Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CenterState Bank Corp | d8k.htm |

Rodman & Renshaw

Annual Global

Investment Conference

September 13, 2010

Exhibit 99.1 |

This presentation contains forward-looking statements, as defined by Federal

Securities Laws, relating to present or future trends or factors affecting

the operations, markets and products

of

CenterState

Banks,

Inc.

(CSFL).

These

statements

are

provided

to

assist

in

the

understanding of future financial performance. Any such statements are based on

current expectations and involve a number of risks and uncertainties. For a

discussion of factors that may cause such forward-looking statements to

differ materially from actual results, please refer to CSFL’s

most recent Form 10-Q and Form 10-K filed with the Securities

Exchange Commission.

CSFL undertakes no obligation to release revisions to these forward-looking

statements or reflect events or circumstances after the date of this

presentation. Forward Looking Statement

2 |

Birmingham

Atlanta

Winston-Salem

Tampa

Winter Haven

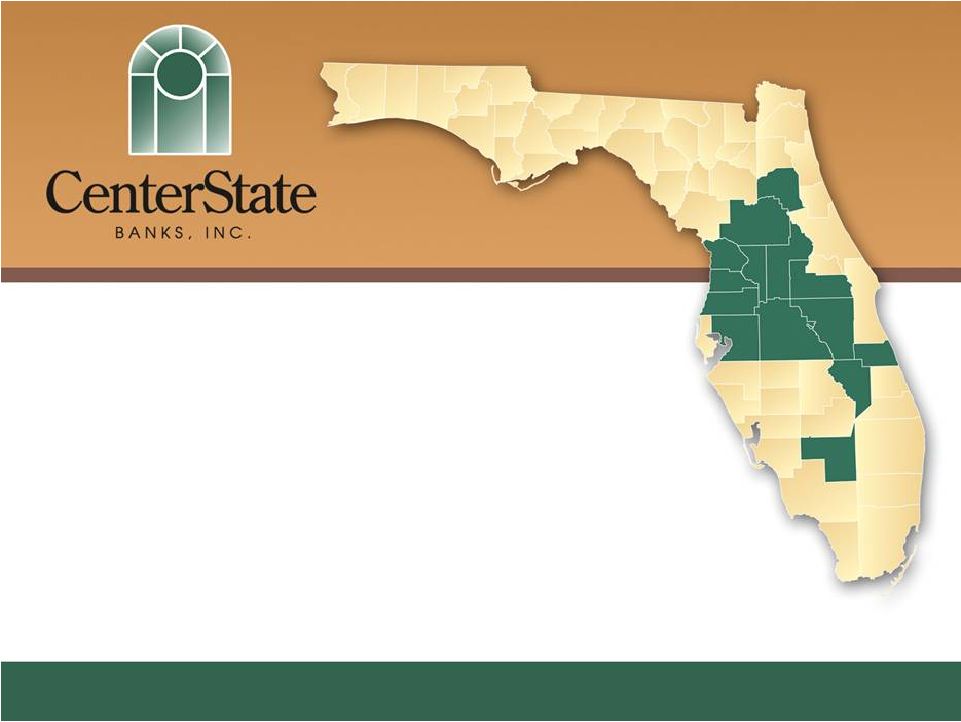

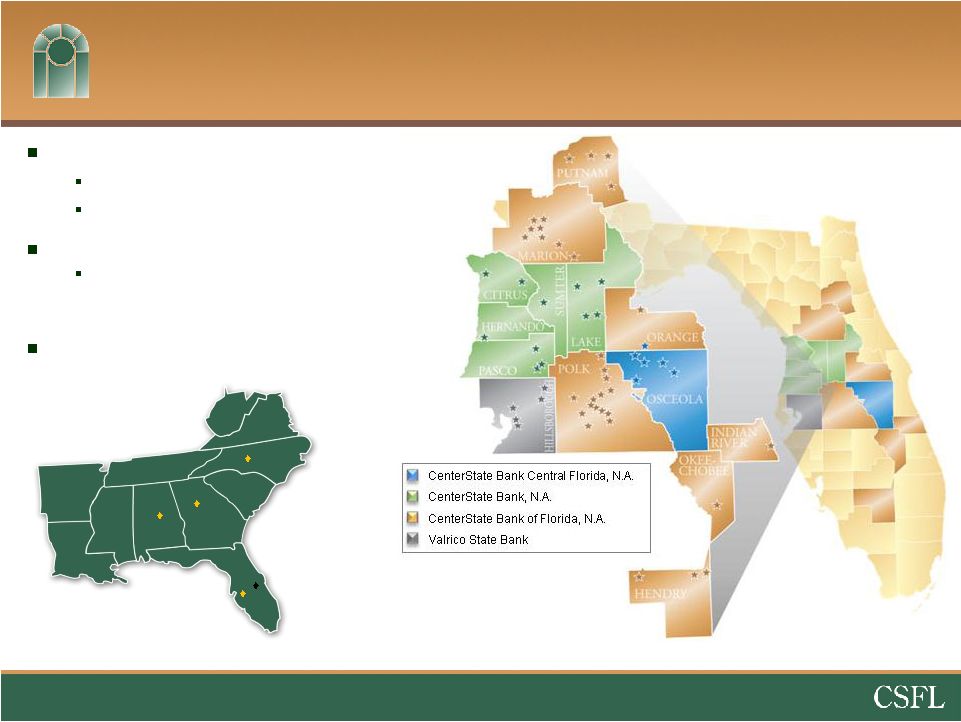

Corporate Overview

Headquartered in Davenport, FL

$2.3 billion in assets

$1.9 billion in deposits

Company formed: June 2000

4 Subsidiary Banks; 54 banking

offices in 14 counties throughout

Central Florida

6 of 14 counties of operation rank in the

top 15 fastest growing counties in Florida

3

Data

pro

forma

for

the

P&A

agreement

with

TD

and

the

acquisitions

of

Olde

Cypress

Community

Bank,

Independent

National

Bank,

and

Community

National

Bank

at

Bartow,

excluding

purchase

accounting

adjustments. |

Recent Initiatives

4

June 2010 –

Opened branch in Vero Beach, Florida to house recently hired team

–

Team led by Andy Beindorf, former CEO of ALAB subsidiary Indian River National

Bank July 16, 2010 –

Announced the acquisition of Olde

Cypress Community Bank, Clewiston, FL ($163mm in assets) from

the FDIC

–

Will serve as base for team led by John Williams, former CEO of Riverside National

Bank and Okeechobee Market President

July 22, 2010 –

Capital Raise -

$35 Million

August 8, 2010 –

Entered into P&A agreement with TD Bank

–

Will acquire four branches in Putnam County, FL with approx. $113mm in deposits

and purchase up to $125mm in loans August 20, 2010 –

Announced the acquisition of Independent National Bank, Ocala FL and Community

National Bank at Bartow, Bartow, FL ($210mm in assets) from the FDIC

September 3, 2010 –

Announced intention to combine our three national chartered subsidiary banks,

subject to regulatory approval

Capital Ratios

CSFL 6/30/10

w/ Cap. Raise

Peer

Average

Leverage Ratio

11.30

%

12.90

%

8.01

%

Tang. Common Equity / Tang. Assets

11.06

12.67

5.47

Total Risk-Based Capital Ratio

18.88

21.75

14.71

Source: SNL Financial, data as of most recent quarter

available. Florida peers include publicly traded banks and thrifts

headquartered in Florida with $1 billion or more in total assets.

Assumes net proceeds from capital raise are initially invested in 0%

risk-weighted assets. |

5

Management Lift Outs –

Team Building

RETAIL/COMMERCIAL BANKING

Vero

Beach

–

Andy

Beindorf

(former

CEO

of

the

$800

million

Indian

River

National

Bank

,subsidiary

of

ALAB)

and

team

of

commercial,

retail,

and

residential

lenders

–

1Q

2010

Okeechobee

–

John

Williams

(former

CEO

of

the

$3

billion

Riverside

National

Bank

and

Market

President

of

Okeechobee

Region)

and

team

of

commercial,

retail,

and

residential

lenders

–

2Q

2010

Lakeland

-

Mike

Crowell

(former

Chief

Credit

Officer

of

the

$800

million

Citrus

&

Chemical

Bank

in

Lakeland,

FL)

–

1Q

2010

Residential

Mortgage

–

Dave

Kopec

(former

director

of

residential

lending

at

an

$800

million

thrift

in

Lakeland)

–

1Q

2010

CORRESPONDENT DIVISION

Silverton

Capital

Markets

and

Operations

Team

–

Atlanta,

GA

and

Winston-Salem,

NC

–

3Q

2009

WEALTH MANAGEMENT

Joe

Keating

(former

CIO

of

ALAB)

and

team

of

two

private

bankers

in

Orlando.

Joe

is

a

regular

contributor

to

CNBC

and

Bloomberg,

and

previously

was

responsible

for

the

Broker

Dealer,

Trust

Dept.

and

Correspondent

Banking

divisions

at

Alabama

National

Bank

–

2Q

2010

SPECIAL ASSETS

Dan

Bockhorst

–

former

special

assets

manager

for

the

State

of

Florida

for

RBC

Bank

FINANCE

Jennifer

Geckler

–

former

CFO

of

Bank

of

Florida

Southeast

and

Bank

of

Florida

Southwest

and

Treasurer

of

holding

company

(BOFL)

–

3Q 2010

PREPAID CARD BUSINESS

Tommy

McCulley

–

President

of

Prepaid

Technologies

with

nearly

a

decade

of

experience

in

prepaid

card

space

–

2Q

2010 |

CSFL Combined Counties of Operation

Market Share Opportunity

6

Indian River County, FL

Okeechobee County, FL

Rank

Institution

Deposits

Market

Share

Branches

Deposits per

Branch

($000)

1

Bank of America Corp.

10,920,662

19.38

%

122

89,514

2

SunTrust Banks, Inc.

9,574,486

16.99

153

62,578

3

Wells Fargo & Co.

9,226,693

16.38

121

76,254

4

BB&T Corp.

3,916,987

6.95

73

53,657

5

Regions Financial Corp.

3,344,588

5.94

92

36,354

6

CenterState

Banks, Inc.

1,675,262

2.97

52

32,217

7

Toronto-Dominion Bank

1,605,970

2.85

38

42,262

8

Fifth Third Bancorp

1,131,031

2.01

30

37,701

9

Villages BanCorp., Inc.

817,150

1.45

9

90,794

10

Tampa Banking Co.

786,536

1.40

9

87,393

Source: FDIC and SNL Financial

Deposit data as of 6/30/09

Market share data for CSFL’s

combined counties of operation, excluding Orange County. Pro

forma to include agreement with TD and acquisitions of Olde

Cypress Community Bank, Community National Bank at Bartow, and

Independent National Bank. Excludes Orange County in which CSFL

has $20.0 million in deposits and 1 branch. Deposits per

Deposits

Market

Branch

Rank

Institution

($000)

Share

Branches

($000)

1

Bank of America Corp.

$111,795

22.13

%

2

$55,898

2

Seacoast Banking Corp. of Florida

106,171

21.01

3

35,390

3

Riverside Banking Co.

97,898

19.38

1

97,898

4

PNC Financial Services Group Inc.

79,337

15.70

1

79,337

5

SunTrust Banks Inc.

69,003

13.66

1

69,003

6

Regions Financial Corp.

32,668

6.47

1

32,668

7

First Bank and Trust Co. of Indiantown

8,356

1.65

1

8,356

Deposits per

Deposits

Market

Branch

Rank

Institution

($000)

Share

Branches

($000)

1

Wells Fargo & Co.

$1,106,210

28.96

%

8

$138,276

2

PNC Financial Services Group Inc.

486,570

12.74

7

69,510

3

Bank of America Corp.

426,851

11.18

7

60,979

4

SunTrust Banks Inc.

309,454

8.10

6

51,576

5

Royal Bank of Canada

308,047

8.06

6

51,341

6

Northern Trust Corp.

288,825

7.56

2

144,413

7

Seacoast Banking Corp. of Florida

207,751

5.44

8

25,969

8

Riverside Banking Co.

184,591

4.83

4

46,148

9

BU Financial Corp.

169,623

4.44

2

84,812

10

Marine Bank & Trust Co.

120,832

3.16

2

60,416 |

Priorities and Goals

Achieve Return on Average Assets of 1.00%

Surpass $5 billion in assets

Expand into new markets with demographics similar to

Central Florida

Remain highly capitalized

Strategic Goals

(3 –

5 Years)

Near-Term

(18 –

24 Months)

Acquire banking institutions through FDIC assisted transactions

Reduce the level of problem assets

Leverage Correspondent Banking Division

Evaluating future strategic whole-bank opportunities

7 |

NEAR-TERM DRIVERS

1.

Home sales up significantly

2.

Foreclosure filings down

3.

Consumer and commercial

deleveraging continues

Florida Outlook –

Long Slow Recovery

Source: Florida Legislature Office of Economic and Demographic Research

8

Florida Home Sales -

YoY % Change

1995-2009

Debt Overhang

+

Low Loan

Growth

Opportunities

=

Bank Consolidation |

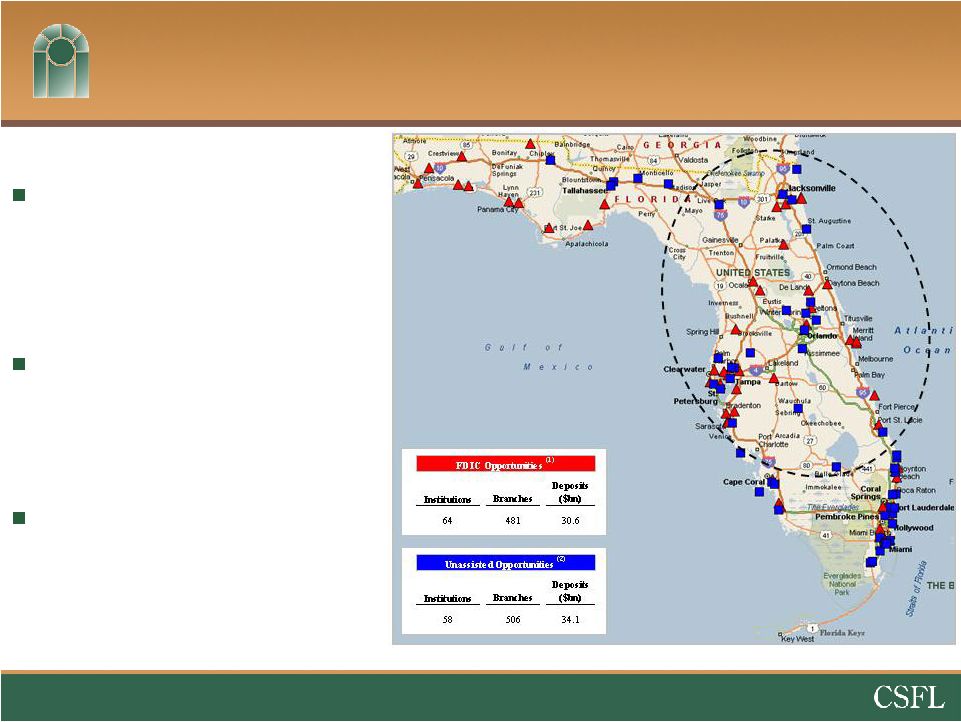

Positioned for FDIC Transaction Opportunities

9

Source: SNL Financial, data as of most recent quarter

available. (1)FDIC Opportunities include banks and thrifts in

Florida with Texas Ratios greater than 100%. (2)Unassisted

Opportunities include banks and thrifts in Florida with Texas Ratios between 50% and 100%.

Prior FDIC acquisition experience

–

Ocala National Bank

–

Olde

Cypress

–

Community National Bank at Bartow

–

Independent National Bank

Many seasoned executive teams within

the Holding Company –

12 bankers

with prior community bank CEO

experience

Recent hires with significant

executive and workout experience |

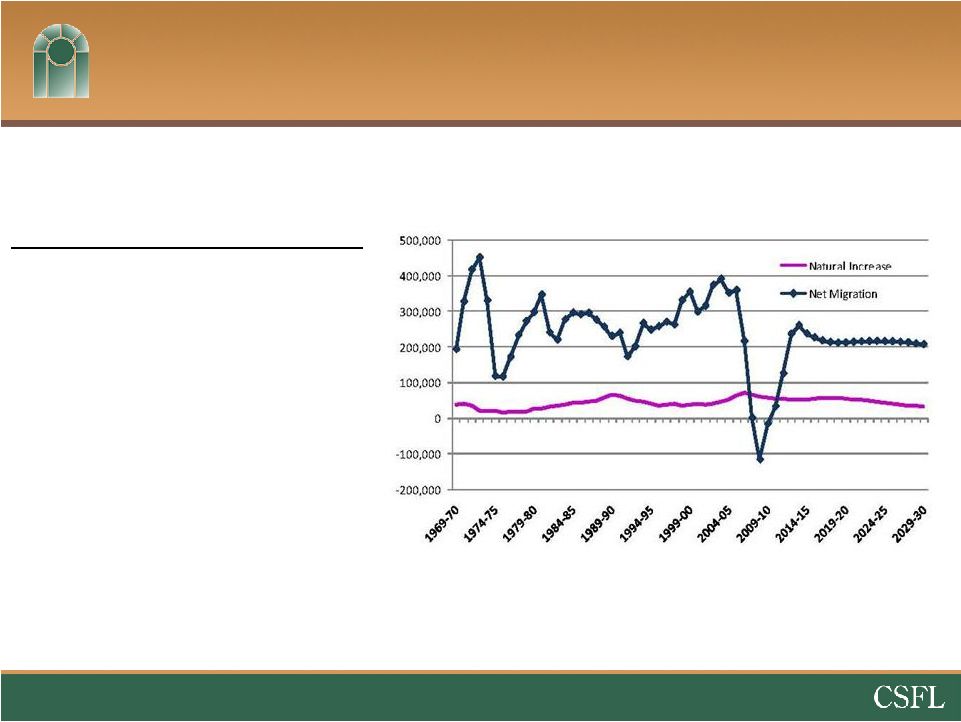

LONG-TERM DRIVERS

1.

Housing more affordable

2.

Baby-Boomers nearing

retirement age

3.

Net migration to return

4.

72 degrees in January

Florida Outlook

Long-Term Future Still Bright

Source: Florida Legislature Office of Economic and Demographic Research

10

Florida’s Population Growth |

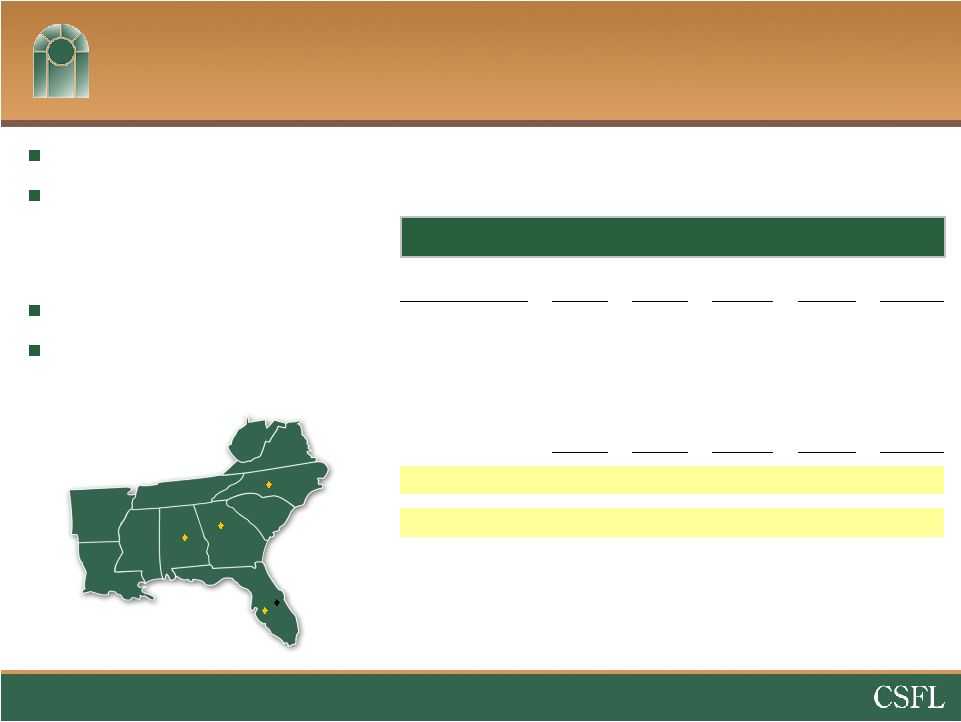

Birmingham

Atlanta

Winston-Salem

Tampa

Winter Haven

Correspondent Banking Division

Primary business lines

–

Bond Sales

–

Fed funds

–

Safekeeping, bond accounting, and

asset/liability consulting services

Customer base –

508 community banks

Opportunity

–

Bank Clearing & Cash Management

–

Talent Recruiting / M&A

Division Contribution

11

($000s, except per share)

2Q09

3Q09

4Q09

1Q10

2Q10

Net Interest Income

$1,975

$1,813

$1,656

$1,526

$1,319

Non-Interest Income

2,670

6,011

7,468

6,622

7,758

Non-Interest Expense

(2,038)

(5,312)

(6,512)

(6,164)

(6,740)

Income Tax Expense

(881)

(967)

(1,006)

(764)

(900)

Net Income Impact

$1,726

$1,545

$1,606

$1,220

$1,437

EPS Impact

$0.14

$0.07

$0.06

$0.05

$0.05

Management

lift

out

from

RBC

(formerly

ALAB)

and

Capital

Markets

Division

of

Silverton

(66

employees) |

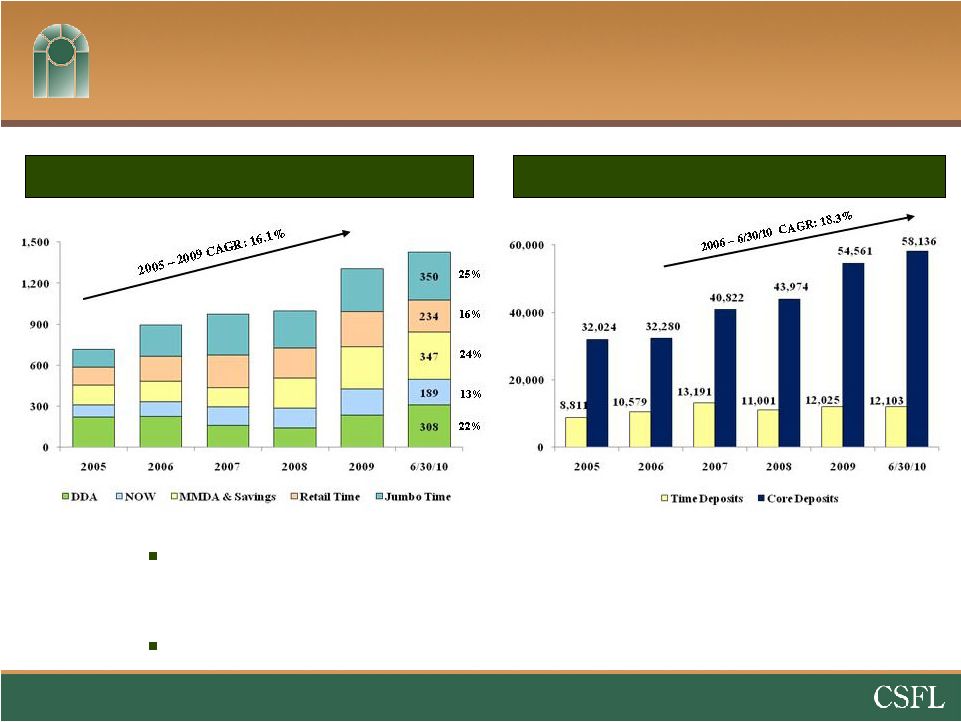

Core Deposit Focus

Approximately 70,239 total accounts -

$20,322 average balance per

account

Ocala National Bank (FDIC assisted) –

Core deposits up 22%

Total Deposits ($MM)

Number of Deposit Accounts

Core deposits defined as non-time deposits.

12 |

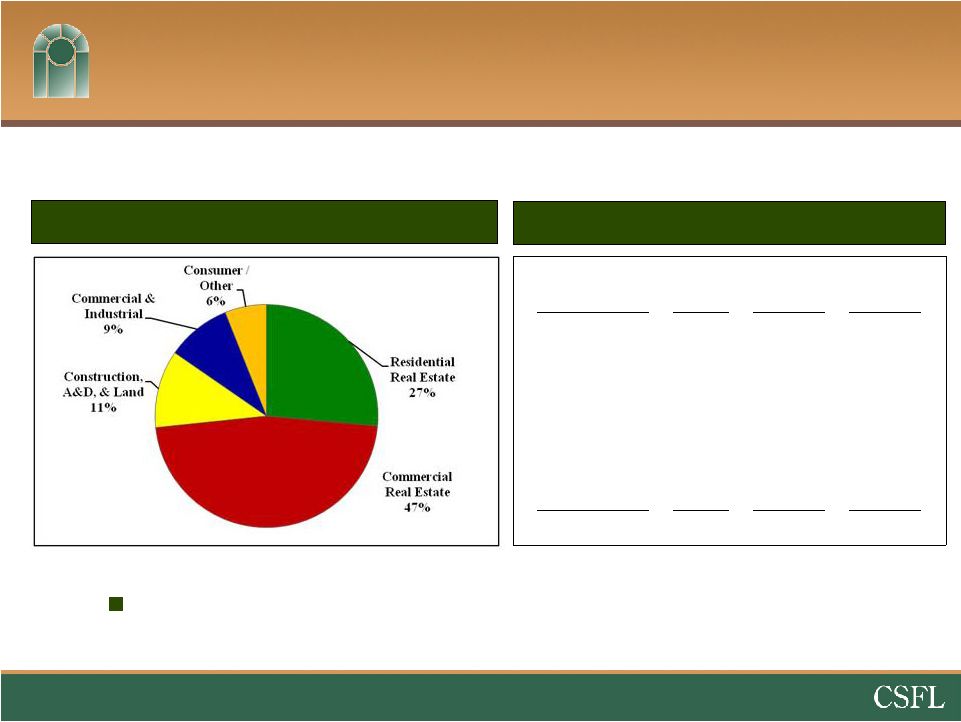

Loan Portfolio

Total Loans by Type (%)

Total Loans Detail

Construction, Development, & land represents only 11% of the total

portfolio 13

Loan Type

No. of

Loans

6/30/10

Balance

Avg

Loan

Balance

Residential Real

Estate

2,619

$249MM

$95,000

Commercial Real

Estate

1,073

442MM

412,000

Construction,

A&D, & Land

565

106MM

188,000

Commercial &

Industrial

971

88MM

90,000

Consumer /Other

2,117

57MM

27,000

Total

7,345

$942MM

$128,000 |

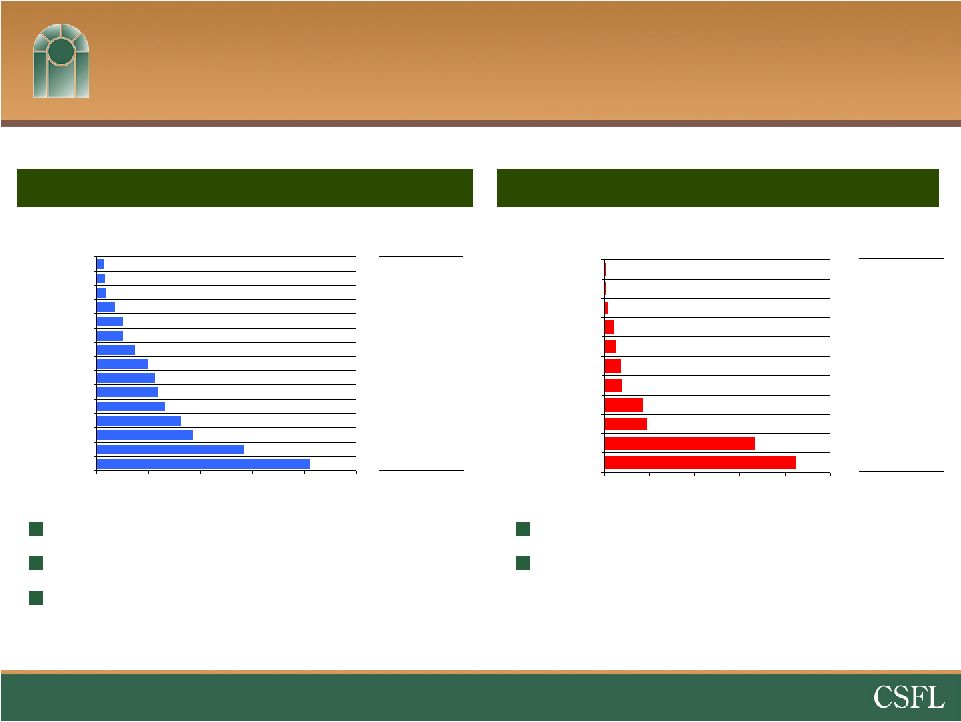

Commercial Real Estate & Construction Loans

Commercial Real Estate by Type

Construction Loans by Type

$442 million (47% of total loan portfolio)

5% Non-Accrual

55% owner-occupied

* CRE concentration –

143% vs

300%

$106 million (11% of total loan portfolio)

10% Non-Accrual

* C&D concentration –

40% vs

100%

14

Data as of 6/30/10.

% of

Average

Total

Size

Loans

($000)

0.0

%

$294

0.0

332

0.1

135

0.2

130

0.3

1,186

0.4

315

0.4

1,285

0.9

288

1.0

715

3.5

93

4.5

333

11.3

%

$188

$42.4

$33.3

$9.3

$8.4

$3.9

$3.5

$2.4

$2.1

$0.8

$0.3

$0.3

$0mm

$10mm

$20mm

$30mm

$40mm

$50mm

Raw Land – Commercial

SF Building Lots

Developed Land

Raw Land – Residential

Const. – Church/Education

Const. – SF Owner

Const. – Industrial

Raw Land – Agriculture

Const. – Spec Home

Const. – Other

Const. – Restaurant

% of

Average

Total

Size

Loans

($000)

0.4

%

$709

0.4

831

0.5

360

0.9

246

1.4

612

1.4

357

1.9

253

2.6

540

3.0

493

3.1

600

3.5

547

4.3

583

4.9

457

7.5

400

10.9

318

46.9

%

$412

$3.5

$4.2

$4.7

$8.9

$12.9

$12.9

$18.2

$24.8

$28.1

$29.4

$32.8

$40.8

$46.6

$71.1

$102.8

$0mm

$25mm

$50mm

$75mm

$100mm

$125mm

Office Buildings

Retail

All Other CRE

Church and Education

Warehouse

Strip Center

Industrial

Medical

Multi-family Residential

Restaurant

Mini Warehouse

Agriculture

Mobile Home Park

Hotel/Lodging

Aviation |

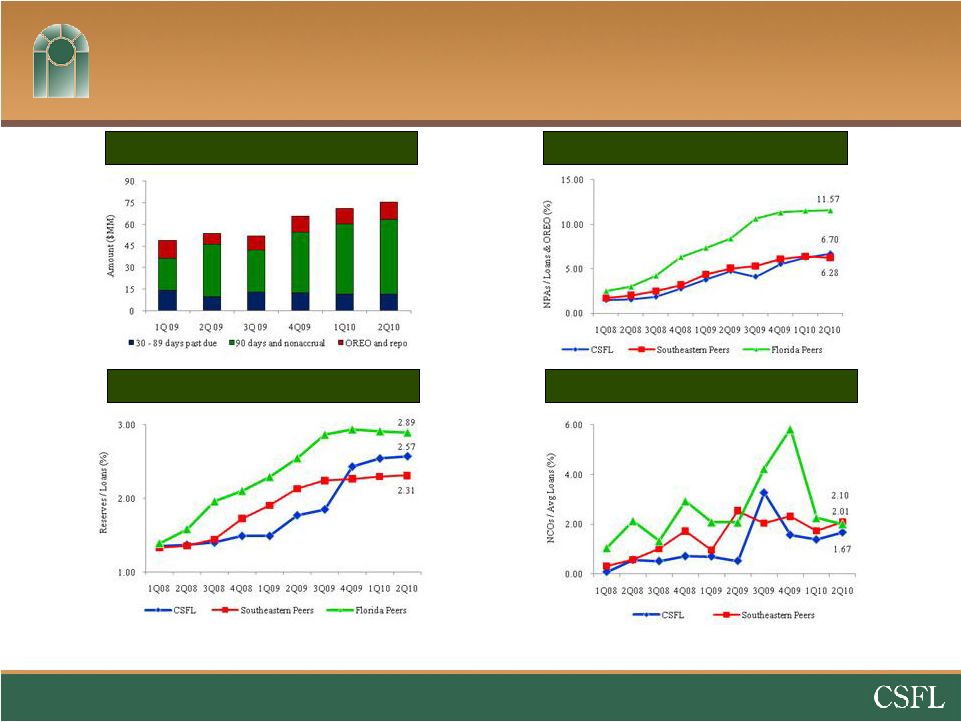

Credit Quality Trends

NPAs

/ Loans & OREO (%)

Net Charge-Offs / Avg. Loans (%)

Problem Loan Trends ($MM)

Reserves / Loans (%)

•

ALLL / NPL ratio of 46% versus 36% for Florida Peers (MRQ)

15

Source: SNL Financial and Company filings.

Nonperforming assets include 90 days or more past due.

Southeastern peers include ABCB, BTFG, GRNB, PNFP, RNST, SCBT, UBSH and

UCBI. Florida peers include publicly traded banks and thrifts

headquartered in Florida with $1 billion or more in total assets. |

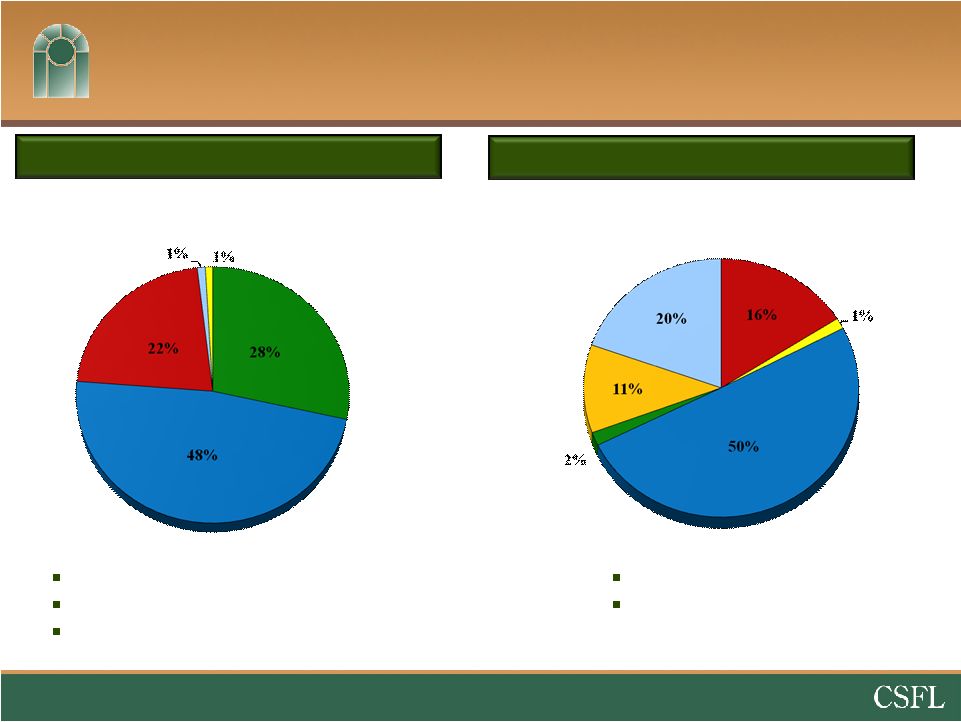

Non-Performing Loans

Other Real Estate Owned

$52,070,000 (5.53% of Gross Loans)

30% of NPLs

are current

79% of legal unpaid loan balance, net of specific reserves

$11,144,000

57% of legal unpaid loan balance at

repossession date

Residential Real

Estate

$14,844K

(87 loans)

Commercial Real Estate

$24,848K

(55 loans)

Construction,

A&D, & Land

$11,401K

(46 loans)

Commercial

$512K

(19 loans)

Consumer / Other

$465K

(27 loans)

16

Commercial Buildings

(15)

$5,609K

Mobile Homes

w/ Land

(6)

$151K

Vacant Land

(14 parcels of land)

$2,185K

Mixed Properties

$187K

Single Family Homes

(22)

$1,783K

Residential Lots

(50)

$1,229K

Data as of 6/30/10

NonPerforming

Assets |

17

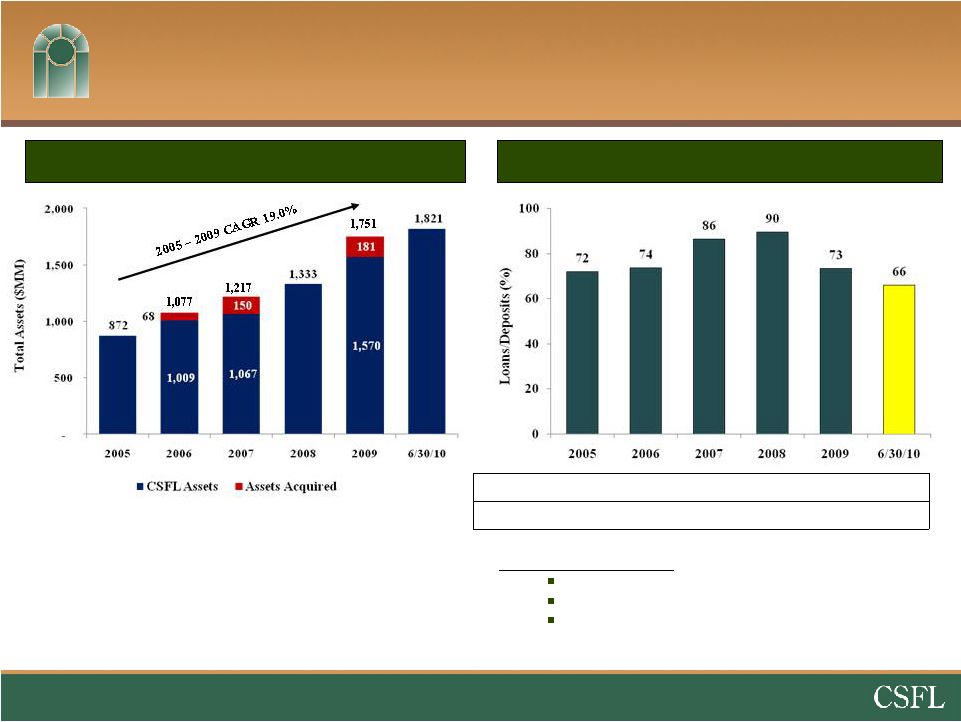

Organic Growth & Earnings Potential

Total Asset Growth

Loans / Deposits (%)

Loans / Deposits ratio

CenterState

Banks, Inc. –

66%

Southeastern Peers Average –

86%

Florida Peers Average –

84%

Loans

$517

$658

$841

$892

$959

$942

Deposits

717

893

973

994

1,305

1,427

Source: SNL Financial and Company filings, data as of most recent

quarter available. Southeastern peers include ABCB, BTFG, GRNB,

PNFP, RNST, SCBT, UBSH and UCBI. Florida peers include publicly

traded banks and thrifts headquartered in Florida with $1 billion or more in total assets. |

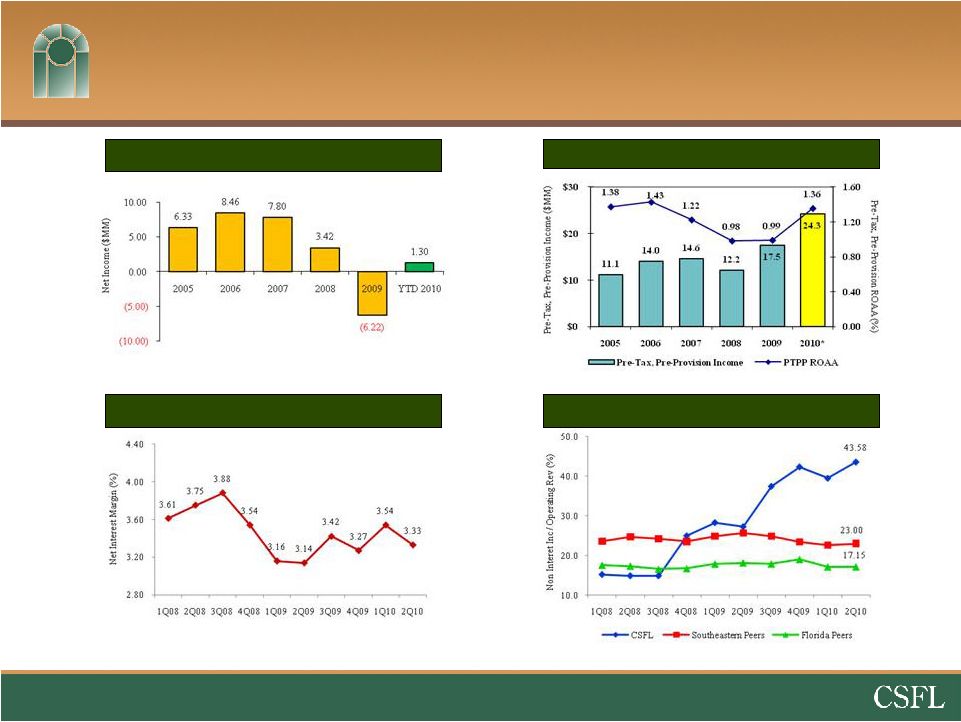

Profitability

Pre-

Tax, Pre-Provision Income & ROAA

(%)

Non Interest Inc / Op. Revenue (%)

Net Income ($MM)

Net Interest Margin (%)

18

Source: SNL Financial and Company filings.

Southeastern peers include ABCB, BTFG, GRNB, PNFP, RNST, SCBT, UBSH and

UCBI. Florida peers include publicly traded banks and thrifts

headquartered in Florida with $1 billion or more in total assets.

*Annualized |

Conservative Balance Sheet

Loans / Assets of 52%

as of 06/30/10

Constr/A&D/Land loans represent 11% of total loans

versus 21% for Southeastern peers and 12% for Florida peers

NPAs

/ Assets of 3.51% versus 4.44% for Southeastern peers

and 5.77% for Florida peers

Robust capital position

*

•

TCE and Tier 1 leverage ratios of 12.7% and

12.9% at 06/30/10

Source: SNL Financial and Company filings, data as of most recent

quarter available. Southeastern peers include ABCB, BTFG, GRNB,

PNFP, RNST, SCBT, UBSH and UCBI. Florida peers include publicly

traded banks and thrifts headquartered in Florida with $1 billion or more in total assets.

*Proforma

to include capital raise of $35 million

19 |

Summary

Energetic, experienced local management team taking

advantage of opportunities

Significant organic growth opportunities

Increased FDIC-assisted deals coming to our market in the next

6 –

9 months

Unprecedented opportunities to add shareholder value

20 |