Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - AIR METHODS CORP | ex32.htm |

| EX-23 - EXHIBIT 23 - AIR METHODS CORP | ex23.htm |

| EX-21 - EXHIBIT 21 - AIR METHODS CORP | ex21.htm |

| EX-31.1 - EXHIBIT 31.1 - AIR METHODS CORP | ex31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - AIR METHODS CORP | ex31_2.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________

FORM 10-K

(Mark One)

|

T

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended

|

December 31, 2009

|

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from

|

to

|

AIR METHODS CORPORATION

(Exact name of registrant as specified in its charter)

Commission file number 0-16079

|

Delaware

|

84-0915893

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. employer identification no.)

|

7301 South Peoria, Englewood, Colorado 80112

(Address of principal executive offices and zip code)

303-792-7400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Not Applicable

Securities registered pursuant to Section 12(g) of the Act:

COMMON STOCK, $.06 PAR VALUE PER SHARE (the "Common Stock")

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No T

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No T

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer,” large accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated Filer ¨

|

Accelerated Filer T

|

|

Non-accelerated Filer ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company ¨

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ¨ No T

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $300,698,000

The number of outstanding shares of Common Stock as of March 5, 2010, was 12,451,721.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required for Part III of this Annual Report on Form 10-K is incorporated by reference to the registrant’s definitive proxy statement for the 2010 annual meeting of stockholders.

TABLE OF CONTENTS

To Form 10-K

|

Page

|

||

|

PART I

|

||

|

ITEM 1.

|

1

|

|

|

1

|

||

|

3

|

||

|

4

|

||

|

4

|

||

|

ITEM 1A.

|

4

|

|

|

ITEM 1B.

|

8

|

|

|

ITEM 2.

|

8

|

|

|

8

|

||

|

9

|

||

|

ITEM 3.

|

9

|

|

|

PART II

|

||

|

ITEM 4.

|

10

|

|

|

ITEM 5.

|

12

|

|

|

ITEM 6.

|

14

|

|

|

14

|

||

|

16

|

||

|

22

|

||

|

24

|

||

|

26

|

||

|

ITEM 6A.

|

26

|

|

|

ITEM 7.

|

26

|

|

|

|

|

|

|

ITEM 8.

|

26

|

|

|

ITEM 8A.

|

27

|

|

|

ITEM 8B.

|

27

|

|

|

PART III

|

||

|

ITEM 9.

|

28

|

|

|

ITEM 10.

|

28

|

|

|

ITEM 11.

|

28

|

|

|

ITEM 12.

|

28

|

|

|

ITEM 13.

|

28

|

|

|

PART IV

|

||

|

ITEM 14.

|

IV-1

|

|

|

IV-4

|

||

PART I

|

ITEM 1.

|

BUSINESS

|

General

Air Methods Corporation, a Delaware corporation, (Air Methods or the Company) was established in Colorado in 1982 and now serves as the largest provider of air medical emergency transport services and systems throughout the United States of America. We provide air medical emergency transport services under two service delivery models: Community-Based Services (CBS) and Hospital-Based Services (HBS). Rocky Mountain Holdings, LLC (RMH), FSS Airholdings, Inc. (FSS), Mercy Air Service, Inc. (Mercy Air), and LifeNet, Inc. (LifeNet) all operate as wholly-owned subsidiaries of Air Methods. FSS is the parent company of CJ Systems Aviation Group, Inc. (CJ).

As of December 31, 2009, our CBS Division provided air medical transportation services in 21 states, while our HBS Division provided air medical transportation services to hospitals located in thirty states under operating agreements with original terms ranging from one to eight years. Under both CBS and HBS operations, we transport persons requiring intensive medical care from either the scene of an accident or general care hospitals to highly skilled trauma centers or tertiary care centers. Under the CBS delivery model, our employees provide medical care to patients en route, while under the HBS delivery model, medical care en route is provided by employees or contractors of our customer hospitals. Our Products Division designs, manufactures, and installs aircraft medical interiors and other aerospace or medical transport products. Financial information for each of our operating segments is included in the notes to our consolidated financial statements included in Item 7 of this report.

In 2008 we entered the voluntary Safety Management System (SMS) administered by the Federal Aviation Administration (FAA) and in the first quarter of 2010 successfully exited Level 1, the second phase of a five-phase program. SMS follows the International Civil Aviation Organization standard as a quality management approach to controlling risk by providing the organizational framework to support a sound safety culture. It also provides our management with a detailed roadmap for monitoring safety-related processes. As part of the SMS initiative, we established several FAA voluntary safety programs in 2009, including an Aviation Safety Action Program (ASAP) and Line Operations Safety Audit (LOSA) program. Each of these allows for greater communications from our field operations and earlier identification of areas of concern to enable us to devote resources and attention to issues on a proactive basis. Over the past several years, we have been in the process of equipping our fleet with Night Vision Goggles (NVG), Terrain Avoidance Warning Systems (TAWS), satellite tracking equipment, satellite weather information equipment, and wire strike kits. In 2009 we invested $7.9 million in equipment and training costs related to this initiative for aircraft already in our fleet. In addition, we took delivery of sixteen new aircraft which were already retrofitted with this equipment.

Community-Based Services

Services provided by our CBS Division include medical care, aircraft operation and maintenance, 24-hour communications and dispatch, and medical billing and collections. CBS aircraft are typically based at fire stations, airports, or hospital locations. CBS revenue consists of flight fees billed directly to patients, their insurers, or governmental agencies. Due to weather conditions and other factors, the number of flights is generally higher during the summer months than during the remainder of the year, causing revenue generated from operations to fluctuate accordingly.

The division operates 136 helicopters and three fixed wing aircraft under both Instrument Flight Rules (IFR) and Visual Flight Rules (VFR) in 21 states. Although the division does not generally contract directly with specific hospitals, it typically has long-standing relationships with several leading healthcare institutions in the metropolitan areas in which it operates.

In 2009 the CBS Division opened ten new bases, including two resulting from the conversion of an HBS customer to CBS operations, and closed six due to insufficient flight volume. The division also entered into service agreements in Georgia with another air medical service provider, allowing for base consolidations in the service area.

Our aircraft are dispatched in response to requests for transport received by our communications centers from sending or receiving hospitals or local emergency personnel, such as firemen or police officers, at the scene of an accident. Communications and dispatch operations for substantially all CBS locations are conducted from our national center in Omaha, Nebraska, or from the regional center in St. Louis, Missouri. Medical billing and collections are processed primarily from our offices in San Bernardino, California.

Competition with the CBS Division comes primarily from three national operators (Air Medical Group Holdings, Inc.; OmniFlight, Inc.; and PHI, Inc.) and from smaller regional carriers and alternative air ambulance providers such as local governmental entities. We believe that our competitive strengths center on the quality of our patient care and customer service, the medical capability of the aircraft we deploy, and our investment in safety equipment and programs for our operations, as well as our ability to tailor the service delivery model to a hospital’s or community’s specific needs. Unlike many operators, we maintain in-house core competencies in hiring, training, and managing medical staff; billing and collection services; dispatch and communication functions; and aviation operations. We believe that choosing not to outsource these services allows us to better ensure the quality of patient care and enhances control over the associated costs.

Hospital-Based Services

Our HBS Division provides hospital clients with medically-equipped helicopters and airplanes which are generally based at hospitals. Our responsibility is to operate and maintain the aircraft in accordance with Federal Aviation Regulations (FAR) Part 135 standards. Hospital clients provide medical personnel and all medical care on board the aircraft. The division operates 178 helicopters and nine fixed wing aircraft in thirty states. Under the typical operating agreement with a hospital, we earn approximately 76% of our revenue from a fixed monthly fee and 24% from an hourly flight fee from the hospital. These fees are earned regardless of when, or if, the hospital is reimbursed for these services by its patients, their insurers, or the federal government. Both monthly and hourly fees are generally subject to annual increases based on changes in the consumer price index, hull and liability insurance premiums, or spare parts prices from aircraft manufacturers. Because the majority of the division's flight revenue is generated from fixed monthly fees, seasonal fluctuations in flight hours do not significantly impact monthly revenue in total. We operate some of our HBS contracts under the service mark AIR LIFE®, which is generally associated within the industry with our standard of service.

In 2009 we began operations under a new three-year contract, representing two aircraft, with a customer in Alaska. Contracts with seventeen hospital customers were due for renewal in 2009, ten of which have been renewed for terms ranging from one to four years. Three other contracts have been extended into 2010, pending negotiation of final contract renewal terms. Five contracts were not renewed upon their expiration in 2009.

Competition with the HBS Division comes primarily from four national operators: Air Medical Group Holdings, Inc.; Metro Aviation, Inc.; OmniFlight, Inc.; and PHI, Inc. Operators generally compete on the basis of price, safety record, accident prevention and training, and the medical capability of the aircraft. Price is a significant element of competition because of the continued pressure on many healthcare organizations to contain costs passed on to their consumers. We believe that our competitive strengths center on the quality of our training, maintenance, and customer service; the medical capability of the aircraft we deploy; and our investment in safety equipment and programs for our operations.

Products Division

Our Products Division designs, manufactures, and certifies modular medical interiors, multi-mission interiors, and other aerospace and medical transport products. These interiors and other products range from basic life support to intensive care suites to advanced search and rescue systems. With a full range of engineering, manufacturing and certification capabilities, the division has also designed and integrated aircraft communication, navigation, environmental control, structural, and electrical systems. Manufacturing capabilities include avionics, electrical, composites, machining, welding, sheet metal, and upholstery. The division also offers quality assurance and certification services pursuant to its FAA Organization Designation (ODA) authorization, Parts Manufacturer Approvals (PMA's), and ISO9001:2000 (Quality Systems) certification.

We maintain patents covering several products. These include the Litter Lift System used in the U.S. Army’s HH-60L helicopter and Medical Evacuation Vehicle (MEV), and the Articulating Patient Loading System and Modular Equipment Frame developed as part of the modular interior concept. Raw materials and components used in the manufacture of interiors and other products are widely available from several different vendors.

As of December 31, 2009, projects in process included forty-eight HH-60L units, four commercial medical interiors, and a design contract for the U.S. Army. During the second quarter of 2009, the U.S. Army notified us that it intended to reduce the number of MEV units to be delivered under the current contract from 306 units to 81 units, plus a number of spares. Revenue and costs related to the termination process were fully recognized during 2009. During the first quarter of 2010, we received a purchase order reinstating the original MEV production contract value, including the impact of termination costs. In the fourth quarter of 2009, we received a contract from the U.S. Army for partial kits for twelve HH-60L units. Deliveries under all contracts in process as of December 31, 2009, including the reinstated MEV purchase order, are expected to be completed by the end of 2011, and remaining revenue is estimated at $15.1 million.

Our competition in the aircraft interior design and manufacturing industry comes primarily from three companies based in the United States and three in Europe. Competition is based mainly on product availability, price, and product features, such as configuration and weight. With our established line of interiors for Bell and Eurocopter aircraft, we believe that we have demonstrated the ability to compete on the basis of each of these factors.

Employees

As of December 31, 2009, we had 2,718 full time and 224 part time employees, comprised of 999 pilots; 619 aviation machinists, airframe and power plant (A&P) engineers, and other manufacturing/maintenance positions; 671 flight nurses and paramedics; and 653 business and administrative personnel. Our pilots are IFR-rated where required by contract, and all have completed an extensive ground school and flight training program at the commencement of their employment with us, as well as local area orientation and annual training provided by us. All of our aircraft mechanics must possess FAA A&P licenses. All flight nurses and paramedics hold the appropriate state and county licenses, as well as Cardiopulmonary Resuscitation, Advanced Cardiac Life Support, and/or Pediatric Advanced Life Support certifications.

In September 2003, our pilots voted to be represented by a collective bargaining unit, and we signed a collective bargaining agreement (CBA) on March 31, 2006. The agreement was effective January 1, 2006, through April 30, 2009. Negotiations on a new CBA commenced in the fourth quarter of 2008 and were referred for mediation during the second quarter of 2009. Under the Railway Labor Act, mediation decisions are non-binding on either party, and the duration of the process may vary depending upon the mediator assigned and the complexity of the issues negotiated.

Government Regulation

We are subject to the Federal Aviation Act of 1958, as amended. All of our flight and maintenance operations are regulated and actively supervised by the U.S. Department of Transportation through the FAA. Medical interiors and other aerospace products developed by us are subject to FAA certification. Air Methods holds a Part 135 Air Carrier Certificate and a Part 145 Repair Station Certificate, which covers one master and four satellite locations, from the FAA. A Part 135 certificate requires that the voting interests of the holder of the certificate cannot be more than 25% owned by foreign persons. As of December 31, 2009, we are not aware of any foreign person who holds more than 5% of our outstanding Common Stock.

The significant number of accidents experienced by the air medical services industry in 2008 led to increased scrutiny by regulatory and legislative bodies. During the first quarter of 2009, the FAA issued revised Operations Specifications which increased weather minima for VFR in uncontrolled airspace operations and enhanced route evaluations prior to flight. The changes did not have a significant adverse impact on our operations because we were already operating in accordance with the higher weather minima. The National Transportation Safety Board conducted hearings regarding industry safety in February 2009 and issued recommendations to the FAA for further rule-making. Future legislation or regulatory changes resulting from the hearings may mandate further changes to flight and duty time, minimum equipment requirements, training requirements, or other standards which may increase the cost of our operations.

We are also subject to laws, regulations, and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, Securities and Exchange Commission (SEC) regulations, and NASDAQ Market rules.

Our internet site is www.airmethods.com. We make available free of charge, on or through the website, all annual, quarterly, and current reports, as well as any amendments to these reports, as soon as reasonably practicable after electronically filing these reports with the Securities and Exchange Commission. This reference to the website does not incorporate by reference the information contained in the website and such information should not be considered a part of this report.

|

ITEM 1A.

|

RISK FACTORS

|

Our actual operating results may differ materially from those described in forward-looking statements as a result of various factors, including but not limited to, those described below.

|

·

|

Flight volume – Almost all CBS revenue and approximately 24% of HBS revenue is dependent upon flight volume. Approximately 19% of our costs primarily associated with flight operations incurred during the year ended December 31, 2009, also vary with the number of hours flown. Poor visibility, high winds, and heavy precipitation can affect the safe operation of aircraft and therefore result in a reduced number of flight hours due to the inability to fly during these conditions. Prolonged periods of adverse weather conditions could have an adverse impact on our operating results due to missed flights or reduced demand for service. Typically, the months from November through February tend to have lower flight volume due to weather conditions and other factors, resulting in lower CBS operating revenue during these months. Flight volume for CBS operations can also be affected by the distribution of calls among competitors by local government agencies and the entrance of new competitors into a market. The number of bases operated by commercial entities within the air medical industry has increased 35% over the last five years. We believe this increase has resulted in overcapacity in certain markets. Transport volume may also be unfavorably impacted by an overall slow-down in economic activity; a decrease in road traffic volume because of unusually high spikes in fuel prices or other factors; cost of the service; loss of confidence in certain markets because of recent, high-profile accidents within the air medical industry; or questions regarding the medical necessity for certain transports.

|

|

·

|

Collection rates – We respond to calls for air medical transport without pre-screening the creditworthiness of the patient. The CBS Division invoices patients and their insurers directly for services rendered and recognizes revenue net of provisions for contractual discounts and estimated uncompensated care. Both provisions are estimated during the period the related services are performed based on historical collection experience and any known trends or changes in reimbursement rate schedules and payer mix. The provisions are adjusted as required based on actual collections in subsequent periods. Net reimbursement per transport for CBS operations is primarily a function of price, payer mix, and timely and effective collection efforts. Both the pace of collections and the ultimate collection rate are affected by the overall health of the U.S. economy and the unemployment rate, which impact the number of indigent patients and funding for state-run programs, such as Medicaid. Medicaid reimbursement rates in many jurisdictions have remained well below the cost of providing air medical transportation. Although we have not yet experienced a direct impact on Medicaid rates, the pressure on state governments to balance their budgets may lead them to decrease Medicaid benefits offered to their citizens. In addition, the collection rate is impacted by changes in the cost of healthcare and health insurance, as well as economic pressures on employers. As the cost of healthcare increases and businesses explore ways to contain or reduce operating costs, health insurance coverage provided by employers may be reduced or eliminated entirely, resulting in an increase in the uninsured population. Under the American Recovery and Reinvestment Act of 2009, the federal government has subsidized the cost of COBRA healthcare coverage for qualified unemployed individuals for up to fifteen months. If this subsidy is reduced or eliminated, the uninsured population resulting from the current economic downturn may increase. Pending healthcare legislation, if enacted, may also affect collections. Healthcare legislation which may call for discounts in Medicare or Medicaid fee schedules or which may incentivize a migration of people from private insurance coverage to public plans with lower reimbursement rates could have an adverse impact on our collection rates. Healthcare legislation which may result in greater coverage of presently uninsured individuals could have a positive impact on our collection rates. There can be no assurance that any healthcare reform legislation will be enacted. The timing of the effect of any legislation on our operations is also currently unknown. A shift of 1% of our payer mix from insured accounts to either Medicaid or uninsured accounts would result in a decrease of $4.2 million to $4.9 million in pre-tax operating results. Our ability to collect price increases in our standard charge structure has generally been limited to accounts covered by insurance providers. Although we have not yet experienced significant increased limitations in the amount reimbursed by insurance companies, continued price increases may cause insurance companies to limit coverage for air medical transport to amounts less than our standard rates. There is no assurance that we will be able to maintain historical collection rates after the implementation of price increases for CBS transports.

|

|

·

|

Dependence on third party suppliers – We currently obtain a substantial portion of our helicopter spare parts and components from AEC and Bell and maintain supply arrangements with other parties for our engine and related dynamic components. As of December 31, 2009, AEC aircraft comprise 79% of our helicopter fleet while Bell aircraft constitute 18%. All of the new helicopters scheduled for delivery in 2010 are AEC aircraft. Increases in spare parts prices tend to be higher for aircraft which are no longer in production. Increases in our monthly and hourly flight fees billed to our HBS customers in a few cases are limited to changes in the consumer price index. As a result, an unusually high increase in the price of parts may not be fully passed on to our HBS customers. The ability to pass on price increases for CBS operations may be limited by reimbursement rates established by Medicare, Medicaid, and insurance providers and by other market considerations. Since current inflation trends are at or near zero, annual price increases for both Medicare and Medicaid for the next few years are expected to be reduced in comparison to previous years. Based upon the manufacturing capabilities and industry contacts of AEC, Bell, and other suppliers, we believe we will not be subject to material interruptions or delays in obtaining aircraft parts and components but do not have an alternative source of supply for AEC, Bell, and certain other aircraft parts. Failure or significant delay by these vendors in providing necessary parts could, in the absence of alternative sources of supply, have a material adverse effect on us.

|

|

·

|

Disposition of aircraft – We are dependent upon the secondary used aircraft market to dispose of older models of aircraft as part of our ongoing fleet rejuvenation efforts. In the past two years, the demand for used aircraft has diminished. If we are unable to dispose of our older aircraft, our aircraft carrying costs may increase above requirements for our current operations, or we may accept lower selling prices, resulting in losses on disposition or reduced gains. The types of aircraft targeted for disposition as part of our fleet rejuvenation usually have lower carrying costs than new aircraft. We have also been able to utilize some aircraft for spare parts to support the operation of our existing fleet, rather than seeking to sell the aircraft to a third party.

|

|

·

|

Employee unionization - In September 2003, our pilots voted to be represented by a collective bargaining unit, and we signed a CBA on March 31, 2006. The agreement was effective January 1, 2006, through April 30, 2009. Negotiations on a new CBA commenced in the fourth quarter of 2008 and were referred for mediation during the second quarter of 2009. Under the Railway Labor Act, mediation decisions are non-binding on either party, and the duration of the process may vary depending upon the mediator assigned and the complexity of the issues negotiated. The CBA establishes procedures for training, addressing grievances, discipline and discharge, among other matters, and defines vacation, holiday, sick, health insurance, and other employee benefits. The CBA also establishes wage scales, including adjustments for geographic locations, covering each year of the agreement. There can be no assurance that the CBA will be renewed under terms resembling those of the current agreement. Union personnel have also actively attempted to organize other employee groups in the past and these groups may elect to be represented by unions in the future.

|

|

·

|

Competition – Our HBS division faces significant competition from several national and regional air medical transportation providers for contracts with hospitals and other healthcare institutions. As used aircraft become more readily available within the industry, pricing for contract renewals may become more competitive. In addition to the national and regional providers, our CBS division also faces competition from smaller regional carriers and alternative air ambulance providers such as sheriff departments. In some cases advanced life support and critical care transport ground ambulance providers may also be competing for the same transports. Air medical operators generally compete on the basis of price, safety record, accident prevention and training, and the medical capability of the aircraft. There can be no assurance that we will be able to continue to compete successfully for new or renewing contracts or CBS market share in the future.

|

|

·

|

Aviation industry hazards and insurance limitations – Hazards are inherent in the aviation industry and may result in loss of life and property, thereby exposing us to potentially substantial liability claims arising from the operation of aircraft. We may also be sued in connection with medical malpractice claims arising from events occurring during or relating to medical flights. Under most HBS operating agreements, our customers have agreed to indemnify us against liability arising from medical malpractice claims and to maintain insurance covering such liability, but there can be no assurance that a hospital will not challenge the indemnification rights or will have sufficient assets or insurance coverage for full indemnity. In CBS operations, our personnel perform medical procedures on transported patients, which may expose us to significant direct legal exposure to medical malpractice claims. We maintain general liability aviation insurance, aviation product liability coverage, and medical malpractice insurance, and believe our level of coverage is customary in the industry and adequate to protect against claims. However, there can be no assurance that it will be sufficient to cover potential claims or that present levels of coverage will be available in the future at reasonable cost. A limited number of hull and liability insurance underwriters provide coverage for air medical operators. Insurance underwriters are required by various federal and state regulations to maintain minimum levels of reserves for known and expected claims. However, there can be no assurance that underwriters have established adequate reserves to fund existing and future claims. The number of air medical accidents, as well as the number of insured losses within other helicopter operations and the commercial airline industry, and the impact of general economic conditions on underwriters may result in increases in premiums above the rate of inflation. In addition, loss of any aircraft as a result of accidents could cause adverse publicity and interruption of services to client hospitals, which could adversely affect our operating results and relationship with such hospitals. Approximately 58% of any increases in hull and liability insurance may be passed through to our HBS customers according to contract terms.

|

|

·

|

Fuel costs – Fuel accounted for 2.5% of total operating expenses for the year ended December 31, 2009. Both the cost and availability of fuel are influenced by many economic and political factors and events occurring in oil-producing countries throughout the world. The price per barrel of oil has fluctuated significantly over the past several years. We cannot predict the future cost and availability of fuel or the impact of disruptions in oil supplies or refinery production from natural disasters. The unavailability of adequate fuel supplies or higher fuel prices could have an adverse effect on our cost of operations and profitability. Generally, our HBS customers pay for all fuel consumed in medical flights. However, our ability to pass on increased fuel costs for CBS operations may be limited by economic and competitive conditions and by reimbursement rates established by Medicare, Medicaid, and insurance providers. In 2009 and 2008, we entered into financial derivative agreements to protect against increases in the cost of Gulf Coast jet fuel above $2.35 per gallon for wholesale purchases from January 1, 2009, through June 30, 2010, and above $2.71 per gallon from July 1, 2010, through December 31, 2010.

|

|

·

|

Employee recruitment and retention - An important aspect of our operations is the ability to hire and retain employees who have advanced aviation, nursing, and other technical skills. In addition, hospital contracts typically contain minimum certification requirements for pilots and mechanics. Although attrition rates have been reduced recently as a result of the economic downturn, employees who meet these standards are in great demand and are likely to remain a limited resource in the foreseeable future. If we are unable to recruit and retain a sufficient number of these employees, the ability to maintain and grow the business could be negatively impacted. A limited supply of qualified applicants may also contribute to wage increases which outpace the rate of inflation.

|

|

·

|

Restrictive debt covenants – Our senior credit facility contains restrictive financial and operating covenants, including restrictions on our ability to incur additional indebtedness and to engage in various corporate transactions such as mergers, acquisitions, asset sales and the payment of cash dividends. These covenants may restrict future growth through the limitation on acquisitions and may adversely impact our ability to implement our business plan. Failure to comply with the covenants defined in the agreement or to maintain the required financial ratios could result in an event of default and accelerate payment of the principal balances due under the senior credit facility. Given factors beyond our control, such as interruptions in operations from unusual weather patterns or decreases in flight volume due to overall economic conditions not included in current projections, there can be no assurance that we will be able to remain in compliance with financial covenants in the future, or that, in the event of non-compliance, we will be able to obtain waivers from the lenders, or that to obtain such waivers, we will not be required to pay lenders significant cash or equity compensation.

|

|

·

|

Governmental regulation – The air medical transportation services and products industry is subject to extensive regulation by governmental agencies, including the FAA, which imposes significant compliance costs on us. In addition, reimbursement rates for air ambulance services established by governmental programs such as Medicare directly affect CBS revenue and indirectly affect HBS revenue from customers. Changes in laws or regulations or in reimbursement rates could have a material adverse impact on our cost of operations or revenue from flight operations. Periodically the FAA issues airworthiness directives covering one or more models of aircraft. Although we believe that our aircraft are currently in compliance with all FAA-issued airworthiness directives, additional airworthiness directives likely will be issued in the future and may result in additional operating costs or make a particular model of aircraft uneconomical to operate. The significant number of accidents experienced by the air medical services industry in 2008 led to increased scrutiny by regulatory and legislative bodies. During the first quarter of 2009, the FAA issued revised Operations Specifications which increased weather minima for VFR in uncontrolled airspace operations and enhanced route evaluations prior to flight. The changes did not have a significant adverse impact on our operations because we were already operating in accordance with the higher weather minima. The National Transportation Safety Board conducted hearings regarding industry safety in February 2009 and issued recommendations to the FAA for further rule-making. Future legislation or regulatory changes resulting from the hearings may mandate further changes to flight and duty time, minimum equipment requirements, training requirements, or other standards which may increase the cost of our operations.

|

|

·

|

Internal controls – We are required by Section 404 of the Sarbanes-Oxley Act of 2002 to include management and auditor reports on internal controls as part of our annual report. Management concluded that internal control over financial reporting was effective at December 31, 2009, and our independent registered public accounting firm attested to that conclusion. There can be no assurance that material weaknesses in internal controls over financial reporting will not be discovered in the future or that we and our independent registered public accounting firm will be able to conclude that internal control over financial reporting is effective in the future. Although it is unclear what impact failure to comply fully with Section 404 or the discovery of a material weakness in internal controls over financial reporting would have on us, it may subject us to regulatory scrutiny and result in additional expenditures to meet the requirements, a reduced ability to obtain financing, or a loss of investor confidence in the accuracy of our financial reports.

|

|

·

|

Debt and lease obligations – We are obligated under debt facilities providing for up to approximately $161.3 million of indebtedness, of which approximately $73.3 million was outstanding (net of $38.1 million of cash) at December 31, 2009, and operating lease obligations which total $386.6 million over the remaining terms of the leases. If we fail to meet our payment obligations or otherwise default under the agreements governing indebtedness or lease obligations, the lenders under those agreements will have the right to accelerate the indebtedness and exercise other rights and remedies against us. These rights and remedies include the rights to repossess and foreclose upon the assets that serve as collateral, initiate judicial foreclosure against us, petition a court to appoint a receiver for us, and initiate involuntary bankruptcy proceedings against us. If lenders exercise their rights and remedies, our assets may not be sufficient to repay outstanding indebtedness and lease obligations, and there may be no assets remaining after payment of indebtedness and lease obligations to provide a return on common stock.

|

|

·

|

Foreign ownership – Federal law requires that United States air carriers be citizens of the United States. For a corporation to qualify as a United States citizen, the president and at least two-thirds of the directors and other managing officers of the corporation must be United States citizens and at least 75% of the voting interest of the corporation must be owned or controlled by United States citizens. If we are unable to satisfy these requirements, operating authority from the Department of Transportation may be revoked. As of December 31, 2009, we are not aware of any foreign person who holds more than 5% of our outstanding Common Stock. Because we are unable to control the transfer of our stock, we are unable to assure that we can remain in compliance with these requirements in the future.

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

None.

|

ITEM 2.

|

PROPERTIES

|

Facilities

Our headquarters consists of approximately 113,000 square feet of office and hangar space in metropolitan Denver, Colorado, at Centennial Airport. We own the buildings, subject to an existing ground lease with the airport authority which expires in October 2044. We also own and lease various properties for depot level maintenance, warehouse, and administration purposes. We believe that these facilities are in good condition and suitable for our present requirements.

Equipment and Parts

As of December 31, 2009, our aircraft fleet consisted of 81 Company-owned aircraft and 190 aircraft leased under operating leases. The table below also includes 55 aircraft owned by HBS customers and operated by us under contracts with them.

|

Type

|

CBS Division

|

HBS Division

|

HBS Customer-Owned

|

Total

|

||||||||||||

|

Single-Engine Helicopters:

|

||||||||||||||||

|

Bell 206

|

-- | 2 | -- | 2 | ||||||||||||

|

Bell 407

|

-- | 18 | 7 | 25 | ||||||||||||

|

Eurocopter AS 350

|

54 | 20 | 4 | 78 | ||||||||||||

|

Eurocopter EC 130

|

10 | 3 | -- | 13 | ||||||||||||

|

Total Single-Engine

|

64 | 43 | 11 | 118 | ||||||||||||

|

Twin-Engine Helicopters:

|

||||||||||||||||

|

Bell 222

|

13 | 3 | -- | 16 | ||||||||||||

|

Bell 230

|

-- | -- | 1 | 1 | ||||||||||||

|

Bell 412

|

3 | 1 | -- | 4 | ||||||||||||

|

Bell 429

|

-- | 1 | -- | 1 | ||||||||||||

|

Bell 430

|

-- | 1 | 8 | 9 | ||||||||||||

|

Eurocopter AS 365

|

-- | 2 | 5 | 7 | ||||||||||||

|

Eurocopter BK 117

|

31 | 21 | 7 | 59 | ||||||||||||

|

Eurocopter EC 135

|

25 | 44 | 5 | 74 | ||||||||||||

|

Eurocopter EC 145

|

-- | 7 | 10 | 17 | ||||||||||||

|

Boeing MD 902

|

-- | -- | 1 | 1 | ||||||||||||

|

Agusta 109

|

-- | 5 | 2 | 7 | ||||||||||||

|

Total Twin-Engine

|

72 | 85 | 39 | 196 | ||||||||||||

|

Total Helicopters

|

136 | 128 | 50 | 314 | ||||||||||||

|

Airplanes:

|

||||||||||||||||

|

King Air E 90

|

-- | 1 | 2 | 3 | ||||||||||||

|

King Air B 100

|

-- | 1 | -- | 1 | ||||||||||||

|

King Air B 200

|

2 | -- | -- | 2 | ||||||||||||

|

Pilatus PC 12

|

1 | 2 | 3 | 6 | ||||||||||||

|

Total Airplanes

|

3 | 4 | 5 | 12 | ||||||||||||

|

TOTALS

|

139 | 132 | 55 | 326 | ||||||||||||

We generally pay all insurance, taxes, and maintenance expense for each aircraft in our fleet. Because helicopters are insured at replacement cost which usually exceeds book value, we believe that helicopter accidents covered by hull and liability insurance will generally result in full reimbursement of any damages sustained. In the ordinary course of business, we may from time to time purchase and sell helicopters in order to best meet the specific needs of our operations.

We have experienced no significant difficulties in obtaining required parts for our helicopters. Repair and replacement components are purchased primarily through AEC and Bell, whose aircraft make up the majority of our fleet. Based upon the manufacturing capabilities and industry contacts of AEC and Bell, we believe we will not be subject to material interruptions or delays in obtaining aircraft parts and components. Any termination of production by AEC or Bell would require us to obtain spare parts from other suppliers, which are not currently in place.

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

None.

PART II

|

ITEM 4.

|

MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

|

Our common stock is traded on the NASDAQ Global Select Market® under the trading symbol "AIRM." The following table shows, for the periods indicated, the high and low closing prices for our common stock. The quotations for the common stock represent prices between dealers and do not reflect adjustments for retail mark-ups, mark-downs or commissions, and may not represent actual transactions.

Year Ended December 31, 2009

|

Common Stock

|

High

|

Low

|

||||||

|

First Quarter

|

$ | 20.68 | $ | 13.51 | ||||

|

Second Quarter

|

29.62 | 17.01 | ||||||

|

Third Quarter

|

35.51 | 25.78 | ||||||

|

Fourth Quarter

|

35.55 | 28.51 | ||||||

Year Ended December 31, 2008

|

Common Stock

|

High

|

Low

|

||||||

|

First Quarter

|

$ | 49.44 | $ | 38.51 | ||||

|

Second Quarter

|

51.02 | 25.00 | ||||||

|

Third Quarter

|

33.90 | 22.68 | ||||||

|

Fourth Quarter

|

28.62 | 14.64 | ||||||

As of March 5, 2010, there were approximately 202 holders of record of our common stock. We estimate that we have approximately 4,000 beneficial owners of common stock.

We have not paid any cash dividends since inception and intend to retain any future earnings to finance the growth of our business rather than to pay dividends. In addition, our senior credit facility contains a covenant which restricts the payment of dividends.

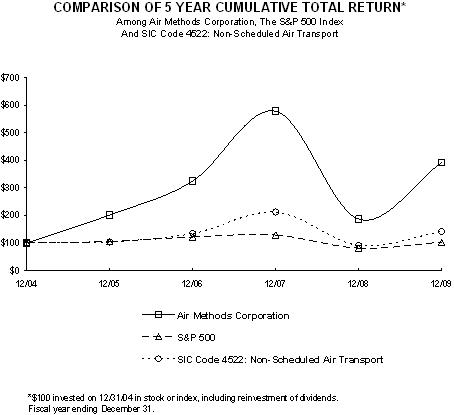

Stock Performance Graph

The following graph compares our cumulative total stockholder return for the period from December 31, 2004 through December 31, 2009, against the Standard & Poor’s 500 Index (S&P 500) and peer group companies in industries similar to those of the Company. The S&P 500 is a widely used composite index reflecting the returns of 500 publicly traded companies in a variety of industries. The Peer Group consists of all publicly traded companies in SIC Group 4522: “Non-scheduled Air Transport,” including Avantair, Inc.; Bristow Group, Inc.; E Prime Aerospace Corp.; Home Energy Savings Corp.; and PHI, Inc. We believe that this Peer Group is our most appropriate peer group for stock comparison purposes due to the limited number of publicly traded companies engaged in air or ground medical transport and because this Peer Group contains a number of companies with capital costs and operating constraints similar to ours. The graph shows the value at the end of each of the last five fiscal years of $100 invested in our common stock or the indices on December 31, 2004, and assumes reinvestment of dividends. Historical stock price performance is not necessarily indicative of future stock price performance.

INDEXED RETURNS

|

Base Period

|

Years Ending

|

|||||||||||||||||||||||

|

Dec-04

|

Dec-05

|

Dec-06

|

Dec-07

|

Dec-08

|

Dec-09

|

|||||||||||||||||||

|

AIR METHODS CORPORATION

|

100.00 | 201.16 | 324.65 | 577.56 | 185.93 | 390.93 | ||||||||||||||||||

|

S & P 500

|

100.00 | 104.91 | 121.48 | 128.16 | 80.74 | 102.11 | ||||||||||||||||||

|

PEER GROUP

|

100.00 | 103.19 | 133.86 | 211.26 | 90.87 | 141.31 | ||||||||||||||||||

|

ITEM 5.

|

SELECTED FINANCIAL DATA

|

The following tables present selected consolidated financial information of the Company and our subsidiaries which has been derived from our audited consolidated financial statements. This selected financial data should be read in conjunction with our consolidated financial statements and notes thereto appearing in Item 7 of this report. Revenue, expenses, and total assets as of and for the years ended December 31, 2009, 2008, and 2007, increased in part as a result of the acquisition of CJ in October 2007. See “Business – General” in Item 1 of this report.

SELECTED FINANCIAL DATA OF THE COMPANY

(Amounts in thousands except share and per share amounts)

|

Year Ended December 31,

|

||||||||||||||||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

Statement of Operations Data:

|

||||||||||||||||||||

|

Revenue

|

$ | 510,605 | 498,802 | 396,349 | 319,504 | 276,178 | ||||||||||||||

|

Operating expenses

|

(397,269 | ) | (398,590 | ) | (293,424 | ) | (244,227 | ) | (211,072 | ) | ||||||||||

|

General and administrative expenses

|

(64,963 | ) | (67,480 | ) | (53,298 | ) | (40,710 | ) | (36,971 | ) | ||||||||||

|

Other expense, net

|

(1,269 | ) | (2,254 | ) | (4,179 | ) | (4,223 | ) | (8,110 | ) | ||||||||||

|

Income before income taxes

|

47,104 | 30,478 | 45,448 | 30,344 | 20,025 | |||||||||||||||

|

Income tax expense

|

(18,151 | ) | (11,209 | ) | (17,911 | ) | (13,144 | ) | (8,193 | ) | ||||||||||

|

Net income

|

$ | 28,953 | 19,269 | 27,537 | 17,200 | 11,832 | ||||||||||||||

|

Basic income per common share

|

$ | 2.36 | 1.59 | 2.30 | 1.46 | 1.07 | ||||||||||||||

|

Diluted income per common share

|

$ | 2.33 | 1.54 | 2.20 | 1.40 | 1.02 | ||||||||||||||

|

Weighted average number of shares of Common Stock outstanding - basic

|

12,267,727 | 12,155,144 | 11,953,871 | 11,748,107 | 11,058,971 | |||||||||||||||

|

Weighted average number of shares of Common Stock outstanding - diluted

|

12,434,586 | 12,530,381 | 12,512,077 | 12,306,047 | 11,654,885 | |||||||||||||||

SELECTED FINANCIAL DATA OF THE COMPANY

(Amounts in thousands)

|

As of December 31,

|

||||||||||||||||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Total assets

|

$ | 424,132 | 394,924 | 369,552 | 250,157 | 221,532 | ||||||||||||||

|

Long-term liabilities

|

153,860 | 142,674 | 125,433 | 95,014 | 89,649 | |||||||||||||||

|

Stockholders' equity

|

196,542 | 160,464 | 142,020 | 107,314 | 86,211 | |||||||||||||||

SELECTED OPERATING DATA

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

For year ended December 31:

|

||||||||||||||||||||

|

CBS patient transports

|

39,613 | 42,394 | 39,256 | (1) | 34,116 | 31,841 | ||||||||||||||

|

HBS medical missions

|

60,545 | 63,577 | 59,658 | (1) | 50,670 | 49,644 | ||||||||||||||

|

As of December 31:

|

||||||||||||||||||||

|

CBS bases

|

105 | 100 | 106 | 76 | 69 | |||||||||||||||

|

HBS bases

|

129 | 145 | 157 | 90 | 87 | |||||||||||||||

(1) Includes transports and missions for CJ locations from October 1, 2007 through December 31, 2007, only.

|

ITEM 6.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

The following discussion of the results of operations and financial condition should be read in conjunction with our consolidated financial statements and notes thereto included in Item 7 of this report. This report, including the information incorporated by reference, contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. The use of any of the words “believe,” “expect,” “anticipate,” “plan,” “estimate,” and similar expressions are intended to identify such statements. Forward-looking statements include statements concerning our possible or assumed future results; flight volume and collection rates for CBS operations; size, structure and growth of our air medical services and products markets; continuation and/or renewal of HBS contracts; acquisition of new and profitable Products Division contracts; and other matters. The actual results that we achieve may differ materially from those discussed in such forward-looking statements due to the risks and uncertainties described in the Risk Factors section of this report, in Management’s Discussion and Analysis of Financial Condition and Results of Operations, and in other sections of this report, as well as in our quarterly reports on Form 10-Q. We undertake no obligation to update any forward-looking statements.

Overview

We provide air medical transportation services throughout the United States and design, manufacture, and install medical aircraft interiors and other aerospace and medical transport products. Our divisions, or business segments, are organized according to the type of service or product provided and consist of the following:

|

·

|

Community-Based Services (CBS) - provides air medical transportation services to the general population as an independent service. Revenue consists of flight fees billed directly to patients, their insurers, or governmental agencies, and cash flow is dependent upon collection from these individuals or entities. In 2009 the CBS Division generated 56% of our total revenue, compared to 59% in 2008 and 64% in 2007.

|

|

·

|

Hospital-Based Services (HBS) - provides air medical transportation services to hospitals throughout the U.S. under exclusive operating agreements. Revenue consists primarily of fixed monthly fees (approximately 76% of total contract revenue) and hourly flight fees (approximately 24% of total contract revenue) billed to hospital customers. In 2009 the HBS Division generated 39% of our total revenue, compared to 38% in 2008 and 33% in 2007.

|

|

·

|

Products Division - designs, manufactures, and installs aircraft medical interiors and other aerospace and medical transport products for domestic and international customers. In 2009 the Products Division generated 5% of our total revenue, compared to 3% in 2008 and 2007.

|

See Note 13 to the consolidated financial statements included in Item 7 of this report for operating results by segment.

We believe that the following factors have the greatest impact on our results of operations and financial condition:

|

·

|

Flight volume. Fluctuations in flight volume have a greater impact on CBS operations than HBS operations because almost all of CBS revenue is derived from flight fees, as compared to approximately 24% of HBS revenue. By contrast, 81% of our costs primarily associated with flight operations (including salaries, aircraft ownership costs, hull insurance, and general and administrative expenses) incurred during the year ended December 31, 2009, are mainly fixed in nature. While flight volume is affected by many factors, including competition and the effectiveness of marketing and business development initiatives, the greatest single variable has historically been weather conditions. Adverse weather conditions—such as fog, high winds, or heavy precipitation—hamper our ability to operate our aircraft safely and, therefore, result in reduced flight volume. Total patient transports for CBS operations were approximately 39,600 for 2009 compared to approximately 42,400 for 2008. Patient transports for CBS bases open longer than one year (Same-Base Transports) were approximately 36,900 in 2009 compared to 39,200 in 2008. Cancellations due to unfavorable weather conditions for CBS bases open longer than one year were 550, or 4.4%, higher in 2009 compared to 2008. We believe that Same-Base Transports, especially in the first six months of 2009, were negatively affected by overall weaker economic conditions in the United States.

|

|

·

|

Reimbursement per transport. We respond to calls for air medical transports without pre-screening the creditworthiness of the patient and are subject to collection risk for services provided to insured and uninsured patients. Medicare and Medicaid also receive contractual discounts from our standard charges for flight services. Flight revenue is recorded net of provisions for contractual discounts and estimated uncompensated care. Both provisions are estimated during the period the related services are performed based on historical collection experience and any known trends or changes in reimbursement rate schedules and payer mix. The provisions are adjusted as required based on actual collections in subsequent periods. Net reimbursement per transport for CBS operations is primarily a function of price, payer mix, and timely and effective collection efforts. Both the pace of collections and the ultimate collection rate are affected by the overall health of the U.S. economy, which impacts the number of indigent patients and funding for state-run programs, such as Medicaid. Medicaid reimbursement rates in many jurisdictions have remained well below the cost of providing air medical transportation. In addition, the collection rate is impacted by changes in the cost of healthcare and health insurance; as the cost of healthcare increases, health insurance coverage provided by employers may be reduced or eliminated entirely, resulting in an increase in the uninsured population. Pending healthcare legislation, if enacted, may also affect collections. The average gross charge per transport increased 12.7% in the year ended December 31, 2009, compared to 2008, contributing to an increase of 6.3% in net reimbursement per transport in the year ended December 31, 2009, compared to 2008. Provisions for contractual discounts and estimated uncompensated care as a percentage of related gross billings for CBS operations were as follows:

|

|

For years ended December 31,

|

||||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

Gross billings

|

100 | % | 100 | % | 100 | % | ||||||

|

Provision for contractual discounts

|

38 | % | 35 | % | 32 | % | ||||||

|

Provision for uncompensated care

|

20 | % | 20 | % | 19 | % | ||||||

The increase in the total percentage of uncollectible accounts for 2009 is primarily attributable to price increases. Although price increases generally increase the net reimbursement per transport from insurance payers, the amount per transport collectible from private patient payers and Medicare and Medicaid does not increase proportionately with price increases. Therefore, depending upon overall payer mix, price increases will usually result in an increase in the percentage of uncollectible accounts. Although we have not yet experienced significant increased limitations in the amount reimbursed by insurance companies, continued price increases may cause insurance companies to limit coverage for air medical transport to amounts less than our standard rates.

|

·

|

Aircraft maintenance. Both CBS and HBS operations are directly affected by fluctuations in aircraft maintenance costs. Proper operation of the aircraft by flight crews and standardized maintenance practices can help to contain maintenance costs. Increases in spare parts prices from original equipment manufacturers tend to be higher for aircraft which are no longer in production. Three models of aircraft within our fleet, representing 24% of the rotor wing fleet, are no longer in production and are, therefore, susceptible to price increases which outpace general inflationary trends. In addition, on-condition components are more likely to require replacement with age. Since January 1, 2008, we have taken delivery of 46 new aircraft and expect to take delivery of twelve new aircraft in 2010. We have replaced discontinued models and other older aircraft with the new aircraft, as well as provided capacity for base expansion. Replacement models of aircraft typically have higher ownership costs than the models targeted for replacement but lower maintenance costs. Total maintenance expense for CBS and HBS operations decreased 15.3% from the year ended December 31, 2008, to the year ended December 31, 2009, while total flight volume for CBS and HBS operations decreased 9.1% over the same period. Maintenance cost per hour on newer aircraft has remained relatively constant on an annual basis. Maintenance cost per hour on older models of aircraft, however, may vary more widely on a quarterly basis depending on component overhaul and replacement and aircraft refurbishment cycles.

|

|

·

|

Competitive pressures from low-cost providers. We are recognized within the industry for our standard of service and our use of cabin-class aircraft. Many of our competitors utilize aircraft with lower ownership and operating costs and do not require a similar level of experience for aviation and medical personnel. Reimbursement rates established by Medicare, Medicaid, and most insurance providers are not contingent upon the type of aircraft used or the experience of personnel. However, we believe that higher quality standards help to differentiate our service from competitors and, therefore, lead to higher utilization.

|

|

·

|

Employee recruitment and relations. The ability to deliver quality services is partially dependent upon our ability to hire and retain employees who have advanced aviation, nursing, and other technical skills. In addition, hospital contracts typically contain minimum certification requirements for pilots and mechanics. In September 2003, our pilots voted to be represented by a collective bargaining unit, and we signed a collective bargaining agreement on March 31, 2006. The agreement was effective January 1, 2006, through April 30, 2009. Negotiations on a new CBA commenced in the fourth quarter of 2008 and were referred for mediation during the second quarter of 2009. Under the Railway Labor Act, mediation decisions are non-binding on either party, and the duration of the process may vary depending upon the mediator assigned and the complexity of the issues negotiated. Other employee groups may also elect to be represented by unions in the future.

|

Results of Operations

Year ended December 31, 2009 compared to 2008

We reported net income of $28,953,000 for the year ended December 31, 2009, compared to $19,269,000 for the year ended December 31, 2008. Net income for 2008 included an income tax benefit of $1,479,000 due to a change in the effective state income tax rate. Net reimbursement per transport for CBS operations increased 6.3% in 2009 compared to 2008, while Same-Base Transports for CBS operations were 5.9% lower over the same period. Aircraft operating expenses decreased 15.3% for 2009 compared to 2008, reflecting lower maintenance and fuel costs.

Flight Operations – Community-based Services and Hospital-based Services

Net flight revenue increased $1,119,000, or 0.2%, from $485,184,000 for the year ended December 31, 2008, to $486,303,000 for the year ended December 31, 2009. Flight revenue is generated by both CBS and HBS operations and is recorded net of provisions for contractual discounts and uncompensated care.

|

·

|

CBS – Net flight revenue decreased $9,835,000, or 3.3%, to $287,425,000 for the following reasons:

|

|

|

·

|

Net revenue of $7,688,000 earned in 2008 pursuant to a contract to support the Federal Emergency Management Agency (FEMA) in disaster recovery efforts. No such revenue was generated in 2009.

|

|

|

·

|

Decrease of approximately 5.9% in Same Base Transports in 2009 compared to 2008. Cancellations due to unfavorable weather conditions for CBS bases open longer than one year were 550 higher in 2009 compared to 2008. In the first six months of 2009, Same Base Transports were negatively affected by overall weaker economic conditions in the United States. In the last six months of 2009, the decrease in Same Base Transports can be attributed almost entirely to increased weather cancellations.

|

|

|

·

|

Increase of 12.7% in average gross charge per transport for the year ended December 31, 2009, compared to 2008. Net reimbursement per transport increased approximately 6.3% over the same period.

|

|

|

·

|

Incremental net revenue of $23,055,000 generated from new service agreements with another air medical service provider in the Atlanta area and the addition of fourteen new CBS bases, including two bases resulting from the conversion of an HBS contract, during either 2009 or 2008.

|

|

|

·

|

Closure of seventeen bases during either 2009 or 2008, resulting in a decrease in net revenue of approximately $17,421,000.

|

|

·

|

HBS – Net flight revenue increased $10,954,000, or 5.8%, to $198,878,000 for the following reasons:

|

|

|

·

|

Incremental net revenue of $8,098,000 generated from the addition of one new contract and the expansion of nine contracts during either 2009 or 2008.

|

|

|

·

|

Cessation of service under ten contracts during either 2009 or 2008 and the conversion of one contract to CBS operations in the second quarter of 2009, resulting in a decrease in net revenue of approximately $10,239,000.

|

|

|

·

|

Annual price increases in the majority of contracts based on changes in the Consumer Price Index or spare parts prices from aircraft manufacturers and the renewal of contracts at higher rates.

|

|

|

·

|

Decrease of 9.2% in flight volume for all contracts excluding new contracts, contract expansions, and closed contracts discussed above.

|

Flight center costs (consisting primarily of pilot, mechanic, and medical staff salaries and benefits) increased $805,000, or 0.4%, to $210,511,000 for the year ended December 31, 2009, compared to 2008. Changes by business segment were as follows:

|

·

|

CBS – Flight center costs decreased $328,000, or 0.3%, to $128,977,000 for the following reasons:

|

|

|

·

|

Increase of $10,272,000 for the addition of personnel and facilities to staff new base locations described above.

|

|

|

·

|

Decrease of $10,081,000 due to the closure of base locations described above.

|

|

|

·

|

Increases in salaries for merit pay raises and in the cost of our medical insurance.

|

|

·

|

HBS - Flight center costs increased $1,132,000, or 1.4%, to $81,534,000 primarily due to the following:

|

|

|

·

|

Increase of approximately $2,606,000 for the addition of personnel to staff new base locations and contract described above.

|

|

|

·

|

Decrease of approximately $3,993,000 due to the base closures described above.

|

|

|

·

|

Increases in salaries for merit pay raises and in the cost of our medical insurance.

|

Aircraft operating expenses decreased $17,988,000, or 15.3%, for the year ended December 31, 2009, in comparison to 2008. Aircraft operating expenses consist of fuel, insurance, and maintenance costs and generally are a function of the size of the fleet, the type of aircraft flown, and the number of hours flown. The decrease in costs is due to the following:

|

·

|

Decrease of $13,404,000, or 15.3%, in aircraft maintenance expense to $73,980,000, primarily attributable to our fleet rejuvenation efforts and to our increasing use of single-engine, rather than twin-engine, aircraft. Since the first quarter of 2008, we have placed 58 new helicopters into service (consisting of 34 single-engine aircraft, 23 twins, and 1 fixed wing aircraft) and eliminated 47 aircraft which were older models (consisting of 11 single-engine aircraft, 32 twins, and 4 fixed wing aircraft). Maintenance cost per hour on newer aircraft has remained relatively constant on an annual basis. Maintenance cost per hour on older models of aircraft, however, may vary more widely on a quarterly basis depending on component overhaul and replacement and aircraft refurbishment cycles. In 2009, as part of our fleet planning, we also utilized components from certain retired aircraft instead of purchasing replacement parts from outside vendors.

|

|

·

|

Decrease of approximately 33.7% in the cost of aircraft fuel per hour flown. Fuel costs decreased by $6,830,000 to a total expense of $11,782,000 for 2009, compared to 2008.

|

|

·

|

Decreases in flight volume for bases open longer than one year for both CBS and HBS as described above.

|

|

·

|

Increases in hull insurance rates effective July 2009 and 2008.

|

Aircraft rental expense increased $2,517,000, or 5.3%, for the year ended December 31, 2009, in comparison to 2008, due primarily to incremental rental expense of $6,354,000 for 35 leased aircraft added to our fleet during either 2008 or 2009. The increase for new aircraft was offset in part by selling or refinancing 27 aircraft at lower lease rates or through debt financing.

Medical Interiors and Products

Sales of medical interiors and products increased $10,684,000, or 78.5%, from $13,618,000 for the year ended December 31, 2008, to $24,302,000 for the year ended December 31, 2009. Significant projects in process during 2009 included 48 HH-60L units, 81 MEV litter systems, and eight medical interior kits for commercial customers. Revenue by product line for the year ended December 31, 2009, was as follows:

|

·

|

$16,919,000 – governmental entities

|

|

·

|

$7,383,000 – commercial customers

|

Significant projects in 2008 included nine modular medical interior kits for commercial customers, three of which were still in process as of December 31, 2008. As of December 31, 2008, two design contracts for the U.S. Army, 48 HH-60L units, and 366 MEV units were also in process. Revenue by product line for the year ended December 31, 2008, was as follows:

|

·

|

$7,905,000 – governmental entities

|

|

·

|

$5,713,000 – commercial customers

|

Cost of medical interiors and products increased $8,313,000, or 85.4%, for the year ended December 31, 2009, as compared to the previous year, due primarily to changes in sales volume and sales mix. The average net margin earned on projects during 2009 was 21.8% compared to 17.1% in 2008. Costs in 2008 included development and design work on avionics and other aircraft interior configurations for commercial customers, leading to higher engineering and documentation costs and lower profit margins.

General Expenses

Depreciation and amortization expense increased $2,779,000, or 16.3%, for the year ended December 31, 2009. In 2009 we added seventeen aircraft totaling approximately $37.6 million to our depreciable assets.

General and administrative (G&A) expenses decreased $2,517,000, or 3.7%, for the year ended December 31, 2009, compared to 2008. G&A expenses include executive management, accounting and finance, billing and collections, information services, human resources, aviation management, pilot training, dispatch and communications, and CBS and HBS program administration. The following events contributed to the change in G&A expenses:

|

·

|

Completion of the consolidation of the Part 135 Air Carrier Certificate for CJ into the Air Methods certificate during the second quarter of 2008. Costs of $1,195,000 were incurred in 2008 related to the consolidation.

|

|

·

|

Reorganization of field-based program management during the second quarter of 2009, resulting in the elimination of fifteen positions and the transfer of other personnel into other open positions within the Company.

|

|

·

|

Closure of the CJ patient billing office and incorporation of these functions into our existing billing department, resulting in the elimination of sixteen full-time positions as well as additional contract positions. The transition was completed during the second quarter of 2008.

|

|

·

|

Consolidation of corporate overhead functions.

|

Income tax expense was $18,151,000, or 38.5% of income before taxes, in 2009 and $11,209,000, or 36.8% of income before taxes, in 2008. In 2008 the effective rate used to determine state income taxes decreased primarily due to a change in Colorado statute defining the apportionment calculation. Income tax benefit of $1,479,000 was recognized for the year ended December 31, 2008, as a result of applying the new rate to deferred tax assets and liabilities. Excluding the effect of this change, the effective tax rate for 2008 was 41.6%. The decrease from 41.6% to 38.5% in the effective tax rate was primarily attributed to a decrease in certain permanent book-tax differences and to a change in the effective state income tax rate as a result of our withdrawal from certain states and revisions in state tax regulations.

Year ended December 31, 2008 compared to 2007

We reported net income of $19,269,000 for the year ended December 31, 2008, compared to $27,537,000 for the year ended December 31, 2007. Net income for 2008 included an income tax benefit of $1,479,000 due to a change in the effective state income tax rate. Net income for 2007 included a pre-tax loss on early extinguishment of debt of $757,000 (with a tax effect of approximately $310,000) and an income tax benefit of $1,052,000 resulting from the recovery of previously expired net operating loss carryforwards. Same-Base Transports for CBS operations were 3,611, or 9.7%, lower in 2008 compared to 2007, partly because cancellations of flights due to unfavorable weather conditions for these bases increased by 1,123. Same-Base Transports were also negatively impacted by a third-quarter spike in fuel prices which decreased road traffic volume and overall weakening economic conditions in the United States. Aircraft operating expenses increased 46.5% in 2008, primarily due to the acquisition of CJ, higher maintenance costs on older models of aircraft, and higher fuel costs.

Flight Operations – Community-based Services and Hospital-based Services

Net flight revenue increased $98,807,000, or 25.6%, from $386,377,000 for the year ended December 31, 2007, to $485,184,000 for the year ended December 31, 2008. Changes by business segment were as follows:

|

·

|

CBS – Net flight revenue increased $42,390,000, or 16.6%, to $297,260,000 for the following reasons:

|

|

|

·

|

Net revenue of $34,059,000 from CJ’s CBS operations from January 1, 2008, through September 30, 2008.

|

|

|

·

|

Increase of 16.2% in average gross charge per transport for the year ended December 31, 2008, compared to 2007. Net reimbursement per transport increased approximately 5.7% over the same period.

|

|

|

·

|

Incremental net revenue of $16,835,000 generated from the addition of fifteen new CBS bases during either 2008 or 2007.

|

|

|

·

|

Revenue of $7,688,000 earned pursuant to a contract to support FEMA in disaster recovery efforts. During the third quarter of 2008, we mobilized 25 and 15 aircraft and crews to respond to the threat posed by Hurricanes Gustav and Ike, respectively, along the Gulf Coast. During 2007, we recognized net revenue of $992,000 pursuant to the same contract.

|

|

|

·

|

Closure of eight bases during either 2007 or 2008 and the conversion of another base to HBS operations, resulting in a decrease in net revenue of approximately $8,105,000.

|

|

|

·

|

Decrease of approximately 9.7% in Same Base Transports in 2008 compared to 2007. Cancellations due to unfavorable weather conditions for CBS bases open longer than one year were 1,123 higher in 2008 compared to 2007. The remaining decline in Same-Base Transports is believed to be attributable to other factors, including a third-quarter spike in fuel prices which decreased road traffic volume, overall economic conditions in the United States, and lost flights due to redeployment of numerous aircraft and crews to respond to Hurricanes Gustav and Ike.

|

|

·

|

HBS – Net flight revenue increased $56,417,000, or 42.9%, to $187,924,000 for the following reasons:

|

|

|

·

|

Net revenue of $47,412,000 from CJ’s HBS operations from January 1, 2008, through September 30, 2008.

|

|

|

·

|