Attached files

| file | filename |

|---|---|

| 8-K - MCDERMOTT INTERNATIONAL, INC. 8-K - MCDERMOTT INTERNATIONAL INC | a6114706.htm |

| EX-99.2 - EXHIBIT 99.2 - MCDERMOTT INTERNATIONAL INC | a6114706ex99_2.htm |

| EX-99.1 - EXHIBIT 99.1 - MCDERMOTT INTERNATIONAL INC | a6114706ex99_1.htm |

Exhibit 99.3

McDermott International, Inc.(NYSE: MDR) MCDERMOTT PLANS TO SEPARATE INTO TWO INDEPENDENT COMPANIES: BABCOCK & WILCOX AND J. RAY MCDERMOTT December 7, 2009

Forward Looking Statements / Safe Harbor In accordance with the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995, McDermott cautions that statements in this presentation that are forward-looking and provide other than historical information involve risks and uncertainties that may impact actual results and any future performance suggested in the forward-looking statements. The forward-looking statements in this presentation speak to conditions as of the date of this presentation and include statements regarding backlog, to the extent backlog may be viewed as an indicator of future revenues; the proposed separation of B&W and J. Ray, including the manner, timing, tax-free nature and expect benefits thereof; and the anticipated management teams and other information about B&W and J. Ray that is not historical in nature. Although McDermott’s management believes that the expectations reflected in those forward-looking statements are reasonable, McDermott can give no assurance that those expectations will prove to have been correct. Those statements are made based on various underlying assumptions and are subject to numerous uncertainties and risks, including, without limitation, delays or other difficulties in completing the proposed separation, the risk that the propose separation may not be completed as anticipated or at all, disruptions experienced with customers and suppliers, the inability of either J. Ray or B&W to successfully operate independently and the inability to retain key personnel. Should one or more of these risks or uncertainties materialize, or should the assumptions underlying the forward-looking statements prove incorrect, actual outcomes could vary materially from those anticipated. For a more complete discussion of these and other risks, please see McDermott’s periodic filings with the Securities and Exchange Commission, including its annual report on Form 10-K for the year ended December 31, 2008 and subsequent quarterly reports on Form 10-Q. We do not undertake any obligation to update the forward-looking statements included in this presentation to reflect events or circumstances after the date of this presentation, unless we are required by applicable securities laws to do so.

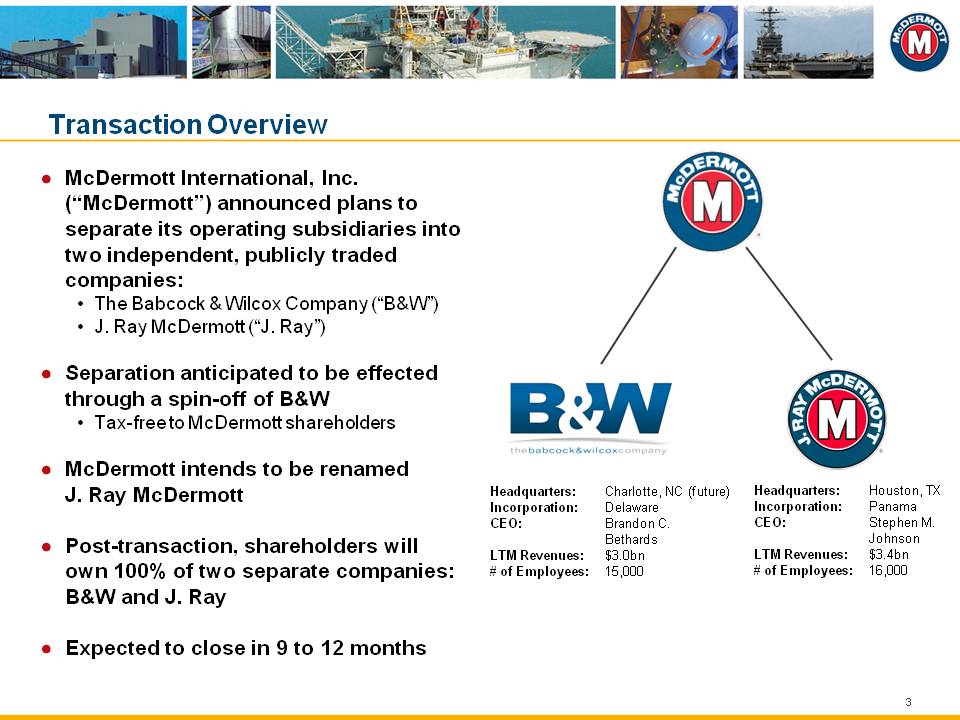

Transaction Overview McDermott International, Inc. (“McDermott”) announced plans to separate its operating subsidiaries into two independent, publicly traded companies: The Babcock & Wilcox Company (“B&W”)J. Ray McDermott (“J. Ray”)Separation anticipated to be effected through a spin-off of B&WTax-free to McDermott shareholdersMcDermott intends to be renamed J. Ray McDermottPost-transaction, shareholders will own 100% of two separate companies: B&W and J. Ray Expected to close in 9 to 12 months Headquarters: Charlotte, NC (future) Incorporation: Delaware CEO: Brandon C. Bethards LTM Revenues: $3.0bn# of Employees: 15,000 Headquarters: Houston, TX Incorporation: Panama CEO: Stephen M. Johnson LTM Revenues: $3.4bn# of Employees: 16,000

Compelling Strategic and Financial Benefits Better positions each company to accelerate growth based on distinct corporate strategy, market opportunities, free cash flow and customer relationships Independent Pure-Play Companies More efficient allocation of capital, which would allow each company to develop an independent investment program without the constraints of a holding company structure Efficient Capital Allocation Distinct publicly traded stock that could be used as currency for future acquisitions Attractive Currencies Sharpened management focus and strategic vision, and closer alignment of incentives with shareholder value creation Focused Management Elimination of the risk posed by recent modifications of the rules under the Federal Acquisition Regulations (“FAR”) that limit the U.S. Government’s ability to contract with “inverted” companies and their subsidiaries Elimination of FAR Issues

Background on U.S. Federal Acquisition Regulation (“FAR”) As outlined in McDermott’s filings with the SEC, recent interim rules prohibit federal agencies from awarding new contracts to inverted companies and their subsidiariesThese interim rules were passed on July 1, 2009 by the Civilian Agency Acquisition Council and the Defense Acquisition Regulations CouncilTo date, FAR has not yet significantly impacted the Company’s operations or profitabilityMcDermott is incorporated in Panama as a result of our inversion in the 1980s, and as such the new regulations may impact our ability to pursue new contract awards with the U.S. GovernmentOnly B&W, which derives a substantial amount of its revenues and profits from services provided to the U.S. Government, would be affected by the regulationsJ. Ray would not be affected – not a Government contractorExisting contracts should not be impacted by FARFollowing the spin-off, B&W would be an independent company still incorporated in Delaware but without a foreign parent, and thus would be able to compete for Government contracts without restriction from the interim rules of the FARNo change to J. Ray’s incorporation is anticipated Separation Eliminates FAR Risks

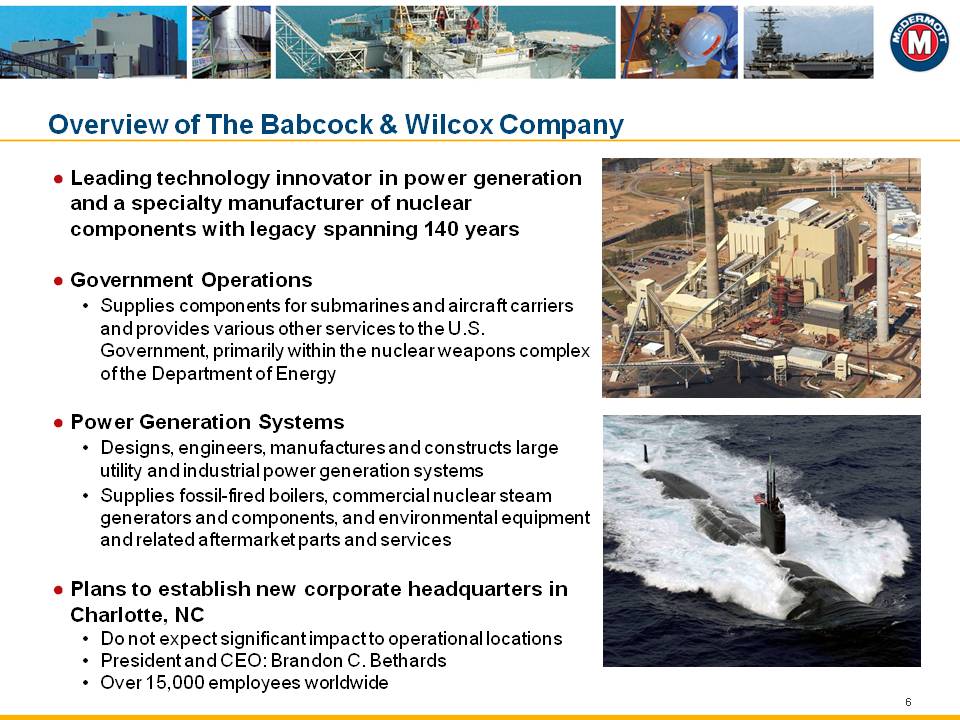

Overview of The Babcock & Wilcox CompanyLeading technology innovator in power generation and a specialty manufacturer of nuclear components with legacy spanning 140 years Goverment OperationsSupplies components for submarines and aircraft carriers and provides various other services to the U.S. Government, primarily within the nuclear weapons complex of the Department of EnergyPower Generation SystemsDesigns, engineers, manufactures and constructs large utility and industrial power generation systemsSupplies fossil-fired boilers, commercial nuclear steam generators and components, and environmental equipment and related aftermarket parts and servicesPlans to establish new corporate headquarters in Charlotte, NC Do not expect significant impact to operational locations President and CEO: Brandon C. Bethards Over 15,000 employees worldwide

Babcock & Wilcox Global Presence Beijing Wuhan Esbjerg Dumbarton Cambridge Malvern Barberton Mt. Vernon West Point Oak Ridge Erwin Lynchburg West Mifflin Melville New Orleans Amarillo Los Alamos Nye County Livermore Idaho Falls Monterrey Lancaster Aiken Euclid Power Generation Systems Government Operations

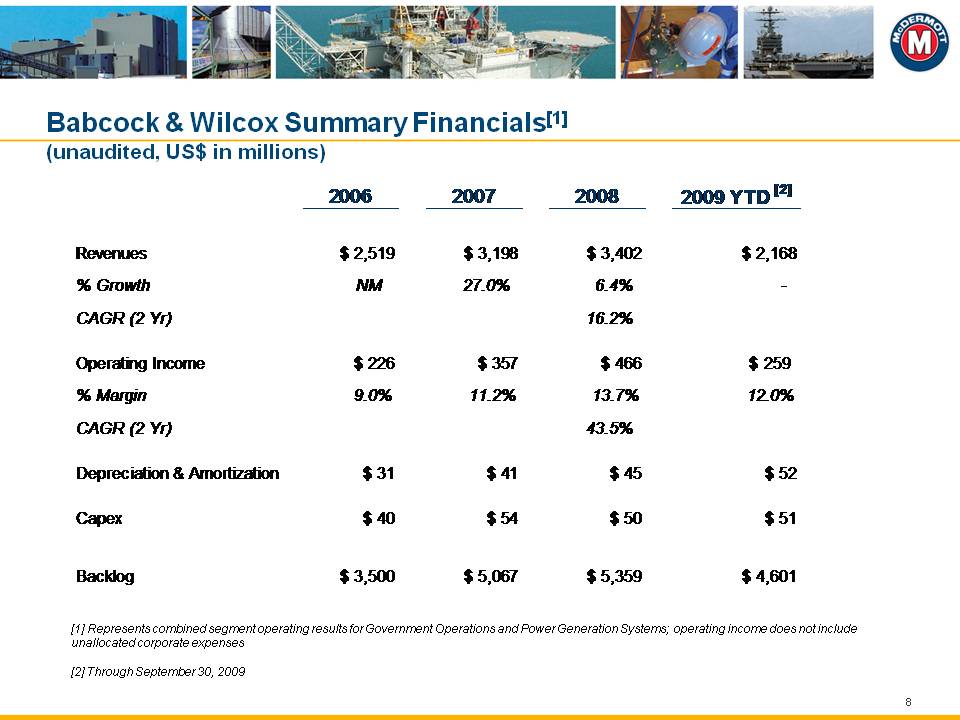

Babcock & Wilcox Summary Financials[1] (unaudited, US$ in millions) [1] Represents combined segment operating results for Government Operations and Power Generation Systems; operating income does not include unallocated corporate expenses[2] Through September 30, 2009 $ 3,198 $ 3,402 NM 27.0% 6.4% 16.2% $ 226 $ 357 $ 466 $ 259 9.0% 11.2% 13.7% 12.0% 43.5% $ 31 $ 41 $ 45 $ 52 $ 40 $ 54 $ 50 $ 51 $ 3,500 $ 5,067 $ 5,359 $ 4,601

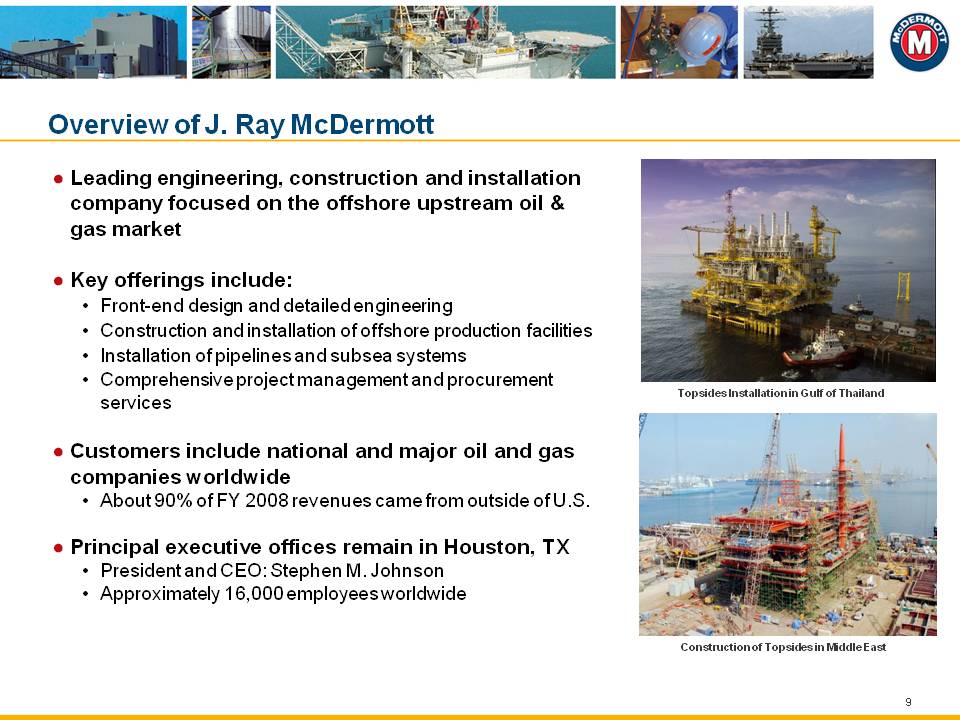

Leading engineering, construction and installation company focused on the offshore upstream oil & gas marketKey offerings include:Front-end design and detailed engineeringConstruction and installation of offshore production facilitiesInstallation of pipelines and subsea systems Comprehensive project management and procurement services Customers include national and major oil and gas companies worldwideAbout 90% of FY 2008 revenues came from outside of U.S.Principal executive offices remain in Houston, TX President and CEO: Stephen M. JohnsonApproximately 16,000 employees worldwide Overview of J. Ray McDermott Topsides Installation in Gulf of Thailand Construction of Topsides in Middle East

J. Ray Global Presence Altamira Morgan City Dartmouth Baku Bautino Al Khobar Doha Jebel Ali Dubai Chennai Kuala Lumpur Batam Jakarta Perth Singapore Ho Chi Minh City Qingdao Offshore Oil & Gas Construction Houston

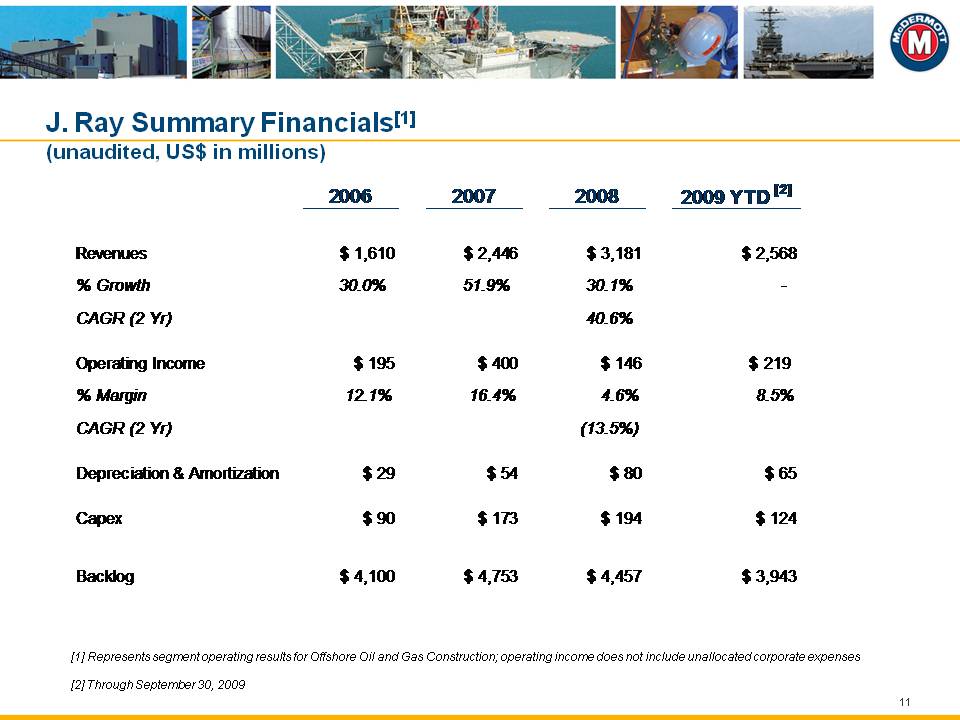

J. Ray Summary Financials[1] (unaudited, US$ in millions) [1] Represents segment operating results for Offshore Oil and Gas Construction; operating income does not include unallocated corporate expenses[2] Through September 30, 2009 $ 1,610 $ 2,446 $ 3,181 $ 2,568 30.0% 51.9% 30.1% 40.6% $ 195 $ 400 $ 146 $ 219 12.1% 16.4% 4.6% 8.5% (13.5%) $ 29 $ 54 $ 80 $ 65 $ 90 $ 173 $ 194 $ 124 $ 4,100 $ 4,753 $ 4,457 $ 3,943

Key Next Steps Preparation of intercompany agreements Preparation of financial statements and filing of Form 10 SEC review of Form 10 Confirmation of tax treatment Board action to declare record and distribution dates No shareholder vote required Anticipated completion within 9-12 months

Transaction Summary McDermott shareholders will own two public companies following the spin-off: B&W and J. Ray B&W and J. Ray are each leaders in their fields and are well-positioned to operate as standalone public companies The spin-off will enable B&W and J. Ray to pursue growth opportunities without the constraints of a holding company structure and eliminate FAR risks B&W and J. Ray will benefit substantially from greater operational and strategic flexibility Independent structure will enhance focus and more closely align incentives for management with shareholder interests B&W and J. Ray will each be led by a highly experienced and talented management team