Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LIGAND PHARMACEUTICALS INC | d8k.htm |

1

1

Investor and Analyst Day

June 24, 2010

Nasdaq: LGND

Exhibit 99.1 |

Ligand

Pharmaceuticals,

Inc.

2

2

Investor and Analyst Day

John Higgins

President and Chief Executive Officer

June 24, 2010 -

New York |

3

3

Safe Harbor Statement

The following presentation contains forward-looking statements regarding Ligand’s

prospects, plans and strategies, drug development programs and collaborations.

Forward- looking statements include financial projections, expectations regarding

research and development programs, and other statements including words such as

“will,“ “should,” “could,” “plan,” etc.

Actual events or results may differ from Ligand’s expectations. For example, the

reverse stock split may not be completed, and the intended benefits of the reverse

stock split, expense reductions and drug development programs may not be

realized. In addition there can be no assurance that Ligand will achieve its guidance

in 2010 and 2011.

The forward-looking statements made in the presentation are subject to several risk

factors, including, but not limited to, Ligand’s reliance on collaborative

partners for milestone and royalty payments, regulatory hurdles facing Ligand’s

product candidates, uncertainty regarding Ligand’s product development costs,

the possibility that Ligand’s drug candidates might not be proved to be safe and

efficacious, the commercial performance of Ligand’s approved products, and a

possible failure to successfully combine the businesses of Neurogen and/or Metabasis

with Ligand’s business. Additional risks may apply to forward- looking

statements made in this presentation. The risk factors facing Ligand are explained in greater detail in Ligand’s, filings

with the SEC, including the most recently filed annual reports on Form 10-K and

quarterly reports on Form 10-Q, as well as other public filings.

While forward-looking statements reflect our good faith beliefs (or those of the

indicated third parties), they are not guarantees of future performance. We disclaim

any obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

|

4

4

Investor and Analyst Day Agenda

Welcome and Company Overview

John Higgins

Financial Highlights

John Sharp

Ligand

Partnered Asset Portfolio

Rob McKay

Promacta

Nezam

H. Afdhal, MD

Expanding the Partnership Pipeline

Syed

Kazmi, PhD

SARM Program

Shalender

Bhasin, MD

Questions & Answers / Reception |

5

5

Investor Day

•

Ligand’s

Directors own ~9% of the company

•

Other top holders

–

Wellington

–

Biotech Value Fund

–

BlackRock

–

UBS

–

Vanguard

–

Pennant

–

Chesapeake Partners

–

DWS Investment GmbH

–

RA Capital |

6

6

We Have Delivered

•

We have fully restructured and rebuilt Ligand

•

We have cut costs while building our asset base

•

We have met our financial guidance

•

We have advanced our pipeline

•

We have completed three valuable acquisitions |

7

7

Our Business Philosophy

•

Run a business that is oriented toward being a financial growth story

–

Our

belief

is

we

should

not

build

a

business

around

“biotech

promises,”

instead

we

should build a business that generates cash flow and makes investors

(shareholders) money

•

Buy or develop a large portfolio of assets that can yield positive cash flow

•

Fiercely manage expenses

–

Unfortunately, this industry has managed to squander vast amounts of money on

programs, infrastructure, and elaborate public enterprises that did not warrant the

investment

–

No

guarantee

what

we

choose

to

fund

will

succeed,

but

we

will

be

very

disciplined

in the process

•

Avoid the biotech financing loop

–

Avoid costly dilution

–

Make better long-term decisions |

8

8

Perception

Reality

•

The rewards from discovering, developing,

and commercializing a biotech drug can be

enormous

•

True, but the vast majority of programs

fail to ever reach that payoff

•

A biotech company should retain late-stage

and/or commercial rights as the economic

reward will be greater

•

The return is not necessarily greater, in

fact it might be smaller. But for certain

the risks will be greater as costs,

timelines, competitiveness and pricing

pressures in this industry have all gone

up dramatically over the last 20 years.

•

Investors and the pharma

industry as a

whole can make money by investing in a

wide array of assets and de-risking

strategies

•

BUT if an individual

biotech company is

going to increase its chances to succeed,

it has to do things differently than how

companies were run in the early 1990s

Ligand: A Business Model Built on Today’s Reality |

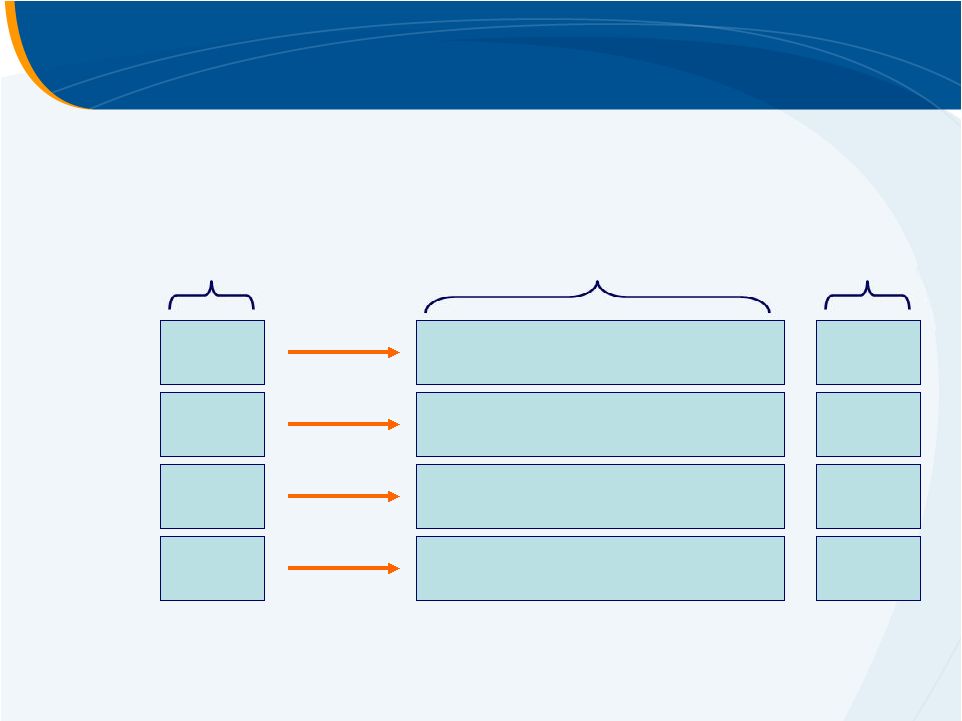

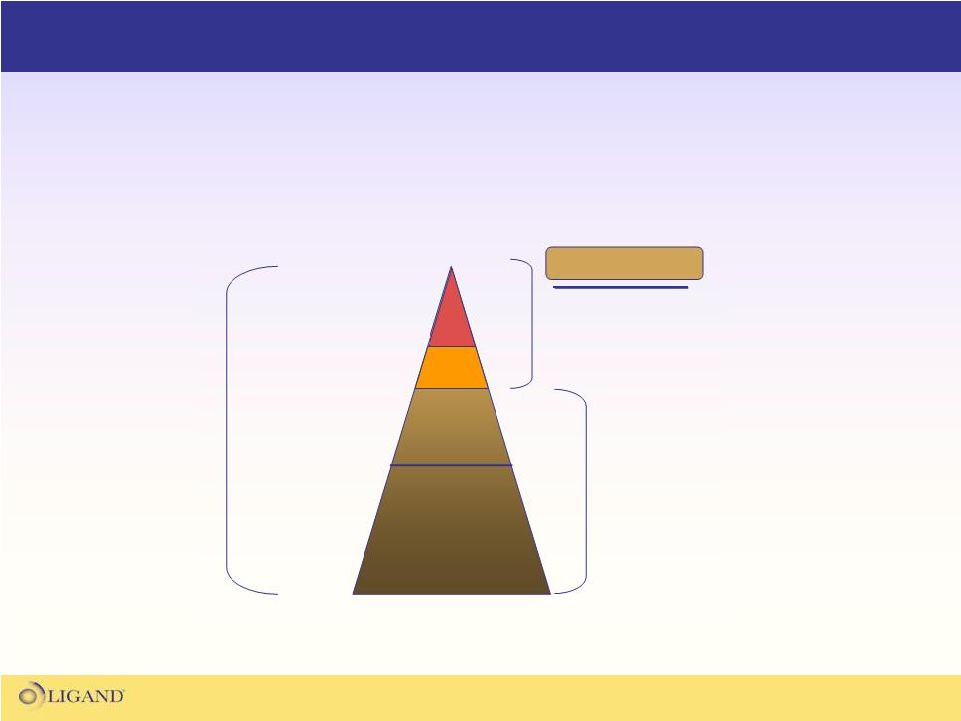

9

9

Why the Ligand

Royalty Model is So Compelling

•

Integrate most

functional expertise into

the company

•

Short remaining patent life

•

Own products through

late-stage development

or commercialization

Vast portfolio of royalty

partnerships

•

1 or 2 royalty streams

Research and partnering

engine

Ligand

Today

Result

•

Unexciting

•

No growth

•

Fixed value company

•

No engine to drive new

deals

“Yesterday’s”

Royalty Model

“Yesterday’s”

FIPCO Model

Result

•

Large revenue potential

•

Substantial growth

potential

•

Substantially lower

costs and risk

Result

•

High costs and risks,

beholden to wall street for

financing

•

Questionable if the ROI

justifies the model |

10

10

Why the Ligand

Royalty Model is So Compelling

•

Integrate most

functional expertise into

the company

•

Short remaining patent life

•

Own products through

late-stage development

or commercialization

Vast portfolio of royalty

partnerships

•

1 or 2 royalty streams

Research and partnering

engine

Ligand

Today

Result

•

Unexciting

•

No growth

•

Fixed value company

•

No engine to drive new

deals

“Yesterday’s”

Royalty Model

“Yesterday’s”

FIPCO Model

Result

•

Large revenue potential

•

Substantial growth

potential

•

Substantially lower

costs and risk

Result

•

High costs and risks,

beholden to wall street for

financing

•

Questionable if the ROI

justifies the model |

11

11

Why the Ligand

Royalty Model is So Compelling

Ligand

Today

Vast portfolio of royalty

partnerships

Research and partnering

engine

Result

•

Large revenue & ER

potential

•

Substantially lower

costs and risks

•

Over 30 programs

•

Long patent lives

•

Some high royalties that

approach a profit split

•

Efficient research

focused on licensing

at early inflection

points |

12

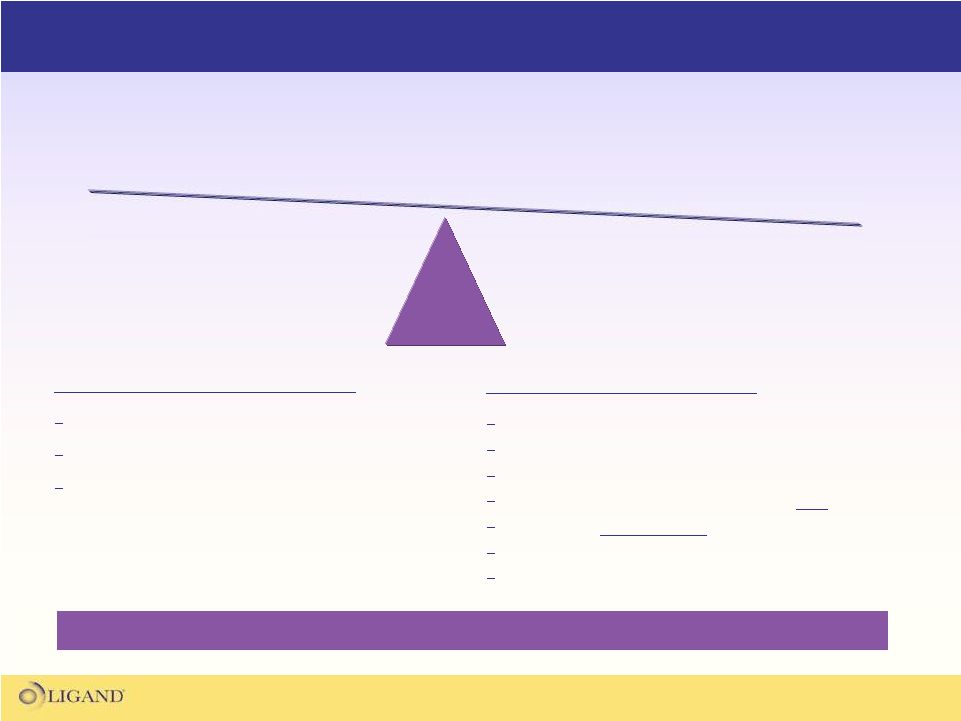

12

Ligand’s

Potential Downside

Individual project set-backs

Slower growth

Partners drop programs

Ligand’s

Potential Upside

Blockbuster product approved/in-development

Near-term profitability

Well funded/financially disciplined

More royalty partnerships than any peer co

Attractive fully-owned

pipeline

Substantial calendar of news flow

Large NOLs

Risk

Reward

The Investment Proposition: Risk vs. Reward

We believe the upside reward is substantially greater than the downside risk

|

13

13

Illustrative Sum of the Parts

•

Cash $30 million

•

Over $500 million in NOLs

with estimated ~$100 million net present value

•

Avinza

–

up to $25 million in net present value -

royalty annuity through 2017

•

Promacta

Currently marketed and in development for five other indications

12 years remaining patent life

Tiered royalties averaging to about 9%

How big will this drug be?

•

SERMS –

approved, could launch soon

•

CXCR2,

P-38,

Dinaciclib,

IL-9

–

High-quality,

mid-stage

programs

•

Over 30 partnered programs –

news flow and milestone potential

•

10 fully owned internal programs |

14

14

Sum of the Parts Illustration

Avinza

•

Promacta

•

SERMs

•

30 other funded programs

•

Fully owned pipeline

Nols

Cash

$180

million Current

Market Capitalization

“Biotech”

Value

How much more

will this grow

over the next few

years?

~$25

~$100

~$30

$155 million |

15

15

Ligand…Why Now?

•

Given reduced expenses and revenue outlook, we project turning

profitable on an operating basis next year

•

Promacta

is a “now”

story

–

New trials have initiated recently

–

New territories are launching for ITP

–

HepC

P-III trials are winding down with data expected in about a year

•

Ligand

just closed a few great acquisitions which have more than

tripled our pipeline and partnered assets

•

Partners have announced several positive developments in past few

months

•

Data is coming out of our internal pipeline over the next six months

|

16

16

A View of the Future

•

2 marketed

products

:

Avinza

and

Promacta

•

2 approved

products

pending

launch:

Conbriza

and

Fablyn

•

2 products

announced

to

have

NDA

filings

by

end

of

2012:

Aprela

and

Acadesine

•

9 drug candidates could launch between 2014 and 2018

CXCR2

BACE

P-38

JNK2

CDK

LXR

IL-9

FXR

Hepatitis |

17

17

Potential Significant Revenue Expansion Over Next Several Years

Illustrative Growth

2016

Promacta

2012

Avinza

Promacta

Conbriza

Avinza

Aprela

Conbriza

Fablyn

Aprela

Acadesine

Fablyn

CDK

>$20 million royalties

CXCR2

Plus license fees

P-38

IL-

9

>$200 million royalties

Plus license fees |

18

18

2012

2016

>$20 Mil.

>$200 Mil.

Potential Significant Revenue Expansion Over Next Several Years

•

10 fold increase in royalties. Growth due to:

–

New product launches

–

New territories

–

New indications

–

Increasing royalty rates upon sales growth

•

Potential for nearly $100 million in milestones over the same period

•

Annual expenses over this projection period estimated to be $15 to $20

million Illustrative Royalty Revenue Growth |

Ligand

Pharmaceuticals, Inc.

19

19

Financial Update

Delivering Good Performance

John Sharp

Vice President, Finance

and Chief Financial Officer |

20

20

Highlights

•

Operating Expenses

•

Overview of Net Operating Losses

•

Financial Guidance

•

Reverse Stock Split |

21

21

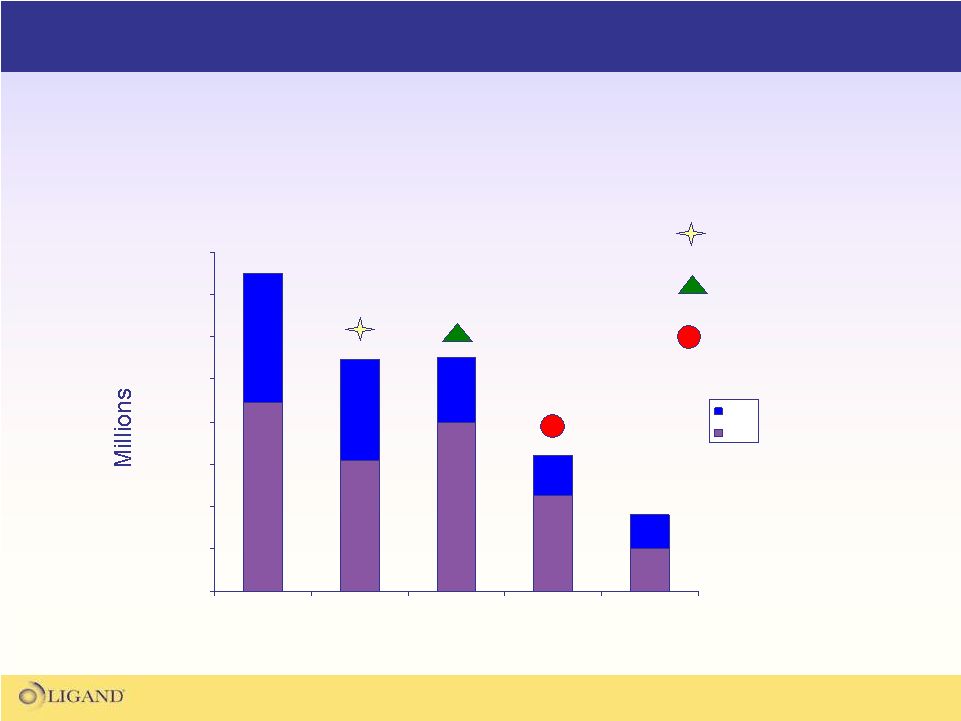

Operating Expense Trend

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

2007

2008

2009

2010

2011*

G&A

R&D

* High end of expense guidance range

•

Ligand

has significantly reduced expenses over the last several years

•

During the same period, the company closed 3 acquisitions while

significantly expanding its asset base

Pharmacopeia Acquisition

Neurogen Acquisition

Metabasis Acquisition |

22

22

Value of Net Operating Loss Carryforwards

(NOL)

•

Ligand

has

accumulated

substantial

NOL’s

through

our

operating

history and acquisitions

•

NOL’s

should provide significant relief on taxable income if the

company turns profitable

•

NOL’s

as of December 31, 2009 = $514 million

•

Due

to

tax

code,

NOL’s

are

limited

in

the

quantity

and

the

timing

in

which

they

can

be

used,

so

we

do

not

expect

to

get

a

full

offset

on

taxable income immediately

•

Estimated

net

present

value

of

NOL’s

=

~$100M

•

In near-term, the NOL tax should reduce federal tax rate from 34%

down to 2% (AMT) |

23

23

Financial Guidance

2010 Guidance:

•

Revenue approximately $25 million

Combination of royalty, contract payments and milestones

•

Operating expenses approximately $30 million

One-third G&A, two-thirds R&D

•

Cash at year end projected to be greater than $30 million

2011 Guidance:

•

Operating

expenses

projected

to

be

in

range

of

$15

-

$18

million

•

Projecting turning profitable on an operating basis and having

positive cash flow from operations |

24

24

Reverse Split

•

Over Ligand's

history, company raised money through a series of

highly dilutive financings

•

Company initiated restructuring about three years ago but never

addressed its bloated share base

•

Now

is

an

appropriate

time

given

the

progress

of

the

company

and

our

outlook for the business

•

A lower share count and higher stock price provides numerous benefits

including improving trading dynamics, lower costs and increased per

share reported amounts

•

The middle of the reverse split range would yield a share count of

approximately 16 million shares versus 118 million shared currently

outstanding |

25

25

Illustrative Income Statement Assuming Reverse Split

($ in millions)

Pre-split

Post-split

Revenue

40.0

$

40.0

$

Expenses

20.0

20.0

EBIT

20.0

20.0

Interest & other

1.0

1.0

Taxes

(0.4)

(0.4)

Net income

20.6

$

20.6

$

EPS

0.18

$

1.31

$

Shares outstanding

117.6

15.7

*

* assumes midpoint of split range;1-for-7.5 |

Ligand

Pharmaceuticals, Inc.

26

Ligand

Partnered Asset Portfolio

Value Through Shots on Goal

Rob McKay

Associate Director,

Business Development |

27

Ligand’s Partnered Asset Portfolio

Ligand has a very large portfolio of partnered programs

which are the core of Ligand's financial growth model |

28

Ligand’s Partnered Asset Portfolio

The Ligand partnered portfolio consists of 33 fully funded

programs that have the potential to generate over $500M

in milestones and royalties on future sales |

29

Ligand’s

Partnered Asset Portfolio

Significant potential for new product launches

and expanded indications the next several years

*

* |

30

Ligand’s

Partnered Asset Portfolio

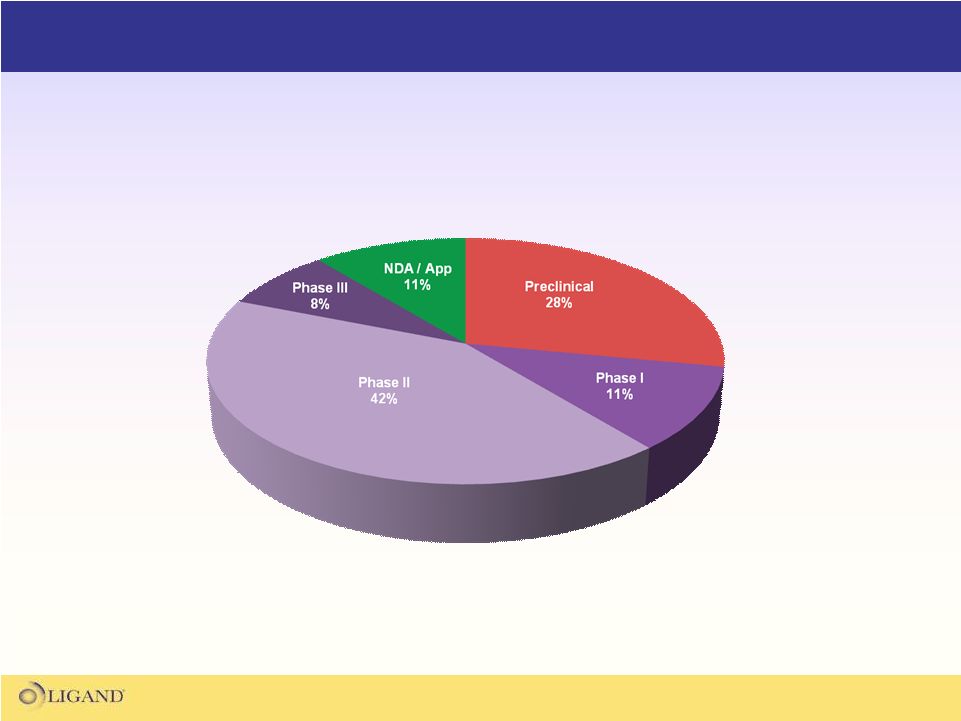

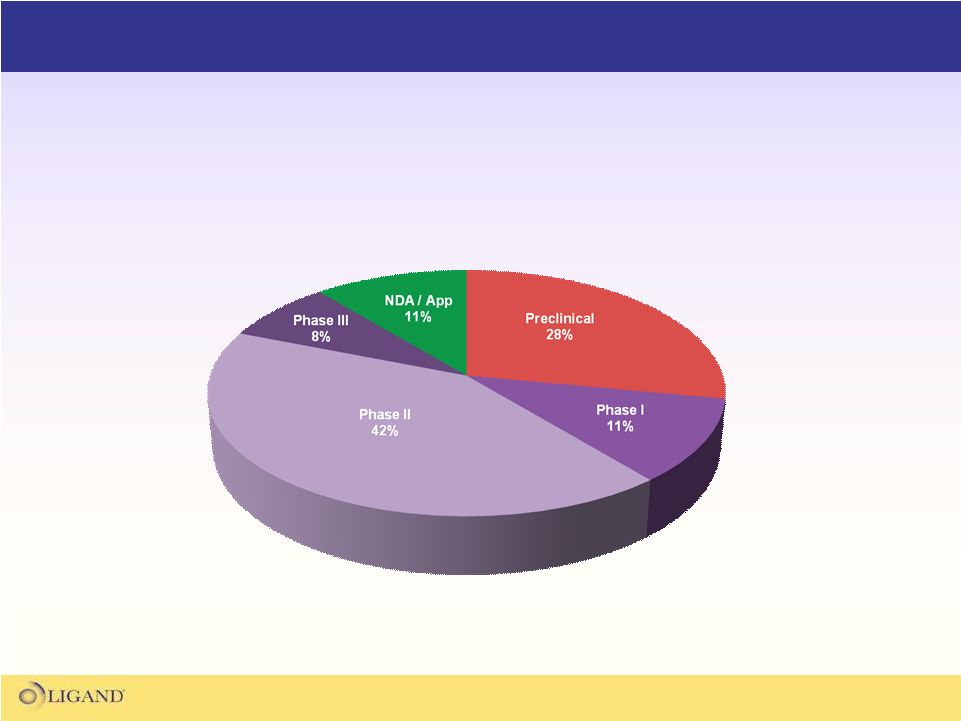

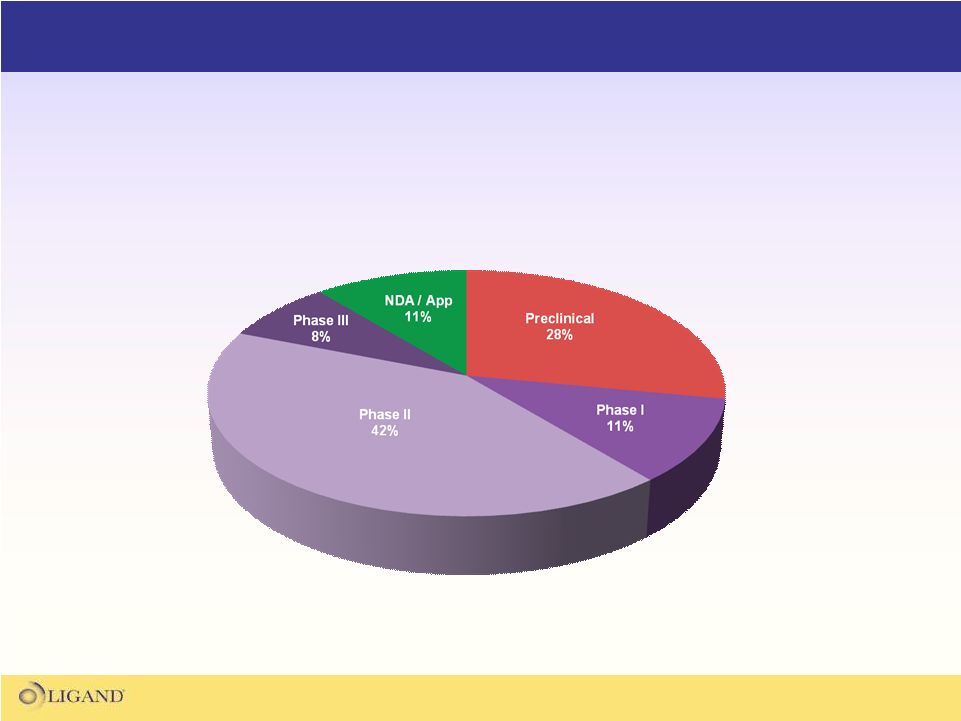

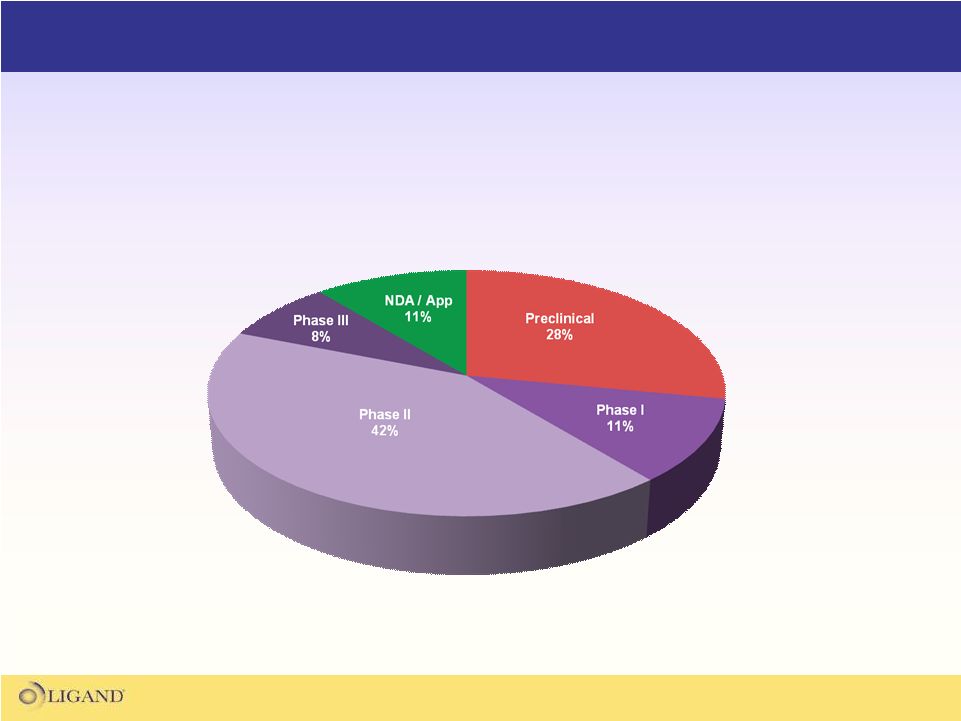

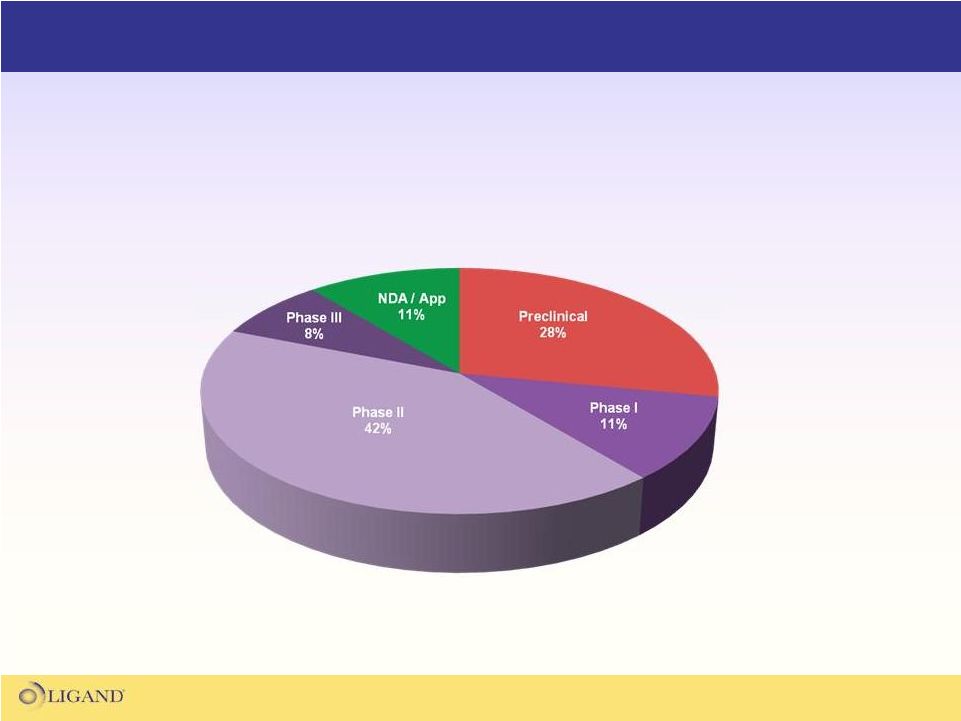

Over half of the partnered portfolio

is in mid-late stage clinical trials |

31

Ligand’s

Partnered Asset Portfolio

Significant news flow over the next 18 months

•

Aprela

NDA Filing

•

Promacta-Japan ITP Approval

•

Promacta

HepC

PIII Data

•

SARM PI Data

•BACE PII Initiation

•

IL-9 PII Completion

•

Conbriza

EU Launch

•

Oral EPO Clinical Candidate

•

Glucagon Clinical Candidate

•

TR-beta Clinical Candidate

•

Dinaciclib

PII Completions

•

Acadesine

PIII Data

•

GCGR PI Initiation

•

Promacta

PII Oncology Data

•

Roche HepC

PII Initiation |

32

Quality Partnerships and Portfolio Value

•

Ligand's

promising long-term growth is firmly based on finding partners who can

deliver our assets into the hands of patients

•

Ligand’s

ideal partners have the following qualities:

–

The expertise to bring each unique asset through development into the

marketplace

–

A need for our product in their portfolio

–

The resources to make it all happen

Long-term Ligand shareholder value is highly based

on the quality of our partnerships |

33

Examples of Value Through Quality Partnerships

Assessing the value of Ligand’s partnered portfolio

by examining two premier partnerships |

34

The Merck-Ligand

Collaboration

•

A pipeline of innovative products in established or emerging Merck franchises

•

The potential for milestone and royalty revenue in the near and

long-term •

Regular news flow from a variety of programs

Phase III

CABG

Phase II

COPD

Phase II

Oncology

Phase I

Alzheimer’s

Pre-clinical

Multiple assets under the control of one of the

world’s leading pharmaceutical companies has the potential to

produce enormous value for Ligand

shareholders

*Acadesine

was licensed to Merck by PeriCor

5 Programs

BACE

Dinaciclib

SCH 527123

Acadesine* |

35

•

What does SCH 527123 do?

Antagonist of chemokine

receptor 2, blocking the activation

of neutrophils.

Reduces airway damage and mucous build up seen in

diseases like COPD

•

What stage of development is SCH 527123 at?

Phase II study for COPD. Expected to be completed in 3Q12

•

Why is SCH 527123 interesting?

12M COPD patients in US with no effective long-term

treatment

Part of the respiratory franchise for Merck

Novel NME with strong patent protection

SCH 527123 (CXCR2 Antagonist)

SCH 527123 is a potential first-in-class, blockbuster medication

for

pulmonary

obstruction

diseases

like

COPD

Airway Obstruction in COPD

(thinkcopddifferently.com-2010) |

36

•

What does Dinaciclib

do?

Inhibitor of cyclin

dependent kinase

(CDK)

Inhibiting CDK should block cell-cycle progression and

promote apoptosis

•

What

stage

of

development

is

Dinaciclib

at?

Multiple Phase II studies for cancer. The studies will

complete in late 2010 through 2012

•

Why is Dinaciclib

interesting?

Merck is making a large commitment to becoming a player in

the oncology field

Novel kinase

inhibitors are the next wave of therapeutics in

the oncology space

Novel NME with strong patent protection

Dinaciclib

(CDK Inhibitor)

Dinaciclib

is a pro-apoptotic cyclin

dependent kinase

inhibitor with potential anti-neoplastic

activity

CDK Control of the Cell Cycle

(sandwalk.blogspot.com-2009) |

37

•

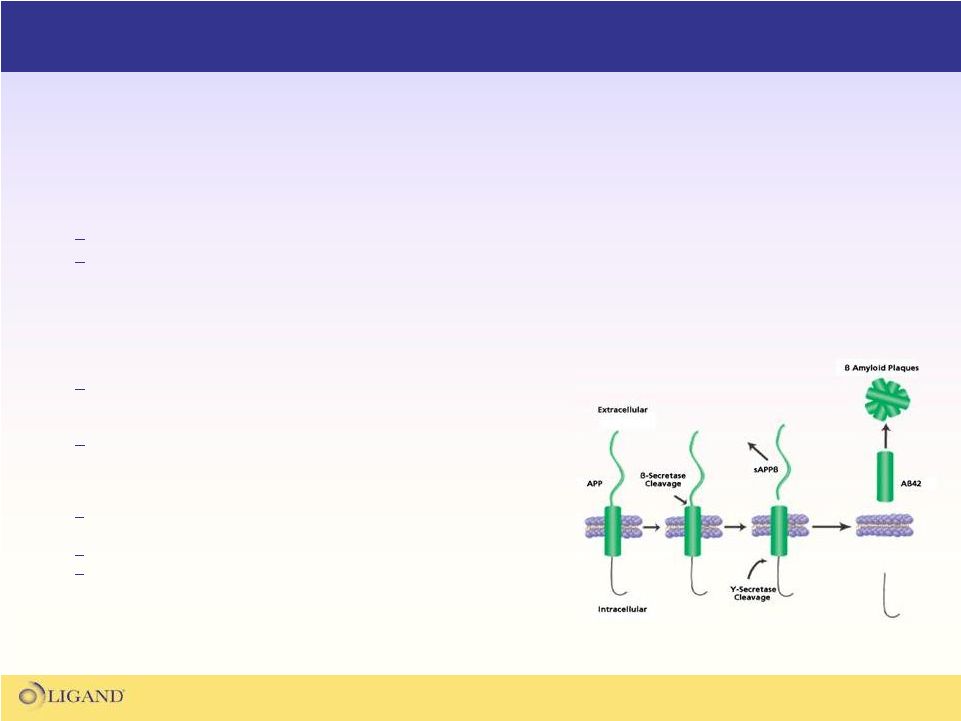

What does a BACE Inhibitor do?

BACE

inhibitors

block

the

activity

beta-secretase

(BACE)

Inhibiting

beta-secretase

should

lower

the

amount

of

beta-

amyloid

protein

produced

in

the

brain,

limiting

the

plaque

formation

that

is

thought

to

be

a

cause

of

Alzheimer’s

disease

•

What stage of development is BACE Program at?

Merck

has

a

BACE

molecule

in

Phase

I

•

58% reduction in beta-amyloid

protein seen in single dose PI

study

Ligand

anticipates a late 2010 Phase II initiation

•

Why are BACE inhibitors interesting?

5-6M patients in the US with little therapeutic options

•

Estimated at more than 15M world-wide

Completely novel mechanism of action

Novel NME with strong patent protection

BACE Inhibitor Program

The Merck BACE inhibitor program is developing a novel, first-in-class

therapeutic

for

Alzheimer’s

disease

by

targeting

beta-secretase

BACE Cleavage of beta-amyloid

Protein

(sigmaaldrich.com-2008) |

38

Merck Collaboration Summary

The Merck collection of assets has the potential to produce one of the next

blockbuster drugs in the Ligand

asset portfolio

Phase III

CABG

Phase II

COPD

Phase II

Oncology

Phase I

Alzheimer’s

Pre-clinical

The opportunity is for any one (or several) of these assets

to become the next Promacta

for Ligand

5 Programs

BACE

Dinaciclib

SCH 527123

Acadesine* |

39

The GSK-Ligand

Collaboration

•

Increasing royalty revenue over time from expanded indications

•

Regular news flow of filings and approvals

•

Regular news flow from a variety of programs

•

2nd Generation TPO Receptor Agonist licensed to GSK as a follow-on

molecule to Promacta

Approved

ITP

Phase III

HepC

Phase II

Oncology

Phase II

Thrombo

Phase I

Other Indications

GSK and Ligand

have a long-standing collaboration to develop

thrombopoietin

receptor agonists for treatment of thrombocytopenia

Promacta

GSK 2285921*

Promacta

Promacta

Promacta |

40

•

What does Promacta

do?

Promacta

is a once daily oral medicine that activates

the thrombopoietin

(TPO) receptor

Activation of the TPO receptor causes an increase in

the production of platelets

•

What is Promacta

approved for?

Promacta

is approved for ITP in multiple countries

•

What are the next indications for Promacta?

Promacta

is in Phase III for HepC-related

thrombocytopenia and we project it to launch in 2012

Promacta

is in Phase II for thrombocytopenia related

to various cancer types

Promacta

Facts

Promacta

is a first-in-class therapy for raising platelet levels

in patients experiencing thrombocytopenia |

41

•

GSK

is

currently

running

two

potentially

large

Phase

III

studies

in

HepC

patients

Study 1 (PEGASYS/Ribavirin)

Study 2 (PEGINTRON/Ribavirin)

•

Both

studies

are

randomized,

double

blind,

placebo

controlled

in

750

patients

currently

on

peginterferon/ribavirin

•

Primary

outcome

is

Sustained

Virologic

Response

(SVR)

6

months

after

treatment

•

Data is expected from both in 3Q11

•

Phase II data showed

65% of patients on 75mg daily of Promacta

finished viral therapy

course, compared to 6% on placebo.

•

10% of all HepC

patients cannot finish viral therapy due to thrombocytopenia, resulting

in a sub-optimal therapeutic response

Promacta

and HepC-Related Thrombocytopenia

The ongoing Phase III studies for HepC-related thrombocytopenia

are the basis for a large expansion of the Promacta

value |

42

•

The platelet segment is the next frontier in the multi-billion dollar

hematology market

•

Promacta and its backup compound will build a long-term platelet franchise

for GSK/Ligand

•

GSK is expending large amounts of resources and money to expand

Promacta markets and indications

Two 750 patient studies for HepC-related thrombocytopenia

•

Data expected in 2H11

Currently in multiple PI and PII studies for cancer-related thrombocytopenia

Filings and approvals in new countries

•

ITP approval in Japan expected in 2H10

Promacta: Reasons for Excitement

Ligand shareholders have many

reasons to be very excited about Promacta |

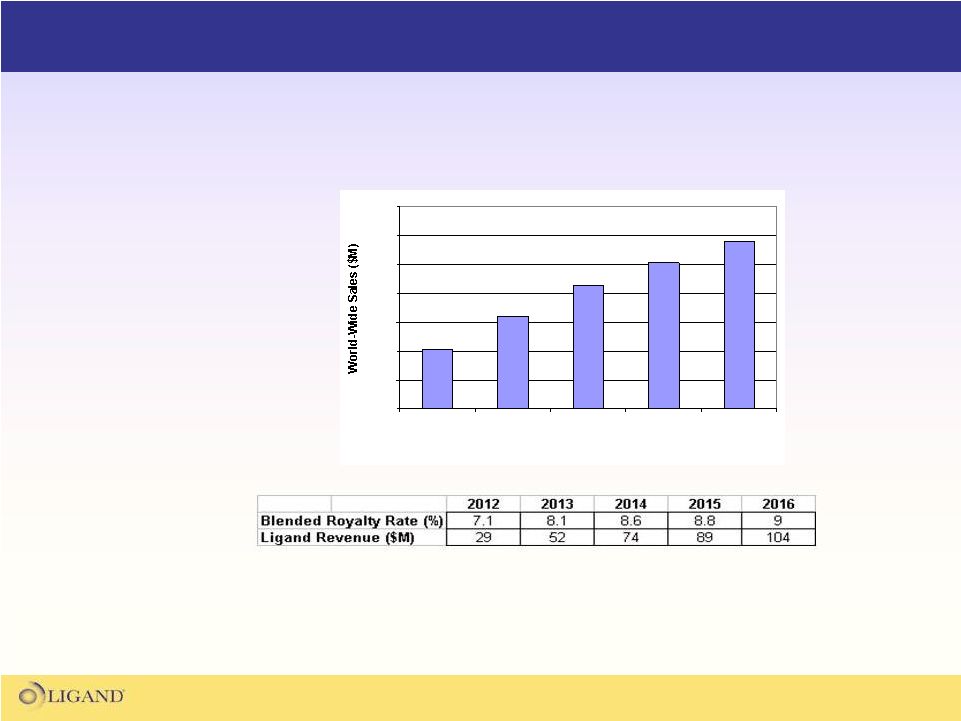

43

What Promacta

Means to Ligand

Independent Analyst

Projected Sales

for Promacta*

Potential royalty revenues from Promacta

are the

basis for transformative growth at Ligand

0

200

400

600

800

1000

1200

1400

2012

2013

2014

2015

2016

Year

Yearly Revenue

Projections for Ligand

from Promacta

Sales**

*Projected sales figures are the average projections from 6 independent analyst

groups, including

Bank

of

America-Merrill

Lynch,

Credit

Suisse,

JP

Morgan,

Morgan

Stanley,

Nomura,

and

UBS

**There can be no assurance these results will be achieved. Projections derived

from analyst revenue estimates. |

Ligand

Pharmaceuticals, Inc.

44

Promacta

and its Role in Treating

HepC-Related Thrombocytopenia

Nezam

Afdhal, M.D.

Gastroenterology Chief of Hepatology,

Beth Israel Deaconess Medical Center |

The

Role for Eltrombopag in the Treatment of HepC-Related

Thrombocytopenia N. Afdhal M.D

Beth Israel Deaconess Liver Center

Harvard Medical School |

Agenda

Eltrombopag Background

Conclusions from the ELEVATE Study

Eltrombopag PII HepC Study Results

The ENABLE 1 and ENABLE 2 PIII Studies |

The

Unmet Medical Need for Thrombocytopenia Thrombocytopenia is a major factor in

patients being unable to achieve a desired clinical outcome in dozens of

diseases Currently estimated to be nearly two million patients annually in

the US who need to be treated for thrombocytopenia

Current non-drug techniques used to increase platelets (i.e. platelet

transfusion, splenectomy) are costly, risky, and inconvenient.

The need for a more convenient and effective method for combating

thrombocytopenia is clear |

Liver

Disease–Associated Thrombocytopenia

Platelet counts may be as low as

20,000–40,000/µL

Prevalence of thrombocytopenia

increases with severity of liver disease

Degree of thrombocytopenia correlated

with severity of liver disease

Thrombocytopenia predictive of

reduced 5-year survival

Thrombocytopenia may develop or

worsen with interferon-based therapy

Degree of Liver

Damage

Thrombocytopenia

Prevalence

Normal liver

2.3%

Fatty liver

5.1%

Chronic hepatitis

20.3%

Advanced liver

disease

31.8% |

Eltrombopag

Thrombopoietin

receptor agonist

Oral, once-daily tablet

Induces megakaryocyte

proliferation and differentiation

Increases platelet counts in

patients with HCV

1

1. McHutchison

J, et al.N

Engl

J Med.

2007;357:2227–2236. |

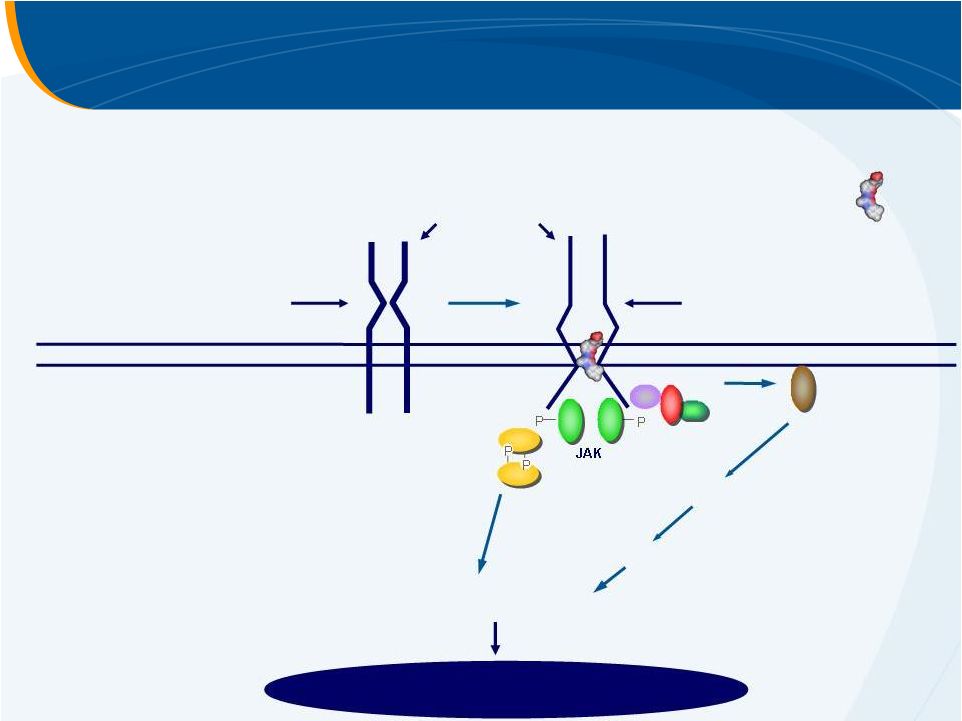

Cytoplasm

STAT

RAS/RAF

MAPKK

p42/44

SOS

SOS

GRB2

SHC

Cell membrane

Eltrombopag

–

Mechanism of Action

thrombopoietin

receptor

inactive receptor

active receptor

Signal Transduction

eltrombopag

Increased platelet production |

Eltrombopag Clinical Studies

Conclusions from the ELEVATE Study |

Eltrombopag

in Chronic Liver Disease Patients

with Thrombocytopenia Undergoing an Elective

Invasive Procedure: Results from ELEVATE,

a Randomised Clinical Trial

N.

Afdhal,

E.

Giannini,

G.N.

Tayyab,

A.

Mohsin,

4

J-W.

Lee,

5

A. Andriulli,

6

L. Jeffers,

7

J. McHutchison,

8

F. Campbell,

9

N. Blackman,

10

D. Hyde,

9

A. Brainsky,

11

D. Theodore

12

1. Division of Gastroenterology/Liver Center, Beth Israel Deaconess Medical Center,

Boston, MA, USA; 2. Gastroenterology Unit, Department of Internal

Medicine, University of Genoa, Genoa, Italy; 3. Department of Medicine,

Gastroenterology and Hepatology, Post Graduate Medical Institute, and Lahore

General Hospital, Lahore, Pakistan; 4. Department of Gastroenterology, Services

Hospital Lahore, Services Institute of Medical Sciences, Lahore,

Pakistan; 5. Department of Internal Medicine, Inha

University Hospital and

School of Medicine, Incheon, Korea; 6. Department of Internal Medicine,

Division of Gastroenterology, Casa Sollievo Sofferenza Hospital,

San Giovanni Rotondo, Italy; 7. Center for Liver Diseases, University of

Miami, Miller School of Medicine, Miami, FL, USA; 8. Division of

Gastroenterology, Duke University Medical Center, Durham, NC, USA; 9. Clinical Development,

GlaxoSmithKline, Stockley

Park, Uxbridge, UK; 10. Biometrics and Epidemiology, GlaxoSmithKline,

Collegeville, PA, USA; 11. Clinical Development, GlaxoSmithKline,

Collegeville, PA, USA; 12. Clinical Development, GlaxoSmithKline, Research Triangle Park, NC, USA

1

2

3 |

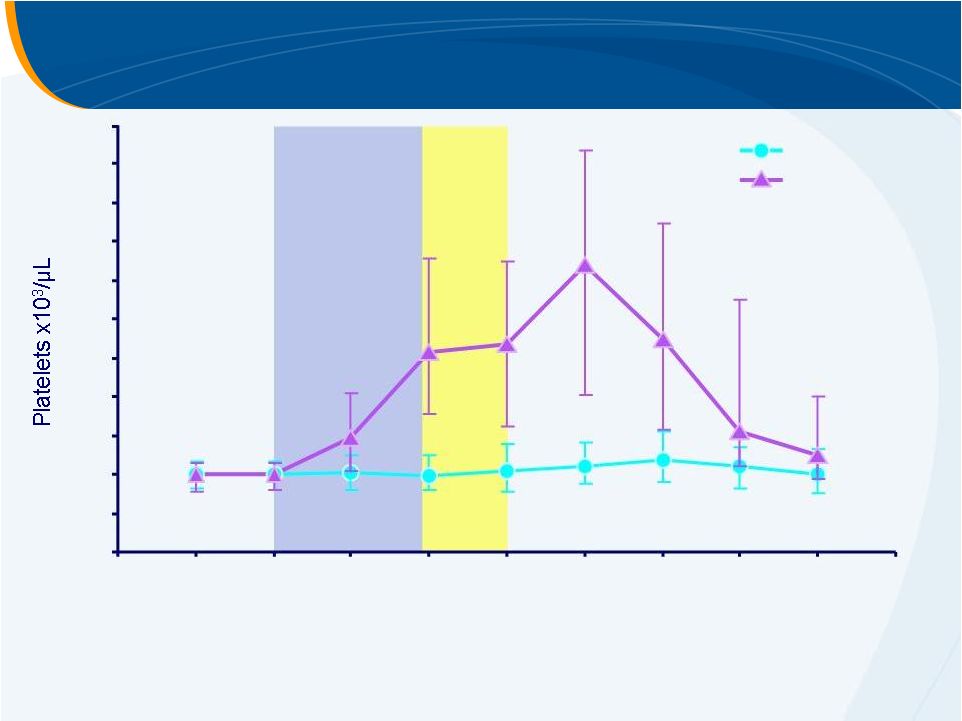

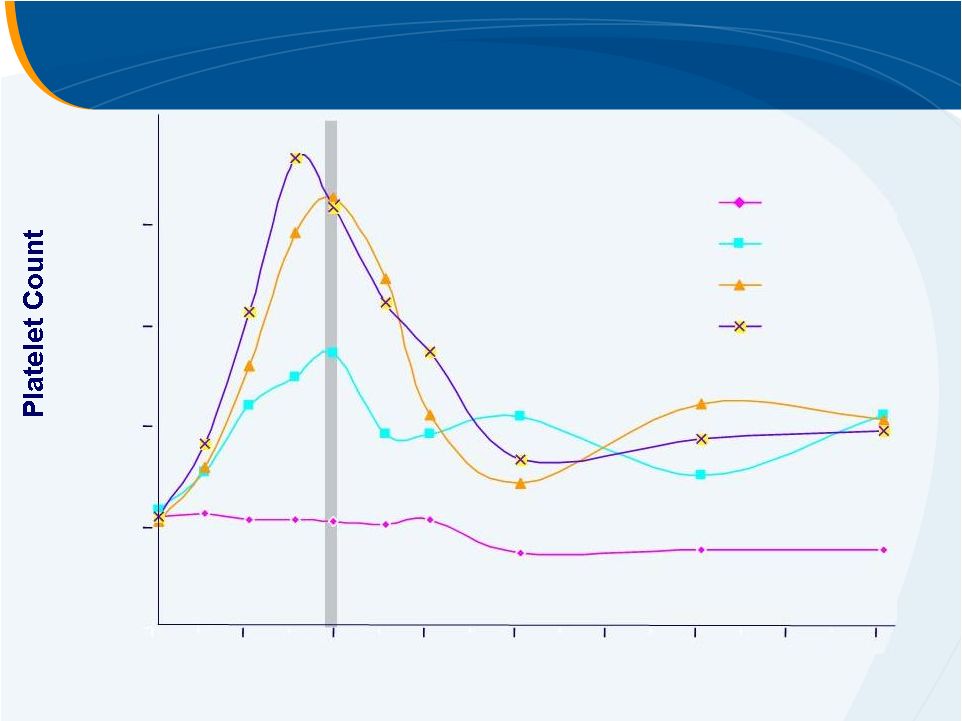

Median Platelet Count from ELEVATE

147

144

145

141

139

134

132

131

50

49

128

125

116

125

120

117

125

127

Placebo

Eltrombopag

n =

n =

Number with available data:

Eltrombopag

Placebo

0

20

40

60

80

100

120

140

160

180

200

220

Screening

Day

1

Day

8

Day

15

Day

16–19

7

DFU

14

DFU

21

DFU

30

DFU

Median (interquartile

range)

Treatment

Period

Procedure |

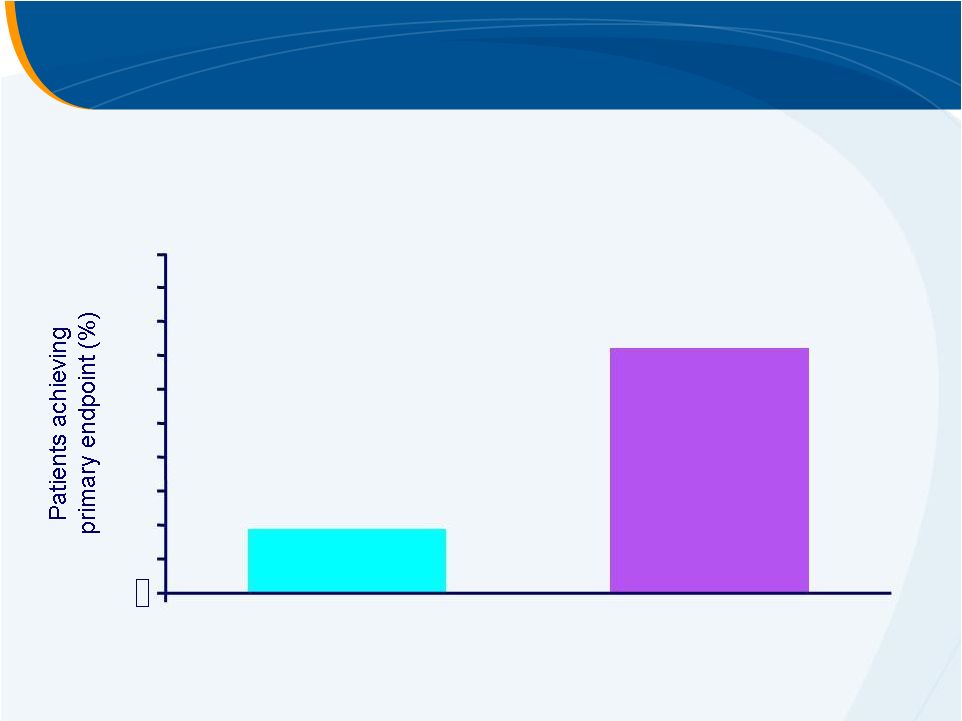

Primary Endpoint: Avoiding Platelet

Transfusions with Elective Invasive Procedure

Difference 53% (95% CI: 43, 62)

p

< 0.0001

0

10

20

30

40

50

60

80

100

Placebo

(N = 147)

Eltrombopag

(N = 145)

70

90

72%

19%

n = 28

n = 104 |

Selected Adverse Events

Placebo

(N = 145)

Eltrombopag

(N = 143)

n (%)

n (%)

Bleeding

25 (17)

19 (13)

Thrombotic event

2 (1)

6 (4)

Ocular (focus on cataracts / visual

acuity decrease)

6 (4)

6 (4)

Malignancies*

1 (<1)

1 (<1)

* Basal cell carcinoma (Grade 2) reported for one patient receiving placebo and B cell lymphoma (Grade

4) reported for one patient receiving eltrombopag; neither was considered to be related to

treatment by the investigator. |

Summary of Thrombotic Events

Thrombotic event

Temporal

relationship to last

dose

Temporal

relationship to

procedure

Platelet count at

event (Gi/L)

Procedure

PV / SMV thrombosis

+1

–6 days

417

Brain tumour

resection

PV thrombosis

+5

+4 days

288

Oesophageal

variceal ligation

SMV thrombosis

+8

+7 days

235

Dental extraction

SMV / mesenteric

thrombosis

+9

+7 days

289

HCC ablation

SPV thrombosis

+14

+13 days

241

TACE

PV thrombosis

+38

+34 days

33

Oesophageal

variceal ligation

Acute MI

+20

+19 days

83

Colon resection

Non-occlusive PV and

mesenteric thrombosis

+128

+128 days

Unknown

Oesophagoduo-

denoscopy

PV, portal vein; SMV, superior mesenteric vein; SPV, spleno-portal vein; MI,

myocardial infarction Eltrombopag

Placebo |

Thrombotic Events and Platelet Count

Platelet count >200,000/µ

L YES

NO

47 patients

(16%)

241 patients

(84%)

YES = 5 (10.6%)

NO = 42 (89.4%)

YES = 3 (1.2%)

NO = 238 (98.8%)

TEs |

Conclusions

Eltrombopag 75 mg for 14 days

–

Reduced the need for platelet transfusions in CLD patients

with thrombocytopenia undergoing elective invasive

procedures

–

Increased platelets during treatment period and up to 2

weeks following treatment

–

Similar incidence of adverse events and serious adverse

events

–

More thrombotic events in the eltrombopag group |

Eltrombopag Clinical Studies

HepC Studies |

Eltrombopag

PII HepC

Study Design

4 wk

12 wk

PEG-IFN + ribavirin

+ eltrombopag

Pre-antiviral

Eltrombopag

4 wk

4 wk

4 wk

12 wk +

Eltrombopag

12 wk

same here

12 wk

same here

INITIATE

antiviral Rx if platelets

>70–100

K/µL 30 mg

50 mg

75 mg

PART

1 PART

2 4 wk

4 wk

4 wk

4 wk

Follow-up |

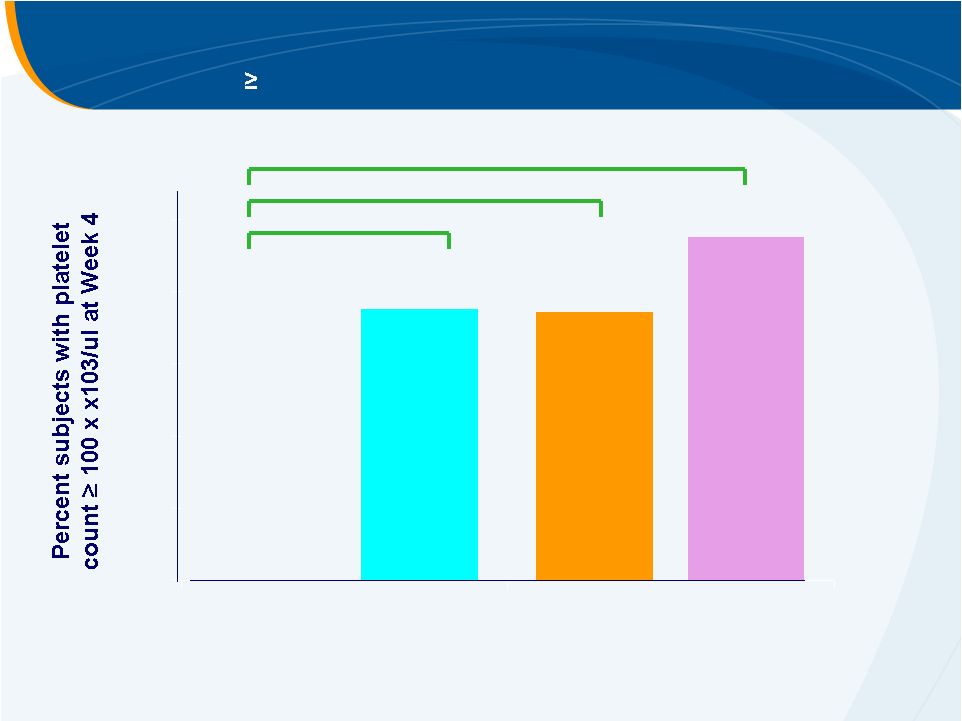

Primary Efficacy Endpoint

Platelet count

100,000/uL at Week 4

PLACEBO

30 mg

50 mg

75 mg

0.0007

0.0003

< 0.0001

0%

74%

75%

95%

0%

20%

40%

60%

80%

100%

McHutchison, NEJM 2007 |

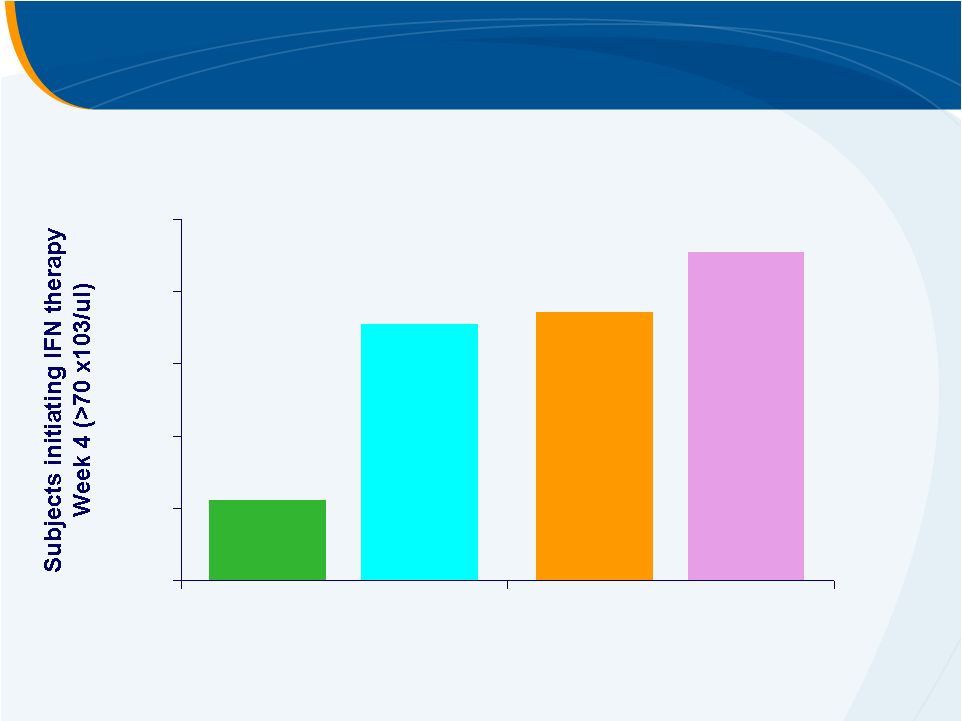

Subjects Initiating PEG-IFN Therapy at Week 4

PLACEBO

30 mg

50 mg

75 mg

22%

74%

71%

91%

0%

20%

40%

60%

80%

100% |

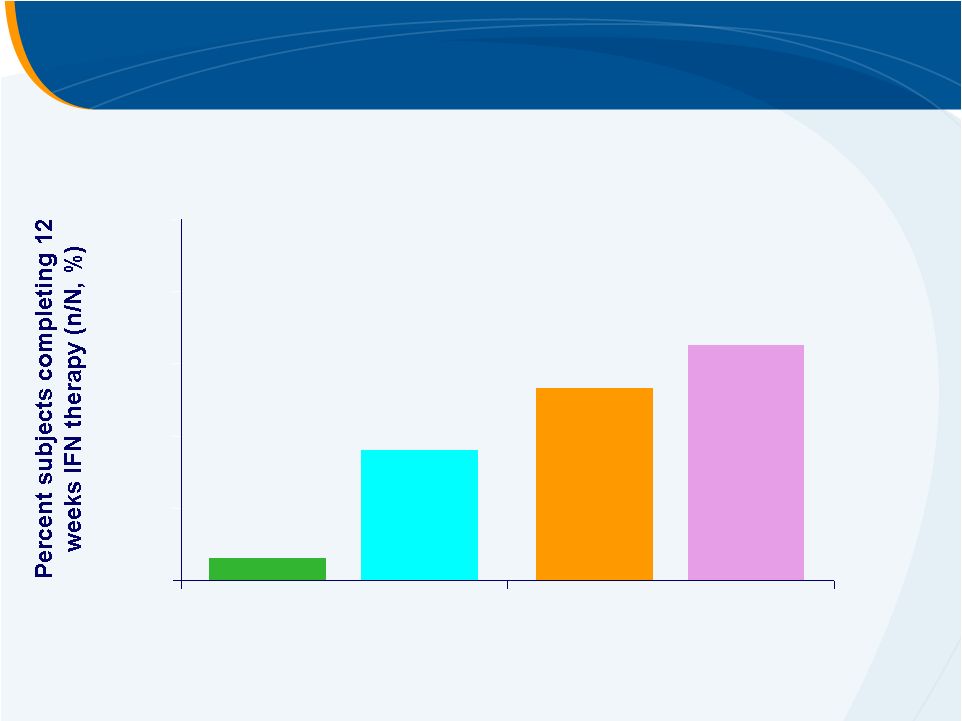

Subjects Completing 12 Weeks of PEG-IFN Therapy

PLACEBO

30 mg

50 mg

75 mg

6%

53%

36%

65%

0%

20%

40%

60%

80%

100% |

HCV

Phase II Study Median Platelet Count

0

50

100

150

200

250

0

14

28

42

56

70

84

98

112

Study Day

Placebo

30 mg

50 mg

75 mg

INITIATION

MAINTENANCE

McHutchison, AASLD 2006 |

Adverse Events –

Pre-Antiviral Phase

Treatment Group, n (%)

PBO

N=18

30mg

N=14

50mg

N=19

75mg

N=23

Any AE

10 (56)

11 (79)

10 (53)

13 (57)

Headache

3 (17)

5 (36)

3 (16)

4 (17)

Dry mouth

1 (6)

2 (14)

2 (11)

2 (9)

Pruritus

0

0

0

2 (9)

Nausea

0

1 (7)

2 (11)

1 (4)

Fatigue

0

0

2 (11)

1 (4)

Upper abdominal pain

0

2 (14)

2 (11)

0

Insomnia

0

0

2 (11)

0

Arthralgia

0

2 (14)

1 (5)

0

No thromboembolic

or elevated LFT events of concern |

Conclusions

Eltrombopag

increased platelet counts in subjects in all dose groups

A

significant

number

of

subjects

achieved

the

primary

endpoint

(Week

4)

in all dose groups compared to placebo

Eltrombopag

enabled 45/56 subjects to initiate IFN therapy

–

31 subjects completed 12 weeks of IFN therapy

Preliminary PK findings in general indicate exposure increases with

dose with wide variability

No safety signals of concern in this initial short term study

Safety and efficacy data supports further investigation of eltrombopag

in this patient population |

2

parallel global Phase III studies

Eltrombopag

to

INitiate

and Maintain Interferon

Antiviral Treatment

to

Benefit Subjects with Hepatitis C related Liver

DiseasE

peginterferon

alfa-2a

(PEGASYS)

plus

ribavirin

–

ENABLE

1

peginterferon

alfa-2b

(PEG-Intron)

plus

ribavirin

–

ENABLE

2

ENABLE 1 & 2 |

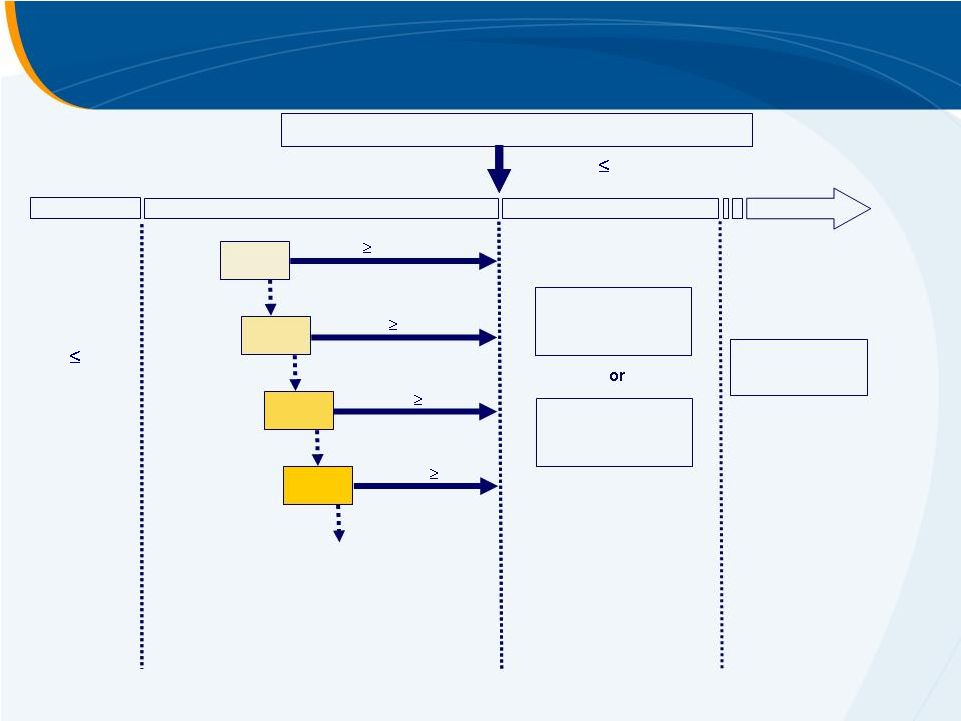

open label

eltrombopag

Eltrombopag

+ PEG-IFN/Rib

Pre-Antiviral Phase

Open-label eltrombopag

(2 –

9 weeks)

Antiviral Phase

Randomised

(up to 48 weeks)

Placebo

+ PEG-IFN/Rib

platelets

>90,000/uL (E1)

or

100,000/uL (E2)

25mg>50mg>75mg>100mg

•

2:1 randomisation eltrombopag:placebo

•

Dose titration of eltrombopag allowed throughout

•

Primary endpoint = proportion of patients achieving SVR (6M off –Tx)

•

N=750 dosed/675 randomised study

•

3 regions, 26 countries, >250 centres

SVR

SVR

6 months

off-Tx

Randomised Withdrawal Design |

ENABLE 1 & 2 Study Design

Screening

45

Days

Platelets

<75K/µL

25mg

Pre-Antiviral Treatment Phase

Open-label eltrombopag

dosed for

up to 9wks until platelet count

increases to enable initiation of

antiviral therapy.

Part 1 (2-9 Wks)

Open-Label

2 Weeks

Platelets

90K/µL*

Platelets

90K/µL*

Platelets

90K/µL*

*Platelets

<90K/µL

*Platelets

<90K/µL

*Platelets

<90K/µL

WD

START

50mg

1-2 Weeks

75mg

1-2 Weeks

100mg

1-3 Weeks

*Platelets

<90K/µL

Platelets

90K/µL*

*90K/µL (ENABLE 1)

100K/µL (ENABLE 2)

2:1 Randomisation (Eltrombopag:Placebo)

Eltrombopag

plus

Antiviral Therapy

Antiviral Treatment Phase

Randomised either to

maintain dose of

eltrombopag

from Part

1 or to matched

placebo.

Part

2

(

48

Wks)

Double-Blind

Placebo

plus

Antiviral Therapy

or

a

24 Week FU

Ocular/SVR

a

Post-last dose of

investigational

product. |

SVR

rate defined as percentage of subjects with non-detectable HCV-RNA at

24 weeks post-completion of the planned treatment period

Platelet count

90-100,000/

L in Part 1

Dose modifications

Safety and tolerability

Platelet counts

PK

RVR,

EVR and ETR

Health-related quality of life

Endpoints |

Eltrombopag is an effective platelet stimulator in CLD

Eltrombopag can reduce need for platelet transfusion in CLD patients

but final dose and safety concerns must be addressed

ENABLE studies will confirm role of eltrombopag in HCV therapy in

2011

Eltrombopag Summary |

Ligand

Pharmaceuticals,

Inc.

72

Ligand

Business Development

Expanding the Partnership Pipeline

Syed

Kazmi, Ph.D.

Vice President,

Business Development and Strategic Planning |

73

•

Conduct only early-stage research

Do what we are good at

•

Very successful track record of discovery and IND generation

–

Over 40 clinical candidates, 22 INDs, 5 drugs approved and 3 on the market

Proven and productive technology platform

•

Strong research capabilities for discovering more selective drugs

•

Select high quality discovery programs

Unmet medical needs

Large, non-primary care markets

Likely branded premium pricing

Tissue selective approach to reduce side effects

•

Partner at appropriate value inflection point from pre-IND to clinical proof of

concept

Likely partners -

big pharma

Generate revenue streams from upfronts, milestones and royalties

The Business Model at Ligand |

74

Ligand Unpartnered Assets

SARM

TRß

Agonist

Glucagon H3

EPO

Androgen

Receptor

Modulator

Thyroid

Receptor-beta

Agonist

Glucagon

Receptor

Antagonist

Histamine H3

Receptor

Antagonist

Oral EPO

Receptor Agonist

Muscle

Wasting

Dyslipidemia

Diabetes

Cognitive

Disorders

Anemia

Phase Ib

Pre-Clinical

Pre-Clinical

Pre-Clinical

Pre-Clinical

Program

Disease

Status |

75

Ligand Unpartnered Assets

SARM

TRß

Agonist

Glucagon H3

EPO

Androgen

Receptor

Modulator

Thyroid

Receptor-beta

Agonist

Glucagon

Receptor

Antagonist

Histamine H3

Receptor

Antagonist

Oral EPO

Receptor Agonist

Muscle

Wasting

Dyslipidemia

Diabetes

Cognitive

Disorders

Anemia

Phase Ib

Pre-Clinical

Pre-Clinical

Pre-Clinical

Pre-Clinical

Program

Disease

Status |

76

•

Metabasis

acquisition brings a robust IP portfolio

and industry-leading experience in liver-targeted

drug delivery using proprietary HepDirect

Technology

•

Ligand

brings deep experience in nuclear hormone

receptor chemistry and pharmacology for

discovering

novel

liver-targeted

TR

agonists

for

hyperlipidemia

The Ligand

TR-beta Program

The combination of Ligand

and Metabasis

creates

a synergistic drug discovery platform for

discovering liver-specific TR

agonists |

77

•

Target validation:

TR activation in liver affects the expression of several genes, leading to

reductions in LDL, triglycerides,Lp(a), and ApoB

TRß

is the major isoform

expressed in liver for tissue-specific effects

•

TR activation in extra-hepatic tissues result in dose-limiting side effects,

including arrhythmia, muscle, bone and thyroid hormones

•

Product Profile:

Oral drug lowering lipids without suppressing thyroid axis or invoking

cardiovascular liabilities

Combination with statins

in patients not reaching LDL goal on current

maximal therapies

•

Avoid mechanism-based safety concerns:

Alterations in thyroid axis –

decrease in T4 and increased TSH levels

Potential for adverse cardiovascular events

Thyroid Receptor

Overview |

78

Dyslipidemia

–

Unmet

Medical

Need

Low Cardio Risk

Med Cardio Risk

High Cardio Risk

Statin

Intolerant

26M US

Dyslipidemic

Patients

Largely Meeting

LDL Goals on

Existing Therapies

20%

15%

Approximately 9M

Patients in need of

Add-On Therapies

Add-on treatments for patients still not reaching LDL goals

on current maximal therapy is a multi-billion dollar market

TR-b Target Pop. |

79

MB07811 -

First generation liver-targeted prodrug

•

Phase Ib

study completed in 56 subjects

Clinical proof of concept with dose-dependent decrease in LDL (15-

41%), Apo B, TGs, and Lp(a)

Modest dose-related side effects including thyroid axis suppression in a

small cohort of subjects

2

nd

generation Liver-selective compounds (e.g. MB10866)

•

Improved preclinical safety and efficacy profiles in validated animal

models

•

Lead

optimization

studies

ongoing

to

further

improve

liver

selectivity

Thyroid Receptor

Program Status |

80

•

Robust Partnering Package

Extensive clinical package with first generation drug candidate to help drive

SARs

2

generation lead candidates representing novel chemistry platforms

Strong IP for a well validated target

Potential for first-in-class NME in a growing area of unmet medical need

•

Partnering Landscape

Established clinical proof of concept with MB07811 (Metabasis) and

Eprotirome

(Karo

Bio)

Well-defined regulatory path to approval

High unmet medical need beyond generic statins

•

Differentiation from Competition

HepDirect

Technology

Nuclear receptor expertise

TR

Partnering Opportunity

nd |

81

•

LGD-4033, a Selective Androgen Receptor

Modulator

(SARM), for the treatment of muscle

wasting disorders

•

LGD-4033 has desirable tissue-selective

properties

A potent, full agonist on bone with anabolic and anti-

resorptive

effects

A potent, full agonist on skeletal muscle with

anabolic effects

A low potency, weak agonist on prostate and

sebaceous glands with high selectivity resulting in

minimal drive on these tissues

SARM Overview

LGD-4033 retains the beneficial properties of natural

androgens, while mitigating the toxic actions and side

effects of steroidal androgens |

82

•

Phase I Single Ascending Dose study completed late 2009

LGD-4033 is safe and well tolerated at single doses up to 22mg

Suitable for once-daily dosing

No SAEs

or dose-related clinical significant adverse events reported

•

Phase I Multiple Ascending Dose study ongoing

LGD-4033

doses

of

0.1

-

3mg

once

daily

for

2-3

weeks

Objectives include safety, tolerability, and measurement of muscle protein

biomarkers, lean body mass, and strength (stair climb)

•

90-day

toxicology

studies

ongoing,

allowing

for

seamless

transition

into

Phase II patient populations

SARM Program Status |

83

The pipeline snapshot below is based upon the developmental agents

listed for treatment of cachexia

(various disease states) and sarcopenia.

Competitive

Pipeline –

Relevant to LGD-4033 Development

Muscle

Wasting

Disease

Development

in the US

Preclinical

Preclinical

Phase II

Phase I

Phase III

Ostarine

(GTx-024)

LGD-3303

SARM

Ghrelin

receptor

Others

Data Source: Thomson-Pharma.com,

LGD-4033

GLPG-0492

Anamorelin

(RC-1291)

VT-122

imidapril |

84

•

Robust Partnering Package

•

New NME with clinical POC data for a well validated target

•

A large library of novel SARM back-up candidates

•

Blockbuster drug potential in a high unmet medical need area

•

Partnership Landscape

Multiple commercial markets allow for both large and orphan indications

•

Muscle Wasting Disorders (cachexia, sarcopenia, frailty)

•

Rehabilitation

•

Muscular dystrophy

•

Osteoporosis (in men and women)

•

Differentiation from Competition

Higher potency

Oral dosing

Enhanced tissue Selectivity

LGD-4033 Partnering Opportunity |

Ligand

Pharmaceuticals,

Inc.

85

Selective Androgen Receptor Modulator

LGD-4033

Shalendar

Bhasin, M.D.

Professor of Medicine, Boston University School of Medicine

Chief, Section of Endocrinology, Diabetes, and Nutrition

Director, Boston Claude D. Pepper Older Americans Independence

Center for Function Promoting Anabolic Therapies

Principal Investigator, LGD-4033 Phase Ib

Clinical Trial |

86

Shalender Bhasin, MD

Professor of Medicine,

Boston University School of Medicine

Chief, Section of Endocrinology, Diabetes, and Nutrition

Director, Boston Claude D. Pepper Older Americans Independence

Center for Function Promoting Therapies

Boston Medical Center

The Unment Medical Need for a SARM Therapeutic

The Unment Medical Need for a SARM Therapeutic |

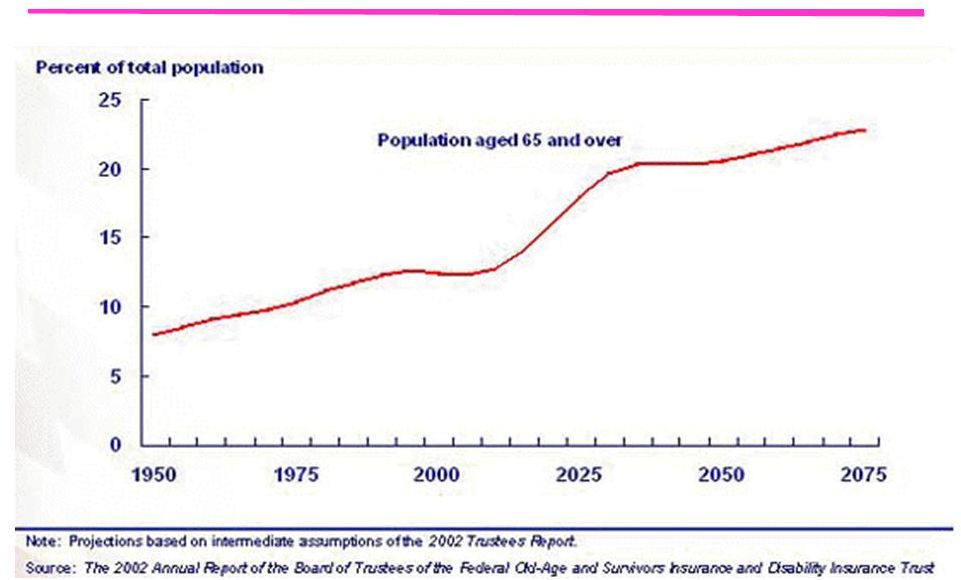

Aged Population as a Share of Total U.S.

Population Continues to Grow |

88

Age-Related Decline in Lean Mass

and Muscle Strength (BLSA; Roy et al 2002)

Age (years)

Leg and Arm Lean Mass (kg)

Quadriceps and Biceps Strength (N)

Age (years) |

89

Aging baby boomers: 65+ will grow from 35 million in

2000 to over 70 million in 2030.

Recent rate of disability —40% (ACS, 2004).

The oldest old: the fastest growing segment

Grow from 3.0 to 6.2 million in the next decade

Social Security Disability Program and the Supplemental

Security Program pay $62.5 billion yearly to 7.5 million

disabled persons; this amount will grow several-fold.

Growth in Disability Among Older Adults:

The Staggering Economic Cost |

90

The Unmet Medical Need –

Frailty & Sarcopenia

•

Age-related loss of muscle

mass, strength and

functionality

•

Estimated 10 million

Americans over the age of 65

suffer from sarcopenia

•

Currently no FDA-approved

treatment options available |

91

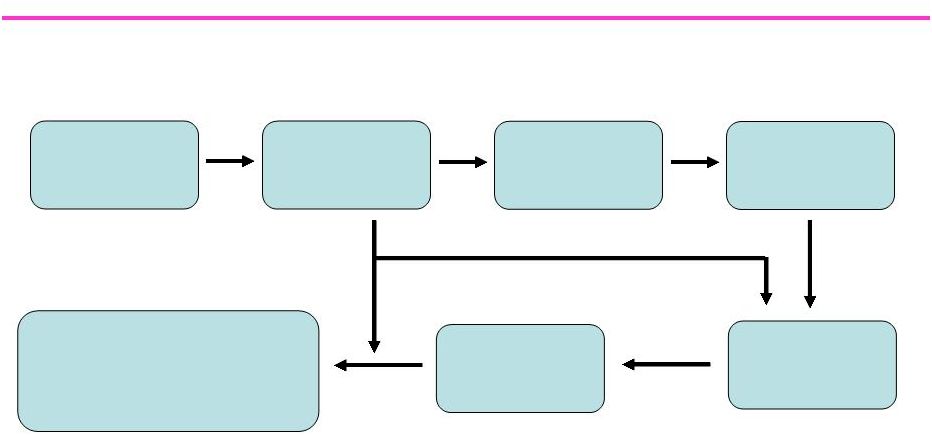

Rationale for Function Promoting Anabolic Therapies

Androgen

Therapy

Alterations in

Gene Expression

Stem Cell

Commitment

Increased

Muscle Mass

Increased

Muscle Strength

and Performance

Improved

Physical Function

Decreased Physical Dependence,

Improved Health Perceptions

and Health-Related Outcomes |

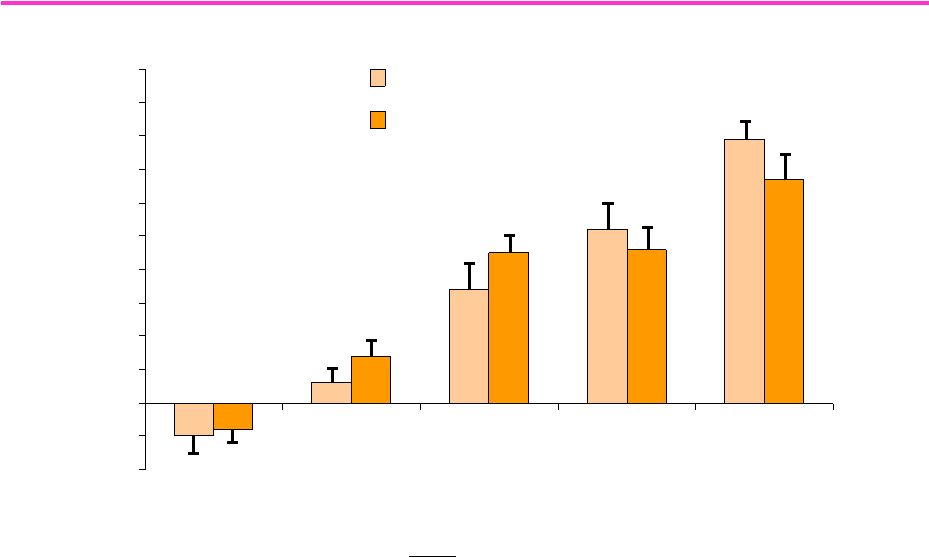

92

-2

-1

0

1

2

3

4

5

6

7

8

9

10

Young Men (18-34)

Older Men (60-75)

T Dose (mg)

25

50

125

300

600

Change in

FFM (kg)

T Dose Effect

P <0.0001

Age Effect

P = 0.22

Change in T X age

P = 0.46

Bhasin et al, JCEM

2005

Testosterone Dose Response in Young and Older Men:

Testosterone Dose Response in Young and Older Men:

Change in Fat Free Mass

Change in Fat Free Mass |

93

The Need for a SARM Therapeutic

80 years of empiric, clinical, epidemiological, and clinical trials data provide

80 years of empiric, clinical, epidemiological, and clinical trials data

provide unequivocal evidence that androgens increase skeletal muscle mass

and unequivocal evidence that androgens increase skeletal muscle mass and

strength.

strength.

Testosterone is not the answer

Testosterone is not the answer

–

Concern about potential adverse effects on prostate

–

Many older men have microscopic foci of prostate cancer. Testosterone

might make these subclinical foci grow.

–

Inherent bias towards detection of greater number of prostate events in

Testosterone-treated men

We need a SARM

SARMs

are non-steroidal and rogens

that act preferentially on skeletal

muscle while sparing tissues associated with side effects, like the

prostate |

| 94

Potential Indications for SARMS are Broader than Frailty Elderly

•

Osteoporosis

•

Anemia

•

Sexual dysfunction

•

Men with prostate cancer who are deemed cured after

radical prostatectomy

•

Muscle wasting

•

Cancer cachexia

•

COPD

•

Chronic Kidney Disease

Potential Indications for SARMS are Broader than Frailty

|

| 95

•

Selective Androgen Receptor Modulator (SARM) that

has the following properties

–

Anabolic in muscle and bone

–

Restores libido/sexual function (CNS-active)

–

Minimal or no drive on prostate in men

–

Minimal or no virilization in women

–

No adverse cardiovascular or hepatic effects at therapeutic

doses

–

Non-steroidal –

cannot be converted to estrogen

SARM Therapeutic Target Profile |

96

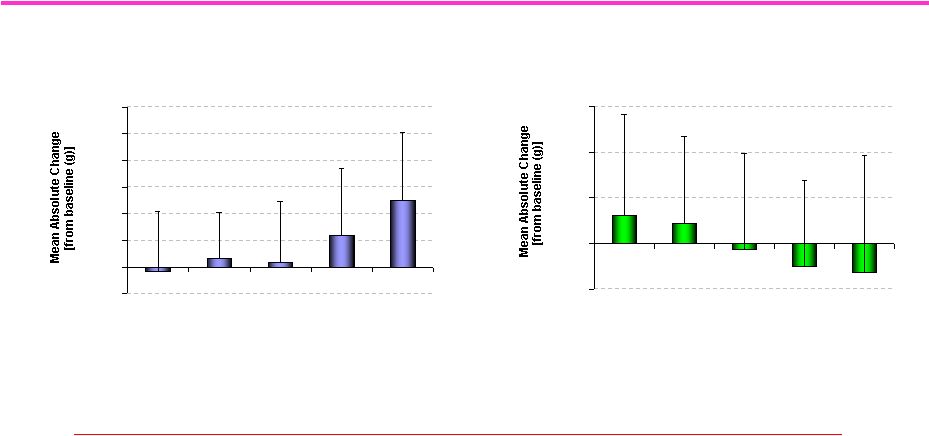

Clinical Trial of Ostarine: Increased Total Lean

Mass and Decreased Total Fat Mass

J Dalton. Data presented at 2007 Endo Meeting, Toronto.

We Need More Potent SARMs

with Greater Tissue Selectivity

Total Lean Mass (all subjects)

-500

0

500

1000

1500

2000

2500

3000

Placebo

0.1 mg

0.3 mg

1 mg

3 mg

Dose

# p<0.001 compared to placebo, p<0.0001 compared to baseline

* p=0.055 compared to placebo, p=0.020 compared to baseline

#

*

Total Fat Mass (all subjects)

-500

0

500

1000

1500

Placebo

0.1 mg

0.3 mg

1 mg

3 mg

Dose

# p=0.049 compared to placebo

# |

97

•

Ligand

is

developing

LGD-4033,

a

Selective

Androgen

Receptor

Modulator

(SARM),

for the treatment of muscle wasting disorders

•

LGD-4033 has desirable tissue-selective properties

–

A

potent,

full

agonist

on

bone

with

anabolic

and

anti-resorptive

effects

–

A potent, full agonist on skeletal muscle with anabolic effects

–

A low potency agonist on prostate with high selectivity resulting in minimal drive

on the prostate

–

A weak, low potency agonist on sebaceous glands resulting in minimal drive on

these tissues LGD-4033 Overview

LGD-4033 retains the beneficial properties of natural androgens, while

mitigating the toxic actions and side effects of steroidal androgens

|

98

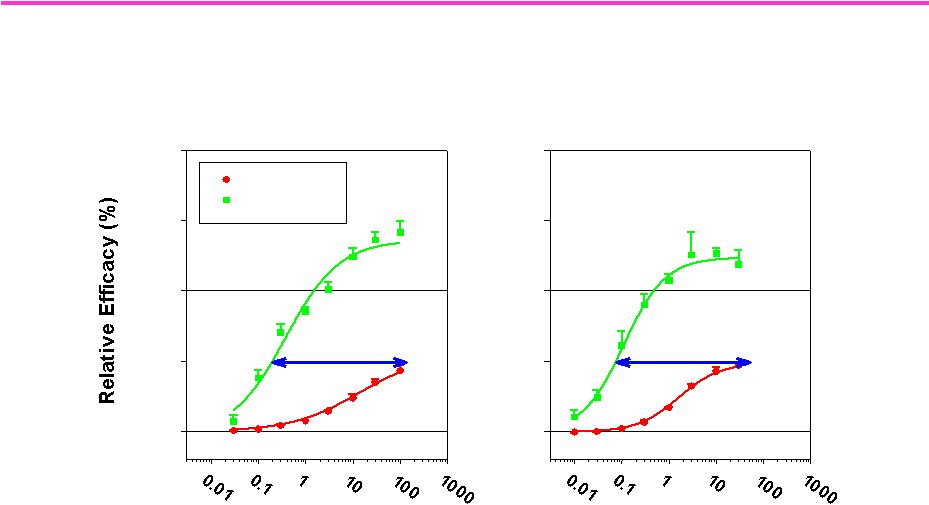

Tissue selectivity of LGD-4033

for skeletal muscle vs. prostate

LGD-4033

0

50

100

150

200

Prostate

Muscle

>500x

Dose (mg/kg/day, po)

Ostarine

0

50

100

150

200

>390x

Comparison of LGD-4033 and Ostarine in the rat model for male

hypogonadism |

99

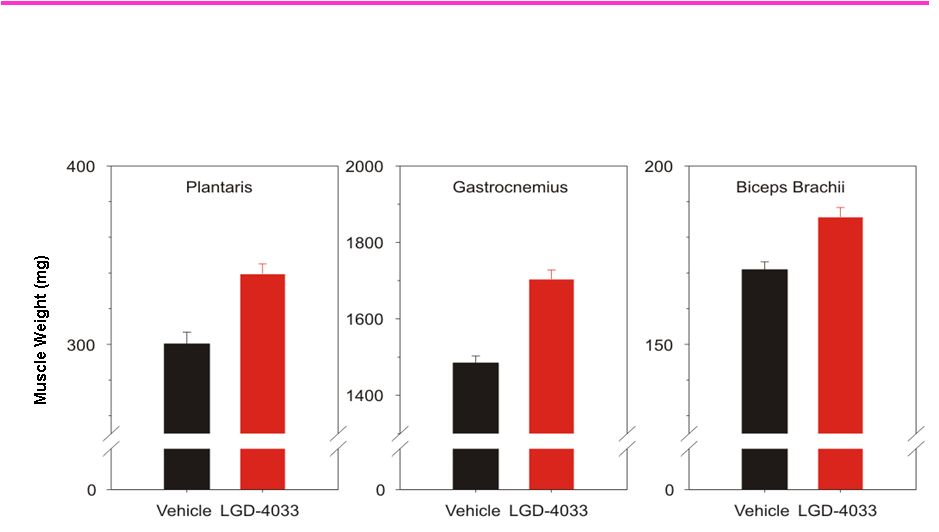

LGD-4033 Increases Muscle Mass Throughout the Body

*

*

*

Effect of LGD-4033 on the weight of skeletal muscle in

female rats treated once daily with 3 mg/kg LGD-4033 for 4 weeks

|

100

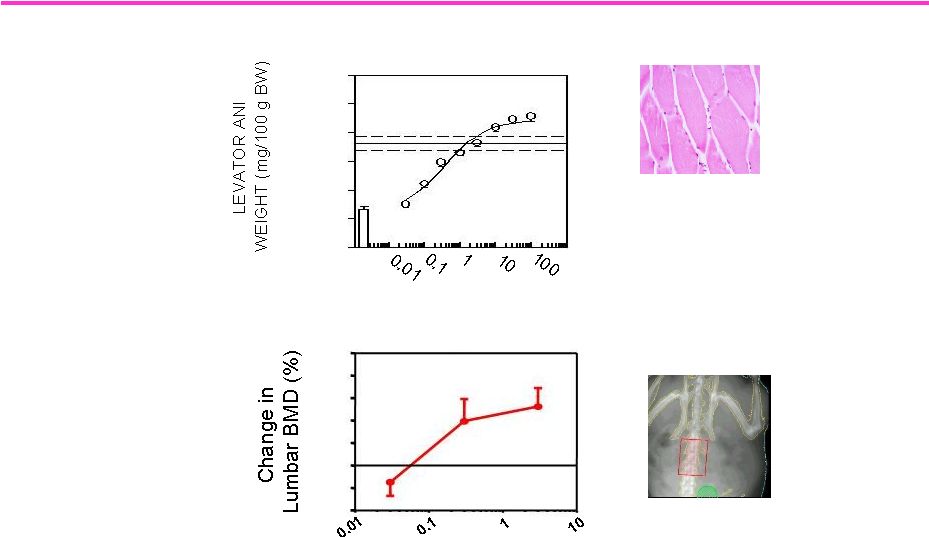

LGD-4033: Similar Potency on Muscle and Bone

Indicates Potential for Treating Osteoporosis

Dose (mg/kg/day, po)

-4

-2

0

2

4

6

8

10

Lumbar Spine DEXA Analysis in Female Rats

Skeletal Muscle Weight in Male Rats

Dose (mg/kg p.o.)

0

20

40

60

80

100

120 |

101

Study

Objective

Key Observations

SAD

—

001

Single dose safety and

tolerability /

Pharmacokinetics

0.1-22 mg

Well tolerated at all doses;

Dose proportional AUC; T

1/2

:

~26-38 hrs

No SAE’s

reported

MAD

—

002

Multiple dose safety

and tolerability /

Pharmacokinetics

Study ongoing

LGD-4033

Phase

I

Development

-

Overview |

102

•

Drug exposure was high and dose-proportional after a

single oral dose suggesting that a low dose will give

sufficient systemic exposure to be therapeutically

effective

•

Elimination half-life (t

1/2

31 hours) consistent with once-

a-day oral dosing

•

No serious adverse events occurred

•

A total of 5 mild-to-moderate AEs

were considered drug-

related by the investigator

–

No AE was dose-related

–

No more than one drug-related AE was observed in any MedRA

category

Summary of Single Ascending Dose Study

(L4033-01) |

103

L4033-02 Multiple Ascending Dose Study

3 mg Dose

Cohort 4

(N=8)

*

1 mg Dose

Cohort 3

(N=20)

0.3 mg

Dose

Cohort 2

(N=20)

0.1 mg

Dose

Cohort 1

(N=8)

Biomarkers:

DEXA for Lean Body Mass, 1-RM for strength, FSR for muscle

protein synthesis

Healthy Males: 21-50 years

Doses: 0.1, 0.3, 1 & 3 mg

Treatment Duration: 21 days

Objective:

Evaluation of Safety, Tolerability,

Pharmacokinetics (PK) and Pharmacodynamics (PD)

Design:

Single-center, randomized, double-blind, placebo-

controlled, sequential escalation, once-daily for 3 weeks

|

104

Regulatory Pathway for SARM Drugs

•

Demonstrating improvements in:

–

Physical function

–

Health outcomes, such as quality of life, reduction in falls

•

FDA feedback on required primary end points for Phase IIb as

disclosed by GTx

–

Total lean body mass

–

Performance measure (e.g.Stair climb)

–

Weight is not an acceptable end point

NIA-Academic Task Force is establishing

a regulatory pathway -

Held in US and

Europe |

| 105

Conclusion

•

Growth in the aged population presents an enormous

unmet need for function promoting therapies

•

Testosterone demonstrates the benefits of androgens in

the frail elderly, but adverse effects limit its use

•

SARMs may produce equal or better functional

improvements with more a favorable safety profile

•

LGD-4033 demonstrates a promising profile of high

potency and selectivity in a SARM |

106

106 |