Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - LUFKIN INDUSTRIES INC | exh21.htm |

| EX-23 - EXHIBIT 23 - LUFKIN INDUSTRIES INC | exh23.htm |

| EX-32.1 - EXHIBIT 32.1 - LUFKIN INDUSTRIES INC | exh32_1.htm |

| EX-18.1 - EXHIBIT 18.1 - LUFKIN INDUSTRIES INC | exh18_1.htm |

| EX-31.2 - EXHIBIT 31.2 - LUFKIN INDUSTRIES INC | exh31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - LUFKIN INDUSTRIES INC | exh31_1.htm |

| EX-32.2 - EXHIBIT 32.2 - LUFKIN INDUSTRIES INC | exh32_2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM

10-K

[X]

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

fiscal year ended December

31, 2009

[ ]

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For

transition period from to

Commission

file number

0-2612

LUFKIN INDUSTRIES, INC.

(Exact

name of registrant as specified in its charter)

|

TEXAS

|

75-0404410

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

|

601

SOUTH RAGUET, LUFKIN, TEXAS

|

75904

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant's

telephone number, including area code (936)

634-2211

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $1 Per Share

(Title of

Class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities

Act. Yes

X No

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the

Act. Yes

No X

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes X

No___

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes

__ No X

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. X

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definitions of “large accelerated filer”, “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

Large

accelerated filer X Accelerated

filer ______

Non-accelerated

filer

______ Smaller

reporting company ______

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes

No X

The

aggregate market value of the Company's voting stock held by non-affiliates as

of the last business day of the Company’s most recently completed second fiscal

quarter, June 30, 2009, was $624,896,430.

There

were 14,925,871 shares of Common Stock, $1.00 par value per share,

outstanding as of February 24, 2010.

DOCUMENTS

INCORPORATED BY REFERENCE

The

information called for by Items 10, 11, 12, 13 and 14 of Part III of this annual

report on Form 10-K are incorporated by reference from the registrant’s

definitive proxy statement for the 2010 Annual Meeting of Stockholders to

be filed pursuant to Regulation 14A.

PART

I

Item 1. Business

Lufkin

Industries, Inc. (the “Company”) was incorporated under the laws of the State of

Texas on March 4, 1902, and since that date has maintained its principal office

and manufacturing facilities in Lufkin, Texas. The Company employed

approximately 2,600 people at December 31, 2009, including approximately 1,600

that were paid on an hourly basis. Certain operations are subject to

a union contract that expires in October 2011. The Company, a global supplier of

oil field and power transmission products, is divided into two operating

segments: Oil Field and Power Transmission.

In

January 2008, the Company announced the decision to suspend its participation in

the commercial trailer markets and to develop a plan to run-out existing

inventories, fulfill contractual obligations and close all trailer facilities

during 2008. During the second quarter of 2008, this plan was completed, with

the majority of the remaining inventory and manufacturing equipment sold and all

facilities closed. As a result, the former Trailer segment was classified as a

discontinued operation during 2008.

Oil

Field

Products:

The Oil

Field segment manufactures and services artificial lift products, including

reciprocating rod lift, commonly referred to as pumping units, gas lift, plunger

lift equipment and related products.

Pumping Units- Four basic

types of pumping units are manufactured: an air-balanced unit; a beam-balanced

unit; a crank-balanced unit; and a Mark II Unitorque unit. The basic

differences between the four types relate to the counterbalancing

system. The depth of a well and the desired fluid production

determine the type of counterbalancing configuration that is

required. There are numerous sizes and combinations of Lufkin oil

field pumping units within the four basic types.

Pumping Unit Service- Through

a network of service centers, the Company transports and repairs pumping units.

The service centers also refurbish used pumping units.

Automation- The Company

designs, manufactures, installs and services computer control equipment and

analytical services for artificial lift equipment that lower production costs

and optimize well efficiency.

Lufkin ILS- Through this

acquisition in 2009, the Company now designs, manufactures, installs and

services gas lift, plunger lift and completion equipment.

Foundry Castings- As part of

the Company’s vertical integration strategy, the Oil Field segment operates an

iron foundry to produce castings for new pumping units. In order to maximize

utilization of this facility, castings for third parties are also

produced.

Raw

Materials & Labor:

Oil Field

purchases a variety of raw materials in manufacturing its products. The

principal raw materials are structural and plate steel, round alloy steel and

iron castings from both its own foundry and third-party foundries. Casting costs

are subject to change from raw material prices on scrap iron and pig iron in

addition to natural gas and electricity prices. Due to the many configurations

of its products and thus sizes of raw material used, Oil Field does not enter

into long-term contracts for raw materials but generally does not experience

shortages of raw materials. During the period of 2007 through 2009, Oil Field

did not experience any significant material shortages. During the first three

quarters of 2008, raw material prices for steel and castings increased

significantly but started declining in the fourth quarter of 2008 and through

2009. As the global economy improves in 2010, raw material prices are expected

to moderately increase. Raw material prices may continue to increase and

availability may decrease with little notice.

The

nature of the products manufactured and serviced generally requires skilled

labor. Oil Field’s ability to increase capacity could be limited by its ability

to hire and train qualified personnel. Also, the main U.S. manufacturing

facilities are unionized, so any labor disruption could have a significant

impact on Oil Field’s ability to maintain production levels. The current labor

contract expires in October 2011.

Markets:

Demand

for artificial lift equipment primarily depends on the level of new onshore oil

well and workover drilling activity as well as the depth and fluid conditions of

that drilling. Drilling activity is driven by the available cash flow of the

Company’s customers as well as their long-term perceptions of the level and

stability of the price of oil. The higher energy prices experienced since 2004

have increased the demand for artificial lift equipment and related service and

products from higher drilling activity, activation of idle wells and the

upgrading of existing wells. During 2008, demand in the North American market

increased significantly compared to 2007 levels due to the impact of increased

drilling in response to higher oil prices and recapturing certain market share

from lower-priced imported equipment as customers reevaluated the total

life-cycle cost differences. Traditionally, as pumping unit demand increases and

availability of used equipment diminishes, demand for new equipment increases.

Increasingly in 2007, lower-priced imported pumping units entered the North

American market in place of used equipment and reduced the incremental demand

for the Company’s new pumping units. In the fourth quarter of 2008, oil prices

decreased significantly and stayed at reduced levels throughout the first half

of 2009. As drilling activity reduced in response to lower oil prices, demand

for artificial lift equipment and related service was also negatively impacted.

Also, as raw material costs declined and surplus equipment increased, there was

competitive pressure to lower selling prices. Lower selling prices combined with

the negative impact of low capacity utilization in manufacturing facilities,

gross margins declined in 2009. In the second half of 2009, oil prices increased

back to 2007 levels and drilling activity, especially for oil, increased. This

trend is expected to continue in 2010, with higher drilling activity and lower

surplus equipment inventory driving demand for new artificial lift equipment.

Longer-term, the demand for artificial lift equipment will continue to increase

in international markets. While a majority of the segment’s revenues are in

North America, international opportunities continue to increase as new drilling

increases and existing fields mature, requiring increased use of artificial

lift, especially in the South American, Russian and Middle Eastern markets. An

Oilfield customer and its related subsidiaries represented 11.0%, 15.4% and

15.9% of consolidated company sales in 2009, 2008 and 2007, respectively. The

loss of this customer would have a material adverse effect on this

segment.

Competition:

The

primary global competitor for artificial lift equipment is Weatherford

International, but Chinese manufacturers of artificial lift equipment are

increasingly present in the market. Used pumping units are also an important

factor in the North American market, as customers will generally attempt to

satisfy requirements through used equipment before purchasing new

equipment. While the Company believes that it is one of the larger

manufacturers of artificial lift equipment in the world, manufacturers of other

types of units like electric submersible pumps have a significant share of the

total artificial lift market. While Weatherford International is the Company’s

single largest competitor in the service market, small independent operators

provide significant competitive pressures.

Because

of the competitive nature of the business and the relative age of many of the

product designs, price, delivery time, product quality and customer service are

important factors in winning orders. To this end, the Company maintains

strategic levels of inventories in order to ensure delivery times and invests in

new capital equipment to maintain quality and price levels.

Power

Transmission

Products:

The Power

Transmission segment designs, manufactures and services speed increasing and

reducing gearboxes for industrial applications. Speed increasers convert lower

speed and higher torque input to higher speed and lower torque output while

speed reducers convert higher speed and lower torque input to lower speed and

higher torque output. The Company produces numerous sizes and designs of

gearboxes depending on the end use. While there are standard designs, the

majority of gearboxes are customized for each application.

High-Speed Gearboxes- Single

stage gearboxes with pitch line velocities equal to or greater than 35 meters

per second or rotational speeds greater than 4500 rpm or multi-stage gearboxes

with at least one stage having a pitch line velocity equal to or greater than 35

meters per second and other stages having pitch line velocities equal to or

greater than 8 meters per second are classified as high-speed gearboxes. These

gearboxes require extremely high precision manufacturing and testing due to the

stresses on the gearing. The ratio of increasers to reducers is fairly even.

These gearboxes more typically service the energy related markets of

petrochemicals, refineries, offshore production and transmission of oil and

gas.

Low-Speed Gearboxes- Gearboxes

which do not meet the pitch line or rotational speed criteria of high-speed

gearboxes are classified as low-speed gearboxes. The majority of low-speed

gearboxes are reducers. While still requiring close tolerances, these gearboxes

do not require the same precision of manufacturing and testing. These gearboxes

more typically service commodity-related industries like rubber, sugar, paper,

steel, plastics, mining and cement as well as marine propulsion.

Parts- The Company

manufactures capital spares for customers in conjunction with the production of

new gearboxes, as well as producing parts for aftermarket service.

Gearbox Repair & Service-

The Company provides on and off-site repair and service for not only its own

products but also those manufactured by other companies. Repair work is

performed in dedicated facilities due to the quick turn-around times

required.

Lufkin RMT- Through this

acquisition in 2009, the Company now participates in the turbo-machinery

industry, specializing in the analysis design and manufacture of precision,

custom-engineered tilting-pad bearings and related components for high-speed

turbo equipment operating in critical duty applications. RMT also

services, repairs and upgrades turbo-expander process units for air and gas

separation.

Raw

Materials & Labor:

Power

Transmission purchases a variety of raw materials in manufacturing its products.

The principal raw materials are steel plate, round alloy steel, iron castings

and steel forgings. Due to the customized nature of its products, Power

Transmission generally does not enter into long-term contracts for raw

materials. Though raw material shortages are infrequent, lead times can be long

due to the custom nature of many of its orders. Raw material prices are not

expected to decline significantly in the short-term and may continue to increase

with little notice. Certain materials like steel round, steel plate, steel

forgings and bearings have continued to experience price increases and longer

lead times. Raw material and component part shortages are not expected in the

short-term, but certain supplier lead-times have grown, especially bearing

suppliers.

The

nature of the products manufactured and serviced generally requires skilled

labor. Power Transmission’s ability to increase capacity could be limited by its

ability to hire and train qualified personnel. Also, the main U.S. manufacturing

facilities are unionized, so any labor disruption could have a significant

impact on Power Transmission’s ability to maintain production levels. The

current labor contract expires in October 2011.

Markets:

Power

Transmission services many diverse markets, with high-speed gearing for markets

such as petrochemicals, refineries, offshore production and transmission of oil

and low-speed gearing for the gas, rubber, sugar, paper, steel, plastics,

mining, cement and marine propulsion, each of which has its own unique set of

drivers. Favorable conditions for one market may be unfavorable for another

market. Generally, if general global industrial capacity utilizations are not

high, spending on new equipment lags. Also impacting demand are government

regulations involving safety and environmental issues that can require capital

spending. Recent market demand increases have come from energy-related markets

such as refining, petrochemical, drilling, coal, marine and power generation in

response to higher global energy prices. RMT products generally follow the

market for high-speed gearboxes. During the latter part of 2008, energy prices

decreased significantly, global growth slowed and large project financing became

difficult to secure. New order booking declined in the first half of 2009, which

negatively impacted sales starting in late 2009. While sales will remain at

these lower levels during the first half of 2010, new order and quotation

activity, especially from large LNG projects, during this period is expected to

increase and should translate into higher sales in the latter half of

2010.

Competition:

Despite

the highly technical nature of the products in this segment, there are many

competitors. While several North American competitors have de-emphasized the

market, many European companies remain in the market. Competitors include

Flender Graffenstaden, BHS, Renk, Rientjes, CMD, Philadelphia Gear and Horsburgh

& Scott. While price is an important factor, proven designs, workmanship and

engineering support are critical factors. Due to this, the Company outsources

very little of the design and manufacturing processes.

Federal

Regulation and Environmental Matters

The

Company’s operations are subject to various federal, state and local laws and

regulations, including those related to air emissions, wastewater discharges,

the handling of solid and hazardous wastes and occupational safety and

health. Environmental laws have, in recent years, become more

stringent and have generally sought to impose greater liability on a larger

number of potentially responsible parties. While the Company is not

currently aware of any situation involving an environmental claim that would

likely have a material adverse effect on its business, it is always possible

that an environmental claim with respect to one or more of the Company’s current

businesses or a business or property that one of our predecessors owned or used

could arise that could have a material adverse effect. The Company’s operations

have incurred, and will continue to incur, capital and operating expenditures

and other costs in complying with these laws and regulations in both the United

States and abroad. However, the Company does not anticipate the future costs of

environmental compliance will have a material adverse effect on its business,

financial results or results of operations.

Available

Information

The

Company makes available, free of charge, through our website, www.lufkin.com,

its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports

on Form 8-K and amendments to those reports filed or furnished pursuant to

Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as

amended. Access to these electronic filings is available as soon as

reasonably practicable after the Company files such material with, or furnishes

it to, the Securities and Exchange Commission. You may also request

printed copies of these documents free of charge by writing to the Company

Secretary at P.O. Box 849, Lufkin, Texas 75902. Our reports filed

with the SEC are also made available to read and copy at the SEC’s Public

Reference Room at 100 F Street, N.E., Washington, D.C., 20549. You

may obtain information about the Public Reference Room by contacting the SEC at

1-800-SEC-0330. Reports filed with or furnished to the SEC are

also made available on its website at www.sec.gov.

Item 1A. Risk

Factors.

The

risks described below are those which the Company believes are the material

risks that it faces. Any of the risk factors described below could

significantly and adversely affect its business, prospects, financial condition

and results of operations.

A

decline in domestic and worldwide oil and gas drilling activity would adversely

affect the Company’s results of operations.

The Oil

Field segment is materially dependent on the level of oil and gas drilling

activity in North America and worldwide, which in turn depends on the level of

capital spending by major, independent and state-owned exploration and

production companies. This capital spending is driven by current

prices for oil and gas and the perceived stability and sustainability of those

prices. Oil and gas prices have been subject to significant

fluctuation in recent years in response to changes in the supply and demand for

oil and gas, market uncertainty, world events, governmental actions, and a

variety of additional factors that are beyond the Company’s control,

including:

|

l

|

the

level of North American and worldwide oil and gas exploration and

production activity;

|

|

l

|

worldwide

economic conditions, particularly economic conditions in North

America;

|

|

l

|

oil

and gas production costs;

|

|

l

|

weather

conditions;

|

|

l

|

the

expected costs of developing new reserves;

|

|

l

|

national

government political requirements and the policies of

OPEC;

|

|

l

|

the

price and availability of alternative fuels;

|

|

l

|

the

effect of worldwide energy conservation measures;

|

|

l

|

environmental

regulation; and

|

|

l

|

tax

policies.

|

Increases in the prices of our raw materials could adversely affect our margins and results of operations.

The

Company uses large amounts of steel, iron and electricity in the manufacture of

its products. The price of these raw materials has a significant

impact on the cost of producing products. Steel and electricity

prices have increased significantly in the last five years, caused primarily by

higher energy prices and increased global demand. Since most of the

Company’s suppliers are not currently parties to long-term contracts with us,

the Company is vulnerable to fluctuations in prices of such raw

materials. Factors such as supply and demand, freight costs and

transportation availability, inventory levels of brokers and dealers, the level

of imports and general economic conditions may affect the price of cast iron and

steel. Raw material prices may increase significantly in the

future. Certain items such as steel round, bearings and aluminum have

continued to experience price increases, price volatility and longer lead times.

If the Company is unable to pass future raw material price increases on to its

customers, margins, results of operations, cash flow and financial condition

could be adversely affected.

Interruption

in our supply of raw materials could adversely affect our results of

operations.

The

Company relies on various suppliers to supply the components utilized to

manufacture our products. The availability of the raw materials is

not only a function of the availability of steel and iron, but also the alloy

materials that are utilized by our suppliers. To date, these shortages have not

caused a material disruption in availability or our manufacturing

operations. However, material disruptions may occur in the

future. Raw material shortages and allocations may result in

inefficient operations and a build-up of inventory, which can negatively affect

the Company’s working capital position. The loss of any of the

Company’s suppliers or their inability to meet its price, quality, quantity and

delivery requirements could have an adverse effect on the Company’s business and

results of operations.

The

inherent dangers and complexity of the Company’s products and services could

subject it to substantial liability claims that could adversely affect our

results of operations.

The

products that the Company manufactures and the services that it provides are

complex, and the failure of this equipment to operate properly or to meet

specifications may greatly increase our customers’ costs. In

addition, many of these products are used in inherently hazardous industries,

such as the oil and gas drilling and production industry where an accident or

product failure can cause personal injury or loss of life, damage to property,

equipment, or the environment, regulatory investigations and penalties and the

suspension of the end-user’s operations. If the Company’s

products or services fail to meet specifications or are involved in accidents or

failures, we could face warranty, contract, or other litigation claims for which

it may be held responsible and its reputation for providing quality products may

suffer.

The

Company’s insurance may not be adequate in risk coverage or policy limits to

cover all losses or liabilities that we may incur or be

responsible. Moreover, in the future we may not be able to maintain

insurance at levels of risk coverage or policy limits that we deem adequate or

at premiums that are reasonable for us, particularly in the recent environment

of significant insurance premium increases. Further, any claims made

under the Company’s policies will likely cause its premiums to

increase.

Any

future damages deemed to be caused by the Company’s products or services that

are assessed against it and that are not covered by insurance, or that are in

excess of policy limits or subject to substantial deductibles, could have a

material adverse effect on our results of operations and financial

condition. Litigation and claims for which we are not insured can

occur, including employee claims, intellectual property claims, breach of

contract claims, and warranty claims.

We

may not be able to successfully integrate future acquisitions, which will cause

us to fail to realize expected returns.

The

Company continually explores opportunities to acquire related businesses, some

of which could be material to the Company. The ability to continue to grow,

however, may depend upon identifying and successfully acquiring attractive

companies, effectively integrating these companies, achieving cost efficiencies

and managing these businesses as part of the Company. The Company may

not be able to effectively integrate the acquired companies and successfully

implement appropriate operational, financial and management systems and controls

to achieve the benefits expected to result from these

acquisitions. The Company’s efforts to integrate these businesses

could be affected by a number of factors beyond its control, such as regulatory

developments, general economic conditions and increased

competition. In addition, the process of integrating these businesses

could cause the interruption of, or loss of momentum in, the activities of our

existing business. The diversion of management’s attention and any

delays or difficulties encountered in connection with the integration of these

businesses could negatively impact the Company’s business and results of

operations. Further, the benefits that the Company anticipates from

these acquisitions may not develop.

Labor

dispute or the expiration of our current labor contract could have a material

adverse effect on our business.

The

Company’s main U.S. manufacturing facilities are unionized and the current labor

contract with respect to those facilities expires in October

2011. The Company cannot assure that any disputes, work stoppages or

strikes will not arise in the future. In addition, when our existing

collective bargaining agreement expires, the Company cannot assure that it will

be able to reach a new agreement with its employees or that any new agreement

will be on substantially similar terms as the existing

agreement. Future disputes with and labor concessions to the

Company’s employees could have a material adverse effect upon its results of

operations and financial position.

The

inability to hire and retain qualified employees may hinder our

growth.

The

ability to provide high-quality products and services depends in part on the

Company’s ability to hire and retain skilled personnel in the areas of

management, product engineering, servicing and sales. Competition for

such personnel is intense and competitors can be expected to attempt to hire the

Company’s skilled employees from time to time. In particular, the

Company’s business and results of operations could be materially adversely

affected if it is unable to retain the customer relationships and technical

expertise provided by the Company’s management team and professional

personnel.

Significant

competition in the industries in which the Company operates may result in its

competitors offering new or better products and services or lower prices, which

could result in a loss of customers and a decrease in revenues.

The

industries in which the Company operates are highly competitive. The

Company competes with other manufacturers and service providers of varying

sizes, some of which may have greater financial and technological resources than

it does. If the Company is unable to compete successfully with other

manufacturers and service providers, it could lose customers and its revenues

may decline. In addition, competitive pressures in the industry may

affect the market prices of the Company’s new and used equipment, which, in

turn, may adversely affect its sales margins, results of operations, cash flow

and financial condition.

Disruption

of our manufacturing operations or management information systems would have an

adverse effect on our financial condition and results of

operations.

While the

Company owns numerous facilities domestically and internationally, its primary

manufacturing facilities in and around Lufkin, Texas account for a significant

percentage of its manufacturing output. An unexpected disruption in

the Company’s production at these facilities or in its management information

systems for any length of time would have an adverse effect on our business,

financial condition and results of operations.

The

Company has foreign operations that would be adversely impacted in the event of

war, political disruption, civil disturbance, economic and legal sanctions and

changes in global trade policies.

The

Company has operations in certain international areas, including parts of the

Middle East and South America, that are subject to risks of war, political

disruption, civil disturbance, economic and legal sanctions (such as

restrictions against countries that the U.S. government may deem to sponsor

terrorism) and changes in global trade policies. The Company’s

operations may be restricted or prohibited in any country in which these risks

occur. In particular, the occurrence of any of these risks could

result in the following events, which in turn, could materially and adversely

impact the Company’s results of operations:

|

l

|

disruption

of oil and natural gas exploration and production

activities;

|

|

l

|

restriction

of the movement and exchange of funds;

|

|

l

|

inhibition

of our ability to collect receivables;

|

|

l

|

enactment

of additional or stricter U.S. government or international sanctions;

and

|

|

l

|

limitation

of our access to markets for periods of

time.

|

Results

of operations could be adversely affected by actions under U.S. trade

laws.

Although

the Company is a U.S.-based manufacturing and services company, it does own and

operate international manufacturing operations that support its U.S.-based

business. If actions under U.S. trade laws were instituted that

limited the Company’s access to these products, the ability to meet its customer

specifications and delivery requirements would be reduced. Any

adverse effects on the Company’s ability to import products from its foreign

subsidiaries could have a material adverse effect on our results of

operations.

The

Company is subject to currency exchange rate risk, which could adversely affect

its results of operations.

The

Company is subject to currency exchange rate risk with intercompany debt

denominated in U.S. dollars owed by its Canadian subsidiary. The

Company cannot assure that future currency exchange rate fluctuations will not

have an adverse affect on its results of operations.

Our

funding policy for our pension plan is to accumulate plan assets that, over the long-run, will approximate the present

value of projected benefit obligations. Our pension cost

is materially affected by the discount rate used to measure pension obligations,

the level of plan assets available to fund those obligations at the measurement

date and the expected long-term rate of return on plan assets. Our pension

plan is supported by pension fund investments that are volatile and subject

to financial market risk, including fixed income, domestic and foreign equity

securities, real estate and hedge funds. Significant changes in investment

performance or a change in the portfolio mix of invested assets could

result in corresponding increases and decreases in the valuation of plan assets

or in a change of the expected rate of return on plan assets. A change in the

discount rate would result in a significant increase or decrease in the

valuation of pension obligations, affecting the reported funded status of our

pension plans as well as the net periodic pension cost in the following fiscal

years. Similarly, changes in the expected return on plan assets could

result in significant changes in the net periodic pension cost for subsequent

fiscal years.

The

Company’s common stock has experienced, and may continue to experience, price

volatility.

The

trading price of the Company’s common stock has been and may continue to be

subject to large fluctuations. The Company’s common stock price may

increase or decrease in response to a number of events and factors,

including:

|

l

|

trends

in the Company’s industries and the markets in which it

operates;

|

|

l

|

changes

in the market price of the products the Company sells;

|

|

l

|

the

introduction of new technologies or products by the Company or its

competitors;

|

|

l

|

changes

in expectations as to the Company’s future financial performance,

including financial estimates by securities analysts and

investors;

|

|

l

|

operating

results that vary from the expectations of securities analysts and

investors;

|

|

l

|

announcements

by the Company or its competitors of significant contracts, acquisitions,

strategic partnerships, joint ventures, financings or capital

commitments;

|

|

l

|

the

price of oil;

|

|

l

|

changes

in laws and regulations; and

|

|

l

|

general

economic and competitive

conditions.

|

Due

to the recent financial and credit crisis, certain of our counterparties may be

unable to meet their financial obligations to the Company or, alternatively, may

be forced to postpone or otherwise cancel their contracts with the

Company.

The

recent credit crisis and the related turmoil in the global financial system have

had an adverse impact on the Company’s business and financial condition and the

business and financial condition of our counterparties. The Company

may face challenges if conditions in the financial markets do not

improve. The Company may be subject to increased counterparty risks

whereby its counterparties may not be willing or able to meet their financial

obligations to the Company or, alternatively, may be forced to postpone or

otherwise cancel their contracts with the Company. To the extent a third-party

is unable to meet its obligations to the Company, the earnings and results of

operations of the Company could be negatively impacted in future reporting

periods. A sustained decline in the ability of the Company’s counterparties to

meet their financial obligations to the Company would adversely affect its

business, results of operations and financial condition.

Climate

change legislation limiting and reducing greenhouse gas emissions through a “cap

and trade” system of allowances and credits could result in increased operating

costs and reduced demand for our products or services.

On June

26, 2009, the U.S. House of Representatives passed the American Clean Energy and

Security Act of 2009 (“ACESA”), which would establish an economy-wide

cap-and-trade program to reduce U.S. emissions of greenhouse gases, including

carbon dioxide and methane. ACESA would require a 17% reduction in greenhouse

gas emissions from 2005 levels by 2020 and just over an 80% reduction of such

emissions by 2050. Under this legislation, the EPA would issue a capped and

steadily declining number of tradable emissions allowances to certain major

sources of greenhouse gas emissions so that such sources could continue to emit

greenhouse gases into the atmosphere. These allowances would be expected to

escalate significantly in cost over time. The net effect of ACESA will be to

impose increasing costs on the combustion of carbon-based fuels such as oil,

refined petroleum products, and natural gas. Similarly, on September 30, 2009,

the Clean Energy Jobs and American Power Act of 2009 was introduced in the U.S.

Senate. The Obama Administration has indicated its support of legislation to

reduce greenhouse gas emissions through an emission allowance system. Although

it is not possible at this time to predict when the Senate may act on climate

change legislation or how any bill passed by the Senate would be reconciled with

ACESA, any future federal laws or implementing regulations that may be adopted

to address greenhouse gas emissions could require the Company to incur increased

operating costs, could adversely impact customers’ operations or demand for

customers’ products, or could adversely affect demand for the Company’s products

or services.

An

array of international climate change accords focused on limiting and reducing

greenhouse gas emissions could result in increased operating costs and reduced

demand for our products or services.

The

Company services customers in numerous foreign countries. As such, we

are subject not only to U.S. climate change legislation but may also be subject

to certain international climate change accords. A variety of regulatory

developments, proposals or requirements have been introduced and/or adopted in

the international regions in which we operate that are focused on restricting

the emission of carbon dioxide, methane and other greenhouse gases. Among these

developments are the United Nations Framework Convention on Climate Change, also

known as the “Kyoto Protocol, ” and the European Union Emissions Trading System

(“EU ETS”), which was launched as an international “cap and trade” system on

allowances for emitting greenhouse gases. These international regulatory

developments may curtail production and demand for fossil fuels such as oil and

gas in areas of the world where the Company and our customers operate and thus

adversely affect future demand for the Company’s products and services, which

may in turn adversely affect the Company’s future results of

operations.

Climate

change regulations restricting emissions of greenhouse gases could result in

increased operating costs and reduced demand for our products or

services.

On

December 15, 2009, the U.S. Environmental Protection Agency (the “EPA”)

officially published its findings that emissions of carbon dioxide, methane and

other greenhouse gases present an endangerment to human health and the

environment because emissions of such gases are, according to the EPA,

contributing to warming of the Earth’s atmosphere and other climatic changes.

These findings by the EPA allow the agency to proceed with the adoption and

implementation of regulations that would restrict emissions of greenhouse gases

under existing provisions of the federal Clean Air Act. In late September 2009,

the EPA had proposed two sets of regulations in anticipation of finalizing its

findings that would require a reduction in emissions of greenhouse gases from

motor vehicles and that could also lead to the imposition of greenhouse gas

emission limitations in Clean Air Act permits for certain stationary sources. In

addition, on September 22, 2009, the EPA issued a final rule requiring the

reporting of greenhouse gas emissions from specified large greenhouse gas

emission sources in the United States beginning in 2011 for emissions occurring

in 2010. The adoption and implementation of any regulations imposing reporting

obligations on, or limiting emissions of greenhouse gases from, our equipment

and operations could require the Company to incur costs to reduce emissions of

greenhouse gases associated with operations, could adversely impact customers’

operations or demand for customers’ products, or could adversely affect demand

for the Company’s products or services.

Item 1B. Unresolved

Staff Comments.

None

Item 2. Properties

The

Company's major manufacturing facilities are located in and near Lufkin, Texas,

are company-owned and include approximately 150 acres, a foundry, machine shops,

structural shops, assembly shops and warehouses. The facilities by

segment are:

|

Oil

Field:

|

|

|

Pumping

Unit Manufacturing

|

240,000

sq. ft.

|

|

Foundry

Operations

|

687,000

sq. ft.

|

|

Power

Transmission:

|

|

|

New

Unit Manufacturing

|

458,000

sq. ft.

|

|

Repair

Operations

|

84,000

sq. ft.

|

|

Former

Trailer Manufacturing

|

388,000

sq. ft.

|

|

Corporate

Facilities

|

33,000

sq. ft.

|

Through

the acquisitions of ILS and RMT in 2009, the Company added two leased

manufacturing facilities:

|

Lufkin

ILS- Houston, TX

|

50,000

sq. ft.

|

|

Lufkin

RMT- Wellsville, NY

|

23,500

sq. ft.

|

Also, the

Company has numerous service centers throughout the U.S. to support the Oil

Field and Power Transmission segments. The majority of these locations are

company-owned, with some leased. None of these leases qualify as capital

leases.

Internationally,

there are company-owned facilities for the production and servicing of pumping

units and power transmission products. The facilities by segment

are:

|

Oil

Field (Pumping unit manufacturing and repair):

|

|

|

Nisku,

Alberta, Canada

|

66,000

sq. ft.

|

|

Comodoro

Rivadia, Argentina

|

125,000

sq. ft.

|

|

Power

Transmission (New unit manufacturing and repair):

|

|

|

Fougerolles,

France

|

377,000

sq. ft.

|

Also, the

Company has several international service centers to support the Oil Field

segment. The majority of these locations are owned by the Company, with some

leased. None of these leases qualify as capital leases.

Item 3. Legal Proceedings

On March

7, 1997, a class action complaint was filed against Lufkin Industries, Inc. (the

“Company”) in the U.S. District Court for the Eastern District of Texas by an

employee and a former employee of the Company who alleged race discrimination in

employment. Certification hearings were conducted in Beaumont, Texas in February

1998 and in Lufkin, Texas in August 1998. In April 1999, the District Court

issued a decision that certified a class for this case, which included all black

employees employed by the Company from March 6, 1994, to the present. The case

was administratively closed from 2001 to 2003 while the parties unsuccessfully

attempted mediation. Trial for this case began in December 2003, and after the

close of plaintiff’s evidence, the court adjourned and did not complete the

trial until October 2004. Although plaintiff’s class certification encompassed a

wide variety of employment practices, plaintiffs presented only disparate impact

claims relating to discrimination in initial assignments and promotions at

trial.

On

January 13, 2005, the District Court entered its decision finding that the

Company discriminated against African-American employees in initial assignments

and promotions. The District Court also concluded that the discrimination

resulted in a shortfall in income for those employees and ordered that the

Company pay those employees back pay to remedy such shortfall, together with

pre-judgment interest in the amount of 5%. On August 29, 2005, the District

Court determined that the back pay award for the class of affected employees was

$3.4 million (including interest to January 1, 2005) and provided a formula for

attorney fees that the Company estimates will result in a total not to exceed

$2.5 million. In addition to back pay with interest, the District Court (i)

enjoined and ordered the Company to cease and desist all racially biased

assignment and promotion practices and (ii) ordered the Company to pay court

costs and expenses.

The

Company reviewed this decision with its outside counsel and on September 19,

2005, appealed the decision to the U.S. Court of Appeals for the Fifth Circuit.

On April 3, 2007, the Company appeared before the appellate court in New Orleans

for oral argument in this case. The appellate court subsequently issued a

decision on Friday, February 29, 2008 that reversed and vacated the plaintiff’s

claim regarding the initial assignment of black employees into the Foundry

Division. The court also denied plaintiff’s appeal for class certification of a

class disparate treatment claim. Plaintiff’s claim on the issue of the Company’s

promotional practices was affirmed but the back pay award was vacated and

remanded for recomputation in accordance with the opinion. The

District Court’s injunction was vacated and remanded with instructions to enter

appropriate and specific injunctive relief. Finally, the issue of plaintiff’s

attorney’s fees was remanded to the District Court for further consideration in

accordance with prevailing authority.

On

December 5, 2008, the U.S. District Court Judge Clark held a hearing in

Beaumont, Texas during which he reviewed the 5th U.S.

Circuit Court of Appeals class action decision and informed the parties that he

intended to implement the decision in order to conclude this litigation. At the

conclusion of the hearing Judge Clark ordered the parties to submit positions

regarding the issues of attorney fees, a damage award and injunctive relief.

Subsequently, the Company reviewed the plaintiff’s submissions which described

the formula and underlying assumptions that supported their positions on

attorney fees and damages. After careful review of the plaintiff’s submission to

the court the Company continued to have significant differences regarding legal

issues that materially impacted the plaintiff’s requests. As a result of these

different results, the court requested further evidence from the parties

regarding their positions in order to render a final decision. The

judge reviewed both parties arguments regarding legal fees, and awarded the

plaintiffs an interim fee, but at a reduced level from the plaintiffs original

request. The Company and the plaintiffs reconciled the majority of the

differences and the damage calculations which also lowered the originally

requested amounts of the plaintiffs on those matters. Due to the

resolution of certain legal proceedings on damages during first half of 2009 and

the District Court awarding the plaintiffs an interim award of attorney fees and

cost totaling $5.8 million, the Company recorded an additional provision of $5.0

million in the first half of 2009 above the $6.0 million recorded in fourth

quarter of 2008. The plaintiffs filed an appeal of the District Court’s interim

award of attorney fees with the U.S. Fifth Circuit Court of Appeals. The Fifth

Circuit subsequently dismissed these appeals on August 28, 2009 on the basis

that an appealable final judgment in this case had not been

issued. The court commented that this issue can be reviewed with an

appeal of final judgment.

On

January 15, 2010, the U.S. District Court for the Eastern District of Texas

notified the Company that it had entered a final judgment related to the

Company’s ongoing class-action lawsuit. The Court ordered the Company to pay the

plaintiffs $3.3 million in damages, $2.2 million in pre-judgment interest and

0.41% interest for any post-judgment interest. The Company had previously

estimated the total liability for damages and interest to be approximately $5.2

million. The Court also ordered the plaintiffs to submit a request for legal

fees and expenses from January 1, 2009 through the date of the final judgment.

The plaintiffs are required to submit this request within 14 days of the final

judgment. On January 29, 2010, the plaintiffs filed a motion with the U.S.

District Court for the Eastern District of Texas for a supplemental award of

$0.7 million for attorney’s fees, costs and expenses incurred between January 1,

2009 and January 15, 2010, as allowed in the final judgment issued by the Court

on January 15, 2010, related to the Company’s ongoing class-action lawsuit. In

the fourth quarter of 2009, the Company recorded a provision of $1.0 million for

these legal expenses and accrual adjustments for the final judgment award of

damages.

On

January 15, 2010, the plaintiffs filed a notice of appeal with the U.S. Fifth

Circuit Court of Appeals of the District Court’s final judgment. On January 21,

2010, The Company filed a notice of cross-appeal with the same

court. In addition, the Company filed a motion with the District

Court to stay the payment of damages referenced in the District Court’s final

judgment pending the outcome of the Fifth Circuit’s decision on both parties’

appeals. The District Court granted this motion to stay.

There are

various other claims and legal proceedings arising in the ordinary course of

business pending against or involving the Company wherein monetary damages are

sought. For certain of these claims, the Company maintains insurance

coverage while retaining a portion of the losses that occur through the use of

deductibles and retention limits. Amounts in excess of the

self-insured retention levels are fully insured to limits believed appropriate

for the Company’s operations. Self-insurance accruals are based on

claims filed and an estimate for claims incurred but not

reported. While the Company does maintain insurance above its

self-insured levels, a decline in the financial condition of its insurer, while

not currently anticipated, could result in the Company recording additional

liabilities. It is management’s opinion that the Company’s liability

under such circumstances or involving any other non-insured claims or legal

proceedings would not materially affect its consolidated financial position,

results of operations, or cash flow.

Item 4. Reserved

None

PART

II

Item 5. Market

for Registrant's Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities

Common

Stock Information

The

Company's common stock is traded on the NASDAQ National Market under the symbol

“LUFK.” As of January 31, 2010, there were approximately 387 record holders of

the Company’s common stock. This number does not include any beneficial owners

for whom shares of common stock may be held in “nominee” or “street” name. The

following table sets forth, for each quarterly period during fiscal 2009 and

2008, the high and low sales price per share of the Company’s common stock and

the dividends paid per share on the Company’s common stock.

|

2009

|

2008

|

|||||||||||||||||||||||

|

Stock

Price

|

Stock

Price

|

|||||||||||||||||||||||

|

Quarter

|

High

|

Low

|

Dividend

|

High

|

Low

|

Dividend

|

||||||||||||||||||

|

First

|

$ | 41.25 | $ | 26.96 | $ | 0.25 | $ | 65.50 | $ | 50.85 | $ | 0.25 | ||||||||||||

|

Second

|

48.16 | 29.51 | 0.25 | 86.82 | 62.53 | 0.25 | ||||||||||||||||||

|

Third

|

53.81 | 36.38 | 0.25 | 95.23 | 70.93 | 0.25 | ||||||||||||||||||

|

Fourth

|

75.74 | 49.53 | 0.25 | 79.25 | 31.45 | 0.25 | ||||||||||||||||||

The

Company has paid cash dividends for 70 consecutive years. Total

dividend payments were $14.9 million, $14.8 million and $13.1 million in 2009,

2008 and 2007, respectively.

Equity

Compensation Plan Information

The

following table sets forth securities of the Company authorized for issuance

under equity compensation plans at December 31, 2009.

|

Plan

Category

|

Number

of securities to be issued upon exercise of outstanding options, warrants

and rights (a)

|

Weighted-average

exercise price of outstanding options, warrants and rights

(b)

|

Number

of securities remaining available for future issuance under equity

compensation plans (excluding securities reflected in column

(a))

|

|||||||||

|

Equity

compensation plans approved by security holders

|

709,015 | $ | 52.56 | 786,592 | ||||||||

|

Equity

compensation plans not approved by security holders

|

- | - | - | |||||||||

|

Total

|

709,015 | $ | 52.56 | 786,592 | ||||||||

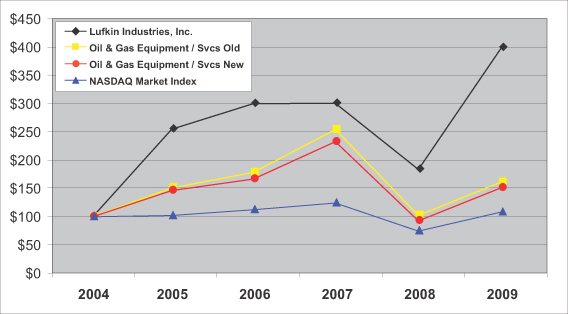

Performance Graph- Total

Stockholder Return

The

following is a line graph comparing cumulative, five –year total shareholder

return with a general market index (the NASDAQ Market Index) and a published

industry index of oil and gas equipment/service providers (Hemscott Industry

Group 124).

The graph

shall not be deemed incorporated by reference by any general statement

incorporating by reference this Form 10-K into any filing under the Securities

Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended,

except to the extent that the Company specifically incorporates this information

by reference, and shall not otherwise be deemed filed under such

acts.

Comparison

of 5 Year Cumulative Total Return*

Among

Lufkin Industries, Inc., the NASDAQ Market Index and an Industry

Index

* $100

invested on 12/31/04 in stock and index-including reinvestment of dividends for

fiscal years ending December 31.

Performance

graph data provided by R. R. Donnelley Financial.

Item 6. Selected Financial Data

Five

Year Summary of Selected Consolidated Financial Data

The

following table sets forth certain selected historical consolidated financial

data from continuing operations and should be read in conjunction with

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and the Consolidated Financial Statements and Notes thereto included

elsewhere in this annual report on Form 10-K. The following

information may not be indicative of future operating results.

|

(In

millions, except per share data)

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

Sales

|

$ | 521.4 | $ | 741.2 | $ | 555.8 | $ | 526.1 | $ | 413.7 | ||||||||||

|

Earnings

from continuing operations

|

22.5 | 88.0 | 71.8 | 71.3 | 44.5 | |||||||||||||||

|

Earnings

per share from continuing operations:

|

||||||||||||||||||||

|

Basic

|

1.51 | 5.96 | 4.82 | 4.80 | 3.05 | |||||||||||||||

|

Diluted

|

1.51 | 5.91 | 4.76 | 4.71 | 2.98 | |||||||||||||||

|

Total

assets

|

541.6 | 530.7 | 500.7 | 409.1 | 338.3 | |||||||||||||||

|

Cash

dividends per share

|

1.00 | 1.00 | 0.88 | 0.62 | 0.38 | |||||||||||||||

Item

7. Management's Discussion and Analysis

of Financial Condition and Results of Operations

Overview

General

Lufkin

Industries is a global supplier of oil field and power transmission products.

Through its Oil Field segment, the Company manufactures and services artificial

lift equipment and related products, which are used to extract crude oil and

other fluids from wells. Through its Power Transmission segment, the Company

manufactures and services high-speed and low-speed increasing and reducing

gearboxes for industrial applications. While these markets are

price-competitive, technological and quality differences can provide product

differentiation.

The

Company’s strategy is to differentiate its products through additional

value-added capabilities. Examples of these capabilities are high-quality

engineering, customized designs, rapid manufacturing response to demand through

plant capacity, inventory and vertical integration, superior quality and

customer service, and an international network of service

locations. In addition, the Company’s strategy is to maintain a low

debt-to-equity ratio in order to quickly take advantage of growth opportunities

and pay dividends even during unfavorable business cycles.

In

support of the above strategy, the Company has been making capital investments

in Oil Field to increase manufacturing capacity and capabilities in its three

main manufacturing facilities in Lufkin, Texas, Canada and Argentina. These

investments should reduce production lead times, improve quality and reduce

manufacturing costs. Investments also continue to be made to expand the

Company’s presence in automation products and international service. During the

first quarter of 2009, the Company purchased International Lift Systems (“ILS”),

which manufactures and services gas lift, plunger lift and completion equipment

for the oil and gas industry. In Power Transmission, the Company continues to

expand its gear repair network by opening and expanding facilities in various

locations in the U.S. and Canada. The Company is making targeted capital

investments in the U.S. and France to expand capacity, develop new product lines

and reduce manufacturing lead times, in addition to certain capital investments

targeting cost reductions. On July 1, 2009, the Company purchased

Rotating Machinery Technology, Inc. (RMT), which specializes in the analysis,

design and manufacture of precision, custom-engineered tilting-pad bearings and

related components for high-speed turbo equipment operating in critical duty

applications. RMT also services, repairs and upgrades turbo-expander process

units for air and gas separation, both on-site with its skilled field service

team and at its repair facility in Wellsville, New York.

Trends/Outlook

Oil

Field

Demand

for artificial lift equipment is primarily dependent on the level of new onshore

oil wells, workover drilling activity, the depth and fluid conditions of such

drilling activity and general field maintenance budgets. Drilling activity is

driven by the available cash flow of the Company’s customers as well as their

long-term perceptions of the level and stability of the price of oil. Increasing

energy prices from 2004 to late 2008 increased the demand for pumping units and

related service and products from higher drilling activity, activation of idle

wells and the upgrading of existing wells. During the first nine months of 2008,

demand levels in North America increased over the levels experienced in 2007 as

higher energy prices drove increased drilling and workover activity.

Additionally, the demand for pumping units, oilfield services and automation

equipment continued to increase in international markets as well as a partial

recapture of market share from imported equipment domestically.

In the

fourth quarter of 2008, energy prices dramatically declined due to reductions in

global demand. Planned new drilling and workover activity has also reduced

significantly as capital and operating budgets have been reduced. Exploration

and production (E&P) companies have reduced drilling in higher-cost fields

that are not economically viable at lower energy prices and have reduced overall

capital budgets in order to remain cash-flow positive and avoid the

more-expensive credit markets. These declines were more pronounced in the U.S.,

but are starting to be reflected in international markets. New pumping unit

booking levels declined in the fourth quarter of 2008 from lower demand, order

cancellations for units scheduled to ship in 2009 and price reductions for units

scheduled to ship in 2009. These price reductions were primarily in response to

the decline in raw material costs in the fourth quarter of 2008 for steel and

iron castings.

These

negative trends continued into the first quarter of 2009 and worsened during the

second quarter of 2009 as E&P companies deferred or cancelled drilling

programs and reduced field spending in response to lower energy prices. This

trend has been more pronounced in North America than in international markets.

As drilling activity reduced in response to lower oil prices, demand for

artificial lift equipment and related service also was negatively impacted.

Also, as raw material costs declined and surplus equipment increased, there was

competitive pressure to lower selling prices. Lower selling prices combined with

the negative impact of low capacity utilization in manufacturing facilities

caused gross margins to decline in 2009. In the second half of 2009, oil prices

increased back to 2007 levels and drilling activity, especially for oil,

increased. This trend is expected to continue in 2010, with higher drilling

activity and lower surplus equipment inventory driving demand for new artificial

lift equipment.

While the

market is suffering a cyclical decline, the Company continues to believe that

there are long-term positive growth trends for artificial lift equipment, and as

existing fields mature, the market will require an increased use of artificial

lift, especially in the South American, Russian and Middle Eastern

markets. The acquisition of ILS is consistent with the

Company’s long-term growth strategy of integrating strategic assets to leverage

Lufkin’s position of industry leadership. ILS has a solid reputation

for high-quality products, customer responsiveness and long-standing

relationships with major independent and super-major integrated

companies. This provides an entry for Lufkin into the offshore market

for artificial lift wells, including deepwater plays, and expanded reach into

the artificial lift market.

Power

Transmission

Power

Transmission services many diverse markets, with high-speed gearing for markets

such as petrochemicals, refineries, offshore production and transmission of oil

and slow-speed gearing for the gas, rubber, sugar, paper, steel, plastics,

mining, cement and marine propulsion, each of which has its own unique set of

drivers. Generally, if global industrial capacity utilizations are not high,

spending on new equipment lags. Also impacting demand are government regulations

involving safety and environmental issues that can require capital spending.

Recent market demand increases have come from energy-related markets such as

refining, petrochemical, drilling, coal, marine and power generation in response

to higher global energy prices. During the latter part of 2008, energy prices

decreased significantly, global growth slowed and large project financing became

difficult to secure. New order booking declined in the first half of 2009, which

negatively impacted sales starting in late 2009. While sales will remain at

these lower levels during the first half of 2010, new order and quotation

activity, especially from large LNG projects, during this period is expected to

increase and should translate into higher sales in the latter half of

2010.

Discontinued

Operations

During

the second quarter of 2008, the Trailer segment was classified as a discontinued

operation. In January 2008, the Company announced the decision to suspend its

participation in the commercial trailer markets and to develop a plan to run-out

existing inventories, fulfill contractual obligations and close all trailer

facilities in 2008. During the second quarter of 2008, this plan was completed,

with the majority of the remaining inventory and manufacturing equipment sold

and all facilities closed.

Trailer

generated expense of $0.5 million in 2009 and income of $0.2 million and $2.4

million, net of tax, during 2008, and 2007, respectively.

Other

During

both 2009 and 2008, the Company booked a contingent liability provision of $6.0

million (pre-tax) per year for its ongoing class-action lawsuit. For

additional information, please see Part I, Item 3 of this Form

10-K.

Summary

of Results

The

Company generally monitors its performance through analysis of sales, gross

margin (gross profit as a percentage of sales) and net earnings, as well as

debt/equity levels, short-term debt levels, and cash balances

Overall,

sales for 2009 decreased to $521.4 million from $741.2 million for 2008, or

29.7%, and were $555.8 million for 2007. This decrease was primarily driven by

decreased sales of Oil Field products and services in the U.S. market but also

weakness in Power Transmission sales.

Gross

margin for 2009 decreased to 21.6% from 28.9% for 2008 and 29.2% for 2007,

primarily due to lower selling prices due to lower customer demand and the

availability of surplus equipment combined with the negative impact of lower

plant utilization in the Oilfield segment.

Higher

selling, general and administrative expenses also negatively impacted net

earnings, with these expenses increasing to $75.1 million during 2009 from $72.0

million during 2008 and $57.6 million during 2007. This increase in 2009 was

primarily related to resources added from the ILS and RMT acquisitions. As a

percentage of sales, selling, general and administrative expenses increased to

14.4% during 2009 compared to 9.7% during 2008 and 10.4% during 2006. The

Company has made the strategic decision to maintain employment levels in this

area to focus on new product and geographic expansion opportunities. Operating

income was also impacted by a litigation reserve of $6.0 million during 2009 and

$6.0 million during 2008 related to its ongoing class-action

lawsuit.

The

Company reported net earnings from continuing operations of $22.5 million, or

$1.51 per share (diluted), for 2009, compared to net earnings from continuing

operations of $88.0 million, or $5.91 per share (diluted), for 2008, and net

earnings from continuing operations of $71.8 million, or $4.76 per share

(diluted), for 2007.

Debt/equity

(long-term debt net of current portion as a percentage of total equity) levels

were 0.3% as of December 31, 2009 and 0.0% as of December 31, 2008 and December

31, 2007. Cash balances at December 31, 2009, were $100.9 million, down from

$107.8 million at December 31, 2008.

Year

Ended December 31, 2009 Compared to Year Ended December 31, 2008:

The

following table summarizes the Company’s sales and gross profit by operating

segment (in thousands of dollars):

|

Increase/

|

%

Increase/

|

|||||||||||||||

|

Year

Ended December 31

|

2009

|

2008

|

(Decrease)

|

(Decrease)

|

||||||||||||

|

Sales

|

||||||||||||||||

|

Oil

Field

|

$ | 349,168 | $ | 551,814 | $ | (202,646 | ) | (36.7 | ) | |||||||

|

Power

Transmission

|

172,191 | 189,380 | (17,189 | ) | (9.1 | ) | ||||||||||

|

Total

|

$ | 521,359 | $ | 741,194 | $ | (219,835 | ) | (29.7 | ) | |||||||

|

Gross Profit

|

||||||||||||||||

|

Oil

Field

|

$ | 65,510 | $ | 153,673 | $ | (88,163 | ) | (57.4 | ) | |||||||

|

Power

Transmission

|

47,034 | 60,286 | (13,252 | ) | (22.0 | ) | ||||||||||

|

Adjustment*

|

- | 115 | (115 | ) | (100.0 | ) | ||||||||||

|

Total

|

$ | 112,544 | $ | 214,074 | $ | (101,530 | ) | (47.4 | ) | |||||||

*Due to

the discontinuation of the Trailer segment, certain items previously allocated

to that segment in cost of sales have been reclassified to continuing

operations. The adjustment is related to pension and postretirement charges

associated with Trailer personnel that will continue to be a liability in future

years.

Oil

Field

Oil Field

sales decreased to $349.2 million, or by 36.7%, for the year ended December 31,

2009, from $551.8 million for the year ended December 31, 2008. New pumping unit

sales of $188.2 million during 2009 were down $153.9 million, or 45.0%, compared

to $342.1 million during 2008, primarily from lower U.S. demand and pricing

pressure. Pumping unit service sales of $84.9 million during 2009

were down $18.1 million, or 17.6%, compared to $103.0 million during 2008, from

declines in the U.S. market. Automation sales of $51.4 million during 2009 were

down $30.9 million, or 37.5%, compared to $82.4 million during 2008, from lower

sales in the U.S and pricing pressure. Commercial casting sales of $9.3 million

during 2009 were down $15.1 million, or 61.6%, compared to $24.4 million during

2008, from lower sales to the machine tool market. Sales from Lufkin ILS

contributed $15.3 million during 2009. Oil Field’s backlog decreased to $43.3

million as of December 31, 2009, from $188.1 million at December 31, 2008. This

decrease was caused primarily by lower orders for new pumping units as U.S. and

international customers deferred or cancelled drilling programs in response to

lower energy prices.

Gross

margin (gross profit as a percentage of sales) for the Oil Field segment

decreased to 18.8% for year ended December 31, 2009, compared to 27.8% for the

year ended December 31, 2008, or 9.0 percentage points. This gross margin

decrease was related to price reductions in response to material price decreases

and lower customer demand and the negative impact of lower plant utilization on

fixed cost coverage.

Direct

selling, general and administrative expenses for Oil Field increased to $26.7

million, or by 18.2%, for the year ended December 31, 2009, from $22.6 million

for the year ended December 31, 2008. The majority of this increase is related

to higher international sales commissions as well as the resources added with

the ILS acquisition. Direct selling, general and administrative expenses as

a percentage of sales increased to 7.6% for the year ended December 31, 2009,

from 4.1% for the year ended December 31, 2008.

Power

Transmission

Sales for

the Company’s Power Transmission segment decreased to $172.2 million, or by

9.1%, for the year ended December 31, 2009, compared to $189.4 million for the

year ended December 31, 2008. New unit sales of $131.8 million during 2009 were

down $13.1 million, or 9.0%, compared to $144.9 million during 2008. Repair and

service sales of $38.4 million during 2009 were down $6.1 million, or 13.7%,

compared to $44.5 million during 2008 as customers deferred spending on

maintenance projects due to poor economic conditions. Sales from Lufkin RMT

contributed $2.0 million during 2009. Power Transmission backlog at December 31,

2009, decreased to $97.0 million from $129.3 million at December 31, 2008,

primarily from decreased bookings of new units for the energy-related and marine

markets.

Gross

margin for the Power Transmission segment decreased to 27.3% for the

year ended December 31, 2009, compared to 31.8% for the year ended December 31,