Attached files

Consumer

Analyst Group of New York (CAGNY) Conference February 17, 2010 Hermann Waldemer Chief Financial Officer Philip Morris International Exhibit 99.2 |

2

Introduction Unless otherwise stated, we will be talking about results in the fourth quarter or the full-year 2009 and comparing them with the same period in 2008 References to PMI volumes refer to shipment data Industry volume and market shares are the latest data available from a number of internal and external sources Organic volume refers to volume excluding acquisitions Net revenues exclude excise taxes Reconciliations of non-GAAP measures included in this presentation to the most comparable GAAP measures are provided at the end of this presentation, and are available on our website |

3

3 Forward-Looking and Cautionary Statements This presentation and related discussion contain statements that, to the extent they do not relate strictly to historical or current facts, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on current plans, estimates and expectations, and are not guarantees of future performance. They are based on management’s expectations that involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. PMI undertakes no obligation to publicly update or revise any forward-looking statements, except in the normal course of its public disclosure obligations. The risks and uncertainties relating to the forward-looking statements in this presentation include those described under Item 1A. “Risk Factors” in PMI’s Form 10-K for the year ended December 31, 2008, and Form 10-Q for the quarter ended September 30, 2009, filed with the Securities and Exchange Commission. |

4

4 Agenda Review of 2009 results 2010 business outlook Superior brand portfolio Cost savings and productivity improvements Cash flow enhancement and capital structure M&A Shareholder returns |

5

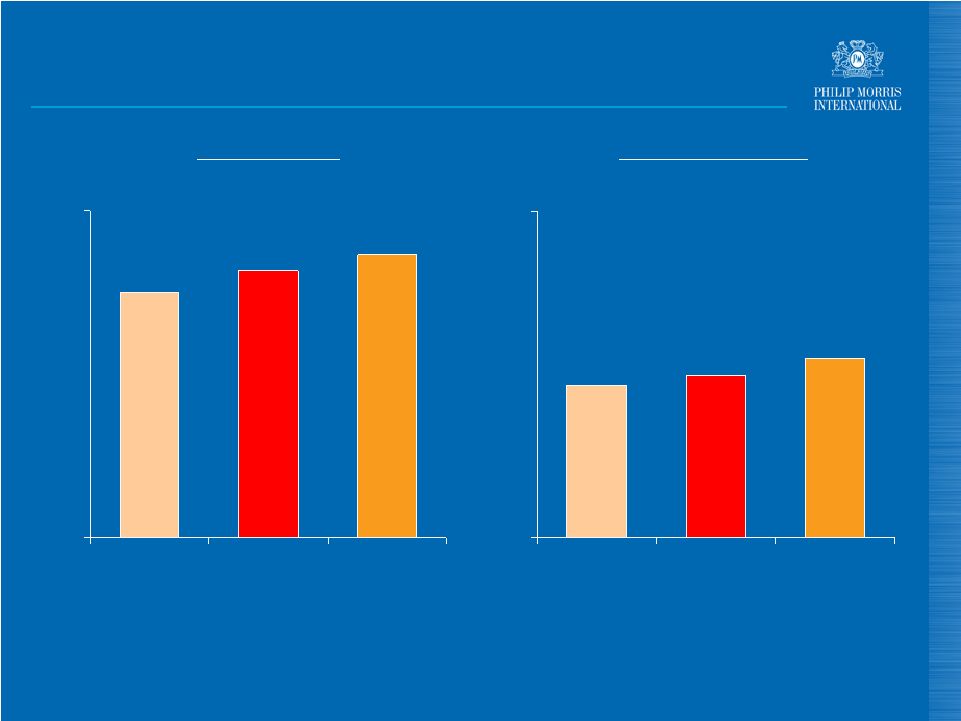

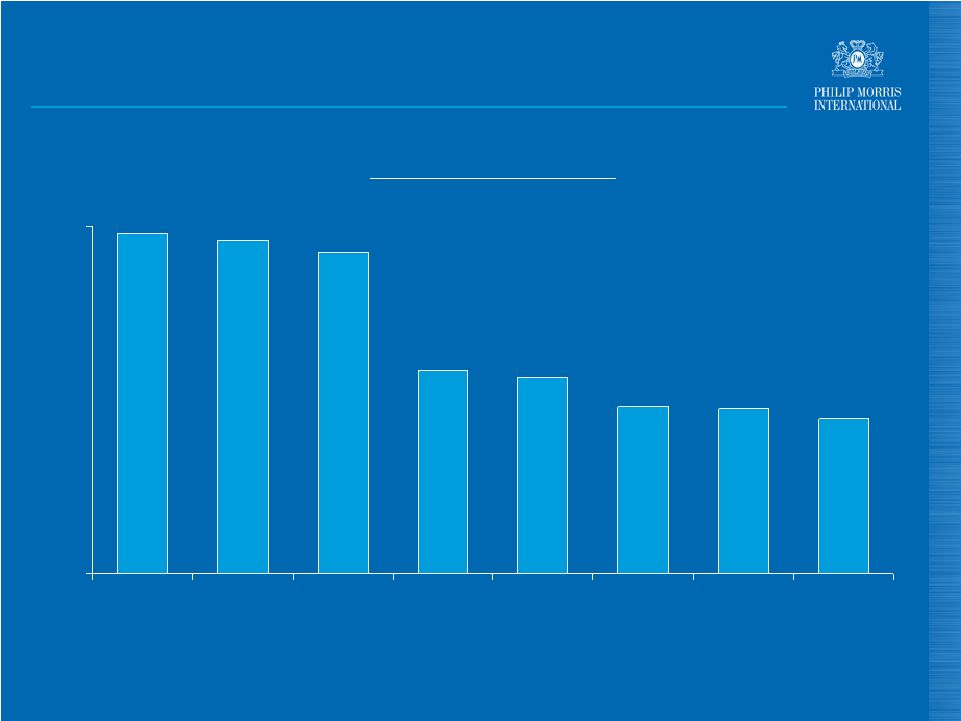

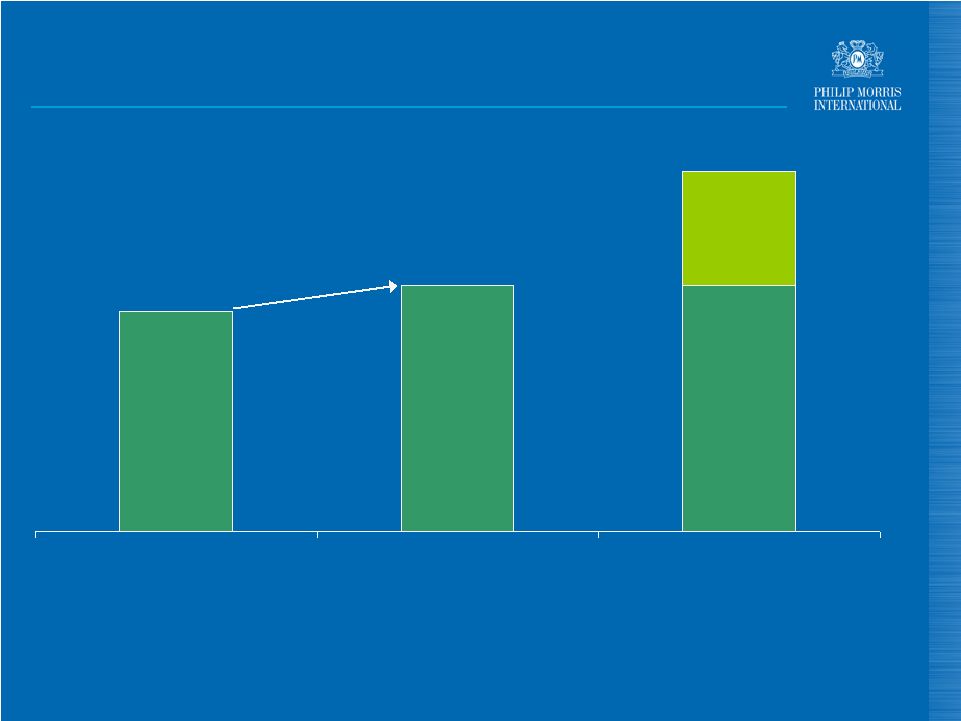

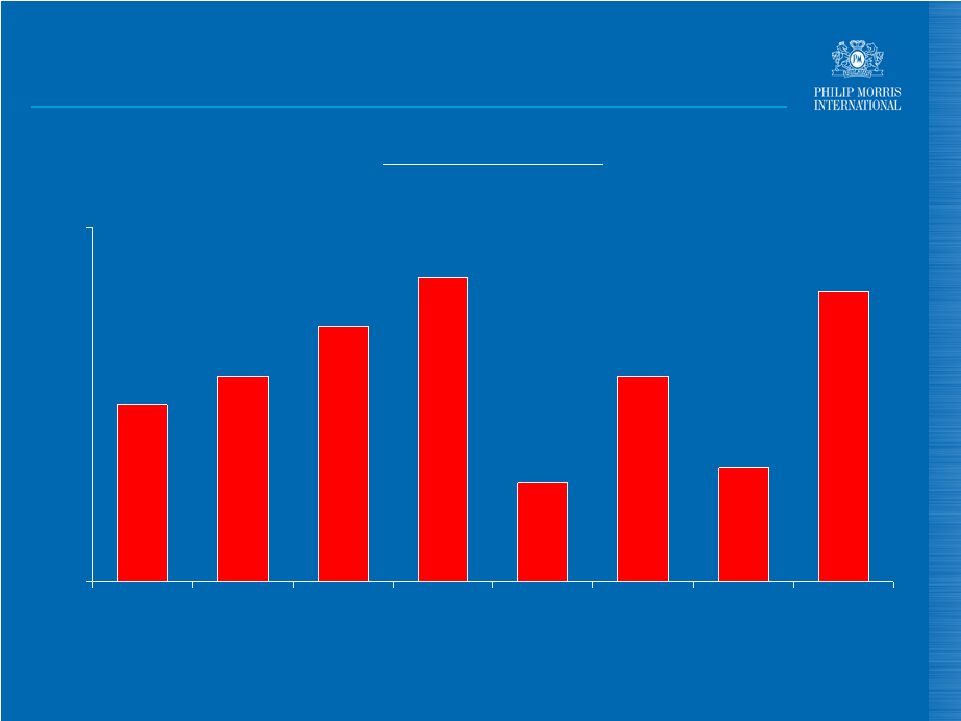

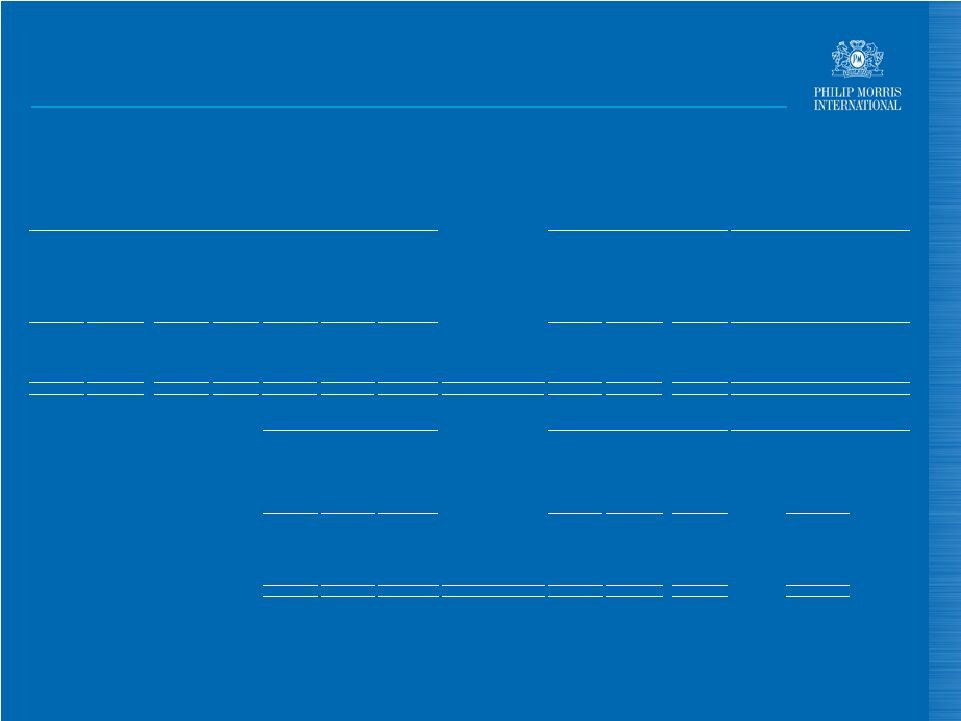

PMI Results Source: PMI Financials 864.0 2009 Results (units billion) 1 – 2% - 1.5% - 0.7% Cigarette Volume Excl. Acquisitions Actual Mid to Long-Term Annual Growth Targets % Growth 2009 vs. 2008 |

6

PMI Results 25.0 2009 Results ($ billion) 4 – 6% + 5.3% - 2.6% Net Revenues Excl. Curr. & Acquisitions Actual Mid to Long-Term Constant Currency Annual Growth Targets % Growth 2009 vs. 2008 Source: PMI Financials. See reconciliations to U.S. GAAP measures at the end of this

presentation. |

7

PMI Results 10.4 25.0 2009 Results ($ billion) 6 – 8% + 8.7% - 1.9% Adjusted OCI (a) 4 – 6% + 5.3% - 2.6% Net Revenues Excl. Curr. & Acquisitions Actual Mid to Long-Term Constant Currency Annual Growth Targets % Growth 2009 vs. 2008 (a) Excludes asset impairment, exit and other costs Source: PMI Financials. See reconciliations to U.S. GAAP measures at the end of this

presentation. |

8

PMI Results 3.29 10.4 25.0 2009 Results ($) 6 – 8% + 8.7% - 1.9% Adjusted OCI (a) 10 – 12% + 15.4% (b) - 0.6% Adjusted Diluted EPS 4 – 6% + 5.3% - 2.6% Net Revenues Excl. Curr. & Acquisitions Actual Mid to Long-Term Constant Currency Annual Growth Targets % Growth 2009 vs. 2008 (a) Excludes asset impairment, exit and other costs (b) Only excludes currency Source: PMI Financials. See reconciliations to U.S. GAAP measures at the end of this

presentation. |

9

9 Agenda Review of 2009 results 2010 business outlook Superior brand portfolio Cost savings and productivity improvements Cash flow enhancement and capital structure M&A Shareholder returns |

10

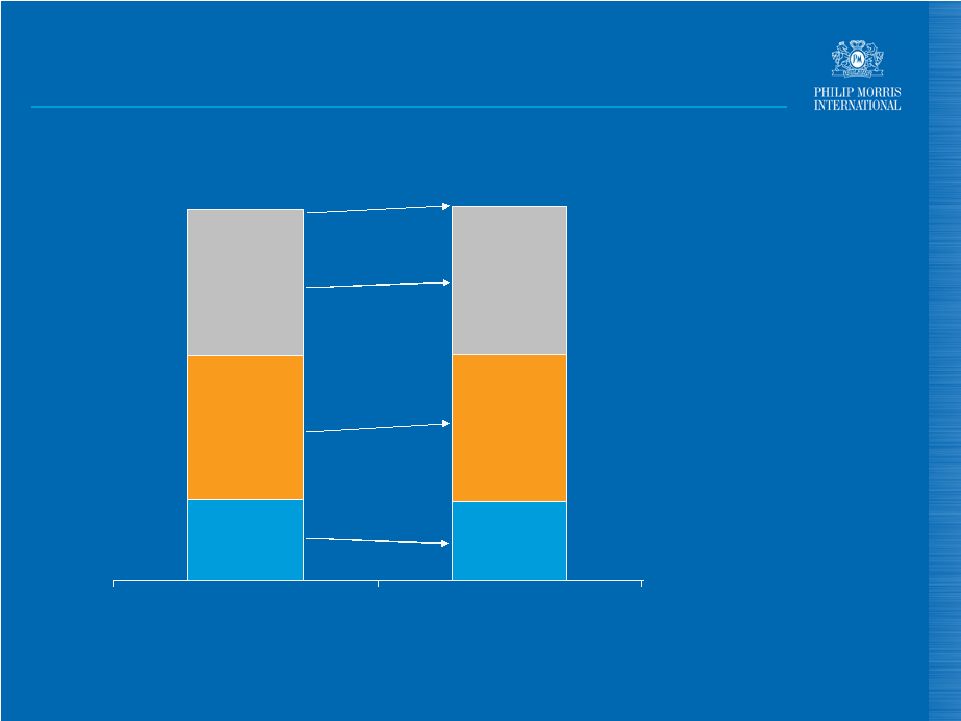

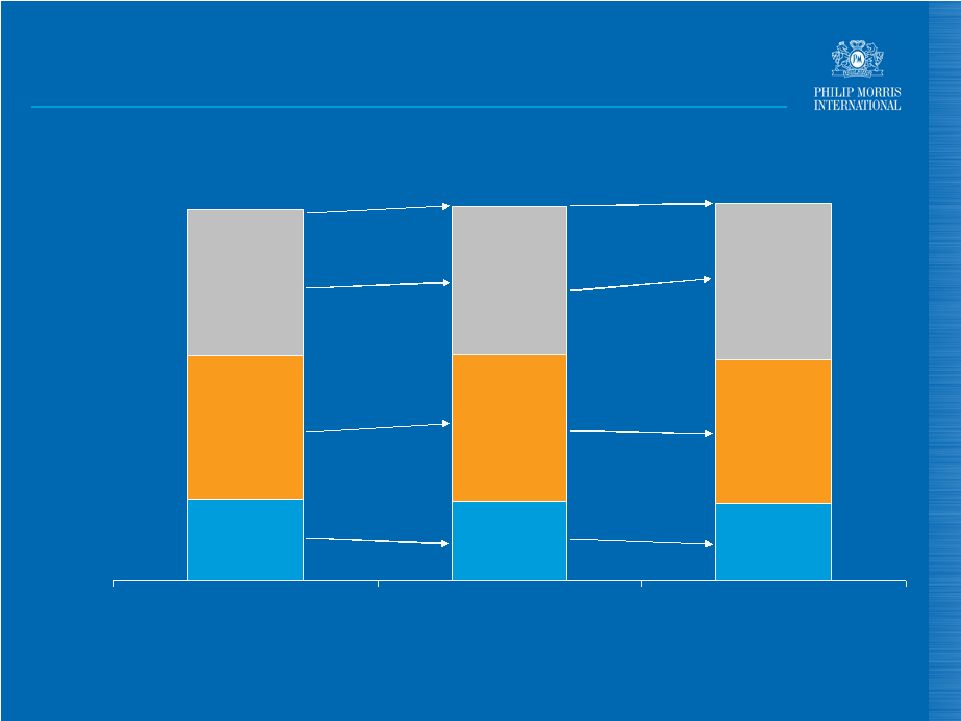

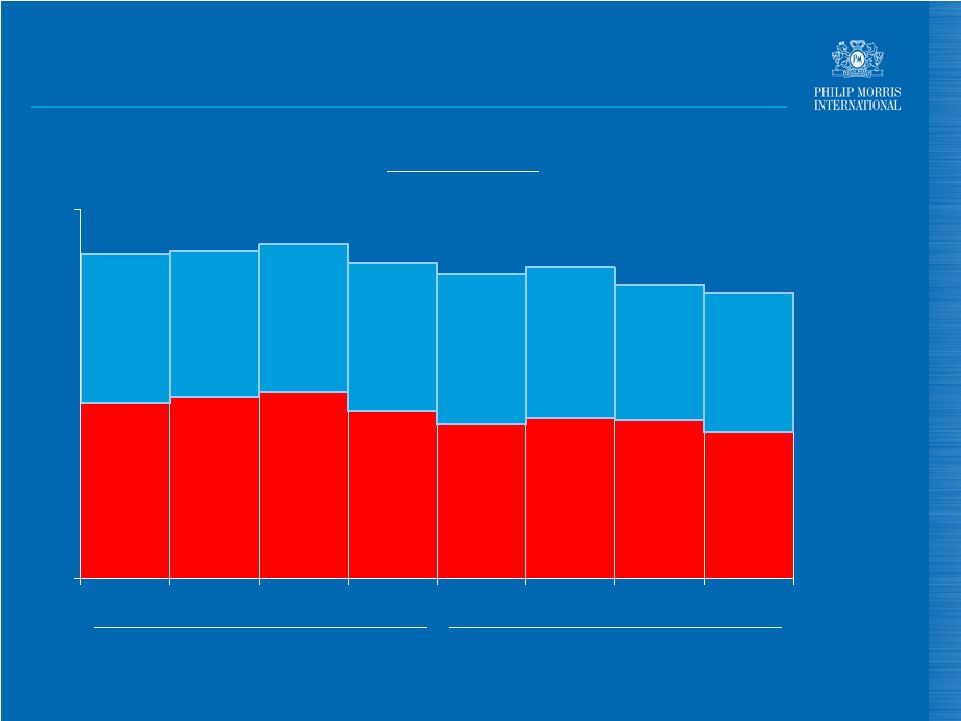

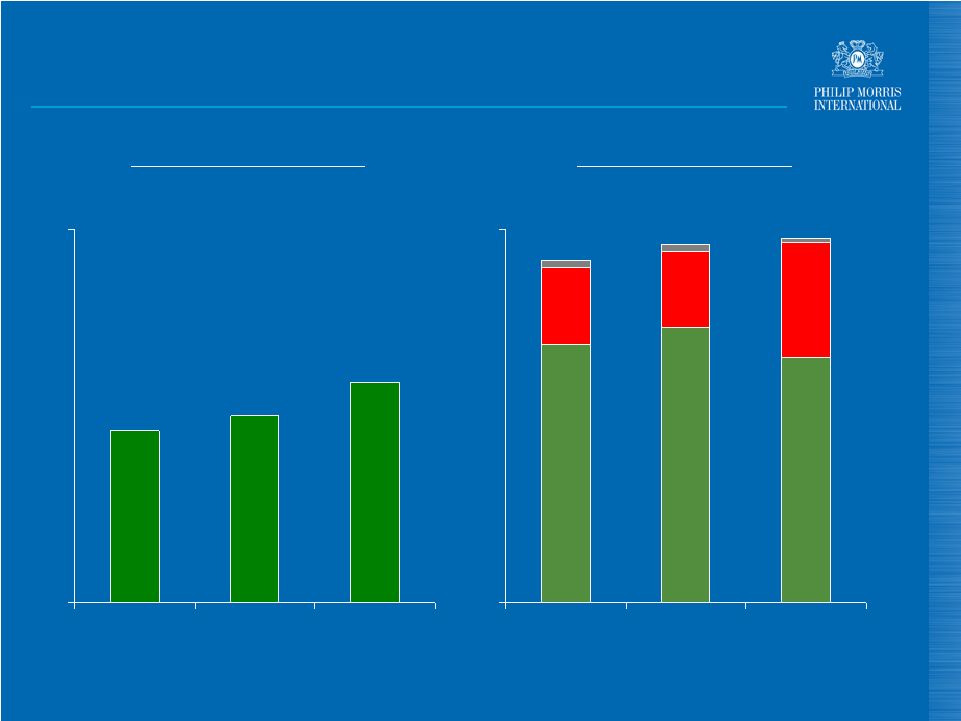

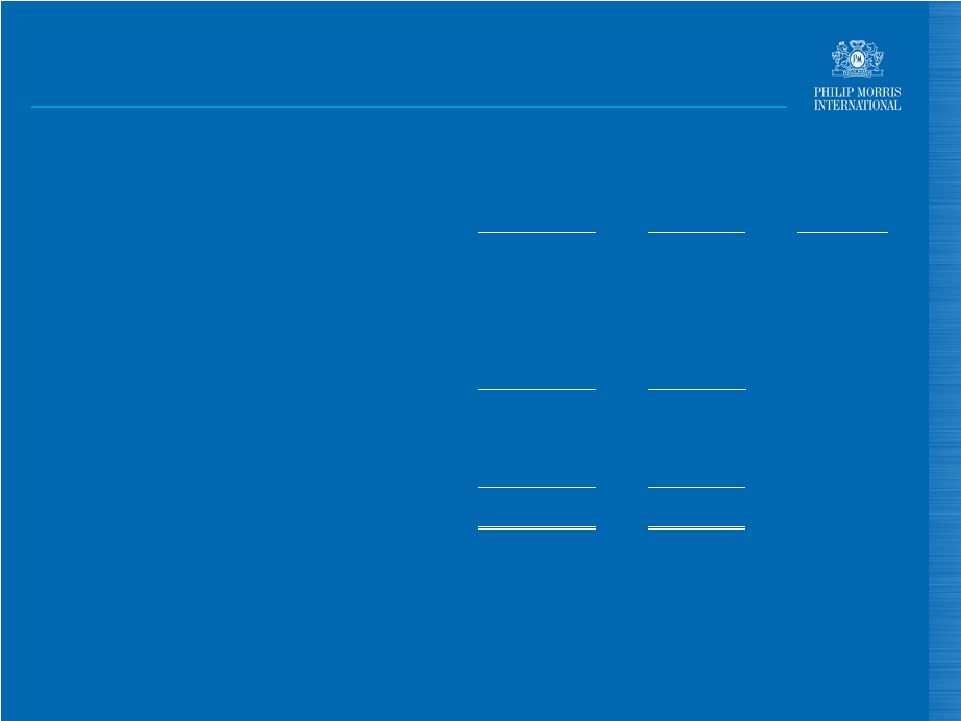

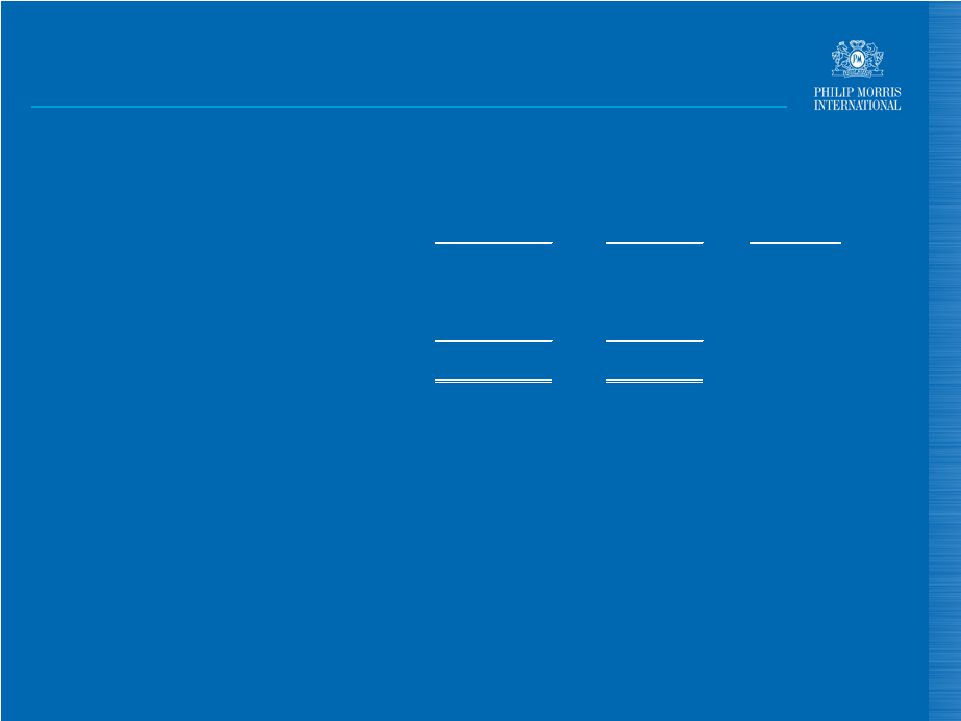

10 Cigarette Industry Volume 1,196 1,156 2,134 2,183 2,140 2,181 5,470 5,520 2007 2008 Non-OECD OECD (a) China (3.3)% +2.3% +1.9% +0.9% (a) Excluding USA and duty-free Note: Organization for Economic Co-operation and Development (“OECD”) Source: PMI estimates (billion units) |

11

11 Cigarette Industry Volume 1,196 1,156 1,130 2,134 2,183 2,141 2,140 2,181 2,289 5,470 5,520 5,560 2007 2008 2009 Non-OECD OECD (a) China (3.3)% +2.3% +1.9% +0.9% (2.2)% (1.9)% +5.0% +0.7% (a) Excluding USA and duty-free Note: Organization for Economic Co-operation and Development (“OECD”) Source: PMI estimates (billion units) |

12

Industry Volume Trends : OECD Western Europe underlying trend: -2.5% to -3.0% a year Central Europe was declining faster, driven by excise tax increases related to EU accession, but volume decline rate should in future be in line with Western Europe Japan underlying trend : -3.5% to -4.0% a year In 2010/11, Japan volume decline will depend on the price/tax outcome Source: PMI estimates |

13

Industry Volume Trends: Non-OECD Driven by Russia (390 billion units in 2009) and Indonesia (260 billion units) Russian market grew by 3.5% in 2008, but declined by 2.7% in 2009 Indonesian market continued to grow in 2009 at previous pace of 4-5% a year Source: PMI estimates |

14

Industry Volume Trends: Outlook for 2010 Emerging markets in Asia, such as Indonesia, to grow Volumes in Russia to gradually stabilize Volatility in Ukraine and adverse impact of large tax- driven price increases in Turkey Western Europe to follow recent underlying volume trend Central Europe trends to converge with Western Europe Underlying volume decline in Japan, with additional impact of tax increase, which is difficult to predict Forecast for global industry volume, excluding China and the United States, is decline of around 2% in 2010, in line with 2009 trend Source: PMI estimates |

15

PMI Volume Trends : 2010 and Beyond Share improvements should enable us to outperform the industry again in 2010 PMI organic volume performance in 2010 expected to be similar to 2009, namely down around 1.5% Progressive return to our 1% annual organic growth target should be feasible, once the economic recovery translates into higher employment levels and improved consumer confidence, thanks to: – Excellent geographic footprint – Strength and breadth of our brand portfolio |

16

Net Revenues While volume is important, our prime focus is on growing net revenues by 4-6% a year, excluding currency and acquisitions Key factors influencing net revenues are excise taxes and prices |

17

Excise Taxation Rate of increase and structure are of paramount importance Desirable approach is regular, reasonable increases: – Government revenues are enhanced – Manageable from industry perspective Large excise tax increases are disruptive and often have unintended consequences, such as encouraging contraband and counterfeit |

18

Excise Taxation Most governments implement reasonable rate increases or participate in price increases through ad-valorem tax elements: - Australia, Mexico and Russia are good examples of first approach - France and Italy are good examples of second approach From time to time, some governments implement unreasonable increases: - Brazil and Ukraine in 2009 - Greece, Romania and Turkey in 2010 |

19

Excise Taxation - Turkey Government increased ad-valorem excise tax rate from 58% to 63% Minimum excise tax was raised from TRL 2.05/pack to TRL 2.65/pack PMI increased retail prices in a magnitude that safeguards our unit margins: – Marlboro from TRL 5.50/pack to TRL 7.00/pack – Lark from TRL 3.50/pack to TRL 4.50/pack Source: Turkish Ministry of Finance and PMSA |

20

20 Excise Taxation - Japan Consumption tax of 5% to be left unchanged Trade margins currently 10% of retail price Unit revenue neutral pass-on retail price increase: 82 Yen per pack Key PMI objective is to obtain pricing freedom (Yen per pack of 20) Current Proposed Variance National Excise Tax 71.04 106.04 35.00 Local Excise Tax 87.44 122.44 35.00 Special Tobacco Tax 16.40 16.40 - Total 174.88 244.88 70.00 Source: Japanese Ministry of Finance and PMJKK |

21

Excise Taxation From a structural perspective, what is needed is a system that protects government revenues and supports public health objectives: – Specific excise taxes – Minimum excise taxes – Minimum reference prices Today, one or more of these are in place in 23 of PMI’s top 25 OCI markets Source: PMI Corporate Affairs |

22

Excise Taxation – European Union Fiscal tool that limits downtrading Cap at 100% of MPPC No cap Minimum Excise Tax Allows for almost specific excise tax system 55.0% 76.5% Maximum Specific to Total Tax Escape clause if tax on WAP above € 115/000 in 2014. Transition periods in Central Europe 57% on MPPC 60% on WAP Minimum Tax Incidence Transition until 2018 for most Central Europe countries € 64/000 on MPPC € 90/000 on all cigarettes Minimum Tax Yield Technical changes as of 2011. New minima as of 2014 Today 2011 Implementation Date Comments Old Directive New Directive Note: WAP is Weighted Average Price. MPPC is Most Popular Price Class. Source: European Union Commission |

23

Pricing Strategy Visible, predictable excise taxation provides strong framework to optimize pricing decisions Key is balanced pricing, on a market by market basis, taking into account: – Consumer affordability – Competitive environment – Margin enhancement vs. volume/mix impact |

24

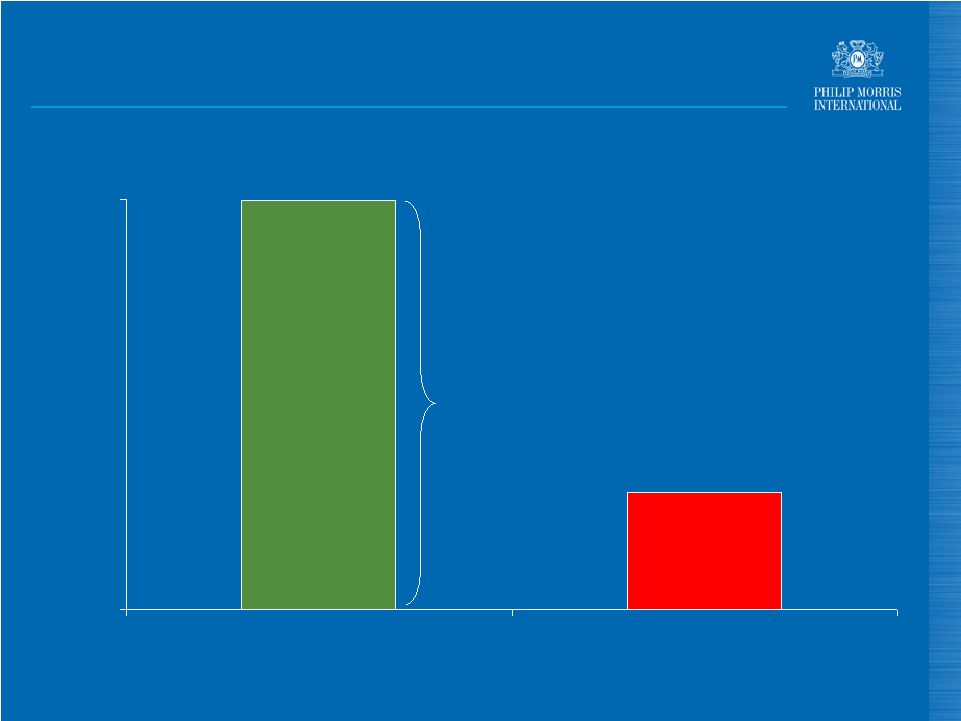

Pricing Variance vs. Volume/Mix (2009) 1,997 (572) 0 2,000 Pricing Volume / Mix Note: variances at level of OCI Source: PMI Financials ($ million) 3.5x |

25

Pricing In last twelve months, PMI implemented price increases notably in: As of end of January, two-thirds of pricing embedded in our 2010 EPS guidance already implemented Argentina Brazil Canada Dominican Rep. Mexico Australia Indonesia Malaysia Pakistan Philippines Romania Russia Saudi Arabia Serbia Turkey Ukraine France Germany Italy Poland Spain UK LA & Canada Asia EEMA EU Source: PMI Financials |

26

26 Russia – PMI Shipment Volume by Price Segment 25% 31% 44% 25% 29% 46% 22% 27% 51% 21% 25% 54% Premium Mid Low/Super-low Source: PMI Financials H1, 2008 H2, 2008 H1, 2009 H2, 2009 |

27

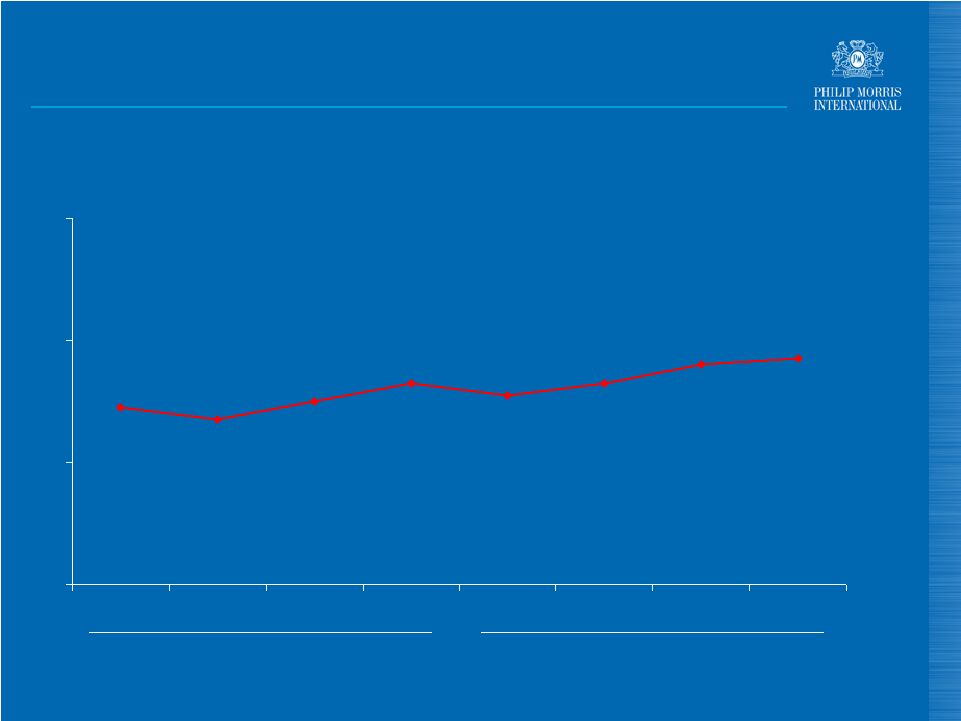

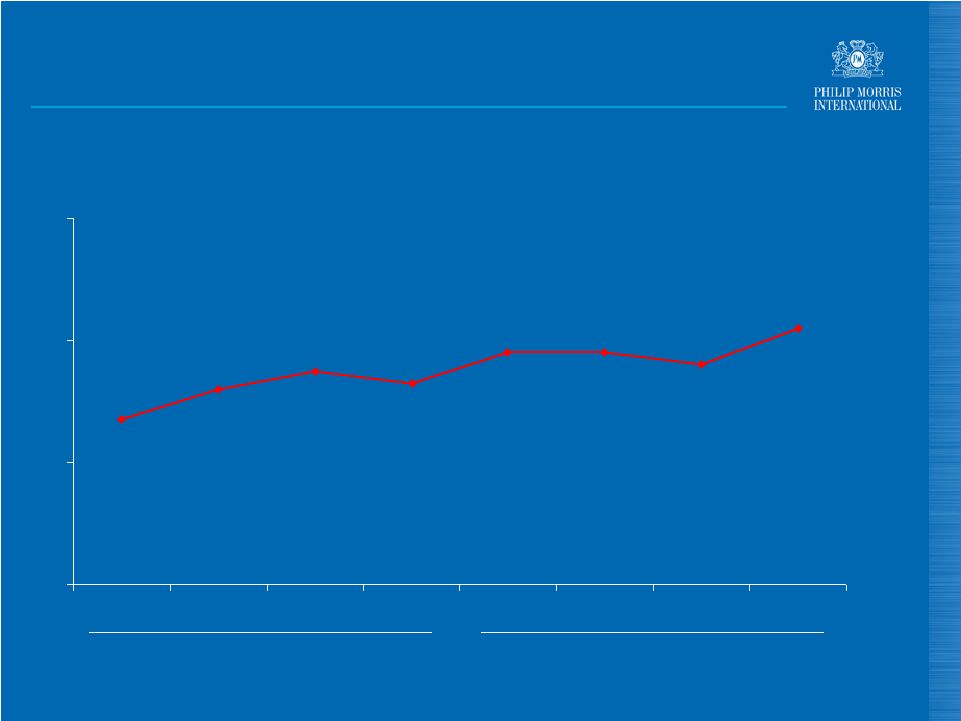

Russia – PMI Market Share 24.9 24.7 25.0 25.3 25.1 25.3 25.6 25.7 22 24 26 28 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Source: A.C. Nielsen 2008 2009 (%) |

28

Ukraine – PMI Shipment Volume by Price Segment 22% 35% 43% 23% 36% 41% 21% 36% 43% 22% 35% 43% Source: PMI Financials H1, 2008 H2, 2008 H1, 2009 H2, 2009 Premium Mid Low/Super-low |

29

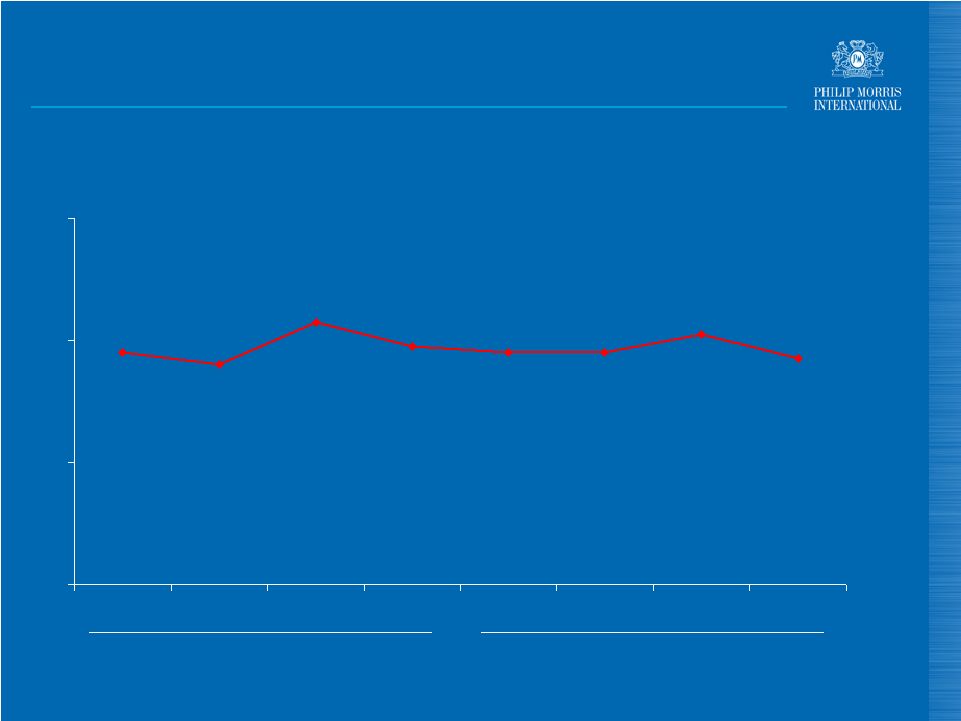

Ukraine – PMI Market Share 34.7 35.2 35.5 35.3 35.8 35.8 35.6 36.2 32 34 36 38 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Source: A.C. Nielsen (%) 2008 2009 |

30

Spain – Price Segmentation 19.0 19.6 20.2 18.1 16.7 17.3 17.1 15.8 16.1 15.8 16.0 16.1 16.3 16.4 14.7 15.1 0 40 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2008 Source: PMI estimates Share of Market 2009 (%) Premium "3.60 Mid !3.35 |

31

Spain – PMI Market Share 31.8 31.6 32.3 31.9 31.8 31.8 32.1 31.7 28 30 32 34 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 (%) 2008 2009 Source: PMI estimates |

32

32 Agenda Review of 2009 results 2010 business outlook Superior brand portfolio Cost savings and productivity improvements Cash flow enhancement and capital structure M&A Shareholder returns |

33

20.8 21.0 21.3 18 24 2008 2009 Q4 PMI Share Developments 34.5 34.9 35.2 30 36 2008 2009 Q4 (a) Excluding USA and duty-free (b) Excluding PRC and duty-free Note: For definition of OECD countries, refer to PMI’s Registration Statement on Form 10

(page 68) dated March 5, 2008 Source: PMI estimates OECD markets (a) Non-OECD markets (b) 2009 2009 (%) (%) |

34

Marlboro The only truly global cigarette brand Volume grew by 4.3% in Asia and by double digits in North Africa in 2009 Global volume adversely impacted in 2009 by: – Continued overall market contractions in developed markets – Consumer downtrading in selected markets Marlboro share in Japan was up 0.4 points to 10.5% in 2009 Market share gains in many markets, driven by: – New Marlboro architecture – Innovative line extensions Source: PMI Financials, Tobacco Institute of Japan, A.C. Nielsen and PMI estimates |

35

35 Marlboro Flavor Line |

36

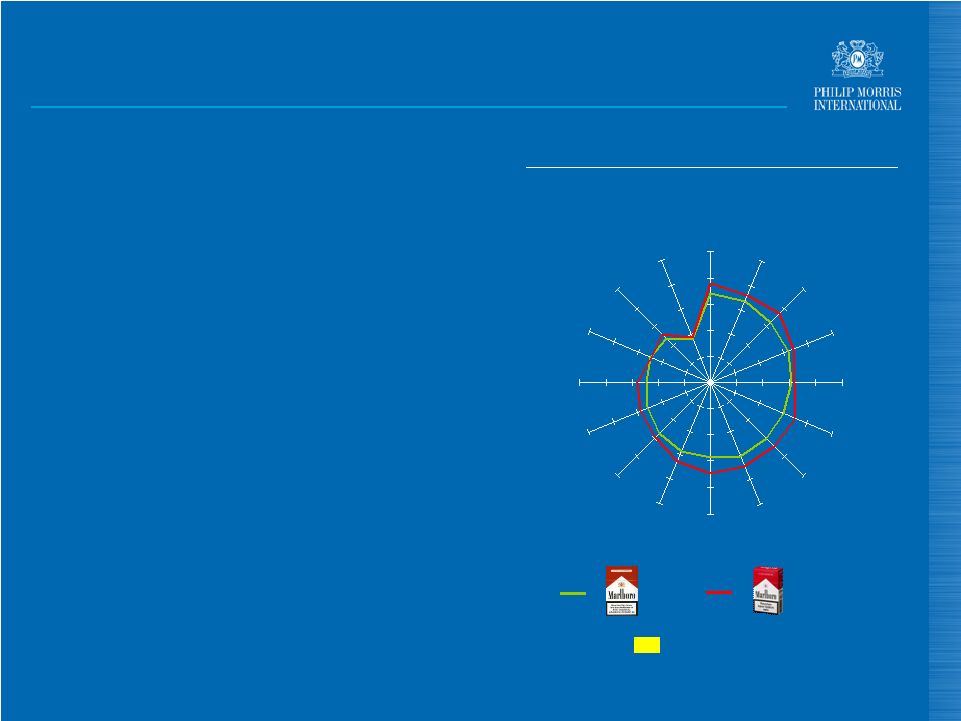

36 Marlboro Red Upgraded packaging Positive consumer reaction Introduced in nine markets (32% of worldwide volume) By year end, expect to cover 75% of worldwide volume 0 2 4 6 8 10 Masculine That I like Beautiful That goes well with me Original In the spirit of the times High-End Elegant/chic Modern Innovative Refined Feminine Worth its price Lets me stand out Proud to show That lacks character New Pack Perception Results – France : : New Pack (n=100) Old Pack (n=100) : Significant Evolution

Source: PMI market research in France (POS study 2 months after launch in

Montpellier) |

37

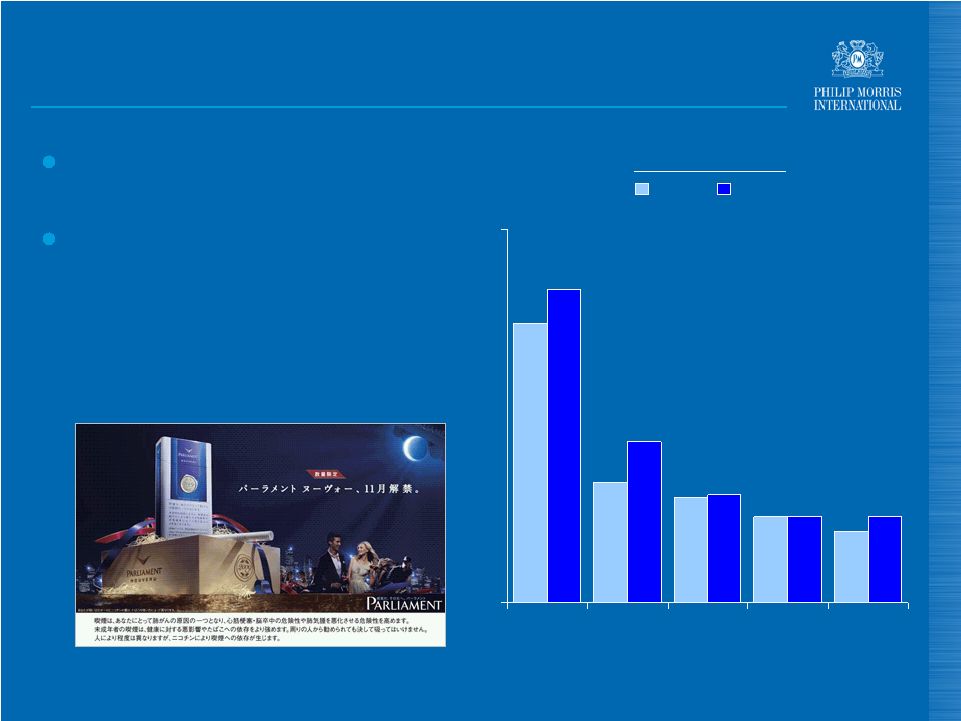

37 Marlboro Filter and Flavor

Plus First introduced in Korea in November 2007 Currently available in 38 markets worldwide Helping to build PMI share in ultra-light and 1mg segments Positive “halo” effect on parent brand Source: A.C. Nielsen and PMI estimates |

38

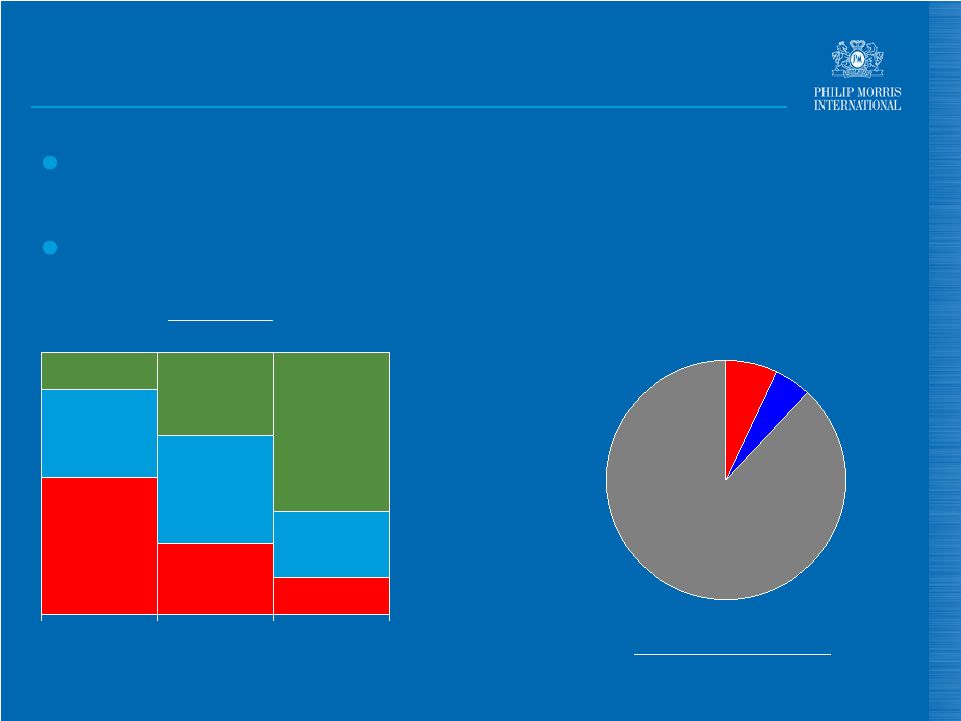

38 28% 22% 17% 41% 32% 25% 31% 46% 58% Marlboro Flavor Plus – Slovakia 6mg variant launched in October 2008 0.7% share of market in Q4, 2009 47% 53% 35-64 25-34 18-24 Age Profile Marlboro Flavor Plus Marlboro Family Total Market Cannibalization Rate Competition Marlboro Source: PM Slovakia market research |

39

39 Marlboro Gold Line |

40

40 Marlboro Gold Touch Slightly slimmer cigarette Novel packaging Launched in 2009 in 8 markets In Q4, 2009, Marlboro Gold Touch achieved market share of: – 1.5% in Italy – 0.8% in Romania – 0.6% in Greece Source: A.C. Nielsen and PMI estimates |

41

41 52% 27% 14% 34% 41% 25% 14% 32% 61% Marlboro Gold Touch – Russia Introduced in 6mg (Gold Touch) and 4mg (Fine Touch) in Moscow in July 2009 In December, combined 0.5% share in Moscow 88% 7% 5% 35-64 25-34 18-24 Age Profile Marlboro Touch Marlboro Family Total Market Cannibalization Rate Competition Marlboro Source: A.C. Nielsen and PM Russia market research Other PMI Brands |

42

42 Marlboro Fresh Line Up Innovative technological approach include: – Different levels of mentholation – Mentholated threads in the filter – Capsules in the filter Delivers different freshness sensations |

43

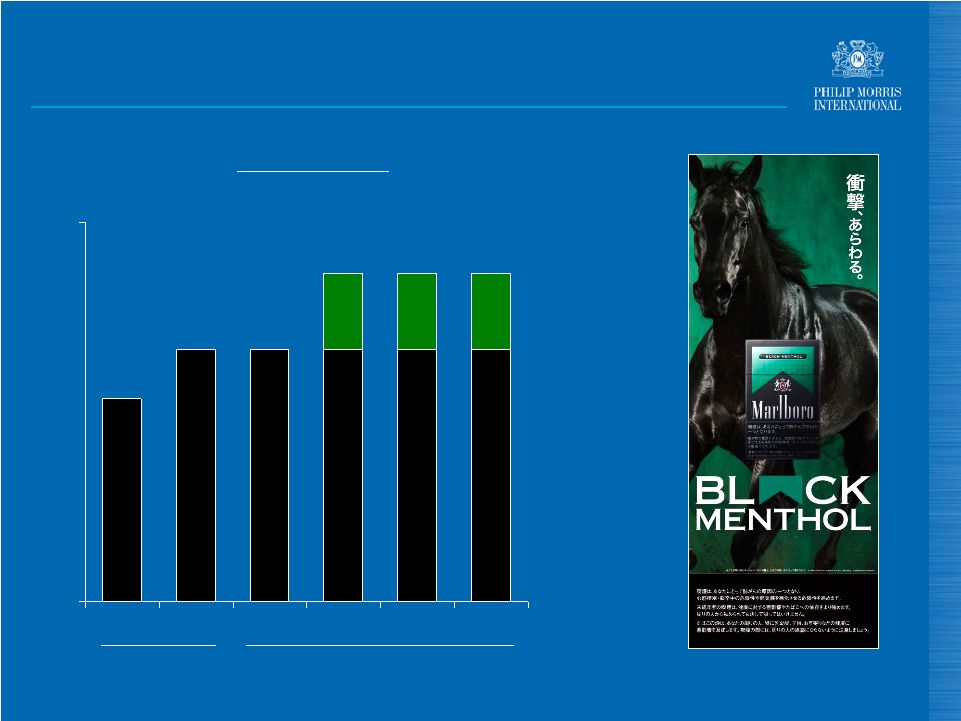

43 Marlboro Black Menthol - Japan Share of Market Source: Tobacco Institute of Japan 1mg Black Menthol (8 mg) (%) 0.8 1.0 1.0 1.0 1.0 1.0 0.3 0.3 0.3 0.8 1.0 1.0 1.3 1.3 1.3 0 1.5 Q3 Q4 Q1 Q2 Q3 Q4 2008 2009 |

44

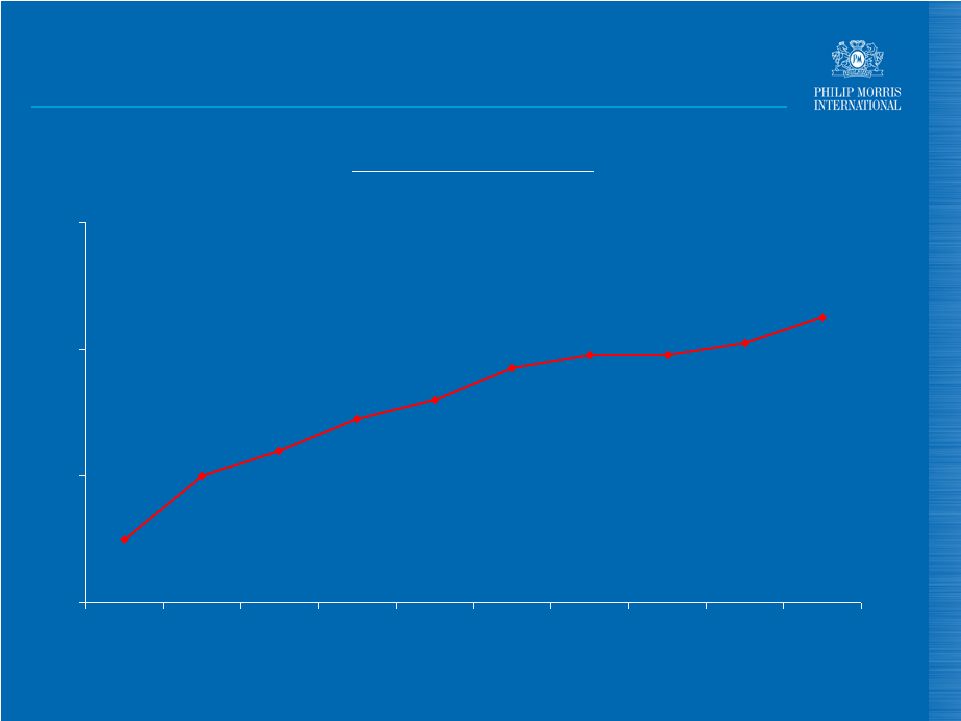

Marlboro - Japan Source: Tobacco Institute of Japan Marlboro Share of Market 7.0 8.0 8.4 8.9 9.2 9.7 9.9 9.9 10.1 10.5 6 8 10 12 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 (%) |

45

45 Menthol - Mexico 4.6 5.0 5.9 0 10 2007 2008 2009 58.9 62.7 55.9 17.4 17.3 26.1 77.9 81.7 83.0 0 85 2007 2008 2009 Menthol Share of Market PMI Share of Segment (%) (%) Source: PMI estimates Other Benson & Hedges Marlboro |

46

21 19 11 7 7 4 0 25 Russia Japan Italy Ukraine Spain Indonesia 46 Marlboro Innovation New Line Extensions as % Marlboro Volume (Q4, 2009) Source: PMI Financials (%) |

47

7.5 3.2 2.8 2.3 1.9 8.4 4.3 2.9 2.3 2.3 0 10 Turkey Korea Russia Japan Ukraine 47 Parliament Volume stable at 37.3 billion units Super-premium Parliament Reserve (Eastern Europe), Platinum and Parliament Nouveau (Japan) reinforcing luxury image Share of Market (%) 2008 2009 Source: PMI Financials, A.C. Nielsen, Korea Research Center and Tobacco Institute of Japan

|

48

48 L&M Our second largest brand, positioned in mid-price in emerging markets and low-price in developed markets Volume declined by 1.7% in 2009 to 90.8 billion units, an improved performance compared to the previous two years Volume grew by 19% last year in the Middle East and Africa Source: PMI Financials |

49

6.7 2.6 2.3 1.5 1.3 0 8 Slovak. Czech Sweden Spain Germ. L&M – EU Region Volume grew by close to 9% in EU Region in 2009 and by 17% in the fourth quarter (a) Through end November Source: PMI Financials, A.C. Nielsen and PMI estimates Share of Market Gains 2009 vs. 2008 (a) (pp) |

50

50 L&M – EU Region 14.7 14.4 13.9 8.8 8.5 7.2 7.1 6.7 0 15 Poland Slovakia Belgium Germany Sweden Czech Republic Neth. Spain Share of Market Q4, 2009 (%) (a) Through end November Source: A.C. Nielsen and PMI estimates (a) |

51

Brand Portfolio Mid-Price Premium & Above Local Heritage International Low-Price |

52

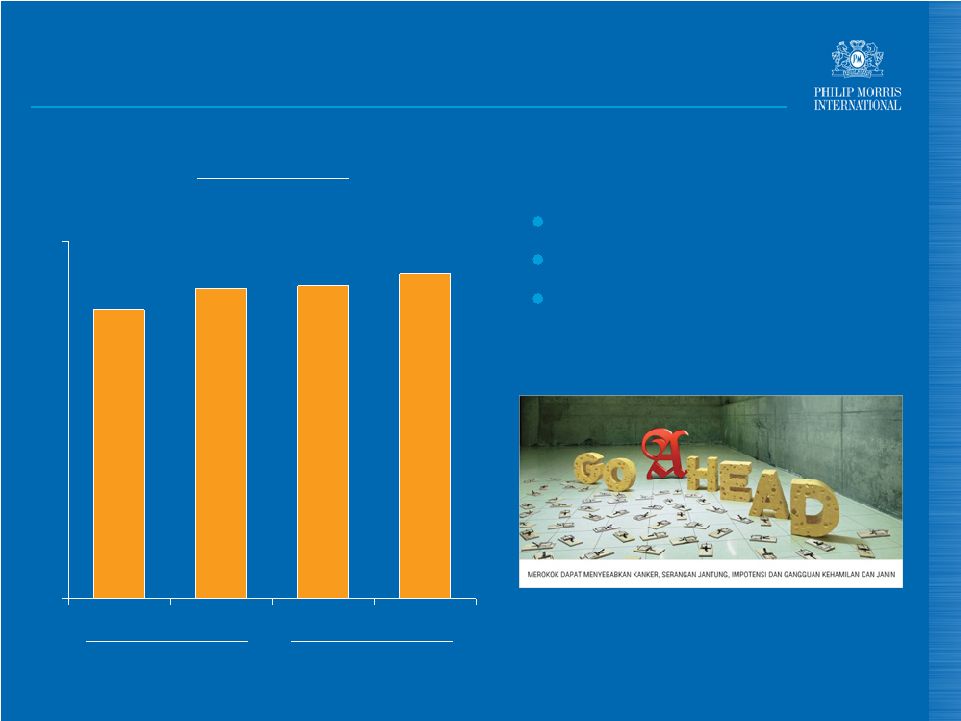

9.7 10.4 10.5 10.9 0 12 H1 H2 H1 H2 52 A Mild - Indonesia Premium price Leading brand in Indonesia Fastest growing top 10 brand 2008 2009 Source: A.C. Nielsen (%) Share of Market |

53

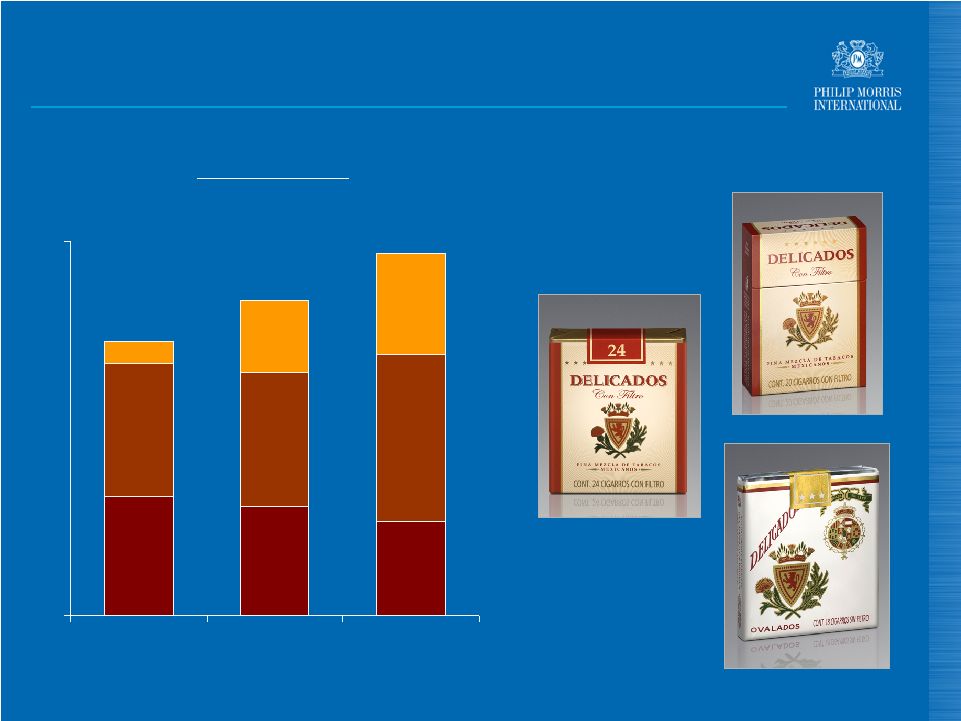

3.8 3.5 3.0 4.3 4.3 5.4 0.7 2.3 3.2 8.8 10.1 11.6 0 12 2007 2008 2009 53 Delicados - Mexico Share of Market Source: PMI estimates Filter Box Filter Soft Non- Filter (%) |

54

54 Bond Street - Russia 20.5 20.5 21.0 21.7 21.6 22.1 23.2 24.7 20 25 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Source: A.C. Nielsen Share of Low Price Segment (%) 2008 2009 |

55

55 Agenda Review of 2009 results 2010 business outlook Superior brand portfolio Cost savings and productivity improvements Cash flow enhancement M&A Shareholder returns |

56

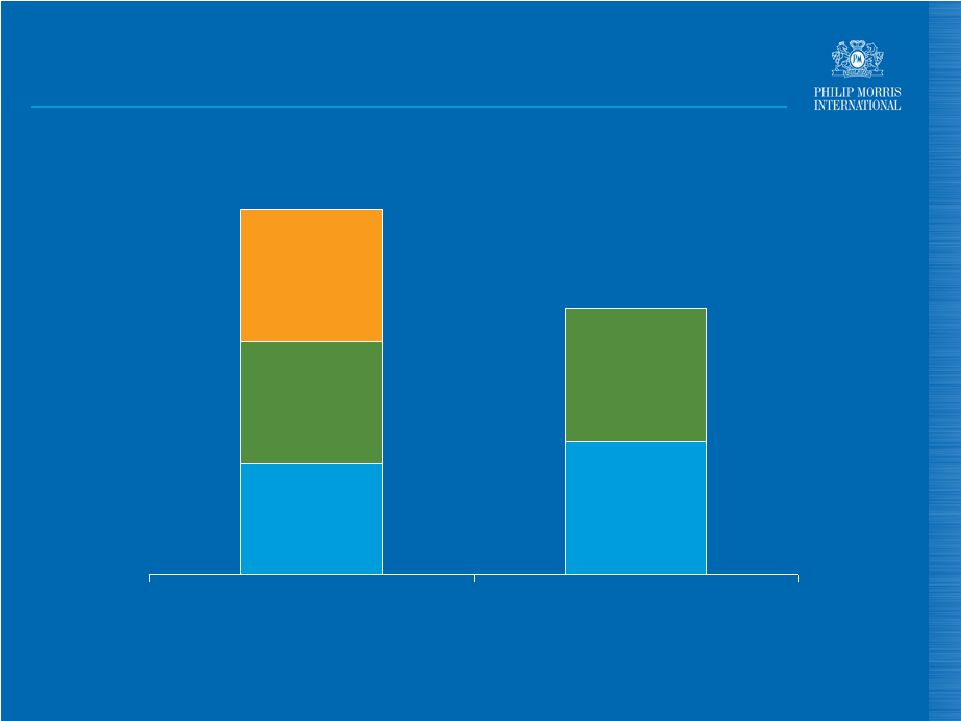

450 250 1,550 850 Manufacturing Productivity G&A + Other EU Program Total ($ million) Forecast Cumulative Gross Cost Savings (2008-10) Productivity and Cost Savings Program Source: PMI Financials |

57

Tobacco As previously communicated, leaf cost increases $200 million higher than anticipated for 2008 - 2010 Objective to stabilize leaf supplies going forward: – PMI requirements quite predictable – Farmers prefer consistent prices Balance between supply and demand should be achievable on a permanent basis Tobacco leaf supply balanced in 2009 and expected to be in 2010 |

58

58 Agenda Review of 2009 results 2010 business outlook Superior brand portfolio Cost savings and productivity improvements Cash flow enhancement and capital structure M&A Shareholder returns |

59

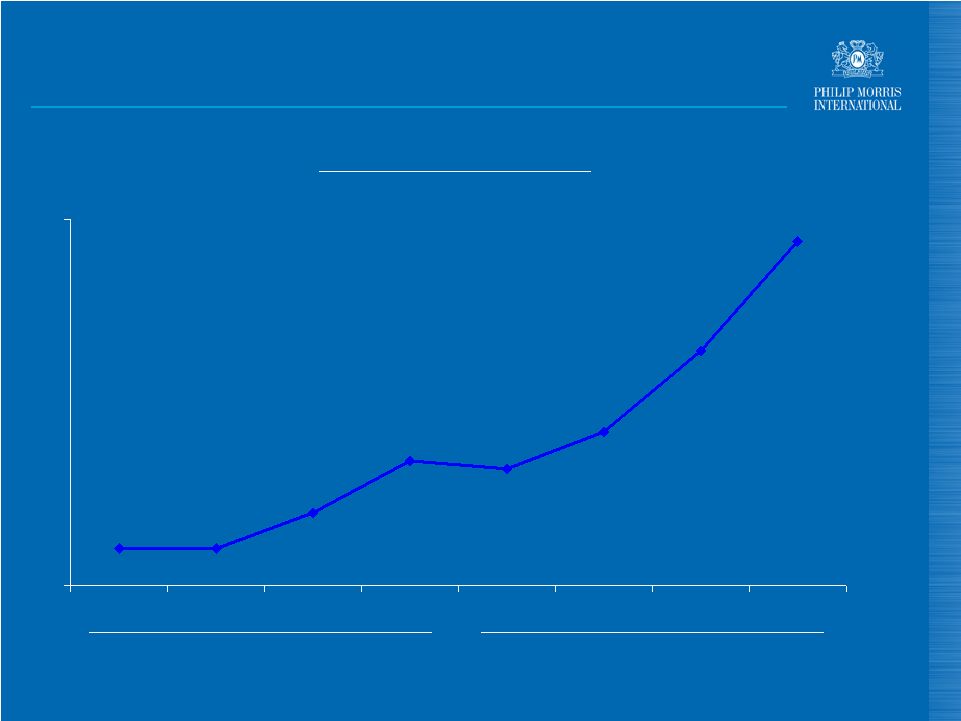

Free Cash Flow (a) 1.5 6.8 8.6 7.1

2008 Actual

2009 Actual

2009 Excluding Currency (a) Free cash flow equals net cash provided by operating activities less capital expenditures. In

2009, net cash provided by operating activities was $7,884 million and capital expenditures were $715 million. In 2008, net cash provided by operating activities was $7,935 million and capital expenditures were $1,099 million Source: PMI Financials +26% vs. 2008 ($ billions) 4.9% |

60

Cumulative Operating Cash Flow (2008-2010) 6.6 7.9 7.3 7.9 7.8 21.7 15.8 March 2008 Actual 2008 2009 2010 ($ billion) Source: PMI Financials |

61

Cash Flow Enhancement Program Our goal is to generate an additional $750 million - $1 billion over three years through improvements in working capital: – Supply chain initiatives – Tobacco leaf inventory durations – Improved forestalling regulations – Tighter finished goods inventory management Systems investment of $15 million to improve working capital management |

62

Capital Structure Tremendous cash flow underpins our strong balance sheet Long-term credit ratings: A2 / A / A Short-term credit ratings: P-1 / A-1 / F1 Over $10 billion well-laddered bonds with an attractive weighted average cost of long-term debt of 5.6% Access to tier 1 commercial paper market Source: PMI Financials |

63

Capital Structure Goal is to preserve current credit ratings whilst having flexibility to make acquisitions |

64

64 Agenda Review of 2009 results 2010 business outlook Superior brand portfolio Cost savings and productivity improvements Cash flow enhancement and capital structure M&A Shareholder returns |

65

Acquisitions Complement organic growth Often provide unique opportunities to enter new markets or significantly step up our presence: - Sampoerna in Indonesia - Lakson in Pakistan - Rothmans Inc. in Canada - Coltabaco in Colombia - Interval (fine cut) in France and other EU markets - Petterøes (fine cut) in Norway - Pipe tobacco and nasal snuff in South Africa - Snus joint venture with Swedish Match |

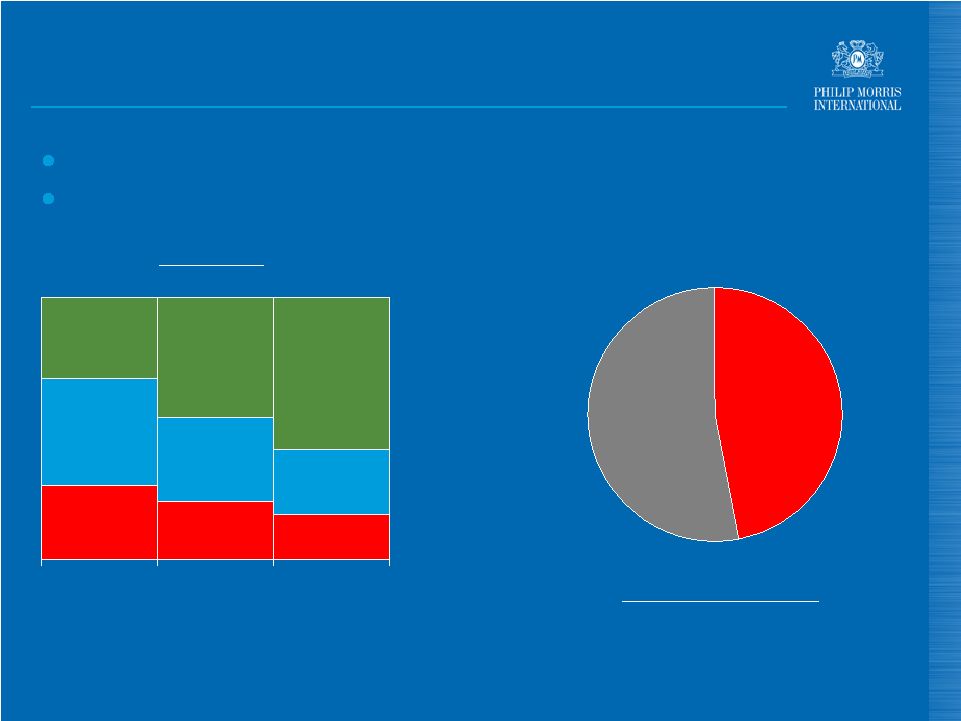

66

24% 66 Top 10 Emerging Markets – PMI Share 16% 2009 Volume : 1.38 trillion units (a) Top ten emerging markets in 2009 excluding China are Russia, Indonesia, Ukraine, Turkey, India,

Brazil, Philippines, Egypt, Vietnam and Pakistan Source: A.C. Nielsen and PMI

estimates PMI PMI 2004 Volume : 1.30 trillion units |

67

67 Top 10 Emerging Markets – PMI Market Shares 25 29 36 43 14 29 16 41 0 50 Russia Indonesia Ukraine Turkey Brazil Philippines Egypt Pakistan Share of Market (2009) (%) Note: PMI has less than 1% market share in India (#5) and Vietnam (#9) Source: A.C. Nielsen and PMI estimates #10 #8 #7 #6 #4 #3 #2 #1 #2 #2 #2 #2 #1 #1 #1 #2 |

68

68 Agenda • Review of 2009 results • 2010 volume and business outlook • Superior brand portfolio • Cost savings and productivity improvements • Cash flow enhancement • M&A • Shareholder returns |

69

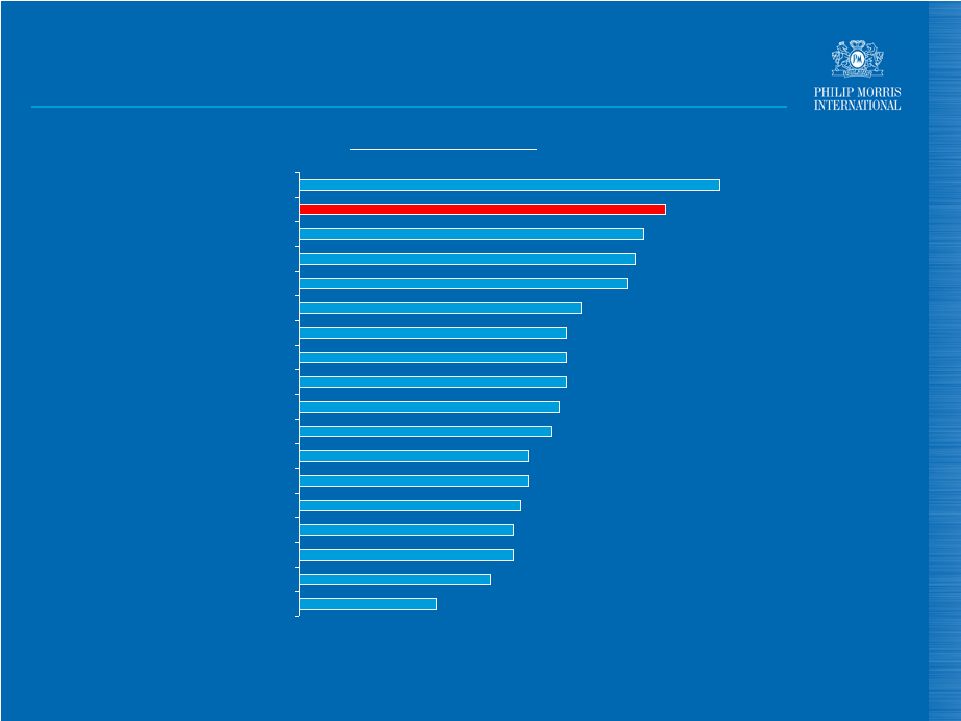

Dividend Yield 1.8% 2.5% 2.8% 2.8% 2.9% 3.0% 3.0% 3.3% 3.4% 3.5% 3.5% 3.5% 3.7% 4.3% 4.4% 4.5% 4.8% 5.5% Heineken Bayer Nestle Roche Coca-Cola PepsiCo Johnson & Johnson Diageo Unilever Pfizer McDonalds Novartis Imperial Tobacco Kraft BAT GlaxoSmithKline PMI Vodafone December 31, 2009 Note: Dividend yield represents the annualized dividend at 12/31/09 over the closing share price

on that date. The share price for PMI was $48.19 as of 12/31/09. The annualized

dividend on 12/31/09 was $2.32 Source: Centerview Partners, based on company filings

and FactSet |

70

Share Repurchases New share repurchase program of $12 billion May 2010 through April 2013 Total 2010 spending expected to be $4 billion Strikes optimal balance between rewarding shareholders and retaining financial flexibility Source: PMI News Release |

71

Shareholder Returns In 2009, $10 billion returned to shareholders through dividends and share repurchases Since March 2008 spin-off, more than $17 billion returned to shareholders, representing 19% of our current market capitalization Source: PMI Financials |

72

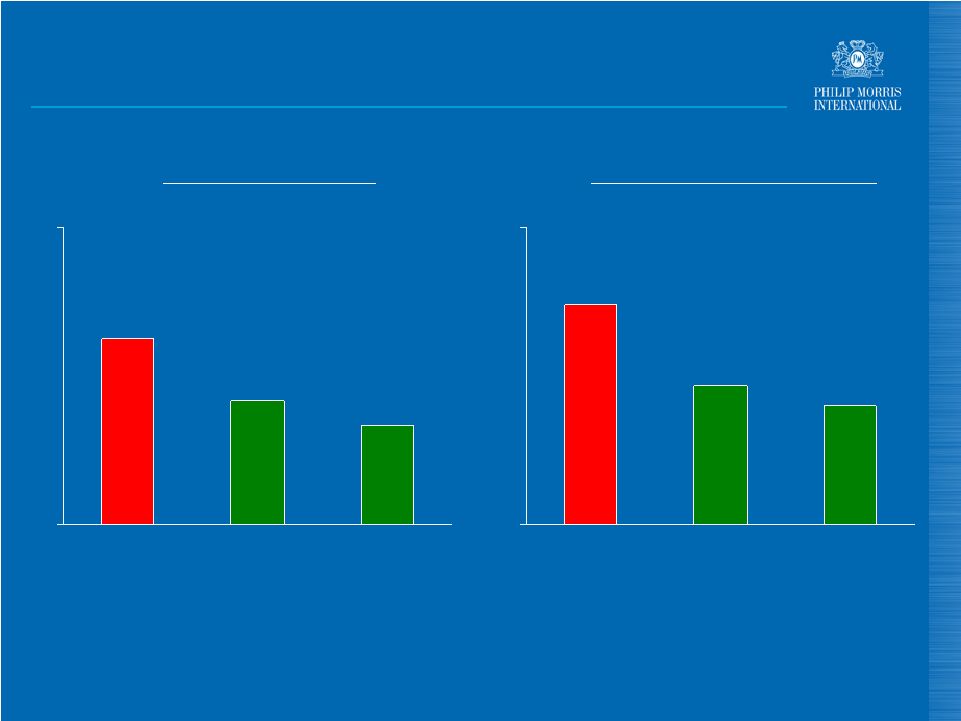

Revenues and Income Growth – Peer Comparison 4.0 5.0 7.5 0 12 PMI PepsiCo Coca-Cola 2009 Revenue Growth (excl. currency) (%) 6.0 7.0 11.1 0 15 PMI Coca-Cola PepsiCo 2009 Adjusted Income Growth (excl. currency) (%) (a) Currency neutral net operating revenue growth after considering items impacting comparability and

structural changes (b) Adjusted OCI growth, excluding the impact of currency. Reported OCI for 2009 was $10,271 million, adjusting for $164 million of one-time costs and for $1,390 million of negative currency impact. Adjusted OCI excluding currency was

$11,825 million for 2009. OCI in 2008 was $10,434 million, adjusting for $208

million of one-time costs, results in a growth rate of 11.1% for adjusted OCI, excluding currency (c) Currency neutral operating income growth after considering items impacting comparability (d) Core division operating profit growth, excluding currency Source: Centerview Partners, based on company reports (a) (b) (c) (d) |

73

73 2010 EPS Guidance Expect to reach or surpass all our currency neutral financial forecasts in 2010 At prevailing exchange rates, reported EPS guidance of $3.75 - $3.85 represents an increase of 16-19% Reported EPS growth rate ex-currency is 12-15% Against adjusted EPS of $3.29 in 2009, reported EPS guidance represents a growth rate of 11-14%, excluding currency Source: PMI Financials |

74

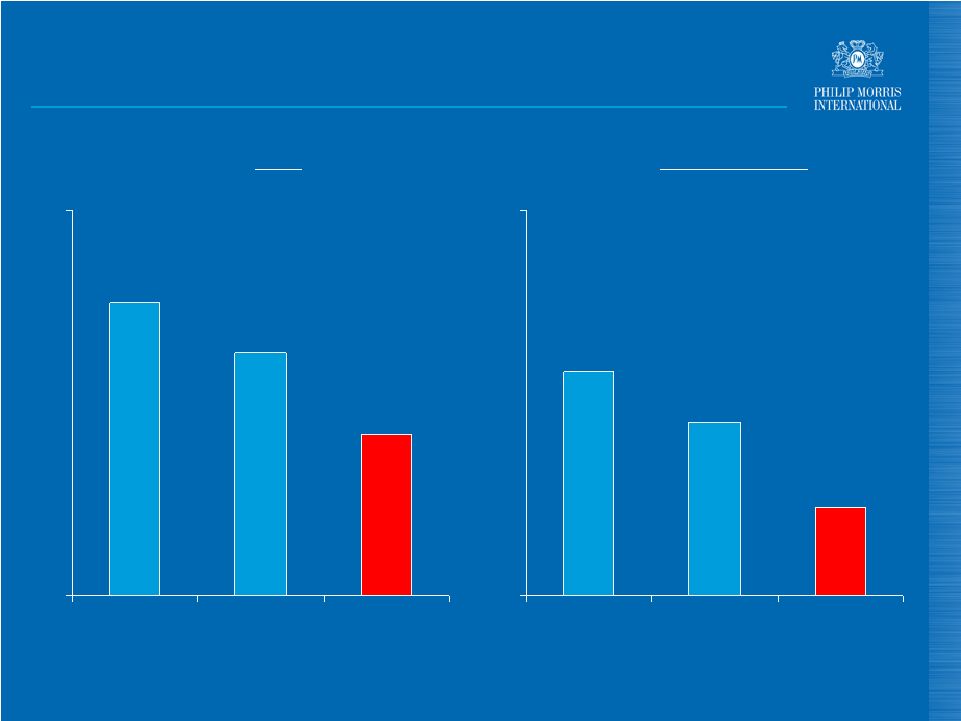

P/E Ratios – Peer Comparison 17.6 16.3 14.2 10 20 Coca-Cola PepsiCo PMI 2009 (%) 15.8 14.5 12.3 10 20 Coca-Cola PepsiCo PMI 2010 Estimates (%) Source: Centerview Partners, based on FactSet |

Consumer

Analyst Group of New York (CAGNY) Conference February 17, 2010 Hermann Waldemer Chief Financial Officer Philip Morris International QUESTIONS & ANSWERS |

76

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Adjustments for Impact of Currency and Acquisitions For the Years Ended December 31, (in millions) (Unaudited) Reported Net Revenues Less Excise Taxes Reported Net Revenues excluding Excise Taxes Less Currency Reported Net Revenues excluding Excise Taxes & Currency Less Acquisi- tions Reported Net Revenues excluding Excise Taxes, Currency & Acquisitions Reported Net Revenues Less Excise Taxes Reported Net Revenues excluding Excise Taxes Reported Reported excluding Currency Reported excluding Currency & Acquisitions 28,550 $ 19,509 $ 9,041 $ (856) $ 9,897 $ 61 $ 9,836 $ European Union 30,265 $ 20,577 $ 9,688 $ (6.7)% 2.2% 1.5% 13,865 7,070 6,795 (1,373) 8,168 41 8,127 EEMA 14,817 7,313 7,504 (9.4)% 8.8% 8.3% 12,413 5,885 6,528 (41) 6,569 - 6,569 Asia 12,222 6,037 6,185 5.5% 6.2% 6.2% 7,252 4,581 2,671 (328) 2,999 462 2,537 Latin America & Canada 6,336 4,008 2,328 14.7% 28.8% 9.0% 62,080 $ 37,045 $ 25,035 $ (2,598) $ 27,633 $ 564 $ 27,069 $ PMI Total 63,640 $ 37,935 $ 25,705 $ (2.6)% 7.5% 5.3% Reported Operating Companies Income Less Currency Reported Operating Companies Income excluding Currency Less Acquisi- tions Reported Operating Companies Income excluding Currency & Acquisitions Reported Operating Companies Income Reported Reported excluding Currency Reported excluding Currency & Acquisitions 4,506 $ (481) $ 4,987 $ 40 $ 4,947 $ European Union 4,738 $ (4.9)% 5.3% 4.4% 2,663 (893) 3,556 18 3,538 EEMA 3,119 (14.6)% 14.0% 13.4% 2,436 146 2,290 - 2,290 Asia 2,057 18.4% 11.3% 11.3% 666 (162) 828 202 626 Latin America & Canada 520 28.1% 59.2% 20.4% 10,271 $ (1,390) $ 11,661 $ 260 $ 11,401 $ PMI Total 10,434 $ (1.6)% 11.8% 9.3% 2009 2008 % Change in Reported Net Revenues excluding Excise Taxes 2009 2008 % Change in Reported Operating Companies Income |

77

Reported Operating Companies Income Less Asset Impairment/ Exit Costs and Other Adjusted Operating Companies Income Less Currency Adjusted Operating Companies Income excluding Currency Less Acquisi- tions Adjusted Operating Companies Income excluding Currency & Acquisitions Reported Operating Companies Income Less Asset Impairment/ Exit Costs and Other Adjusted Operating Companies Income Adjusted Adjusted excluding Currency Adjusted excluding Currency & Acquisitions 4,506 $ (29) $ 4,535 $ (481) $ 5,016 $ 40 $ 4,976 $ European Union 4,738 $ (66) $ 4,804 $ (5.6)% 4.4% 3.6% 2,663 - 2,663 (893) 3,556 18 3,538 EEMA 3,119 (1) 3,120 (14.6)% 14.0% 13.4% 2,436 - 2,436 146 2,290 - 2,290 Asia 2,057 (14) 2,071 17.6% 10.6% 10.6% 666 (135) (1) 801 (162) 963 202 761 Latin America & Canada 520 (127) (2) 647 23.8% 48.8% 17.6% 10,271 $ (164) $ 10,435 $ (1,390) $ 11,825 $ 260 $ 11,565 $ PMI Total 10,434 $ (208) $ 10,642 $ (1.9)% 11.1% 8.7% % Points Change Adjusted Operating Companies Income excluding Currency Net Revenues excluding Excise Taxes & Currency (3) Adjusted Operating Companies Income Margin excluding Currency Adjusted Operating Companies Income Net Revenues excluding Excise Taxes (3) Adjusted Operating Companies Income Margin Adjusted Operating Companies Income Margin excluding Currency 5,016 $ 9,897 $ 50.7% European Union 4,804 $ 9,688 $ 49.6% 1.1 pp 3,556 8,168 43.5% EEMA 3,120 7,504 41.6% 1.9 pp 2,290 6,569 34.9% Asia 2,071 6,185 33.5% 1.4 pp 963 2,999 32.1% Latin America & Canada 647 2,328 27.8% 4.3 pp 11,825 $ 27,633 $ 42.8% PMI Total 10,642 $ 25,705 $ 41.4% 1.4 pp 2009 2008 2009 2008 % Change in Adjusted Operating Companies Income PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Operating Companies Income to Adjusted Operating Companies Income

& Reconciliation of Adjusted Operating Companies Income Margin Excluding

Currency For the Years Ended December 31, (in millions) (Unaudited) (1) Represents 2009 Colombian investment and cooperation agreement charge. (2) Represents 2008 equity loss from RBH legal settlement ($124 million) and asset impairment and

exit costs ($3 million). (3) For the calculation of net revenues excluding excise

taxes and currency, refer to previous slide. |

78

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted Diluted EPS,

Excluding Currency For the Years Ended December 31, (Unaudited) 2009 2008 % Change Reported Diluted EPS 3.24 $ 3.31 $ (2.1)% Less: Colombian investment and cooperation agreement charge (0.04) - Asset impairment and exit costs (0.01) (0.02) Equity loss from RBH legal settlement - (0.06) Tax items - 0.08 Adjusted Diluted EPS 3.29 $ 3.31 $ (0.6)% Less: Currency Impact (0.53) Adjusted Diluted EPS, Excluding Currency 3.82 $ 3.31 $ 15.4% |

79

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Reported Diluted EPS, Excluding Currency For the Years Ended December 31, (Unaudited) 2009 2008 % Change Reported Diluted EPS 3.24 $ 3.31 $ (2.1)% Less: Currency Impact (0.53) Reported Diluted EPS, Excluding Currency 3.77 $ 3.31 $ 13.9% |