Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INDEPENDENT BANK CORP /MI/ | brhc10013763_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - INDEPENDENT BANK CORP /MI/ | brhc10013763_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - INDEPENDENT BANK CORP /MI/ | brhc10013763_ex99-1.htm |

Exhibit 99.3

Q2 EARNINGSIndependent Bank CorporationConference Call – July 28, 2020

Cautionary note regarding forward-looking statements This presentation contains forward-looking statements

about Independent Bank Corporation. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and

estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future plans and prospects of Independent Bank Corporation. Forward-looking

statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. The COVID-19 pandemic is adversely affecting Independent Bank Corporation, its customers,

counterparties, employees, and third-party service providers, and the ultimate extent of the impacts on its business, financial position, results of operations, liquidity, and prospects is uncertain. Continued deterioration in general business

and economic conditions or turbulence in domestic or global financial markets could adversely affect Independent Bank Corporation’s revenues and the values of its assets and liabilities, reduce the availability of funding from certain financial

institutions, lead to a tightening of credit, and increase stock price volatility. In addition, changes to statutes, regulations, or regulatory policies or practices could affect Independent Bank Corporation in substantial and unpredictable ways.

Independent Bank Corporation’s results could also be adversely affected by changes in interest rates; further increases in unemployment rates; deterioration in the credit quality of its loan portfolios or in the value of the collateral securing

those loans; deterioration in the value of its investment securities; legal and regulatory developments; litigation; increased competition from both banks and non-banks; changes in the level of tariffs and other trade policies of the United

States and its global trading partners; changes in customer behavior and preferences; breaches in data security; failures to safeguard personal information; effects of mergers and acquisitions and related integration; effects of critical

accounting policies and judgments; and management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputation risk. Certain risks and important

factors that could affect Independent Bank Corporation's future results are identified in its Annual Report on Form 10-K for the year ended December 31, 2019 and other reports filed with the SEC, including among other things under the heading

“Risk Factors” in such Annual Report on Form 10-K. Any forward-looking statement speaks only as of the date on which it is made, and Independent Bank Corporation undertakes no obligation to update any forward-looking statement, whether to reflect

events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise. 2

Agenda Formal Remarks.William B. (Brad) Kessel, President and Chief Executive OfficerRobert N. Shuster,

Executive Vice President and Chief Financial OfficerQuestion and Answer session.Closing Remarks.Note: This presentation is available at www.IndependentBank.com in the Investor Relations area under the “Presentations” tab. 3

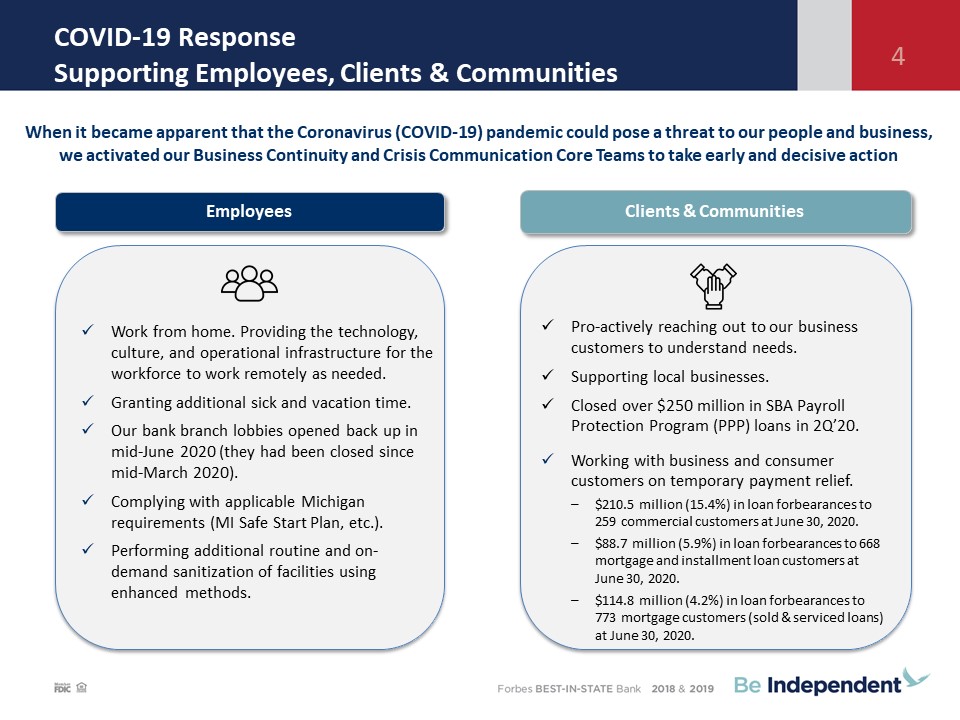

COVID-19 ResponseSupporting Employees, Clients & Communities 4 Employees Clients &

Communities Work from home. Providing the technology, culture, and operational infrastructure for the workforce to work remotely as needed.Granting additional sick and vacation time. Our bank branch lobbies opened back up in mid-June 2020

(they had been closed since mid-March 2020).Complying with applicable Michigan requirements (MI Safe Start Plan, etc.).Performing additional routine and on-demand sanitization of facilities using enhanced methods. Pro-actively reaching out to

our business customers to understand needs. Supporting local businesses. Closed over $250 million in SBA Payroll Protection Program (PPP) loans in 2Q’20. Working with business and consumer customers on temporary payment relief.$210.5 million

(15.4%) in loan forbearances to 259 commercial customers at June 30, 2020.$88.7 million (5.9%) in loan forbearances to 668 mortgage and installment loan customers at June 30, 2020.$114.8 million (4.2%) in loan forbearances to 773 mortgage

customers (sold & serviced loans) at June 30, 2020. When it became apparent that the Coronavirus (COVID-19) pandemic could pose a threat to our people and business, we activated our Business Continuity and Crisis Communication Core Teams to

take early and decisive action

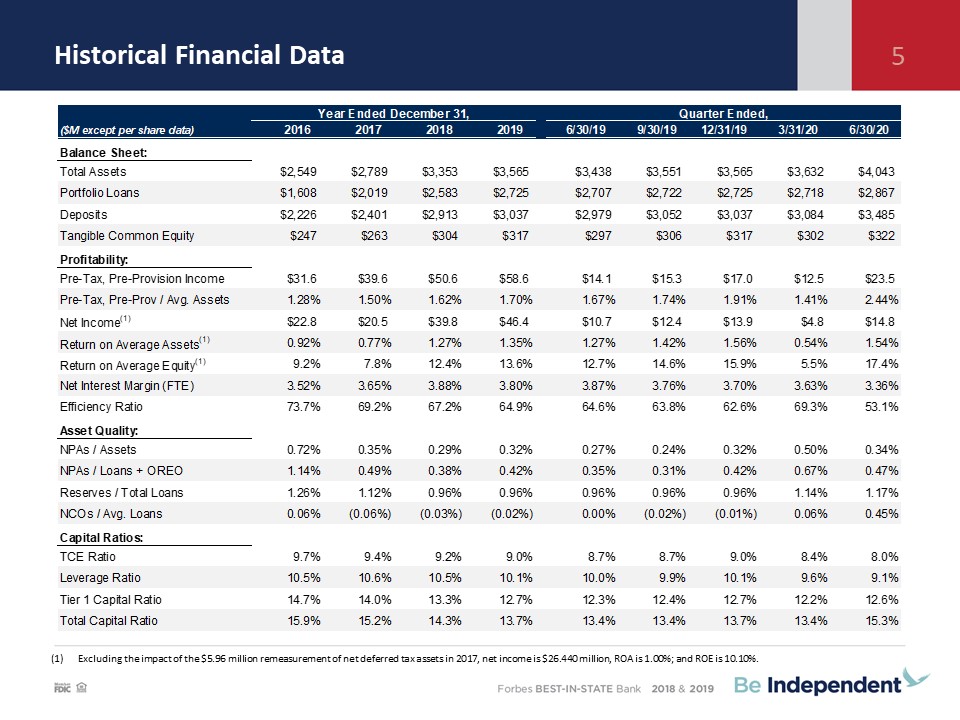

Historical Financial Data 5 Excluding the impact of the $5.96 million remeasurement of net deferred tax

assets in 2017, net income is $26.440 million, ROA is 1.00%; and ROE is 10.10%.

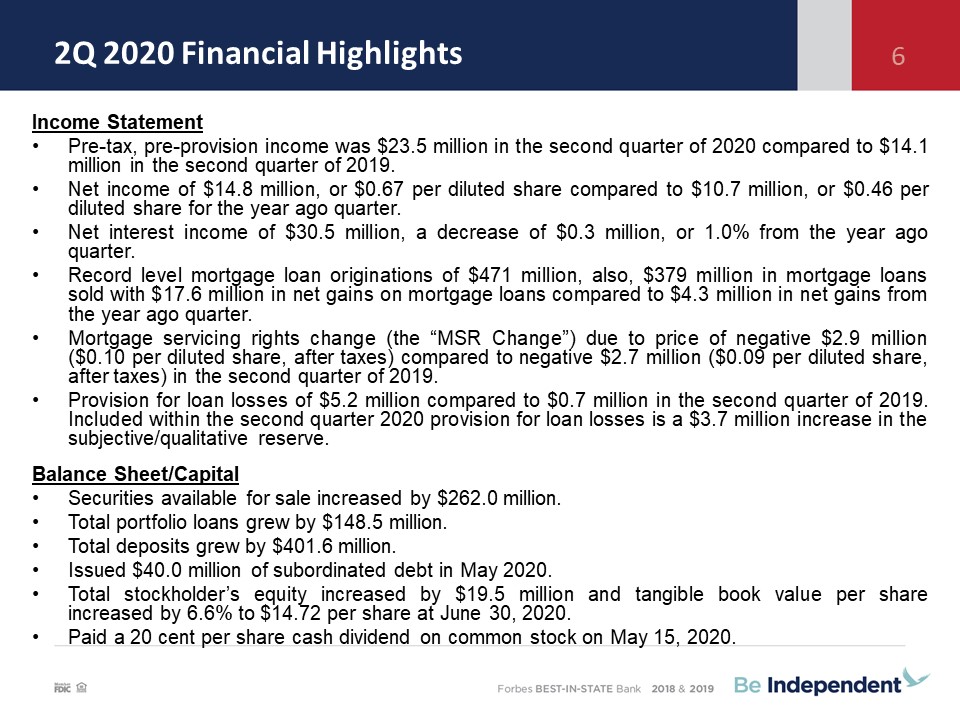

2Q 2020 Financial Highlights Income StatementPre-tax, pre-provision income was $23.5 million in the second

quarter of 2020 compared to $14.1 million in the second quarter of 2019.Net income of $14.8 million, or $0.67 per diluted share compared to $10.7 million, or $0.46 per diluted share for the year ago quarter.Net interest income of $30.5 million, a

decrease of $0.3 million, or 1.0% from the year ago quarter.Record level mortgage loan originations of $471 million, also, $379 million in mortgage loans sold with $17.6 million in net gains on mortgage loans compared to $4.3 million in net gains

from the year ago quarter. Mortgage servicing rights change (the “MSR Change”) due to price of negative $2.9 million ($0.10 per diluted share, after taxes) compared to negative $2.7 million ($0.09 per diluted share, after taxes) in the second

quarter of 2019. Provision for loan losses of $5.2 million compared to $0.7 million in the second quarter of 2019. Included within the second quarter 2020 provision for loan losses is a $3.7 million increase in the subjective/qualitative

reserve.Balance Sheet/CapitalSecurities available for sale increased by $262.0 million.Total portfolio loans grew by $148.5 million.Total deposits grew by $401.6 million.Issued $40.0 million of subordinated debt in May 2020.Total stockholder’s

equity increased by $19.5 million and tangible book value per share increased by 6.6% to $14.72 per share at June 30, 2020. Paid a 20 cent per share cash dividend on common stock on May 15, 2020. 6

Our Michigan Markets 7 Source: S&P Global Market Intelligence and Company documents. Map does not

include loan production offices. Deposit market share data based on FDIC Summary of Deposits Annual Survey as of June 30, 2019.Note: Loan and deposit balances exclude the loans and deposits (such as brokered deposits) that are not clearly

allocable to a certain market region. Loans specifically exclude: $159 million of Ohio mortgage loans, $64 million of resort loans and $20 million of purchased mortgage loans. 94 96 75 69 Michigan’s community

bank. #1 deposit market share amongst Michigan banks < $10B in assets and #10 deposit market share overall. Top 10 market share in 19 of 23 counties of operation – with opportunity to gain market share in attractive Michigan markets.Low cost

and stable deposit base in East/”Thumb” and Central regions utilized to fund loan growth in the West and Southeast regions (higher growth & more metropolitan).Eight bank branches were or soon will be closed (two on June 26, 2020 and six will

be on July 31, 2020). The closures by region were: 3 in the East/”Thumb”, 2 in the Central and 1 each in the West, Northwest and Southeast. These closures reduce the total bank branch footprint to 60.11 Loan Production Offices (LPOs), including 9

throughout Michigan and 2 in Ohio (residential mortgage lending only). Branches (60) East / “Thumb”Branches: 20Deposits: $1,057MLoans: $478M SoutheastBranches: 6Deposits: $452MLoans: $756M CentralBranches: 10Deposits: $476MLoans:

$220M WestBranches: 20Deposits: $1,049MLoans: $828M NorthwestBranches: 4Deposits: $289MLoans: $337M

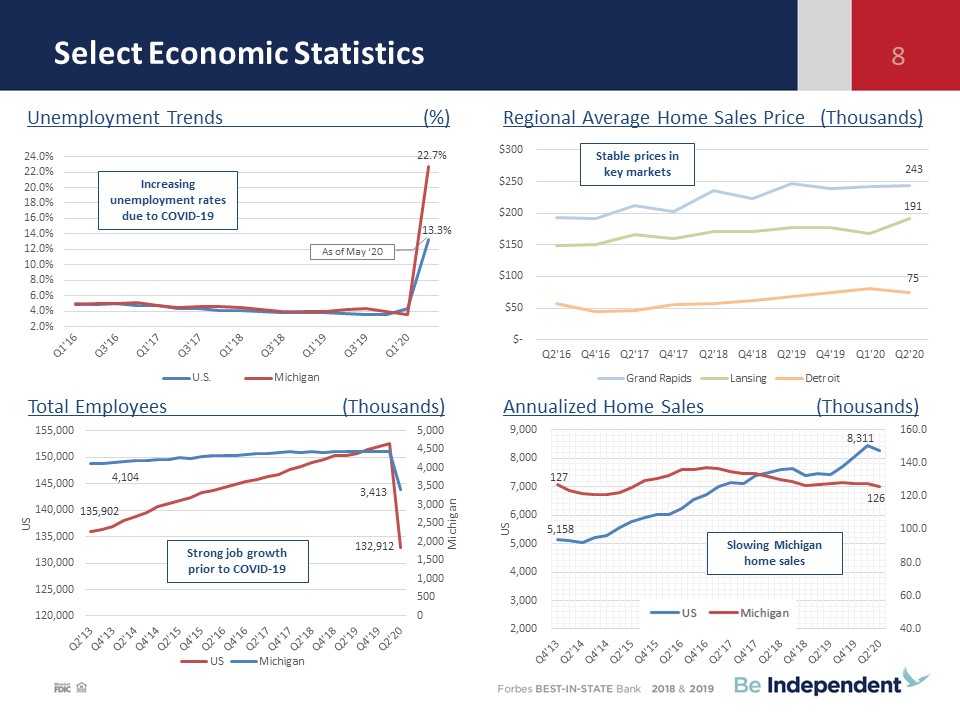

Select Economic Statistics Unemployment Trends (%) Total Employees (Thousands) Regional Average Home

Sales Price (Thousands) Annualized Home Sales (Thousands) Increasing unemployment rates due to COVID-19 Strong job growth prior to COVID-19 Stable prices in key markets Slowing Michigan home sales 8 As of May ‘20

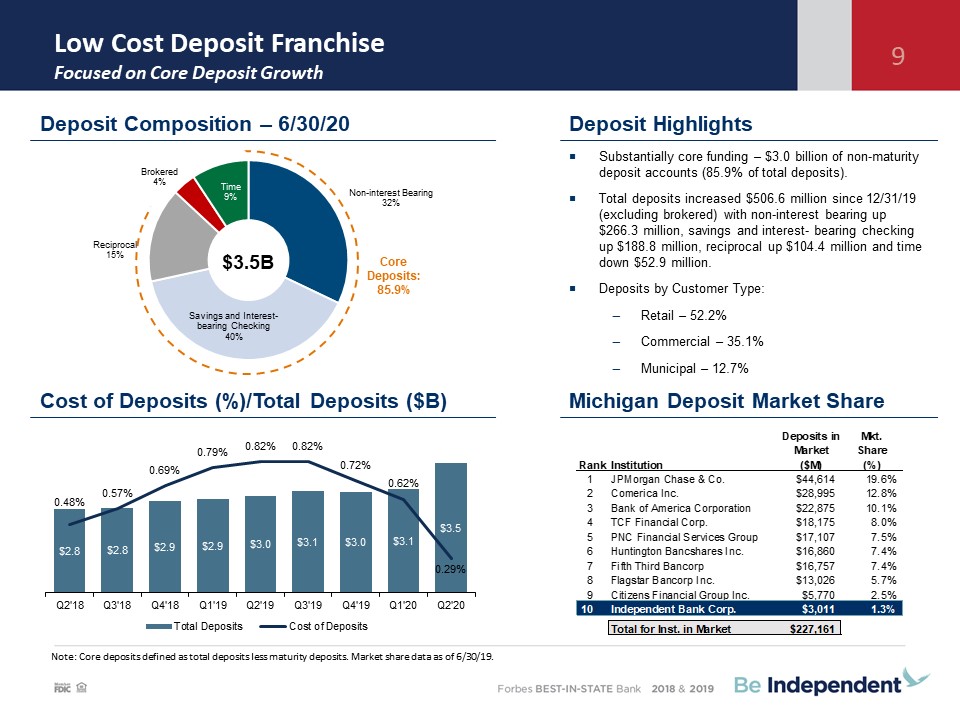

Low Cost Deposit Franchise Focused on Core Deposit Growth 9 Substantially core funding – $3.0 billion

of non-maturity deposit accounts (85.9% of total deposits).Total deposits increased $506.6 million since 12/31/19 (excluding brokered) with non-interest bearing up $266.3 million, savings and interest- bearing checking up $188.8 million,

reciprocal up $104.4 million and time down $52.9 million.Deposits by Customer Type:Retail – 52.2%Commercial – 35.1%Municipal – 12.7% Deposit Composition – 6/30/20 Deposit Highlights Michigan Deposit Market Share $3.5B Core Deposits:

85.9% Cost of Deposits (%)/Total Deposits ($B) Note: Core deposits defined as total deposits less maturity deposits. Market share data as of 6/30/19.

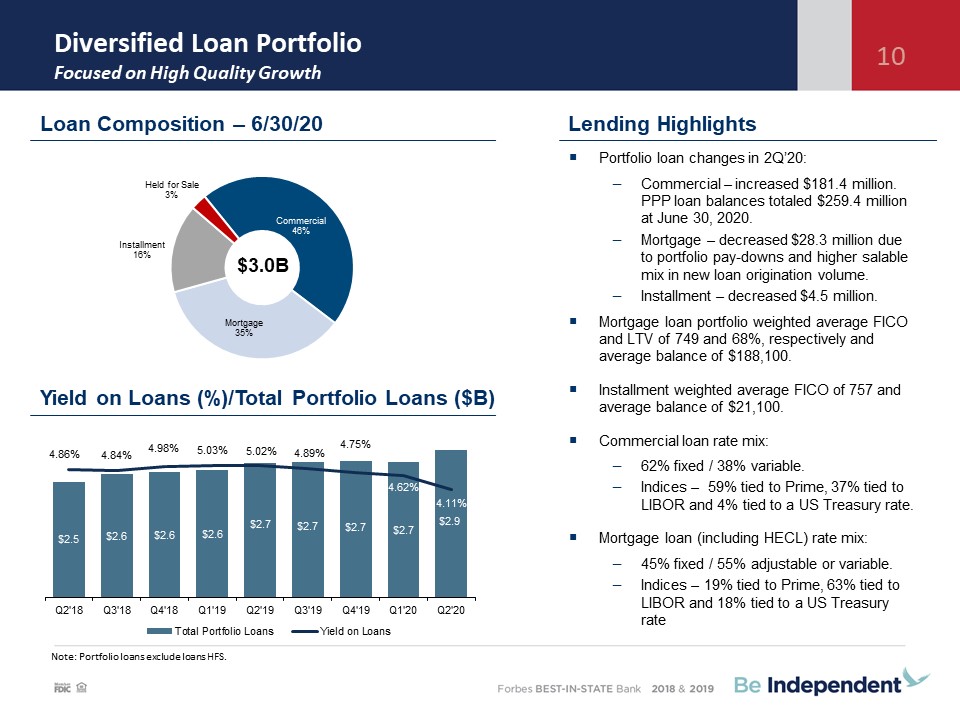

Diversified Loan PortfolioFocused on High Quality Growth 10 Lending Highlights Note: Portfolio loans

exclude loans HFS. Portfolio loan changes in 2Q’20:Commercial – increased $181.4 million. PPP loan balances totaled $259.4 million at June 30, 2020.Mortgage – decreased $28.3 million due to portfolio pay-downs and higher salable mix in new loan

origination volume. Installment – decreased $4.5 million.Mortgage loan portfolio weighted average FICO and LTV of 749 and 68%, respectively and average balance of $188,100.Installment weighted average FICO of 757 and average balance of

$21,100.Commercial loan rate mix:62% fixed / 38% variable.Indices – 59% tied to Prime, 37% tied to LIBOR and 4% tied to a US Treasury rate.Mortgage loan (including HECL) rate mix: 45% fixed / 55% adjustable or variable. Indices – 19% tied to

Prime, 63% tied to LIBOR and 18% tied to a US Treasury rate Loan Composition – 6/30/20 $3.0B Yield on Loans (%)/Total Portfolio Loans ($B)

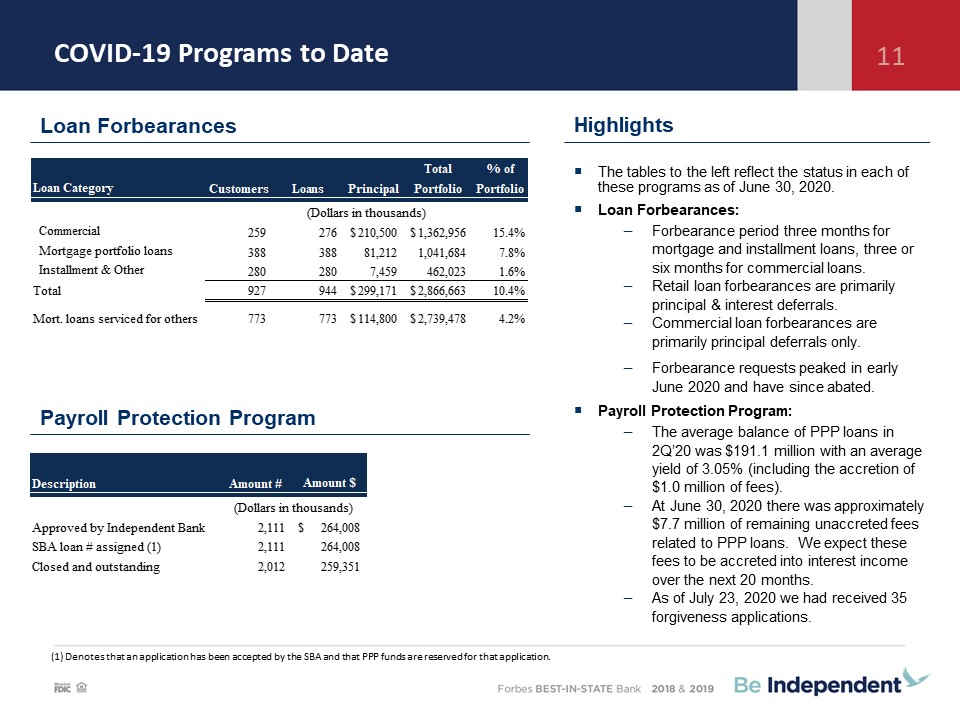

COVID-19 Programs to Date 11 Payroll Protection Program Loan Forbearances (1) Denotes that an

application has been accepted by the SBA and that PPP funds are reserved for that application. The tables to the left reflect the status in each of these programs as of June 30, 2020.Loan Forbearances:Forbearance period three months for mortgage

and installment loans, three or six months for commercial loans. Retail loan forbearances are primarily principal & interest deferrals.Commercial loan forbearances are primarily principal deferrals only.Forbearance requests peaked in early

June 2020 and have since abated.Payroll Protection Program:The average balance of PPP loans in 2Q’20 was $191.1 million with an average yield of 3.05% (including the accretion of $1.0 million of fees).At June 30, 2020 there was approximately $7.7

million of remaining unaccreted fees related to PPP loans. We expect these fees to be accreted into interest income over the next 20 months. As of July 23, 2020 we had received 35 forgiveness applications. Highlights

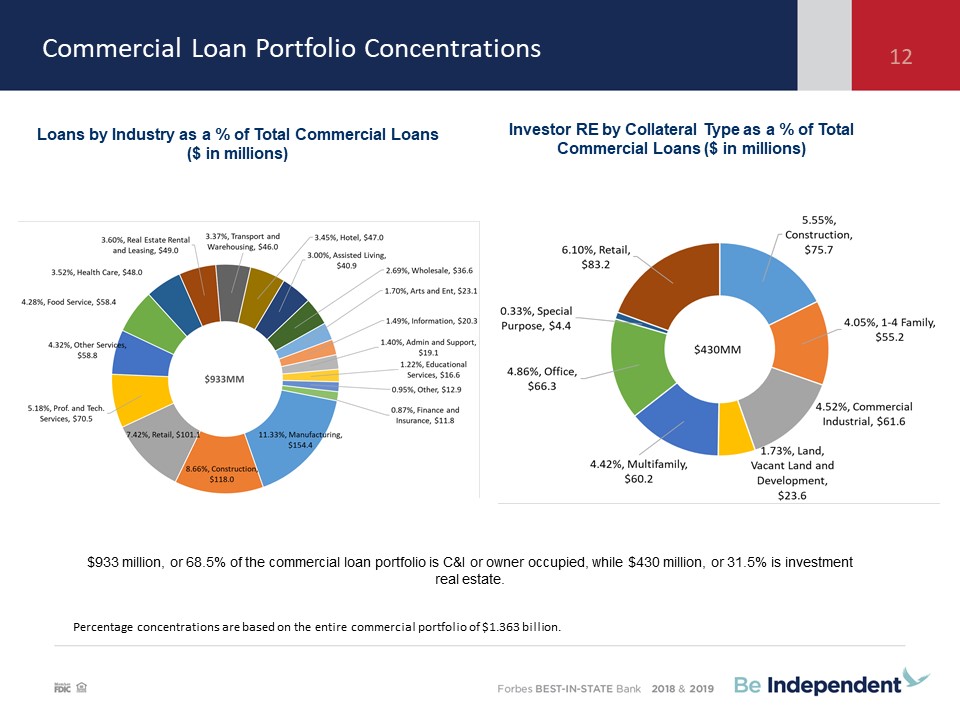

Loan Portfolio Concentrations by Industry Percentage concentrations are based on the entire commercial

portfolio of $1.363 billion. Loans by Industry as a % of Total Commercial Loans ($ in millions) Investor RE by Collateral Type as a % of Total Commercial Loans ($ in millions) $933 million, or 68.5% of the commercial loan portfolio is C&I

or owner occupied, while $430 million, or 31.5% is investment real estate. 12 Commercial Loan Portfolio Concentrations

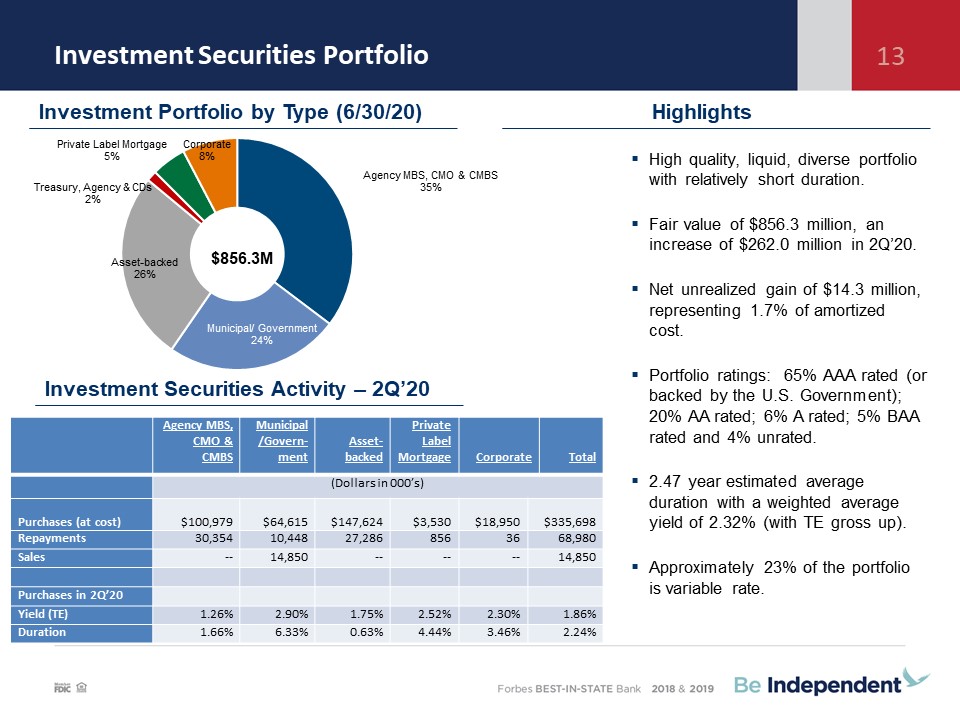

Investment Securities Portfolio 13 Highlights High quality, liquid, diverse portfolio with relatively

short duration.Fair value of $856.3 million, an increase of $262.0 million in 2Q’20.Net unrealized gain of $14.3 million, representing 1.7% of amortized cost.Portfolio ratings: 65% AAA rated (or backed by the U.S. Government); 20% AA rated; 6% A

rated; 5% BAA rated and 4% unrated.2.47 year estimated average duration with a weighted average yield of 2.32% (with TE gross up).Approximately 23% of the portfolio is variable rate. $856.3M Investment Portfolio by Type (6/30/20) Investment

Securities Activity – 2Q’20 Agency MBS, CMO & CMBS Municipal/Govern-ment Asset-backed Private Label Mortgage Corporate Total (Dollars in 000’s) Purchases (at

cost) $100,979 $64,615 $147,624 $3,530 $18,950 $335,698 Repayments 30,354 10,448 27,286 856 36 68,980 Sales -- 14,850 -- -- -- 14,850 Purchases in 2Q’20 Yield

(TE) 1.26% 2.90% 1.75% 2.52% 2.30% 1.86% Duration 1.66% 6.33% 0.63% 4.44% 3.46% 2.24%

Strong Capital Position 14 Source: S&P Global Market Intelligence and Company documents.Note:

Company closed acquisition of TCSB Bancorp, Inc. in Q2 ‘18. TCE / TA (%) Leverage Ratio (%) CET1 Ratio (%) Total RBC Ratio (%) IBCP Target 8.50% - 9.50 % Capital retention to support (i) organic growth and (ii) acquisitions; and Return

of capital through (i) strong and consistent dividend and (ii) share repurchases Long-Term Capital Priorities: Strong Capital Position

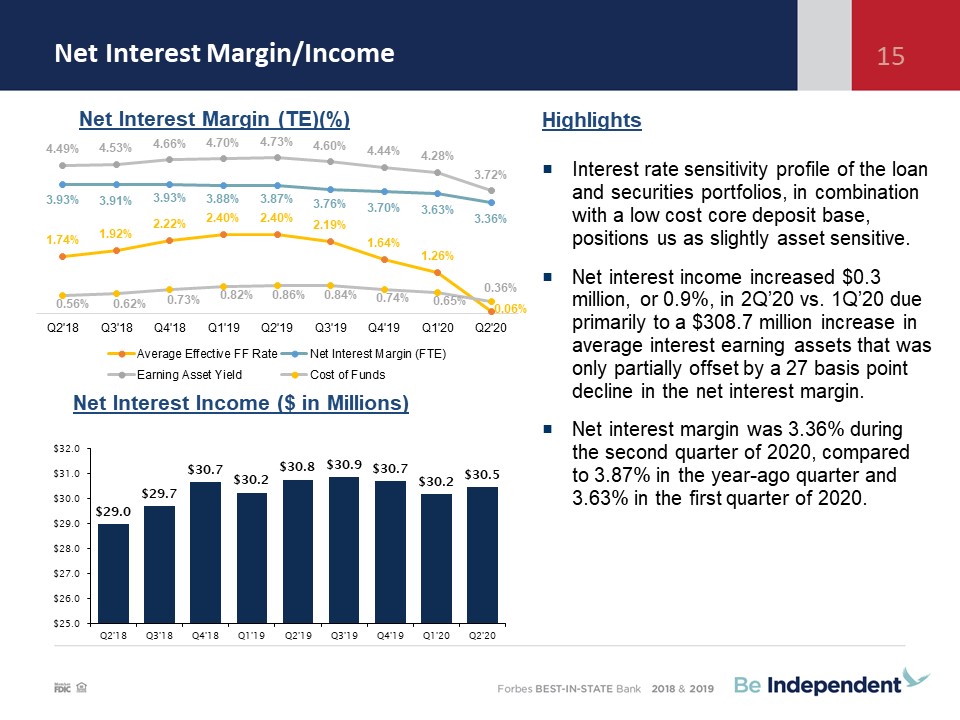

HighlightsInterest rate sensitivity profile of the loan and securities portfolios, in combination with a

low cost core deposit base, positions us as slightly asset sensitive.Net interest income increased $0.3 million, or 0.9%, in 2Q’20 vs. 1Q’20 due primarily to a $308.7 million increase in average interest earning assets that was only partially

offset by a 27 basis point decline in the net interest margin.Net interest margin was 3.36% during the second quarter of 2020, compared to 3.87% in the year-ago quarter and 3.63% in the first quarter of 2020. Net Interest Margin (TE)(%) Net

Interest Income ($ in Millions) Net Interest Margin/Income 15

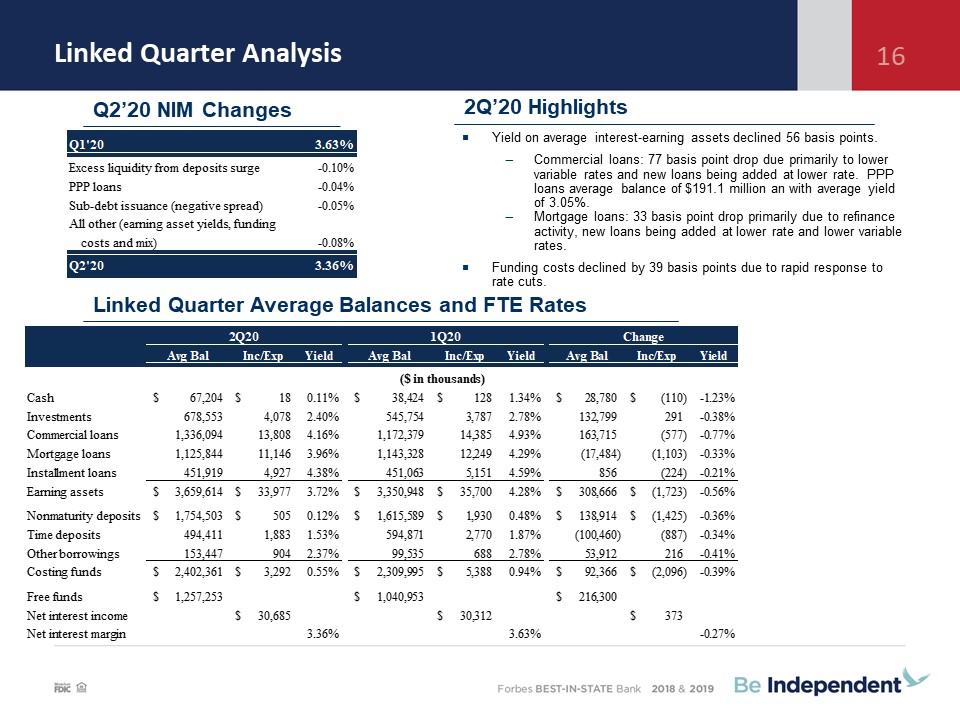

Linked Quarter Analysis 16 Q2’20 NIM Changes Linked Quarter Average Balances and FTE Rates Yield on

average interest-earning assets declined 56 basis points.Commercial loans: 77 basis point drop due primarily to lower variable rates and new loans being added at lower rate. PPP loans average balance of $191.1 million an with average yield of

3.05%.Mortgage loans: 33 basis point drop primarily due to refinance activity, new loans being added at lower rate and lower variable rates.Funding costs declined by 39 basis points due to rapid response to rate cuts. 2Q’20 Highlights

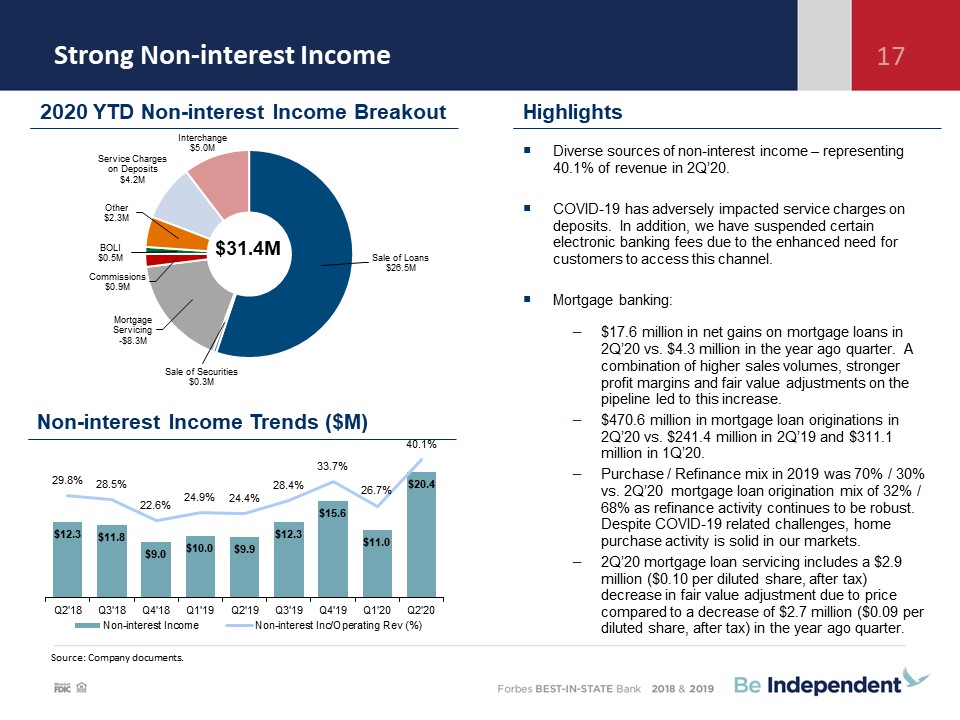

Strong Non-interest Income 17 Diverse sources of non-interest income – representing 40.1% of revenue in

2Q’20.COVID-19 has adversely impacted service charges on deposits. In addition, we have suspended certain electronic banking fees due to the enhanced need for customers to access this channel.Mortgage banking: $17.6 million in net gains on

mortgage loans in 2Q’20 vs. $4.3 million in the year ago quarter. A combination of higher sales volumes, stronger profit margins and fair value adjustments on the pipeline led to this increase.$470.6 million in mortgage loan originations in 2Q’20

vs. $241.4 million in 2Q’19 and $311.1 million in 1Q’20.Purchase / Refinance mix in 2019 was 70% / 30% vs. 2Q’20 mortgage loan origination mix of 32% / 68% as refinance activity continues to be robust. Despite COVID-19 related challenges, home

purchase activity is solid in our markets.2Q’20 mortgage loan servicing includes a $2.9 million ($0.10 per diluted share, after tax) decrease in fair value adjustment due to price compared to a decrease of $2.7 million ($0.09 per diluted share,

after tax) in the year ago quarter. Source: Company documents. $31.4M 2020 YTD Non-interest Income Breakout Non-interest Income Trends ($M) Highlights

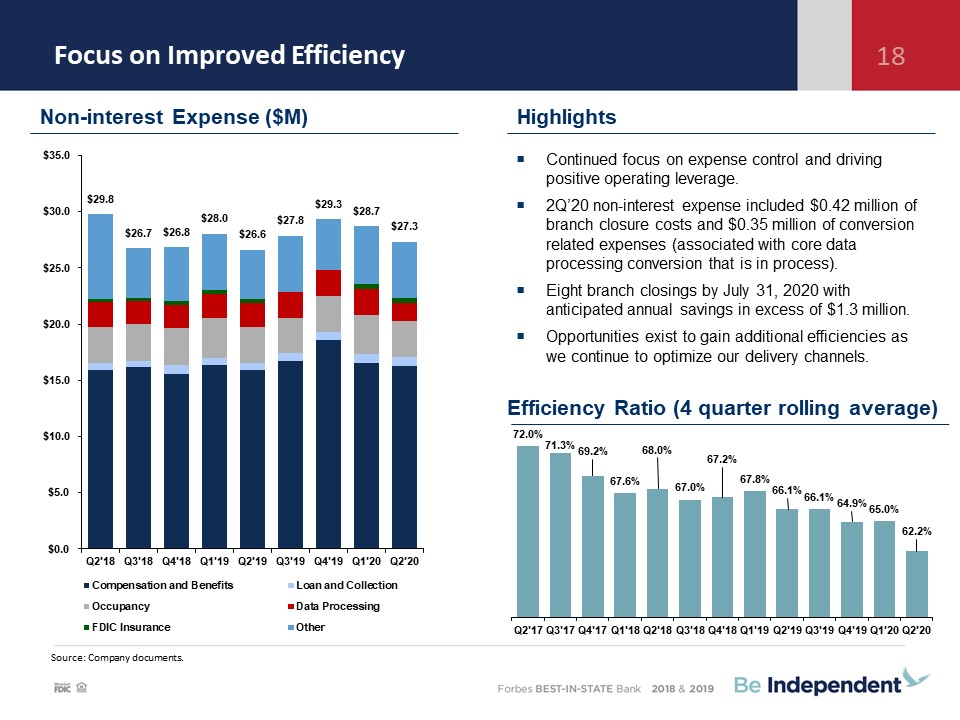

Focus on Improved Efficiency 18 Source: Company documents. Non-interest Expense

($M) Highlights Efficiency Ratio (4 quarter rolling average) Continued focus on expense control and driving positive operating leverage. 2Q’20 non-interest expense included $0.42 million of branch closure costs and $0.35 million of conversion

related expenses (associated with core data processing conversion that is in process).Eight branch closings by July 31, 2020 with anticipated annual savings in excess of $1.3 million.Opportunities exist to gain additional efficiencies as we

continue to optimize our delivery channels.

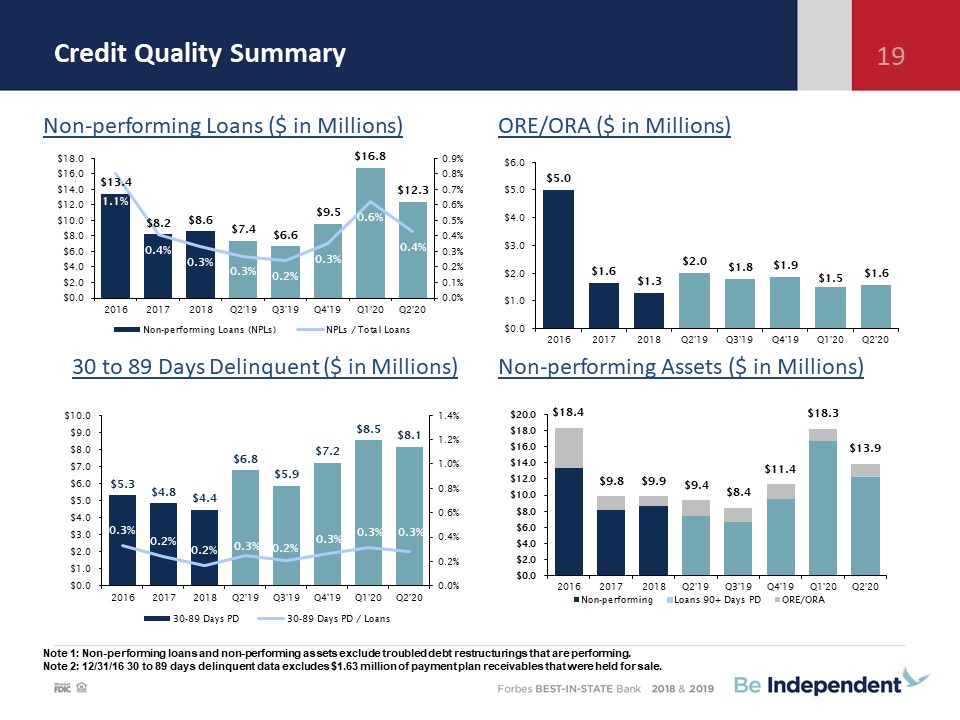

Credit Quality Summary Note 1: Non-performing loans and non-performing assets exclude troubled debt

restructurings that are performing.Note 2: 12/31/16 30 to 89 days delinquent data excludes $1.63 million of payment plan receivables that were held for sale. Non-performing Assets ($ in Millions) ORE/ORA ($ in Millions) Non-performing Loans ($

in Millions) 30 to 89 Days Delinquent ($ in Millions) 19

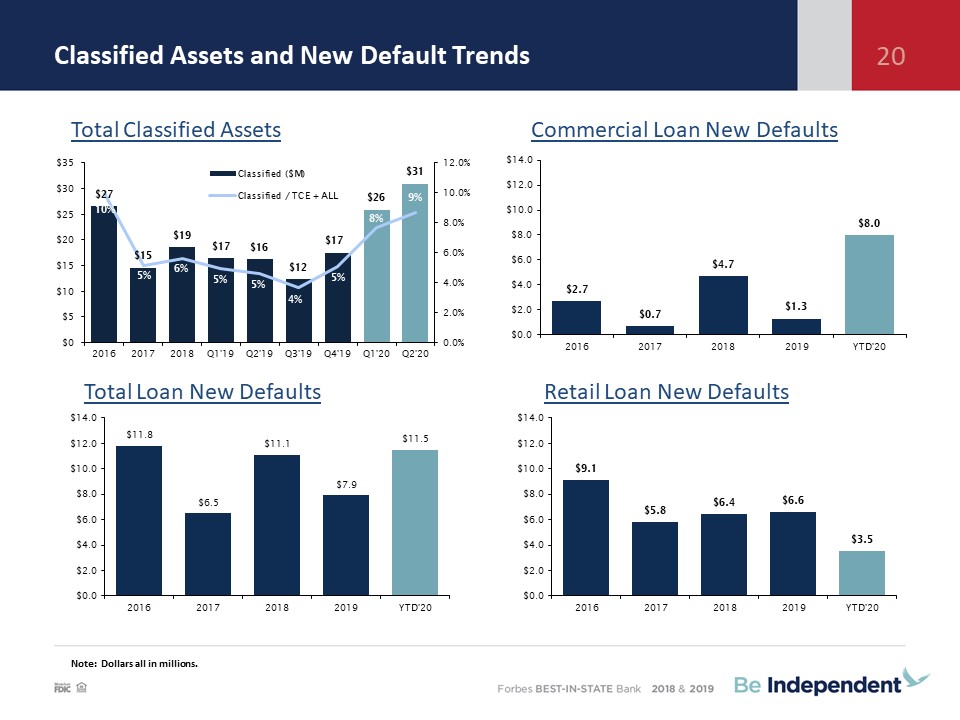

Classified Assets and New Default Trends Note: Dollars all in millions. Total Classified

Assets Commercial Loan New Defaults Total Loan New Defaults Retail Loan New Defaults 20

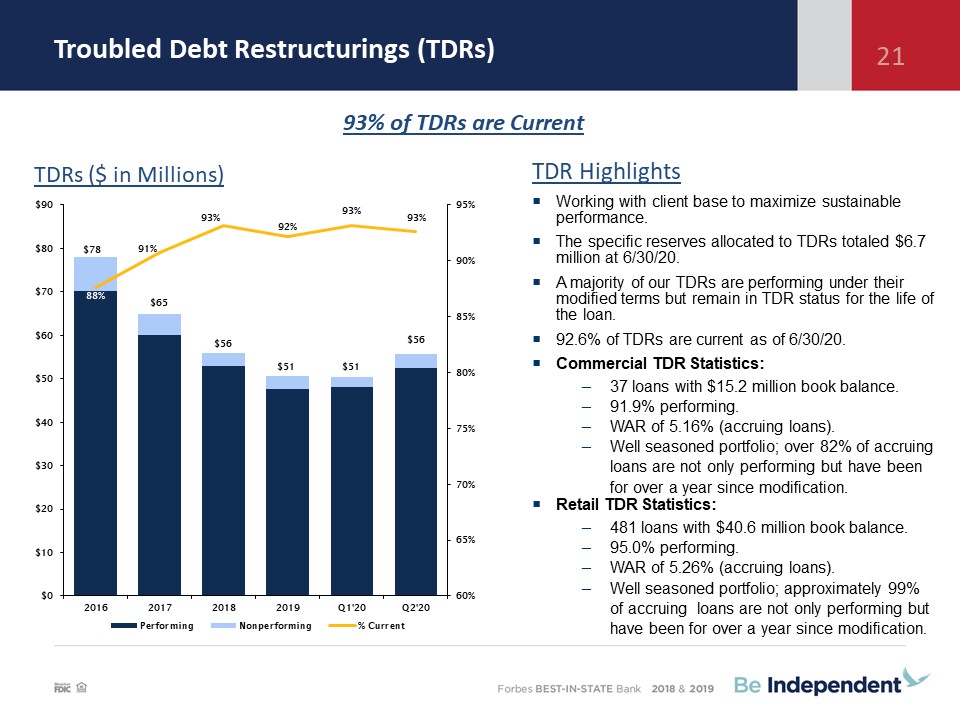

Troubled Debt Restructurings (TDRs) TDR HighlightsWorking with client base to maximize sustainable

performance.The specific reserves allocated to TDRs totaled $6.7 million at 6/30/20.A majority of our TDRs are performing under their modified terms but remain in TDR status for the life of the loan.92.6% of TDRs are current as of

6/30/20.Commercial TDR Statistics:37 loans with $15.2 million book balance.91.9% performing.WAR of 5.16% (accruing loans).Well seasoned portfolio; over 82% of accruing loans are not only performing but have been for over a year since

modification.Retail TDR Statistics:481 loans with $40.6 million book balance.95.0% performing.WAR of 5.26% (accruing loans).Well seasoned portfolio; approximately 99% of accruing loans are not only performing but have been for over a year since

modification. TDRs ($ in Millions) 93% of TDRs are Current 21

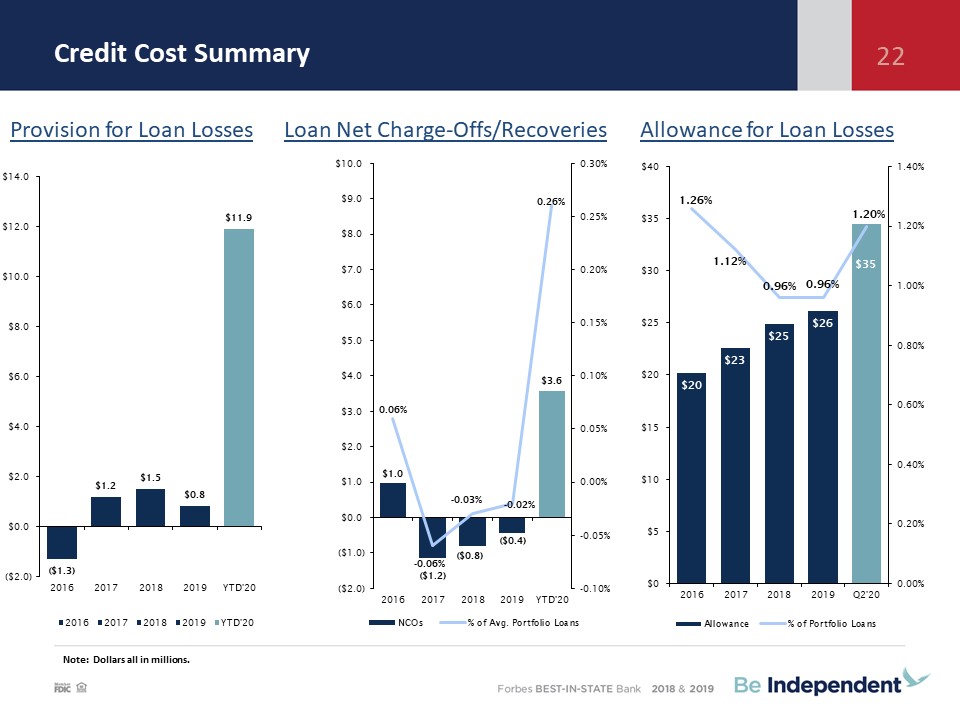

Note: Dollars all in millions. Provision for Loan Losses Loan Net Charge-Offs/Recoveries Allowance for

Loan Losses Credit Cost Summary 22

Incurred Loss Model vs CECL 23 Incurred vs. CECL ($ in Thousands) 6/30/20 “As If” ACL and percent of

loans calculated at midpoint of incremental range with additional $9.0 million at Day 1 and $8.7 million at Q2’20. % Loans 0.96% 1.20% 1.51%(1) “As-if CECL” Illustrative Only Incurred Loss Build We delayed adopting CECL under the CARES

Act:Increased visibility into the economic (local, regional, national) impact of the COVID-19 pandemic. Unemployment forecast sources exhibiting wide disparity.Relationship between unemployment and credit impacted by non-traditional factors,

including “stay at home” executive orders, increased unemployment eligibility as well as supplemental unemployment benefits. Incurred Model:Reserve build with Q2 provision expense of $5.2 million. June 30, 2020 allowance for loan losses of $34.5

million or,1.20% of portfolio loans;1.38% of portfolio loans excluding PPP loans and remaining Traverse City State Bank acquired loans; and280% of non-performing loans.Qualitative/subjective allocation increased $3.7 million in 2Q’20 (and by $8.6

million in the first six months of 2020) due to impact of: economic shock, high unemployment claims, “stay at home” executive orders and initial wave of forbearance requests.CECL:CECL day 1 impact range is $8.0 million to $10.0 million with $1.0

million to $2.0 million for unfunded commitments.“As if” CECL in Q2’20: $42.0 million to $45.0 million with $2.0 million to $3.0 million for unfunded commitments.CECL Model Details:Discounted cash flow model with fourteen loan

segments.Probability of default and loss given default based on long-term average for commercial loans and regression for mortgage and installment loans.Regression uses two year forecast / two year reversion to mean driven primarily by

unemployment.Unemployment data: median of Bloomberg survey: 11.1% Q2, falls to 9.5% in Q4, reaches 6.6% by Q4, 2021.Q factors: model maturity, economic shock and forbearance activity.Slightly lower loan balances (excluding PPP loans) at June 30,

2020. Allocation of Incurred ALLL $26,148 $34,500 $43,240 (1) $8,352 $8,000 to $10,000 $(260) 12/31/19 ALLL Reserve Build Under Incurred Loss 6/30/20 Incurred Loss Reserve "As If" Day

1 CECL Reserve "As If" Incremental 6/30 CECL Reserve Change 6/30/20 "As If" ACL

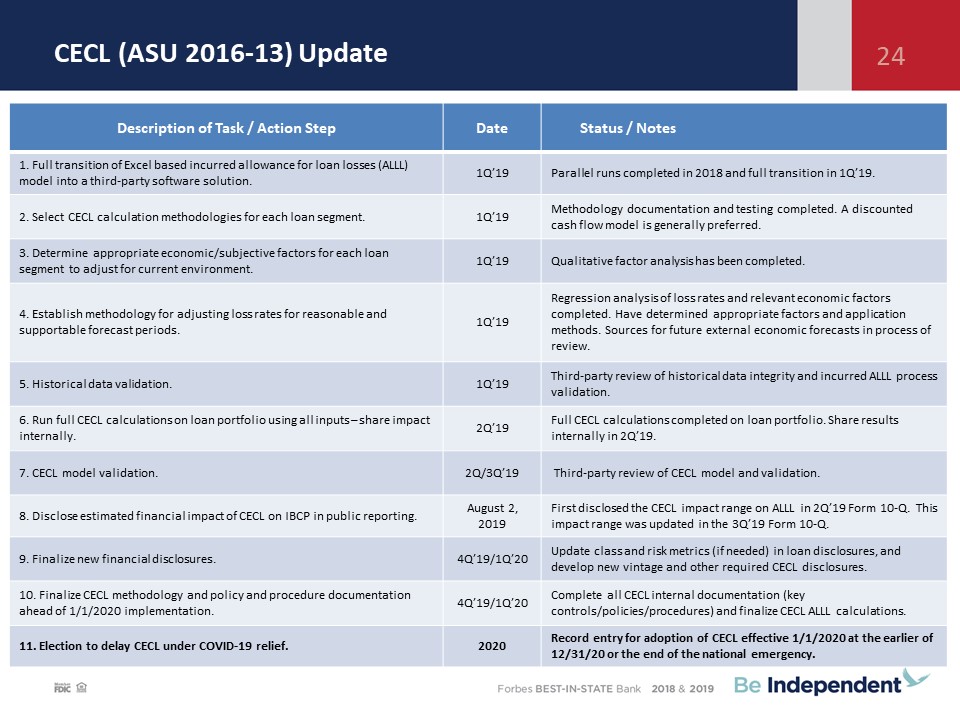

CECL (ASU 2016-13) Update Description of Task / Action Step Date Status / Notes 1. Full transition of

Excel based incurred allowance for loan losses (ALLL) model into a third-party software solution. 1Q’19 Parallel runs completed in 2018 and full transition in 1Q’19. 2. Select CECL calculation methodologies for each loan

segment. 1Q’19 Methodology documentation and testing completed. A discounted cash flow model is generally preferred. 3. Determine appropriate economic/subjective factors for each loan segment to adjust for current

environment. 1Q’19 Qualitative factor analysis has been completed. 4. Establish methodology for adjusting loss rates for reasonable and supportable forecast periods. 1Q’19 Regression analysis of loss rates and relevant economic factors

completed. Have determined appropriate factors and application methods. Sources for future external economic forecasts in process of review. 5. Historical data validation. 1Q’19 Third-party review of historical data integrity and incurred ALLL

process validation. 6. Run full CECL calculations on loan portfolio using all inputs – share impact internally. 2Q’19 Full CECL calculations completed on loan portfolio. Share results internally in 2Q’19. 7. CECL model validation. 2Q/3Q’19

Third-party review of CECL model and validation. 8. Disclose estimated financial impact of CECL on IBCP in public reporting. August 2, 2019 First disclosed the CECL impact range on ALLL in 2Q’19 Form 10-Q. This impact range was updated in the

3Q’19 Form 10-Q. 9. Finalize new financial disclosures. 4Q’19/1Q’20 Update class and risk metrics (if needed) in loan disclosures, and develop new vintage and other required CECL disclosures. 10. Finalize CECL methodology and policy and

procedure documentation ahead of 1/1/2020 implementation. 4Q’19/1Q’20 Complete all CECL internal documentation (key controls/policies/procedures) and finalize CECL ALLL calculations. 11. Election to delay CECL under COVID-19

relief. 2020 Record entry for adoption of CECL effective 1/1/2020 at the earlier of 12/31/20 or the end of the national emergency. 24

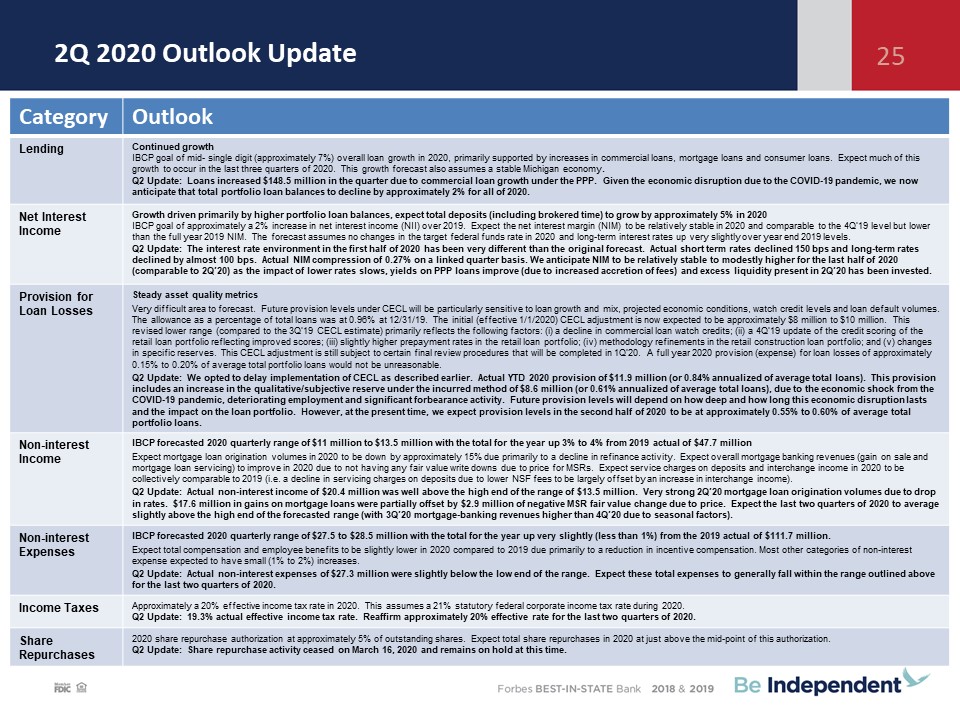

2Q 2020 Outlook Update Category Outlook Lending Continued growthIBCP goal of mid- single digit

(approximately 7%) overall loan growth in 2020, primarily supported by increases in commercial loans, mortgage loans and consumer loans. Expect much of this growth to occur in the last three quarters of 2020. This growth forecast also assumes a

stable Michigan economy.Q2 Update: Loans increased $148.5 million in the quarter due to commercial loan growth under the PPP. Given the economic disruption due to the COVID-19 pandemic, we now anticipate that total portfolio loan balances to

decline by approximately 2% for all of 2020. Net Interest Income Growth driven primarily by higher portfolio loan balances, expect total deposits (including brokered time) to grow by approximately 5% in 2020 IBCP goal of approximately a 2%

increase in net interest income (NII) over 2019. Expect the net interest margin (NIM) to be relatively stable in 2020 and comparable to the 4Q’19 level but lower than the full year 2019 NIM. The forecast assumes no changes in the target federal

funds rate in 2020 and long-term interest rates up very slightly over year end 2019 levels. Q2 Update: The interest rate environment in the first half of 2020 has been very different than the original forecast. Actual short term rates declined

150 bps and long-term rates declined by almost 100 bps. Actual NIM compression of 0.27% on a linked quarter basis. We anticipate NIM to be relatively stable to modestly higher for the last half of 2020 (comparable to 2Q’20) as the impact of lower

rates slows, yields on PPP loans improve (due to increased accretion of fees) and excess liquidity present in 2Q’20 has been invested. Provision for Loan Losses Steady asset quality metricsVery difficult area to forecast. Future provision

levels under CECL will be particularly sensitive to loan growth and mix, projected economic conditions, watch credit levels and loan default volumes. The allowance as a percentage of total loans was at 0.96% at 12/31/19. The initial (effective

1/1/2020) CECL adjustment is now expected to be approximately $8 million to $10 million. This revised lower range (compared to the 3Q’19 CECL estimate) primarily reflects the following factors: (i) a decline in commercial loan watch credits; (ii)

a 4Q’19 update of the credit scoring of the retail loan portfolio reflecting improved scores; (iii) slightly higher prepayment rates in the retail loan portfolio; (iv) methodology refinements in the retail construction loan portfolio; and (v)

changes in specific reserves. This CECL adjustment is still subject to certain final review procedures that will be completed in 1Q’20. A full year 2020 provision (expense) for loan losses of approximately 0.15% to 0.20% of average total

portfolio loans would not be unreasonable.Q2 Update: We opted to delay implementation of CECL as described earlier. Actual YTD 2020 provision of $11.9 million (or 0.84% annualized of average total loans). This provision includes an increase in

the qualitative/subjective reserve under the incurred method of $8.6 million (or 0.61% annualized of average total loans), due to the economic shock from the COVID-19 pandemic, deteriorating employment and significant forbearance activity. Future

provision levels will depend on how deep and how long this economic disruption lasts and the impact on the loan portfolio. However, at the present time, we expect provision levels in the second half of 2020 to be at approximately 0.55% to 0.60%

of average total portfolio loans. Non-interest Income IBCP forecasted 2020 quarterly range of $11 million to $13.5 million with the total for the year up 3% to 4% from 2019 actual of $47.7 millionExpect mortgage loan origination volumes in 2020

to be down by approximately 15% due primarily to a decline in refinance activity. Expect overall mortgage banking revenues (gain on sale and mortgage loan servicing) to improve in 2020 due to not having any fair value write downs due to price for

MSRs. Expect service charges on deposits and interchange income in 2020 to be collectively comparable to 2019 (i.e. a decline in servicing charges on deposits due to lower NSF fees to be largely offset by an increase in interchange income). Q2

Update: Actual non-interest income of $20.4 million was well above the high end of the range of $13.5 million. Very strong 2Q’20 mortgage loan origination volumes due to drop in rates. $17.6 million in gains on mortgage loans were partially

offset by $2.9 million of negative MSR fair value change due to price. Expect the last two quarters of 2020 to average slightly above the high end of the forecasted range (with 3Q’20 mortgage-banking revenues higher than 4Q’20 due to seasonal

factors). Non-interest Expenses IBCP forecasted 2020 quarterly range of $27.5 to $28.5 million with the total for the year up very slightly (less than 1%) from the 2019 actual of $111.7 million.Expect total compensation and employee benefits to

be slightly lower in 2020 compared to 2019 due primarily to a reduction in incentive compensation. Most other categories of non-interest expense expected to have small (1% to 2%) increases.Q2 Update: Actual non-interest expenses of $27.3 million

were slightly below the low end of the range. Expect these total expenses to generally fall within the range outlined above for the last two quarters of 2020. Income Taxes Approximately a 20% effective income tax rate in 2020. This assumes a

21% statutory federal corporate income tax rate during 2020.Q2 Update: 19.3% actual effective income tax rate. Reaffirm approximately 20% effective rate for the last two quarters of 2020. Share Repurchases 2020 share repurchase authorization at

approximately 5% of outstanding shares. Expect total share repurchases in 2020 at just above the mid-point of this authorization.Q2 Update: Share repurchase activity ceased on March 16, 2020 and remains on hold at this time. 25

Strategic Initiatives 26 Improve net interest income via balanced loan growth, disciplined risk

adjusted loan pricing and active management of deposit pricing. Innovative and targeted customer acquisition, retention and cross sales strategies leveraging data analytics, inside sales staff, and intra-company referrals with strategic business

unit partners.Add new customers and grow revenue through outbound calling.Add new customers and grow revenue through the addition of new talented sales professionals in our existing markets. Supplement our organic growth initiatives via selective

and opportunistic bank acquisitions and branch acquisitions. Growth Completion of core data processing provider contract.On-going branch optimization: including assessing existing locations; new locations; service hours; staffing;

workflow; and our leveraging of existing technology. Modernize branch delivery technology/systems.Expand Digital Branch (Call Center) services.All business lines and departments: streamline/automate operating processes and workflows Build/enhance

dashboard reporting and business intelligence. Process Improvement & Cost Controls We recognize that the path to organizational success is through the success of each and every one of our team members. Accordingly we encourage and

support the professional development of our colleagues through our IB Leadership Program, mentoring and other initiatives. We are passionate about our desire to ensure that our team members are empowered and supported in a way that will best

position them to serve our customers. We believe that if we are committed to the well-being of our team members, and recognize and reward their contributions, they will ensure our success. Talent Management Maintain strong, high quality,

capital levels – augmented by consistent earnings. Maintain excellent asset quality and strong proactive monitoring.Active liquidity and interest rate risk monitoring and management.Strong, independent and collaborative risk management, utilizing

3 layers of defense (business unit, risk management and internal audit). Effective operational controls with special emphasis on cyber security, fraud prevention, regulatory compliance, crisis communications and business continuity plan.Effective

working relationships with banking regulators and other key outside oversight partners. Risk Management

Q&A and Closing Remarks Question and Answer SessionClosing RemarksThank you for attending!NASDAQ:

IBCP 27