Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - WEST PHARMACEUTICAL SERVICES INC | pressrelease.htm |

| 8-K - CJS SECURITIES CONFERENCE - WEST PHARMACEUTICAL SERVICES INC | file8kcjs.htm |

1

Donald

E. Morel, Jr., Ph.D.

Chairman and Chief

Executive Officer

William

J. Federici

Vice

President and Chief Financial Officer

Investor

Relations Contact:

Michael

A. Anderson

Vice

President and Treasurer

mike.anderson@westpharma.com

CJS

“New Ideas” Investor Conference

New

York, New York

January

14, 2010

NYSE:

WST

westpharma.com

All

trademarks and registered trademarks are the property of West Pharmaceutical

Services, Inc., unless noted otherwise.

2

This

presentation contains forward-looking statements, within the meaning of

Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, that are based on management’s beliefs and

assumptions, current expectations, estimates and forecasts. Statements that are not

historical facts, including statements that are preceded by, followed by, or that

include, words such as “estimate,” “expect,” “intend,” “believe,” “plan,” “anticipate”

and other words and terms of similar meaning are forward-looking statements. West’s

estimated or anticipated future results, product performance or other non-historical

facts are forward-looking and reflect our current perspective on existing trends and

information.

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, that are based on management’s beliefs and

assumptions, current expectations, estimates and forecasts. Statements that are not

historical facts, including statements that are preceded by, followed by, or that

include, words such as “estimate,” “expect,” “intend,” “believe,” “plan,” “anticipate”

and other words and terms of similar meaning are forward-looking statements. West’s

estimated or anticipated future results, product performance or other non-historical

facts are forward-looking and reflect our current perspective on existing trends and

information.

Many

of the factors that will determine the Company’s future results are beyond

the

ability of the Company to control or predict. These statements are subject to known or

unknown risks or uncertainties, and therefore, actual results could differ materially

from past results and those expressed or implied in any forward-looking statement.

You should bear this in mind as you consider forward-looking statements. A non-

exclusive list of important factors that may affect future results may be found in

West’s filings with the Securities and Exchange Commission, including our annual

report on Form 10-K and our periodic reports on Form 10-Q and Form 8-K.

ability of the Company to control or predict. These statements are subject to known or

unknown risks or uncertainties, and therefore, actual results could differ materially

from past results and those expressed or implied in any forward-looking statement.

You should bear this in mind as you consider forward-looking statements. A non-

exclusive list of important factors that may affect future results may be found in

West’s filings with the Securities and Exchange Commission, including our annual

report on Form 10-K and our periodic reports on Form 10-Q and Form 8-K.

You

should evaluate any statement in light of these important factors.

Forward

Looking Statements

3

Corporate

Profile

• Founded

in 1923

• Leading

global supplier of

components and systems

for injectable drug delivery

components and systems

for injectable drug delivery

– Vial

closure systems

– Prefillable

syringe components

– Components

for diagnostics

– Devices

and device sub-

assemblies

assemblies

– Safety

and administration

systems

systems

• Market

capitalization $1.3 billion

• Diverse,

stable customer base

• Global

footprint

|

|

|

Devices

|

|

Proprietary

Products

|

4

• Challenges:

– Adverse

effects of pension expense, currency effects

– Recession

impacted customer behavior/order patterns

• Tighter

cost/ working capital/inventory management and

• Major

program delays and cancellations

– Slowed

growth coming into 2009 continued through Q2

• Q3

revenues grew by 4.3% excluding currency

– H1N1-related

sales growth

– Customer

cyclical inventory adjustments moderating

• Key

developments:

– Validated

Daikyo Crystal Zenith 1ml single cavity manufacturing cell

• Four

cavity cell installed late Q4; commercial production should

start Q3 2010

start Q3 2010

– Plastef

acquisition completed

– Officially

opened China Plastics facility

– Announced

plans to restructure and re-align operating segments in Q4

Announcement

of Q4 and full-year 2009 results, of financial guidance for 2010,

and the related analyst call are scheduled for February 18, 2010

and the related analyst call are scheduled for February 18, 2010

2009

in Retrospect

5

Long

Term Business Drivers

• Demographics

• Growth

in Biologics & Vaccines

• Requirement

for easy, safe,

accurate dosing

accurate dosing

• Combination

product growth

• Generic

growth

• Increasing

global access to

advanced healthcare

advanced healthcare

West

supplies sophisticated

packaging systems for the top 20

biologic drugs (by sales) currently

on the market.

packaging systems for the top 20

biologic drugs (by sales) currently

on the market.

6

Therapeutic Category Drivers

|

Category

|

Key

Customers

|

Projected

Growth |

|

Diabetes

|

|

8

- 10%

|

|

Oncology

|

|

6

- 8%

|

|

Vaccines

|

4

- 6%

|

|

|

Autoimmune

|

|

6

- 8%

|

7

• Global economic

conditions remain soft, but show signs of

improvement

improvement

• Uncertainty over

pending US healthcare legislation

• Global pharma

revenue growth projected to be 4-6% (per

IMS)

IMS)

• North America growth

projected at 4.5 - 5.5%

• Europe growth

moderate 2-4%

• Emerging economies

should grow > 10% (India, China, Brazil)

• Customer

consolidation increasing focus on large molecule

therapies:

therapies:

• Pfizer -

Wyeth

• Roche - Genentech

• AstraZeneca - Medimmune

• Lilly -

Imclone

• Merck - Schering

Plough

2010

Outlook

8

|

Packaging

Systems

(How drugs are

contained)

|

|

Primary

Container Solutions

|

|

Delivery

Systems

(How drugs are

administered)

|

|

Administration

Systems

|

Business

Unit Re-alignment

• Safety

systems (NovaGuard, Eris)

• Reconstitution

systems -

MediMop

MediMop

• CZ

prefillable syringe systems

• Advanced

Injection Systems

(Confidose)

(Confidose)

• Tech

Group Contract

Manufacturing

Manufacturing

• Small

volume parenteral

packaging

packaging

• Large

volume parenteral

packaging

packaging

• Prefillable

syringe components

• Disposable

medical device

components

components

• Diagnostic,

dental, veterinary

packaging

packaging

9

Five-Year

Growth Opportunity

$2

billion combined markets for safety,

prefilled and auto-injectors, with unit

growth 6-12%, depending on product and

therapeutic segment

prefilled and auto-injectors, with unit

growth 6-12%, depending on product and

therapeutic segment

Strategic

Planning Goals:

• Projected

2014 sales of $0.6 billion

• Projected

2014 Operating margin: 20%

$1.5

billion market for components with unit

growth 0% to 8% per year, depending on

product and therapeutic segment

growth 0% to 8% per year, depending on

product and therapeutic segment

Strategic

Planning Goals:

• Projected

2014 sales of $1.0 billion

• Projected

2014 Operating margin: 20%

|

Packaging

Systems

(How drugs are

contained)

|

|

Primary

Container Solutions

|

|

Delivery

Systems

(How drugs are

administered)

|

|

Administration

Systems

|

Consolidated 2014

Planning Objectives

• 2014

Sales: $1.6 billion

• 2014

Operating Margin: 19%

• 2014

Consolidated ROIC: 17%

10

Our

Growth Strategy

West’s

Competitive Advantages:

• Unmatched

expertise in drug -

material interactions

material interactions

• Market

leader in packaging for

biologics

biologics

• Protected

IP: Proprietary materials

and processing technology - Drug

Master File (DMF) 1546

and processing technology - Drug

Master File (DMF) 1546

• Regulatory

barriers to entry:

US NDAs

and ANDAs

require proof of stability

require proof of stability

• Global

technical support

|

Packaging

Systems

(How drugs are

contained)

|

|

Primary

Container Solutions

|

• Therapeutic

segment focus

• Generate

incremental value per

unit

unit

• Leverage

changing regulatory

environment

environment

• Optimize

manufacturing

productivity

productivity

• Strategic

acquisitions

• Geographic

expansion

• China

• India

11

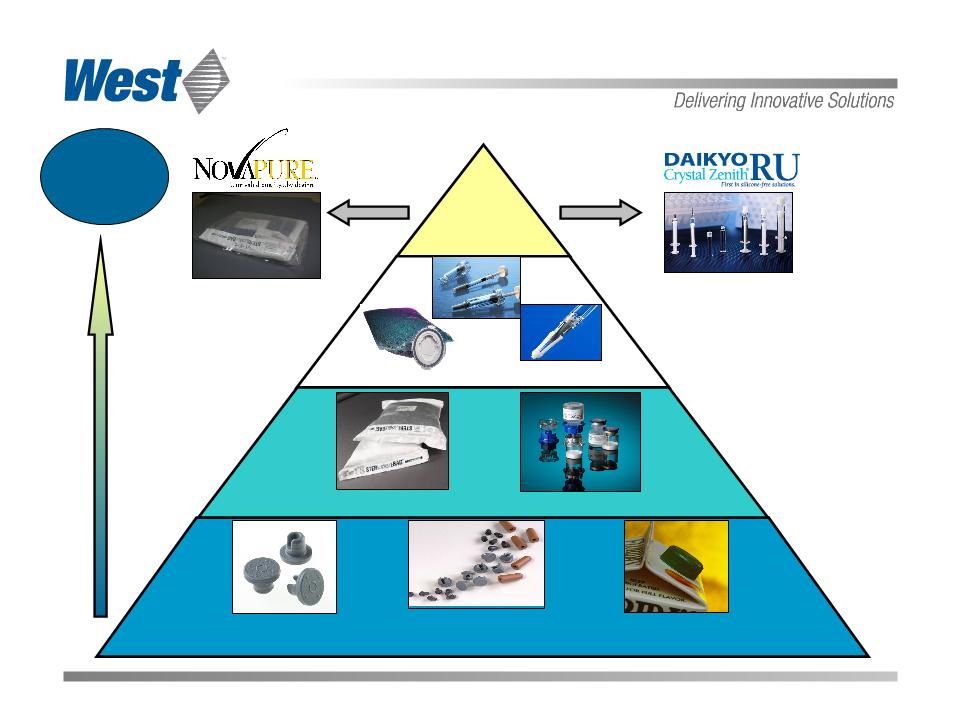

Value

Proposition

PROPRIETARY

PRODUCTS

Revenue

and

Margin

Opportunity

Opportunity

Disposable

Device

Disposable

Device

Components

Components

Westar®

RS

Mix2Vial®

NovaGuard™

éris™

Westar®

RU

Standard

Components

Components

Standard

Components

Components

Consumer

Consumer

Products

Products

12

Our

Growth Strategy

• Concentrate

on systems for unmet

market needs

market needs

• Build

market share in multi-

component systems for drug

administration utilizing Daikyo CZ as

a platform technology

component systems for drug

administration utilizing Daikyo CZ as

a platform technology

• Production

supported by existing

design, multi-material molding, and

assembly capabilities

design, multi-material molding, and

assembly capabilities

• Expand

through innovation and

strategic technology acquisitions

strategic technology acquisitions

|

Packaging

Systems

(How drugs are

contained)

|

|

Primary

Container Solutions

|

|

Delivery

Systems

(How drugs are

administered)

|

|

Administration

Systems

|

• Therapeutic

segment focus

• Generate

incremental value per

unit

unit

• Leverage

changing regulatory

environment

environment

• Optimize

manufacturing

productivity

productivity

• Strategic

acquisitions

• Geographic

expansion

• China

• India

13

Delivery Systems - Key Programs

Vial2Bag™

Mix2Vial®

MixJect®

NovaGuard™

Safety

Needle Device

Needle Device

(luer-lock

syringe)

ConfiDose®

Auto-injector

Auto-injector

Daikyo

Crystal Zenith®

éris™

Safety

Needle Device

(fixed-needle

syringe)

14

Management

Focus

• Packaging

Systems Segment

– Organic growth (on

average) of 3-5% per year

– Margin expansion

through improved operating efficiency

– Positive mix with

increasing biologic product sales

– Capital investments

targeted at quality improvements

• Delivery

Systems Segment

– Deliver the

potential of Daikyo CZ products

– Contract

manufacturing revenue growth from healthcare consumables

– Growth in

proprietary West systems

• Continued

investment for the future

– Innovation - meeting

the challenge of biologics

– Geographic

expansion

– Technology &

product acquisitions

• Financial

discipline

– Focus on operating

cash flow: Discretionary

SG&A, R&D and capital spending

supported by revenue growth.

supported by revenue growth.

– Maintain a balance

sheet that supports current plans and new

opportunities.

– Invest and execute

to deliver returns on invested capital (“ROIC”) that can and do

regularly exceed weighted average cost of capital (“WACC”).

regularly exceed weighted average cost of capital (“WACC”).

– Align management

incentives with financial performance and value.

15

Summary

• A

valuable franchise

– Substantial

market share

– Proprietary

technology

– Diversified

Customer Base

– Global

footprint

• Positioned

to grow

– Strength

in new product

pipeline

pipeline

– Preferred

products for

biologics

biologics

• With

the financial strength to

invest

invest

– Reliable

operating cash

flow

flow

– Balance

sheet strength

• Led

by an experienced

management team

management team

– Aligned

incentives

Injectable

Container Solutions

Advanced

Injection

Systems

Injection

Systems

Prefillable

Syringe Systems

Safety

and

Administration Systems

Administration Systems

16

Donald

E. Morel, Jr., Ph.D.

Chairman and Chief

Executive Officer

William

J. Federici

Vice

President and Chief Financial Officer

Investor

Relations Contact:

Michael

A. Anderson

Vice

President and Treasurer

mike.anderson@westpharma.com

CJS

“New Ideas” Investor Conference

New

York, New York

January

14, 2010

NYSE:

WST

westpharma.com

All

trademarks and registered trademarks are the property of West Pharmaceutical

Services, Inc., unless noted otherwise.