Attached files

| file | filename |

|---|---|

| EX-31.1 - Benda Pharmaceutical, Inc. | v203300_ex31-1.htm |

| EX-32.1 - Benda Pharmaceutical, Inc. | v203300_ex32-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-Q

|

x

|

QUARTERLY REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the quarterly period ended September 30, 2010

|

o

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the transition period from ______to______.

BENDA

PHARMACEUTICAL, INC.

(Exact

name of registrant as specified in Charter

|

Delaware

|

000-16397

|

41-2185030

|

||

|

(State

or other jurisdiction of

incorporation

or organization)

|

(Commission

File No.)

|

(IRS

Employee Identification

No.)

|

Taibei

Mingju, 4th

Floor,

6

Taibei Road, Wuhan, Hubei Province, 430015, PRC

(Address

of Principal Executive Offices)

+86

(27) 85494916

(Issuer

Telephone number)

(Former

Name or Former Address if Changed Since Last Report)

Check

whether the issuer (1) has filed all reports required to be filed by Section 13

or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter

period that the issuer was required to file such reports), and (2)has been

subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes ¨ No ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company filer.

See definition of “accelerated filer” and “large accelerated filer” in

Rule 12b-2 of the Exchange Act (Check one):

Large

Accelerated Filer ¨ Accelerated

Filer ¨ Non-Accelerated

Filer ¨ Smaller

Reporting Company x

Indicate

by check mark whether the registrant is a shell company as defined in Rule 12b-2

of the Exchange Act.

Yes ¨ No x

State the

number of shares outstanding of each of the issuer’s classes of common equity,

as of November 19, 2010: 105,155,355 shares of common stock.

BENDA

PHARMACEUTICAL, INC.

FORM

10-Q

September

30, 2010

INDEX

|

PART

I— FINANCIAL INFORMATION

|

|||

|

Item

1.

|

Financial

Statements

|

3

|

|

|

Item

2.

|

Management’s

Discussion and Analysis of Financial Condition

|

17

|

|

|

Item

3.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

22

|

|

|

Item

4T.

|

Control

and Procedures

|

22

|

|

|

PART

II— OTHER INFORMATION

|

|||

|

Item

1

|

Legal

Proceedings

|

23

|

|

|

Item

2.

|

Unregistered

Sales of Equity Securities and Use of Proceeds

|

26

|

|

|

Item

3.

|

Defaults

Upon Senior Securities

|

26

|

|

|

Item

4.

|

(Removed

and Reserved)

|

26

|

|

|

Item

5.

|

Other

Information

|

26

|

|

|

Item

6.

|

Exhibits

|

27

|

|

|

SIGNATURE

|

28

|

||

2

PART

I—FINANCIAL INFORMATION

Item

1. Financial Information

Benda

Pharmaceutical, Inc.

Consolidated

Balance Sheets

|

September 30,

2010

|

December 31,

2009

|

|||||||

|

(Unaudited)

|

||||||||

|

Assets

|

||||||||

|

Current

Assets

|

||||||||

|

Cash

and cash equivalents

|

$

|

1,398,815

|

$

|

191,095

|

||||

|

Trade

receivables, net of allowance of doubtful accounts of $5,318,313 and

$5,202,311,

respectively

|

13,975,083

|

12,405,018

|

||||||

|

Advance

for inventory purchase

|

2,149,960

|

2,110,857

|

||||||

|

Note

receivables

|

-

|

81,426

|

||||||

|

Inventories

|

4,355,908

|

2,038,987

|

||||||

|

Due

from related parties, short term

|

305,271

|

30,861

|

||||||

|

Prepaid

expenses and other current assets

|

1,082,665

|

1,720,237

|

||||||

|

Total

current assets

|

23,267,702

|

18,578,481

|

||||||

|

Due

from related parties, long term

|

3,120,477

|

3,032,726

|

||||||

|

Property

and equipments, net

|

28,645,233

|

28,658,131

|

||||||

|

Investment

|

119,760

|

-

|

||||||

|

Intangible

assets, net

|

6,307,780

|

6,629,501

|

||||||

|

Restricted

cash

|

4,762,897

|

4,409,334

|

||||||

|

Other

assets

|

2,338,697

|

2,285,581

|

||||||

|

Total

Assets

|

$

|

68,562,546

|

$

|

63,593,754

|

||||

|

Liabilities

& Shareholders' Equity

|

||||||||

|

Current

Liabilities

|

||||||||

|

Accounts

payable

|

$

|

1,672,332

|

$

|

902,079

|

||||

|

Customer

deposit

|

1,341,377

|

1,507,147

|

||||||

|

Other

payable

|

4,453,474

|

4,547,558

|

||||||

|

Accrued

liabilities

|

7,681,574

|

6,175,538

|

||||||

|

Convertible

notes

|

7,260,000

|

7,260,000

|

||||||

|

Short-term

debt

|

14,132,787

|

11,598,066

|

||||||

|

Accrued

VAT and other taxes

|

709,132

|

795,013

|

||||||

|

Acquisition

price payable

|

1,455,807

|

1,422,743

|

||||||

|

Wages

payable

|

|

432,338

|

1,187,075

|

|||||

|

Due

to related parties, short term

|

|

2,857,055

|

2,791,447

|

|||||

|

Redeemable

common stock, 2,049,560 shares at $3.6 per share

|

7,376,366

|

7,376,366

|

||||||

|

Total

current liabilities

|

49,372,242

|

45,563,032

|

||||||

|

Government

grant payable

|

1,831,026

|

1,789,439

|

||||||

|

Due

to related parties, long-term

|

120,949

|

118,202

|

||||||

|

Deferred

tax liability

|

754,483

|

778,026

|

||||||

|

Total

liabilities

|

52,078,700

|

48,248,699

|

||||||

|

Shareholders'

Equity

|

||||||||

|

Preferred

stock, $0.001 par value; 5,000,000 shares authorized;

|

||||||||

|

None

issued and outstanding

|

-

|

-

|

||||||

|

Common

stock, $0.001 par value; 150,000,000 shares authorized; 105,155,355 shares

issued and outstanding

|

105,155

|

105,155

|

||||||

|

Additional

paid in capital

|

22,108,427

|

22,108,427

|

||||||

|

Accumulated

deficit

|

(18,346,146

|

)

|

(17,481,559

|

)

|

||||

|

Statutory

surplus reserve fund

|

2,642,775

|

2,642,775

|

||||||

|

Accumulative

other comprehensive income

|

8,218,466

|

6,268,111

|

||||||

|

Shares

issuable for services

|

503,860

|

503,860

|

||||||

|

Total

Benda Pharmaceutical, Inc.'s Shareholders' Equity

|

15,232,537

|

14,146,769

|

||||||

|

Noncontrolling

Interest

|

1,251,309

|

1,198,286

|

||||||

|

Total

Shareholders' Equity

|

16,483,846

|

15,345,055

|

||||||

|

Total

Liabilities & Shareholders' Equity

|

$

|

68,562,546

|

$

|

63,593,754

|

||||

The

accompany notes are an integral part of these consolidated financial

statements.

3

Benda

Pharmaceutical, Inc.

Consolidated

Statements of Operations

(Unaudited)

|

NINE MONTHS ENDED

|

THREE MONTHS ENDED

|

|||||||||||||||

|

SEPTEMBER 30,

|

SEPTEMBER 30,

|

|||||||||||||||

|

(Restated)

|

(Restated)

|

|||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

|||||||||||||

|

Revenue

|

$

|

16,857,713

|

$

|

17,345,065

|

$

|

6,697,864

|

$

|

5,904,653

|

||||||||

|

Cost

of goods sold

|

(9,499,325

|

)

|

(9,770,370

|

)

|

(3,734,008

|

)

|

(3,071,291

|

)

|

||||||||

|

Gross

profit

|

7,358,388

|

7,574,695

|

2,963,856

|

2,833,362

|

||||||||||||

|

Selling

expenses

|

(1,786,412

|

)

|

(1,868,482

|

)

|

(421,395

|

)

|

(852,116

|

)

|

||||||||

|

General

and administrative expenses

|

(2,061,356

|

)

|

(5,230,595

|

)

|

(618,268

|

)

|

(1,208,938

|

)

|

||||||||

|

Depreciation

and amortization expenses

|

(1,268,299

|

)

|

(724,749

|

)

|

(451,329

|

)

|

(278,967

|

)

|

||||||||

|

Research

and development expenses

|

(1,154,203

|

)

|

(283,473

|

)

|

(388,921

|

)

|

(165,390

|

)

|

||||||||

|

Total

operating expenses

|

(6,270,270

|

)

|

(8,107,299

|

)

|

(1,879,913

|

)

|

(2,505,411

|

)

|

||||||||

|

Operating

income / (loss)

|

1,088,118

|

(532,604

|

)

|

1,083,943

|

327,951

|

|||||||||||

|

Interest

expense

|

(1,187,545

|

)

|

(2,104,510

|

)

|

(458,777

|

)

|

(471,263

|

)

|

||||||||

|

Other

income (expense)

|

(14,813

|

)

|

106,161

|

(3,248

|

)

|

60,385

|

||||||||||

|

Government

subsidies

|

-

|

26,386

|

-

|

3

|

||||||||||||

|

Net

income (loss) before income taxes

|

(114,240

|

)

|

(2,504,567

|

)

|

621,918

|

(82,924

|

)

|

|||||||||

|

Income

taxes

|

(654,921

|

)

|

(123,043

|

)

|

(338,326

|

)

|

(65,808

|

)

|

||||||||

|

Net

Income (Loss)

|

(769,161

|

)

|

(2,627,610

|

)

|

283,592

|

(148,732

|

)

|

|||||||||

|

Less:

Net income (loss) attributable to the noncontrolling

Interests

|

95,426

|

(166,068

|

)

|

46,004

|

64,824

|

|||||||||||

|

Net

income (loss) attributable to Benda Pharmaceutical, Inc.

|

$

|

(864,587

|

)

|

$

|

(2,461,542

|

)

|

$

|

237,588

|

$

|

(213,556

|

)

|

|||||

|

Other

Comprehensive Income (Loss)

|

||||||||||||||||

|

Foreign

currency translation gain

|

1,907,952

|

-

|

1,750,042

|

461,784

|

||||||||||||

|

Comprehensive

Income (Loss)

|

1,138,791

|

(2,627,610

|

)

|

2,033,634

|

313,052

|

|||||||||||

|

Comprehensive

income (loss) attributable to the noncontrolling interest

|

53,023

|

(166,068

|

)

|

183,512

|

64,824

|

|||||||||||

|

Comprehensive

income (loss) attributable to Benda Pharmaceutical, Inc.

|

$

|

1,085,768

|

$

|

(2,461,542

|

)

|

$

|

1,850,122

|

$

|

248,228

|

|||||||

|

Net

earnings (loss) per share - basic and diluted

|

||||||||||||||||

|

Net

earnings (loss) attributable to Benda Pharmaceutical, Inc.

|

$

|

(0.01

|

)

|

$

|

(0.02

|

)

|

$

|

0.00

|

$

|

(0.00

|

)

|

|||||

|

Weighted

average shares outstanding - basic and diluted

|

105,155,355

|

105,155,355

|

105,155,355

|

105,155,355

|

||||||||||||

The

accompany notes are an integral part of these consolidated financial

statements.

4

Benda

Pharmaceutical, Inc.

Consolidated

Statements of Cash Flows

(Unaudited)

|

NINE MONTHS ENDED

SEPTEMBER 30,

|

||||||||

|

2010

|

2009

|

|||||||

|

(Restated)

|

||||||||

|

Cash

Flows From Operating Activities

|

||||||||

|

Net

loss

|

$

|

(769,161

|

)

|

$

|

(2,627,610

|

)

|

||

|

Adjustments

to reconcile net loss to net cash provided by (used in) operating

activities:

|

||||||||

|

Loss

on disposals of fixed assets

|

4,551

|

-

|

||||||

|

Bad

debt provision

|

243,929

|

3,080,334

|

||||||

|

Inventory

written down to net realizable value

|

-

|

196,628

|

||||||

|

Depreciation,

including amounts in cost of sales

|

1,737,563

|

1,471,304

|

||||||

|

Amortization

of intangible assets

|

442,467

|

528,501

|

||||||

|

Amortization

of debt issuance costs

|

-

|

55,485

|

||||||

|

Amortization

of convertible notes discount

|

-

|

864,049

|

||||||

|

Changes

in operating assets and liabilities:

|

||||||||

|

Trade

receivables

|

(1,813,993

|

)

|

(2,435,969

|

)

|

||||

|

Advance

for inventory purchase

|

(39,103

|

)

|

(2,294,717

|

)

|

||||

|

Prepaid

expenses and other current assets

|

637,572

|

(1,015,785

|

)

|

|||||

|

Inventories

|

(2,316,921

|

)

|

(195,850

|

)

|

||||

|

Accounts

payable

|

2,276,288

|

2,860,986

|

||||||

|

Customer

deposit

|

(165,770

|

)

|

-

|

|||||

|

Other

payable

|

(116,029

|

)

|

-

|

|||||

|

Wages

payable

|

(754,737

|

)

|

-

|

|||||

|

Accrued

taxes

|

(109,424

|

)

|

396,142

|

|||||

|

Net

cash provided by (used in) operating activities

|

(742,768

|

)

|

883,498

|

|||||

|

Cash

Flows From Investing Activities

|

||||||||

|

Investment

in joint venture

|

(119,760

|

)

|

-

|

|||||

|

Purchases

of property and equipment and construction-in-progress

|

(688,892

|

)

|

(455,488

|

)

|

||||

|

Restricted

cash

|

(353,563

|

)

|

-

|

|||||

|

Collection

of notes receivable

|

81,426

|

154,691

|

||||||

|

Net

cash used in investing activities

|

(1,080,789

|

)

|

(300,797

|

)

|

||||

|

|

||||||||

|

Cash

Flows From Financing Actives

|

||||||||

|

Proceeds

and repayments of borrowings under related parties, net

|

(293,806

|

)

|

-

|

|||||

|

Proceeds

and repayments of borrowings under short term debt

|

2,556,666

|

10,807

|

||||||

|

Net

cash provided by (used in) financing activities

|

2,262,860

|

10,807

|

||||||

|

Effect

of exchange rate changes on cash

|

768,417

|

303,761

|

||||||

|

Net

increase in cash and cash equivalents

|

1,207,720

|

897,269

|

||||||

|

Cash

and cash equivalents, beginning of period

|

191,095

|

584,266

|

||||||

|

Cash

and cash equivalents, end of period

|

$

|

1,398,815

|

$

|

1,481,535

|

||||

|

Supplemental

Disclosure of Cash Flow Information

|

||||||||

|

Cash

paid for interest

|

$

|

99,312

|

$

|

298,139

|

||||

|

Cash

paid for income taxes

|

$

|

344,214

|

$

|

935,208

|

||||

The

accompany notes are an integral part of these consolidated financial

statements

5

Benda

Pharmaceutical, Inc.

Notes

to Consolidated Financial Statements

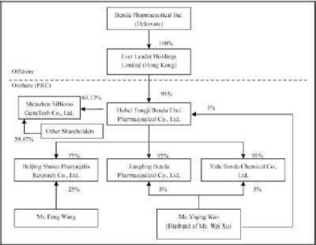

1. Organization

Benda

Pharmaceutical, Inc. (“Benda”) is a corporation organized under Delaware Law and

headquartered in Hubei Province, the People’s Republic of China

(“PRC”).

Ever

Leader Holdings Limited (“Ever Leader”), a wholly owned subsidiary of Benda, is

a company incorporated under the laws of Hong Kong SAR.

Ever

Leader owns 95% of the issued and outstanding capital of Hubei Tongji Benda Ebei

Pharmaceutical Co. Ltd. (“Benda Ebei”), a Sino-Foreign Equity Joint Venture

company incorporated under the laws of PRC. Mr. Yiqing Wan owns 5% of the issued

and outstanding capital stock of Benda Ebei. Benda Ebei owns: (i) 95% of the

issued and outstanding capital stock of Jiangling Benda Pharmaceutical Co. Ltd.,

(“Jiangling Benda”) a company formed under the laws of PRC; (ii) 95% of the

issued and outstanding capital stock of Yidu Benda Chemical Co. Ltd., (“Yidu

Benda”) a company incorporated under the laws of PRC; and (iii) 75% of the

issued and outstanding capital stock of Beijing Shusai Pharyngitis Research Co.

Ltd., (“Beijing Shusai”) a company incorporated under the laws of PRC. Mr.

Yiqing Wan owns: (i) 5% of the issued and outstanding capital stock of Jingling

Benda; and (ii) 5% of the issued and outstanding capital stock of Yidu Benda.

Mr. Feng Wang owns 25% of the issued and outstanding capital stock of Beijing

Shusai.

On April

5, 2007, Benda Ebei entered into an Equity Transfer Agreements with Shenzhen

Yuanzheng Investment Development Co., Ltd. and Shenzhen Yuanxing Gene City

Development Co., Ltd., the shareholders of Shenzhen SiBiono GeneTech Co., Ltd

(“SiBiono”), to purchase 27.57% and 30% respectively of the shares of SiBiono’s

common stock for total consideration of RMB 60 million due and payable on or

before April 30, 2007. On June 11, 2007, Benda Ebei entered into an Equity

Transfer Agreement with Huimin Zhang and Yaojin Wang, the individual

shareholders of SiBiono, to purchase 1.6% and 0.96% respectively of the shares

of SiBiono’s common stock for total consideration of RMB 2.56 million due

and payable on or before June 30, 2007. Altogether, the total

consideration for 60.13% shares of SiBiono’s common stock was RMB 62.56

million or $8.58 million. As of Sep 30, 2010 an accumulated amount,

approximately RMB 52.83 million or $7.16 million was paid leaving a balance of

RMB 9.73 million or $1.42 million.

Benda,

Ever Leader, Benda Ebei, Jiangling Benda, Yidu Benda, Beijing Shusai and SiBiono

shall be referred to herein collectively as the “Company”. The Company is

engaged principally in the business of identifying, discovering, developing, and

manufacturing conventional medicines, active pharmaceuticals, bulk chemicals (or

pharmaceutical immediates), and Traditional Chinese Medicines (“TCM”) for the

treatment of some of the most widespread common ailments and diseases (e.g.

common cold, diabetes, and cancer).

The

organization and ownership structure of the Company is as follows:

Going

Concern

The

accompanying consolidated financial statements have been prepared assuming that

the Company will continue as a going concern. As reflected in the accompanying

consolidated financial statements, the Company has recurring losses and has a

working capital deficiency at September 30, 2010. These conditions raise

substantial doubt as to the Company’s ability to continue as a going

concern.

6

While the

Company is attempting to produce sufficient revenues, the Company’s cash

position may not be enough to support the Company’s daily operations. Management

intends to raise additional funds by way of a public or private offering.

Management believes that the actions presently being taking to further implement

its business plan and generate sufficient revenues provide the opportunity for

the Company to continue as a going concern. While the Company believes in the

viability of its strategy to increase revenues and in its ability to raise

additional funds, there can be no assurance to that effect. The ability of the

Company to continue as a going concern is dependent upon the Company’s ability

to further implement its business plan and generate sufficient revenues. The

financial statements do not include any adjustments that might be necessary if

the Company is unable to continue as a going concern.

2. Basis

of Preparation

The

accompanying unaudited consolidated financial statements of the Company have

been prepared in accordance with accounting principles generally accepted in the

United States of America and rules of the Securities and Exchange Commission,

and should be read in conjunction with the audited financial statements and

notes thereto contained in the Company’s annual report on Form 10-K for the

year ended December 31, 2009 filed with the SEC on May 18, 2010. In the opinion

of management, all adjustments, consisting of normal recurring adjustments,

necessary for a fair presentation of financial position and the results of

operations for the interim periods presented have been reflected herein. The

results of operations for interim periods are not necessarily indicative of the

results to be expected for the full year. Notes to the consolidated financial

statements which would substantially duplicate the disclosure contained in the

audited financial statements as reported in the 2009 annual report on Form 10-K

have been omitted.

These

consolidated financial statements include the accounts of Benda, Ever Leader,

Benda Ebei, Jiangling Benda, Yidu Benda, Beijing Shusai and Sibiono. All

significant inter-company balances and transactions have been eliminated in the

consolidation.

Certain

amounts in the consolidated financial statements for the prior year have been

reclassified to conform to the presentation of the current year.

The

preparation of financial statements in conformity with US GAAP requires

management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and liabilities at

the date of the financial statements, and the reported amounts of

revenue and expenses during the reporting period. Actual results when

ultimately realized could differ from those estimates.

3. Earnings per

share

Basic earnings per share is computed by

dividing net income by weighted average number of shares of common stock

outstanding during each period. Diluted earnings per share is

computed by dividing net income by the weighted average number of shares of

common stock, common stock equivalents and potentially diluting securities

outstanding during each period. At September 30, 2010, potential

dilutive securities had an anti-dilutive effect and were not included in the

calculation of diluted earnings per share.

4. Restatement

On May

12, 2010, the Company discovered that its financial statements for the year

ended December 31, 2008 and 2007, and the quarterly periods within the year 2007

to 2009 should not be relied upon due to multiple errors found in the accounting

treatment of a business combination transaction completed in March 2007

resulting in adjustment of assets and liabilities to fair market value. The

Company also adjusted certain other assets and intangible assets due to errors

in the accounting treatment of these assets resulting in additional expenses for

the prior periods. To correct the above noted errors, the Company has restated

the accompanying Consolidated Statements of Operations and Cash Flows for the

three and nine months period ended September 30, 2009, and the notes to the

consolidated financial statements. The impact to the September 30, 2009 Balance

Sheet is not presented here. The following is a summary items affected by the

corrections described above:

7

|

NINE MONTHS ENDED SEPTEMBER 30, 2009

|

||||||||||||

|

As previously

reported

|

Adjustments

|

As Restated

|

||||||||||

|

Revenue

|

$

|

17,345,065

|

$

|

-

|

$

|

17,345,065

|

||||||

|

Cost

of goods sold

|

(9,770,370

|

)

|

-

|

(9,770,370

|

)

|

|||||||

|

Gross

profit

|

7,574,695

|

-

|

7,574,695

|

|||||||||

|

Selling

expenses

|

(1,868,482

|

)

|

-

|

(1,868,482

|

)

|

|||||||

|

General

and administrative expenses

|

||||||||||||

|

Bad

debts

|

(3,080,334

|

)

|

-

|

(3,080,334

|

)

|

|||||||

|

Depreciation

and amortization expense

|

(688,730

|

)

|

(36,019

|

)

|

(724,749

|

)b

|

||||||

|

Inventory

wirtten down to net realizable value

|

(196,628

|

)

|

-

|

(196,628

|

)

|

|||||||

|

Other

general and administrative expenses

|

(2,008,979

|

)

|

55,346

|

(1,953,633

|

)a

|

|||||||

|

Research

and development expenses

|

(283,473

|

)

|

-

|

(283,473

|

)

|

|||||||

|

Total

operating expenses

|

(8,126,626

|

)

|

19,327

|

(8,107,299

|

)

|

|||||||

|

Operating

loss

|

(551,931

|

)

|

19,327

|

(532,604

|

)

|

|||||||

|

Other

income (expenses)

|

||||||||||||

|

Government

subsidies / grants

|

26,386

|

-

|

26,386

|

|||||||||

|

Interest

income

|

-

|

-

|

-

|

|||||||||

|

Interest

expenses

|

(2,104,510

|

)

|

-

|

(2,104,510

|

)

|

|||||||

|

Other

income

|

106,161

|

-

|

106,161

|

|||||||||

|

Net

loss before income taxes

|

(2,523,894

|

)

|

19,327

|

(2,504,567

|

)

|

|||||||

|

Income

taxes

|

(163,803

|

)

|

40,760

|

(123,043

|

)c

|

|||||||

|

Net

loss

|

(2,687,697

|

)

|

60,087

|

(2,627,610

|

)c

|

|||||||

|

Less:

Net loss attributable to the noncontrolling interests

|

(123,599

|

)

|

(42,469

|

)

|

(166,068

|

)c

|

||||||

|

Net

loss attributable to Benda Pharmaceutical, Inc.

|

$

|

(2,564,098

|

)

|

$

|

102,556

|

$

|

(2,461,542

|

)

|

||||

|

Other

Comprehensive Loss

|

||||||||||||

|

Foreign

currency translation loss

|

-

|

-

|

-

|

|||||||||

|

Comprehensive

Loss

|

(2,687,697

|

)

|

60,087

|

(2,627,610

|

)

|

|||||||

|

Comprehensive

loss attributable to the noncontrolling interest

|

(123,599

|

)

|

(42,469

|

)

|

(166,068

|

)c

|

||||||

|

Comprehensive

loss attributable to Benda Pharmaceutical, Inc.

|

$

|

(2,564,098

|

)

|

$

|

(102,556

|

)

|

$

|

(2,461,542

|

)

|

|||

|

Net

loss per share - basic and diluted

|

||||||||||||

|

Net

loss attributable to Benda Pharmaceutical, Inc.

|

$

|

(0.02

|

)

|

$

|

(0.02

|

)

|

||||||

|

Weighted

average shares outstanding - basic and diluted

|

105,155,355

|

105,155,355

|

||||||||||

8

Benda

Pharmaceutical, Inc.

Consolidated

Statements of Cash Flows

(unaudited)

|

NINE MONTHS ENDED SEPTEMBER 30, 2009

|

||||||||||||

|

As previously

reported

|

Adjustments

|

As Restated

|

||||||||||

|

Cash

Flows From Operating Activities

|

||||||||||||

|

Net

loss

|

$

|

(2,687,697

|

)

|

$

|

60,087

|

$

|

(2,627,610

|

)c

|

||||

|

Adjustments

to reconcile net loss to net cash provided by operating

activities:

|

-

|

|||||||||||

|

Bad

debt provision

|

3,080,334

|

-

|

3,080,334

|

|||||||||

|

Inventory

written down to net realizable value

|

196,628

|

-

|

196,628

|

|||||||||

|

Depreciation,

including amounts in cost of sales

|

1,471,304

|

-

|

1,471,304

|

|||||||||

|

Amortization

of intangible assets

|

547,919

|

(19,418

|

)

|

528,501

|

b

|

|||||||

|

Amortization

of debt issuance costs

|

55,485

|

-

|

55,485

|

|||||||||

|

Amortization

of convertible notes discount

|

864,049

|

-

|

864,049

|

|||||||||

|

Changes

in operating assets and liabilities:

|

||||||||||||

|

Trade

receivables

|

(2,427,968

|

)

|

(8,001

|

)

|

(2,435,969

|

)d

|

||||||

|

Advance

for inventory purchase

|

-

|

(2,294,717

|

)

|

(2,294,717

|

)d

|

|||||||

|

Inventories

|

(195,850

|

)

|

-

|

(195,850

|

)

|

|||||||

|

Prepaid

expenses and other current assets

|

(1,578,837

|

)

|

563,052

|

(1,015,785

|

)d

|

|||||||

|

Accounts

payable

|

2,860,986

|

-

|

2,860,986

|

|

||||||||

|

Accrued

taxes

|

(991,582

|

)

|

1,387,724

|

396,142

|

d

|

|||||||

|

Net

cash provided by operating activities

|

1,194,771

|

(311,273

|

)

|

883,498

|

||||||||

|

Cash

Flows From Investing Activities

|

-

|

|||||||||||

|

Collection

of notes receivable

|

154,691

|

154,691

|

d

|

|||||||||

|

Purchases

of property and equipment and construction-in-progress

|

(455,488

|

)

|

-

|

(455,488

|

)

|

|||||||

|

Net

cash used in investing activities

|

(455,488

|

)

|

154,691

|

(300,797

|

)

|

|||||||

|

Cash

Flows From Financing Actives

|

||||||||||||

|

Proceeds

and repayments of borrowings under short term debt

|

69,172

|

(58,365

|

)

|

10,807

|

d

|

|||||||

|

Net

cash used in financing activities

|

69,172

|

(58,365

|

)

|

10,807

|

||||||||

|

Effect

of exchange rate changes on cash

|

579

|

303,182

|

303,761

|

c

|

||||||||

|

Net

increase in cash and cash equivalents

|

809,034

|

88,235

|

897,269

|

|||||||||

|

Cash

and cash equivalents, beginning of period

|

569,019

|

15,247

|

584,266

|

c

|

||||||||

|

Cash

and cash equivalents, end of period

|

$

|

1,378,053

|

$

|

103,482

|

$

|

1,481,535

|

||||||

a – These

are minor reclassifications between G&A expense items.

b - When

SiBiono was acquired at March 31, 2007, the assets and liabilities of SiBiono

were not fair valued at March 31, 2007. The differences in these items are due

to the difference between the fair value per valuation and book value at March

31, 2007.

c – The

combination of other adjustments above.

d – Due

to minor reclassifications between asset and liability items.

9

5. Inventories

The

Company’s inventories were comprised as follows:

|

September 30,

2010

|

December 31,

2009

|

|||||||

|

Raw materials

|

$

|

2,685,169

|

$

|

489,348

|

||||

|

Packing

materials

|

294,151

|

290,601

|

||||||

|

Other

materials / supplies

|

69,123

|

83,247

|

||||||

|

Finished

goods

|

1,258,283

|

588,604

|

||||||

|

Work-in-process

|

58,659

|

596,449

|

||||||

|

Total

inventories at cost

|

4,365,385

|

2,048,249

|

||||||

|

Less:

Reserves on inventories

|

(9,477

|

)

|

(9,262

|

)

|

||||

|

Total

inventories, net

|

$

|

4,355,908

|

$

|

2,038,987

|

||||

6. Short-term

debt

The

Company’s short term debt was comprised as follows:

|

September 30,

2010

|

December 31,

2009

|

|||||||

|

Ebei

- one year bank loan due in October 2010 but paid off in September 2010,

bear interest at 9% per annum, secured by Ebei Benda’s

Machinery.

|

$

|

-

|

$

|

438,900

|

||||

|

Ebei

- one year bank loan due in September 2011, bear interest at 9% per annum,

secured by Ebei Benda’s Machinery.

|

$

|

299,400

|

$

|

-

|

||||

|

Ebei-

bank acceptance notes from SHPudong Development Bank with redemption dates

various from one to six months subsequent to period end, secured by

buildings, machinery and equipment of Benda Ebei and Jiangling

Benda.

|

9,112,538

|

8,160,503

|

||||||

|

Ebei

- Five-month loan from Shenzhen Shourenben Enterprise Consulting (SZ) Co.,

Ltd. matured in May 2010, bearing monthly interest at 1% and unsecured.

Loan is currently in default.

|

394,519

|

-

|

||||||

|

Sibiono

- Three loans from Shourenben Enterprise Consulting (SZ) Co., Ltd. due in

June 2011, bearing monthly interest at 1.5% and

unsecured.

|

284,430

|

21,945

|

||||||

|

Sibiono-

three-year bank loan due in April 2008 bearing annual interest at 6.366%.

The loan was paid off in August 2010. See (a) below for more

detail.

|

-

|

2,976,718

|

(a)

|

|||||

|

Sibiono-

three-month loan from Yichang Shengshitongda Enterprises Ltd. due on

November 20, 2010 bearing annual interest at 60% and

unsecured.

|

3,742,500

|

-

|

||||||

|

Jiangling- One-year

bank loan from Hubei Province Rural Credit due in April 2011, bearing

annual interest at 7.2% and secured by a third party commercial loan

guarantee company.

|

299,400

|

-

|

||||||

|

$

|

14,132,787

|

$

|

11,598,066

|

|||||

10

(a)

SiBiono – Bank Loan in default

At

December 31, 2009, Sibiono, had an outstanding bank loan for the amount of

$2,976,718, which was used primarily to fund construction in progress projects

and for general working capital purposes. The loan carries annual interest rate

of 6.366% and matured in April 2008. The loan is personally guaranteed by

Zhaohui Peng, the former Chairman and a shareholder of SiBiono and is

collateralized by Sibiono’s land use rights.

The loan

is in default since the maturity date until August 2010 when the Company

borrowed funds from Yichang Shengshitongda Enterprises, Ltd. and paid off the

loan.

7. Related

Party Transactions

Due from

related parties at September 30, 2010 and December 31, 2009 were comprised

as follows:

|

Relationship

|

September 30,

2010

|

December 31,

2009

|

||||||||

|

Current

|

||||||||||

|

Qin

Yu

|

Vice

president

|

|||||||||

|

Shenzhen

SiBiono

|

$

|

1,517

|

$

|

2,024

|

||||||

|

Xiaoji

Zhang

|

Minority

shareholder

|

|||||||||

|

Shenzhen

SiBiono

|

5,550

|

5,423

|

||||||||

|

Hua

Xu

|

General

Manager's Sister

|

|||||||||

|

Shenzhen

SiBiono

|

23,254

|

22,726

|

||||||||

|

Rong

He

|

Manager

|

|||||||||

|

Shenzhen

SiBiono

|

-

|

688

|

||||||||

|

Wei

Xu

|

VP,

CEO's Spouse & Director

|

|||||||||

|

Benda

Ebei

|

274,950

|

-

|

||||||||

|

$

|

305,271

|

$

|

30,861

|

|||||||

|

Non

current

|

||||||||||

|

Yiqing

Wan

|

CEO

& Director

|

|||||||||

|

Ever

Leader

|

$

|

650,091

|

$

|

646,586

|

||||||

|

Benda

Ebei

|

565,707

|

520,712

|

||||||||

|

Hubei

Benda Science and Technology Co. Ltd

|

Controlled

by CEO

|

|||||||||

|

Yidu

Benda

|

1,640,204

|

1,602,950

|

||||||||

|

Ever

Leader

|

231,464

|

230,216

|

||||||||

|

Feng

Wang

|

Minority

shareholder

|

|||||||||

|

Beijing

Shusai

|

33,011

|

32,262

|

||||||||

|

$

|

3,120,477

|

$

|

3,032,726

|

|||||||

The

balance owned by the Yiqing Wan, CEO & Director, and the Company under his

control, totaled $ 3,087,466 and $3,000,464 as of September 30, 2010

and December 31, 2009, respectively. This is a violation of Section 402 of the

Sarbanes-Oxley Act of 2002 which prohibits personal loans to

executives.

11

Due to

related parties at September 30, 2010 and December 31, 2009 were comprised as

follows:

|

Relationship

|

September 30,

2010

|

December 31,

2009

|

||||||||

|

Current

|

||||||||||

|

Wei

Xu

|

VP,

CEO's Spouse & Director

|

|||||||||

|

Shenzhen

SiBiono

|

$

|

301,596

|

$

|

234,569

|

||||||

|

Everleader

|

1,434,205

|

1,356,172

|

||||||||

|

BPMA

|

36,184

|

36,184

|

||||||||

|

Hubei

Benda Science and Technology Co. Ltd

|

Controlled

by CEO

|

|||||||||

|

Benda

Ebei

|

29,191

|

28,528

|

||||||||

|

Jiangliang

Benda

|

795,801

|

793,864

|

||||||||

|

Beijing

Shusai

|

14,439

|

14,111

|

||||||||

|

SiBiono

Zhongjia Gene Tech (SZ) Co., Ltd.

|

Associate

company

|

|||||||||

|

Shenzhen

SiBiono

|

-

|

103,948

|

||||||||

|

Yiqing,

Wan

|

CEO

& Director

|

|||||||||

|

Shenzhen

SiBiono

|

240,721

|

224,071

|

||||||||

|

Pong,

Tsiaohuei

|

Shareholder

& Chairman

|

|||||||||

|

Shenzhen

SiBiono

|

4,918

|

-

|

||||||||

|

$

|

2,857, 055

|

$

|

2,791,447

|

|||||||

|

Non

current

|

||||||||||

|

Wei

Xu

|

VP,

CEO's Spouse & Director

|

|||||||||

|

Benda

Ebei

|

$

|

24,450

|

$

|

23,894

|

||||||

|

Beijing

Shusai

|

66,857

|

65,339

|

||||||||

|

Yiqing,

Wan

|

CEO

& Director

|

|||||||||

|

Yidu

Benda

|

572

|

559

|

||||||||

|

Hui

Xu

|

Manager

|

|||||||||

|

Benda

Ebei

|

29,070

|

28,410

|

||||||||

|

$

|

120,949

|

$

|

118,202

|

|||||||

Except

for the loans from the shareholder Wei Xu by Everleader which bears interest

rate at 12% per annum, unsecure and matures within six months, the above

advances bear no interest and the above loans due to related parties are

unsecured, non-interest bearing and are not convertible into equity. Proceeds

from the above loans were used primarily for general working capital purposes,

among which the current portion does not have definitive terms and for

those portions which are long-term debts in nature, is expected to be repaid by

the Company in over 12-month period.

8. Equity

Investment

Sibiono

and North American Gene Diagnostics and Therapeutics Ltd. (HK) entered into a

business agreement to set up Shenzhen Sibiono Zhongjia Gene Technology Ltd.

(Zhongjia) during June 2009. The business license of the new joint entity was

obtained in January 2010 and Sibiono made the capital contribution of

approximately $119,000 (RMB 800,000) in February 2010. The new entity's legal

representative is Mr. Wan, Yiqing. The registered capital is approximately

$292,500 (RMB 2 million). Sibiono's share of the registered capital is 40% (RMB

800,000), the other party’s share is 60% (RMB 1.2 million).

Zhongjia

did not have significant operations during the nine months period ended

September 30, 2010.

9. Segment

Information

The

Company states the segment information according to the requirement stated in

ASC 280-10-50. The Company produces five different categories of products and

each category of product is produced in different subsidiaries or operation

plants. The details are stated as follows:

|

|

1.

|

Benda

Ebei produces conventional medicines which including branded and generic

medicines;

|

|

|

2.

|

Jiangling

Benda produces active pharmaceutical ingredients,

APIs;

|

|

|

3.

|

Yidu

Benda produces bulk chemicals;

|

|

|

4.

|

Beijing

Shusai produces pharyngitis killer therapy;

and

|

|

|

5.

|

SiBiono

produces gene therapy medicines,

Gendicine.

|

Since

each subsidiary produces the corresponding products by using the production

facilities of each subsidiary, therefore according to the requirement stated ASC

280-10-50, the Company reports the segment information according to the

un-identical products that produced in each subsidiary.

12

Selected

financial information for each of these segments for the nine and three

months ended September 30, 2010 and 2009 were as follows:

|

NINE MONTHS ENDED

|

THREE MONTHS ENDED

|

|||||||||||||||

|

SEPTEMBER 30,

|

SEPTEMBER 30,

|

|||||||||||||||

|

Branded/Generic

medicine segment

|

2010

|

2009

|

2010

|

2009

|

||||||||||||

|

Revenue

from external customers

|

$

|

13,047,872

|

$

|

13,617,252

|

$

|

5,536,515

|

$

|

4,887,566

|

||||||||

|

Cost

of sales

|

(8,317,348

|

)

|

(8,600,569

|

)

|

(3,509,332

|

)

|

(3,051,518

|

)

|

||||||||

|

Gross

profit

|

4,730,524

|

5,016,683

|

2,027,183

|

1,836,047

|

||||||||||||

|

Gross

margin

|

36

|

%

|

37

|

%

|

37

|

%

|

38

|

%

|

||||||||

|

Research

and development

|

(1,026,023

|

)

|

-

|

(343,914

|

)

|

2,301

|

||||||||||

|

Selling

expense

|

(1,028,714

|

)

|

(942,604

|

)

|

(194,692

|

)

|

(529,292

|

)

|

||||||||

|

General

and administrative expense

|

(727,140

|

)

|

(2,683,831

|

)

|

(210,913

|

)

|

(707,287

|

)

|

||||||||

|

Segment

contribution

|

$

|

1,948,647

|

$

|

1,390,248

|

$

|

1,277,664

|

$

|

601,770

|

||||||||

|

Contribution

margin

|

15

|

%

|

10

|

%

|

23

|

%

|

12

|

%

|

||||||||

|

Total

assets, segment

|

$

|

29,460,319

|

$

|

24,091,492

|

$

|

29,460,319

|

$

|

24,091,492

|

||||||||

|

NINE MONTHS ENDED

|

THREE MONTHS ENDED

|

|||||||||||||||

|

SEPTEMBER 30,

|

SEPTEMBER 30,

|

|||||||||||||||

|

Active pharmaceutical ingredients segment

|

2010

|

2009

|

2010

|

2009

|

||||||||||||

|

Revenue

from external customers

|

$

|

1,109,268

|

$

|

817,137

|

$

|

98,020

|

$

|

27,075

|

||||||||

|

Cost

of sales

|

(898,934

|

)

|

(901,431

|

)

|

(97,425

|

)

|

66,164

|

|||||||||

|

Gross

profit

|

210,334

|

(84,294

|

)

|

595

|

93,238

|

|||||||||||

|

Gross

margin

|

19

|

%

|

-10

|

%

|

1

|

%

|

344

|

%

|

||||||||

|

Research

and development

|

-

|

(143

|

)

|

-

|

(70

|

)

|

||||||||||

|

Selling

expense

|

(27,719

|

)

|

(16,576

|

)

|

(7,431

|

)

|

(1,851

|

)

|

||||||||

|

General

and administrative expense

|

(402,470

|

)

|

(526,094

|

)

|

(143,850

|

)

|

(205,085

|

)

|

||||||||

|

Segment

contribution

|

$

|

(219,855

|

)

|

$

|

(627,107

|

)

|

$

|

(150,686

|

)

|

$

|

(113,768

|

)

|

||||

|

Contribution

margin

|

-20

|

%

|

-77

|

%

|

-154

|

%

|

-420

|

%

|

||||||||

|

Total

assets, segment

|

$

|

13,530,958

|

$

|

12,541,258

|

$

|

13,530,958

|

$

|

12,541,258

|

||||||||

|

NINE MONTHS ENDED

|

THREE MONTHS ENDED

|

|||||||||||||||

|

SEPTEMBER 30,

|

SEPTEMBER 30,

|

|||||||||||||||

|

Bulk chemicals segment

|

2010

|

2009

|

2010

|

2009

|

||||||||||||

|

Revenue

from external customers

|

$

|

3,273

|

$

|

-

|

$

|

999

|

$

|

-

|

||||||||

|

Cost

of sales

|

-

|

-

|

-

|

-

|

||||||||||||

|

Gross

profit

|

3,273

|

-

|

999

|

-

|

||||||||||||

|

Gross

margin

|

100

|

%

|

0

|

%

|

100

|

%

|

0

|

%

|

||||||||

|

Research

and development

|

-

|

-

|

-

|

-

|

||||||||||||

|

Selling

expense

|

-

|

-

|

-

|

-

|

||||||||||||

|

General

and administrative expense

|

(438,336

|

)

|

(313,966

|

)

|

(146,455

|

)

|

(105,518

|

)

|

||||||||

|

Segment

contribution

|

$

|

(435,063

|

)

|

$

|

(313,966

|

)

|

$

|

(145,456

|

)

|

$

|

(105,518

|

)

|

||||

|

Contribution

margin

|

0

|

%

|

0

|

%

|

-14560

|

%

|

0

|

%

|

||||||||

|

Total

assets, segment

|

$

|

8,269,131

|

$

|

8,820,946

|

$

|

8,269,131

|

$

|

8,820,946

|

||||||||

|

NINE MONTHS ENDED

|

THREE MONTHS ENDED

|

|||||||||||||||

|

SEPTEMBER 30,

|

SEPTEMBER 30,

|

|||||||||||||||

|

Pharynigitis killer therapy segment

|

2010

|

2009

|

2010

|

2009

|

||||||||||||

|

Revenue

from external customers

|

$

|

147

|

$

|

-

|

$

|

147

|

$

|

-

|

||||||||

|

Cost

of sales

|

(8

|

)

|

-

|

(8

|

)

|

-

|

||||||||||

|

Gross

profit

|

139

|

-

|

139

|

-

|

||||||||||||

|

Gross

margin

|

95

|

%

|

0

|

%

|

95

|

%

|

0

|

%

|

||||||||

|

Research

and development

|

-

|

-

|

-

|

-

|

||||||||||||

|

Selling

expense

|

-

|

(733

|

)

|

-

|

(733

|

)

|

||||||||||

|

General

and administrative expense

|

(15,156

|

)

|

(19,609

|

)

|

(5,077

|

)

|

(5,134

|

)

|

||||||||

|

Segment

contribution

|

$

|

(15,017

|

)

|

$

|

(20,342

|

)

|

$

|

(4,938

|

)

|

$

|

(5,867

|

)

|

||||

|

Contribution

margin

|

0

|

%

|

0

|

%

|

0

|

%

|

0

|

%

|

||||||||

|

Total

assets, segment

|

$

|

74,648

|

$

|

92,931

|

$

|

74,648

|

$

|

92,931

|

||||||||

13

|

NINE MONTHS ENDED

|

THREE MONTHS ENDED

|

|||||||||||||||

|

SEPTEMBER 30,

|

SEPTEMBER 30,

|

|||||||||||||||

|

Gendicine (Ad-p53) segment

|

2010

|

2009

|

2010

|

2009

|

||||||||||||

|

Revenue

from external customers

|

$

|

2,697,153

|

$

|

2,910,676

|

$

|

1,062,183

|

$

|

990,013

|

||||||||

|

Cost

of sales

|

(283,035

|

)

|

(268,370

|

)

|

(127,243

|

)

|

(85,937

|

)

|

||||||||

|

Gross

profit

|

2,414,118

|

2,642,306

|

934,940

|

904,076

|

||||||||||||

|

Gross

margin

|

90

|

%

|

91

|

%

|

88

|

%

|

91

|

%

|

||||||||

|

Research

and development

|

(128,180

|

)

|

(283,330

|

)

|

(45,007

|

)

|

(167,621

|

)

|

||||||||

|

Selling

expense

|

(729,979

|

)

|

(908,569

|

)

|

(219,272

|

)

|

(320,238

|

)

|

||||||||

|

General

and administrative expense

|

(926,274

|

)

|

(1,745,240

|

)

|

(329,993

|

)

|

(270,520

|

)

|

||||||||

|

Segment

contribution

|

$

|

629,685

|

$

|

(294,833

|

)

|

$

|

340,668

|

$

|

145,697

|

|||||||

|

Contribution

margin

|

23

|

%

|

0

|

%

|

32

|

%

|

15

|

%

|

||||||||

|

Total

assets, segment

|

$

|

15,751,458

|

$

|

15,193,562

|

$

|

15,751,458

|

$

|

15,193,562

|

||||||||

|

NINE MONTHS ENDED

|

THREE MONTHS ENDED

|

|||||||||||||||

|

SEPTEMBER 30,

|

SEPTEMBER 30,

|

|||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

|||||||||||||

|

Total

revenue from external customers

|

$

|

16,857,713

|

$

|

17,345,065

|

$

|

6,697,864

|

$

|

5,904,653

|

||||||||

|

Cost

of sales

|

(9,499,325

|

)

|

(9,770,370

|

)

|

(3,734,008

|

)

|

(3,071,291

|

)

|

||||||||

|

Gross

profit

|

7,358,388

|

7,574,695

|

2,963,856

|

2,833,362

|

||||||||||||

|

Gross

margin

|

44

|

%

|

44

|

%

|

44

|

%

|

48

|

%

|

||||||||

|

Research

and development

|

(1,154,203

|

)

|

(283,473

|

)

|

(388,921

|

)

|

(165,390

|

)

|

||||||||

|

Selling

expense

|

(1,786,412

|

)

|

(1,868,482

|

)

|

(421,395

|

)

|

(852,114

|

)

|

||||||||

|

General

and administrative expense

|

(2,509,376

|

)

|

(5,288,740

|

)

|

(836,288

|

)

|

(1,293,544

|

)

|

||||||||

|

Segment

contribution

|

$

|

1,908,397

|

$

|

134,000

|

$

|

1,317,252

|

$

|

522,314

|

||||||||

|

Contribution

margin

|

11

|

%

|

1

|

%

|

20

|

%

|

9

|

%

|

||||||||

|

Total

assets, segment

|

$

|

67,086,204

|

$

|

60,740,188

|

$

|

67,086,204

|

$

|

60,740,188

|

||||||||

14

The

results of the total consolidated net profit before income taxes for the

reporting periods are as follows:

|

NINE MONTHS ENDED

|

THREE MONTHS ENDED

|

|||||||||||||||

|

SEPTEMBER

30,

|

SEPTEMBER

30,

|

|||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

|||||||||||||

|

Total

segment contribution

|

$

|

1,908,397

|

$

|

134,000

|

$

|

1,317,252

|

$

|

522,314

|

||||||||

|

Unallocated

amounts:

|

||||||||||||||||

|

Government

subsidies / grants

|

-

|

26,386

|

-

|

4

|

||||||||||||

|

Other

income/(expenses)

|

(726,769

|

)

|

(230,771

|

)

|

(395,808

|

)

|

(108,601

|

)

|

||||||||

|

Other

corporate expenses

|

(1,295,868

|

)

|

(2,434,182

|

)

|

(299,526

|

)

|

(496,641

|

)

|

||||||||

|

Total

net loss before noncontrolling interest and income taxes

|

$

|

(114,240

|

)

|

$

|

(2,504,567

|

)

|

$

|

621,918

|

$

|

(82,924

|

)

|

|||||

The other

corporate expenses per the above table for the nine and three months ended

September 30, 2010 and 2009 composed of the following events:

|

NINE MONTHS ENDED

|

THREE MONTHS ENDED

|

|||||||||||||||

|

SEPTEMBER 30,

|

SEPTEMBER 30,

|

|||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

|||||||||||||

|

Wages

and salaries

|

$

|

195,000

|

$

|

283,817

|

$

|

65,000

|

$

|

88,802

|

||||||||

|

Audit

and accounting

|

62,997

|

74,995

|

27,091

|

24,999

|

||||||||||||

|

Consulting

fee

|

14,517

|

9,336

|

4,775

|

3,120

|

||||||||||||

|

Investor

relation, transfer agent and filing fees

|

-

|

2,720

|

-

|

-

|

||||||||||||

|

Director

renumeration

|

67,500

|

67,500

|

22,500

|

22,500

|

||||||||||||

|

Legal

fee

|

479,846

|

158,134

|

113,844

|

53,567

|

||||||||||||

|

Taxes

and levies

|

-

|

-

|

-

|

-

|

||||||||||||

|

Interest

expense

|

475,589

|

1,767,578

|

66,217

|

302,277

|

||||||||||||

|

Miscellaneous

|

419

|

70,102

|

99

|

1,376

|

||||||||||||

|

Total

|

$

|

1,295,868

|

$

|

2,434,182

|

$

|

299,526

|

$

|

496,641

|

||||||||

For the

details of information of this particular, it should be read in conjunction

with the management discussion and analysis section.

The

following table shows the reconciliation between the segments assets and the

total assets for the nine and three months ended September 30, 2010 and

2009:

|

NINE MONTHS ENDED

|

THREE MONTHS ENDED

|

|||||||||||||||

|

SEPTEMBER 30,

|

SEPTEMBER 30,

|

|||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

|||||||||||||

|

Total

assets, segment

|

$

|

67,086,204

|

$

|

60,740,188

|

$

|

67,086,204

|

$

|

60,740,188

|

||||||||

|

Total

assets of corporate:

|

||||||||||||||||

|

Cash

and cash equivalent

|

11,662

|

12,168

|

11,662

|

12,168

|

||||||||||||

|

Prepaid

expense and deposit

|

232

|

-

|

232

|

-

|

||||||||||||

|

Due

from related parties

|

638,650

|

660,067

|

638,650

|

660,067

|

||||||||||||

|

Construction-in-progress

capitalized interest

|

825,798

|

-

|

825,798

|

-

|

||||||||||||

|

Total

assets

|

$

|

68,562,546

|

$

|

61,412,423

|

$

|

68,562,546

|

$

|

61,412,423

|

||||||||

15

The

following table shows how the non-controlling interest for the

nine months ended September 30, 2010 and 2009 was derived:

|

Nine Months Ended September 30, 2010

|

|||||||||||||||||||||||

|

Benda

|

Jiangling

|

Yidu

|

Beijing

|

Shenzhen

|

|||||||||||||||||||

|

Ebei

|

Benda

|

Benda

|

Shusai

|

SiBiono

|

Total

|

||||||||||||||||||

|

Segment

operating profit / (loss)

|

$

|

1,948,647

|

(219,855

|

)

|

(435,063

|

)

|

(15,017

|

)

|

629,685

|

$

|

1,908,397

|

||||||||||||

|

Interest

income/ (expenses)

|

(304,197

|

)

|

(24,781

|

)

|

1

|

-

|

(382,979

|

)

|

(711,956

|

)

|

|||||||||||||

|

Other

income / (expenses)

|

(73,037

|

)

|

(4,531

|

)

|

-

|

-

|

(9,972

|

)

|

(87,540

|

)

|

|||||||||||||

|

Income

taxes

|

(695,820

|

)

|

-

|

-

|

(3

|

)

|

40,902

|

(654,921

|

)

|

||||||||||||||

|

Income

/ (loss) before non-controlling interest

|

$

|

875,593

|

(249,167

|

)

|

(435,062

|

)

|

(15,020

|

)

|

277,636

|

$

|

453,980

|

||||||||||||

|

Non-controlling

interest percentage

|

5.00

|

%

|

5.00

|

%

|

5.00

|

%

|

25.00

|

%

|

39.87

|

%

|

|||||||||||||

|

Non-controlling

interest

|

$

|

22,699

|

(12,458

|

)

|

(21,753

|

)

|

(3,755

|

)

|

110,693

|

$

|

95,426

|

||||||||||||

|

Nine Months Ended September 30, 2009

|

|||||||||||||||||||||||

|

Benda

|

Jiangling

|

Yidu

|

Beijing

|

Shenzhen

|

|||||||||||||||||||

|

Ebei

|

Benda

|

Benda

|

Shusai

|

SiBiono

|

Total

|

||||||||||||||||||

|

Segment

operating profit / (loss)

|

$

|

1,390,248

|

(627,107

|

)

|

(313,966

|

)

|

(20,342

|

)

|

(294,833

|

)

|

$

|

134,000

|

|||||||||||

|

Interest

income/ (expenses)

|

(186,293

|

)

|

(253

|

)

|

4

|

-

|

(150,390

|

)

|

(336,932

|

)

|

|||||||||||||

|

Other

income / (expenses)

|

149,299

|

(175

|

)

|

2,968

|

-

|

118,697

|

270,789

|

||||||||||||||||

|

Government

subsidy

|

-

|

26,386

|

-

|

-

|

-

|

26,386

|

|||||||||||||||||

|

Income

taxes

|

(163,803

|