Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - QUANTENNA COMMUNICATIONS INC | exhibit992quantennaq4fy2.htm |

| 8-K - 8-K - QUANTENNA COMMUNICATIONS INC | qtna-21218x8k.htm |

| EX-99.1 - EXHIBIT 99.1 - QUANTENNA COMMUNICATIONS INC | exhibit991newsrelease-21218.htm |

Fourth Quarter 2017 Earnings Presentation

February 12, 2018

Semiconductors Cloud Analytics

System

Software

Wi-Fi Perfected

is

Safe Harbor and Non-GAAP Financial Measures

2

This presentation contains “forward-looking” statements that are based on our beliefs and assumptions and on information

currently available to us. Forward-looking statements include information concerning our possible or assumed future results

of operations, business strategies, product development plans, competitive position, potential growth opportunities, use of

proceeds and the effects of competition. Forward-looking statements include all statements that are not historical facts and

can be identified by terms such as “anticipate,” “believe,” “could,” “seek,” “estimate,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “will,” “would” or similar expressions and the negatives of those terms.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual

results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements. These risks, uncertainties and other factors include, but are not

limited to, the risk factors listed in our 10-K dated March 2, 2017 and subsequent 10Q filings. Forward-looking statements

represent our beliefs and assumptions only as of the date of this presentation. Except as required by law, we assume no

obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially

from those anticipated in the forward-looking statements, even if new information becomes available in the future.

This presentation includes certain non-GAAP financial measures as defined by the SEC rules. We have provided a

reconciliation of those measures to the most directly comparable GAAP measures, which is available in the appendix to this

presentation.

$40

$67

$84

$129

$176

2013 2014 2015 2016 2017

At a Glance

3

Strong Revenue Growth Profile

$MM

150 million+

chips shipped

60+

products with

Quantenna inside

50+

service providers

40+

OEMs / ODMs

~400

employees

45%

CAGR

85+

patents

Company Highlights

High-performance Wi-Fi leader

Pioneer in both 8x8 and 4x4 advanced MIMO technology

Trendsetter and influencer within IEEE 802.11 standards body

Proven execution & innovation

across four generations of solutions

Land and expand within each product generation yields rapid

revenue growth with less incremental selling expense

Sustainable advantage & multiple

barriers to entry

Over 1,400 man years of R&D and IP development

Long product lifecycles and sticky

design wins

Service provider positioning in Wi-Fi is unmatched

Over 90% follow-on design success with existing sockets

Demonstrated initial success with

multiple growth drivers

Service provider telco opened up satellite opportunity >> current

opportunity is cable MSO >> future is retail and enterprise

Attractive financial model with

significant operating leverage

Drove a 45% CAGR in revenue over last five years

Generated cash from operations for the last two fiscal years

Strong gross margin profile of ~50%

4

Premium Strategy Drives Share Gains Each Tech Cycle

5

Current Wi-Fi Generation Future Wi-Fi Generation

Mainstream

Low Cost

Premium

Mainstream

Low Cost

Premium

Launch next-

generation products

Continue leadership in the premium

market with new products

Extend the previous generation to mainstream with

cost-optimized products and introduce new products

Diverse Applications

Retail Access Point

Video Bridge

Broadband Gateway

Wi-Fi Booster Repeater & Mesh Node

Video Client

Enterprise / Outdoor

6

Sizing Up the Premium Wi-Fi Market

7

Total Wi-Fi Chipset Revenue

$2.1 B $2.6 B

$1.5 B

$1.4 B

$0.2 B $1.3 B

2016 2021

Source: ABI Research Wi-Fi Market Data 3Q 2016, Table 4, Table 11 and Table 26 and Quantenna assumptions

Portable Devices include cellular phones, laptops, netbooks, Ultrabooks, Chromebooks, PC accessories, mobile devices, gaming controllers, OEM remote controls, 3D glasses, and wearables and healthcare devices

Non-Portable Devices include networking, set-top boxes, televisions, gaming consoles, DVD / Blu-ray players, desktop PCs, printers, smart home, automotive, industrial, and others

2.1 B

2.9 B

0.7 B

1.1 B

0.0 B

0.2 B

2016 2021

Total Wi-Fi Enabled Device Shipments

53%

2016-2021

CAGR

8%

7%

50%

2016-2021

CAGR

-2%

4%

Premium Wi-Fi * in

Non-Portable Devices

Mainstream Wi-Fi in

Non-Portable Devices

Wi-Fi in Portable

Devices

* Premium Wi-Fi chipsets are

defined by 4x4 MIMO or

higher performance.

Quantenna’s premium Wi-Fi

technology leads the high

performance, non-portable

device market.

Q4 2017 Financial Highlights

Quarterly revenue of $41.3 million

• 10% Y/Y growth vs Q4 2016

Gross margin of 51.7%

• Within the 50.5% to 52.5% guidance range

• Up 270bps Q/Q vs Q3 2017

Earnings of $0.5 million

• $0.01 in EPS exceeded ($0.02) to ($0.04)

guidance range

0

30

60

90

120

150

180

Q4 2016 Q4 2017 2016 2017

37%

YoY

Strong Revenue Growth Profile

$MM

10%

YoY

8

*Gross margin, income and EPS figures are fully diluted based on non-GAAP reporting which excludes stock-based compensation and other specified one-time items. See reconciliation table.

TTM means trailing twelve months.

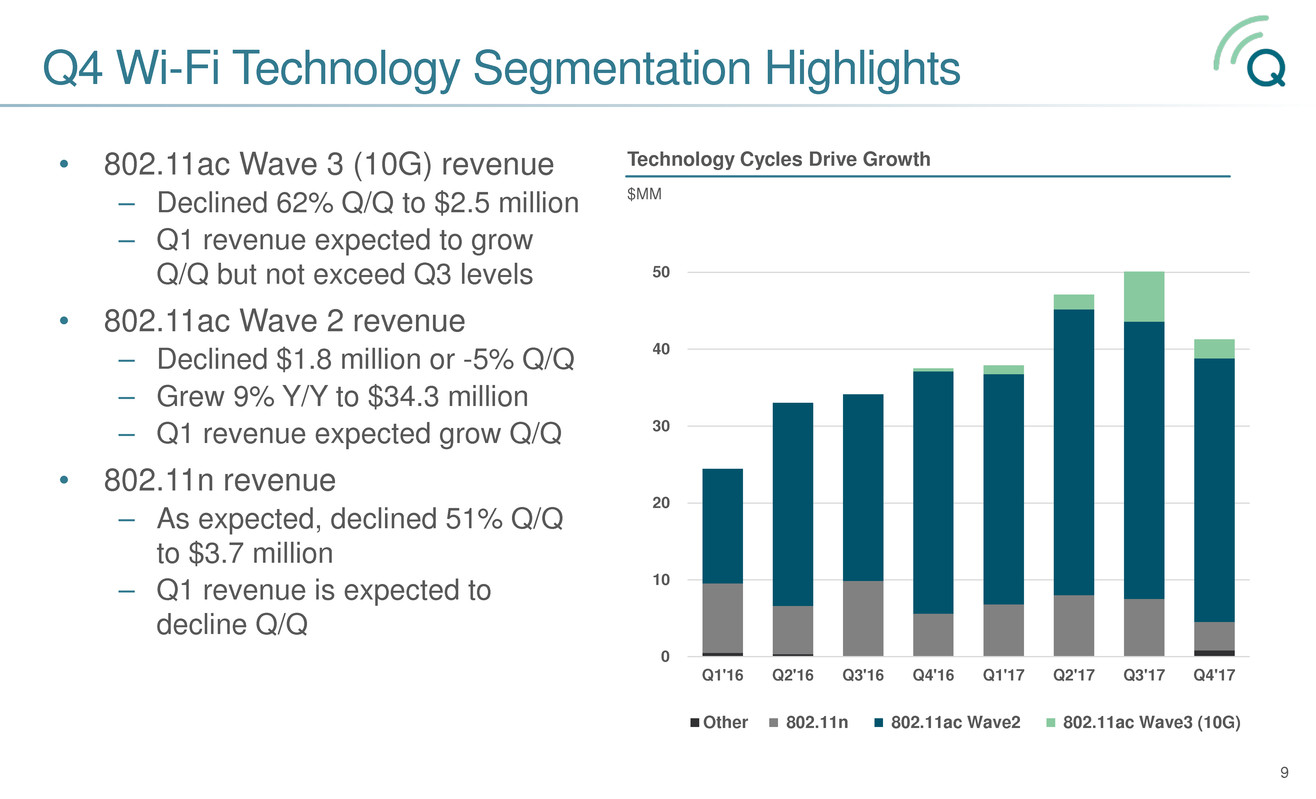

Technology Cycles Drive Growth

$MM

0

10

20

30

40

50

Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17

Other 802.11n 802.11ac Wave2 802.11ac Wave3 (10G)

• 802.11ac Wave 3 (10G) revenue

– Declined 62% Q/Q to $2.5 million

– Q1 revenue expected to grow

Q/Q but not exceed Q3 levels

• 802.11ac Wave 2 revenue

– Declined $1.8 million or -5% Q/Q

– Grew 9% Y/Y to $34.3 million

– Q1 revenue expected grow Q/Q

• 802.11n revenue

– As expected, declined 51% Q/Q

to $3.7 million

– Q1 revenue is expected to

decline Q/Q

Q4 Wi-Fi Technology Segmentation Highlights

9

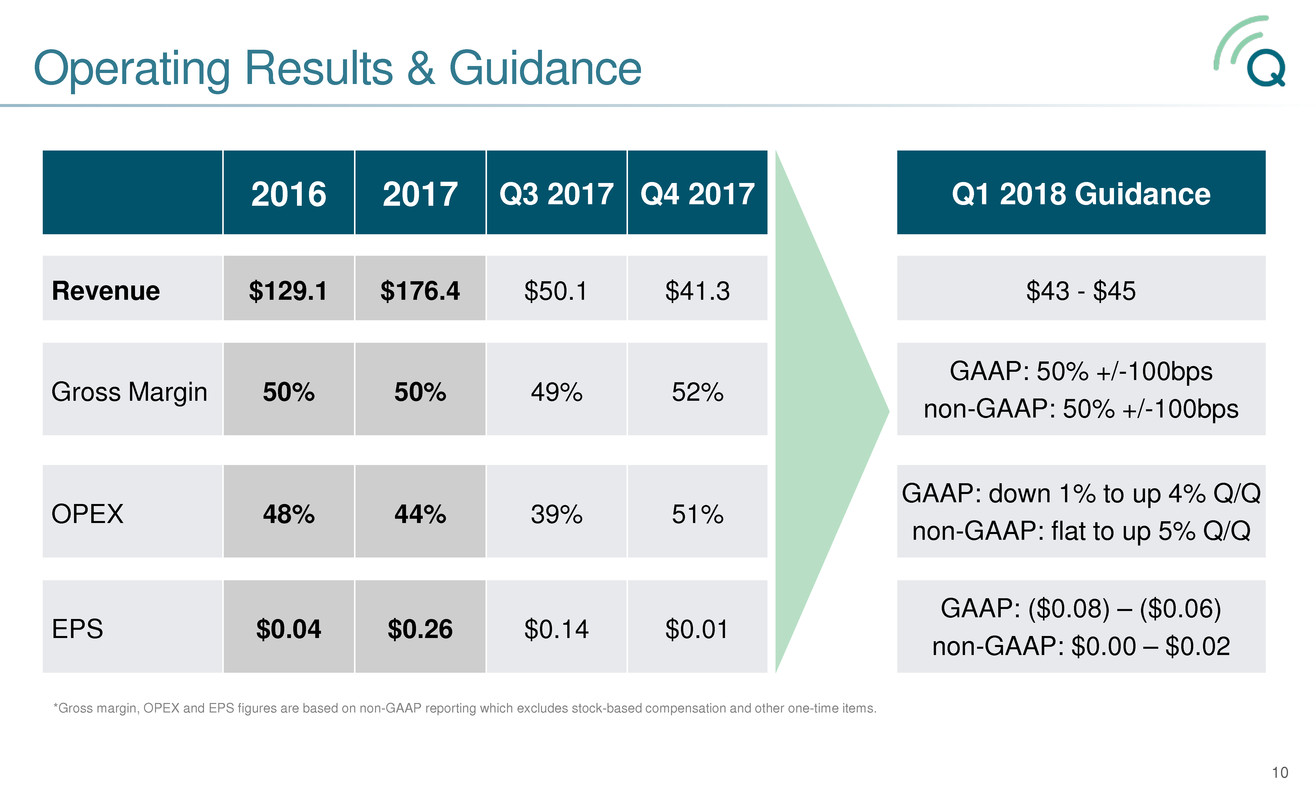

Operating Results & Guidance

2016 2017 Q3 2017 Q4 2017 Q1 2018 Guidance

Revenue $129.1 $176.4 $50.1 $41.3 $43 - $45

Gross Margin 50% 50% 49% 52%

GAAP: 50% +/-100bps

non-GAAP: 50% +/-100bps

OPEX 48% 44% 39% 51%

GAAP: down 1% to up 4% Q/Q

non-GAAP: flat to up 5% Q/Q

EPS $0.04 $0.26 $0.14 $0.01

GAAP: ($0.08) – ($0.06)

non-GAAP: $0.00 – $0.02

10

*Gross margin, OPEX and EPS figures are based on non-GAAP reporting which excludes stock-based compensation and other one-time items.

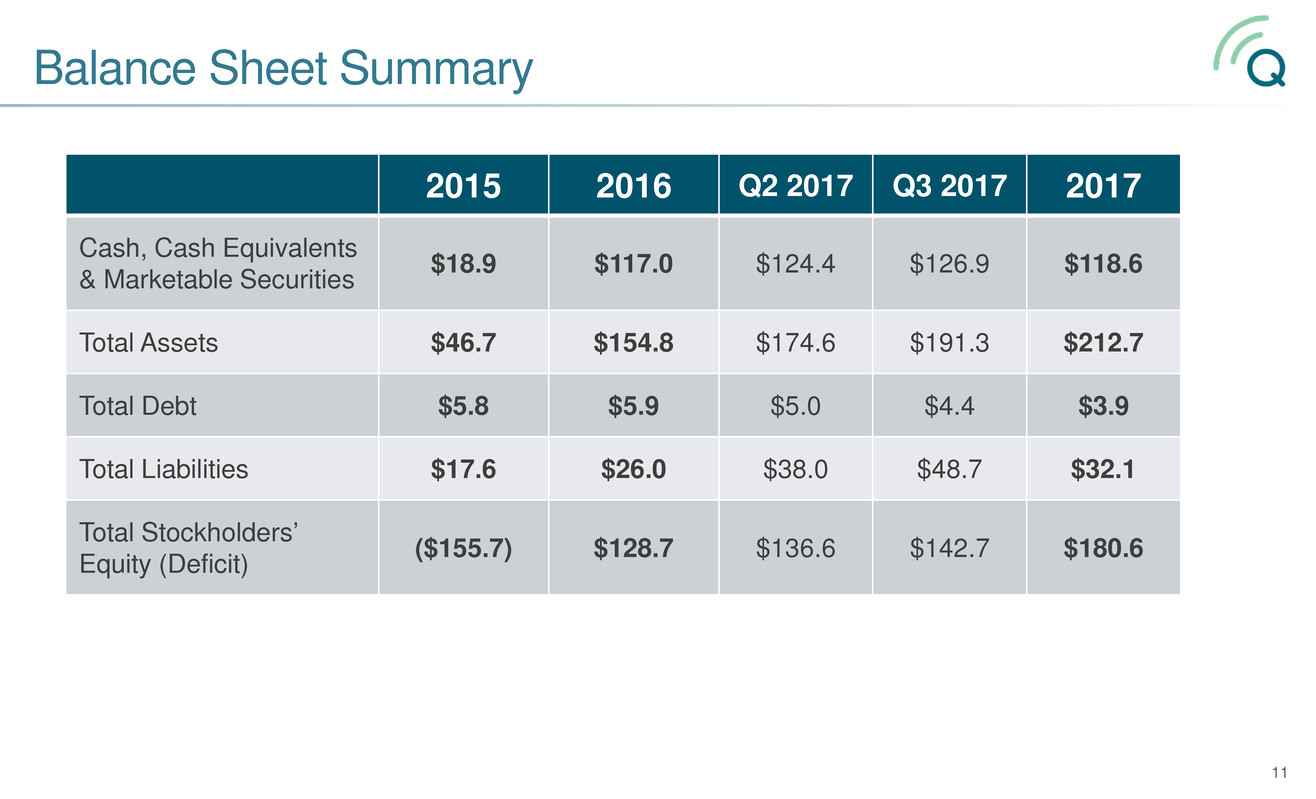

Balance Sheet Summary

2015 2016 Q2 2017 Q3 2017 2017

Cash, Cash Equivalents

& Marketable Securities $18.9 $117.0 $124.4 $126.9 $118.6

Total Assets $46.7 $154.8 $174.6 $191.3 $212.7

Total Debt $5.8 $5.9 $5.0 $4.4 $3.9

Total Liabilities $17.6 $26.0 $38.0 $48.7 $32.1

Total Stockholders’

Equity (Deficit) ($155.7) $128.7 $136.6 $142.7 $180.6

11

Appendix

12

Non-GAAP to GAAP Operating Margin Reconciliation

13

SBC means stock-based compensation, non-recurring items comprised of executive severance, percentages may not total due to rounding

2015 2016 Q3 2017 Q4 2017 2017

Non-GAAP Gross Margin 49% 50% 49% 52% 50%

SBC: Gross Margin 0% 0% 0% 0% 0%

GAAP Gross Margin 49% 50% 49% 52% 50%

Non-GAAP Operating Margin (6%) 2% 10% 0% 6%

SBC: R&D 0% 1% 3% 4% 3%

SBC: S&M 1% 0% 1% 1% 1%

SBC: G&A 1% 1% 2% 2% 2%

Non-recurring items 0% 0% 0% 0% 0%

GAAP Operating Margin (7%) (1%) 5% (8%) (1%)

Non-GAAP to GAAP Net Margin Reconciliation

14

SBC means stock-based compensation, non-recurring items comprised of executive severance and income tax adjustment relating to recognition of US Federal

deferred tax asset pursuant to release of valuation allowance. Percentages may not total due to rounding

2015 2016 Q3 2017 Q4 2017 2017

Non-GAAP Net Margin (7%) 1% 11% 1% 6%

SBC: Gross Margin 0% 0% 0% 0% 0%

SBC: R&D 0% 1% 3% 4% 3%

SBC: S&M 1% 0% 1% 1% 1%

SBC: G&A 1% 1% 2% 2% 2%

Non-recurring items 0% 0% 0% (85%) (20%)

GAAP Net Margin (8%) (1%) 6% 78% 20%

Wi-Fi Perfected™

15

Semiconductors Cloud Analytics

System

Software