Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - ROYAL MINES & MINERALS CORP | exhibit32-2.htm |

| EX-31.1 - CERTIFICATION - ROYAL MINES & MINERALS CORP | exhibit31-1.htm |

| EX-31.2 - CERTIFICATION - ROYAL MINES & MINERALS CORP | exhibit31-2.htm |

| EX-32.1 - CERTIFICATION - ROYAL MINES & MINERALS CORP | exhibit32-1.htm |

| EX-10.35 - EXTENSION AGREEMENT - ROYAL MINES & MINERALS CORP | exhibit10-35.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-Q

(Mark One)

[ X ] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended January 31,

2010

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________to ________

COMMISSION FILE NUMBER 000-52391

ROYAL MINES AND MINERALS

CORP.

(Exact name of registrant as specified in its

charter)

| NEVADA | 20-4178322 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| Suite 112, 2580 Anthem Village Dr. | |

| Henderson, NV | 89052 |

| (Address of principal executive offices) | (Zip code) |

(702) 588-5973

(Registrant's telephone number,

including area code)

Not Applicable

(Former name, former address and

former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (s. 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date: As of March 9, 2010, the Registrant had 111,785,352 shares of common stock outstanding.

PART I - FINANCIAL INFORMATION

| ITEM 1. | FINANCIAL STATEMENTS. |

The accompanying unaudited financial statements have been prepared in accordance with the instructions to Form 10-Q and Rule 8-03 of Regulation S-X, and, therefore, do not include all information and footnotes necessary for a complete presentation of financial position, results of operations, cash flows, and stockholders' equity in conformity with generally accepted accounting principles. In the opinion of management, all adjustments considered necessary for a fair presentation of the results of operations and financial position have been included and all such adjustments are of a normal recurring nature. Operating results for the three and nine months ended January 31, 2010 are not necessarily indicative of the results that can be expected for the year ending April 30, 2010.

As used in this Quarterly Report, the terms “we,” “us,” “our,” “Royal Mines,” and the “Company” mean Royal Mines And Minerals Corp. and its subsidiaries, unless otherwise indicated. All dollar amounts in this Quarterly Report are expressed in U.S. dollars, unless otherwise indicated.

2

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| BALANCE SHEET |

| (Unaudited) |

| As of | As of | |||||

| January 31, 2010 | April 30, 2009 | |||||

| ASSETS | ||||||

| Current assets | ||||||

| Cash and cash equivalents | $ | 23,461 | $ | 1,819 | ||

| Loan Receivable | 470,000 | - | ||||

| Total current assets | 493,461 | 1,819 | ||||

| Property and equipment, net | 258,666 | 277,797 | ||||

| Intellectual property, net | 160,000 | 190,000 | ||||

| Mineral properties | 35,800 | 29,000 | ||||

| Other assets | 5,500 | 5,500 | ||||

| Total non-current assets | 459,966 | 502,297 | ||||

| Total assets | $ | 953,427 | $ | 504,116 | ||

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | ||||||

| Current liabilities | ||||||

| Accounts payable | $ | 31,496 | $ | 177,239 | ||

| Accounts payable - related party | 45,000 | 24,418 | ||||

| NVRM payable | 90,000 | 102,683 | ||||

| Loans payable - related party | 45,277 | 382,569 | ||||

| Loans payable | - | - | ||||

| Accrued interest - related party | 116,223 | 64,626 | ||||

| Deferred revenue | 834 | 4,583 | ||||

| Current portion of long-term debt | - | - | ||||

| Total current liabilities | 328,830 | 756,118 | ||||

| Long-term debt | - | - | ||||

| Total liabilities | 328,830 | 756,118 | ||||

| Commitments and contingencies | ||||||

| Stockholders' equity (deficit) | ||||||

| Common stock, $0.001 par value;

300,000,000 shares authorized, 111,580,352 and 72,679,852 shares, respectively, issued and outstanding |

111,580 |

72,680 |

||||

| Preferred stock, $0.001 par value; 100,000,000

shares authorized, zero shares issued and outstanding |

- |

- |

||||

| Additional paid-in capital | 9,754,883 | 7,341,030 | ||||

| Accumulated deficit during exploration stage | (9,241,866 | ) | (7,665,712 | ) | ||

| Total stockholders' equity (deficit) | 624,597 | (252,002 | ) | |||

| Total liabilities and stockholders' equity (deficit) | $ | 953,427 | $ | 504,116 | ||

See Accompanying Notes to Financial Statements

F-2

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| STATEMENTS OF OPERATIONS |

| (Unaudited) |

| For the Period | |||||||||||||||

| July 13, 2005 | |||||||||||||||

| (Date of Inception) | |||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | Through | |||||||||||||

| January 31, 2010 | January 31, 2009 | January 31, 2010 | January 31, 2009 | January 31, 2010 | |||||||||||

| Revenue | $ | 1,938 | $ | - | $ | 45,248 | $ | - | $ | 47,448 | |||||

| Operating expenses | |||||||||||||||

| Mineral exploration and evaluation expenses | 166,097 | 97,376 | 614,419 | 357,935 | 2,605,929 | ||||||||||

| General and administrative | 515,060 | 407,503 | 808,441 | 677,005 | 6,285,455 | ||||||||||

| Depreciation and amortization | 50,065 | 25,000 | 146,734 | 75,000 | 372,337 | ||||||||||

| Total operating expenses | 731,222 | 529,879 | 1,569,594 | 1,109,940 | 9,263,721 | ||||||||||

| Loss from operations | (729,284 | ) | (529,879 | ) | (1,524,346 | ) | (1,109,940 | ) | (9,216,273 | ) | |||||

| Other income (expense): | |||||||||||||||

| Other income | - | - | - | - | 94,115 | ||||||||||

| Interest income | - | - | - | - | 4,551 | ||||||||||

| Interest expense | (22,492 | ) | (19,475 | ) | (51,808 | ) | (48,547 | ) | (124,259 | ) | |||||

| Total other income (expense) | (22,492 | ) | (19,475 | ) | (51,808 | ) | (48,547 | ) | (25,593 | ) | |||||

| Loss from operations before provision for income taxes | (751,776 | ) | (549,354 | ) | (1,576,154 | ) | (1,158,487 | ) | (9,241,866 | ) | |||||

| Income tax benefit | - | - | - | - | - | ||||||||||

| Net loss | $ | (751,776 | ) | $ | (549,354 | ) | $ | (1,576,154 | ) | $ | (1,158,487 | ) | $ | (9,241,866 | ) |

| Loss per common share - basic and diluted:

Net loss |

$ | (0.01 |

) | $ | (0.01 |

) | $ | (0.02 |

) | $ | (0.02 |

) | |||

| Weighted average common shares outstanding

- Basic and diluted |

81,684,635 |

46,729,519 |

78,366,761 |

46,386,703 |

|||||||||||

See Accompanying Notes to Financial Statements

F-3

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| STATEMENT OF STOCKHOLDERS' EQUITY (DEFICIT) |

| (Unaudited) |

| Accumulated | |||||||||||||||

| Deficit During | Total | ||||||||||||||

| Common Stock | Additional | Exploration | Stockholders' | ||||||||||||

| Shares | Amount | Paid-in Capital | Stage | Equity (Deficit) | |||||||||||

| Balance, July 13, 2005 | - | $ | - | $ | - | $ | - | $ | - | ||||||

| Issuance of common stock for cash, $0.001 per share | 1,000 | 1 | - | - | 1 | ||||||||||

| Net loss | - | - | - | (174,500 | ) | (174,500 | ) | ||||||||

| Balance, April 30, 2006 | 1,000 | 1 | - | (174,500 | ) | (174,499 | ) | ||||||||

| Issuance of common stock for cash, $0.001 per share | 12,500,000 | 12,500 | - | - | 12,500 | ||||||||||

| Issuance of common stock for cash, $0.01 per share | 7,800,000 | 7,800 | 70,200 | - | 78,000 | ||||||||||

| Issuance of common stock for mineral property

options, $0.01 per share |

1,050,000 |

1,050 |

9,450 |

- |

10,500 |

||||||||||

| Issuance of common stock for cash, $0.10 per share | 1,250,000 | 1,250 | 123,750 | - | 125,000 | ||||||||||

| Issuance of common stock for cash, Reg. S - Private Placement, $0.10 per share |

1,800,000 |

1,800 |

178,200 |

- |

180,000 |

||||||||||

| Issuance of common stock in acquisition of intellectual property and equipment, $0.10 per share |

2,000,000 |

2,000 |

198,000 |

- |

200,000 |

||||||||||

| Net loss | - | - | - | (517,768 | ) | (517,768 | ) | ||||||||

| Balance, April 30, 2007 | 26,401,000 | $ | 26,401 | $ | 579,600 | $ | (692,268 | ) | $ | (86,267 | ) | ||||

| Issuance of common stock for cash and subscriptions

received, Reg. S - Private Placement, $0.25 per share |

2,482,326 |

2,482 |

618,100 |

- |

620,582 |

||||||||||

| Issuance of common stock for cash, Reg. D - Private Placement, $0.25 per share |

3,300,000 |

3,300 |

821,700 |

- |

825,000 |

||||||||||

| Issuance of common stock in reverse acquisition of Centrus Ventures Inc. |

13,968,926 |

13,969 |

(77,164 |

) | - |

(63,195 |

) | ||||||||

| Issuance of stock options for 4,340,000 shares of common stock to three officers and five consultants. |

- |

- |

3,583,702 |

- |

3,583,702 |

||||||||||

| Net loss | - | - | - | (5,256,444 | ) | (5,256,444 | ) | ||||||||

| Balance, April 30, 2008 | 46,152,252 | $ | 46,152 | $ | 5,525,938 | $ | (5,948,712 | ) | $ | (376,622 | ) | ||||

| Issuace of common stock for cash, Reg. S -

Private Placement, $0.50 per share; with attached warrants exercisable at $0.75 per share |

200,000 |

200 |

99,800 |

- |

100,000 |

||||||||||

| Issuance of common stock in satisfaction of debt, $0.30 per

share, with attached warrants exercisable at $0.50 per share. |

450,760 |

451 |

134,777 |

- |

135,228 |

||||||||||

| Issuance of stock options for 5,000,000 shares

of common stock to two officers and nine consultants. |

- |

- |

342,550 |

- |

342,550 |

||||||||||

| Issuace of common stock for cash, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

9,140,000 |

9,140 |

447,860 |

- |

457,000 |

||||||||||

See Accompanying Notes to Financial Statements

F-5

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| STATEMENT OF STOCKHOLDERS' EQUITY (DEFICIT) |

| (Unaudited) |

| Accumulated | |||||||||||||||

| Deficit During | Total | ||||||||||||||

| Common Stock | Additional | Exploration | Stockholders' | ||||||||||||

| Shares | Amount | Paid-in Capital | Stage | Equity (Deficit) | |||||||||||

| Issuance of common stock in satisfaction of

loans made to the Company, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

12,400,000 |

12,400 |

607,600 |

- |

620,000 |

||||||||||

| Issuance of common stock in satisfaction of debt, $0.05 per

share, with attached warrants exercisable at $0.10 per share. |

1,336,840 |

1,337 |

65,505 |

- |

66,842 |

||||||||||

| Issuance of common stock to one officer as

compensation pursuant to the management consulting agreement. |

3,000,000 |

3,000 |

117,000 |

- |

120,000 |

||||||||||

| Net loss | - | - | - | (1,717,000 | ) | (1,717,000 | ) | ||||||||

| Balance, April 30, 2009 | 72,679,852 | $ | 72,680 | $ | 7,341,030 | $ | (7,665,712 | ) | $ | (252,002 | ) | ||||

| Issuance of common stock in satisfaction of loans made to the

Company, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

2,000,000 |

2,000 |

98,000 |

- |

100,000 |

||||||||||

| Issuance of common stock in satisfaction of

debt, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

500,000 |

500 |

24,500 |

- |

25,000 |

||||||||||

| Issuance of common stock for warrants excercised, $0.10 per

share, in satisfaction of debt for legal services. |

295,000 |

295 |

29,205 |

- |

29,500 |

||||||||||

| Issuance of common stock for options excercised,

$0.05 per share, in satisfaction of debt for legal services. |

750,000 |

750 |

36,750 |

- |

37,500 |

||||||||||

| Issuance of common stock to investor relations services firm

pursuant to terms of consulting agreement. |

1,500,000 |

1,500 |

- |

- |

1,500 |

||||||||||

| Issuance of common stock in satisfaction of

loans to the Company, $0.10 per share, with attached warrants excercisable at $0.20 per share. |

3,500,000 |

3,500 |

346,500 |

- |

350,000 |

||||||||||

| Issuance of stock options for 7,000,000 shares of common stock to two directors and nine consultants. |

- |

- |

391,478 |

- |

391,478 |

||||||||||

| Issuance of common stock for options excercised,

$0.05 per share, in satisfaction of debt for legal services. |

900,000 |

900 |

44,100 |

- |

45,000 |

||||||||||

| Issuance of common stock in satisfaction of loans to the Company,

$0.05 per share, with attached warrants exercisable at $0.10 per share. |

19,400,000 |

19,400 |

950,600 |

- |

970,000 |

||||||||||

| Issuace of common stock for cash, $0.05 per

share, with attached warrants exercisable at $0.10 per share. |

8,280,000 |

8,280 |

405,720 |

- |

414,000 |

||||||||||

| Issuance of common stock in satisfaction of debt, $0.05 per

share, with attached warrants exercisable at $0.10 per share. |

1,775,500 |

1,775 |

87,000 |

- |

88,775 |

||||||||||

| Net loss | - | - | - | (1,576,154 | ) | (1,576,154 | ) | ||||||||

| Balance, January 31, 2010 | 111,580,352 | $ | 111,580 | $ | 9,754,883 | $ | (9,241,866 | ) | $ | 624,597 | |||||

See Accompanying Notes to Financial Statements

F-5

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| STATEMENTS OF CASH FLOWS |

| (Unaudited) |

| For the Period | |||||||||

| July 13, 2005 | |||||||||

| (Date of Inception) | |||||||||

| For the Nine Months Ended | Through | ||||||||

| January 31, 2010 | January 31, 2009 | January 31, 2010 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||

| Net loss | $ | (1,576,154 | ) | $ | (1,158,487 | ) | $ | (9,241,866 | ) |

| Adjustments to reconcile loss

from operating to net cash used in operating activities: |

|||||||||

| Depreciation and amortization | 146,733 | 75,000 | 372,336 | ||||||

| Stock based expenses | 223,702 | 178,126 | 1,095,448 | ||||||

| Stock based expenses - related party | 167,776 | 164,424 | 3,342,282 | ||||||

| Changes in operating assets and liabilities: | - | ||||||||

| Other current assets and liabilities | (16,433 | ) | (46,552 | ) | (11,850 | ) | |||

| Other assets | - | - | (5,500 | ) | |||||

| Loan receivable | (470,000 | ) | - | (470,000 | ) | ||||

| Accounts payable and accrued interest | (28,742 | ) | 128,195 | 508,862 | |||||

| Accounts payable and accrued interest- related party | 127,179 | 247,282 | 203,113 | ||||||

| Net cash used in operating activities | (1,425,939 | ) | (412,012 | ) | (4,207,175 | ) | |||

| CASH FLOW FROM INVESTING ACTIVITIES | |||||||||

| Cash paid on mineral property claims | (6,800 | ) | (6,500 | ) | (25,300 | ) | |||

| Cash acquired on reverse merger | - | - | 2,306 | ||||||

| Purchase of fixed assets | (97,603 | ) | - | (591,003 | ) | ||||

| Net cash used in investing activities | (104,403 | ) | (6,500 | ) | (613,997 | ) | |||

| CASH FLOW FROM FINANCING ACTIVITIES | |||||||||

| Proceeds from stock issuance | 415,500 | 100,000 | 2,813,581 | ||||||

| Share subscriptions | - | 271,000 | - | ||||||

| Proceeds / (Payments) on long-term debt | - | (3,841 | ) | - | |||||

| Proceeds / (Payments) on borrowings | 1,136,484 | 142,020 | 2,031,052 | ||||||

| Net cash provided by financing activities | 1,551,984 | 509,179 | 4,844,633 | ||||||

| NET CHANGE IN CASH | 21,642 | 90,667 | 23,461 | ||||||

| CASH AT BEGINNING OF PERIOD | 1,819 | 9,794 | - | ||||||

| CASH AT END OF PERIOD | $ | 23,461 | $ | 100,461 | $ | 23,461 | |||

| SUPPLEMENTAL INFORMATION | |||||||||

| Interest Paid | $ | 1,093 | $ | 428 | $ | 3,833 | |||

| Income Taxes Paid | $ | - | $ | - | $ | - | |||

| SUPPLEMENTARY DISCLOSURE FOR NON-CASH INVESTING AND FINANCING ACTIVITIES |

|||||||||

| Acquisition of intellectual property for stock | $ | - | $ | - | $ | 200,000 | |||

| Acquisition of mineral property for stock | $ | - | $ | - | $ | 10,500 | |||

| Stock issued in reverse acquisition of Centrus Ventures Inc. | $ | - | $ | - | $ | (63,195 | ) | ||

| Stock issued in satisfaction of debt | $ | 225,775 | $ | 135,228 | $ | 427,845 | |||

| Stock issued in satisfaction of loans made to the Company | $ | 1,420,000 | $ | 2,040,000 | |||||

| Stock issued as compensation | $ | - | $ | - | $ | 120,000 | |||

See Accompanying Notes to Financial Statements

F-6

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES |

Basis of presentation – These financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States. The Company’s fiscal year-end is April 30.

Description of Business – The Company is considered an exploration stage company. The Company's primary objectives are to 1) commercially extract and refine precious and base metals from others and its own mining assets, 2) joint venture, acquire and develop projects in North America, and 3) generate ongoing revenues from the licensing of its proprietary, environmentally-friendly lixiviation process. The Company has not yet realized significant revenues from its primary objectives.

History – The Company was incorporated on December 14, 2005 under the laws of the State of Nevada. On June 13, 2007, the Company incorporated a wholly-owned subsidiary, Royal Mines Acquisition Corp., in the state of Nevada.

On October 5, 2007, Centrus Ventures Inc. (Centrus) completed the acquisition of Royal Mines Inc. (“Royal Mines”). The acquisition of Royal Mines was completed by way of a “triangular merger” pursuant to the provisions of the Agreement and Plan of Merger dated September 24, 2007 (the “First Merger Agreement”) among Centrus, Royal Mines Acquisition Corp. (“Centrus Sub”), a wholly owned subsidiary of Centrus, Royal Mines and Kevin B. Epp, the former sole executive officer and director of Centrus. On October 5, 2007, under the terms of the First Merger Agreement, Royal Mines was merged with and into Centrus Sub, with Centrus Sub continuing as the surviving corporation (the “First Merger”).

On October 6, 2007, a second merger was completed pursuant to an Agreement and Plan of Merger dated October 6, 2007 (the “Second Merger Agreement”) between Centrus and its wholly owned subsidiary, Centrus Sub, whereby Centrus Sub was merged with and into Centrus, with Centrus continuing as the surviving corporation (the “Second Merger”). As part of the Second Merger, Centrus changed its name from “Centrus Ventures Inc.” to “Royal Mines And Minerals Corp.”(“the Company”). Other than the name change, no amendments were made to the Articles of Incorporation.

Under the terms and conditions of the First Merger Agreement, each share of Royal Mines’ common stock issued and outstanding immediately prior to the completion of the First Merger was converted into one share of Centrus’ common stock. As a result, a total of 32,183,326 shares of Centrus common stock were issued to former stockholders of Royal Mines. In addition, Mr. Epp surrendered 23,500,000 shares of Centrus common stock for cancellation in consideration of payment by Centrus of $0.001 per share for an aggregate consideration of $23,500. As a result, upon completion of the First Merger, the former stockholders of Royal Mines owned approximately 69.7% of the issued and outstanding common stock.

As such, Royal Mines is deemed to be the acquiring enterprise for financial reporting purposes. All acquired assets and liabilities of Centrus were recorded at fair value on the date of the acquisition, as required by the purchase method of accounting, and the tangible net liabilities were debited against equity of the Company. There are no continuing operations of Centrus from the date of acquisition.

Going Concern - As of January 31, 2010, the Company incurred cumulative net losses of approximately $9,241,866 from operations and has working capital of $164,631. The Company is still in the exploration stage and has not fully commenced its mining and metals extraction processing operations, raising substantial doubt about its ability to continue as a going concern.

F-7

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES (continued) |

The ability of the Company to continue as a going concern is dependent on the Company raising additional sources of capital and the successful execution of the Company’s objectives. The Company will seek additional sources of capital through the issuance of debt or equity financing, but there can be no assurance the Company will be successful in accomplishing its objectives.

The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

Use of Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents - The Company considers all investments with an original maturity of three months or less to be a cash equivalent.

Property and Equipment - Property and equipment are stated at cost less accumulated depreciation. Depreciation is provided principally on the straight-line method over the estimated useful lives of the assets, which are generally 3 to 10 years. The cost of repairs and maintenance is charged to expense as incurred. Expenditures for property betterments and renewals are capitalized. Upon sale or other disposition of a depreciable asset, cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in other income (expense).

The Company periodically evaluates whether events and circumstances have occurred that may warrant revision of the estimated useful life of fixed assets or whether the remaining balance of fixed assets should be evaluated for possible impairment. The Company uses an estimate of the related undiscounted cash flows over the remaining life of the fixed assets in measuring their recoverability.

Mineral Property Rights – The Company capitalizes acquisition and option costs of mineral property rights in accordance with Emerging Issues Task Force (EITF) abstract 04-02. The amount capitalized represents the fair value at the time the mineral rights are acquired. The accumulated costs of acquisition for properties that are developed to the stage of commercial production will be amortized using the unit-of-production method.

Exploration Costs – Mineral exploration costs are expensed as incurred.

Impairment of Long-Lived Assets – The Company evaluates the carrying value of acquired mineral property rights in accordance with EITF 04-03, “Mining Assets: Impairment and Business Combinations,” using the Value Beyond Proven and Probable (VBPP) method. The fair value of a mining asset generally includes both VBPP and an estimate of the future market price of the minerals.

The Company reviews and evaluates long-lived assets for impairment when events or changes in circumstances indicate the related carrying amounts may not be recoverable. Asset impairment is considered to exist if the total estimated future cash flows, on an undiscounted basis, are less than the carrying amount of the long-lived asset. An impairment loss is measured and recorded based on the discounted estimated future cash flows. Future cash flows are based on estimated quantities of recoverable minerals, expected gold and other commodity prices (considering current and historical prices, price trends and related factors), production levels and cash costs of production, capital and reclamation costs, all based on detailed engineering life-of-mine plans.

F-8

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES (continued) |

In estimating future cash flows, assets are grouped at the lowest levels for which there are identifiable cash flows that are largely independent of future cash flows from other asset groups. With the exception of other mine-related exploration potential and exploration potential in areas outside of the immediate mine-site, all assets at a particular operation are considered together for purposes of estimating future cash flows. In the case of mineral interests associated with other mine-related exploration potential and exploration potential in areas outside of the immediate mine-site, cash flows and fair values are individually evaluated based primarily on recent exploration results.

Various factors could impact the Company’s ability to achieve forecasted production schedules from proven and probable reserves. Additionally, commodity prices, capital expenditure requirements and reclamation costs could differ from the assumptions used in the cash flow models used to assess impairment. The ability to achieve the estimated quantities of recoverable minerals from exploration stage mineral interests involves further risks in addition to those factors applicable to mineral interests where proven and probable reserves have been identified, due to the lower level of confidence that the identified mineralized material can ultimately be mined economically. Material changes to any of these factors or assumptions discussed above could result in future impairment charges to operations.

Fair Value of Financial Instruments – Statement of Financial Accounting Standards (SFAS) No. 107, “Disclosure about Fair Value of Financial Instruments,” requires the Company to disclose, when reasonably attainable, the fair market value of its assets and liabilities which are deemed to be financial instruments. The carrying amounts and estimated fair value of the Company’s financial instruments approximate their fair value due to the short-term nature. The Company is not exposed to significant interest or credit risk arising from these financial instruments.

Revenue Recognition – Revenues from processing ore are recognized when services are completed and billed. Revenue from licensing our technology is recognized over the term of the license agreement. Costs and expenses are recognized during the period in which they are incurred.

Research and Development - All research and development expenditures during the period have been charged to operations.

Earnings (Loss) Per Share - The Company follows SFAS No. 128, “Earnings Per Share” and SFAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity,” which establish standards for the computation, presentation and disclosure requirements for basic and diluted earnings per share for entities with publicly-held common shares and potential common stock issuances. Basic earnings (loss) per share are computed by dividing net income by the weighted average number of common shares outstanding. In computing diluted earnings per share, the weighted average number of shares outstanding is adjusted to reflect the effect of potentially dilutive securities, such as stock options and warrants. Common stock equivalent shares are excluded from the computation if their effect is antidilutive. Common stock equivalents, which include stock options and warrants to purchase common stock, that were not included in the computations of diluted earnings per share because the effect would be antidilutive were 68,938,100 and 9,890,760 on January 31, 2010 and January 31, 2009, respectively

Income Taxes - The Company accounts for its income taxes in accordance with SFAS No. 109, “Accounting for Income Taxes,” which requires recognition of deferred tax assets and liabilities for future tax consequences

F-9

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES (continued) |

attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and tax credit carry-forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

On July 13, 2006, the Financial Accounting Standards Board (FASB) issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes – An Interpretation of FASB Statement No. 109” (“FIN 48”). FIN 48 clarifies the accounting for uncertainty in income taxes recognized in an entity’s financial statements in accordance with SFAS No. 109, and prescribes a recognition threshold and measurement attributes for financial statement disclosure of tax positions taken or expected to be taken on a tax return. Under FIN 48, the impact of an uncertain income tax position on the income tax return must be recognized at the largest amount that is more-likely-than-not to be sustained upon audit by the relevant taxing authority. An uncertain income tax position will not be recognized if it has less than 50% likelihood of being sustained. Additionally, FIN 48 provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. The Company adopted the provision of FIN 48 on April 30, 2007, which did not have any impact on the financial statements.

For acquired properties that do not constitute a business as defined in Emerging Issues Task Force Issue No. 98-03 (“EITF 98-03”), “Determining Whether a Nonmonetary Transaction Involves Receipt of Productive Assets or of a Business”, deferred income tax liability is recorded on GAAP basis over income tax basis using statutory federal and state rates. The resulting estimated future federal and state income tax liability associated with the temporary difference between the acquisition consideration and the tax basis is computed in accordance with EITF 98-11 “Accounting for Acquired Temporary Differences in Certain Purchase Transactions That Are Not Accounted for as Business Combinations” and SFAS 109, and is reflected as an increase to the total purchase price which is then applied to the underlying acquired assets in the absence of there being a goodwill component associated with the acquisition transactions.

Reclassification - Certain reclassifications have been made to the prior year’s financial statements to conform to the current year’s presentation, with no effect on previously reported net loss.

Expenses of Offering - The Company accounts for specific incremental costs directly to a proposed or actual offering of securities as a direct charge against the gross proceeds of the offering.

Stock-Based Compensation – On December 16, 2004, the FASB issued SFAS No. 123R, “Share-Based Payment”, which replaces SFAS No. 123, “Accounting for Stock-Based Compensation” and supersedes APB Opinion No. 25, “Accounting for Stock Issued to Employees.” SFAS No. 123R requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements based on the grant date fair value of the award. SFAS No. 123R was to be effective for interim or annual reporting periods beginning on or after June 15, 2005, but in April 2005 the SEC issued a rule that will permit most registrants to implement SFAS No. 123R at the beginning of their next fiscal year, instead of the next reporting period as required by SFAS No. 123R. The pro forma disclosures previously permitted under SFAS No. 123 no longer will be an alternative to financial statement recognition. Under SFAS No. 123R, the Company must determine the appropriate fair value model to be used for valuing share-based payments, the amortization method for compensation cost and the transition method to be used at date of adoption. The transition methods include prospective and retroactive adoption option. Under the retroactive option, prior periods may be restated either as of the beginning of the year of adoption or for all periods presented. The prospective method requires that compensation expense be recorded for all unvested stock options and restricted

F-10

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES (continued) |

stock at the beginning of the first quarter of adoption of SFAS No. 123R, while the retroactive methods would record compensation expense for all unvested stock options and restricted stock beginning with the first period restated. The Company has adopted the requirements of SFAS No. 123R for the fiscal year beginning after April 30, 2006.

New Accounting Pronouncements – The Financial Accounting Standards Board (FASB) has issued FASB Statement No. 168, The “FASB Accounting Standards Codification TM ” and the Hierarchy of Generally Accepted Accounting Principles. Statement 168 establishes the FASB Accounting Standards Codification TM (Codification) as the single source of authoritative U.S. generally accepted accounting principles (U.S. GAAP) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal securities laws are also sources of authoritative U.S. GAAP for SEC registrants. Statement 168 and the Codification are effective for financial statements issued for interim and annual periods ending after September 15, 2009.

The FASB has issued FASB Statement No. 167, “Amendment to FASB Interpretation No. 46(R)”. Statement 167 is a revision to FASB Interpretation No. 46 (Revised December 2003), ‘Consolidation of Variable Interest Entities”, and changes how a reporting entity determines when an entity that is insufficiently capitalized or is not controlled through voting (or similar rights) should be consolidated. The determination of whether a reporting entity is required to consolidate another entity is based on, among other things, the other entity’s purpose and design and the reporting entity’s ability to direct the activities of the other entity that most significantly impact the other entity’s economic performance. Statement 167 will require a reporting entity to provide additional disclosures about its involvement with variable interest entities and any significant changes in risk exposure due to that involvement. A reporting entity will be required to disclose how its involvement with a variable interest entity affects the reporting entity’s financial statements. Statement 167 will be effective at the start of a reporting entity’s first fiscal year beginning after November 15, 2009, or January 1, 2010, for a calendar year-end entity. Adoption of this statement is not expected to have a material impact on the Company’s financial statements.

The FASB has issued FASB Statement No. 166, “Accounting for Transfers of Financial Assets”. Statement 166 is a revision to FASB Statement No. 140, “Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities”, and will require more information about transfers of financial assets, including securitization transactions, and where entities have continuing exposure to the risk related to the transferred financial assets. It eliminates the concept of a “qualifying special-purpose entity”, changes the requirements for derecognizing financial assets, and requires additional disclosures. Statement 166 enhances information reported to users of financial statements by providing greater transparency about transfers of financial assets and an entity’s continuing involvement in transferred financial assets. Statement 166 will be effective at the start of a reporting entity’s first fiscal year beginning after November 15, 2009, or January 1, 2010, for a calendar year-end entity. Adoption of this statement is not expected to have a material impact on the Company’s financial statements.

The FASB has issued FASB Statement No. 165, “Subsequent Events”. Statement 165 establishes general standards of accounting for and disclosure of events that occur after the balance sheet but before financial statements are issued or are available to be issued. Specifically, Statements 165 provides: (i) the period after the balance sheet date during which management of a reporting entity should evaluate events or transactions that may occur for potential recognition or disclosure in the financial statements; (ii) the circumstances under which an entity should recognize events or transactions occurring after the balance sheet date in its financial statements; and (iii) the disclosures that an entity should make about events or transactions that occurred after the balance sheet date. Statement 165 is effective for interim or annual financial periods ending after June 15,

F-11

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES (continued) |

2009, and shall be applied prospectively. The required disclosures of this statement have been incorporated into the Company’s financial statements.

In April 2009, FASB Staff Position (FSP) No. FAS 107-1 and APB 28-1 was issued to amend SFAS No. 107, “Disclosures about Fair Value of Financial Instruments”, to require disclosures about fair value of financial instruments for interim reporting period as well as in annual financial statements. This FSP also amends APB Opinion No. 28, “Interim Financial Reporting”, to require those disclosures in summarized financial information at interim reporting periods. FSP No. 107-1 and APB 28-1 is effective for interim reporting period ending after June 15, 2009. Adoption of this guidance did not have a material impact on the Company’s financial statements.

In April 2009, FSP No. FAS 157-4, “Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly”, was issued to provide additional guidance for estimating the fair value in accordance with SFAS No. 157, “Fair Value Measurements”, when the volume and level of activity for the asset or liability have significantly decreased. This FSP also provides guidance on identifying circumstances that indicate a transaction is not orderly. FSP No. FAS 157-4 is effective for interim and annual reporting periods ending after June 15, 2009, and shall be applied prospectively. Adoption of this guidance did not have a material impact on the Company’s financial statements.

In April 2009, FSP No. FAS 141(R)-1, “Accounting for Assets Acquired and Liabilities Assumed in a Business Combination That Arise from Contingencies”. This FSP amends the guidance in FASB Statement No. 141 to require that assets acquired and liabilities assumed in a business combination that arise from contingencies be recognized at fair value if fair value can be reasonably estimated. If fair value of such asset or liability cannot be reasonably estimated, the asset or liability would generally be recognized in accordance with FASB Statement No. 5, “Accounting for Contingencies”, and FASB Interpretation (FIN) No. 14, “Reasonable Estimation of the Amount of a Loss”. This FSP eliminates the requirements to disclose an estimate of the range of outcomes of recognized contingencies at the acquisition date. This FSP also requires that contingent consideration arrangements of an acquiree assumed by the acquirer in a business combination be treated as contingent consideration of the acquirer and should be initially and subsequently measured at fair value in accordance with Statement 141R. This FSP is effective for assets or liabilities arising from contingencies in business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. The adoption of this statement had little or no effect on the Company’s financial position, results of operations, and disclosures.

In December 2008, the FASB issued FSP No. FAS 132(R)-1, “Employers’ Disclosures about Post-Retirement Benefit Plan Assets” (“FSP FAS 132(R)-1”), which amends FASB Statement No. 132 “Employers’ Disclosures about Pensions and Other Post-Retirement Benefits” (“FAS 132”), to provide guidance on an employer’s disclosures about plan assets of a defined benefit pension or other post-retirement plan. The objective of FSP FAS 132(R)-1 is to require more detailed disclosures about employers’ plan assets, including employers’ investment strategies, major categories of plan assets, concentrations of risk within plan assets, and valuation techniques used to measure the fair value of plan assets. FSP FAS 132(R)-1 is effective for the Company’s fiscal year beginning May 1, 2009. Upon initial application, the provisions of this FSP are not required for earlier periods that are presented for comparative purposes. The Company does not currently have a benefit pension or any post-retirement benefit plans and the Company has determined that the adoption of this statement will have little or no effect on the Company’s financial position, results of operations, and disclosures.

F-12

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES (continued) |

In November 2008, the EITF reached consensus on Issue No. 08-6, “Equity Method Investment Accounting Considerations” (“EITF 08-6”), which clarifies the accounting for certain transactions and impairment considerations involving equity method investments. The intent of EITF 08-6 is to provide guidance on (i) determining the initial carrying value of an equity method investment, (ii) performing an impairment assessment of an underlying indefinite-lived intangible asset of an equity method investment, (iii) accounting for an equity method investee’s issuance of shares, and (iv) accounting for a change in an investment from the equity method to the cost method. EITF 08-6 is effective for the Company’s fiscal year beginning May 1, 2009 and is to be applied prospectively. The Company determined that the adoption of EITF 08-6 will have little or no effect on the Company’s financial position, results of operations, and disclosures..

In June 2008, the EITF reached consensus on Issue No. 07-5, “Determining Whether an Instrument (or Embedded Feature) Is Indexed to an Entity’s Own Stock” (“EITF 07-5”). EITF 07-5 clarifies the determination of whether an instrument (or an embedded feature) is indexed to an entity’s own stock, which would qualify as a scope exception under FASB Statement No. 133, “Accounting for Derivative Instruments and Hedging Activities” (“FAS 133”). EITF 07-5 is effective for the Company’s fiscal years beginning May 1, 2009. Early adoption for an existing instrument is not permitted. The Company determined the adoption of EITF 07-5 will have little or no effect on the Company’s financial position or results of operations.

The FASB issued FASB Staff Position (FSP) FAS 157-3, “Determining the Fair Value of a Financial Asset When the Market for that Asset Is Not Active”. The FSP clarifies the application of SFAS No. 157, “Fair Value Measurements”, in a market that is not active and provides an example to illustrate key considerations in determining the fair value of a financial asset when the market for that financial asset is not active. The FSP is effective October 10, 2008, and for prior periods for which financial statements have not been issued. Revisions resulting from a change in the valuation technique or its application should be accounted for as a change in accounting estimate following the guidance in SFAS No. 154, “Accounting Changes and Error Corrections”. However, the disclosure provisions in SFAS No. 154 for a change in accounting estimate are not required for revisions resulting from a change in valuation techniques or its application. The Company has determined that the adoption of this statement will have little or no effect on the Company’s financial position, results of operations, and disclosures.

In May 2008, the FASB issued SFAS No. 162, “Hierarchy of Generally Accepted Accounting Principles”. This statement is intended to improve financial reporting by identifying a consistent framework, or hierarchy, for selecting accounting principles to be used in preparing financial statements of nongovernmental entities that are presented in conformity with GAAP. This statement will be effective 60 days following the U.S. Securities and Exchange Commission’s approval of the Public Company Accounting Oversight Board amendment to AU Section 411, “The Meaning of Present Fairly in Conformity with Generally Accepted Accounting Principles.” The Company has determined that the adoption of this statement will have little or no effect on the Company’s financial position, results of operations, and disclosures.

In May 2008, the FASB issued FSP No. APB 14-1, “Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion (Including Partial Cash Settlement)” (“FSP APB 14-1”). FSP APB 14-1 applies to convertible debt instruments that, by their stated terms, may be settled in cash (or other assets) upon conversion, including partial cash settlement, unless the embedded conversion option is required to be separately accounted for as a derivative under FAS 133. Convertible debt instruments within the scope of FSP APB 14-1 are not addressed by the existing APB 14. FSP APB 14-1 requires that the liability and equity components of convertible debt instruments within the scope of FSP APB 14-1 be separately accounted for in a manner that reflects the entity’s nonconvertible debt borrowing rate. This requires an allocation of the convertible debt proceeds between the liability component and the embedded conversion option (i.e., the equity component).

F-13

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES (continued) |

The difference between the principal amount of the debt and the amount of the proceeds allocated to the liability component will be reported as a debt discount and subsequently amortized to earnings over the instrument’s expected life using the effective interest method. FSP APB 14-1 is effective for the Company’s fiscal year beginning May 1, 2009 and will be applied retrospectively to all periods presented. The Company does not currently have convertible debt instruments and the Company has determined that the adoption of this statement will have little or no effect on the Company’s financial position, results of operations, and disclosures.

In April 2008, the FASB issued FSP No. FAS 142-3, “Determination of the Useful Life of Intangible Assets” (“FSP 142-3”) which amends the factors that should be considered in developing renewal or extension assumptions used to determine the useful life of a recognized intangible asset under FASB Statement No. 142, “Goodwill and Other Intangible Assets” (“FAS 142”). The intent of this FSP is to improve the consistency between the useful life of a recognized intangible asset under FAS 142 and the period of expected cash flows used to measure the fair value of the asset under FASB Statement No. 141, “Business Combinations” (“FAS 141”). FSP 142-3 is effective for the Company’s fiscal year beginning May 1, 2009 and will be applied prospectively to intangible assets acquired after the effective date. The Company does not expect the adoption of FSP 142-3 to have an impact on the Company’s financial position, results of operations or cash flows.

On March 19, 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities.” This statement is intended to improve financial reporting about derivative instruments and hedging activities by requiring enhanced disclosures. This statement is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, with early application encouraged. The Company has determined that the adoption of this statement will have little or no effect on the Company’s financial position, results of operations, and disclosures.

In February 2008, the FASB staff issued Staff Position No. 157-2 “Effective Date of FASB Statement No. 157” (“FSP FAS 157-2”). FSP FAS 157-2 delayed the effective date of SFAS 157 for nonfinancial assets and nonfinancial liabilities, except for items that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually). The provisions of FSP FAS 157-2 are effective for the Company’s fiscal year beginning May 1, 2009. SFAS 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements.

In December 2007, the FASB issued SFAS No. 141(R), “Business Combinations,” which amends SFAS No. 141, and provides revised guidance for recognizing and measuring identifiable assets and goodwill acquired, liabilities assumed, and any noncontrolling interest in the acquiree. It also provides disclosure requirements to enable users of the financial statements to evaluate the nature and financial effects of the business combination. SFAS No. 141(R) is effective for the Company’s fiscal year beginning May 1, 2009 and is to be applied prospectively. This statement will impact how the Company accounts for future business combinations and the Company’s future financial position, results of operations and cash flows.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements - an amendment of ARB No. 51” which establishes accounting and reporting standards pertaining to ownership interests in subsidiaries held by parties other than the parent, the amount of net income attributable to the parent and to the noncontrolling interest, changes in a parent’s ownership interest, and the valuation of any retained noncontrolling equity investment when a subsidiary is deconsolidated. SFAS No. 160 also establishes disclosure requirements that clearly identify and distinguish between the interests of the parent and the interests of the non-controlling owners. SFAS No. 160 is effective for the Company’s fiscal year beginning May 1, 2009.

F-14

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES (continued) |

The Company is evaluating the potential impact of adopting this statement on the Company’s financial position, results of operations and cash flows.

| 2. | LOAN RECEIVABLE |

| Between October 8, 2009 and January 31, 2010, the Company advanced $470,000 to Golden Anvil, in accordance with the toll processing agreement dated December 3, 2009, bearing no interest and secured by Golden Anvil’s interest in shipments of concentrate, their land and their facilities. |

|

| 3. | PROPERTY AND EQUIPMENT |

| Property and equipment consists of the following: |

| As of | As of | ||||||

| January 31, 2010 | April 30, 2009 | ||||||

| Process, lab and office equipment | $ | 411,734 | $ | 348,000 | |||

| Site Equipment | 179,269 | 145,400 | |||||

| Less: accumulated depreciation | 332,337 | 215,603 | |||||

| $ | 258,666 | $ | 277,797 |

| 4. | INTELLECTUAL PROPERTY |

| On April 2, 2007 the Company entered into a Technology and Asset Purchase Agreement (“NVRM Agreement”) with Robert H. Gunnison and New Verde River Mining Co. Inc. (“NVRM”), whereby the Company acquired equipment and the technology for lixiviation of metals from ore utilizing thiourea stabilization (“Intellectual Property”). The equipment and intellectual property were acquired with the issuance of 2,000,000 shares of the Company’s $0.10 per share common stock and a future cash payment of $300,000, for a purchase price of $500,000. The remaining cash payment balance of $90,000 (NVRM Payable) will be fully paid on or before June 30, 2010. The purchase price was allocated to the assets acquired and liabilities assumed based on their respective fair values at the date of acquisition. The intellectual property was valued at $200,000 and will be amortized quarterly on a straight-line basis over a 5 year period starting with the recognition of revenue from the licensing of the Company’s technology. The Company recorded $30,000 and zero of amortization expense for the nine months ended January 31, 2010 and 2009, respectively. |

|

| 5. | MINERAL PROPERTIES |

| As of January 31, 2010 and April 30, 2009, mineral properties totaling $35,800 and $29,000, respectively, consist of twenty-one (21) mining claims located south of Searchlight, Nevada in the Piute Valley. On January 28, 2007, the Company entered into mineral option agreements to acquire an 87.5% interest in twenty-four (24) mining claims with the issuance of 1,050,000 shares of the Company’s common stock on the date of signing of the option agreement, with the provision that the Company issue an additional 420,000 and 210,000 shares on the fifth anniversary and tenth anniversary, respectively, of the signing of the option agreement if the Company wishes to acquire legal interest to the mining claims. The transaction was valued at an agreed upon price of $10,500. Annual renewal fees are capitalized. Each mining claim is comprised of 160 acres. In August 2008 the Company did not pay the renewal fee on four (4) of the mining claims after confirming title to the claims were void due to not being properly located and being subject to prior segregation. |

F-15

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 5. | MINERAL PROPERTIES (continued) |

| On March 16, 2007 the Company entered into a lease agreement of property with one (1) mining claim, for a term of twenty years, for exploration and potential mining production on 20 acres in Searchlight, Nevada. The Company paid a one-time signing bonus of $5,000 upon execution of the agreement and pays a $4,000 rental fee each August. The Company will also pay an annual royalty equal to five (5) percent of the net profit from any mining production on the property. |

|

| Mining claims are capitalized as tangible assets in accordance with Emerging Issues Task Force abstract 04-02. Upon completion of a bankable feasibility study, the claims will be amortized using the unit-of-production method over the life of the claim. If the Company does not continue with exploration after the completion of the feasibility study, the claims will be expensed at that time. |

|

| 6. | ACCOUNTS PAYABLE - RELATED PARTY |

| As of January 31, 2010 and April 30, 2009, accounts payable – related party consisted of $45,000 and $24,418, respectively, due to directors and officers of the Company for consulting fees and reimbursable expenses. |

|

| 7. | NVRM PAYABLE |

| As of January 31, 2010 and April 30, 2009, NVRM payable consists of $90,000 and $102,683, respectively, payable to New Verde River Mining and Robert H. Gunnison pursuant to the NVRM Agreement noted above (see Note 3). Mr. Gunnison signed an extension agreement extending the payment deadline to June 30, 2010. As a condition of the extension, the payable will bear 6% interest annually. |

|

| 8. | LOANS PAYABLE AND ACCRUED INTEREST – RELATED PARTY |

| As of January 31, 2010 and April 30, 2009, loans payable of $45,277 and $382,569, respectively, consists of borrowings, directly and indirectly, from two directors and one affiliate (5% or greater beneficial owner) of the Company. The balances bear 10% interest, are unsecured and are due on demand. As of January 31, 2010 and April 30, 2009, accrued interest – related party was $116,223 and $64,626, respectively. |

|

| 9. | COMMITMENTS AND CONTINGENCIES |

| Lease obligations – The Company has operating leases for its corporate office and plant facility. Future minimum lease payments under the operating leases as of January 31, 2010 are as follows: |

| Fiscal year ending April 30, 2010 | $ | 17,417 | |

| Fiscal year ending April 30, 2011 | $ | 55,358 | |

| Fiscal year ending April 30, 2012 | $ | 57,771 | |

| Thereafter | $ | 88,967 |

Legal proceedings – The Company is not a party to any legal proceeding and, to our knowledge, no other legal proceedings are pending, threatened or contemplated.

F-16

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 10. | STOCKHOLDERS’ EQUITY |

||

| Common and Preferred Stock: |

|||

| As of January 31, 2009 and April 30, 2009, there were 111,850,352 and 72,679,852 shares of common stock outstanding and zero and zero shares of preferred stock outstanding, respectively. Outstanding shares of common stock consist of the following: |

|||

| a) | On March 16, 2006, the Company issued 1,000 shares of common stock to one individual for cash at $0.001 per share. |

||

| b) | On November 30, 2006, the Company issued 12,500,000 shares of common stock to three individuals for cash at $0.001 per share. |

||

| c) | On December 29, 2006, the Company issued 7,800,000 shares of common stock for cash at $0.01 per share. |

||

| d) | On January 10, 2007, the Company issued 1,050,000 shares of common stock for the purchase of 7/8ths interest in 24 minerals claims at $0.01 per share. |

||

| e) | On February 28, 2007, the Company issued 1,250,000 shares of common stock to three individuals for cash at $0.10 per share. |

||

| f) | On March 31, 2007, the Company issued 1,800,000 shares of common stock to four individuals for cash at $0.10 per share. |

||

| g) | On April 2, 2007, the Company issued 2,000,000 shares of common stock to one individual, in connection with the NVRM Agreement, for the purchase of intellectual property and equipment. |

||

| h) | On May 31, 2007, the Company closed a private placement offering for proceeds of $620,582, of which $505,114 was received and recorded as share subscriptions received as of April 30, 2007. The Company issued 2,482,326 shares of common stock, at $0.25 per share, to non-U.S. investors pursuant to Regulation S of the Securities Act of 1933. |

||

| i) | On June 4, 2007, the Company closed a private placement offering for proceeds of $825,000 and issued 3,300,000 shares of common stock, at $0.25 per share, to accredited U.S. investors pursuant to Regulation D of the Securities Act of 1933. |

||

| j) | On October 5, 2007, the Company issued 13,968,926 shares of common stock in the reverse acquisition of Centrus Ventures Inc. |

||

| k) | On September 3, 2008, the Company completed a private placement of 200,000 units at a price of $0.50 per unit for total proceeds of $100,000. Each unit is comprised of one share of common stock and one-half of one share purchase warrant. Each whole share purchase warrant will entitle the holder to purchase one additional share of common stock at a price of $0.75 per share for a period ending September 2, 2010. |

||

| l) | On November 15, 2008, under the terms of a settlement agreement, the Company issued 450,760 units at a price of $0.30 per unit, with each unit consisting of one common share and one share purchase warrant of the Company. Each warrant is exercisable to purchase an additional common share at a price of $0.50 per share for a period of two (2) years from the date of issuance. The units were issued pursuant to the provisions of Regulation S promulgated under the Securities Act of 1933. |

||

F-17

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 10. | STOCKHOLDERS’ EQUITY (continued) |

|

| m) | On February 24, 2009, the Company issued 9,140,000 units for $457,000 in cash, 12,400,000 units for $620,000 ($400,000 from one director) in loans made to the Company and 1,336,840 units to retire $65,505 in corporate indebtedness under three separate private placement offerings. Each unit was comprised of one share of the Company’s common stock and one share purchase warrant, with each warrant entitling the holder to purchase an additional share of common stock for a period of two years at an exercise price of $0.10 per share. The Company also entered into a management consulting agreement with an officer of the Company, and pursuant to the terms of the agreement issued an aggregate of 3,000,000 restricted shares of its common stock. |

|

| n) | On July 16, 2009, the Company issued 2,000,000 units for $100,000 in loans made to the Company and 500,000 units to retire $25,000 in corporate indebtedness for consulting services under two separate private placement offerings. Each unit was comprised of one share of the Company’s common stock and one share purchase warrant, with each warrant entitling the holder to purchase an additional share of common stock for a period of two years at an exercise price of $0.10 per share. |

|

| o) | On August 4, 2009, the Company issued 295,000 shares of common stock for warrants exercised at $0.10 per share in satisfaction of debt for legal services. |

|

| p) | On August 4, 2009, the Company issued 750,000 shares of common stock for options exercised at $0.05 per share in satisfaction of debt for legal services. |

|

| q) | On August 14, 2009, the Company issued 1,500,000 shares of common stock to an investor relations services firm pursuant to the terms of the consulting agreement. |

|

| r) | On August 18, 2009, the Company issued 3,500,000 units, for $350,000 in loans made to the Company by one director, at a price of $0.10 per unit, with each unit consisting of one share of common stock and one share purchase warrant, with each warrant entitling the holder to purchase one additional share of common stock at a price of $0.20 per share for a period of two years from the date of issue. |

|

| s) | On December 15, 2009, the Company issued 900,000 shares of common stock for options exercised at $0.05 per share in satisfaction of debt for legal services. |

|

| t) | On January 31, 2010, the Company issued 19,400,000 units for $970,000 ($900,000 from one director) in loans made to the Company, 8,280,000 units for $414,000 in cash and 1,775,500 units to retire $88,775 in corporate indebtedness, at a price of $0.10 per unit, with each unit consisting of one share of common stock and one share purchase warrant, with each warrant entitling the holder to purchase one additional share of common stock at a price of $0.20 per share for a period of two years from the date of issue. |

|

| 11. | STOCK INCENTIVE PLANS |

|

| 2010 Stock Incentive Plan - Effective December 7, 2009, the Company adopted the 2010 Stock Incentive Plan (the “2010 Plan"). The 2010 Plan allows the Company to grant certain options to its directors, officers, employees and eligible consultants. A total of 10,000,000 shares of the Company’s common stock are available for issuance under the 2010 Plan. However, the Company may increase the maximum aggregate number of shares of the Company’s common stock that may be optioned and sold under the 2010 Plan provided the maximum aggregate number of shares of common stock that may be optioned and sold under the 2010 Plan shall at no time be greater than 12.5% of the total number of shares of common stock outstanding. |

||

F-18

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 11. | STOCK INCENTIVE PLANS (continued) |

On December 8, 2009, the Company granted non-qualified stock options under the 2010 Plan for the purchase of 7,000,000 shares of common stock at $0.05 per share. The nonqualified stock options were granted to various officers, directors and consultants, are fully vested and expire December 7, 2011. As of January 31, 2010, 900,000 options under the 2010 Plan have been exercised.

From the date of inception through January 31, 2010, compensation expense related to the granting of stock options under the 2010 Plan was $391,478 and is included in general and administrative expense. The Company calculated the value of the options using the Black-Scholes option pricing model using the following assumptions: a risk-free rate of 1.00%, volatility of 252%, estimated life of 2 years and closing stock price of $0.06 per share on the date of grant.

2009 Stock Incentive Plan - Effective January 12, 2009, the Company adopted the 2009 Stock Incentive Plan (the “2009 Plan"). The 2009 Plan allows the Company to grant certain options to its directors, officers, employees and eligible consultants. A total of 5,000,000 shares of the Company’s common stock are available for issuance under the 2009 Plan.

On January 16, 2009, the Company granted non-qualified stock options under the 2009 Plan for the purchase of 5,000,000 shares of common stock at $0.05 per share. The nonqualified stock options were granted to various officers, directors and consultants, are fully vested and expire January 15, 2011. As of January 31, 2010, 750,000 options under the 2009 Plan have been exercised.

From the date of inception through January 31, 2010, compensation expense related to the granting of stock options under the 2009 Plan was $342,550 and is included in general and administrative expense. The Company calculated the value of the options using the Black-Scholes option pricing model using the following assumptions: a risk-free rate of 1.00%, volatility of 316%, estimated life of 2 years and closing stock price of $0.07 per share on the date of grant.

Effective December 7, 2009, the Company suspended the 2009 Plan. No new options may be granted under the 2009 Plan and the 2009 Plan will be terminated once all outstanding options granted under the 2009 Plan have been exercised, expired or otherwise terminated.

2008 Stock Incentive Plan - Effective February 1, 2008, the Company adopted the 2008 Stock Incentive Plan (the “2008 Plan"). The 2008 Plan allowed the Company to grant certain options to its directors, officers, employees and eligible consultants. A total of 4,600,000 shares of the Company’s common stock are available for issuance under the 2008 Plan.

On February 1, 2008, the Company granted non-qualified stock options under the 2008 Plan for the purchase of 4,340,000 shares of common stock at $0.74 per share. The nonqualified stock options were granted to various officers, directors and consultants, are fully vested and expire January 31, 2010. As of January 31, 2010 all 4,340,000 stock options expired without exercise.

From the date of inception through January 31, 2010, compensation expense related to the granting of stock options under the 2008 Plan was $3,583,702 and is included in general and administrative expense. The Company calculated the value of the options using the Black-Scholes option pricing model using the following assumptions: a risk-free rate of 4.50%, volatility of 107%, estimated life of 2 years and closing stock price of $1.22 per share on the date of grant.

F-19

| ROYAL MINES AND MINERALS CORP. |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| (Unaudited) |

| JANUARY 31, 2010 |

| 12. | RELATED PARTY TRANSACTIONS |

For the three months ended January 31, 2010 and 2009, the Company incurred $81,000 and $51,000, respectively, in consulting fees expense from companies with a common director or officer. For the nine months ended January 31, 2010 and 2009, the Company incurred $243,000 and $228,000, respectively, in consulting fees expense from companies with a common director or officer.

F-20

| ITEM 2. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Quarterly Report constitute "forward-looking statements.” These statements, identified by words such as “plan,” "anticipate," "believe," "estimate," "should," "expect" and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements. Such risks and uncertainties include those set forth under the caption "Part II –Item 1A. Risk Factors" and elsewhere in this Quarterly Report. We do not intend to update the forward-looking information to reflect actual results or changes in the factors affecting such forward-looking information. We advise you to carefully review the reports and documents, particularly our Annual Reports, Quarterly Reports and Current Reports, that we file from time to time with the United States Securities and Exchange Commission (the “SEC”).

OVERVIEW

We were incorporated on December 14, 2005 under the laws of the State of Nevada. We are an exploration stage company and our primary objectives are to: (i) commercially extract and refine precious metals from mined ore at our Phoenix Facility; (ii) joint venture, acquire and develop mining projects in North America; and (iii) generate ongoing revenues from the licensing of our proprietary, environmentally-friendly lixiviation.

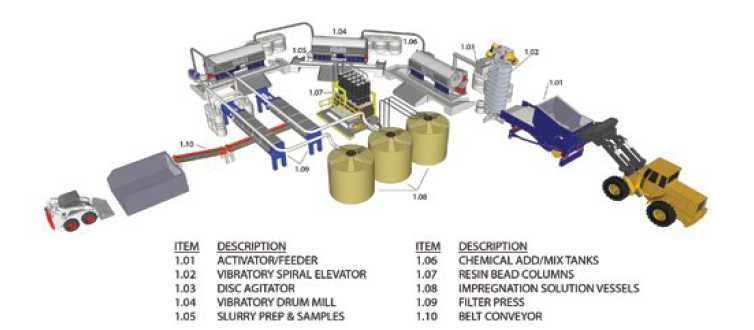

We are focusing our business on toll processing mined ore for third party mining companies at our processing and refining plant located in Phoenix, Arizona (the “Phoenix Facility”). Our Phoenix Facility is a compact, modular, cost efficient, turn-key operation, with a capacity to process up to 10 tons per day. In processing ore at our Phoenix Facility, we utilize our environmentally friendly proprietary technology for the lixiviation of minerals using thiourea stabilization (the “Lixiviation Technology”). The use of thiourea stabilization is more environmentally friendly than cyanide or sulfuric acid, which have traditionally been used for this purpose.

We continued to earn revenues, although minimal, from the processing of ore at our Phoenix Facility during the nine months ended January 31, 2010. On December 3, 2009, we entered into a Toll Process Agreement with Golden Anvil, SA de CV (“Golden Anvil”), a company which we previously entered into a Letter of Intent with respect to a proposed 50/50 joint venture. We are continuing our due diligence of the Golden Anvil project in order to form a proposed 50/50 joint venture with Golden Anvil. The details of the Letter of Intent and Toll Processing Agreement are set out under the heading “Golden Anvil” below.

We also plan to engage in the exploration and development of our Piute Valley Property located in Clark County, Nevada. Our Piute Valley Property is a potential gold project that consists of a mineral lease covering 20.61 acres of patented claims (the “Smith Lease”) and an option to acquire a 7/8th interest in 20 unpatented claims (the “BLM Claims”) located near the Smith Lease. Each BLM Claim is comprised of 160 acres.

We are actively seeking to enter into agreements to license our Lixiviation Technology to third parties and we are also seeking to enter into joint ventures with third parties to explore and develop additional mining projects. There are no assurances that we will be able to license our Lixiviation Technology or enter into joint ventures for the exploration and development of additional mining projects.

RECENT CORPORATE DEVELOPMENTS

The following corporate developments occurred since our fiscal quarter ended October 31, 2009:

3

| 1. |

Golden Anvil Toll Processing Agreement. On December 4, 2009, we entered into a toll processing agreement dated for reference December 3, 2009 (the “Toll Processing Agreement”) with Golden Anvil. The details of the Toll Processing Agreement are set out under the heading “Golden Anvil” below. |

| 2. |

Adoption of 2010 Stock Incentive Plan. On December 7, 2009, our Board of Directors adopted our 2010 Stock Incentive Plan (the “2010 Plan”). The 2010 Plan allows us to grant options to our officers, directors and employees. In addition, we may grant options to individuals who act as consultants for us, so long as those consultants do not provide services connected to the offer or sale of our securities in capital raising transactions and do not directly or indirectly promote or maintain a market for our securities. |

|

A total of 10,000,000 shares of our common stock are available for issuance under the 2010 Plan. However, our Board of Directors may increase the maximum aggregate number of shares of our common stock that may be optioned or sold under the 2010 Plan provided that the maximum aggregate number of shares of common stock that may be optioned and sold under the plan shall at no time be greater than 12.5% of the total number of shares of common stock outstanding. | |

|

The 2010 Plan provides for the grant of incentive stock and non-qualified stock options. Incentive stock options granted under the 2010 Plan are those intended to qualify as “incentive stock options” as defined under Section 422 of the Internal Revenue Code. However, in order to qualify as “incentive stock options” under Section 422 of the Internal Revenue Code, the 2010 Plan must be approved by our stockholders within 12 months of its adoption. The 2010 has not been approved by our stockholders. Non-qualified stock options granted under the 2010 Plan are option grants that do not qualify as incentive stock options under Section 422 of the Internal Revenue Code. | |

| 3. |