Attached files

| file | filename |

|---|---|

| 8-K - 8K LAZARD CONFERENCE - WEST PHARMACEUTICAL SERVICES INC | lazard8k.htm |

| EX-99.2 - PRESS RELEASE LAZARD - WEST PHARMACEUTICAL SERVICES INC | pressrelease.htm |

1

Donald E. Morel, Jr., Ph.D.

Chairman and Chief Executive Officer

William J. Federici

Vice President and Chief Financial Officer

Investor Relations Contact:

Michael A. Anderson

Vice President and Treasurer

mike.anderson@westpharma.com

Lazard Capital Markets 6th Annual Healthcare Conference

New York, New York

November 17, 2009

NYSE: WST

westpharma.com

All trademarks and registered trademarks are the property of West Pharmaceutical Services, Inc., unless noted otherwise.

2

This presentation contains forward-looking statements, within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, that are based on management’s beliefs and

assumptions, current expectations, estimates and forecasts. Statements that are not

historical facts, including statements that are preceded by, followed by, or that

include, words such as “estimate,” “expect,” “intend,” “believe,” “plan,” “anticipate”

and other words and terms of similar meaning are forward-looking statements. West’s

estimated or anticipated future results, product performance or other non-historical

facts are forward-looking and reflect our current perspective on existing trends and

information.

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, that are based on management’s beliefs and

assumptions, current expectations, estimates and forecasts. Statements that are not

historical facts, including statements that are preceded by, followed by, or that

include, words such as “estimate,” “expect,” “intend,” “believe,” “plan,” “anticipate”

and other words and terms of similar meaning are forward-looking statements. West’s

estimated or anticipated future results, product performance or other non-historical

facts are forward-looking and reflect our current perspective on existing trends and

information.

Many of the factors that will determine the Company’s future results are beyond the

ability of the Company to control or predict. These statements are subject to known or

unknown risks or uncertainties, and therefore, actual results could differ materially

from past results and those expressed or implied in any forward-looking statement.

You should bear this in mind as you consider forward-looking statements. A non-

exclusive list of important factors that may affect future results may be found in

West’s filings with the Securities and Exchange Commission, including our annual

report on Form 10-K and our periodic reports on Form 10-Q and Form 8-K.

ability of the Company to control or predict. These statements are subject to known or

unknown risks or uncertainties, and therefore, actual results could differ materially

from past results and those expressed or implied in any forward-looking statement.

You should bear this in mind as you consider forward-looking statements. A non-

exclusive list of important factors that may affect future results may be found in

West’s filings with the Securities and Exchange Commission, including our annual

report on Form 10-K and our periodic reports on Form 10-Q and Form 8-K.

You should evaluate any statement in light of these important factors.

Forward Looking Statements

3

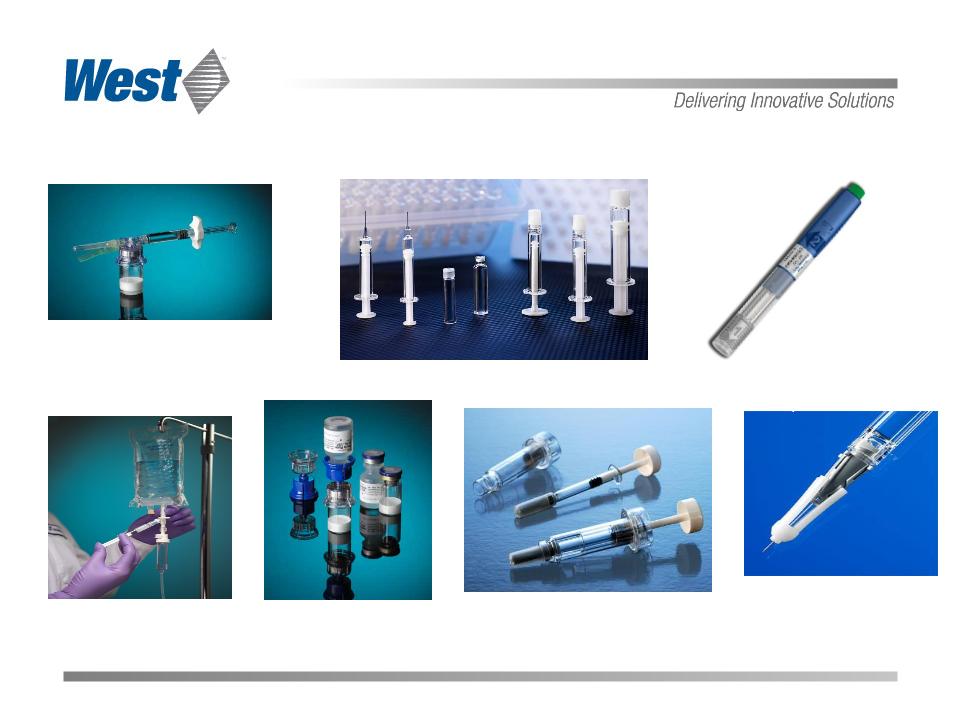

Who We Are

• Founded in 1923

• Leading global supplier of

components and systems

for injectable drug packaging

and delivery

components and systems

for injectable drug packaging

and delivery

– Vial

closure systems and

prefillable syringe components

prefillable syringe components

– Components

for disposable

delivery systems and diagnostics

delivery systems and diagnostics

– Devices

and device sub-

assemblies

assemblies

– Safety

and administration

systems

systems

• Market capitalization ~$1.3 billion

• Diverse, stable customer base

4

Each and every day,

more than 80 million

West products are used

to enhance the quality of

healthcare around the world.

5

• Global economic conditions remain soft, but show signs of

improvement

improvement

• Ongoing US healthcare reform debate

• Pharma remains under substantial pressure

• Global growth projected at 2.5%

- 5% (down from 5% - 7%)

• North America down 1%

- 2%

• Europe 0% - 1%

• Emerging economies 5% - 7% (India,

China, Brazil)

• Fundamental underlying industry change - consolidation - focus

on large molecule therapies

on large molecule therapies

• Pfizer - Wyeth

• Roche - Genentech

• AstraZeneca - Medimmune

• Lilly - Imclone

• Merck - Schering

Plough

Business Environment

6

Third Quarter Highlights

• Quarterly revenues grew 4.3% vs. 2008, excluding currency

– H1N1-related sales contributed to growth

– Customers’ cyclical inventory adjustments

concluding?

• Adjusted Diluted EPS 21.6% higher than prior year quarter

• Announced Fourth-Quarter Restructuring Plans

• Key Developments:

– Validated CZ insert needle now available

– Plastef acquisition completed

– Official Opening of China Manufacturing Facility

• Updated 2009 Guidance:

– Revenue between $1.03 billion and $1.05 billion

– Adjusted Diluted EPS between $2.08 and $2.13

7

Third Quarter and Year-To-Date Results

($ in millions, except per share data)

($ in millions, except per share data)

|

Quarter 3 |

|

Year-to-date | ||

|

2009 |

2008 |

|

2009 |

2008 |

|

$258.9 |

$256.2 |

Net Sales |

$762.3 |

$806.3 |

|

27.7% |

25.7% |

Gross Margin |

28.8% |

28.9% |

|

$5.1 |

$4.6 |

R&D |

$14.1 |

$14.8 |

|

$44.3 |

$41.5 |

SG&A |

$132.3 |

$122.5 |

|

$22.0 |

$19.7 |

Operating Profit (Non-GAAP) * |

$73.0 |

$94.9 |

|

$15.1 |

$12.2 |

Net Income (Non-GAAP) * |

$49.2 |

$62.6 |

|

$0.45 |

$0.37 |

Diluted EPS (Non-GAAP) * |

$1.45 |

$1.83 |

*2009 Q3 and YTD operating profit, net income and diluted EPS excludes a ($0.02) per share YTD impact of Tech restructuring charges, a $0.01

and $0.06 per share impact, respectively, of discrete tax benefits and a $0.04 Q3/YTD benefit for Brazil tax amnesty.

and $0.06 per share impact, respectively, of discrete tax benefits and a $0.04 Q3/YTD benefit for Brazil tax amnesty.

*2008 Q3 and YTD operating profit, net income and diluted EPS excludes a ($0.03) and $0.11 per share net (loss)/gain, respectively, on the

Nektar contract settlement, a ($0.05) per share YTD impact of Tech restructuring charges and a $0.06 and $0.09 per share impact, respectively,

of discrete tax benefits.

Nektar contract settlement, a ($0.05) per share YTD impact of Tech restructuring charges and a $0.06 and $0.09 per share impact, respectively,

of discrete tax benefits.

8

Capital Management

|

($M) |

9/30/09 |

12/31/08 |

|

Total Debt |

$397.0 |

$386.0 |

|

Total Equity |

$565.7 |

$487.1 |

|

Net Debt to Total Capital |

35.9% |

38.0% |

|

|

|

|

|

Capital Expenditures: |

|

|

|

YTD Spending |

$70.4 |

|

|

Full Year Forecast / Actual |

$110 - $120 |

$131.8 |

|

|

|

|

9

Market Dynamics Support Future Growth

• Increasing number of patients

with chronic illnesses

with chronic illnesses

• Many of these are treated with

biologic drugs

biologic drugs

• Biologic drugs demand ultra-

clean delivery systems

clean delivery systems

• Point of care shift: hospital to

specialty clinic to home

specialty clinic to home

• Need for safe, accurate dosing is

pushing the market toward

integrating the container/

closure system into the delivery

system

pushing the market toward

integrating the container/

closure system into the delivery

system

• Generic growth

Autoimmune Disease

Vaccines

Oncology

Diabetes

10

Why West - Our Competitive Advantage

• Unmatched experience/expertise: drug - material interface

– Global regulatory and technical support

• Protected IP: proprietary materials and technology

• Regulatory barrier to entry: US

NDA and ANDA filings must

include reference to packaging/components in contact

with the drug

include reference to packaging/components in contact

with the drug

1. West Drug Master File (DMF) 1546 is confidential

2. West DMF includes functionality data (multi-year

studies)

3. All primary package changes require new stability/functionality

studies for new filing

studies for new filing

• Global manufacturing footprint

• Market leader in packaging and delivery systems

for biologics

11

Packaging & Delivery Systems for Large Molecules

are a Key Business Driver

are a Key Business Driver

• Currently all large molecule drugs are delivered

by injection

by injection

• West components are preferred and used for the

top selling biotech therapeutics

top selling biotech therapeutics

• Used predominantly to treat chronic diseases

– Diabetes

– Cancer

– Auto-immune

• Fastest growing segment of our business

• Strong profit driver

12

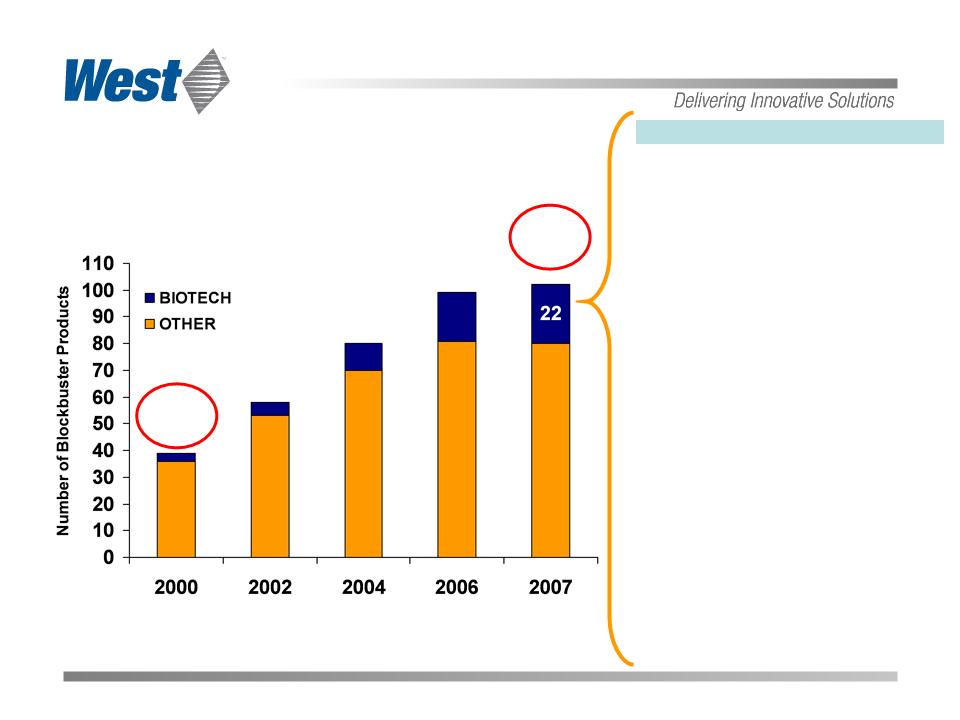

Global Biotech Blockbusters

(Annual Sales >$1Billion)

(Annual Sales >$1Billion)

Total

39

39

Total

106

106

|

2007’s 22 Biotech Blockbusters |

|

Enbrel (Amgen/Wyeth) |

|

Aranesp (Amgen) |

|

Remicade (J&J/SP) |

|

Rituxan (Roche) |

|

Neulasta (Amgen) |

|

Erypo/Procrit (J&J) |

|

Herceptin (Roche) |

|

Epogen (Amgen) |

|

Avastin (Roche) |

|

Humira (Abbott) |

|

Lantus (Sanofi-Aventis) |

|

Avonex (Biogen Idec) |

|

Neorecormon (Roche) |

|

Gardasil (Merck) |

|

Rebif (Serono) |

|

Neupogen (Amgen) |

|

Novorapid (Novo Nordisk) |

|

Erbitux (Imclone/Merck KGaA/BMS) |

|

Lucentis (Roche/Novartis/Genentech) |

|

Synagis (MedImmune) |

|

Humalog (Lilly) |

|

Betaferon (Bayer/Schering AG) |

Sources: IMS 2008 Global Biotech Perspective report and Company

Estimates

Estimates

West supplies components for all

current Biotech Blockbuster products

current Biotech Blockbuster products

13

|

Drug Packaging

(How it is contained) |

|

Primary Container Solutions |

|

Prefillable Syringe Systems |

|

Drug Delivery

(How it gets into the patient) |

|

Administration Systems |

|

Advanced Injection Systems |

Our Growth Strategy

• Build

market share in multi-

component systems for drug

administration

component systems for drug

administration

• Expand

proprietary product portfolio

through innovation and strategic

technology acquisitions

through innovation and strategic

technology acquisitions

• Market

segmentation to generate

incremental value per unit

incremental value per unit

• New

product innovation

• Lean

manufacturing

• Strategic

acquisitions

• Geographic

expansion

• China

• India

14

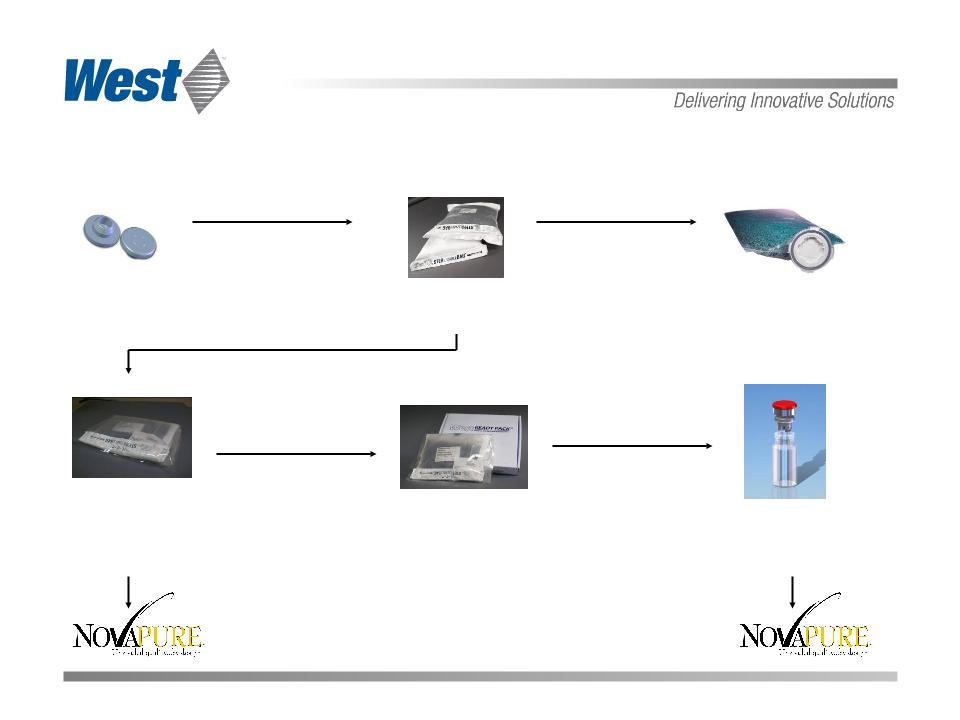

Core Strategy - Add Incremental Quality and Value

(representative prices per thousand units)

(representative prices per thousand units)

Uncoated 4432/50 V35

$50

$200

4432/50 S2 FluroTec®

Westar RS

Westar RS

$250

4432/50 S2 FluroTec®

Westar RS B2-40 Port Bag

Westar RS B2-40 Port Bag

$300

4432/50 S2 FluroTec®

Westar® RS B2-40

(1000 packs)

Westar® RS B2-40

(1000 packs)

Ready-to-sterilize

components

components

$465

4432/50 Sterile S2 W

(RU) Ready Pack®

(RU) Ready Pack®

(1000 packs)

$2,900

RU Ready Pack® System

(small volume sourcing only)

(small volume sourcing only)

Vials and closure system,

Ready-to-use (sterile)

$3,500

$360

15

China Plastics Facility

16

|

Drug Packaging

(How it is contained) |

|

Primary Container Solutions |

|

Prefillable Syringe Systems |

|

Drug Delivery

(How it gets into the patient) |

|

Administration Systems |

|

Advanced Injection Systems |

Our Growth Strategy

• Build

market share in multi-

component systems for drug

administration

component systems for drug

administration

• Expand

proprietary product portfolio

through innovation and strategic

technology acquisitions

through innovation and strategic

technology acquisitions

• Market

segmentation to generate

organic growth

organic growth

• New

product innovation

• Lean

manufacturing

• Strategic

acquisitions

• Geographic

expansion

• Capacity

build - Europe, Singapore,

North America

North America

• China

plastics

• India

rubber site selection

17

Delivery Systems - Key Programs

Vial2Bag™

Mix2Vial®

MixJect®

NovaGuard™ Safety

Needle Device

Needle Device

(luer-lock syringe)

ConfiDose®

Auto-injector

Auto-injector

Daikyo Crystal Zenith®

éris™

Safety Needle Device

(fixed-needle syringe)

18

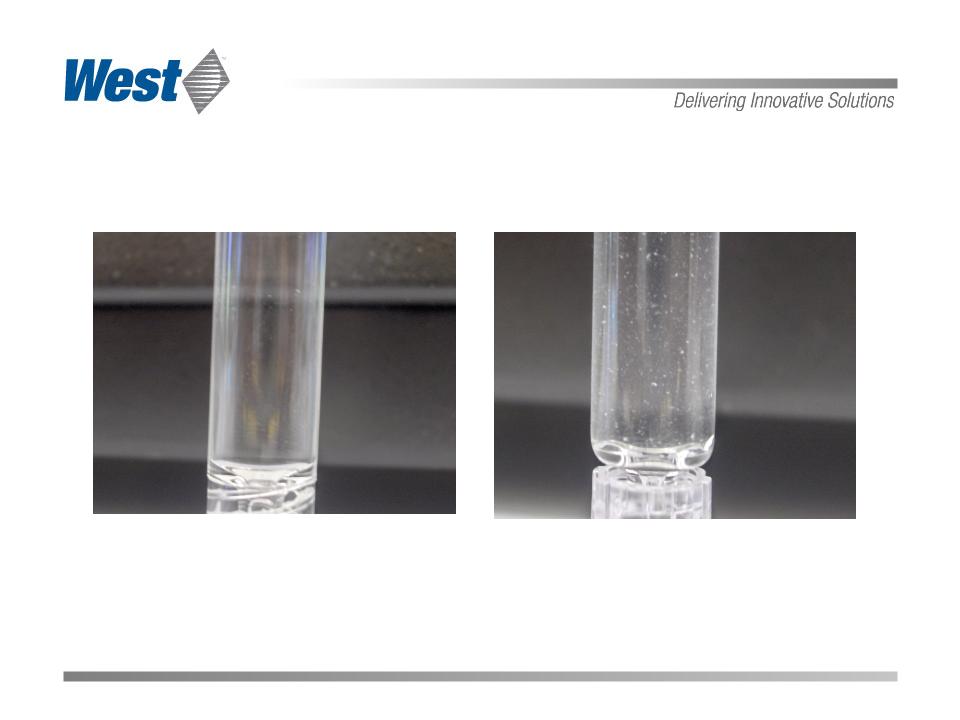

Comparison of protein aggregation in glass versus CZ for

a model antibody

a model antibody

Daikyo Crystal Zenith®

Glass

19

Our Long-term Focus

• Superior quality and service

• Margin improvement - lean manufacturing, OEE

• Continued investment for the future

– Innovation: New products that meet the challenge

of biologics

– Geographic expansion

– Technology & product acquisitions

• Financial discipline

– Maintain strong operating cash flow

– Prudent spending: discretionary SG&A,

R&D and Capex

– Maintain a strong balance sheet

– Return on Invested Capital > Weighted

Average Cost of Capital

20

|

Drug Packaging

(How it is contained) |

|

Primary Container Solutions |

|

Prefillable Syringe Systems |

|

Drug Delivery

(How it gets into the patient) |

|

Administration Systems |

|

Advanced Injection Systems |

Five-Year Growth Opportunity

$2 billion combined markets for safety,

prefilled and auto-injectors:

prefilled and auto-injectors:

• Annual

unit growth 6-12%,

depending on segment

depending on segment

• West

2009 sales: $250 million

• 2009

OP margin: 5%

Strategic Planning Goals:

• Projected

2014 sales of $600 million

• Projected

2014 OP margin 20%

$1.5 billion market for packaging

components:

components:

• Annual

unit growth 0-8%, depending

on segment

on segment

• West

2009 sales: $750 million

• 2009

OP margin: 18%

Strategic Planning Goals:

• Projected

2014 sales of $1.0 billion

• Projected

2014 OP margin 20%

21

Summary

• Market leader

• Proprietary technology

• Regulatory expertise

• Customer base

• Global footprint

• Partnerships

– Daikyo

– Mexico

• New product pipeline

• Financial position

– Cash flow

– Balance sheet

• People

Injectable Container Solutions

Advanced

Injection

Systems

Injection

Systems

Prefillable Syringe

Systems

Systems

Safety and Administration

Systems

Systems

22

Donald E. Morel, Jr., Ph.D.

Chairman and Chief Executive Officer

William J. Federici

Vice President and Chief Financial Officer

Investor Relations Contact:

Michael A. Anderson

Vice President and Treasurer

mike.anderson@westpharma.com

Lazard Capital Markets 6th Annual Healthcare Conference

New York, New York

November 17, 2009

NYSE: WST

westpharma.com

All trademarks and registered trademarks are the property of West Pharmaceutical Services, Inc., unless noted otherwise.