Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Year Ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 000-51531

SUNESIS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

94-3295878 (I.R.S. Employer Identification Number) |

395 Oyster Point Boulevard, Suite 400

South San Francisco, California 94080

(Address of principal executive offices, including zip code)

(650) 266-3500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: |

Name of Each Exchange on Which Registered: | |

| Common Stock, par value $0.0001 per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ (Do not check if a smaller reporting |

Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2.) Yes ¨ No x

The aggregate market value of common stock held by non-affiliates of the registrant, based on the closing sales price for such stock on June 30, 2009, as reported by The Nasdaq Stock Market, was $11,301,666. The calculation of the aggregate market value of voting and non-voting stock excludes 6,854,138 shares of the registrant’s common stock held by current executive officers, directors and stockholders that the registrant has concluded are affiliates of the registrant. Exclusion of such shares should not be construed to indicate that any such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant or that such person is controlled by or under common control with the registrant.

The total number of shares outstanding of the registrant’s common stock, $0.0001 par value per share, as of March 31, 2010, was 57,981,195.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the 2010 Annual Meeting of Stockholders of Sunesis Pharmaceuticals, Inc. (hereinafter referred to as “Proxy Statement”) are incorporated by reference in Part III of this report. Such Proxy Statement will be filed with the Securities and Exchange Commission not later than 120 days after the conclusion of the registrant’s fiscal year ended December 31, 2009.

Table of Contents

| Page No. | ||||

| PART I | ||||

| ITEM 1. |

3 | |||

| ITEM 1A. |

17 | |||

| ITEM 1B. |

34 | |||

| ITEM 2. |

34 | |||

| ITEM 3. |

35 | |||

| ITEM 4. |

35 | |||

| PART II | ||||

| ITEM 5. |

35 | |||

| ITEM 6. |

37 | |||

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

39 | ||

| ITEM 7A. |

51 | |||

| ITEM 8. |

51 | |||

| ITEM 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

77 | ||

| ITEM 9A(T). |

77 | |||

| ITEM 9B. |

78 | |||

| PART III | ||||

| ITEM 10. |

79 | |||

| ITEM 11. |

79 | |||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

79 | ||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

80 | ||

| ITEM 14. |

80 | |||

| PART IV | ||||

| ITEM 15. |

81 | |||

| 82 | ||||

| 83 | ||||

Table of Contents

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report, including the information we incorporate by reference, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve risks, uncertainties and assumptions. All statements, other than statements of historical facts, are “forward-looking statements” for purposes of these provisions, including without limitation any statements relating to the completion of any financing transaction or the satisfaction of closing conditions relating to any financing, any projections of revenue, expenses or other financial items, any statement of the plans and objectives of management for future operations, any statements concerning proposed clinical trials, regulatory activities or licensing or collaborative arrangements, any statements regarding future economic conditions or performance, and any statement of assumptions underlying any of the foregoing. In some cases, forward-looking statements can be identified by the use of terminology such as “anticipates,” “believe,” “continue,” “estimates,” “expects,” “intend,” “look forward,” “may,” “could,” “seeks,” “plans,” “potential,” or “will” or the negative thereof or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements contained herein are reasonable, there can be no assurance that such expectations or any of the forward-looking statements will prove to be correct, and actual results could differ materially from those projected or assumed in the forward-looking statements. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including but not limited to those set forth under “Risk Factors,” and elsewhere in this report. We urge you not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. All forward-looking statements included in this report are based on information available to us on the date of this report, and we assume no obligation to update any forward-looking statements contained in this report.

In this report, “Sunesis,” the “Company,” “we,” “us,” and “our” refer to Sunesis Pharmaceuticals, Inc. and its wholly owned subsidiary, Sunesis Europe Limited, except where it is made clear that the term refers only to the parent company.

| ITEM 1. | BUSINESS |

General

We are a biopharmaceutical company focused on the development and commercialization of new oncology therapeutics for the treatment of hematologic and solid tumor cancers. Our efforts are currently focused primarily on the development of voreloxin for the treatment of acute myeloid leukemia, or AML. We have built a highly experienced cancer drug development organization committed to advancing our lead product candidate, voreloxin, in multiple indications to improve the lives of people with cancer.

We own worldwide development and commercialization rights to voreloxin and are currently preparing for anticipated Phase 3 development of the compound. Voreloxin is a first-in-class anti-cancer quinolone derivative, or AQD—a class of compounds that has not been used previously for the treatment of cancer. Quinolone derivatives have been shown to mediate anti-tumor activity by targeting mammalian topoisomerase II, an enzyme critical for cell replication, and have demonstrated promising preclinical anti-tumor activity.

We are currently completing three clinical trials of voreloxin: (i) a Phase 2 clinical trial (known as the REVEAL-1 trial) in previously untreated elderly patients with AML, for which enrollment was completed in October 2009, with a total of 113 patients dosed in one of three dosing schedules, (ii) a Phase 1b/2 clinical trial of voreloxin in combination with cytarabine for the treatment of patients with relapsed/refractory AML, for which enrollment was completed in January 2010, with a total of 108 patients dosed, and (iii) a Phase 2 single agent clinical trial in platinum-resistant ovarian cancer patients, for which enrollment was completed in

3

Table of Contents

December 2008, with a total of 137 patients dosed across one of three dosing schedules. In November 2009, we announced that the U.S. Food and Drug Administration, or FDA, had granted voreloxin orphan drug designation for the treatment of AML. In February 2010, we announced that we received formal guidance from the FDA from End-of-Phase 2 meetings regarding further development of voreloxin for AML. Based on this guidance, we will look to conduct a randomized, double-blind, placebo-controlled, pivotal trial evaluating the effect on overall survival of voreloxin in combination with cytarabine, a widely used chemotherapy in AML, compared to placebo with cytarabine, in patients with relapsed or refractory AML. We anticipate initiating this multi-national Phase 3 trial in the second half of 2010. Management is currently in the process of evaluating alternatives for funding the voreloxin development program.

The most recent data from our two Phase 2 trials of voreloxin in AML were presented at the 51st Annual Meeting of the American Society of Hematology (ASH) in December 2009. The most recent data from the Phase 2 trial of voreloxin in platinum-resistant ovarian cancer were presented at the American Society of Clinical Oncology (ASCO) 2009 Annual Meeting in June 2009. We believe the data from these three ongoing clinical trials demonstrate that voreloxin shows promising safety and efficacy in AML and in platinum-resistant ovarian cancer.

From our incorporation in 1998 through 2001, our operations consisted primarily of developing and refining our proprietary methods of discovering drugs in pieces, or fragments. From 2002 through June 2008, we focused on the discovery, in-licensing and development of novel small molecule drugs. In June 2008, we announced a corporate realignment to focus on the development of voreloxin. In conjunction with this strategic restructuring, or the 2008 Restructuring, we expanded our late-stage development team, announced the winding down of our internal discovery research activities, ceasing development of an enhanced fragment-based discovery platform, and reduced our workforce by approximately 60%.

We have also taken a number of other important steps to focus our resources and efforts on the advancement of voreloxin:

| • | We discontinued development of our product candidate, SNS-032, a selective inhibitor of cyclin-dependent kinases, or CDKs, 2, 7 and 9, which we had in-licensed from Bristol-Myers Squibb Company, or BMS. In March 2009, the license agreement was terminated and SNS-032 was returned to BMS. |

| • | In the first quarter of 2009, we completed a Phase 1 trial of SNS-314, a potent and selective pan-Aurora kinase inhibitor discovered internally at Sunesis, in patients with advanced solid tumors. As a maximum tolerated dose was not established in the trial and no responses were observed, further development of SNS-314 was suspended. |

| • | In March 2009, we announced the sale of our interest in all of our lymphocyte function-associated antigen-1, or LFA-1, patents and related know-how to SARcode Corporation, or SARcode, for total cash consideration of $2.0 million, which was recorded as revenue in the second quarter of 2009. In connection with the sale, the license agreement was terminated. SARcode had been the exclusive licensee of those assets since March 2006. |

| • | In February 2010, we granted Carmot Therapeutics, Inc. an exclusive license to our proprietary fragment-based lead discovery technology. We retain full rights to the technology for use in our future internal discovery efforts. |

In July 2009, we received a milestone of $1.5 million pursuant to a collaboration entered into with Biogen Idec in 2002 for Biogen Idec’s selection of a Raf kinase inhibitor development candidate for the treatment of cancer, which was earned and recorded as revenue in the second quarter. Biogen Idec is currently conducting IND-enabling preclinical work with the Raf kinase development candidate.

4

Table of Contents

On March 31, 2009, we entered into a securities purchase agreement with accredited investors, including certain members of management, providing for a private placement of up to $43.5 million, or the Private Placement. We completed the initial closing of $10.0 million of the Private Placement on April 3, 2009, and the second closing of $5.0 million on October 30, 2009. In the initial closing, $10.0 million of units were sold, resulting in net proceeds of $8.8 million, and in the second closing, $5.0 million of units were sold, resulting in net proceeds of $4.7 million. The units consist of Series A convertible preferred stock and warrants to purchase common stock. The Private Placement also contemplates the sale of up to the remaining $28.5 million in common stock at $0.275 per share to the same group of investors, subject to certain terms and conditions described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below.

On January 20, 2010, we entered into a controlled equity offering sales agreement with Cantor Fitzgerald & Co., or Cantor, pursuant to which we could issue and sell shares of our common stock having an aggregate offering price of up to $15.0 million from time to time through Cantor acting as agent and/or principal. Sales of our common stock through Cantor, if any, would be made on the NASDAQ Capital Market by means of ordinary brokers’ transactions at market prices, in block transactions or as otherwise agreed by Cantor and us. Cantor agreed to use its best efforts to sell our common stock from time to time, based upon our instructions (including any price, time or size limits or other customary parameters or conditions we might impose). We agreed to pay Cantor a commission rate ranging between 3.0% and 5.0% of the gross sales price per share of any common stock sold through Cantor as agent under the sales agreement. We also agreed to reimburse Cantor for certain expenses incurred in connection with entering into the sales agreement and provided Cantor with customary indemnification rights. Under the terms of the sales agreement, we may also sell shares of our common stock to Cantor, as principal for its own account, at a price negotiated at the time of sale. If we sell shares to Cantor in this manner, we will enter into a separate agreement setting forth the terms of any such transactions. As of March 31, 2010, the full $15.0 million available under the facility had been sold, for net proceeds of $14.2 million after commissions and expenses.

We have incurred significant losses in each year since our inception. As of December 31, 2009, we had an accumulated deficit of $356.4 million. We expect to continue to incur significant net losses for the foreseeable future, as we continue the development of, and seek regulatory approvals for, voreloxin. We believe that currently available cash, cash equivalents and marketable securities, including the net proceeds of $14.2 million from sales of common stock through March 31, 2010 under the agreement with Cantor, are sufficient to fund our operations through at least September 30, 2010. We will need to raise substantial additional funding in the near term in order to sustain operations beyond that date and before undertaking any additional clinical trials of voreloxin. Our significant negative cash flows and lack of financial resources raise substantial doubt as to our ability to continue as a going concern. Management is currently in the process of evaluating alternative funding sources. If we are unable to raise additional funding to meet our working capital needs, we will be forced to delay or reduce the scope of our voreloxin development program and/or limit or cease our operations.

On August 3, 2009, upon NASDAQ’s approval, the listing of our common stock was transferred from The NASDAQ Global Market to The NASDAQ Capital Market.

Voreloxin

Voreloxin is a first-in-class AQD—a class of compounds that has not been used previously for the treatment of cancer. Quinolone derivatives have been shown to mediate anti-tumor activity by targeting mammalian topoisomerase II, an enzyme critical for cell replication, and have demonstrated promising preclinical anti-tumor activity. Voreloxin acts by DNA intercalation and inhibition of topoisomerase II in replicating cancer cells. The resulting site-selective DNA damage rapidly causes the cancer cells to stop dividing and die. In preclinical studies, voreloxin demonstrates broad anti-tumor activity and appears to exhibit additive or synergistic activity when combined with several therapeutic agents currently used in the treatment of cancer. Clinical activity is observed in both solid and hematologic malignancies. We licensed worldwide development and commercialization rights to voreloxin from Dainippon Sumitomo Pharma Co., Ltd. in 2003.

5

Table of Contents

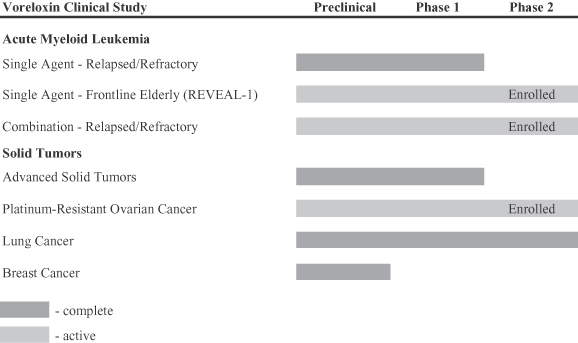

The following chart summarizes the status of the clinical trials that have been conducted or that we are currently conducting with voreloxin:

Since 2004, we have initiated eight clinical trials with voreloxin. Two Phase 1 clinical trials were conducted to evaluate doses and schedules of administration of voreloxin in patients with advanced solid tumors. We also conducted Phase 2 studies in non-small cell lung cancer and small cell lung cancer. Partial responses were observed in both lung cancer studies, but it was determined that voreloxin could be dosed with greater intensity given the low incidence of grade 3/4 neutropenia (15% or less). Thus, the studies were halted and we may consider future voreloxin studies in lung cancer either as a single agent at higher doses or in combination with other anti-cancer agents.

In January 2010, we completed enrollment of a Phase 1b/2 clinical trial of voreloxin in combination with cytarabine for the treatment of patients with relapsed/refractory AML The trial is designed to evaluate the safety, pharmacokinetics and anti-leukemic activity of escalating doses of voreloxin when administered in combination with cytarabine given either as continuous infusion or as a two hour IV infusion. A total of 66 patients have been treated in the expansion Phase 2 populations of the trial, which includes primary refractory and first relapse AML patients. Of these, 64 patients were evaluable for efficacy outcomes. Among evaluable first relapse (n=36) and primary refractory patients (n=28), preliminary median overall survival is 7.8 months and the remission rate is 31% (complete remission, or CR, is 27%, complete remission without full platelet recovery, or CRp, is 2%, and complete remission with incomplete recovery, or CRi, is 2%). Voreloxin in combination with either bolus or continuous infusion cytarabine was generally well-tolerated. Infection-related toxicities were the most common Grade 3 or higher non-hematologic adverse events. In addition, Grade 3 or higher oral mucositis was observed. All-cause mortality among these patients was 2% at 30 days and 8% at 60 days.

In October 2009, we completed enrollment in a Phase 2 single agent clinical trial of voreloxin in previously untreated elderly AML patients. The trial includes three dosing schedules: Schedule A, once weekly for three weeks (n=29); Schedule B, once weekly for two weeks (n=35); and Schedule C, on days one and four at either 72 mg/m2 (n=29) or 90 mg/m2 (n=20). Median survival was 8.7 months in Schedule A, 5.8 months in Schedule B, and 7.3 months (preliminary) in Schedule C (72 mg/m2 on days one and four). Median duration of remission was 10.7 months and one year survival was 38% for Schedule A. For the other schedules, median

6

Table of Contents

duration of remission has not been reached and one year survival is too early to evaluate. Patients age 75 or older (n=49) with at least 1 additional risk factor at diagnosis, a population identified by the National Comprehensive Cancer Network (2010) AML Guidelines as having poor outcome to standard treatment, experienced a CR rate of 30% and a 30-day all-cause mortality of 5%. Survival in these patients was too early to evaluate. Based on trial results, Schedule C has been determined to be the recommended pivotal dose regimen. For Schedule C, response rates (CR and CRp) are 38%; 30- and 60-day all-cause mortality are 7% and 17%, with improved tolerability over Schedule A.

In December 2008, we completed enrollment in a Phase 2 single agent trial of voreloxin in platinum-resistant ovarian cancer. Three dose cohorts of voreloxin were studied: 48 mg/m2 given every three weeks (n=65), 60 mg/m2 given every four weeks (n=37) and 75 mg/m2 given every four weeks (n=35). Data from this trial show encouraging durable anti-tumor activity across all three dose cohorts. The overall response rate, or ORR, was 11% for each of the three dosing cohorts. A total of 74 patients (52%) experienced disease control, defined as an objective response or stable disease for 12 weeks or more. The median progression free survival, or PFS, for cohort A was 82 days. The preliminary median PFS for cohorts B and C is 84 days and 109 days, respectively. Overall PFS was longer in the 60 and 75 mg/m2 cohorts vs. 48 mg/m2, suggesting a benefit to higher voreloxin doses. Four partial responses were achieved in the 44 women who were Doxil® failures for an ORR of 9% and 28, or 64%, achieved disease control. The preliminary median PFS in these Doxil® failure patients is 90 days. PFS was not statistically different from those who had not failed Doxil®. Overall, the adverse event profile was similar across cohorts and voreloxin was generally well-tolerated. Grade 3 or higher adverse events occurring in more than 10% of patients include neutropenia febrile neutropenia, and anemia.

Licensing Agreements

Dainippon Sumitomo Pharma Co., Ltd.

In October 2003, we entered into an agreement with Dainippon Sumitomo Pharma Co., Ltd., or Dainippon, to acquire exclusive worldwide development and marketing rights for our lead anti-cancer product candidate, voreloxin. We may in the future make a series of milestone payments of up to $7.5 million to Dainippon for starting Phase 3 clinical testing, for filing new drug applications, or NDAs, and for receiving regulatory approval in the United States, Europe and Japan for cancer treatment. If voreloxin is approved for a non-cancer indication, additional milestone payments become payable to Dainippon.

The agreement also provides for royalty payments to Dainippon at rates that are based on total annual net sales. Under the agreement, we may reduce our royalty payments to Dainippon if a third party markets a competitive product and we must pay royalties for third-party intellectual property rights necessary to commercialize voreloxin. Royalty obligations under the agreement continue on a country-by-country and product-by-product basis until the later of the date on which no valid patent claims relating to a product exist or 10 years from the date of the first sale of the product.

If we discontinue seeking regulatory approval and/or the sale of the product in a region, we are required to return to Dainippon its rights to the product in that region. The agreement may be terminated by either party for the other party’s uncured breach or bankruptcy.

Strategic Collaborations

Overview

Over the past three years, we generated revenue primarily through payments received in connection with our collaborations with Biogen Idec, Inc., Johnson & Johnson Pharmaceutical Research & Development LLC, or J&JPRD, and Merck & Co., Inc., or Merck, consisting principally of research funding and milestones paid by our collaborators, substantially offsetting our related research and development expenses. As of March 31, 2010, our

7

Table of Contents

only remaining ongoing collaboration is with Biogen Idec. Our collaboration with Merck will terminate effective as of June 8, 2010 and our collaboration with J&JPRD terminated on January 13, 2010.

Biogen Idec

In August 2004, we entered into a collaboration agreement with Biogen Idec, Inc., or Biogen Idec, to discover, develop and commercialize small molecule inhibitors of Raf kinase and up to five additional targets that play a role in oncology and immunology indications or in the regulation of the human immune system. Concurrent with the signing of the agreement, Biogen Idec paid a $7.0 million upfront technology access fee and made a $14.0 million equity investment in the company through the purchase of our Series C-2 preferred stock, which converted into common stock upon our initial public offering in September 2005. Biogen Idec’s equity ownership was 8.1% of our common shares outstanding as of December 31, 2009.

Pursuant to the terms of the collaboration agreement, we applied our proprietary fragment-based drug discovery technology, Tethering, to generate small molecule leads during the research term, for which we received research funding, which was paid in advance to support some of our scientific personnel. In connection with our 2008 Restructuring, the parties agreed to terminate the research term and related funding as of June 30, 2008. A total of $20.0 million of research funding was received through this date. We have received a total of $3.0 million in milestone payments for meeting certain preclinical milestones through December 31, 2009, including a $1.5 million milestone received in cash in July 2009 for Biogen Idec’s selection of a Raf kinase inhibitor development candidate for the treatment of cancer, which was recorded as revenue in June 2009, and a $0.5 million milestone received in cash and recorded as revenue in June 2008.

We may in the future receive pre-commercialization milestone payments of up to $60.5 million per target, as well as royalty payments depending on product sales. Royalty payments may be increased if we exercise our option to co-develop and co-promote product candidates for up to two targets worldwide (excluding Japan) and may be reduced if Biogen Idec is required to in-license additional intellectual property related to certain technology jointly developed under the collaboration agreement in order to commercialize a collaboration product. However, we do not expect to generate any royalty revenue from this collaboration in the foreseeable future, if at all.

Manufacturing

We do not have internal manufacturing capabilities and outsource the manufacture of the voreloxin active pharmaceutical ingredient, or API, and the finished drug product incorporating the API, or FDP, to third-party contract manufacturers. The voreloxin API is currently manufactured by one of two suppliers with whom we have an established relationship, through a multi-step convergent synthesis in which two intermediates are manufactured in a parallel process and then combined and de-protected in the final two steps. The API is then formulated and vials are filled and finished by one of two FDP suppliers with whom we have an established relationship. The API is classified as a toxic substance, and the number of suppliers qualified to manufacture it or the FDP is limited.

To date, voreloxin has been manufactured in sufficient quantities for our preclinical studies and clinical trials. New lots of FDP will need to be manufactured and released as required to support our current and planned clinical activities. Prior to being approved for commercial sale, we may need to manufacture API and FDP in larger quantities. Scale-up of manufacturing will be accompanied by validation studies, which will be reviewed by the FDA prior to approval. If we are unable to successfully increase the manufacturing capacity for voreloxin, the regulatory approval or commercial launch may be delayed or there may be a shortage in commercial supply.

Competition

We face significant competition from many pharmaceutical, biopharmaceutical and biotechnology companies that are researching, developing and marketing products designed to address the treatment of cancer,

8

Table of Contents

including AML and ovarian cancer. Many of our competitors have significantly greater financial, manufacturing, marketing and drug-development resources than we do. Large pharmaceutical companies in particular have extensive experience in the clinical testing of, obtaining regulatory approvals for, and marketing drugs.

Voreloxin is currently being clinically tested as a treatment for AML and platinum-resistant ovarian cancer. Some of the current key competitors to voreloxin in AML include Genzyme Corporation’s clofarabine, Eisai Corporation’s decitabine, Celgene Corporation’s azacitidine and Vion Pharmaceuticals, Inc.’s laromustine, any of which could change the treatment paradigm for acute leukemia. Each of these compounds is further along in clinical development than voreloxin. Liposomal doxorubicin and topotecan are current standards of care in platinum-resistant ovarian cancer patients, and we are aware that several of our competitors have initiated Phase 3 clinical trials for this indication.

We believe that our ability to successfully compete in the marketplace with voreloxin and any future product candidates, if any, will depend on, among other things:

| • | our ability to develop novel compounds with attractive pharmaceutical properties and to secure, protect and maintain intellectual property rights based on our innovations; |

| • | the efficacy, safety and reliability of our product candidates; |

| • | the speed at which we develop our product candidates; |

| • | our ability to design and successfully execute appropriate clinical trials; |

| • | our ability to maintain a good relationship with regulatory authorities; |

| • | our ability to obtain, and the timing and scope of, regulatory approvals; |

| • | our ability to manufacture and sell commercial quantities of future products to the market; and |

| • | acceptance of future products by physicians and other healthcare providers. |

Intellectual Property

We believe that patent protection is crucial to our business and that our future success depends in part on our ability to obtain patents protecting voreloxin or future drug candidates, if any. We have an exclusive license to 44 issued composition-of-matter patents that cover the voreloxin drug substance. The U.S. composition-of-matter patent is due to expire in October 2015 and most of its foreign counterparts are due to expire in June 2015. As of December 31, 2009, approximately 64 U.S. and foreign applications pertaining to voreloxin life cycle development were pending. When appropriate, we intend to seek patent term restoration, orphan drug status and/or data exclusivity in the United States and their equivalents in other relevant jurisdictions, to the maximum extent that the respective laws will permit at such time. In November 2009, we announced that the FDA had granted voreloxin orphan drug designation for the treatment of AML.

Historically we have patented a wide range of technology, inventions and improvements related to our business, but which we are no longer actively developing. As of December 31, 2009, we owned, co-owned or licensed rights to approximately 40 issued U.S. and foreign patents and approximately 104 pending U.S. and foreign patent applications relating to such intellectual property.

Our ability to build and maintain our proprietary position for voreloxin and any future drug candidates, if any, will depend on our success in obtaining effective claims and enforcing those claims if granted. The patent positions of biopharmaceutical companies like ours are generally uncertain and involve complex legal and factual

9

Table of Contents

questions for which some important legal principles remain unresolved. No consistent policy regarding the breadth of patent claims has emerged to date in the United States. The patent situation outside the United States is even more uncertain. We do not know whether any of our patent applications or those patent applications that we license will result in the issuance of any patents. Even if patents are issued, they may not be sufficient to protect voreloxin or future drug candidates, if any. The patents we own or license and those that may issue in the future may be challenged, invalidated or circumvented, and the rights granted under any issued patents may not provide us with proprietary protection or competitive advantages.

Patent applications filed before November 29, 2000 in the United States are maintained in secrecy until patents issue. Later filed U.S. applications and patent applications in most foreign countries generally are not published until at least 18 months after they are filed. Scientific and patent publication often occurs long after the date of the scientific discoveries disclosed in those publications. Accordingly, we cannot be certain that we were the first to invent the subject matter covered by any patent application or that we were the first to file a patent application for any inventions.

Our commercial success depends on our ability to operate without infringing patents and proprietary rights of third parties. We cannot determine with certainty whether patents or patent applications of other parties may materially affect our ability to conduct our business. The existence of third party patent applications and patents could significantly reduce the coverage of patents owned by or licensed to us and limit our ability to obtain meaningful patent protection. If patents containing competitive or conflicting claims are issued to third parties and these claims are ultimately determined to be valid, we may be enjoined from pursuing research, development or commercialization of voreloxin or future drug candidates, if any, or be required to obtain licenses to these patents or to develop or obtain alternative technology.

We may need to commence or defend litigation to enforce or to determine the scope and validity of any patents issued to us or to determine the scope and validity of third party proprietary rights. Litigation would result in substantial costs, even if the eventual outcome is favorable to us. An adverse outcome in litigation affecting proprietary rights we own or have licensed could present significant risk of competition for voreloxin or future drug candidates, if any, we market or seek to develop. Any adverse outcome in litigation affecting third party proprietary rights could subject us to significant liabilities to third parties and could require us to seek licenses of the disputed rights from third parties or to cease using the technology if such licenses are unavailable.

We also rely on trade secrets to protect our technology, especially where we do not believe patent protection is appropriate or obtainable. However, trade secrets are difficult to maintain and do not protect technology against independent developments made by third parties.

We seek to protect our proprietary information by requiring our employees, consultants, contractors and other advisers to execute nondisclosure and assignment of invention agreements upon commencement of their employment or engagement. Agreements with our employees also prevent them from bringing the proprietary rights of third parties to us. We also require confidentiality or material transfer agreements from third parties that receive our confidential data or materials. There can be no assurance that these agreements will provide meaningful protection, that these agreements will not be breached, that we will have an adequate remedy for any such breach, or that our trade secrets will not otherwise become known or independently developed by a third party.

We seek to protect our company name and the names of our products and technologies by obtaining trademark registrations, as well as common law rights in trademarks and service marks, in the United States and in other countries. There can be no assurance that the trademarks or service marks we use or register will protect our company name or any products or technologies that we develop and commercialize, that our trademarks, service marks, or trademark registrations will be enforceable against third parties, or that our trademarks and service marks will not interfere with or infringe trademark rights of third parties.

10

Table of Contents

We may need to commence litigation to enforce our trademarks and service marks or to determine the scope and validity of our or a third party’s trademark rights. Litigation would result in substantial costs, even if the eventual outcome is favorable to us. An adverse outcome in litigation could subject us to significant liabilities to third parties and require us to seek licenses of the disputed rights from third parties or to cease using the trademarks or service marks if such licenses are unavailable.

Government Regulation

The FDA and comparable regulatory agencies in state and local jurisdictions and in foreign countries impose substantial requirements upon the clinical development, manufacture, marketing and distribution of drugs. These agencies and other federal, state and local entities regulate research and development activities and the testing, manufacture, quality control, safety, efficacy, labeling, storage, recordkeeping, approval, advertising and promotion of voreloxin and any future drug candidates we may develop. The application of these regulatory frameworks to the development, approval and commercialization of voreloxin or our future drug candidates, if any, will take a number of years to accomplish, if at all, and involve the expenditure of substantial resources.

In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act, as amended, and implementing regulations. The process required by the FDA before voreloxin and any future drug candidates may be marketed in the United States generally involves the following:

| • | completion of extensive preclinical laboratory tests, in vivo preclinical studies and formulation studies; |

| • | submission to the FDA of an Investigational New Drug, or IND, application which must become effective before clinical trials begin; |

| • | performance of adequate and well-controlled clinical trials to establish the safety and efficacy of the product candidate for each proposed indication; |

| • | submission of an NDA, to the FDA; |

| • | satisfactory completion of an FDA pre-approval inspection of the manufacturing facilities at which the product candidate is produced to assess compliance with current Good Manufacturing Practice, or cGMP, regulations; and |

| • | FDA review and approval of the NDA, including proposed labeling (package insert information) and promotional materials, prior to any commercial marketing, sale or shipment of the drug. |

The testing and approval process requires substantial time, effort and financial resources, and we cannot be certain that any approvals for voreloxin or our future drug candidates, if any, will be granted on a timely basis, if at all.

Preclinical Testing and INDs

Preclinical tests include laboratory evaluation of product chemistry, formulation and stability, as well as studies to evaluate toxicity in animals. Laboratories that comply with the FDA Good Laboratory Practice regulations must conduct preclinical safety tests. The results of preclinical tests, together with manufacturing information and analytical data, are submitted as part of an IND application to the FDA. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30-day time period, raises concerns or questions about the conduct of the clinical trial, including concerns that human research subjects will be exposed to unreasonable health risks. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. Our submission of an IND, or those of our collaboration

11

Table of Contents

partners, may not result in FDA authorization to commence a clinical trial. A protocol amendment for an existing IND must be made for each successive clinical trial conducted during product development.

Clinical Trials

Clinical trials involve the administration of the investigational new drug to healthy volunteers or to patients under the supervision of a qualified principal investigator. Clinical trials are conducted in accordance with the FDA’s Protection of Human Subjects regulations and Good Clinical Practices, or GCP, under protocols that detail the objectives of the study, the parameters to be used to monitor safety, and the efficacy criteria to be evaluated. Each protocol must be submitted to the FDA as part of the IND.

In addition, each clinical study must be conducted under the auspices of an independent institutional review board, or IRB, at each institution where the study will be conducted. Each IRB will consider, among other things, ethical factors, the safety of human subjects and the possible liability of the institution. The FDA, an IRB or the sponsor may suspend a clinical trial at any time on various grounds, including a finding that the subjects or patients are being exposed to an unacceptable health risk. Clinical testing also must satisfy extensive GCP requirements and regulations for informed consent.

Clinical trials are typically conducted in the three sequential phases, which may overlap, sometimes followed by a fourth phase:

| • | Phase 1 clinical trials are initially conducted in a limited population to test the drug candidate for safety (adverse effects), dose tolerance, absorption, metabolism, distribution and excretion in healthy humans or, on occasion, in patients, such as cancer patients. In some cases, particularly in cancer trials, a sponsor may decide to conduct what is referred to as a “Phase 1b” evaluation, which is a second safety-focused Phase 1 clinical trial typically designed to evaluate the impact of the drug candidate in combination with currently approved drugs. |

| • | Phase 2 clinical trials are generally conducted in a limited patient population to identify possible adverse effects and safety risks, to determine the efficacy of the drug candidate for specific targeted indications and to determine dose tolerance and optimal dosage. Multiple Phase 2 clinical trials may be conducted by the sponsor to obtain information prior to beginning larger and more expensive Phase 3 clinical trials. In some cases, a sponsor may decide to conduct what is referred to as a “Phase 2b” evaluation, which is a second, confirmatory Phase 2 clinical trial that could, if positive and accepted by the FDA, serve as a pivotal clinical trial in the approval of a drug candidate. |

| • | Phase 3 clinical trials are commonly referred to as pivotal trials. When Phase 2 clinical trials demonstrate that a drug candidate has potential activity in a disease or condition and has an acceptable safety profile, Phase 3 clinical trials are undertaken to further evaluate clinical efficacy and to further test for safety in an expanded patient population at multiple, geographically dispersed clinical trial sites. |

| • | Phase 4 (post-marketing) clinical trials may be required by the FDA in some cases. The FDA may condition approval of an NDA for a drug candidate on a sponsor’s agreement to conduct additional clinical trials to further assess the drug’s safety and efficacy after NDA approval. Such post-approval trials are typically referred to as Phase 4 clinical trials. |

New Drug Applications

The testing and approval processes are likely to require substantial cost, time and effort, and there can be no assurance that any approval will be granted on a timely basis, if at all. The FDA may withdraw product

12

Table of Contents

approvals if compliance with regulatory standards is not maintained or if problems occur following initial marketing.

The results of development, preclinical testing and clinical trials, together with extensive manufacturing information, are submitted to the FDA as part of an NDA for approval of the marketing and commercial distribution of the drug. For priority reviews, once the NDA submission has been accepted for filing, the FDA has the goal of reviewing and acting on such NDA filing within 180 days of its receipt. The review process is often significantly extended by FDA requests for additional information or clarification. The FDA may refer the NDA to an advisory committee for review, evaluation and recommendation as to whether the application should be approved. The FDA is not bound by the recommendation of an advisory committee, but it generally follows such recommendations. The FDA may deny approval of an NDA if the applicable regulatory criteria are not satisfied, or it may require additional clinical testing. Even if data from such testing are obtained and submitted, the FDA may ultimately decide that the NDA does not satisfy the criteria for approval. Data from clinical trials are not always conclusive and the FDA may interpret data differently than we or our collaboration partners interpret data. If regulatory approval is granted, such approval may entail limitations on the indicated uses for which the product may be marketed.

Once issued, the FDA may withdraw drug approval if ongoing regulatory requirements are not met or if safety problems occur after the drug reaches the market. In addition, the FDA may require testing, including Phase 4 clinical trials, and surveillance programs to monitor the effect of approved products that have been commercialized, and the FDA has the power to prevent or limit further marketing of a drug based on the results of these post-marketing programs. Drugs may be marketed only for approved indications and in accordance with the provisions of the approved label. Further, if there are any modifications to the drug, including changes in indications, labeling, or manufacturing processes or facilities, we may be required to submit and obtain FDA approval of a new NDA or NDA supplement, which may require us to develop additional data or conduct additional preclinical studies and clinical trials.

Fast Track Designation

FDA’s fast track program is intended to facilitate the development, and to expedite the review, of drugs that are intended for the treatment of a serious or life-threatening condition for which there is no effective treatment and demonstrate the potential to address unmet medical needs for the condition. Under the fast track program, the sponsor of a new drug candidate must request that the FDA designate the drug candidate for a specific indication as a fast track drug concurrent with or after the filing of the IND for the drug candidate. The FDA must within 60 days of receipt of the sponsor’s request determine if the drug candidate qualifies for fast track designation.

If fast track designation is obtained, the FDA may initiate review of sections of an NDA before the application is complete. This rolling review is available if the applicant provides and the FDA approves a schedule for the submission of the remaining information and the applicant pays applicable user fees. However, the time period specified in the Prescription Drug User Fees Act, which governs the time period goals the FDA has committed to reviewing an application, does not begin until the complete application is submitted. Additionally, the fast track designation may be withdrawn by the FDA if the FDA believes that the designation is no longer supported by data emerging in the clinical trial process.

In some cases, a fast track designated drug candidate may also qualify for one or more of the following programs:

| • | Priority Review. Under FDA policies, a drug candidate is eligible for priority review, or review within six-months from the time a complete NDA is accepted for filing, if the drug candidate provides a significant improvement compared to marketed drugs in the treatment, diagnosis or prevention of a disease. A fast track designated drug candidate would ordinarily meet the FDA’s criteria for priority review. |

13

Table of Contents

| • | Accelerated Approval. Under the FDA’s accelerated approval regulations, the FDA is authorized to approve drug candidates that have been studied for their safety and efficacy in treating serious or life-threatening illnesses and that provide meaningful therapeutic benefit to patients over existing treatments based upon either a surrogate endpoint that is reasonably likely to predict clinical benefit or on the basis of an effect on a clinical endpoint other than patient survival. In clinical trials, surrogate endpoints are alternative measurements of the symptoms of a disease or condition that are substituted for measurements of observable clinical symptoms. A drug candidate approved on this basis is subject to rigorous post-marketing compliance requirements, including the completion of Phase 4 clinical trials to validate the surrogate endpoint or confirm the effect on the clinical endpoint. Failure to conduct required post-approval studies, or to validate a surrogate endpoint or confirm a clinical benefit during post-marketing studies, will allow the FDA to withdraw the drug from the market on an expedited basis. All promotional materials for drug candidates approved under accelerated regulations are subject to prior review by the FDA. |

When appropriate, we or our collaboration partners may seek fast track designation, accelerated approval or priority review for voreloxin or our future drug candidates, if any. We do not know whether voreloxin or our future drug candidates, if any, will receive a priority review designation or, if a priority designation is received, whether that review or approval will be faster than conventional FDA procedures. We also cannot predict whether voreloxin or our future drug candidates, if any, will obtain a fast track or accelerated approval designation, or the ultimate impact, if any, of the fast track or the accelerated approval process on the timing or likelihood of FDA approval of voreloxin or our future drug candidates, if any.

Satisfaction of FDA regulations and approval requirements or similar requirements of foreign regulatory agencies typically takes several years, and the actual time required may vary substantially based upon the type, complexity and novelty of the product or disease. Typically, if a drug candidate is intended to treat a chronic disease, as is the case with voreloxin, safety and efficacy data must be gathered over an extended period of time. Government regulation may delay or prevent marketing of drug candidates for a considerable period of time and impose costly procedures upon our activities. The FDA or any other regulatory agency may not grant approvals for new indications for our drug candidates on a timely basis, or at all. Even if a drug candidate receives regulatory approval, the approval may be significantly limited to specific disease states, patient populations and dosages. Further, even after regulatory approval is obtained, later discovery of previously unknown problems with a drug may result in restrictions on the drug or even complete withdrawal of the drug from the market. Delays in obtaining, or failures to obtain, regulatory approvals for any of our drug candidates would harm our business. In addition, we cannot predict what adverse governmental regulations may arise from future United States or foreign governmental action.

Other Regulatory Requirements

Any drugs manufactured or distributed by us or our collaboration partners pursuant to FDA approvals are subject to continuing regulation by the FDA, including recordkeeping requirements and reporting of adverse experiences associated with the drug. Drug manufacturers and their subcontractors are required to register with the FDA and certain state agencies, and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with ongoing regulatory requirements, including cGMPs, which impose certain procedural and documentation requirements upon us and our third-party manufacturers. Failure to comply with the statutory and regulatory requirements can subject a manufacturer to possible legal or regulatory action, such as warning letters, suspension of manufacturing, seizure of product, injunctive action or possible civil penalties.

The FDA closely regulates the post-approval marketing and promotion of drugs, including standards and regulations for direct-to-consumer advertising, off-label promotion, industry-sponsored scientific and educational activities and promotional activities involving the Internet. A company can make only those claims relating to safety and efficacy that are approved by the FDA. Failure to comply with these requirements can result in adverse publicity, warning letters, corrective advertising and potential civil and criminal penalties. Physicians

14

Table of Contents

may prescribe legally available drugs for uses that are not described in the drug’s labeling and that differ from those tested by us and approved by the FDA. Such off-label uses are common across medical specialties, including cancer therapy. Physicians may believe that such off-label uses are the best treatment for many patients in varied circumstances. The FDA does not regulate the behavior of physicians in their choice of treatments. The FDA does, however, impose stringent restrictions on manufacturers’ communications regarding off-label use.

Foreign Regulation

In addition to regulations in the United States, we are subject to foreign regulations governing clinical trials and commercial sales and distribution of voreloxin or our future drug candidates, if any. We are currently conducting clinical trials in Canada and may in the future initiate clinical trials in countries in Europe, South America, or elsewhere. Whether or not we obtain FDA approval for a product, we must obtain approval of a product by the comparable regulatory authorities of foreign countries before we can commence clinical trials or marketing of the product in those countries. The approval process varies from country to country, and the time may be longer or shorter than that required for FDA approval. The requirements governing the conduct of clinical trials, product licensing, pricing and reimbursement vary greatly from country to country.

Under the Canadian regulatory system, Health Canada is the regulatory body that governs the sale of drugs for the purposes of use in clinical trials. Accordingly, any company that wishes to conduct a clinical trial in Canada must submit a clinical trial application to Health Canada. Health Canada reviews the application and notifies the company within 30 days if the application is found to be deficient. If the application is deemed acceptable, Health Canada will issue a no objection letter to the company within the 30-day review period which means the company may proceed with its clinical trial(s).

Under European Union regulatory systems, permission to conduct clinical research is granted by the Competent Authority of each European Member State, or MS, and the applicable Ethics Committees, or EC, through the submission of a Clinical Trial Application. An EC in the European Union serves the same function as an IRB in the United States. The review times vary by MS but may not exceed 60 days. The EC has a maximum of 60 days to give its opinion on the acceptability of the Clinical Trial Application to both the governing MS and the sponsor applicant. If the application is deemed acceptable, the MS informs the applicant (or does not within the 60 day window inform the applicant of non-acceptance) and the company may proceed with the clinical trial.

Under the European Union regulatory systems, marketing authorizations may be submitted either under a centralized or mutual recognition procedure. The centralized procedure provides for the grant of a single marketing authorization that is valid for all European Union member states. The mutual recognition procedure provides for mutual recognition of national approval decisions. Under this procedure, the holder of a national marketing authorization may submit an application to the remaining member states. Within 90 days of receiving the application and assessment report, each member state must decide whether to recognize approval.

In addition to regulations in the United States, Canada and the European Union, we will be subject to a variety of other foreign regulations governing clinical trials and commercial distribution of our current and possible future product candidates. Our ability to sell drugs will also depend on the availability of reimbursement from government and private practice insurance companies.

Research and Development Expenses

We incurred $13.2 million, $26.3 million and $36.1 million of research and development expenses in 2009, 2008 and 2007, respectively. As a result of our 2008 Restructuring and the resulting wind down of our research activities and focus on voreloxin development in the near term, we do not anticipate incurring any significant additional research expenses related to the discovery of additional product candidates, the development or application of our proprietary fragment-based drug discovery methods, the development of in-house research capabilities, or on the clinical development of product candidates other than voreloxin. In

15

Table of Contents

addition, we are no longer conducting any research activities in connection with any of our collaborations. However, we have incurred and expect to continue to incur substantial research and development expenses to conduct further clinical and related development of voreloxin.

Environment

We have made, and will continue to make, expenditures for environmental compliance and protection. In 2008, we incurred approximately $0.3 million in expenses related to the closure of our laboratory space at 341 Oyster Point Boulevard in South San Francisco, California, in accordance with environmental laws and regulations. We do not expect that expenditures for compliance with environmental laws will have a material effect on our capital expenditures or results of operations in the future.

Employees

As of December 31, 2009, our workforce consisted of 28 full-time employees. Of our total workforce, 18 are engaged in research and development and 10 are engaged in general and administrative functions. We have no collective bargaining agreements with our employees, and we have not experienced any work stoppages.

Corporate Background

We were incorporated in Delaware in February 1998 as Mosaic Pharmaceuticals, Inc., and subsequently changed our name to Sunesis Pharmaceuticals, Inc. Our offices are headquartered at 395 Oyster Point Boulevard, Suite 400, South San Francisco, California 94080, and our telephone number is (650) 266-3500. Our website address is www.sunesis.com. Information contained in, or accessible through, our website is not incorporated by reference into and does not form a part of this report.

16

Table of Contents

| ITEM 1A. | RISK FACTORS |

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below and all information contained in this report in weighing a decision to purchase our common stock. If any of the possible adverse events described below actually occurs, we may be unable to conduct our business as currently planned and our financial condition and operating results could be adversely affected. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations. In addition, the trading price of our common stock could decline due to the occurrence of any of these risks, and you may lose all or part of your investment. Please see “Special Note Regarding Forward-Looking Statements.”

Risks Related to Our Business

If we are unable to raise additional capital in the near term, we will not be able to continue to operate as a going concern.

We will need to raise substantial additional capital to continue the development and commercialization of voreloxin, and our business in general. We will need to raise substantial additional capital in the near term to:

| • | fund clinical trials and seek regulatory approvals; |

| • | continue and expand our development activities; |

| • | hire additional development personnel; |

| • | maintain, defend and expand the scope of our intellectual property portfolio; |

| • | implement additional internal systems and infrastructure; and |

| • | build or access manufacturing and commercialization capabilities. |

Our future funding requirements will depend on many factors, including but not limited to:

| • | the rate of progress and cost of our clinical trials, need for additional clinical trials, and other development activities; |

| • | the economic and other terms and timing of any licensing or other partnering arrangement into which we may enter; |

| • | the costs associated with building or accessing manufacturing and commercialization capabilities; |

| • | the costs of acquiring or investing in businesses, product candidates and technologies, if any; |

| • | the costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights; |

| • | the costs and timing of seeking and obtaining FDA and other regulatory approvals; and |

| • | the effect of competing technological and market developments. |

On April 3, 2009, we closed the initial $10.0 million of the Private Placement of up to $43.5 million of our securities. On October 30, 2009, we completed the second closing of $5.0 million of the Private Placement. In the initial closing, $10.0 million of units were sold, resulting in net proceeds of $8.8 million, and in the second

17

Table of Contents

closing, $5.0 million of units were sold, resulting in net proceeds of $4.7 million. The units consist of Series A convertible preferred stock and warrants to purchase common stock, and were sold to accredited investors, including certain members of management. An additional $28.5 million of common stock may be sold at $0.275 per share in a common equity closing upon the election of the holders of a majority of the Series A convertible preferred stock issued in the Private Placement prior to the earlier of June 30, 2010, or a date determined with reference to our cash and investments balance dropping below $2.5 million. The common equity closing may also be completed upon our election prior to the earlier of June 30, 2010 or a qualifying alternative common stock financing, subject to the approval of the purchasers holding a majority of the Series A convertible preferred stock issued in the Private Placement and subject to us selling at least $28.5 million of common stock in the common equity closing. The common equity closing is entirely at the discretion of the investors in the Private Placement, and it is possible that they will not elect to complete that closing for reasons related to our business or other factors.

We believe that currently available cash, cash equivalents and marketable securities, including the net proceeds of $14.2 million from sales of common stock through March 31, 2010 under the agreement with Cantor, are sufficient to fund our operations through at least September 30, 2010. We will need to raise substantial additional funding in the near term in order to sustain operations beyond that date and before undertaking any additional clinical trials of voreloxin. If we are unable to raise substantial additional funding, we will be forced to delay or reduce the scope of our voreloxin development program and/or limit or cease our operations.

Until we can generate a sufficient amount of collaboration or product revenue to finance our cash requirements, which we may never do, we expect to finance future cash needs primarily through equity issuances (including the possible common equity closing of the Private Placement and subject to the satisfaction of the conditions described above), debt arrangements and/or a possible partnership or license of development and/or commercialization rights to voreloxin. We do not know whether additional funding will be available on acceptable terms, or at all.

We are currently conducting clinical trials of voreloxin in acute myeloid leukemia, or AML, and ovarian cancer. If we are not able to secure additional funding when needed, we may have to delay, reduce the scope of or eliminate one or more of our clinical trials, scale back our development program, conduct additional workforce or other expense reductions, or cease operations. Any one of the foregoing would have a material adverse effect on our business, financial condition and results of operations.

Our independent registered public accounting firm has indicated that our recurring operating losses raise substantial doubt as to our ability to continue as a going concern.

Our audited financial statements for the fiscal year ended December 31, 2009 were prepared on a basis that our business would continue as a going concern in accordance with United States generally accepted accounting principles. This basis of presentation assumes that we will continue in operation for the foreseeable future and will be able to realize our assets and discharge our liabilities and commitments in the normal course of business. However, our independent registered public accounting firm has indicated in their audit report on our 2009 consolidated financial statements that our recurring operating losses raise substantial doubt as to our ability to continue as a going concern. We will be forced to delay or reduce the scope of our voreloxin development program and/or limit or cease our operations if we are unable to raise substantial additional funding to meet our working capital needs. However, we cannot guarantee that we will be able to obtain sufficient additional funding when needed or that such funding, if available, will be obtainable on terms satisfactory to us. In the event that these plans cannot be effectively realized, there can be no assurance that we will be able to continue as a going concern.

Economic conditions may make it more difficult and costly to raise additional capital.

Recently, there has been turmoil in the U.S. economy, which has led to reduced credit availability. Banks have tightened their lending standards and investors have been unwilling to buy certain corporate stock and

18

Table of Contents

bonds. If economic conditions continue to affect the capital markets, our ability to raise capital may be adversely affected.

We have incurred losses since inception and anticipate that we will continue to incur losses for the foreseeable future. We may not ever achieve or sustain profitability.

We are not profitable and have incurred losses in each year since our inception in 1998. Our net losses for the years ended December 31, 2009, 2008 and 2007 were $40.2 million, $37.2 million and $38.8 million, respectively. As of December 31, 2009, we had an accumulated deficit of $356.4 million. We do not currently have any products that have been approved for marketing, and we continue to incur substantial development and general and administrative expenses related to our operations. We expect to continue to incur losses for the foreseeable future, and we expect these losses to increase significantly, especially upon commencing pivotal and Phase 3 clinical trials for voreloxin, as we conduct development of, and seek regulatory approvals for, voreloxin, and as we commercialize any approved drugs. Our losses, among other things, have caused and will continue to cause our stockholders’ equity and working capital to decrease.

Our business model had been based in part upon entering into strategic collaborations for the discovery and/or the development of some of our product candidates. To date, we have derived substantially all of our revenue from research collaboration agreements with Biogen Idec, Inc. Merck & Co., and Johnson & Johnson Pharmaceutical Research & Development LLC. As of March 31, 2010, our only remaining ongoing collaboration is with Biogen Idec; however, the research phase for this collaboration is completed. We do not expect to enter into any new collaboration agreement that will result in research revenue for us. We also do not anticipate that we will generate revenue from the sale of products for the foreseeable future. In the absence of additional sources of capital, which may not be available to us on acceptable terms, or at all, the development of voreloxin or future product candidates, if any, may be reduced in scope, delayed or terminated. If our product candidates or those of our collaborators fail in clinical trials or do not gain regulatory approval, or if our future products do not achieve market acceptance, we may never become profitable. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods.

The development of voreloxin could be halted or significantly delayed for various reasons; our clinical trials for voreloxin may not demonstrate safety or efficacy or lead to regulatory approval.

Voreloxin is vulnerable to the risks of failure inherent in the drug development process. We need to conduct significant additional preclinical studies and clinical trials before we can attempt to demonstrate that voreloxin is safe and effective to the satisfaction of the FDA and other regulatory authorities. Failure can occur at any stage of the development process, and successful preclinical studies and early clinical trials do not ensure that later clinical trials will be successful. A number of companies in the pharmaceutical industry have suffered significant setbacks in advanced clinical trials, even after obtaining promising results in earlier trials.

For example, we terminated two Phase 2 trials of voreloxin in small cell and non-small cell lung cancer. We ceased development of SNS-032 and terminated our related license agreement with BMS after completion of a Phase 1 trial as no responses demonstrating efficacy were observed in that trial. In addition, in our Phase 1 trial of SNS-314, a maximum tolerated dose was not established and no responses were observed. As a result, we have suspended further development of SNS-314. If our clinical trials result in unacceptable toxicity or lack of efficacy, we may have to terminate them. If clinical trials are halted, or if they do not show that voreloxin is safe and effective in the indications for which we are seeking regulatory approval, our future growth will be limited and we may not have any other product candidates to develop.

We do not know whether our ongoing clinical trials or any other future clinical trials with voreloxin or any of our product candidates will be completed on schedule, or at all, or whether our ongoing or planned clinical trials will begin or progress on the time schedule we anticipate. The commencement of our planned clinical trials could be substantially delayed or prevented by several factors, including:

| • | delays or failures to raise additional funding; |

19

Table of Contents

| • | results of meetings with the FDA and/or other regulatory bodies; |

| • | a limited number of, and competition for, suitable patients with particular types of cancer for enrollment in our clinical trials; |

| • | delays or failures in obtaining regulatory approval to commence a clinical trial; |

| • | delays or failures in obtaining sufficient clinical materials; |

| • | delays or failures in obtaining approval from independent institutional review boards to conduct a clinical trial at prospective sites; or |

| • | delays or failures in reaching acceptable clinical trial agreement terms or clinical trial protocols with prospective sites. |

The completion of our clinical trials could also be substantially delayed or prevented by several factors, including:

| • | delays or failures to raise additional funding; |

| • | slower than expected rates of patient recruitment and enrollment; |

| • | failure of patients to complete the clinical trial; |

| • | unforeseen safety issues; |

| • | lack of efficacy during clinical trials; |

| • | inability or unwillingness of patients or clinical investigators to follow our clinical trial protocols; and |

| • | inability to monitor patients adequately during or after treatment. |

Additionally, our clinical trials may be suspended or terminated at any time by the FDA, other regulatory authorities, ourselves or, in some cases, our collaboration partners. Any failure to complete or significant delay in completing clinical trials for our product candidates could harm our financial results and the commercial prospects for our product candidates.

In March 2008, we informed the FDA of a stability observation in our voreloxin finished drug product, or FDP. Specifically, visible particles were observed during stability studies of one of our voreloxin FDP lots. We have since identified a process impurity in the voreloxin active pharmaceutical ingredient, or API, that, when formulated into the packaged vial of the voreloxin FDP, can result in the formation of particles over time. As a response to these findings, we implemented a revised manufacturing process to attempt to control the impurity and thereby prevent particle formation. Two lots of voreloxin API manufactured using the revised manufacturing process have been formulated into FDP lots that have completed up to 12 months of stability testing at room temperature without formation of particles. These FDP lots are currently being used in our clinical trials. It will take time to evaluate whether or not this revised manufacturing process for voreloxin API will be successful in stopping the formation of particles in these FDP lots over the longer term, and to evaluate whether or not such control of particle formation would also be reliably and consistently achieved in subsequent lots over the shorter or longer term. We provided updates on the results from our process optimization activities to the FDA in December 2008, and again most recently in October 2009 within the briefing materials that were discussed at the January 2010 CMC-focused End-of-Phase 2 meeting with the FDA. If the change in manufacturing process does

20

Table of Contents

not adequately control the formation of visible particles, we will need to discuss other possibilities with the FDA, which could include temporary clinical hold until the issue has been resolved to their satisfaction.

The failure to enroll patients for clinical trials may cause delays in developing voreloxin.

We may encounter delays if we are unable to enroll enough patients to complete clinical trials of voreloxin. Patient enrollment depends on many factors, including the size of the patient population, the nature of the protocol, the proximity of patients to clinical sites and the eligibility criteria for the trial. Moreover, when one product candidate is evaluated in multiple clinical trials simultaneously, patient enrollment in ongoing trials can be adversely effected by negative results from completed trials. Voreloxin is being tested in patients with AML and ovarian cancer, which can be difficult patient populations to recruit.

The results of preclinical studies and clinical trials may not satisfy the requirements of the FDA or other regulatory agencies.

Prior to receiving approval to commercialize voreloxin or future product candidates, if any, in the United States or abroad, we and our collaboration partners must demonstrate with substantial evidence from well-controlled clinical trials, to the satisfaction of the FDA and other regulatory authorities, that such product candidates are safe and effective for their intended uses. The results from preclinical studies and clinical trials can be interpreted in different ways. Even if we and our collaboration partners believe the preclinical or clinical data are promising, such data may not be sufficient to support approval by the FDA and other regulatory authorities.

We rely on third parties to manufacture our voreloxin drug product and its active pharmaceutical ingredient, and depend on one of two suppliers for production of the drug product and for production of the active pharmaceutical ingredient. There are a limited number of manufacturers that are capable of manufacturing voreloxin.