Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OneSpan Inc. | d8k.htm |

VASCO

Data Security Investor Summit New York 2010 1 Investor Summit 2010 T. Kendall Hunt, Chairman & CEO Jan Valcke, President & COO Clifford Bown, EVP & CFO New York, February 18, 2010 Exhibit 99.1 |

VASCO

Data Security Investor Summit New York 2010 2 Forward Looking Statements Statements made in this presentation that relate to future plans, events or performances are forward-looking statements within the meaning of Section 21e of the Securities and Exchange Act of 1934 and section 27a of the Securities Act of 1933. These forward-looking statements (1) are identified by use of terms and phrases such as “expect”, “believe”, “will”,

“anticipate”, “emerging”, “intend”,

“plan” , “could”, “may”, “estimate”,

“should”, “objective” and “goal” and similar words and expressions, but such words and phrases are not the exclusive means of identifying them, and (2) are subject to risks and uncertainties and represent our present expectations or beliefs concerning future events. VASCO cautions that the forward-looking statements are qualified by important factors that could cause actual results to differ materially from those in the forward-looking statements. I direct your attention to the company’s filings with the securities and exchange commission for a discussion of such risks and uncertainties in this regard. |

VASCO

Data Security Investor Summit New York 2010 3 • VASCO Corporate Info • Results 2009: recap • Guidance 2010 • Strategy: Organic growth (end-to-end) The next step • Q&A Agenda |

VASCO

Data Security Investor Summit New York 2010 4 VASCO Corporate Info |

VASCO

Data Security Investor Summit New York 2010 5 • Global company with HQ in US and Europe and Operational HQ in Europe • Listed on Nasdaq: VDSI • A leading software company, specializing in Internet security • Almost 9,500 customers in 100+ countries, including approximately 1,400 banks • Fast growing market share in 2004, 2005, 2006, 2007 and 2008 • Profitable throughout the crisis year 2009 • 28 consecutive profitable quarters allowing VASCO to finance its organic growth and acquisitions • A global leader in authentication, electronic & digital signatures Corporate Profile |

VASCO

Data Security Investor Summit New York 2010 6 VASCO Offices VASCO sales presence VASCO Worldwide |

VASCO

Data Security Investor Summit New York 2010 7 Results 2009: recap |

VASCO

Data Security Investor Summit New York 2010 8 Results Q4 2009 • Revenue: $ 31.9 million (+10 %)* • Operating Income: $ 5.4 million (+ 197 %)* • Net income: $ 5.6 million ( +100 %)* • Gross Margin: 70% • Earnings Per Share: $ 0.15 per fully diluted share (+100%) *

Compared to Q4 2008 |

VASCO

Data Security Investor Summit New York 2010 9 Results Full Year 2009 |

VASCO Data Security Investor Summit New York 2010 10 Results Full Year 2009 • Revenue: $ 101.7 million (-24 %)* • Operating Income: $ 13.4 million (-52 %)* • Net income: $ 12.6 million (-48 %)* • Gross Margin: 70% • Earnings Per Share : $ 0.33 per fully diluted share (-48%)* Compared to Full Year

2008 |

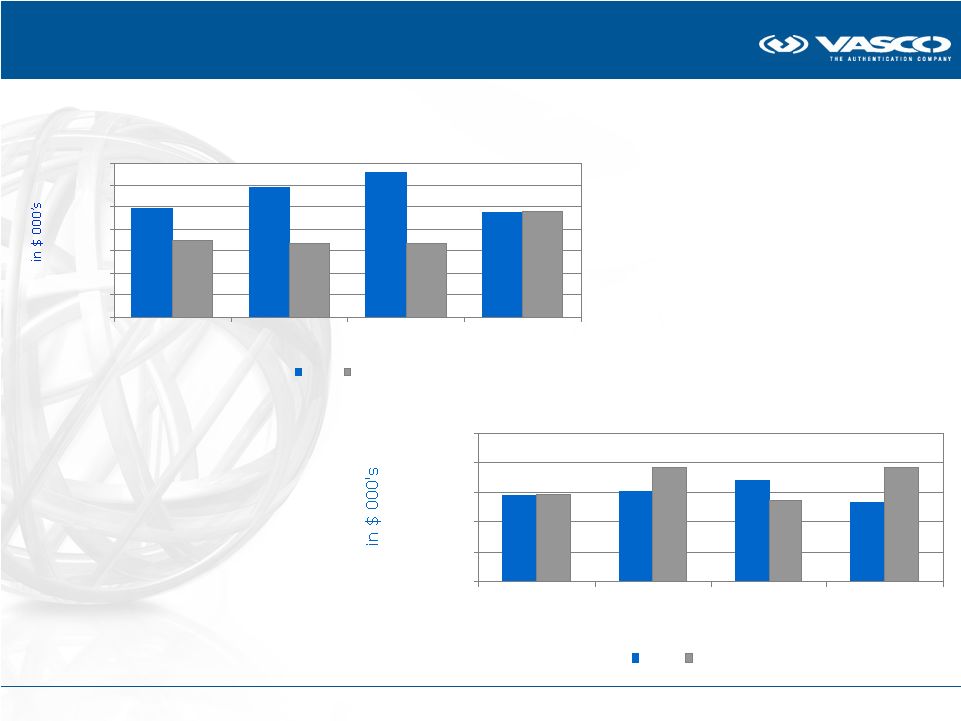

VASCO Data Security Investor Summit New York 2010 11 VASCO’s SUCCESS STORY 2003-2009 $22,866 $29,893 $54,579 $76,062 $119,980 $132,977 $101,695 $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 2003 2004 2005 2006 2007 2008 2009 Sales (000's) $1,123 $5,552 $10,953 $18,942 $30,893 $28,137 $13,413 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 2003 2004 2005 2006 2007 2008 2009 Operating Income (000's) |

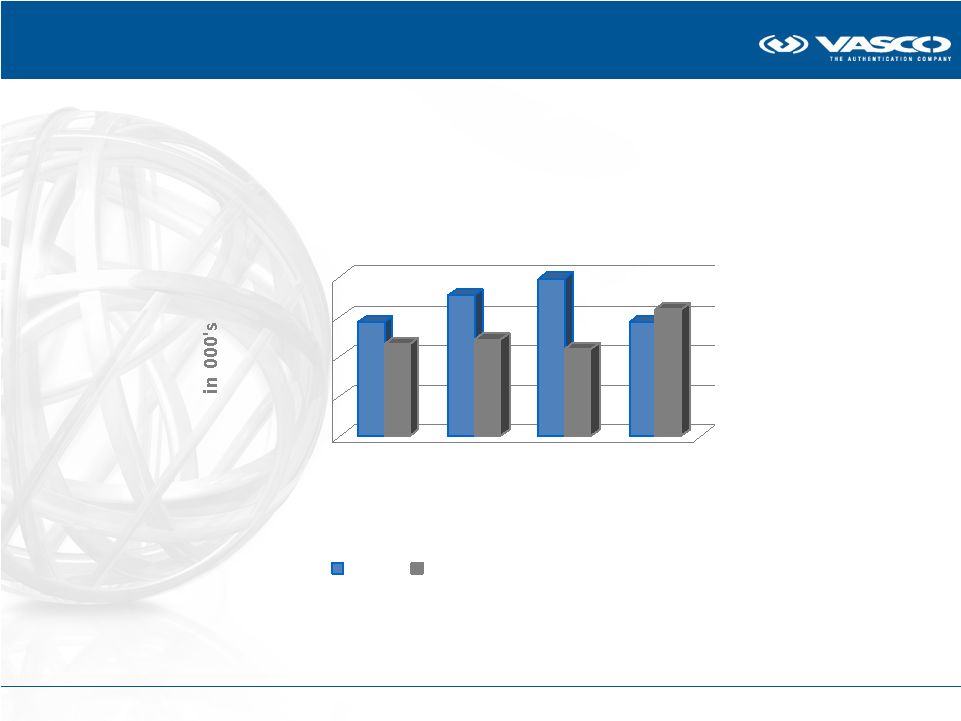

VASCO Data Security Investor Summit New York 2010 12 VASCO’s SUCCESS STORY 2003-2009 572 543 821 1553 2509 1827 1485 0 500 1000 1500 2000 2500 3000 2003 2004 2005 2006 2007 2008 2009 Total New Customers |

VASCO REVENUE

2008-2009 VASCO Data Security Investor Summit New York 2010 13 |

VASCO Data Security Investor Summit New York 2010 14 VASCO REVENUE 2008-2009 Banking Revenue 2008-2009 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 Q1 Q2 Q3 Q4 2008 2009 Non-banking revenue 2008-2009 $0 $2,000 $4,000 $6,000 $8,000 $10,000 Q1 Q2 Q3 Q4 2008 2009 |

VASCO Data Security Investor Summit New York 2010 15 VASCO REVENUE 2008-2009 $0 $10,000 $20,000 $30,000 $40,000 Q1 Q2 Q3 Q4 Total Revenue 2008-2009 2008 2009 |

VASCO Data Security Investor Summit New York 2010 16 Evolution sales 2001 vs 2009 $21,331 $1,359 $74,900 $26,800 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 2001 2009 Evolution Sales 2001-2009: Banking vs. ES Banking Enterprise Security 94% 74% 26% 6% |

VASCO Data Security Investor Summit New York 2010 17 Small volume High margin High volume Lower margin Success in times of recession and beyond VASCO’s Strong Business Mix |

VASCO Data Security Investor Summit New York 2010 18 CONCLUSIONS 1. VASCO’s defensive strengths: profitable strong worldwide business large installed customer base excellent business mix (GM 70%) a solid balance sheet no long-term debt healthy cash position 2. Evolution non-banking markets: VASCO grew 11% in non-banking segment despite a decline of 24% in total revenue important increase in sales per customer some vertical markets are growing very fast (e.g. gaming) |

VASCO Data Security Investor Summit New York 2010 19 CONCLUSIONS 3. Evolution banking market: We believe the decline in banking business is over Time to grow again 4. VASCO is a stronger company after the crisis than it was before |

VASCO Data Security Investor Summit New York 2010 20 Guidance 2010 |

VASCO Data Security Investor Summit New York 2010 21 Guidance Full Year 2010 We are offering guidance that • Full-year 2010 revenue will grow from 15% to 20% over full-year 2009. • Full-year 2010 operating income will range between 5% to 10% of revenue. |

VASCO Data Security Investor Summit New York 2010 22 Questions & Answers |

VASCO Data Security Investor Summit New York 2010 23 Strategy: End-to-end authentication |

VASCO Data Security Investor Summit New York 2010 24 Successful evolution of the company • Up to 2005: VASCO sells DIGIPASS (hardware) tokens to banks Due to success: margins under pressure • Challenge: How to grow gross margin? • Solution: diversification in products, markets, business mix |

VASCO Data Security Investor Summit New York 2010 25 Successful evolution of the company • Beginning in 2006 – now VASCO announces “Full option, all-terrain authentication”

VASCO becomes a Software Company higher margins VASCO sells outside of the banking market more sales and higher margins • End-to-End authentication With VACMAN Controller, IDENTIKEY and aXsGUARD Identifier DIGIPASS is now e-signature software and firmware on a multitude of platforms (tokens, readers, smart cards, PKI, PDA’s, PC’s…) with over 50 different form factors • Results: Gross margin around 70% Growing business beyond banking Increased non-hardware business |

VASCO Data Security Investor Summit New York 2010 26 VASCO Business Model • End-to-End Authentication Direct sales Indirect Sales |

VASCO Data Security Investor Summit New York 2010 27 Direct sales model VASCO’s success in the banking market showed that we need to work with competence centers for other vertical markets A competence center coordinates all marketing (lead generation) activities and other support for sales for worldwide applications that have a potential of more than 5 million users. |

VASCO Data Security Investor Summit New York 2010 28 Direct sales model Development of Competence Centers Applications: • Financial institutions (e-banking, brokerage, insurance) • Gaming & Gambling • E-Government • SaaS & ASP Marketing: Summits, events where customers talk to prospects (immature markets) VASCO TRUSTED CLUB: customer events in mature markets Sales: Covered by local sales people |

VASCO Data Security Investor Summit New York 2010 29 Direct Sales: 2010 investments Investments in 2010 • Banking: higher presence in key geographic markets • Higher investment in new non-banking competence centers • Recruitment of additional sales staff • Creation of an Advanced Development Team |

VASCO Data Security Investor Summit New York 2010 30 Indirect sales: distributors & resellers • REMOTE ACCESS SECURITY is VASCO’s first entry point Employee security: remote users. Bundling strategy. • ENTERPRISE SECURITY (large corporations) Employee security for all employees. Internet and network applications (7 to 1). Authentication end-to-end • APPLICATION SECURITY B-to-B applications. Entire product range. |

VASCO Data Security Investor Summit New York 2010 31 Indirect sales model • Remote Access Security All distributors & resellers Indirect sales Managed by Distribution Managers • Enterprise Security prospects (large corporations) Selected resellers, integrators and solution partners Indirect sales with direct touch Managed by Channel Managers • Application Security prospects Selected resellers, integrators and solution partners Direct touch with indirect sales Managed by Channel Managers |

VASCO Data Security Investor Summit New York 2010 32 Indirect sales: 2010 investments Investments in 2010 • Extra hires in Sales, Engineering and Business Development to support the growth in ES & B2B • Extra Marketing budget for ES & B2B compared to 2009 |

VASCO Data Security Investor Summit New York 2010 33 Indirect sales: conclusions Conclusions • More sales per customer • Very good recurrent business • Strong product portfolio • Competition focuses less on authentication market • Excellent execution strategy • 2010: substantial increase in investments |

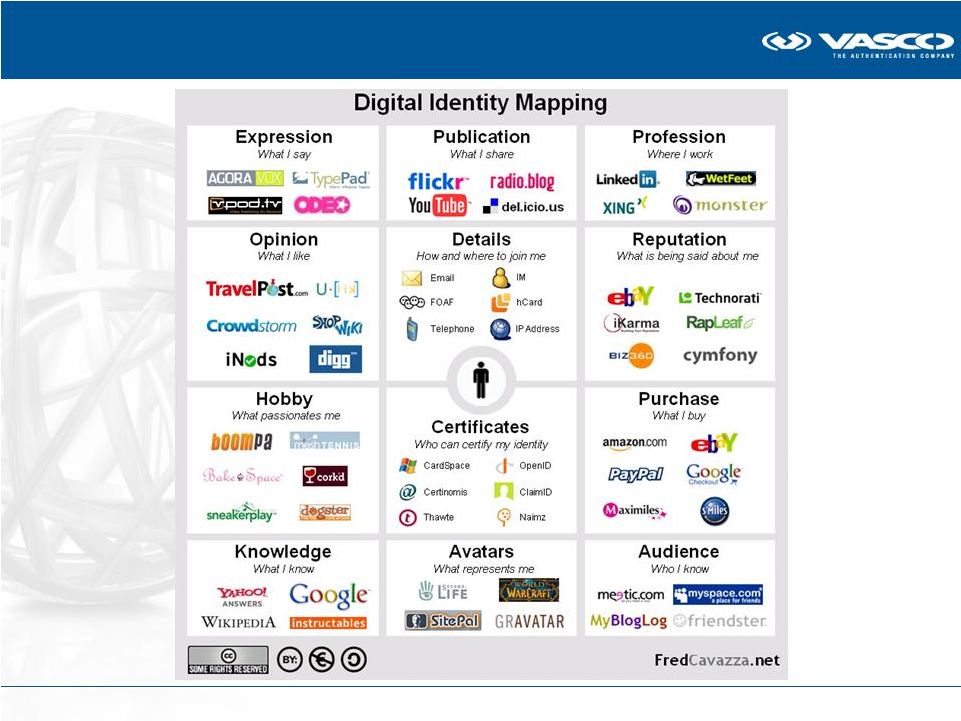

VASCO Data Security Investor Summit New York 2010 34 The next step How to tackle online applications previously out of our reach? |

VASCO Data Security Investor Summit New York 2010 35 DIGIPASS as a Service (DaaS)™ On Demand Identity and Transaction Security The next step |

DIGIPASS as a

Service (DaaS)™ VASCO Data Security Investor Summit New York 2010 36 |

DIGIPASS as a

Service (DaaS) Client Platform Employees Consumers DaaS Platform Business Application Consumer Application VASCO Data Security Investor Summit New York 2010 37 |

VASCO Data Security Investor Summit New York 2010 38 DIGIPASS as a Service: potential sources of income 3 Potential revenue streams 1. Activation Code: one-time membership fee 2. Monthly Service Fee: Access to the DaaS platform basic version of anti-virus, firewalls… is for free advanced versions need to be paid aXsGUARD Gatekeeper product suite 3. ID Security Fee: to be paid per year per application Social networks E-commerce E-gaming … : |

VASCO Data Security Investor Summit New York 2010 39 Who pays VASCO? • For employee security: Employer, corporation pays Activation Code, Monthly Service Fee & ID Security Fee • For consumer security: Consumer pays Activation Code, Monthly Service Fee & ID Security Fee For some applications, application owner will pay Activation Code, Monthly Service Fee & ID Security Fee • e.g. online newspaper |

VASCO Data Security Investor Summit New York 2010 40 Long Term Strategy: Client platform • DIGIPASS Embedded Security Solution (DESS) strategy for client platforms: Integrating DIGIPASS on hardware devices & software platforms • Solution Partners for applications: Solution Partners integrate VACMAN Controller in existing Applications. Over 100 partners currently. |

VASCO Data Security Investor Summit New York 2010 41 Conclusion DIGIPASS as a Service (DaaS)™ On Demand Identity and Transaction Security |

VASCO Data Security Investor Summit New York 2010 42 Questions & Answers |