Attached files

| file | filename |

|---|---|

| 8-K - Vystar Corp | v171450_8k.htm |

Vystar Investor Presentation

NOVEMBER 2009

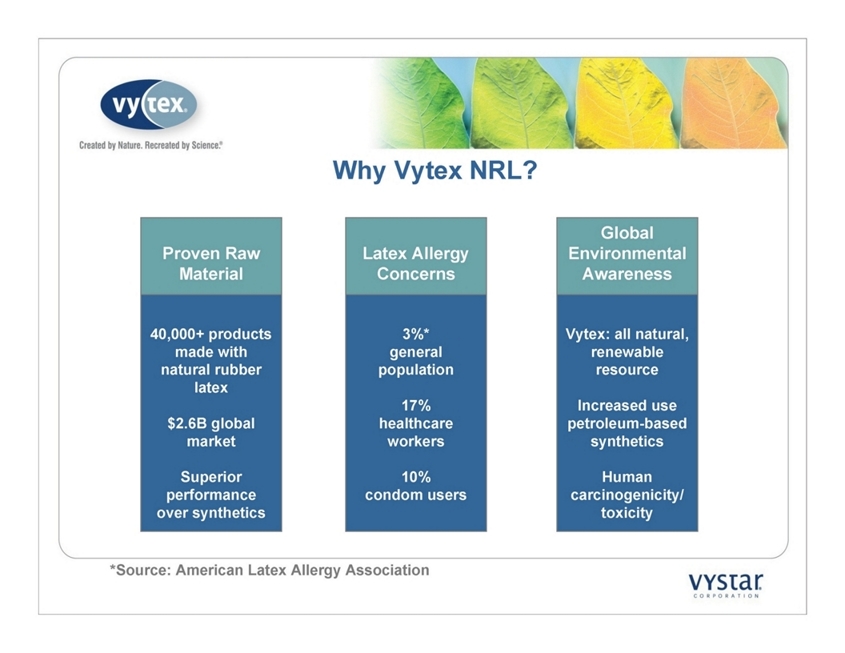

Why Vytex NRL?

Latex Allergy Concerns

3%*

general population

17%

healthcare workers

10%

condom users

Global Environmental

Awareness

Vytex: all natural, renewable resource

Increased use petroleum-based synthetics

Human carcinogenicity/

toxicity

Proven Raw Material

40,000+ products made with natural rubber latex

$2.6B global

market

Superior performance over synthetics

*Source: American Latex Allergy Association

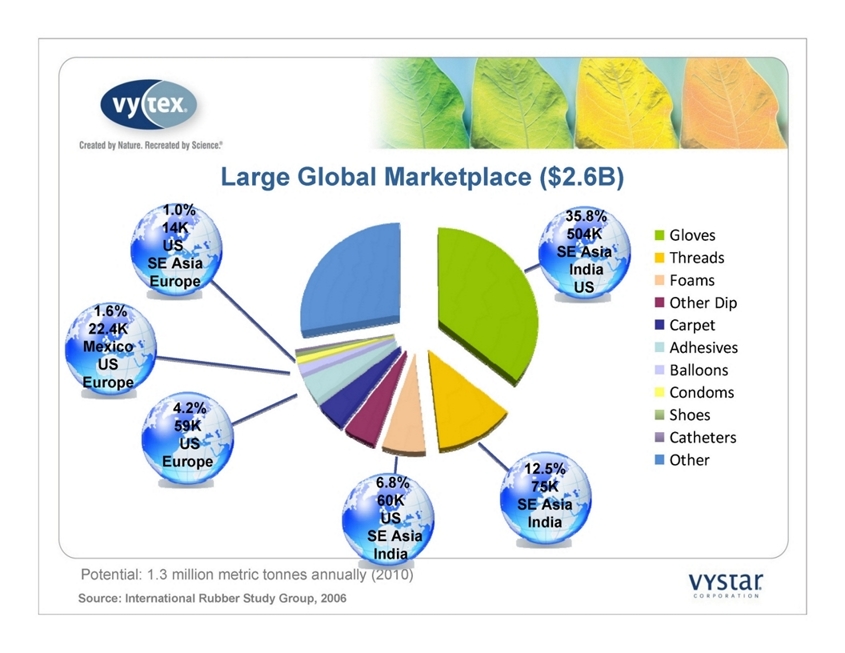

1.6%

22.4K

Mexico

US

Europe

4.2%

59K

US

Europe

6.8%

60K

US

SE Asia

India

12.5%

75K

SE Asia

India

35.8%

504K

SE Asia

India

US

Potential: 1.3 million metric tonnes annually (2010)

Source: International Rubber Study Group, 2006

Large Global Marketplace ($2.6B)

Gloves

Threads

Foams

Other Dip

Carpet

Adhesives

Balloons

Condoms

Shoes

Catheters

Other

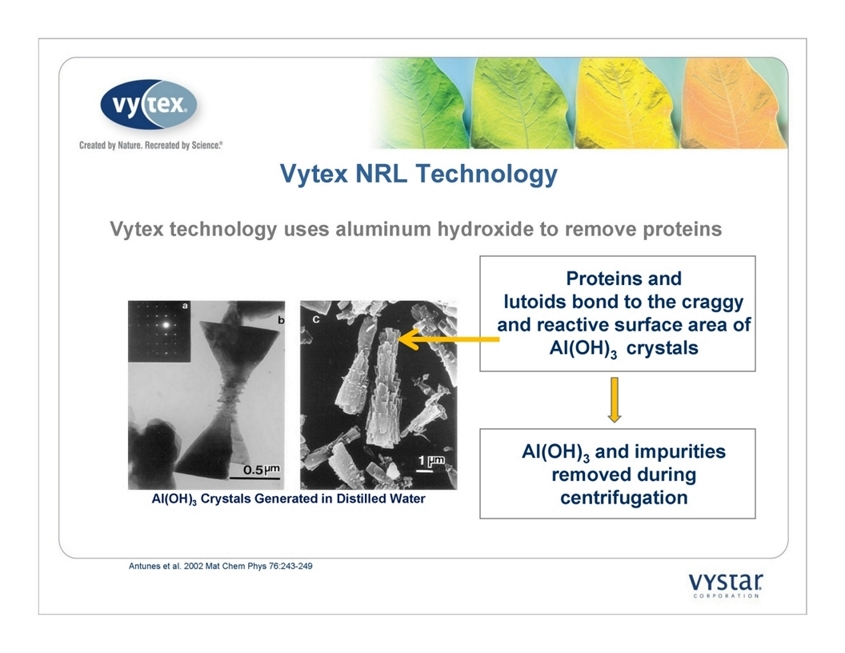

Antunes et al. 2002 Mat Chem Phys 76:243-249

Al(OH)3 Crystals Generated in Distilled Water

Vytex NRL Technology

Vytex technology uses aluminum hydroxide to remove proteins

Proteins and

lutoids bond to the craggy and reactive surface area of Al(OH)

3 crystals

Al(OH)3 and impurities removed

during centrifugation

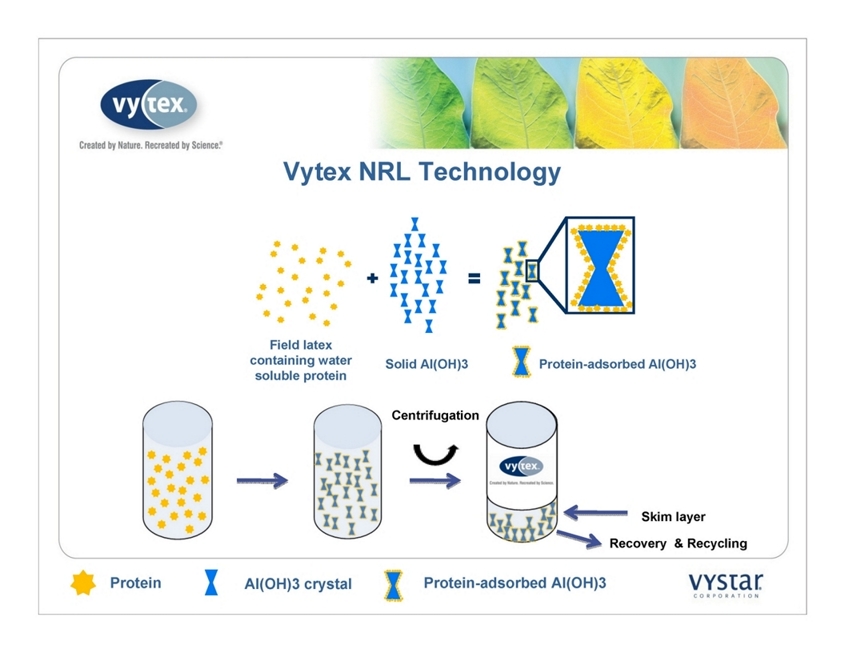

Vytex NRL Technology

Protein

Al(OH)3 crystal

Field latex containing water soluble protein

Solid Al(OH)3

Protein-adsorbed Al(OH)3

Protein-adsorbed Al(OH)3

Recovery & Recycling

Skim layer

Centrifugation

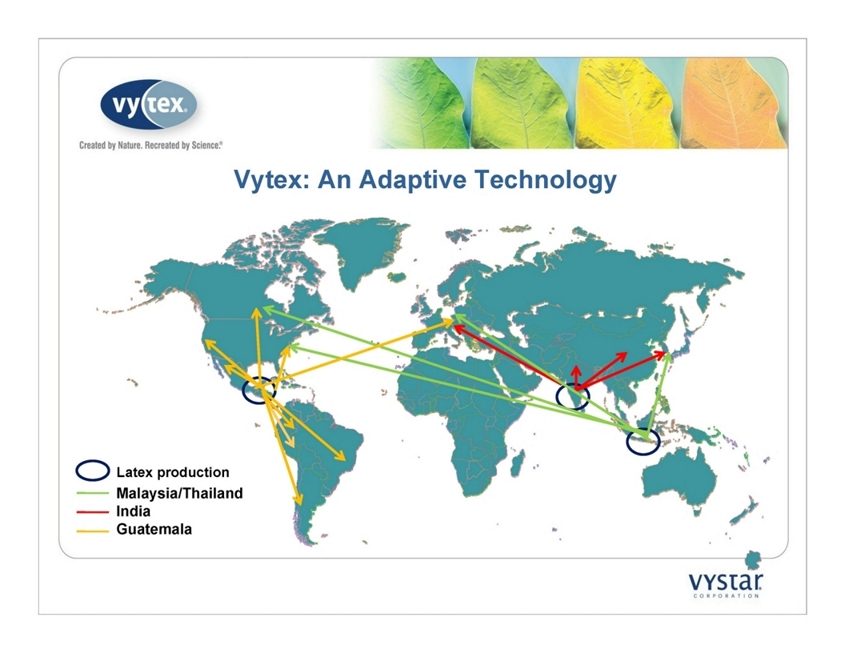

Vytex: An Adaptive Technology

Latex production

Malaysia/Thailand

India

Guatemala

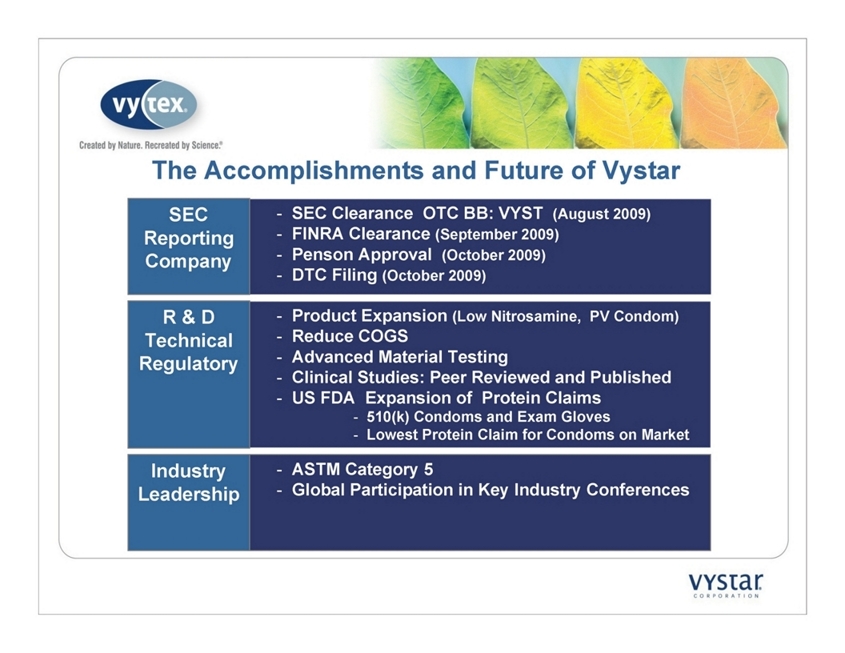

The Accomplishments and Future of Vystar

-

R & D

Technical

Regulatory

Line Extensions

Process Improvements to Reduce COGS

Advanced Material Testing to Enhance Value

Clinical Studies: Peer Reviewed and Published

-

-

Industry

Leadership

ASTM Category 5

Global Participation in Key Industry Conferences

SEC Reporting

Company

SEC Clearance OTC BB: VYST (August 2009)

FINRA Clearance (September 2009)

Penson Approval (October 2009)

DTC Filing (October 2009)

Product Expansion (Low Nitrosamine, PV Condom)

Reduce COGS

Advanced Material Testing

Clinical Studies: Peer Reviewed and Published

US FDA Expansion of Protein Claims

510(k) Condoms and Exam Gloves

Lowest Protein Claim for Condoms on Market

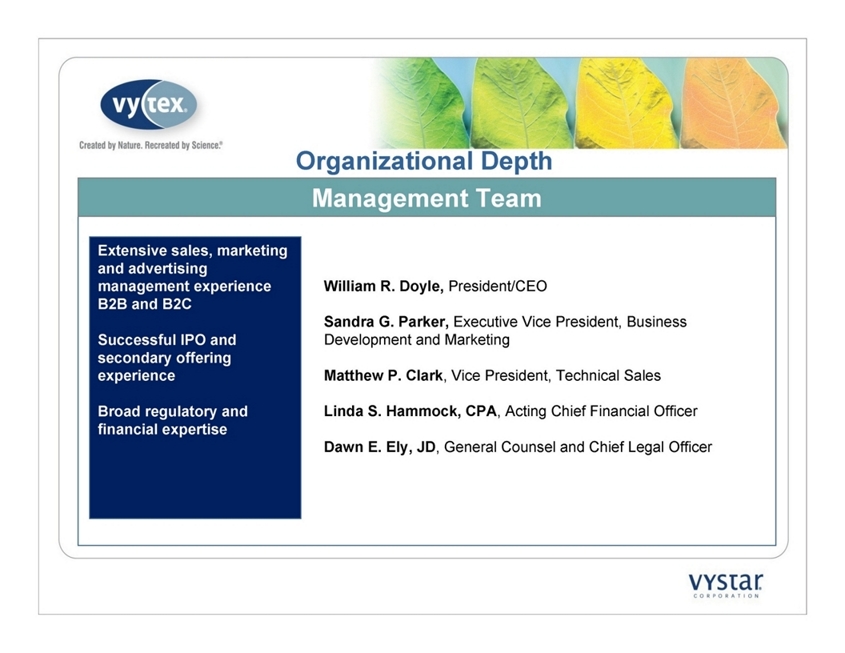

Management Team

Extensive sales, marketing and advertising management experience B2B and B2C

Successful IPO and secondary offering experience

Broad regulatory and financial expertise

William R. Doyle, President/CEO

Sandra G. Parker, Executive Vice President, Business Development and Marketing

Matthew P. Clark, Vice President, Technical Sales

Linda S. Hammock, CPA, Acting Chief Financial Officer

Dawn E. Ely, JD, General Counsel and Chief Legal Officer

Organizational Depth

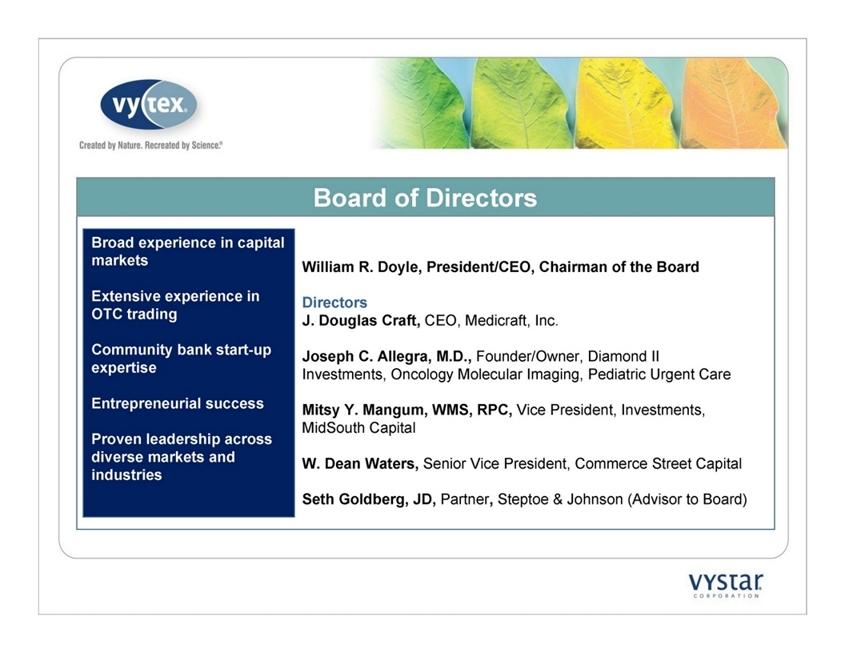

Board of Directors

Broad experience in capital markets

Extensive experience in OTC trading

Community bank start-up expertise

Entrepreneurial success

Proven leadership across diverse markets and industries

William R. Doyle, President/CEO, Chairman of the Board

Directors

J. Douglas Craft, CEO, Medicraft, Inc.

Joseph C. Allegra, M.D., Founder/Owner, Diamond II

Investments, Oncology Molecular Imaging, Pediatric Urgent Care

Mitsy Y. Mangum, WMS, RPC, Vice President, Investments, MidSouth Capital

W. Dean Waters, Senior Vice President, Commerce Street Capital

Seth Goldberg, JD, Partner, Steptoe

& Johnson (Advisor to Board)

Technical

Catharine C. Calkins-Burke, Ph.D

Ranjit K.

Matthan, Ph.D, KA Prevulcanised P Ltd.

Mark C. Swanson, Quan-Tec Air, Inc.; formerly Mayo Foundation

Michael Dochniak, Jasmine

Elastomerics

Selvaraj V

M Muthuraja, Stratoshift Technologies, Sdn Bhd

Clinical

Sinoma Brown, RN, formerly Shands at University of Florida

Larry Creech, RN, Carillon Clinic

Susan Jones, RN, UCLA Medical Center

Margaret Meeker, RN, formerly Ohio State University Medical Center

Parker

Lee, formerly CEO, Ansell Medical Products, Ansell Ltd.

Advisors

Extensive raw

materials research and

development

Known expertise on

natural rubber latex

Active management

P&L responsibilities

and purchasing

influence

Noted clinical

authors and speakers

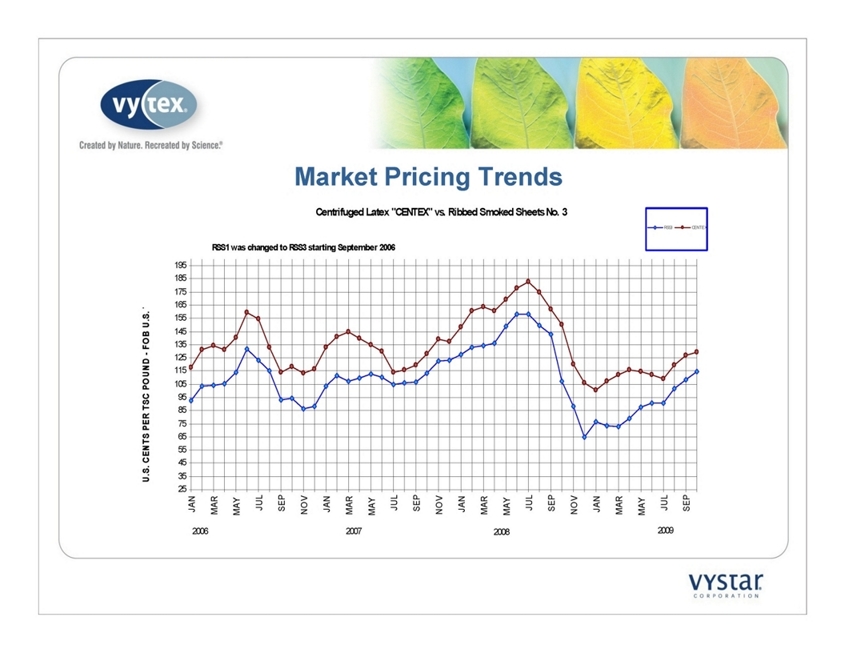

Market Pricing Trends

Financial Projections

THE FOLLOWING PROJECTIONS ARE FORWARD-LOOKING STATEMENTS. WE MAY NOT ACTUALLY

ACHIEVE THE PROJECTIONS DISCLOSED AND YOU SHOULD NOT PLACE UNDUE RELIANCE UPON

SUCH FORWARD-LOOKING STATEMENTS. ACTUAL RESULTS COULD DIFFER MATERIALLY FROM SUCH

PROJECTIONS. IN OUR PRIVATE PLACEMENT MEMORANDUM DATED OCTOBER 28, 2009, WE HAVE

INCLUDED IMPORTANT FACTORS IN THE “RISK FACTORS” SECTION OF THE MEMORANDUM THAT WE

BELIEVE COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE PROJECTIONS THAT

WE MAKE. OUR FORWARD-LOOKING STATEMENTS DO NOT REFLECT THE POTENTIAL IMPACT OF

ANY FUTURE ACQUISITIONS, MERGERS, DISPOSITIONS, JOINT VENTURES OR INVESTMENTS WE

MAY MAKE.

YOU SHOULD READ OUR PRIVATE PLACEMENT MEMORANDUM COMPLETELY AND WITH THE

UNDERSTANDING THAT OUR ACTUAL FUTURE RESULTS MAY BE MATERIALLY DIFFERENT FROM

WHAT WE EXPECT. WE DO NOT ASSUME ANY OBLIGATION TO UPDATE ANY FORWARD-LOOKING

STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE,

EXCEPT AS REQUIRED BY LAW.

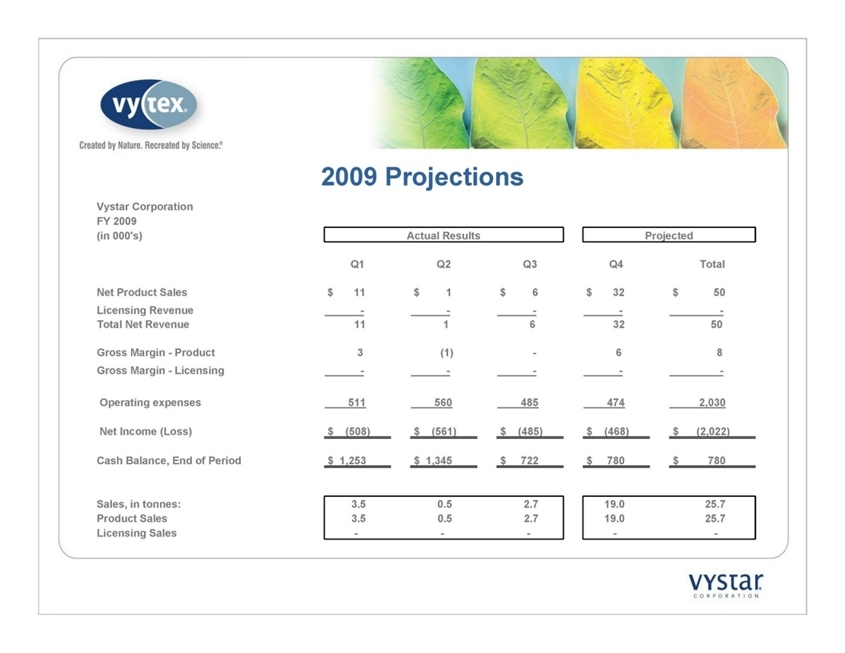

2009 Projections

Vystar Corporation

FY 2009

(in 000's)

Actual Results

Projected

Q1

Q2

Q3

Q4

Total

Net Product Sales

$ 11

$ 1

$ 6

$ 32

$ 50

Licensing Revenue

-

-

-

-

-

Total Net Revenue

11

1

6

32

50

Gross Margin - Product

3

(1)

-

6

8

Gross Margin - Licensing

-

-

-

-

-

Operating expenses

511

560

485

474

2,030

Net Income (Loss)

$ (508)

$ (561)

$ (485)

$ (468)

$ (2,022)

Cash Balance, End of Period

$ 1,253

$ 1,345

$ 722

$ 780

$ 780

Sales, in tonnes:

3.5

0.5

2.7

19.0

25.7

Product Sales

3.5

0.5

2.7

19.0

25.7

Licensing Sales

-

-

-

-

-

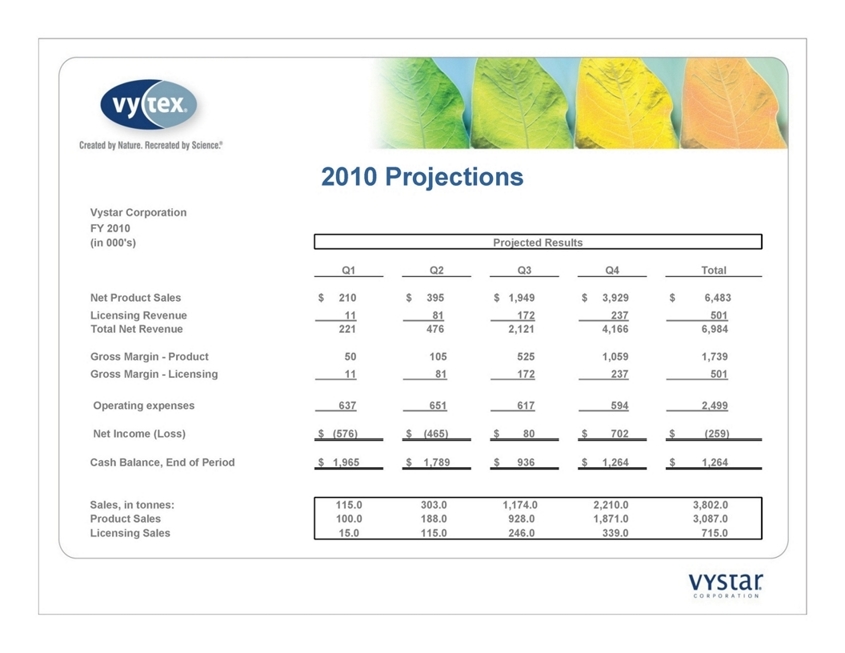

2010 Projections

Vystar Corporation

FY 2010

(in 000's)

Projected Results

Q1

Q2

Q3

Q4

Total

Net Product Sales

$ 210

$ 395

$ 1,949

$ 3,929

$ 6,483

Licensing Revenue

11

81

172

237

501

Total Net Revenue

221

476

2,121

4,166

6,984

Gross Margin - Product

50

105

525

1,059

1,739

Gross Margin - Licensing

11

81

172

237

501

Operating expenses

637

651

617

594

2,499

Net Income (Loss)

$ (576)

$ (465)

$ 80

$ 702

$ (259)

Cash Balance, End of Period

$ 1,965

$ 1,789

$ 936

$ 1,264

$ 1,264

Sales, in tonnes:

115.0

303.0

1,174.0

2,210.0

3,802.0

Product Sales

100.0

188.0

928.0

1,871.0

3,087.0

Licensing Sales

15.0

115.0

246.0

339.0

715.0

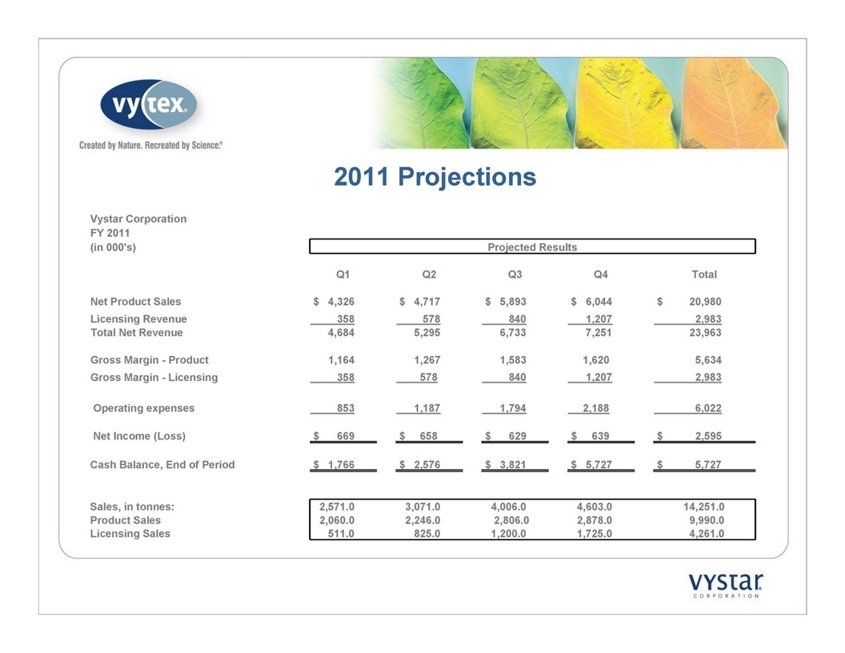

2011 Projections

Vystar Corporation

FY 2011

(in 000's)

Projected Results

Q1

Q2

Q3

Q4

Total

Net Product Sales

$ 4,326

$ 4,717

$ 5,893

$ 6,044

$ 20,980

Licensing Revenue

358

578

840

1,207

2,983

Total Net Revenue

4,684

5,295

6,733

7,251

23,963

Gross Margin - Product

1,164

1,267

1,583

1,620

5,634

Gross Margin - Licensing

358

578

840

1,207

2,983

Operating expenses

853

1,187

1,794

2,188

6,022

Net Income (Loss)

$ 669

$ 658

$ 629

$ 639

$ 2,595

Cash Balance, End of Period

$ 1,766

$ 2,576

$ 3,821

$ 5,727

$ 5,727

Sales, in tonnes:

2,571.0

3,071.0

4,006.0

4,603.0

14,251.0

Product Sales

2,060.0

2,246.0

2,806.0

2,878.0

9,990.0

Licensing Sales

511.0

825.0

1,200.0

1,725.0

4,261.0

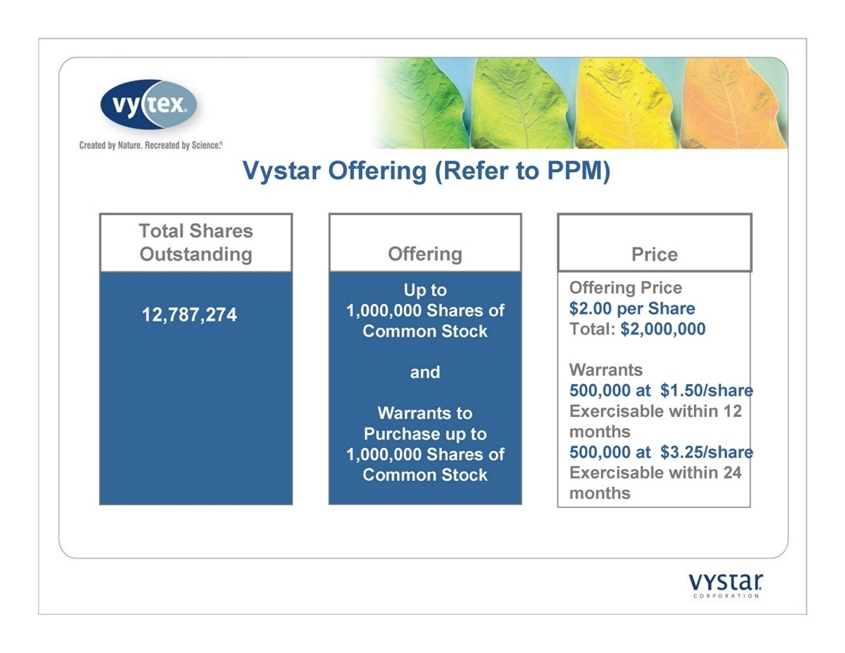

Vystar Offering (Refer to PPM)

Offer

Up to

1,000,000 Shares of Common Stock

and

Warrants to Purchase up to 1,000,000 Shares of Common Stock

Offering

Offer

Total Shares Outstanding

Offer

Price

Offering Price

$2.00 per Share

Total: $2,000,000

Warrants

500,000 at $1.50/share

Exercisable within 12 months

500,000 at $3.25/share

Exercisable within 24

months

12,787,274

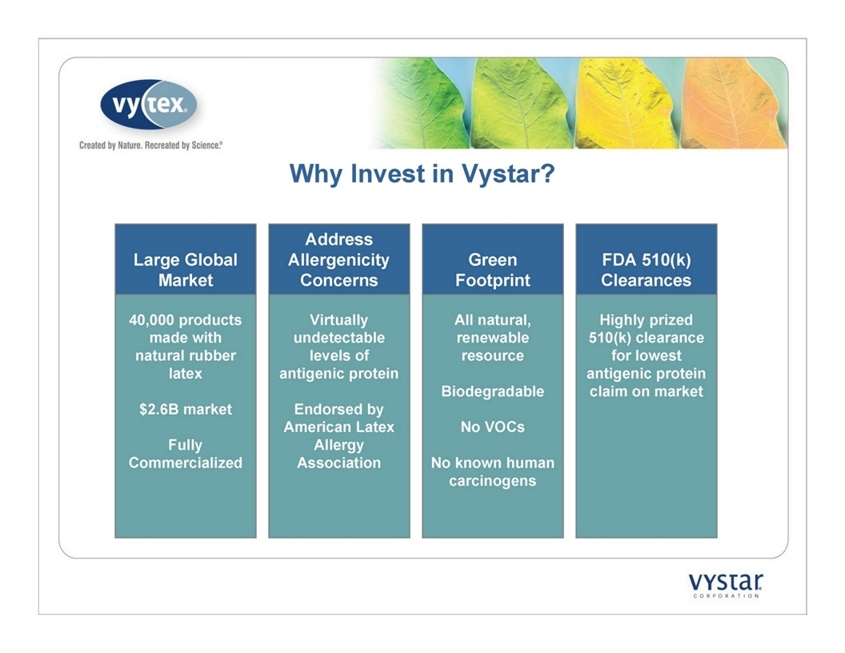

Why Invest in Vystar?

Large Global

Market

40,000 products made with natural rubber latex

$2.6B market

Fully

Commercialized

Address

Allergenicity Concerns

Virtually undetectable levels of antigenic protein

Endorsed by American Latex Allergy

Association

Green Footprint

All natural,

renewable resource

Biodegradable

No VOCs

No known human carcinogens

FDA 510(k) Clearances

Highly prized 510(k) clearance for lowest antigenic protein claim on market