Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EAGLE BANCORP INC | f8k_090110.htm |

Ticker: EGBN

www.eaglebankcorp.com

www.eaglebankcorp.com

Forward Looking Statements

This presentation contains forward looking statements within the meaning of the Securities and

Exchange Act of 1934, as amended, including statements of goals, intentions, and expectations as

to future trends, plans, events or results of Company operations and policies and regarding general

economic conditions. In some cases, forward-looking statements can be identified by use of words

such as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,” “estimates,” “potential,”

“continue,” “should,” and similar words or phrases. These statements are based upon current and

anticipated economic conditions, nationally and in the Company’s market, interest rates and

interest rate policy, competitive factors and other conditions which by their nature, are not

susceptible to accurate forecast and are subject to significant uncertainty. For details on factors

that could affect these expectations, see the risk factors and other cautionary language included in

the Company’s Annual Report on Form 10-K and other periodic and current reports filed with the

SEC. Because of these uncertainties and the assumptions on which this discussion and the

forward-looking statements are based, actual future operations and results in the future may differ

materially from those indicated herein. Readers are cautioned against placing undue reliance on

any such forward-looking statements. The Company’s past results are not necessarily indicative of

future performance. The Company does not undertake to publicly revise or update forward-

looking statements in this presentation to reflect events or circumstances that arise after the date

of this presentation, except as may be required under applicable law.

Exchange Act of 1934, as amended, including statements of goals, intentions, and expectations as

to future trends, plans, events or results of Company operations and policies and regarding general

economic conditions. In some cases, forward-looking statements can be identified by use of words

such as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,” “estimates,” “potential,”

“continue,” “should,” and similar words or phrases. These statements are based upon current and

anticipated economic conditions, nationally and in the Company’s market, interest rates and

interest rate policy, competitive factors and other conditions which by their nature, are not

susceptible to accurate forecast and are subject to significant uncertainty. For details on factors

that could affect these expectations, see the risk factors and other cautionary language included in

the Company’s Annual Report on Form 10-K and other periodic and current reports filed with the

SEC. Because of these uncertainties and the assumptions on which this discussion and the

forward-looking statements are based, actual future operations and results in the future may differ

materially from those indicated herein. Readers are cautioned against placing undue reliance on

any such forward-looking statements. The Company’s past results are not necessarily indicative of

future performance. The Company does not undertake to publicly revise or update forward-

looking statements in this presentation to reflect events or circumstances that arise after the date

of this presentation, except as may be required under applicable law.

For further information on the Company please contact: Michael T. Flynn

Executive Vice President

240-497-2040

mflynn@eaglebankcorp.com

1

History of Growth

Founding members had extensive banking experience

Founding members had extensive banking experience Raised $16.5 million in initial subscription offering - 1997*

Raised $16.5 million in initial subscription offering - 1997* Commenced operations with three Maryland branches - July, 1998

Commenced operations with three Maryland branches - July, 1998 Second subscription offering raised $30 million - 2003*

Second subscription offering raised $30 million - 2003* Reached $500 million in assets in 2004

Reached $500 million in assets in 2004 Private placement of $12.1 million of subordinated debt - August 2008 (Current balance $9.3 million)

Private placement of $12.1 million of subordinated debt - August 2008 (Current balance $9.3 million) Fidelity & Trust Financial Corporation (“F&T”) acquisition completed - August 31, 2008

Fidelity & Trust Financial Corporation (“F&T”) acquisition completed - August 31, 2008 $1.4 billion of assets upon completion of acquisition

$1.4 billion of assets upon completion of acquisition Placed $38.2 million of TARP Preferred Stock - December, 2008 (Current balance $23.2 million)

Placed $38.2 million of TARP Preferred Stock - December, 2008 (Current balance $23.2 million) $55 million common stock offering - September, 2009

$55 million common stock offering - September, 2009 Reached $1.9 billion in assets - June, 2010

Reached $1.9 billion in assets - June, 2010*1997, 2003 and 2009 subscription offerings were over subscribed

2

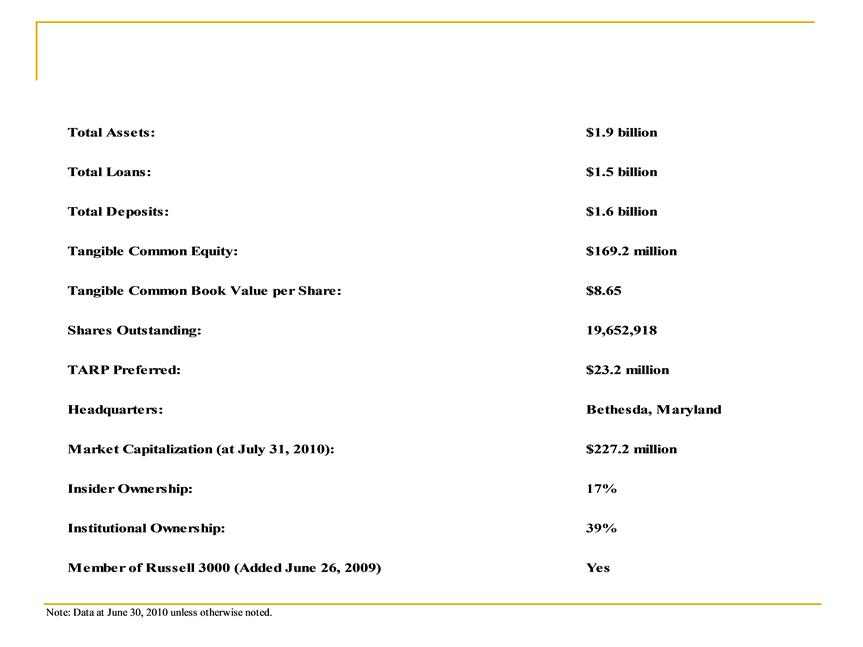

Summary Statistics - June 30, 2010

3

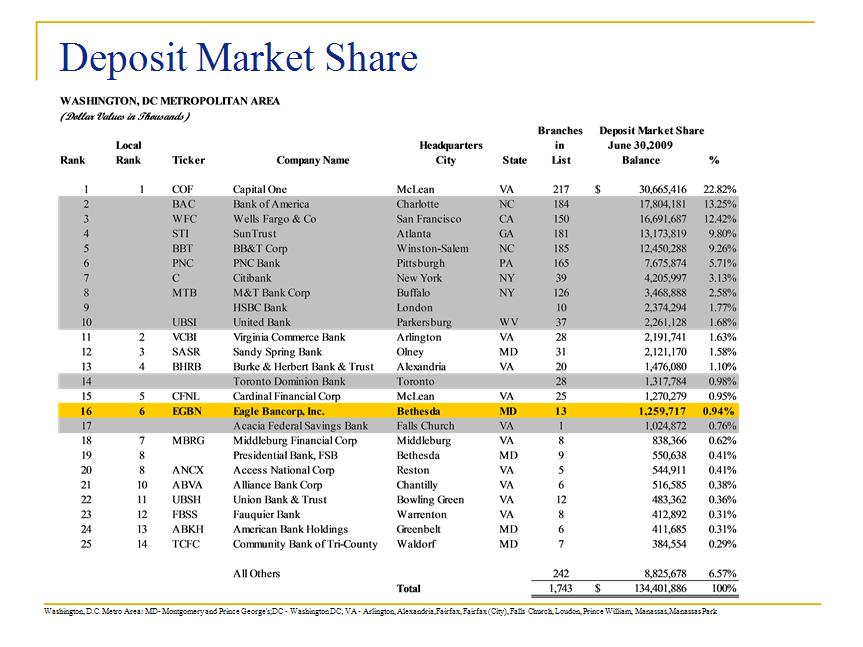

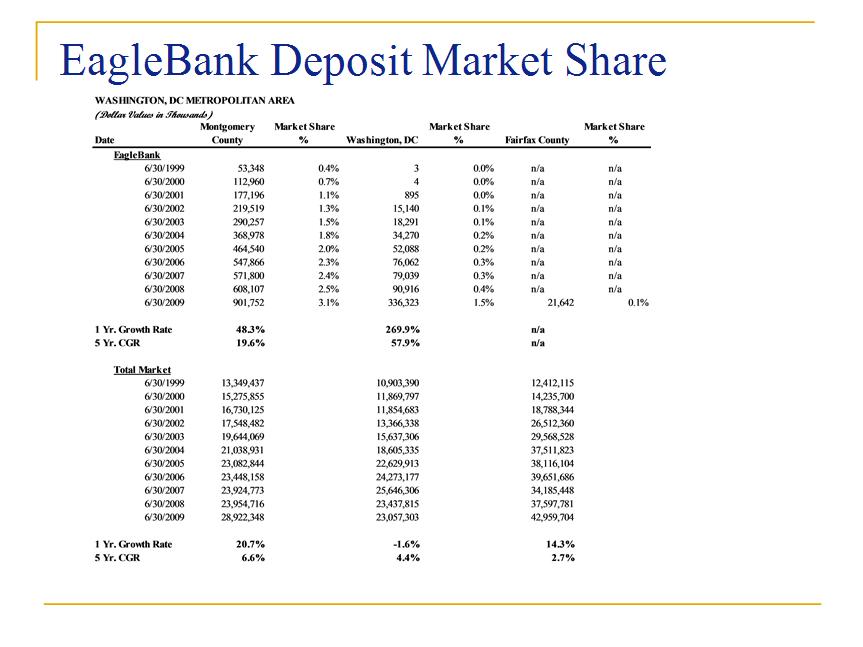

Company Overview

Eagle Bancorp, Inc. is a rapidly growing commercial bank headquartered in

Eagle Bancorp, Inc. is a rapidly growing commercial bank headquartered in Bethesda, Maryland

o $1.9 billion in assets, focused on Washington, DC Metro Area with 13 branches

o Commercially oriented business model with deep relationships on loan and deposit side

of balance sheet

o 2nd largest bank headquartered in Maryland by Assets and Market Capitalization

Positioned as an alternative solution between small community banks and regional /

Positioned as an alternative solution between small community banks and regional /money center banks

o Growth oriented culture based on sales and service

o Provides customers with immediate access to senior management/decision-makers with

local market knowledge

o Largest deposit market share in Washington, DC (proper) of any locally-based bank, and

6th largest locally-based bank in the Metro Area

6th largest locally-based bank in the Metro Area

o Quickly becoming the leading community bank in the Washington, DC Metro Area

Note: Financial data at June 30, 2010. Deposit market share data as of June 30, 2009.

4

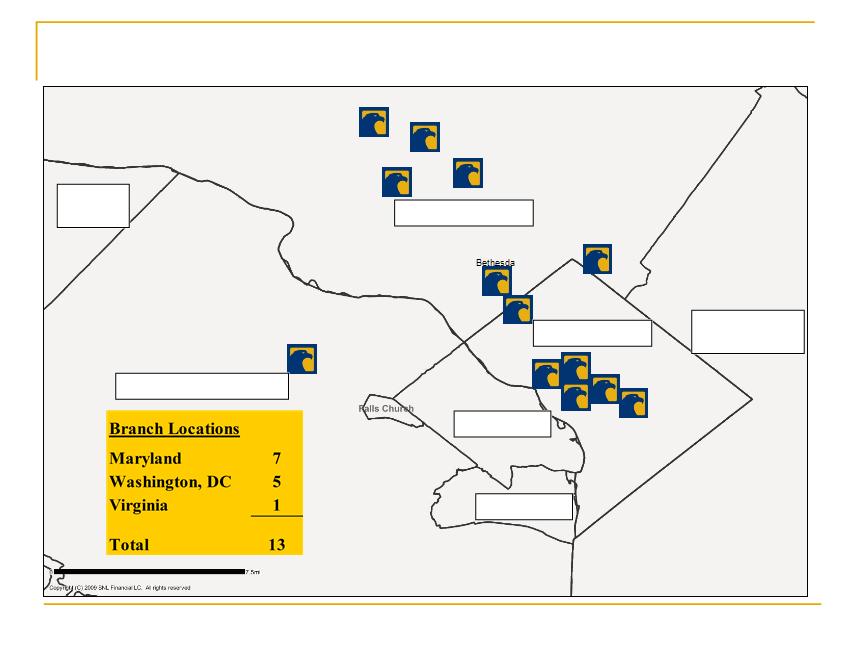

EagleBank Locations

Tyson's Corner

Montgomery County

Prince George’s

County

County

Alexandria

Arlington

Fairfax County

Loudoun

County

County

Washington, DC

Reston

5

6

Why Invest in EGBN?

Driven by Profitability

Driven by Profitability Superior Net Interest Margin

Superior Net Interest Margin Emphasis on Core Deposits and Deep Relationship Banking

Emphasis on Core Deposits and Deep Relationship Banking Strong Organic Growth

Strong Organic Growth Geographic Market Positioning

Geographic Market Positioning Experienced and Dedicated Board and Management Team

Experienced and Dedicated Board and Management Team Exceptional Asset Quality Record

Exceptional Asset Quality Record Conservative Securities Portfolio

Conservative Securities Portfolio Proven Ability to Execute Acquisitions

Proven Ability to Execute Acquisitions7

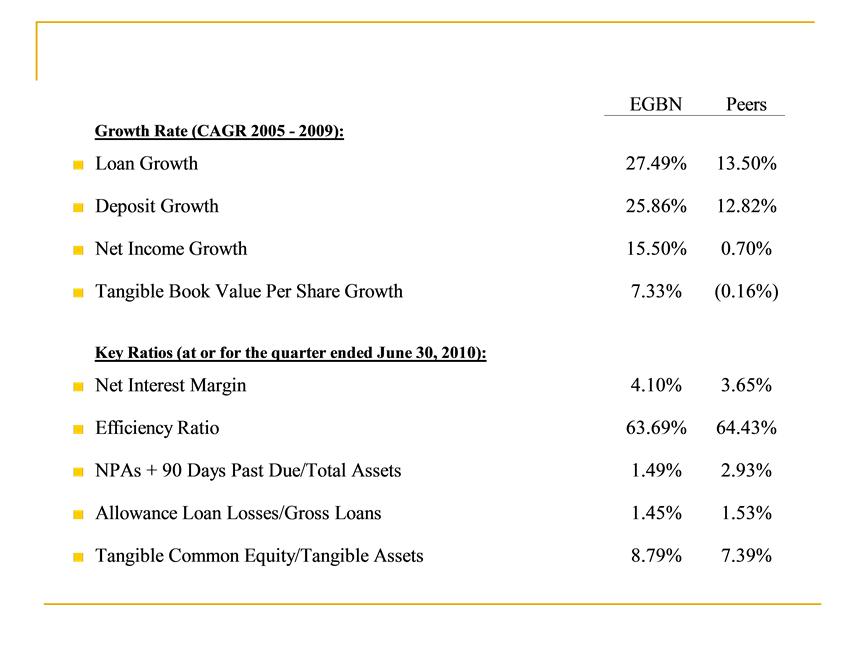

Financial Indicators - Regional Peer Analysis

Note: Regional peers includes publicly-traded commercial banks with Assets between $1 and $5 billion and headquartered in Washington, DC, Virginia, West Virginia, Maryland, Pennsylvania and

Delaware who reported at all reporting periods shown above

Delaware who reported at all reporting periods shown above

Source: SNL Financial

8

Financial Indicators - Local Peer Analysis

Note: Local peers in the Washington D.C. metro area: Access National Bank, Alliance Bank Corp., Cardinal Bank, Community Bank of Tri-County, Frederick County Bank, Sandy Spring Bank and Virginia

Commerce Bank.

Commerce Bank.

Source: SNL Financial

9

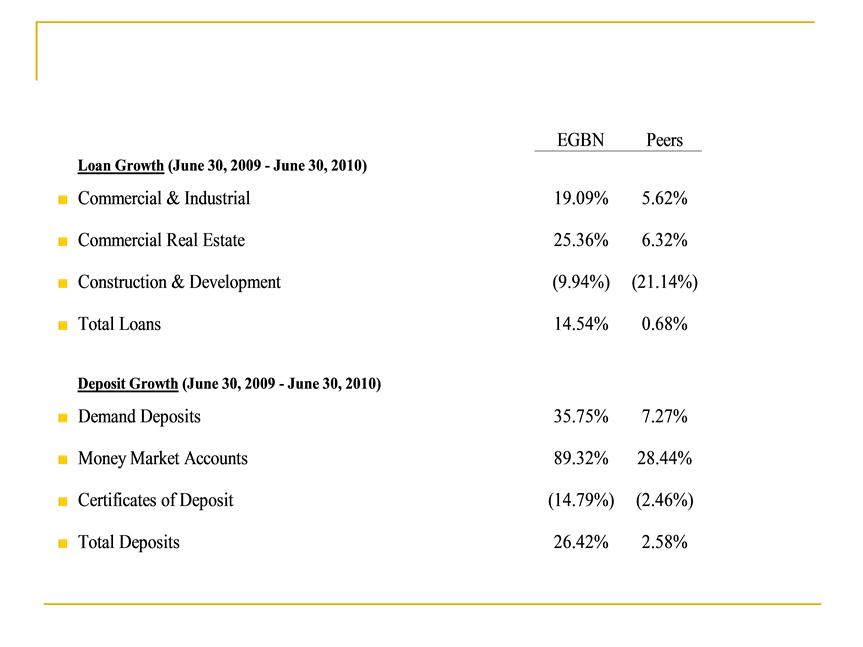

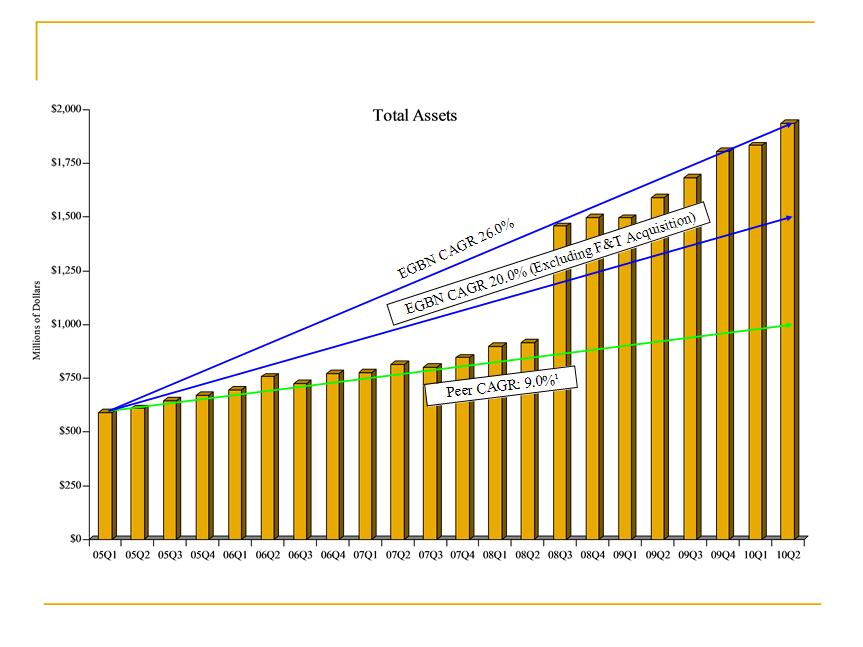

Consistent Balance Sheet Growth

(1) Regional peers includes publicly-traded commercial banks with assets between $1 and $5 billion and headquartered in Washington, DC, Virginia, West Virginia, Maryland, Pennsylvania and Delaware

who reported total assets at all reporting periods shown above

who reported total assets at all reporting periods shown above

Source: SNL Financial

10

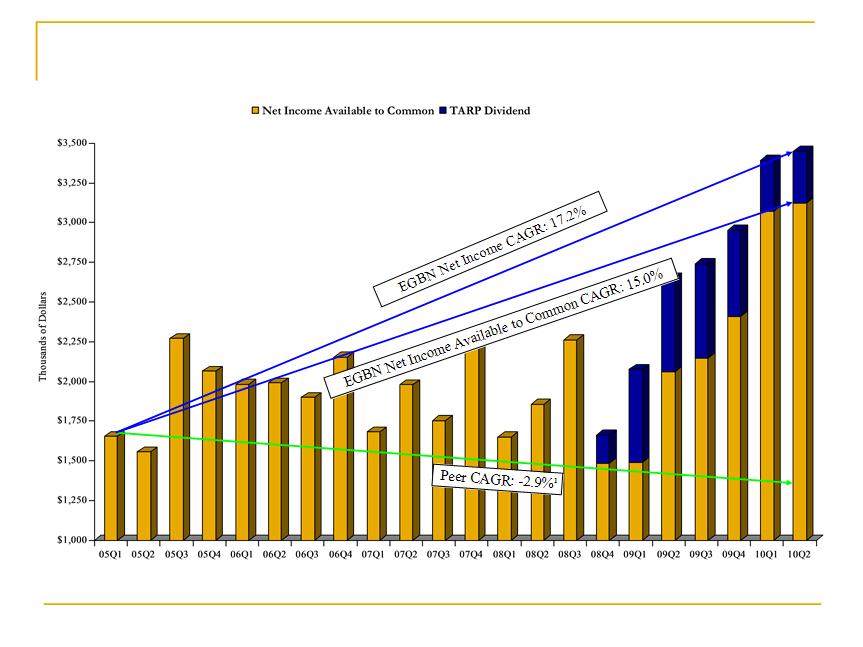

Net Income

(1) Regional peers includes publicly-traded commercial banks with assets between $1 and $5 billion and headquartered in Washington, DC, Virginia, West Virginia, Maryland, Pennsylvania and Delaware

who reported net income or loss for all reporting periods shown above

who reported net income or loss for all reporting periods shown above

Source: SNL Financial

$3,447

11

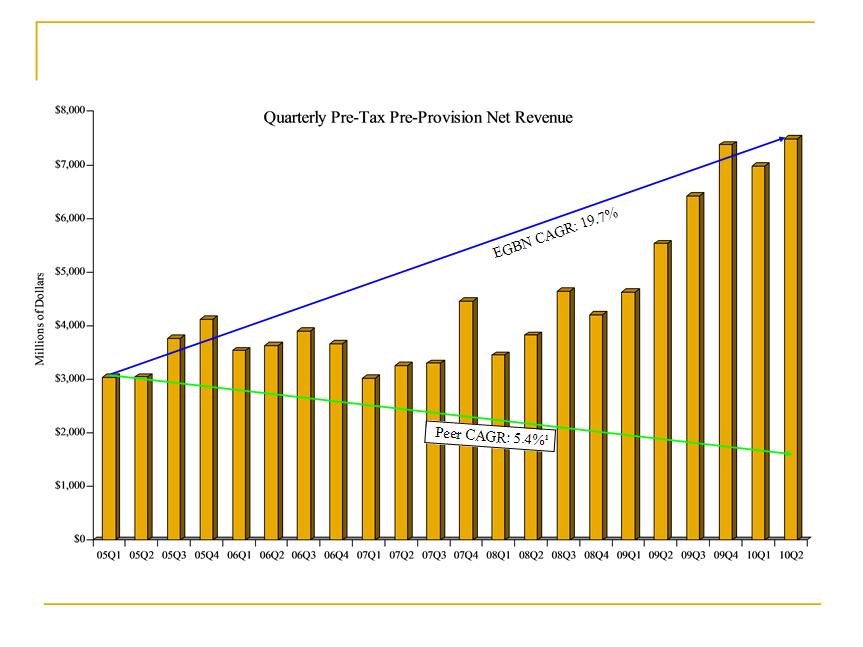

Pre-Tax, Pre-Provision Income

(1) Regional peers includes publicly-traded commercial banks with assets between $1 and $5 billion and headquartered in Washington, DC, Virginia, West Virginia, Maryland, Pennsylvania and

Delaware who reported pre-tax pre-provision net revenues for all reporting periods shown above

Delaware who reported pre-tax pre-provision net revenues for all reporting periods shown above

Source: SNL Financial

12

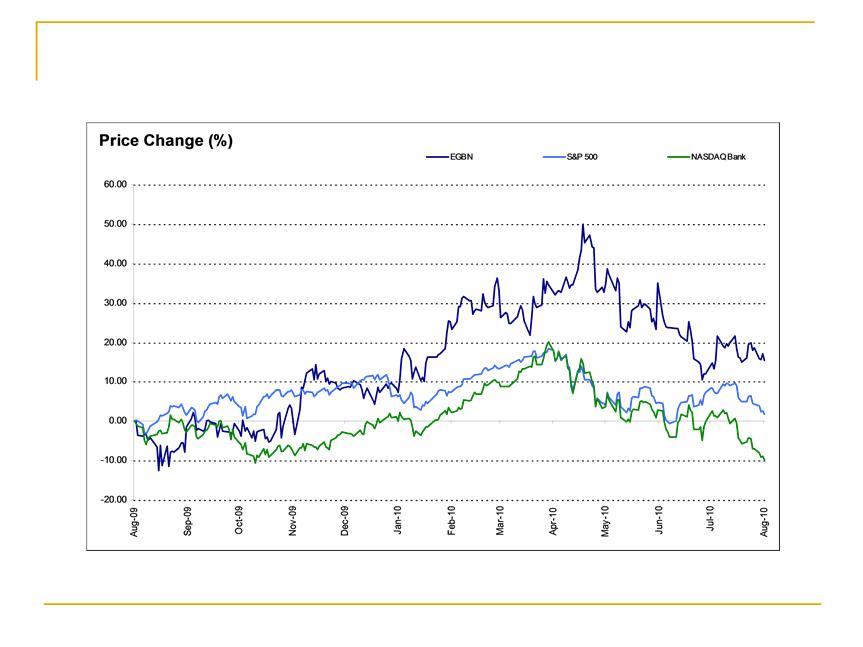

EGBN Stock Price Performance

Source: SNL Financial

13

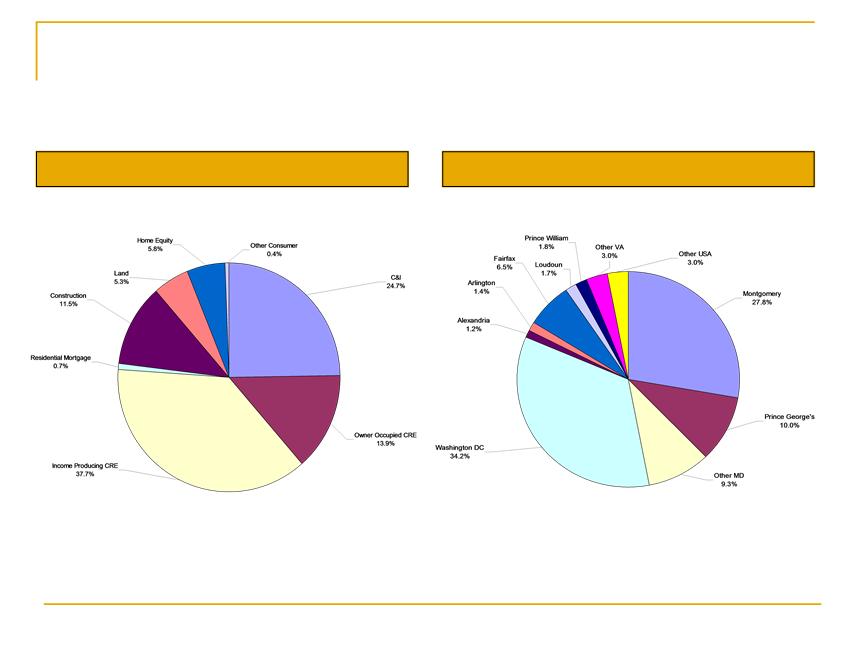

Loan Portfolio Composition

Loan Portfolio by Type

Loan Portfolio by Location

Note: At June 30, 2010

Total Gross Loans: $1.5 Billion

14

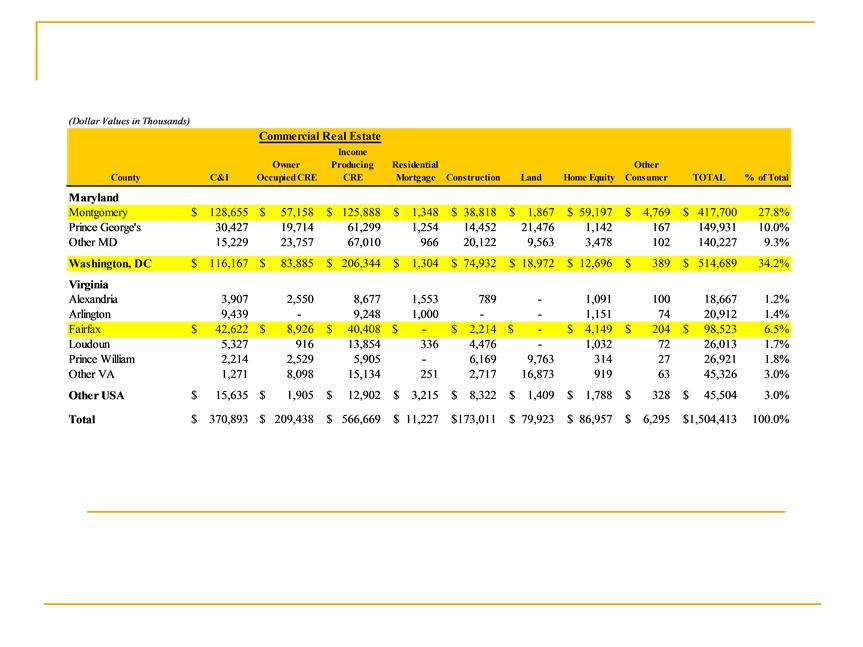

Geographic Detail of Loan Portfolio

Note: At June 30, 2010

Concentration in quality markets: Washington, DC, Montgomery County,

Concentration in quality markets: Washington, DC, Montgomery County,Fairfax County

Low levels of exposure to markets hit hardest by real estate downturn

Low levels of exposure to markets hit hardest by real estate downturn15

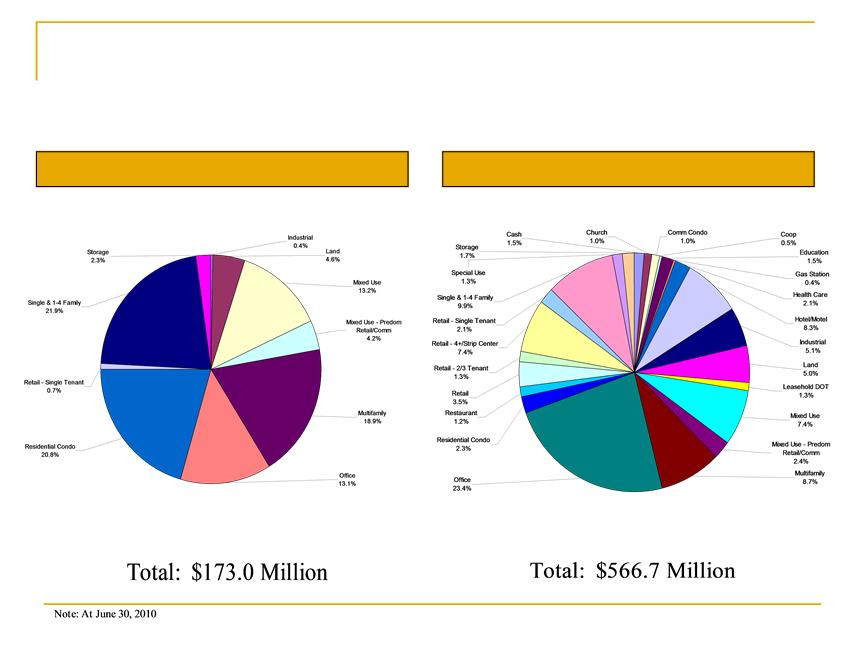

Detail of Loan Portfolio

Construction Loans by Type

Income Producing CRE by Type

16

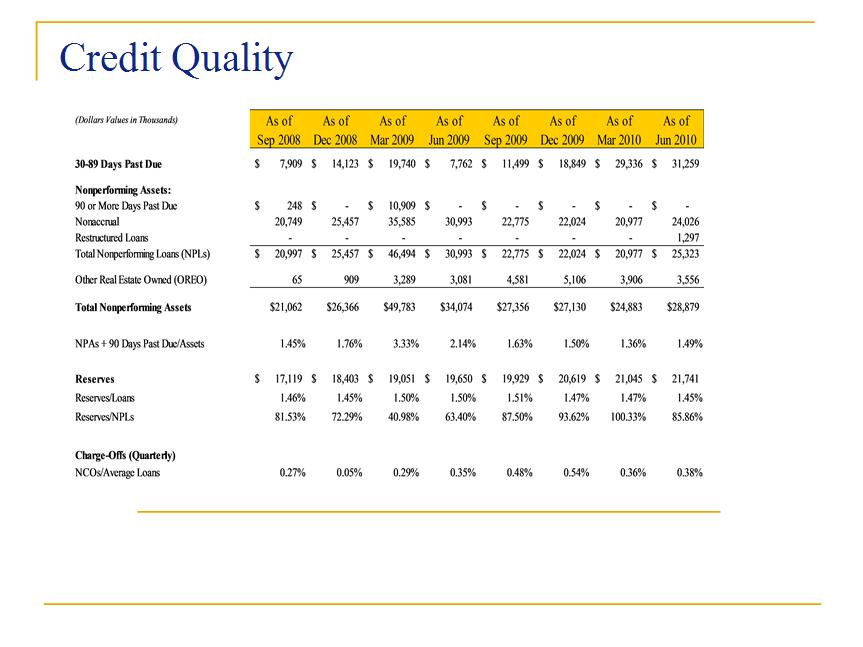

Asset Quality remains at a very strong level

Asset Quality remains at a very strong level An adequate Allowance is being maintained

An adequate Allowance is being maintained17

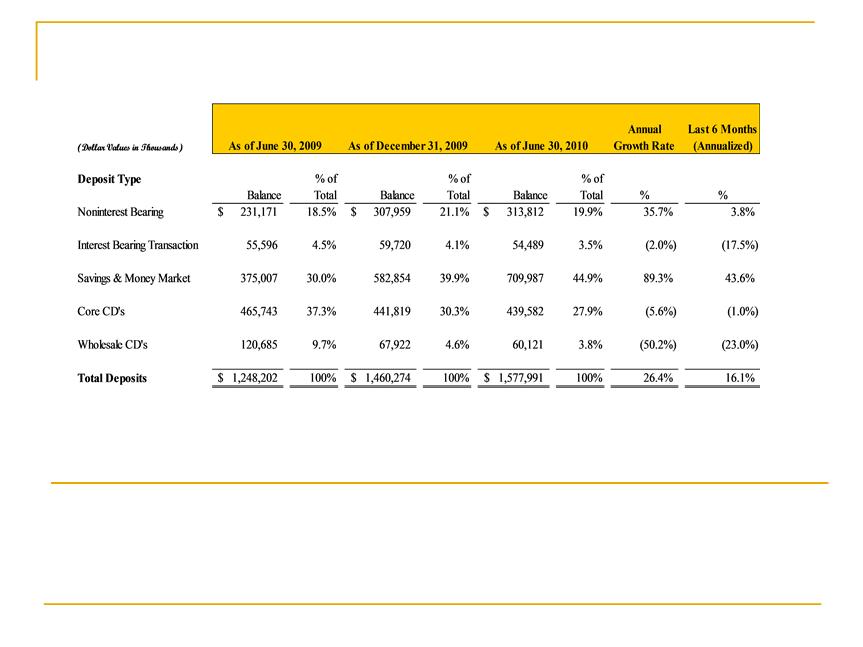

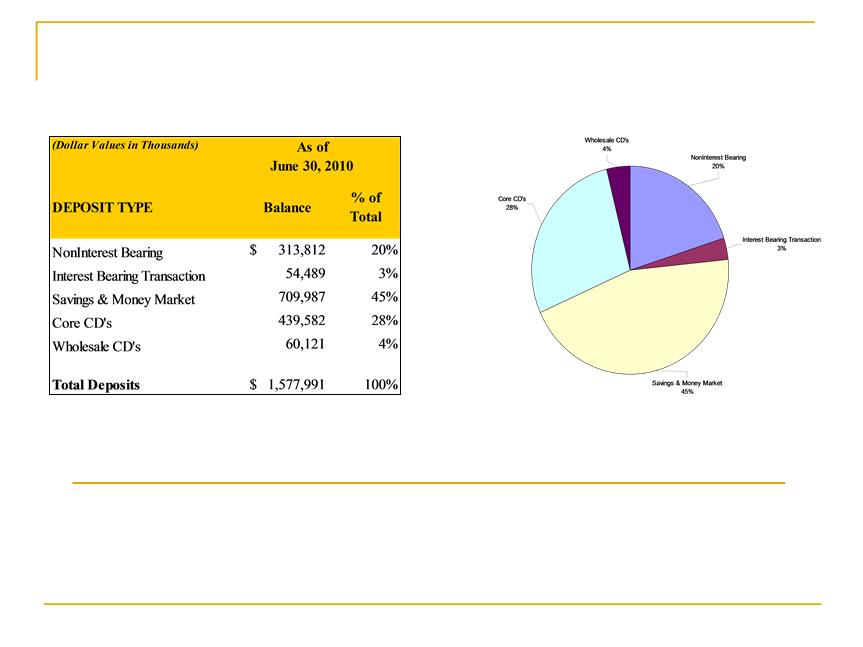

Commercial focus drives growth of Non-interest Bearing Demand accounts

Commercial focus drives growth of Non-interest Bearing Demand accounts Taking business from regional/super-regional banks, but demanding relationship pricing

Taking business from regional/super-regional banks, but demanding relationship pricing Still have tremendous opportunity based on current market share in DC Metro Area

Still have tremendous opportunity based on current market share in DC Metro AreaDeposit Composition

18

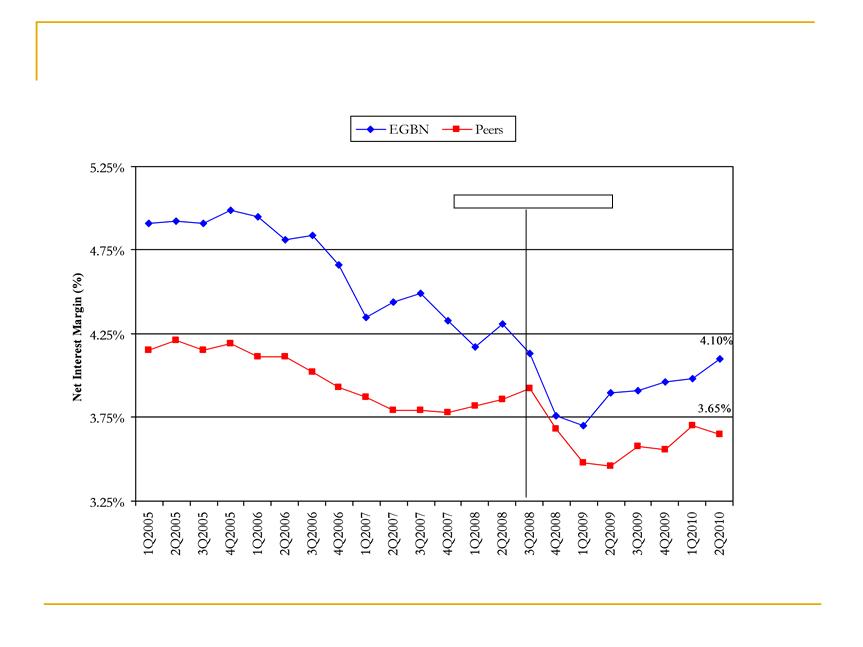

Superior Relationships/Net Interest Margin

Note: Regional peers includes publicly-traded commercial banks with Assets between $1 and $5 billion and headquartered in Washington, DC, Virginia,

West Virginia, Maryland, Pennsylvania and Delaware who reported net interest margin for all periods shown above.

West Virginia, Maryland, Pennsylvania and Delaware who reported net interest margin for all periods shown above.

Source: SNL Financial

F&T closed August 31, 2008

19

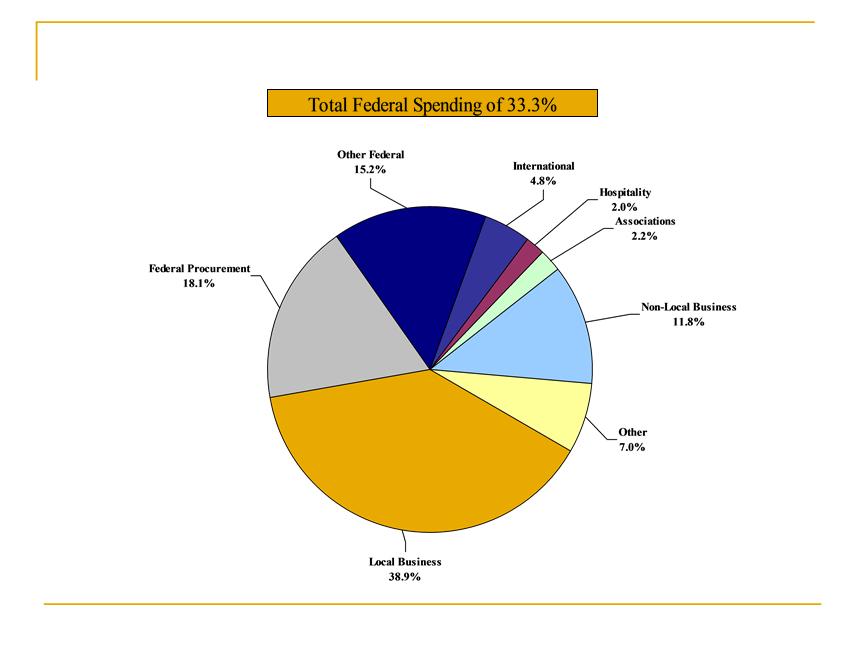

Market Information -Washington, DC

Metropolitan Statistical Area

Metropolitan Statistical Area

Population 6.2 Million

Population 6.2 Million 5th largest market in the U.S.

5th largest market in the U.S. Employment 2.9 Million

Employment 2.9 Million Average annual job creation is 37,500

Average annual job creation is 37,500 Highest in net new job growth in the U.S. over last decade

Highest in net new job growth in the U.S. over last decade Washington DC Metro area has highest concentration of fastest

Washington DC Metro area has highest concentration of fastest growing private companies in U.S. (according to Inc. Magazine)

Gross Regional Product (GRP) $454 Billion

Gross Regional Product (GRP) $454 Billion 4th largest regional economy in the U.S.

4th largest regional economy in the U.S. 3.7% CAGR in GRP over last decade

3.7% CAGR in GRP over last decade Federal Government Spending is 33.3% of GRP

Federal Government Spending is 33.3% of GRPSource: Greater Washington Initiative 2009 Regional Report

20

Greater Washington Economy

Note: Other includes Health/Education, Media

Source: George Mason University, Center for Regional Analysis

Source: George Mason University, Center for Regional Analysis

21

Note: Shaded companies in grey denote those companies headquartered outside of Washington, D.C. Metro Area. Data excludes: E*Trade and UNIFI Mutual Holding Company whose deposits are substantially from

outside of the defined market area.

outside of the defined market area.

Source: FDIC, as of June 30, 2009

22

23

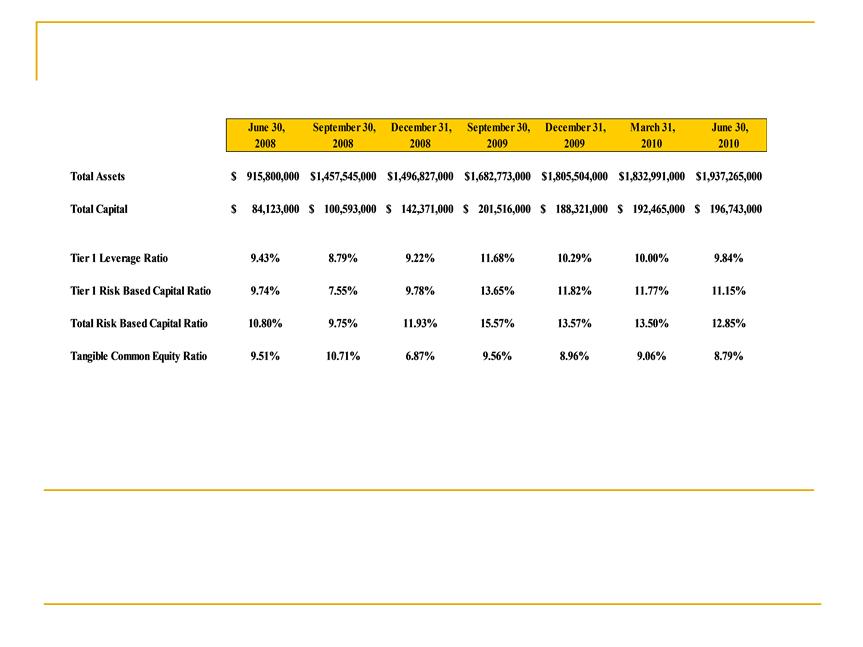

Capital Strength

$12.1 million of Sub-debt raised in August, 2008, $2.9 million repaid in September, 2009

$12.1 million of Sub-debt raised in August, 2008, $2.9 million repaid in September, 2009 $38.2 million of TARP Preferred Stock placed in December, 2008, $15 million redeemed in

$38.2 million of TARP Preferred Stock placed in December, 2008, $15 million redeemed inDecember, 2009

$55.2 million raised through common stock offering in September, 2009

$55.2 million raised through common stock offering in September, 200924

Looking Ahead

Focus on organic growth

Focus on organic growth o Take advantage of dislocation in market

o Hire seasoned lenders

o Increase Northern Virginia footprint

o Focus on relationships to increase deposit penetration

Profitability

Profitability o Continued focus on Net Interest Margin

o Grow noninterest components of revenue

o Diligent expense control to improve Efficiency Ratio

o Lower effective tax rate

o Continued evaluation of redemption of remaining TARP funds

Potential acquisitions

Potential acquisitions Continued emphasis on credit quality

Continued emphasis on credit quality25

Minimal Impact from Dodd-Frank

Regulatory Reform

Regulatory Reform

Increase in FDIC Limit to $250,000 is a plus

Increase in FDIC Limit to $250,000 is a plus Revision to FDIC assessment base is a relative benefit to

Revision to FDIC assessment base is a relative benefit tocommunity banks

No impact on EagleBank from the Volker Rule

No impact on EagleBank from the Volker Rule No direct impact on EagleBank from new derivatives rules.

No direct impact on EagleBank from new derivatives rules.Impact on overall derivatives markets to be determined

Current organization structure is equipped to manage reporting

Current organization structure is equipped to manage reportingrequirements

Modest impact to Debit and Credit Card fees

Modest impact to Debit and Credit Card fees New proxy rules are similar to prior experience from TARP

New proxy rules are similar to prior experience from TARP26

Appendices

27

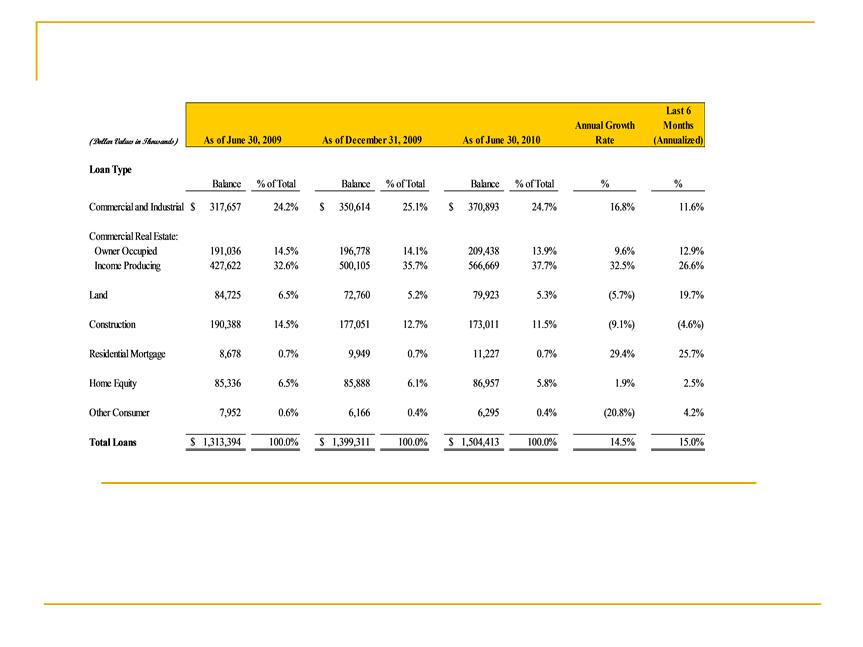

Loan Portfolio Trends

Focus on reducing construction as a percentage of the overall portfolio

Focus on reducing construction as a percentage of the overall portfolio Continued effort to grow C&I and Owner Occupied loans

Continued effort to grow C&I and Owner Occupied loans28

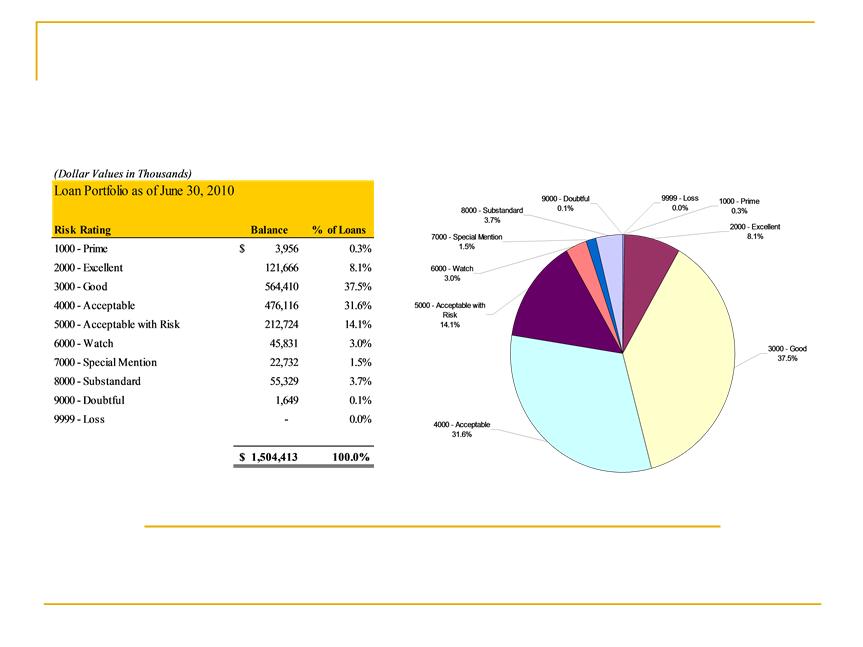

Loan Portfolio by Risk Rating

Loan portfolio and risk ratings reviewed by independent, third-party

Loan portfolio and risk ratings reviewed by independent, third-partycredit review quarterly

29

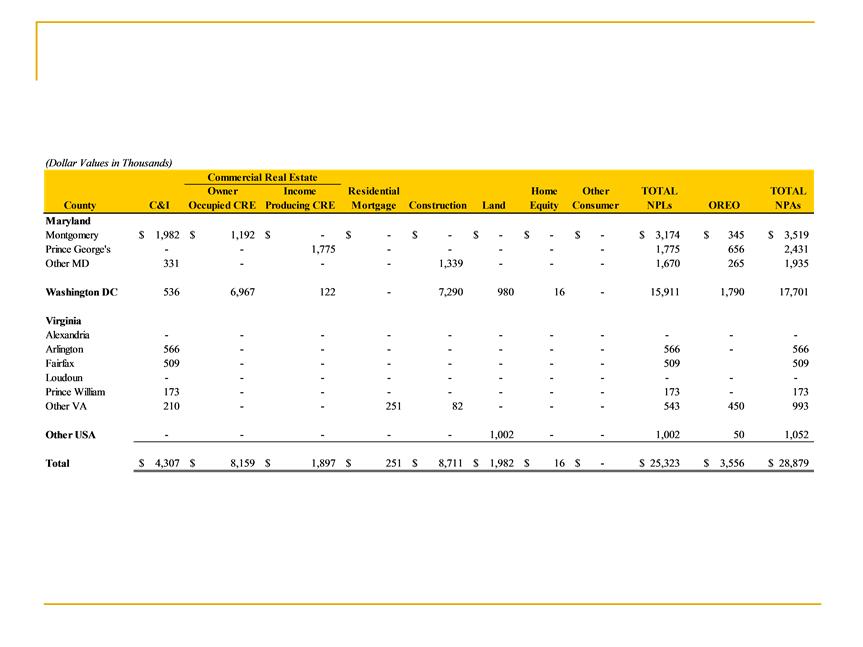

Geographic Detail of NPA’s

30

Commercial focus drives growth of Non-Interest Bearing Demand accounts

Commercial focus drives growth of Non-Interest Bearing Demand accounts Taking market share from regional/super-regional banks, but demanding relationship

Taking market share from regional/super-regional banks, but demanding relationshippricing

Quickly becoming the leading community bank in Washington DC Metro Area

Quickly becoming the leading community bank in Washington DC Metro AreaDeposit Composition

31

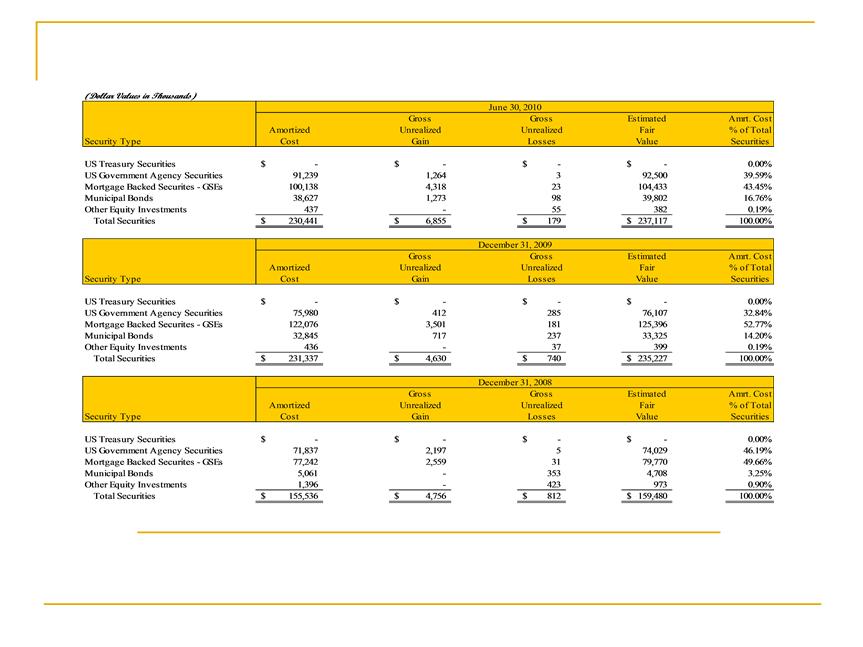

Portfolio has $6.7 million of net unrealized gains at June 30, 2010

Portfolio has $6.7 million of net unrealized gains at June 30, 2010 No holdings of GSE equities or bank Trust Preferred or bank Trust Preferred CDOs

No holdings of GSE equities or bank Trust Preferred or bank Trust Preferred CDOs Average life of portfolio is 2.8 years

Average life of portfolio is 2.8 years Excludes Federal Reserve and Federal Home Loan Bank stock

Excludes Federal Reserve and Federal Home Loan Bank stockConservative Securities Portfolio

32

Proven Acquisition Capabilities

Evaluated many acquisition opportunities in 12 year history and

Evaluated many acquisition opportunities in 12 year history andonly pursued one transaction - F&T

Acquisition of F&T completed on August 31, 2008

Acquisition of F&T completed on August 31, 2008 System conversion successfully completed one week after close

System conversion successfully completed one week after close Targeted expense savings achieved in methodical and thoughtful

Targeted expense savings achieved in methodical and thoughtfulmanner, without disrupting relationships with customers

Contributions from key F&T employees have been meaningful

Contributions from key F&T employees have been meaningfulto relationship growth

Adopted best practices of both companies

Adopted best practices of both companies33

Fidelity & Trust Acquisition

Strategic Matters:

Strategic Matters: Strong cultural match

Strong cultural match Both institutions were growth oriented

Both institutions were growth oriented Both institutions were “high touch”

Both institutions were “high touch” Both institutions were “well connected” to community

Both institutions were “well connected” to community Financial Matters:

Financial Matters: Stock-for-stock transaction - 1,638,031 shares issued

Stock-for-stock transaction - 1,638,031 shares issued Acquisition cost - $13.1 million

Acquisition cost - $13.1 million Price to book value 83%

Price to book value 83% Business Matters:

Business Matters: Additional six banking offices in Maryland, Washington, DC and Tysons Corner

Additional six banking offices in Maryland, Washington, DC and Tysons Corner 79 additional employees

79 additional employees Total assets acquired: $471 million

Total assets acquired: $471 million Total loans acquired: $361 million

Total loans acquired: $361 million Total securities acquired: $ 99 million

Total securities acquired: $ 99 million Total deposits acquired: $385 million

Total deposits acquired: $385 millionNote: F&T balance sheet data at August 31, 2008.

34

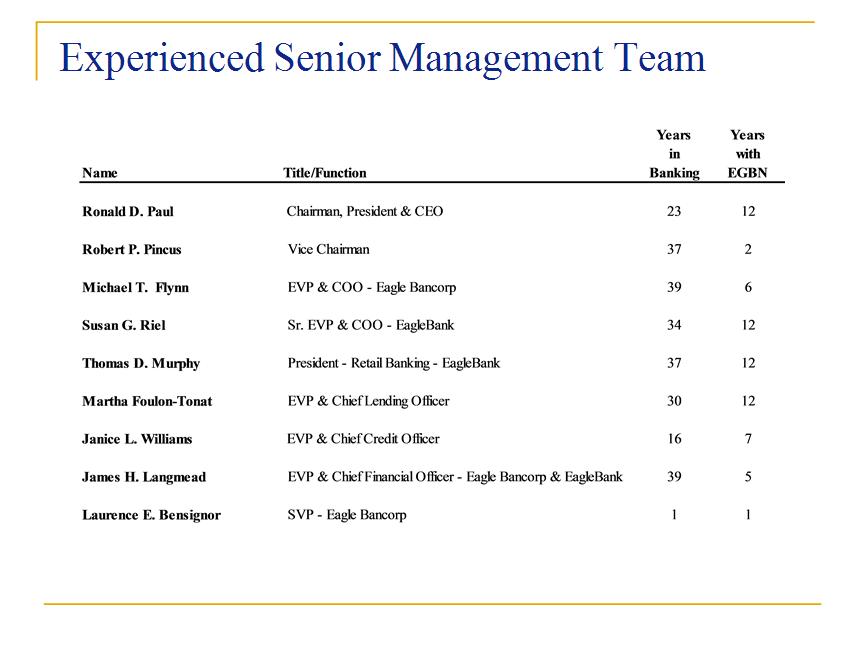

Experienced Management Team

Ronald D. Paul, Chairman, President and CEO

Mr. Paul, a founder of EagleBank, has served as Chairman since May 2008, and prior to that time was Vice Chairman and

Chief Executive Officer since the organization of the Company. He also has served as Chairman of the Board of Directors of

the Bank since the organization of the Bank. Since June 2006, he has served as Chief Executive Officer of the Bank. Mr.

Paul is also President of Ronald D. Paul Companies and RDP Management, which are engaged in the business of real estate

investment and management for office and multi-family properties. Mr. Paul was a director of Allegiance Bank and of

Allegiance Banc Corporation from 1990 until its acquisition by F&M, including serving as Vice Chairman of the Board of

Directors from 1995. Mr. Paul is also active in various charitable organizations, including serving as Vice Chairman of the

Board of Directors of the National Kidney Foundation from 1996 to 1997, and Chairman from 2002 to 2003.

Robert P. Pincus, Vice Chairman of the Board of Directors of Eagle Bancorp, Inc. and EagleBank

Prior to joining the Company in August 2008 upon the acquisition of Fidelity & Trust Financial Corporation (“Fidelity”) and

its wholly owned subsidiary, Fidelity & Trust Bank (“F&T Bank”), Mr. Pincus served as Chairman of F&T Bank from 2005.

He was Chairman of the Board of BB&T, DC Metro Region and was Regional President from 1998 to 2002. From 1991 to

1998, Mr. Pincus was President and Chief Executive Officer of Franklin National Bank of Washington, D.C. From 1986 to

1991, he was the Regional President of the DC metropolitan region of Sovran Bank. From 1971 to 1986, Mr. Pincus was with

DC National Bancorp, Inc., where he eventually served as President and Chief Executive Officer, prior to its merger with

Sovran Bank. Mr. Pincus also serves as Chairman of the Board of Blackstreet Capital Partners, L.P. and Chairman of

Milestone Merchant Partners, LLC. He is a Trustee of the University of Maryland Foundation, Inc. and is a member of the

board of directors of Comstock Homebuilding Companies, Inc.

35

Experienced Management Team

Susan G. Riel, Senior EVP, Chief Operating Officer of EagleBank

Ms. Riel, Senior Executive Vice President - Chief Operating Officer of the Bank, and formerly Chief Administrative Officer.

Ms.Riel has been with the bank for 12 years. She previously served as Executive Vice President - Chief Operating Officer of

Columbia First Bank, FSB from 1989 until that institution’s acquisition by First Union Bancorp in 1995. She is one of the

founding officers of EagleBank. Ms. Riel has over 29 years of experience in the commercial banking industry.

Michael T. Flynn, EVP, Chief Operating Officer of Eagle Bancorp, Inc.

Mr. Flynn has been with EagleBank for 6 years and has served as Chief Operating Officer of Eagle Bancorp, Inc, since June

2006. He has over 38 years of experience in the banking industry in the Washington, D.C. and Maryland region. Prior to

joining EagleBank, he was the Washington region executive for Mercantile Bankshares Corporation. He previously was the

Director of Strategic Planning for Allfirst Financial, Inc., and prior to that, held several executive level positions for Bank of

America and predecessor companies. Mr. Flynn is a Director of the Workforce Investment Council of the District of Columbia

and the Maryland Banking

School.

Thomas D. Murphy, President, Retail Banking Division

Mr. Murphy is one of the founding officers of EagleBank and has been with the bank for 12 years and has served as President-

Retail Banking Division of the Bank since August 2009. He served at Allegiance Bank from September 1994, including as

Executive Vice President and Chief Operating Officer from December 1995 until November 1997. Prior to his service at

Allegiance, he held the same position at First Montgomery Bank from August 1991 until its acquisition by Sandy Spring National

Bank of Maryland in December 1993, and was a Vice President of that organization until September 1994. Mr. Murphy has 34

years of experience in the commercial banking industry. Active in community affairs, he is past president of the Bethesda-Chevy

Chase Chamber of Commerce.

36

Experienced Management Team

Martha Foulon-Tonat, EVP, Chief Lending Officer

Ms. Foulon-Tonat is one of the founding officers and has been with EagleBank for 12 years. She previously served at

Allegiance Bank from January 1990 to December 1997. She was Senior Vice President and Chief Lending Officer. Prior to

her service at Allegiance Bank, Ms. Foulon-Tonat served at various commercial banks in the area. She has over 25 years of

experience in the commercial banking industry.

Janice L. Williams, EVP, Chief Credit Officer

Ms. Williams, Executive Vice President and Chief Credit Officer of the Bank, has served the Bank as Credit Officer, Senior

Credit Officer and Chief Credit Officer for the past 7 years. Prior to employment with the Bank, Ms. Williams was with

Capital Bank, Sequoia Bank, and American Security Bank. Additionally, Ms. Williams, a graduate of Georgetown University

Law Center and a Member of the Maryland Bar, was previously employed in the private practice of law in Maryland.

James H. Langmead, EVP, Chief Financial Officer, Eagle Bancorp, Inc. and EagleBank

Mr. Langmead, Executive Vice President and Chief Financial Officer of the Company since January 2007, and Executive Vice

President and Chief Financial Officer of the Bank since January 2005, previously served as Chief Financial Officer of Sandy

Spring Bank and Sandy Spring Bancorp. Mr. Langmead, a CPA, served in various financial and senior management roles with

Sandy Spring Bank from 1992 through 2004. Prior to that time, Mr. Langmead managed the finance group at the Bank of

Baltimore.

Laurence E. Bensignor, Senior Vice President, Eagle Bancorp, Inc.

Mr. Bensignor recently joined the bank after 29 years in the legal and real estate industries in the Washington, DC area. For ten

years, Mr. Bensignor served as Trustee of the Van Metre Family Trusts, the controlling owner of a private, multifaceted real

estate organization. Previously, he was a partner and chaired the real estate practice group in the Washington, DC office of the

national law firm of Arter & Hadden and formerly was a partner in the Washington, DC law firm of Melrod, Redman &

Gartlan. Mr. Bensignor is a Fellow of the American College of Real Estate Lawyers.

37

38

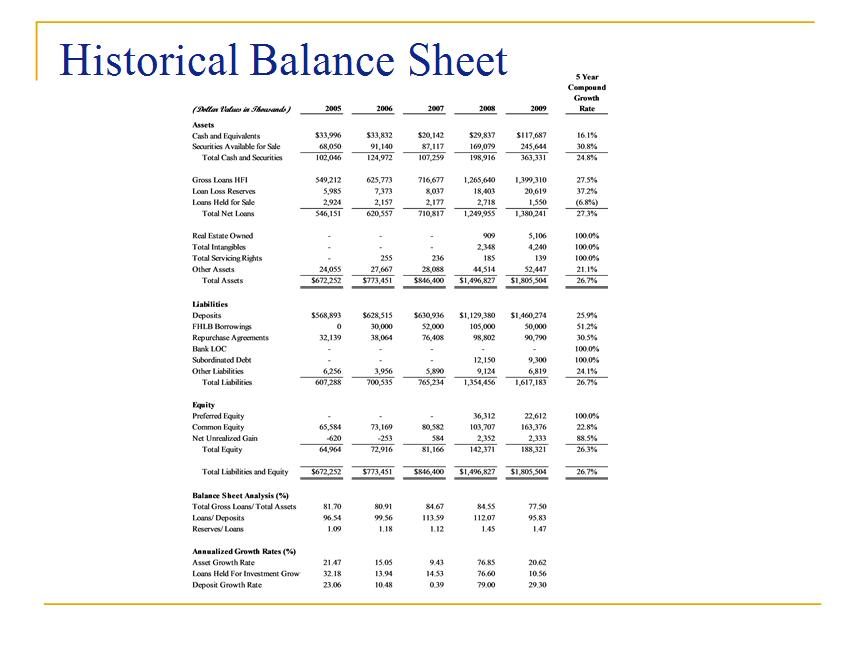

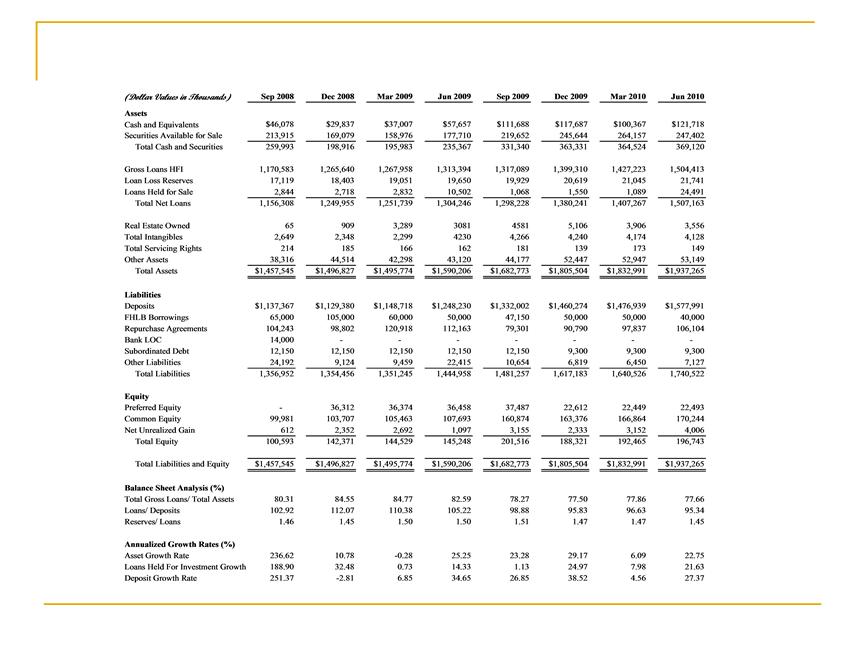

Historical Quarterly Balance Sheet

39

40

41