Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - AutoWeb, Inc. | ex99-1.htm |

| 8-K - CURRENT REPORT - AutoWeb, Inc. | auto8k.htm |

Exhibit

99.2

AUTOWEB, INC.

Moderator: Sean Mansouri

November 2, 2017

5:00 p.m. ET

Operator:

This is Conference

#8799839.

Good

afternoon, everyone, and thank you for participating in

today’s conference call to discuss AutoWeb’s financial

results for the third quarter ended September 30, 2017. Joining us

today are AutoWeb’s President and CEO, Jeff Coats; the

company’s CFO, Kimberly Boren; and the company’s

outside investor relations adviser, Sean Mansouri, with Liolios

Group. As a reminder, this conference call is being recorded.

Following their remarks, we’ll open the call for your

questions.

I would

now like to turn the call over to Mr. Mansouri for some

introductory comments.

Sean

Mansouri:

Thank you. Before I

introduce Jeff, I’ll remind you that during today’s

call, including the question-and-answer session, any projections

and forward-looking statements made regarding future events or

AutoWeb’s future financial performance are covered by the

safe harbor statements contained in today’s press release,

the slides accompanying this presentation and the company’s

public filings with the SEC. Actual events may differ materially

from those forward-looking statements. Specifically, please refer

to the company’s Form 10-Q for the quarter ended September

30, 2017, which was filed prior to this call as well as other

filings made by AutoWeb with the SEC from time-to-time. These

filings identify factors that could cause results to differ

materially from those forward-looking statements.

There

are slides included with today’s presentation to help

illustrate some of the points being made and discussed during the

call. The slides can be accessed by visiting AutoWeb’s

website at www.autoweb.com.

When there, go to Investor Relations and then click on Events &

Presentations. Please also note that during this call and/or in the

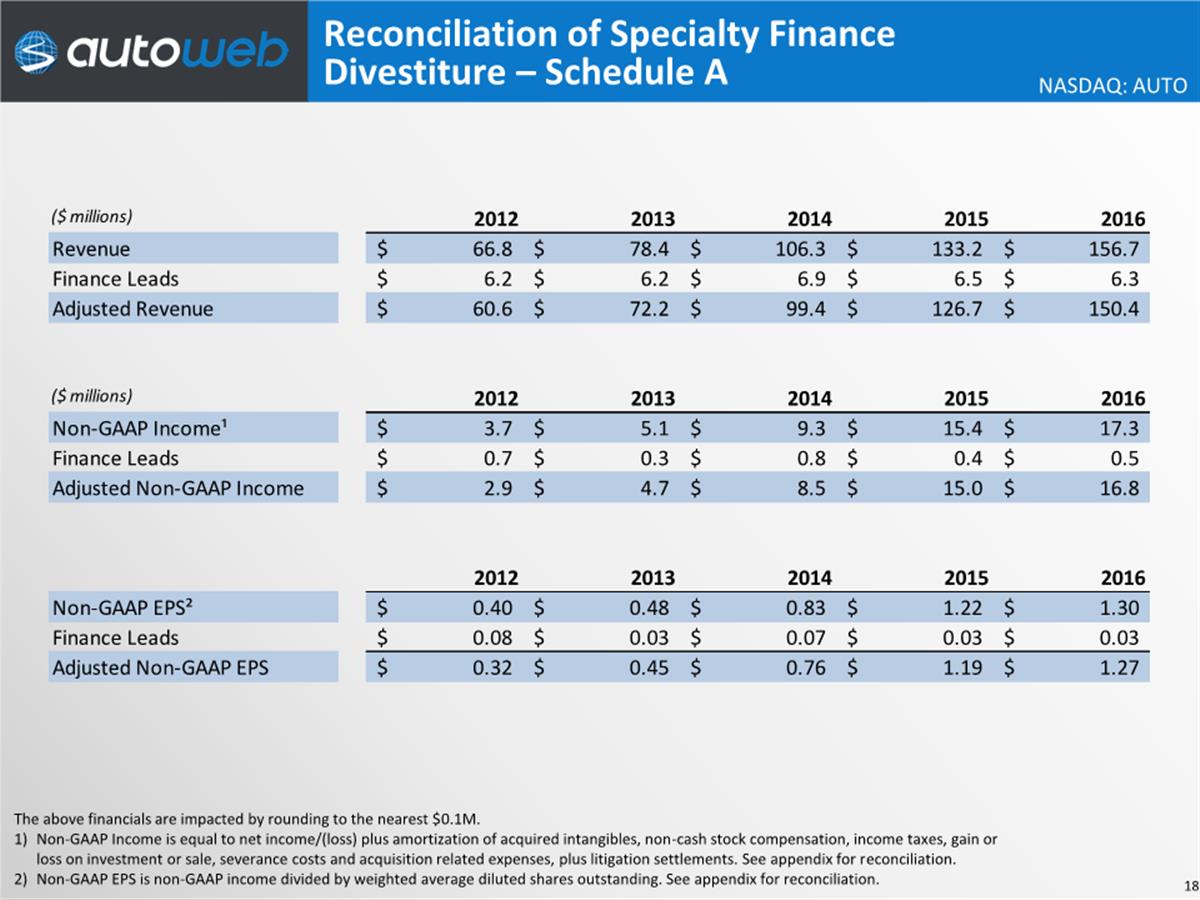

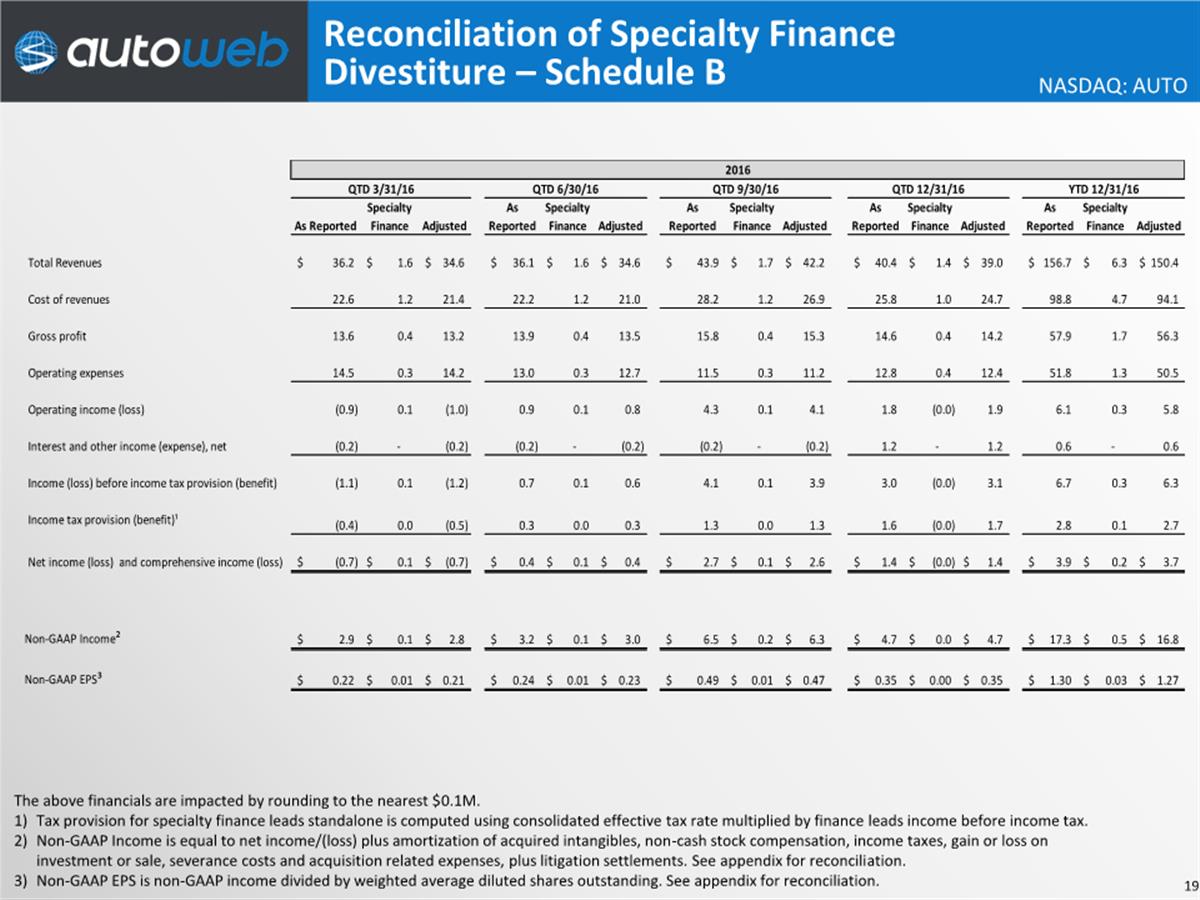

accompanying slides, management will be disclosing non-GAAP income

and non-GAAP EPS. For purposes of its 2017 guidance, we’ll be

adjusting 2016 revenues and non-GAAP EPS to reflect the exclusion

of the company’s specialty finance leads product that was

divested at December 31, 2016, and for year-over-year comparisons,

prior year results with the exception of cash flow from operations

for all periods presented are adjusted to exclude the

company’s specialty finance leads product, which was divested

on December 31, 2016. These are non-GAAP financial measures as

defined by SEC Regulation G. Reconciliations of these non-GAAP

financial measures to the most directly comparable GAAP measures

are included in today’s press release and/or in the slides,

which are posted on the company’s website.

And

with that, I’ll turn the call over to Jeff.

Jeffrey

Coats:

Thank you, Sean.

Good afternoon, everyone. Thank you for joining us today to discuss

our third quarter 2017 results. As a reminder to those of you who

are new to AutoWeb, we were founded 22 years ago at 1995 as

Autobytel, the original pioneer and leading provider of digital

online automotive marketing services connecting in-market car

buyers with our dealer and manufacturer customers. We recently

initiated the corporate rebranding and renamed the company AutoWeb

as we believe this name better aligns with today’s corporate

strategy and operations. Our third quarter was highlighted by the

continued strong growth of our clicks business, which was up more

than 15 percent from Q2 and 35 percent from the year-ago quarter

for record revenues of $7.4 million.

During

the quarter, we also made progress, implementing solutions to

improve our traffic acquisition as we work to continue to rebuild

our original high-quality traffic streams from quarters passed.

Each subsequent month, we’re seeing improvements to margin

and conversion rates as our systems continuously relearn and build

upon the previous months’ bid optimization

processes.

During

the quarter, we also purchased the usedtrucks.com URL and have

begun investing in the development of the site. We expect this

strong domain to be a key part of accelerating growth and our used

product moving forward. As you may recall this builds upon two of

our key stated its initiatives for 2017 by expanding our used

vehicles business and enhancing consumer-facing

properties.

Subsequent to the

quarter, we licensed the RoiQ audience creation and management

platform from DealerX. RoiQ utilizes a proprietary platform and

technology for targeted online marketing to end market car buyers.

This platform employs extensive machine learning to determine when

and what content to show a consumer across multiple devices. This

audience intelligence will enable us to generate highly targeted

clicks and leads for our dealer and OEM customers, while building

upon our initiatives to diversify and expand our sources of

high-quality traffic.

Before

commenting further on these exciting developments, I would like to

turn the call over to Kim and have her take us through the

important details of our Q3 financial results. Kim?

Kimberly

Boren:

Thanks, Jeff, and

good afternoon, everyone. As noted in our press release today, for

year-over-year comparative purposes, the results for all periods

presented and discussed on our call today exclude our specialty

finance leads product, which was divested on December 31,

2016.

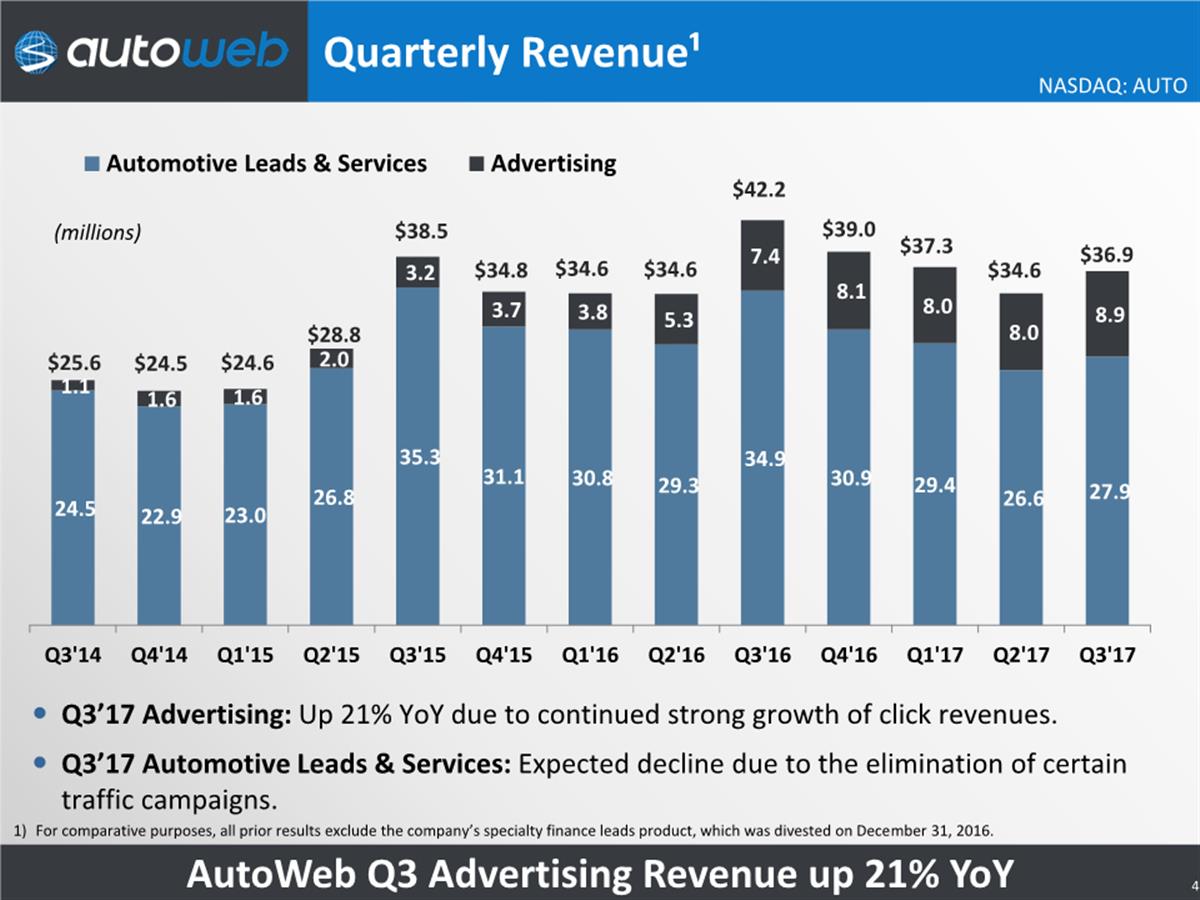

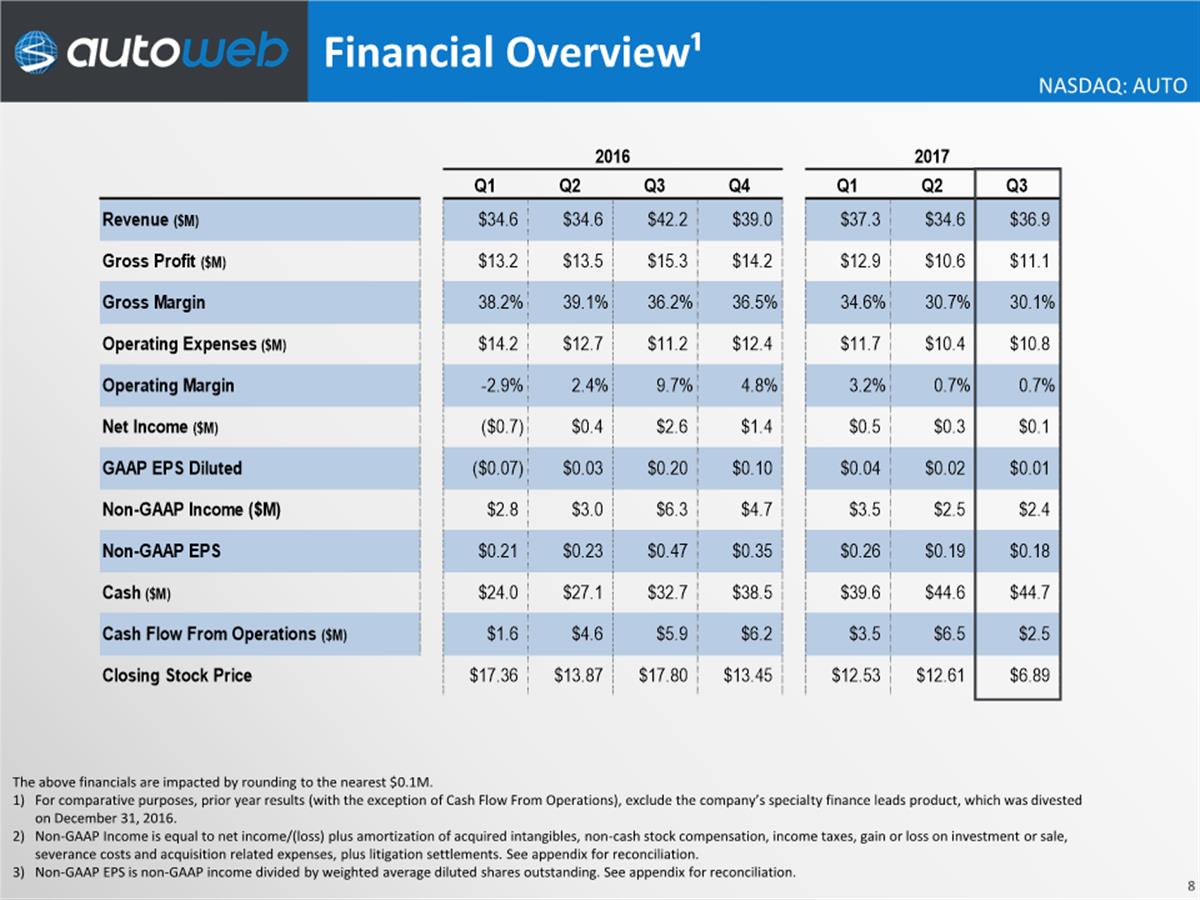

For

those of you following along with our earnings presentation, on

slide four, you can see that our third quarter revenue came in at

$36.9 million, down from $42.2 million in the adjusted year-ago

quarter. The expected decline was largely driven by the effect of

eliminated lower quality traffic campaign that we discussed last

quarter. This was partially offset by the continued strong growth

in advertising revenues, which increased 21 percent to $8.9

million.

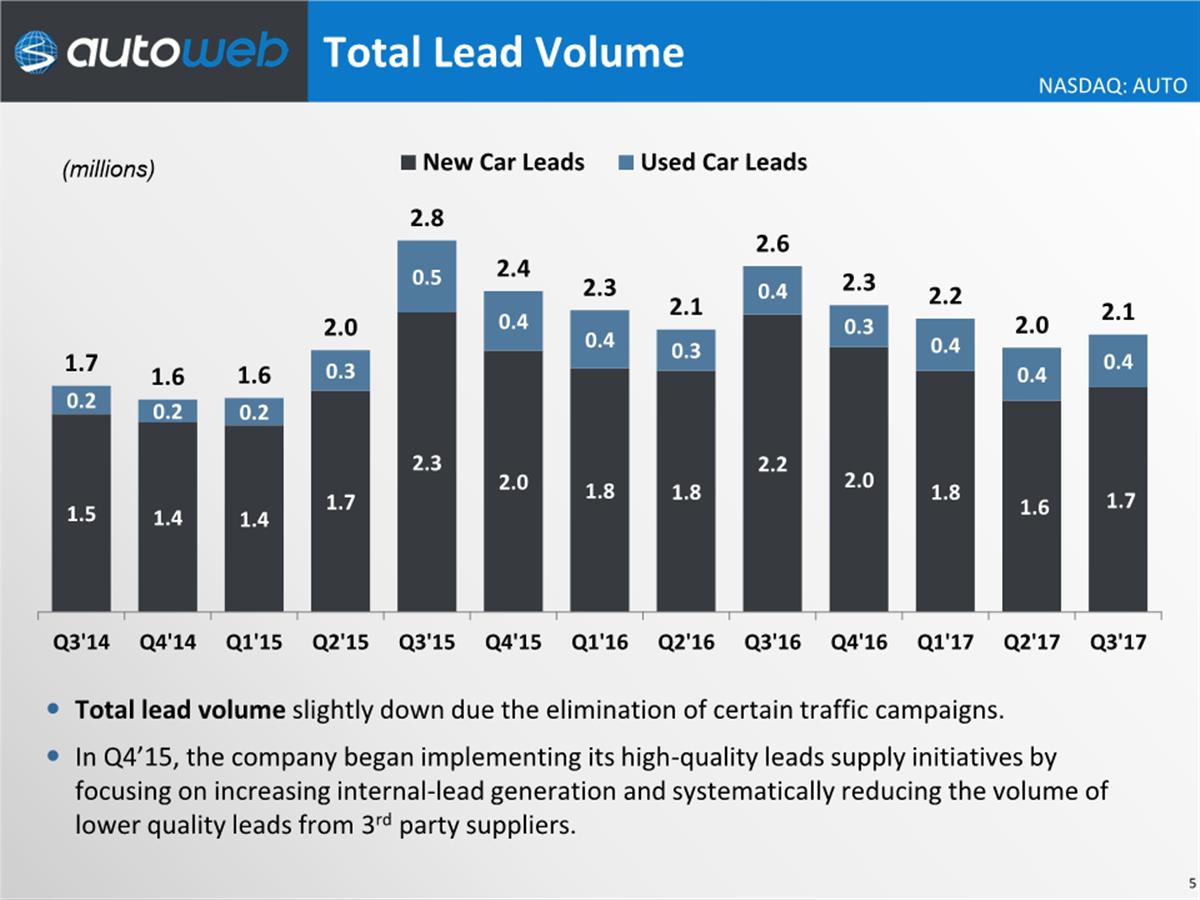

Moving

to slide five, you’ll see that we delivered approximately 2.1

million automotive leads during the third quarter compared to 2.6

million last year, a reduction resulting primarily on the

eliminated traffic. Note that this lead volume reflects all leads

sold to both the retail and wholesale channels. As a reminder, the

retail channel comprises leads sold directly to dealers whereas our

wholesale channel primarily reflects the leads sold to OEMs that

are then distributed to dealers and their corporate leads program

at the OEM’s discretion.

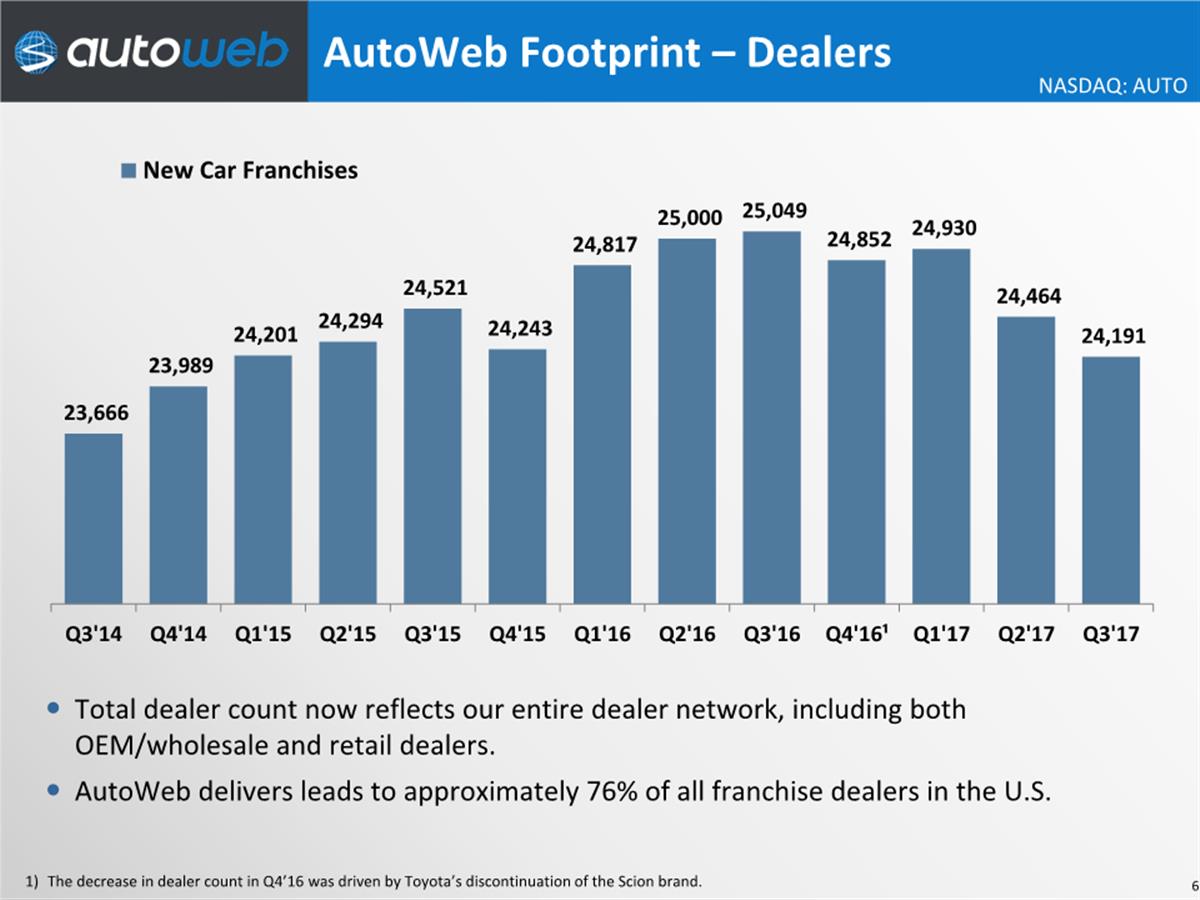

And on

slide six, you’ll see that dealer count stood at 24,191 at

September 30th, a 1 percent decrease from Q2. Similar to our leads

breakout, this dealer count reflects all of the dealers we sell

leads to, including both the wholesale and retail channels for new

cars. It’s worth noting that we saw slight headwinds to both

revenue, and lead and click volumes in the third quarter as a

result of the hurricanes in both Houston and Florida. In fact,

parts of Florida were without power and therefore Internet

connectivity for an extended period of time leading to

mid-September. We have since seen recovery and expect to see a

slight uptick in volumes in Houston in the coming months as

consumers begin to replace their damaged vehicles. It goes without

saying that our thoughts are with all of those who were affected in

regions impacted by natural disasters.

Moving

on to advertising. As mentioned earlier, our advertising revenues

increased 21 percent to $8.9 million, compared to $7.4 million in

the year-ago quarter. The growth was due to a significant increased

input revenue.

On

slide seven, you’ll see click revenues increased 35 percent

to a record $7.4 million compared to $5.5 million in the same

period last year. The increase was driven by continued strong

customer demand, partially offset by the eliminated

traffic.

Now

moving to slide eight. Gross profit during the third quarter was

$11.1 million compared to an adjusted $15.3 million in the year-ago

quarter; with the gross margin coming in at 30.1 percent compared

to an adjusted 36.2 percent. The decline was driven by the

investment in additional traffic acquisition beginning in late Q3

2016, investments in our used vehicle business, and the

aforementioned eliminated traffic campaign. We expect gross margin

to remain in the low 30 percent range, as we focus on the

optimization of traffic acquisition costs and used vehicles’

investments.

Total

operating expenses in the third quarter decreased to $10.8 million

compared to an adjusted $11.2 million in the year-ago quarter. As a

percentage of revenues, total operating expenses were 29.4 percent,

compared to an adjusted 26.5 percent for the year-ago quarter. We

expect operating expenses as the percentage of revenues to be in

the low 30 percent range as we increase investments in technology,

and sales and marketing resources over the next year.

On a

GAAP basis, net income in the third quarter was $69,000 or 1 cent

per diluted share on 13.2 million shares, compared to adjusted net

income of $2.6 million or 20 cents per share on 13.3 million shares

in the year-ago quarter. For the third quarter, non-GAAP income,

which adds back amortization on acquired intangibles, noncash

stock-based compensation, acquisition costs, severance costs,gain

or loss on investment or sale, litigation settlements, and income

taxes was $2.4 million or 18 cents per diluted share, compared to

an adjusted $6.3 million or 47 cents per diluted share in the third

quarter of 2016. The decline was primarily driven by lower revenue

in gross margins, resulting from the aforementioned eliminated

traffic and used vehicles investments.

Cash

provided by operations in the third quarter was $2.5 million

compared to $5.9 million unadjusted in the prior-year quarter. We

also repurchased $1.2 million of stock during the third quarter and

have an additional $3 million authorized, of which up to $1.8

million may be used in 2017.

On

slide nine, you’ll see that our cash balance remains strong

despite debt paydown, stock repurchases, and the usedtrucks.com URL

purchase with cash and cash equivalents of $44.7 million at

September 30, 2017, compared to $38.5 million at December 31, 2016.

Total debt at September 30, 2017, was reduced to $19.1 million

compared to $23.1 million at the end of 2016.

With

that, I’ll now turn the call back over to Jeff.

Jeffrey

Coats:

Thank you, Kim.

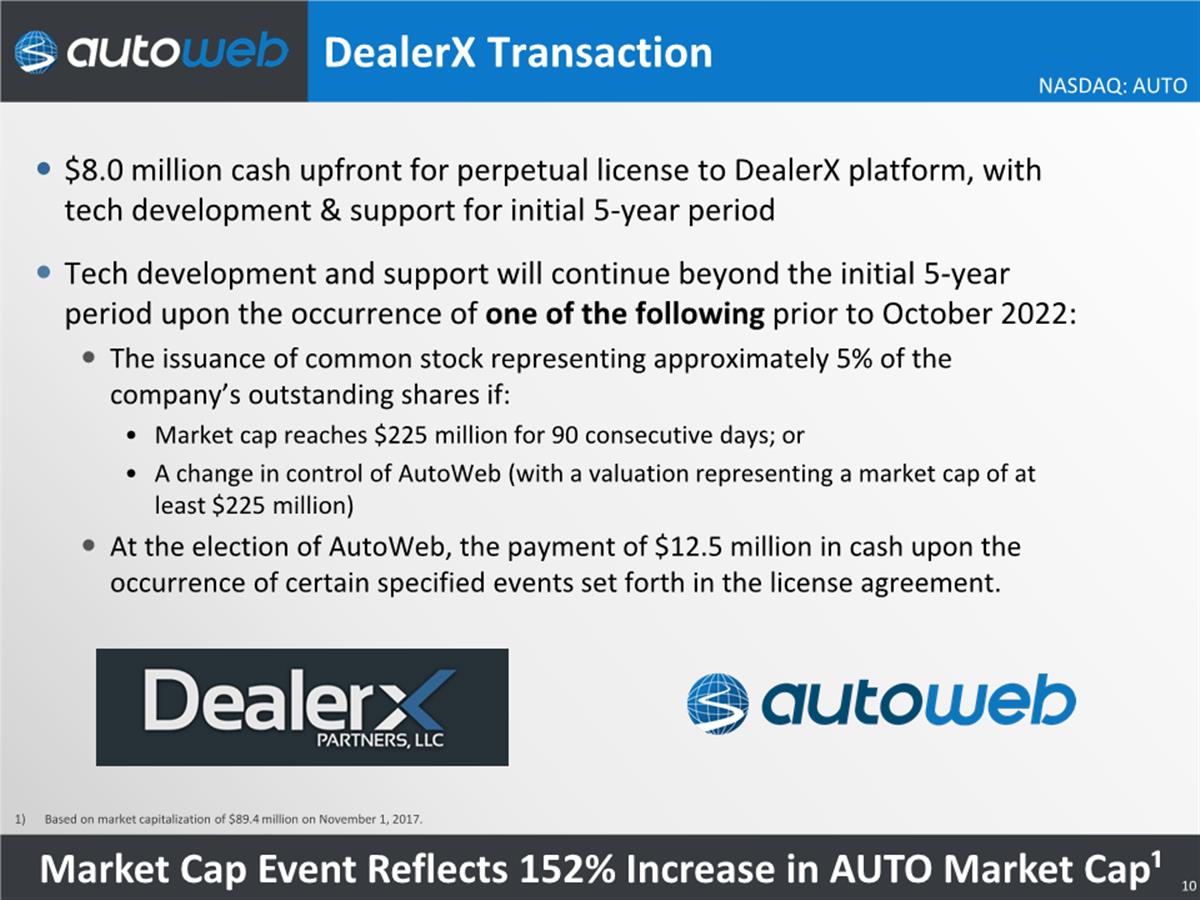

Before getting into some of the usual quarterly metrics, I’d

like to provide some more color on DealerX. First, the transaction

structure. As you can see on slide 10, we paid $8 million upfront

to DealerX to license its technology in perpetuity. During the

initial five-year period, we will receive tech development and

support from their team, including product upgrades, new product

development, and audience expansion. During this initial

period, DealerX has the contingent right to receive approximately

711,000 shares of our AutoWeb common stock, if our market

capitalization reaches $225 million and maintains that level for 90

consecutive days or if there is a change in control of AutoWeb that

reflects the market capitalization of $225 million or more. If

these shares are issued to DealerX, its obligation to provide

platform operations and support will continue in

perpetuity.

It’s also

worth noting that we have the option upon the occurrence of certain

events to make a lump sum payment of $12.5 million to extend

DealerX’s platform support obligations in perpetuity. At

which point, their right to receive any AutoWeb stock is

terminated.

With

that out of the way, I’d like to expand on the DealerX

platform a bit. DealerX has created a unique all-in-one automotive

online marketing platform that is a truly end-to-end operation from

data collection and activation to analytics and attribution. Their

technology records countless consumer-driven behavioral events

online and scores them in real-time to determine what content to

show a consumer with optimal location and timing. We plan to

utilize this technology to support both our clicks and leads

products as we can target the right consumer and monetizes the

events in multiple ways.

As you

can see on slide 11, DealerX has comprehensive dashboards that

provide analytics to show multi-pronged attribution. The data

showcased in these dashboards will allow us to demonstrate to our

dealer and OEM customers, the significant value we are providing

with this high-quality traffic and leads in helping them sell more

cars and trucks.

In

addition to the monetary benefits, the DealerX platform will

provide us with an entirely new source of traffic, which builds

upon our strategy to diversify our consumer acquisition partners.

We’ve been testing the technology for several months, and

both the conversion rates and margin profile have been very

impressive. This was a critical factor in our decision to license

the technology as we remain committed to only providing the highest

quality consumer leads and clicks to our dealer and OEM

customers.

Now,

moving back to the third quarter. In our clicks business, we

continue to increase click volumes with existing clients and have

added new dealers, OEMs, and advertising customers. As I’ve

mentioned in the past, our strong growth in clicks up to this point

has only come from a small number of customers, so there’s

still plenty of room for ongoing growth. It should be noted that

even though we have seen strong growth in click revenue, this

growth has been limited by the elimination of traffic campaigns

that we referenced earlier on the call as well as last

quarter.

We

continue to make progress on recovering the lost traffic from these

eliminated campaigns and improving our bid optimization strategies

with our traffic partners. As I mentioned earlier, each subsequent

month, we’re seeing improvements to margin and conversion

rates as our systems continuously relearn and build upon the

previous months’ bid optimization processes. We expect this

rebuilding to continue into 2018.

Moving

on to our used vehicles business. The usedcars.com site continues

to gain traction. Q3 traffic is up at 120 percent year-over-year,

and our engineers have continued to improve site load time. We will

continue to work with our Google experts to adopt more adaptive

experiences to create an optimal user flow for

usedcars.com.

As I

mentioned earlier, we purchased the usedtrucks.com URL during the

third quarter. Trucks and SUVs continue to be among the bestselling

new and used vehicles for our dealers and manufacturer customers,

and they generally also carry the highest margins for them.

Accordingly, we are very exciting to have acquired this strong

domain to further boost our used product.

In its

current form, the temporary site has very limited functionality but

also has click listings monetization. We expect to launch a more

robust version of the site in the second half of 2018. As we

continue to improve the user experience for our consumers and

expand inventory across our used vehicle sites, we will accelerate

our approach and mission to drive new traffic in the coming

quarters. We have a lot of opportunity to grow here with our paid

SEM efforts only represent a fraction of our overall investment,

and we have a clear path to get there. We are creating a mobile

first experience that we believe will allow us to reach all end

market consumers with ease.

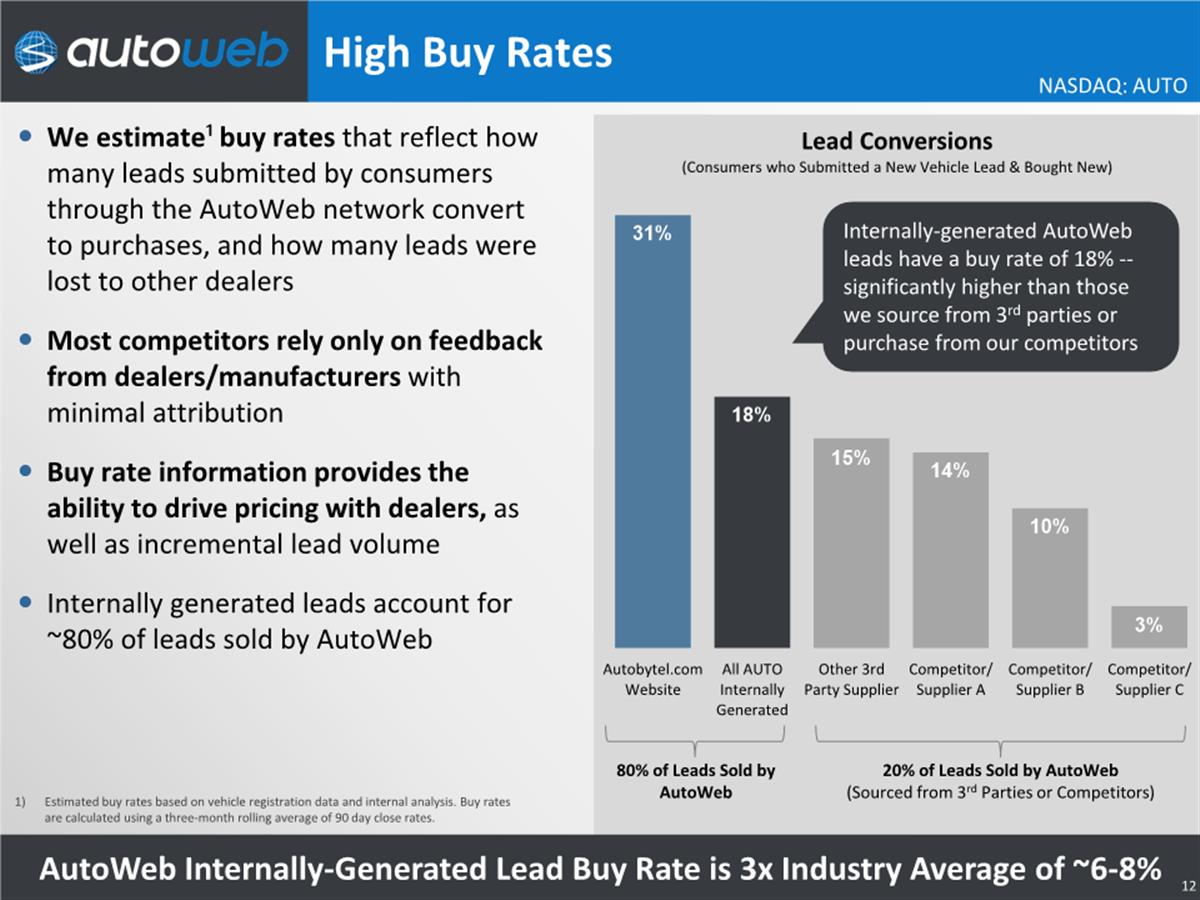

On

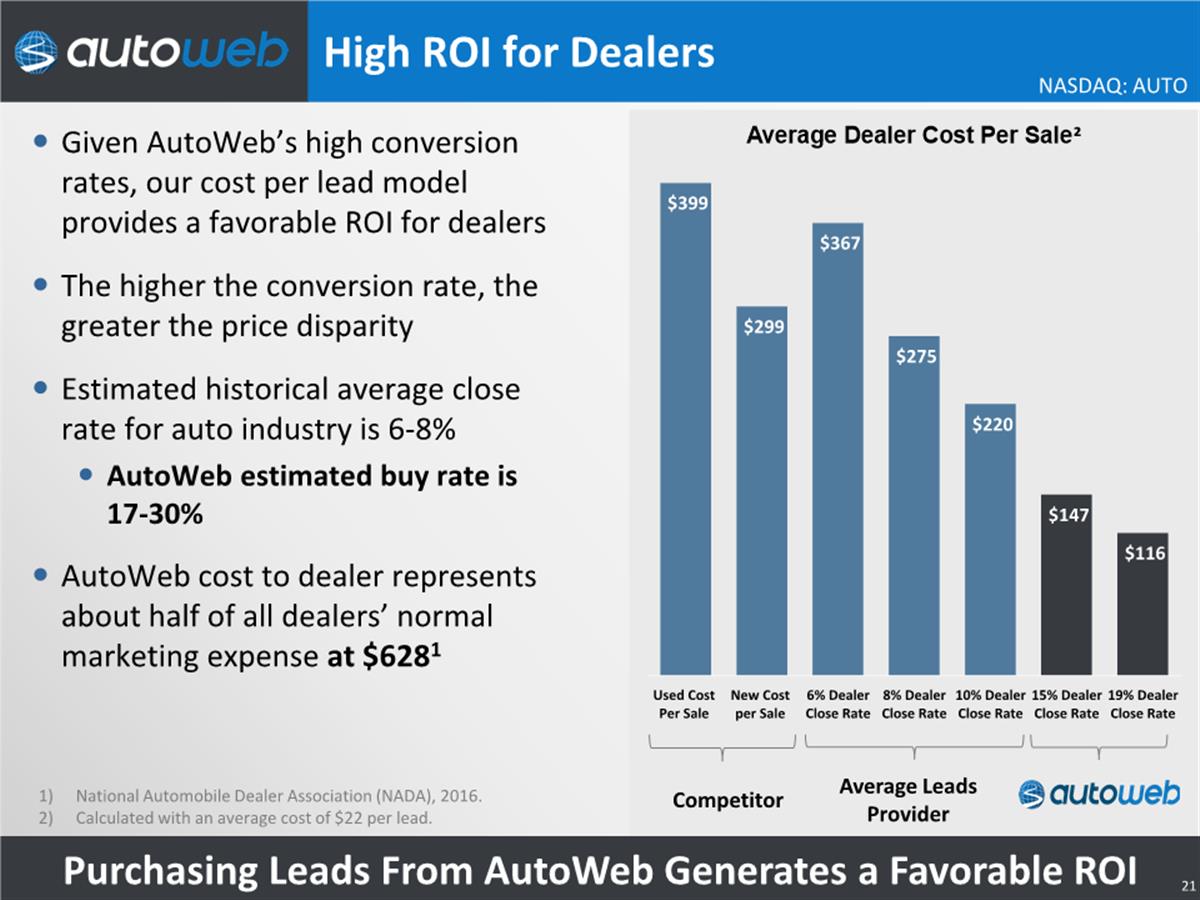

slide 12, you’ll see that our estimated average buy rate for

internally generated leads in the third quarter was 18 percent,

which remains within our targeted range of 16 percent to 24

percent. And on slide 13, you’ll note that these estimated

buy rates have remained consistently strong since Q1 2011, with

Autobytel.com generating an average buy rate of 27 percent and all

Autobytel internally generated leads at about 18 percent. Note that

we have relaunched Autoweb.com to now be our corporate site, and we

plan to keep the Autobytel.com site active along with our other

consumer facing sites, car.com, usedcars.com, and usedtrucks.com,

as they remain strong consumer-facing sites and continue to

generate high margin, meaningful advertising revenue for

us.

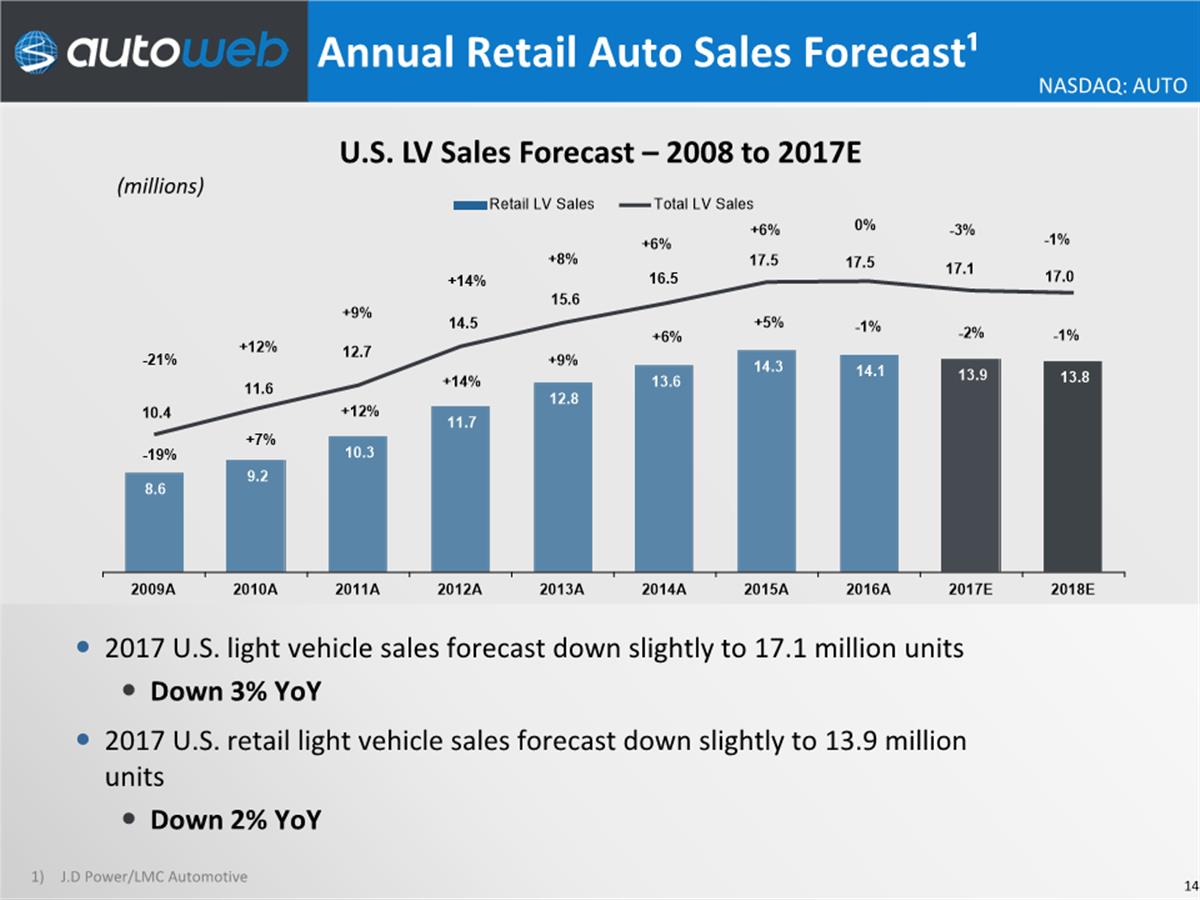

On

slide 14, you’ll see that J.D. Power LMC Automotive is

holding their forecast for full year 2017, total light vehicle

sales at 17.1 million units, and retail light vehicle sales at 13.9

million units, both down slightly from 2016. For 2018, J.D. Power

LMC Automotive forecast total light vehicle sales to be 17 million

units with retail light vehicles at 13.8 million.

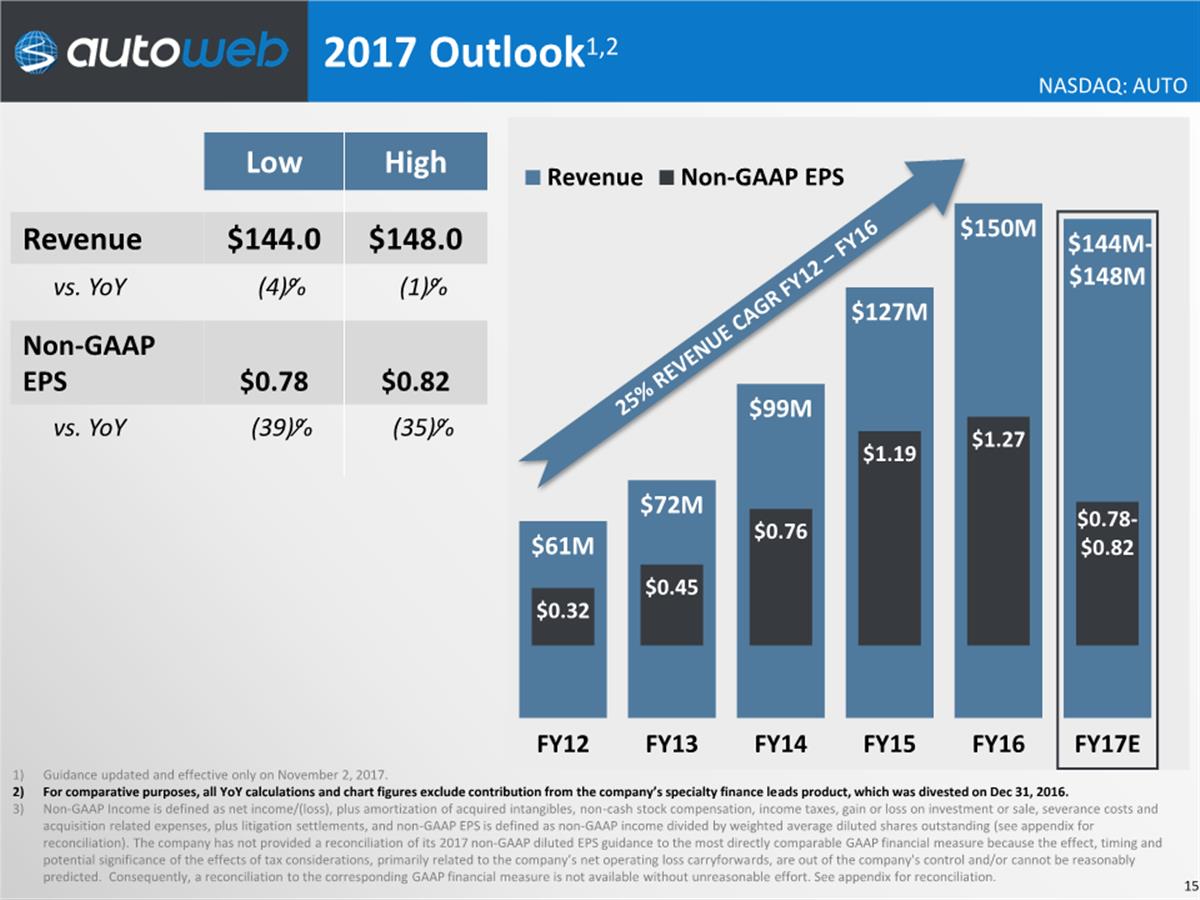

Moving

now to our 2017 business outlook highlighted on slide 15. We are

maintaining our previously issued guidance and expect revenue to

range between $144 million and $148 million, compared to an

adjusted $150.4 million in 2016. We also continue to expect

non-GAAP EPS to range between 78 cents and 82 cents on 13.3 million

shares.

Though

2017 fell short of our financial expectations due to extenuating

circumstances with our traffic acquisitions, we made solid progress

on our stated goals that were laid out to start the year.

We’ve enhanced our consumer-facing websites and expanded our

used vehicles business with investments in usedcars.com and

usedtrucks.com, and have diversified our sources of traffic by

licensing the RoiQ platform from DealerX.

Looking

ahead, we intend to continue to execute on these initiatives and

work with our traffic partners to rebuild our high quality traffic

streams, while restoring our revenue and margin profiles. We also

plan to accelerate our clicks business by expanding the offerings

to more dealer and OEM customers, while utilizing the new sources

of traffic from DealerX to increase click volumes. We expect the

incremental sources of traffic to equally support our new and used

vehicle leads business. With multiple initiatives and products in

place, we will continue to serve our dealers and OEMs with highly

targeted clicks and leads, while developing a more efficient

pathway to purchase for consumers.

At this

time, Andrew, we’re ready to open the call for

questions.

Operator:

Thank you, sir.

Ladies and gentlemen, if you have a question at this time, please

press star then the one key on your touch-tone telephone. If your

question has been answered or you wish to remove yourself from the

queue, please press the pound key. To prevent any background noise,

we ask that you please place your line on mute once your question

has been stated.

Our

first question comes from Sameet Sinha with B. Riley. Your line is

now open.

Sameet

Sinha:

Yes, thank you very

much. A couple of questions –if you look at guidance in the

implied fourth quarter, it indicates that the height of guidance

could be flat sequentially. How realistic is that expectation? And

is that a function of what you indicated earlier about the

hurricanes benefiting fourth quarter?

Secondly, can you

talk – you spoke about tech investments in technology, and

sales and marketing. Can you elaborate on where exactly

you’re investing, I guess, to have a better sense of sales

and marketing investments, but technology would also be

helpful?

And

last question would be just if you can talk about the demand

dynamics and the clicks business; if I remember correctly, last

year, you had about 200 partners from a demand side. And if you can

talk about how much has that number expanded or increased. Thank

you.

Kimberly

Boren:

Hi, Sameet.

I’ll start with the guidance questions first. Around our

range, the lower end of the range assumes the current run rate as

is the higher end of the range assumes the spike for the used

vehicles in the fourth quarter and a spike for seasonally adjusted

number as we head into the holiday season. So it’s consistent

with the model that you guys have put out.

The

second question is regarding investment in technology, and sales

and marketing. With the branding change, we’re going to

continue to invest in getting the AutoWeb name out there, so

you’ll see a significant uptick in what we’re spending

right now. It’s not significant and material those numbers,

but it’s more than we’re currently spending today from

a marketing perspective. And in addition, we’re adding sales

and customer service headcounts. With regard to technology, we are

continuing to invest, as Jeff mentioned, in used trucks, used cars,

and other URLs as well as the ad server and other things that

we’ve talked about throughout the year.

Jeff, I

don’t know, if you want to go into the demand dynamics on the

clicks?

Jeffrey

Coats:

On the demand side,

Sameet, for the clicks business, we have a significant amount of

demand. We have added some new customers mostly around agencies

that represent dealers as well as a couple of OEMs. But given some

of the volume and quality problems we had during the first half of

the year that caused us to pull the bad traffic out of our

campaign, we were kind of slow walking the clicks product a little

bit until we fully diagnosed from where the quality problems were

coming.

So, now

that we’ve got that behind us, we are beginning to push it

– we have already begun to push it again, and we’re

seeing continued signup. And also, we have pretty strong demand for

it. The click product is very well received by our OEM customers as

well as the agencies that represent dealers as well as some that

represent OEMs. So it’s quite positive.

Sameet

Sinha:

OK. Thank

you.

Operator:

Thank you. Our next

question is from Ed Woo with Ascendiant Capital. Your line is now

open.

Ed

Woo:

Yes, thank you for

taking my question. A clarifying question in terms of the guidance

you gave earlier, Kim, about gross margin in the 30 percent range

and operating expense in the 30 percent range as well. Is that just

for the fourth quarter? Or is it for the next couple of

quarters?

Kimberly

Boren:

That’s

planned to roll for the fourth quarter and moving into the next

period in 2018. Although, we’d expect that the OpEx as a

percentage would be lower than gross margin in those

periods.

Ed

Woo:

OK. And then that

leads me to my question is now that you’re making these

investments and I know you’re not going to be giving specific

guidance for 2018, but is there leverage in the model? And when do

you think that opportunity is to, really, get back to the gross

profit profiles that you previously had?

Kimberly

Boren:

That’s a good

question, Ed. So, right now, we’re actually going through the

process of budgeting for 2018. I wish I could provide you more

guidance at this point in time. But we are a little (way down)

until nailing down where we’re ready to guide for 2018. So I

would expect that on our next call.

Jeffrey

Coats:

Ed, this is Jeff.

I’d also point out the leverage in our P&L is certainly

more pronounced at the higher revenue level that we had to back off

from a traffic standpoint. So there is still leverage in our

product lines and then our approach. But we’ve got to rebuild

our traffic campaigns to get our revenue back in line in order to

really demonstrate it.

Ed

Woo:

I guess more just a

qualitative high-level view, Jeff. Obviously, when you, guys, made

the acquisition of AutoWeb last year, you guys had a lot of

expectations and whatnot. Has anything changed in the past year to

really get you guys to change your expectations on a long-term

basis in the clicks business?

Jeffrey

Coats:

No, I

wouldn’t say that anything has changed from a long-term or

even medium-term standpoint with the product. I mean we’re

continuing to see really strong growth. We had a flat

quarter-over-quarter and year in the second quarter, but

that’s in-part because we were really slow locking some stuff

related to some of the quality concerns for a while.

We are

continuing to sign up customers for it. We have taken a little bit

slower approach. We would be further along. But as we talked about

on the second quarter call, we started identifying some quality

problems late last year and they rolled over into this year. And

that’s really caused us to just expand that product a little

bit more slowly until we got the quality stuff straightened out. I

mean the last thing we wanted to do was potentially screw up a

great new product by pushing poor quality traffic to some new

customers.

Ed

Woo:

Right. Well, thanks

for answering my questions. Thanks a lot. Thank you.

Jeffrey

Coats:

Thank

you.

Operator:

Our next question

comes from Tom Cullen with Lake Street. Your line is now

open.

Tom

Cullen:

Thank you. Good

afternoon. Just a few questions and some are follow-ups to some of

that have already been asked, but curious about the expectation in

the fourth quarter for OEM incentives or other potential tools to

increase demand around the holidays and Black Friday. Also

wondering about your relationships, have they improved or changed

in any way with some of the search partners since the Q2 traffic

issues? And then, if you could, just expand a little on your growth

expectations for pay per click in 2018 and also if the traction for

the used car leads business is as you saw on plan; just where you

in that process.

Jeffrey

Coats:

Let me – you

might have to remind me on some of those as we go through with. So

the first one, we do think there will be increased incentives. Oh,

good, Kim wrote them down. Thank you, Kim. Going through the fourth

quarter, we do believe there will be increased incentives. You may

have noticed that over the last two or three years, or three years,

I guess, a lot of the manufacturers have started doing Black Friday

advertising right after Thanksgiving and that has really changed

the profile of Q4 for us over these years. It was very successful

for General Motors and some of the others. But GM, in particular,

last year and a couple of years before that, it’s our

understanding that they’re planning to do the same thing

again this year. It was – they kind of started it in

‘14, expanded it in ‘15. A lot of other guys started

jumping in a little bit in ‘15 and ‘16. And so, we

would expect to see more this year.

In

addition, to our understanding, incentives have been pretty much at

an all-time high this year, particularly during the summer. So the

manufacturers have been pushing very hard to move metal,

particularly in the second half of this year, I assume, in part to

get their own inventories in line as they approach the end of their

fiscal years in December.

I would

say our partner relationships remain very strong across all of our

search partners. We have a very strong relationship. And even

though we’ve had some issues, we continue to work very

closely with those partners in order to diagnose and take care of

the issues. So, if anything, the relationships are probably

stronger now than ever.

Click

growth in 2018, we would expect it to continue to grow in double

digits next year. It will be – how strongly that is, is a

function of our leads traffic to some extent, but also now the

DealerX traffic partnership that we have begun developing. It

operates on a day-to-day basis, somewhat like relationships with

our search partners. And that we opened accounts with them and do

campaigns somewhat similarly in order to buy traffic. And so we

would expect that to continue to support both sides of the

business. But, again, we expect the clicks business to grow double

digits next year.

Used

cars, I would acknowledge used cars has grown a little more slowly

than we would have liked. We have been adding resources to it. We

have been expanding and improving the usedcars.com website with

more functionality. We’ve been also adding more dealers to

the program and getting their inventory posted. We need to do

better. And we are in fact, doing that, we’re adding more

sales resources as well to what we are doing. So we are a little

behind where we had hoped to be by this point in time. But we do

expect to accelerate in 2018.

Tom

Cullen:

Much appreciated.

Thank you very much.

Operator:

At this time, this

includes our question-and-answer session. I would now like to turn

the call back to Mr. Coats for closing remarks.

Jeffrey

Coats:

Thanks, Andrew.

Thanks, everybody, for joining us today. I’d also like, as

always, to thank our team of hard-working and dedicated employees.

We look forward to meeting with all of our current and prospective

shareholders, I think, next in December at the LD Micro Conference

in Los Angeles and through our periodic non-deal road shows. If we

don’t see you before, we will be doing our Q4 call in early

March. Thank you.

Operator:

Ladies and

gentlemen, this does conclude today’s teleconference call.

You may now disconnect your lines at this time. Thank you for your

participation.

END