Attached files

| file | filename |

|---|---|

| 8-K - OSG FORM 8-K - OVERSEAS SHIPHOLDING GROUP INC | earn8k1q.htm |

| EX-99 - OSG FORM 8-K - EXHIBIT 99.1 - OVERSEAS SHIPHOLDING GROUP INC | earn8k991.htm |

EXHIBIT 99.2

First Quarter Fiscal 2010 Earnings Conference Call

May 4, 2010

Page 2

This presentation contains forward-looking statements regarding the Company's prospects, including the outlook

for tanker and articulated tug barge markets, changing oil trading patterns, anticipated levels of newbuilding and

scrapping, prospects for certain strategic alliances and investments, estimated fixed revenue for 2010,

forecasted newbuilding delivery schedule for 2010 and 2011, projected scheduled drydock and off hire days for

the second, third and fourth quarters of 2010, projected locked-in charter revenue and locked-in time charter

days, forecasted 2010 vessel expenses, charter hire expenses, depreciation and amortization, general and

administrative expenses, interest expense, and levels of equity income, other income, taxes and capital

expenditures, timely delivery of newbuildings in accordance with contractual terms, the outcome of OSG

negotiations with Maersk Oil Qatar, the sustainability of OSG’s annual dividend, prospects of OSG’s strategy of

being a market leader in the segments in which it competes and the forecast of world economic activity and oil

demand. These statements are based on certain assumptions made by OSG management based on its

experience and perception of historical trends, current conditions, expected future developments and other

factors it believes are appropriate in the circumstances. Forward-looking statements are subject to a number of

risks, uncertainties and assumptions, many of which are beyond the control of OSG, which may cause actual

results to differ materially from those implied or expressed by the forward-looking statements. Factors, risks and

uncertainties that could cause actual results to differ from the expectations reflected in these forward-looking

statements are described in the Company’s Annual Report for 2009 on Form 10-K and those risks discussed in

the other reports OSG files with the Securities and Exchange Commission.

for tanker and articulated tug barge markets, changing oil trading patterns, anticipated levels of newbuilding and

scrapping, prospects for certain strategic alliances and investments, estimated fixed revenue for 2010,

forecasted newbuilding delivery schedule for 2010 and 2011, projected scheduled drydock and off hire days for

the second, third and fourth quarters of 2010, projected locked-in charter revenue and locked-in time charter

days, forecasted 2010 vessel expenses, charter hire expenses, depreciation and amortization, general and

administrative expenses, interest expense, and levels of equity income, other income, taxes and capital

expenditures, timely delivery of newbuildings in accordance with contractual terms, the outcome of OSG

negotiations with Maersk Oil Qatar, the sustainability of OSG’s annual dividend, prospects of OSG’s strategy of

being a market leader in the segments in which it competes and the forecast of world economic activity and oil

demand. These statements are based on certain assumptions made by OSG management based on its

experience and perception of historical trends, current conditions, expected future developments and other

factors it believes are appropriate in the circumstances. Forward-looking statements are subject to a number of

risks, uncertainties and assumptions, many of which are beyond the control of OSG, which may cause actual

results to differ materially from those implied or expressed by the forward-looking statements. Factors, risks and

uncertainties that could cause actual results to differ from the expectations reflected in these forward-looking

statements are described in the Company’s Annual Report for 2009 on Form 10-K and those risks discussed in

the other reports OSG files with the Securities and Exchange Commission.

Forward-Looking Statements

Page 3

< A mixed rate environment leads to disappointing first quarter 2010 results

• TCE revenues of $230M down 21% from $293M

• EBITDA totaled $44M

• Net loss of $9M and $0.34 per diluted share

• Special charges totaled ~$7M

– Adjusted net loss $3M

– Adjusted diluted loss per share $0.09

< Solid VLCC rates, but most segments declined quarter-over-quarter

< 2Q 2010 bookings-to-date are as expected

• $44.5K/day VLCC

• $29.5K/day Suezmax

• $16.5K/day Aframax

< Financial condition of OSG is strong

• $1.9B in liquidity

• Manageable debt and refinancing obligations over next three years

• $413M of future construction commitments fully funded

• Annual dividend of $1.75 is sustainable

• $19.5K/day Panamax

• $12.5K/day MR

OSG’s balanced growth strategy enables us to remain strong in any rate environment

Financial Highlights

Page 4

Focused on improving and strengthening the Company

Shuttle Tanker Overseas Cascade

FSO Africa Leaving the Shipyard

Quarter/Current Highlights

< Executed two capital market transactions that diversified funding

sources, lengthened our debt maturity profile and increased flexibility

for investment and expansion

sources, lengthened our debt maturity profile and increased flexibility

for investment and expansion

• ~$290M in net proceeds from 8.125% 8-year note issue

• ~$160M in net proceeds from 3.5 million equity share issue

< Technically challenging newbuild/conversion projects completed

• Overseas Cascade

– 5-year charter to Petrobras America commenced April 1st

– Vessel currently supporting recovery efforts for U.S. Gulf of Mexico oil spill

• OSG 350

– Long-term contract of affreightment with Sunoco commenced with delivery

– Delaware Bay lightering operations currently service Sunoco, Valero and

ConocoPhillips

ConocoPhillips

< FSO update

• FSO Asia on site and operating at full capacity

• Additional performance bonus received for superior environmental

performance

performance

• FSO Africa conversion completed

• Discussions with various parties concerning employment of the FSO Africa

are ongoing

are ongoing

Page 5

Commitments / Construction in Progress

Vessel Delivery Schedule

§ $3B of vessel assets as of March 31, 2010

- $625M construction in progress; capital

paid but not generating revenue

paid but not generating revenue

- During Q1 2010, four vessels delivered

mid-to-very late in the quarter

mid-to-very late in the quarter

§ $413M shipyard contract commitments

Chartered-in

Owned

Built-in Fleet Growth Over Next Two Years

Built-in Growth

Page 6

§ Active S&P activity, effective management of long-standing yard relationships

and OSG’s financial strength enabled us to make significant modifications to

our orderbook in 2009 and 2010.

and OSG’s financial strength enabled us to make significant modifications to

our orderbook in 2009 and 2010.

§ Modifications have reduced contract costs of specific orders and enabled us

to replace our MR fleet faster.

to replace our MR fleet faster.

|

OSG Orderbook Actions

|

|

Financing Activities

|

|

2 LR1s cancelled

|

|

<$124M>

|

|

Price reductions on 2 LR1s

|

|

<$12M>

|

|

3 new MRs

|

|

+$117M

|

|

1 new MR bareboat

|

|

+$17M addition to charter-in obligations

|

|

2 MR bareboat swaps

|

|

$6M savings in charter-in obligations

|

|

Other price reductions achieved in lieu of prepayments

|

|

<$13M>

|

Active asset management continues to support our growth strategy

Orderbook Modifications

Page 7

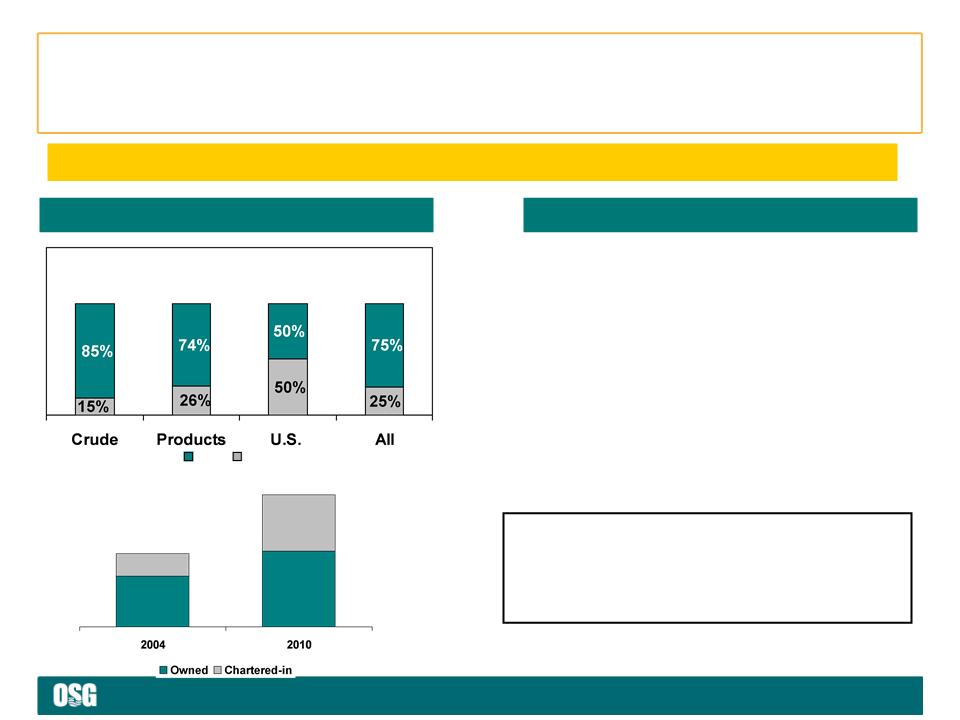

Portfolio Mix*

Chartered Portfolio

• Average duration of chartered-in portfolio: 4.4 years

- Crude 2.5 years

- Products 7.5 years

- U.S. Flag 5.1 years

• Average duration of chartered-out portfolio: 1.7 years

- Crude 0.8 years

- Products 0.7 years

- U.S. Flag 2.7 years

69% of Fleet

57% of Fleet

110 Vessels

61 Vessels

Two newbuild MRs, time chartered-in for 7 years and

delivering in 2011 swapped for two 2009-built 8-year

time charters delivering Q110 and Q210.

delivering in 2011 swapped for two 2009-built 8-year

time charters delivering Q110 and Q210.

Charter-in commitment savings = $6M

MR Swap Transaction

Portfolio of owned and chartered-in tonnage is managed based on market cycle

Spot

Fixed

*Based on 2010 projected revenue days

Time charters-out will generate ~$260M TCE revenues in 2010

Owned and Chartered-in Portfolio

Page 8

OSG

Market / Competitive Outlook

Our U.S. Flag strategy is to become the leading operator of modern double hull

tankers/ATBs in the Jones Act market with the majority of the fleet committed to

servicing long-term COAs and time charters

tankers/ATBs in the Jones Act market with the majority of the fleet committed to

servicing long-term COAs and time charters

§ 2010 expected to be as tough as 2009

§ Refinery utilization expected to remain in the

mid-80% range

mid-80% range

§ U.S. demand levels are expected to remain

relatively constant

relatively constant

§ 8 ships in the Jones Act fleet currently in layup

§ The competitive market of owners with high

quality, new ships is shrinking

quality, new ships is shrinking

§ OPA-90 retirements has market turning

favorable in 2012; we expect timing could be

accelerated by bankruptcies and earlier

retirement of marginal tonnage

favorable in 2012; we expect timing could be

accelerated by bankruptcies and earlier

retirement of marginal tonnage

U.S. Flag

< 2010 OSG Deliveries

• Overseas Cascade (complete)

• OSG 350 (complete)

• Overseas Martinez

• Overseas Anacortes

• OSG 351

< 2011 OSG Deliveries

• Overseas Chinook

• Overseas Tampa

< 65% of fleet is chartered-out through 12/31/10

< 56% of fleet is chartered-out through 12/31/11

< 2 owned shuttle tankers chartered at premium

rates

rates

Page 9

Products: Refinery Expansions Will Benefit Ton-mile Demand

Brazil

Petrobras 380K bpd 2013

India

850K bpd 2010-2014

Essar Oil, BROL, Indian Oil

Company, Hindustan

Petroleum, Nagarjuna

Company, Hindustan

Petroleum, Nagarjuna

China

Qingdao, Tianjin, Quizhou 700K bpd 2010

Jilin, Yueyan 300K bpd 2011

PetroChina, Sinopec 400K bpd 2012

Jilin, Yueyan 300K bpd 2011

PetroChina, Sinopec 400K bpd 2012

In Planning

760K bpd 2013-2014

760K bpd 2013-2014

Middle East

Saudi Arabia JV 800K bpd

- Yanbu 2014/2015

- Jubail 2013/2014

UAE 400K bpd 2014

- Yanbu 2014/2015

- Jubail 2013/2014

UAE 400K bpd 2014

Our products strategy is to be the ship operator of choice by offering high quality ships and

technical management and fostering strong relationships with customers and partners

technical management and fostering strong relationships with customers and partners

Page 10

Our crude strategy is to maintain our market leadership positions through commercial

pool participation and build cargo portfolios with key partners and customers

pool participation and build cargo portfolios with key partners and customers

Source of China oil imports: ESAI

Chinese auto sales in March 2010 hit a

new record of 1.75 million vehicles, up

56% year-over-year

new record of 1.75 million vehicles, up

56% year-over-year

Crude oil imports into China have increased

from 2.9 mbpd in 2006 to 4.0 mbpd in 2009 and

are forecast to increase to 5.6 mbpd in 2014

from 2.9 mbpd in 2006 to 4.0 mbpd in 2009 and

are forecast to increase to 5.6 mbpd in 2014

Crude: China Isn’t Slowing Down

Page 11

Key Takeaways / Differentiators

< Focused on running our business for the long-term

• Consistent strategy throughout the 2008-2009 financial/credit crisis

• Board holds us accountable for both short-term performance and long-term value creation

< Confident about our relative competitive position

• Market leader in crude, products and U.S. Flag segments

• Strong balance sheet and financial position

– Predominantly unsecured borrower

– Liquidity position is strong

– Conservative, consistent financial management

– Annual dividend is sustainable

– Well within all covenant limitations

• Built-in growth with 17-ship newbuild program over next two years

• Commercial pools and cargo systems uniquely enable OSG to outperform the market

• Active asset management generates cash, creates optionality and results in competitive

vessel ownership costs

vessel ownership costs

• Leveraged to rebound with OPEC production increases, spot rate improvement and start-

up of export refineries in Asia

up of export refineries in Asia

Page *

Financial Review

Myles Itkin, CFO

Page 13

Spot rates down across all fleets, except VLCCs.

Q110 Q109

VLCC $49.9K/day $47.2K/day

Suezmax $28.3K/day $40.1K/day

Aframax $17.5K/day $28.4K/day

Panamax $20.3K/day $27.3K/day

MR $15.2K/day $22.4K/day

VLCC $49.9K/day $47.2K/day

Suezmax $28.3K/day $40.1K/day

Aframax $17.5K/day $28.4K/day

Panamax $20.3K/day $27.3K/day

MR $15.2K/day $22.4K/day

Redelivery of 11 older MR vessels and layup of 6

U.S. Flag vessels

U.S. Flag vessels

$6.5M reduction in profit share and redelivery of 11

older MR product carriers.

older MR product carriers.

FSO Africa not yet employed; $4.5M charge on

hedge dedesignation of FSO Africa interest rate

swap.

hedge dedesignation of FSO Africa interest rate

swap.

Increase in average amount of debt outstanding of

$411M; partially offset by lower rates on floating rate

debt

$411M; partially offset by lower rates on floating rate

debt

Financial Review - Income Statement

Page 14

Raised net $450M in capital market transactions; offset

by $400M repayment of credit facility; $112M on vessel

expenditures and $92M advanced to FSO joint venture

by $400M repayment of credit facility; $112M on vessel

expenditures and $92M advanced to FSO joint venture

Increase in VLCC rates drove up balances due from TI

Pool (Q110 spot rate of $50K/day v. Q409 spot rate of

$24K/day) and increase in lightering activities and rates

in U.S. Gulf

Pool (Q110 spot rate of $50K/day v. Q409 spot rate of

$24K/day) and increase in lightering activities and rates

in U.S. Gulf

Reflects $112M costs for construction in progress.

Includes CIP of $625M

Includes CIP of $625M

Funding conversion on FSO Africa $20M; cash collateral

required by FSO JV banks $72M; offset by net operating

losses and ATC incentive hire distribution

required by FSO JV banks $72M; offset by net operating

losses and ATC incentive hire distribution

Financial Review - Balance Sheet

Page 15

Sources & Uses of Cash During the Period

Page 16

2010 Guidance

< Estimated vessel expenses

• $280M to $300M

< Time and bareboat charter hire expenses

• $345M to $370M

< Depreciation and Amortization

• $170M to $190M

< G&A

• $100M to $115M

< Equity income of affiliated companies (updated from $15M to $20M due to change in assumptions on FSO Africa)

• $10M to $15M

< Interest expense (updated from $50M to $60M to reflect $300M 8.125% bond issue)

• Interest expense approx. $65M to $75M

< Capital expenditures for the balance of the year

• $20M in drydock costs (Q2 $10M; Q3 $3M and Q4 $7M) on 20 vessels

• $254M newbuild progress payments, vessel improvements and capitalized interest (Q2 $64M; Q3

$20M and Q4 $170M)

$20M and Q4 $170M)

Page *

Appendix

Page 18

Set forth below are significant items of income and expense that affected the Company’s results for the three months ended March 31, 2010 and

2009, all of which are typically excluded by securities analysts in their published estimates of the Company’s financial results

2009, all of which are typically excluded by securities analysts in their published estimates of the Company’s financial results

Special Items Affecting Net Income/(Loss)

Reconciling Items and Other Information

Page 19

EBITDA represents operating earnings excluding net income attributable to the noncontrolling interest, which is before interest expense and

income taxes, plus other income and depreciation and amortization expense. EBITDA is presented to provide investors with meaningful additional

information that management uses to monitor ongoing operating results and evaluate trends over comparative periods. EBITDA should not be

considered a substitute for net income / (loss) attributable to the Company or cash flow from operating activities prepared in accordance with

accounting principles generally accepted in the United States or as a measure of profitability or liquidity. While EBITDA is frequently used as a

measure of operating results and performance, it is not necessarily comparable to other similarly titled captions of other companies due to

differences in methods of calculation.

income taxes, plus other income and depreciation and amortization expense. EBITDA is presented to provide investors with meaningful additional

information that management uses to monitor ongoing operating results and evaluate trends over comparative periods. EBITDA should not be

considered a substitute for net income / (loss) attributable to the Company or cash flow from operating activities prepared in accordance with

accounting principles generally accepted in the United States or as a measure of profitability or liquidity. While EBITDA is frequently used as a

measure of operating results and performance, it is not necessarily comparable to other similarly titled captions of other companies due to

differences in methods of calculation.

EBITDA

Consistent with general practice in the shipping industry, the Company uses time charter equivalent revenues, which represents shipping revenues

less voyage expenses, as a measure to compare revenue generated from a voyage charter to revenue generated from a time charter. Time charter

equivalent revenues, a non-GAAP measure, provides additional meaningful information in conjunction with shipping revenues, the most directly

comparable GAAP measure, because it assists Company management in making decisions regarding the deployment and use of its vessels and in

evaluating their financial performance.

less voyage expenses, as a measure to compare revenue generated from a voyage charter to revenue generated from a time charter. Time charter

equivalent revenues, a non-GAAP measure, provides additional meaningful information in conjunction with shipping revenues, the most directly

comparable GAAP measure, because it assists Company management in making decisions regarding the deployment and use of its vessels and in

evaluating their financial performance.

TCE Revenues

Reconciling Items and Other Information (continued)

Page 20

|

|

Owned

|

Chartered-in

|

Total

|

Newbuild

|

Total

|

|

VLCC

|

9

|

7

|

16

|

2

|

18

|

|

FSO

|

2

|

-

|

2

|

-

|

2

|

|

Suezmax

|

-

|

2

|

2

|

-

|

2

|

|

Aframax

|

6

|

7

|

13

|

-

|

13

|

|

Panamax

|

9

|

-

|

9

|

-

|

9

|

|

Lightering

|

2

|

5

|

7

|

-

|

7

|

|

Total Crude

|

28

|

21

|

49

|

2

|

51

|

|

LR2

|

-

|

1

|

1

|

-

|

1

|

|

LR1

|

2

|

2

|

4

|

4

|

8

|

|

MR*

|

13

|

16

|

29

|

6

|

35

|

|

Total Products

|

15

|

19

|

34

|

10

|

44

|

|

Handysize

|

5

|

7

|

12

|

4

|

16

|

|

ATB

|

7

|

-

|

7

|

-

|

7

|

|

Lightering

|

4

|

-

|

4

|

1

|

5

|

|

Total U.S. Flag

|

16

|

7

|

23

|

5

|

28

|

|

Total Gas

|

4

|

-

|

4

|

-

|

4

|

|

TOTAL

|

63

|

47

|

110

|

17

|

127

|

*Operating fleet Includes 2 owned U.S. Flag product carriers that trade internationally and a car carrier; newbuild fleet includes chemical tanker

Fleet Composition - As of 4/30/10

Page 21

Off Hire and Scheduled Drydock

In addition to regular inspections by OSG personnel, all vessels are subject to periodic drydock,

special survey and other scheduled maintenance. The table below sets forth actual days off hire for

the first quarter of 2010 and anticipated days off hire for the above-mentioned events by class for the

second, third and fourth quarters of 2010.

special survey and other scheduled maintenance. The table below sets forth actual days off hire for

the first quarter of 2010 and anticipated days off hire for the above-mentioned events by class for the

second, third and fourth quarters of 2010.

Off Hire Schedule

Page 22

For the Quarter Ended March 31, 2010

Charter Hire Expense by Segment

Page 23

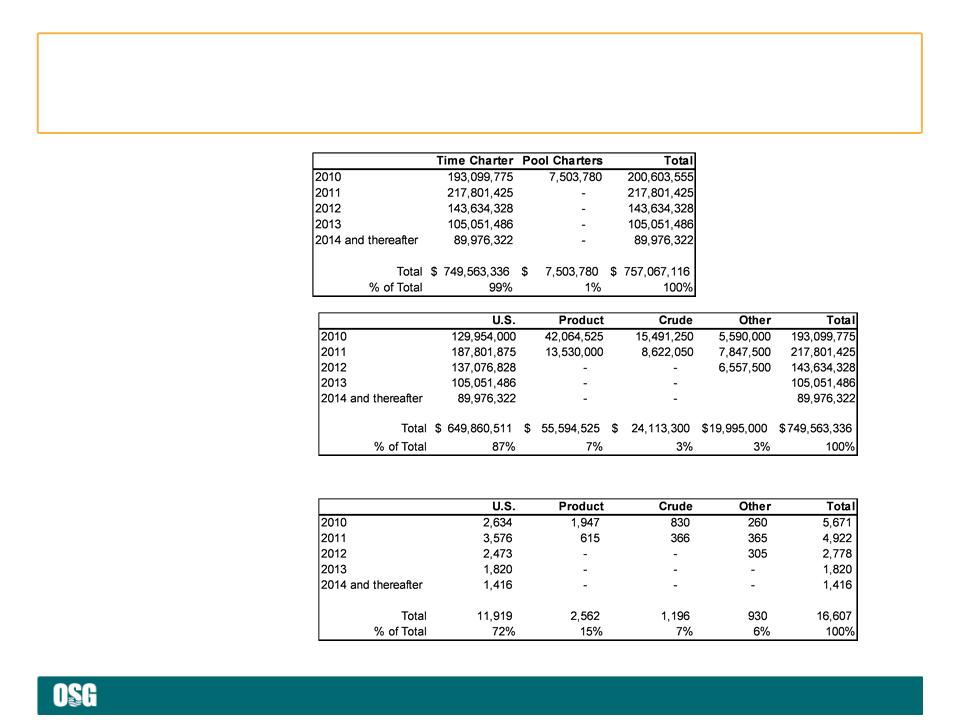

Locked-in Time Charter

Days by Segment

Days by Segment

Locked-in Time Charter

Revenue by Segment

Revenue by Segment

Locked-in

Charter Revenue

Charter Revenue

Note: Locked in time charter days above for 2010 are as of 3/31/10 and will differ from a more current date

used in Appendices 3 and 4 in the quarterly earnings press release

used in Appendices 3 and 4 in the quarterly earnings press release

Future Revenue $/Days by Segment - As of 3/31/10

Page *

www.osg.com