage

• Markets gas commodities to retail

customers in GA & other states

customers in GA & other states

Other

9

AGL Resources

Nicor

• Markets energy-related retail

products including warranty plans, bill

management & HVAC-related

services

products including warranty plans, bill

management & HVAC-related

services

• Sequent provides natural gas asset

management, producer and storage

services, full-requirements supply and

peaking needs

management, producer and storage

services, full-requirements supply and

peaking needs

• Asset manager for all AGL Resources

utilities

utilities

• Jefferson Island storage facility in

Louisiana online (7.5 Bcf)

Louisiana online (7.5 Bcf)

• Golden Triangle storage facility in

Texas - first cavern online, second

cavern online in 2012 (12 Bcf total)

Texas - first cavern online, second

cavern online in 2012 (12 Bcf total)

• Central Valley storage facility in

California online 2012 (11 Bcf)

California online 2012 (11 Bcf)

• NA

• Tropical Shipping segment transports

containerized freight in the Caribbean

and Bahamas

containerized freight in the Caribbean

and Bahamas

• Expected to be ~4% of pro forma

EBIT

EBIT

• Enerchange provides wholesale

marketing of gas supply, transport

and storage services

marketing of gas supply, transport

and storage services

• Operates Chicago Hub

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

10

Pro Forma Business Mix

Remains a Highly Regulated Business

Remains a Highly Regulated Business

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

AGL Resources Standalone

2009 EBIT

2009 EBIT

AGL Resources Pro Forma 2009

EBIT

EBIT

Nicor Standalone

2009 EBIT

2009 EBIT

11

• Substantial upfront value to shareholders

– Implied transaction premium of ~22% to unaffected closing price on December 1, 2010

– Implied transaction premium of ~17% based on the average volume-weighted Nicor closing

price over the last 20 trading days ending December 1, 2010

price over the last 20 trading days ending December 1, 2010

– AGL Resources’ current dividend represents a 32% increase on the stock portion of

consideration for Nicor shareholders

consideration for Nicor shareholders

• Increased scope, scale and diversification of regulated operations

– Creates one of the largest gas utilities with operations in seven states

– Pro forma regulated EBIT contribution expected to remain at ~67%

• Highly complementary unregulated businesses

– Anticipate strong cash flow through additional growth opportunities

– Leverage AGL Resources’ transaction integration experience to generate high degree of

synergy potential

synergy potential

• Experienced management team committed to maintaining solid investment grade credit ratings

• Continued involvement of four Nicor Board members going forward

Nicor Combination Rationale

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Additional Nicor Transaction Benefits

• Customers can rely on same local gas companies

• Continuation of the industry-leading low rates

• Retention of the Nicor Gas brand and personnel

• Integration of Nicor Gas into AGL Resources’ family of gas utilities in a

seamless fashion for customers

seamless fashion for customers

Customers

Employees

• Establish newly expanded natural gas distribution headquarters in Naperville,

Illinois in the Chicago area

Illinois in the Chicago area

• Commitment to maintaining existing Nicor levels of community involvement

and charitable giving in Illinois

and charitable giving in Illinois

12

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Communities

• Commitment to maintain Nicor Gas employment levels in Illinois for at least

three years

three years

• New opportunities for employees created as part of a larger organization

• Combined company will continue to fully honor union collective bargaining

agreements

agreements

Financial Highlights

14

• Anticipate transaction to be neutral to AGL Resources’ EPS in the first year

post closing and accretive thereafter

post closing and accretive thereafter

– Expect accretion through scale benefits, cost efficiencies and the

enhanced revenue opportunities of the combined company

enhanced revenue opportunities of the combined company

• Financial and operational benefits from the combination expected to be highly

achievable

achievable

– Savings through the elimination of duplicate public company costs

– Mutual leveraging of respective retail business capabilities and services

across a broader geographic base

across a broader geographic base

– Efficiencies from similar and complementary unregulated wholesale and

retail businesses

retail businesses

• AGL Resources successfully integrated previous acquisitions for the

benefit of customers and shareholders

benefit of customers and shareholders

Pro Forma Earnings Profile

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

15

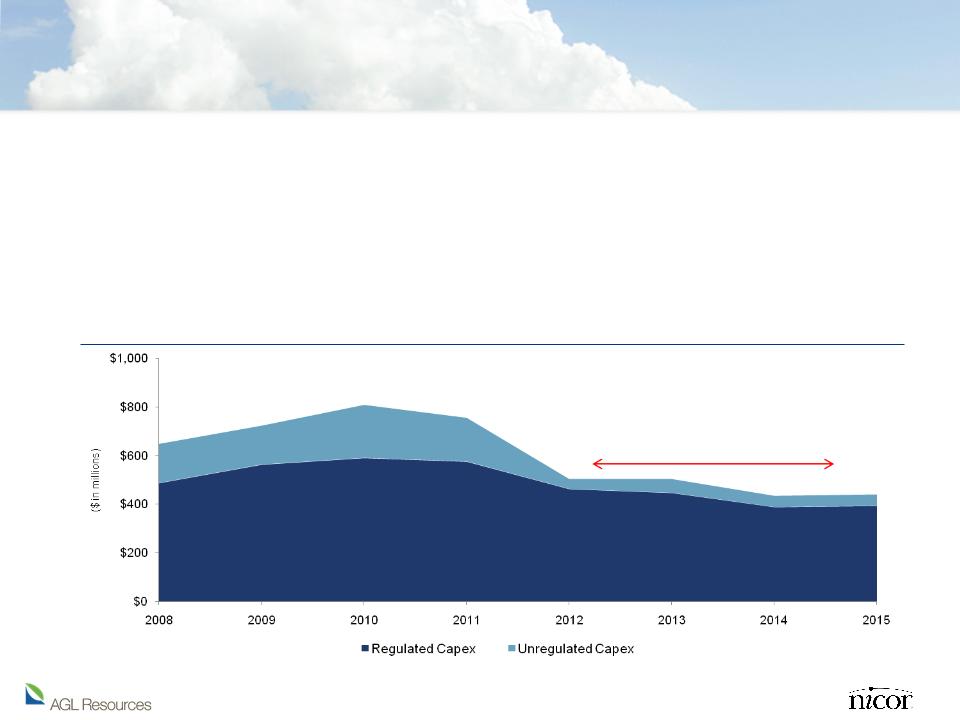

Pro Forma Capital Expenditure Profile

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Total Capital Expenditure Profile

Period of additional discretionary

cash flow for attractive capital

deployment opportunities

cash flow for attractive capital

deployment opportunities

• Pro forma business expected to have greater proportion of regulated capex

• Significant portion of regulatory capex under riders, reducing time for recovery

• Non-utility gas storage construction largely complete

– By year-end 2011, virtually all currently planned construction capex will have been

spent

spent

16

Strong Track Record of Dividend Growth

Commitment to Steady Payout Ratio

Commitment to Steady Payout Ratio

AGL Resources Dividend Per Share and Payout Ratio

• Strong cash generation and investment grade balance sheet to support dividend

• Expected to grow dividend in-line with earnings and maintain payout ratio

consistent with peer group

consistent with peer group

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

17

Strong Credit Profile

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

|

Pro Forma Key Credit

Ratios |

Average

2005-2009 |

Year 1

|

Year 2

|

|

Funds from Operations/

Total Debt

|

21%

|

20% - 22%

|

22% - 24%

|

|

Funds from Operations

Interest Coverage

|

5.2x

|

4.8x - 5.2x

|

4.8x - 5.2x

|

|

Debt / EBITDA

|

3.9x

|

3.1x - 3.5x

|

2.9x - 3.3x

|

|

Debt / Capitalization

|

58%

|

52% - 55%

|

50% - 53%

|

• Combined businesses expected to generate strong operating cash flow

• Solid balance sheet with significant opportunity to fund growth capital requirements

• Combined company credit metrics expected to support solid, investment-grade

credit ratings

credit ratings

(1)

(1)

Value Creation Potential

• Enhanced EPS growth

opportunities

opportunities

• Greater stock liquidity

• Broader equity

research coverage

research coverage

• Expected inclusion in

additional important

indices

additional important

indices

Improved P/E

Potential

Potential

¹ Based on I/B/E/S consensus EPS estimates and market data as of 01-Dec-2010

18

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Transaction Timeline and Summary

Transaction Timeline

Dec 2010

Closing Expected in the Second Half of 2011

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Transaction

Announced

Announced

File Joint Proxy

Statement

Statement

Secure Regulatory Approvals

AGL Resources and

Nicor Shareholder

Meetings

Nicor Shareholder

Meetings

Develop Transition Implementation Plans

Close Transaction

prairielight\02.

Presentations\Investor Relations

Pres\Investor Presentation_Final

Draft_12.7.pptx

Presentations\Investor Relations

Pres\Investor Presentation_Final

Draft_12.7.pptx

20

Long-Term Financing for Cash

Consideration

Consideration

21

Summary

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

|

• Combined company poised to deliver superior returns

|

|

• Additional scope and scale expected to enhance low cost leadership position

and optimize capital spending opportunities |

|

• Complementary unregulated businesses with enhanced opportunities

|

|

• Non-utility storage investment requirements for both companies will be nearly

complete at transaction closing |

|

• Significant cash flow generation for attractive capital deployment opportunities

|

|

• Dividend growth supported by solid investment grade balance sheet

|

|

• Seasoned and well regarded management team with proven track record

|

Appendix

Detailed Utility Profile

23

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

|

State

|

Rate Base

|

% of Total

|

Customers (mm)

|

% of Total

|

|

Regulatory Attributes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Illinois

|

$ 1,338.3

|

35%

|

2.2

|

49%

|

|

Bad Debt Expense Tracker,

Recently Approved Avg. HDD |

|

Georgia

|

1,323.0

|

35%

|

1.6

|

35%

|

|

Decoupling

|

|

New Jersey

|

448.0

|

12%

|

0.3

|

6%

|

|

Weather Normalization

|

|

Virginia

|

442.0

|

12%

|

0.3

|

6%

|

|

Decoupling, Weather

Normalization |

|

Florida

|

153.0

|

4%

|

0.1

|

2%

|

|

Negotiated Rates Over

5-yr Period

|

|

Tennessee

|

105.0

|

3%

|

0.1

|

1%

|

|

Revenue Normalization

|

|

Maryland

|

NA

|

|

0.0

|

0%

|

|

Revenue Normalization

|

|

Total

|

$ 3,809.3

|

100%

|

4.5

|

100%

|

|

|

Note: Totals may not sum due to rounding.

Nicor Dividend Uplift

|

|

Per Share

|

|

AGL Resources current dividend (maintained for AGL Resources SH’s)

|

$1.76

|

|

× Transaction Exchange ratio1

|

1.397x

|

|

Implied Nicor exchange ratio adjusted dividend

|

$2.46

|

|

|

|

|

Current Nicor Dividend

|

$1.86

|

|

Dividend Uplift for Nicor (Stock Portion of Consideration)

|

$0.60 or ~32%

|

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

24

• Both companies to continue existing dividend policy through closing

• Pro Forma dividend policy expected to retain focus of growing dividend in-line with

earnings

earnings

• Nicor shareholders will receive a dividend uplift for the stock portion of consideration

based on current annual dividends per share. Example below:

based on current annual dividends per share. Example below:

1 Transaction exchange ratio based on the 20 day volume weighted average stock price for AGL for the 20 days ending December 1, 2010.