Attached files

| file | filename |

|---|---|

| EX-31.1 - China Energy Recovery, Inc. | v200723_ex31-1.htm |

| EX-32.1 - China Energy Recovery, Inc. | v200723_ex32-1.htm |

| EX-31.2 - China Energy Recovery, Inc. | v200723_ex31-2.htm |

| EX-21.1 - China Energy Recovery, Inc. | v200723_ex21-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

10-K

(Mark

One)

|

ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year

ended December

31, 2009

or

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from

to

Commission

file

number 000-53283

CHINA

ENERGY RECOVERY, INC.

(Exact

Name of Registrant as Specified in its Charter)

|

Delaware

|

90-0459730

|

|

|

(State

or Other Jurisdiction of

Incorporation

or Organization)

|

(I.R.S.

Employer

Identification

No.)

|

|

7F,

No. 267 Qu Yang Road

Hongkou

District, Shanghai

China

|

200081

|

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

Registrant's

telephone number, including area

code +86 (0)21

5556-0020

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

Name

of Each Exchange on Which Registered

|

|

|

NONE

|

Securities

registered pursuant to Section 12(g) of the Act:

|

Common

stock, par value $0.001

|

|

(Title

of Class)

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No

x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes ¨ No

x

NOTE –

Checking the box above will not relieve any registrant required to file reports

pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under

those Sections.

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes ¨ No

x

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405) is not contained herein, and will not be contained, to

the best of registrant's knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of "large accelerated filer," "accelerated filer" and "smaller

reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer

|

¨

|

Accelerated

filer

|

||

|

Non-accelerated

filer

|

¨

|

Smaller

reporting company

|

x

|

|

|

(Do

not check if a smaller reporting company)

|

||||

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes ¨ No x

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates is $6,147,412 [as computed by reference to the price at which the

common equity was last sold, or the average bid and asked price of such common

equity, as of the last business day of the registrant's most recently completed

third fiscal quarter.]

Number of

shares outstanding of the registrant's common stock as of September 30,

2010:

30,934,203

shares of Common Stock, $0.001 par value per share

DOCUMENTS

INCORPORATED BY REFERENCE

None

Table

of Content

|

PART

I

|

5

|

|

|

Item

1 Business

|

5

|

|

|

Overview

of Our Business

|

5

|

|

|

Our

History

|

6

|

|

|

Organizational

Structure and Subsidiaries

|

7

|

|

|

Industry

Overview

|

11

|

|

|

Global

Market Overview

|

12

|

|

|

Competitive

Markets and Competition

|

13

|

|

|

Design

and Engineering

|

14

|

|

|

Manufacturing

|

14

|

|

|

Marketing

and Sales

|

15

|

|

|

Products

and Technology

|

15

|

|

|

Customers

|

17

|

|

|

Intellectual

Property and Other Proprietary Rights

|

17

|

|

|

Our

Business Strategy

|

18

|

|

|

Raw

Materials and Principal Suppliers

|

18

|

|

|

Employees

|

19

|

|

|

Governmental

Regulation

|

19

|

|

|

Compliance

with Environmental Laws

|

19

|

|

|

Item

1A Risk Factors

|

19

|

|

|

Risks

Related to Our Business

|

20

|

|

|

Risks

Related to Our Corporate Structure

|

25

|

|

|

Risks

Related to Doing Business in China

|

26

|

|

|

Risks

Related to our Common Stock

|

28

|

|

|

Risks

Related to Our Company

|

30

|

|

|

Item

1B Unresolved Staff Comments

|

32

|

|

|

Item

2 Properties

|

32

|

|

|

Item

3 Legal Proceedings

|

32

|

|

|

Item

4 [Reserved]

|

32

|

|

|

PART

II

|

33

|

|

|

Item

5 Market for Registrant's Common Equity, Related Stockholder Matters

and Issuer Purchases of Equity Securities

|

33

|

|

|

Market

Information

|

33

|

|

|

Dividends

|

33

|

|

|

Recent

Sales of Unregistered Securities

|

34

|

|

|

Securities

Authorized for Issuance under Equity Compensation Plans

|

34

|

|

|

Item

6 Selected Financial Data

|

35

|

2

|

Item

7 Management's Discussion and Analysis of Financial Condition and

Results of Operations

|

35

|

|

|

Overview

|

35

|

|

|

Critical

Accounting Policies and Estimates

|

39

|

|

|

Results

of Operations

|

44

|

|

|

Liquidity

and Capital Resources

|

47

|

|

|

Table

Disclosure of Contractual Obligations

|

50

|

|

|

Off-Balance

Sheet Arrangements

|

52

|

|

|

Item

7A Quantitative and Quantitative Disclosures about Market

Risk

|

52

|

|

|

Item

8 Financial Statements and Supplementary Data

|

52

|

|

|

Report

of Independent Registered Public Accounting Firm

|

F-1

|

|

|

Note

1 – Organization

|

F-6

|

|

|

Note 2

Restatement of Consolidated Financial Statements for Year ended December

31, 2008

|

F-8

|

|

|

Note

3 – Summary of Significant Accounting Policies

|

F-11

|

|

|

Note

4 – Accounts Receivable

|

F-17

|

|

|

Note

5– Inventories

|

F-18

|

|

|

Note

6 – Equipment, Net

|

F-18

|

|

|

Note

7 – Intangible Assets

|

F-18

|

|

|

Note

8 – Short-term Bank Loans

|

F-19

|

|

|

Note

9 – Convertible Notes

|

F-19

|

|

|

Note

10 – Taxation

|

F-20

|

|

|

Note

11 – Earnings/(Loss) per Share

|

F-22

|

|

|

Note

12 – Convertible Preferred Stocks

|

F-23

|

|

|

Note

13 – Warrant and Derivative Liabilities

|

F-24

|

|

|

Note

14 - Stock-Based Compensation

|

F-25

|

|

|

Note

15 – Interest Expenses

|

F-28

|

|

|

Note

16 – Related Party Transactions

|

F-28

|

|

|

Note

17 – Retirement Benefits

|

F-28

|

|

|

Note

18 – Statutory Reserve

|

F-28

|

|

|

Note

19 – Commitments and Contingencies

|

F-29

|

|

|

Note

20 – Subsequent events

|

F-30

|

|

|

Note

21 – Restricted Net Assets

|

F-31

|

|

|

Item

9 Change

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

53

|

|

|

Item

9A (T) Controls and Procedures

|

54

|

|

|

Item

9B Other Information

|

57

|

|

|

PART

III

|

57

|

|

|

Item

10 Directors, Executive Officers and Corporate

Governance

|

57

|

|

|

Directors

and Executive Officers

|

57

|

|

|

Family

Relationships

|

58

|

|

|

Section

16(a) Beneficial Ownership Reporting Compliance

|

58

|

3

|

Audit

Committee

|

59

|

|

|

Item

11 Executive Compensation

|

59

|

|

|

Outstanding

Equity Awards at Fiscal Year-End

|

59

|

|

|

Option

Exercises

|

59

|

|

|

Item

12 Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters

|

61

|

|

|

Item

13 Certain Relationships and Related Transactions, and Director

Independence

|

62

|

|

|

Transactions

with Related Persons

|

62

|

|

|

Director

Independence

|

62

|

|

|

Item

14 Principal Accountant Fees and Services

|

62

|

|

|

PART

IV

|

63

|

|

|

|

||

|

Item

15 Exhibits and Financial Statement Schedules

|

|

63

|

4

PART I CAUTIONARY NOTE

REGARDING FORWARD LOOKING STATEMENTS

This

Annual Report on Form 10-K and other materials we will file with the U.S.

Securities and Exchange Commission (the "SEC") contain, or will contain,

disclosures which are forward-looking statements. Forward-looking statements

include all statements that do not relate solely to historical or current facts,

such as, but not limited to, the discussion of economic conditions in market

areas and their effect on revenue growth, the discussion of our growth strategy,

the potential for and effect of future governmental regulation, fluctuations in

global energy costs, the effectiveness of our management information systems,

and the availability of financing and working capital to meet funding

requirements, and can generally be identified by the use of words such as "may,"

"believe," "will," "expect," "project," "estimate," "anticipate," "plan" or

"continue." These forward-looking statements are based on our management's

current plans and expectations and are subject to certain risks and

uncertainties that could cause actual results to differ materially from

historical results or those anticipated. These risks and uncertainties include,

but are not limited to: our limited operating history; our ability to

effectively market our products and services; the loss of key personnel; our

inability to attract and retain new qualified personnel; our capital needs and

the availability of and costs associated with potential sources of financing;

adverse effects of the current turmoil in the credit markets; adverse effects of

the current depressed global economic conditions; our inability to increase

manufacturing capacity to meet demand; economic conditions affecting

manufacturers of energy recovery systems and the industry segments they serve;

our dependence on certain customer segments; difficulties associated with

managing future growth; our failure to protect our intellectual property rights;

allegations of claims of infringements of intellectual property rights brought

against us; the loss of our ability to sell and install energy recovery systems

made by third parties or such systems manufactured by us under licenses from

third parties; fluctuations in currency exchange rates; our failure to comply

with applicable environmental regulations; increased competition in our

industry; our exposure to litigation from performing work on our customers'

properties; an increase in warranty claims; our liability for injuries caused by

our products; our inability to cover damages owed by insurance; fluctuations in

energy prices resulting in fluctuating demand for our products and services;

risks related to our corporate structure, such as our inability to control our

affiliated entities and conflicts of interest between our Chief Executive

Officer’s duties to us and to our affiliated entities; the uncertainties

associated with the environmental, economic, political and legal conditions in

China and changes thereof; the adverse effect of governmental regulation and

other matters affecting energy recovery system manufacturers; Chinese

restrictions on foreign currency exchange transactions; restrictions on foreign

investments in China; ineligibility for and expiration of current Chinese

governmental incentives; natural disasters and health related concerns; the

development of an active trading market for our common stock; the loss of

coverage of our common stock by securities analysts; the failure of our

complying with securities laws in private placements; our common stock being a

penny stock; a sudden increase in the number of shares of our common stock in

the market as a result of Rule 144 sales or conversion or exercise of derivative

securities, and our failure to maintain adequate internal controls over

financial reporting.

These

forward-looking statements speak only as of the date of this Annual Report on

Form 10-K. Except as required by law, we undertake no obligation to publicly

update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise. You should also read, among other

things, the risks and uncertainties described in the section of this Annual

Report on Form 10-K entitled "Risk Factors."

Item

1 Business

Overview

of Our Business

China

Energy Recovery, Inc. (the "Company," "we," "us," or "our") is headquartered in

Shanghai, China, and, through its subsidiaries and affiliates, is in the

business of designing, fabricating, implementing and servicing industrial energy

recovery systems. The Company's energy recovery systems capture industrial waste

energy for reuse in industrial processes or to produce electricity and thermal

power, thereby allowing industrial manufacturers to reduce their energy costs,

shrink their emissions and generate sellable emissions credits. A majority of

the manufacturing takes place at the Company's leased manufacturing facilities

in Shanghai, China. The Company transports the manufactured systems in parts via

truck, train or ship to the customers' facilities where the system is assembled

and installed. The Company has primarily sold energy recovery systems to

chemical manufacturing plants to reduce their energy costs by increasing the

efficiency of their manufacturing equipment. The Company has installed over 120

energy recovery systems both in China and internationally. The Company mainly

sells its energy recovery systems and services directly to

customers.

5

Our

History

Unless

otherwise noted, the disclosures about our history reflect the Company's capital

structure as of the time of the occurrences described and do not take into

account subsequent stock splits or other adjustments to the Company's capital

structure.

We

incorporated in the State of Maryland in May 1998 under the name Majestic

Financial, Ltd. We changed our name to Commerce Development Corporation, Ltd. in

April 2002. Effective June 5, 2007, we changed our name to MMA Media

Inc.

On

January 24, 2008, we entered into a Share Exchange Agreement (the "Share

Exchange Agreement") with Poise Profit International, Ltd., a private British

Virgin Islands corporation ("Poise Profit"), and Poise Profit's shareholders

pursuant to which we agreed to acquire all of the issued and outstanding shares

of Poise Profit's common stock in exchange for the issuance of 41,514,179 shares

of our common stock (on a post-1-for-9 stock split basis approved by our board

of directors in connection with entering into the Share Exchange Agreement) to

Poise Profit's shareholders (the "Share Exchange").

On

January 25, 2008, we entered into and closed an Asset Purchase Agreement with

MMA Acquisition Company, a Delaware corporation, pursuant to which we sold

substantially all of our assets to MMA Acquisition Company in exchange for MMA

Acquisition Company's assuming a substantial majority of our outstanding

liabilities. The transferred assets consisted of letters of intent for the

proposed acquisitions of MMAWeekly.com, dated June 9, 2007, and Blackbelt TV,

Inc., dated July 16, 2007, and all shares of common stock in Blackbelt TV, Inc.

we owned, among other things. The total book value of the assets acquired was

approximately $317,000. The assumed liabilities consist of accounts payable,

convertible debt, accrued expenses and shareholder advances of approximately

$360,000.

Effective

February 5, 2008, we changed our name to China Energy Recovery, Inc. and

conducted a 1-for-9 reverse stock split of our issued and outstanding capital

stock pursuant to which each nine shares of our common stock issued and

outstanding on the record date of February 4, 2008 was converted into one share

of our common stock. We had 84,922,000 shares of common stock issued and

outstanding immediately prior to the reverse stock split and 9,435,780 shares

thereafter.

On April

15, 2008, we closed the Share Exchange pursuant to which we acquired all of the

issued and outstanding shares of Poise Profit's common stock in exchange for the

issuance of 41,514,179 shares of our common stock to Poise Profit's

stockholders. Upon the closing of the Share Exchange, Poise Profit became our

wholly-owned subsidiary and our business operations consisted of those of Poise

Profit's wholly-owned subsidiary, HAIE Hi-tech Engineering (Hong Kong) Company,

Limited ("Hi-tech"), incorporated in the Hong Kong Special Administration

Region, China.

Also on

April 15, 2008 and as a condition to closing of the Share Exchange, we entered

into Securities Purchase Agreements (the "Securities Purchase Agreement") with

25 accredited investors pursuant to which we issued and sold an aggregate of

7,874,241 units at a price per unit of $1.08 with each unit consisting of one

share of our Series A Convertible Preferred Stock, par value $0.001 per share,

and one warrant to purchase one-half of one share of our common stock at an

exercise price of $1.29 per share (the "Financing"). Thus, at the closing of the

Financing, we issued 7,874,241 shares of our Series A Convertible Preferred

Stock to the investors and we also issued warrants to the investors for the

purchase of an aggregate of 3,937,121 shares of our common stock for an

aggregate purchase price of $8,504,181. After the April 16, 2008 1-for-2 reverse

stock split described below, the warrants are exercisable into 1,968,561 shares

of common stock at an exercise price of $2.58.

On April

16, 2008, we conducted a 1-for-2 reverse stock split of our issued and

outstanding capital stock pursuant to which each two shares of our common stock

issued and outstanding on the record date of April 15, 2008 was converted into

one share of our common stock. We had 50,949,959 shares of common stock issued

and outstanding immediately prior to the reverse stock split and 25,474,980

shares thereafter.

6

On May 6,

2008, we filed a registration statement on Form S-1 to register for resale

certain shares of our common stock held by selling stockholders. The

registration statement became effective on September 8, 2009.

On June

17, 2008, we filed a registration statement on Form 8-A to register our common

stock under Section 12(g) of the Securities Exchange Act of 1934, as amended

(the "Exchange Act").

Starting

in the summer of 2008, we began a reorganization of our corporate structure as

further described under the caption "Organizational Structure and Subsidiaries"

below.

As a

result of the closing of the Share Exchange on April 15, 2008, our new business

operations consist of those of Poise Profit's Chinese subsidiary, Hi-tech, which

were subsequently transferred to CER (Hong Kong) Holdings Limited (“CER Hong

Kong”) as described in Item 1 Business - Organizational Structure and

Subsidiaries. CER Hong Kong is principally engaged in designing, marketing,

licensing, fabricating, implementing and servicing industrial energy recovery

systems capable of capturing industrial waste energy for reuse in industrial

processes or to produce electricity and thermal power.

Organizational

Structure and Subsidiaries

After

closing of the Share Exchange, our organizational structure reflected Chinese

limitations on foreign investments and ownership in Chinese businesses.

Generally, these limitations prevent a U.S. corporation from owning directly

certain types of Chinese businesses. Instead, a U.S. corporation can obtain the

benefits and risk of equity ownership of a Chinese business either by being a

part-owner of a Chinese joint venture or by entering into fairly extensive and

complicated contractual relationships with Chinese companies wholly-owned by

Chinese owners. At that time, and still to a significant extent, our business

relied on contractual relationships. However, we began a corporate

reorganization process in the summer of 2008 to gradually move our assets and

operations from affiliated entities with which we have only contractual

relationships into wholly-owned subsidiaries. Until our reorganization is

complete, our corporate structure will reflect a combination of control via

direct ownership and contractual arrangements.

Poise

Profit, a wholly-owned subsidiary of the Company, was incorporated on November

23, 2007 under the laws of the British Virgin Islands. Poise Profit, in turn,

owns 100% of the issued and outstanding equity interests in Hi-tech and CER

(Hong Kong) Holdings Limited ("CER Hong Kong"). Historically, all of our

operations were conducted through Hi-tech via contractual arrangements with

affiliated Chinese entities, but we are in the process of transferring our

assets and operations from Hi-tech to CER Hong Kong and its wholly-owned

subsidiary CER Energy Recovery (Shanghai) Co., Ltd. ("CER Shanghai"). As part of

our reorganization, CER Hong Kong was incorporated on August 13, 2008 under the

laws of the Hong Kong Special Administrative Region, China and was originally

jointly owned by Mr. Qinghuan Wu, one of our directors and our Chairman of the

Board and Chief Executive Officer, and his spouse, Mrs. Jialing Zhou, who is one

of our directors. On December 3, 2008, Mr. Qinghuan Wu and Mrs. Zhou transferred

ownership of CER Hong Kong to Poise Profit. CER Shanghai was incorporated on

November 11, 2008 as a wholly foreign-owned enterprise in Shanghai, China. After

our reorganization is complete, CER Shanghai will be our primary operating

entity in China and CER Hong Kong will be our primary holding entity holding all

equity interests in our Chinese subsidiaries, including CER Shanghai. While we

are gradually transferring our current assets and operations to CER Shanghai, we

plan that CER Shanghai will enter into the majority of all new business

contracts.

At the

time of the closing of the Share Exchange, Hi-tech owned 90% of a joint venture

called Shanghai Haie Investment Consultation Co., Ltd. ("JV Entity"), a company

organized in Shanghai, China, providing investment consultancy services,

enterprise management consultancy services and marketing policy planning

services to third-party customers as well as affiliates. The remaining 10% was

owned by Shanghai Engineering. In compliance with the new Chinese regulation

effective January 2008, on June 16, 2008, JV Entity's board of directors

approved a plan to dissolve JV Entity. The application for dissolution was

approved by the Chinese governmental authority in July 2008. We dissolved JV

Entity on September 1, 2008 and its assets, in the form of an initial capital

contribution from Hi-tech, were returned to Hi-tech on September 18,

2008.

7

Before

December 3, 2008, all of our operations were conducted through Hi-tech and its

affiliated companies. Hi-Tech was engaged in the marketing and sale of energy

recovery systems which were designed, manufactured and installed by affiliated

companies. Hi-tech had entered into contractual relationships with two entities

incorporated in Shanghai, China: Shanghai Hai Lu Kun Lun Hi-tech Engineering

Co., Ltd. ("Shanghai Engineering") and Shanghai Xin Ye Environmental Protection

Engineering Technology Co., Ltd. ("Shanghai Environmental"). Each of Shanghai

Engineering and Shanghai Environmental was considered a "variable interest

entity" and its financial information was consolidated with Hi-tech's pursuant

to the Accounting Standard Codification (“ASC”) 810-10. Hi-tech entered into

contractual relationships with Shanghai Engineering and Shanghai Environmental

to comply with Chinese laws regulating foreign-ownership of Chinese companies.

Shanghai Engineering is engaged in the business of designing, manufacturing and

installing energy recovery systems. All manufacturing is done by Vessel Works

Division pursuant to a cooperative manufacturing agreement between Shanghai

Engineering and Vessel Works Division's parent, Shanghai Si Fang Boiler Factory

("Shanghai Si Fang"), as further described below. Vessel Works Division holds

important permits for the manufacturing and installation of boilers used in our

energy recovery systems. Shanghai Environmental is not an operating company but

it served in the past as a vehicle for arranging sales and maximizing tax

benefits. We did not use Shanghai Environmental for these purposes during our

2009 fiscal year and do not intend to do so in the future. We intend to start

the process to dissolve Shanghai Environmental in 2010. Shanghai Engineering is

owned jointly by Mr. Qinghuan Wu, our Chairman of the Board and Chief Executive

Officer, and his spouse, Mrs. Jialing Zhou, who is one of our directors.

Shanghai Environmental is wholly-owned by Mr. Qinghuan Wu.

The

material contractual relationships between Hi-tech and each of Shanghai

Engineering and Shanghai Environmental consisted of:

|

|

·

|

Consulting

Services Agreements - These agreements allow Hi-tech to manage and operate

Shanghai Engineering and Shanghai Environmental, and collect the

respective net profits of each company. Under the terms of the agreements,

Hi-tech is the exclusive provider of advice and consultancy services to

Shanghai Engineering and Shanghai Environmental, respectively, related to

the companies' general business operations, human resources needs and

research and development, among other things. In exchange for such

services, each of Shanghai Engineering and Shanghai Environmental must pay

to Hi-tech such company's respective net profits. Hi-tech will own all

intellectual property rights developed or discovered through research and

development in the course of providing services under the agreements but

will grant a license to use such intellectual property back to the

respective company if necessary to conduct the business. Each of Shanghai

Engineering and Shanghai Environmental are required to cause their

respective shareholders to pledge such shareholders' equity interests in

the respective companies to secure the fee payable by Shanghai Engineering

and Shanghai Environmental, respectively, under the agreements. The

agreements contain affirmative covenants requiring each of Shanghai

Engineering and Shanghai Environmental to take certain actions, such as

(but not limited to) delivering periodic financial reports to Hi-tech. The

agreements also contain negative covenants preventing each of Shanghai

Engineering and Shanghai Environmental from taking certain actions such as

(but not limited to) issuing equity, incurring indebtedness and changing

its business. The agreements are effective until terminated and they may

be terminated by Hi-tech for any or no reason and by either party for

reasons explicitly set forth in the agreements, including (but not limited

to) a breach by the other party or the other party's becoming bankrupt or

insolvent. The parties may not assign or transfer their rights or

obligations under the respective agreements without the prior written

consent of the other party, except that Hi-tech may assign its rights or

obligations under the agreements to an

affiliate.

|

|

|

·

|

Operating

Agreements - The parties to each of these agreements are Hi-tech, Shanghai

Engineering, Shanghai Environmental, respectively, and all of the

shareholders of each of Shanghai Engineering and Shanghai Environmental,

respectively. Under the agreements, Hi-tech guarantees the contractual

performance by each company under any agreements with third parties, in

exchange for a pledge by each of Shanghai Engineering and Shanghai

Environmental of all of its respective assets, including accounts

receivable. Hi-tech has the right to approve any transactions that may

materially affect the assets, liabilities, rights or operations of each

company and provide, binding advice regarding each company's daily

operations, financial management and employment matters, including the

dismissal of employees. In addition, Hi-tech has the right to recommend

director candidates and appoint the senior executives of each company. The

agreements expire 10 years from execution unless renewed. Hi-tech has the

right to terminate each of the agreements upon 30 days' written notice but

Shanghai Engineering and Shanghai Environmental do not have the right to

terminate their respective agreement during its term. Hi-tech may freely

assign its rights and obligations under the agreements upon written notice

to Shanghai Engineering and Shanghai Environmental, respectively. Shanghai

Engineering and Shanghai Environmental may not assign their rights or

obligations under the respective agreements without the prior written

consent of Hi-tech.

|

8

|

|

·

|

Proxy

Agreements - Hi-tech has entered into proxy agreements with all of the

shareholders of each of Shanghai Engineering and Shanghai Environmental

under which the shareholders have vested their voting power of the

companies in Hi-tech and agreed to not transfer the shareholders'

respective equity interests in the two companies to anyone but Hi-tech or

its designee(s). The agreements do not have an expiration date. Hi-tech

has the right to terminate each of the agreements upon 30 days' written

notice but the shareholders may not terminate the agreements without

Hi-tech's consent.

|

|

|

·

|

Option

Agreements - The parties to each of these agreements are Hi-tech, Shanghai

Engineering, Shanghai Environmental, respectively, and all of the

shareholders of each of Shanghai Engineering and Shanghai Environmental,

respectively. The shareholders of each of Shanghai Engineering and

Shanghai Environmental have granted Hi-tech or its designee(s) the

irrevocable right and option to acquire all or a portion of such

shareholders' equity interests in the two companies. The shareholders have

also agreed not to grant such an option to anyone else. The purchase price

for a shareholder's equity interests will be equal to such shareholder's

original paid-in price for such equity interest. Pursuant to the terms of

the agreements, the shareholders and each of Shanghai Engineering and

Shanghai Environmental have agreed to certain restrictive covenants to

safeguard Hi-tech's rights under the respective agreement. The agreements

expire 10 years from execution unless renewed. Hi-tech may freely assign

its rights and obligations under the agreements upon written notice to

Shanghai Engineering, Shanghai Environmental and the shareholders,

respectively. Shanghai Engineering, Shanghai Environmental and the

shareholders, respectively, may not assign their rights or obligations

under the respective agreements without the prior written consent of

Hi-tech.

|

|

|

·

|

Equity

Pledge Agreements - The parties to each of these agreements are Hi-tech,

Shanghai Engineering, Shanghai Environmental, respectively, and all of the

shareholders of each of Shanghai Engineering and Shanghai Environmental,

respectively. The shareholders of each of Shanghai Engineering and

Shanghai Environmental have pledged all of their respective equity

interests in the two companies to Hi-tech to guarantee each of Shanghai

Engineering and Shanghai Environmental performance of these companies'

respective obligations under the Consulting Services Agreements. The

pledge expires two years after the obligations under the Consulting

Services Agreements described above are fulfilled. Hi-tech has the right

to collect any and all dividends paid on the pledged equity interests.

Pursuant to the terms of the agreements, the shareholders and each of

Shanghai Engineering and Shanghai Environmental have agreed to certain

restrictive covenants to safeguard Hi-tech's rights under the respective

agreement. Upon an event of default under the agreements, Hi-tech may

vote, control, sell or dispose of the pledged equity interests and may

require the shareholders to pay all outstanding and unpaid amounts due

under the Consulting Services Agreement. Pursuant to the terms of the

agreements, the shareholders have agreed to certain restrictive covenants

to safeguard Hi-tech's rights under the respective agreement. Hi-tech may

freely assign its rights and obligations under the agreements upon written

notice to the shareholders. The shareholders may not assign their rights

or obligations under the respective agreements without the prior written

consent of Hi-tech.

|

On

December 3, 2008, as a part of our reorganization, all of the above-referenced

contracts between Hi-tech and Shanghai Engineering and between Hi-tech and

Shanghai Environmental were transferred to CER Hong Kong. Since that date, CER

Hong Kong has been engaged in the marketing and sale of energy recovery systems

which are designed, manufactured and installed by its subsidiaries and

affiliated companies.

All of

Shanghai Engineering’s manufacturing activities are conducted through a Leasing

and Operation Agreement, a form of cooperative manufacturing agreement,

originally effective as of May 1, 2003 and subsequently renewed and amended with

a state-owned enterprise, Shanghai Si Fang. Pursuant to the

agreement, Shanghai Si Fang leases certain land use right, buildings and fixed

assets (lease elements) in one of its subsidiaries, Vessel Works Division, and

provides management services and licenses the “Si Fang” brand and manufacturing

license (non-lease elements) of Vessel Works Division to Shanghai

Engineering. Because the arrangement contains both the lease and

non-lease elements, the amount of quarterly payment is allocated between the

lease and non-lease deliverables. The lease elements are classified

and accounted for as operating leases and the lease expense is recorded on a

straight-line basis. The non-lease elements are accounted for as

prepayment for management and licensing fees and the payment is amortized on a

straight-line basis over each contractual period.

9

Shanghai

Engineering does not have a variable interest in Vessel Works Division through

this agreement as the arrangement is established between Shanghai Engineering

and Shanghai Si Fang. Shanghai Engineering does not have any

contractual or ownership interest in Vessel Works Division, and therefore,

Shanghai Engineering does not have variable interests in Vessel Works

Division.

The

arrangement, however, may result in Shanghai Engineering having variable

interests in Shanghai Si Fang, but as Shanghai Si Fang is a state-owned

enterprise that has substantive operations other than this lease and operation

arrangement, Shanghai Engineering is not the primary beneficiary of Shanghai Si

Fang.

In August

2009, CER Hong Kong entered into a series of contracts with Yangzhou (Yizheng)

Automobile Industrial Park Administration Committee, a government entity of the

City of Yangzhou, Jiangsu Province, China, to acquire a tract of land on which

CER Hong Kong plans to build a new manufacturing facility. The plant is

currently under construction, and is expected to be completed by December 2010.

Once the plant is operational, we intend to transfer the production function of

Vessel Works Division to CER Yangzhou.

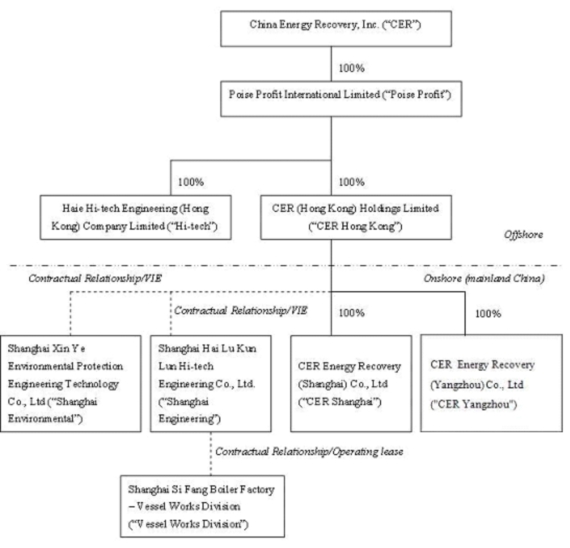

The

following is an organizational chart setting forth the current status of the

Company's subsidiaries and affiliated companies as of December 31

2009:

10

Industry

Overview

Global

demand is increasing for innovative environmental protection and renewable

energy solutions for sustainable economic growth. Modern industrial nations and

emerging markets today are faced with the growing challenge of reducing and

controlling air pollution emissions that present serious health risks to

national populations, cross international borders, and damage the environment.

Increased energy consumption has forced governments and industries to invest in

improving energy efficiency and alternative forms of power generation and

conservation. As the global power generation industry and manufacturing

industries increase their focus on improving efficiency and mitigating the

environmental impact of their processes, we believe that energy recovery systems

will play a major role in improving the output that can be obtained from current

supplies.

Energy

recovery systems can salvage the majority of the wasted energy from excess heat

that industrial manufacturing facilities and power plants release into the

atmosphere in the form of hot exhaust gases or high pressure steam by converting

the heat into electricity (often through steam driven generator turbines) which

can be used in industrial processes, thereby lowering energy costs. In addition,

energy recovery systems can also capture harmful pollutants that would otherwise

be released into the environment from certain industrial processes. These

reduced emissions can also help companies meet environmental regulations. Energy

recovery systems may also be used in heat recovery applications whereby excess

heat may be used to heat buildings and water. Examples of end-users of this type

of energy recovery system include hospitals and schools that may heat their

buildings and water with excess heat generated by their own large electrical

equipment. This type of energy recovery system is less complicated and requires

significantly less technical qualifications to build than the industrial energy

recovery systems described above as it is essentially redirecting the heat

generated by one system into other on-site systems. As a result, this type of

energy recovery system is cheaper to build and the barriers to entry into this

market are lower than in the market for industrial energy recovery systems. Our

business focuses on energy recovery systems for industrial

applications.

We

believe that energy recovery systems represent a large-scale, environmentally

friendly and economically feasible form of power generation and tool for

improving energy efficiency. Compared with other alternative forms of power,

such as solar, wind or biomass, we believe that energy recovery systems are

dramatically more affordable for technology capable of delivering power on the

scale necessary for industrial clients. In our opinion, energy recovery systems

are cost competitive even with large-scale, traditional power sources such as

coal, fossil fuels and nuclear power, but have the added benefit of reducing

pollution and greenhouse gas emissions.

According

to recent studies from the U.S. Department of Energy and the U.S. Environmental

Protection Agency, energy recovery systems could generate nearly 200 gigawatt

("GW") new power, equivalent to approximately 20% of current U.S. power

generation capacity. The European Union is a significant user of energy recovery

systems, with 104 GW installed power generating capacity. Germany and Italy have

the most installed capacity at 16 GW and 13 GW, respectively.

We have

developed and commercialized our proprietary customized energy recovery

technologies and solutions to cost-effectively reduce pollution and capture the

waste heat released by our customer's industrial processes. Our energy recovery

systems can help our customers improve their energy use efficiency. For example,

our energy recovery systems applied in sulfuric acid manufacturing processes can

produce as much as three times the useable energy from the same fuel by

recovering otherwise lost energy and reusing it in the manufacturing processes

directly or to further generate electrical power, which may allow customers to

slash energy expenditures by up to two-thirds. Additionally, these systems can

reduce harmful emissions resulting from certain types of sulfuric acid

manufacturing processes that otherwise would have been released into the

atmosphere. Other benefits include our customers' ability to sell carbon

credits, reduction of flue gas and equipment sizes of all flue gas handling

equipment such as fans, stacks, ducts, and burners, and a reduction in auxiliary

energy consumption.

The most

notable target customers for our energy recovery systems are major types of

industrial manufacturing facilities, such as chemical plants, petrochemical

plants, paper manufacturing plants, oil refineries, cement plants, steel mills,

etc. These types of customers generally operate manufacturing equipment that

release waste heat into which our energy recovery systems can be implemented and

integrated to capture such waste heat for direct reuse or, if connected with

steam-driven turbines, to produce electricity.

11

In March

2010, the Chinese People's Political Consultative Conference (“CPPCC”) and

National People's Congress (“NPC”) convened, during which the No 1 proposal on

low carbon: Suggestion On Promotion of Low Carbon Life and Improve Social

Sustainable Development, proposed by Jiu San Society, was highly received by the

NPC and CPPCC; over 10% proposals of CPPCC and NPC were related to low carbon

issues. The Government Work Report of 2009, issued by Premier Wen Jiabao,

addressed that Energy Saving and Environmental Protection is one of the ninth

Key jobs of the government in 2010, which means low carbon will be a State

Strategy in the near future. The issues mentioned above implied that the energy

saving industry should experience significant growth over the next few years.

Furthermore, at the Copenhagen Climate Conference, Premier Wen Jiabao announced

that China would decrease carbon emission by 40%-45% in 2020, as compared with

2005, which is further evidence that the Energy Saving industry should

experience significant growth in the near future in China, which should benefit

CER to grow its business in the domestic Chinese market.

Global

Market Overview

The world

currently faces fundamental problems with its energy supply, which are due

primarily to the reliance on fossil fuels. The economic prosperity of the

wealthiest nations in the twentieth century was built on a ready supply of

inexpensive fossil fuel and developing nations have continued in the

twenty-first century to consume fossil fuel reserves at an ever increasing rate.

This has led to worldwide reserve depletions, indicating that both oil and gas

are likely to be effectively exhausted before the end of this century. Only coal

reserves are expected to last into the next century. Yet even if fossil fuel

supplies were unconstrained, their continued use poses its own problems. All

fossil fuel combustion produces carbon dioxide, which appears to result in the

warming of the earth's atmosphere with profound environmental implications

across the globe.

These

problems have resulted in the realization that the world must both increase the

efficiency of its utilization of fossil fuels and decrease its reliance upon

them. Environmental issues related to fossil fuel combustion arose first during

the 1980s with the advent of acid rain, a product of the sulfur and nitrogen

emissions from fossil fuel combustion. Power plants were forced by legislation

and economic measures to control these emissions. However it is the recognition

of global warming that presents the most serious challenge because carbon

dioxide exists at much higher levels in the flue gases of power plants and major

types of industrial manufacturing facilities than sulfur dioxide and nitrogen

oxides.

Although

renewable energy capacity offers a hedge against major price rises because most

renewable technologies exploit a source of energy that is freely available, many

renewable technologies today still rely on government subsidies to make them

competitive. Governments may also impose penalties upon companies, such as

carbon trading schemes, which discourage the use of fossil fuels or increase its

costs by imposing stringent emissions limits.

Given the

international concerns regarding global warming and pollution and the need to

more efficiently utilize fossil fuels, we believe that there exists substantial

worldwide demand and a growing market for technologies that can enable companies

to generate greater amounts of energy from the same supply of fossil fuels and

that also reduce the amount of harmful emissions that would otherwise be

released from the combustion of those fossil fuels. These technologies,

including energy recovery systems, could benefit companies by both reducing

energy costs and mitigating possible emissions penalties.

China

Market Overview

Booming

economic growth and rapid industrialization has spurred demand for electric

power in China over the previous few years. For example, by the end of 2009,

China's total installed generating capacity reached 874 GW, an increase of more

than 10% over the capacity at the end of 2008. Due to the expansion of energy

intensive industrial sectors such as steel, cement, and chemicals, China's

energy consumption has been growing faster than the country's gross domestic

product ("GDP") and thus causing a shortage of electricity and coal and

blackouts in over 20 of the country's 32 provinces, autonomous regions and

municipalities. With the rapid modernization and industrialization of the

country's economy, China is the world's second largest consumer of energy after

the United States with its demand now accounting for over 17% of the world's

energy consumption. According to the International Energy Agency, China needs to

add 1,300 GW to its electricity-generating capacity, more than the total

installed capacity currently in the United States, to meet its demands over the

next several years. We predict that the result of this massive increase in

electric generation capacity will be a rapid rise in harmful emissions. China

has already surpassed the United States to become the world's largest emitter of

greenhouse gases, and the country faces enormous challenges from the pollution

brought about by its energy needs. Only 1% of China's 560 million city dwellers

breathe air considered safe by EU standards, environmental problems have led to

industrial cities where people rarely see the sun, and birth defects in infants

have soared nearly 40% since 2001. In addition, sulfur dioxide and nitrogen

oxides released by coal-fired power plants in China fall as acid rain on Seoul,

South Korea and Tokyo, Japan. A 2005 report by Chinese environmental experts,

quoted in a New York Times article ("As China Roars, Pollution Reaches Deadly

Extremes," August 26, 2007), estimates that annual premature deaths attributable

to outdoor air pollution in China were likely to reach 380,000 in 2010 and

550,000 in 2020.

12

In

November 2009, the Chinese government announced a "voluntary action" before the

Copenhagen Conference to reduce the intensity of carbon dioxide emissions per

unit of GDP in 2020 by 40 to 45 percent compared with 2005 levels, in order to

address global climate change.

On March

1, 2010, the National Development and Reform Commission also confirmed that the

government would take concrete actions to develop a low-carbon

economy.

China

would include the low-carbon targets in the 12th five-year plan for national

economic development (2011-2015) to build an energy-saving, ecologically

friendly society, the commission said.

It would

launch a series of technological and fiscal support policies to promote the use

of non-fossil, renewable energies including wind, solar, biomass, geothermal and

nuclear power, aiming to increase its proportion of primary energy consumption

to about 15 percent by 2020 from 9.9 percent at year-end 2009.

Use of

alternative and renewable energy is expanding rapidly in China and currently

contributes more than 23% to total electricity generation and 9.9% to total

primary energy supply. In China the generation capacity of electricity from

renewable energy is dominated by hydropower, which accounted for more than 95%

of the total electricity from renewable energy in 2009 to reduce the country's

current reliance on coal-fired generation, the Chinese government is stepping up

efforts to accelerate the development of renewable energy. The Renewable Energy

Law, which came into effect on January 1, 2006, along with a number of incentive

policies ranging from tax incentives to subsidies, have been introduced to

stimulate investment in renewable energy technologies. This includes development

of 300 GW of hydropower, 30 GW of wind power, 30 GW of biomass power, 1.8 GW of

solar photovoltaic systems, and smaller amounts of solar thermal and geothermal

power. Business Insights, a company involved in providing strategic market and

company analyses, estimates that realizing this target would require

approximately 130 GW of new renewable energy capacity with an investment of up

to $184 billion.

Competitive

Markets and Competition

Competition

in the energy recovery system industry generally is divided by segment following

the differentiation between low-grade energy recovery systems used for heat

recovery applications (lower power extraction/generation capacity) and

high-grade energy recovery systems used in industrial applications (higher power

extraction/generation capacity).

Most of

the players in the market are engineering firms that produce low-grade energy

recovery systems for heat recovery applications mainly used by schools,

hospitals and similar facilities. These products are generally undifferentiated

and require lower levels of capital to develop. This type of energy recovery

system is less complicated and requires significantly less technical

qualifications to build than high-grade industrial energy recovery systems. As a

result, this type of energy recovery system is cheaper to build and the barriers

to entry into this market are lower than in the market for industrial energy

recovery systems.

High-grade

energy recovery systems for industrial applications, like ours, require large

amounts of capital investment and high levels of expertise resulting in barriers

to entry to most prospective market entrants. Because energy recovery systems of

this type are highly customized based on the particular customer's need,

manufacturers mainly compete based on their respective engineering capabilities.

The manufacturers of industrial energy recovery systems generally fall into one

of the following classifications:

|

|

1

|

Companies

that specialize exclusively in energy recovery systems and account for the

majority of the larger and more advanced production of energy recovery

systems; and

|

13

|

|

2

|

Major

equipment manufacturers for which energy recovery systems are not a key

focus but which have the necessary resources to build effective

systems.

|

Barriers

to entry for the production of high grade energy recovery systems have resulted

in a majority of the global sales for energy recovery systems being generated by

a few large players. These industry participants focus on large scale projects

leaving many intermediate opportunities for companies such as ours. The largest

of these players globally include Babcock-Hitachi (Japan), Foster Wheeler (USA),

and Mitsubishi Heavy Industries (Japan). The major players in China include Dong

Fang Boiler Group, Wuhan Boiler, Hangzhou Boiler Group, and Anshan

Boiler.

We are

principally engaged in designing, manufacturing, installing and servicing

fully-customized energy recovery systems. While most of our competitors only

offer one or two off-the-rack models, we develop products across varying

specifications to best suit each customer's needs and objectives. Our products

can recycle as much as 70% of the energy that would otherwise have been

lost.

We

believe that our products enable our customers to achieve substantial gains in

energy efficiency and we continue to carry out research and development

activities along with the design and engineering activities for customers’

projects to enhance efficiencies and decrease environmental impact. We employ

approximately 90 highly trained engineers in our engineering team and are

planning to hire more.

We have

targeted our products at industrial sectors with significant amounts of waste

heat. These sectors include:

|

|

|

Chemical

and Petrochemical Industries;

|

|

|

|

Paper

Manufacturing;

|

|

|

|

Refining

Industry; and

|

|

|

|

Metallurgical

Industry.

|

We

differentiate ourselves from our competitors by specializing in energy recovery

systems and being one of the few players in the market capable of providing

engineering, procurement and construction ("EPC") services for waste heat

recovery (as further described below under the caption "Products and

Technology"). Although we have the capacity and ability to provide EPC services,

it was relatively rare in the past that a customer requests such services. For

example, we did not enter into any EPC contracts in 2006 but entered into three

EPC contracts upon customers' request in 2007 and 2008. The number of EPC

contracts increased to four in 2009, and the revenue generated from EPC

contracts increased to 43.6% of the total revenue. We believe that we are

currently a dominant player in energy recovery systems to sulfuric acid

manufacturers in China. We believe that energy recovery systems for sulfuric

manufacturing are the most difficult to design and engineer due to the strong

corrosive character of the sulfuric acid.

Design

and Engineering

Our

primary design and engineering facility is located in Shanghai, China. The

facility employs approximately 100 engineers. Approximately 70 of the engineers

engage in project design, customizing the energy recovery systems to meet the

individual needs of various industries. The others manage our production

processes at the facility. We believe that our engineering team is highly

experienced and accomplished in its field.

Manufacturing

We

operate a manufacturing facility, owned by Shanghai Si Fang through Shanghai

Engineering as further described above, in Shanghai, China. The facility

occupies approximately 10 acres (4 hectares) of land with approximately 191,300

square feet of manufacturing space and storage. We employ a team of 230 skilled

workers, technicians and quality assurance personnel at the manufacturing

facility. Our employees utilize a vast array of equipment including lathes,

drills, metal cutting machines, forging equipment, handling equipment (cranes),

welding machines, and testing equipment. A majority of the equipment is leased

from Shanghai Si Fang pursuant to the cooperative manufacturing agreement

described above. This equipment will remain the property of Shanghai Si Fang

when the agreement expires. Shanghai engineering does not own the facility but

leases it from Shanghai Si Fang.

14

In August

2009, we started to build our new manufacturing base in Yangzhou Auto Industry

Park, Jiangsu Province. The new factory will be about 300,000 square meters,

with a total investment is about USD 60 million. Total registered capital is USD

20 million. One special railway is planned from Yizheng railway station leading

directly to the plant. Meanwhile, there are three ports adjoining the Park:

Yangzhou Port, Yizheng Liquid Dock of Nanjing Port Inc. and Yihua Port. Our

objective is to construct a facility for the manufacturing of energy-saving and

highly effective waste heat boilers, and also for the manufacturing of Pressure

Vessels and other equipment, forming the capability of manufacturing Level-A

boilers and Class I, II and III pressure vessels. Our plan is to establish CER

(Yangzhou) as an international manufacturing base of waste heat equipment,

leading in both products and technology. More specifically, we plan to make

energy-saving and highly effective products, make advanced manufacturing process

and equipment, for this manufacturing facility to embody a completely new look

of a modern factory, and make the Company more competitive; while promoting the

development of the local economy and further exploiting the manufacturing

advantages in renewable energy equipment and waste heat recovery core equipment.

We estimate that the production capability will reach an annual capability of 10

sets of biomass boilers, 4 sets of alkali recovery boilers, 20 sets of waste

heat recovery boilers, 1500t coal chemical vessel synthesizing towers and 2000t

stainless steel vessel, etc, with an annual metal production amount of

32500t.

Marketing

and Sales

We market

and sell our products worldwide through our direct sales force, which is based

in Shanghai, China. Our marketing programs include industrial conferences, trade

fairs, sales training, and trade publication advertising. Our sales and

marketing groups work closely with our design and engineering, and manufacturing

groups to coordinate our product development activities, product launches and

ongoing demand and supply planning. Primarily we sell our products directly to

the end users of our energy recovery systems, but we also sell energy recovery

systems to leading engineering firms who in turn sell them to their end

users.

We are

also planning on entering into marketing partnerships and licensing deals that

will enable us to reach a boarder segment of the market. We believe that there

is significant opportunity in international markets such as the Middle East, the

United States, Europe and Latin America, and we intend to enter these markets

through partnerships. Additionally, we will look to expand into new industrial

sectors through partnerships with leading engineering firms that specialize in

specific industry groups.

Products

and Technology

We have

four main service offerings available to our customers, of which the first three

generate the majority of our revenue stream:

|

|

|

Fabrication.

We have highly-trained manufacturing teams capable of building high

quality energy recovery systems in a timely fashion. All of our energy

recovery systems are of modular design with a high degree of factory

assembly. With modular construction, site welds on heat exchanger pressure

parts are kept to a minimum. We design all energy recovery systems we

manufacture to protect our brand. We collect a one-time fee for the

fabrication of each of our units. Of the over 100 unique customers who

have purchased energy recovery systems from us, more than 25% of them have

also purchased some of the other three major services that we offer which

are auxiliary to our fabrication services, or have returned to us for new

projects.

|

|

|

|

Design.

Our primary product line of energy recovery systems can be designed to

meet the specific needs of our customers. We typically focus on heavy

industrial applications. In addition to the designing of energy recovery

systems for our own customers, we occasionally are approached by and

contract with third party manufacturers or engineering firms to design

systems for their customers. This offers a peripheral revenue stream to

supplement our core operations. We employ a flexible pricing scheme when

designing for third parties that depends upon the size, application and

deadline of the proposed energy recovery

system.

|

15

|

|

|

Implementation

and EPC Projects. Similar to the revenue model employed for our design

services, we either package the implementation (installation) of our

energy recovery system with the design and fabrication of our units, or

outsource this function to third party manufacturers for a service charge;

this allows smaller third party manufacturers to convert fixed costs to

variable costs, while offering us an ancillary revenue stream. We do not

perform implementation services on a stand-alone basis. We also possess the

resources, expertise and capabilities to act as the lead engineering

procurement and construction contractor, overseeing the implementation of

energy recovery systems for our customers. EPC services involve the whole

process of the construction of projects from design, development,

engineering, manufacturing up to

installation.

|

|

|

|

Maintenance.

Our team is responsible for the overall maintenance of the energy recovery

systems we install. In the event that major repairs are needed, the

maintenance team is capable of rebuilding the equipment in order to repair

or replace any necessary components. The maintenance team is contracted to

service our own as well as other manufacturers' energy recovery systems.

Our maintenance team charges an hourly fee for its

services.

|

Our

energy recovery systems represent a fully-customizable technology capable of

meeting the varying needs of a diversified customer base. The systems are

capable of recycling up to 70% of the energy that would otherwise be lost in

customers' industrial processes, in many cases allowing our customers to recover

their costs of the energy recovery system in energy savings within one to three

years. The energy recovery systems can also capture and eliminate harmful

particles, carbon dioxide, sulfur dioxide and other pollutants where the main

industrial facilities release such harmful emissions.

Our

energy recovery systems are suitable for use in a wide range of industries,

including chemical processing, papermaking, and oil and ethanol refining. The

core technology is easily adaptable to meet a variety of different size

facilities and types of plant design. Below is an illustration of our technology

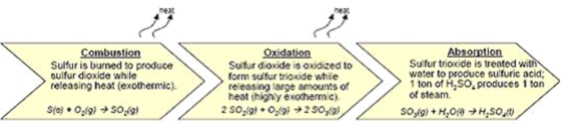

as it is implemented in the sulfuric acid production industry.

|

|

|

Traditional

Sulfuric Acid Production Process. The production of sulfuric acid involves

highly exothermic chemical reactions. Most of the heat is released into

the atmosphere through cooling towers without capturing any of the energy

contained therein. Some of the heat from the production process is

captured as steam, which the manufacturer can use to, for example,

generate electricity. Without the use of an energy recovery system, the

production of one ton of sulfuric acid will produce approximately one ton

of steam.

|

|

|

|

Sulfuric

Acid Production Process with Energy Recovery System. The incorporation of

an energy recovery system increases the manufacturer's ability to extract

energy from the production process such that the production of one ton of

sulfuric acid can produce between 1.3 and 1.65 tons of steam. In so doing,

94% of the heat that would have otherwise been released to the atmosphere

is utilized to provide a larger quantity of steam that can be used in

industrial applications. The harnessed steam can be used for various

applications, most commonly to drive generator turbines to produce

electricity. Doing so decreases the manufacturer's demand for externally

produced energy as the manufacturer instead can use internally produced

energy resulting from the energy recovery system's increased production

and utilization of steam.

|

16

Customers

We have

provided over 100 unique customers with energy recovery systems, and more than

25% of these customers have purchased multiple other products and services from

us such as design and implementation services. Our customers are mainly

industrial manufacturers, such as chemical plants, paper manufacturers and

industrial engineering firms. Our energy recovery systems are currently deployed

and being deployed in a variety of international markets, including Egypt,

Pakistan, Korea, Vietnam and Malaysia, as well as in 20 of China's 32 provinces,

including Yunnan, Jiangsu, Shandong, Sichuan, Hunan and Hubei.

Because

of the nature and long life of our energy recovery systems, a majority of our

sales are from new customers when comparing our customer base from year to year.

However, we do receive repeat business from previous customers, especially those

in China, when they are expanding their capacities or building new plants. For

the years ended December 31, 2008 and 2009, our five largest customers accounted

for 50% and 69% of our sales, respectively. Receivables from these five

customers were 47% and 66% of total accounts receivable at December 31, 2008 and

2009, respectively. There were two and one customers with balances greater than

10% at December 31, 2008 and 2009, respectively. The two customers with balances

greater than 10% at December 31, 2008 were ShuangShi (Zhangjiaguang) Chemical

Co., Ltd. and Jilin Chemical Industrial Co., Ltd.. The customer with balance

greater than 10% at December 31, 2009 was Zhenjiang Sopo Chemical New

Development Co., Ltd. (“Sopo”). Our large customers may not be the same from

year to year. Therefore, we do not believe that we are dependent upon any

specific major customers to continue our current level of sales.

Intellectual

Property and Other Proprietary Rights

The

Chinese State IPR Office has authorized and granted the following patents to

Shanghai Engineering on various components of our energy recovery

systems:

|

Patent

Type

|

Patent

Name

|

Expiration

Date

|

||

|

Utility

model

|

Drum-type

sectional ache fire tube boiler made by sulphur

|

5/6/2013

|

||

|

Utility

model

|

Double

drum-type fire tube exhaust-heat boiler which shares one steam

dome

|

11/6/2013

|

||

|

Utility

model

|

Improvement

of tube compensator breed which makes ache fume

|

11/6/2013

|

||

|

Utility

model

|

Improvement

of protective casing tube

|

11/6/2013

|

||

|

Utility

model

|

Triple

drum-type fire tube exhaust-heat boiler which shares one steam

dome

|

1/30/2015

|

||

|

Utility

model

|

|

Cement

kiln forced-circulated waste heat recovery boiler

|

|

4/2/2019

|

Shanghai

Engineering has, together with an unrelated company, Zhejiang Jia Hua Group

Joint Stock Co., Ltd., submitted the following patent applications to the

Chinese State IPR Office, which are currently pending

authorization:

|

Patent

Type

|

Patent

Name

|

Application

Date

|

||

|

Utility

model

|

Spray

pump synthesizing tower

|

8/31/2007

|

||

|

Invention

|

Chlorosulfonic

acid preparation new craftwork and equipment

|

8/31/2007

|

||

|

Utility

model

|

The

center pipe smoke double disc regulator

|

4/17/2009

|

||

|

Utility

model

|

|

Steam

air reactor

|

|

3/29/2010

|

The

patent application for “chlorosulfonic acid preparation new craftwork and

equipment” passed the publication period and entered into the examination period

in March 2009. If our application is successful, we expect that it will take

between two to three years until we are granted a patent for this invention, if

at all.

17

Research

and Development

We are

focused on a strategy of utilizing our research and development capabilities to

continuously improve the waste heat and emissions capture technology of our

energy recovery systems. Our research and development efforts focus specifically

on maximizing efficiency and reliability while minimizing the cost to customers.

We have currently been focusing our efforts on new products with immediate

demand in the markets such as capturing and reducing emissions released in

various industrial processes, such as sulfur dioxide (a byproduct in sulfuric

acid processes) and alkali (a byproduct in paper-making processes). We maintain

strong relationships with many professional engineering firms in China that can

provide technical support in the development process.

We employ

approximately 100 specialized engineers at our Shanghai, China facilities who

are engaged in refining the core technology for our energy recovery systems,

developing our intellectual property rights, enhancing energy efficiencies and

decreasing environmental impact for our customers. Our engineers carry out

development activities alongside with the design work for our customers’

projects and the expenses associated with our research and development

activities are passed along to our customers as part of the price paid for our

products and services. However, since expenses incurred in research and

development are immaterial, we do not record research and development expenses

as a separate line item in our financial statements. Shanghai Engineering has a

portfolio of core Chinese patents on various components of our energy recovery

systems as described above.

Our

Business Strategy

We have

established a three-phase growth strategy:

|

|

|

Phase

One. During the first phase of our growth strategy, we will continue to

fulfill our current orders while growing our domestic Chinese business.

During this time, we intend to establish long-term strategic purchasing

agreements with suppliers that provide key raw

materials.

|

|

|

|

Phase

Two. The second phase of our growth strategy involves increased

expenditures that will support our growth. We intend to complete the first

phase of the construction of our first owned manufacturing facility, which