Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ROYAL MINES & MINERALS CORP | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - ROYAL MINES & MINERALS CORP | exhibit31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - ROYAL MINES & MINERALS CORP | exhibit32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - ROYAL MINES & MINERALS CORP | exhibit32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - ROYAL MINES & MINERALS CORP | exhibit31-1.htm |

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended April 30, 2014

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

COMMISSION FILE NUMBER 000-52391

ROYAL MINES AND MINERALS CORP.

(Exact name of registrant as specified in its charter)

| NEVADA | 20-4178322 |

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) |

| 2580 Anthem Village Dr. | |

| Henderson, NV | 89052 |

| (Address of principal executive offices) | (Zip Code) |

| Registrant's telephone number, including area code: | (702) 588-5973 |

| Securities registered pursuant to Section 12(b) of the Act: | NONE. |

| Securities registered pursuant to Section 12(g) of the Act: | Common Stock, $0.001 Par Value Per Share. |

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined by Rule 405 of the Securities Act.

[

] Yes [X] No

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or Section 15(d) of the

Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

[X] Yes

[ ] No

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (s. 229.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (s229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act).

[ ]

Yes [X] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $673,710 as of October 31, 2013, based on the price at which the common equity was last sold on the OTC Bulletin Board.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of August 12, 2014, the Registrant had 212,813,141 shares of common stock outstanding.

ROYAL MINES AND MINERALS CORP.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED APRIL 30, 2014

TABLE OF CONTENTS

Page 2 of 29

PART I

The information in this discussion contains forward-looking statements. These forward-looking statements involve risks and uncertainties, including statements regarding the Company's capital needs, business strategy and expectations. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "intend," "anticipate," "believe," "estimate,” "predict," "potential" or "continue," the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks described below, and, from time to time, in other reports the Company files with the United States Securities and Exchange Commission (the “SEC”). These factors may cause the Company's actual results to differ materially from any forward-looking statement. The Company disclaims any obligation to publicly update these statements, or disclose any difference between its actual results and those reflected in these statements.

As used in this Annual Report, the terms “we,” “us,” “our,” “Royal Mines,” and the “Company” mean Royal Mines And Minerals Corp., unless otherwise indicated.

All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

| ITEM 1. | BUSINESS. |

Overview

We were incorporated on December 14, 2005 under the laws of the State of Nevada. We are an exploration stage company and our primary objectives are to: (i) commercially extract and refine precious metals from our own and others mineralized materials; (ii) use our leaching process (Cholla) to recover precious metals from specific ore bearing materials; and (iii) joint venture, acquire and develop mining projects in North America.

We are focusing our business on commercially processing specific fly ash and other mineable materials, using a leach process that exposes extractable gold (the “Cholla Process”) at our processing and refining plant located in Scottsdale, Arizona (the “Scottsdale Facility”). In November 2012, we shut down our Phoenix Facility and we have no plans to continue that operation.

In August 2012, we did not pay the renewal fee on our interest a gold project that consisted of a mineral lease covering 20.61 acres of patented claims and an option to acquire a 100% interest in 20 unpatented claims located near the mineral lease.

In September 2013, we released Golden Anvil S.A. de C.V. (“Golden Anvil”) from loan agreements pursuant to which, Golden Anvil owed us USD$983,055 in secured indebtedness. In exchange for the release, Golden Anvil had 2,000,000 common shares of Gainey Capital Corp. (“Gainey”) issued to us as part of an asset purchase agreement between Golden Anvil and Gainey.

We are actively seeking to enter into joint ventures with third parties who have legal rights to fly ash resources, including landfills/monofills. There is no assurance that we will be able to commercially extract precious metals from fly ash or other mineable ores using our Cholla process or that we will be able to enter into joint ventures for the exploration and development of additional mining projects.

RECENT CORPORATE DEVELOPMENTS

The following corporate developments occurred since the filing of our Form 10-Q for the fiscal quarter ended January 31, 2014:

Letter of Intent

On July 10, 2014, we entered into a letter of intent with Lafarge North America Inc. (“Lafarge”) dated for reference July 7, 2014 (the “Letter of Intent"). As outlined in the Letter of Intent, we wish to enter into a joint venture (the “Venture”) with Lafarge, with respect to the commercialization of our process for the recovery of precious metals from coal ash and other materials (the “Technology”). The Venture is subject to completion of

satisfactory due diligence by both parties and the entry into a definitive agreement. The Letter of Intent shall terminate on December 31, 2015.

During the term of the Letter of Intent, We and Lafarge have agreed to do the following:

| (a) |

Lafarge has agreed to provide the time and expertise of Steve Butler, a Lafarge technician, to assist us in the commercialization of the Technology, for up to 50 hours per month, for a period expiring December 31, 2014. In addition, Lafarge has agreed to provide sufficient lab facilities and equipment to Mr. Butler and cover all of the expenses related to Mr. Butler’s services, including, but not limited to, salary, benefits and reasonable travel costs. |

| (b) |

In exchange for Mr. Butler’s services, we have agreed to grant an exclusive right to Lafarge to exploit the Technology, subject to certain royalties, at 28 coal fired power generation stations under contract with Lafarge, up to 7 additional stations to be identified by Lafarge, and at facilities where Lafarge stores its coal by-products. |

| (c) |

We have agreed to develop a business plan for the commercialization of the Technology and present it to Lafarge no later than January 31, 2015. |

Loan Agreement

On April 16, 2014, we entered into a convertible loan agreement (the “Loan Agreement") with Bruce Matheson. Under the terms of the Convertible Loan Agreement, Mr. Matheson has agreed to loan us up to $250,000 (the “Principal”), of which $100,000 has already been advanced. The loan bears interest at a rate of 6% per annum, compounded annually and has a maturity date of April 1, 2015 (the “Maturity Date").

At any time prior to the Maturity Date, Mr. Matheson may elect to receive units (each a “Unit") in exchange for any portion of the Principal outstanding on the basis of one Unit for each $0.05 of indebtedness converted (the “Unit Conversion Option"). Each Unit consists of one share of our common stock and one warrant to purchase an additional share of our common stock at a price of $0.10 per share for a period of two years from the date of issuance. If Mr. Matheson exercises the Unit Conversion Option, any interest that accrued on the portion of the Principal that was converted shall be forgiven.

At any time prior to the Maturity Date, if the amount advanced under the Convertible Loan Agreement equals $250,000 and Mr. Matheson has not exercised the Unit Conversion Option, Mr. Matheson may elect to forgive the Principal, including any interest accrued on the Principal, in exchange for the option to form a joint venture with us (the “Joint Venture Option”) for the purpose of constructing and operating a processing plant at a new facility that will utilize our process for the recovery of precious metals from coal ash and other materials (the “Joint Venture"). The Joint Venture Option, if exercised, would involve Mr. Matheson and us forming a limited liability company (“Newco”) to operate the Joint Venture and ownership of Newco would be split equally between Mr. Matheson and us. In addition, Mr. Matheson would advance $250,000 to Newco to fund the initial construction and operation costs of the Joint Venture.

Mr. Matheson represented that he was not a "US Person" as that term is defined by Regulation S of the Securities Act of 1933, as amended.

Loan and Joint Venture Agreement

On April 16, 2014, we entered into a loan and joint venture agreement (the “Loan and Joint Venture Agreement") with GJS Capital Corp. (the "Creditor"). Under the terms of the Loan and Joint Venture Agreement, the Creditor has agreed to loan us $150,000 (the “Principal”), which has already been advanced. The loan bears interest at a rate of 6% per annum, compounded annually and has a maturity date of August 31, 2014 (the “Maturity Date").

At any time prior to the Maturity Date, the Creditor may elect to receive units (each a “Unit") in exchange for any portion of the Principal outstanding on the basis of one Unit for each $0.05 of indebtedness converted (the “Unit Conversion Option"). Each Unit consists of one share of our common stock and one warrant to purchase an additional share of our common stock at a price of $0.10 per share for a period of two years from the date of issuance. If the Creditor exercises the Unit Conversion Option, any interest that accrued on the portion of the Principal that was converted shall be forgiven.

If the Creditor exercises the Unit Conversion Option, the Creditor will receive a net profits interest (the “Net Profits Interest”) an any future profits received by Company that are derived from our process for the recovery of precious metals from coal ash and other materials (the “Technology”) at a basis of 1% of our net profits for every $10,000 of converted Principal. The Net Profits Interest will terminate when the Creditor receives eight times the amount of converted Principal.

In addition, if the Creditor exercises the Unit Conversion Option, we will use our best efforts to ensure that a director nominated by the Creditor is appointed to our Board of Directors. If the Creditor does nominate such director, we will by allowed to nominate and appoint an additional director to our Board of Directors.

The Creditor has agreed to form a joint venture with us for the purpose of constructing and operating a processing plant at our Scottsdale Facility, an existing facility, utilizing our licensed technology. Under the agreement, the Creditor and we agreed to form a limited liability company (“Newco”) to operate the Joint Venture, and ownership of Newco would be split equally between the Creditor and us. In addition, the Creditor would advance $250,000 plus up to 15% for contingencies, a total of $287,500, to Newco to fund the initial construction and operation costs of Newco. These advances are not expected to be paid back to the Creditor.

We have been operating in the Scottsdale Facility in prior years using the same licensed technology. As of April 30, 2014 and through the filing date of the Form 10-K, the Creditor and we have not established a limited liability corporation in accordance with the agreement. The equipment used in the Scottsdale facility, lease agreements for the Scottsdale facility, and other supplies purchased and costs incurred by the Scottsdale facility were incurred by us and are our legal obligation. As of April 30, 2014, no bank account has been established for the joint venture and as a result we have been paying all expenses related to the Scottsdale facility directly via our bank accounts. Funding under the joint venture been deposited by the Company into bank accounts owned by the Company. As of April 30, 2014, the Creditor funded a total of $163,654..

The Creditor represented that it was not a "US Person" as that term is defined by Regulation S of the Securities Act of 1933, as amended.

Extension of Warrants

On July 10, 2014, we extended the expiration dates of 23,020,000 warrants previously issued on July 13, 2011, from an expiration date of July 12, 2014 to July 12, 2015. Each warrant entitles the holder to purchase an additional share of our common stock at a price of $0.10 per share.

Facilities and Technologies

Our Scottsdale Facility is an industrial building of approximately 4,550 square feet located in Scottsdale, Arizona. The Scottsdale Facility is designed specifically for processing coal ash using our licensed technology. We have yet to realize significant revenue using our licensed technology.

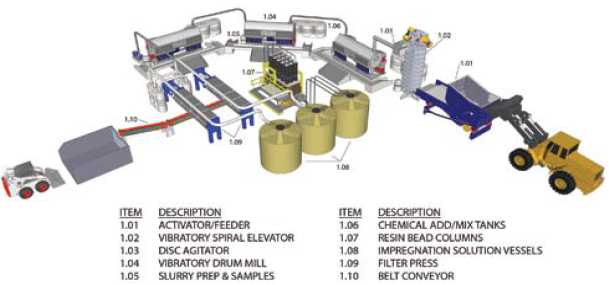

Our Phoenix Facility is an industrial building of approximately 9,800 square feet located in Phoenix, Arizona. The Phoenix Facility was designed as a compact, modular, cost efficient, turn-key operation, with a capacity of processing 4 tons of fly ash per day. In our Phoenix Facility we utilized our Cholla Process and our Lixiviation Technology, being a closed loop, zero liquid discharge, leach extraction process. Below is a diagram of a 2 ton per hour processing circuit. The circuit at our Phoenix Facility is smaller in size. In November 2012, we shut down our Phoenix Facility and we have no plans to continue that operation. Our lease on the Phoenix Facility expired in August 2013 and we did not renew the lease. We have yet to realize significant revenues from our Cholla Process and Lixiviation Technology.

We acquired our interest in the Lixiviation Technology and our Phoenix Facility on April 2, 2007 under the terms of a Technology and Asset Purchase Agreement (the “Technology Agreement”) with New Verde River Mining Co., Inc. (“New Verde”) and Robert H. Gunnison. In consideration of the Lixiviation Technology and the Phoenix Facility, we paid and issued the following:

| (a) |

$300,000 to New Verde for the purchase of the equipment within the Phoenix Facility as follows: | ||

| (i) |

$175,000 upon execution of the Technology Agreement (which amount has been paid); and | ||

| (ii) |

$125,000 (of which $50,000 is outstanding). | ||

| (b) |

issued 2,000,000 shares to Mr. Gunnison for the Lixiviation Technology. | ||

Concurrent with the acquisition of the Lixiviation Technology and the Phoenix Facility, we entered into an Employment Agreement dated April 2, 2007 (the “Employment Agreement”) with Robert H. Gunnison whereby Mr. Gunnison agreed to act as our Production Manager commencing on April 2, 2008. In consideration of Mr. Gunnison’s services, we paid Mr. Gunnison a salary of $120,000 per annum. Mr. Gunnison left as Production Manager in January 2012, but assists us on a consulting basis.

On March 13, 2009, we entered into the Payment Extension and License Agreement with New Verde and Mr. Gunnison whereby New Verde and Mr. Gunnison agreed to extend the deadline for the balance owed to New Verde to June 30, 2010. In consideration of the extension, we agreed to pay interest at 6% per annum on the balance owing to New Verde. We also agreed to grant New Verde and Mr. Gunnison a non-exclusive worldwide license on the Technology (the “License”). The License will only take effect in the event of the termination of the employment agreement between Mr. Gunnison and the Company. New Verde and Mr. Gunnison will not be permitted to assign or sub-license without our prior written approval. On July 22, 2010 and July 7, 2011, we entered into a payment extension with New Verde and Mr. Gunnison whereby New Verde and Mr. Gunnison agreed to extend the deadline for the balance owed to New Verde to June 30, 2011 and June 30, 2012, respectively. In consideration of the extension, we agreed to extend the accrual of interest at 6% per annum on the balance owing to New Verde. As of the date of this filing the deadline has been extended to June 30, 2015.

Compliance with Government Regulation

Our activities are subject to extensive federal, state, and local regulations in the United States. These statutes regulate the mining of and exploration for mineral properties, and also the possible effects of such activities upon the environment. Future legislation and regulations could cause additional expense, capital expenditures, restrictions and delays in the development of the Piute Valley Property, the extent of which cannot be predicted. Our Piute Valley Property is comprised of patented and unpatented mining claims located on federal land

managed by the U.S. Bureau of Land Management. Mining activities on the Piute Valley Property must be carried out in accordance with a permit issued by the Bureau of Land Management.

Other regulatory requirements monitor the following:

| (a) |

Explosives and explosives handling. | |

| (b) |

Use and occupancy of site structures associated with mining. | |

| (c) |

Hazardous materials and waste disposal. | |

| (d) |

State Historic site preservation. | |

| (e) |

Archaeological and paleontological finds associated with mining. | |

| (f) |

Wildlife preservation. |

The State of Nevada adopted the Mined Land Reclamation Act (the “Nevada Act”) in 1989 that established design, operation, monitoring and closure requirements for all mining facilities. The Nevada Act has increased the cost of designing, operating, monitoring and closing new mining facilities and could affect the cost of operating, monitoring and closing existing mining facilities. The State of Nevada has also adopted reclamation regulations. The Nevada Act also requires reclamation plans and permits for exploration projects that will result in more than five acres of surface disturbance.

In the context of environmental permitting, we must comply with known standards, existing laws and regulations that may entail greater or lesser costs and delays, depending on the nature of the activity to be permitted and how stringently the regulations are implemented by the permitting authority. We are not presently aware of any specific material environmental constraints affecting our property that would preclude the economic development or operation of any specific property.

If our property merits additional exploration or extraction work, it is reasonable to expect that compliance with environmental regulations will increase our costs. Such compliance may include feasibility studies on the surface impact of our proposed operations, costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on our mineral property.

Competition

We are an exploration stage company. We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

We will also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to make investments in junior mineral exploration companies. The presence of competing junior mineral exploration companies may impact our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors. We will also compete with other junior and senior mineral companies for available resources, including, but not limited to, professional geologists, camp staff, helicopter or float planes, mineral exploration supplies and drill rigs.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

Research and Development Expenditures

During our fiscal year ended April 30, 2014, we spent approximately $466,930 on mineral exploration and evaluation costs. During our fiscal year ended April 30, 2013, we spent approximately $584,970 on mineral exploration and evaluation costs.

Employees

Other than our executive officers, we do not have any employees at the time of this Annual Report.

| ITEM 1A. | RISK FACTORS. |

The following are some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates contained in our forward-looking statements. We may encounter risks in addition to those described below. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also impair or adversely affect our business, financial condition or results of operation.

If we do not obtain additional financing, we may not be able to continue our operations at our Scottsdale Facility or enter into any potential joint venture or licensing agreements.

As of April 30, 2014, we had cash on hand of $67,991 and accumulated net loss of $15,794,055 and accumulated other comprehensive loss of $500,000 since inception. Our plan of operation calls for significant expenses in connection with the operation of our Scottsdale Facility and the entry of any potential joint ventures. If we are unable to raise sufficient financing there is a substantial risk that we will be unable to meet payments of principal and interest to our creditors and pay our consultants and employees. In November 2012, we shut down our Phoenix Facility and we have no plans to continue that operation. In addition, we will require substantial financing in order to implement our plan of operation over the next twelve months. There is no assurance that this will satisfy all of our working capital requirements for the next twelve months or that these funds will be sufficient to complete our planned exploration and development programs.

We are currently, party to a lawsuit that may be expensive and time consuming, and, if resolved adversely, could have a significant impact on our business and financial condition.

We received a verified complaint (the “Complaint”), dated September 12, 2013, that was filed in Arizona Superior Court, Maricopa County, by McKendry Enterprises, Inc. Profit Sharing Plan and Retirement Trust (the “Landlord”), alleging breach of contract and breach of covenant of good faith and fair dealing in relation to the lease agreement dated June 6, 2007, between the Landlord and us, as amended (the “Lease Agreement”). The Complaint seeks to recover damages of at least $108,581, including, but not limited to: (1) $56,358 in rent; (ii) $52,223 for maintenance, clean up costs and construction; and (3) undetermined damages for additional repair, clean up and legal fees. We intend to vigorously defend this lawsuit. There is no assurance that we will be able to successfully defend the lawsuit. If the lawsuit is resolved unfavorably it will have a significant impact on our business operations and will limit our ability to continue our operations.

Because we are an exploration stage company, we face a high risk of business failure.

We have earned minimal revenues from the processing of ore at our Phoenix and Scottsdale Facilities. Our primary business activities have involved the exploration and development on the Piute Valley Property and the commencement of operations at our Phoenix Facility and Scottsdale Facility. In August 2012, we did not pay the renewal fee on the Piute Valley Property and the BLM Claims, allowing those claims to lapse. In November 2012, we shut down our Phoenix Facility and we have no plans to continue that operation. Potential investors should be aware of the difficulties normally encountered by exploration stage companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

Because we anticipate our operating expenses will increase prior to our earning significant revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses prior to realizing any significant revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the operation of our Scottsdale Facility or the exploration and development of our mineral property and the production of minerals thereon, if any, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we may not be able to ever generate any operating revenues or achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found and our business will fail.

The search for valuable minerals as a business is extremely risky. We may not find commercially exploitable reserves of precious metals on our mineral claims. Exploration for minerals is a speculative venture, necessarily involving substantial risk. The expenditures to be made by us in the upcoming exploration of the mineral claims may not result in the discovery of commercial quantities of ore. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages if and when we conduct mineral exploration activities.

The search for valuable minerals involves numerous hazards. As a result, if and when we conduct exploration activities we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

Certain work to be performed at our facilities may require us to apply for permits from federal, state or local regulatory bodies.

If our applications for permits from the relevant regulatory bodies are denied, we may not be able to proceed with our exploration and development programs as disclosed above, which could have a negative effect on our business.

If we are unable to hire and retain key personnel, we may not be able to implement our business plan and our business will fail.

Our success will largely depend on our ability to hire highly qualified personnel with experience in geological exploration. These individuals may be in high demand and we may not be able to attract the staff we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel, or may lose such employees after they are hired. Our failure to hire key personnel when needed could have a significant negative effect on our business.

If we complete additional financings through the sale of shares of our common stock, our existing stockholders will experience dilution.

The most likely source of future financing presently available to us is through the issuance of our common stock. The only other anticipated alternative for the financing of further exploration would be the offering by us of an interest in our properties to be earned by another party or parties carrying out further exploration thereof, which is not presently contemplated. Issuing shares of our common stock, for financing purposes or otherwise, will dilute the interests of our existing stockholders.

Because our stock is a penny stock, stockholders will be more limited in their ability to sell their stock.

Our common stock is considered to be a “penny stock” since it does not qualify for one of the exemptions from the definition of “penny stock” under Section 3a51-1 of the Exchange Act. Our common stock is a “penny stock”

because it meets one or more of the following conditions (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded on a “recognized” national exchange; (iii) it is not quoted on the Nasdaq Stock Market, or even if so, has a price less than $5.00 per share; or (iv) is issued by a company that has been in business less than three years with net tangible assets less than $5 million.

The principal result or effect of being designated a “penny stock” is that securities broker-dealers participating in sales of our common stock will be subject to the “penny stock” regulations set forth in Rules 15-2 through 15g-9 promulgated under the Exchange Act. For example, Rule 15g-2 requires broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document at least two business days before effecting any transaction in a penny stock for the investor's account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor's financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult and time consuming for holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

| ITEM 2. | PROPERTIES. |

Our principal office is at 2580 Anthem Village Dr., Henderson, NV 89052, consisting of approximately 150 square feet, which we rent at a cost of $850 per month. We entered into a lease agreement through December 31, 2013, and thereafter the lease continues on a month-to-month basis.

We also rent premises located at 7815 E. Thunderbird Rd., Scottsdale, AZ 85260, for use as corporate housing, at a cost of $2,600 per month. We entered into a lease with respect to this premises which expires May 31, 2015.

We also lease our Scottsdale Facility located at 14325 N. 79th St., Scottsdale, AZ 85260. The Scottsdale Facility is leased pursuant to a Lease Agreement dated June 6, 2011 with Cimarron Industrial Partners, LLC at a cost of $3,486 per month. The Scottsdale Facility consists of office and warehouse space of approximately 4,550 square feet. This lease agreement is month-to-month.

| ITEM 3. | LEGAL PROCEEDINGS. |

We are not a party to any other legal proceedings and, to our knowledge, no other legal proceedings are pending, threatened or contemplated.

| ITEM 4. | MINE SAFETY DISCLOSURES. |

None.

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

MARKET INFORMATION

Our common shares are currently quoted on the OTC Bulletin Board under the symbol “RYMM." The following table indicates the high and low prices of the common shares obtained during the periods indicated:

| 2014 | 2013 | |||||||||||

| High | Low | High | Low | |||||||||

| First Quarter ended July 31 | $ | 0.035 | $ | 0.007 | $ | 0.04 | $ | 0.02 | ||||

| Second Quarter ended October 31 | $ | 0.049 | $ | 0.01 | $ | 0.04 | $ | 0.00 | ||||

| Third Quarter ended January 31 | $ | 0.05 | $ | 0.03 | $ | 0.02 | $ | 0.00 | ||||

| Fourth Quarter ended April 30 | $ | 0.05 | $ | 0.018 | $ | 0.01 | $ | 0.00 | ||||

REGISTERED HOLDERS OF OUR COMMON STOCK

As of August •, 2014, there were 137 registered holders of record of our common stock. We believe that a number of stockholders hold stock on deposit with their brokers or investment bankers registered in the name of stock depositories.

DIVIDENDS

We have neither declared nor paid any cash dividends on our capital stock since our inception and do not contemplate paying cash dividends in the foreseeable future. It is anticipated that earnings, if any, will be retained for the operation of our business. Our board of directors will determine future dividend declarations and payments, if any, in light of the then-current conditions they deem relevant and in accordance with the Nevada Revised Statutes.

There are no restrictions in our articles of incorporation or in our bylaws which prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of a dividend:

| (a) |

We would not be able to pay our debts as they become due in the usual course of business; or | |

| (b) |

Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving distributions. |

RECENT SALES OF UNREGISTERED SECURITIES

All unregistered sales of our equity securities made during the year ended April 30, 2014 have been reported by us in our Quarterly Reports and our Current Reports filed with the SEC during the year.

| ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

RESULTS OF OPERATIONS

Summary of Year End Results

| Years Ended April 30, | Percentage | ||||||||

| 2014 | 2013 | Increase / (Decrease) | |||||||

| Revenue | $ | - | $ | - | n/a | ||||

| Operating Expenses | (1,363,124 | ) | (1,239,454 | ) | 10.0% | ||||

| Other Items | (81,098 | ) | (79,557 | ) | 1.9% | ||||

| Net Loss | $ | (1,444,222 | ) | $ | (1,319,011 | ) | 9.5% | ||

Revenues

During the years ended April 30, 2014 and 2013, we earned no revenues. We are currently in the exploration stage of our business. We can provide no assurances that we will be able to develop a commercially viable process or earn significant revenue from the processing of coal ash.

Operating Expenses

The major components of our operating expenses for the years ended April 30, 2014 and 2013 are outlined in the table below:

| Percentage | |||||||||

| Year Ended | Year Ended | Increase / | |||||||

| April 30, 2014 | April 30, 2013 | (Decrease) | |||||||

| Mineral exploration and evaluation expenses | $ | 466,930 | $ | 584,970 | (20.2)% | ||||

| Mineral exploration and evaluation expenses – related party | 60,000 | 5,000 | 1100.0% | ||||||

| General and administrative | 238,633 | 127,161 | 87.7% | ||||||

| General and administrative – related party | 497,666 | 204,000 | 144.0% | ||||||

| Depreciation and amortization | 99,895 | 103,995 | (3.9)% | ||||||

| Impairment of mineral properties | - | 63,400 | (100.0)% | ||||||

| Impairment of intellectual property | - | 150,000 | (100.0)% | ||||||

| Bad debt expense | - | 14,041 | (100.0)% | ||||||

| Gain on settlement of accounts payable | - | (1,613 | ) | (100.0)% | |||||

| Gain on sale of fixed asset | - | (11,500 | ) | (100.0)% | |||||

| Total Expenses | $ | 1,363,124 | $ | 1,239,454 | 10.0% |

Our operating expenses for the year ended April 30, 2014 increased as compared to the year ended April 30, 2013. The increase in our operating expenses primarily relates to an increase in mineral exploration and evaluation – related party expenses, and general and administrative expenses in fiscal 2014. The increase was partially offset by decreases in mineral exploration and evaluation expenses and the fact that we did not record any impairment of mineral or intellection properties or have any bad debt expense in fiscal 2014.

Mineral exploration and evaluation expenses primarily consisted of rent, leased equipment, extraction-processing costs, consulting fees and labor expenses in connection with our Scottsdale Facility and Phoenix Facility. The decrease in mineral exploration and evaluation expenses in fiscal 2014 was primarily due to the closure of our Phoenix Facility in November 2012 and a decrease in equipment rental and extraction processing costs due to reduced activities at our Scottsdale Facility in October 2012. The decrease was offset by $119,400 in compensation expense for stock options issued to consultants and contract labor in November 2013.

Our general and administrative expenses primarily consisted of: (i) monthly consulting fees paid to our Chief Financial Officer, Mr. Mitchell and accrued for our Chief Executive Officer, Mr. Matheson (in fiscal 2013 only); (ii) legal and audit fees in connection with meeting our reporting requirements under the Exchange Act; and (iii) $452,572 in compensation expense for stock options issued to our executives, directors and consultants in November 2013.

Impairment of mineral properties relates to our decision not to renew the Smith Lease and BLM Claims. Impairment of intellectual property relates to the impairment of our thiourea lixiviation technology.

We anticipate that our operating expenses will increase significantly as we implement our plan of operation for our Scottsdale Facility.

LIQUIDITY AND CAPITAL RESOURCES

Cash Flows

| Years Ended April 30 | ||||||

| 2014 | 2013 | |||||

| Net Cash Used In Operating Activities | $ | (584,014 | ) | $ | (751,499 | ) |

| Net Cash Provided By (Used In) Investing Activities | (120,478 | ) | 11,810 | |||

| Net Cash Provided By Financing Activities | 758,777 | 682,717 | ||||

| Net Increase (Decrease) in Cash During Period | $ | 54,285 | $ | (56,972 | ) | |

Working Capital

| Percentage | |||||||||

| At April 30, 2014 | At April 30, 2013 | Increase / (Decrease) | |||||||

| Current Assets | $ | 76,250 | $ | 25,243 | 202.1% | ||||

| Current Liabilities | (1,166,591) | (1,731,745) | (32.6)% | ||||||

| Working Capital Deficit | $ | (1,090,341) | $ | (1,706,502) | (36.1)% |

As at April 30, 2014, we had a working capital deficit of $1,090,341 as compared to a working capital deficit of $1,706,502 as at our year ended April 30, 2013. The decrease in our working capital deficit is primarily due to a decrease in accounts payable – related parties, and loans payable – related parties related to the issuance of stock and warrants in November 2013. The decrease was partially offset by increases in accounts payable, accrued interest – related parties and loans payable.

Financing Requirements

Currently, we do not have sufficient financial resources to complete our plan of operation for the next twelve months. As such, our ability to complete our plan of operation is dependent upon our ability to obtain additional financing in the near term.

We anticipate continuing to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing shareholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our planned mining, development, and exploration activities.

OFF-BALANCE SHEET ARRANGEMENTS

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures, or capital resources that is material to stockholders.

CRITICAL ACCOUNTING POLICIES

We have identified certain accounting policies, described below, that are most important to the portrayal of our current financial condition and results of operations. Our significant accounting policies are disclosed in Note 1 to our audited financial statements included in this Annual Report.

Use of Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Mineral Property Rights – Costs of acquiring mining properties are capitalized upon acquisition. Mine development costs incurred either to develop new ore deposits, to expand the capacity of mines, or to develop mine areas substantially in advance of current production are also capitalized once proven and probable reserves exist and the property is a commercially mineable property. Costs incurred to maintain current production or to maintain assets on a standby basis are charged to operations. Costs of abandoned projects are charged to operations upon abandonment. The Company evaluates the carrying value of capitalized mining costs and related property and equipment costs, to determine if these costs are in excess of their recoverable amount whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable. Evaluation of the carrying value of capitalized costs and any related property and equipment costs would be based upon expected future cash flows and/or estimated salvage value in accordance with Accounting Standards Codification (ASC) 360-10-35-15, Impairment or Disposal of Long-Lived Assets.

Exploration Costs – Mineral exploration costs are expensed as incurred.

Revenue Recognition – The Company recognizes revenues and the related costs when persuasive evidence of an arrangement exists, delivery and acceptance has occurred or service has been rendered, the price is fixed or determinable, and collection of the resulting receivable is reasonably assured. Revenue from licensing our technology is recognized over the term of the license agreement. Costs and expenses are recognized during the period in which they are incurred.

Research and Development - All research and development expenditures are expensed as incurred.

Stock-Based Compensation – The Company accounts for share based payments in accordance with ASC 718, Compensation - Stock Compensation, which requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements based on the grant date fair value of the award. In accordance with ASC 718-10-30-9, Measurement Objective – Fair Value at Grant Date, the Company estimates the fair value of the award using a valuation technique. For this purpose, the Company uses the Black-Scholes option pricing model. The Company believes this model provides the best estimate of fair value due to its ability to incorporate inputs that change over time, such as volatility and interest rates, and to allow for actual exercise behavior of option holders. Compensation cost is recognized over the requisite service period which is generally equal to the vesting period. Upon exercise, shares issued will be newly issued shares from authorized common stock.

ASC 505, "Compensation-Stock Compensation", establishes standards for the accounting for transactions in which an entity exchanges its equity instruments to non employees for goods or services. Under this transition method, stock compensation expense includes compensation expense for all stock-based compensation awards granted on or after January 1, 2006, based on the grant-date fair value estimated in accordance with the provisions of ASC 505.

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. |

| 1. |

Report of Independent Registered Public Accounting Firm (De Joya Griffith, LLC); |

| 2. |

Audited Financial Statements for the Years Ended April 30, 2014 and 2013, including: |

| 3. | |

| 4. | |

| 5. | |

| 6. | |

| 7. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

Royal Mines and

Minerals Corp.

We have audited the accompanying balance sheets of Royal Mines and Minerals Corp. (An Exploration Stage Company) (the “Company”) as of April 30, 2014 and 2013 and the related statements of operations, stockholders’ equity (deficit) and cash flows for the years ended April 30, 2014 and d 2013, and for the period from inception (December 14, 2005) through April 30, 2014. Royal Mines and Minerals Corp.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over fina ancial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Royal Mines and Minerals Corp. (An Exploration Stage Company) as of April 30, 2014 and 2013 and the results of its operations and its cash flows for the years ended April 30, 20114 and 2013, and for the period from inception (December 14, 2005) through April 30, 2014 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered losses from operations, which raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ De Joya Griffith, LLC

Henderson, Nevada

August 8,

2014

Corporate Headquarters:

De Joya Griffith, LLC

2580

Anthem Village Drive, Henderson, NV 89052 Phone: (702) 563-1600 Fax: (702)

920-8049

F-1

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage

Company)

BALANCE SHEETS

(Audited)

| April 30, 2014 | April 30, 2013 | |||||

| ASSETS | ||||||

| Current assets | ||||||

| Cash and cash equivalents | $ | 67,991 | $ | 13,706 | ||

| Prepaid expenses | 7,500 | 10,500 | ||||

| Other current assets | 759 | 1,037 | ||||

| Total current assets | 76,250 | 25,243 | ||||

| Non-current assets | ||||||

| Loan receivable | - | 983,055 | ||||

| Investment in marketable securities | 500,000 | - | ||||

| Property and equipment, net | 241,439 | 237,801 | ||||

| Other assets | 16,240 | 10,985 | ||||

| Total non-current assets | 757,679 | 1,231,841 | ||||

| Total assets | $ | 833,929 | $ | 1,257,084 | ||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||

| Current liabilities | ||||||

| Accounts payable | $ | 200,857 | $ | 140,669 | ||

| Accounts payable - related parties | 196,083 | 447,516 | ||||

| Accrued interest | 47,218 | 34,259 | ||||

| Accrued interest - related parties | 113,863 | 63,394 | ||||

| Loans payable | 348,030 | 248,030 | ||||

| Loans payable - related parties | 258,000 | 797,877 | ||||

| Other current liabilities | 2,540 | - | ||||

| Total current liabilities | 1,166,591 | 1,731,745 | ||||

| Notes payable | 50,000 | 50,000 | ||||

| Deferred rent | 25,399 | 35,804 | ||||

| Total non-current liabilities | 75,399 | 85,804 | ||||

| Total liabilities | 1,241,990 | 1,817,549 | ||||

| Commitments and contingencies | ||||||

| Stockholders' deficit | ||||||

| Preferred stock, $0.001 par

value; 100,000,000

shares authorized, zero shares issued and outstanding |

- | - | ||||

| Common

stock, $0.001 par value; 900,000,000

shares authorized, 212,813,141 and 185,593,141 shares issued and outstanding, respectively |

212,813 | 185,593 | ||||

| Additional paid-in capital | 15,673,181 | 13,603,775 | ||||

| Accumulated deficit during exploration stage | (15,794,055 | ) | (14,349,833 | ) | ||

| Accumulated other comprehensive loss | (500,000 | ) | - | |||

| Total stockholders' deficit | (408,061 | ) | (560,465 | ) | ||

| Total liabilities and stockholders' deficit | $ | 833,929 | $ | 1,257,084 |

The accompanying notes are an integral part of these financial

statements.

F-2

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage

Company)

STATEMENTS OF OPERATIONS

(Audited)

| For the Period | |||||||||

| From Inception | |||||||||

| (December 14, 2005) | |||||||||

| For the Years Ended | Through | ||||||||

| April 30, 2014 | April 30, 2013 | April 30, 2014 | |||||||

| Revenue | $ | - | $ | - | $ | 138,537 | |||

| Operating expenses: | |||||||||

| Mineral exploration and evaluation expenses | 466,930 | 584,970 | 5,189,468 | ||||||

| Mineral exploration and evaluation expenses - related parties | 60,000 | 5,000 | 884,500 | ||||||

| General and administrative | 238,633 | 127,161 | 3,416,519 | ||||||

| General and administrative - related parties | 497,666 | 204,000 | 5,199,309 | ||||||

| Depreciation and amortization | 99,895 | 103,995 | 721,405 | ||||||

| Impairment of mineral properties | - | 63,400 | 63,400 | ||||||

| Impairment of intellectual property | - | 150,000 | 200,000 | ||||||

| Bad debt expense | - | 14,041 | 14,041 | ||||||

| Gain on sale of fixed asset | - | (11,500 | ) | (11,500 | ) | ||||

| Gain on settlement of accounts payable | - | (1,613 | ) | (1,613 | ) | ||||

| Total operating expenses | 1,363,124 | 1,239,454 | 15,675,529 | ||||||

| Loss from operations | (1,363,124 | ) | (1,239,454 | ) | (15,536,992 | ) | |||

| Other income (expense): | |||||||||

| Interest and other income | 12 | - | 103,838 | ||||||

| Interest expense | (81,110 | ) | (79,557 | ) | (360,901 | ) | |||

| Total other income (expense) | (81,098 | ) | (79,557 | ) | (257,063 | ) | |||

| Net loss | $ | (1,444,222 | ) | $ | (1,319,011 | ) | $ | (15,794,055 | ) |

| Other comprehensive loss: | |||||||||

| Unrealized loss on marketable securities | (500,000 | ) | - | (500,000 | ) | ||||

| Comprehensive loss | $ | (1,944,222 | ) | $ | (1,319,011 | ) | $ | (16,294,055 | ) |

| Net loss per common share - basic | $ | (0.01 | ) | $ | (0.01 | ) | |||

| Weighted average common shares outstanding - basic | 197,746,182 | 185,537,251 | |||||||

The accompanying notes are an integral part of these financial

statements.

F-3

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage

Company)

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT)

(Audited)

| Accumulated | Accumulated | |||||||||||||||||

| Deficit During | Other | Total | ||||||||||||||||

| Common Stock | Additional | Exploration | Comprehensive | Stockholders' | ||||||||||||||

| Shares | Amount | Paid-in Capital | Stage | Loss | Equity (Deficit) | |||||||||||||

| Balance, December 14, 2005 | - | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||

| Issuance of common stock for cash, $0.001 per share | 1,000 | 1 | - | - | - | 1 | ||||||||||||

| Net loss | - | - | - | (174,500 | ) | - | (174,500 | ) | ||||||||||

| Balance, April 30, 2006 | 1,000 | 1 | - | (174,500 | ) | - | (174,499 | ) | ||||||||||

| Issuance of common stock for cash, $0.001 per share | 12,500,000 | 12,500 | - | - | - | 12,500 | ||||||||||||

| Issuance of common stock for cash, $0.01 per share | 7,800,000 | 7,800 | 70,200 | - | - | 78,000 | ||||||||||||

| Issuance of common stock for

mineral property options, $0.01 per share |

1,050,000 | 1,050 | 9,450 | - | - | 10,500 | ||||||||||||

| Issuance of common stock for cash, $0.10 per share | 1,250,000 | 1,250 | 123,750 | - | - | 125,000 | ||||||||||||

| Issuance of common stock for

cash, Reg. S - Private Placement, $0.10 per share |

1,800,000 | 1,800 | 178,200 | - | - | 180,000 | ||||||||||||

| Issuance of common stock in acquisition

of intellectual property and equipment, $0.10 per share |

2,000,000 | 2,000 | 198,000 | - | - | 200,000 | ||||||||||||

| Net loss | - | - | - | (517,768 | ) | - | (517,768 | ) | ||||||||||

| Balance, April 30, 2007 | 26,401,000 | 26,401 | 579,600 | (692,268 | ) | - | (86,267 | ) | ||||||||||

| Issuance of common stock for

cash and subscriptions received, Reg. S - Private Placement, $0.25 per share |

2,482,326 | 2,482 | 618,100 | - | - | 620,582 | ||||||||||||

| Issuance of common stock for

cash, Reg. D - Private Placement, $0.25 per share |

3,300,000 | 3,300 | 821,700 | - | - | 825,000 | ||||||||||||

| Issuance of common stock in

reverse acquisition of Centrus Ventures Inc. |

13,968,926 | 13,969 | (77,164 | ) | - | - | (63,195 | ) | ||||||||||

| Issuance of stock options for 4,340,000

shares of common stock to three officers and five consultants. |

- | - | 3,583,702 | - | - | 3,583,702 | ||||||||||||

| Net loss | - | - | - | (5,256,444 | ) | - | (5,256,444 | ) | ||||||||||

| Balance, April 30, 2008 | 46,152,252 | 46,152 | 5,525,938 | (5,948,712 | ) | - | (376,622 | ) | ||||||||||

| Issuace of common stock for

cash, Reg. S - Private Placement, $0.50 per share; with attached warrants exercisable at $0.75 per share |

200,000 | 200 | 99,800 | - | - | 100,000 | ||||||||||||

| Issuance of common stock in satisfaction of

debt, $0.30 per share, with attached warrants exercisable at $0.50 per share. |

450,760 | 451 | 134,777 | - | - | 135,228 | ||||||||||||

| Issuance of stock options for

5,000,000 shares of common stock to two officers and nine consultants. |

- | - | 342,550 | - | - | 342,550 | ||||||||||||

| Issuace of common stock for cash, $0.05 per

share, with attached warrants exercisable at $0.10 per share. |

9,140,000 | 9,140 | 447,860 | - | - | 457,000 | ||||||||||||

| Issuance of common stock in

satisfaction of loans made to the Company, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

12,400,000 | 12,400 | 607,600 | - | - | 620,000 | ||||||||||||

| Issuance of common stock in satisfaction of

debt, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

1,336,840 | 1,337 | 65,505 | - | - | 66,842 | ||||||||||||

| Issuance of common stock to

one officer as compensation pursuant to the management consulting agreement. |

3,000,000 | 3,000 | 117,000 | - | - | 120,000 | ||||||||||||

| Net loss | - | - | - | (1,717,000 | ) | - | (1,717,000 | ) | ||||||||||

| Balance, April 30, 2009 | 72,679,852 | 72,680 | 7,341,030 | (7,665,712 | ) | - | (252,002 | ) | ||||||||||

| Issuance of common stock in satisfaction of

loans made to the Company, $0,05 per share, with attached warrants exercisable at $0.10 per share. |

2,000,000 | 2,000 | 98,000 | - | - | 100,000 | ||||||||||||

| Issuance of common stock in

satisfaction of debt, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

500,000 | 500 | 24,500 | - | - | 25,000 | ||||||||||||

| Issuance of common stock for warrants

excercised, $0.10 per share, in satisfaction of debt for legal services. |

295,000 | 295 | 29,205 | - | - | 29,500 | ||||||||||||

| Issuance of common stock for

options excercised, $0.05 per share, in satisfaction of debt for legal services. |

750,000 | 750 | 36,750 | - | - | 37,500 | ||||||||||||

| Issuance of common stock to investor

relations services firm pursuant to terms of consulting agreement. |

1,500,000 | 1,500 | - | - | - | 1,500 | ||||||||||||

The accompanying notes are an integral part of these financials

statements.

F-4

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage

Company)

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT)

(Audited)

| Accumulated | Accumulated | |||||||||||||||||

| Deficit During | Other | Total | ||||||||||||||||

| Common Stock | Additional | Exploration | Comprehensive | Stockholders' | ||||||||||||||

| Shares | Amount | Paid-in Capital | Stage | Loss | Equity (Deficit) | |||||||||||||

| Issuance of common stock in

satisfaction of loans to the Company, $0.10 per share, with attached warrants excercisable at $0.20 per share. |

3,500,000 | 3,500 | 346,500 | - | - | 350,000 | ||||||||||||

| Issuance of stock options for 7,000,000

shares of common stock to two directors and nine consultants. |

- | - | 391,478 | - | - | 391,478 | ||||||||||||

| Issuance of common stock for

options excercised, $0.05 per share, in satisfaction of debt for legal services. |

900,000 | 900 | 44,100 | - | - | 45,000 | ||||||||||||

| Issuance of common stock in satisfaction of

loans to the Company, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

19,400,000 | 19,400 | 950,600 | - | - | 970,000 | ||||||||||||

| Issuace of common stock for

cash, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

8,280,000 | 8,280 | 405,720 | - | - | 414,000 | ||||||||||||

| Issuance of common stock in satisfaction of

debt, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

1,775,500 | 1,775 | 87,000 | - | - | 88,775 | ||||||||||||

| Issuance of common stock for

options excercised, $0.05 per share, in satisfaction of debt for legal services. |

100,000 | 100 | 4,900 | - | - | 5,000 | ||||||||||||

| Issuance of common stock for warrants

excercised, $0.10 per share, in satisfaction of debt for legal services. |

105,000 | 105 | 10,395 | - | - | 10,500 | ||||||||||||

| Net loss | - | - | - | (1,929,128 | ) | - | (1,929,128 | ) | ||||||||||

| Balance, April 30, 2010 | 111,785,352 | 111,785 | 9,770,178 | (9,594,840 | ) | - | 287,123 | |||||||||||

| Issuance of stock options for

6,000,000 shares of common stock to three directors and eight consultants. |

- | - | 178,159 | - | - | 178,159 | ||||||||||||

| Issuance of common stock for options

excercised, $0.05 per share, in satisfaction of debt. |

1,700,000 | 1,700 | 83,300 | - | - | 85,000 | ||||||||||||

| Issuance of common stock for

options excercised, $0.05 per share, in satisfaction of debt. |

1,950,000 | 1,950 | 95,550 | - | - | 97,500 | ||||||||||||

| Issuance of common stock in satisfaction of

loans to the Company, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

17,020,000 | 17,020 | 833,980 | - | - | 851,000 | ||||||||||||

| Issuance of common stock for

cash, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

13,100,000 | 13,100 | 641,900 | - | - | 655,000 | ||||||||||||

| Issuance of common stock to investor

relations services firm pursuant to terms of consulting agreement. |

315,000 | 315 | 15,435 | - | - | 15,750 | ||||||||||||

| Issuance of common stock to

two officers and three consultants as as compensation for services previously provided. |

2,550,000 | 2,550 | 124,950 | - | - | 127,500 | ||||||||||||

| Net loss | - | - | - | (1,692,134 | ) | - | (1,692,134 | ) | ||||||||||

| Balance, April 30, 2011 | 148,420,352 | 148,420 | 11,743,452 | (11,286,974 | ) | - | 604,898 | |||||||||||

| Issuance of common stock for cash, $0.05 per

share, with attached warrants exercisable at $0.10 per share. |

10,000,000 | 10,000 | 490,000 | - | - | 500,000 | ||||||||||||

| Issuance of common stock in

satisfaction of loans to the Company, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

10,340,000 | 10,340 | 506,660 | - | - | 517,000 | ||||||||||||

| Issuance of common stock in satisfaction of

debt, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

2,680,000 | 2,680 | 131,320 | - | - | 134,000 | ||||||||||||

| Issuance of warrants for

1,030,000 shares of common stock to one consultant pursuant to terms of consulting agreement. |

- | - | 42,073 | - | - | 42,073 | ||||||||||||

| Issuance of common stock to one consultant as

compensation pursuant to terms of consulting agreement. |

320,000 | 320 | 15,680 | - | - | 16,000 | ||||||||||||

| Issuance of common stock in

satisfaction of debt, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

1,000,000 | 1,000 | 49,000 | - | - | 50,000 | ||||||||||||

| Issuance of common stock for mineral property options, $0.04 per share. | 350,000 | 350 | 13,650 | - | - | 14,000 | ||||||||||||

| Issuance of common stock in

satisfaction of loans to the Company, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

9,000,000 | 9,000 | 441,000 | - | - | 450,000 | ||||||||||||

| Issuance of common stock for cash, $0.05 per

share, with attached warrants exercisable at $0.10 per share. |

2,742,789 | 2,743 | 134,397 | - | - | 137,140 | ||||||||||||

| Issuance of common stock to

one consultant as compensation pursuant to terms of consulting agreement. |

640,000 | 640 | 21,760 | - | - | 22,400 | ||||||||||||

The accompanying notes are an integral part of these financials

statements.

F-5

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage

Company)

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT)

(Audited)

| Accumulated | Accumulated | |||||||||||||||||

| Deficit During | Other | Total | ||||||||||||||||

| Common Stock | Additional | Exploration | Comprehensive | Stockholders' | ||||||||||||||

| Shares | Amount | Paid-in Capital | Stage | Loss | Equity (Deficit) | |||||||||||||

| Issuance of warrants for 300,000 shares of

common stock to one vendor for services provided. |

- | - | 11,496 | - | - | 11,496 | ||||||||||||

| Net loss | - | - | - | (1,743,848 | ) | - | (1,743,848 | ) | ||||||||||

| Balance, April 30, 2012 | 185,493,141 | 185,493 | 13,600,488 | (13,030,822 | ) | - | 755,159 | |||||||||||

| Issuance of common stock in

satisfaction of debt, $0.02 per share, with attached warrants exercisable at $0.10 per share. |

100,000 | 100 | 1,900 | - | - | 2,000 | ||||||||||||

| Issuance of warrants exercisable at $0.10 per

share for 100,000 shares of common stock in satisfaction of debt. |

- | - | 1,387 | - | - | 1,387 | ||||||||||||

| Net loss | - | - | - | (1,319,011 | ) | - | (1,319,011 | ) | ||||||||||

| Balance, April 30, 2013 | 185,593,141 | $ | 185,593 | $ | 13,603,775 | $ | (14,349,833 | ) | $ | - | $ | (560,465 | ) | |||||

| Issuance of stock options for

18,100,000 shares of common stock to three directors and four consultants. |

- | - | 542,487 | - | - | 542,487 | ||||||||||||

| Issuance of common stock for cash, $0.05 per

share, with attached warrants exercisable at $0.10 per share. |

6,900,000 | 6,900 | 338,100 | - | - | 345,000 | ||||||||||||

| Issuance of common stock in

satisfaction of loans to the Company, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

13,800,000 | 13,800 | 676,200 | - | - | 690,000 | ||||||||||||

| Issuance of common stock in satisfaction of

debt, $0.05 per share, with attached warrants exercisable at $0.10 per share. |

6,520,000 | 6,520 | 319,480 | - | - | 326,000 | ||||||||||||

| Issuance of stock options for

1,500,000 shares of common stock to one consultant. |

- | - | 29,485 | - | - | 29,485 | ||||||||||||

| Contribution on 50% of future profits from Scottsdale facility | - | - | 163,654 | - | - | 163,654 | ||||||||||||

| Net loss | - | - | - | (1,444,222 | ) | - | (1,444,222 | ) | ||||||||||

| Comprehensive loss | - | - | - | - | (500,000 | ) | (500,000 | ) | ||||||||||

| Balance, April 30, 2014 | 212,813,141 | $ | 212,813 | $ | 15,673,181 | $ | (15,794,055 | ) | $ | (500,000 | ) | $ | (408,061 | ) | ||||

The accompanying notes are an integral part of these financials

statements.

F-6

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage

Company)

STATEMENTS OF CASH FLOWS

(Audited)

| For the Period | |||||||||

| From Inception | |||||||||

| (December 14, 2005) | |||||||||

| For the Years Ended | Through | ||||||||

| April 30, 2014 | April 30, 2013 | April 30, 2014 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||

| Net loss | $ | (1,444,222 | ) | $ | (1,319,011 | ) | $ | (15,794,055 | ) |

| Adjustments to reconcile net loss | |||||||||

| to net cash used in operating activities: | |||||||||

| Depreciation and amortization | 99,895 | 103,995 | 721,405 | ||||||

| Impairment of mineral properties | - | 63,400 | 63,400 | ||||||

| Impairment of intellectual property | - | 150,000 | 200,000 | ||||||

| Stock-based expenses | 218,306 | - | 1,517,675 | ||||||

| Stock-based expenses - related parties | 353,666 | - | 3,892,844 | ||||||

| Allowance for bad debt | - | 14,041 | 14,041 | ||||||

| Gain on sale of fixed asset | - | (11,500 | ) | (11,500 | ) | ||||

| Gain on settlement of accounts payable | - | (1,613 | ) | (1,613 | ) | ||||

| Changes in operating assets and liabilities: | |||||||||

| Prepaid expenses | 3,000 | 1,216 | 5,061 | ||||||

| Other assets | (4,977 | ) | 4,489 | (31,040 | ) | ||||

| Accounts payable | 60,188 | 75,663 | 711,221 | ||||||

| Accounts payable - related parties | 58,567 | 60,000 | 440,457 | ||||||

| Other current liabilities | 2,540 | (5,000 | ) | (6,587 | ) | ||||

| Accrued interest | 23,959 | 20,401 | 58,218 | ||||||

| Accrued interest - related parties | 55,469 | 56,616 | 288,107 | ||||||

| Deferred rent | (10,405 | ) | 35,804 | 25,399 | |||||

| Net cash used in operating activities | (584,014 | ) | (751,499 | ) | (7,906,967 | ) | |||

| CASH FLOW FROM INVESTING ACTIVITIES | |||||||||

| Reimbursement of Golden Anvil expenses | (16,945 | ) | - | (16,945 | ) | ||||

| Loan receivable | - | - | (983,055 | ) | |||||

| Cash paid on mineral property claims | - | 310 | (38,900 | ) | |||||

| Cash acquired on reverse merger | - | - | 2,306 | ||||||

| Proceeds from sale of fixed assets | - | 11,500 | 11,500 | ||||||

| Purchase of fixed assets | (103,533 | ) | - | (725,328 | ) | ||||

| Net cash provided by (used in) investing activities | (120,478 | ) | 11,810 | (1,750,422 | ) | ||||

| CASH FLOW FROM FINANCING ACTIVITIES | |||||||||

| Proceeds from contribution on Scottsdale facility | 163,654 | - | 163,654 | ||||||

| Proceeds from stock issuance | 345,000 | - | 4,450,721 | ||||||

| Payments on borrowing - related party | (127 | ) | - | (127 | ) | ||||

| Proceeds from borrowings | 250,000 | 148,030 | 498,030 | ||||||

| Proceeds from borrowings - related parties | 250 | 534,687 | 4,613,102 | ||||||

| Net cash provided by financing activities | 758,777 | 682,717 | 9,725,380 | ||||||

| NET CHANGE IN CASH | 54,285 | (56,972 | ) | 67,991 | |||||

| CASH AT BEGINNING OF PERIOD | 13,706 | 70,678 | - | ||||||

| CASH AT END OF PERIOD | $ | 67,991 | $ | 13,706 | $ | 67,991 | |||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | |||||||||

| Interest paid | $ | 681 | $ | 2,540 | $ | 9,632 | |||

| Income taxes paid | $ | - | $ | - | $ | - | |||

| NON-CASH INVESTING AND FINANCING ACTIVITIES | |||||||||

| Acquisition of intellectual property for stock | $ | - | $ | - | $ | 200,000 | |||

| Acquisition of mineral property for stock | $ | - | $ | - | $ | 24,500 | |||

| Stock issued in reverse acquisition of Centrus Ventures Inc. | $ | - | $ | - | $ | (63,195 | ) | ||

| Stock and warrants issued in satisfaction of accounts payable | $ | - | $ | (3,387 | ) | $ | (224,004 | ) | |

| Stock issued in satisfaction of accounts payable - related parties | $ | (310,000 | ) | $ | - | $ | (675,228 | ) | |

| Stock issued in safisfaction of accrued interest - related parties | $ | (5,000 | ) | $ | - | $ | (139,000 | ) | |

| Stock issued in safisfaction of accrued interest | $ | (11,000 | ) | $ | - | $ | (11,000 | ) | |

| Stock issued in satisfaction of accrued liabilities | $ | - | $ | - | $ | (50,000 | ) | ||

| Stock issued in satisfaction of notes payable | $ | - | $ | - | $ | (40,000 | ) | ||

| Stock issued in satisfaction of loans payable, including related party | $ | (690,000 | ) | $ | - | $ | (4,548,000 | ) | |

| Unrealized loss on marketable securities | $ | (500,000 | ) | $ | - | $ | (500,000 | ) | |

| Marketable securities received as payment on loans receivable | $ | 983,055 | $ | - | $ | 983,055 | |||

The accompanying notes are an integral part of these financial

statements.

F-7

ROYAL MINES AND MINERALS CORP.

(An Exploration Stage

Company)

NOTES TO FINANCIAL STATEMENTS

APRIL 30, 2014 AND 2013

(AUDITED)

| 1. | DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES |

Basis of Presentation – The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. Royal Mines and Minerals Corp’s (the “Company”) fiscal year-end is April 30.

Description of Business – The Company is considered an exploration stage company. The Company's primary objectives are to 1) commercially extract and refine precious metals from its own and other’s leachable assets, 2) use its lixiviation processes to convert specific ore bodies and fly ash landfills/monofills into valuable assets, and 3) joint venture, acquire and develop mining projects in North America. The Company has not yet realized significant revenues from its primary objectives.

History – The Company was incorporated on December 14, 2005 under the laws of the State of Nevada. On June 13, 2007, the Company incorporated a wholly-owned subsidiary, Royal Mines Acquisition Corp., in the state of Nevada.

On October 5, 2007, Centrus Ventures Inc. (Centrus) completed the acquisition of Royal Mines Inc. (“Royal Mines”). The acquisition of Royal Mines was completed by way of a “triangular merger” pursuant to the provisions of the Agreement and Plan of Merger dated September 24, 2007 (the “First Merger Agreement”) among Centrus, Royal Mines Acquisition Corp. (“Centrus Sub”), a wholly owned subsidiary of Centrus, Royal Mines and Kevin B. Epp, the former sole executive officer and director of Centrus. On October 5, 2007, under the terms of the First Merger Agreement, Royal Mines was merged with and into Centrus Sub, with Centrus Sub continuing as the surviving corporation (the “First Merger”).

On October 6, 2007, a second merger was completed pursuant to an Agreement and Plan of Merger dated October 6, 2007 (the “Second Merger Agreement”) between Centrus and its wholly owned subsidiary, Centrus Sub, whereby Centrus Sub was merged with and into Centrus, with Centrus continuing as the surviving corporation (the “Second Merger”). As part of the Second Merger, Centrus changed its name from “Centrus Ventures Inc.” to “Royal Mines And Minerals Corp.”(“the Company”). Other than the name change, no amendments were made to the Articles of Incorporation.

Under the terms and conditions of the First Merger Agreement, each share of Royal Mines’ common stock issued and outstanding immediately prior to the completion of the First Merger was converted into one share of Centrus’ common stock. As a result, a total of 32,183,326 shares of Centrus common stock were issued to former stockholders of Royal Mines. In addition, Mr. Epp surrendered 23,500,000 shares of Centrus common stock for cancellation in consideration of payment by Centrus of $0.001 per share for an aggregate consideration of $23,500. As a result, upon completion of the First Merger, the former stockholders of Royal Mines owned approximately 69.7% of the issued and outstanding common stock.